Annual Meeting of Shareholders May 20, 2015 1 LSS Bancorp logo.epsLake Shore Bancorp, Inc. Copyright 2015

Annual Meeting of Shareholders May 20, 2015 1 LSS Bancorp logo.epsLake Shore Bancorp, Inc. Copyright 2015

Welcoming Remarks Gary W. Winger Chairman of the Board 2 Lake Shore Bancorp, Inc. Copyright 2015

Welcoming Remarks Gary W. Winger Chairman of the Board 2 Lake Shore Bancorp, Inc. Copyright 2015

Agenda Call to Order - Gary W. Winger, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment 3 Lake Shore Bancorp, Inc. Copyright 2015

Agenda Call to Order - Gary W. Winger, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment 3 Lake Shore Bancorp, Inc. Copyright 2015

Board of Directors 4 Lake Shore Bancorp, Inc. Copyright 2015 M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Bancorp\LSBANCORP CMYK.jpgM:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Director Since Susan C. Ballard 2012 Tracy S. Bennett 2010 Sharon E. Brautigam, Governance Committee Chairperson 2004 Reginald S. Corsi 2008 David C. Mancuso, Asset/Liability Committee Chairperson 1998 Daniel P. Reininga, President and Chief Executive Officer 1994 Kevin M. Sanvidge, Compensation Committee Chairperson 2012 Gary W. Winger, Chairman of the Board 1997 Nancy L. Yocum, Vice Chairman of the Board and Audit Committee Chairperson 1995

Board of Directors 4 Lake Shore Bancorp, Inc. Copyright 2015 M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Bancorp\LSBANCORP CMYK.jpgM:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Director Since Susan C. Ballard 2012 Tracy S. Bennett 2010 Sharon E. Brautigam, Governance Committee Chairperson 2004 Reginald S. Corsi 2008 David C. Mancuso, Asset/Liability Committee Chairperson 1998 Daniel P. Reininga, President and Chief Executive Officer 1994 Kevin M. Sanvidge, Compensation Committee Chairperson 2012 Gary W. Winger, Chairman of the Board 1997 Nancy L. Yocum, Vice Chairman of the Board and Audit Committee Chairperson 1995

Business of Annual Shareholders Meeting 5 Lake Shore Bancorp, Inc. Copyright 2015 •Election of Three Directors: David C. Mancuso Gary W. Winger Nancy L. Yocum • An advisory vote on executive compensation (“Say-on-Pay”) •Ratification of the appointment of Baker Tilly Virchow Krause, LLP as independent registered public accounting firm for 2015

Business of Annual Shareholders Meeting 5 Lake Shore Bancorp, Inc. Copyright 2015 •Election of Three Directors: David C. Mancuso Gary W. Winger Nancy L. Yocum • An advisory vote on executive compensation (“Say-on-Pay”) •Ratification of the appointment of Baker Tilly Virchow Krause, LLP as independent registered public accounting firm for 2015

Executive Management Presentation 6 Lake Shore Bancorp, Inc. M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Daniel P. Reininga President and Chief Executive Officer

Executive Management Presentation 6 Lake Shore Bancorp, Inc. M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Daniel P. Reininga President and Chief Executive Officer

Safe Harbor Statement 7 Lake Shore Bancorp, Inc. Copyright 2015 This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the Safe Harbor Provision and are including this statement for the purpose of such Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs, such as “will,” “would,” “should,” “could” or “may”. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company's business and results is discussed in the Company's periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise.

Safe Harbor Statement 7 Lake Shore Bancorp, Inc. Copyright 2015 This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the Safe Harbor Provision and are including this statement for the purpose of such Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs, such as “will,” “would,” “should,” “could” or “may”. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company's business and results is discussed in the Company's periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise.

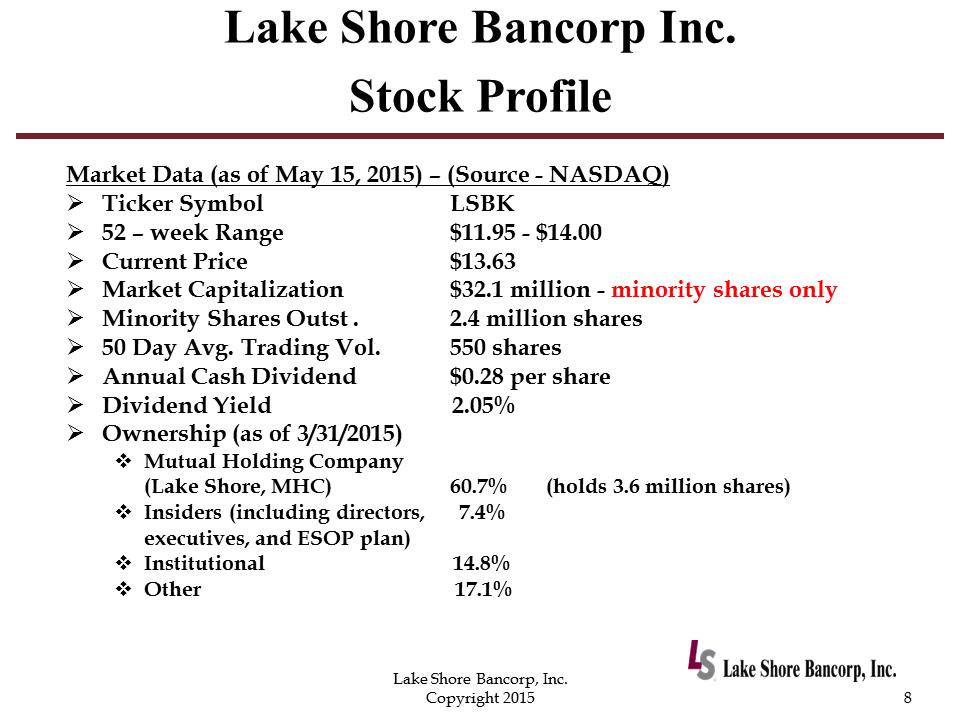

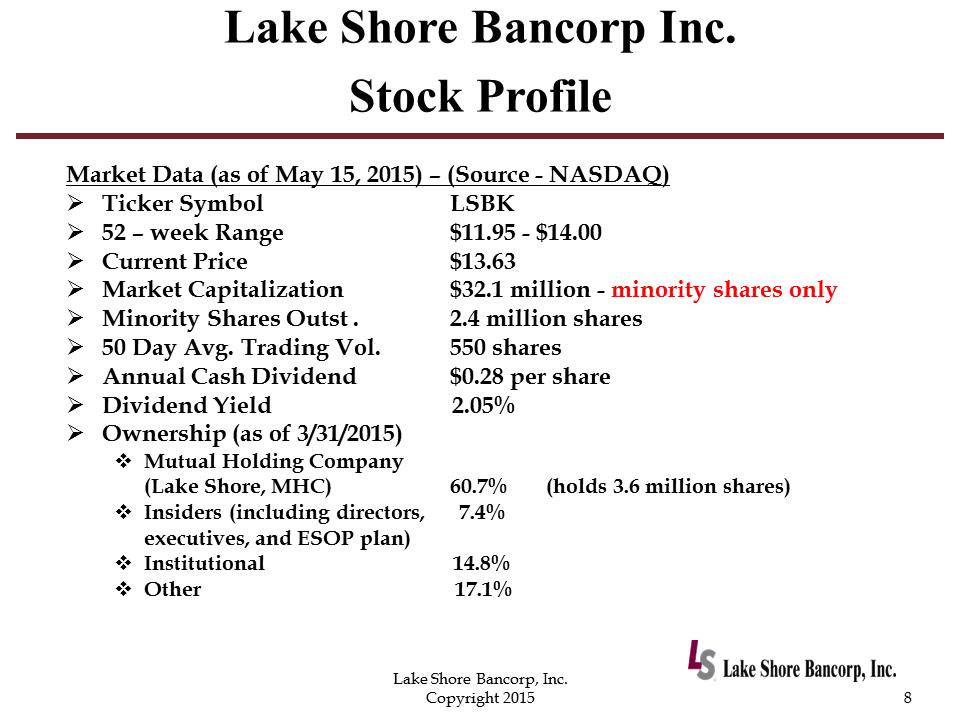

Lake Shore Bancorp Inc. Stock Profile 8 Lake Shore Bancorp, Inc. Copyright 2015 Market Data (as of May 15, 2015) – (Source - NASDAQ) .Ticker Symbol LSBK .52 – week Range $11.95 - $14.00 .Current Price $13.63 .Market Capitalization $32.1 million - minority shares only .Minority Shares Outst . 2.4 million shares .50 Day Avg. Trading Vol. 550 shares .Annual Cash Dividend $0.28 per share .Dividend Yield 2.05% .Ownership (as of 3/31/2015) .Mutual Holding Company (Lake Shore, MHC) 60.7% (holds 3.6 million shares) .Insiders (including directors, 7.4% executives, and ESOP plan) .Institutional 14.8% .Other 17.1%

Lake Shore Bancorp Inc. Stock Profile 8 Lake Shore Bancorp, Inc. Copyright 2015 Market Data (as of May 15, 2015) – (Source - NASDAQ) .Ticker Symbol LSBK .52 – week Range $11.95 - $14.00 .Current Price $13.63 .Market Capitalization $32.1 million - minority shares only .Minority Shares Outst . 2.4 million shares .50 Day Avg. Trading Vol. 550 shares .Annual Cash Dividend $0.28 per share .Dividend Yield 2.05% .Ownership (as of 3/31/2015) .Mutual Holding Company (Lake Shore, MHC) 60.7% (holds 3.6 million shares) .Insiders (including directors, 7.4% executives, and ESOP plan) .Institutional 14.8% .Other 17.1%

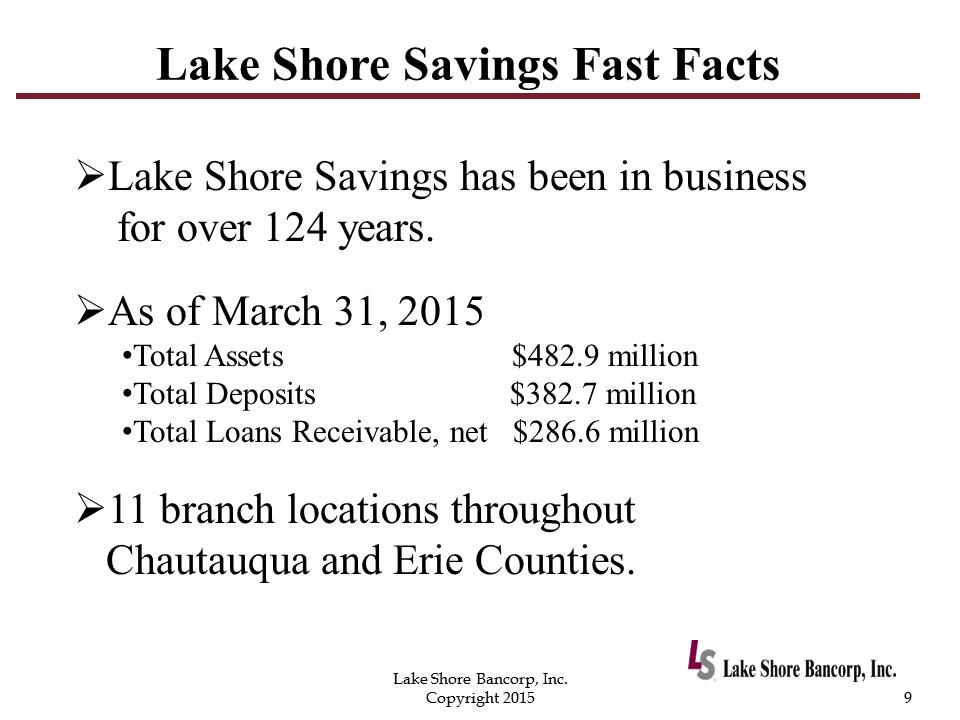

Lake Shore Savings Fast Facts 9 Lake Shore Bancorp, Inc. Copyright 2015 .Lake Shore Savings has been in business for over 124 years. .As of March 31, 2015 •Total Assets $482.9 million •Total Deposits $382.7 million •Total Loans Receivable, net $286.6 million .11 branch locations throughout Chautauqua and Erie Counties.

Lake Shore Savings Fast Facts 9 Lake Shore Bancorp, Inc. Copyright 2015 .Lake Shore Savings has been in business for over 124 years. .As of March 31, 2015 •Total Assets $482.9 million •Total Deposits $382.7 million •Total Loans Receivable, net $286.6 million .11 branch locations throughout Chautauqua and Erie Counties.

Lake Shore Balance Sheet Strategy 10 Lake Shore Bancorp, Inc. Copyright 2015 Manage Interest Rate Risk .Extended low interest rate environment Reduce Interest Rate Risk exposure: . Change Balance Sheet Mix .Sold $10.3 million of long-term, fixed-rate securities in 2014.Increased Commercial Loan origination volume, shorter duration and higher interest rates .Sell long-term, fixed rate residential mortgage loans on secondary market at time of origination, with servicing retained .Increase low-rate core deposits

Lake Shore Balance Sheet Strategy 10 Lake Shore Bancorp, Inc. Copyright 2015 Manage Interest Rate Risk .Extended low interest rate environment Reduce Interest Rate Risk exposure: . Change Balance Sheet Mix .Sold $10.3 million of long-term, fixed-rate securities in 2014.Increased Commercial Loan origination volume, shorter duration and higher interest rates .Sell long-term, fixed rate residential mortgage loans on secondary market at time of origination, with servicing retained .Increase low-rate core deposits

Lake Shore Balance Sheet Strategy 11 Lake Shore Bancorp, Inc. Copyright 2015 Strategic Impact of Managing Interest Rate Risk .Positioning of Balance Sheet for rising interest rate environment .Effectively manage Net Interest Margin .Short term decrease in Net Income, offset by strong capital position

Lake Shore Balance Sheet Strategy 11 Lake Shore Bancorp, Inc. Copyright 2015 Strategic Impact of Managing Interest Rate Risk .Positioning of Balance Sheet for rising interest rate environment .Effectively manage Net Interest Margin .Short term decrease in Net Income, offset by strong capital position

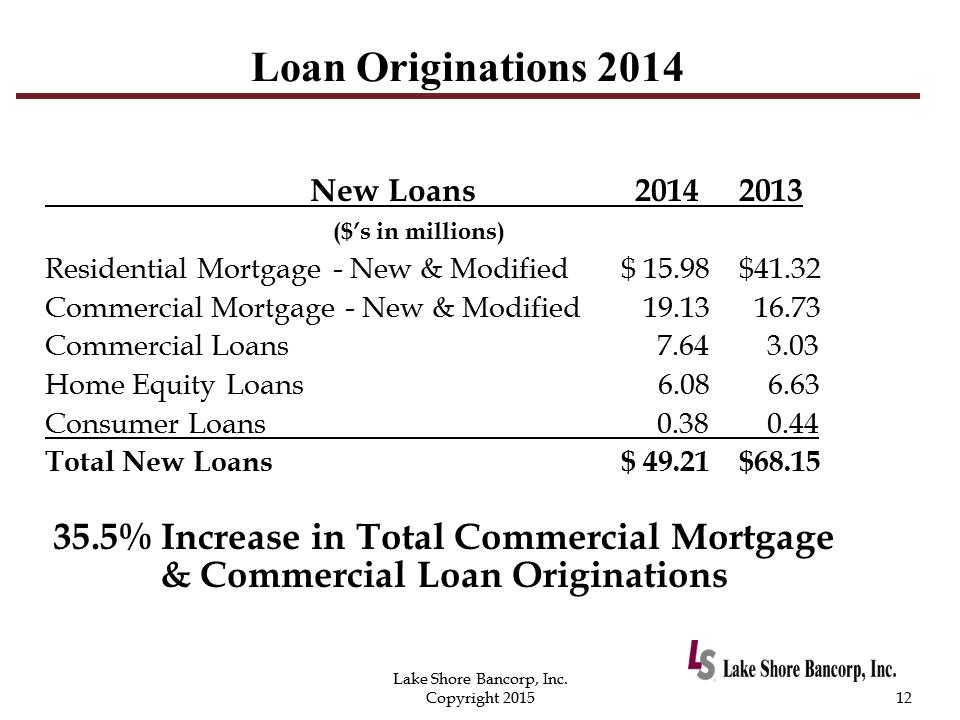

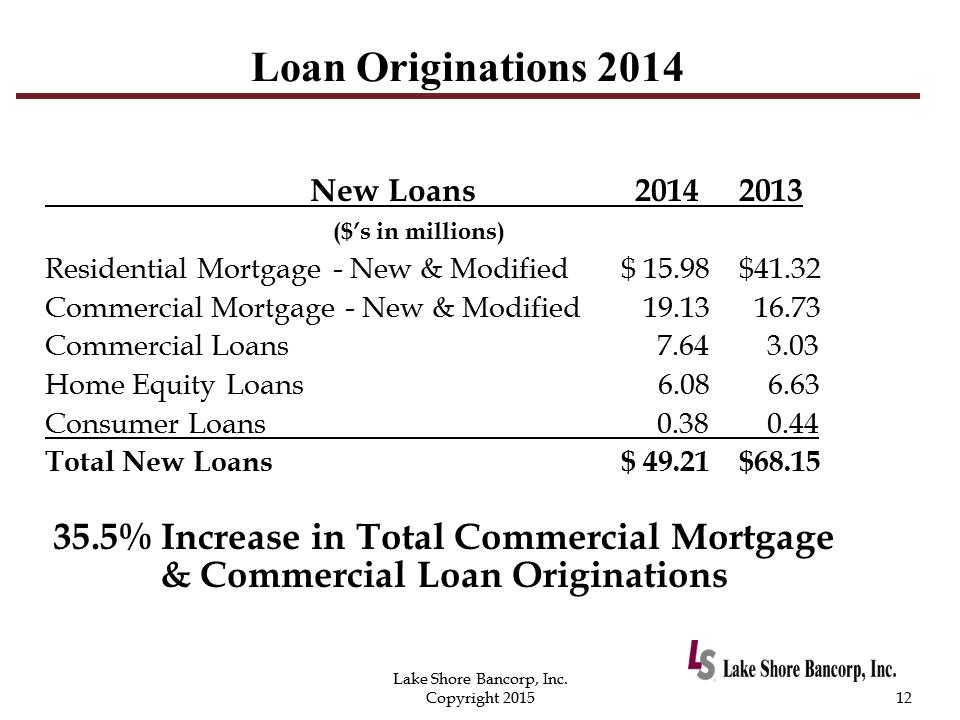

Loan Originations 2014 New Loans 2014 2013 ($’s in millions) Residential Mortgage - New & Modified $ 15.98 $41.32 Commercial Mortgage - New & Modified 19.13 16.73 Commercial Loans 7.64 3.03 Home Equity Loans 6.08 6.63 Consumer Loans 0.38 0.44 Total New Loans $ 49.21 $68.15 35.5% Increase in Total Commercial Mortgage & Commercial Loan Originations 12 Lake Shore Bancorp, Inc.Copyright 2015

Loan Originations 2014 New Loans 2014 2013 ($’s in millions) Residential Mortgage - New & Modified $ 15.98 $41.32 Commercial Mortgage - New & Modified 19.13 16.73 Commercial Loans 7.64 3.03 Home Equity Loans 6.08 6.63 Consumer Loans 0.38 0.44 Total New Loans $ 49.21 $68.15 35.5% Increase in Total Commercial Mortgage & Commercial Loan Originations 12 Lake Shore Bancorp, Inc.Copyright 2015

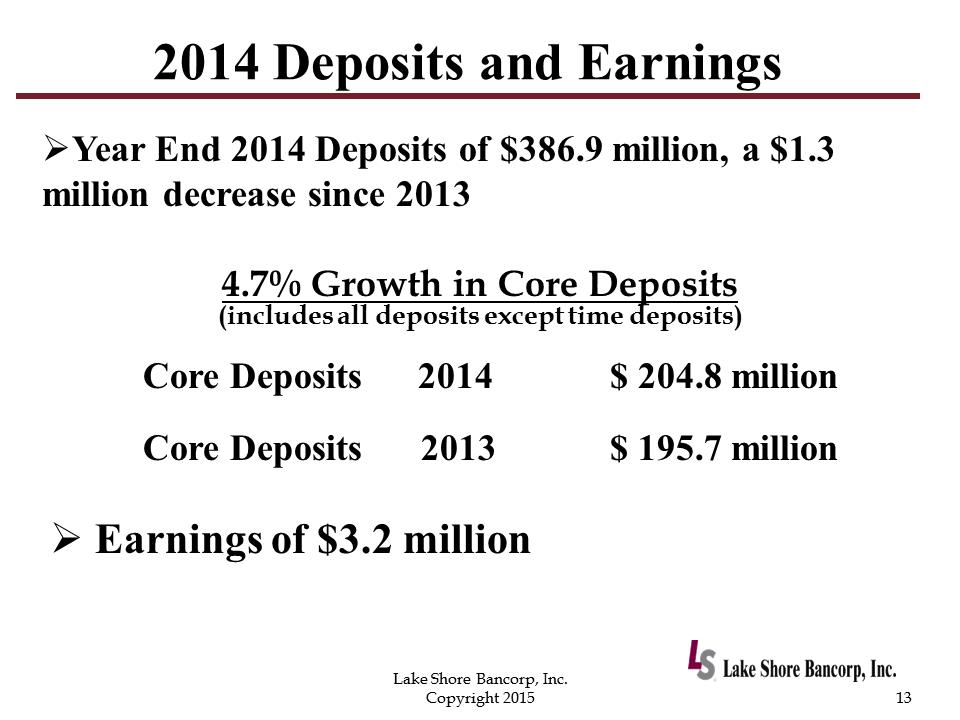

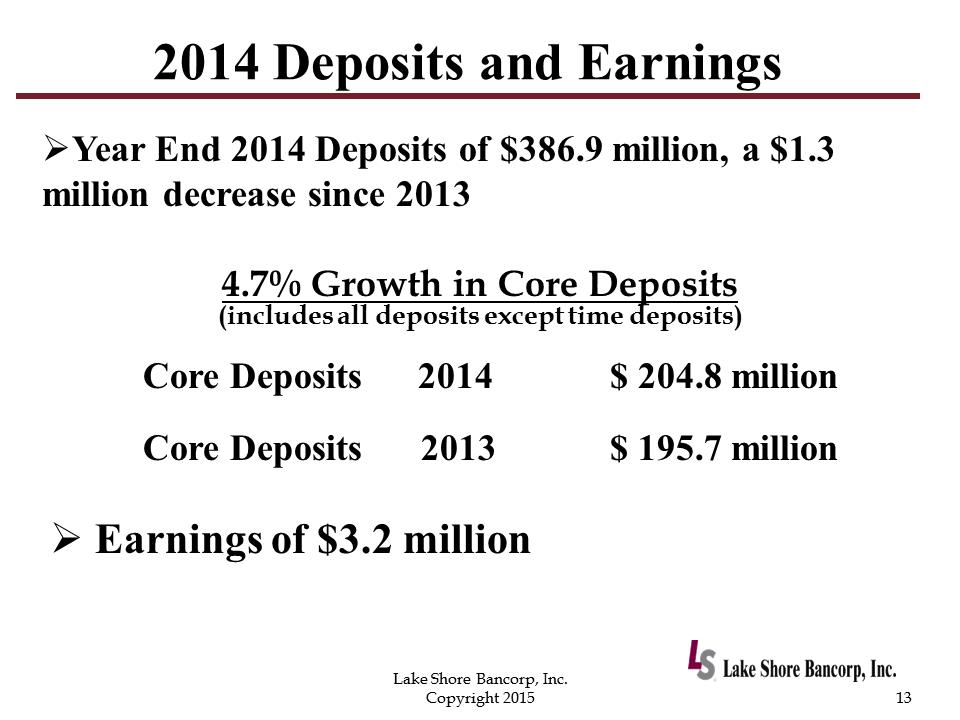

2014 Deposits and Earnings 13 Lake Shore Bancorp, Inc. Copyright 2015 4.7% Growth in Core Deposits (includes all deposits except time deposits) Core Deposits 2014 $ 204.8 million Core Deposits 2013 $ 195.7 million .Year End 2014 Deposits of $386.9 million, a $1.3 million decrease since 2013 . Earnings of $3.2 million

2014 Deposits and Earnings 13 Lake Shore Bancorp, Inc. Copyright 2015 4.7% Growth in Core Deposits (includes all deposits except time deposits) Core Deposits 2014 $ 204.8 million Core Deposits 2013 $ 195.7 million .Year End 2014 Deposits of $386.9 million, a $1.3 million decrease since 2013 . Earnings of $3.2 million

Operational and Strategic Review 14 Lake Shore Bancorp, Inc. Copyright 2015 .Regulatory Update .Fundamental Banking Practices .2014 Operational Highlights .Banking for the Future

Operational and Strategic Review 14 Lake Shore Bancorp, Inc. Copyright 2015 .Regulatory Update .Fundamental Banking Practices .2014 Operational Highlights .Banking for the Future

Regulatory Oversight 15 Lake Shore Bancorp, Inc. Copyright 2015 .OCC is the Primary Regulator of Lake Shore Savings Bank. .Federal Reserve is the Primary Regulator of: Lake Shore Bancorp, Inc. Lake Shore, MHC

Regulatory Oversight 15 Lake Shore Bancorp, Inc. Copyright 2015 .OCC is the Primary Regulator of Lake Shore Savings Bank. .Federal Reserve is the Primary Regulator of: Lake Shore Bancorp, Inc. Lake Shore, MHC

Regulatory Environment 16 Lake Shore Bancorp, Inc. Copyright 2015 .Ever Changing Regulatory Environment OCC, FDIC, CFPB, The Federal Reserve, The State of New York .Implementation of the Qualified Mortgage Rules as created by the Consumer Financial Protection Bureau. Lake Shore Best Practices .2014 Community Reinvestment Act Exam

Regulatory Environment 16 Lake Shore Bancorp, Inc. Copyright 2015 .Ever Changing Regulatory Environment OCC, FDIC, CFPB, The Federal Reserve, The State of New York .Implementation of the Qualified Mortgage Rules as created by the Consumer Financial Protection Bureau. Lake Shore Best Practices .2014 Community Reinvestment Act Exam

Fundamental Banking Practices 17 Lake Shore Bancorp, Inc. Copyright 2015 .Corporate Mission .Board of Directors and Management are Proactive .Comprehensive Strategic Planning .Sound Policies and Procedures .Effective Risk Management Systems .Continue to Accumulate Capital

Fundamental Banking Practices 17 Lake Shore Bancorp, Inc. Copyright 2015 .Corporate Mission .Board of Directors and Management are Proactive .Comprehensive Strategic Planning .Sound Policies and Procedures .Effective Risk Management Systems .Continue to Accumulate Capital

2014 Operating Highlights 18 Lake Shore Bancorp, Inc. Copyright 2015 .Continued Focus on Digital Banking Efficiencies .Implemented in 2014: .Mobile Banking App for cell phones and tablets .Upgraded Retail Online Banking •New Bill Pay features •e-Alerts .Introduced Business Online Banking with integration of: •ACH processing •Remote deposit capture •Wire transfer processing

2014 Operating Highlights 18 Lake Shore Bancorp, Inc. Copyright 2015 .Continued Focus on Digital Banking Efficiencies .Implemented in 2014: .Mobile Banking App for cell phones and tablets .Upgraded Retail Online Banking •New Bill Pay features •e-Alerts .Introduced Business Online Banking with integration of: •ACH processing •Remote deposit capture •Wire transfer processing

2014 Operating Highlights (cont.) 19 Lake Shore Bancorp, Inc. Copyright 2015 .Converted to new Item Processing vendor •New statement format •Upgraded e-statements and e-notices .Constructed Data Center Back-up Hot Site .Focused on Commercial Loan Portfolio Growth .Implemented Strategy to Reduce Interest Rate Risk

2014 Operating Highlights (cont.) 19 Lake Shore Bancorp, Inc. Copyright 2015 .Converted to new Item Processing vendor •New statement format •Upgraded e-statements and e-notices .Constructed Data Center Back-up Hot Site .Focused on Commercial Loan Portfolio Growth .Implemented Strategy to Reduce Interest Rate Risk

2014 Operating Highlights (cont.) 20 Lake Shore Bancorp, Inc. Copyright 2015 .Continued focus on Enterprise Risk Management .Dividend Waiver .Protecting the Shareholder’s Investment in LSBK

2014 Operating Highlights (cont.) 20 Lake Shore Bancorp, Inc. Copyright 2015 .Continued focus on Enterprise Risk Management .Dividend Waiver .Protecting the Shareholder’s Investment in LSBK

Commercial Lending .Commercial Division Activities in 2014 .Executive Vice President, Commercial Division .Growth of the Commercial Lending Portfolio .New Originations Totaled $25.55 Million .Portfolio Outstandings Grew to $81.7 Million, a 14.4 percent YOY increase .The Right Kind of Interest. 21 Lake Shore Bancorp, Inc. Copyright 2015

Commercial Lending .Commercial Division Activities in 2014 .Executive Vice President, Commercial Division .Growth of the Commercial Lending Portfolio .New Originations Totaled $25.55 Million .Portfolio Outstandings Grew to $81.7 Million, a 14.4 percent YOY increase .The Right Kind of Interest. 21 Lake Shore Bancorp, Inc. Copyright 2015

2015 Operating Highlights 22 Lake Shore Bancorp, Inc. .Implemented in 1st Quarter of 2015 •Mobile Deposit Capture •Converted to new vendor for Record Management and Document Imaging •Regulatory Changes •Basel III Capital Standards Implemented

2015 Operating Highlights 22 Lake Shore Bancorp, Inc. .Implemented in 1st Quarter of 2015 •Mobile Deposit Capture •Converted to new vendor for Record Management and Document Imaging •Regulatory Changes •Basel III Capital Standards Implemented

Future Strategy .Operational Focus on Managing Interest Rate Risk .Commitment to an efficient Operating Profile .Solid Community Banking core business .Focusing on increasing market share in Western New York. .Developing Brand Awareness .Maximize customer’s use of our digital capabilities .Solid asset quality metrics .High Capital levels .Experienced Management Team .Protecting Shareholders Investment in LSBK! 23 Lake Shore Bancorp, Inc. Copyright 2015

Future Strategy .Operational Focus on Managing Interest Rate Risk .Commitment to an efficient Operating Profile .Solid Community Banking core business .Focusing on increasing market share in Western New York. .Developing Brand Awareness .Maximize customer’s use of our digital capabilities .Solid asset quality metrics .High Capital levels .Experienced Management Team .Protecting Shareholders Investment in LSBK! 23 Lake Shore Bancorp, Inc. Copyright 2015

Summary 24 Lake Shore Bancorp, Inc. Copyright 2015 Putting People First is not simply our Bank’s Mission Statement, it is a fundamental belief shared by all of Lake Shore Savings Bank Associates!

Summary 24 Lake Shore Bancorp, Inc. Copyright 2015 Putting People First is not simply our Bank’s Mission Statement, it is a fundamental belief shared by all of Lake Shore Savings Bank Associates!

Rachel Foley Chief Financial Officer Lake Shore Bancorp, Inc. Copyright 2015 Lake Shore Bancorp, Inc. Financial Presentation 25

Rachel Foley Chief Financial Officer Lake Shore Bancorp, Inc. Copyright 2015 Lake Shore Bancorp, Inc. Financial Presentation 25

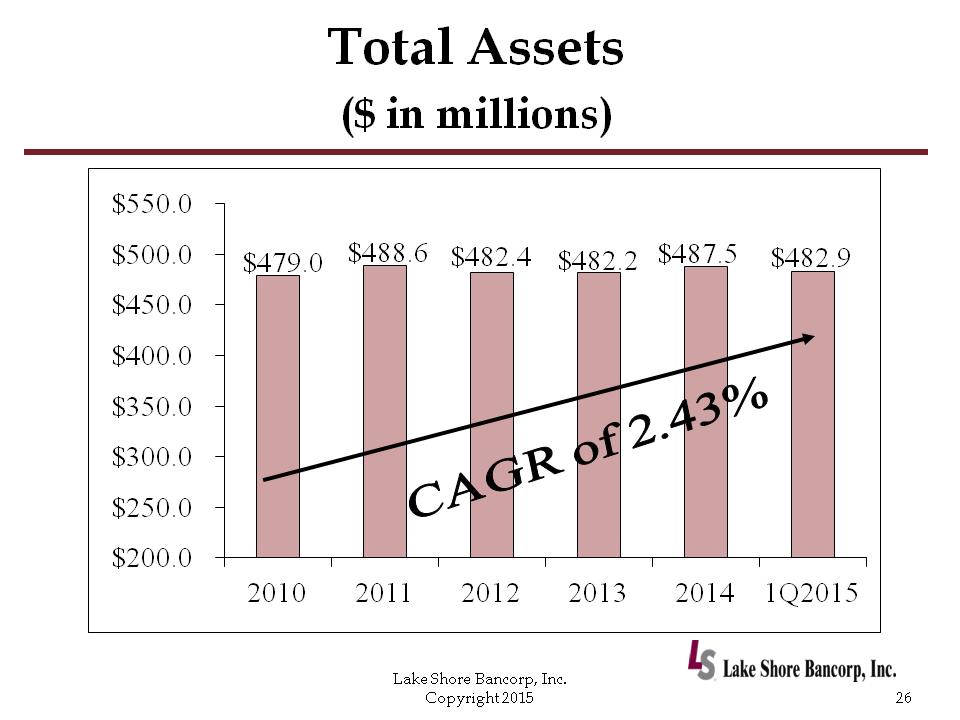

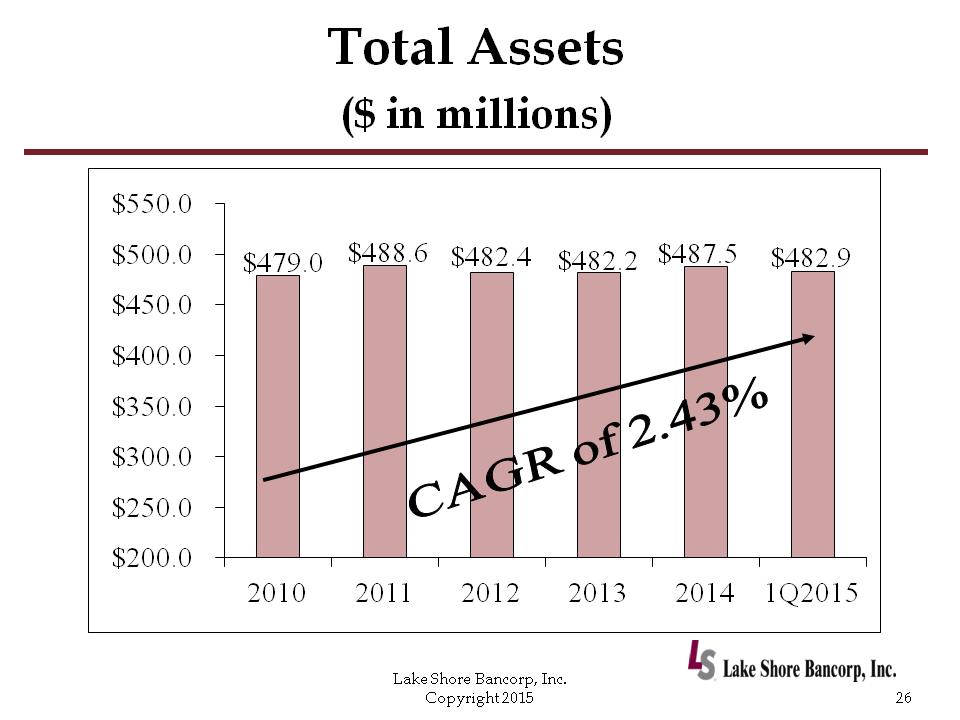

Total Assets ($ in millions) 26 Lake Shore Bancorp, Inc. Copyright 2015 $479.0 $488.6 $482.4 $482.2 $487.5 $482.9 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0201020112012201320141Q2015

Total Assets ($ in millions) 26 Lake Shore Bancorp, Inc. Copyright 2015 $479.0 $488.6 $482.4 $482.2 $487.5 $482.9 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0201020112012201320141Q2015

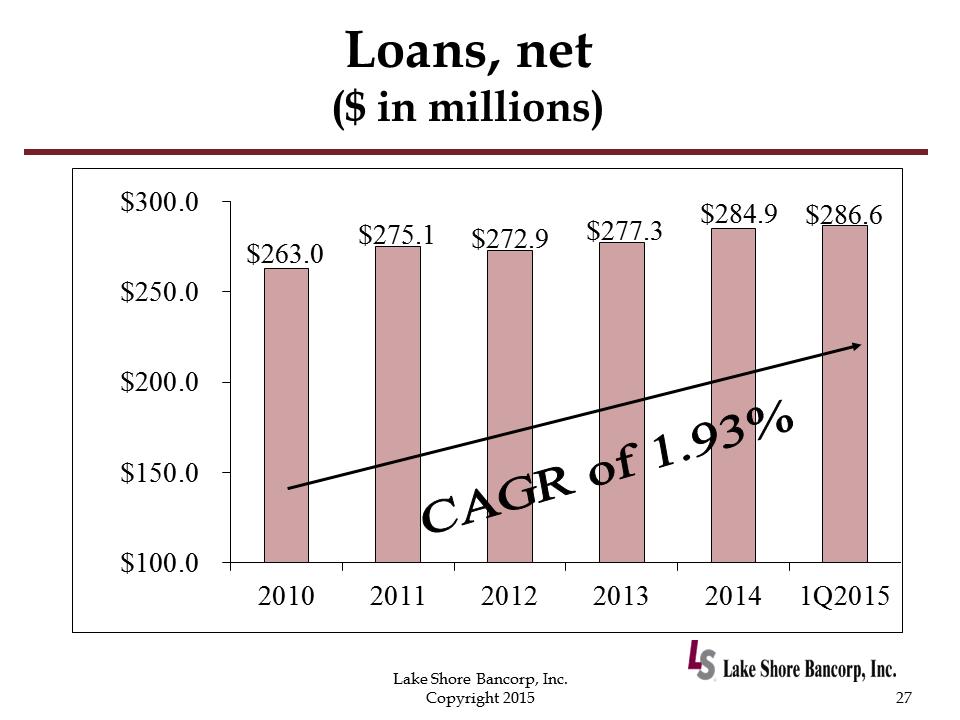

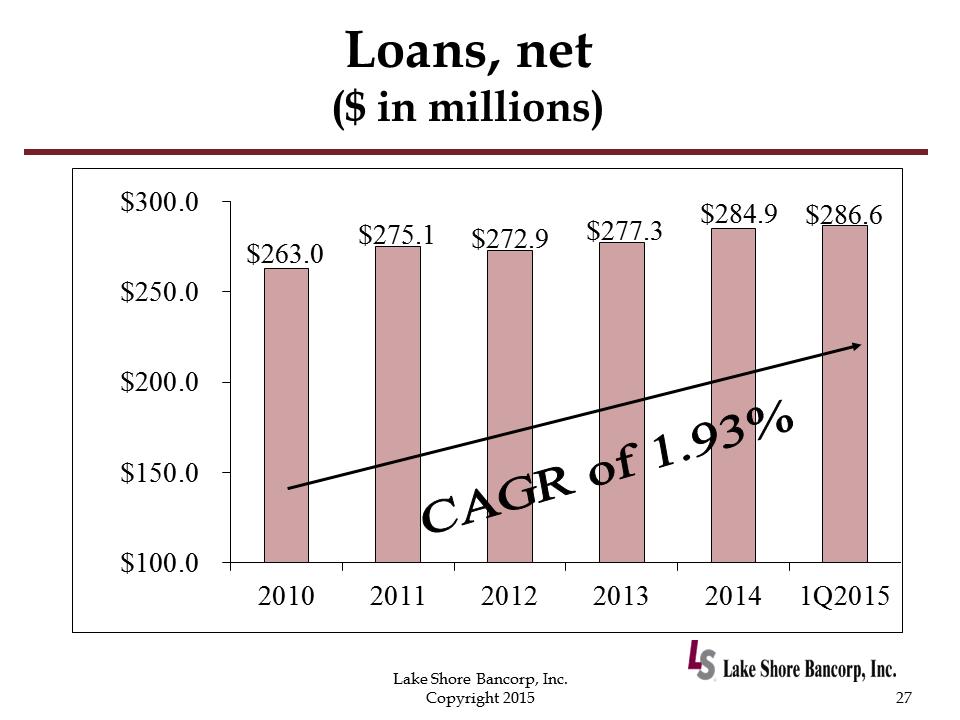

Loans, net ($ in millions) 27 Lake Shore Bancorp, Inc. Copyright 2015 $263.0 $275.1 $272.9 $277.3 $284.9 $286.6 $100.0 $150.0 $200.0 $250.0 $300.0201020112012201320141Q2015

Loans, net ($ in millions) 27 Lake Shore Bancorp, Inc. Copyright 2015 $263.0 $275.1 $272.9 $277.3 $284.9 $286.6 $100.0 $150.0 $200.0 $250.0 $300.0201020112012201320141Q2015

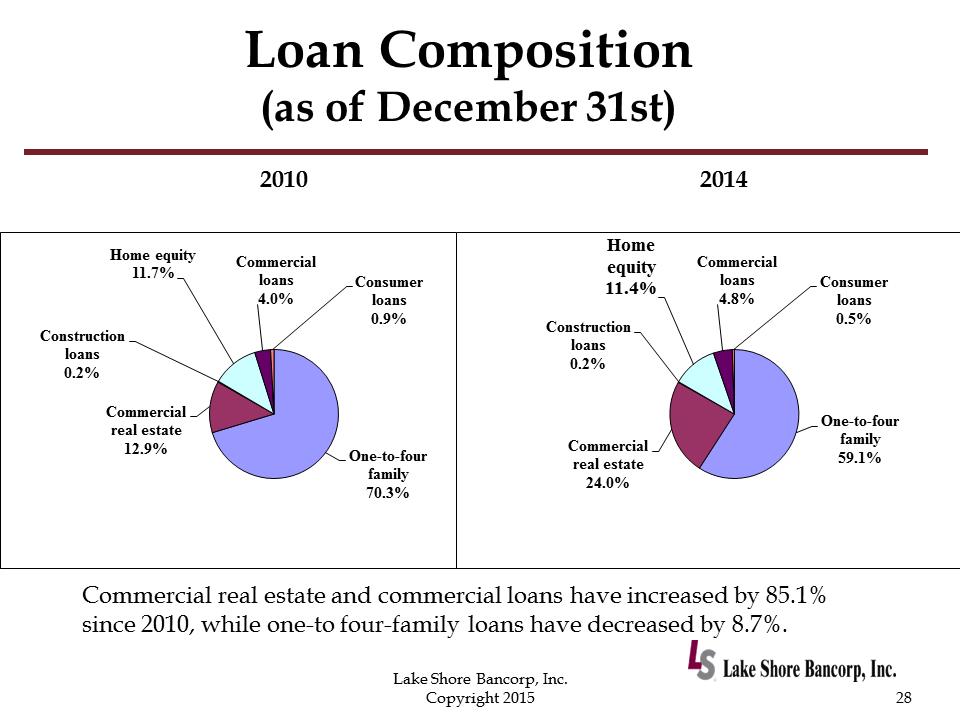

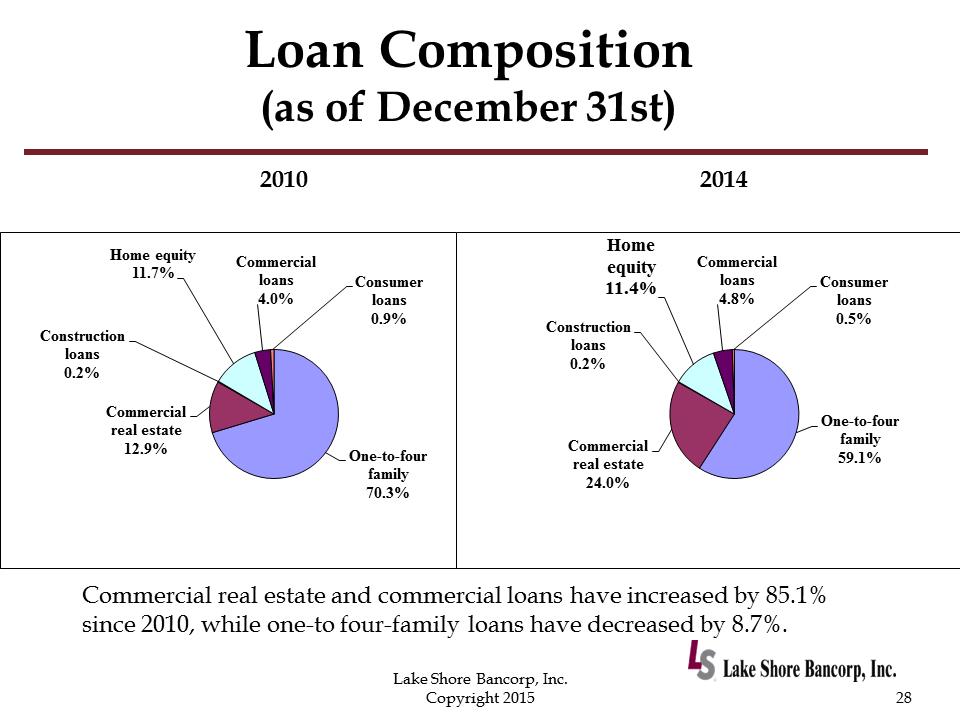

Loan Composition (as of December 31st) 28 Lake Shore Bancorp, Inc. Copyright 2015 2010 2014 One-to-four family 70.3% Commercial real estate 12.9% Construction loans 0.2% Home equity 11.7% Commercial loans 4.0% Consumer loans 0.9% One-to-four family 59.1% Commercial real estate 24.0% Construction loans 0.2% Home equity 11.4% Commercial loans 4.8% Consumer loans 0.5% Commercial real estate and commercial loans have increased by 85.1% since 2010, while one-to four-family loans have decreased by 8.7%.

Loan Composition (as of December 31st) 28 Lake Shore Bancorp, Inc. Copyright 2015 2010 2014 One-to-four family 70.3% Commercial real estate 12.9% Construction loans 0.2% Home equity 11.7% Commercial loans 4.0% Consumer loans 0.9% One-to-four family 59.1% Commercial real estate 24.0% Construction loans 0.2% Home equity 11.4% Commercial loans 4.8% Consumer loans 0.5% Commercial real estate and commercial loans have increased by 85.1% since 2010, while one-to four-family loans have decreased by 8.7%.

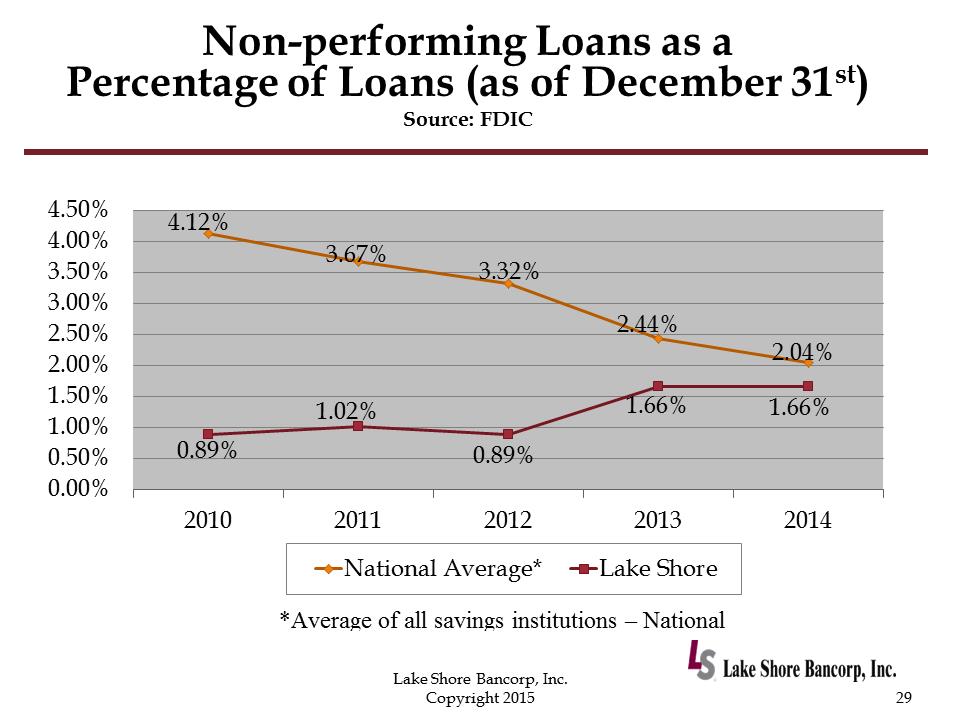

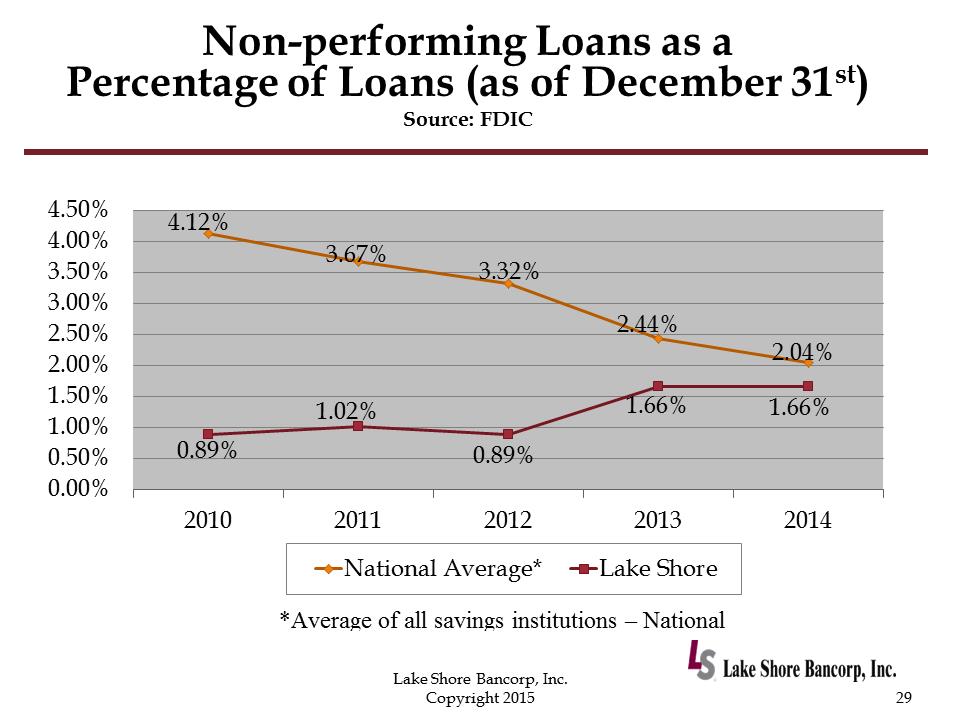

Non-performing Loans as a Percentage of Loans (as of December 31st) Source: FDIC 29 Lake Shore Bancorp, Inc. Copyright 2015 4.12% 3.67% 3.32% 2.44% 2.04% 0.89% 1.02% 0.89% 1.66% 1.66% 0.00%0.50%1.00%1.50%2.00%2.50%3.00%3.50%4.00%4.50%20102011201220132014National Average*Lake Shore*Average of all savings institutions – National

Non-performing Loans as a Percentage of Loans (as of December 31st) Source: FDIC 29 Lake Shore Bancorp, Inc. Copyright 2015 4.12% 3.67% 3.32% 2.44% 2.04% 0.89% 1.02% 0.89% 1.66% 1.66% 0.00%0.50%1.00%1.50%2.00%2.50%3.00%3.50%4.00%4.50%20102011201220132014National Average*Lake Shore*Average of all savings institutions – National

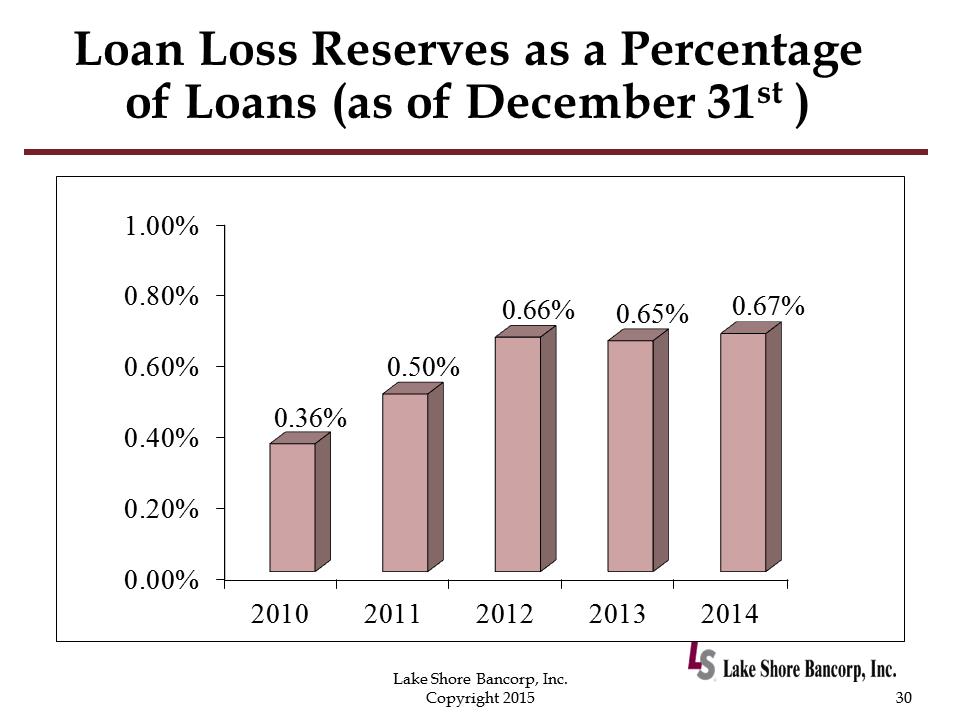

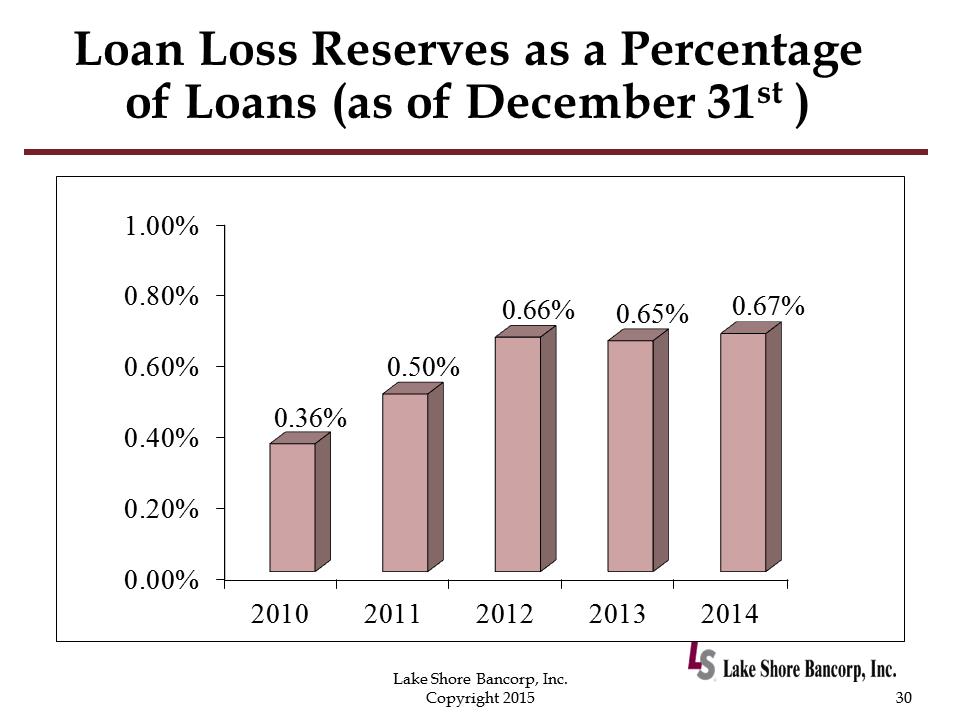

Loan Loss Reserves as a Percentage of Loans (as of December 31st ) 30 Lake Shore Bancorp, Inc. Copyright 2015 0.00%0.20%0.40%0.60%0.80%1.00%201020112012201320140.36% 0.50% 0.66% 0.65% 0.67%

Loan Loss Reserves as a Percentage of Loans (as of December 31st ) 30 Lake Shore Bancorp, Inc. Copyright 2015 0.00%0.20%0.40%0.60%0.80%1.00%201020112012201320140.36% 0.50% 0.66% 0.65% 0.67%

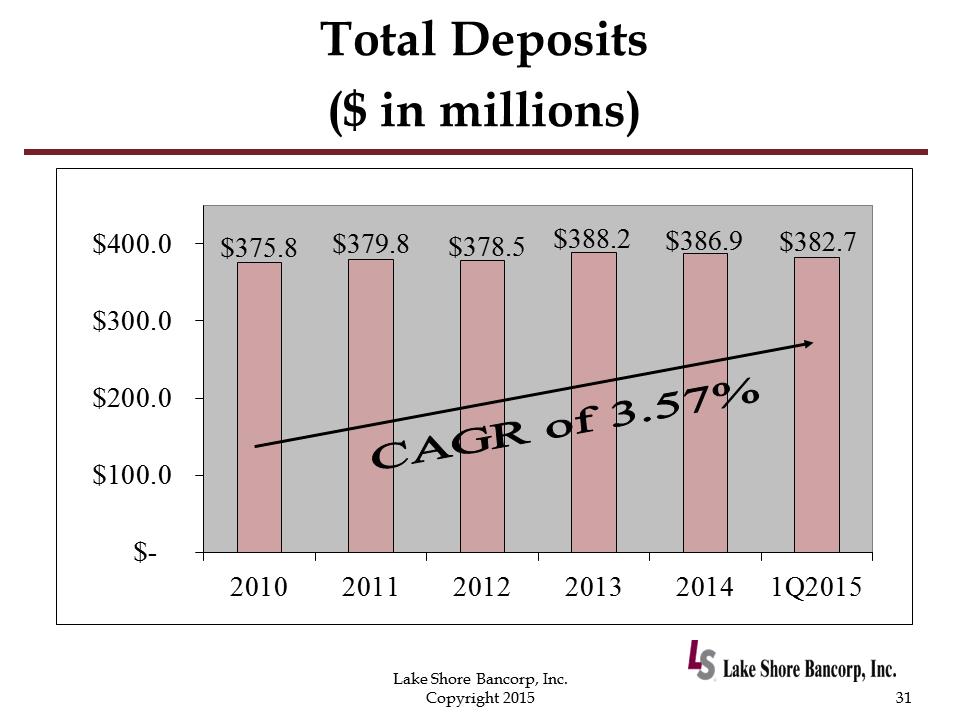

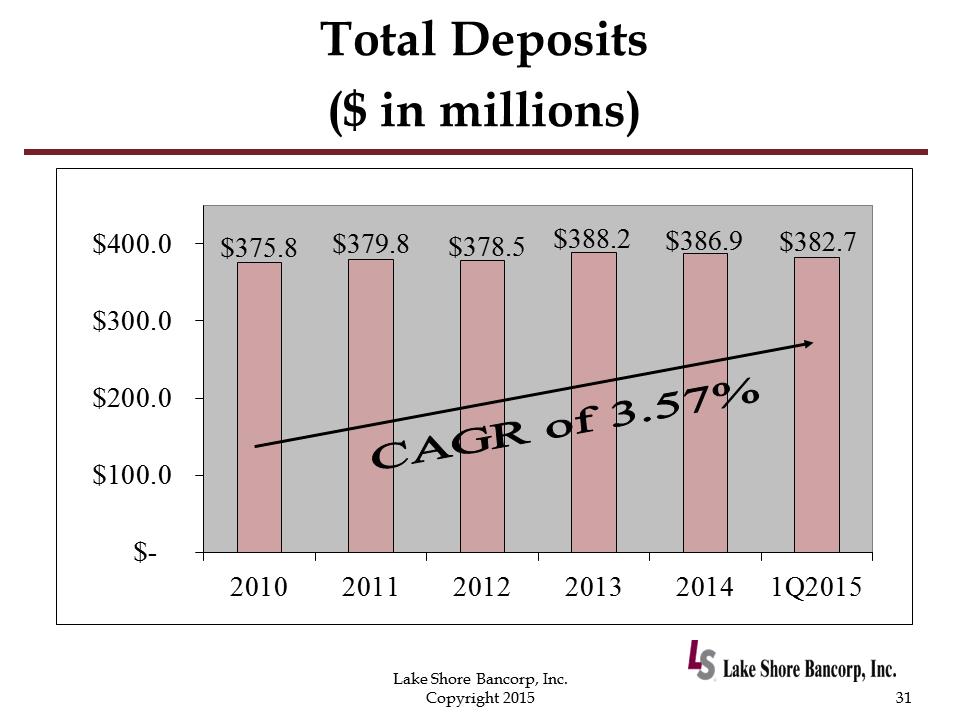

Total Deposits ($ in millions) 31 Lake Shore Bancorp, Inc. Copyright 2015 $375.8 $379.8 $378.5 $388.2 $386.9 $382.7 $- $100.0 $200.0 $300.0 $400.020102011201220132014 1Q2015

Total Deposits ($ in millions) 31 Lake Shore Bancorp, Inc. Copyright 2015 $375.8 $379.8 $378.5 $388.2 $386.9 $382.7 $- $100.0 $200.0 $300.0 $400.020102011201220132014 1Q2015

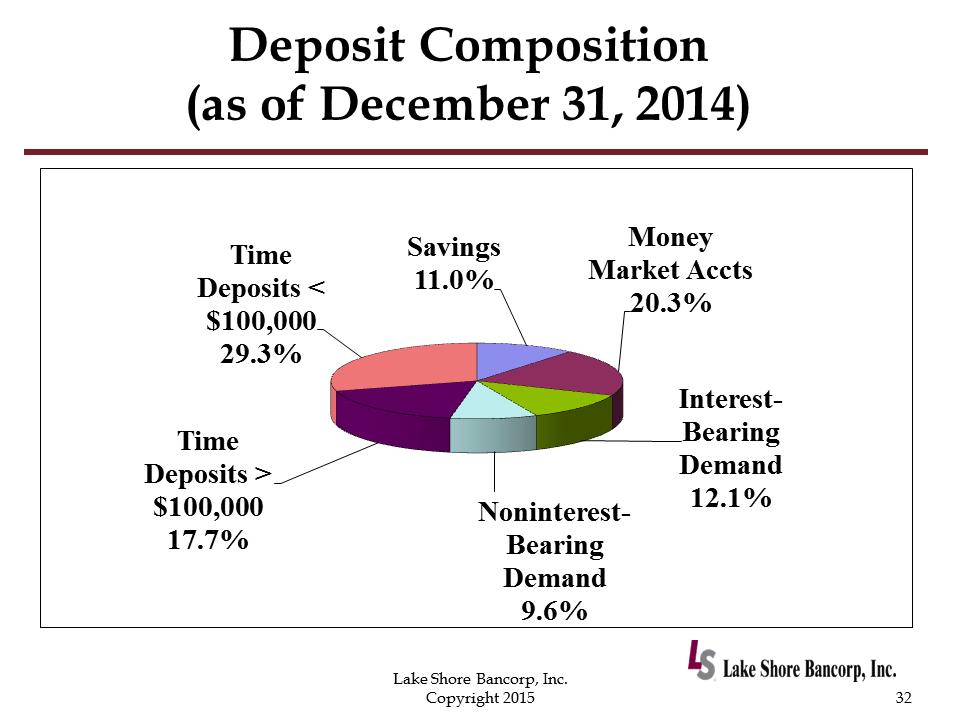

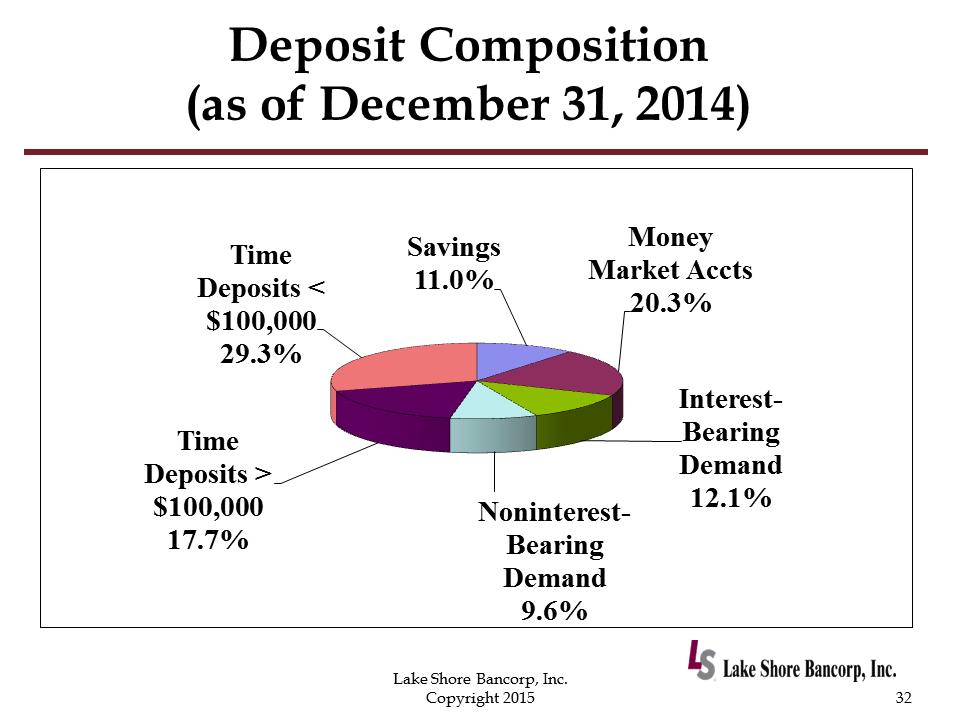

Deposit Composition (as of December 31, 2014) 32 Lake Shore Bancorp, Inc. Copyright 2015 Savings 11.0% Money Market Accts 20.3% Interest-Bearing Demand 12.1% Noninterest-Bearing Demand 9.6% Time Deposits > $100,000 17.7% Time Deposits < $100,000 29.3%

Deposit Composition (as of December 31, 2014) 32 Lake Shore Bancorp, Inc. Copyright 2015 Savings 11.0% Money Market Accts 20.3% Interest-Bearing Demand 12.1% Noninterest-Bearing Demand 9.6% Time Deposits > $100,000 17.7% Time Deposits < $100,000 29.3%

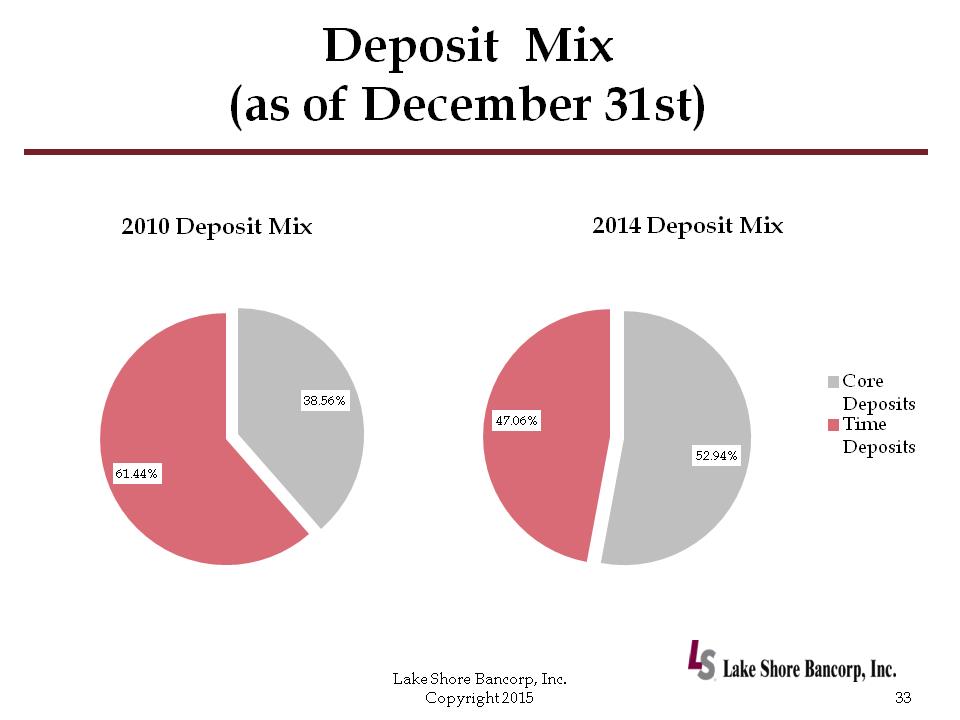

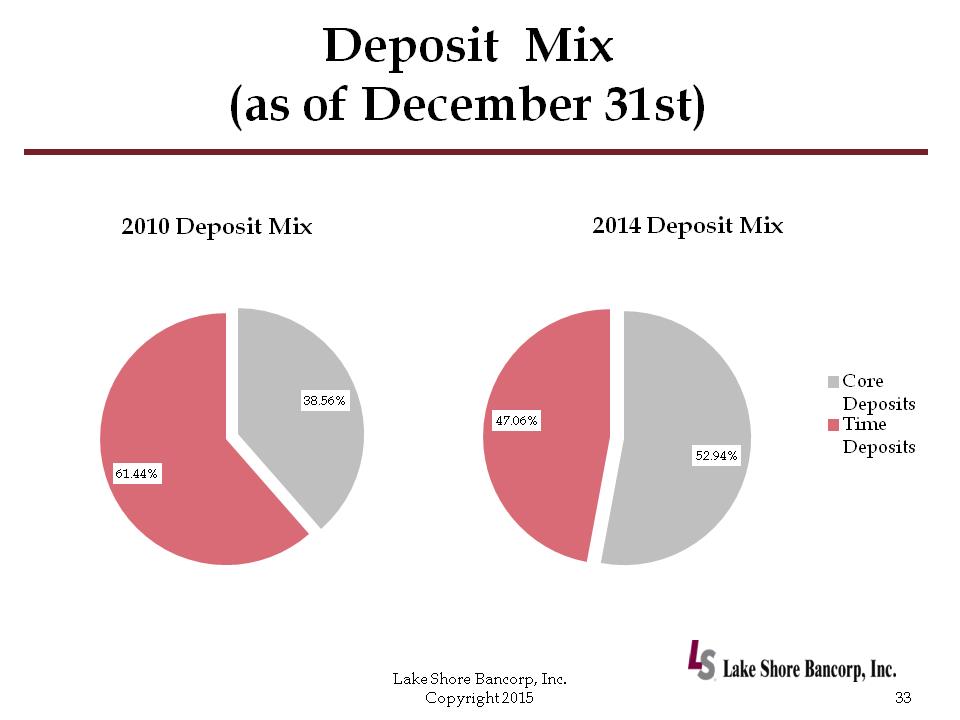

Deposit Mix (as of December 31st) 33 Lake Shore Bancorp, Inc. Copyright 2015 38.56% 61.44% 2010 Deposit Mix 52.94% 47.06% 2014 Deposit Mix CoreDepositsTimeDeposits

Deposit Mix (as of December 31st) 33 Lake Shore Bancorp, Inc. Copyright 2015 38.56% 61.44% 2010 Deposit Mix 52.94% 47.06% 2014 Deposit Mix CoreDepositsTimeDeposits

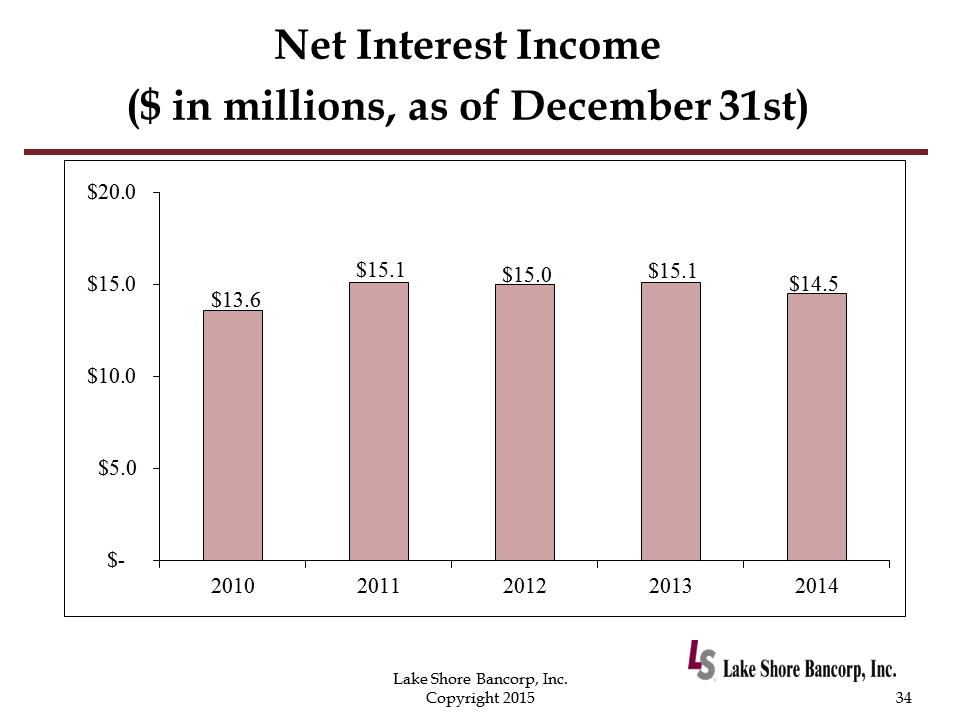

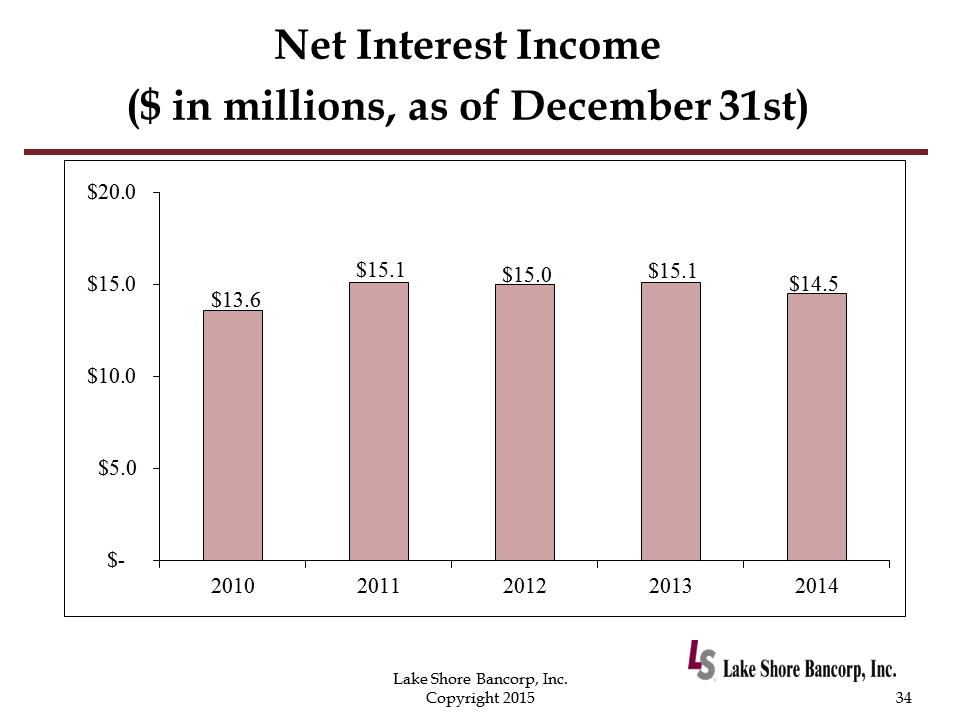

Net Interest Income ($ in millions, as of December 31st) 34 Lake Shore Bancorp, Inc. Copyright 2015 $13.6 $15.1 $15.0 $15.1 $14.5 $- $5.0 $10.0 $15.0 $20.020102011201220132014

Net Interest Income ($ in millions, as of December 31st) 34 Lake Shore Bancorp, Inc. Copyright 2015 $13.6 $15.1 $15.0 $15.1 $14.5 $- $5.0 $10.0 $15.0 $20.020102011201220132014

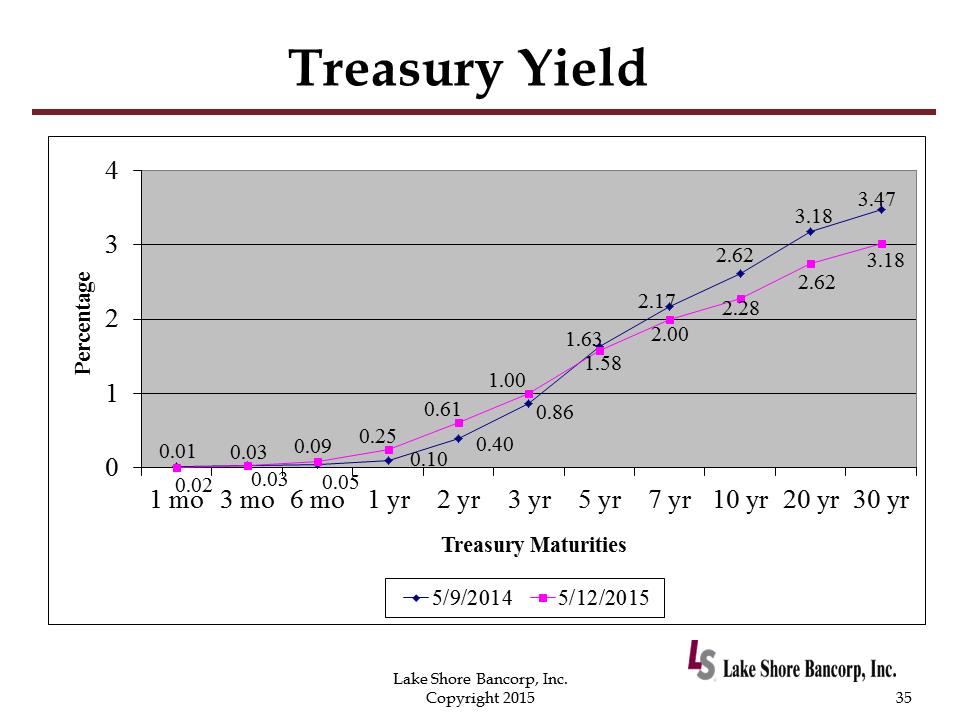

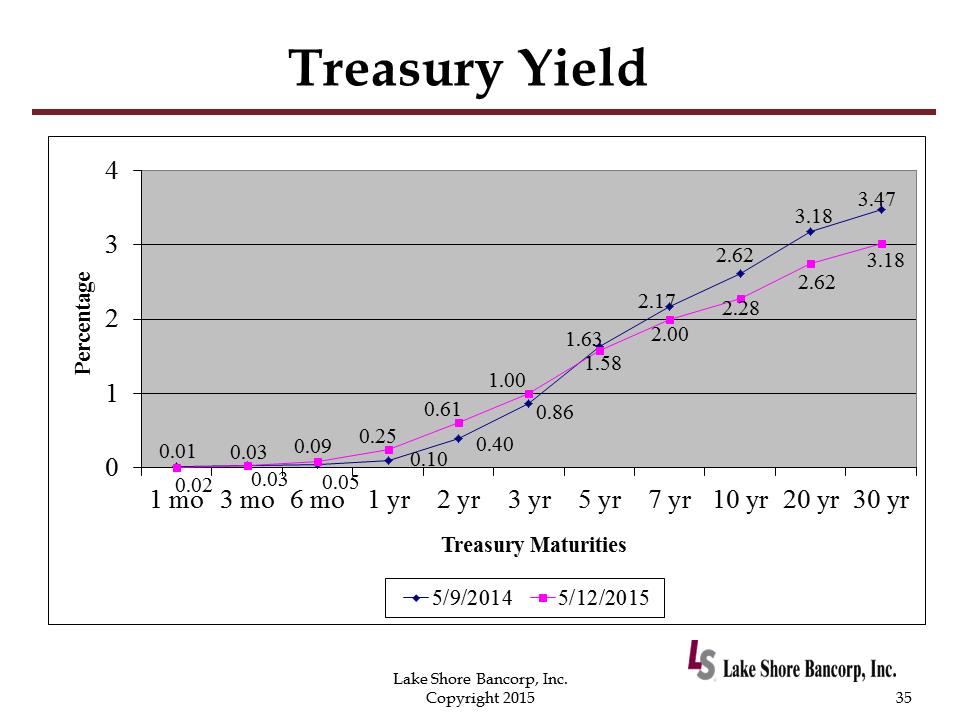

Treasury Yield 35 Lake Shore Bancorp, Inc. Copyright 2015 0.02 0.03 0.05 0.10 0.40 0.86 1.63 2.17 2.62 3.18 3.47 0.01 0.03 0.09 0.25 0.61 1.00 1.58 2.00 2.28 2.62 3.18 012341 mo3 mo6 mo1 yr2 yr3 yr5 yr7 yr10 yr20 yr30 yrPercentage Treasury Maturities 5/9/20145/12/2015

Treasury Yield 35 Lake Shore Bancorp, Inc. Copyright 2015 0.02 0.03 0.05 0.10 0.40 0.86 1.63 2.17 2.62 3.18 3.47 0.01 0.03 0.09 0.25 0.61 1.00 1.58 2.00 2.28 2.62 3.18 012341 mo3 mo6 mo1 yr2 yr3 yr5 yr7 yr10 yr20 yr30 yrPercentage Treasury Maturities 5/9/20145/12/2015

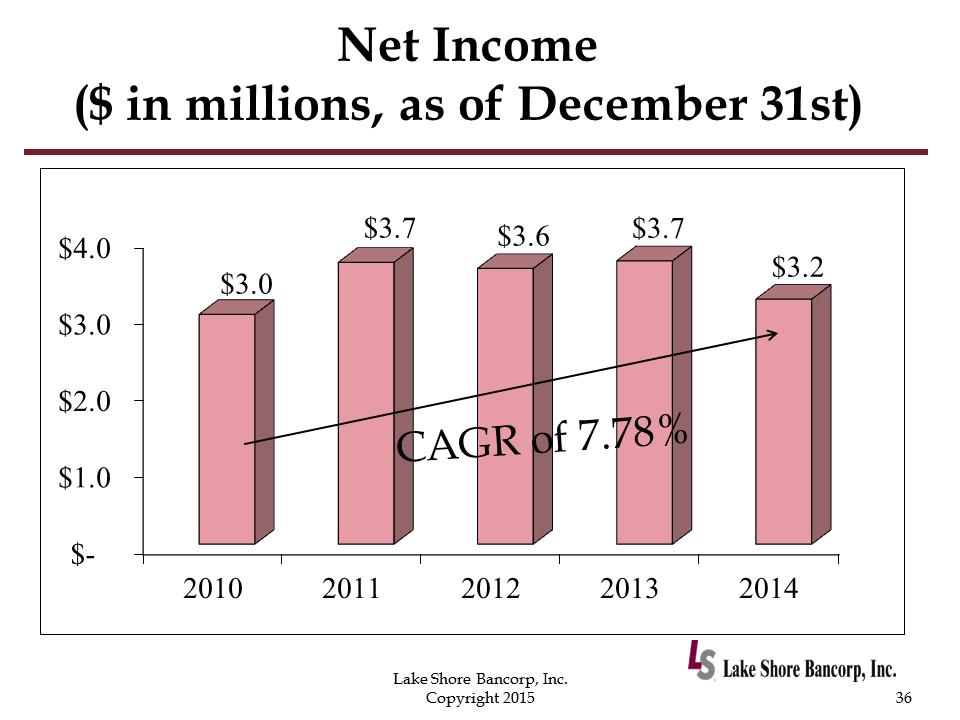

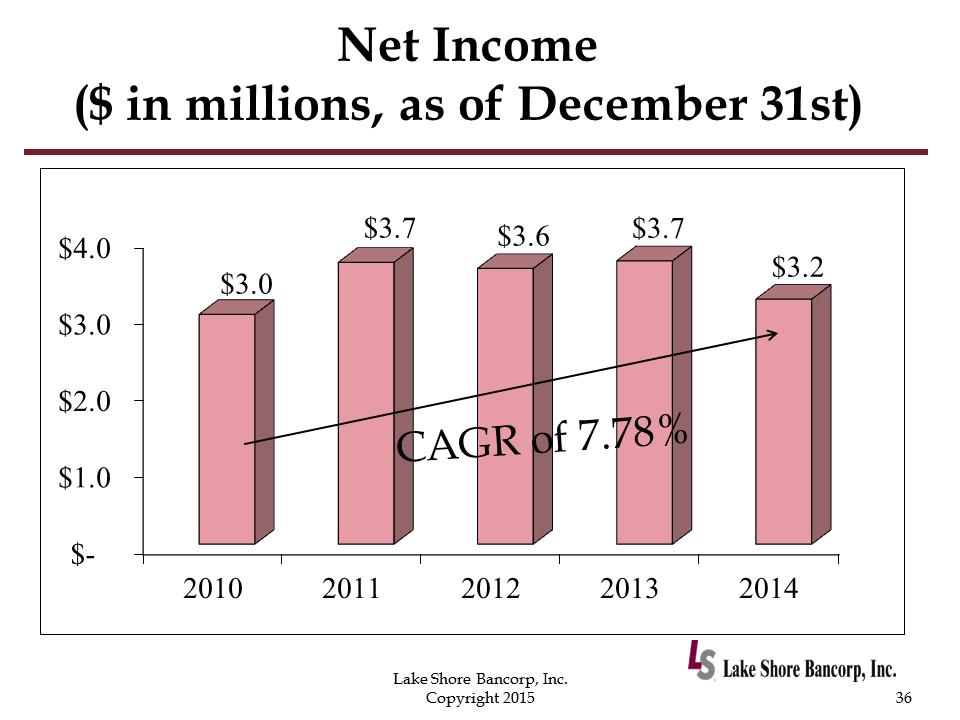

Net Income ($ in millions, as of December 31st) 36 Lake Shore Bancorp, Inc. Copyright 2015 $- $1.0 $2.0 $3.0 $4.020102011201220132014 $3.0 $3.7 $3.6 $3.7 $3.2 CAGR of 7.78%

Net Income ($ in millions, as of December 31st) 36 Lake Shore Bancorp, Inc. Copyright 2015 $- $1.0 $2.0 $3.0 $4.020102011201220132014 $3.0 $3.7 $3.6 $3.7 $3.2 CAGR of 7.78%

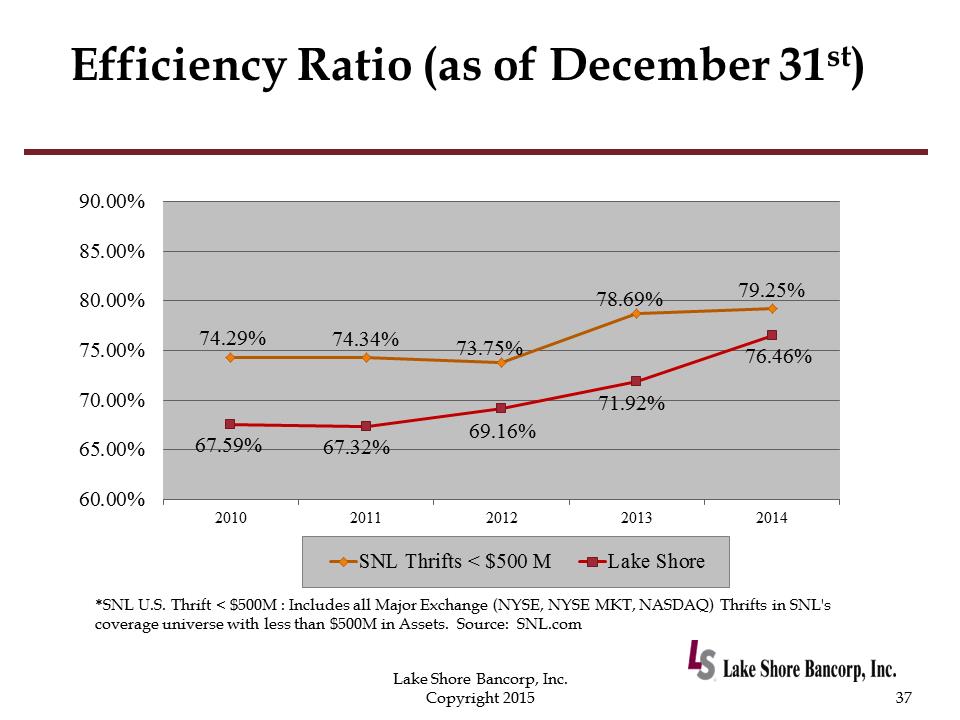

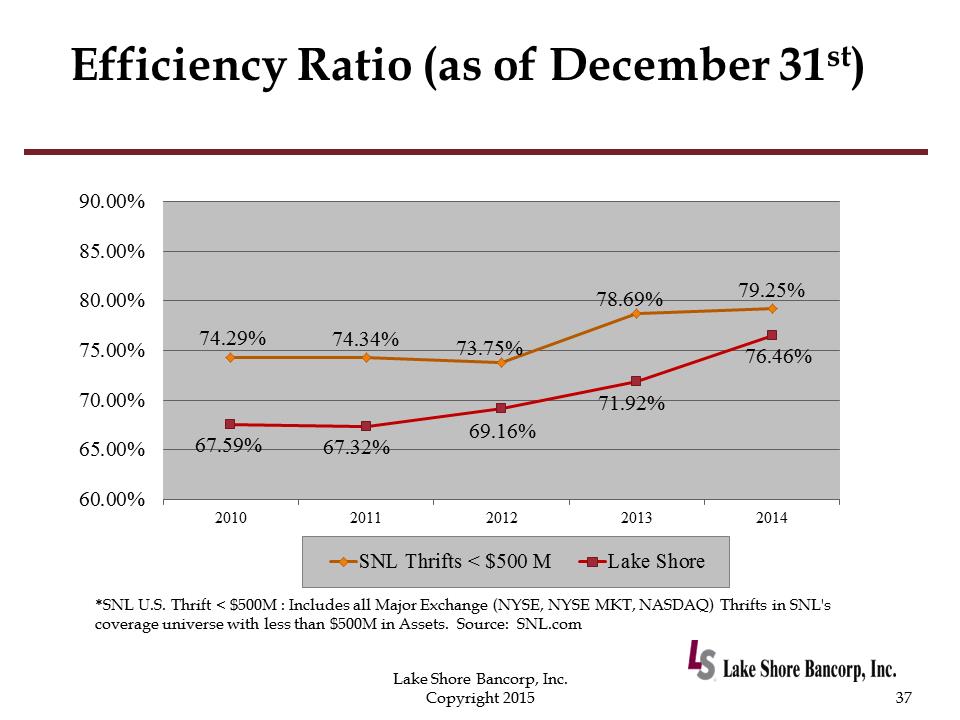

Efficiency Ratio (as of December 31st) Source: SNL.com 37 Lake Shore Bancorp, Inc. Copyright 2015 74.29% 74.34% 73.75% 78.69% 79.25% 67.59% 67.32% 69.16% 71.92% 76.46% 60.00%65.00%70.00%75.00%80.00%85.00%90.00%20102011201220132014National Average*Lake Shore*SNL U.S. Thrift < $500M : Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Thrifts in SNL's coverage universe with less than $500M in Assets. Source: SNL.com

Efficiency Ratio (as of December 31st) Source: SNL.com 37 Lake Shore Bancorp, Inc. Copyright 2015 74.29% 74.34% 73.75% 78.69% 79.25% 67.59% 67.32% 69.16% 71.92% 76.46% 60.00%65.00%70.00%75.00%80.00%85.00%90.00%20102011201220132014National Average*Lake Shore*SNL U.S. Thrift < $500M : Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Thrifts in SNL's coverage universe with less than $500M in Assets. Source: SNL.com

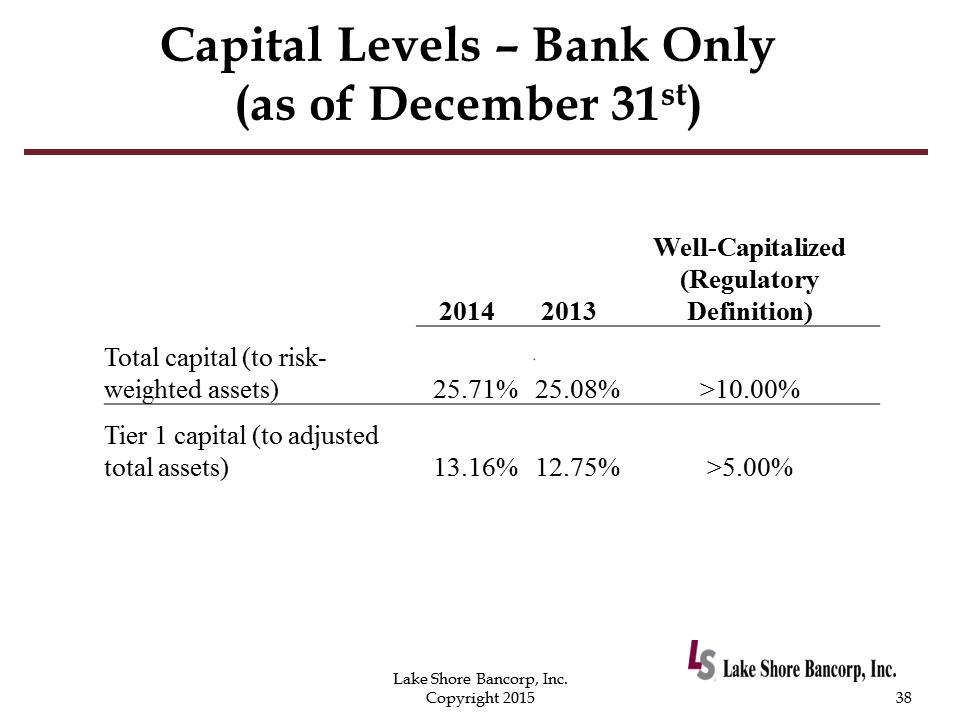

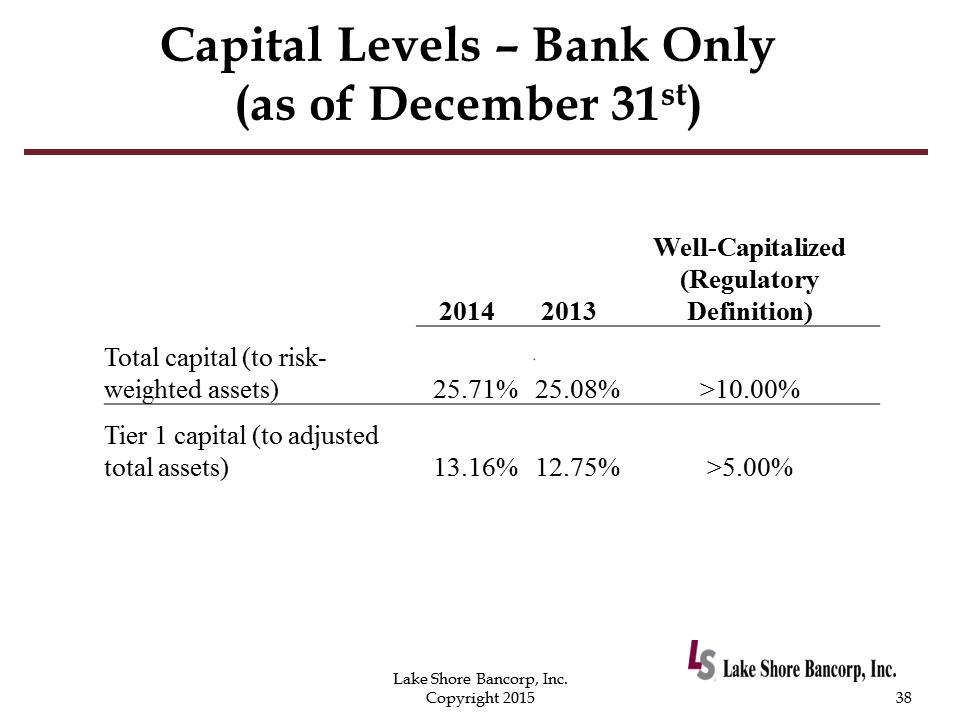

Capital Levels – Bank Only (as of December 31st) 38 Lake Shore Bancorp, Inc. Copyright 2015 Well-Capitalized 2014 2013 (Regulatory Definition) Total capital (to risk-weighted assets) 25.71% 25.08% >10.00% Tier 1 capital (to adjusted total assets) 13.16% 12.75% >5.00%

Capital Levels – Bank Only (as of December 31st) 38 Lake Shore Bancorp, Inc. Copyright 2015 Well-Capitalized 2014 2013 (Regulatory Definition) Total capital (to risk-weighted assets) 25.71% 25.08% >10.00% Tier 1 capital (to adjusted total assets) 13.16% 12.75% >5.00%

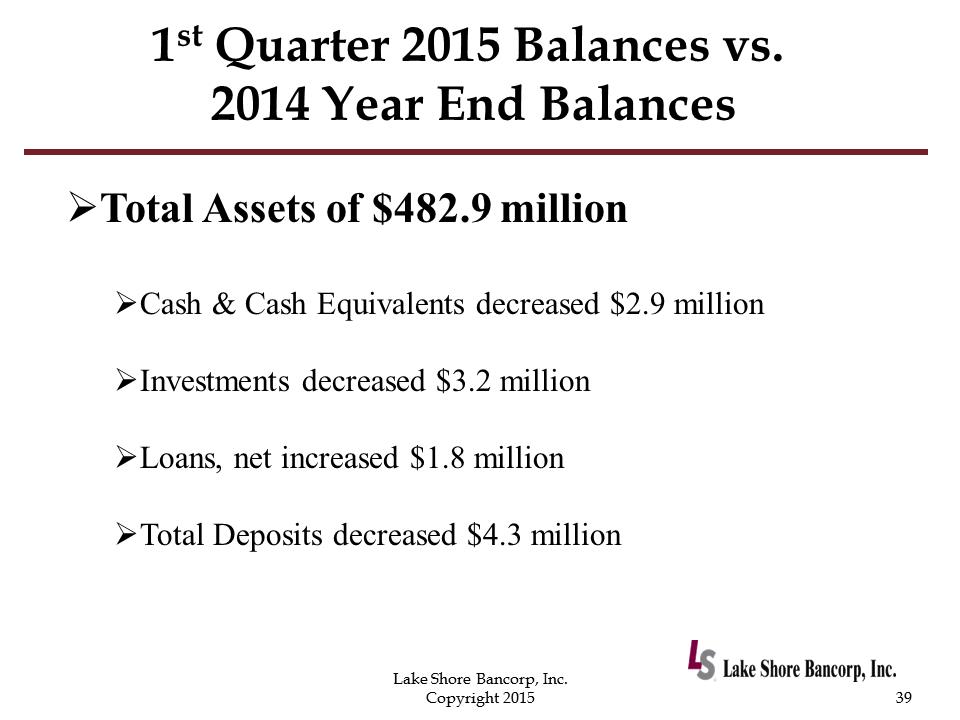

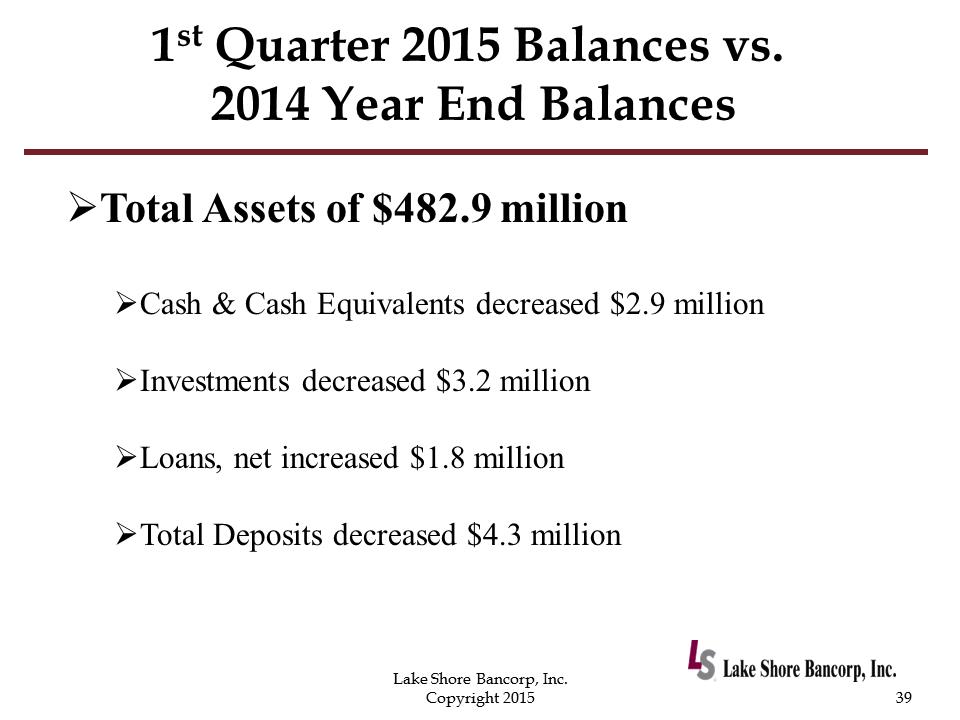

1st Quarter 2015 Balances vs. 2014 Year End Balances 39 Lake Shore Bancorp, Inc. Copyright 2015 .Total Assets of $482.9 million .Cash & Cash Equivalents decreased $2.9 million .Investments decreased $3.2 million .Loans, net increased $1.8 million .Total Deposits decreased $4.3 million

1st Quarter 2015 Balances vs. 2014 Year End Balances 39 Lake Shore Bancorp, Inc. Copyright 2015 .Total Assets of $482.9 million .Cash & Cash Equivalents decreased $2.9 million .Investments decreased $3.2 million .Loans, net increased $1.8 million .Total Deposits decreased $4.3 million

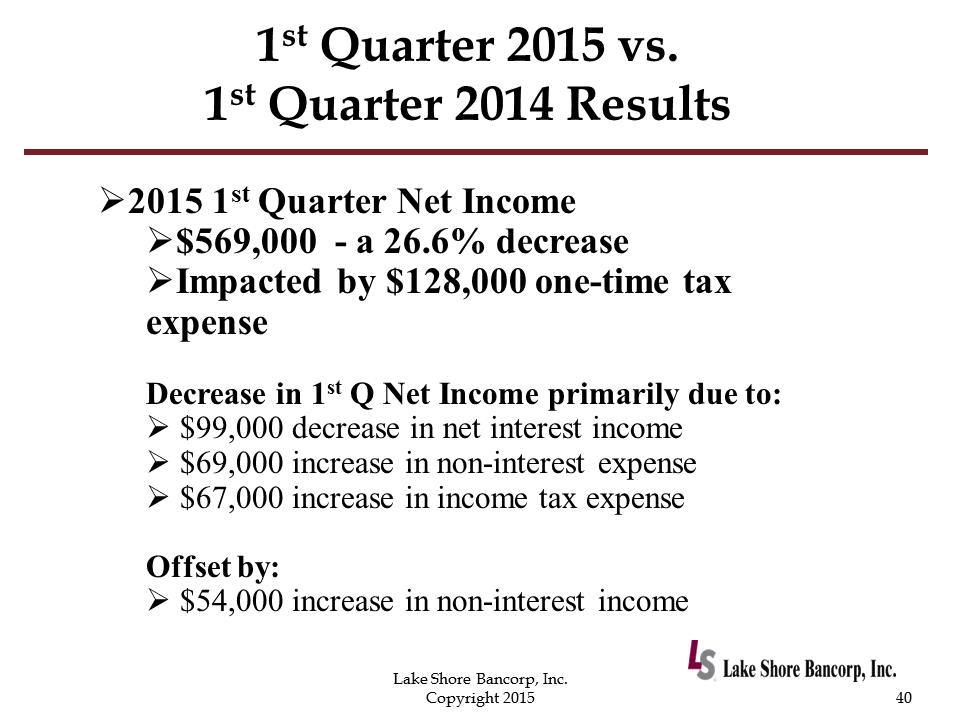

1st Quarter 2015 vs. 1st Quarter 2014 Results 40 Lake Shore Bancorp, Inc. Copyright 2015 .2015 1st Quarter Net Income .$569,000 - a 26.6% decrease .Impacted by $128,000 one-time tax expense Decrease in 1st Q Net Income primarily due to: . $99,000 decrease in net interest income . $69,000 increase in non-interest expense . $67,000 increase in income tax expense Offset by: . $54,000 increase in non-interest income

1st Quarter 2015 vs. 1st Quarter 2014 Results 40 Lake Shore Bancorp, Inc. Copyright 2015 .2015 1st Quarter Net Income .$569,000 - a 26.6% decrease .Impacted by $128,000 one-time tax expense Decrease in 1st Q Net Income primarily due to: . $99,000 decrease in net interest income . $69,000 increase in non-interest expense . $67,000 increase in income tax expense Offset by: . $54,000 increase in non-interest income

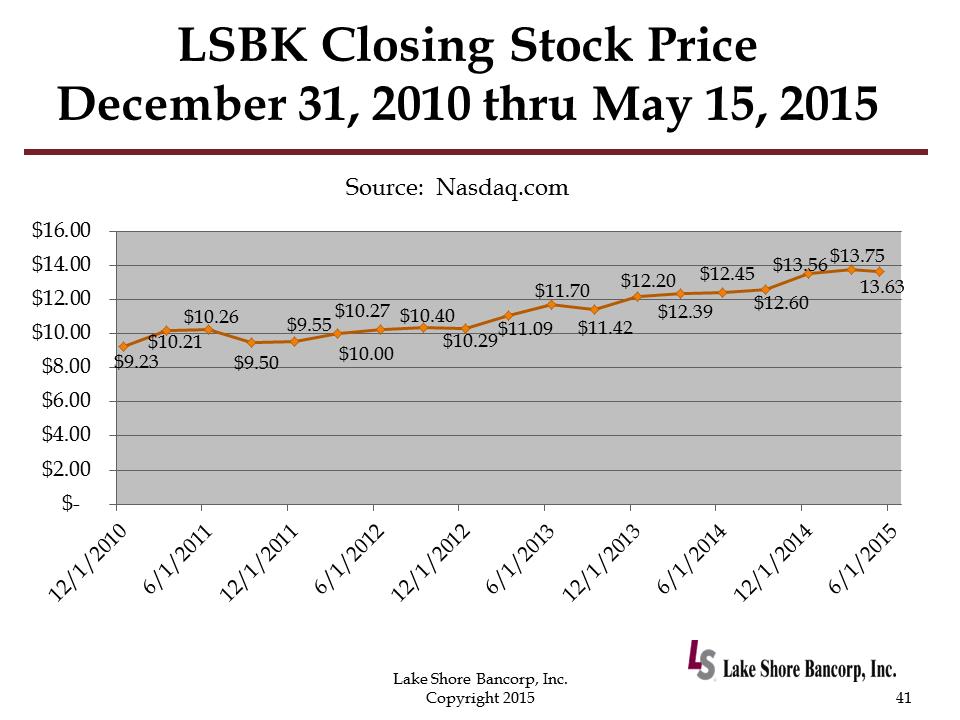

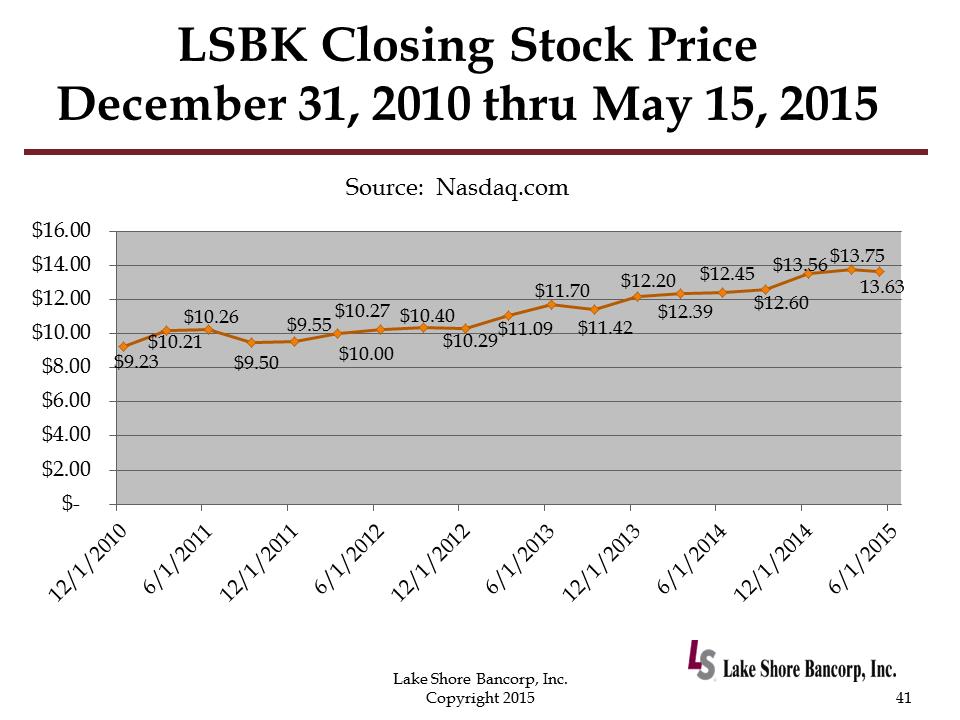

LSBK Closing Stock Price December 31, 2010 thru May 15, 2015 41 Lake Shore Bancorp, Inc. Copyright 2015 Source: Nasdaq.com $9.23 $10.21 $10.26 $9.50 $9.55 $10.00 $10.27 $10.40 $10.29 $11.09 $11.70 $11.42 $12.20 $12.39 $12.45 $12.60 $13.56 $13.75 13.63 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.0012/1/20106/1/201112/1/20116/1/201212/1/20126/1/201312/1/20136/1/201412/1/20146/1/2015

LSBK Closing Stock Price December 31, 2010 thru May 15, 2015 41 Lake Shore Bancorp, Inc. Copyright 2015 Source: Nasdaq.com $9.23 $10.21 $10.26 $9.50 $9.55 $10.00 $10.27 $10.40 $10.29 $11.09 $11.70 $11.42 $12.20 $12.39 $12.45 $12.60 $13.56 $13.75 13.63 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.0012/1/20106/1/201112/1/20116/1/201212/1/20126/1/201312/1/20136/1/201412/1/20146/1/2015

Conclusion 42 Lake Shore Bancorp, Inc. Copyright 2015 Questions? Thank you for your continued confidence in Lake Shore Bancorp, Inc.!

Conclusion 42 Lake Shore Bancorp, Inc. Copyright 2015 Questions? Thank you for your continued confidence in Lake Shore Bancorp, Inc.!

Lake Shore, MHC Annual Meeting of Members 43 Lake Shore Bancorp, Inc. Copyright 2015 •Call to Order • Introduction of Proposal to Elect Directors •Tabulation of Votes •Adjournment

Lake Shore, MHC Annual Meeting of Members 43 Lake Shore Bancorp, Inc. Copyright 2015 •Call to Order • Introduction of Proposal to Elect Directors •Tabulation of Votes •Adjournment

Annual Meeting of Shareholders May 20, 2015 1 LSS Bancorp logo.epsLake Shore Bancorp, Inc. Copyright 2015

Annual Meeting of Shareholders May 20, 2015 1 LSS Bancorp logo.epsLake Shore Bancorp, Inc. Copyright 2015 Welcoming Remarks Gary W. Winger Chairman of the Board 2 Lake Shore Bancorp, Inc. Copyright 2015

Welcoming Remarks Gary W. Winger Chairman of the Board 2 Lake Shore Bancorp, Inc. Copyright 2015 Agenda Call to Order - Gary W. Winger, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment 3 Lake Shore Bancorp, Inc. Copyright 2015

Agenda Call to Order - Gary W. Winger, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment 3 Lake Shore Bancorp, Inc. Copyright 2015 Board of Directors 4 Lake Shore Bancorp, Inc. Copyright 2015 M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Bancorp\LSBANCORP CMYK.jpgM:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Director Since Susan C. Ballard 2012 Tracy S. Bennett 2010 Sharon E. Brautigam, Governance Committee Chairperson 2004 Reginald S. Corsi 2008 David C. Mancuso, Asset/Liability Committee Chairperson 1998 Daniel P. Reininga, President and Chief Executive Officer 1994 Kevin M. Sanvidge, Compensation Committee Chairperson 2012 Gary W. Winger, Chairman of the Board 1997 Nancy L. Yocum, Vice Chairman of the Board and Audit Committee Chairperson 1995

Board of Directors 4 Lake Shore Bancorp, Inc. Copyright 2015 M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Bancorp\LSBANCORP CMYK.jpgM:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Director Since Susan C. Ballard 2012 Tracy S. Bennett 2010 Sharon E. Brautigam, Governance Committee Chairperson 2004 Reginald S. Corsi 2008 David C. Mancuso, Asset/Liability Committee Chairperson 1998 Daniel P. Reininga, President and Chief Executive Officer 1994 Kevin M. Sanvidge, Compensation Committee Chairperson 2012 Gary W. Winger, Chairman of the Board 1997 Nancy L. Yocum, Vice Chairman of the Board and Audit Committee Chairperson 1995 Business of Annual Shareholders Meeting 5 Lake Shore Bancorp, Inc. Copyright 2015 •Election of Three Directors: David C. Mancuso Gary W. Winger Nancy L. Yocum • An advisory vote on executive compensation (“Say-on-Pay”) •Ratification of the appointment of Baker Tilly Virchow Krause, LLP as independent registered public accounting firm for 2015

Business of Annual Shareholders Meeting 5 Lake Shore Bancorp, Inc. Copyright 2015 •Election of Three Directors: David C. Mancuso Gary W. Winger Nancy L. Yocum • An advisory vote on executive compensation (“Say-on-Pay”) •Ratification of the appointment of Baker Tilly Virchow Krause, LLP as independent registered public accounting firm for 2015 Executive Management Presentation 6 Lake Shore Bancorp, Inc. M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Daniel P. Reininga President and Chief Executive Officer

Executive Management Presentation 6 Lake Shore Bancorp, Inc. M:\Users\Bank Sketches and other pics\LSS Logo\Lake Shore Savings\LS only.JPG Daniel P. Reininga President and Chief Executive Officer Safe Harbor Statement 7 Lake Shore Bancorp, Inc. Copyright 2015 This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the Safe Harbor Provision and are including this statement for the purpose of such Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs, such as “will,” “would,” “should,” “could” or “may”. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company's business and results is discussed in the Company's periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise.

Safe Harbor Statement 7 Lake Shore Bancorp, Inc. Copyright 2015 This presentation includes "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the Safe Harbor Provision and are including this statement for the purpose of such Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning future business, revenue and earnings. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs, such as “will,” “would,” “should,” “could” or “may”. These statements are not historical facts or guarantees of future performance, events or results. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company's business and results is discussed in the Company's periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise. Lake Shore Bancorp Inc. Stock Profile 8 Lake Shore Bancorp, Inc. Copyright 2015 Market Data (as of May 15, 2015) – (Source - NASDAQ) .Ticker Symbol LSBK .52 – week Range $11.95 - $14.00 .Current Price $13.63 .Market Capitalization $32.1 million - minority shares only .Minority Shares Outst . 2.4 million shares .50 Day Avg. Trading Vol. 550 shares .Annual Cash Dividend $0.28 per share .Dividend Yield 2.05% .Ownership (as of 3/31/2015) .Mutual Holding Company (Lake Shore, MHC) 60.7% (holds 3.6 million shares) .Insiders (including directors, 7.4% executives, and ESOP plan) .Institutional 14.8% .Other 17.1%

Lake Shore Bancorp Inc. Stock Profile 8 Lake Shore Bancorp, Inc. Copyright 2015 Market Data (as of May 15, 2015) – (Source - NASDAQ) .Ticker Symbol LSBK .52 – week Range $11.95 - $14.00 .Current Price $13.63 .Market Capitalization $32.1 million - minority shares only .Minority Shares Outst . 2.4 million shares .50 Day Avg. Trading Vol. 550 shares .Annual Cash Dividend $0.28 per share .Dividend Yield 2.05% .Ownership (as of 3/31/2015) .Mutual Holding Company (Lake Shore, MHC) 60.7% (holds 3.6 million shares) .Insiders (including directors, 7.4% executives, and ESOP plan) .Institutional 14.8% .Other 17.1% Lake Shore Savings Fast Facts 9 Lake Shore Bancorp, Inc. Copyright 2015 .Lake Shore Savings has been in business for over 124 years. .As of March 31, 2015 •Total Assets $482.9 million •Total Deposits $382.7 million •Total Loans Receivable, net $286.6 million .11 branch locations throughout Chautauqua and Erie Counties.

Lake Shore Savings Fast Facts 9 Lake Shore Bancorp, Inc. Copyright 2015 .Lake Shore Savings has been in business for over 124 years. .As of March 31, 2015 •Total Assets $482.9 million •Total Deposits $382.7 million •Total Loans Receivable, net $286.6 million .11 branch locations throughout Chautauqua and Erie Counties. Lake Shore Balance Sheet Strategy 10 Lake Shore Bancorp, Inc. Copyright 2015 Manage Interest Rate Risk .Extended low interest rate environment Reduce Interest Rate Risk exposure: . Change Balance Sheet Mix .Sold $10.3 million of long-term, fixed-rate securities in 2014.Increased Commercial Loan origination volume, shorter duration and higher interest rates .Sell long-term, fixed rate residential mortgage loans on secondary market at time of origination, with servicing retained .Increase low-rate core deposits

Lake Shore Balance Sheet Strategy 10 Lake Shore Bancorp, Inc. Copyright 2015 Manage Interest Rate Risk .Extended low interest rate environment Reduce Interest Rate Risk exposure: . Change Balance Sheet Mix .Sold $10.3 million of long-term, fixed-rate securities in 2014.Increased Commercial Loan origination volume, shorter duration and higher interest rates .Sell long-term, fixed rate residential mortgage loans on secondary market at time of origination, with servicing retained .Increase low-rate core deposits Lake Shore Balance Sheet Strategy 11 Lake Shore Bancorp, Inc. Copyright 2015 Strategic Impact of Managing Interest Rate Risk .Positioning of Balance Sheet for rising interest rate environment .Effectively manage Net Interest Margin .Short term decrease in Net Income, offset by strong capital position

Lake Shore Balance Sheet Strategy 11 Lake Shore Bancorp, Inc. Copyright 2015 Strategic Impact of Managing Interest Rate Risk .Positioning of Balance Sheet for rising interest rate environment .Effectively manage Net Interest Margin .Short term decrease in Net Income, offset by strong capital position Loan Originations 2014 New Loans 2014 2013 ($’s in millions) Residential Mortgage - New & Modified $ 15.98 $41.32 Commercial Mortgage - New & Modified 19.13 16.73 Commercial Loans 7.64 3.03 Home Equity Loans 6.08 6.63 Consumer Loans 0.38 0.44 Total New Loans $ 49.21 $68.15 35.5% Increase in Total Commercial Mortgage & Commercial Loan Originations 12 Lake Shore Bancorp, Inc.Copyright 2015

Loan Originations 2014 New Loans 2014 2013 ($’s in millions) Residential Mortgage - New & Modified $ 15.98 $41.32 Commercial Mortgage - New & Modified 19.13 16.73 Commercial Loans 7.64 3.03 Home Equity Loans 6.08 6.63 Consumer Loans 0.38 0.44 Total New Loans $ 49.21 $68.15 35.5% Increase in Total Commercial Mortgage & Commercial Loan Originations 12 Lake Shore Bancorp, Inc.Copyright 2015 2014 Deposits and Earnings 13 Lake Shore Bancorp, Inc. Copyright 2015 4.7% Growth in Core Deposits (includes all deposits except time deposits) Core Deposits 2014 $ 204.8 million Core Deposits 2013 $ 195.7 million .Year End 2014 Deposits of $386.9 million, a $1.3 million decrease since 2013 . Earnings of $3.2 million

2014 Deposits and Earnings 13 Lake Shore Bancorp, Inc. Copyright 2015 4.7% Growth in Core Deposits (includes all deposits except time deposits) Core Deposits 2014 $ 204.8 million Core Deposits 2013 $ 195.7 million .Year End 2014 Deposits of $386.9 million, a $1.3 million decrease since 2013 . Earnings of $3.2 million Operational and Strategic Review 14 Lake Shore Bancorp, Inc. Copyright 2015 .Regulatory Update .Fundamental Banking Practices .2014 Operational Highlights .Banking for the Future

Operational and Strategic Review 14 Lake Shore Bancorp, Inc. Copyright 2015 .Regulatory Update .Fundamental Banking Practices .2014 Operational Highlights .Banking for the Future Regulatory Oversight 15 Lake Shore Bancorp, Inc. Copyright 2015 .OCC is the Primary Regulator of Lake Shore Savings Bank. .Federal Reserve is the Primary Regulator of: Lake Shore Bancorp, Inc. Lake Shore, MHC

Regulatory Oversight 15 Lake Shore Bancorp, Inc. Copyright 2015 .OCC is the Primary Regulator of Lake Shore Savings Bank. .Federal Reserve is the Primary Regulator of: Lake Shore Bancorp, Inc. Lake Shore, MHC Regulatory Environment 16 Lake Shore Bancorp, Inc. Copyright 2015 .Ever Changing Regulatory Environment OCC, FDIC, CFPB, The Federal Reserve, The State of New York .Implementation of the Qualified Mortgage Rules as created by the Consumer Financial Protection Bureau. Lake Shore Best Practices .2014 Community Reinvestment Act Exam

Regulatory Environment 16 Lake Shore Bancorp, Inc. Copyright 2015 .Ever Changing Regulatory Environment OCC, FDIC, CFPB, The Federal Reserve, The State of New York .Implementation of the Qualified Mortgage Rules as created by the Consumer Financial Protection Bureau. Lake Shore Best Practices .2014 Community Reinvestment Act Exam Fundamental Banking Practices 17 Lake Shore Bancorp, Inc. Copyright 2015 .Corporate Mission .Board of Directors and Management are Proactive .Comprehensive Strategic Planning .Sound Policies and Procedures .Effective Risk Management Systems .Continue to Accumulate Capital

Fundamental Banking Practices 17 Lake Shore Bancorp, Inc. Copyright 2015 .Corporate Mission .Board of Directors and Management are Proactive .Comprehensive Strategic Planning .Sound Policies and Procedures .Effective Risk Management Systems .Continue to Accumulate Capital 2014 Operating Highlights 18 Lake Shore Bancorp, Inc. Copyright 2015 .Continued Focus on Digital Banking Efficiencies .Implemented in 2014: .Mobile Banking App for cell phones and tablets .Upgraded Retail Online Banking •New Bill Pay features •e-Alerts .Introduced Business Online Banking with integration of: •ACH processing •Remote deposit capture •Wire transfer processing

2014 Operating Highlights 18 Lake Shore Bancorp, Inc. Copyright 2015 .Continued Focus on Digital Banking Efficiencies .Implemented in 2014: .Mobile Banking App for cell phones and tablets .Upgraded Retail Online Banking •New Bill Pay features •e-Alerts .Introduced Business Online Banking with integration of: •ACH processing •Remote deposit capture •Wire transfer processing 2014 Operating Highlights (cont.) 19 Lake Shore Bancorp, Inc. Copyright 2015 .Converted to new Item Processing vendor •New statement format •Upgraded e-statements and e-notices .Constructed Data Center Back-up Hot Site .Focused on Commercial Loan Portfolio Growth .Implemented Strategy to Reduce Interest Rate Risk

2014 Operating Highlights (cont.) 19 Lake Shore Bancorp, Inc. Copyright 2015 .Converted to new Item Processing vendor •New statement format •Upgraded e-statements and e-notices .Constructed Data Center Back-up Hot Site .Focused on Commercial Loan Portfolio Growth .Implemented Strategy to Reduce Interest Rate Risk 2014 Operating Highlights (cont.) 20 Lake Shore Bancorp, Inc. Copyright 2015 .Continued focus on Enterprise Risk Management .Dividend Waiver .Protecting the Shareholder’s Investment in LSBK

2014 Operating Highlights (cont.) 20 Lake Shore Bancorp, Inc. Copyright 2015 .Continued focus on Enterprise Risk Management .Dividend Waiver .Protecting the Shareholder’s Investment in LSBK Commercial Lending .Commercial Division Activities in 2014 .Executive Vice President, Commercial Division .Growth of the Commercial Lending Portfolio .New Originations Totaled $25.55 Million .Portfolio Outstandings Grew to $81.7 Million, a 14.4 percent YOY increase .The Right Kind of Interest. 21 Lake Shore Bancorp, Inc. Copyright 2015

Commercial Lending .Commercial Division Activities in 2014 .Executive Vice President, Commercial Division .Growth of the Commercial Lending Portfolio .New Originations Totaled $25.55 Million .Portfolio Outstandings Grew to $81.7 Million, a 14.4 percent YOY increase .The Right Kind of Interest. 21 Lake Shore Bancorp, Inc. Copyright 2015 2015 Operating Highlights 22 Lake Shore Bancorp, Inc. .Implemented in 1st Quarter of 2015 •Mobile Deposit Capture •Converted to new vendor for Record Management and Document Imaging •Regulatory Changes •Basel III Capital Standards Implemented

2015 Operating Highlights 22 Lake Shore Bancorp, Inc. .Implemented in 1st Quarter of 2015 •Mobile Deposit Capture •Converted to new vendor for Record Management and Document Imaging •Regulatory Changes •Basel III Capital Standards Implemented Future Strategy .Operational Focus on Managing Interest Rate Risk .Commitment to an efficient Operating Profile .Solid Community Banking core business .Focusing on increasing market share in Western New York. .Developing Brand Awareness .Maximize customer’s use of our digital capabilities .Solid asset quality metrics .High Capital levels .Experienced Management Team .Protecting Shareholders Investment in LSBK! 23 Lake Shore Bancorp, Inc. Copyright 2015

Future Strategy .Operational Focus on Managing Interest Rate Risk .Commitment to an efficient Operating Profile .Solid Community Banking core business .Focusing on increasing market share in Western New York. .Developing Brand Awareness .Maximize customer’s use of our digital capabilities .Solid asset quality metrics .High Capital levels .Experienced Management Team .Protecting Shareholders Investment in LSBK! 23 Lake Shore Bancorp, Inc. Copyright 2015 Summary 24 Lake Shore Bancorp, Inc. Copyright 2015 Putting People First is not simply our Bank’s Mission Statement, it is a fundamental belief shared by all of Lake Shore Savings Bank Associates!

Summary 24 Lake Shore Bancorp, Inc. Copyright 2015 Putting People First is not simply our Bank’s Mission Statement, it is a fundamental belief shared by all of Lake Shore Savings Bank Associates! Rachel Foley Chief Financial Officer Lake Shore Bancorp, Inc. Copyright 2015 Lake Shore Bancorp, Inc. Financial Presentation 25

Rachel Foley Chief Financial Officer Lake Shore Bancorp, Inc. Copyright 2015 Lake Shore Bancorp, Inc. Financial Presentation 25 Total Assets ($ in millions) 26 Lake Shore Bancorp, Inc. Copyright 2015 $479.0 $488.6 $482.4 $482.2 $487.5 $482.9 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0201020112012201320141Q2015

Total Assets ($ in millions) 26 Lake Shore Bancorp, Inc. Copyright 2015 $479.0 $488.6 $482.4 $482.2 $487.5 $482.9 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 $550.0201020112012201320141Q2015 Loans, net ($ in millions) 27 Lake Shore Bancorp, Inc. Copyright 2015 $263.0 $275.1 $272.9 $277.3 $284.9 $286.6 $100.0 $150.0 $200.0 $250.0 $300.0201020112012201320141Q2015

Loans, net ($ in millions) 27 Lake Shore Bancorp, Inc. Copyright 2015 $263.0 $275.1 $272.9 $277.3 $284.9 $286.6 $100.0 $150.0 $200.0 $250.0 $300.0201020112012201320141Q2015 Loan Composition (as of December 31st) 28 Lake Shore Bancorp, Inc. Copyright 2015 2010 2014 One-to-four family 70.3% Commercial real estate 12.9% Construction loans 0.2% Home equity 11.7% Commercial loans 4.0% Consumer loans 0.9% One-to-four family 59.1% Commercial real estate 24.0% Construction loans 0.2% Home equity 11.4% Commercial loans 4.8% Consumer loans 0.5% Commercial real estate and commercial loans have increased by 85.1% since 2010, while one-to four-family loans have decreased by 8.7%.

Loan Composition (as of December 31st) 28 Lake Shore Bancorp, Inc. Copyright 2015 2010 2014 One-to-four family 70.3% Commercial real estate 12.9% Construction loans 0.2% Home equity 11.7% Commercial loans 4.0% Consumer loans 0.9% One-to-four family 59.1% Commercial real estate 24.0% Construction loans 0.2% Home equity 11.4% Commercial loans 4.8% Consumer loans 0.5% Commercial real estate and commercial loans have increased by 85.1% since 2010, while one-to four-family loans have decreased by 8.7%. Non-performing Loans as a Percentage of Loans (as of December 31st) Source: FDIC 29 Lake Shore Bancorp, Inc. Copyright 2015 4.12% 3.67% 3.32% 2.44% 2.04% 0.89% 1.02% 0.89% 1.66% 1.66% 0.00%0.50%1.00%1.50%2.00%2.50%3.00%3.50%4.00%4.50%20102011201220132014National Average*Lake Shore*Average of all savings institutions – National

Non-performing Loans as a Percentage of Loans (as of December 31st) Source: FDIC 29 Lake Shore Bancorp, Inc. Copyright 2015 4.12% 3.67% 3.32% 2.44% 2.04% 0.89% 1.02% 0.89% 1.66% 1.66% 0.00%0.50%1.00%1.50%2.00%2.50%3.00%3.50%4.00%4.50%20102011201220132014National Average*Lake Shore*Average of all savings institutions – National Loan Loss Reserves as a Percentage of Loans (as of December 31st ) 30 Lake Shore Bancorp, Inc. Copyright 2015 0.00%0.20%0.40%0.60%0.80%1.00%201020112012201320140.36% 0.50% 0.66% 0.65% 0.67%

Loan Loss Reserves as a Percentage of Loans (as of December 31st ) 30 Lake Shore Bancorp, Inc. Copyright 2015 0.00%0.20%0.40%0.60%0.80%1.00%201020112012201320140.36% 0.50% 0.66% 0.65% 0.67% Total Deposits ($ in millions) 31 Lake Shore Bancorp, Inc. Copyright 2015 $375.8 $379.8 $378.5 $388.2 $386.9 $382.7 $- $100.0 $200.0 $300.0 $400.020102011201220132014 1Q2015

Total Deposits ($ in millions) 31 Lake Shore Bancorp, Inc. Copyright 2015 $375.8 $379.8 $378.5 $388.2 $386.9 $382.7 $- $100.0 $200.0 $300.0 $400.020102011201220132014 1Q2015 Deposit Composition (as of December 31, 2014) 32 Lake Shore Bancorp, Inc. Copyright 2015 Savings 11.0% Money Market Accts 20.3% Interest-Bearing Demand 12.1% Noninterest-Bearing Demand 9.6% Time Deposits > $100,000 17.7% Time Deposits < $100,000 29.3%

Deposit Composition (as of December 31, 2014) 32 Lake Shore Bancorp, Inc. Copyright 2015 Savings 11.0% Money Market Accts 20.3% Interest-Bearing Demand 12.1% Noninterest-Bearing Demand 9.6% Time Deposits > $100,000 17.7% Time Deposits < $100,000 29.3% Deposit Mix (as of December 31st) 33 Lake Shore Bancorp, Inc. Copyright 2015 38.56% 61.44% 2010 Deposit Mix 52.94% 47.06% 2014 Deposit Mix CoreDepositsTimeDeposits

Deposit Mix (as of December 31st) 33 Lake Shore Bancorp, Inc. Copyright 2015 38.56% 61.44% 2010 Deposit Mix 52.94% 47.06% 2014 Deposit Mix CoreDepositsTimeDeposits Net Interest Income ($ in millions, as of December 31st) 34 Lake Shore Bancorp, Inc. Copyright 2015 $13.6 $15.1 $15.0 $15.1 $14.5 $- $5.0 $10.0 $15.0 $20.020102011201220132014

Net Interest Income ($ in millions, as of December 31st) 34 Lake Shore Bancorp, Inc. Copyright 2015 $13.6 $15.1 $15.0 $15.1 $14.5 $- $5.0 $10.0 $15.0 $20.020102011201220132014 Treasury Yield 35 Lake Shore Bancorp, Inc. Copyright 2015 0.02 0.03 0.05 0.10 0.40 0.86 1.63 2.17 2.62 3.18 3.47 0.01 0.03 0.09 0.25 0.61 1.00 1.58 2.00 2.28 2.62 3.18 012341 mo3 mo6 mo1 yr2 yr3 yr5 yr7 yr10 yr20 yr30 yrPercentage Treasury Maturities 5/9/20145/12/2015

Treasury Yield 35 Lake Shore Bancorp, Inc. Copyright 2015 0.02 0.03 0.05 0.10 0.40 0.86 1.63 2.17 2.62 3.18 3.47 0.01 0.03 0.09 0.25 0.61 1.00 1.58 2.00 2.28 2.62 3.18 012341 mo3 mo6 mo1 yr2 yr3 yr5 yr7 yr10 yr20 yr30 yrPercentage Treasury Maturities 5/9/20145/12/2015 Net Income ($ in millions, as of December 31st) 36 Lake Shore Bancorp, Inc. Copyright 2015 $- $1.0 $2.0 $3.0 $4.020102011201220132014 $3.0 $3.7 $3.6 $3.7 $3.2 CAGR of 7.78%

Net Income ($ in millions, as of December 31st) 36 Lake Shore Bancorp, Inc. Copyright 2015 $- $1.0 $2.0 $3.0 $4.020102011201220132014 $3.0 $3.7 $3.6 $3.7 $3.2 CAGR of 7.78% Efficiency Ratio (as of December 31st) Source: SNL.com 37 Lake Shore Bancorp, Inc. Copyright 2015 74.29% 74.34% 73.75% 78.69% 79.25% 67.59% 67.32% 69.16% 71.92% 76.46% 60.00%65.00%70.00%75.00%80.00%85.00%90.00%20102011201220132014National Average*Lake Shore*SNL U.S. Thrift < $500M : Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Thrifts in SNL's coverage universe with less than $500M in Assets. Source: SNL.com

Efficiency Ratio (as of December 31st) Source: SNL.com 37 Lake Shore Bancorp, Inc. Copyright 2015 74.29% 74.34% 73.75% 78.69% 79.25% 67.59% 67.32% 69.16% 71.92% 76.46% 60.00%65.00%70.00%75.00%80.00%85.00%90.00%20102011201220132014National Average*Lake Shore*SNL U.S. Thrift < $500M : Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Thrifts in SNL's coverage universe with less than $500M in Assets. Source: SNL.com Capital Levels – Bank Only (as of December 31st) 38 Lake Shore Bancorp, Inc. Copyright 2015 Well-Capitalized 2014 2013 (Regulatory Definition) Total capital (to risk-weighted assets) 25.71% 25.08% >10.00% Tier 1 capital (to adjusted total assets) 13.16% 12.75% >5.00%

Capital Levels – Bank Only (as of December 31st) 38 Lake Shore Bancorp, Inc. Copyright 2015 Well-Capitalized 2014 2013 (Regulatory Definition) Total capital (to risk-weighted assets) 25.71% 25.08% >10.00% Tier 1 capital (to adjusted total assets) 13.16% 12.75% >5.00% 1st Quarter 2015 Balances vs. 2014 Year End Balances 39 Lake Shore Bancorp, Inc. Copyright 2015 .Total Assets of $482.9 million .Cash & Cash Equivalents decreased $2.9 million .Investments decreased $3.2 million .Loans, net increased $1.8 million .Total Deposits decreased $4.3 million

1st Quarter 2015 Balances vs. 2014 Year End Balances 39 Lake Shore Bancorp, Inc. Copyright 2015 .Total Assets of $482.9 million .Cash & Cash Equivalents decreased $2.9 million .Investments decreased $3.2 million .Loans, net increased $1.8 million .Total Deposits decreased $4.3 million 1st Quarter 2015 vs. 1st Quarter 2014 Results 40 Lake Shore Bancorp, Inc. Copyright 2015 .2015 1st Quarter Net Income .$569,000 - a 26.6% decrease .Impacted by $128,000 one-time tax expense Decrease in 1st Q Net Income primarily due to: . $99,000 decrease in net interest income . $69,000 increase in non-interest expense . $67,000 increase in income tax expense Offset by: . $54,000 increase in non-interest income

1st Quarter 2015 vs. 1st Quarter 2014 Results 40 Lake Shore Bancorp, Inc. Copyright 2015 .2015 1st Quarter Net Income .$569,000 - a 26.6% decrease .Impacted by $128,000 one-time tax expense Decrease in 1st Q Net Income primarily due to: . $99,000 decrease in net interest income . $69,000 increase in non-interest expense . $67,000 increase in income tax expense Offset by: . $54,000 increase in non-interest income LSBK Closing Stock Price December 31, 2010 thru May 15, 2015 41 Lake Shore Bancorp, Inc. Copyright 2015 Source: Nasdaq.com $9.23 $10.21 $10.26 $9.50 $9.55 $10.00 $10.27 $10.40 $10.29 $11.09 $11.70 $11.42 $12.20 $12.39 $12.45 $12.60 $13.56 $13.75 13.63 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.0012/1/20106/1/201112/1/20116/1/201212/1/20126/1/201312/1/20136/1/201412/1/20146/1/2015

LSBK Closing Stock Price December 31, 2010 thru May 15, 2015 41 Lake Shore Bancorp, Inc. Copyright 2015 Source: Nasdaq.com $9.23 $10.21 $10.26 $9.50 $9.55 $10.00 $10.27 $10.40 $10.29 $11.09 $11.70 $11.42 $12.20 $12.39 $12.45 $12.60 $13.56 $13.75 13.63 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.0012/1/20106/1/201112/1/20116/1/201212/1/20126/1/201312/1/20136/1/201412/1/20146/1/2015 Conclusion 42 Lake Shore Bancorp, Inc. Copyright 2015 Questions? Thank you for your continued confidence in Lake Shore Bancorp, Inc.!

Conclusion 42 Lake Shore Bancorp, Inc. Copyright 2015 Questions? Thank you for your continued confidence in Lake Shore Bancorp, Inc.! Lake Shore, MHC Annual Meeting of Members 43 Lake Shore Bancorp, Inc. Copyright 2015 •Call to Order • Introduction of Proposal to Elect Directors •Tabulation of Votes •Adjournment

Lake Shore, MHC Annual Meeting of Members 43 Lake Shore Bancorp, Inc. Copyright 2015 •Call to Order • Introduction of Proposal to Elect Directors •Tabulation of Votes •Adjournment