UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21839

AARP PORTFOLIOS

(Exact name of registrant as specified in charter)

650 F Street, NW

Washington, DC 20004-1604

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Jeff Gaboury AARP Financial Incorporated Two Highwood Drive, Suite 202 Tewksbury, MA 01876 | | Gary O. Cohen, Esq. Jorden Burt LLP 1025 Thomas Jefferson Street, NW Suite 400 East Washington, DC 20007-5208 |

Registrant’s telephone number, including area code: (202) 434-3650

Date of fiscal year end: June 30

Date of reporting period: June 30, 2010

| Item 1. | Report to Shareholders |

Annual Report

June 30, 2010

U.S. Bond Market Portfolio

U.S. Stock Market Portfolio

International Stock Market Portfolio

…

A NOTE ABOUT AARP PORTFOLIOS

The series, “Portfolios”, of AARP Portfolios seek to match the performance of market indexes for U.S. stocks, international stocks, and U.S. bonds. They serve as the underlying investments to the AARP Funds’ asset allocation funds, which include the AARP Conservative Fund, AARP Moderate Fund, AARP Aggressive Fund, and AARP Income Fund, (collectively,) (“the Fund”).’s

Shares of AARP Portfolios are not offered to the public for investment.

An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get a prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

AARP Funds are distributed by ALPS Distributors, Inc.

Table of Contents

An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get a prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

AARP Funds are distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 1 |

U.S. Bond Market Portfolio

| | | | | | | | |

| |

Portfolio composition (As a percentage of net assets) |

| June 30, 2010 | | | | | | | | |

| | | | | |

Mortgage-backed securities | | 34.4% | | | | Municipal bonds | | 0.5 % |

| |

U.S. Treasury | | 32.2% | | | | Asset-backed securities | | 0.3 % |

| |

Corporate bonds | | 18.1% | | | | Cash equivalents | | 3.4 % |

| |

U.S. Government Agencies | | 6.6% | | | | Other assets and liabilities, net | | (3.8)% |

| |

International debt | | 5.1% | | | | Total net assets | | 100.0 % |

| | | | | | | |

Commercial mortgage-backed securities | | 3.2% | | | | | | |

| | | | | | | |

See Notes to Financial Statements. | | | | | | | | |

| | | | |

| |

Performance as of June 30, 2010 |

| | | |

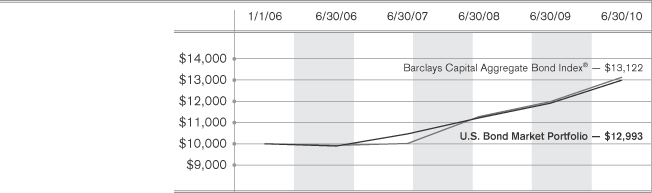

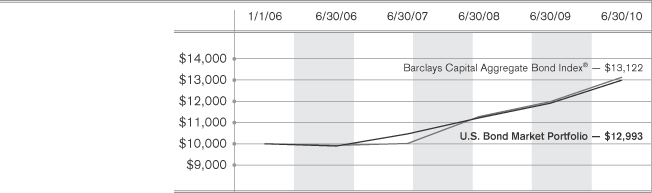

| Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the U.S. Bond

Market Portfolio from

December 30, 2005

(inception date) through

June 30, 2010, compared to

the Barclays Capital

Aggregate Bond Index®. | |  | | |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | |

| Performance Summary | | Average Annual Returns as of June 30, 2010 | | 1-Year | | 3-Years | | Since

inception |

| | | |

| | | U.S. Bond Market Portfolio | | 9.12% | | 7.47% | | 5.99%1 |

| | | |

| | | Barclays Capital Aggregate Bond Index® | | 9.50% | | 7.55% | | 6.20%1 |

| | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal

value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund

performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds

are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Fund assumes the

reinvestment of all dividends and distributions. The index above has been adjusted to reflect reinvestment of dividends on

securities in the index. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been

waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457. 1 For the period from December 30, 2005 (inception date) to June 30, 2010. Sources: Barclays Capital, Inc., AARP Financial |

| | | | |

| 2 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

Barclays Capital Aggregate Bond Index*

This index serves as the benchmark for the U.S. Bond Market Portfolio. The index includes a large variety of U.S. bonds that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset-backed securities. The index is unmanaged and you cannot directly invest in it. In addition, indexes do not have expenses.

U.S. Bond Market Portfolio

The fund seeks to replicate the total return of the Barclays Capital Aggregate Bond Index.

For the 12-month period ending June 30, 2010, the U.S. Bond Market portfolio returned +9.12%, net of fees, versus the benchmark return of +9.50%. The index return reflects all items in terms of income, gain and loss, and the reinvestment of other income.*

At the start of the 3rd quarter 2009, signs that the U.S economy was getting back on track continued to emerge. The U.S. Congress provided an additional $2 Billion to the “cash for clunkers” program, which was spurring much-needed demand for the auto industry. Further good news included a slowing in the economy’s overall decline, as U.S. GDP contracted only -0.7% in the second quarter versus the -1% previously estimated. By comparison, GDP fell -6.4% in the 1st quarter of 2009 and -5.4% in the 4th quarter of 2008. This improvement was spurred by inventory replacement activity and increased Government spending. At the same time, the Eurozone saw its highest unemployment in 10 years, as prices declined, indicating continued challenges for our overseas trading partners. Japan elected a new party into power for the first time since 1955, raising questions about policy changes for the future.

The 4th quarter saw Treasury rates rise across the maturity spectrum, with 10-year maturities higher by 0.53% at quarter-end. In October, the global economy continued to build a foundation for growth as the market crisis moved further into the past, with many areas of Asia experiencing the strongest results. While the end of November brought concerns in the form of Dubai World’s refinancing challenges, within a week an announcement its debt would be restructured defused the situation and a feared global contagion never ensued. December, true to form with the rest of the year, saw continued enthusiasm for risk taking across all areas of the fixed income markets globally. At year end, the U.S. economy was showing continued positive signs as the dollar reversed its course to the upside. While the first few months of 2009 saw equity markets continue their swoon from 2008, by year-end they had turned universally positive around the globe, in many cases in spectacular fashion. The S&P 500 ended up +23.5%, with the Dow Jones World ex-U.S. up 37.0%. Commodities found strength in a global economy that seemed to have turned the corner by year-end, with oil rising +77.9% for the year. Amidst the celebration for all things risky, pity the poor Treasury investor. The sector experienced one of the worst results on record, with a -3.57% overall return for the year. Certainly, the fact there was $2.1 trillion in issuance, the highest on record, had something to do with this.

Near the beginning of the 1st quarter 2010, it was announced that U.S. gross domestic product (GDP) growth for the last quarter of 2009 had actually reached a six year high, largely because inventories continued to liquidate more slowly. Even so, risk taking in the global

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 3 |

capital markets softened somewhat in January, as investors began to worry about the robustness of sovereign credits in the face of continued hand-wringing over the health of the Greek economy, a lack of confidence in vacillating government policy statements, and continued questioning of just how solid the outlook for global recovery really was. By month-end, U.S. equity markets had actually turned in their worst performance in about a year, with the S&P 500 index down -3.7%, and corporate spreads widening across the board. As February dawned, at an international gathering of economic leaders in Switzerland, the International Monetary Fund (IMF) chief urged governments to continue with fiscal stimulus at the risk of heightened inflation down the road, as the world’s economy remained at risk of another downturn. February saw the markets vacillate between positive and negative sentiment with regard to risk-taking as economic statistics were similarly mixed. However, despite some slippage in the final week the S&P 500 was up 3.1% by month-end, with Treasury rates higher and corporate bond performance mixed. March saw the bulls take charge. By quarter-end, the Dow Industrials had turned in their best first quarter since 1999, based on corporate earnings continuing to come in stronger than expectations.

Risky assets recorded their best performance of the year early in the second quarter of 2010, with broad indices peaking in late April. The bond market in the US benefited from the instability in Europe and subsequent movement into dollar denominated assets. It was able to absorb near record supply of new issue investment grade debt and significant supply in government debt without any perceptible price concession. Investment grade credit spreads in fact had tightened to such a degree that the Investment Grade Index was trading at a very tight level of 87 basis points above comparable dated Treasuries. The high yield market benefited from strong retail investor flows, bidding up the price and lowering the effective yield of the index through 8.5%. Even structured finance bonds performed well, Commercial Mortgage Backed Bonds broke through the +400 spread level and reached a tighter spread in early April of +350.

By mid June, after teetering on the edge of the abyss, secondary markets in risky assets began to return to some sense of normalcy. Retail flows that had been so negative in the mid part of the quarter began to reverse themselves. The economic picture remained mixed, however, and real concerns about a double dip persisted through the end of the quarter. The employment picture in the US remains tepid at best. In reaction to European debt concerns, some governments have floated the idea of fiscal austerity programs. They are being feared by some economists as too much too soon given the frail state of the financial markets. The quarter finished with two year US Treasury notes yielding only 60 basis points, and ten year US Treasuries under 3%.

The Portfolio invests in investment-grade bonds, and uses a sampling strategy to gain benchmark exposure. The cornerstone of this strategy is stratified sampling executed under strict guidelines that

| | | | |

| 4 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

eliminate active over/underweight positions. The Portfolio is built with no active management bias and seeks to match the index in all major characteristics, such as duration, term structure, quality distribution, and issuer and sector exposure. As of June 30, 2010 the portfolio held 787 of the 8,191 benchmark constituents, or roughly 9.61%.

Sources: Bloomberg, SSgA Performance Group, FactSet, Barclay’s Capital, Citigroup, Wall Street Journal, Financial Times

The views expressed in this material are the views of SSgA through the period ended June 30, 2010 and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

*At a meeting on July 13, 2010, the Board of Trustees of the AARP Funds approved, in principle, the liquidation, dissolution and termination (“liquidation”) of the AARP Funds. Shareholders of the AARP Funds will receive checks for the value of the shares they hold on the date of liquidation, which is expected to be on or about October 1, 2010. Shareholders have the right to redeem shares of the AARP Funds prior to the liquidation date. The Board of Trustees of the AARP Portfolios in which some of the AARP Funds invest also approved the liquidation of the AARP Portfolios at the meeting held on July 13, 2010. Subsequently, on July 20, 2010, the Board of Trustees of the AARP Funds and of the AARP Portfolios approved a Plan of Liquidation, Dissolution and Termination (“Plan”) for the AARP Funds and the AARP Portfolios (each, a “Trust,” and together the “Trusts”). Shareholder approval of the liquidations is not required.

Effective at the close of business on July 20, 2010, the AARP Funds were closed to new shareholders, and no longer accept orders from existing shareholders to purchase additional shares (including automatic investment programs). However, exchanges into the AARP Money Market Fund will be permitted up to the liquidation date. In addition, the AARP Funds’ dividend payment schedule may be adjusted.

The Plans provide for the liquidation of the assets of the respective Trusts and the distribution to the shareholders of the respective Trusts of all of the proceeds of the liquidation. Shareholders will receive cash for their shares in the AARP Funds. While the AARP Funds (and the AARP Portfolios) will likely maintain higher cash positions to meet anticipated redemption requests, to the extent reasonably practical, the AARP Funds (and the AARP Portfolios) are expected to continue to be managed according to their investment objectives until the liquidation date. By October 1, 2010, assets of the AARP Portfolios are expected to be transitioned into cash. As a result, as of that date the AARP Portfolios (and the AARP Funds) will no longer be pursuing their investment objectives or engaging in any business activities except for the purpose of winding up their business affairs and distributing their remaining cash assets to the AARP Funds for distribution, in turn, to shareholders of the AARP Funds. Shareholders remaining in the AARP Funds prior to or on the date of liquidation may indirectly bear increased transaction fees incurred in connection with the disposition of assets by the AARP Portfolios. However, AARP is a significant investor in each of the AARP Portfolios and has committed to remain invested in the AARP Portfolios until the liquidation date. Moreover, AARP Financial Inc., the investment adviser of AARP Funds and AARP Portfolios, has committed to keep the current expense limitation agreements in place through the date of liquidation.

Prior to liquidation of each Trust, the Trust will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed all of its investment company taxable income, if any, and net realized capital gains, if any, for the current taxable year through the liquidation date. The payment date for these special dividends is September 28, 2010, based on records as of the close of business on September 24, 2010.

The liquidation will not result in income tax liability for either Trust. Distribution of cash liquidation proceeds to shareholders of the AARP Funds may result in a taxable event for shareholders depending on their individual circumstances. Shareholders should consult with their own tax advisers about any tax liability resulting from the receipt of liquidation proceeds.

| | | | |

| U.S. Stock Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 5 |

U.S. Stock Market Portfolio

| | | | | | | | |

| |

Portfolio composition (As a percentage of net assets) |

| June 30, 2010 | | | | | | | | |

| | | | | |

Information technology | | 17.3% | | | | Utilities | | 4.1% |

| |

Financials | | 16.3% | | | | Materials | | 3.9% |

| |

Health care | | 11.6% | | | | Telecommunication services | | 3.0% |

| |

Industrials | | 11.6% | | | | Cash equivalents | | 1.7% |

| |

Consumer discretionary | | 11.4% | | | | Other assets and liabilities, net | | 1.5% |

| |

Energy | | 9.2% | | | | Total net assets | | 100.0% |

| | | | | | | |

Consumer staples | | 8.4% | | | | | | |

| | | | | | | |

See Notes to Financial Statements. | | | | | | | | |

| | |

| |

Performance as of June 30, 2010 |

| | |

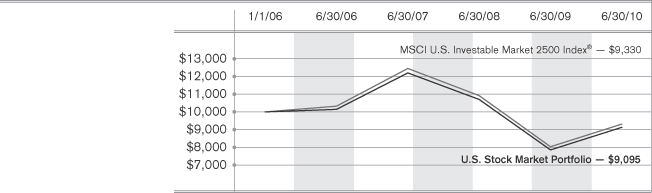

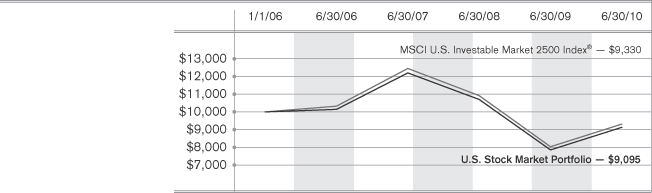

| Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the U.S. Stock

Market Portfolio from

December 30, 2005

(inception date) through

June 30, 2010, compared to

the MSCI U.S. Investable

Market 2500 Index®. | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | |

| Performance Summary | | Average Annual Returns as of June 30, 2010 | | 1-Year | | 3-Years | | Since

inception |

| | | |

| | | U.S. Stock Market Portfolio | | 15.65% | | (9.34)% | | (2.09)%1 |

| | | |

| | | MSCI U.S. Investable Market 2500 Index® | | 15.92% | | (9.17)% | | (1.53)%1 |

| | | |

| | | | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal

value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund

performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not

reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds

are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Fund assumes the

reinvestment of all dividends and distributions. The index above has been adjusted to reflect reinvestment of dividends on

securities in the index. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been

waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call (800) 958-6457. 1 For the period from December 30, 2005 (inception date) to June 30, 2010. Sources: MSCI Barra., AARP Financial |

| | | | |

| 6 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Stock Market Portfolio |

MSCI U.S. Investable Market 2500 Index

This index serves as the benchmark for the U.S. Stock Market Portfolio. The index includes about 2,500 securities listed on the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks represent companies of all types and sizes. The index is unmanaged and you cannot directly invest in it. In addition, indexes do not have expenses.

U.S. Stock Market Portfolio

The fund seeks to replicate the total return of the MSCI US Investable Market 2500 Index.

For the 12 month period ended June 30, 2010 the U.S. Stock Market portfolio returned 15.65% versus the benchmark return of 15.92%. The index return reflects all items in terms of income, gain, and loss and the reinvestment of dividends and other income.*

From June 30, 2009 through June 30, 2010 all sectors experienced positive returns. The Information Technology (16.52%), Financials (18.71%), and Consumer Discretionary (29.91%) sectors had the most influence on index performance. Within the Information Technology sector, Apple Inc. (76.60%), International Business Machines Corp. (20.50%) and Cisco Systems Inc. (14.26%), had the largest impact. The Financials sector was influenced by JPMorgan Chase & Co. (7.86%), American Express Co. (74.01%), and Bank of America Corp. (9.14%). Many companies impacted the performance of the Consumer Discretionary sector however, Walt Disney Co. (36.53%), Ford Motor Co. (66.06%) and McDonald’s Corp. (18.56%) were the largest. The sectors that had the least positive contribution to the return include Telecommunications Services (5.63%), Utilities (6.97%) and Energy (3.04%). Within the Telecommunication Services sector AT&T Inc. (3.83%), American Tower Corp. (41.14%), and Crown Castle International Corp. (55.12%) were the largest contributors. Within the Utilities sector, Dominion Resources Inc. (Virginia) (21.67%), Duke Energy Corp. (16.38%) and Southern Co. (12.73%) were the largest contributors. The top three contributors to the Energy sector include Occidental Petroleum Corp. (19.29%), ConocoPhillips (21.71%) and Chevron Corp. (6.35%).

Individually, the largest positive contributor was Apple (76.60%) which contributed 0.80% to the fund’s performance. The largest negative contribution was from Exxon Mobil Corp. (-16.28%) which impacted performance by -0.41%.

Sources: Bloomberg, SSgA Performance Group, FactSet, Barclay’s Capital, Citigroup, Wall Street Journal, Financial Times

The views expressed in this material are the views of SSgA through the period ended June 30, 2010 and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

*At a meeting on July 13, 2010, the Board of Trustees of the AARP Funds approved, in principle, the liquidation, dissolution and termination (“liquidation”) of the AARP Funds. Shareholders of the AARP Funds will receive checks for the value of the shares they hold on the date of liquidation, which is expected to be on or about October 1, 2010. Shareholders have the right to redeem shares of the AARP Funds prior to the liquidation date. The Board of Trustees of the AARP Portfolios in which some of the AARP Funds invest also approved the liquidation of the AARP Portfolios at the meeting held on July 13, 2010. Subsequently, on July 20, 2010, the Board of Trustees of the AARP Funds and of the AARP Portfolios approved a Plan of Liquidation, Dissolution and Termination (“Plan”) for the AARP Funds and the AARP Portfolios (each, a “Trust,” and together the “Trusts”). Shareholder approval of the liquidations is not required.

| | | | |

| U.S. Stock Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 7 |

Effective at the close of business on July 20, 2010, the AARP Funds were closed to new shareholders, and no longer accept orders from existing shareholders to purchase additional shares (including automatic investment programs). However, exchanges into the AARP Money Market Fund will be permitted up to the liquidation date. In addition, the AARP Funds’ dividend payment schedule may be adjusted.

The Plans provide for the liquidation of the assets of the respective Trusts and the distribution to the shareholders of the respective Trusts of all of the proceeds of the liquidation. Shareholders will receive cash for their shares in the AARP Funds. While the AARP Funds (and the AARP Portfolios) will likely maintain higher cash positions to meet anticipated redemption requests, to the extent reasonably practical, the AARP Funds (and the AARP Portfolios) are expected to continue to be managed according to their investment objectives until the liquidation date. By October 1, 2010, assets of the AARP Portfolios are expected to be transitioned into cash. As a result, as of that date the AARP Portfolios (and the AARP Funds) will no longer be pursuing their investment objectives or engaging in any business activities except for the purpose of winding up their business affairs and distributing their remaining cash assets to the AARP Funds for distribution, in turn, to shareholders of the AARP Funds. Shareholders remaining in the AARP Funds prior to or on the date of liquidation may indirectly bear increased transaction fees incurred in connection with the disposition of assets by the AARP Portfolios. However, AARP is a significant investor in each of the AARP Portfolios and has committed to remain invested in the AARP Portfolios until the liquidation date. Moreover, AARP Financial Inc., the investment adviser of AARP Funds and AARP Portfolios, has committed to keep the current expense limitation agreements in place through the date of liquidation.

Prior to liquidation of each Trust, the Trust will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed all of its investment company taxable income, if any, and net realized capital gains, if any, for the current taxable year through the liquidation date. The payment date for these special dividends is September 28, 2010, based on records as of the close of business on September 24, 2010.

The liquidation will not result in income tax liability for either Trust. Distribution of cash liquidation proceeds to shareholders of the AARP Funds may result in a taxable event for shareholders depending on their individual circumstances. Shareholders should consult with their own tax advisers about any tax liability resulting from the receipt of liquidation proceeds.

| | | | |

| 8 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | International Stock Market Portfolio |

International Stock Market Portfolio

| | | | | | | | |

| | |

Portfolio composition (As a percentage of net assets) | | |

| June 30, 2010 | | | | | | | | |

| | | | | |

Financials | | 16.3% | | | | Telecommunication services | | 3.7% |

| |

Industrials | | 8.1% | | | | Information technology | | 3.6% |

| |

Consumer discretionary | | 7.5% | | | | Utilities | | 3.1% |

| |

Materials | | 6.9% | | | | Exchange-traded funds | | 30.6% |

| |

Consumer staples | | 6.5% | | | | Cash equivalents | | 1.0% |

| |

Health care | | 5.9% | | | | Other assets and liabilities, net | | 1.5% |

| |

Energy | | 5.3% | | | | Total net assets | | 100.0% |

| | | | | | | |

| See Notes to Financial Statements. | | | | | | | | |

| | |

| |

Performance as of June 30, 2010 |

| | |

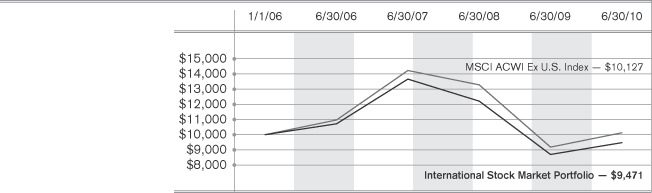

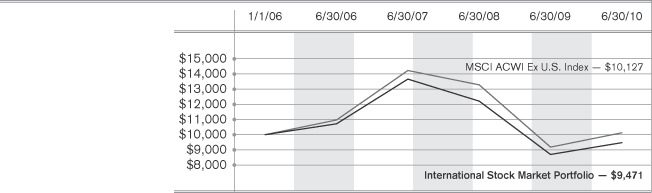

| Growth of $10,000 This graph illustrates the

hypothetical investment of

$10,000 in the International

Stock Market Portfolio from

December 30, 2005

(inception date) through

June 30, 2010, compared to

the MSCI ACWI Ex U.S.

Index. | |  |

| | |

| | | This hypothetical example does not represent the returns of any particular investment. |

| | | | | | | | |

| | | |

| Performance summary | | Average Annual Returns as of June 30, 2010 | | 1-Year | | 3-Years | | Since

inception |

| | | |

| | | International Stock Market Portfolio | | 8.99% | | (11.46)% | | (1.20)%1 |

| | | |

| | | MSCI ACWI Ex US Index | | 10.43% | | (10.70)% | | 0.28%1 |

| | | |

|

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate

so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and

current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder would pay

on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally

insured. The performance of the Fund assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to

reflect reinvestment of dividends on securities in the indexes. The adviser is waiving a portion of its advisory fee and other operating expenses.

Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call (800) 958-6457. 1 For the period from December 30, 2005 (inception date) to June 30, 2010. Sources: MSCI Barra., AARP Financial |

| | | | |

| International Stock Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 9 |

International Stock Market Portfolio

The fund seeks to replicate the total return of the MSCI ACWI ex-US Index.

For the 12 month period ended June 30, 2010 the International Stock Market portfolio returned 8.99% versus the benchmark return of 10.43%. The index return reflects all items in terms of income, gain, and loss and the reinvestment of dividends and other income.*

From June 30, 2009 through June 30, 2010 almost all sectors experienced positive returns with the exception of two sectors. The Consumer Staples (18.72%), Industrials (14.58%), and Materials (13.28%) sectors had the most influence on index performance. Within the Consumer Staples sector, Nestle S.A. (32.67%), British American Tobacco PLC (21.52%) and Anheuser-Busch InBev (35.90%), had the largest impact. The Industrials sector was influenced by Siemens AG (34.63%), Koninklijke Philips Electronics (69.27%), and Schneider Electric S.A. (37.94%). Many companies impacted the performance of the Materials sector however, BASF SE (44.43%), BHP Billiton Ltd. (16.10%) and BHP Billiton PLC (20.29%) were the largest. The two sectors that detracted from return include Energy (-9.16%) and Utilities (-4.24%). Within the Energy sector Royal Dutch Shell PLC (CLA) (8.07%), Cairn Energy PLC (60.94%), and Tenaris S.A. (31.23%) were the largest contributors. Within the Utilities sector, Centrica PLC (26.35%), Hong Kong & China Gas Co. Ltd. (32.25%) and Tokyo Electric Power Co. Inc. (8.68%) were the largest contributors. The top three contributors to the Information Technology sector include SAP AG (13.27%), Canon Inc. (18.33%) and Ericsson Sh B (17.71%).

Individually, the largest positive contributor was Nestle S.A. (32.67%) which contributed 0.45% to the fund’s performance. The largest negative contribution was from BP PLC (-36.50%) which impacted performance by -0.54%.

Sources: Bloomberg, SSgA Performance Group, FactSet, Barclay’s Capital, Citigroup, Wall Street Journal, Financial Times

The views expressed in this material are the views of SSgA through the period ended June 30, 2010 and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

*At a meeting on July 13, 2010, the Board of Trustees of the AARP Funds approved, in principle, the liquidation, dissolution and termination (“liquidation”) of the AARP Funds. Shareholders of the AARP Funds will receive checks for the value of the shares they hold on the date of liquidation, which is expected to be on or about October 1, 2010. Shareholders have the right to redeem shares of the AARP Funds prior to the liquidation date. The Board of Trustees of the AARP Portfolios in which some of the AARP Funds invest also approved the liquidation of the AARP Portfolios at the meeting held on July 13, 2010. Subsequently, on July 20, 2010, the Board of Trustees of the AARP Funds and of the AARP Portfolios approved a Plan of Liquidation, Dissolution and Termination (“Plan”) for the AARP Funds and the AARP Portfolios (each, a “Trust,” and together the “Trusts”). Shareholder approval of the liquidations is not required.

Effective at the close of business on July 20, 2010, the AARP Funds were closed to new shareholders, and no longer accept orders from existing shareholders to purchase additional shares (including automatic investment programs). However, exchanges into the AARP Money Market Fund will be

Country allocation

| | |

| | | Percentage

of Net Assets |

Japan | | 15.8% |

United Kingdom | | 13.8% |

France | | 6.2% |

Australia | | 5.4% |

Switzerland | | 5.3% |

Germany | | 5.2% |

Spain | | 2.3% |

Netherlands | | 1.9% |

Sweden | | 1.9% |

Italy | | 1.8% |

Hong Kong | | 1.4% |

Singapore | | 1.1% |

United States | | 1.1% |

Denmark | | 0.7% |

Finland | | 0.7% |

Belgium | | 0.6% |

Israel | | 0.6% |

Norway | | 0.4% |

Bermuda | | 0.3% |

Ireland | | 0.3% |

Luxembourg | | 0.3% |

Austria | | 0.2% |

Greece | | 0.2% |

Portugal | | 0.2% |

Cayman Islands | | 0.1% |

New Zealand | | 0.1% |

Other securities1 | | 30.6% |

Other assets and liabilities | | 1.5% |

| | | |

Total net assets | | 100.0% |

| 1 | Other securities include exchange-traded funds that invest in 22 emerging market countries as well as Canada. |

MSCI ACWI ex-U.S. Index

This index is a free float adjusted market capitalization weighted index that is designed to mirror the equity market performance of developed and emerging markets. The MSCI ACWI ex-U.S. Index® consisted of 46 country indices comprised of 22 developed and 24 emerging market indices.

| | | | |

| 10 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | International Stock Market Portfolio |

permitted up to the liquidation date. In addition, the AARP Funds’ dividend payment schedule may be adjusted.

The Plans provide for the liquidation of the assets of the respective Trusts and the distribution to the shareholders of the respective Trusts of all of the proceeds of the liquidation. Shareholders will receive cash for their shares in the AARP Funds. While the AARP Funds (and the AARP Portfolios) will likely maintain higher cash positions to meet anticipated redemption requests, to the extent reasonably practical, the AARP Funds (and the AARP Portfolios) are expected to continue to be managed according to their investment objectives until the liquidation date. By October 1, 2010, assets of the AARP Portfolios are expected to be transitioned into cash. As a result, as of that date the AARP Portfolios (and the AARP Funds) will no longer be pursuing their investment objectives or engaging in any business activities except for the purpose of winding up their business affairs and distributing their remaining cash assets to the AARP Funds for distribution, in turn, to shareholders of the AARP Funds. Shareholders remaining in the AARP Funds prior to or on the date of liquidation may indirectly bear increased transaction fees incurred in connection with the disposition of assets by the AARP Portfolios. However, AARP is a significant investor in each of the AARP Portfolios and has committed to remain invested in the AARP Portfolios until the liquidation date. Moreover, AARP Financial Inc., the investment adviser of AARP Funds and AARP Portfolios, has committed to keep the current expense limitation agreements in place through the date of liquidation.

Prior to liquidation of each Trust, the Trust will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed all of its investment company taxable income, if any, and net realized capital gains, if any, for the current taxable year through the liquidation date. The payment date for these special dividends is September 28, 2010, based on records as of the close of business on September 24, 2010.

The liquidation will not result in income tax liability for either Trust. Distribution of cash liquidation proceeds to shareholders of the AARP Funds may result in a taxable event for shareholders depending on their individual circumstances. Shareholders should consult with their own tax advisers about any tax liability resulting from the receipt of liquidation proceeds.

| | | | |

| Understanding Your Expenses | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 11 |

Understanding Your Expenses

As a shareholder of a Portfolio, you incur ongoing costs, including investment advisory fees, and other expenses of running a fund. It’s important to understand exactly how much you pay to purchase and own a fund and to compare the costs of owning different funds because these costs reduce your returns.

The example in the table on the next page is intended to help you to understand your ongoing costs in dollars of investing in an AARP Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2010 to June 30, 2010.

Actual expenses

The first line for each Portfolio in the table on the next page provides information about actual account values and actual expenses. You may use the information in the first line, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses paid during period” to estimate the expenses attributable to your investment during this period.

Hypothetical example for comparison purposes

The second line in the table on the next page labeled “Hypothetical”, helps you to compare the costs of a Portfolio to other funds using a 5% return as required by the Securities and Exchange Commission for all mutual funds. It provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. You should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Portfolio with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | |

| 12 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | Understanding Your Expenses |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | |

| | | | |

| | | Beginning account value

1/1/10 | | Ending account value

6/30/10 | | Expenses paid

during period1 |

| |

U.S. Bond Market Portfolio | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,052.40 | | $ | 1.27 |

Hypothetical | | $ | 1,000 | | $ | 1,023.55 | | $ | 1.25 |

(assuming a 5% return before expenses) | | | | | | | | | |

| |

U.S. Stock Market Portfolio | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 939.30 | | $ | 1.20 |

Hypothetical | | $ | 1,000 | | $ | 1,023.55 | | $ | 1.25 |

(assuming a 5% return before expenses) | | | | | | | | | |

| |

International Stock Market Portfolio | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 883.60 | | $ | 1.40 |

Hypothetical | | $ | 1,000 | | $ | 1,023.31 | | $ | 1.51 |

(assuming a 5% return before expenses) | | | | | | | | | |

| |

| |

1 Expenses reflect the Portfolio’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The annualized net expense ratios are as follows: U.S. Bond Market Portfolio 0.25%, U.S. Stock Market Portfolio 0.25% and International Stock Market Portfolio 0.30%. |

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 13 |

U.S. Bond Market Portfolio

June 30, 2010

| | | | | | |

| Portfolio of investments |

| | |

| | | Par Amount | | Value |

| | | | | | |

| |

Asset-Backed Securities–0.3% | | | |

Capital One Multi-Asset | | | | | | |

Execution Trust, 4.900%, 12/15/2017 | | $ | 25,000 | | $ | 27,125 |

Citibank Credit Card | | | | | | |

Issuance Trust, 4.900%, 12/12/2016 | | | 100,000 | | | 110,745 |

Citibank Credit Card | | | | | | |

Issuance Trust 2003-A10, 4.750%, 12/10/2015 | | | 15,000 | | | 16,410 |

Ford Credit Auto Owner | | | | | | |

Trust, 5.240%, 7/15/2012 | | | 50,000 | | | 52,022 |

PSE&G Transition Funding | | | | | | |

LLC, 6.750%, 6/15/2016 | | | 10,000 | | | 11,715 |

TXU Electric Delivery | | | | | | |

Transition Bond Co. LLC, 5.290%, 5/15/2018 | | | 50,000 | | | 56,613 |

USAA Auto Owner Trust, | | | | | | |

2.530%, 7/15/2015 | | | 10,000 | | | 10,289 |

| |

| Total Asset-Backed | | | | | | |

Securities–(Identified Cost $256,581) | | | | | | 284,919 |

| |

| | |

Corporate Bonds–18.1% | | | | | | |

| Consumer Discretionary–1.9% | | | |

Altria Group, Inc., 8.500%, | | | | | | |

11/10/2013 | | | 50,000 | | | 58,411 |

Anheuser-Busch Cos., Inc., | | | | | | |

6.450%, 9/1/2037 | | | 25,000 | | | 28,040 |

Anheuser-Busch InBev | | | | | | |

Worldwide, Inc., 3.000%, 10/15/2012 | | | 25,000 | | | 25,678 |

Anheuser-Busch InBev | | | | | | |

Worldwide, Inc., 4.125%, 1/15/2015 | | | 50,000 | | | 52,395 |

CBS Corp., 7.875%, | | | | | | |

7/30/2030 | | | 30,000 | | | 34,828 |

Clorox Co., 5.450%, | | | | | | |

10/15/2012 | | | 50,000 | | | 54,414 |

Coca-Cola Co., 5.350%, | | | | | | |

11/15/2017 | | | 25,000 | | | 28,634 |

Coca-Cola Enterprises, Inc., | | | | | | |

6.750%, 9/15/2028 | | | 25,000 | | | 30,747 |

Comcast Corp., 5.900%, | | | | | | |

3/15/2016 | | | 50,000 | | | 56,416 |

| | | | |

| | | | |

Comcast Corp., 6.450%, | | | | |

3/15/2037 | | 25,000 | | 27,122 |

Comcast Corp., 6.950%, | | | | |

8/15/2037 | | 50,000 | | 57,062 |

Costco Wholesale Corp., | | | | |

5.500%, 3/15/2017 | | 50,000 | | 57,632 |

DaimlerChrysler North | | | | |

America Holdings, 8.500%, 1/18/2031 | | 25,000 | | 32,023 |

DaimlerChrysler North America | | | | |

Holdings Senior Note, 6.500%, 11/15/2013 | | 50,000 | | 56,005 |

DIRECTV Holdings LLC, | | | | |

3.550%, 3/15/2015 | | 50,000 | | 50,386 |

DIRECTV Holdings LLC, | | | | |

5.200%, 3/15/2020 | | 35,000 | | 36,547 |

Dr Pepper Snapple Group, | | | | |

Inc., 6.120%, 5/1/2013 | | 50,000 | | 55,672 |

FedEx Corp., 7.375%, | | | | |

1/15/2014 | | 10,000 | | 11,691 |

Fortune Brands, Inc., | | | | |

3.000%, 6/1/2012 | | 50,000 | | 50,626 |

Home Depot, Inc., 5.400%, | | | | |

3/1/2016 | | 50,000 | | 55,719 |

Home Depot, Inc., 5.875%, | | | | |

12/16/2036 | | 50,000 | | 51,428 |

Kohl’s Corp., 6.250%, | | | | |

12/15/2017 | | 25,000 | | 29,164 |

Lowe’s Cos., Inc., 5.800%, | | | | |

10/15/2036 | | 25,000 | | 27,115 |

News America Holdings, Inc., | | | | |

9.250%, 2/1/2013 | | 35,000 | | 41,237 |

News America, Inc. Senior | | | | |

Note, 6.150%, 3/1/2037 | | 25,000 | | 26,160 |

Nordstrom, Inc., 6.750%, | | | | |

6/1/2014 | | 10,000 | | 11,631 |

PepsiCo, Inc., 3.750%, | | | | |

3/1/2014 | | 50,000 | | 53,350 |

PepsiCo, Inc., 4.500%, | | | | |

1/15/2020 | | 50,000 | | 53,410 |

Target Corp. Note, 5.875%, | | | | |

3/1/2012 | | 50,000 | | 53,948 |

Time Warner Cable, Inc., | | | | |

3.500%, 2/1/2015 | | 25,000 | | 25,583 |

| | | | |

Time Warner Cable, Inc., | | | | |

5.000%, 2/1/2020 | | 35,000 | | 35,860 |

Time Warner Cable, Inc., | | | | |

5.850%, 5/1/2017 | | 50,000 | | 54,975 |

| | | | |

| 14 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

U.S. Bond Market Portfolio (continued)

June 30, 2010

| | | | | | |

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par Amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Consumer Discretionary (continued) | | | |

Time Warner, Inc., 5.875%, | | | | | | |

11/15/2016 | | $ | 25,000 | | $ | 28,220 |

Time Warner, Inc., 7.700%, | | | | | | |

5/1/2032 | | | 50,000 | | | 60,475 |

United Parcel Service, Inc., | | | | | | |

6.200%, 1/15/2038 | | | 25,000 | | | 30,163 |

Vanderbilt University, | | | | | | |

5.250%, 4/1/2019 | | | 50,000 | | | 55,798 |

Wal-Mart Stores, Inc., | | | | | | |

5.000%, 4/5/2012 | | | 100,000 | | | 107,062 |

Wal-Mart Stores, Inc., | | | | | | |

5.250%, 9/1/2035 | | | 25,000 | | | 26,424 |

| |

Total Consumer Discretionary | | | | | | 1,632,051 |

| |

| | |

| Consumer Staples–0.7% | | | | | | |

Campbell Soup Co., | | | | | | |

4.500%, 2/15/2019 | | | 20,000 | | | 21,824 |

ConAgra Foods, Inc., | | | | | | |

7.000%, 10/1/2028 | | | 25,000 | | | 29,488 |

CVS Caremark Corp., | | | | | | |

6.125%, 9/15/2039 | | | 50,000 | | | 53,635 |

CVS Caremark Corp., | | | | | | |

6.250%, 6/1/2027 | | | 25,000 | | | 27,349 |

H.J. Heinz Finance Co., | | | | | | |

6.000%, 3/15/2012 | | | 25,000 | | | 26,888 |

Hershey Co., 4.850%, | | | | | | |

8/15/2015 | | | 25,000 | | | 27,426 |

Kraft Foods, Inc., 5.375%, | | | | | | |

2/10/2020 | | | 25,000 | | | 26,839 |

Kraft Foods, Inc., 6.125%, | | | | | | |

2/1/2018 | | | 25,000 | | | 28,416 |

Kraft Foods, Inc., 6.250%, | | | | | | |

6/1/2012 | | | 50,000 | | | 54,524 |

Kraft Foods, Inc., 6.500%, | | | | | | |

2/9/2040 | | | 25,000 | | | 28,056 |

Kroger Co., 5.500%, | | | | | | |

2/1/2013 | | | 50,000 | | | 54,482 |

McDonald’s Corp., 6.300%, | | | | | | |

3/1/2038 | | | 25,000 | | | 30,640 |

Procter & Gamble Co., | | | | | | |

5.550%, 3/5/2037 | | | 25,000 | | | 28,354 |

Ralcorp Holdings, Inc., | | | | | | |

6.625%, 8/15/2039 | | | 25,000 | | | 27,375 |

| | | | |

| | | | |

Whirlpool Corp., 8.600%, | | | | |

5/1/2014 | | 10,000 | | 11,800 |

Xerox Corp., 6.350%, | | | | |

5/15/2018 | | 50,000 | | 55,859 |

Yum! Brands, Inc., 6.250%, | | | | |

3/15/2018 | | 50,000 | | 57,499 |

| |

Total Consumer Staples | | | | 590,454 |

| |

| | |

| Energy–2.0% | | | | |

Alberta Energy Co. Ltd., | | | | |

8.125%, 9/15/2030 | | 25,000 | | 31,376 |

Ameren Energy Generating | | | | |

Co., 6.300%, 4/1/2020 | | 25,000 | | 25,492 |

Anadarko Petroleum Corp., | | | | |

5.950%, 9/15/2016 | | 25,000 | | 21,544 |

Apache Corp., 6.000%, | | | | |

1/15/2037 | | 25,000 | | 27,725 |

Appalachian Power Co., | | | | |

5.000%, 6/1/2017 | | 10,000 | | 10,580 |

Baker Hughes, Inc., | | | | |

6.500%, 11/15/2013 | | 25,000 | | 28,582 |

Boardwalk Pipelines LLC, | | | | |

5.500%, 2/1/2017 | | 20,000 | | 20,709 |

Canadian Natural Resources | | | | |

Ltd., 5.700%, 5/15/2017 | | 25,000 | | 28,022 |

Cenovus Energy, Inc., | | | | |

6.750%, 11/15/2039 | | 25,000 | | 28,801 |

Cisco Systems, Inc., 4.950%, | | | | |

2/15/2019 | | 50,000 | | 55,054 |

Cisco Systems, Inc., 5.500%, | | | | |

1/15/2040 | | 50,000 | | 52,601 |

ConocoPhillips, 4.400%, | | | | |

5/15/2013 | | 100,000 | | 107,798 |

ConocoPhillips, 6.500%, | | | | |

2/1/2039 | | 25,000 | | 30,298 |

ConocoPhillips Canada | | | | |

Funding Co., 5.950%, 10/15/2036 | | 25,000 | | 28,114 |

Diamond Offshore Drilling, Inc., | | | | |

5.875%, 5/1/2019 | | 40,000 | | 41,529 |

DTE Energy Co., 7.625%, | | | | |

5/15/2014 | | 25,000 | | 29,241 |

Duke Energy Corp., | | | | |

3.350%, 4/1/2015 | | 100,000 | | 102,109 |

El Paso Natural Gas Co., | | | | |

5.950%, 4/15/2017 | | 50,000 | | 53,381 |

Enbridge Energy Partners LP, | | | | |

5.200%, 3/15/2020 | | 15,000 | | 15,485 |

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 15 |

| | | | | | |

| Portfolio of investments | | | | |

| | |

| | | Par Amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Energy (continued) | | | | | | |

EnCana Corp., 4.750%, | | | | | | |

10/15/2013 | | $ | 25,000 | | $ | 26,828 |

Enterprise Products Operating | | | | | | |

LLC, 5.250%, 1/31/2020 | | | 50,000 | | | 51,573 |

Enterprise Products Operating | | | | | | |

LP, 6.875%, 3/1/2033 | | | 10,000 | | | 10,950 |

EOG Resources, Inc., | | | | | | |

6.875%, 10/1/2018 | | | 25,000 | | | 30,434 |

FirstEnergy Corp., 6.450%, | | | | | | |

11/15/2011 | | | 1,000 | | | 1,057 |

FirstEnergy Corp., 7.375%, | | | | | | |

11/15/2031 | | | 20,000 | | | 21,146 |

FirstEnergy Solutions Corp., | | | | | | |

6.050%, 8/15/2021 | | | 20,000 | | | 20,440 |

General Electric Co., 5.000%, | | | | | | |

2/1/2013 | | | 100,000 | | | 107,300 |

Halliburton Co., 7.450%, | | | | | | |

9/15/2039 | | | 25,000 | | | 29,786 |

Hess Corp., | | | | | | |

7.300%, 8/15/2031 | | | 25,000 | | | 29,580 |

Kerr-McGee Corp., 6.950%, | | | | | | |

7/1/2024 | | | 25,000 | | | 22,765 |

KeySpan Corp., 8.000%, | | | | | | |

11/15/2030 | | | 25,000 | | | 32,453 |

Kinder Morgan Energy Partners | | | | | | |

LP, 5.800%, 3/15/2035 | | | 50,000 | | | 47,332 |

Magellan Midstream Partners L, | | | | | | |

6.550%, 7/15/2019 | | | 25,000 | | | 28,125 |

Marathon Oil Corp., 6.600%, | | | | | | |

10/1/2037 | | | 25,000 | | | 27,409 |

Murphy Oil Corp., 6.375%, | | | | | | |

5/1/2012 | | | 25,000 | | | 26,569 |

Ohio Power Co., 5.375%, | | | | | | |

10/1/2021 | | | 15,000 | | | 16,040 |

Pemex Project Funding Master | | | | | | |

Trust, 6.625%, 6/15/2035 | | | 25,000 | | | 25,839 |

Petro-Canada, 7.000%, | | | | | | |

11/15/2028 | | | 25,000 | | | 28,089 |

Plains All American Pipeline LP, | | | | | | |

6.650%, 1/15/2037 | | | 25,000 | | | 25,046 |

Praxair, Inc., 2.125%, | | | | | | |

6/14/2013 | | | 50,000 | | | 50,873 |

| | | | |

| | | | |

Progress Energy, Inc., | | | | |

6.850%, 4/15/2012 | | 50,000 | | 54,393 |

Progress Energy, Inc., | | | | |

7.750%, 3/1/2031 | | 25,000 | | 31,748 |

Rowan Cos, Inc., 7.875%, | | | | |

8/1/2019 | | 15,000 | | 16,552 |

San Diego Gas & Electric Co., | | | | |

6.000%, 6/1/2039 | | 20,000 | | 23,453 |

Sempra Energy, 6.500%, | | | | |

6/1/2016 | | 30,000 | | 34,468 |

Spectra Energy Capital LLC, | | | | |

5.900%, 9/15/2013 | | 50,000 | | 54,482 |

Talisman Energy, Inc., | | | | |

7.750%, 6/1/2019 | | 5,000 | | 6,149 |

Toledo Edison Co., 7.250%, | | | | |

5/1/2020 | | 15,000 | | 18,206 |

TransCanada Pipelines Ltd., | | | | |

9.875%, 1/1/2021 | | 25,000 | | 35,033 |

Transocean, Inc., 6.000%, | | | | |

3/15/2018 | | 25,000 | | 23,043 |

Valero Energy Corp., | | | | |

7.500%, 4/15/2032 | | 25,000 | | 26,282 |

XTO Energy, Inc., 6.100%, | | | | |

4/1/2036 | | 25,000 | | 29,709 |

XTO Energy, Inc., 6.750%, | | | | |

8/1/2037 | | 25,000 | | 32,320 |

| |

Total Energy | | | | 1,783,913 |

| |

| | |

| Financials–7.5% | | | | |

American Express Bank | | | | |

FSB, 3.150%, 12/9/2011 | | 25,000 | | 25,898 |

American Express Co., | | | | |

7.000%, 3/19/2018 | | 100,000 | | 115,515 |

American International Group, | | | | |

Inc., 5.600%, 10/18/2016 | | 50,000 | | 45,900 |

American International Group, | | | | |

Inc., 6.250%, 5/1/2036 | | 25,000 | | 20,000 |

Ameritech Capital Funding, | | | | |

6.550%, 1/15/2028 | | 20,000 | | 21,032 |

Asian Development Bank, | | | | |

2.750%, 5/21/2014 | | 60,000 | | 62,277 |

Bank of America Corp., | | | | |

2.100%, 4/30/2012 | | 50,000 | | 51,226 |

Bank of America Corp., | | | | |

3.125%, 6/15/2012 | | 50,000 | | 52,241 |

Bank of America Corp., | | | | |

4.750%, 8/15/2013 | | 100,000 | | 102,754 |

| | | | |

| 16 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

U.S. Bond Market Portfolio (continued)

June 30, 2010

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Financials (continued) | | | | | | |

Bank of America Corp., | | | | | | |

5.625%, 10/14/2016 | | $ | 50,000 | | $ | 51,880 |

Bank of America Corp., | | | | | | |

7.625%, 6/1/2019 | | | 100,000 | | | 114,740 |

Bank of America NA, 5.300%, | | | | | | |

3/15/2017 | | | 50,000 | | | 50,415 |

Bank of America NA, | | | | | | |

6.000%, 10/15/2036 | | | 25,000 | | | 24,118 |

Bank of New York Mellon | | | | | | |

Corp., 4.300%, 5/15/2014 | | | 30,000 | | | 32,250 |

BB&T Corp., 3.375%, | | | | | | |

9/25/2013 | | | 25,000 | | | 25,803 |

BB&T Corp., 5.250%, | | | | | | |

11/1/2019 | | | 25,000 | | | 25,870 |

Bear Stearns Cos., Inc., | | | | | | |

5.300%, 10/30/2015 | | | 30,000 | | | 32,464 |

Bear Stearns Cos., Inc., | | | | | | |

6.950%, 8/10/2012 | | | 150,000 | | | 164,611 |

Berkshire Hathaway Finance | | | | | | |

Corp., 4.000%, 4/15/2012 | | | 50,000 | | | 52,616 |

Berkshire Hathaway Finance | | | | | | |

Corp., 4.850%, 1/15/2015 | | | 10,000 | | | 10,994 |

Berkshire Hathaway Finance | | | | | | |

Corp., 5.750%, 1/15/2040 | | | 25,000 | | | 26,569 |

BlackRock, Inc., | | | | | | |

3.500%, 12/10/2014 | | | 25,000 | | | 25,954 |

Capital One Capital IV, | | | | | | |

6.745%, 2/17/2037 | | | 25,000 | | | 21,125 |

Capital One Capital VI, | | | | | | |

8.875%, 5/15/2040 | | | 40,000 | | | 41,955 |

Capital One Financial Corp., | | | | | | |

7.375%, 5/23/2014 | | | 15,000 | | | 17,167 |

Chubb Corp., 6.000%, | | | | | | |

11/15/2011 | | | 10,000 | | | 10,609 |

Cincinnati Financial Corp., | | | | | | |

6.920%, 5/15/2028 | | | 10,000 | | | 10,149 |

Citibank NA, | | | | | | |

1.250%, 9/22/2011 | | | 50,000 | | | 50,423 |

Citigroup Funding, Inc., | | | | | | |

1.875%, 10/22/2012 | | | 100,000 | | | 102,159 |

| | | | |

| | | | |

Citigroup Funding, Inc., | | | | |

2.250%, 12/10/2012 | | 100,000 | | 103,001 |

Citigroup, Inc., | | | | |

2.875%, 12/9/2011 | | 25,000 | | 25,786 |

Citigroup, Inc., | | | | |

5.500%, 2/15/2017 | | 150,000 | | 147,884 |

Citigroup, Inc., | | | | |

5.850%, 12/11/2034 | | 50,000 | | 47,479 |

Citigroup, Inc., | | | | |

6.125%, 5/15/2018 | | 100,000 | | 104,531 |

Citigroup, Inc., | | | | |

6.125%, 8/25/2036 | | 50,000 | | 45,585 |

Citigroup, Inc., | | | | |

8.125%, 7/15/2039 | | 15,000 | | 17,950 |

CNA Financial Corp., | | | | |

6.000%, 8/15/2011 | | 25,000 | | 25,736 |

Corp. Andina De Fomento, | | | | |

8.125%, 6/4/2019 | | 15,000 | | 18,491 |

Credit Suisse, | | | | |

3.450%, 7/2/2012 | | 50,000 | | 51,668 |

Credit Suisse USA, Inc., | | | | |

5.125%, 8/15/2015 | | 100,000 | | 108,977 |

Devon Financing Corp. | | | | |

ULC, 6.875%, 9/30/2011 | | 50,000 | | 53,399 |

Discover Financial Services, | | | | |

6.450%, 6/12/2017 | | 25,000 | | 25,265 |

Duke Realty LP, | | | | |

6.750%, 3/15/2020 | | 25,000 | | 26,310 |

Fifth Third Bancorp, | | | | |

8.250%, 3/1/2038 | | 50,000 | | 56,220 |

Financing Corp. (FICO), | | | | |

9.650%, 11/2/2018 | | 25,000 | | 36,600 |

General Electric Capital | | | | |

Corp., 2.625%, 12/28/2012 | | 100,000 | | 103,981 |

General Electric Capital | | | | |

Corp., 2.800%, 1/8/2013 | | 100,000 | | 101,171 |

General Electric Capital | | | | |

Corp., 3.000%, 12/9/2011 | | 50,000 | | 51,668 |

General Electric Capital | | | | |

Corp., 5.400%, 2/15/2017 | | 50,000 | | 53,182 |

General Electric Capital | | | | |

Corp., 5.625%, 5/1/2018 | | 100,000 | | 106,440 |

General Electric Capital | | | | |

Corp., 5.875%, 1/14/2038 | | 50,000 | | 49,195 |

General Electric Capital | | | | |

Corp., 5.875%, 2/15/2012 | | 150,000 | | 159,473 |

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 17 |

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Financials (continued) | | | | | | |

General Electric Capital | | | | | | |

Corp., 6.750%, 3/15/2032 | | $ | 60,000 | | $ | 64,763 |

General Electric Insurance | | | | | | |

Solutions Corp., 7.000%, 2/15/2026 | | | 50,000 | | | 52,856 |

Goldman Sachs Group, Inc., | | | | | | |

1.625%, 7/15/2011 | | | 50,000 | | | 50,601 |

Goldman Sachs Group, Inc., | | | | | | |

3.250%, 6/15/2012 | | | 100,000 | | | 104,762 |

Goldman Sachs Group, Inc., | | | | | | |

3.625%, 8/1/2012 | | | 35,000 | | | 35,672 |

Goldman Sachs Group, Inc., | | | | | | |

5.125%, 1/15/2015 | | | 50,000 | | | 52,575 |

Goldman Sachs Group, Inc., | | | | | | |

5.450%, 11/1/2012 | | | 100,000 | | | 105,401 |

Goldman Sachs Group, Inc., | | | | | | |

5.950%, 1/15/2027 | | | 30,000 | | | 28,386 |

Goldman Sachs Group, Inc., | | | | | | |

6.000%, 5/1/2014 | | | 30,000 | | | 32,267 |

Goldman Sachs Group, Inc., | | | | | | |

6.125%, 2/15/2033 | | | 25,000 | | | 24,548 |

Goldman Sachs Group, Inc., | | | | | | |

6.150%, 4/1/2018 | | | 50,000 | | | 52,456 |

Goldman Sachs Group, Inc., | | | | | | |

6.345%, 2/15/2034 | | | 15,000 | | | 13,498 |

Goldman Sachs Group, Inc., | | | | | | |

6.750%, 10/1/2037 | | | 25,000 | | | 24,584 |

Hartford Financial Services | | | | | | |

Group, Inc., 6.100%, 10/1/2041 | | | 25,000 | | | 21,748 |

Healthcare Realty Trust, Inc., | | | | | | |

6.500%, 1/17/2017 | | | 25,000 | | | 26,177 |

Hospitality Properties Trust, | | | | | | |

7.875%, 8/15/2014 | | | 25,000 | | | 27,586 |

HSBC Finance Corp., | | | | | | |

4.750%, 7/15/2013 | | | 100,000 | | | 104,815 |

HSBC Finance Corp., | | | | | | |

5.000%, 6/30/2015 | | | 25,000 | | | 26,114 |

HSBC Finance Corp., | | | | | | |

6.375%, 11/27/2012 | | | 50,000 | | | 54,027 |

Inter-American Development | | | | | | |

Bank, 4.250%, 9/10/2018 | | | 50,000 | | | 54,460 |

| | | | |

| | | | |

International Finance Corp., | | | | |

3.000%, 4/22/2014 | | 105,000 | | 110,934 |

Jefferies Group, Inc., | | | | |

8.500%, 7/15/2019 | | 25,000 | | 28,127 |

John Deere Capital Corp., | | | | |

5.250%, 10/1/2012 | | 50,000 | | 54,209 |

JPMorgan Chase & Co., | | | | |

3.125%, 12/1/2011 | | 100,000 | | 103,487 |

JPMorgan Chase & Co., | | | | |

6.000%, 1/15/2018 | | 25,000 | | 27,648 |

JPMorgan Chase & Co., | | | | |

6.625%, 3/15/2012 | | 100,000 | | 107,641 |

JPMorgan Chase Capital | | | | |

XVIII, 6.950%, 8/17/2036 | | 25,000 | | 25,061 |

JPMorgan Chase Capital | | | | |

XXVII, 7.000%, 11/1/2039 | | 50,000 | | 51,006 |

Keycorp, 6.500%, | | | | |

5/14/2013 | | 50,000 | | 54,729 |

Lazard Group, 6.850%, | | | | |

6/15/2017 | | 50,000 | | 50,704 |

Liberty Property LP, | | | | |

6.625%, 10/1/2017 | | 50,000 | | 53,775 |

Lincoln National Corp., | | | | |

8.750%, 7/1/2019 | | 15,000 | | 18,414 |

Mack-Cali Realty Corp., | | | | |

7.750%, 8/15/2019 | | 25,000 | | 29,428 |

Markel Corp., 7.125%, | | | | |

9/30/2019 | | 50,000 | | 54,949 |

Merrill Lynch & Co., Inc., | | | | |

6.150%, 4/25/2013 | | 100,000 | | 106,983 |

MetLife, Inc., 5.700%, | | | | |

6/15/2035 | | 10,000 | | 9,812 |

MetLife, Inc., 6.125%, | | | | |

12/1/2011 | | 10,000 | | 10,584 |

MetLife, Inc., 6.400%, | | | | |

12/15/2036 | | 25,000 | | 22,125 |

MetLife, Inc., 6.750%, | | | | |

6/1/2016 | | 50,000 | | 56,637 |

Morgan Stanley, 3.250%, | | | | |

12/1/2011 | | 100,000 | | 103,647 |

Morgan Stanley, 5.625%, | | | | |

1/9/2012 | | 100,000 | | 104,093 |

Morgan Stanley, 5.950%, | | | | |

12/28/2017 | | 100,000 | | 101,418 |

Morgan Stanley, 6.000%, | | | | |

5/13/2014 | | 100,000 | | 106,050 |

Northern Trust Corp., | | | | |

4.625%, 5/1/2014 | | 15,000 | | 16,411 |

| | | | |

| 18 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

U.S. Bond Market Portfolio (continued)

June 30, 2010

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Financials (continued) | | | | | | |

PACCAR Financial Corp., | | | | | | |

1.950%, 12/17/2012 | | $ | 25,000 | | $ | 25,264 |

PNC Bank NA, 4.875%, | | | | | | |

9/21/2017 | | | 50,000 | | | 51,222 |

Private Export Funding | | | | | | |

Corp., 4.300%, 12/15/2021 | | | 25,000 | | | 26,146 |

ProLogis, 7.625%, | | | | | | |

8/15/2014 | | | 25,000 | | | 26,555 |

Protective Life Corp., | | | | | | |

8.450%, 10/15/2039 | | | 25,000 | | | 26,754 |

Prudential Financial, Inc., | | | | | | |

4.500%, 7/15/2013 | | | 50,000 | | | 51,951 |

Prudential Financial, Inc., | | | | | | |

6.000%, 12/1/2017 | | | 50,000 | | | 53,528 |

Raymond James Financial, | | | | | | |

Inc., 8.600%, 8/15/2019 | | | 25,000 | | | 29,492 |

Realty Income Corp., | | | | | | |

5.950%, 9/15/2016 | | | 25,000 | | | 27,225 |

Regions Financial Corp., | | | | | | |

7.750%, 11/10/2014 | | | 50,000 | | | 52,795 |

Shell International Finance BV, | | | | | | |

4.000%, 3/21/2014 | | | 100,000 | | | 105,861 |

Simon Property Group LP, | | | | | | |

5.100%, 6/15/2015 | | | 25,000 | | | 26,399 |

Simon Property Group LP, | | | | | | |

5.650%, 2/1/2020 | | | 25,000 | | | 26,526 |

SLM Corp., 5.400%, | | | | | | |

10/25/2011 | | | 25,000 | | | 24,860 |

Sovereign Bank, 5.125%, | | | | | | |

3/15/2013 | | | 25,000 | | | 25,350 |

Toll Brothers Finance Corp., | | | | | | |

6.750%, 11/1/2019 | | | 25,000 | | | 24,549 |

Transatlantic Holdings, Inc., | | | | | | |

5.750%, 12/14/2015 | | | 20,000 | | | 20,543 |

Travelers Cos., Inc., | | | | | | |

5.500%, 12/1/2015 | | | 25,000 | | | 28,121 |

Travelers Cos., Inc., | | | | | | |

5.750%, 12/15/2017 | | | 25,000 | | | 27,397 |

US Bancorp, 4.200%, | | | | | | |

5/15/2014 | | | 50,000 | | | 53,532 |

USB Capital XIII Trust, | | | | | | |

6.625%, 12/15/2039 | | | 15,000 | | | 15,868 |

| | | | |

| | | | |

Wachovia Bank NA, | | | | |

4.875%, 2/1/2015 | | 50,000 | | 52,455 |

Wachovia Bank NA, | | | | |

6.600%, 1/15/2038 | | 25,000 | | 27,273 |

Wachovia Corp., 5.625%, | | | | |

10/15/2016 | | 50,000 | | 54,035 |

Wachovia Corp., 5.700%, | | | | |

8/1/2013 | | 50,000 | | 54,487 |

Wells Fargo & Co., 3.000%, | | | | |

12/9/2011 | | 25,000 | | 25,849 |

Wells Fargo & Co., 5.250%, | | | | |

10/23/2012 | | 50,000 | | 53,537 |

Wells Fargo & Co., 5.625%, | | | | |

12/11/2017 | | 25,000 | | 27,372 |

Wells Fargo Bank NA, | | | | |

5.750%, 5/16/2016 | | 100,000 | | 109,170 |

1 Western Union Co/The | | | | |

5.253%, 4/1/2020 | | 53,000 | | 56,653 |

Willis North America, Inc., | | | | |

5.625%, 7/15/2015 | | 25,000 | | 26,474 |

| |

Total Financials | | | | 6,511,117 |

| |

| | |

| Health Care–1.1% | | | | |

Abbott Laboratories, 6.000%, | | | | |

4/1/2039 | | 50,000 | | 57,703 |

Aetna, Inc., 6.625%, | | | | |

6/15/2036 | | 35,000 | | 39,079 |

Aflac, Inc., 6.900%, | | | | |

12/17/2039 | | 15,000 | | 15,642 |

Allstate Corp., 5.950%, | | | | |

4/1/2036 | | 25,000 | | 25,810 |

AmerisourceBergen Corp., | | | | |

5.875%, 9/15/2015 | | 10,000 | | 11,200 |

Amgen, Inc., 5.850%, | | | | |

6/1/2017 | | 25,000 | | 29,021 |

Amgen, Inc., 6.375%, | | | | |

6/1/2037 | | 25,000 | | 29,492 |

Baxter International, Inc., | | | | |

4.625%, 3/15/2015 | | 10,000 | | 11,030 |

Baxter International, Inc., | | | | |

5.900%, 9/1/2016 | | 50,000 | | 58,742 |

Bristol-Myers Squibb Co., | | | | |

5.875%, 11/15/2036 | | 25,000 | | 27,966 |

Eli Lilly & Co., 5.200%, | | | | |

3/15/2017 | | 50,000 | | 56,984 |

Hospira, Inc., 6.400%, | | | | |

5/15/2015 | | 5,000 | | 5,687 |

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 19 |

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| Health Care (continued) | | | | | | |

Johnson & Johnson, | | | | | | |

4.950%, 5/15/2033 | | $ | 10,000 | | $ | 10,455 |

Life Technologies Corp., | | | | | | |

3.375%, 3/1/2013 | | | 25,000 | | | 25,570 |

McKesson Corp., | | | | | | |

7.500%, 2/15/2019 | | | 50,000 | | | 62,120 |

Medtronic, Inc., 5.550%, | | | | | | |

3/15/2040 | | | 25,000 | | | 28,013 |

Merck & Co., Inc., | | | | | | |

5.000%, 6/30/2019 | | | 100,000 | | | 111,436 |

Pfizer, Inc., 5.350%, | | | | | | |

3/15/2015 | | | 100,000 | | | 113,416 |

Schering-Plough Corp., | | | | | | |

6.000%, 9/15/2017 | | | 25,000 | | | 29,415 |

Teva Pharmaceutical | | | | | | |

Finance LLC, 5.550%, 2/1/2016 | | | 10,000 | | | 11,409 |

Teva Pharmaceutical | | | | | | |

Finance LLC, 6.150%, 2/1/2036 | | | 10,000 | | | 11,651 |

UnitedHealth Group, Inc., | | | | | | |

6.000%, 2/15/2018 | | | 50,000 | | | 55,837 |

Watson Pharmaceuticals, | | | | | | |

Inc., 5.000%, 8/15/2014 | | | 20,000 | | | 21,443 |

WellPoint, Inc., 6.375%, | | | | | | |

1/15/2012 | | | 50,000 | | | 53,490 |

Wyeth, 5.500%, 2/15/2016 | | | 25,000 | | | 28,691 |

|

Wyeth, 7.250%, 3/1/2023 | | | 25,000 | | | 30,986 |

|

| |

Total Health Care | | | | | | 962,288 |

| |

| | |

| Industrials–1.6% | | | | | | |

ACE INA Holdings, Inc., | | | | | | |

5.900%, 6/15/2019 | | | 15,000 | | | 16,482 |

Air Products & Chemicals, | | | | | | |

Inc., 4.375%, 8/21/2019 | | | 25,000 | | | 26,148 |

Altria Group, Inc., | | | | | | |

9.250%, 8/6/2019 | | | 100,000 | | | 125,013 |

Bemis Co., Inc., 5.650%, | | | | | | |

8/1/2014 | | | 5,000 | | | 5,511 |

Boeing Capital Corp. Ltd., | | | | | | |

6.500%, 2/15/2012 | | | 50,000 | | | 54,321 |

Boston Properties LP, | | | | | | |

5.875%, 10/15/2019 | | | 25,000 | | | 26,795 |

| | | | |

| | | | |

| | | | |

Burlington Northern Santa Fe | | | | |

Corp., 5.900%, 7/1/2012 | | 50,000 | | 54,181 |

Cabot Corp., 5.000%, | | | | |

10/1/2016 | | 25,000 | | 26,569 |

Canadian Pacific Railway | | | | |

Co., 5.950%, 5/15/2037 | | 25,000 | | 26,717 |

Caterpillar Financial | | | | |

Services Corp., 4.250%, 2/8/2013 | | 50,000 | | 53,370 |

Caterpillar Financial | | | | |

Services Corp., 5.125%, 10/12/2011 | | 50,000 | | 52,508 |

Caterpillar, Inc., 6.625%, | | | | |

7/15/2028 | | 10,000 | | 11,935 |

Cooper US, Inc., 6.100%, | | | | |

7/1/2017 | | 25,000 | | 28,636 |

CRH America, Inc., | | | | |

5.625%, 9/30/2011 | | 25,000 | | 25,958 |

CSX Corp., 6.250%, | | | | |

3/15/2018 | | 25,000 | | 28,749 |

Deere & Co., 4.375%, | | | | |

10/16/2019 | | 25,000 | | 26,688 |

Deere & Co., 5.375%, | | | | |

10/16/2029 | | 25,000 | | 27,407 |

Dover Corp., 5.450%, | | | | |

3/15/2018 | | 25,000 | | 28,302 |

Emerson Electric Co., | | | | |

5.375%, 10/15/2017 | | 25,000 | | 28,480 |

Honeywell International, Inc., | | | | |

5.300%, 3/1/2018 | | 50,000 | | 57,187 |

Honeywell International, Inc., | | | | |

5.700%, 3/15/2036 | | 25,000 | | 28,360 |

International Business | | | | |

Machines Corp., 2.100%, 5/6/2013 | | 50,000 | | 50,988 |

International Business | | | | |

Machines Corp., 6.500%, 1/15/2028 | | 50,000 | | 60,766 |

International Paper Co., | | | | |

7.500%, 8/15/2021 | | 40,000 | | 46,927 |

Lockheed Martin Corp., | | | | |

4.121%, 3/14/2013 | | 25,000 | | 26,787 |

Lockheed Martin Corp., | | | | |

7.750%, 5/1/2026 | | 25,000 | | 32,890 |

Norfolk Southern Corp., | | | | |

7.700%, 5/15/2017 | | 10,000 | | 12,453 |

Norfolk Southern Corp., | | | | |

7.800%, 5/15/2027 | | 15,000 | | 19,357 |

| | | | |

| 20 | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | U.S. Bond Market Portfolio |

U.S. Bond Market Portfolio (continued)

June 30, 2010

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| | |

| Industrials (continued) | | | | | | |

Northrop Grumman Corp., | | | | | | |

7.750%, 2/15/2031 | | $ | 15,000 | | $ | 20,175 |

Philip Morris International, | | | | | | |

Inc., 5.650%, 5/16/2018 | | | 50,000 | | | 54,784 |

Pitney Bowes, Inc., | | | | | | |

5.750%, 9/15/2017 | | | 25,000 | | | 28,117 |

Potash Corp. of | | | | | | |

Saskatchewan, Inc., 5.250%, 5/15/2014 | | | 25,000 | | | 27,600 |

Procter & Gamble Co., | | | | | | |

4.700%, 2/15/2019 | | | 50,000 | | | 54,887 |

Raytheon Co., 4.400%, | | | | | | |

2/15/2020 | | | 25,000 | | | 26,874 |

RR Donnelley & Sons Co., | | | | | | |

8.600%, 8/15/2016 | | | 25,000 | | | 27,421 |

Southwest Airlines Co., | | | | | | |

5.250%, 10/1/2014 | | | 50,000 | | | 52,679 |

Tyco International Finance | | | | | | |

SA, 4.125%, 10/15/2014 | | | 25,000 | | | 26,564 |

Tyco International Group | | | | | | |

SA, 6.000%, 11/15/2013 | | | 25,000 | | | 28,004 |

Union Pacific Corp., | | | | | | |

6.125%, 2/15/2020 | | | 25,000 | | | 29,061 |

Waste Management, Inc., | | | | | | |

6.375%, 11/15/2012 | | | 25,000 | | | 27,407 |

| |

Total Industrials | | | | | | 1,413,058 |

| |

| |

| Information Technology–0.5% | | | |

Arrow Electronics, Inc., | | | | | | |

6.000%, 4/1/2020 | | | 25,000 | | | 25,882 |

Electronic Data Systems | | | | | | |

Corp., 6.000%, 8/1/2013 | | | 25,000 | | | 28,209 |

General Dynamics Corp., | | | | | | |

1.800%, 7/15/2011 | | | 15,000 | | | 15,105 |

Hewlett-Packard Co., | | | | | | |

5.250%, 3/1/2012 | | | 25,000 | | | 26,762 |

Microsoft Corp., 2.950%, | | | | | | |

6/1/2014 | | | 75,000 | | | 78,550 |

Oracle Corp., 6.500%, | | | | | | |

4/15/2038 | | | 25,000 | | | 30,444 |

Oracle Corp. and Ozark | | | | | | |

Holding, Inc., 5.250%, 1/15/2016 | | | 50,000 | | | 56,805 |

| | | | |

| | | | |

Rockwell Collins, Inc., | | | | |

5.250%, 7/15/2019 | | 50,000 | | 55,193 |

Science Applications | | | | |

International Corp., 6.250%, 7/1/2012 | | 20,000 | | 21,875 |

United Technologies Corp., | | | | |

4.500%, 4/15/2020 | | 30,000 | | 32,522 |

United Technologies Corp., | | | | |

6.050%, 6/1/2036 | | 25,000 | | 28,612 |

Xerox Corp., 5.500%, | | | | |

5/15/2012 | | 50,000 | | 53,321 |

| |

Total Information Technology | | | | 453,280 |

| |

| | |

| Materials–0.5% | | | | |

Alcoa, Inc., 5.900%, | | | | |

2/1/2027 | | 25,000 | | 22,048 |

Continental Airlines, Inc., | | | | |

9.000%, 7/8/2016 | | 47,979 | | 51,577 |

Dow Chemical Co., | | | | |

6.000%, 10/1/2012 | | 50,000 | | 53,791 |

Dow Chemical Co., | | | | |

8.550%, 5/15/2019 | | 50,000 | | 61,305 |

EI du Pont de Nemours & | | | | |

Co., 4.625%, 1/15/2020 | | 25,000 | | 26,935 |

EI Du Pont de Nemours & | | | | |

Co., 4.750%, 3/15/2015 | | 25,000 | | 27,632 |

EI Du Pont de Nemours & | | | | |

Co., 5.600%, 12/15/2036 | | 25,000 | | 27,440 |

Falconbridge Ltd., 5.500%, | | | | |

6/15/2017 | | 25,000 | | 26,618 |

StatoilHydro ASA, 5.250%, | | | | |

4/15/2019 | | 20,000 | | 21,976 |

Vale Overseas Ltd., | | | | |

6.875%, 11/21/2036 | | 50,000 | | 52,251 |

Valspar Corp., 7.250%, | | | | |

6/15/2019 | | 25,000 | | 29,761 |

| |

Total Materials | | | | 401,334 |

| |

| |

| Telecommunication Services–1.0% | | |

AT&T Wireless Services, | | | | |

Inc., 8.125%, 5/1/2012 | | 50,000 | | 55,974 |

AT&T, Inc., 4.950%, | | | | |

1/15/2013 | | 100,000 | | 108,613 |

AT&T, Inc., 6.150%, | | | | |

9/15/2034 | | 25,000 | | 26,332 |

AT&T, Inc., 6.400%, | | | | |

5/15/2038 | | 50,000 | | 55,159 |

AT&T, Inc., 6.800%, | | | | |

5/15/2036 | | 25,000 | | 28,773 |

| | | | |

| U.S. Bond Market Portfolio | | AARP PORTFOLIOS 2010 ANNUAL REPORT | | 21 |

| | | | | | |

| Portfolio of investments | | |

| | |

| | | Par amount | | Value |

| | | | | | |

| |

Corporate Bonds (continued) | | | |

| |

| Telecommunication Services (continued) | | | |

BellSouth Capital Funding | | | | | | |

Corp., 7.875%, 2/15/2030 | | $ | 25,000 | | $ | 30,727 |

BellSouth Corp., 5.200%, | | | | | | |

9/15/2014 | | | 30,000 | | | 33,368 |

BellSouth Corp., 6.000%, | | | | | | |

11/15/2034 | | | 10,000 | | | 10,366 |

Embarq Corp., 7.082%, | | | | | | |

6/1/2016 | | | 50,000 | | | 53,367 |

Motorola, Inc., 6.000%, | | | | | | |

11/15/2017 | | | 25,000 | | | 26,875 |

1NBC Universal, Inc., 3.650%, | | | | | | |

4/30/2015 | | | 50,000 | | | 51,186 |

Quest Diagnostics, Inc., | | | | | | |

5.750%, 1/30/2040 | | | 10,000 | | | 9,880 |

Qwest Corp., 8.375%, | | | | | | |

5/1/2016 | | | 30,000 | | | 32,925 |

Telecom Italia Capital SA, | | | | | | |

6.175%, 6/18/2014 | | | 100,000 | | | 104,635 |

Time Warner, Inc., 6.200%, | | | | | | |

3/15/2040 | | | 25,000 | | | 26,461 |

Verizon Communications, Inc., | | | | | | |

5.500%, 2/15/2018 | | | 50,000 | | | 54,951 |

Verizon Communications, Inc., | | | | | | |

5.550%, 2/15/2016 | | | 50,000 | | | 56,069 |

Verizon Global Funding Corp., | | | | | | |

5.850%, 9/15/2035 | | | 10,000 | | | 10,349 |

Verizon Global Funding Corp., | | | | | | |

7.750%, 12/1/2030 | | | 25,000 | | | 31,242 |

Verizon New England, Inc., | | | | | | |

6.500%, 9/15/2011 | | | 30,000 | | | 31,692 |

Vodafone Group PLC, | | | | | | |

4.150%, 6/10/2014 | | | 50,000 | | | 52,512 |

| |

Total Telecommunication Services | | | 891,456 |

| |

| | |

| Utilities–1.3% | | | | | | |

Arizona Public Service Co., | | | | | | |

6.500%, 3/1/2012 | | | 10,000 | | | 10,728 |

Atlantic City Electric Co., | | | | | | |

7.750%, 11/15/2018 | | | 15,000 | | | 18,928 |

Carolina Power & Light Co., | | | | | | |

5.125%, 9/15/2013 | | | 10,000 | | | 11,022 |

CenterPoint Energy Resources | | | | | | |

Corp., 6.000%, 5/15/2018 | | | 25,000 | | | 27,583 |

| | | | |

| | | | |