F i r s t Q u a r t e r 2 0 1 9 F i n a n c i a l S u p p l e m e n t 1 1

D I S C L O S U R E S In this presentation (1) “CatchMark” refers to CatchMark Timber Trust, Inc., a Maryland corporation that has elected to be taxed as a real estate investment trust (NYSE: CTT), (2) “Triple T” refers to TexMark Timber Treasury, L.P., a Delaware limited partnership that is a joint venture managed by CatchMark and in which CatchMark holds a common limited partnership interest, and (3) “Dawsonville Bluffs” refers to Dawsonville Bluffs, LLC, a Delaware limited liability company that is a joint venture managed by CatchMark and in which CatchMark holds a 50% limited liability company interest. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Forward-looking statements in this presentation include, but are not limited to, our guidance with respect to our anticipated 2019 results. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations, including, but not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate; (ii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties; (iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long-term; (x) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; and (xi) the factors described in Item 1A Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law. 2 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

S T R AT E G I E S P R O D U C E S TA B L E , V I S I B L E , H I G H - Q U A L I T Y C A S H F L O W CatchMark acquires prime timberlands in high-demand mill markets and manages operations to generate highly-predictable and stable cash flow that comfortably covers its dividend and delivers consistent growth through the business cycle. PRIME QUALITY HIGH-DEMAND SUPERIOR MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH DISCIPLINED ACQUISITIONS OF HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT PRIME TIMBERLANDS PROVIDES RELIABLE OUTLET FOR MAXIMIZES CASH FLOWS THROUGHOUT PRODUCES DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY THE BUSINESS CYCLE DRIVES STABILITY AND PREDICTABILITY OF CASH FLOW 3

Financial and Operating Information 4 4

F I N A N C I A L H I G H L I G H T S (in thousands, except per share data) Results of Operations Q1 2019 Q4 2018 Q1 2018 Revenues $22,573 $22,927 $24,104 Operating income (loss) $1,506 $(98) $(1,019) Net loss $(30,395) $(38,218) $(3,385) Net loss per share – basic and diluted $(0.62) $(0.78) $(0.08) Adjusted EBITDA (1) $10,162 $9,420 $14,895 Adjusted EBITDA per share (1) $0.21 $0.19 $0.34 Weighted-average common shares outstanding - basic and diluted 49,063 49,082 44,380 Capital Resources and Liquidity Q1 2019 Q4 2018 Q1 2018 Cash provided by operating activities $5,247 $525 $10,947 Cash used in investing activities $(463) $76,873 $(3,864) Cash used in by financing activities $(7,978) $(87,107) $(6,801) Cash Available for Distribution (CAD) (4) $4,932 $2,359 $7,880 3/31/2019 12/31/2018 Debt (2) $478,619 $478,619 Cash $2,420 $5,614 Net Debt $476,199 $473,005 Net Debt/Adjusted EBITDA (1) 10.6x 9.5x Net Debt/Enterprise Value (3) 50% 58% Cash $2,420 $5,614 Credit Facilities Capacity Revolving line of credit 35,000 35,000 Acquisition facility 130,000 130,000 $167,420 $170,614 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 2. Debt is gross of deferred financing costs. 5 3. Enterprise value is based on equity market capitalization as of the last trading day of the respective period plus net debt. 4. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution and slide 7 for a reconciliation of Cash Provided by Operating Activities to Cash Available for Distribution.

A D J U S T E D E B I T D A B Y S O U R C E (in thousands) Q1 2019 Q4 2018 Q1 2018 Timber sales $16,551 $16,315 $18,653 Other revenue 1,090 1,152 1,163 (-) Contract logging and hauling costs (7,356) (7,315) (8,582) (-) Forestry management expenses (1,734) (1,661) (1,830) (-) Land rent expense (142) (170) (161) (-) Other operating expenses (1,644) (2,106) (1,396) (+) Stock-based compensation 88 23 249 (+) Other1 407 613 44 Harvest EBITDA $7,260 $6,851 $8,140 Timberland sales $2,090 $2,616 $4,252 (-) Cost of timberland sales (1,560) (1,922) (3,147) (+) Basis of timberland sold 1,427 1,707 2,856 Real Estate EBITDA $1,957 $2,401 $3,961 Asset Management Fees $2,842 $2,844 $36 Unconsolidated Dawsonville Bluffs Joint Venture EBITDA 573 423 5,077 Investment Management EBITDA $3,415 $3,267 $5,113 Total Operating EBITDA $12,632 $12,519 $17,214 (-) General and administrative expense $(3,363) $(3,823) $(2,945) (+) Stock-based compensation 571 495 516 (+) Interest Income 30 82 64 (+/-) Other1 292 147 46 Non-allocated / Corporate EBITDA $(2,470) $(3,099) $(2,319) Adjusted EBITDA $10,162 $9,420 $14,895 1. Other includes (a) non-cash items: amortization, depreciation, stock-based compensation, casualty loss, and other timber asset basis removed; and (b) certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 6 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

C A S H AVA I L A B L E F O R D I S T R I B U T I O N (in thousands, except per share data) Q1 2019 Q4 2018 Q1 2018 Cash Provided by Operating Activities $5,247 $525 $10,947 Capital expenditures (excluding timberland acquisitions) (1,259) (1,750) (1,545) Working capital change 38 3,561 (1,557) Distributions from unconsolidated joint ventures 796 (114) - Other 110 137 35 Cash Available for Distribution (1) $4,932 $2,359 $7,880 Adjusted EBITDA (2) $10,162 $9,420 $14,895 Interest paid (4,372) (4,889) (2,581) Capital expenditures (excluding timberland acquisitions) (1,259) (1,750) (1,545) Distributions from unconsolidated joint ventures 975 1 2,188 Adjusted EBITDA from unconsolidated joint ventures (574) (423) (5,077) Other - - - Cash Available for Distribution (1) $4,932 $2,359 $7,880 Dividends paid $6,578 $6,588 $5,815 Weighted-average shares outstanding, end of period 49,063 49,082 44,380 Dividends per Share $0.135 $0.135 $0.135 1. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution. 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 7 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

U . S . S O U T H T I M B E R O V E R V I E W 2018 2019 1Q 2Q 3Q 4Q FY 1Q 2Q 3Q 4Q FY Timber Sales Volume ('000 tons) Pulpwood 354 342 343 317 1,356 294 - - - 294 Sawtimber 221 219 185 192 817 188 - - - 188 Total 575 561 528 509 2,173 482 - - - 482 Delivered vs Stumpage Delivered % as of total volume 83% 80% 78% 78% 80% 79% - - - 79% Stumpage % as of total volume 17% 20% 22% 22% 20% 21% - - - 21% Net Timber Sales Price ($ per ton) Pulpwood $14 $13 $13 $14 $14 $15 - - - $15 Sawtimber $23 $24 $24 $25 $24 $24 - - - $24 Sold Under Timber Supply Agreements Volume 171 168 190 178 707 130 - - - 130 % of total volume 30% 43% 36% 35% 33% 27% - - - 27% Summary Financial Data ($ in '000s) Timber sales $18,653 $17,745 $16,742 16,315 $69,455 $16,551 - - - $16,551 (-) Contract logging and hauling costs (8,582) (7,959) (7,613) (7,315) (31,469) (7,356) - - - (7,356) Net timber sales $10,071 $9,786 $9,129 $9,000 $37,986 $9,195 - - - $9,195 Other revenues 1,199 1,670 1,319 1,152 5,279 1,090 - - - 1,090 Total net timber sales and other revenues $11,270 $11,456 $10,448 $10,152 $43,265 $10,285 - - - $10,285 Period-end Acres Fee 477 474 472 415 415 414 - - - 414 Lease 31 30 30 30 30 27 - - - 27 Wholly-owned Total 508 504 502 445 445 441 - - - 441 Joint venture interest 6 6 1,106 1,105 1,105 1,104 - - - 1,104 Total 514 510 1,608 1,550 1,550 1,545 - - - 1,545 8

R E A L E S TAT E O V E R V I E W 2018 2019 1Q 2Q 3Q 4Q FY 1Q 2Q 3Q 4Q FY Timberland Sales Gross sales ('000s) $4,252 $6,834 $3,818 $2,616 $17,520 $2,090 - - - $2,090 Acres sold 2,200 3,100 1,900 1,300 8,500 900 - - - 900 % of fee acres (1) 0.5% 0.7% 0.4% 0.3% 1.8% 0.2% - - - 0.2% Price per acre $1,955 $2,199 $1,967 $2,064 $2,064 $2,236 - - - $2,236 Margin on sale (4) 26% 23% 16% 27% 23% 25% - - - 25% Average hold (years) 6 5 4 8 5 7 - - - 7 Stocking (tons/acre) (2) 13 30 28 36 26 52 - - - 52 Pine Stocking (tons per acre) 7 23 25 24 19 35 - - - 35 Pulpwood (%) 62% 43% 58% 61% 53% 42% - - - 42% Sawtimber (%) 38% 57% 42% 39% 47% 58% - - - 58% Hardwood Stocking (tons per acre) 6 7 3 12 7 17 - - - 17 Pulpwood (%) 59% 69% 54% 57% 62% 84% - - - 84% Sawtimber (%) 41% 31% 46% 43% 38% 16% - - - 16% Timber Reservations Entered During Period (3, 5) Tons 9,100 6,600 10,300 213,000 239,000 - - - - - Book Basis ('000) $112 $88 $207 $2,762 $3,169 $- - - - $- Timber Reservations Remaining at Period End (5) Tons - - 28,500 217,800 217,800 207,300 - - - 207,300 Book Basis ('000) $- $- $898 $2,779 $2,779 $2,557 - - - $2,557 1. Calculated using average fee acres owned during the respective period. 2. Stocking refers to merchantable timber inventory per acre. CatchMark considers 15-year or older pine as merchantable. 3. Represents timber reservations added in respective period related to land sold. 4. Excludes value of timber reservations. 5. Includes volumes from large disposition. 9 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

S O L I D C A P I TA L P O S I T I O N Credit Metrics Credit Facilities and Maturity Schedule Fixed charge coverage ratio1 2.8x Total Credit Facilities of $643.6 Million 2, 3 Net Debt /Adjusted EBITDA 10.6x Weighted-Average Life of Outstanding Debt is 6.8 Years 2 4 Net Debt /Enterprise value 50% $ Millions Weighted average cost of debt5 3.52% 250 Interest rate mix Fixed: 73% / Floating: 27% $200M MDTL $100M No debt maturities Allocation of Capital 200 Term Loan until late 2024. Well-laddered Millions $140M maturity schedule: $325 1% Term 0.5% No more than 27% of Loan $300 8% 150 total capacity due in $130M $275 any one year. $100M Term Loan $250 6% $225 100 $68.6M $200 Term Loan $175 2% 2% $70M MDTL $150 12% 90.5% 94% 50 $125 $35M LOC $100 3% 84% 6% 1.5% 6% xx% 19% 83% $75 84% 23.5% $50 $0 $0 $0 $0 $0 0 72% 69% $25 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 57 12% 14% $0 % 74% 2014 2015 2016 2017 2018 1Q 2019 Debt Available Debt Outstanding Investments Dividends Share Repurchases CAPEX As of 3/31/2019. 1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 3/31/2019. 2. Net debt equals outstanding borrowings net of cash on hand. 10 3. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 4. Enterprise value is based on equity market capitalization as of 3/31/2019 plus net debt. 5. After consideration of effects of interest rate swaps and patronage refund.

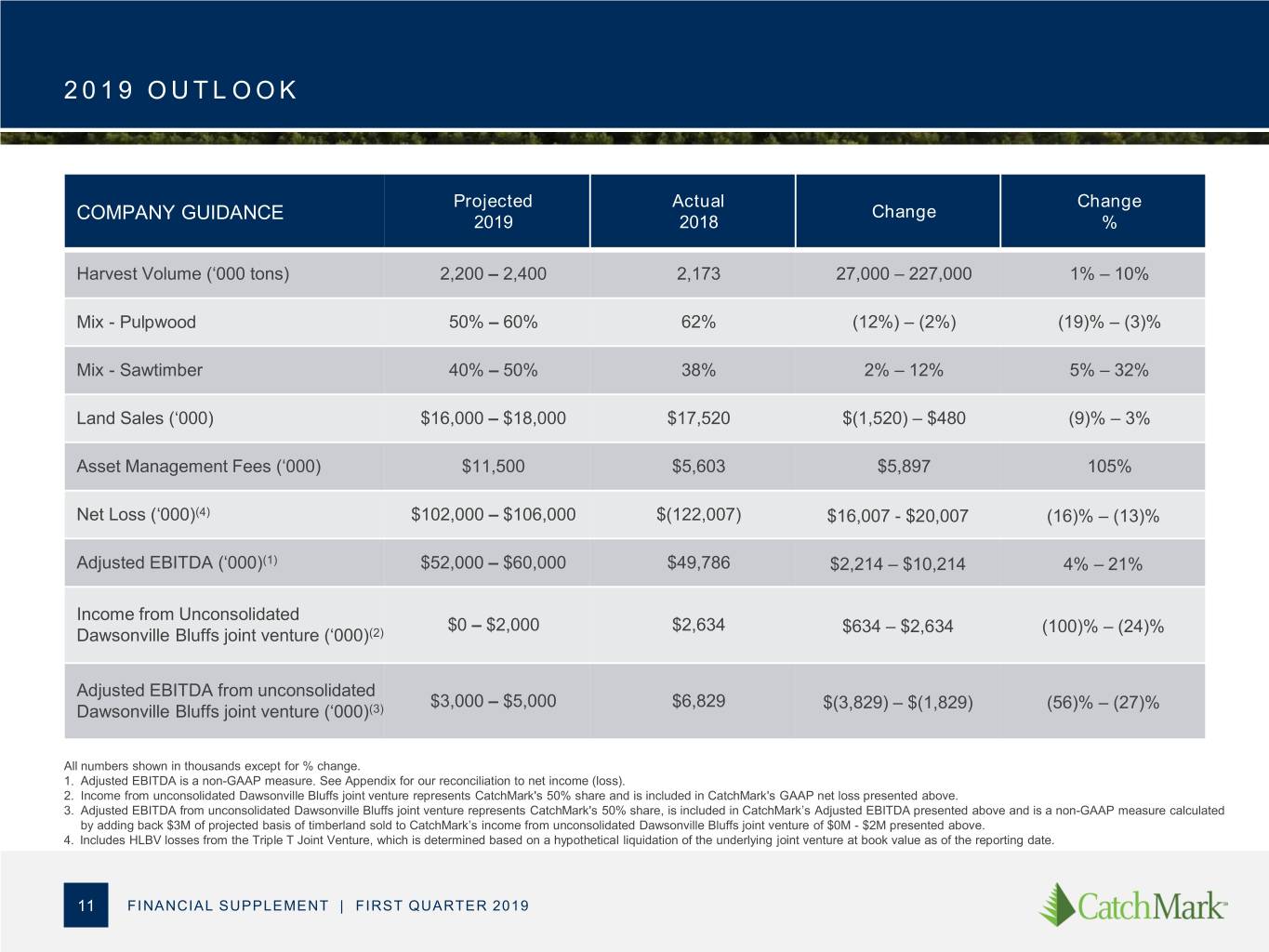

2 0 1 9 O U T L O O K Projected Actual Change Change COMPANY GUIDANCE 2019 2018 % Harvest Volume (‘000 tons) 2,200 – 2,400 2,173 27,000 – 227,000 1% – 10% Mix - Pulpwood 50% – 60% 62% (12%) – (2%) (19)% – (3)% Mix - Sawtimber 40% – 50% 38% 2% – 12% 5% – 32% Land Sales (‘000) $16,000 – $18,000 $17,520 $(1,520) – $480 (9)% – 3% Asset Management Fees (‘000) $11,500 $5,603 $5,897 105% Net Loss (‘000)(4) $102,000 – $106,000 $(122,007) $16,007 - $20,007 (16)% – (13)% Adjusted EBITDA (‘000)(1) $52,000 – $60,000 $49,786 $2,214 – $10,214 4% – 21% Income from Unconsolidated $0 – $2,000 $2,634 $634 – $2,634 (100)% – (24)% Dawsonville Bluffs joint venture (‘000)(2) Adjusted EBITDA from unconsolidated $3,000 – $5,000 $6,829 $(3,829) – $(1,829) (56)% – (27)% Dawsonville Bluffs joint venture (‘000)(3) All numbers shown in thousands except for % change. 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our reconciliation to net income (loss). 2. Income from unconsolidated Dawsonville Bluffs joint venture represents CatchMark's 50% share and is included in CatchMark's GAAP net loss presented above. 3. Adjusted EBITDA from unconsolidated Dawsonville Bluffs joint venture represents CatchMark's 50% share, is included in CatchMark’s Adjusted EBITDA presented above and is a non-GAAP measure calculated by adding back $3M of projected basis of timberland sold to CatchMark’s income from unconsolidated Dawsonville Bluffs joint venture of $0M - $2M presented above. 4. Includes HLBV losses from the Triple T Joint Venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date. 11 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

Appendix 12

A D J U S T E D E B I T D A Earnings before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating performance. EBITDA is defined by the SEC however, we have excluded certain other expenses which we believe are not indicative of the ongoing operating results of our timberland portfolio, and we refer to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies and should not be considered in isolation or as an alternative to, or substitute for net income, cash from operations, or other financial statement data presented in our consolidated financial statements as indicators of our operating performance. Due to the significant amount of timber assets subject to depletion, significant income (losses) from unconsolidated joint ventures based on HLBV, and the significant amount of financing subject to interest and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations are: • Adjusted EBITDA does not reflect our capital expenditures, or our future requirements for capital expenditures; • Adjusted EBITDA does not reflect changes in, or our interest expense or the cash requirements necessary to service interest or principal payments on, our debt; and • Although depletion is a non-cash charge, we will incur expenses to replace the timber being depleted in the future, and Adjusted EBITDA does not reflect all cash requirements for such expenses. • Although HLBV income and losses are primarily hypothetical and non-cash in nature, Adjusted EBITDA does not reflect cash income or losses from unconsolidated joint ventures for which we use the HLBV method of accounting to determine our equity in earnings. Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our credit agreement contains a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure is representative of adjusted income available for interest payments. 13 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

R E C O N C I L I AT I O N O F N E T I N C O M E ( L O S S ) T O A D J U S T E D E B I T D A (in thousands unless otherwise noted) Q1 2018 Q4 2018 Q1 2019 Projected 2019 Net Income (loss) $(3,385) $(38,218) $(30,395) $(102,000) – $(106,000) Add: Depletion 7,062 6,028 5,628 31,000 – 35,000 Basis of timberland sold, lease terminations and other1 2,856 2,282 1,807 12,000 Amortization2 1,725 289 458 — Depletion, amortization, and basis of timberland and mitigation tax credits sold included in loss from unconsolidated 3,256 310 395 3,000 Dawsonville Bluffs Joint Venture 3 HLBV (income) loss from unconsolidated joint venture4 — 32,795 27,488 90,000 Stock-based compensation expense 765 518 659 3,000 Interest expense2 2,581 4,889 4,372 19,000 (Gain) loss from large dispositions5 — 390 — — Other6 35 137 110 — Adjusted EBITDA $14,895 $9,420 $10,162 $52,000 – $60,000 1. Includes non-cash basis of timber and timberland assets written-off related to timberland sold, terminations of timberland leases and casualty losses. Certain prior periods amounts have been reclassified to conform with the current presentation. 2. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of intangible lease assets, and amortization of mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of operations. 3. Reflects our 50% share of depletion, amortization, and basis of timberland and mitigation credits sold of the unconsolidated Dawnsonville Bluffs, LLC joint venture. 4. Reflects HLBV (income) losses from the Triple T Joint Venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date. 5. Large dispositions are defined as larger transactions in acreage and gross sales price than recurring HBU sales. Large dispositions are not part of core operations, are infrequent in nature and would cause material variances in comparative results if not reported separately. Large dispositions may or may not have a higher or better use than timber production or result in a price premium above the land’s timber production value. 6. Includes certain gains, reimbursements, losses and/or expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 14 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

D E F I N I T I O N S O F N O N - G A A P M E A S U R E S Adjusted EBITDA: Earnings before taxes, interest, depletion, amortization, non-cash cost of timberland sales, stock-based compensation expense, such amounts related to unconsolidated joint ventures, Large Dispositions and certain gains, reimbursements, losses and/or expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including amounts required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. Cash Available for Distribution (CAD): Cash provided by operating activities adjusted for capital expenditures (excluding timberland acquisitions), working capital changes, cash distributions from unconsolidated joint ventures and certain cash expenditures that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 15 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

E Q U I T Y A N A LY S T C O V E R A G E Craig Kucera B. Riley FBR, Inc. 540.277.3366 craigkucera@brileyfbr.com Anthony Pettinari Citi 212.816.4693 anthony.pettinari@citi.com Collin Mings Raymond James 727.567.2585 collin.mings@raymondjames.com Paul C. Quinn Charan Sanghera RBC Dominion Securities Inc. 604.257.7048 604.257.7657 paul.c.quinn@rbccm.com charan.sanghera@rbccm.com David B. Rodgers, CFA Robert W. Baird & Co. 216.737.7341 drodgers@rwbaird.com Simon Yarmak Stifel, Nicolaus & Company, Inc. 443.224.1345 yarmaks@stifel.com 16 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019

C O M PA N Y I N F O R M AT I O N CatchMark (NYSE: CTT) seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high demand U.S. mill markets. Headquartered in Atlanta and focused exclusively on timberland ABOUT US ownership and management, CatchMark began operations in 2007 and owns interests in 1.6 million acres* of timberlands located in Alabama, Florida, Georgia, North Carolina, Oregon, South Carolina, Tennessee and Texas. Jerry Barag Chief Executive Officer and Director Brian M. Davis President and Chief Financial Officer MANAGEMENT Todd P. Reitz Senior Vice President - Forest Resources Lesley H. Solomon General Counsel and Corporate Secretary 5 Concourse Parkway Suite 2650 Atlanta, GA 30328 CONTACT 855.858.9794 www.catchmark.com info@catchmark.com * As of 3/31/2019 17 FINANCIAL SUPPLEMENT | FIRST QUARTER 2019