UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 333-129208

Actions Semiconductor Co., Ltd.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

15-1, No. 1, HIT Road

Tangjia. Zhuhai, Guangdong, 519085

The People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of quotation system on which registered |

| American Depositary Shares, each representing Six Ordinary Shares, par value US$0.000001 per share | | Nasdaq—Global Market System |

| |

| Ordinary Shares, par value US$0.000001 per share | | Nasdaq—Global Market System* |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Ordinary Shares 516,000,000

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.:

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

| * | Not for trading purposes, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. |

TABLE OF CONTENTS

2

CERTAIN DEFINED TERMS

References to “China” or “PRC” or “Mainland China” herein are references to the People’s Republic of China and references to “Hong Kong” are references to the Hong Kong Special Administrative Region of the PRC. References to “United States” or “U.S.” are to the United States of America. All references to the “Government” herein are references to the government of the People’s Republic of China.

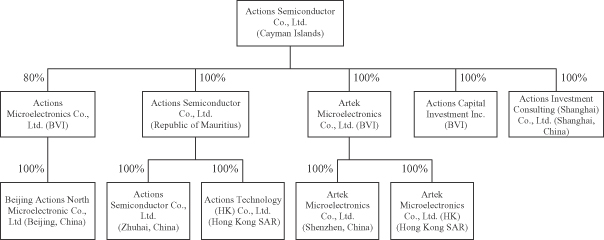

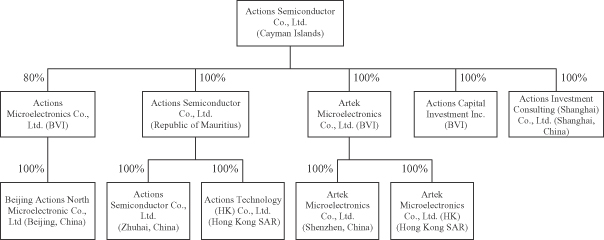

All references herein to “we,” “us,” “our,” “Actions” and the “Company” are references to Actions Semiconductor Co., Ltd. and, unless the context otherwise requires, all such references include our subsidiaries.

References in this annual report to “U.S. dollars,” “$” and “US$” are to United States dollars, the lawful currency of the United States and references herein to “RMB” are to Renminbi, the lawful currency of the People’s Republic of China. Certain figures (including percentages) have been rounded for convenience, and therefore indicated and actual sums, quotients, percentages and ratios may differ. Unless otherwise indicated, our financial information has been presented in United States dollars in accordance with U.S. GAAP, and is presented on a consolidated basis.

Solely for the convenience of the reader, certain Renminbi amounts have been translated into U.S. dollars at specified rates. Unless otherwise noted, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi were made at the noon buying rate in the City of New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York on December 29, 2006, which was RMB7.8041 to US$1.00. As of April 23, 2007, the noon buying rate was RMB7.7280 =US$1.00. We make no representation that the Renminbi or U.S. dollar amounts referred to herein could have been or could be converted to U.S. dollars or Renminbi, as the case may be, at any particular rate.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 20-F, including those statements contained under the captions “Item 4—Information on the Company” and “Item 5—Operating and Financial Review and Prospects” that are not statements of historical fact, are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements can be generally identified by the use of terms such as “may,” “will,” “could,” “would,” “plans,” “intends,” “believes,” “expects,” “projects,” “estimates” or “anticipates”, the negatives of such terms, or comparable terms. In addition to the statements contained in this Form 20-F, we (or our directors or executive officers authorized to speak on our behalf) from time to time may make forward-looking statements, orally or in writing, regarding Actions (including its subsidiaries) and its business, including in press releases, oral presentations, filings under the Securities Act, the Exchange Act or securities laws of other countries, and filings with Nasdaq, or other stock exchanges.

Such forward-looking statements represent our judgment or expectations regarding the future, and are subject to risks and uncertainties that may cause actual events and our future results to be materially different than expected by us or indicated by such statements. Such risks and uncertainties include in particular (but are not limited to) the risks and uncertainties related to: the risk that we may not be able to develop and successfully market new products; the risk that consumer preferences will shift away from the products manufactured by our customers; the risk that our rights to intellectual property used in our products may be challenged by our competitors; the risk that we will not be able to develop and implement additional operational and financial systems to manage our operations as they expand; intensifying competition in the market in which we operate; the outcome of legal proceedings in which we are currently engaged; the risk that we may be unable to retain or attract key personnel; governmental uncertainties; and the risk that our various relationships with our distributor and contract manufacturer customers will change in a way that adversely affects our business.

1

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

A. Selected Financial Data

The selected consolidated financial data presented below as of and for the years ended December 31, 2002, 2003, 2004, 2005 and 2006 have been prepared in accordance with U.S. GAAP and are derived from our audited consolidated financial statements included elsewhere in this document. The historical results are not necessarily indicative of results to be expected in any future period. All amounts below are in U.S. dollars, except data regarding number of shares and units shipped. Our principal operations in Zhuhai, China were established in December 2001 and we commenced commercial sales of our System-on-a-Chip products (“SoCs”) in the fourth quarter of 2002.

INCOME STATEMENT

| | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | |

| | | (thousands, except per share and share data) | |

Revenues: | | | | | | | | | | | | | | | |

System-on-a-chip products | | US$137 | | | US$4,319 | | | US$55,236 | | | US$149,369 | | | US$170,129 | |

Semiconductor product testing services | | — | | | 1,242 | | | 2,021 | | | 253 | | | 99 | |

| | | | | | | | | | | | | | | |

Total net revenues | | 137 | | | 5,561 | | | 57,257 | | | 149,622 | | | 170,228 | |

| | | | | | | | | | | | | | | |

Cost of revenues: | | | | | | | | | | | | | | | |

System-on-a-chip products | | (93 | ) | | (2,868 | ) | | (25,565 | ) | | (60,518 | ) | | (75,853 | ) |

Semiconductor product testing services | | — | | | (793 | ) | | (1,575 | ) | | (68 | ) | | (58 | ) |

| | | | | | | | | | | | | | | |

Total cost of revenues | | (93 | ) | | (3,661 | ) | | (27,140 | ) | | (60,586 | ) | | (75,911 | ) |

| | | | | | | | | | | | | | | |

Gross profit | | 44 | | | 1,900 | | | 30,117 | | | 89,036 | | | 94,317 | |

| | | | | | | | | | | | | | | |

Other income | | 113 | | | 118 | | | 128 | | | 1,122 | | | 1,634 | |

Operating expenses: | | | | | | | | | | | | | | | |

Research and development | | (344 | ) | | (1,139 | ) | | (2,400 | ) | | (7,825 | ) | | (9,773 | ) |

General and administrative | | (242 | ) | | (331 | ) | | (769 | ) | | (8,968 | ) | | (8,663 | ) |

Selling and marketing | | (72 | ) | | (417 | ) | | (594 | ) | | (1,375 | ) | | (1,626 | ) |

| | | | | | | | | | | | | | | |

Total operating expenses | | (658 | ) | | (1,887 | ) | | (3,763 | ) | | (18,168 | ) | | (20,062 | ) |

| | | | | | | | | | | | | | | |

Income (loss) from operations | | (501 | ) | | 131 | | | 26,482 | | | 71,990 | | | 75,889 | |

Interest income | | — | | | 2 | | | 28 | | | 1,148 | | | 4,876 | |

Interest expenses | | — | | | — | | | — | | | (77 | ) | | (160 | ) |

| | | | | | | | | | | | | | | |

Income (loss) before income taxes, equity in net loss of an affiliate and minority interest | | (501 | ) | | 133 | | | 26,510 | | | 73,061 | | | 80,605 | |

Income taxes/benefit | | — | | | — | | | (25 | ) | | 526 | | | (5,984 | ) |

Equity in net loss of an affiliate | | — | | | — | | | — | | | — | | | (156 | ) |

Minority Interests | | — | | | — | | | — | | | 18 | | | 96 | |

| | | | | | | | | | | | | | | |

Net income (loss) | | US$(501 | ) | | US$ 133 | | | US$26,485 | | | US$ 73,605 | | | US$ 74,561 | |

| | | | | | | | | | | | | | | |

2

| | | | | | | | | | | | | | | |

| | | For the year ended December 31, |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 |

| | | (thousands, except per share and share data) |

Net income per share: | | | | | | | | | | | | | | | |

Basic and diluted | | US$ | (0.001) | | US$ | — | | | US$0.055 | | US$ | 0.152 | | US$ | 0.144 |

| | | | | | | | | | | | | | | |

Net income per ADS: | | | | | | | | | | | | | | | |

Basic and diluted | | US$ | (0.006) | | US$ | 0.002 | | US$ | 0.331 | | US$ | 0.914 | | US$ | 0.867 |

| | | | | | | | | | | | | | | |

Dividend per share | | | — | | | — | | | — | | US$ | 0.041 | | | — |

| | | | | | | | | | | | | | | |

Weighted-average shares used in computation: | | | | | | | | | | | | | | | |

Basic and diluted | | | 480,000,000 | | | 480,000,000 | | | 480,000,000 | | | 483,000,000 | | | 516,000,000 |

| | | | | | | | | | | | | | | |

CASH FLOW

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | |

| | | (thousands) | |

Cash provided by (used in): | | | | | | | | | | | | | | | | | | | | |

Operating activities | | US$ | (572 | ) | | US$ | (381 | ) | | US$ | 29,694 | | | US$ | 77,140 | | | US$ | 76,786 | |

Investing activities | | | (517 | ) | | | (355 | ) | | | (997 | ) | | | (28,567 | ) | | | (48,200 | ) |

Financing activities | | | 1,882 | | | | 2,381 | | | | 877 | | | | 27,128 | | | | (1,917 | ) |

| | | | | |

| BALANCE SHEET | | | | | | | | | | | | | | | | | | | | |

| |

| | | At December 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | |

| | | (thousands) | |

Cash and cash equivalents | | US$ | 793 | | | US$ | 2,438 | | | US$ | 32,013 | | | US$ | 108,896 | | | US$ | 137,778 | |

Time deposits | | | — | | | | — | | | | — | | | | 23,172 | | | | 45,713 | |

Restricted cash | | | — | | | | — | | | | — | | | | 2,478 | | | | — | |

Marketable securities | | | — | | | | — | | | | — | | | | — | | | | 20,531 | |

Accounts receivable | | | 137 | | | | 10 | | | | 3,529 | | | | 8,025 | | | | 5,859 | |

Notes receivable | | | — | | | | — | | | | 1,825 | | | | 1,722 | | | | 2,154 | |

Inventories | | | 138 | | | | 1,069 | | | | 5,018 | | | | 7,023 | | | | 6,280 | |

Prepaid expenses and other current assets | | | 42 | | | | 660 | | | | 1,328 | | | | 1,973 | | | | 6,413 | |

Amount due from an affiliate | | | — | | | | — | | | | — | | | | — | | | | 133 | |

Deferred tax assets | | | — | | | | — | | | | — | | | | 528 | | | | 662 | |

Income tax recoverable | | | — | | | | — | | | | — | | | | 11 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 1,110 | | | | 4,177 | | | | 43,713 | | | | 153,828 | | | | 225,523 | |

| | | | | | | | | | | | | | | | | | | | |

Investment in an affiliate | | | — | | | | — | | | | — | | | | 500 | | | | 1,469 | |

Rental deposits | | | 8 | | | | 16 | | | | 24 | | | | 11 | | | | 52 | |

Deposit paid for acquisition of property, plant and equipment | | | — | | | | — | | | | — | | | | — | | | | 91 | |

Property, plant and equipment, net | | | 456 | | | | 646 | | | | 1,411 | | | | 2,360 | | | | 6,749 | |

Acquired intangible assets, net | | | 6 | | | | 25 | | | | 14 | | | | 1,889 | | | | 3,787 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | US$ | 1,580 | | | US$ | 4,864 | | | US$ | 45,162 | | | US$ | 158,588 | | | US$ | 237,671 | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 199 | | | | 969 | | | | 13,900 | | | | 27,307 | | | | 28,165 | |

| | | | | | | | | | | | | | | | | | | | |

Other liabilities | | | — | | | | — | | | | 145 | | | | 124 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 199 | | | | 969 | | | | 14,045 | | | | 27,431 | | | | 28,165 | |

| | | | | | | | | | | | | | | | | | | | |

Minority Interests | | | — | | | | — | | | | — | | | | 582 | | | | 486 | |

| | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity | | | 1,381 | | | | 3,895 | | | | 31,117 | | | | 130,575 | | | | 209,020 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities & shareholders’ equity | | US$ | 1,580 | | | US$ | 4,864 | | | US$ | 45,162 | | | US$ | 158,588 | | | US$ | 237,671 | |

| | | | | | | | | | | | | | | | | | | | |

3

| | | | | | | | | | | | | | | |

| | | For the year ended December 31, |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 |

| | | (thousand, except average selling price) |

Operating Data: | | | | | | | | | | | | | | | |

Sales of SoCs for MP3 players | | US$ | — | | US$ | 3,285 | | US$ | 54,069 | | US$ | 146,619 | | US$ | 168,907 |

Units shipped | | | — | | | 744 | | | 12,228 | | | 48,866 | | | 76,059 |

Average selling price | | US$ | — | | US$ | 4.40 | | US$ | 4.40 | | US$ | 3.00 | | US$ | 2.22 |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

We wish to caution the readers that the following important factors, and those important factors described in other reports submitted to, or filed with, the Securities and Exchange Commission, among other factors, could affect our actual results and could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. In particular, as we are a non-U.S. company, there are risks associated with investing in our ADSs that are not typical with investments in shares of U.S. companies. If any of the following risks actually occurs, our business, financial condition and results of operations would likely suffer. In such case, the trading price of our ADSs could decline, and you could lose all or part of your investment.

Risks Related to Our Company

We are involved in an intellectual property dispute with SigmaTel, the outcome of which we cannot predict.

On January 4, 2005, one of our main competitors, SigmaTel, Inc., filed a complaint in the U.S. District Court for the Western District of Texas, Austin Division against us and Sonic Impact Technologies, LLC. Sonic Impact is a brand owner that incorporated our ATJ 2075 series SoC into their MP3 players. The complaint alleged that some of our SoC designs infringed SigmaTel’s U.S. patents, including U.S. patent numbers 6,633,187, or the 187 patent, and 6,366,522, or the 522 patent, and that Sonic Impact’s incorporation of such SoC designs into its MP3 players and subsequent importation and sale in the United States of those MP3 players also infringed SigmaTel’s U.S. patents. Subsequently, SigmaTel filed complaints with the U.S. International Trade Commission, or ITC, alleging that we had infringed SigmaTel’s U.S. patents in the design of some of our SoCs for MP3 players. A settlement was subsequently reached between SigmaTel and Sonic Impact, and SigmaTel’s case against us in Texas was stayed pending the final determination of the ITC proceedings.

On September 15, 2006, the ITC announced its final determination that certain of our SoCs had infringed the 187 patent and certain of our SoCs, utilizing a prior version of firmware, had infringed the 522 patent. The ITC’s final determination is subject to further discretionary review by the President of the United States and will be subject to appeal at the United States Circuit Court for the Federal Circuit. On January 3, 2007, SigmaTel’s complaint in the U.S. District Court for the Western District of Texas, Austin Division was dismissed without prejudice. On January 4, 2007, we filed a Notice of Appeal with the United States Court of Appeals for the Federal Circuit to review the September 15, 2006 ITC decision.

Substantially all of the SoCs we sold in 2005 and the first half of 2006 embodied the designs that were found to infringe these patents. However, we have not sold any SoCs to customers in the United States, and based on information provided to us by our customers, we estimate that less than 10% of our SoCs sold during this period were incorporated into products ultimately sold in the United States.

4

We expect that our dispute with SigmaTel over patent infringement will continue. We have retained outside counsel and are vigorously participating in the defense against the infringement allegations. However, our customers may be forced to discontinue selling their products in the United States that incorporate certain of our SoCs. We may also be required to pay monetary damages to SigmaTel for past infringement. In addition, our ability to sell in the United States may be adversely affected, or we may incur additional costs to create alternative designs that do not infringe SigmaTel’s patents. Such an outcome could negatively affect our revenues as well as harm our business reputation and relationships with our existing customers. We also anticipate that our dispute with SigmaTel will involve similar legal proceedings in other parts of the world, including China, Europe or elsewhere. For instance, on September 13, 2006, we filed a complaint in Shenzhen Intermediate People’s Court in China, asserting that certain SigmaTel products infringe one of our key digital audio processing technology patents in China. Further, we have learned that certain of our European customers recently received letters from SigmaTel requesting them to cease importing products that incorporate our SoCs, failing which these customers may face litigation by SigmaTel. We may incur significant legal expenses in connection with this dispute, which could adversely affect our operating results.

We have a limited operating history, which may make it difficult for you to evaluate us and our prospects.

We established our operations in December 2001 and commercially launched our initial products in the fourth quarter of 2002. The market in which we operate, as well as the technologies used in the products serving that market, are rapidly evolving. We have only limited insight into the emerging trends that may affect our business, and we face numerous risks, uncertainties, expenses and difficulties frequently encountered by companies at an early stage of development.

We have limited historical financial data from which to predict our future sales and operating results for our SoCs. Our limited operating experience with these products, combined with the rapidly evolving nature of the markets in which we sell our products, and other factors such as consumer preferences, which are beyond our control, limit our ability to accurately forecast quarterly or annual sales.

Most of our key products have only been sold in significant quantities for a short time. As a result, we have limited experience in predicting and responding to fluctuations in demand for our products. Further, since we cannot accurately monitor sell-through of our SoCs in the portable media players sold by brand owners to retail consumers, it is difficult for us to forecast demand for our products. Our direct and indirect customers could experience inventory growth that could cause them to purchase fewer products from us or seek to return products to us in the future. Our direct and indirect customers may place orders in excess of their requirements in response to actual or perceived shortages in the supply of our SoCs. In such event, it will be more difficult for us to forecast our future revenues and budget our operating expenses, and our operating results would be adversely affected to the extent such excess orders are cancelled or rescheduled.

As a result of the reasons above, our historical financial data may not provide a meaningful basis upon which to evaluate us and our prospects.

We do not expect to sustain our growth rate.

Due to increased sales of our SoCs for portable media players, we have experienced significant revenue growth and have gained significant market share in a relatively short period of time. Specifically, our annual revenues for our SoC products increased from US$4.3 million in 2003 to US$55.2 million in 2004 and US$149.4 million in 2005. However, we do not expect similar revenue growth or market share gains in future periods. For example, revenues for our SoC products increased only by 13.9 % from US$ 149.4 million in 2005 to US$170.1 million in 2006. Accordingly, you should not rely on the results of any prior quarterly or annual periods as an indication of our future operating performance.

5

Our failure to manage adequately our growth and expansion could result in deterioration in our results of operations and financial condition.

We have grown rapidly since establishing our operations in December 2001. This expansion presented, and our anticipated growth in the future may continue to present, a significant challenge to our management and administrative systems and resources and, as a result, to our results of operations and financial condition. Our future success will depend on, among other things, our ability to:

| | • | | effectively maintain and service our existing customer relationships while developing new value-added distributor, contract manufacturer and brand owner customers; |

| | • | | continue training, motivating and retaining our existing employees and attract and integrate new technical, engineering and sales and marketing employees; |

| | • | | identify and attract new management personnel to our company as we continue to expand; |

| | • | | protect our intellectual property effectively; |

| | • | | integrate new businesses, technologies, services and products that we acquire by way of acquisitions or investments into our operations; |

| | • | | effectively manage our capital expenditures and working capital requirements; |

| | • | | maintain and further improve our operational, financial, accounting and other internal systems and controls; and |

| | • | | maintain adequate controls and procedures to ensure that our periodic public disclosure under applicable laws, including U.S. securities laws, is complete and accurate. |

We cannot assure you that no significant deficiencies in our internal control over financial reporting will be identified in the future.

In 2005 and 2006, we became aware of a number of deficiencies in our internal control over financial reporting, or control deficiencies. Control deficiencies exist when the design or operation of a company’s internal control system does not allow its management or employees, in the normal course of performing their assigned functions, to quickly detect or prevent misstatements of its financial statements. The identified control deficiencies were in the areas of our design and effectiveness with respect to our financial closing and reporting processes, and in our information and technology system. The existence of such control deficiencies may adversely affect our management’s ability to record, process, summarize, and report financial data on a timely basis. In 2006, we performed significant work to obtain reasonable assurance regarding the reliability of our financial statements and we have remedied all of the material control deficiencies identified as of December 31, 2006. Significant resources from our management team and additional expenses have been, and may continue to be, required to maintain effective controls and procedures in order to remedy any additional deficiencies we and our independent registered public accounting firm may identify in the future. Further, we cannot assure you that additional significant deficiencies in our internal control over financial reporting will not be identified in the future. If the significant deficiencies we have identified recur, or if we identify additional deficiencies or fail to implement new or improved controls successfully in a timely manner, our ability to issue timely and accurate financial reporting may be adversely affected, we may be required to restate our financial statements, and investors could lose confidence in the reliability of our financial statements, which in turn could negatively impact the trading price of our ADSs, or otherwise harm our reputation.

We derive almost all of our revenues from our SoCs for portable media players, and we cannot be sure that sales of these products will remain at current levels or will not decline.

Our recent revenue growth has resulted from sales of our SoCs for portable media players. We cannot be sure that our SoCs will continue to be successful in the markets in which we compete, or that portable media players will continue to remain popular with retail customers. Our future success depends on our ability to develop successful new products in a timely and cost-effective manner. We are required to continually evaluate expenditures for planned product developments and choose among alternatives based upon our expectations of

6

future market trends, which are difficult to predict. For example, if market demand shifts rapidly toward portable, multifunctional electronic products such as mobile phones with add-on portable media player functionality and away from stand-alone portable media players, our sales of our SoCs for portable media players may decline. The migration and adoption of 3G mobile phone networks may also cause the embedding of portable media player functionality into mobile phones to grow in popularity as 3G technology allows audio, image and video files to be readily downloaded to mobile phones. We may not be able to compete with SoC providers that target mobile phone manufacturers by combining mobile phone and portable media player functionality into one SoC. We may not be able to timely develop and introduce new or enhanced products in a timely and cost-effective manner, keep pace with market trends, or be sure that our products will generate significant revenues. The development of our SoCs and total solutions is highly complex, and successful product development and market acceptance of our products depend on a number of factors, including:

| | • | | our accurate prediction of the changing requirements of our customers; |

| | • | | our timely completion and introduction of new designs; |

| | • | | the availability of third-party manufacturing, assembly, and testing capacity; |

| | • | | the ability of our contract foundries to achieve high manufacturing yields for our products; |

| | • | | the quality, price, performance, power efficiency and size of our products relative to our competitors; |

| | • | | our management of our sales channels; |

| | • | | our customer service capabilities and responsiveness; |

| | • | | the success of our relationships with existing and potential customers; and |

| | • | | changes in industry standards. |

The selling prices of our products tend to decline over time, and if we are unable to develop successful new products in a timely manner, our operating results and competitive position could be harmed.

As is typical in the semiconductor industry, the selling prices of our products tend to decline significantly over the life of the product. If we are unable to offset reductions in the selling prices of our products by introducing new products at higher prices or by reducing our costs, our revenues, gross margins and operating results will be adversely affected. We must continuously develop new SoCs or other products and enhancements for existing SoCs to keep pace with evolving industry standards and rapidly changing customer requirements. We may not have the financial resources necessary to fund future innovation. Even if we have sufficient financial resources, if our future innovation produces technology that is behind that of our competitors, we may lose customers. Similarly, if our new products are ahead of the then-current technological standards in our industry, our customers may be unwilling to invest in developing consumer electronics products that can utilize our products, or purchase our SoCs, until the consumer electronics market is ready to accept them. Further, we may be required to develop products that utilize technologies with which our engineers are not familiar. Our efforts to develop in-house capability to work with these technologies or to acquire such expertise through acquisitions or investments in businesses may not be successful. If we are unable to successfully define, develop and introduce competitive new SoCs or other products, we may not be able to compete successfully. In addition, if we, or our customers, are unable to manage product transitions, our business and results of operations would be negatively affected.

Because of the lengthy product development periods for our products and the fixed nature of a significant portion of our expenses, we may incur substantial expenses before we earn associated revenues and may not ultimately achieve our forecasted sales for our products.

It can take up to 12 months for us to design, develop and commence production of our products, and commercial production of consumer end-products that use our SoCs can take an additional three to six months. Product development cycles for our products are lengthy for a number of reasons:

| | • | | our customers usually complete an in-depth technical evaluation of our products before they place a purchase order; |

7

| | • | | the commercial adoption of our products by value-added distributors, contract manufacturers and brand owners is typically limited during the initial release of their new products while they evaluate product performance and consumer demand; |

| | • | | new product introductions often center around key trade shows and failure to deliver a product prior to such an event can seriously delay or cancel introduction of a product; and |

| | • | | the development and commercial introduction of products incorporating new technology frequently are delayed or canceled. |

Because most of our expenses are fixed in the short term or incurred in advance of anticipated sales, we may not be able to decrease our expenses in a timely manner to offset any shortfall in sales. We are currently expanding our staffing and increasing our expenditures to support future growth, which may increase our cost of revenues and operating expenses. If our growth does not materialize, our operating results would be adversely impacted.

As a result of the time it takes to begin commercial production and sales of a new product, and the fact that a significant portion of our operating expenses are relatively fixed or incurred in advance of anticipated sales, we may incur substantial expenses in developing new products before we earn associated revenues. For example, we incurred significant development expenses in late 2004 and early 2005 in connection with our ATJ 2097 series SoCs, while we were not able to introduce this product to the market until June 2005. Similarly, we incurred significant development expenses in 2005 and 2006 in connection with the development of our new 13 series SoCs, and we were not able to rollout these products until January 2007. In addition, as the markets for the end products that incorporate our products are rapidly evolving and subject to changing consumer preferences, the products we design may not be in demand by our customers at the time we complete our product development process. This could cause us to miss the sales targets we set for these products when we commence development activities and we may not be able to decrease our operating expenses in a timely manner to offset such short-fall in sales, which would adversely affect our results of operations.

We currently rely on one third-party contractor to manufacture almost all of our SoC products; any event that prevents this foundry from producing our products, or our failure to successfully manage our relationship with this foundry, could damage our relationships with our customers, decrease our sales, and limit our growth.

We do not own or operate a semiconductor fabrication facility. Instead we rely on third-parties to manufacture our semiconductors. Presently, He Jian Technology Company, or He Jian, manufactures almost all of our semiconductors. As a result, if He Jian were to experience any catastrophic or other event that caused it to be unable to conduct manufacturing operations, or otherwise choose to discontinue manufacturing our products, it could have a significant adverse impact on our ability to sell our products. While we have in the past utilized, and continue to maintain relationships with, other contract foundries to have access to alternative manufacturing capabilities, we cannot be sure that these other contract foundries would be willing or have the capacity to produce our products. Even if such other foundries were willing to produce semiconductors for us, they may be unable to provide us with the same committed capacity, or be able to manufacture our semiconductors with the same yield rate, as we currently have with He Jian. As a result, we depend significantly on our maintaining a strong relationship with He Jian, and He Jian’s continued ability to manufacture our semiconductor products, to maintain our revenues and customer relationships.

We provide He Jian with monthly rolling forecasts of our production requirements; however, the ability of He Jian to provide silicon wafers to us is limited by He Jian’s available capacity. Moreover, the price of our silicon wafers fluctuates based on changes in available industry capacity. We do not have a long term supply contract with He Jian or any other contract foundry. Therefore, He Jian could choose to prioritize capacity for other customers, reduce or eliminate deliveries to us on short notice or increase the prices they charge us. Accordingly, we cannot be certain that He Jian or any other contract foundry will allocate sufficient capacity to satisfy our requirements. If we are unable to obtain foundry capacity as required, we may experience delays in

8

our ability to deliver our products, which would harm our relationships with our existing customers and result in decreased sales. There are additional risks associated with our reliance on third-party contractors, including:

| | • | | their inability to increase production and achieve acceptable yields on a timely basis; |

| | • | | reduced control over delivery schedules and product quality; |

| | • | | increased exposure to potential misappropriation of our intellectual property; |

| | • | | limited warranties on wafers or products supplied to us; |

| | • | | shortages of materials that foundries use to manufacture our products; |

| | • | | labor shortages or labor strikes; and |

| | • | | actions taken by our third-party contractors that breach our agreements. |

We may experience difficulties in transitioning to smaller process geometry technologies or in achieving higher levels of design integration, which may result in reduced manufacturing yields, delays in product deliveries and increased expenses.

We are currently transitioning our SoCs for portable media players from 0.18 microns to 0.16 microns in order to make sure we continue to satisfy our customers’ demands and to maintain our competitiveness. This transition requires us to redesign some products and integrated circuit designs that we use in multiple products, and will require our contract foundries to modify the manufacturing processes they use to produce our products. In addition, we will incur significant engineering costs and the attention of our engineering personnel will be diverted from other product development efforts during this transition. In the past, we have experienced some difficulties in shifting to smaller process geometry technologies or new manufacturing processes, which resulted in periods of reduced manufacturing yields, delays in product deliveries and increased expenses. We may face similar difficulties, delays and expenses as we continue to transition our products to smaller micron process geometry.

In addition, we will depend on our contract foundries to transition to smaller process geometries successfully. Our contract foundries may not be able to effectively manage this transition. If our contract foundries or we experience significant delays in this transition or fail to efficiently implement this transition, we could experience reduced manufacturing yields, delays in product deliveries and increased expenses, all of which could harm our relationships with our customers and our results of operations. As smaller process geometries become more prevalent, we expect to continue to integrate greater levels of functionality, as well as customer and third-party intellectual property, into our products. However, we may not be able to achieve higher levels of design integration or deliver new integrated products on a timely basis, or at all. Further, we cannot be sure that integrating greater functionality into an SoC will result in a corresponding increase in selling price.

Because our customers are able to change or cancel orders on relatively short notice, we could unexpectedly lose anticipated sales.

The lengthy product development periods for our products make forecasting the volume and timing of orders difficult. In addition, the delays inherent in lengthy product development periods raise additional risks that customers may cancel or change their orders. Because industry practice allows contract manufacturers and brand owners to reschedule or cancel orders on relatively short notice, backlog and customer forecasts are not always good indicators of our future sales. If customers reduce or cancel their orders, it could result in the loss of anticipated sales without allowing us sufficient time to reduce our inventory and operating expenses. Further, because our sales are made by means of standard purchase orders rather than long term contracts, our customers may not continue to purchase our products at current levels, or at all.

We depend on a few key customers for a substantial majority of our sales and the loss of, or a significant reduction in orders from, any of them would likely significantly reduce our revenues.

In 2004, 2005 and 2006, sales to our top five customers accounted for approximately 82%, 76% and 64%, respectively, of our revenues. Our operating results in the foreseeable future will likely continue to depend on

9

sales to a relatively small number of customers, as well as the ability of these customers to sell products that use our SoCs and solution development kits. Our revenues would likely decline if one or more of these customers were to significantly reduce, delay or cancel their orders for any reason. In addition, any difficulty in collecting outstanding amounts due from our customers, particularly customers who place large orders, would harm our financial performance.

Many of our key customers are value-added distributors, who integrate our products into a system platform and sell that system platform to contract manufacturers. We also sell some of our products directly to contract manufacturers. Growth in our business will depend on our ability to maintain and expand our relationships with both value-added distributor customers and contract manufacturer customers. However, some of our value-added distributor customers may also carry and sell product lines that are competitive with ours. As these customers are not required to maintain a specified minimum level of purchases from us, we cannot be sure that they will prioritize selling our products. As we continue to expand our sales capabilities, we will also need to manage the potential conflicts that may arise between us and our value-added distributor customers. Further, we rely on our customers to accurately and timely report to us their sales of our products and to provide certain engineering support services to the brand owners who market and distribute the end products to consumers. Our inability to obtain accurate and timely reports and to successfully manage these relationships would adversely affect our business and financial results.

If our products are not manufactured with satisfactory yields or quality, our sales could decrease, and our relationships with our customers and our reputation may be harmed.

Minor deviations in the semiconductor manufacturing process can cause substantial decreases in yields, and in some cases, cause production to be suspended. We establish a minimum yield with our foundries at the time our products are qualified. If actual yield at the foundry is below the minimum, the foundry incurs the cost of the wafers, and if actual yield is above the minimum, we incur the cost. However, the fact that a contract foundry is achieving minimum yields on a product does not mean that the yield is sufficient to allow us to maintain or increase our profits on that product. Further, even though if a contract foundry is responsible for yield losses we incur on a particular shipment of SoCs, these yield losses could cause us to delay shipments to our customers and damage our relationship with them.

The manufacturing yields for our new products tend to be lower initially and increase as the contract foundry achieves full production. For example, it took us nine months to increase the yield of our ATJ 2085 series SoCs from 67% in April 2004 to 90% in January 2005 and it took us one full month to increase the yield of our ACU 75 series SoCs from 68% to 86%. Our product pricing is based on the assumption that this increase in manufacturing yields will continue, even with the increasing complexity of our semiconductors. Shorter product life cycles require us to develop new products faster and require our contract foundry to manufacture these products in shorter periods of time. In some cases, these shorter manufacturing periods may not reach the high volume manufacturing periods conducive to higher manufacturing yields and declining costs. If our contract foundry fails to deliver fabricated silicon wafers of satisfactory quality in the volume and at the price required, we may be unable to meet our customers’ demand for our products or to sell those products at an acceptable profit margin, which would adversely affect our sales and margins and damage our customer relationships.

Our products are complex and may require modifications to resolve undetected errors or failures in our hardware and software, which could lead to an increase in our costs, a loss of customers or a delay in market acceptance of our products.

Our SoCs and total solutions are complex and may contain undetected hardware and software errors or failures when first introduced or as new versions are released. These errors could cause us to incur significant re- engineering costs, divert the attention of our engineering personnel from product development efforts and harm both our customer relations and business reputation. If we deliver products with errors, defects or bugs, our credibility and the market acceptance and sales of our products could be harmed. We experienced a small delay in gaining market acceptance of our ATJ 2097 series SoCs, due to the need to revise our design to correct problems with its processing speed and power consumption. We also experienced a delay in the introduction of

10

our 13 series SoCs, due to the need to revise a part of our design to integrate certain Universal Serial Bus features we acquired from third party. We provide warranties for product defects under which we must collect and replace defective goods upon receipt of notice from our customers. Increased claims under these warranties would increase our costs and adversely affect our profitability. Defects could also lead to liability as a result of lawsuits against us or against our customers.

Our principal contract foundry, other subcontractors and many of our customers are located in the Pacific Rim, an area subject to significant earthquake risk and adverse consequences related to the outbreak of SARS and other public health concerns.

The principal contract foundry that manufactures our products and all of the principal subcontractors that assemble, package, and test our products are located in either China, Hong Kong, or Taiwan. Many of our customers are also located in these areas. The risk of earthquakes, typhoons and other natural disasters in these Pacific Rim locations is significant. The occurrence of an earthquake or other natural disaster near our principal contract foundry or subcontractors could result in damage, power outages and other disruptions that impair their production and assembly capacity. Any disruption resulting from such events could cause significant delays in the production or shipment of our products until we are able to shift our manufacturing, assembling, packaging or production testing from the affected contractor to another third-party vendor. The 2003 outbreak of severe acute respiratory syndrome, or SARS, curtailed travel to and from certain countries (primarily in the Asia-Pacific region) and limited travel and consumer activities within those countries, which had a significant adverse effect on the economies of many countries in this region. Any future outbreaks of SARS or other public health concerns, such as the emergence of an avian influenza, could have similar consequences.

We may experience significant period-to-period quarterly and annual fluctuations in our revenues and operating results, which may result in volatility in our stock price.

We may in the future experience significant period-to-period fluctuations in our revenues and operating results. It is possible that our revenues and operating results in some quarters may be below market expectations, which would cause the value of our ordinary shares and ADSs to decline. Our quarterly and annual operating results are affected by a number of factors, including:

| | • | | the unpredictable timing and volume of purchase orders and cancellations from our customers; |

| | • | | the rate of acceptance of our products by our customers; |

| | • | | the rate of growth of the market for portable media players and our SoCs; |

| | • | | fluctuation and seasonality in demand for consumer electronics products; |

| | • | | increases in prices charged by contract foundries and other third-party subcontractors; |

| | • | | the availability of third-party foundry capacity; |

| | • | | the availability and pricing of other components used in our customers’ products; |

| | • | | fluctuations in our contract foundry’s manufacturing yields; |

| | • | | the difficulty of forecasting and managing our inventory and production levels; |

| | • | | our ability to successfully develop, introduce and sell new or enhanced products; |

| | • | | additions or departures of key personnel; |

| | • | | our involvement in litigation; |

| | • | | natural disasters, particularly earthquakes, or disease outbreaks, such as the recent outbreak of SARS, affecting countries in which we conduct our business or in which our products are manufactured, assembled, or tested; and |

| | • | | the evolution of industry standards and introduction of new products by our competitors. |

Any variations in our period-to-period performance may cause our stock price to fluctuate.

11

Because the markets in which we compete are highly competitive and many of our competitors have greater resources than us, we cannot be certain that our products will compete successfully and we may lose or be unable to gain market share.

We face competition from a relatively large number of competitors in China and internationally. In the portable media player market, our principal competitors include ALi, Broadcom, Philips Semiconductor, PortalPlayer, Samsung, SigmaTel, Sunplus, Rockchip, Telechips, and Texas Instruments. As we diversify and expand our product categories, we may also face competition from other semiconductor companies and manufacturers of consumer electronics and mobile devices. We expect to face increased competition in the future from our current and emerging competitors. In addition, some of our customers have developed and other customers could develop technology or products internally that could replace their need for our products or otherwise reduce demand for our products. Our customers may also enter into strategic relationships with or acquire existing semiconductor design houses.

The consumer electronics market, which is the principal end market for our SoCs, has historically been subject to intense price competition. In many cases, low cost, high volume producers have entered markets and driven down profit margins. If a low cost, high volume producer should develop products that are competitive with our products, our sales and profit margins would suffer.

Some of our potential competitors may have longer operating histories, greater name recognition, access to larger customer bases and significantly greater financial, sales and marketing, manufacturing, distribution, technical and other resources than us. As a result, they may be able to respond more quickly to changing customer demands or to devote greater resources to the development, promotion and sales of their products than we can. Our current and potential competitors may develop and introduce new products that will be priced lower, provide superior performance or achieve greater market acceptance than our products. In addition, in the event of a manufacturing capacity shortage, these competitors may be able to obtain capacity when we are unable to do so. Furthermore, our current or potential competitors have established, or may establish, financial and strategic relationships among themselves or with existing or potential customers or other third-parties to increase the ability of their products to address the needs of our prospective customers. Accordingly, it is possible that new competitors or alliances among competitors could emerge and rapidly acquire significant market share, which would harm our business. If we fail to compete successfully, our business will suffer and we may lose or be unable to gain market share.

Our business may be severely disrupted if we lose the services of our key executives and employees or fail to add new senior and mid-level managers to our management.

Our future success is heavily dependent upon the continued service of our board of directors and key executives. Our future success is also dependent upon our ability to attract and retain qualified senior and mid- level managers to our management team. If one or more of our key executives and employees are unable or unwilling to continue in their present positions, we may not be able to easily replace them, and our business may be severely disrupted. In addition, if any of these key executives or employees joins a competitor or forms a competing company, we could lose customers and suppliers and incur additional expenses to recruit and train personnel. We do not maintain life insurance for any of our key executives.

We also rely on a number of key technology staff for the operation of our company. Given the competitive nature of our industry, the risk of key technology staff leaving our company is high and losses of significant numbers of technology staff could disrupt our operations. Our inability to retain and attract qualified technical personnel in the future, or delays in hiring additional such personnel, could make it difficult to meet key objectives, such as timely and effective product introductions.

We may not be able to successfully execute future acquisitions or investments or manage or effectively integrate any acquired business, technologies or teams.

We seek to acquire or invest in businesses that are complementary to ours. This may require a significant commitment of management time, capital investment and other management resources. We cannot assure you

12

that we will be successful in identifying and negotiating acquisitions or investments on terms favorable to us. If we are unable to execute, manage or integrate our acquisitions and investments effectively, our growth, operating results and financial condition may be materially and adversely affected.

We have limited business insurance coverage and may be subject to losses that might not be covered by existing insurance coverage.

The insurance industry in China is still at an early stage of development. Insurance companies in China offer limited business insurance products. As a result, we do not have business liability or disruption insurance coverage for our operations. Any business disruption, litigation or natural disaster might result in substantial costs and diversion of resources.

Risks Related to Intellectual Property

We or our customers may be exposed to infringement claims on intellectual property rights by third-parties.

Third-parties, including our competitors, may in the future make claims or initiate litigation that assert patent, copyright, trademark and other intellectual property rights in technologies, related standards and product names that are relevant to us. As we continue to expand our operations and the number of products we manufacture, the risk of such claims may increase. In addition to making claims against us, third-parties may make claims against our customers that incorporate our SoCs into their products. Such actions could adversely affect our relationships with such customers and hurt our sales. The large number of patents in the semiconductor industry, the confidential treatment of some pending patent applications and the rapid rate of issuance of new patents make it neither economically feasible nor possible to determine conclusively in advance whether a product, any of its components, its method of manufacture or use, or its ornamental design, currently infringes or will in the future infringe upon the patent rights of others. Parties making infringement claims may be able to obtain an injunction that could prevent us from selling our products or using technology that contains the allegedly infringing intellectual property, which could have a material negative effect on our business. Third-parties making infringement claims may also be able to bring an action before the ITC that could result in an order stopping the importation into the United States of our products or bring similar actions in other parts of the world. Further, in addition to claims that may be made directly against us, we may be named in infringement actions made against our manufacturers, suppliers or customers. Some of our customer contracts provide that we indemnify the customer against claims of infringement based on our products. Regardless of the merit of these claims, they can be time-consuming, and result in costly litigation and divert the attention of our technical and management personnel.

To resolve any claims made against us, we may be required to develop alternative non-infringing technology or obtain a license for the relevant intellectual property, each of which could be costly and time consuming. Licenses may not be available to us on commercially reasonable terms and conditions, or at all. We might also be required to cease using the trademark or trademarks under which our products were being marketed and sold. If any infringement or other intellectual property-based claim made against us by any third-party is successful, or if we fail to develop non-infringing technology or license the proprietary rights on commercially reasonable terms and conditions, our business, financial condition and results of operations could be materially and adversely affected.

We rely upon third-party licensed technology to develop our products. If licenses of third-party technology do not continue to be available to us or become very expensive, our ability to develop and introduce new products could be negatively impacted.

We integrate third-party software or other licensed technology into almost all of our products. From time to time, we may be required to license additional technology from third-parties to develop new products or product enhancements. However, these third-party licenses may not be available to us on commercially reasonable terms or at all. Further, some of our existing licenses can be terminated without cause by the licensor. Our inability to maintain existing licenses on reasonable teams, or obtain additional licenses necessary to develop new products

13

and product enhancements, could require us to obtain substitute technology at a greater cost or of lower quality or performance standards or delay product development. Any of these results may limit our ability to develop new products that utilize the latest technologies, which could harm our business, financial condition and results of operations.

Our rights to the intellectual property we develop may be difficult to enforce.

We generally rely on patent, copyright, trademark, trade secret and other intellectual property laws to establish and protect the proprietary rights in our know-how, technology, products, and product names. As of December 31, 2006, we had filed five trademark applications, 21 invention patent applications and two utility model patent applications in China and had registered seven trademarks, one patent for utility model, nine invention patents, nine proprietary rights for integrated circuit design diagrams and two computer software copyrights in China. In addition, as of December 31, 2006, we had registered three trademarks in Hong Kong and filed five trademark applications in Hong Kong, Taiwan, European Union, Russia and India, respectively. The applications may not be granted, or if granted, may be challenged, invalidated, or circumvented by others. Further, we cannot be sure that any rights granted under patents, trademarks, copyrights or proprietary rights that are issued or registered will be sufficient to protect our technology or will in fact provide competitive advantages to us. If we are unable to protect the key intellectual properties that we develop and use in our products, our ability to compete effectively may be diminished.

From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources. Even where we take such actions, we cannot assure you that we will be successful or that our rights will be protected. Further, our headquarters and principal operations are located in China. Our efforts to protect our proprietary rights could be ineffective in China where the laws may not protect proprietary rights as effectively as do laws in other countries such as the United States.

Our intellectual property indemnification practices may adversely impact our business.

From time to time we may be required to indemnify our customers for certain costs and damages of patent and copyright infringement in circumstances where our product is the factor creating the customer’s infringement exposure. This practice may subject us to significant indemnification claims by our customers. Our products are designed for use in devices manufactured by our customers that comply with international standards, such as the MP3 standard. These international standards are often covered by patents or copyrights held by third-parties, which may include our competitors. Before we design our products, we discuss with our customers the proprietary technologies that we must incorporate into our SoCs and the international standards our SoCs must meet to function in the targeted portable media player products. We then obtain licenses required to incorporate each of those proprietary technologies into SoCs that meet these standards. The combined costs of identifying and obtaining licenses from all holders of patents and copyrights essential to such international standards could be high and could reduce our profitability or increase our losses. The cost of not obtaining such licenses could also be high if a holder of such patent or copyrights brings a claim for patent or copyright infringement. Any claims for indemnification that may be made could not have a material adverse effect on our business, financial condition and results of operations.

Risks Related to our Industry

Demand for our products is highly dependent on the consumer electronics market, which is characterized by short product life cycles and subject to risks related to product transitions and supply of other components.

We derive almost all of our revenues from a limited number of products that are used in consumer electronic devices. The consumer electronics market is characterized by intense competition, rapidly changing technology, and continuously evolving consumer preferences. These factors result in the frequent introduction of new products, short product life cycles and significant price competition. The dynamic nature of this market limits our, as well as our customers’, ability to accurately forecast quarterly and annual sales. If we or our customers are unable to manage product transitions, our business and results of operations could be negatively affected. In

14

addition, we are subject to the risk of supply problems for other components, such as flash memory, that our customers require for manufacturing the consumer end product. For example, if our customers are unable to obtain sufficient supplies of other key components in their portable media players, the sales of our products that are also used in such devices would be adversely affected. A decrease in demand for consumer electronics will also decrease demand for our products, which will adversely affect our business and results of operations.

The availability of digital media content may affect demand for our products.

The demand for portable media players may be adversely impacted by the enforcement of limits on file sharing and downloadable media content. The major record labels are pursuing ways to curb consumer downloading of music from the Internet without paying any fees or royalties to the owners of that music. In particular, the Recording Industry Association of America, a recording industry trade group, has sued numerous individuals for distributing copyrighted songs over the Internet. Most recently, the U.S. Supreme Court ruled that distributors of software for sharing music and video files may be held responsible for theft if their intent was to encourage users to illegally trade copyrighted files. This may cause websites offering such software to cease operating. If the record labels, other music or video producers, or other parties are successful in limiting the ability of consumers to obtain free music or videos on the Internet, the demand for consumer electronic devices such as portable media players that use our products may decline, which in turn could harm our business, financial condition and results of operations.

We are subject to the highly cyclical nature of the semiconductor industry.

The semiconductor industry is highly cyclical. The industry has experienced significant downturns, often in connection with, or in anticipation of, maturing product life cycles (of both semiconductor companies’ and their customers’ products) and declines in general economic conditions. These downturns have been characterized by production overcapacity, high inventory levels and accelerated erosion of average selling price. Any future downturns could significantly harm our sales or reduce our profitability for a prolonged period of time. From time to time, the semiconductor industry also has experienced periods of increased demand and production capacity constraints. We may experience substantial changes in future operating results due to semiconductor industry conditions, general economic conditions and other factors.

The industry standards supported by our products are continually evolving, and our success depends on our ability to adapt our products to meet these changing industry standards.

Our ability to compete in the future will depend on our ability to ensure that our products comply with changing industry standards.The emergence of new industry standards could render our products incompatible with products developed by our customers. As a result, we could be required to invest significant time and effort and to incur significant expense to redesign our products to ensure compliance with relevant standards. If our products do not comply with prevailing industry standards for a significant period of time, we could miss opportunities to achieve crucial product introductions. We may invest substantial effort and expense in developing or using new technologies or in developing new products or product enhancements, but such effort and expense may not result in market acceptance of our products.

Risks Related to Doing Business in China

Taiwan regulations and recent changes in the policies of the Investment Commission in Taiwan relating to the involvement of Taiwanese persons in companies that have direct and indirect investments in the PRC may limit our ability to retain certain employees and members of our management.

Pursuant to various Taiwan regulations promulgated by Taiwan’s Ministry of Economic Affairs, Investment Commission, or IC, no Taiwanese person or entity established under the laws of Taiwan, which we refer to as Taiwanese Persons, may invest, directly or indirectly, in a PRC entity unless the investment complies with certain regulations and policies relating to restrictions on investment and participation in investments in PRC companies, which we refer to as the PRC Investment Regulations, and is approved by the IC, or, in limited

15

circumstances, a report to the IC has been filed. Furthermore, the IC has prohibited investments by Taiwanese Persons in certain industries in the PRC, including the semiconductor design industry and certain sectors of the semiconductor manufacturing industry. Under the PRC Investment Regulations, if (A) a Taiwanese Person invests in a non-Taiwan entity, or NTE, that invests in a PRC entity, and (B) such Taiwanese Person has “control and influence” over the NTE, that Taiwanese Person will be deemed to have made an indirect investment in the PRC and must abide by the PRC Investment Regulations. According to a press release issued by the IC on June 14, 2005, a Taiwanese Person will be deemed to have control and influence over the NTE if (1) that Taiwanese Person holds more than 5% of the equity of the NTE or is the largest shareholder of the NTE; (2) the investment amount made by that Taiwanese Person in the NTE is over US$200,000; or (3) that Taiwanese Person acts as a director, supervisory director or president of the NTE. Taiwanese Persons who violate these regulations and policies may be subject to both civil and even criminal sanctions in Taiwan.

Certain of our employees and management, including our chief executive officer, are Taiwanese Persons. The Taiwan government may interpret its current regulations and policies, or the Taiwan government may change or amend its regulations and policies in this area, such that it considers one or more of our employees and management as having inappropriate control and influence. Such employee or manager, including our chief executive officer, could be required to leave the company or be subject to sanctions by the Taiwan Government.

A slowdown in the growth of the Chinese economy may slow down our growth and profitability.

Our business is primarily dependent upon the economy and the business environment in China. In particular, our growth strategy is based upon the assumption that demand in China for portable media players and portable media players, in particular, will continue to grow with the Chinese economy. However, the growth of the Chinese economy has been uneven across geographic regions and economic sectors. Several years ago, the Chinese economy also experienced deflation, which may reoccur in the foreseeable future. There can be no assurance that growth of the Chinese economy will be steady, uniform or that any slowdown will not have a negative effect on our business.

China’s legal system is characterized by uncertainty that could negatively impact our business and results of operations.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little value as precedent. Beginning in 1979, the PRC government promulgated a comprehensive system of laws and regulations governing economic matters, which has had the overall effect of significantly enhancing the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively new and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors. In addition, enforcement of existing laws, or contracts based on existing law, may be uncertain and sporadic, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The relative inexperience of China’s judiciary in many cases creates additional uncertainty as to the outcome of any litigation. Furthermore, interpretation of statutes and regulations may be subject to new government policies reflecting domestic political changes.

Our activities in China will be subject to administrative review and approval by various national and local agencies of the PRC government. Because of the changes occurring in China’s legal and regulatory structure, we may not be able to secure the requisite governmental approval for our activities. Failure to obtain the requisite governmental approval for any of our activities could adversely affect our business and results of operations.

Any recurrence of SARS or another widespread public health problem, such as the emergence of an avian influenza, could negatively impact our business and results of operations.

A renewed outbreak of SARS or another widespread public health problem in China and Hong Kong, where substantially all of our revenue is derived and where our operations are located, could have a negative effect on our operations. Our operations may be impacted by a number of health-related factors, including the following:

| | • | | quarantines or closures of some of our offices which would severely disrupt our operations; |

16

| | • | | the sickness or death of our key officers and employees; and |

| | • | | a general slowdown in the Chinese economy. |

Any of the foregoing events or other unforeseen consequences of public health problems could adversely affect our business and results of operations.

Changes in China’s political and economic policies could negatively impact our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject in a significant degree to the economic, political and legal developments in China. China’s economy has historically been a planned economy subject to governmental plans and quotas and has, in certain aspects, been transitioning to a more market-oriented economy. Although we believe that the economic reform and the macroeconomic measures adopted by the PRC government have had a positive effect on the economic development of China, we cannot predict the future direction of these economic reforms or the effects these measures may have on our business, financial position or results of operations. In addition, the Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD. These differences include:

| | • | | level of government involvement in the economy; |

| | • | | level of capital reinvestment; |

| | • | | control of foreign exchange; |

| | • | | methods of allocating resources; and |

| | • | | balance of payments position. |

As a result of these differences, our business may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Restrictions on foreign currency exchange may limit our ability to receive and use our revenues effectively.

Any future restrictions on currency exchanges may limit our ability to use revenues generated in Renminbi to fund our business activities outside China or to make dividend or other payments in U.S. dollars or other foreign currencies. Although the PRC government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents. In addition, remittance of foreign currencies abroad and conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi, especially with respect to foreign exchange transactions.

The discontinuation of any of the preferential tax treatments currently available to us in China could materially and adversely affect our business, financial condition and results of operations.

Currently, our principal PRC subsidiary, Actions Semiconductor Zhuhai, through which substantially all of our operations are conducted, enjoys preferential tax treatment, in the form of reduced tax rates or tax holidays, provided by the PRC government or its local agencies or bureaus. As a technology company operating in a designated economic zone, we benefit from a 15% preferential enterprise income tax rate, compared to a standard rate of 33%. In addition, we were granted an income tax exemption for the years ended December 31, 2004 and

17