ANNUAL SHAREHOLDERS’ MEETING May 2024

Safe Harbor Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are based on current expectations, estimates and projections about the Company’s and the Bank’s industry, and management’s beliefs and assumptions. Words such as anticipates, expects, intends, plans, believes, estimates and variations of such words and expressions are intended to identify forward-looking statements. Such statements are not a guarantee of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to forecast. Therefore, actual results may differ materially from those expressed or forecast in such forward-looking statements. The Company and Bank undertake no obligation to update publicly any forward-looking statements, whether as a result of new information or otherwise. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company’s business and results is discussed in the Company’s periodic reports filed with the Securities and Exchange Commission, including in the section “Risk Factors”. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise. LAKE SHORE BANCORP, INC.

Agenda Call to Order – Kevin M. Sanvidge, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment LAKE SHORE BANCORP, INC.

Board of Directors LAKE SHORE BANCORP, INC. Director Since Kevin M. Sanvidge, Chairman of the Board, Compliance Committee Chairman 2012 Sharon E. Brautigam, Vice Chairperson of the Board, Nominating and Governance Committee Chairperson 2004 Michelle M. DeBergalis, Compensation and Nominating and Governance Committee Member 2022 Kim C. Liddell, President and Chief Executive Officer 2023 John P. McGrath, Audit, Enterprise Risk and Loan Committee Member 2019 John (“Jack”) L. Mehltretter, Enterprise Risk Management Chairman 2016 Ronald J. Passafaro, Compensation Committee Chairman 2019 Ann M. Segarra, Audit Committee Chairperson 2023

Business of Annual Shareholders Meeting Election of Directors: Elect three Class One directors to serve until the 2027 annual meeting: Class One Directors John P. McGrath Ronald J. Passafaro Kim C. Liddell Elect one Class Two director to serve until the 2025 annual meeting: Class Two Director Ann M. Segarra LAKE SHORE BANCORP, INC.

Business of Annual Shareholders Meeting (Continued) Say on Pay Proposal: A non-binding “say on pay” proposal to approve the compensation of the named executive officers. Appointment of Independent Registered Public Accounting Firm: Ratify the appointment of Yount, Hyde & Barbour, P.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2024. LAKE SHORE BANCORP, INC.

Executive Management Presentation Kim C. Liddell, President and Chief Executive Officer LAKE SHORE BANCORP, INC.

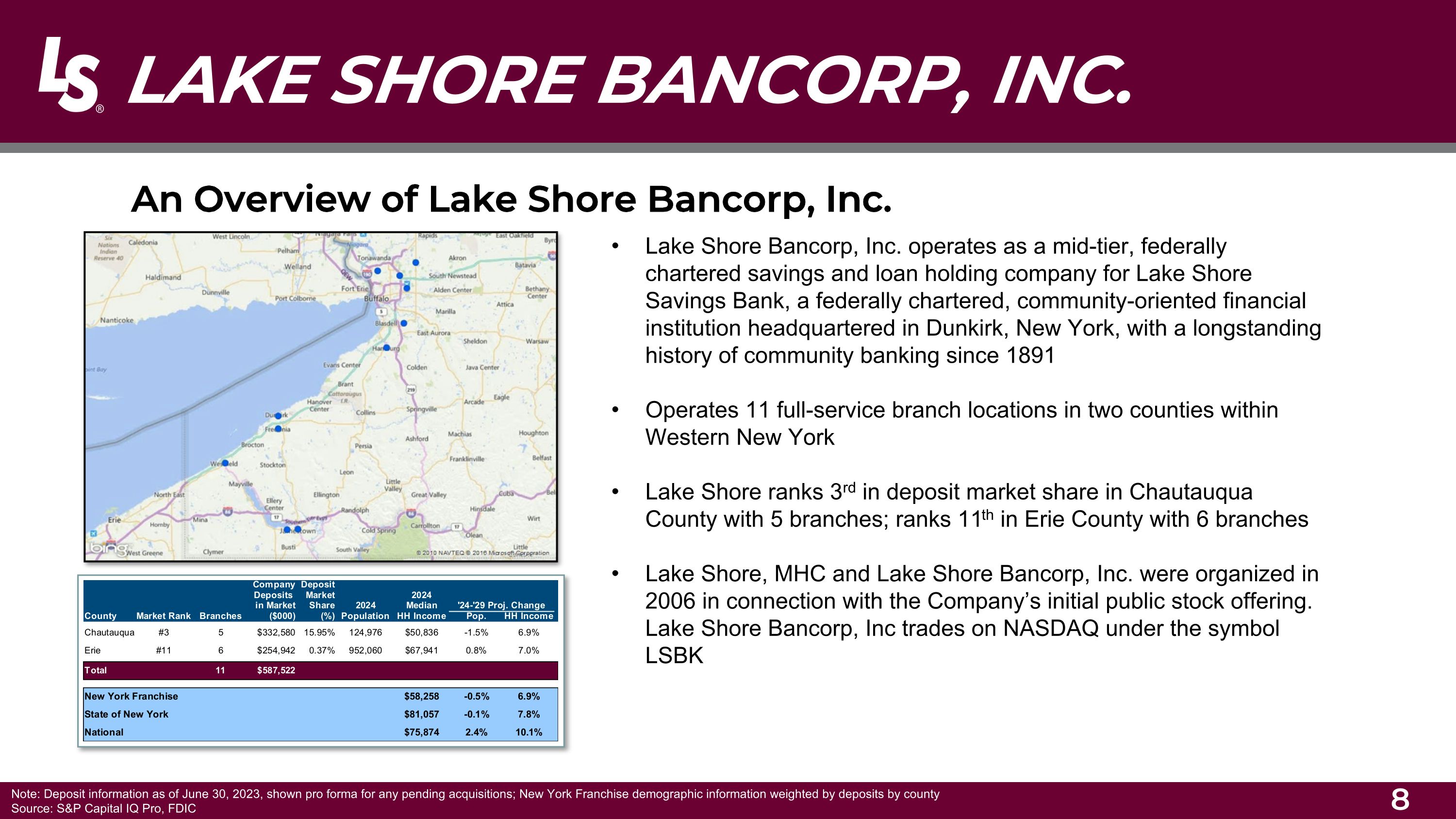

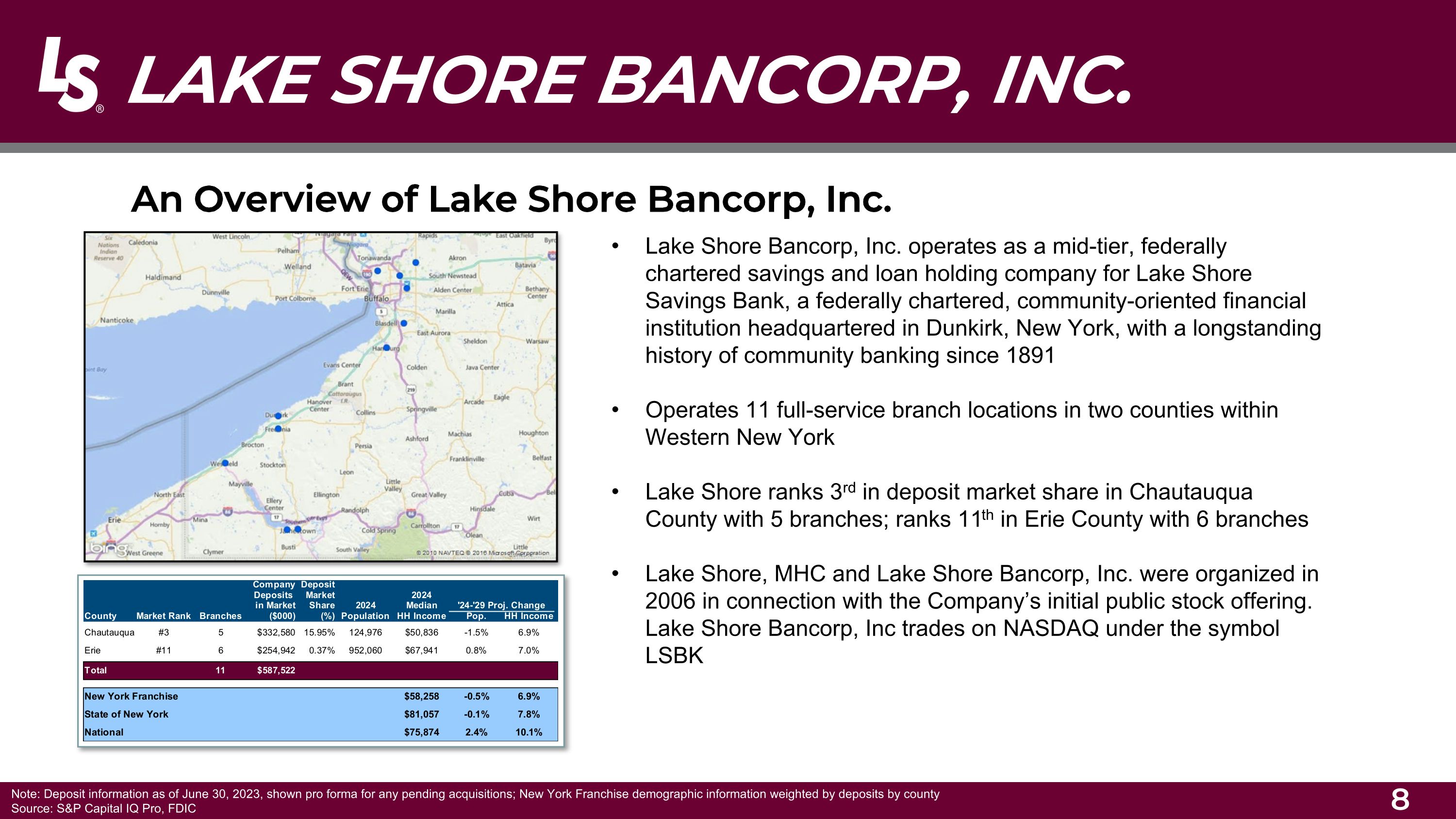

An Overview of Lake Shore Bancorp, Inc. Lake Shore Bancorp, Inc. operates as a mid-tier, federally chartered savings and loan holding company for Lake Shore Savings Bank, a federally chartered, community-oriented financial institution headquartered in Dunkirk, New York, with a longstanding history of community banking since 1891 Operates 11 full-service branch locations in two counties within Western New York Lake Shore ranks 3rd in deposit market share in Chautauqua County with 5 branches; ranks 11th in Erie County with 6 branches Lake Shore, MHC and Lake Shore Bancorp, Inc. were organized in 2006 in connection with the Company’s initial public stock offering. Lake Shore Bancorp, Inc trades on NASDAQ under the symbol LSBK LAKE SHORE BANCORP, INC. Note: Deposit information as of June 30, 2023, shown pro forma for any pending acquisitions; New York Franchise demographic information weighted by deposits by county Source: S&P Capital IQ Pro, FDIC

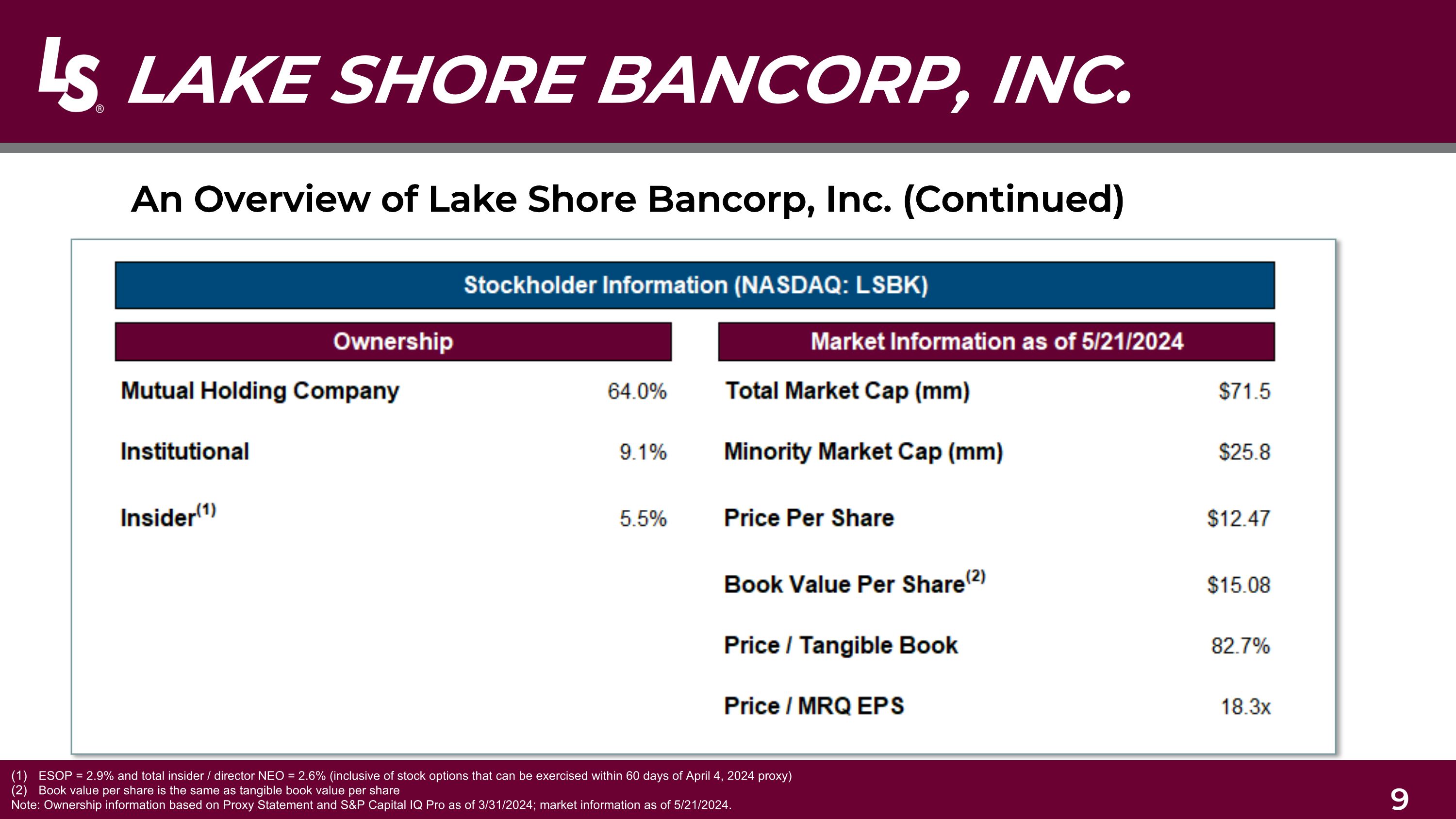

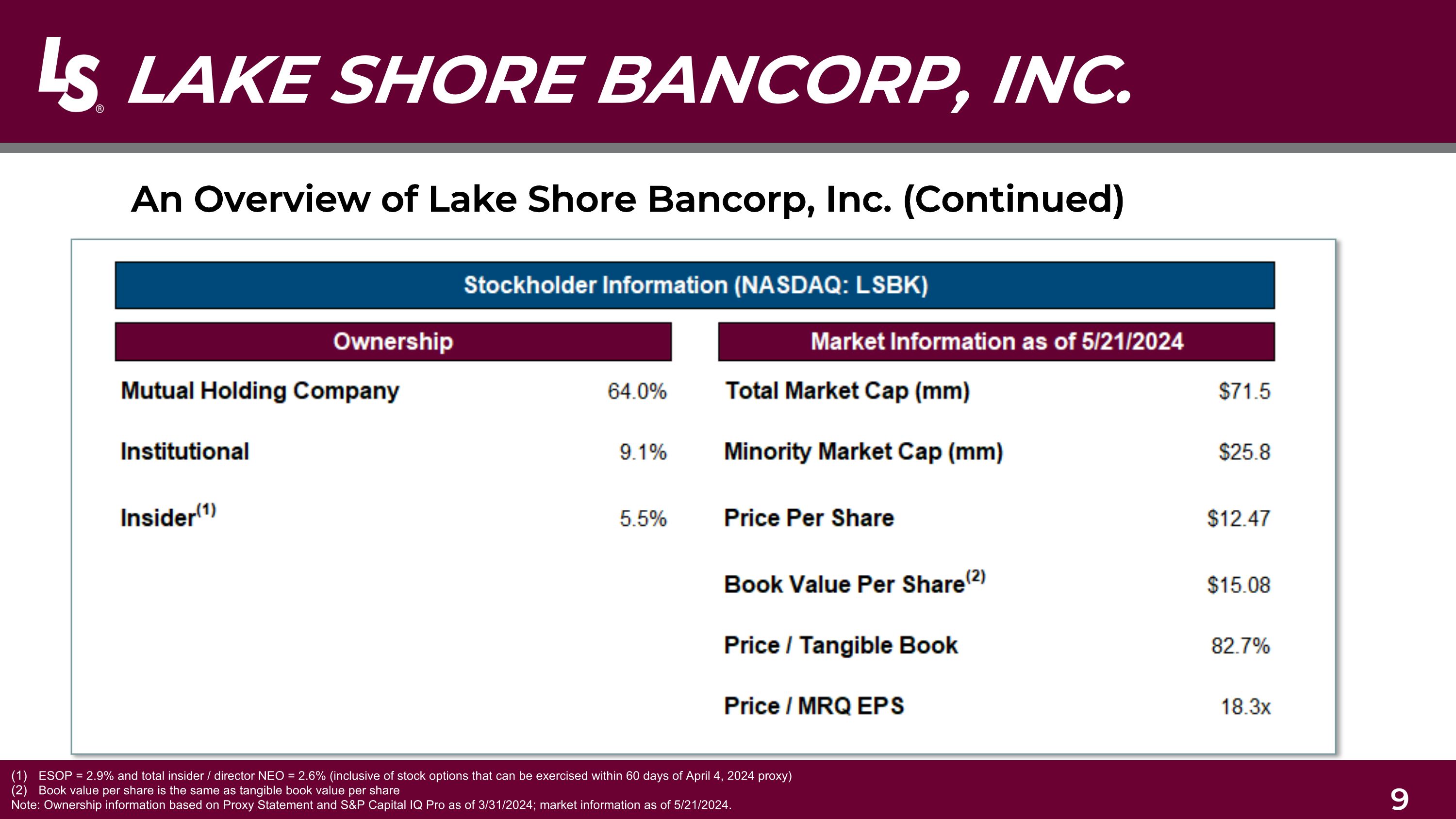

An Overview of Lake Shore Bancorp, Inc. (Continued) LAKE SHORE BANCORP, INC. ESOP = 2.9% and total insider / director NEO = 2.6% (inclusive of stock options that can be exercised within 60 days of April 4, 2024 proxy) Book value per share is the same as tangible book value per share Note: Ownership information based on Proxy Statement and S&P Capital IQ Pro as of 3/31/2024; market information as of 5/21/2024.

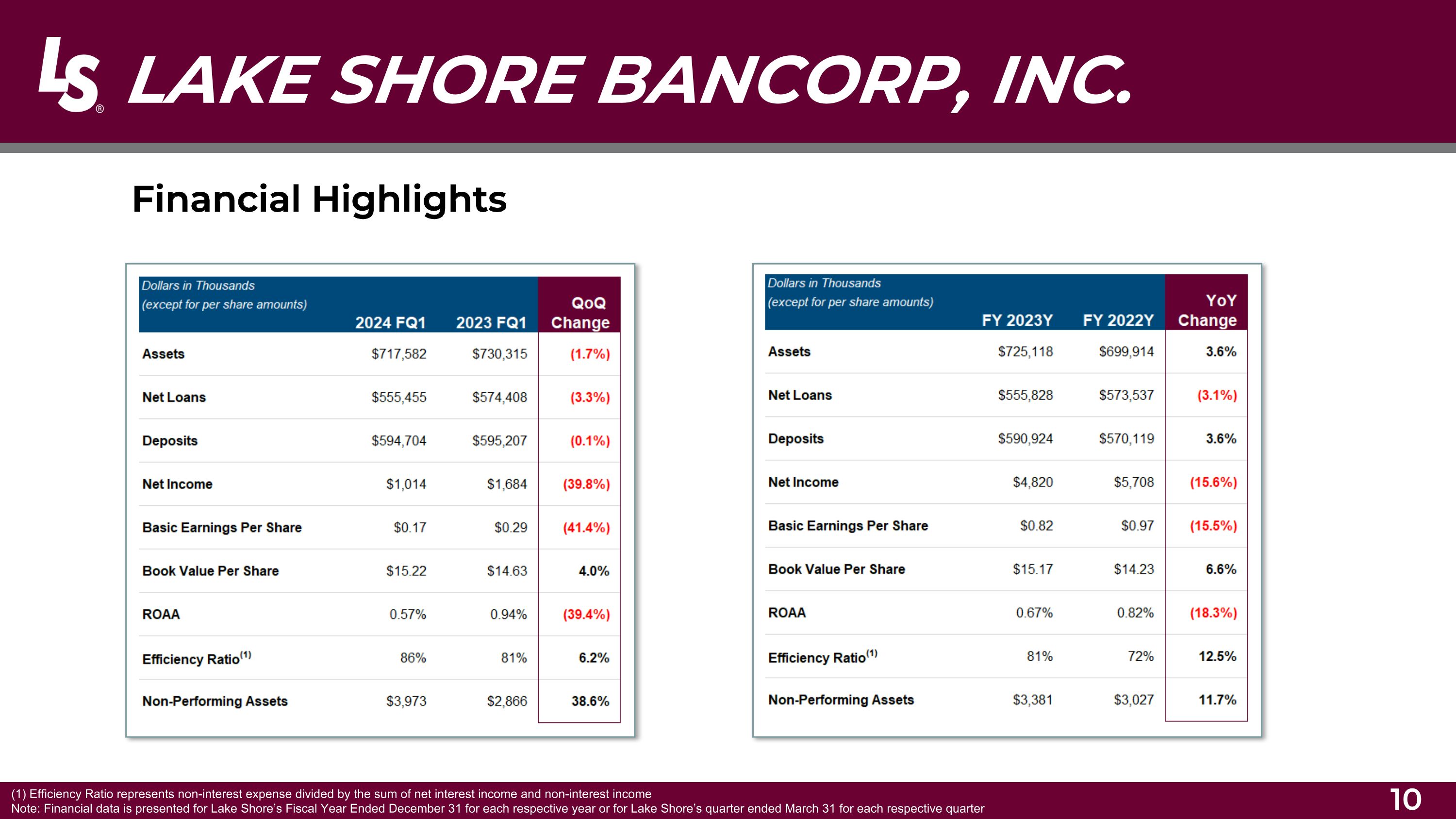

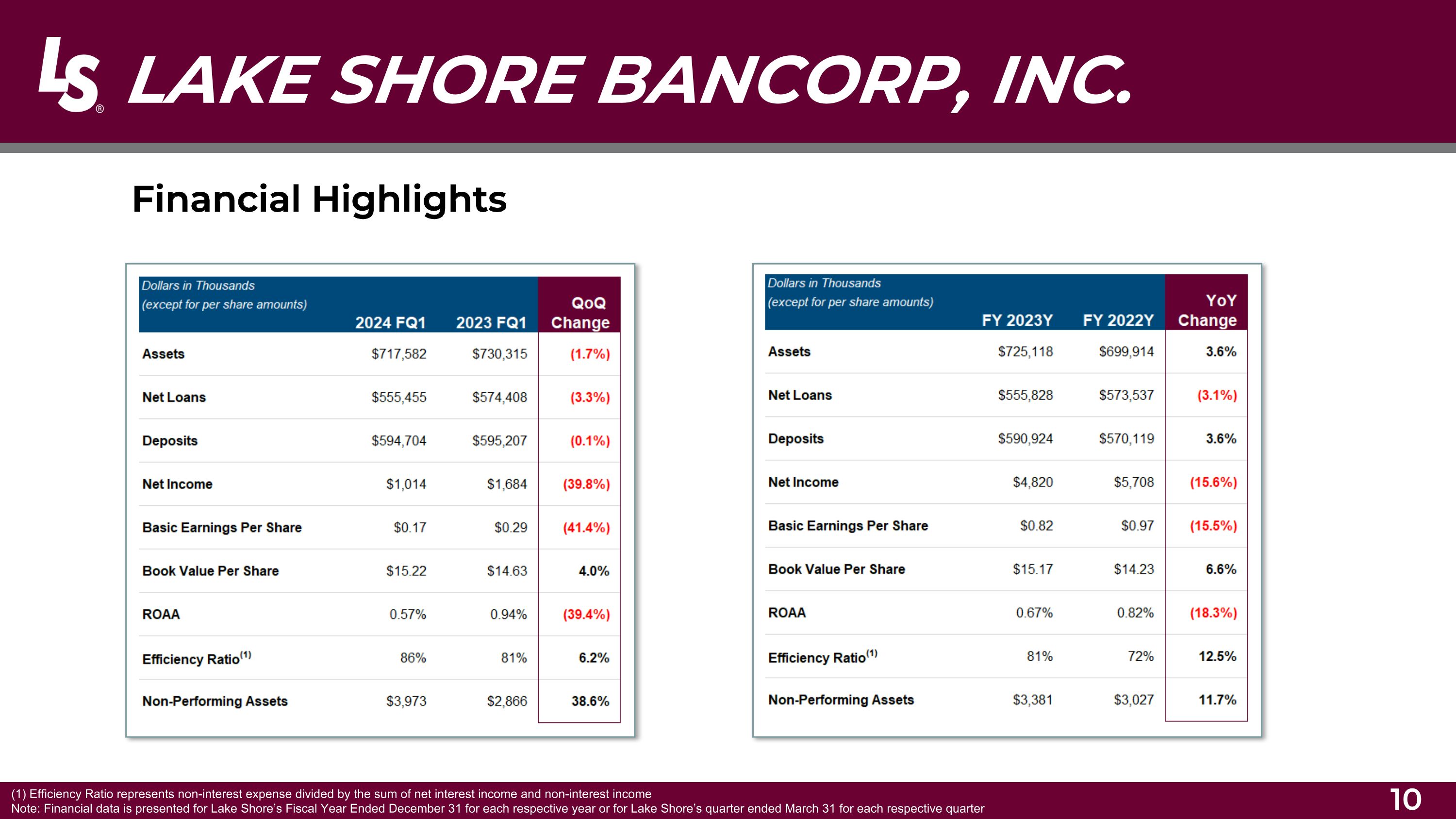

9 Financial Highlights LAKE SHORE BANCORP, INC. (1) Efficiency Ratio represents non-interest expense divided by the sum of net interest income and non-interest income Note: Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year or for Lake Shore’s quarter ended March 31 for each respective quarter

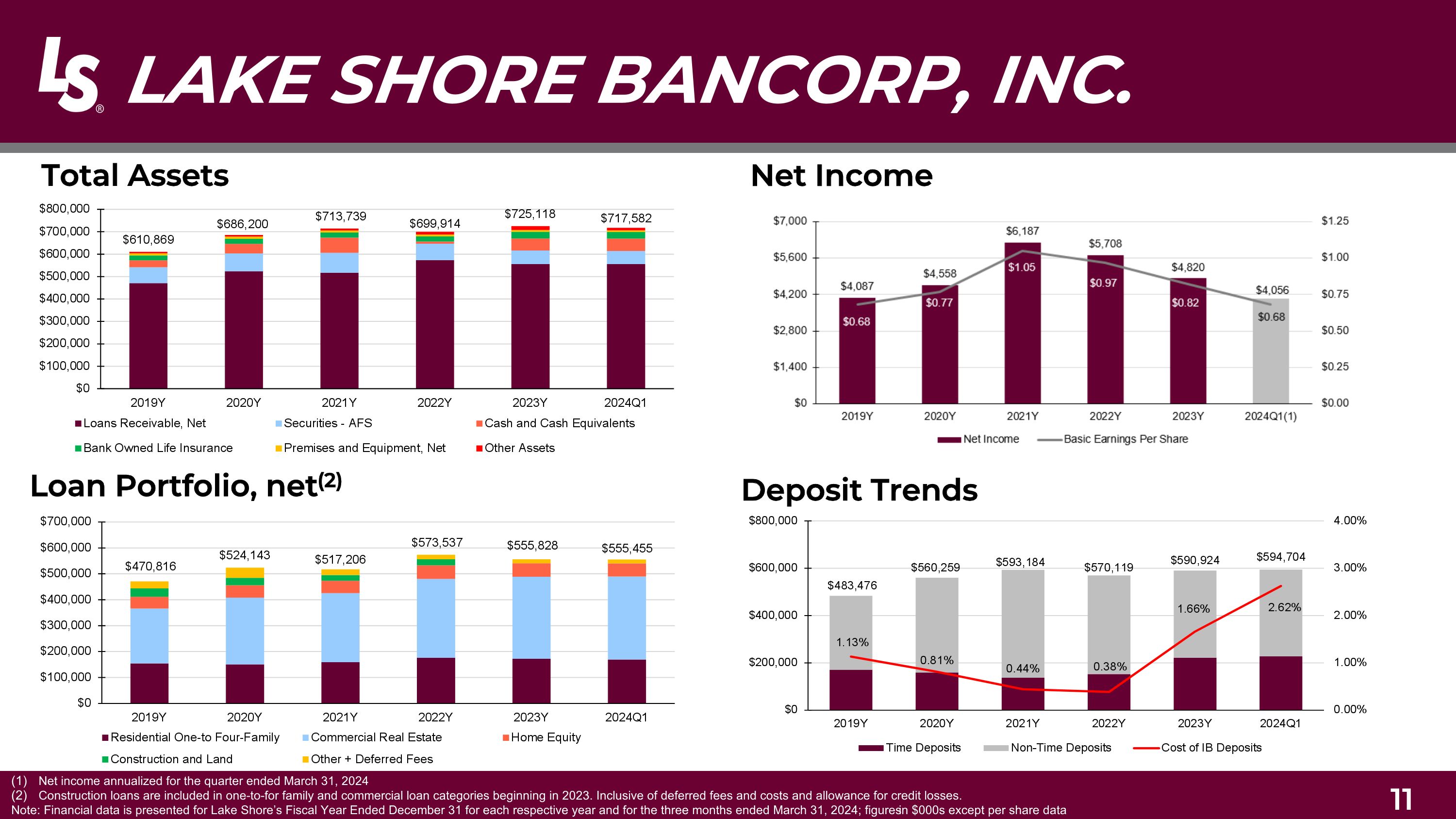

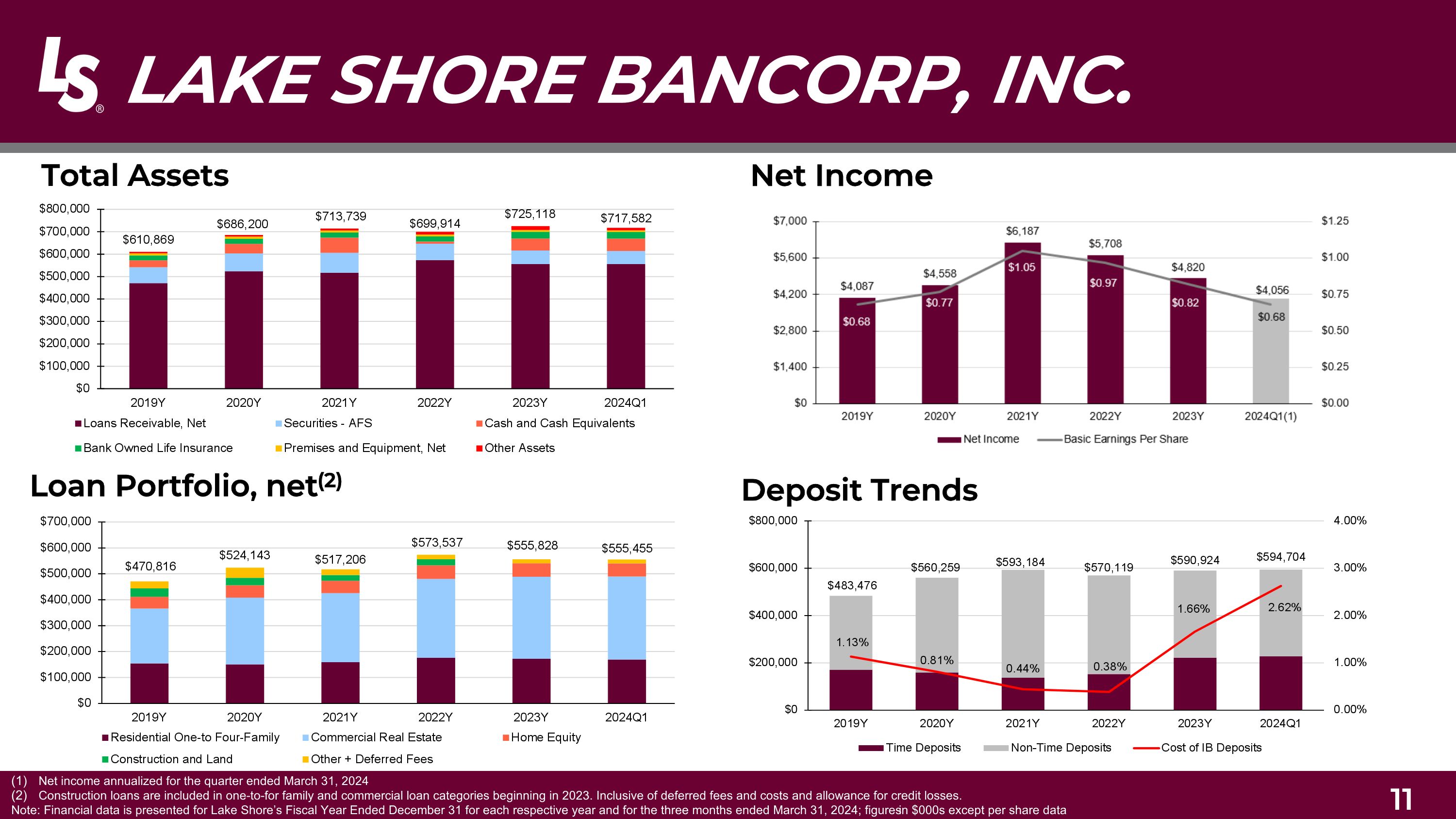

LAKE SHORE BANCORP, INC. Net income annualized for the quarter ended March 31, 2024 Construction loans are included in one-to-for family and commercial loan categories beginning in 2023. Inclusive of deferred fees and costs and allowance for credit losses. Note: Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2024; figures in $000s except per share data Total Assets Loan Portfolio, net(2) Net Income Deposit Trends

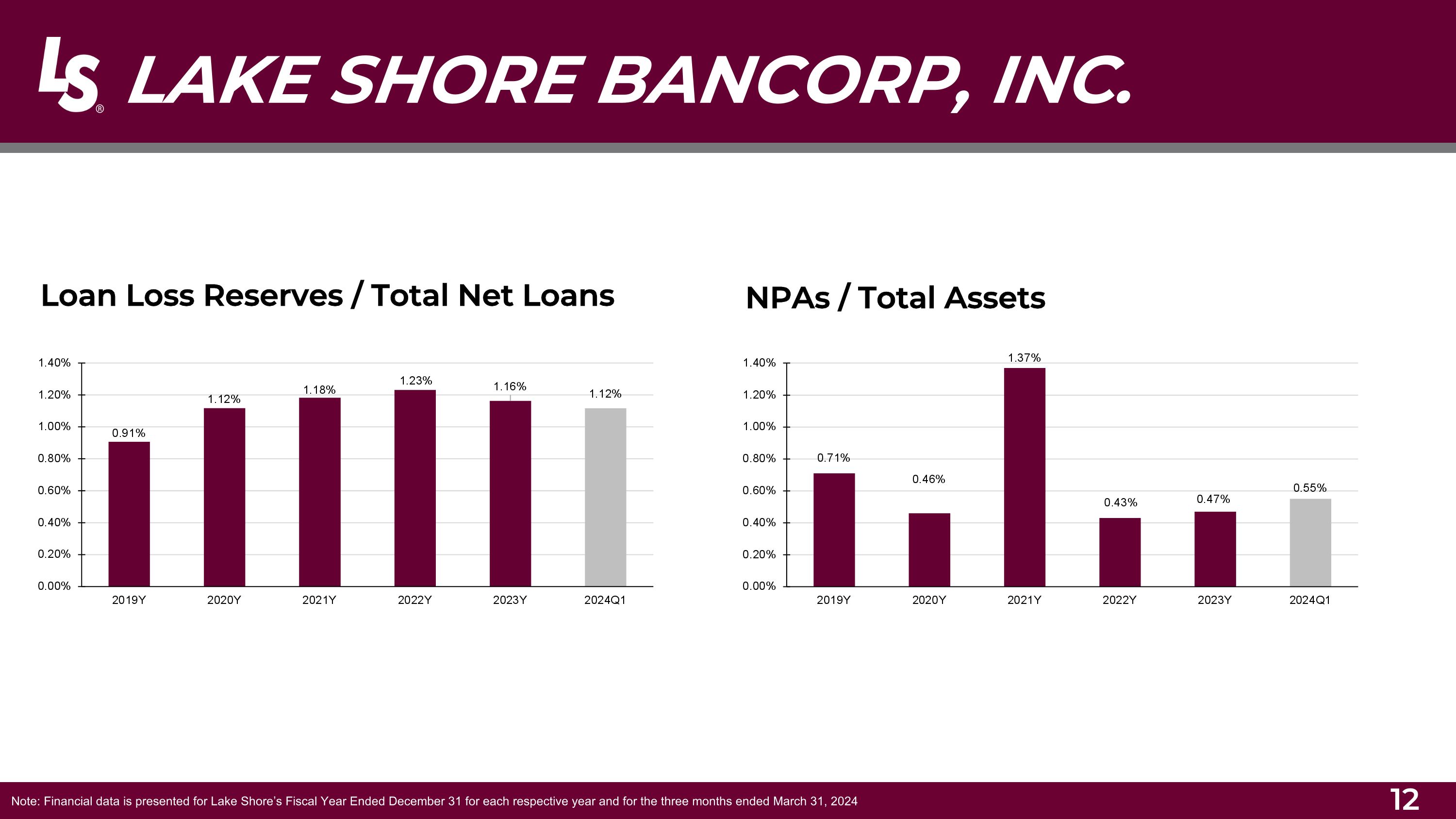

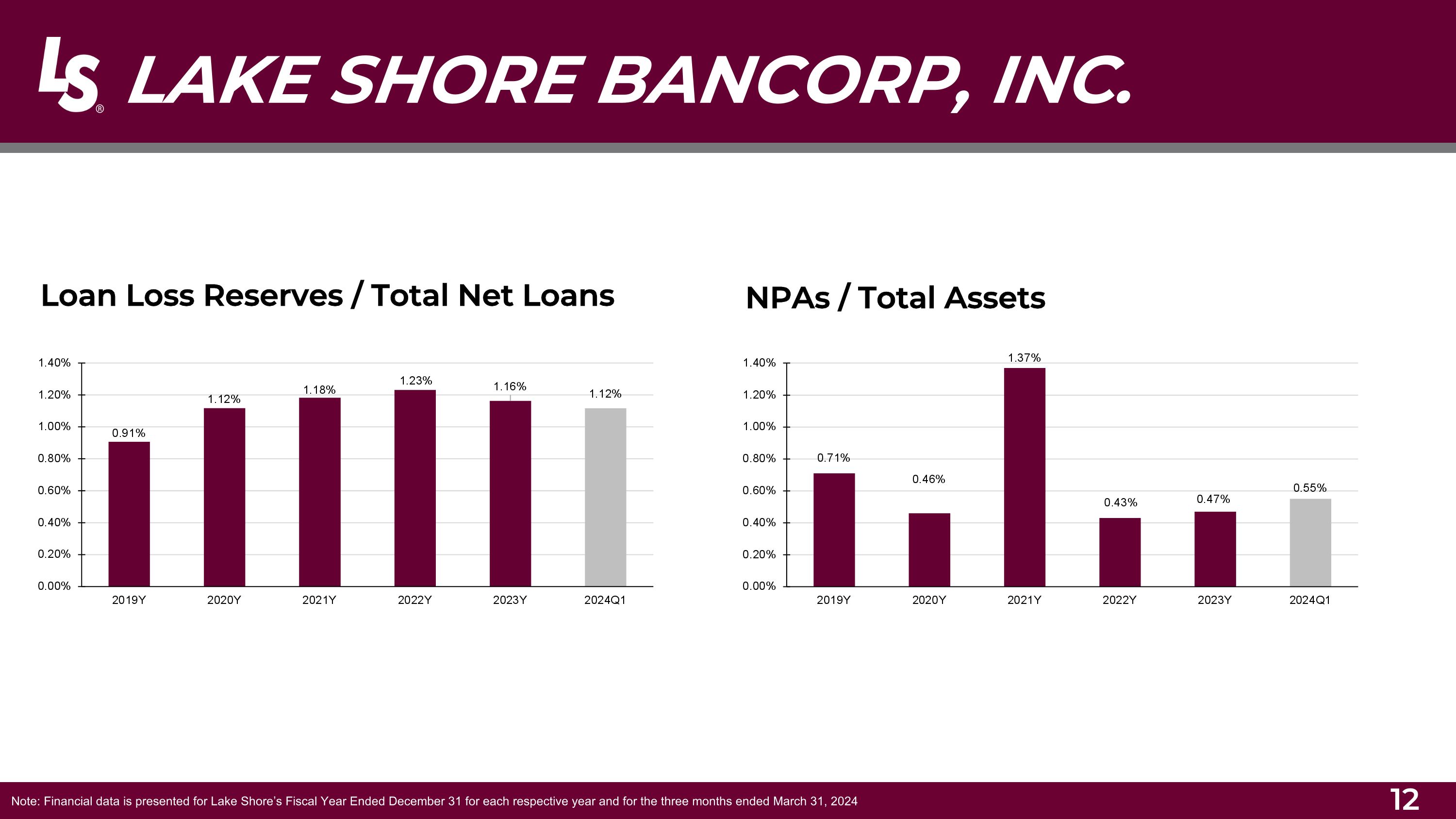

Loan Loss Reserves / Total Net Loans LAKE SHORE BANCORP, INC. Note: Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2024 NPAs / Total Assets

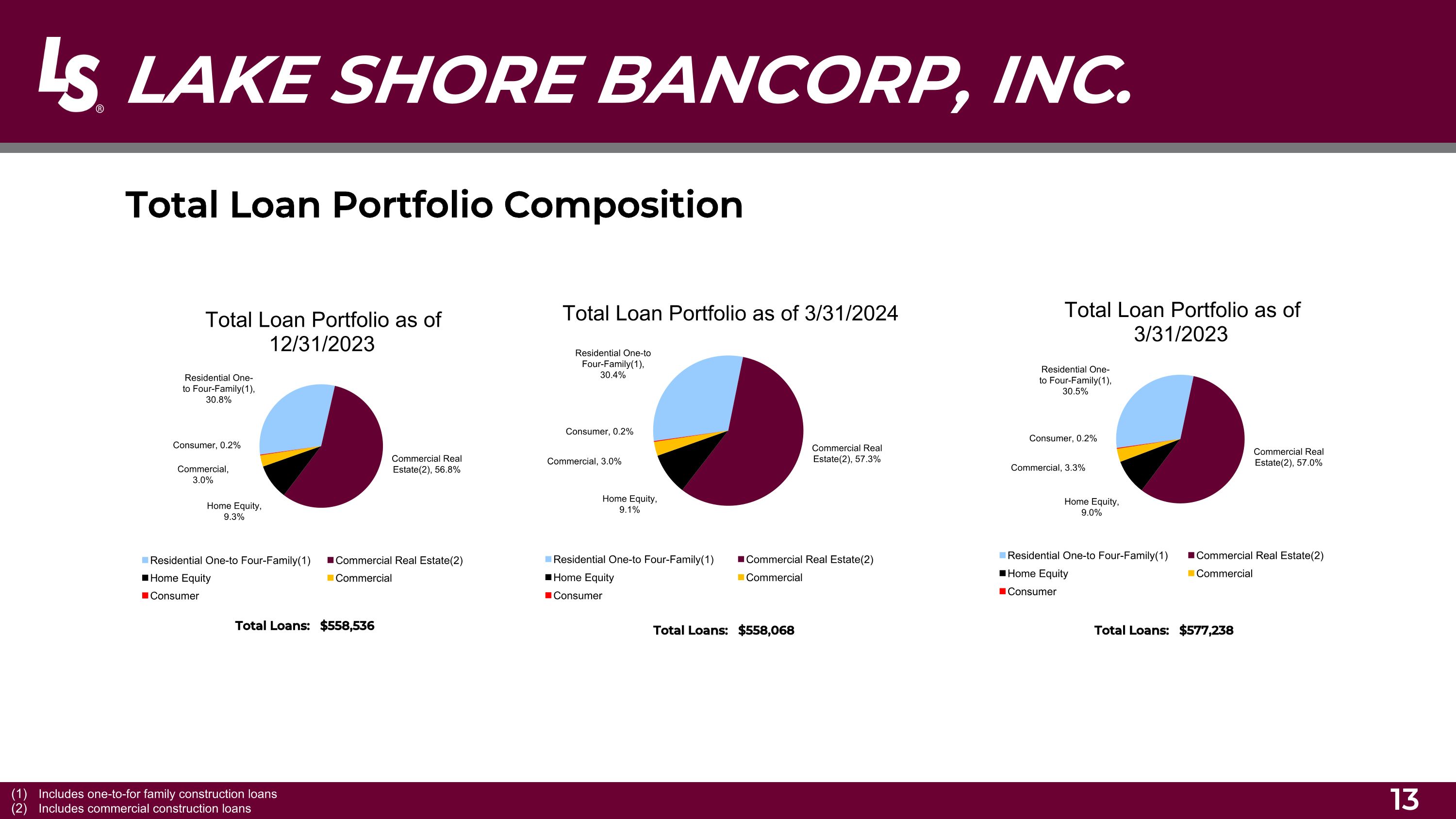

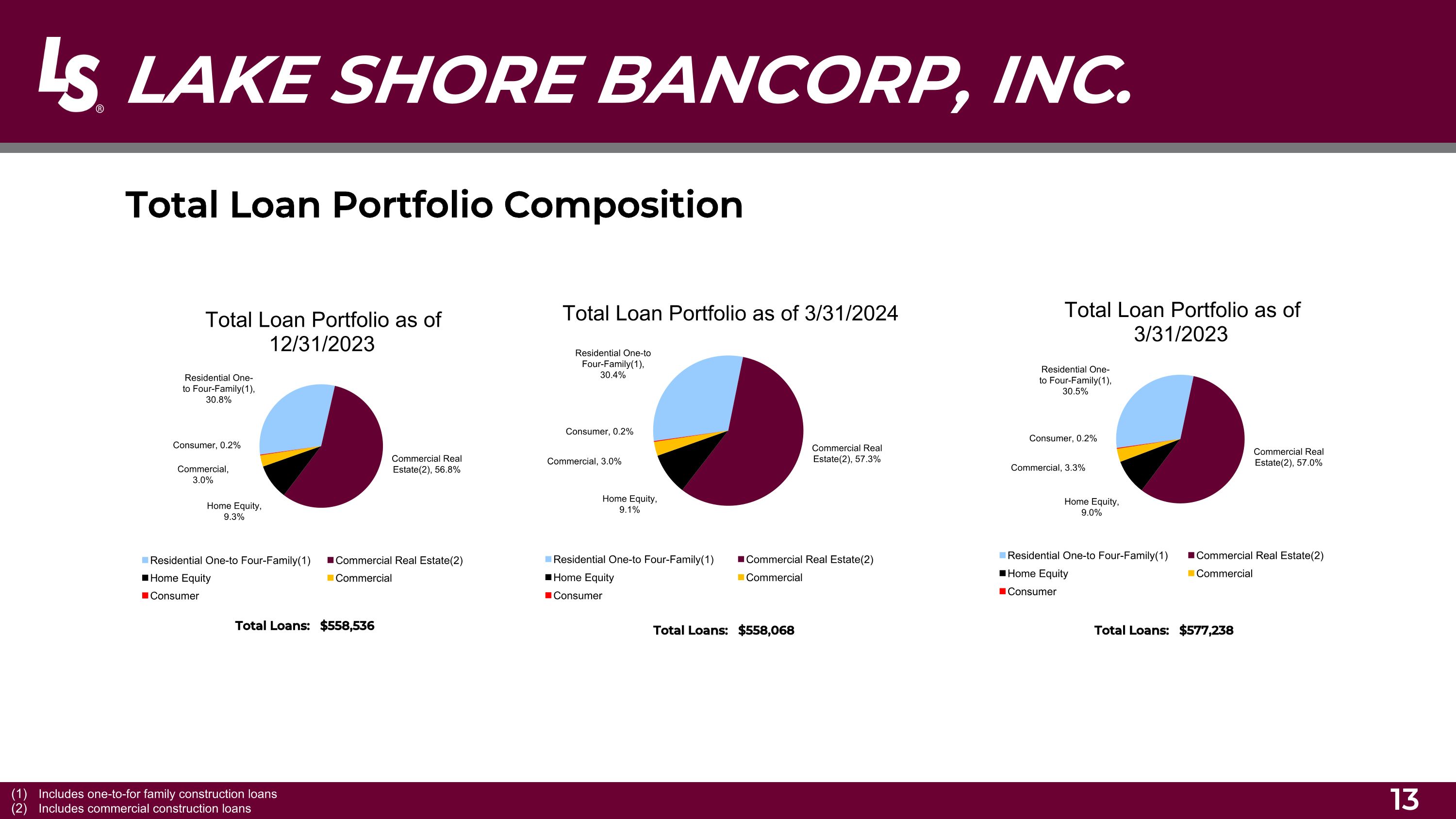

Total Loan Portfolio Composition LAKE SHORE BANCORP, INC. Includes one-to-for family construction loans Includes commercial construction loans Total Loans: $558,536 Total Loans: $558,068 Total Loans: $577,238

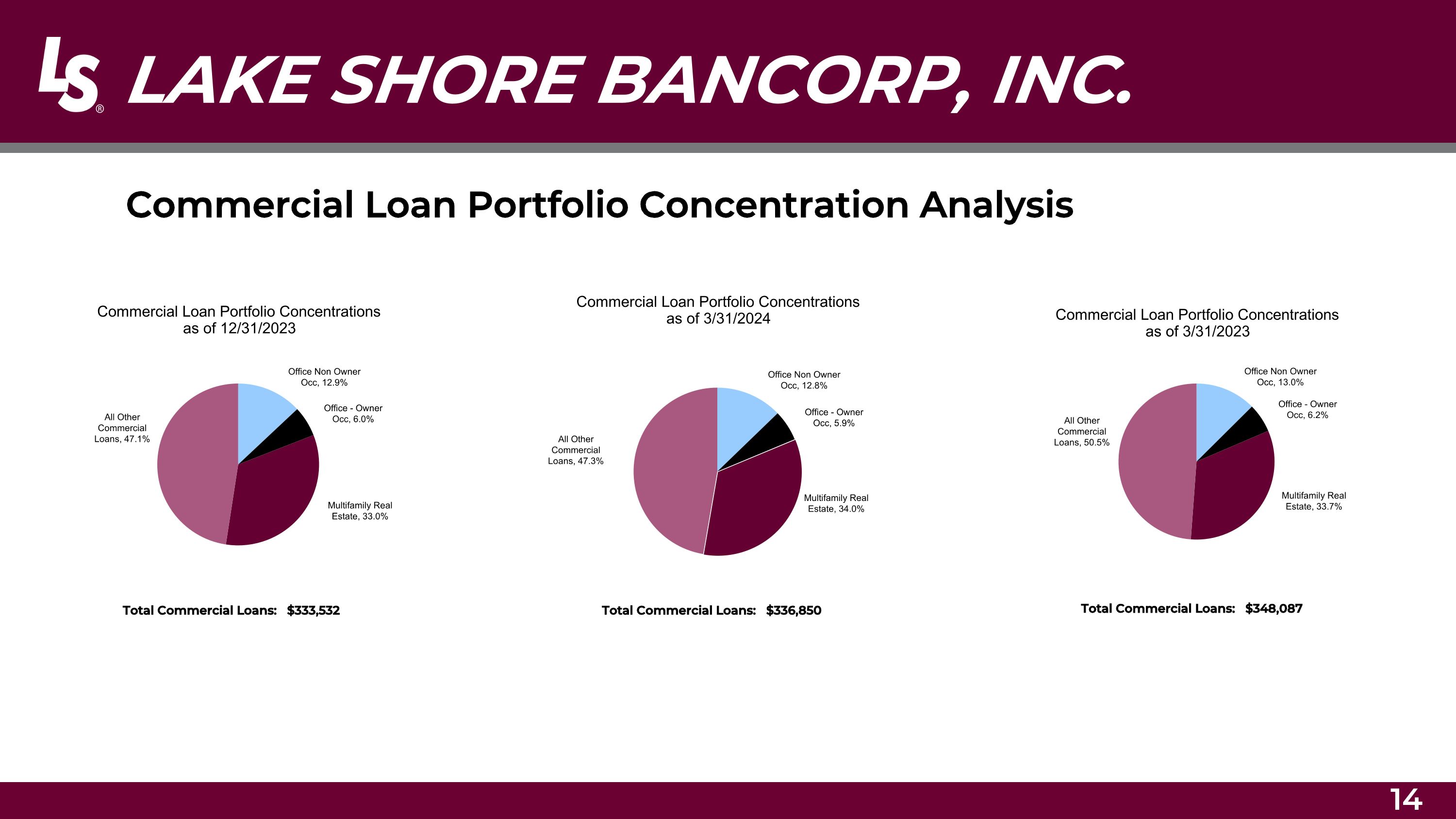

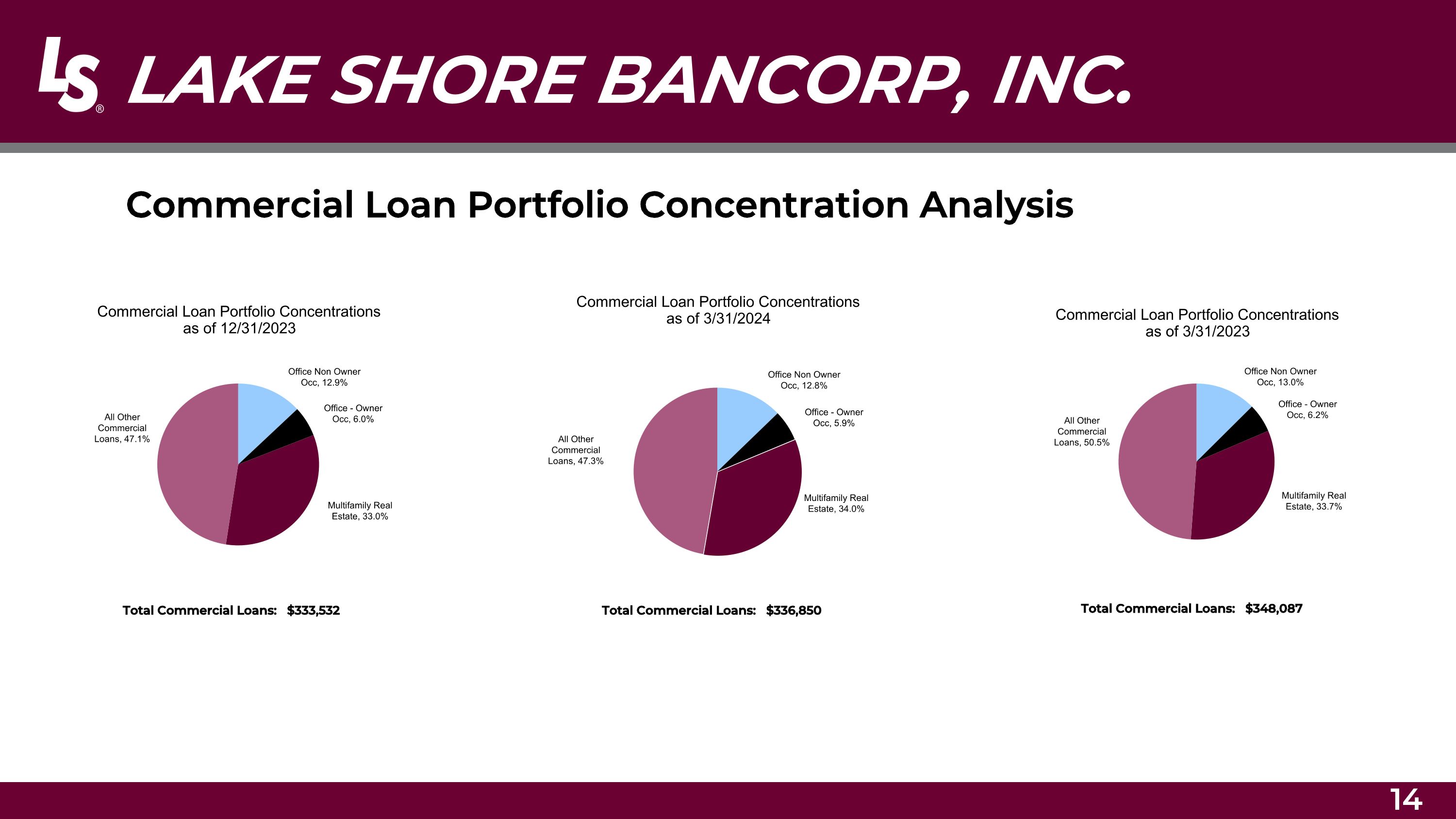

Commercial Loan Portfolio Concentration Analysis LAKE SHORE BANCORP, INC. Total Commercial Loans: $333,532 Total Commercial Loans: $336,850 Total Commercial Loans: $348,087

Change in Deposit Mix LAKE SHORE BANCORP, INC. Note: Uninsured deposits made up 12.6% of total deposits as of March 31, 2024 Total Deposits: $594,704 Total Deposits: $590,924 Total Deposits: $595,207

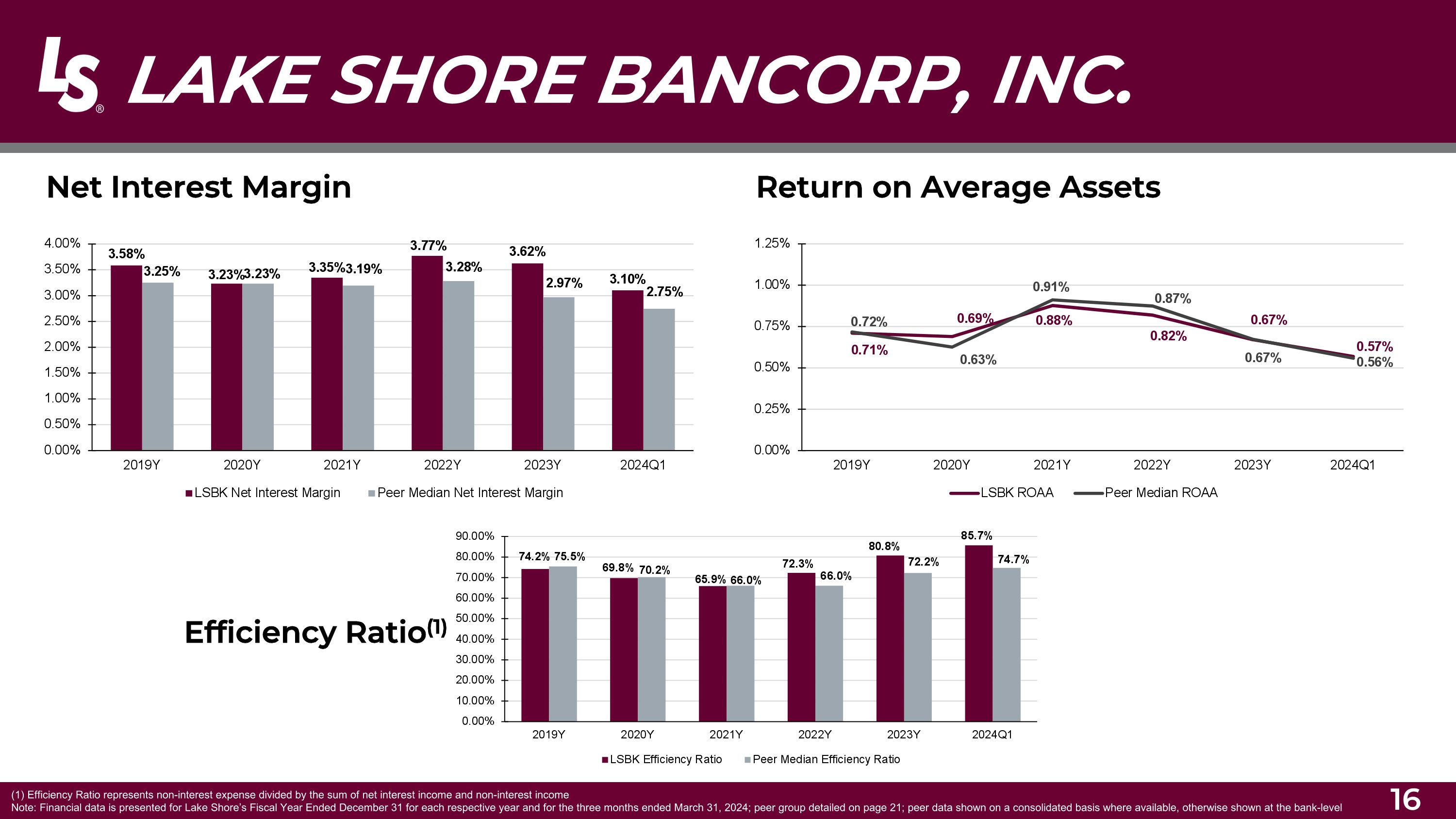

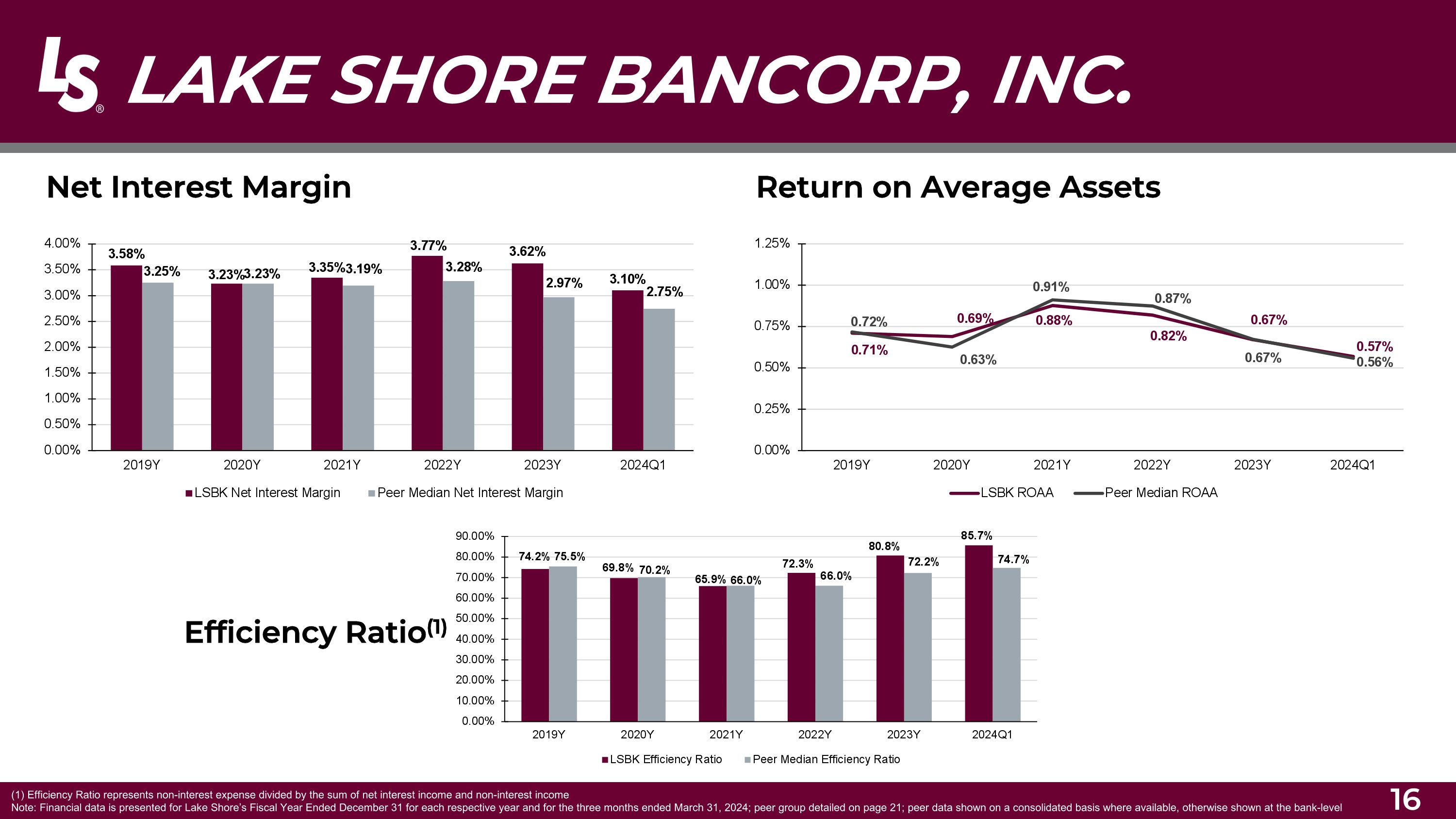

Net Interest Margin LAKE SHORE BANCORP, INC. (1) Efficiency Ratio represents non-interest expense divided by the sum of net interest income and non-interest income Note: Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2024; peer group detailed on page 21; peer data shown on a consolidated basis where available, otherwise shown at the bank-level Return on Average Assets Efficiency Ratio(1)

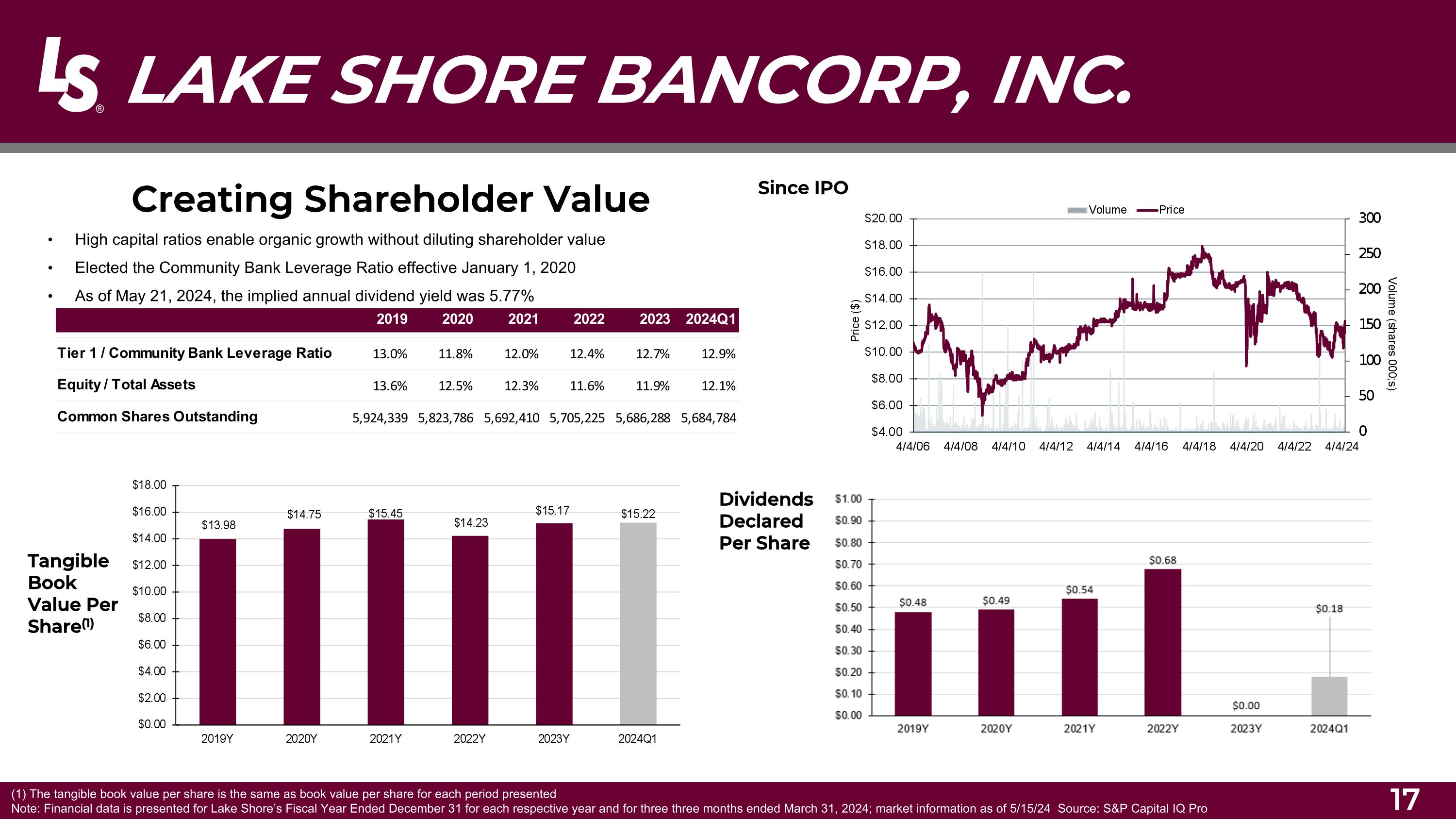

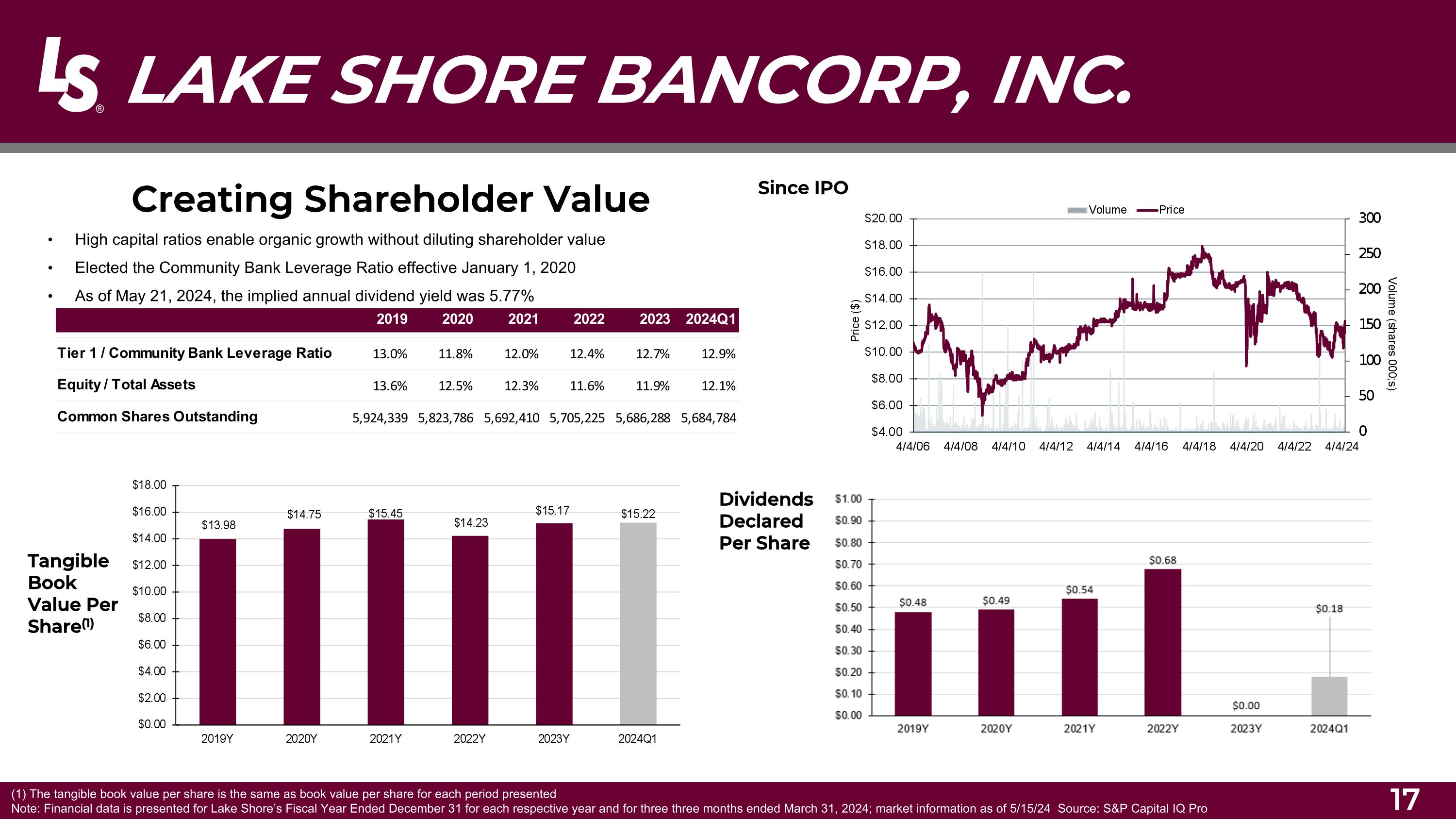

Creating Shareholder Value High capital ratios enable organic growth without diluting shareholder value Elected the Community Bank Leverage Ratio effective January 1, 2020 As of May 21, 2024, the implied annual dividend yield was 5.77% LAKE SHORE BANCORP, INC. (1) The tangible book value per share is the same as book value per share for each period presented Note: Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for three three months ended March 31, 2024; market information as of 5/15/24 Source: S&P Capital IQ Pro Tangible Book Value Per Share(1) Since IPO Dividends Declared Per Share

Summary After 133 years in business, we continue to be a local bank that cares about its customers and communities. At Lake Shore Savings, that has always meant “Putting People First.” We will continue to put our customers, communities, and shareholders FIRST, as we adopt new technology, products, and services to meet the future needs of our customers. LAKE SHORE BANCORP, INC.

QUESTIONS AND ANSWERS

Vote Report Adjournment of Annual Shareholder’ Meeting LAKE SHORE BANCORP, INC.

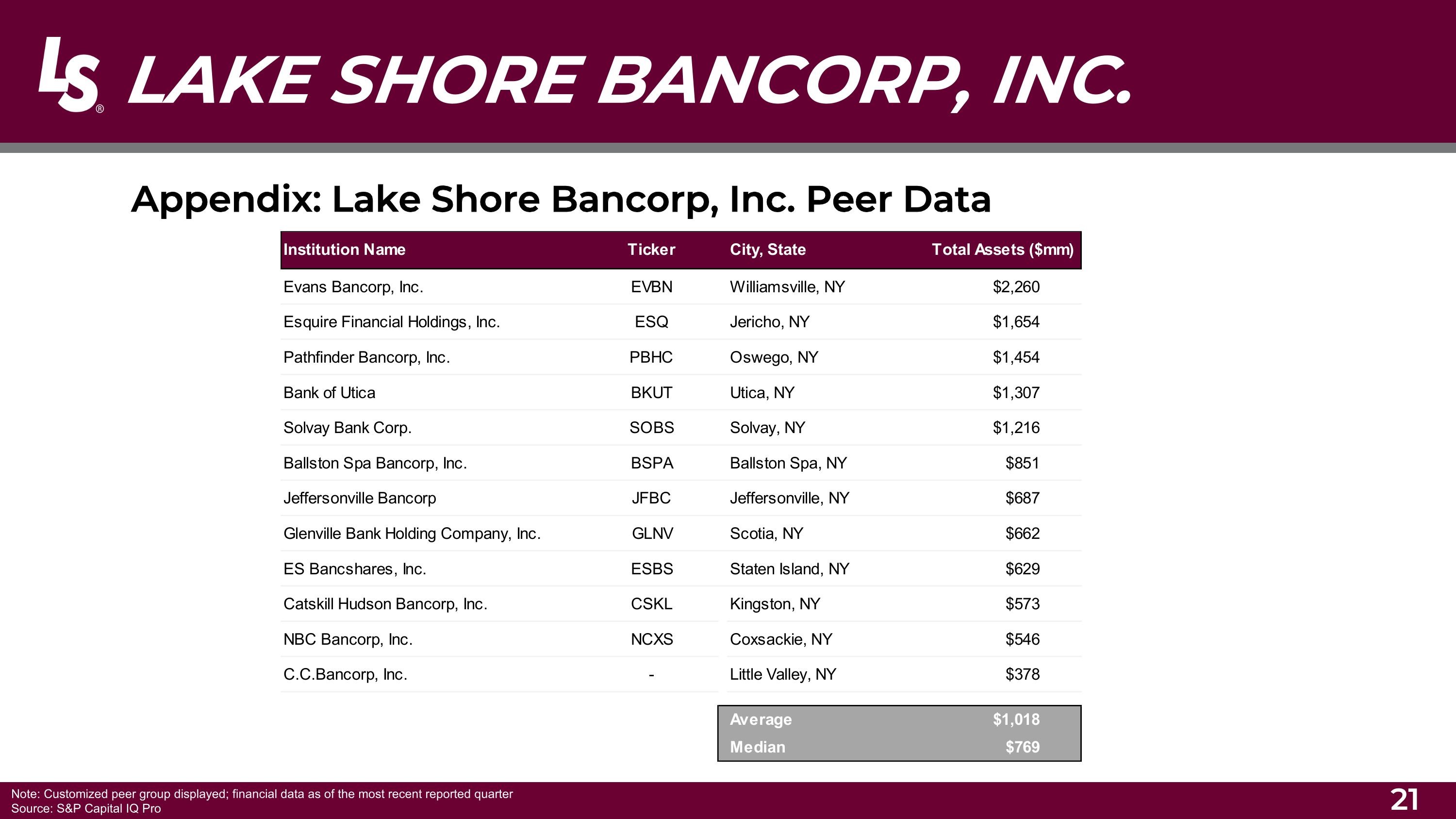

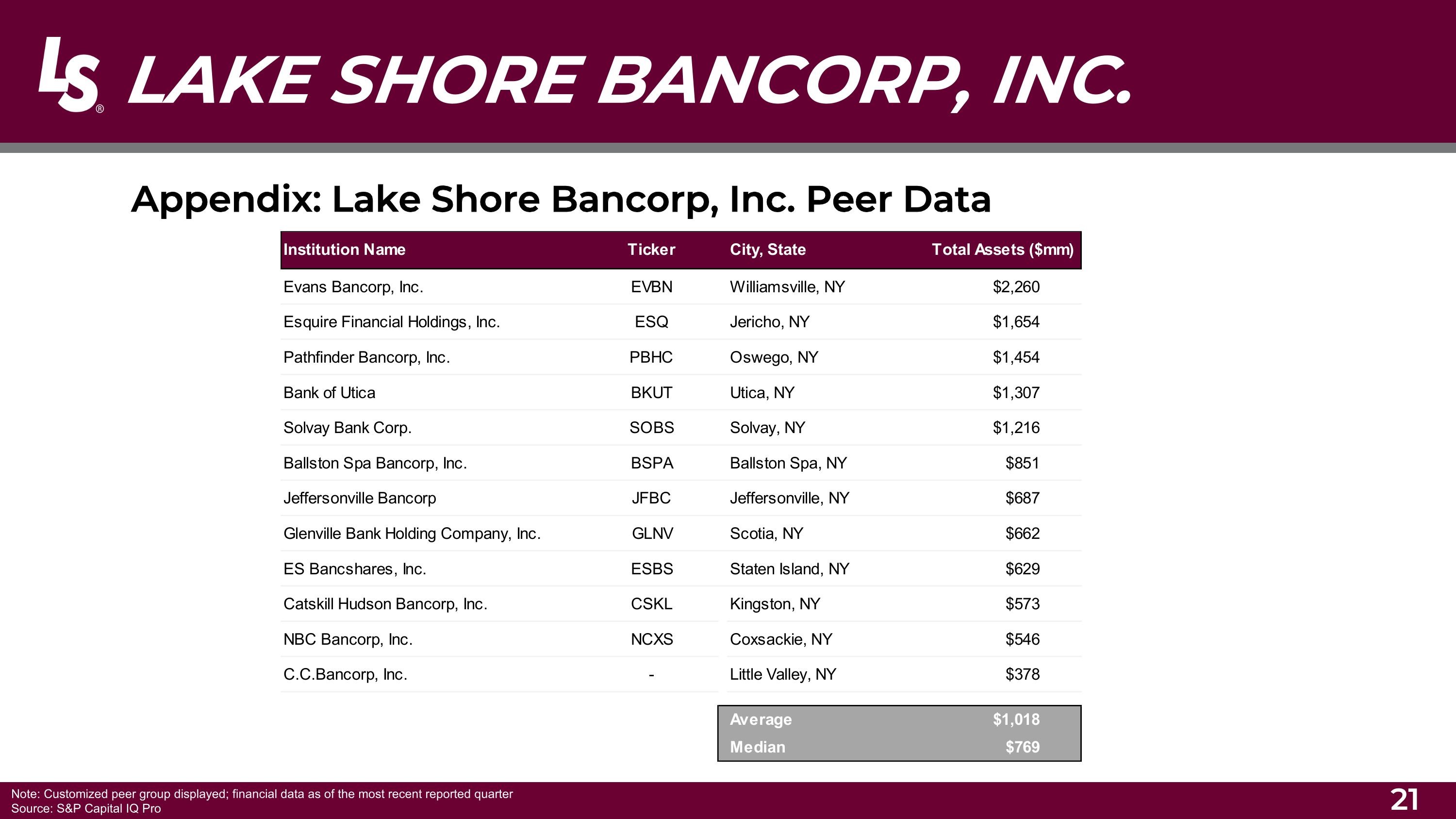

Appendix: Lake Shore Bancorp, Inc. Peer Data LAKE SHORE BANCORP, INC. Note: Customized peer group displayed; financial data as of the most recent reported quarter Source: S&P Capital IQ Pro

Lake Shore, MHC Annual Meeting of Members Call to Order Introduction of Proposal to Elect Directors Tabulation of Votes Adjournment LAKE SHORE BANCORP, INC.