F i r s t Q u a r t e r 2 0 1 9 I n v e s t o r P r e s e n t a t i o n 1 1

F O R WA R D - L O O K I N G S TAT E M E N T S This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward- looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Forward-looking statements in this presentation include, but are not limited to, that we will grow our cash flows through actively managing our timberlands located in high-demand mill markets, that the strong productivity characteristics of our timberlands will enhance overall portfolio yields, that our evolving harvest mix will enhance our prospects for revenue growth, and that we will unlock future value in the Triple T joint venture by optimizing the inventory and delivery on existing supply agreements. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations, including, but not limited to: (i) we may not generate the harvest volumes from our timberlands that we currently anticipate may not be able to deliver cash flow growth; (ii) the demand for our timber may not increase at the rate we currently anticipate or at all due to changes in general economic and business conditions in the geographic regions where our timberlands are located; (iii) the cyclical nature of the real estate market generally, including fluctuations in demand and valuations, may adversely impact our ability to generate income and cash flow from sales of higher-and-better use properties or to recycle capital into better performing properties; (iv) timber prices may not increase at the rate we currently anticipate or could decline, which would negatively impact our revenues; (v) the supply of timberlands available for acquisition that meet our investment criteria may be less than we currently anticipate; (vi) we may be unsuccessful in winning bids for timberland that are sold through an auction process; (vii) we may not be able to access external sources of capital at attractive rates or at all; (viii) potential increases in interest rates could have a negative impact on our business; (ix) our share repurchase program may not be successful in improving stockholder value over the long-term; (x) our joint venture strategy may not enable us to access non-dilutive capital and enhance our ability to make acquisitions; (xi) we may not be successful in operating the Triple T joint venture in a manner that unlocks additional value or enable us to earn the asset management fee or an incentive-based promote; and (xii) the factors described in Item 1A Risk Factors of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our other filings with Securities and Exchange Commission. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We undertake no obligation to update our forward-looking statements, except as required by law. 2

TA B L E O F C O N T E N T S SECTION PAGE # CatchMark Overview 4 Disciplined Acquisitions 10 High-Demand Mill Markets 21 Superior Management 25 Capital Strategy 31 Triple T Timberlands 38 Summary 40 Appendix 42 In this presentation (1) “CatchMark” refers to CatchMark Timber Trust, Inc., a Maryland corporation that has elected to be taxed as a real estate investment trust (NYSE: CTT), (2) “Triple T” refers to TexMark Timber Treasury, L.P., a Delaware limited partnership that is a joint venture managed by CatchMark and in which CatchMark holds a common limited partnership interest, (3) “Dawsonville Bluffs” refers to Dawsonville Bluffs, LLC, a Delaware limited liability company that is a joint venture managed by CatchMark and in which CatchMark holds a 50% limited liability company interest, and (4) “IPO” refers to CatchMark’s initial listed offering in December 2013. 3

CatchMark Overview 4 4

CatchMark (NYSE: CTT) seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high-demand U.S. mill markets. 5

A B O U T C AT C H M A R K Significant Growth: IPO - 20182 Acres Owned as of March 31, 2019 Total1 Compound Annual Growth Rates U.S. South Alabama 74,200 ‒ Revenues 25% Florida 2,000 ‒ Adjusted EBITDA 70% Georgia 290,600 Consistently paid fully-covered quarterly distributions North Carolina 200 South Carolina 77,700 Expanded investment management platform—recognized $5.6 million in new Tennessee 300 asset management fee revenues in 2018 Texas 1,099,500 75% Increase in fee timberland ownership, 295,100 acres acquired 1,544,500 Pacific Northwest Diversified into the Pacific Northwest—acquired 18,100 acres, primarily Oregon 18,100 sawtimber, and integrated into operations Total 1,562,600 Annual harvest: 136% increase to 2.2 million tons Increased acreage under control and management by 5x IMPROVED EARNINGS DIVERSITY – Adjusted EBITDA by Source3 27% 35% 52% 65% 21% 2014 2018 1. Includes timberlands held by Dawsonville Bluffs and Triple T, in which CTT owns interests. 2. From IPO in December 2013 through December 31, 2018. 6 3. See definition of Adjusted EBITDA, a non-GAAP measure, reconciliation of net income (loss) to Adjusted EBITDA and Adjusted EBITDA by source in Appendix. All data as of 12/31/2018 except otherwise noted.

S T R AT E G I E S P R O D U C E S TA B L E , V I S I B L E , H I G H - Q U A L I T Y C A S H F L O W CatchMark acquires prime timberlands in high-demand mill markets and manages operations to generate highly-predictable and stable cash flow that comfortably covers its dividend and delivers consistent growth through the business cycle. PRIME QUALITY HIGH-DEMAND SUPERIOR MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH DISCIPLINED ACQUISITIONS OF HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT PRIME TIMBERLANDS PROVIDES RELIABLE OUTLET FOR MAXIMIZES CASH FLOWS THROUGHOUT PRODUCES DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY THE BUSINESS CYCLE DRIVES STABILITY AND PREDICTABILITY OF CASH FLOW 7

P R I M E T I M B E R L A N D S , P R E M I E R M A R K E T S , S U P E R I O R M A N A G E M E N T Prime timberlands located in high-demand mill markets and a focus on operations excellence drive CatchMark’s cash flow growth. DISCIPLINED ACQUISITIONS OF HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT PRIME TIMBERLANDS PROVIDES RELIABLE OUTLETS FOR MAXIMIZES CASH FLOWS THROUGHOUT PRODUCES DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY THE BUSINESS CYCLE Since 2013 IPO, acquired high-quality assets with • 95% of CatchMark’s timberlands are located • Outperformed industry peers significantly on a superior stocking and strong productivity in the top four markets in the U.S. South. Harvest EBITDA per acre basis (U.S. South, characteristics: 2017-2018). • Consistently achieve premium pricing in CTT • Increased merchantable inventory by 11.7 markets vs. non-CTT markets. • Established a diversified customer base. million tons.1 • Increased delivered wood sales to creditworthy • Target markets feature favorable current and • Averaged 46 tons per acre of merchantable counterparties—80% of total timber sales long-term supply/demand fundamentals. inventory.1 volume. • Harvest productivity grew from 4.1 tons/acre to • Relationships with industry leading • Maintained long-term supply agreements with 4.6 ton/acre in 2018.1 customers/end users account for 73% of blue-chip mill operators, representing 32% of CatchMark’s annual timber sales revenue, total harvest volume in 2018. • Stocking improved from 38 tons/acre to 43 securing dependable outlets and pricing for tons/acre in 2018.1 • Consistent disposition strategy that achieves harvests. attractive pricing/margins and focuses on non- • Improved average site index for inventory from core assets with lower productivity, only 1%- 68 to 73 and diversified age (older/more 2% of fee acreage annually. mature) classifications.1 • 100% committed to sustainability. • Achieved 25% compound annual growth in revenues. 70% Compound Annual Growth in Adjusted EBITDA Since IPO. As of 12/31/2018. 8 1. U.S. South timberlands only.

C AT C H M A R K H A S A L O W R I S K C A S H F L O W M O D E L CatchMark focuses entirely on investing in and managing timberlands, and does not undertake volatile land development or manufacturing. Timber Commercial/ Operations/Asset Land Sales Residential Land Management (<2% of fee acres) Development Manufacturing CTT ✓ ✓ None None WY ✓ ✓ ✓ ✓ PCH ✓ ✓ None ✓ RYN ✓ ✓ ✓ None Risk LOWER LOW HIGH HIGHER 9

Disciplined Acquisitions 10

O N LY P R I M E T I M B E R L A N D S CatchMark pursues investments in prime timberlands located in leading mill markets, which can produce durable revenue growth. Targeted Areas • Focus on highly-desirable wood basket and mill markets with tight supply/demand dynamics, domestic and international exposure. • Invest in timber with superior stocking characteristics to enhance annual harvest volume. • Seek assets with organic growth potential due to better soil and favorable growing environments. • Diversify holdings to reduce individual market volatility and customer concentration. • Increase returns through operating efficiencies from delivering increased volume to best customers and spreading fixed costs over larger tracts. • Target opportunities for profitable land sales. 11

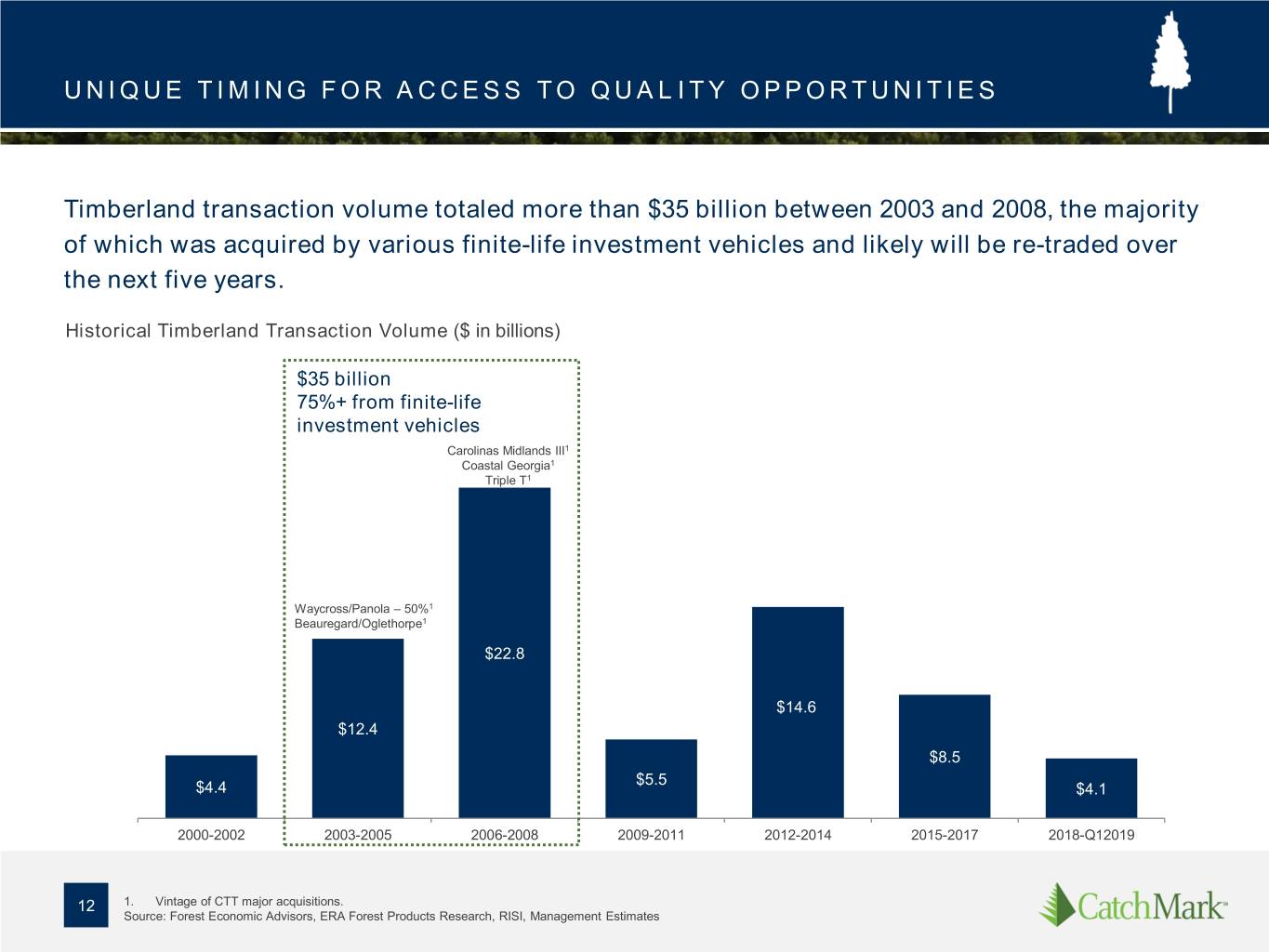

U N I Q U E T I M I N G F O R A C C E S S T O Q U A L I T Y O P P O R T U N I T I E S Timberland transaction volume totaled more than $35 billion between 2003 and 2008, the majority of which was acquired by various finite-life investment vehicles and likely will be re-traded over the next five years. Historical Timberland Transaction Volume ($ in billions) $35 billion 75%+ from finite-life investment vehicles Carolinas Midlands III1 Coastal Georgia1 Triple T1 Waycross/Panola – 50%1 Beauregard/Oglethorpe1 $22.8 $14.6 $12.4 $8.5 $5.5 $4.4 $4.1 2000-2002 2003-2005 2006-2008 2009-2011 2012-2014 2015-2017 2018-Q12019 12 1. Vintage of CTT major acquisitions. Source: Forest Economic Advisors, ERA Forest Products Research, RISI, Management Estimates

IN- D E P T H A C Q U I S I T I O N P R O C E S S CatchMark employs a disciplined five-step process in analyzing and assessing potential new investments to help ensure prudent decision making and successful long-term outcomes. 1. 2. 3. 4. 5. MILL/ COMPS FIELD MODELING/ FORMALIZED MARKET SALES TRIP ANALYSIS APPROVAL STUDY ANALYSIS • Growth/drain ratios • Detailed inventory • Harvest modeling and • Analysis of market trends, • Rigorous review by and • Mill consumption and end- measurement, verification DCF analysis with capital flows and necessary approval from use products • Soil analysis and management cost and valuations. Investment Committee • Cost curves of mills productivity CAPEX assumptions: and Board of Directors. • Property management • Tons / Acre cost analysis • Allocation of • Capital Improvements Softwood Acres • Mill visits • Harvest Productivity • Unleveraged CAD Yield • Unleveraged IRR • Leveraged IRR 13

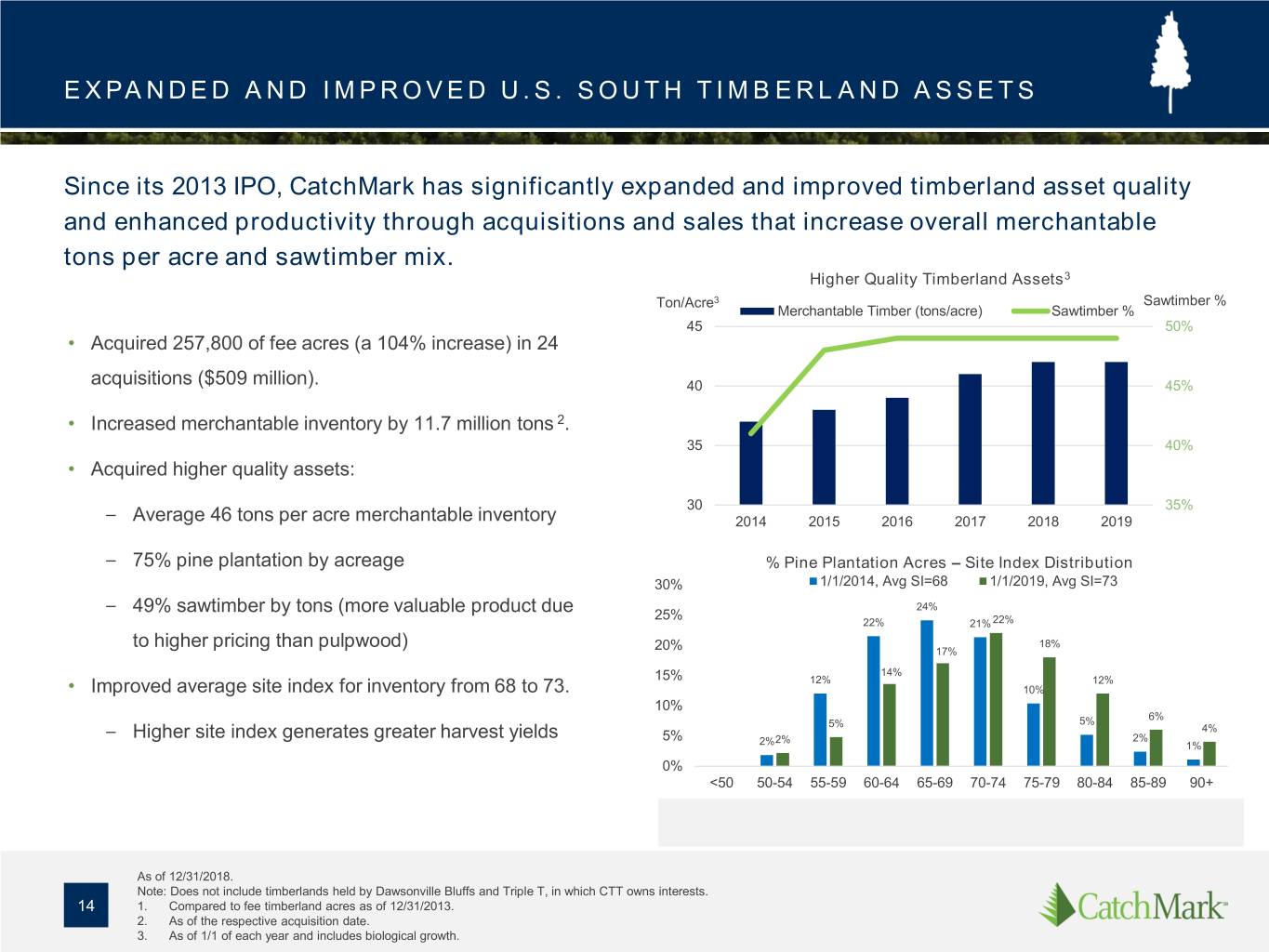

E X PA N D E D A N D I M P R O V E D U . S . S O U T H T I M B E R L A N D A S S E T S Since its 2013 IPO, CatchMark has significantly expanded and improved timberland asset quality and enhanced productivity through acquisitions and sales that increase overall merchantable tons per acre and sawtimber mix. Higher Quality Timberland Assets3 Ton/Acre3 Sawtimber % Merchantable Timber (tons/acre) Sawtimber % 45 50% • Acquired 257,800 of fee acres (a 104% increase) in 24 acquisitions ($509 million). 40 45% • Increased merchantable inventory by 11.7 million tons 2. 35 40% • Acquired higher quality assets: 30 35% – Average 46 tons per acre merchantable inventory 2014 2015 2016 2017 2018 2019 – 75% pine plantation by acreage % Pine Plantation Acres – Site Index Distribution 30% 1/1/2014, Avg SI=68 1/1/2019, Avg SI=73 24% – 49% sawtimber by tons (more valuable product due 25% 22% 21% 22% to higher pricing than pulpwood) 18% 20% 17% 14% 15% 12% 12% • Improved average site index for inventory from 68 to 73. 10% 10% 5% 6% 5% 4% – Higher site index generates greater harvest yields 5% 2% 2% 2% 1% 0% <50 50-54 55-59 60-64 65-69 70-74 75-79 80-84 85-89 90+ As of 12/31/2018. Note: Does not include timberlands held by Dawsonville Bluffs and Triple T, in which CTT owns interests. 14 1. Compared to fee timberland acres as of 12/31/2013. 2. As of the respective acquisition date. 3. As of 1/1 of each year and includes biological growth.

A C Q U I S I T I O N S E N H A N C E O V E R A L L P O R T F O L I O Y I E L D CatchMark’s acquisitions exhibit strong productivity characteristics, which enhance overall portfolio yields. Harvest Volume per Acre (tons) 3.9 6.0 @12/31/13 Comparable Company Data (U.S. South) (10-year Historical Average)1 5.0 Pro forma based on 5-Year Harvest Plan 4.3 - 4.7 4.0 @ 12/31/18 3.9 3.7 3.9 3.5 @12/31/13 3.0 +29% versus 3.0 Comparable Company 2.0 Historical Average 1.0 0.0 WY RYN PCH Average CTT U.S. SOUTH 1. Represents comparable publicly-traded timber company 10-year (2009-2018) historical average in the U.S. South. 15

B A L A N C E D H A R V E S T M I X D R I V E S C A S H F L O W CatchMark is steadily increasing the share of sawtimber in its harvest mix, improving overall asset quality and enhancing prospects for future revenue growth. Average Harvest Mix 2019 – 2023 2011 - 2013 2014 – 2018 (Near-Term Target2) Sawtimber 30% Sawtimber 38% Sawtimber Pulpwood Pulpwood 50% 50% Pulpwood 62% 70% 7% 13% Increase in cash flow with Increase in cash flow with 60% pulpwood/40% sawtimber mix1 50% pulpwood/50% sawtimber mix1 1. When compared to a 70% pulpwood/30% sawtimber mix. Based on current pricing and based on weighted averages. Sawtimber includes chip-n-saw and 16 sawtimber. 2. Does not include recently acquired Pacific Northwest timberlands.

H I G H Q U A L I T Y A N D P R O D U C T I V I T Y D E L I V E R S D U R A B L E E A R N I N G S CatchMark’s U.S. South timberlands are comprised primarily of softwood plantations with superior growing conditions and diversified age classifications, providing long-term harvest yields. Adjusted EBITDA4 Per Weighted Average Share Outstanding $1.20 70% CAGR $1.00 $0.80 $0.60 $0.40 $0.20 $0.00 2013 2014 2015 2016 2017 2018 90,000 Forest Age Class Profile (Pine) As of 12/31/2018 70,000 Natural Pine and Hardwood Acre 2 Pine Plantation Acre 3 1 50,000 Acres 30,000 10,000 3-5 6-8 9-11 12-14 15-17 18-20 21-23 24+ (10,000) 1. Acres presented in the graph includes fee timberland only, excludes 11,700 acres of non-forest land and excludes acres aged 0-2 years. 2. Natural Pine and Hardwood represents acres that have been seeded by standing older pine trees near the site through the natural process of seeds dropping from the cones of the older trees. Natural pine sites generally include some mix of natural occurring hardwood trees as well. 17 3. Pine Plantation represents acres planted or to be planted with pine seedlings to maximize the growth potential and inventory carrying capacity of the soils. Planted pine acre inventory is devoted to pine species only. 4. Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation to net income (loss).

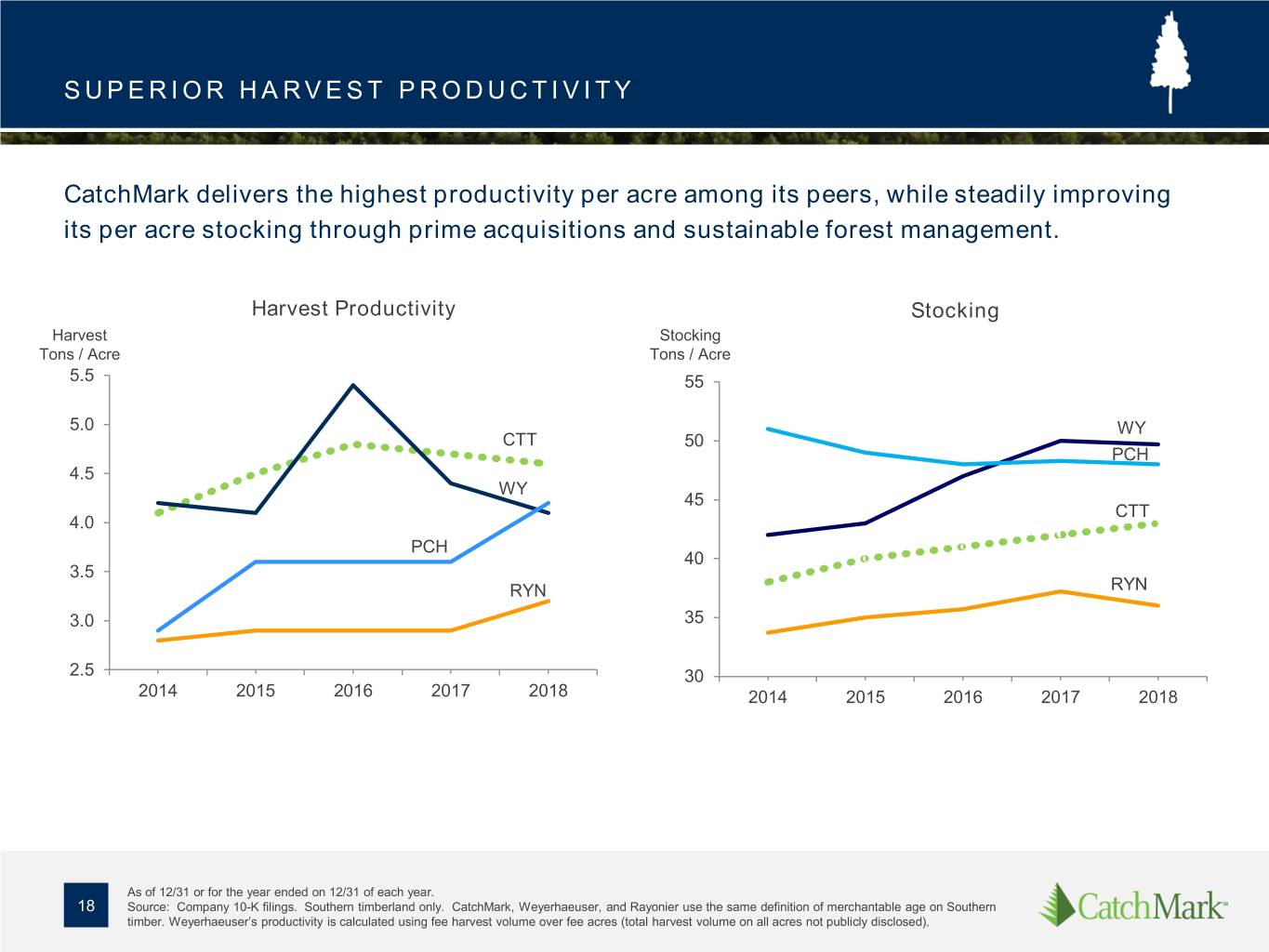

S U P E R I O R H A R V E S T P R O D U C T I V I T Y CatchMark delivers the highest productivity per acre among its peers, while steadily improving its per acre stocking through prime acquisitions and sustainable forest management. Harvest Productivity Stocking Harvest Stocking Tons / Acre Tons / Acre 5.5 55 5.0 WY CTT 50 PCH 4.5 WY 45 CTT 4.0 PCH 40 3.5 RYN RYN 3.0 35 2.5 30 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 As of 12/31 or for the year ended on 12/31 of each year. 18 Source: Company 10-K filings. Southern timberland only. CatchMark, Weyerhaeuser, and Rayonier use the same definition of merchantable age on Southern timber. Weyerhaeuser’s productivity is calculated using fee harvest volume over fee acres (total harvest volume on all acres not publicly disclosed).

U . S . S O U T H : M A R K E T O U T P E R F O R M A N C E Pine Sawtimber1 Pine Pulpwood1 ($ per ton) ($ per ton) Avg Difference = $2.55 $35 Avg Difference = $3.67 Current Difference = $2.01 $15 Current Difference = $3.18 $13 CTT Pine Pulpwood Markets $30 CTT Pine Sawtimber Markets $11 35% 8% $25 $9 Non-CTT Pine Sawtimber Markets Non-CTT Pine Pulpwood Markets $20 $7 2014 2015 2016 2017 2018 2019 2014 2015 2016 2017 2018 2019 Attribute CatchMark - U.S. South U.S. South Average2 Advantage Stocking Level 27 Tons / Acre3 21 Tons / Acre4 29% Site Index5 73 ft. 64 ft.4 14% Pine Pulpwood Pricing $14 / ton6 $9 / ton7 56% Pine Chip-n-Saw Pricing $22 / ton6 $17 / ton7 29% Pine Sawtimber Pricing $25 / ton6 $24 / ton7 4% Pine Plantation Average Age 14 years old 12 years old8 17% As of December 31, 2018 1. Price represents simple average prices as reported by TimberMart-South. 5. Site index is the height, in feet, of a softwood tree at age 25. 2. Privately-owned timberlands; excludes public lands with forests. 6. Reflects CatchMark pricing for 2018. 19 3. Merchantable pine inventory divided by total acreage regardless of cover 7. Represent South-wide annual stumpage prices as published in U.S. South type. Annual Review: 2018 by Timber-Mart South. 4. Source: Forisk Consulting LLC 8. Based on CTT estimate.

D I V E R S I F I C AT I O N I N T O PA C I F I C N O R T H W E S T CatchMark’s 2018 acquisition of 18,100 acres of prime Oregon timberlands diversifies operations into a highly desirable wood basket with tight supply-demand dynamics and improves sawtimber mix. • Prime Stocking: Merchantable stocking of 38 tons/acre, with a five-year average harvest of 79,000 tons per year and superior site index (higher productivity). • Primarily Sawtimber: More than 90% of the expected five-year average harvest volume from sawtimber, high demand, high- price Douglas fir. • Access to Key Export Markets: Exposure to Chinese, Japanese and Korean export markets, which buy approximately 10% of all log harvests. Attribute CatchMark – Pacific Northwest U.S. West Average2 Advantage Sawtimber Volume Represented by 74% 50%3 48% Douglas fir Site Index1 118 ft. 103 ft.4 15% Productive Acres 90% 88%5 2% Douglas-fir Regional Pricing, 2018 $815 / MBF6 $808 / MBF7 1% Note: As of 12/31/2018. 1. Site index in the Pacific Northwest is the height, in feet, of a tree at age 50. 5. Management estimate based on the weighted-average of comparable 2. Privately-owned timberlands; excludes public lands with forests. properties in the region 20 3. Source: U.S. Forest Services, Forest Inventory & Analysis, 2016, for the 6. RISI Log Lines Region 3 Delivered Pricing. coastal regions of Washington and Oregon. 7. RISI Log Lines Region 1-3 Delivered Pricing Average. 4. Source: Forisk Consulting LLC

High-Demand Mill Markets 21

H I G H - D E M A N D M I L L M A R K E T S CatchMark strategically invests in prime timberlands located in leading mill markets to facilitate strong relationships with customers and secure reliable outlets for harvests. In the U.S. South, 95% of CatchMark’s timberlands are • Focus on US South, the largest active wood basin in the located in the top four markets. world and Pacific Northwest, second most active U.S % of CatchMark Market CatchMark market. Market U.S. South Rank Acres1 • Mills cluster near prime timberlands where CatchMark Holdings invests by design. 1 Georgia 290,600 19% • Significant presence of leading lumber producers 2 Florida 2,000 0% provides access to creditworthy counterparties. 3 South Carolina 77,700 5% • Ongoing mill expansions and greenfield projects 4 Texas 1,099,500 71% promise to ramp up demand further, reduce supply and 5 Louisiana - 0% increase prices over time. 6 North Carolina 200 0% 7 Alabama 74,200 5% • Access to forester pools ensures competitive labor 8 Arkansas - 0% costs. 9 Mississippi - 0% • Proximity to transport routes and mills creates cost 10 Virginia - 0% efficiencies from shorter haul distances. 11 Tennessee 300 0% As of 3/31/2019. 1. By acreage. Source: Forisk Consulting LLC, 22

H I G H - D E M A N D M I L L M A R K E T S W I T H S T R O N G F U N D A M E N TA L S CatchMark targets investments in markets with favorable current and long-term supply/demand fundamentals. 23 Source: Forisk Consulting LLC, February 2019

I N D U S T R Y L E A D I N G C U S T O M E R S / E N D U S E R S Strong relationships and supply agreements with leading lumber producers and paper/packaging manufacturers helps secure dependable outlets and pricing for CatchMark’s harvests. Relationships with the following companies account for 73% of CatchMark’s annual timber sales revenue:1 Canfor Top 10 lumber producer in the US with 11 mills and nearly 1,500 MMBF of production capacity Georgia-Pacific #2 US lumber producer-- nearly 3,000 MMBF of production capacity across 27 mills Interfor U.S. Top 5 US lumber producer with nearly 2,000 MMBF of production capacity across 13 mills International Paper World’s largest pulp and paper company‒$21.7B in revenues and 56,000 employees (2017) Norbord #1 producer of Oriented Strand Board in North America Resolute Forest Products Top-tier forest products company‒40 facilities in US and Canada West Fraser #3 lumber producer in US with 15 mills and 2,354 MMBF WestRock #2 packaging company in the world, based on revenues of $14.8 B in 2018, 42,000 employees in 30 countries. 24 1. For the year ended December 31, 2018.

Superior Management 25

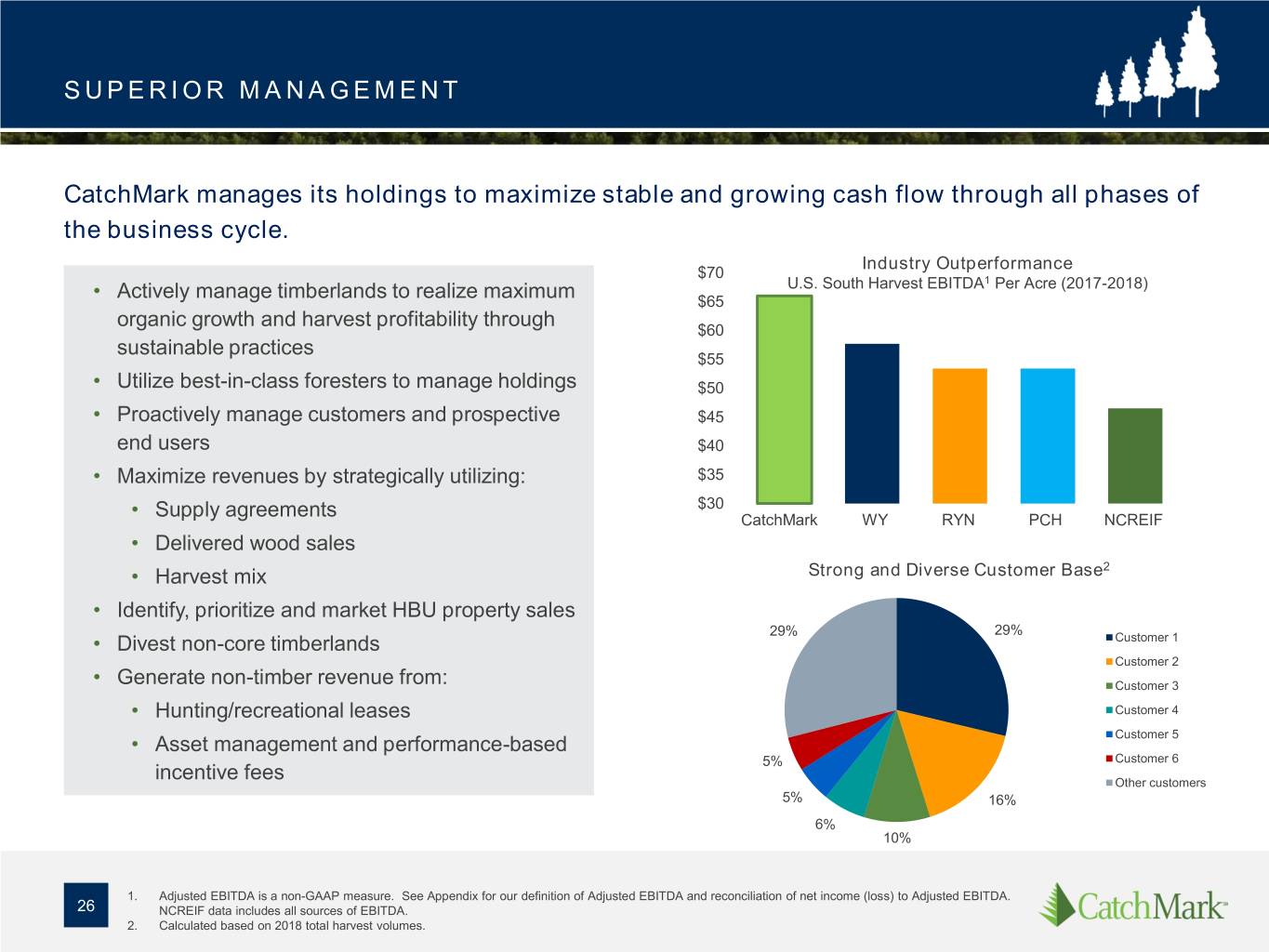

S U P E R I O R M A N A G E M E N T CatchMark manages its holdings to maximize stable and growing cash flow through all phases of the business cycle. Industry Outperformance $70 U.S. South Harvest EBITDA1 Per Acre (2017-2018) • Actively manage timberlands to realize maximum $65 organic growth and harvest profitability through $60 sustainable practices $55 • Utilize best-in-class foresters to manage holdings $50 • Proactively manage customers and prospective $45 end users $40 • Maximize revenues by strategically utilizing: $35 $30 • Supply agreements CatchMark WY RYN PCH NCREIF • Delivered wood sales • Harvest mix Strong and Diverse Customer Base2 • Identify, prioritize and market HBU property sales 29% 29% • Divest non-core timberlands Customer 1 Customer 2 • Generate non-timber revenue from: Customer 3 • Hunting/recreational leases Customer 4 • Asset management and performance-based Customer 5 5% Customer 6 incentive fees Other customers 5% 16% 6% 10% 1. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 26 NCREIF data includes all sources of EBITDA. 2. Calculated based on 2018 total harvest volumes.

D E L I V E R E D W O O D S A L E S A D VA N TA G E S CatchMark’s increasing emphasis on delivered wood sales to creditworthy counterparties—80% of total timber sales volume—keeps better control of supply chain, producing more stable cash flows with greater visibility. Increasing Delivered Wood Sales Volume • Instead of leasing access to third parties to harvest 100% timber (stumpage), delivered wood sales allow 80% CatchMark to direct the harvesting/delivering of wood 60% to end-users. 40% • CatchMark works in concert with loggers to secure 20% more profitable outcomes. 0% 2014 2015 2016 2017 2018 • By focusing activity in top-tier mill markets and using Delivered % of total volume Stumpage % of total volume delivered sales, CatchMark establishes direct Delivered Wood Sales of Pure-Play Timberland REITs relationships with leading end-users and becomes a preferred supplier. Delivered Wood Sales as % of Total Volume 2014 2015 2016 2017 2018 CatchMark 70% 60% 64% 74% 80% RYN 39% 39% 39% 34% 40% 27

L O N G - T E R M S U P P LY A G R E E M E N T S CatchMark employs long-term supply agreements with creditworthy mill operators, establishing stable baseload demand and corresponding cash-flow visibility, lowering risk in down markets. • Initial agreement terms range between 10 and 25 years. 32% of 2018 Total Harvest Volume from Key Counterparties • Quarterly pricing adjustments capture market pricing International WestRock • Represent 33% of total harvest volume in 2018 Paper (IP) (WRK) – 93% of this volume is pulpwood Market Cap1 $18.8B $9.8 B • 95% of CatchMark acres in regions covered by Moody’s: Baa2 Moody’s: Baa2 agreements are located close to mills (within a 75-mile Credit Rating2 S&P: BBB S&P: BBB radius). Consumer Mill Type Pulp/Paper packaging, lumber Food, beverage, Healthcare, merchandising Uses printing, writing, displays, building consumer products products Demand Outlook Stable Stable/Growing 1. As of 04/30/2019 Source: NASDAQ. 2. As of 04/30/2019 Source: Moody’s and S&P 28

L A N D S A L E S T R AT E G Y S U P P L E M E N T S P O R T F O L I O R E T U R N S CatchMark undertakes selective land sales to take advantage of buyer demand for higher-and- better use (HBU) opportunities, divesting assets with stocking below portfolio averages and augmenting overall portfolio returns. Land Sale Revenue and % Fee Acres Disposition Strategy Thousands $20,000 2.0% Land Sales $ % Fee Acres • Focus on non-core operating assets: $18,000 1.8% $16,000 1.6% – Heavy to hardwood mix $14,000 1.4% $12,000 1.2% – Poor productivity $10,000 1.0% • Target HBU buyers looking at $8,000 0.8% $6,000 0.6% development, conservation, recreational $4,000 0.4% uses at prices above traditional timberland $2,000 0.2% $- 0.0% values 2014 2015 2016 2017 2018 • Use timber reservations to enhance returns on sales Land Sales Data 2014 2015 2016 2017 2018 • Lower execution risk by targeting 1% - 2% Price per acre1 $2,382 $1,849 $1,718 $1,924 $2,064 of fee acreage annually Margin1 48% 18% 17% 29% 23% Stocking (tons/acre)2 46 33 20 27 26 Premium (Discount) of Stocking to CTT Portfolio 21% (18%) (51%) (36%) (38%) Average 1. Excludes value of timber reservations. 29 2. Stocking refers to merchantable timber inventory per acre. CatchMark considers 15-year or older pine as merchantable.

1 0 0 % C O M M I T T E D T O S U S TA I N A B I L I T Y Conscientious forest management serves investors by promoting a healthier environment and enhancing the potential market value of our timberland assets. 100% 9M ALL OUR TIMBERLANDS ARE CERTIFIED WE PLANTED MORE THAN SUSTAINABLE BY THE SUSTAINABLE FOREST 9 MILLION TREES IN 2018 INITIATIVE® 4:1 40M FOR EVERY TREE WE HARVEST, SINCE 2013, WE’VE PLANTED APPROXIMATELY WE PLANT FOUR SEEDLINGS1 40 MILLION TREES * SFI Re-certification Audit (2018) 30 1. Excludes trees cut in thinning operations.

Capital Strategy 31

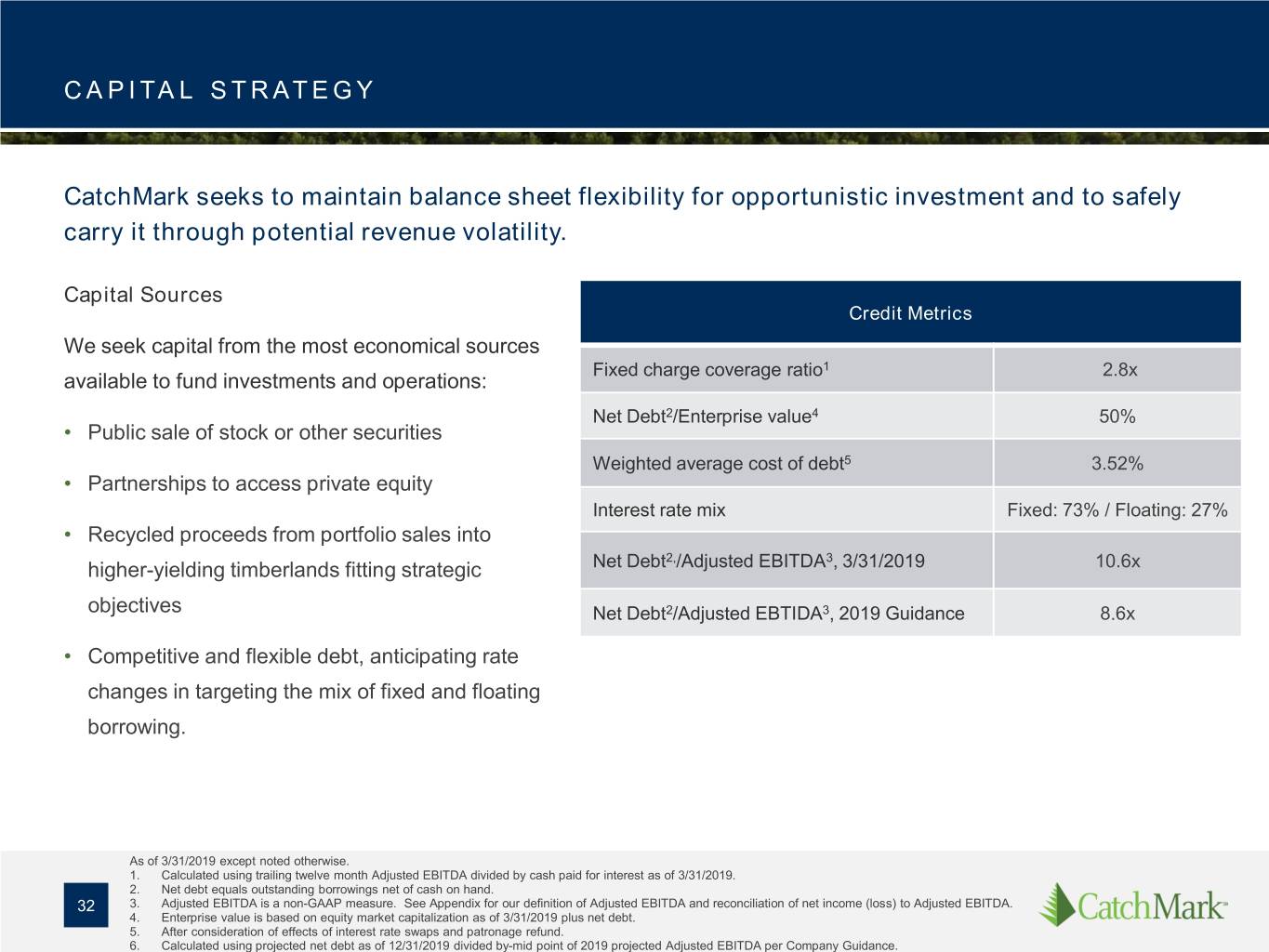

C A P I TA L S T R AT E G Y CatchMark seeks to maintain balance sheet flexibility for opportunistic investment and to safely carry it through potential revenue volatility. Capital Sources Credit Metrics We seek capital from the most economical sources Fixed charge coverage ratio1 2.8x available to fund investments and operations: Net Debt2/Enterprise value4 50% • Public sale of stock or other securities Weighted average cost of debt5 3.52% • Partnerships to access private equity Interest rate mix Fixed: 73% / Floating: 27% • Recycled proceeds from portfolio sales into 2, 3 higher-yielding timberlands fitting strategic Net Debt /Adjusted EBITDA , 3/31/2019 10.6x objectives Net Debt2/Adjusted EBTIDA3, 2019 Guidance 8.6x • Competitive and flexible debt, anticipating rate changes in targeting the mix of fixed and floating borrowing. As of 3/31/2019 except noted otherwise. 1. Calculated using trailing twelve month Adjusted EBITDA divided by cash paid for interest as of 3/31/2019. 2. Net debt equals outstanding borrowings net of cash on hand. 32 3. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA. 4. Enterprise value is based on equity market capitalization as of 3/31/2019 plus net debt. 5. After consideration of effects of interest rate swaps and patronage refund. 6. Calculated using projected net debt as of 12/31/2019 divided by-mid point of 2019 projected Adjusted EBITDA per Company Guidance.

A C C E S S T O P R I VAT E C A P I TA L CatchMark gains scale and diversification by partnering with major institutions aligned with company investment objectives. Triple T Dawsonville Bluffs • $1.39 billion acquisition of 1.1 million acres of high- • $20 million acquisition of 11,000 acres of prime quality industrial East Texas timberlands in July 2018 timberlands in North Georgia • CatchMark tripled its acreage under management by • 50/50 joint venture fund, formed April 2017 investing $200 million in this transaction. • Partner: Missouri Department of Transportation & • Partners: Consortium of institutional investors Patrol Retirement System (MPERS) 33

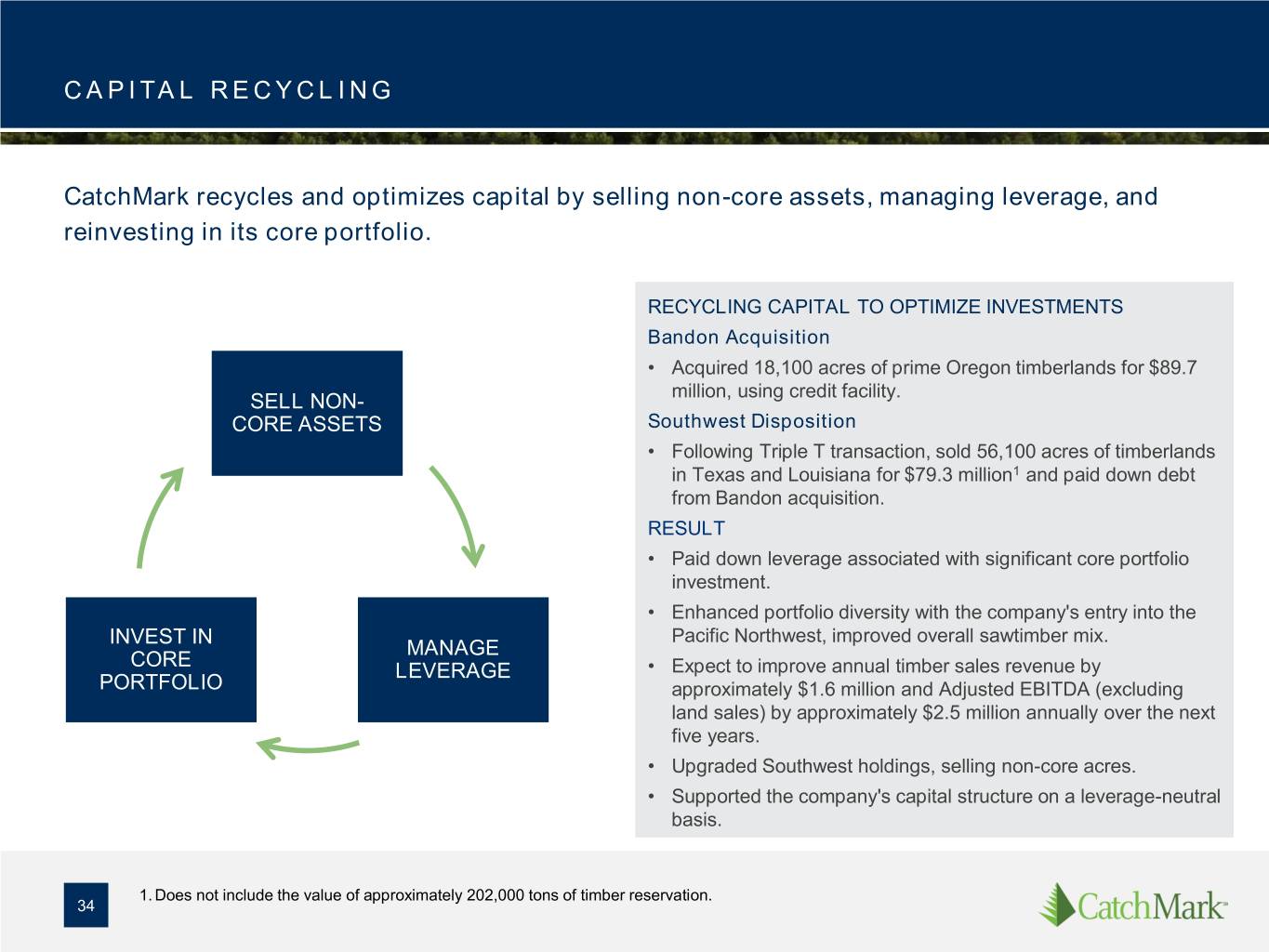

C A P I TA L R E C Y C L I N G CatchMark recycles and optimizes capital by selling non-core assets, managing leverage, and reinvesting in its core portfolio. RECYCLING CAPITAL TO OPTIMIZE INVESTMENTS Bandon Acquisition • Acquired 18,100 acres of prime Oregon timberlands for $89.7 SELL NON- million, using credit facility. CORE ASSETS Southwest Disposition • Following Triple T transaction, sold 56,100 acres of timberlands in Texas and Louisiana for $79.3 million1 and paid down debt from Bandon acquisition. RESULT • Paid down leverage associated with significant core portfolio investment. • Enhanced portfolio diversity with the company's entry into the INVEST IN Pacific Northwest, improved overall sawtimber mix. MANAGE CORE LEVERAGE • Expect to improve annual timber sales revenue by PORTFOLIO approximately $1.6 million and Adjusted EBITDA (excluding land sales) by approximately $2.5 million annually over the next five years. • Upgraded Southwest holdings, selling non-core acres. • Supported the company's capital structure on a leverage-neutral basis. 1. Does not include the value of approximately 202,000 tons of timber reservation. 34

S O L I D C A P I TA L P O S I T I O N A sound credit profile and access to multiple forms of capital provide a clear path for funding future CatchMark growth opportunities. Liquidity Credit Facilities and Maturity Schedule Total Credit Facilities of $643.6 Million Weighted-Average Life of Outstanding Debt is 6.8 Years $ Millions $ Millions Acquisition facility RLOC Cash 180 250 160 $2.4M $35M 140 $200M MDTL $100M 120 200 Term Loan 100 No debt maturities $140M until late 2024. $130M $167.4M Term 80 Well-laddered Loan 150 maturity schedule: 60 $130M No more than 27% of $100M 40 total capacity due in Term Loan any one year. 20 100 $70M $68.6M - Term Loan 50 $35M RLOC $0 $0 $0 $0 $0 0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Debt Available Debt Outstanding 35 As of 3/31/2019.

C A P I TA L A L L O C AT I O N S CatchMark prudently allocates capital to fund growth through investments, make sustainable distributions to deliver current income to its investors, opportunistically repurchase shares at attractive prices, and provide for reinvestment needs to sustain portfolio value. Allocation of Capital Millions $350 Investments Dividends Share Repurchases CAPEX $325 1% 0.5% $300 8% $275 $250 6% $225 $200 $175 2% 2% 90.5% $150 12% $125 94% $100 6% 3% 19% 1.5% 6% $75 83% 23.5% $50 72% 69% $25 $0 2014 2015 2016 2017 2018 36

C O N S I S T E N T D I V I D E N D C O V E R A G E CatchMark generates highly-predictable and stable cash flows that comfortably cover its dividend. • 100% of CatchMark’s 2018 dividends were treated as return of capital, largely due to non-cash depletion expense deduction. • Payout target: 75%-85% of cash available for distribution. • Sustainable harvest volumes from acquisitions and/or lasting product price appreciations support dividend growth. 2018 Tax Treatment CTT RYN PCH WY CAD2 Payout Ratio 2014-2018 Total 1 Dividend Yield (before tax) 7.6% 3.8% 5.1% 6.0% CTT 77% % Return of Capital 100% 0% 0% 0% RYN 98% % Capital Gain 0% 100% 100% 100% WY 108% % Ordinary Income 0% 0% 0% 0% Dividend Yield (after tax)1 7.6% 3.1% 4.1% 4.8% PCH 77%3 1. Calculated based on respective closing price as of 12/31/2018. 2. Cash Available for Distributions (CAD) is a non-GAAP measure. See Appendix for our reconciliation of CAD to cash provided by operating activities. 37 3. Excludes special dividend made related to the Potlatch Deltic merger to satisfy distribution requirements under the REIT rules. Sources: Company filings.

Triple T Timberlands 38

T R I P L E T I N V E S T M E N T — D U R A B L E G R O W T H , F E E R E V E N U E , U P S I D E CatchMark’s $200 million investment in the $1.39 billion Triple T joint venture provides substantial upside potential from an improving inventory profile, opportunities to unlock future value through sophisticated harvest management, and significant ongoing asset management fee income as well as incentive-based promotes. • Immediately CAD Accretive: The JV secures ongoing asset management fee income and potential for attractive promotes. • Rapidly Improving Inventory Profile: Results in enhanced future harvests and provides the opportunity to restructure operations to optimize cash flow and value. Since acquisition, merchantable inventory has improved from 38.7 million tons to 42.9 million tons1. • Ability to Recapitalize: CatchMark can recapitalize the asset in the future, retaining long-term ownership control. • High-Quality Portfolio: Triple T fits CatchMark’s profile for high-quality timberland assets with excellent stocking that can provide durable growth for shareholders. • Unlocking Future Value: CatchMark has identified opportunities to unlock future value, including optimizing inventory and delivery on existing long-term supply agreements. • Expanded Investment Management Business: CatchMark has expanded its investment management business, supplementing harvest revenues with additional fee income to support its dividend and growth strategy. 1. As of 12/31/2018. The Triple T Joint Venture considers inventory to be merchantable at age 12. Merchantable timber inventory includes 39 growth and adjustments identified during the annual recruise of the Triple T Timberlands.

Summary 40

S U M M A R Y CatchMark acquires prime timberlands in high-demand mill markets and manages operations to generate highly-predictable and stable cash flow that comfortably covers its dividend and delivers consistent growth through the business cycle. PRIME QUALITY HIGH-DEMAND SUPERIOR MANAGEMENT PREDICATABLE TIMBERLANDS MILL MARKETS CASH FLOW GROWTH DISCIPLINED ACQUISITIONS OF HIGH-DEMAND MILL MARKETS SUPERIOR MANAGEMENT PRIME TIMBERLANDS PROVIDES RELIABLE OUTLET FOR MAXIMIZES CASH FLOWS THROUGHOUT PRODUCES DURABLE REVENUE GROWTH AVAILABLE MERCHANTABLE INVENTORY THE BUSINESS CYCLE DRIVES STABILITY AND PREDICTABILITY OF CASH FLOW 41

Appendix 42

A D J U S T E D E B I T D A Earnings before Interest, Taxes, Depletion, and Amortization (“EBITDA”) is a non-GAAP measure of operating performance. EBITDA is defined by the SEC however, we have excluded certain other expenses which we believe are not indicative of the ongoing operating results of our timberland portfolio, and we refer to this measure as Adjusted EBITDA. As such, our Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies and should not be considered in isolation or as an alternative to, or substitute for net income, cash from operations, or other financial statement data presented in our consolidated financial statements as indicators of our operating performance. Due to the significant amount of timber assets subject to depletion, significant income (losses) from unconsolidated joint ventures based on HLBV, and the significant amount of financing subject to interest and amortization expense, management considers Adjusted EBITDA to be an important measure of our financial performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of the limitations are: • Adjusted EBITDA does not reflect our capital expenditures, or our future requirements for capital expenditures; • Adjusted EBITDA does not reflect changes in, or our interest expense or the cash requirements necessary to service interest or principal payments on, our debt; and • Although depletion is a non-cash charge, we will incur expenses to replace the timber being depleted in the future, and Adjusted EBITDA does not reflect all cash requirements for such expenses. • Although HLBV income and losses are primarily hypothetical and non-cash in nature, Adjusted EBITDA does not reflect cash income or losses from unconsolidated joint ventures for which we use the HLBV method of accounting to determine our equity in earnings. Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Our credit agreement contains a minimum debt service coverage ratio based, in part, on Adjusted EBITDA since this measure is representative of adjusted income available for interest payments. 43

R E C O N C I L I AT I O N O F N E T I N C O M E ( L O S S ) T O A D J U S T E D E B I T D A (in thousands unless otherwise noted) 2014 2015 2016 2017 2018 Net Income (loss) $660 $(8,387) $(11,070) $(13,510) $(122,007) Add: Depletion 14,788 27,091 28,897 29,035 25,912 Basis of timberland sold, lease terminations and other1 5,072 8,886 10,089 10,112 13,053 Amortization2 836 765 1,093 1,270 2,821 Depletion, amortization, and basis of timberland and mitigation tax credits sold included in loss from unconsolidated — — — 865 4,195 Dawsonville Bluffs Joint Venture 3 HLBV (income) loss from unconsolidated joint venture4 — — — — 109,550 Stock-based compensation expense 418 889 1,724 2,786 2,689 Interest expense2 1,897 2,924 5,753 10,093 13,643 (Gain) loss from large dispositions5 — — — — 390 Other6 151 111 322 1,319 (460) Adjusted EBITDA $23,822 $32,279 $36,808 $41,970 $49,786 1. Includes non-cash basis of timber and timberland assets written-off related to timberland sold, terminations of timberland leases and casualty losses. Certain prior periods amounts have been reclassified to conform with the current presentation. 2. For the purpose of the above reconciliation, amortization includes amortization of deferred financing costs, amortization of intangible lease assets, and amortization of mainline road costs, which are included in either interest expense, land rent expense, or other operating expenses in the accompanying consolidated statements of operations. 3. Reflects our 50% share of depletion, amortization, and basis of timberland and mitigation credits sold of the unconsolidated Dawnsonville Bluffs, LLC joint venture. 4. Reflects HLBV (income) losses from the Triple T Joint Venture, which is determined based on a hypothetical liquidation of the underlying joint venture at book value as of the reporting date. 5. Large dispositions are defined as larger transactions in acreage and gross sales price than recurring HBU sales. Large dispositions are not part of core operations, are infrequent in nature and would cause material variances in comparative results if not reported separately. Large dispositions may or may not have a higher or better use than timber production or result in a price premium above the land’s timber production value. 6. Includes certain gains, reimbursements, losses and/or expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities. 44

A D J U S T E D E B I T D A B Y S O U R C E (in thousands) 2014 2015 2016 2017 2018 Timber sales $40,635 $52,837 $65,035 $71,353 $69,455 Other revenue 3,026 4,440 4,305 5,066 5,279 (-) Contract logging and hauling costs (17,322) (19,911) (25,918) (31,108) (31,469) (-) Forestry management expenses (3,567) (4,495) (6,092) (6,758) (6,283) (-) Land rent expense (831) (736) (625) (621) (660) (-) Other operating expenses (2,942) (4,295) (5,017) (5,264) (6,303) (+) Other1 160 268 784 1,187 1,172 Harvest EBITDA $19,159 $28,108 $32,472 $33,855 $31,191 Timberland sales $10,650 $11,845 $12,515 $14,768 $17,520 (-) Cost of timberland sales (5,558) (9,747) (10,405) (10,423) (13,512) (+) Basis of timberland sold 5,072 8,886 9,728 9,890 12,380 Real Estate EBITDA $10,164 $10,984 $11,838 $14,235 $16,388 Asset Management Fees - - - $108 $5,603 Unconsolidated Joint Venture EBITDA - - - 2,003 6,828 Investment Management EBITDA - - - $2,111 $12,431 Total Operating EBITDA $29,323 $39,092 $44,310 $50,201 $60,010 (-) General and administrative expense $(6,185) $(7,667) $(9,309) $(11,660) $(12,425) (+) Stock-based compensation 342 718 1,411 1,956 2,356 (+) Interest Income 177 6 44 113 262 (+) Other1 165 130 352 1,360 (417) Non-allocated / Corporate EBITDA $(5,501) $ (6,811) $(7,502) $(8,231) $(10,224) Adjusted EBITDA $23,822 $32,279 $36,808 $41,970 $49,786 Net Debt to Adjusted EBITDA 4.3x 5.5x 8.6x 7.9x 9.5x 1. Other includes (a) non-cash items: amortization, depreciation, stock-based compensation, casualty loss, and other timber asset basis removed; and (b) 45 certain cash expenses that management believes do not directly reflect the core business operations of our timberland portfolio on an on-going basis, including costs required to be expensed by GAAP related to acquisitions, transactions, joint ventures or new business activities.

C A S H AVA I L A B L E F O R D I S T R I B U T I O N (in thousands, except per share data) 2014 2015 2016 2017 2018 Cash Provided by Operating Activities $19,845 $28,494 $30,849 $27,419 $29,796 Capital expenditures (excluding timberland acquisitions) (906) (2,668) (3,195) (5,617) (4,571) Working capital change 1,929 750 (116) 1,136 3,751 Distributions from unconsolidated joint ventures - - - - 4,744 Other 151 111 322 1,319 (460) Cash Available for Distribution (1) $21,019 $26,687 $27,860 $24,257 $33,260 Adjusted EBITDA (2) $23,822 $32,279 $36,808 $41,970 $49,786 Interest paid (1,897) (2,924) (5,753) (10,093) (13,643) Capital expenditures (excluding timberland acquisitions) (906) (2,668) (3,195) (5,617) (4,571) Distributions from unconsolidated joint ventures - - - - 8,516 Adjusted EBITDA from unconsolidated joint ventures - - - (2,003) (6,828) Other - - - - - Cash Available for Distribution (1) $21,019 $26,687 $27,860 $24,257 $33,260 Dividends paid $15,336 $19,590 $20,382 $21,349 $25,601 Weighted-average shares outstanding, end of period 31,568 39,348 38,830 39,751 47,937 Dividends per Share $0.47 $0.50 $0.53 $0.54 $0.54 Payout Ratio 73% 73% 73% 88% 77% 1. Cash Available for Distribution is a non-GAAP measure. See Appendix for our definition of Cash Available for Distribution. 46 2. Adjusted EBITDA is a non-GAAP measure. See Appendix for our definition of Adjusted EBITDA and reconciliation of net income (loss) to Adjusted EBITDA.

C A D R E C O N C I L I AT I O N A N D D I V I D E N D PAY O U T R AT I O C A L C U L AT I O N (Dollars in millions) RAYONIER (RYN) 2014 2015 2016 2017 2018 Dividends Paid $257.5 $124.9 $122.8 $127.1 $136.8 Cash provided by operating activities, as reported $320.4 $177.2 $203.8 $256.3 $310.1 (-) Capital Expenditures (excluding timberland acquisitions) (63.7) (57.3) (58.7) (65.3) (62.3) (-) Working capital changes (39.5) (2.5) (0.8) (2.3) (7.7) (-) Other2 (123.8) - - - - CAD $93.4 $117.4 $144.3 $188.7 $240.1 Payout Ratio 276% 106% 85% 68% 57% WEYERHAEUSER (WY) 20141 20151 2016 2017 2018 Dividends Paid $563 $619 $932 $941 $136.8 Cash provided by operating activities, as reported $1,088 $1,064 $735 $1,201 $1,112.0 (-) Capital Expenditures (excluding timberland acquisitions) (395) (483) (510) (419) (370) +/(-) Working capital changes 160 10 (129) (30) 227 (+) Incomes taxes paid for discontinued operations - - 243 - - CAD $853 $591 $339 $752 $969 Payout Ratio 66% 105% 275% 125% 103% POTLATCHDELTIC (PCH) 2014 2015 2016 2017 20183 Dividends Paid $57.8 $61.0 $60.8 $61.9 $102.3 Cash provided by operating activities, as reported $131.4 $74.0 $102.1 $162.7 $178.9 (-) Capital Expenditures (excluding timberland acquisitions) (24.2) (32.7) (19.3) (28.1) (52.1) +/(-) Working capital changes (7.2) 4.8 13.8 13.4 - CAD $100.0 $46.1 $96.6 $148.0 $126.8 Payout Ratio 58% 132% 63% 42% 76% 1. Weyerhaeuser's 2014 and 2015 numbers were calculated from its Form 10-K filed in 2015. 2. For 2014, Other includes $21.4M adjustment for large dispositions and $102.4M adjustment for cash flows from discontinued operations, as reported in 47 Rayonier’s 2016 Form 10K. 3. Excludes special dividend made related to the Potlatch Deltic merger to satisfy distribution requirements under the REIT rules. Sources: Company filings.

H I G H LY E X P E R I E N C E D M A N A G E M E N T T E A M CatchMark’s seasoned leadership provides significant industry experience and capability to help realize company objectives and growth plan. Jerry Barag, Chief Executive Officer Brian Davis, President and Chief Financial Officer • Over 30 years of real estate, timberland and investment • More than 25 years of experience in business and financial experience, including expertise in acquisitions, divestitures, services, and has held key roles in finance, treasury, and asset management, property management and financing strategy • Managing Director and Founder TimberStar Advisors and • Senior Vice President and Chief Financial Officer of Wells TimberStar Timberland • Chief Investment Officer at Lend Lease Real Estate • Various finance roles with SunTrust Bank and CoBank, Investments delivering capital market solutions – advisory, capital raising, and financial risk management to public and private • Executive Vice President, Equitable Real Estate companies. Todd Reitz, Senior Vice President, Forestry Operations Lesley H. Solomon, General Counsel and Corporate Secretary • More than 20 years in the timber industry • Over 20 years experience in REIT industry • Atlantic South Regional Marketing Manager for • Former partner with Alston & Bird Weyerhaeuser with operational oversite for all log and • Experience representing public and private companies and pulpwood production from East Alabama to Virginia investment banks in equity and debt financings and mergers • Previous roles with Weyerhaeuser, Plum Creek and Stone and acquisitions with a focus on real estate investment trusts Container Corporation – extensive marketing, harvesting, and financial institutions. silviculture and business development experience across the • Specialist in public company compliance with SEC U.S. South from East Texas to Virginia. regulations, stock exchange policies, Dodd-Frank and Sarbanes-Oxley requirements. John D. Capriotti Ursula Godoy-Arbelaez Vice President – Acquisitions Vice President and Treasurer Donald L. Warden Glen F. Smith Vice President - Real Estate and Alternative Income Chief Accounting Officer, Vice President and Assistant Secretary 48