UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21825

AARP FUNDS

(Exact name of registrant as specified in charter)

650 F. Street, N.W.

Washington, DC 20004

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Larry C. Renfro AARP Funds 650 F Street, N.W. Washington, DC 20004 | | Gary O. Cohen, Esq. Jorden Burt LLP 1025 Thomas Jefferson Street, NW Suite 400 East Washington, DC 20007-5208 |

Registrant’s telephone number, including area code: (202) 434-3650

Date of fiscal year end: June 30

Date of reporting period: December 31, 2007

| Item 1. | Report to Shareholders |

A Letter to Shareholders

| | |

| | A LETTER TO SHAREHOLDERS |

| |

Larry C. Renfro President, AARP Funds | | Dear Fellow Shareholder, If you’ve been following the news on the economy and the financial markets, you know that these are challenging times. • A housing downturn, record energy prices, slower job growth and rising unemployment have weakened economic growth and made consumers less confident about the future. In fact, an increasing number of economists now forecast a recession for the U.S. economy. • At the same time, rising mortgage defaults and foreclosures, particularly in the subprime segment of the mortgage market, have led to tighter lending standards. |

We have received many calls about the economy in general and the subprime crisis in particular. While the accompanying Market Commentary discusses the general economy in more detail, the following is our perspective on the subprime mortgage crisis.

THE SUBPRIME CRISIS AND ITS LINK TO THE MARKETS

When the housing market was strong and mortgage rates were generally low, subprime lenders granted mortgages to buyers with lower credit ratings and other real estate investors. These borrowers had to pay higher rates than borrowers with better credit records. To qualify for loans, subprime borrowers often chose adjustable rate mortgages with low introductory interest rates. When these adjustable rate loans reset to higher rates, many homeowners who were already stretched to the limit were unable to make their payments. The increase in homeowner defaults and the subsequent foreclosures has forced some subprime lenders to declare bankruptcy. In addition, some large financial institutions that bought bonds backed by these lower-quality mortgages have also incurred losses. As a result, lenders have tightened their standards and credit market concerns have weighed on the bond and credit markets, in general.

We do not expect a quick resolution to these conditions: There is risk that credit concerns could spread to other segments of the fixed income markets. However, we expect conditions to improve over time. It is also important to keep in mind that subprime mortgages represent only ten percent of the U.S. mortgage market. The vast majority of mortgage loans continue to be repaid on a timely basis. And only seven percent of subprime loans are in foreclosure. Furthermore, the Federal Reserve Board has taken swift action to restore confidence in the credit markets and to stimulate the economy, including significant reductions in short-term interest rates.

MARKET VOLATILITY IN PERSPECTIVE

The deteriorating credit conditions that unsettled the credit markets also contributed to stock market volatility in 2007. In 2007, the markets experienced more volatility than in recent years. Market volatility is unsettling because no one can predict what will happen next. However, it’s easier to ignore short-term market fluctuations if you understand your personal investment time horizon and risk tolerance—and have a plan for achieving your long term goals.

The AARP Funds adhere to five investment principles that can help you stay focused on the long term and avoid mistakes that many investors make in a declining market. They offer low

NOT PART OF THE SEMI-ANNUAL REPORT

A Letter to Shareholders

fees, the benefits of indexing, automatic rebalancing, simple choices and diversification across asset classes, which provides a built in cushion against declining performance in any one segment of the markets.1

In 2007, all five of the AARP Funds performed competitively relative to their peers during the fourth quarter and for the year. The strong relative performance was largely due to the conservative bias in the positioning of the Funds. More specifically, the market environment in the latter part of 2007 favored conservative fixed income investments over other asset classes, including equities.

What should you do now? When the market and economic news is disappointing, it’s important to understand that history is on the side of the patient investor. Quick decisions based on recent market performance—whether it’s up or down—are rarely rewarded. And that is why the AARP Funds have been designed with a long-term focus so that you can weather the storm. In addition, you have access to an independent source of guidance. Our Investment Counselors are salaried professionals, focused on your needs—not on commissions. They are here to provide guidance and help you make informed investment decisions. Many of you have already taken advantage of this unique service, and we appreciate the consistently high ratings you have awarded our Investment Counselors. You can discuss your financial needs with one of these capable and experienced professionals by calling 1-800-958-6457 any time between 8:00 a.m. and 6:00 p.m. Eastern Time, Monday through Friday.

Thank you for investing in AARP Funds. We will continue to work hard to earn your confidence and to help you keep your long-term financial goals on target.

Sincerely,

Larry C. Renfro, President

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

This Letter to Shareholders must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP does not offer financial products or services itself, and it cannot recommend that you or any specific individual should purchase any particular product or service. AARP Financial Inc. is a registered investment adviser and a subsidiary of AARP.

Investment Counselors are FINRA registered representatives through ALPS Distributors, Inc., a registered broker/dealer, and employed by AARP Financial Inc.

AARP Funds are advised by AARP Financial Inc. and distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

1 | Diversification reduces risk but does not eliminate it. |

NOT PART OF THE SEMI-ANNUAL REPORT

Market Commentary

Market Commentary December 31, 2007 (unaudited)

Rising energy costs, deteriorating credit markets, and a weak housing market weighed heavily on investors in the fourth quarter as worries about consumer spending, which accounts for more than two-thirds of the U.S. economy, dominated the economic news. Weakened consumer spending has already had an impact on the pace of economic growth: Growth slowed from an annualized rate of 4.9% in the third quarter to an estimated 0.6% in the fourth quarter.

Despite a volatile fourth quarter, equity markets—both here and abroad—posted gains for 2007. The MSCI US Investable Market 2500 Index recorded a 3.25% loss for the quarter, but ended the year with a positive return of 5.80%. International equities, as measured by the MSCI EAFE Index, recorded a 1.75% loss for the quarter, but ended the year with a positive return of 11.17%. The Federal Reserve Board (the Fed) has responded to weak economic news and problems in the credit markets by reducing a key short-term interest rate, the federal funds rate, in an effort to stimulate economic growth. The Fed’s actions helped lift prices on longer-term fixed income securities. Bonds, as measured by the Lehman Aggregate Bond Index, returned 3.00% for the fourth quarter and ended the year with a positive return of 6.97%.

AARP Funds

Despite mixed returns in the fourth quarter, both stock and bond markets gained ground for the year. In the equity markets, sharp gains in the energy and materials sectors helped offset steep losses in the financial sector—the worst-performing sector for the year. Outside the U.S., double digit returns from the Nordic and Pacific markets (ex Japan) helped offset negative performance from Japan as well as Ireland, Belgium and Sweden. These returns, plus strong performance in many smaller developed markets, resulted in strong returns for developed foreign markets for the year, despite the quarter’s losses. Bonds were positive performers for both the quarter and the year. Long-term, high quality securities led the fixed income markets. Against this backdrop, all AARP Funds posted positive returns for 2007. Given the relatively strong performance of bonds during the fourth quarter, the AARP Conservative Fund and Income Fund both posted positive returns for the quarter as well.

As uncertainty over the economy’s prospects continues, the markets are likely to remain volatile. History shows that periods of volatility are not unusual. They call for patience, focus and commitment to a diversified portfolio. An emotional response to short-term fluctuations can result in immediate losses—and missed opportunities down the road. However, a diversified portfolio can be an investor’s best ally during volatile times.1

NOT PART OF THE SEMI-ANNUAL REPORT

Market Commentary

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes and do not reflect the expenses of managing a fund. It is not possible to invest directly in an Index. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

The views, forecasts and supporting information contained in this Market Commentary are as of December 31, 2007 and are subject to change. This Market Commentary must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP does not offer financial products or services itself, and it cannot recommend that you or any specific individual should purchase any particular product or service. AARP Financial Inc. is a registered investment adviser and a subsidiary of AARP.

Investment Counselors are FINRA registered representatives through ALPS Distributors, Inc., a registered broker/dealer, and employed by AARP Financial Inc.

AARP Funds are advised by AARP Financial Inc. and distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

1 | Diversification reduces risk but does not eliminate it. |

NOT PART OF THE SEMI-ANNUAL REPORT

AARP FUNDS

…

Semi-Annual Report

December 31, 2007 (unaudited)

…

KEEPING YOU INFORMED

This shareholder report for the AARP Funds represents our commitment to providing communications that are clear, concise and informative. One of our highest priorities at AARP Funds is to help you make sense of investment information that is often complex. We hope you find it helpful in evaluating your investment with us.

EXPERTISE AND GUIDANCE

WHEN YOU NEED IT

AARP Financial’s Investment Counselors are ready to help you determine if you are on track financially for retirement and to answer specific questions about AARP Funds. They work on salary, not commission, and are there to help you focus on your goals, take decisive action and feel comfortable with your decisions. Investment Counselors are FINRA registered representatives through ALPS Distributors, Inc., and are employed by AARP Financial.

AARP FUNDS 2007 SEMI-ANNUAL REPORT 1

Table of Contents

This Shareholder Report must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP cannot recommend that you or any specific individual should purchase shares of a particular fund. AARP is not a registered investment adviser or broker/dealer.

AARP Funds are distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

2 AARP FUNDS 2007 SEMI-ANNUAL REPORT AARP Funds Overview

AARP Funds Overview

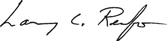

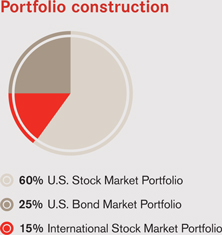

The AARP Funds (excluding the AARP Money Market Fund) are “funds of funds” because they invest substantially all of their assets in the underlying AARP Portfolios (the “AARP Portfolios”), each of which is a separately registered investment company.

The AARP Funds (excluding the AARP Money Market Fund) invest in one or more of the AARP Portfolios, but in different amounts. In addition to its investment in the U.S. Bond Market Portfolio, the AARP Income Fund also invests a portion of its assets in the State Street Money Market Portfolio (the “State Street Portfolio”), a series of a separately registered investment company called the State Street Master Funds.

The AARP Money Market Fund is a feeder fund, buying shares of the master fund, the State Street Portfolio. This is called a “master-feeder” structure because it allows different feeder funds to pool their assets in an underlying master fund to seek economies of scale.

| | | | | | | | | | | | | | | |

| | | AARP

Aggressive Fund | | | AARP

Moderate Fund | | | AARP

Conservative Fund | | | AARP

Income Fund | | | AARP Money

Market Fund | |

Investment Objective | | Seeks growth of

capital and some

current income | | | Seeks a balance

of growth of

capital and

current income | | | Seeks primarily

current income,

with some growth

of capital | | | Seeks current

income and long-

term preservation

of capital | | | Seeks current

income, liquidity,

preservation of

capital, and a

stable $ 1.00

per share price | |

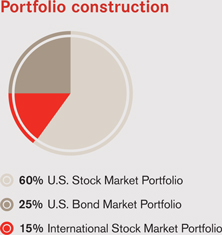

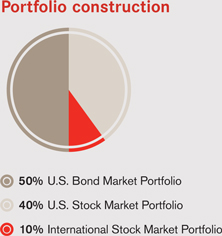

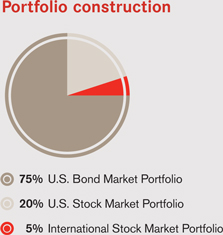

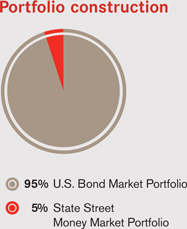

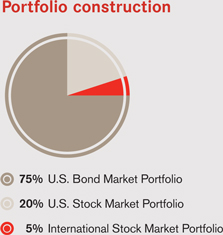

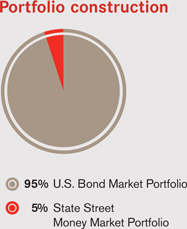

U.S. Stock Market Portfolio | | 60 | % | | 40 | % | | 20 | % | | — | | | — | |

U.S. Bond Market Portfolio | | 25 | % | | 50 | % | | 75 | % | | 95 | % | | — | |

International Stock Market Portfolio | | 15 | % | | 10 | % | | 5 | % | | — | | | — | |

State Street Portfolio | | — | | | — | | | — | | | 5 | % | | 100 | % |

Source: AARP Funds

AARP Portfolios Top 10 Holdings as a percentage of net assets at December 31, 2007 (unaudited)

| | | |

U.S. Stock Market Portfolio | | | |

Exxon Mobil Corp. | | 3.2 | % |

General Electric Co. | | 2.4 | % |

Microsoft Corp. | | 1.9 | % |

AT&T, Inc. | | 1.6 | % |

Procter & Gamble Co. | | 1.4 | % |

Chevron Corp. | | 1.2 | % |

Johnson & Johnson | | 1.2 | % |

Bank of America Corp. | | 1.1 | % |

Apple Computer, Inc. | | 1.1 | % |

Cisco Systems, Inc. | | 1.0 | % |

Total | | 16.1 | % |

| | | |

U.S. Bond Market Portfolio | | | |

FNMA, 7.000%, 8/1/37 | | 1.2 | % |

U.S. Treas. Notes, 4.250%, 11/1/15 | | 1.2 | % |

FNMA, 5.500%, 4/01/35 | | 1.1 | % |

U.S. Treas. Notes, 4.250%, 9/30/12 | | 1.1 | % |

U.S. Treas. Notes, 4.000%, 2/15/15 | | 1.1 | % |

FHLMC, 5.500%, 3/1/36 | | 1.0 | % |

FNMA, 4.750%, 12/15/10 | | 1.0 | % |

U.S. Treas. Notes, 4.500%, 3/31/12 | | 0.9 | % |

FNMA, 4.331%, 6/1/36 | | 0.9 | % |

U.S. Treas. Notes, 4.625%, 12/31/11 | | 0.9 | % |

Total | | 10.4 | % |

| | | |

International Stock Market Portfolio | | | |

BP PLC | | 1.6 | % |

Vodafone Group PLC | | 1.4 | % |

HSBC Holdings PLC | | 1.4 | % |

Nestle SA | | 1.3 | % |

Total SA | | 1.2 | % |

Royal Dutch Shell | | 1.1 | % |

Nokia OYJ | | 1.1 | % |

Toyota Motor Corp. | | 1.0 | % |

GlaxoSmithKline PLC | | 1.0 | % |

Telefonica SA | | 1.0 | % |

Total | | 12.1 | % |

How the Funds Performed AARP FUNDS 2007 SEMI-ANNUAL REPORT 3

How the Funds Performed as of December 31, 2007 (unaudited)

| | | | | | | | | | | | |

| | | 6-months | | | 12 months | | | Average

annual since

inception | | | Cumulative

since

inception | |

AARP Aggressive Fund | | 0.51 | % | | 6.81 | % | | 10.01 | %1 | | 21.08 | %1 |

Aggressive Composite Index | | 0.57 | % | | 7.01 | % | | 10.61 | %1 | | 22.35 | %1 |

MSCI U.S. Investable Market 2500 Index®2 | | -1.66 | % | | 5.80 | % | | 10.64 | %1 | | 22.41 | %1 |

| | | | |

AARP Moderate Fund | | 2.22 | % | | 6.71 | % | | 8.37 | %1 | | 17.50 | %1 |

Moderate Composite Index | | 2.37 | % | | 7.09 | % | | 8.99 | %1 | | 18.78 | %1 |

MSCI U.S. Investable Market 2500 Index®2 | | -1.66 | % | | 5.80 | % | | 10.64 | %1 | | 22.41 | %1 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 5.64 | %1 | | 11.61 | %1 |

| | | | |

AARP Conservative Fund | | 4.12 | % | | 6.76 | % | | 6.84 | %1 | | 14.19 | %1 |

Conservative Composite Index | | 4.16 | % | | 7.04 | % | | 7.32 | %1 | | 15.19 | %1 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 5.64 | %1 | | 11.61 | %1 |

| | | | |

AARP Income Fund | | 5.78 | % | | 6.67 | % | | 6.04 | %3 | | 7.66 | %3 |

Income Composite Index | | 5.74 | % | | 6.83 | % | | 6.46 | %3 | | 8.18 | %3 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 6.57 | %3 | | 2.21 | %3 |

Citigroup 3-Month Treasury Bill Index | | 2.20 | % | | 4.74 | % | | 4.81 | %3 | | 6.07 | %3 |

| | | | |

AARP Money Market Fund | | 2.49 | % | | 5.09 | % | | 5.07 | %4 | | 7.73 | %4 |

Citigroup 3-Month Treasury Bill Index | | 2.20 | % | | 4.74 | % | | 4.84 | %4 | | 7.38 | %4 |

1 | For the period from January 1, 2006 (commencement of operations) to December 31, 2007. |

2 | The MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index serve as broad measures of the U.S equity and taxable bond markets, respectively. Since the Funds invest in differing combinations of these and other markets, Composite Indexes have been constructed utilizing the proportionate weightings of the indexes for each market. These Composite Indexes provide a particularly useful benchmark to measure the performance of the Funds. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see A Word about Benchmarks below. |

3 | For the period from September 29, 2006 (commencement of operations) to December 31, 2007. |

4 | For the period from July 1, 2006 (commencement of operations) to December 31, 2007. |

Sources: MSCI Barra, Lehman Brothers Inc., Citigroup, AARP Financial Inc.

Total annual fund operating fees and expenses are 1.42% for the Aggressive Fund, 1.00% for the Moderate Fund, 1.86% for the Conservative Fund, 6.84% for the Income Fund and 0.92% for the Money Market Fund. Net annual fund operating fees and expenses for the funds (after contractual waivers and/or reimbursements) are 0.30% for the Money Market Fund and 0.50% for the others through November 1, 2008 and November 1, 2009, respectively.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

4 AARP FUNDS 2007 SEMI-ANNUAL REPORT A Word about Benchmarks

A Word about Benchmarks

A useful tool to measure the performance of AARP Funds.

When evaluating how your investment performed, it’s helpful to compare it to an appropriate benchmark. You can think of the benchmark as a handy yardstick for measuring how well the fund did in meeting its investment objectives. For example, the AARP Income Fund tries to produce returns comparable to the Lehman Brothers Aggregate Bond Index.

The AARP Aggressive Fund, AARP Moderate Fund and AARP Conservative Fund are indexed and try to produce the returns of a mixture of three indexes. For these Funds, a particularly useful benchmark is one that combines the three indexes in similar amounts to the target investments of the Funds. When you combine different indexes into one benchmark, it’s called a “composite index”.

We also believe it is useful for you to consider the returns of the overall bond and stock markets when you assess the performance of the AARP Funds. This allows you to see how diversification works in practice. Sometimes the bond and stock markets move in opposite directions, or when the stock market goes down, the bond market doesn’t go quite as far down.

There is one caveat though. Please remember that a benchmark of indexes has a built-in performance advantage over an actual mutual fund. An index is merely a list of securities in a stock or bond market so the returns of indexes do not reflect the real world costs of managing a mutual fund. It is difficult to match the returns of an index because of this difference.

Indexes vs. index funds

Indexes, as opposed to index funds, are a group or list of securities representing a market or part of a market. The returns of the index do not reflect the costs of actually investing in the index and do not include fees, brokerage commissions or other expenses of investing. While you can invest in an index fund – it’s a real investment, you cannot invest directly in an index – it’s just a list.

A Word about Benchmarks AARP FUNDS 2007 SEMI-ANNUAL REPORT 5

Following is a table that shows the make up of the index weightings for each AARP Fund:

| | | | | | | | | | | | | | | |

| | | AARP

Aggressive Fund

Aggressive

Composite Index | | | AARP

Moderate Fund

Moderate

Composite Index | | | AARP

Conservative Fund

Conservative

Composite Index | | | AARP

Income Fund

Income

Composite Index | | | AARP Money

Market Fund | |

Lehman Brothers Aggregate Bond Index® | | 25 | % | | 50 | % | | 75 | % | | 95 | % | | — | |

MSCI U.S. Investable Market 2500 Index® | | 60 | % | | 40 | % | | 20 | % | | — | | | — | |

MSCI EAFE Index® | | 15 | % | | 10 | % | | 5 | % | | — | | | — | |

Citigroup 3-Month Treasury Bill Index | | — | | | — | | | — | | | 5 | % | | 100 | % |

Source: AARP Funds

A description of each index

• | | Lehman Brothers Aggregate Bond Index® — The index includes a large variety of U.S. and foreign bonds traded in U.S. markets that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset-backed securities. |

• | | MSCI U.S. Investable Market 2500 Index®* — The index includes about 2,500 securities listed on the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks include companies of all types and sizes, which represent the investable universe of companies in the U.S. Equity market. |

• | | MSCI EAFE Index®* — The index includes about 1,000 securities that are listed on the stock exchanges of 21 developed countries, excluding the United States and Canada. |

| • | | Citigroup 3-Month Treasury Bill Index — The index is comprised of equal dollar amounts of 3-Month Treasury Bills purchased at the beginning of each of the prior three consecutive months. As each bill matures, all proceeds are reinvested in a new 3-month bill. |

| * | Please note that although the AARP Funds seek to track these MSCI indexes, MSCI does not sponsor, endorse, or promote the AARP Funds. For a more detailed description of our relationship with MSCI please see the statement of additional information for the AARP Funds. |

6 AARP FUNDS 2007 SEMI-ANNUAL REPORT AARP Aggressive Fund Overview

AARP Aggressive Fund Overview

Portfolio of investments

December 31, 2007 (unaudited)

Mutual funds: 99.9%

| | | | | |

| | | Shares | | Value |

U.S. Stock Market Portfolio1 | | 1,419,667 | | $ | 16,311,969 |

U.S. Bond Market Portfolio1 | | 675,241 | | | 6,819,931 |

International Stock Market Portfolio1 | | 316,127 | | | 3,999,003 |

Total investments: 99.9% (Identified cost $26,323,843) | | | | | 27,130,903 |

| | | | | |

Other assets and liabilities, net: 0.1% | | | | | 17,942 |

| | | | | |

Total net assets: 100.0% | | | | $ | 27,148,845 |

See Notes to Financial Statements.

Performance summary

Average Annual Returns as of December 31, 2007 (unaudited)

| | | | | | | | | |

| | | 6-month | | | 1-year | | | Since

inception | |

AARP Aggressive Fund | | 0.51 | % | | 6.81 | % | | 10.01 | %1 |

Aggressive Composite Index | | 0.57 | % | | 7.01 | % | | 10.61 | %1 |

MSCI U.S. Investable Market 2500 Index®2 | | -1.66 | % | | 5.80 | % | | 10.64 | %1 |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

1 | For the period from January 1, 2006 (commencement of operations) to December 31, 2007. |

2 | The MSCI U.S. Investable Market 2500 Index serves as broad measure of the U.S equity market. Since the Fund invests in differing combinations of this and other markets, the Aggressive Composite Index has been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

Sources: MSCI Barra, AARP Financial Inc.

AARP Moderate Fund Overview AARP FUNDS 2007 SEMI-ANNUAL REPORT 7

AARP Moderate Fund Overview

Portfolio of investments

December 31, 2007 (unaudited)

Mutual funds: 100.2%

| | | | | | |

| | | Shares | | Value | |

U.S. Bond Market Portfolio1 | | 2,038,280 | | $ | 20,586,623 | |

U.S. Stock Market Portfolio1 | | 1,419,472 | | | 16,309,737 | |

International Stock Market Portfolio1 | | 323,516 | | | 4,092,474 | |

Total investments: 100.2% (Identified cost $39,830,641) | | | | | 40,988,834 | |

| | | | | | |

Other assets and liabilities, net: (0.2)% | | | | | (77,153 | ) |

| | | | | | |

Total net assets: 100.0% | | | | $ | 40,911,681 | |

See Notes to Financial Statements.

Performance summary

Average Annual Returns as of December 31, 2007 (unaudited)

| | | | | | | | | |

| | | 6-month | | | 1-year | | | Since

inception | |

AARP Moderate Fund | | 2.22 | % | | 6.71 | % | | 8.37 | %1 |

Moderate Composite Index | | 2.37 | % | | 7.09 | % | | 8.99 | %1 |

MSCI U.S. Investable Market 2500 Index®2 | | -1.66 | % | | 5.80 | % | | 10.64 | %1 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 5.64 | %1 |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

1 | For the period from January 1, 2006 (commencement of operations) to December 31, 2007. |

2 | The MSCI U.S. Investable Market 2500 Index and the Lehman Brothers Aggregate Bond Index serve as broad measures of the U.S equity and taxable bond markets, respectively. Since the Fund invests in differing combinations of these and other markets, the Moderate Composite Index has been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

Sources: MSCI Barra, Lehman Brothers, Inc., AARP Financial Inc.

8 AARP FUNDS 2007 SEMI-ANNUAL REPORT AARP Conservative Fund Overview

AARP Conservative Fund Overview

Portfolio of investments

December 31, 2007 (unaudited)

Mutual funds: 99.2%

| | | | | |

| | | Shares | | Value |

U.S. Bond Market Portfolio1 | | 1,052,124 | | $ | 10,626,449 |

U.S. Stock Market Portfolio1 | | 244,646 | | | 2,810,985 |

International Stock Market Portfolio1 | | 55,290 | | | 699,413 |

Total investments: 99.2% (Identified cost $13,766,093) | | | | | 14,136,847 |

| | | | | |

Other assets and liabilities, net: 0.8% | | | | | 111,059 |

| | | | | |

Total net assets: 100.0% | | | | $ | 14,247,906 |

See Notes to Financial Statements.

Performance summary

Average Annual Returns as of December 31, 2007 (unaudited)

| | | | | | | | | |

| | | 6-month | | | 1-year | | | Since

inception | |

AARP Conservative Fund | | 4.12 | % | | 6.76 | % | | 6.84 | %1 |

Conservative Composite Index | | 4.16 | % | | 7.04 | % | | 7.32 | %1 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 5.64 | %1 |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

1 | For the period from January 1, 2006 (commencement of operations) to December 31, 2007. |

2 | The Lehman Brothers Aggregate Bond Index serves as broad measure of the U.S taxable bond market. Since the Fund invests in differing combinations of this and other markets, the Conservative Composite Index has been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. Sources: Lehman Brothers, Inc., AARP Financial Inc. |

AARP Income Fund Overview AARP FUNDS 2007 SEMI-ANNUAL REPORT 9

AARP Income Fund Overview

Portfolio of investments

December 31, 2007 (unaudited)

Mutual funds: 101.0%

| | | | | | |

| | | Shares | | Value | |

U.S. Bond Market Portfolio1 | | 319,052 | | $ | 3,222,424 | |

State Street Money Market Portfolio2 | | 174,501 | | | 174,501 | |

Total investments: 101.0% (Identified cost $3,346,733) | | | | | 3,396,925 | |

| | | | | | |

Other assets and liabilities, net: (1.0)% | | | | | (34,020 | ) |

| | | | | | |

Total net assets: 100.0% | | | | $ | 3,362,905 | |

2 | Investment in non-controlled affiliate. |

See Notes to Financial Statements.

Performance summary

Average Annual Returns as of December 31, 2007 (unaudited)

| | | | | | | | | |

| | | 6-month | | | 1-year | | | Since

inception | |

AARP Income Fund | | 5.78 | % | | 6.67 | % | | 6.04 | %1 |

Income Composite Index | | 5.74 | % | | 6.83 | % | | 6.46 | %1 |

Lehman Brothers Aggregate Bond Index®2 | | 5.93 | % | | 6.97 | % | | 6.57 | %1 |

Citigroup 3-Month Treasury Bill Index | | 2.20 | % | | 4.74 | % | | 4.81 | %1 |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

1 | For the period from September 29, 2006 (commencement of operations) to December 31, 2007. |

2 | The Lehman Brothers Aggregate Bond Index serves as broad measure of the U.S taxable bond market. Since the Fund invests in differing combinations of this and other markets, the Income Composite Index has been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 4. |

Sources: Lehman Brothers, Inc., Citigroup, AARP Financial Inc.

10 AARP FUNDS 2007 SEMI-ANNUAL REPORT AARP Money Market Fund Overview

AARP Money Market Fund Overview

Portfolio of investments

December 31, 2007 (unaudited)

Mutual funds: 99.7%

| | | |

| | | Value |

Investment in State Street Money Market Portfolio1 | | $ | 52,506,747 |

Total investments: 99.7% (Identified cost $52,506,747) | | | 52,506,747 |

| | | |

Other assets and liabilities, net: 0.3% | | | 132,535 |

| | | |

Total net assets: 100.0% | | $ | 52,639,282 |

1 | The financial statements of the State Street Money Market Portfolio, including its investment portfolio, are included elsewhere within this report and should be read in conjunction with the AARP Money Market Fund’s financial statements. |

AARP Money Market Fund invests only in State Street Money Market Portfolio. At December 31, 2007, AARP Money Market Fund owned 0.76% of the State Street Money Market Portfolio.

See Notes to Financial Statements.

Performance summary

Average Annual Returns as of December 31, 2007 (unaudited)

| | | | | | | | | |

| | | 6-month | | | 1-year | | | Since

inception | |

AARP Money Market Fund | | 2.49 | % | | 5.09 | % | | 5.07 | %1 |

Citigroup 3-month Treasury Bill Index | | 2.20 | % | | 4.74 | % | | 4.84 | %1 |

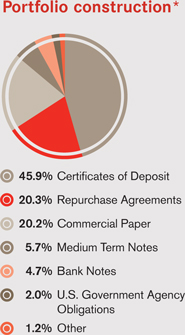

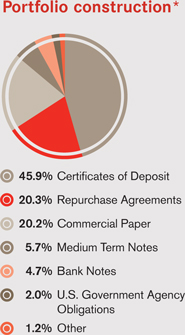

Maturity ladder

Maturities as of December 31, 2007 (unaudited)

| | | |

0-3 Days | | 20.3 | % |

4-90 Days | | 55.8 | % |

90+ Days | | 23.9 | % |

Total | | 100.0 | % |

Average Maturity | | 38 Days | |

| * | Portfolio construction represents the composition of the underlying holdings in the State Street Money Market Portfolio, whose financial statements are included elsewhere in this report. As a percentage of net assets as of the date indicated. The Portfolio’s composition will vary over time. |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfunds.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1 | For the period from July 1, 2006 (commencement of operations) to December 31, 2007. |

Sources: Citigroup, AARP Financial Inc.

Understanding Your Expenses AARP FUNDS 2007 SEMI-ANNUAL REPORT 11

Understanding Your Expenses (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including investment advisory fees, distribution (12b-1) fees, shareholder services fees, and other expenses of running a fund. It is important to understand exactly how much you pay to purchase and own a fund and to compare the costs of owning different funds because these costs reduce your returns.

The example in the table on the next page is intended to help you to understand your ongoing costs in dollars of investing in an AARP Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2007 to December 31, 2007.

Actual expenses

The first line for each Fund in the table on the next page, labeled “Actual”, provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line labeled “Actual” under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical example for comparison purposes

The second line for each fund in the table, labeled “Hypothetical”, helps you compare the costs of an AARP Fund to other funds using a 5% return as required by the Securities and Exchange Commission for all mutual funds. It provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Fund’s actual return. You should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures help you to compare the ongoing costs of investing in an AARP Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as redemption fees, which are charged by some mutual funds. Therefore, the line labeled “Hypothetical” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transaction costs were included, your costs would have been higher.

12 AARP FUNDS 2007 SEMI-ANNUAL REPORT Understanding Your Expenses

In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the underlying portfolios in which the Fund invests. Because the underlying portfolios have varied expenses and fee levels and the Fund may own different proportions of the underlying portfolios at different times, the amount of fees and expenses incurred indirectly by the Fund may vary in the future. However AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Funds, including the indirect fees and expenses of the underlying portfolios, at 0.50% of average daily net assets through at least November 1, 2008. In addition, effective March 1, 2007, AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Money Market Fund, including its pro-rata allocation of expenses from the State Street Portfolio, at 0.30% of average daily net assets through at least November 1, 2009.

| | | | | | | | | | | | | | | | | | |

| | | Beginning

account

value

7/1/07 | | Ending

account

value

12/31/07 | | Expenses

paid

during

period2 | | Annualized

expense

ratio2 | | | Effective

expenses

paid

during the

period3 | | Effective

annualized

expense

ratio3 | |

AARP Aggressive Fund | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,005.10 | | $ | 1.21 | | 0.24 | % | | $ | 2.52 | | 0.50 | % |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.93 | | $ | 1.22 | | | | | $ | 2.54 | | | |

AARP Moderate Fund | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,022.20 | | $ | 1.22 | | 0.24 | % | | $ | 2.54 | | 0.50 | % |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.93 | | $ | 1.22 | | | | | $ | 2.54 | | | |

AARP Conservative Fund | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,041.20 | | $ | 1.28 | | 0.25 | % | | $ | 2.57 | | 0.50 | % |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.88 | | $ | 1.27 | | | | | $ | 2.54 | | | |

AARP Income Fund | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,057.80 | | $ | 1.34 | | 0.26 | % | | $ | 2.59 | | 0.50 | % |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.83 | | $ | 1.32 | | | | | $ | 2.54 | | | |

AARP Money Market Fund | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,024.90 | | $ | 1.53 | | 0.30 | % | | $ | 1.53 | | 0.30 | % |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.63 | | $ | 1.53 | | | | | $ | 1.53 | | | |

1 | The Hypothetical example assumes a 5% return before expenses. |

2 | Expenses reflect the Fund’s annualized net expense ratios multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). The fees and expenses of the underlying portfolios are not included in these amounts. |

3 | Effective expenses reflect the sum of the expenses borne directly by the Fund plus the Fund’s pro-rata share of the weighted average expense ratio of the underlying portfolios in which it invests. The effective annualized expense ratio combines the Fund’s annualized net expense ratio and the annualized weighted average expense ratios of the underlying portfolios. The annualized weighted average expense ratio includes the annualized expense ratio for each underlying portfolio weighted for the Fund’s relative average investment during the same period. |

How to Read Financial Statements AARP FUNDS 2007 SEMI-ANNUAL REPORT 13

How to Read Financial Statements

Mutual funds are companies that pool money from many investors and invest that money in stocks, bonds and other securities and assets. Mutual fund financial statements show investors where a fund’s money came from, where it went, where it is and what it is worth as of the close of the fund’s most recent fiscal period. The portfolio of investments shows where the money is as of the close of the fund’s most recent fiscal period. The holdings of each AARP Fund as of December 31, 2007 are shown in the individual Fund Overview sections of this annual report. In addition, this section of the annual report contains four additional financial statements:

1. Statements of assets and liabilities.

These statements are the Funds’ balance sheets as of the close of the period (December 31, 2007). They show the value and the cost of what each Fund owned, how much it owed to others and the resulting difference or “net assets”.

| • | | Assets are the stocks, bonds, cash, and other financial instruments that a fund owns and has purchased with monies investors pay when they purchase shares. |

| • | | Liabilities are the amounts of money that a fund owes. Liabilities include payments due for the purchase of financial investments as well as bills that a fund incurs for services that are needed to run a fund, such as legal services and printing. |

| • | | Net assets=total assets–total liabilities. Net assets represent what is left of assets after liabilities are subtracted. This leftover amount belongs to the investors, or shareholders, of the fund. |

2. Statements of operations

These statements provide a summary of the investment income, such as dividends, that a fund has earned as well as gains and losses from its investment activities for the period ended December 31, 2007. Realized gains or losses reflect the difference between purchase price and selling price for transactions that took place during the period. Unrealized gains and losses reflect the difference between purchase price and the value of investments that are still held as of the end of the period. The statements also include specific details of fund expenses.

3. Statements of changes in net assets

These statements describe the changes in net assets during the current and prior period, which result from operations, any distributions of earnings to investors, and any shareholder transactions.

4. Financial highlights

The financial highlights table is intended to help you understand a fund’s financial performance for a share outstanding for the current period and each of the applicable prior periods.

The Notes to Financial Statements provide additional information to help you better understand the financial statements. They include a description of the most important accounting policies used in portraying the company’s financial condition and results, including how a fund records and values its investments, tax information, as well as additional detail on shareholder and investment transactions.

14 AARP FUNDS 2007 SEMI-ANNUAL REPORT Financial Statements

Financial Statements

Statements of assets and liabilities December 31, 2007 (unaudited)

| | | | | | | | | | | | | | | | | | |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | AARP

Conservative

Fund | | AARP

Income

Fund | | | AARP

Money Market

Fund | |

Assets: | | | | | | | | | | | | | | | | | | |

Investments in affiliated issuers, at value (identified cost of $26,323,843, $39,830,641 $13,766,093 and $3,172,232, respectively) | | $ | 27,130,903 | | | $ | 40,988,834 | | $ | 14,136,847 | | $ | 3,222,424 | | | $ | — | |

Investments in State Street | | | | | | | | | | | | | | | | | | |

Money Market Portfolio, at value (identified cost of $174,501 and $52,506,747, respectively) | | | — | | | | — | | | — | | | 174,501 | | | | 52,506,747 | |

Cash | | | — | | | | 55 | | | — | | | — | | | | — | |

Reimbursement receivable | | | 33,130 | | | | 31,158 | | | 24,720 | | | 23,122 | | | | 38,902 | |

Receivable for fund shares sold | | | 93,389 | | | | 44,086 | | | 134,848 | | | 11,134 | | | | 241,205 | |

| | | | | | | | | | | | | | | | | | |

Total assets | | $ | 27,257,422 | | | $ | 41,064,133 | | $ | 14,296,415 | | $ | 3,431,181 | | | $ | 52,786,854 | |

| | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | |

Payable for fund shares redeemed | | | 52,425 | | | | 91,303 | | | 5,135 | | | 33,543 | | | | 79,097 | |

Income distribution payable | | | — | | | | — | | | — | | | — | | | | 6,434 | |

Accrued portfolio acct. fees (Note 6) | | | 1,555 | | | | 1,597 | | | 1,533 | | | 1,422 | | | | 1,305 | |

Accrued administration fees (Note 6) | | | 793 | | | | 1,200 | | | 406 | | | 97 | | | | 1,528 | |

Accrued transfer agent fees (Note 6) | | | 14,856 | | | | 15,160 | | | 6,030 | | | 1,451 | | | | 15,484 | |

Accrued distribution services fee | | | 4,521 | | | | 6,841 | | | 2,315 | | | 555 | | | | 8,716 | |

Accrued audit fees | | | 10,027 | | | | 10,027 | | | 10,027 | | | 10,403 | | | | 10,403 | |

Accrued insurance fees | | | 3,288 | | | | 6,024 | | | 2,081 | | | 211 | | | | 696 | |

Accrued registration fees | | | — | | | | — | | | — | | | — | | | | 989 | |

Accrued printing and postage expenses | | | 9,021 | | | | 9,021 | | | 9,021 | | | 10,241 | | | | 10,241 | |

Accrued legal fees | | | 6,190 | | | | 6,190 | | | 6,190 | | | 6,190 | | | | 6,190 | |

Other accrued expenses and liabilities | | | 5,901 | | | | 5,089 | | | 5,771 | | | 4,163 | | | | 6,489 | |

Total liabilities | | $ | 108,577 | | | $ | 152,452 | | $ | 48,509 | | $ | 68,276 | | | $ | 147,572 | |

| | | | | | | | | | | | | | | | | | |

Net assets | | $ | 27,148,845 | | | $ | 40,911,681 | | $ | 14,247,906 | | $ | 3,362,905 | | | $ | 52,639,282 | |

| | | | | | | | | | | | | | | | | | |

Net assets consist of: | | | | | | | | | | | | | | | | | | |

Paid-in capital | | $ | 26,150,883 | | | $ | 39,573,477 | | $ | 13,850,596 | | $ | 3,324,704 | | | $ | 52,639,286 | |

Net unrealized appreciation of investments | | | 807,060 | | | | 1,158,193 | | | 370,754 | | | 50,192 | | | | — | |

Accumulated net realized gain (loss) on investments | | | 191,020 | | | | 179,958 | | | 26,496 | | | (12,010 | ) | | | (4 | ) |

Undistributed (distributions in excess of) net investment income | | | (118 | ) | | | 53 | | | 60 | | | 19 | | | | — | |

| | | | | | | | | | | | | | | | | | |

Net assets | | $ | 27,148,845 | | | $ | 40,911,681 | | $ | 14,247,906 | | $ | 3,362,905 | | | $ | 52,639,282 | |

| | | | | | | | | | | | | | | | | | |

Shares of beneficial interest outstanding | | | 2,359,136 | | | | 3,710,984 | | | 1,354,371 | | | 331,718 | | | | 52,639,286 | |

| | | | | | | | | | | | | | | | | | |

Net asset value per share | | $ | 11.51 | | | $ | 11.02 | | $ | 10.52 | | $ | 10.14 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

Financial Statements AARP FUNDS 2007 SEMI-ANNUAL REPORT 15

Financial Statements (continued)

Statements of operations Six months ended December 31, 2007 (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | | AARP

Conservative

Fund | | | AARP

Income

Fund | | | AARP

Money Market

Fund | |

| Investment income: | | | | | | | | | | | | | | | | | | | | |

Dividends from affiliated issuers | | $ | 398,394 | | | $ | 712,153 | | | $ | 281,836 | | | $ | 64,730 | | | $ | — | |

Interest allocated from State Street | | | | | | | | | | | | | | | | | | | | |

Money Market Portfolio | | | — | | | | — | | | | — | | | | 3,484 | | | | 1,207,577 | |

| | | | | | | | | | | | | | | | | | | | |

Total investment income | | $ | 398,394 | | | $ | 712,153 | | | $ | 281,836 | | | $ | 68,214 | | | $ | 1,207,577 | |

| | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

Expenses allocated from State Street Money Market Portfolio | | | — | | | | — | | | | — | | | | 68 | | | | 23,364 | |

Investment adviser fee (Note 6) | | | 1,223 | | | | 1,848 | | | | 632 | | | | 131 | | | | — | |

Administration fees (Note 6) | | | 4,281 | | | | 6,468 | | | | 2,211 | | | | 457 | | | | 8,152 | |

Registration fees | | | 12,957 | | | | 14,882 | | | | 13,058 | | | | 12,246 | | | | 11,329 | |

Transfer and dividend disbursing agent fees and expenses (Note 6) | | | 58,306 | | | | 49,180 | | | | 17,398 | | | | 4,369 | | | | 54,522 | |

Trustees’ fees | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | 10,000 | |

Audit fees | | | 9,373 | | | | 9,373 | | | | 9,373 | | | | 8,999 | | | | 8,999 | |

Legal fees | | | 29,386 | | | | 29,385 | | | | 29,386 | | | | 29,385 | | | | 29,385 | |

Portfolio accounting fees (Note 6) | | | 8,600 | | | | 8,778 | | | | 8,524 | | | | 8,498 | | | | 8,395 | |

Distribution service fees | | | 24,461 | | | | 36,959 | | | | 12,633 | | | | 2,613 | | | | 46,580 | |

Printing and postage expenses | | | 7,818 | | | | 7,818 | | | | 7,818 | | | | 8,038 | | | | 8,038 | |

Insurance expense | | | 3,288 | | | | 6,024 | | | | 2,081 | | | | 211 | | | | 695 | |

Miscellaneous | | | 4,331 | | | | 4,331 | | | | 4,331 | | | | 4,334 | | | | 4,331 | |

| | | | | | | | | | | | | | | | | | | | |

Total expenses | | $ | 174,024 | | | $ | 185,046 | | | $ | 117,445 | | | $ | 89,349 | | | $ | 213,790 | |

| | | | | | | | | | | | | | | | | | | | |

| Waivers and reimbursements (Note 6): | | | | | | | | | | | | | | | | | | | | |

Reduction of expenses by investment adviser | | | (144,411 | ) | | | (139,848 | ) | | | (101,869 | ) | | | (85,945 | ) | | | (143,918 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net expenses | | | 29,613 | | | | 45,198 | | | | 15,576 | | | | 3,404 | | | | 69,872 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 368,781 | | | | 666,955 | | | | 266,260 | | | | 64,810 | | | | 1,137,705 | |

| | | | | | | | | | | | | | | | | | | | |

| Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on affiliated investments | | | 130,261 | | | | 215,358 | | | | 59,560 | | | | (8,318 | ) | | | — | |

Capital gain distributions from affiliated investments | | | 181,150 | | | | 181,796 | | | | 34,405 | | | | — | | | | — | |

Net change in unrealized appreciation (depreciation) of investments | | | (567,438 | ) | | | (220,903 | ) | | | 143,405 | | | | 86,443 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments | | | (256,027 | ) | | | 176,251 | | | | 237,370 | | | | 78,125 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Change in net assets resulting from operations | | $ | 112,754 | | | $ | 843,206 | | | $ | 503,630 | | | $ | 142,935 | | | $ | 1,137,705 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

16 AARP FUNDS 2007 SEMI-ANNUAL REPORT Financial Statements

Financial Statements (continued)

Statements of changes in net assets

| | | | | | | | | | | | | | | | |

| | | AARP Aggressive Fund | | | AARP Moderate Fund | |

| | | Six months

ended

12/31/07

(unaudited) | | | Year

ended

6/30/07 | | | Six months

ended

12/31/07

(unaudited) | | | Year

ended

6/30/07 | |

Increase (decrease) in net assets | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 368,781 | | | $ | 311,276 | | | $ | 666,955 | | | $ | 706,669 | |

Net realized gain (loss) on affiliated investments | | | 311,411 | | | | 64,523 | | | | 397,154 | | | | 174,252 | |

Net change in unrealized appreciation (depreciation) of investments | | | (567,438 | ) | | | 1,463,167 | | | | (220,903 | ) | | | 1,590,280 | |

| | | | | | | | | | | | | | | | |

Change in net assets resulting from operations | | | 112,754 | | | | 1,838,966 | | | | 843,206 | | | | 2,471,201 | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | |

From net investment income | | | (368,959 | ) | | | (326,680 | ) | | | (667,488 | ) | | | (726,251 | ) |

From net realized gains on investments | | | (161,853 | ) | | | (485 | ) | | | (362,860 | ) | | | (448 | ) |

| | | | | | | | | | | | | | | | |

Change in net assets resulting from distributions to shareholders | | | (530,812 | ) | | | (327,165 | ) | | | (1,030,348 | ) | | | (726,699 | ) |

| | | | | | | | | | | | | | | | |

Share transactions: | | | | | | | | | | | | | | | | |

Proceeds from sales of shares | | | 9,096,824 | | | | 14,326,319 | | | | 11,884,700 | | | | 20,156,884 | |

Net asset value of shares issued on reinvestment of dividends | | | 500,976 | | | | 306,759 | | | | 982,357 | | | | 690,077 | |

Cost of shares redeemed | | | (2,252,675 | ) | | | (2,376,776 | ) | | | (3,693,704 | ) | | | (3,798,646 | ) |

| | | | | | | | | | | | | | | | |

Change in net assets resulting from share transactions | | | 7,345,125 | | | | 12,256,302 | | | | 9,173,353 | | | | 17,048,315 | |

| | | | | | | | | | | | | | | | |

Change in net assets | | | 6,927,067 | | | | 13,768,103 | | | | 8,986,211 | | | | 18,792,817 | |

| | | | | | | | | | | | | | | | |

Net assets: | | | | | | | | | | | | | | | | |

Beginning of period | | $ | 20,221,778 | | | $ | 6,453,675 | | | $ | 31,925,470 | | | $ | 13,132,653 | |

| | | | | | | | | | | | | | | | |

End of period | | $ | 27,148,845 | | | $ | 20,221,778 | | | $ | 40,911,681 | | | $ | 31,925,470 | |

| | | | | | | | | | | | | | | | |

Undistributed (distributions in excess of) net investment income included in net assets at end of period | | $ | (118 | ) | | $ | 60 | | | $ | 53 | | | $ | 586 | |

| | | | | | | | | | | | | | | | |

1 | For the period from September 29, 2006 (commencement of operations) through June 30, 2007. |

See Notes to Financial Statements.

Financial Statements AARP FUNDS SEMI-ANNUAL REPORT 17

| | | | | | | | | | |

AARP Conservative Fund | | AARP Income Fund | | AARP Money Market Fund |

Six months ended 12/31/07 (unaudited) | | Year ended 6/30/07 | | Six months ended 12/31/07 (unaudited) | | Year ended 6/30/071 | | Six months ended 12/31/07 (unaudited) | | Year ended 6/30/07 |

$ 266,260 | | $ 342,687 | | $ 64,810 | | $ 38,730 | | $ 1,137,705 | | $ 257,459 |

93,965 | | 34,092 | | (8,318) | | (3,660) | | — | | (4) |

143,405 | | 332,822 | | 86,443 | | (36,251) | | — | | — |

| | | | | | | | | | | |

503,630 | | 709,601 | | 142,935 | | (1,181) | | 1,137,705 | | 257,455 |

| | | | | | | | | | | |

(267,815) | | (346,605) | | (64,880) | | (38,730) | | (1,137,705) | | (257,459) |

(93,875) | | (849) | | (32) | | — | | — | | — |

| | | | | | | | | | | |

(361,690) | | (347,454) | | (64,912) | | (38,730) | | (1,137,705) | | (257,459) |

| | | | | | | | | | | |

3,583,862 | | 6,121,245 | | 1,459,583 | | 2,568,586 | | 31,974,591 | | 38,408,002 |

331,893 | | 313,936 | | 52,450 | | 29,841 | | 1,091,982 | | 246,685 |

(1,431,317) | | (1,756,336) | | (564,916) | | (220,751) | | (16,168,960) | | (2,913,014) |

| | | | | | | | | | | |

2,484,438 | | 4,678,845 | | 947,117 | | 2,377,676 | | 16,897,613 | | 35,741,673 |

| | | | | | | | | | | |

2,626,378 | | 5,040,992 | | 1,025,140 | | 2,337,765 | | 16,897,613 | | 35,741,669 |

| | | | | | | | | | | |

$11,621,528 | | $ 6,580,536 | | 2,337,765 | | $ — | | 35,741,669 | | $ — |

| | | | | | | | | | | |

$14,247,906 | | $11,621,528 | | 3,362,905 | | $2,337,765 | | 52,639,282 | | $35,741,669 |

| | | | | | | | | | | |

$ 60 | | $ 1,615 | | $ 19 | | $ 89 | | $ — | | $ — |

| | | | | | | | | | | |

18 AARP FUNDS 2007 SEMI-ANNUAL REPORT Financial Statements

Financial Statements (continued)

Financial highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | |

| | | AARP Aggressive Fund | |

| | | Six months

ended 12/31/07

(unaudited) | | | Year

ended

6/30/07 | | | Period

ended

6/30/061 | |

Net asset value, beginning of period | | $ | 11.68 | | | $ | 10.17 | | | $ | 10.00 | |

| | | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income | | | 0.16 | | | | 0.24 | | | | 0.09 | |

Net realized and unrealized gain (loss) on affiliated investments | | | (0.10 | ) | | | 1.52 | | | | 0.17 | |

| | | | | | | | | | | | |

Total from investment operations | | | 0.06 | | | | 1.76 | | | | 0.26 | |

| | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | |

From net investment income | | | (0.16 | ) | | | (0.25 | ) | | | (0.09 | ) |

From net realized gains on investments | | | (0.07 | ) | | | (0.00 | )2 | | | — | |

| | | | | | | | | | | | |

Total distributions | | | (0.23 | ) | | | (0.25 | ) | | | (0.09 | ) |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.51 | | | $ | 11.68 | | | $ | 10.17 | |

| | | | | | | | | | | | |

Total return3 | | | 0.51 | % | | | 17.41 | % | | | 2.60 | % |

| | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | |

Net expenses | | | 0.24 | %4,5 | | | 0.24 | %4 | | | 0.24 | %4,5 |

| | | | | | | | | | | | |

Net investment income | | | 3.02 | %5 | | | 2.55 | % | | | 3.36 | %5 |

| | | | | | | | | | | | |

Expense waiver/reimbursement6 | | | (1.18 | )%5 | | | (2.00 | )% | | | (11.22 | )%5 |

| | | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | | |

Net assets, at end of period (000 omitted) | | $ | 27,149 | | | $ | 20,222 | | | $ | 6,454 | |

| | | | | | | | | | | | |

Portfolio Turnover | | | 6 | % | | | 12 | % | | | 7 | % |

| | | | | | | | | | | | |

1 | For the period from January 1, 2006 (commencement of operations) to June 30, 2006. |

2 | Represents less than $0.01. |

3 | Total returns for periods of less than one year are not annualized. |

4 | In addition to the fees and expenses which the Funds bear directly, the Funds indirectly bear a pro-rata share of the fees and expenses of the underlying portfolios in which the Funds invest. The net expense ratio shown does not include these indirect expenses. If included, the net expense ratio for each fund would be 0.50%. |

5 | Computed on an annualized basis. |

6 | This expense decrease is reflected in both the net expense and net investment income (loss) ratios shown above. |

See Notes to Financial Statements.

Financial Statements AARP FUNDS 2007 SEMI-ANNUAL REPORT 19

Financial Statements (continued)

Financial highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | |

| | | AARP Moderate Fund | |

| | | Six months

ended 12/31/07

(unaudited) | | | Year

ended

6/30/07 | | | Period

ended

6/30/061 | |

Net asset value, beginning of period | | $ | 11.06 | | | $ | 10.04 | | | $ | 10.00 | |

| | | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income | | | 0.19 | | | | 0.31 | | | | 0.10 | |

Net realized and unrealized gain (loss) on affiliated investments | | | 0.06 | | | | 1.02 | | | | 0.04 | |

| | | | | | | | | | | | |

Total from investment operations | | | 0.25 | | | | 1.33 | | | | 0.14 | |

| | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | |

From net investment income | | | (0.19 | ) | | | (0.31 | ) | | | (0.10 | ) |

From net realized gains on investments | | | (0.10 | ) | | | (0.00 | )2 | | | — | |

| | | | | | | | | | | | |

Total distributions | | | (0.29 | ) | | | (0.31 | ) | | | (0.10 | ) |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.02 | | | $ | 11.06 | | | $ | 10.04 | |

| | | | | | | | | | | | |

Total return3 | | | 2.22 | % | | | 13.32 | % | | | 1.44 | % |

| | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | |

Net expenses | | | 0.24 | %4,5 | | | 0.24 | %4 | | | 0.24 | %4,5 |

| | | | | | | | | | | | |

Net investment income | | | 3.61 | %5 | | | 3.27 | % | | | 4.58 | %5 |

| | | | | | | | | | | | |

Expense waiver/reimbursement6 | | | (0.76 | )%5 | | | (1.11 | )% | | | (6.82 | )%5 |

| | | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | | |

Net assets, at end of period (000 omitted) | | $ | 40,912 | | | $ | 31,925 | | | $ | 13,133 | |

| | | | | | | | | | | | |

Portfolio Turnover | | | 9 | % | | | 13 | % | | | 5 | % |

| | | | | | | | | | | | |

1 | For the period from January 1, 2006 (commencement of operations) to June 30, 2006. |

2 | Represents less than $0.01. |

3 | Total returns for periods of less than one year are not annualized. |

4 | In addition to the fees and expenses which the Funds bear directly, the Funds indirectly bear a pro-rata share of the fees and expenses of the underlying portfolios in which the Funds invest. The net expense ratio shown does not include these indirect expenses. If included, the net expense ratio for each fund would be 0.50%. |

5 | Computed on an annualized basis. |

6 | This expense decrease is reflected in both the net expense and net investment income (loss) ratios shown above. |

See Notes to Financial Statements.

20 AARP FUNDS 2007 SEMI-ANNUAL REPORT Financial Statements

Financial Statements (continued)

Financial highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | |

| | | AARP Conservative Fund | |

| | | Six months

ended 12/31/07

(unaudited) | | | Year

ended

6/30/07 | | | Period

ended

6/30/061 | |

Net asset value, beginning of period | | $ | 10.38 | | | $ | 9.86 | | | $ | 10.00 | |

| | | |

Income from investment operations: | | | | | | | | | | | | |

Net investment income | | | 0.21 | | | | 0.39 | | | | 0.16 | |

Net realized and unrealized gain (loss) on affiliated investments | | | 0.21 | | | | 0.53 | | | | (0.14 | ) |

| | | | | | | | | | | | |

Total from investment operations | | | 0.42 | | | | 0.92 | | | | 0.02 | |

| | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | |

From net investment income | | | (0.21 | ) | | | (0.40 | ) | | | (0.16 | ) |

From net realized gains on investments | | | (0.07 | ) | | | (0.00 | )2 | | | – | |

| | | | | | | | | | | | |

Total distributions | | | (0.28 | ) | | | (0.40 | ) | | | (0.16 | ) |

| | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.52 | | | $ | 10.38 | | | $ | 9.86 | |

| | | | | | | | | | | | |

Total return3 | | | 4.12 | % | | | 9.40 | % | | | 0.24 | % |

| | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | |

Net expenses | | | 0.25 | %4,5 | | | 0.25 | %4 | | | 0.24 | %4,5 |

| | | | | | | | | | | | |

Net investment income | | | 4.22 | %5 | | | 4.01 | % | | | 5.31 | %5 |

| | | | | | | | | | | | |

Expense waiver/reimbursement6 | | | (1.61 | )%5 | | | (2.16 | )% | | | (11.00 | )%5 |

| | | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | | |

Net assets, at end of period (000 omitted) | | $ | 14,248 | | | $ | 11,622 | | | $ | 6,581 | |

| | | | | | | | | | | | |

Portfolio Turnover | | | 12 | % | | | 17 | % | | | 7 | % |

| | | | | | | | | | | | |

1 | For the period from January 1, 2006 (commencement of operations) to June 30, 2006. |

2 | Represents less than $0.01. |

3 | Total returns for periods of less than one year are not annualized. |

4 | In addition to the fees and expenses which the Funds bear directly, the Funds indirectly bear a pro-rata share of the fees and expenses of the underlying portfolios in which the Funds invest. The net expense ratio shown does not include these indirect expenses. If included, the net expense ratio for each fund would be 0.50%. |

5 | Computed on an annualized basis. |

6 | This expense decrease is reflected in both the net expense and net investment income (loss) ratios shown above. |

See Notes to Financial Statements.

Financial Statements AARP FUNDS 2007 SEMI-ANNUAL REPORT 21

Financial Statements (continued)

Financial highlights

(For a share outstanding throughout the period)

| | | | | | | | | | | | | | | | |

| | | AARP Income Fund | | | AARP Money Market

Fund | |

| | Six months

ended 12/31/07

(unaudited)1 | | | Period

ended

6/30/071,2 | | | Six months

ended 12/31/07

(unaudited) | | | Year

ended

6/30/071 | |

Net asset value, beginning of period | | $ | 9.82 | | | $ | 10.00 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.24 | | | | 0.36 | | | | 0.02 | | | | 0.05 | |

Net realized and unrealized gain (loss) on affiliated investments | | | 0.32 | | | | (0.18 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.56 | | | | 0.18 | | | | 0.02 | | | | 0.05 | |

| | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | |

From net investment income | | | (0.24 | ) | | | (0.36 | ) | | | (0.02 | ) | | | (0.05 | ) |

From net realized gains on investments | | | (0.00 | )3 | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions | | | (0.24 | ) | | | (0.36 | ) | | | (0.02 | ) | | | (0.05 | ) |

| | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.14 | | | $ | 9.82 | | | $ | 1.00 | | | $ | 1.00 | |

| | | | | | | | | | | | | | | | |

Total return4 | | | 5.78 | % | | | 1.78 | % | | | 2.49 | % | | | 5.11 | % |

| | | | | | | | | | | | | | | | |

Ratios to average net assets: | | | | | | | | | | | | | | | | |

Net expenses | | | 0.26 | %5,6 | | | 0.25 | %5,6 | | | 0.30 | %5,6,7 | | | 0.33 | % |

| | | | | | | | | | | | | | | | |

Net investment income | | | 4.96 | %6 | | | 5.36 | %6 | | | 4.90 | %6 | | | 5.06 | % |

| | | | | | | | | | | | | | | | |

Expense waiver/reimbursement8 | | | (6.58 | )%6 | | | (21.21 | )%6 | | | (0.62 | )%6 | | | (3.91 | )% |

| | | | | | | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | | | | | | |

Net assets, at end of period (000 omitted) | | $ | 3,363 | | | $ | 2,338 | | | $ | 52,639 | | | $ | 35,742 | |

| | | | | | | | | | | | | | | | |

Portfolio Turnover | | | 20 | % | | | 30 | % | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

1 | The per share amounts and percentages include the Fund’s proportionate share of income, expenses and net realized and unrealized gains or losses of the State Street Money Market Portfolio. |

2 | For the period from September 29, 2006 (commencement of operations) to June 30, 2007. |

3 | Represents less than $0.01. |

4 | Total returns for periods of less than one year are not annualized. |

5 | In addition to the fees and expenses which the Funds bear directly, the Funds indirectly bear a pro-rata share of the fees and expenses of the underlying portfolios in which the Funds invest. The net expense ratio shown does not include these indirect expenses. If included, the net expense ratio for each fund would be 0.50%. |

6 | Computed on an annualized basis. |