UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21825

AARP FUNDS

(Exact name of registrant as specified in charter)

650 F Street, NW

Washington, DC 20004-1604

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

Richard Hisey AARP Financial Incorporated Two Highwood Drive, Suite 202 Tewksbury, MA 01876 | | Gary O. Cohen, Esq. Jorden Burt LLP 1025 Thomas Jefferson Street, NW Suite 400 East Washington, DC 20007-5208 |

Registrant’s telephone number, including area code: (202) 434-3650

Date of fiscal year end: June 30

Date of reporting period: December 31, 2009

| Item 1. | Report to Shareholders |

Letter to Shareholders

Market Commentary

Semi-Annual Report

December 31, 2009 (unaudited)

AARP Aggressive Fund (AAGSX)

AARP Moderate Fund (AAMDX)

AARP Conservative Fund (AACNX)

AARP Income Fund (AANCX)

AARP Money Market Fund (AARXX)

| | |

A LETTER TO SHAREHOLDERS |

Richard M. Hisey President, AARP Funds | | Dear Fellow Shareholders, Although the financial markets have stabilized and the economy appears to be recovering, many of the problems associated with the recession are still with us. Unemployment remains high, credit is still tight and uncertainty over interest rates continues to cause anxiety among investors. The economy may have ended the year with better than expected Gross Domestic Product (GDP) growth, but many analysts attribute that to one-time stimulus initiatives such as the “Cash for Clunkers” program and the first time homeowners’ tax credit. Some economists believe the real pace of recovery will slow to a crawl until we can improve the three “D’s” – debt, deficit and the dollar. Heavy debt |

continues to weigh on millions of American households as well as on state and federal governments. The U.S. budget deficit is higher than the entire budgets of most countries and the weakening value of the dollar could threaten its position as the world’s reserve currency.

INTERNATIONAL AND EMERGING MARKETS

International markets, especially emerging markets, continue to perform very well. Economically, we believe that pent-up consumer demand in other countries will continue to outpace the U.S. where consumers are still feeling tapped out. Since the consumer has historically been such an important factor in U.S. economic growth, this adds to our conviction that U.S. economic growth could remain fairly muted. You may recall that we anticipated this trend at the beginning of 2009 when we not only increased the allocation to international equities in the AARP Funds, but we also broadened the funds’ international exposure to include emerging markets.

REVISIT YOUR RISK TOLERANCE AND REBALANCE YOUR ASSET ALLOCATION

For shareholders, we have three key messages when it comes to investing in this or any market. First, it is essential to know your risk tolerance and to make sure it is consistent with your asset allocation (proportion of investments in stocks, bonds and cash). Second, keep in mind that asset allocation is critical to anything you do because it is one of the most important factors in explaining investment returns over the long term. And third, while it is always prudent to revisit and rebalance your portfolio on a regular basis, you may now want to do so more often, because of the sharp swings we have seen in the market over the past few months and years. For example, last year at this time, you may have had too much fixed income and you should have rebalanced with a higher percentage of equity. It is also always important to have a cash reserve in any economic environment but especially so in these more volatile times. But now, following a strong run in equities you should be looking to rebalance again.

ARE YOU DIVERSIFIED?

While maintaining a proper asset allocation and rebalancing regularly are critical to successful investing, it is also important to remain diversified* especially in such dynamic economic

NOT PART OF THE SEMI-ANNUAL REPORT

environments. As we move from economic downturn, to economic stability, and then to economic growth, various industrial sectors will perform differently at different times. If you are over weighted in one sector, you could get hit hard, which is why we recommend you have a well-diversified portfolio, across the breadth of industrial sectors. The key is to stay diversified, focus on your long-term goals and have realistic expectations of what the markets will do in the coming years.

3 AARP FUNDS RECEIVE 5 STAR MORNINGSTAR RATING

The AARP Aggressive Fund, the AARP Moderate Fund and the AARP Conservative Fund each maintained their “5 Star” Morningstar Rating for the three years ending December 31, 2009. Five Stars means that each of the funds ranked in the top 10% of its respective category – the highest rating a fund can receive. The AARP Aggressive Fund posted negative performance during this period. The AARP Income Fund received a “3 Star” Morningstar Rating for the three years ending December 31, 2009.

The AARP Aggressive Fund was ranked 107th out of 1757 Large Blend Category Funds for the three year period ending 12/31/09. The AARP Moderate Fund was ranked 71 st out of 953 Moderate Allocation Category Funds for the three year period ending 12/31/09. The AARP Conservative Fund was ranked 26th out of 522 Conservative Allocation Category Funds for the three year period ending 12/31/09. The AARP Income Fund was ranked 378th out of 978 Intermediate Term Bond Category Funds for the three year period ending 12/31/09. Morningstar Ratings are based on a risk adjusted performance.

OUR MISSION

Our mission, as always, is to provide you with objective and trusted advice and guidance and to help simplify your investment decisions by providing access to straightforward financial products. We invite you to call our Financial Advisors with questions about your personal investments as well as any other financially related questions. As you know, our Financial Advisors are highly trained and experienced salaried professionals who do not work on commission. They are available between 8 a.m. and 6 p.m. Eastern Time, Monday through Friday by calling 1-800-958-6457.

Thank you for your trust and confidence and for investing in the AARP Funds.

Sincerely,

Richard M. Hisey

President, AARP Funds

* Diversification reduces risk but does not eliminate it.

NOT PART OF THE SEMI-ANNUAL REPORT

When investing in bonds, you are subject, but not limited to, the same interest rate, inflation, and credit risk associated with the underlying bonds owned by the Fund. The Income Fund’s prospectus allows for investment in non-investment grade securities. All investments involve some risk, including the AARP Funds. Each of the three funds, Conservative, Moderate, and Aggressive, invest in a mix of domestic and international stocks and U.S. bonds.

In addition to the normal risks associated with investing, emerging market investments do involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume.

This Shareholder Report must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

Past performance cannot guarantee future results. The Overall Morningstar Rating is derived from a weighted average of the fund’s performance figures for three year Morningstar rating metrics. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The top 10% of the funds in an investment category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star.

2009 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP does not offer financial products or services itself, and it cannot recommend that you or any specific individual should purchase any particular product or service. AARP Financial Inc. is an investment adviser and a subsidiary of AARP.

The AARP Financial, Inc, Financial Advisors are registered as representatives of ALPS Distributors, Inc., a registered broker-dealer, and as investment adviser representatives of AARP Financial Inc an investment adviser.

AARP Financial Inc. offers investment advisory services and is not affiliated with ALPS Distributors, Inc.

AARP Funds are advised by AARP Financial Inc. and distributed by ALPS Distributors, Inc.

NOT PART OF THE SEMI-ANNUAL REPORT

Market Commentary December 31, 2009 (unaudited)

The rally in financial markets that started in March continued through the fourth quarter of 2009. The S&P 500 Index returned 6% in the fourth quarter and finished 2009 with a gain of 24%. Although this advancement helped regain some of the ground lost in 2008, the S&P 500 Index closed the year at a level of 1115, still 29% below its October 2007 peak of 1576. Broader market indices performed well during this time with the Morgan Stanley Capital International (“MSCI”) U.S. Investable Market 2500 Index recording a 6% gain in the fourth quarter and finished 2009 with a gain of 29%.

International markets also performed well and were led by emerging markets. Recall that at the beginning of 2009, the AARP Funds not only increased the allocation to international equities, but also changed international benchmarks from the MSCI EAFE (Europe, Australasia, and Far East) Index (a developed markets index) to the MSCI ACWI (All Country World) ex U.S. Index (a combination of developed and emerging markets). Although this change is long-term and strategic, shareholders were rewarded in 2009 as the MSCI ACWI ex U.S. Index outperformed the MSCI EAFE Index by nearly 1000 basis points or 10%. In fact the MSCI ACWI ex U.S. Index returned 4% during the fourth quarter, and finished 2009 with a gain of 41%. With the exception of Morocco, every country index in the MSCI ACWI ex US Index posted gains in 2009 with returns ranging from +6% in Japan (developed market) to +128% in Brazil (emerging market).

U.S. investment grade bonds, as measured by the Barclays Capital Aggregate Bond Index, were little changed in the fourth quarter, but finished 2009 with a gain of 6%. Indeed, this index recorded its tenth consecutive year of positive performance. The high yield bond segment, as measured by the Barclays Capital U.S. High Yield Very Liquid Index, continued to perform well and returned 6% during the fourth quarter and 63% during 2009. (Recall that performance in the high yield bond market is closely correlated to performance in the equity markets.) Besides improving economic conditions and a more optimistic economic outlook, significant inflows to bond funds in 2009 have contributed to rising prices and falling yields as many income-oriented (and highly risk-averse) investors, who cannot bear or afford the extremely low rates offered in U.S. Treasuries, money market funds and certificates of deposit, have now ventured further out on the risk spectrum seeking additional return.

NOT PART OF THE SEMI-ANNUAL REPORT

In terms of the economic setting, typically, a recovery on Main Street follows a recovery on Wall Street. Despite the robust returns in global equities in 2009, some economists are predicting a tepid recovery for the U.S. economy in 2010 and beyond. Although GDP figures released in the second half of 2009 imply that the economy is on track, encouragement about future GDP growth is tempered by one-time effects of stimulus recorded in those figures. Economists now believe that Cash for Clunkers, homebuyer tax credits (extended to April 2010) and inventory adjustments accounted for most of the increase in GDP in 2009. The U.S. economy still faces many challenges including: weakness in the labor markets, limited credit to consumers and small businesses, higher savings rates and excess capacity (across commercial, residential and industrial sectors). These factors, as well as others, have left both Main Street and Wall Street wondering where the economy will go from here.

Performance data quoted represents past performance which is no guarantee of future results. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes and do not reflect the expenses of managing a fund. It is not possible to invest directly in an Index.

The views, forecasts and supporting information contained in this Market Commentary are as of December 31, 2009 and are subject to change. This Market Commentary must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP does not offer financial products or services itself, and it cannot recommend that you or any specific individual should purchase any particular product or service. AARP Financial Inc. is a registered investment adviser and a subsidiary of AARP.

Financial Advisors are FINRA registered representatives through ALPS Distributors, Inc., a registered broker/dealer, and employed by AARP Financial Inc. AARP Funds are advised by AARP Financial Inc. and distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

NOT PART OF THE SEMI-ANNUAL REPORT

S&P 500 Index – The index includes 500 securities that are considered to be widely held. This index provides a broad snapshot of the overall U.S. equity market.

MSCI U.S. Investable Market 2500 Index – The index includes 2500 securities listed on the New York and American Exchanges and the NASDAQ over-the-counter market. The stocks include companies of all types and sizes, which represent the investable universe of companies in the U.S. Equity market.

MSCI ACWI Index ex US Index – The index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

MSCI EAFE Index – The index includes about 1,000 securities that are listed on the stock exchanges of 21 developed countries excluding the United States and Canada.

Barclays High Yield Very Liquid Index – The index includes publicly issued U.S. dollar denominated, non-investment grade, fixed-rate, taxable corporate bonds that have a remaining maturity of at least one year. The High Yield Index includes only corporate sectors.

Barclays Capital Aggregate Bond Index – The index includes a large variety of U.S. and foreign bonds traded in U.S. markets that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset backed securities.

While you can invest in an index fund – it’s a real investment, you cannot invest in an index – it’s just a list.

Sources: SSgA Funds Management, Inc., MSCI Barra, The Portfolio Advisory Group

NOT PART OF THE SEMI-ANNUAL REPORT

AARP FUNDS

…

Semi-Annual Report

December 31, 2009 (unaudited)

…

KEEPING YOU INFORMED

This shareholder report for the AARP Funds represents our commitment to providing communications that are clear, concise and informative. One of our highest priorities at AARP Funds is to help you make sense of investment information that is often complex. We hope you find it helpful in evaluating your investment with us.

EXPERTISE AND GUIDANCE

WHEN YOU NEED IT

AARP Financial’s Financial Advisors are ready to help you determine if you are on track financially for retirement and to answer specific questions about AARP Funds. They work on salary, not commission, and are there to help you focus on your goals, take decisive action and feel comfortable with your decisions. Financial Advisors are FINRA registered representatives through ALPS Distributors, Inc., and are employed by AARP Financial.

| | | | |

| | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 1 |

Table of Contents

This Shareholder Report must be preceded or accompanied by the AARP Funds prospectus for individuals who are not current AARP Funds shareholders. An investor should consider the investment objectives, risks, charges and expenses of AARP Funds carefully before investing. To get an additional prospectus containing this and other information, please call 1-800-958-6457. Read the prospectus carefully before you invest.

While AARP has licensed the use of its name to AARP Funds and endorses the services provided by AARP Financial Inc., AARP cannot recommend that you or any specific individual should purchase shares of a particular fund. AARP is not a registered investment adviser or broker/dealer.

AARP Funds are distributed by ALPS Distributors, Inc.

AARP Financial Inc. is not affiliated with ALPS Distributors, Inc.

| | | | |

| 2 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | AARP Funds Overview |

AARP Funds Overview

Each of the AARP Funds (except for the AARP Money Market Fund) are “fund-of-funds” because they invest substantially all of their assets in of the underlying AARP Portfolios (the “AARP Portfolios”), which are separate registered investment company.

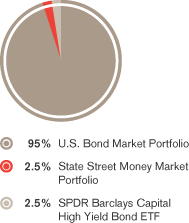

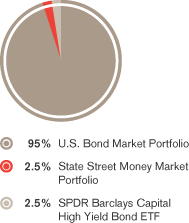

In the fund of funds structure, each fund (except for the AARP Money Market Fund) invests its assets in a mix of asset classes. The AARP Income Fund, in addition to its investment in the U.S. Bond Market Portfolio, also invests a portion of its assets in the State Street Money Market Portfolio (the “State Street Portfolio”), a series of a separate registered investment company called the State Street Master Funds, and the SPDR Barclays Capital High Yield Bond exchange traded fund.

The AARP Money Market Fund is a feeder fund, buying shares of the master fund to the State Street Portfolio. This is called a “master-feeder” structure because it allows different feeder funds to pool their assets in an underlying master fund to seek economies of scale.

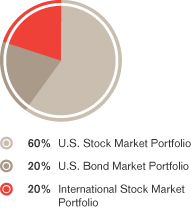

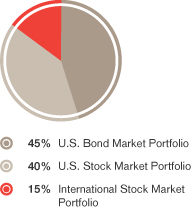

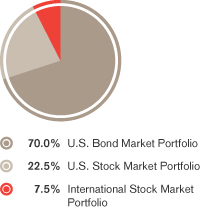

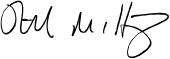

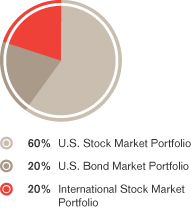

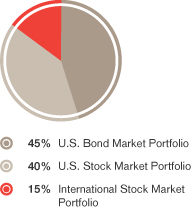

Effective January 1, 2009, the target allocations of each AARP Fund among the underlying portfolios are as follows:

| | | | | | | | | | |

| | | | | | |

| | | AARP

Aggressive Fund | | AARP

Moderate Fund | | AARP

Conservative Fund | | AARP

Income Fund | | AARP Money

Market Fund |

| Investment Objective | | Seeks growth of capital and some current income | | Seeks a balance of growth of capital and current income | | Seeks primarily current income, with some growth of capital | | Seeks current income and preservation of capital over the long term | | Seeks to maximize current income, while providing for liquidity, the preservation of capital, and a stable $1.00 per

share price |

U.S. Stock

Market Portfolio | | 60% | | 40% | | 22.5% | | – | | – |

U.S. Bond

Market Portfolio | | 20% | | 45% | | 70% | | 95% | | – |

International Stock

Market Portfolio | | 20% | | 15% | | 7.5% | | – | | – |

State Street

Portfolio | | – | | – | | – | | 2.5% | | 100% |

| SPDR Barclays Capital High Yield Bond ETF | | – | | – | | – | | 2.5% | | – |

Source: AARP Funds

On January 1, 2009, the target allocations of the Conservative, Moderate and Aggressive Funds among the underlying Portfolios were changed to increase the Funds’ exposure to international equities by 5 percentage points.

| | | | |

| AARP Funds Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 3 |

The following chart displays the top 10 holdings of each of the underlying AARP Portfolios as of December 31, 2009.

AARP Portfolios Top 10 Holdings as a percentage of net assets at December 31, 2009 (unaudited)

| | | | | | | | | | | | | | | | | | |

| U.S. Stock Market Portfolio | | | | | | U.S. Bond Market Portfolio | | | | | | International Stock Market Portfolio |

| | | | | | | | | |

Exxon Mobil Corp. | | 2.7% | | | | | | FNMA, 4.500%, 5/1/2039 | | 1.2% | | | | | | HSBC Holdings PLC | | 1.3% |

Microsoft Corp. | | 2.0% | | | | | | GNMA, 30 YR, 5.000% | | 1.0% | | | | | | BP PLC | | 1.2% |

Apple Computer, Inc. | | 1.6% | | | | | | U.S. Treasury Notes, 4.500%, 4/30/12 | | 0.7% | | | | | | Nestle SA | | 1.1% |

Johnson & Johnson | | 1.5% | | | | | | U.S. Treasury Notes, 4.625%, 12/31/11 | | 0.7% | | | | | | Total SA | | 0.9% |

Procter & Gamble Co. | | 1.4% | | | | | | FHLMC, 2.125%, 3/23/12 | | 0.6% | | | | | | Banco Santander Central Hispano SA | | 0.9% |

International Business Machines Corp. | | 1.4% | | | | | | FHLMC, 5.000%, 2/1/37 | | 0.6% | | | | | | BHP Billiton Ltd. | | 0.9% |

AT&T, Inc. | | 1.4% | | | | | | FHLMC, 2.500%, 1/7/14 | | 0.6% | | | | | | Toyota Motor Corp. | | 0.8% |

JPMorgan Chase & Co. | | 1.3% | | | | | | U.S. Treasury Notes, 3.750%, 11/15/18 | | 0.6% | | | | | | Vodafone Group PLC | | 0.8% |

General Electric Co. | | 1.3% | | | | | | U.S. Treasury Notes, 1.875%, 2/28/14 | | 0.6% | | | | | | Roche Holdings AG | | 0.8% |

Chevron Corp. | | 1.3% | | | | | | FHLMC, 4.500%, 7/1/39 | | 0.6% | | | | | | Telefonica SA | | 0.8% |

Total | | 15.9% | | | | | | | | 7.2% | | | | | | | | 9.5% |

| | | | |

| 4 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | How the Funds Performed |

How the Funds Performed as of December 31, 2009 (unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | 1 Year | | | | 3 Years | | | | Average

annual since

inception4 | | | |

| | | AARP Aggressive Fund | | | | 25.03% | | | | -1.73% | | | | 1.84% | | | |

| | | Aggressive Composite Index5 | | | | 25.78% | | | | -0.84% | | | | 2.84% | | | |

| | | MSCI U.S. Investable Market 2500 Index®1 | | | | 28.63% | | | | -4.99% | | | | -0.19% | | | |

| | | AARP Moderate Fund | | | | 18.96% | | | | 1.18% | | | | 3.34% | | | |

| | | Moderate Composite Index5 | | | | 19.40% | | | | 2.04% | | | | 4.25% | | | |

| | | MSCI U.S. Investable Market 2500 Index®1 | | | | 28.63% | | | | -4.99% | | | | -0.19% | | | |

| | | Barclays Capital Aggregate Bond Index®1 | | | | 5.93% | | | | 6.04% | | | | 5.61% | | | |

| | | AARP Conservative Fund | | | | 12.59% | | | | 3.75% | | | | 4.54% | | | |

| | | Conservative Composite Index5 | | | | 13.10% | | | | 4.42% | | | | 5.24% | | | |

| | | Barclays Capital Aggregate Bond Index®1 | | | | 5.93% | | | | 6.04% | | | | 5.61% | | | |

| | | AARP Income Fund | | | | 5.90% | | | | 5.64% | | | | 5.48% | 2 | | |

| | | Income Composite Index | | | | 6.95% | | | | 6.05% | | | | 5.97% | | | |

| | | Barclays Capital Aggregate Bond Index®1 | | | | 5.93% | | | | 6.04% | | | | 5.94% | 2 | | |

| | | J.P. Morgan 1-Month LIBOR | | | | 0.36% | | | | 2.98% | | | | 3.31% | | | |

| | | AARP Money Market Fund | | | | 0.33% | | | | 2.67% | | | | 3.00% | 3 | | |

| | | J.P. Morgan 1-Month LIBOR | | | | 0.36% | | | | 2.98% | | | | 3.34% | | | |

| | | AARP Money Market Fund 7-Day Effective Yield | | | | 0.01% | | | | | | | | | | | |

| |

1 The MSCI U.S. Investable Market 2500 Index and the Barclays Capital Aggregate Bond Index serve as broad measures of the U.S equity and taxable bond markets, respectively. Since the Funds invest in differing combinations of these and other markets, Composite Indexes have been constructed utilizing the proportionate weightings of the indexes for each market. These Composite Indexes provide a particularly useful benchmark to measure the performance of the Funds. For more detailed information regarding the Composite Indexes, please see A Word about Benchmarks that follows. 2 For the period from September 29, 2006 (commencement of operations) to December 31, 2009. 3 For the period from July 1, 2006 (commencement of operations) to December 31, 2009. 4 The inception date for the Aggressive, Moderate and Conservative Funds was December 30, 2005. 5 The weightings of these composite indexes were changed to reflect the January 1, 2009 weighting changes for the Conservative, Moderate and Aggressive Funds. The composite performance reflects the new weightings calculations from July 1, 2009 to December 31, 2009. Sources: MSCI Barra, Barclays Capital Inc., J.P. Morgan, AARP Financial Inc. Total returns for period less than one year are not annualized. |

Total annual fund operating fees and expenses are 1.74% for the Aggressive Fund, 1.20% for the Moderate Fund, 1.66% for the Conservative Fund, 2.15% for the Income Fund and 0.85% for the Money Market Fund. Net annual fund operating fees and expenses for the funds (after contractual waivers and/or reimbursements) are 0.30% for the Money Market Fund and 0.50% for the others through November 1, 2010. Total annual operating fees and expenses as of December 31, 2009 can be found on pages 24, 25 of this report.

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed, returns would have been lower. It is not possible to invest directly in an Index.

For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457.

An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| | | | |

| A Word about Benchmarks | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 5 |

Indexes vs. index funds

Indexes, as opposed to index funds, are a group or list of securities representing a market or part of a market. The returns of the index do not reflect the costs of actually investing in the index and do not include fees, brokerage commissions or other expenses of investing. While you can invest in an index fund – it’s a real investment, you cannot invest directly in an index – it’s just a list.

A Word about Benchmarks

A useful tool to measure the performance of AARP Funds.

When evaluating how your investment performed, it’s helpful to compare it to an appropriate benchmark. You can think of the benchmark as a handy yardstick for measuring how well the fund did in meeting its investment objectives. For example, the AARP Income Fund tries to produce returns comparable to the Barclays Capital Aggregate Bond Index.

The AARP Aggressive Fund, AARP Moderate Fund and AARP Conservative Fund are indexed and try to produce the returns of a mixture of three indexes. For these Funds, a particularly useful benchmark is one that combines the three indexes in similar amounts to the target investments of the Funds. When you combine different indexes into one benchmark, it’s called a “composite index”.

We also believe it is useful for you to consider the returns of the overall bond and stock markets when you assess the performance of the AARP Funds. This allows you to see how diversification works in practice. Sometimes the bond and stock markets move in opposite directions, or when the stock market goes down, the bond market doesn’t go quite as far down.

There is one caveat though. Please remember that a benchmark of indexes has a built-in performance advantage over an actual mutual fund. An index is merely a list of securities in a stock or bond market, so the returns of indexes do not reflect the real world costs of managing a mutual fund. It is difficult to match the returns of an index because of this difference.

The mix underlying the composite index for the Aggressive, Moderate and Conservative Funds was changed to reflect the January 1, 2009 revised allocations of these funds among the underlying portfolios. Historical composite indexes performance from January 1, 2009 was recalculated to reflect the revised allocations.

| | | | |

| 6 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | A Word about Benchmarks |

Following is a table that shows the make up of the index weightings for each AARP Fund:

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | AARP

Aggressive Fund1 | | AARP

Moderate Fund1 | | AARP

Conservative

Fund1 | | AARP

Income Fund | | AARP Money

Market Fund | | |

| | | | | Aggressive Composite Index | | Moderate Composite Index | | Conservative Composite Index | | Income Composite Index | | | | |

| | | Barclays Capital

Aggregate Bond Index® | | 20% | | 45% | | 70% | | 95% | | – | | |

| | | MSCI U.S. Investable

Market 2500 Index®* | | 60% | | 40% | | 22.5% | | – | | – | | |

| | | MSCI ACWI ex US

Index®2,* | | 20% | | 15% | | 7.5% | | – | | – | | |

| | | JP Morgan 1 Month

LIBOR | | – | | – | | – | | 2.5% | | 100% | | |

| | | Barclays Capital High

Yield Very Liquid Index | | – | | – | | – | | 2.5% | | – | | |

Source: AARP Funds

A description of each index

| • | | MSCI U.S. Investable Market 2500 Index®* – The index includes about 2,500 securities listed on the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks include companies of all types and sizes, which represent the investable universe of companies in the U.S. Equity market. |

| • | | MSCI ACWI ex US Index®* – The index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of November 2008, the MSCI ACWI ex US index® consisted of 44 county indices comprised of 22 developed and 22 emerging market country indices. |

| • | | Barclays Capital Aggregate Bond Index® – The index includes a large variety of U.S. and foreign bonds traded in U.S. markets that are investment grade and taxable, covering three major types of bonds: government and corporate bonds, mortgage-backed securities and asset-backed securities. |

| • | | Barclays Capital High Yield Very Liquid Index – This index measures the performance of publicly issued U.S. dollar denominated high yield corporate bonds with above average liquidity. The index includes only corporate sectors like Industrial, Utility, and Financial Institutions. |

| • | | JP Morgan 1-Month LIBOR – This benchmark is the rate for a one month deposit in U.S. Dollars on the last business day of the previous month. LIBOR stands for the “London Interbank Offered Rate” and is produced each business day by the British Bankers Association. |

| 1 | Effective January 1, 2009, the AARP Conservative, Moderate and Aggressive Fund increased their allocation percentages to equities by 5 percentage points. See page 2 for new allocation amounts. |

| 2 | Effective January 1, 2009 the underlying International Portfolio changed its index to the MSCI All Country World Index, excluding U.S. Index (MSCI ACWI ex US index) |

| * | Please note that although the AARP Funds seek to track these MSCI indexes, MSCI does not sponsor, endorse, or promote the AARP Funds. For a more detailed description of our relationship with MSCI please see the statement of additional information for the AARP Funds. |

| | | | |

| AARP Aggressive Fund Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 7 |

AARP Aggressive Fund Overview

| | | | | | | | |

| | | |

Portfolio construction

| | Portfolio of investments

December 31, 2009 (unaudited) | | | | |

| | Mutual funds: 100.1% | | | | | | |

| | | | Shares | | Value | |

| | | | | | | | |

| | U.S. Stock Market Portfolio1 – 60.1% | | 2,004,539 | | $ | 17,840,397 | |

| | | |

| | International Stock Market

Portfolio1 – 20.0% | | 636,023 | | | 5,953,178 | |

| | | |

| | U.S. Bond Market Portfolio1 – 20.0% | | 579,610 | | | 5,946,795 | |

| | | |

| | Total investments: 100.1%

(Identified cost $29,327,737) | | | | | 29,740,370 | |

| | | | | | | | |

| | Other assets and liabilities, net: (0.1)% | | | | | (24,218 | ) |

| | | | | | | | |

| | Total net assets: 100.0% | | | | $ | 29,716,152 | |

| | 1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | | | | | | | | | | | | | | |

| |

Affiliated companies |

| |

The fund invests substantially all of its assets in the Portfolios, which are considered affiliated companies. As defined by the Investment Company Act of 1940 (“the Act”), an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or of a company which is under common ownership or control. |

| | | | | | |

| Affiliate | | Purchase Cost* | | Sales Proceeds* | | Investment Income | | Value 6/30/09 | | Value 12/31/09 |

| |

| U.S. Bond Market Portfolio | | $ | 1,605,780 | | $ | 399,262 | | $ | 116,592 | | $ | 4,683,019 | | $ | 5,946,795 |

| |

| U.S. Stock Market Portfolio | | | 1,978,925 | | | 1,333,881 | | | 100,035 | | | 13,990,809 | | | 17,840,397 |

| |

| International Stock Market Portfolio | | | 907,055 | | | 654,093 | | | 54,127 | | | 4,657,894 | | | 5,953,178 |

| |

| TOTAL | | $ | 4,491,760 | | $ | 2,387,236 | | $ | 270,754 | | $ | 23,331,722 | | $ | 29,740,370 |

| |

|

| |

* These numbers reflect the purchase and sales volume of each respective Portfolio during the six months ended December 31, 2009. Amounts reflected on the accompanying financial statements include the following amounts related to affiliated companies: |

| | | | |

| Investment in securities, at cost | | $ | 29,327,737 | |

| | |

| Income distributions from underlying AARP Portfolios | | $ | 270,754 | |

| | |

| Realized gain (loss) on sales of underlying AARP Portfolios | | $ | (725,161 | ) |

| | |

| Capital gain distributions from underlying AARP Portfolios | | $ | 5,148 | |

| | |

| | | | |

| 8 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | AARP Aggressive Fund Overview |

| | | | | | | | | | | | | |

| | | Performance summary | | Average annual returns as of December 31, 2009 (unaudited) |

| | | | | | | | |

| | | | | | | 1-Year | | 3-Years | | Since

inception | | | |

| | | | | AARP Aggressive Fund1 | | 25.03% | | -1.73% | | 1.84% | | | |

| | | | | Aggressive Composite Index2 | | 25.78% | | -0.84% | | 2.84% | | | |

| | | | | MSCI U.S. Investable Market 2500 Index®2 | | 28.63% | | -4.99% | | -0.19% | | | |

| | | | | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Fund assumes the reinvestment of all dividends and distributions. The index above has

been adjusted to reflect reinvestment of dividends on securities in the index. The returns of the Funds are net of expenses. Indexes do not have

expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed,

returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457. 1 Inception date December 30, 2005.

2 The MSCI U.S. Investable Market 2500 Index serves as a broad measure of the U.S. equity market. Since the Fund invests in differing

combinations of this and other markets, the Aggressive Composite Index has been constructed utilizing the proportionate weightings of the

indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more

detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 5. |

| | | | |

| AARP Moderate Fund Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 9 |

AARP Moderate Fund Overview

| | | | | | | | |

| | | |

Portfolio construction

| | Portfolio of investments

December 31, 2009 (unaudited) | | | | |

| | Mutual funds: 100.1% | | | | | | |

| | | | Shares | | Value | |

| | | | | | | | |

| | U.S. Bond Market Portfolio1 – 45.0% | | 2,187,672 | | $ | 22,445,510 | |

| | | |

| | U.S. Stock Market Portfolio1 – 40.0% | | 2,241,749 | | | 19,951,566 | |

| | | |

| | International Stock Market

Portfolio1 – 15.1% | | 800,207 | | | 7,489,937 | |

| | | |

| | Total investments: 100.1%

(Identified cost $47,416,186) | | | | | 49,887,013 | |

| | | | | | | | |

| | Other assets and liabilities, net: (0.1)% | | | | | (27,045 | ) |

| | | | | | | | |

| | Total net assets: 100.0% | | | | $ | 49,859,968 | |

| | 1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | | | | | | | | | | | | | | | |

| |

Affiliated companies The fund invests substantially all of its assets in the Portfolios, which are considered affiliated companies. As defined by the Investment Company Act of 1940 (“the Act”), an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or of a company which is under common ownership or control. | |

| | | | | | |

| Affiliate | | Purchase Cost* | | Sales Proceeds* | | Investment Income | | Value 6/30/09 | | Value 12/31/09 | |

| | |

| U.S. Bond Market Portfolio | | $ | 5,532,867 | | $ | 893,991 | | $ | 447,345 | | $ | 17,582,800 | | $ | 22,445,510 | |

| | |

| U.S. Stock Market Portfolio | | | 2,907,424 | | | 2,184,755 | | | 113,674 | | | 15,603,327 | | | 19,951,566 | |

| | |

| International Stock Market Portfolio | | | 1,209,372 | | | 885,685 | | | 69,095 | | | 5,844,330 | | | 7,489,937 | |

| | |

TOTAL | | $ | 9,649,663 | | $ | 3,964,431 | | $ | 630,114 | | $ | 39,030,457 | | $ | 49,887,013 | |

| | |

| |

* These numbers reflect the purchase and sales volume of each respective Portfolio during the six months ended December 31, 2009. Amounts reflected on the accompanying financial statements include the following amounts related to affiliated companies: | |

| Investment in securities, at cost | | $ | 47,416,186 | |

| | |

| Income distributions from underlying AARP Portfolios | | $ | 630,114 | |

| | |

| Realized gain (loss) on sales of underlying AARP Portfolios | | $ | (964,446 | ) |

| | |

| Capital gain distributions from underlying AARP Portfolios | | $ | 19,623 | |

| | | | |

| 10 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | AARP Moderate Fund Overview |

| | | | | | | | | | | | | |

| | | Performance summary | | Average annual returns as of December 31, 2009 (unaudited) | | | |

| | | | | | | | |

| | | | | | | 1-Year | | 3-Years | | Since

inception | | | |

| | | | | AARP Moderate Fund1 | | 18.96% | | 1.18% | | 3.34% | | | |

| | | | | Moderate Composite Index2 | | 19.40% | | 2.04% | | 4.25% | | | |

| | | | | MSCI U.S. Investable Market 2500 Index®2 | | 28.63% | | -4.99% | | -0.19% | | | |

| | | | | Barclays Capital Aggregate Bond Index®2 | | 5.93% | | 6.04% | | 5.61% | | | |

| | | | | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Fund assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do

not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or

reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457. 1 Inception date December 30, 2005.

2 The MSCI U.S. Investable Market 2500 Index and the Barclays Capital Aggregate Bond Index serve as broad measures of the U.S. equity

and taxable bond market. Since the Fund invests in differing combinations of this and other markets, the Moderate Composite Index has

been constructed utilizing the proportionate weightings of the indexes for each market. This Composite Index provides a particularly useful

benchmark to measure the performance of the Fund. For more detailed information regarding the Composite Indexes and the Underlying

Indexes, please see “A Word about Benchmarks” on page 5. |

| | | | |

| AARP Conservative Fund Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 11 |

AARP Conservative Fund Overview

| | | | | | | | |

| | | |

Portfolio construction

| | Portfolio of investments

December 31, 2009 (unaudited) | | | | |

| | Mutual funds: 100.1% | | | | | | |

| | | | Shares | | Value | |

| | | | | | | | |

| | U.S. Bond Market Portfolio1 – 70.1% | | 1,674,917 | | $ | 17,184,647 | |

| | | |

| | U.S. Stock Market Portfolio1 – 22.5% | | 620,634 | | | 5,523,639 | |

| | | |

| | International Stock Market

Portfolio1 – 7.5% | | 196,923 | | | 1,843,197 | |

| | | |

| | Total investments: 100.1%

(Identified cost $22,929,473) | | | | | 24,551,483 | |

| | | | | | | | |

| | Other assets and liabilities, net: (0.1)% | | | | | (16,776 | ) |

| | | | | | | | |

| | Total net assets: 100.0% | | | | $ | 24,534,707 | |

| | 1 Affiliated issuer. See Notes to Financial Statements. | | | | | | |

| | | | | | | | | | | | | | | | |

| |

Affiliated companies The fund invests substantially all of its assets in the Portfolios, which are considered affiliated companies. As defined by the Investment Company Act of 1940 (“the Act”), an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or of a company which is under common ownership or control. | |

| | | | | | |

| Affiliate | | Purchase Cost* | | Sales Proceeds* | | Investment Income | | Value 6/30/09 | | Value 12/31/09 | |

| | |

U.S. Bond Market

Portfolio | | $ | 4,342,835 | | $ | 547,100 | | $ | 334,963 | | $ | 13,225,726 | | $ | 17,184,647 | |

| | |

U.S. Stock Market

Portfolio | | | 1,009,366 | | | 720,694 | | | 30,640 | | | 4,244,540 | | | 5,523,639 | |

| | |

| International Stock Market Portfolio | | | 454,327 | | | 343,802 | | | 16,607 | | | 1,411,278 | | | 1,843,197 | |

| | |

TOTAL | | $ | 5,806,528 | | $ | 1,611,596 | | $ | 382,210 | | $ | 18,881,544 | | $ | 24,551,483 | |

| | |

| |

* These numbers reflect the purchase and sales volume of each respective Portfolio during the six months ended December 31, 2009. Amounts reflected on the accompanying financial statements include the following amounts related to affiliated companies: | |

| Investment in securities, at cost | | | | | $ | 22,929,473 | |

| | |

| Income distributions from underlying AARP Portfolios | | | | | $ | 382,210 | |

| | |

| Realized gain (loss) on sales of underlying AARP Portfolios | | | | | $ | (175,191 | ) |

| | |

| Capital gain distributions from underlying AARP Portfolios | | | | | $ | 14,720 | |

| | | | |

| 12 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | AARP Conservative Fund Overview |

| | | | | | | | | | | | |

| | | Performance summary | | Average annual returns as of December 31, 2009 | | |

| | | | | | | |

| | | | | | | 1-Year | | 3-Years | | Since

inception | | |

| | | | | AARP Conservative Fund1 | | 12.59% | | 3.75% | | 4.54% | | |

| | | | | Conservative Composite Index2 | | 13.10% | | 4.42% | | 5.24% | | |

| | | | | MSCI U.S. Investable Market 2500 Index®2 | | 28.63% | | -4.99% | | -0.19% | | |

| | | | | Barclays Capital Aggregate Bond Index®2 | | 5.93% | | 6.04% | | 5.61% | | |

| | | | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Fund assumes the reinvestment of all dividends and distributions. The index above has

been adjusted to reflect reinvestment of dividends on securities in the index. The returns of the Funds are net of expenses. Indexes do not have

expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or reimbursed,

returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www. aarpfinancial.com or call 1-800-958-6457. 1 Inception date December 30, 2005.

2 The Barclays Capital Aggregate Bond Index serves as a broad measure of the U.S. taxable bond market. Since the Fund invests in differing

combinations of this and other markets, the Conservative Composite Index has been constructed utilizing the proportionate weightings of the

indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more

detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 5.

• MSCI U.S. Investable Market 2500 Index®* – The index includes about 2,500 securities listed on

the New York and American Stock Exchanges and the Nasdaq over-the-counter market. The stocks

include companies of all types and sizes, which represent the investable universe of companies in the

U.S. Equity market. Sources: Barclays Capital, Inc., AARP Financial Inc. |

| | | | |

| AARP Income Fund Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 13 |

AARP Income Fund Overview

| | | | | | | | |

| | | |

Portfolio construction

| | Portfolio of investments

December 31, 2009 (unaudited) | | | | |

| | Mutual funds: 100.2% | | | | | | |

| | | | Shares | | Value | |

| | | | | | | | |

| | U.S. Bond Market Portfolio1 – 95.0% | | 1,471,551 | | $ | 15,098,113 | |

| | | |

| | State Street Money Market

Portfolio2 – 2.6% | | 410,597 | | | 410,597 | |

| | | |

| | SPDR Barclays Capital High Yield

Bond ETF2 – 2.6% | | 10,514 | | | 408,890 | |

| | | |

| | Total investments: 100.2%

(Identified cost $15,568,249) | | | | | 15,917,600 | |

| | | | | | | | |

| | Other assets and liabilities, net: (0.2)% | | | | | (26,634 | ) |

| | | | | | | | |

| | Total net assets: 100.0% | | | | $ | 15,890,966 | |

| | 1 Affiliated issuer. 2 Investment in non-controlled affiliate. See Notes to Financial Statements. | | | | | | |

| | | | | | | | | | | | | | | |

Affiliated companies The fund invests substantially all of its assets in the underlying portfolios, and is considered an affiliated company. As defined by the Investment Company Act of 1940 (“the Act”), an affiliated company is one in which the fund owns 5% or more of the outstanding voting securities, or of a company which is under common ownership or control. |

| | | | | | |

| Affiliate | | Purchase Cost* | | Sales Proceeds* | | Investment Income | | Value 6/30/09 | | Value 12/31/09 |

| |

| U.S. Bond Market Portfolio | | $ | 3,392,285 | | $ | 1,297,187 | | $ | 310,869 | | $ | 12,841,346 | | $ | 15,098,113 |

| |

| |

* These numbers reflect the purchase and sales volume of each respective Portfolio during the six months ended December 31, 2009. Amounts reflected on the accompanying financial statements include the following amounts related to affiliated companies: |

| Investment in securities, at cost | | | | | $ | 14,796,681 |

| |

| Income distributions from underlying AARP Portfolios | | | | | $ | 310,869 |

| |

| Realized gain (loss) on sales of underlying AARP Portfolios | | | | | $ | 16,976 |

| |

| Capital gain distributions from underlying AARP Portfolios | | | | | $ | 13,394 |

| | | | |

| 14 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | AARP Income Fund Overview |

| | | | | | | | | | | | | | |

| | | Performance summary | | Average annual returns as of December 31, 2009 (unaudited) |

| | | | | | | | | |

| | | | | | | 1-Year | | 3-Years | | Since

inception | | | | |

| | | | | AARP Income Fund1 | | 5.90% | | 5.64% | | 5.48% | | | | |

| | | | | Income Composite Index2 | | 6.95% | | 6.05% | | 5.97% | | | | |

| | | | | Barclays Capital Aggregate Bond Index®2 | | 5.93% | | 6.04% | | 5.94% | | | | |

| | | | | J.P. Morgan 1-Month LIBOR | | 0.36% | | 2.98% | | 3.31% | | | | |

| | | | | | | | | |

| | |

| |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Fund assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do

not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or

reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457. 1 Inception date September 29, 2006.

2 The Barclays Capital Aggregate Bond Index serves as a broad measure of the U.S. taxable bond market. Since the Fund invests in differing

combinations of this and other markets, the Income Composite Index has been constructed utilizing the proportionate weightings of the

indexes for each market. This Composite Index provides a particularly useful benchmark to measure the performance of the Fund. For more

detailed information regarding the Composite Indexes and the Underlying Indexes, please see “A Word about Benchmarks” on page 5. |

| | | | |

| AARP Money Market Fund Overview | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 15 |

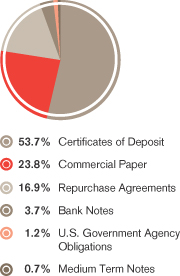

AARP Money Market Fund Overview

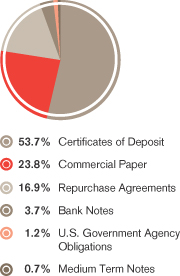

Portfolio construction*

| | | | |

|

Portfolio of investments

December 31, 2009 (unaudited) | |

Mutual funds: 100.1% | | | | |

| | | Value | |

| Investment in State Street Money Market Portfolio1 – 100.1% | | $ | 38,033,905 | |

| | |

| Total investments: 100.1% (Identified cost $38,033,905) | | | 38,033,905 | |

| | | | |

| Other assets and liabilities, net: (0.1)% | | | (39,769 | ) |

| | | | |

| Total net assets: 100.0% | | $ | 37,994,136 | |

1 The financial statements of the State Street Money Market Portfolio, including its investment portfolio, are included elsewhere within this report and should be read in conjunction with the AARP Money Market Fund’s financial statements. AARP Money Market Fund invests only in State Street Money Market Portfolio. At December 31, 2009, AARP Money Market Fund owned 0.25% of the State Street Money Market Portfolio. See Notes to Financial Statements. | |

Performance summary

Maturity ladder

| | | | | | | | | | | | | |

| | | |

| | | Average annual returns as of December 31, 2009 (unaudited) | | | | | |

| | | | | | | |

| | | | | 1-Year | | 3-Years | | Since

inception | | | | | |

| | AARP Money Market Fund | | 0.33% | | 2.67% | | 3.00% | 1 | | | | |

| | J.P. Morgan 1-Month LIBOR | | 0.36% | | 2.98% | | 3.34% | 1 | | | | |

| | AARP Money Market Fund 7-Day Yield

as of 12/31/09 | | 0.01% | | | | | | | | | |

| | | Maturities as of December 31, 2009 (unaudited) | | | | | |

| | | | | | | |

| | 0-3 Days | | | | | | 0.07% | | | | | |

| | 4-90 Days | | | | | | 89.6% | | | | | |

| | 90+ Days | | | | | | 9.7% | | | | | |

| | Total | | | | | | 100% | | | | | |

| | Average Maturity | | | | | | | | | | | |

| | | | | | | |

| | |

|

*Portfolio construction represents the composition of the underlying holdings in the State Street Money Market Portfolio, whose financial

statements are included elsewhere in this report. As a percentage of net assets as of the date indicated. The Portfolio’s composition will vary

over time. Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will

fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes

over time and current performance may be lower or higher than what is stated. Returns shown do not reflect the deduction of taxes that a

shareholder may pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank

and are not federally insured. The performance of the Funds assumes the reinvestment of all dividends and distributions. The indexes above

have been adjusted to reflect reinvestment of dividends on securities in the indexes. The returns of the Funds are net of expenses. Indexes do

not have expenses. The adviser is waiving a portion of its advisory fee and other operating expenses. Had the fees not been waived or

reimbursed, returns would have been lower. It is not possible to invest directly in an Index. For the most recent month-end performance and after-tax returns, visit www.aarpfinancial.com or call 1-800-958-6457. An investment in the AARP Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation

or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is

possible to lose money by investing in the Fund. 1 For the period from July 1, 2006 (commencement of operations) to December 31, 2009 (unaudited). Sources: J.P Morgan, AARP Financial Inc. |

| | | | |

| 16 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | Understanding Your Expenses |

Understanding Your Expenses (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including investment advisory fees, distribution (12b-1) fees, shareholder services fees, and other expenses of running a fund. It’s important to understand exactly how much you pay to purchase and own a fund and to compare the costs of owning different funds because these costs reduce your returns.

The example in the table on page xx is intended to help you to understand your ongoing costs in dollars of investing in an AARP Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2009 to December 31, 2009.

Actual expenses

The first line for each Fund in the table on the next page, labeled “Actual”, provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line labeled “Actual” under the heading entitled “Expenses paid during period” to estimate the expenses attributable to your investment during this period.

Hypothetical example for comparison purposes

The second line for each fund in the table, labeled “Hypothetical”, helps you compare the costs of an AARP Fund to other funds using a 5% return as required by the Securities and Exchange Commission for all mutual funds. It provides information about hypothetical account values and hypothetical expenses based on an AARP Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not an AARP Fund’s actual return. You should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures help you to compare the ongoing costs of investing in an AARP Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the line labeled “Hypothetical” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

In addition to the fees and expenses which the AARP Fund bears directly, the AARP Fund indirectly bears a pro rata share of the fees and expenses of the underlying portfolios in which the Fund invests. Because

| | | | |

| Understanding Your Expenses | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 17 |

the underlying portfolios have varied expenses and fee levels and the Fund may own different proportions of the underlying funds at different times, the amount of fees and expenses incurred indirectly by the AARP Fund may vary in the future. However AARP Financial has agreed contractually to waive fees and reimburse expenses to keep the net total operating expenses of the AARP Funds, including the indirect fees and expenses of the underlying portfolios, at 0.50% of average daily net assets through at least November 1, 2010 (0.30% with respect to the AARP Money Market Fund).

| | | | |

| 18 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | Understanding Your Expenses |

| | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Beginning

account

value

7/1/09 | | Ending

account

value

12/31/09 | | Expenses

paid

during

period2 | | Annualized

expense

ratio2 | | Effective

expenses

paid

during

period3 | | Effective

annualized

expense

ratio3 |

| |

| |

| AARP Aggressive Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,189.10 | | $ | 1.32 | | 0.24% | | $ | 2.76 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,024.00 | | $ | 1.22 | | | | $ | 2.55 | | |

| |

| |

| AARP Moderate Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,140.30 | | $ | 1.29 | | 0.24% | | $ | 2.70 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,024.00 | | $ | 1.22 | | | | $ | 2.55 | | |

| |

| |

| AARP Conservative Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,091.20 | | $ | 1.32 | | 0.25% | | $ | 2.64 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.95 | | $ | 1.28 | | | | $ | 2.55 | | |

| |

| |

| AARP Income Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,038.50 | | $ | 1.34 | | 0.26% | | $ | 2.57 | | 0.50% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.89 | | $ | 1.33 | | | | $ | 2.55 | | |

| |

| |

| AARP Money Market Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,000.50 | | $ | 1.51 | | 0.30% | | $ | 1.51 | | 0.30% |

Hypothetical1 | | $ | 1,000 | | $ | 1,023.69 | | $ | 1.53 | | | | $ | 1.53 | | |

| |

| |

| |

1 The Hypothetical example assumes a 5% return before expenses. 2 Expenses reflect the Fund’s annualized net expense ratios multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The fees and expenses of the underlying portfolios are not included in these amounts. 3 Effective expenses reflect the sum of the expenses borne directly by the Fund plus the Fund’s pro-rata share of the weighted average expense ratio of the underlying portfolios in which it invests. The effective annualized expense ratio combines the Fund’s annualized net expense ratio (after applying contractual waivers and/or reimbursements) and the annualized weighted average expense ratios of the underlying portfolios. The annualized weighted average expense ratio includes the annualized expense ratio for each underlying portfolio weighted for the Fund’s relative average investment during the same period. |

| | | | |

| How to Read Financial Statements | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 19 |

How to Read Financial Statements

Mutual funds are companies that pool money from many investors and invest that money in stocks, bonds and other securities and assets. Mutual fund financial statements show investors where a fund’s money came from, where it went, where it is and what it is worth as of the close of the fund’s most recent fiscal period. The portfolio of investments shows where the money is as of the close of the fund’s most recent fiscal period. The holdings of each AARP Fund as of June 30, 2009 are shown in the individual Fund Overview sections of this annual report. In addition, this section of the annual report contains four additional financial statements:

1. Statements of assets and liabilities.

These statements are the Funds’ balance sheets as of the close of the period (December 31, 2009). They show the value and the cost of what each Fund owned, how much it owed to others and the resulting difference or “net assets”.

| • | | Assets are the stocks, bonds, cash, and other financial instruments that a fund owns and has purchased with monies investors pay when they purchase shares. |

| • | | Liabilities are the amounts of money that a fund owes. Liabilities include payments due for the purchase of financial investments as well as bills that a fund incurs for services that are needed to run a fund, such as legal services and printing. |

| • | | Net assets = total assets – total liabilities. Net assets represent what is left of assets after liabilities are subtracted. This leftover amount belongs to the investors, or shareholders, of the fund. |

2. Statements of operations

These statements provide a summary of the investment income, such as dividends, that a Fund has earned as well as gains and losses from its investment activities for the period ended December 31, 2009. Realized gains or losses reflect the difference between purchase price and selling price for transactions that took place during the period. Unrealized gains and losses reflect the difference between purchase price and the value of investments that are still held as of the end of the period. The statements also include specific details of fund expenses.

3. Statements of changes in net assets

These statements describe the changes in net assets during the current and prior period, which result from operations, any distributions of earnings to investors, and any shareholder transactions.

4. Financial highlights

The financial highlights table is intended to help you understand a fund’s financial performance for a share outstanding for the current period and each of the applicable prior periods.

The Notes to Financial Statements provide additional information to help you better understand the financial statements. They include a description of the most important accounting policies used in portraying the company’s financial condition and results, including how a fund records and values its investments, tax information, as well as additional detail on shareholder and investment transactions.

| | | | |

| 20 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | Financial Statements |

Financial Statements

| | | | | | | | | | | | | | | | | | | | |

| |

Statements of assets and liabilities December 31, 2009 (unaudited) | | | | | |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | | AARP

Conservative

Fund | | | AARP

Income

Fund | | | AARP

Money Market

Fund | |

| | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | | |

| Investments in affiliated issuers, at value (identified cost of $29,327,737, $47,416,186, $22,929,473 and $14,796,681, respectively) | | $ | 29,740,370 | | | $ | 49,887,013 | | | $ | 24,551,483 | | | $ | 15,098,113 | | | $ | – | |

| Investments in unaffiliated issuer (identified cost of $360,971) | | | – | | | | – | | | | – | | | | 408,890 | | | | – | |

| Investments in State Street Money Market Portfolio, at value (identified cost of $410,597 and $38,033,905, respectively) | | | – | | | | – | | | | – | | | | 410,597 | | | | 38,033,905 | |

| Dividends and interest receivable | | | – | | | | – | | | | – | | | | 3,803 | | | | – | |

| Receivable from adviser | | | 28,064 | | | | 33,788 | | | | 27,863 | | | | 20,781 | | | | 20,643 | |

| Receivable for investments sold | | | 176,932 | | | | 447,720 | | | | 45,450 | | | | 11,322 | | | | – | |

| Receivable for fund shares sold | | | 5,783 | | | | – | | | | 365,891 | | | | 2,800 | | | | 18,918 | |

| Total assets | | $ | 29,951,149 | | | $ | 50,368,521 | | | $ | 24,990,687 | | | $ | 15,956,306 | | | $ | 38,073,466 | |

| | | | | | | | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | | | | | | | | |

| Payable for investments purchased | | | 138,740 | | | | 314,040 | | | | 410,966 | | | | – | | | | – | |

| Payable for fund shares redeemed | | | 43,975 | | | | 133,680 | | | | 375 | | | | 23,363 | | | | 15,683 | |

| Income distribution payable | | | – | | | | – | | | | – | | | | – | | | | 8 | |

| Accrued portfolio acct. fees (Note 6) | | | 2,136 | | | | 2,108 | | | | 2,122 | | | | 1,350 | | | | 1,344 | |

| Accrued administration fees (Note 6) | | | 873 | | | | 1,477 | | | | 710 | | | | 477 | | | | 1,339 | |

| Accrued transfer agent fees (Note 6) | | | 13,777 | | | | 15,867 | | | | 7,294 | | | | 4,873 | | | | 16,050 | |

| Accrued distribution services fee | | | 4,978 | | | | 8,422 | | | | 4,053 | | | | 2,727 | | | | 7,632 | |

| Accrued audit fees | | | 9,018 | | | | 9,018 | | | | 9,018 | | | | 9,518 | | | | 10,518 | |

| Accrued insurance fees | | | 2,250 | | | | 4,237 | | | | 2,063 | | | | 1,705 | | | | 9,005 | |

| Accrued registration fees | | | 945 | | | | 1,399 | | | | 1,074 | | | | 3,022 | | | | 2,684 | |

| Accrued printing and postage expenses | | | 8,750 | | | | 8,750 | | | | 8,750 | | | | 8,750 | | | | 8,750 | |

| Accrued legal fees | | | 2,293 | | | | 2,293 | | | | 2,293 | | | | 2,293 | | | | 2,293 | |

| Accrued miscellaneous expense | | | 7,262 | | | | 7,262 | | | | 7,262 | | | | 7,262 | | | | 4,024 | |

| Total liabilities | | $ | 234,997 | | | $ | 508,553 | | | $ | 455,980 | | | $ | 65,340 | | | $ | 79,330 | |

| | | | | | | | | | | | | | | | | | | | |

| Net assets | | $ | 29,716,152 | | | $ | 49,859,968 | | | $ | 24,534,707 | | | $ | 15,890,966 | | | $ | 37,994,136 | |

| Net assets consist of: | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital | | $ | 32,152,266 | | | $ | 52,219,540 | | | $ | 24,411,830 | | | $ | 15,582,498 | | | $ | 37,992,484 | |

| Net unrealized appreciation of investments | | | 412,633 | | | | 2,470,827 | | | | 1,622,010 | | | | 349,351 | | | | – | |

| Accumulated net realized gain (loss) on investments | | | (2,849,236 | ) | | | (4,830,723 | ) | | | (1,499,374 | ) | | | (40,729 | ) | | | (247 | ) |

| | | | | |

| Undistributed (distributions in excess of) net investment income | | | 489 | | | | 324 | | | | 241 | | | | (154 | ) | | | 1,899 | |

| Net assets | | $ | 29,716,152 | | | $ | 49,859,968 | | | $ | 24,534,707 | | | $ | 15,890,966 | | | $ | 37,994,136 | |

| | | | | | | | | | | | | | | | | | | | |

| Shares of beneficial interest outstanding | | | 3,078,404 | | | | 4,982,799 | | | | 2,399,686 | | | | 1,548,599 | | | | 37,992,484 | |

| Net asset value per share | | $ | 9.65 | | | $ | 10.01 | | | $ | 10.22 | | | $ | 10.26 | | | $ | 1.00 | |

| | | | | |

| See Notes to Financial Statements. | | | | | | | | | | | | | | | | | | | | |

| | | | |

| Financial Statements | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | 21 |

Financial Statements (continued)

| | | | | | | | | | | | | | | | | | | | |

|

Statements of operations Six months ended December 31, 2009 (unaudited) | |

| | | AARP

Aggressive

Fund | | | AARP

Moderate

Fund | | | AARP

Conservative

Fund | | | AARP

Income

Fund | | | AARP

Money Market

Fund | |

| | | | | | | | | | | | | | | | | | | | |

| Investment income: | | | | | | | | | | | | | | | | | | | | |

| Dividends from affiliated issuers | | $ | 270,753 | | | $ | 630,114 | | | $ | 382,210 | | | $ | 310,869 | | | $ | – | |

| Dividends from an unaffiliated issuer | | | – | | | | – | | | | – | | | | 27,075 | | | | – | |

| Interest allocated from State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | 771 | | | | 97,614 | |

| Total investment income | | $ | 270,753 | | | $ | 630,114 | | | $ | 382,210 | | | $ | 338,715 | | | $ | 97,614 | |

| | | | | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | | | | | |

| Expenses allocated from State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | 236 | | | | 29,275 | |

| Investment adviser fee (Note 6) | | | 1,362 | | | | 2,307 | | | | 1,101 | | | | 752 | | | | – | |

| Administration fees (Note 6) | | | 4,766 | | | | 8,074 | | | | 3,853 | | | | 2,632 | | | | 8,595 | |

| Registration fees | | | 17,098 | | | | 19,157 | | | | 16,850 | | | | 12,581 | | | | 8,217 | |

| Transfer and dividend disbursing agent fees and expenses (Note 6) | | | 48,308 | | | | 52,258 | | | | 24,145 | | | | 16,767 | | | | 50,804 | |

| Trustees’ fees | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | 10,000 | | | | 10,000 | |

| Audit fees | | | 9,845 | | | | 9,845 | | | | 9,845 | | | | 10,345 | | | | 11,345 | |

| Legal fees | | | 19,030 | | | | 19,030 | | | | 19,030 | | | | 19,030 | | | | 19,030 | |

| Portfolio accounting fees (Note 6) | | | 9,173 | | | | 9,388 | | | | 9,039 | | | | 8,288 | | | | 8,332 | |

| Distribution service fees | | | 27,233 | | | | 46,140 | | | | 22,018 | | | | 15,042 | | | | 49,112 | |

| Printing and postage expenses | | | 7,496 | | | | 7,496 | | | | 7,496 | | | | 7,496 | | | | 7,496 | |

| Insurance expense | | | 2,250 | | | | 4,237 | | | | 2,063 | | | | 1,705 | | | | 9,005 | |

| Miscellaneous | | | 4,229 | | | | 4,229 | | | | 4,229 | | | | 4,229 | | | | 7,467 | |

| Total expenses | | $ | 160,790 | | | $ | 192,161 | | | $ | 129,669 | | | $ | 109,103 | | | $ | 218,678 | |

| | | | | | | | | | | | | | | | | | | | |

| Waivers and reimbursements (Note 6): | | | | | | | | | | | | | | | | | | | | |

| Reduction of expenses by investment adviser | | | (128,170 | ) | | | (136,289 | ) | | | (102,607 | ) | | | (89,340 | ) | | | (145,434 | ) |

| Net expenses | | | 32,620 | | | | 55,872 | | | | 27,062 | | | | 19,763 | | | | 73,244 | |

| Net investment income | | | 238,133 | | | | 574,242 | | | | 355,148 | | | | 318,952 | | | | 24,370 | |

| | | | | | | | | | | | | | | | | | | | |

| Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on affiliated

investments | | | (725,161 | ) | | | (964,446 | ) | | | (175,191 | ) | | | 9,224 | | | | – | |

Net realized gain allocated from

State Street Money Market Portfolio | | | – | | | | – | | | | – | | | | – | | | | 12 | |

| Capital gain distributions from affiliated investments | | | 5,148 | | | | 19,623 | | | | 14,720 | | | | 13,394 | | | | – | |

| Net change in unrealized appreciation (depreciation) of investments | | | 5,029,285 | | | | 6,135,770 | | | | 1,650,198 | | | | 189,206 | | | | – | |

| Net realized and unrealized gain on investments | | | 4,309,272 | | | | 5,190,947 | | | | 1,489,727 | | | | 211,824 | | | | 12 | |

| Change in net assets resulting from operations | | $ | 4,547,405 | | | $ | 5,765,189 | | | $ | 1,844,875 | | | $ | 530,776 | | | $ | 24,382 | |

| See | Notes to Financial Statements. |

| | | | |

| 22 | | AARP FUNDS 2009 SEMI-ANNUAL REPORT | | Financial Statements |

Financial Statements (continued)

| | | | | | | | | | | | | | | | | | |

| | | |

Statements of changes in net assets | | | | | | | | | | | |

| | | AARP Aggressive Fund | | | AARP Moderate Fund | | | |

| | | | | |

| | | Six months

ended

12/31/09

(unaudited) | | | Year

ended

6/30/09 | | | Six months

ended

12/31/09

(unaudited) | | | Year

ended

6/30/09 | | | |

| Increase (decrease) in net assets | | | | | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | $ | 238,133 | | | $ | 553,796 | | | $ | 574,242 | | | $ | 1,183,882 | | | |

| Net realized gain (loss) on investments | | | (720,013 | ) | | | (1,865,555 | ) | | | (944,823 | ) | | | (3,659,558 | ) | | |

| Net change in unrealized appreciation (depreciation) of investments | | | 5,029,285 | | | | (3,129,597 | ) | | | 6,135,770 | | | | (2,136,252 | ) | | |

| Change in net assets resulting from operations | | | 4,547,405 | | | | (4,441,356 | ) | | | 5,765,189 | | | | (4,611,928 | ) | | |

| | | | | | | | | | | | | | | | | | |

| Distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (237,644 | ) | | | (555,111 | ) | | | (573,939 | ) | | | (1,188,697 | ) | | |

| From net realized gains on investments | | | – | | | | (206,931 | ) | | | – | | | | (267,888 | ) | | |

| Change in net assets resulting from distributions to shareholders | | | (237,644 | ) | | | (762,042 | ) | | | (573,939 | ) | | | (1,456,585 | ) | | |

| | | | | | | | | | | | | | | | | | |

| Share transactions: | | | | | | | | | | | | | | | | | | |

| Proceeds from sales of shares | | | 4,777,952 | | | | 7,802,845 | | | | 8,500,999 | | | | 10,582,167 | | | |