UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Morgans Hotel Group Co.

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

On May 29, 2013, Morgans Hotel Group Co. (the “Company”) issued a press release containing a letter to the Company’s stockholders updating the stockholders on recent developments and urging them to vote for the Company’s director nominees at the Company’s 2013 annual meeting of stockholders. The letter is being mailed to the Company’s stockholders. A copy of the press release is set forth below.

MORGANS HOTEL GROUP BOARD BEST POSITIONED TO MAXIMIZE SHAREHOLDER VALUE

OTK’s “Plan” Doesn’t Add Up

OTK Attempting to Seize Control without Paying a Control Premium

NEW YORK, May 29, 2013 — Morgans Hotel Group Co. (NASDAQ: MHGC) (“MHG” or the “Company”) today issued a letter to shareholders in connection with its 2013 Annual Meeting scheduled to be held on June 14, 2013.

The text of the May 29 letter follows:

Dear Fellow Morgans Hotel Group Shareholder:

YOUR VOTE IS IMPORTANT – VOTE THE WHITE PROXY CARD TODAY

Your vote at the June 14, 2013 Morgans Hotel Group Annual Meeting is critical to the future of your investment.

Your Board of Directors and management have executed a focused strategy to position Morgans Hotel Group Co. (“Morgans” or the “Company”) for significant and accelerated growth and profitability. Morgans’ Board of Directors (“Board”) is committed to pursuing the path that maximizes value for shareholders and exploring all alternatives to do so. This strategy has received strong endorsement from independent Wall Street analysts.

Among other actions, Morgans’ Board and management have:

| | • | | Successfully executed its strategy to transition Morgans into an “asset-light” platform to accelerate growth in fees and profitability; |

| | • | | Successfully developed a robust pipeline of potential attractive new hotel management deals that we expect will dramatically grow the Company; |

| | • | | Created a high-return business model with significant profit leverage, allowing us to scale with limited capital investments; |

| | • | | Proposed a deleveraging transaction that would significantly improve a burdensome and complex balance sheet and capital structure; and |

| | • | | Delivered recent positive financial results that demonstrate our strategy is working. |

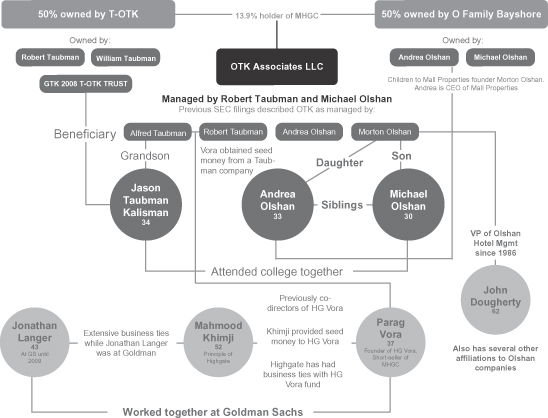

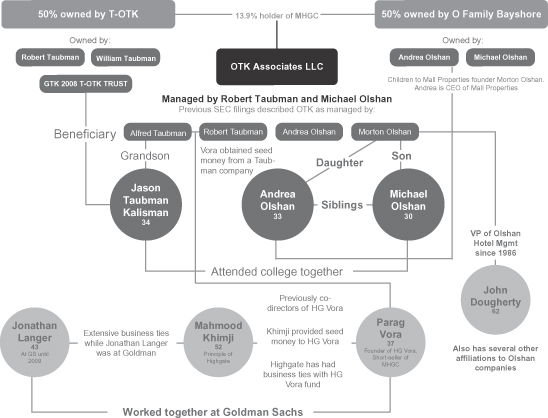

Unfortunately, a dissident shareholder named OTK Associates LLC (“OTK”) has launched a campaign to block us from executing our value-creation strategy and to take control of Morgans’ Board at our 2013 Annual Meeting. We strongly believe that the nominees put forward by OTK are under-qualified, have conflicts of interest and will be unable to exercise independent judgment due to their close affiliations with OTK and the Olshan and Taubman families. We believe OTK is seeking control of the Board to achieve its own objectives – objectives that may not be aligned with those of all Morgans shareholders. We urge you not to be misled by OTK’s self-serving statements and instead look at OTK’s questionable actions.

Consider the facts:

| | • | | OTK is attempting to take control of the Company with a proposed board that is beholden to OTK and the Taubman and Olshan families that control it without paying any premium to shareholders. |

1

| | • | | OTK has sought to derail a deleveraging transaction that would significantly improve Morgans’ highly leveraged balance sheet, remove obstacles for growth and provide greater flexibility to pursue strategic alternatives. |

| | • | | OTK has offered no credible plan to address Morgans’ significant balance sheet and capital structure challenges. |

| | • | | OTK has offered a flimsy attempt at a business plan that does not add up, fails to address the challenges of our capital structure, and demonstrates their lack of experience in the boutique hotel segment in which Morgans operates. |

| | • | | Three of OTK’s nominees are young members of the Olshan and Taubman families with virtually no experience outside of the family business interests. |

| | • | | One of OTK’s nominees manages a fund that is a recent short-seller and day-trader in Morgans stock. |

| | • | | Another OTK nominee runs a company that previously made a proposal to take over the operations of Morgans’ hotel assets. |

| | • | | OTK’s nominees have little public company board experience – and no experience at all representing public, non-affiliated shareholders. |

Your vote on the WHITE PROXY CARD will help ensure that Morgans has a Board of Directors focused on advancing our positive momentum and creating the most value for all Morgans shareholders. By supporting the Morgans director nominees and signing and dating the WHITE PROXY CARD, you can ensure that you have directors on the Board committed to considering the interests of all Morgans shareholders, not just a single shareholder with a self-serving agenda.

VOTE THE WHITE PROXY CARD TODAY. You may vote by telephone, by Internet, or by signing, dating and returning the enclosed WHITE PROXY CARD in the postage-paid envelope provided.

MORGANS IS IMPLEMENTING A CLEAR PLAN TO GROW SHAREHOLDER VALUE

When the new leadership team of Morgans was appointed by the Board two years ago, we had a collection of properties operating under 11 different names, and roughly half of our properties were owned directly by the Company. This new management team, selected by the Board, was brought in with over 74 years of experience specific to the hotel industry.

Under the direction and supervision of the Board, this new team articulated a clear strategy to establish an “asset light” platform for accelerated growth in fees and profitability, to reduce our risk profile and to enhance our position as a global leader in lifestyle hospitality management. Specifically, we outlined plans to:

| • | | Expand our higher-margin brand and management business globally in key gateway cities and luxury resort destinations under three core brands – Delano, Mondrian and Hudson; |

| • | | Invest in our product and service offerings to enhance operating performance at our existing portfolio of hotels and the attractiveness of our brands; |

| • | | Invest in our infrastructure and organization to enable us to scale our management business with minimal increase in our overhead cost base; and |

| • | | Divest real estate assets to fund our expansion and to improve our risk profile by reducing debt and preferred securities. |

The goal of this strategy is to dramatically improve the cash flow and profit potential of the Company, thereby creating new opportunities for maximizing value for shareholders.

2

Two years later, we have executed on this strategy, successfully taking important steps in our transition from an owner-operator of hotels to a global brand and management company with significant potential to rapidly grow.

| • | | We have signed eight hotel contracts that will virtually double the size of our portfolio. |

| • | | We have completed major investments in our people, food and beverage offerings and physical product to increase room rates, hotel revenues and profits and enhance asset values. |

| • | | We have invested in the scalability of our infrastructure so that the vast majority of fee revenue from the signed hotel agreements in our pipeline will flow directly through to EBITDA and cash flow. |

| • | | We have achieved great execution of asset sales generating $341 million in proceeds at an average price per key of approximately $611,000. |

| • | | We have reduced our consolidated debt by a total of $129 million primarily through these real estate divestitures. |

OUR ROBUST DEVELOPMENT PIPELINE OFFERS BUILT-IN GROWTH AND LONG-TERM POTENTIAL

Our team has increased the number of existing new hotel agreements and cultivated a deep pipeline of prospective deals in various stages of development that we believe will dramatically grow the Company.

| • | | Three of these hotels will open in 2014 (Delano Las Vegas, Mondrian Doha and Mondrian London), another three will open in 2015 (Delano Moscow, Mondrian Bahamas, and Hudson London) and another two will open in 2016 (Delano Cesme and Mondrian Istanbul). |

| • | | We have signed Letters of Intent or are in advanced discussions in attractive markets including Los Angeles, Rio de Janeiro, Berlin, Amsterdam, Paris, Barcelona, Istanbul, Dubai, Sydney, Melbourne, Delhi, Goa, Costa Rica, and Cartagena. |

| • | | Our pipeline of prospective deals is the strongest it has ever been. |

WE HAVE BUILT A HIGH-RETURN ECONOMIC MODEL WITH A CLEAR PATH TO SIGNIFICANT GROWTH IN FEES AND CASH FLOW

Our operational and economic model presents significant opportunity to create value for shareholders.

| • | | We currently are targeting signing two to four new hotel agreements per year; we announced four in 2012. These agreements are long-term contracts with 15-20 year durations plus renewals. These agreements will provide base fees and chain service reimbursements on managed hotels plus incentive fees and license fees on selected hotels. |

| • | | These new hotel deals require limited capital investments and we expect them to provide contractual, high-margin revenue streams over 15 to 20 years excluding extension options. We believe these agreements will yield a three- to four-year payback on upfront invested capital. |

| • | | We have invested in our scalable infrastructure to support a growing and significantly larger portfolio of properties. As a result, we believe the cash flow conversion from the new hotel agreements we have signed will be as high as 90 per cent going forward. |

| • | | We are creating a high-returning, self-funding business with recurring revenues for our shareholders with a very attractive return on investment. |

| • | | With projected growth in fees from our 12 existing hotels, fees from the eight deals already signed and under construction, and additional fees from our near-term pipeline, we believe we have substantial built-in growth that, with the right funding, could take us to $50-60 million of stabilized run-rate gross fees and $25-35 million of free cash flow per year by 2015. |

3

RECENT FINANCIAL RESULTS DEMONSTRATE THAT OUR STRATEGY IS WORKING

Our recent financial results show that we are gaining traction and are beginning to reap the benefits of the investments we have made. In the first quarter of 2013, we reported:

| • | | Strong topline growth:RevPAR at our System-wide Comparable Hotels was up 17 percent in Q1, which isthe highest rate of growth since the first quarter of 2007 and the highest among major hotel operator competitors; at our Non-Comparable hotel, Hudson, room revenue was up 42 percent and RevPAR was up 39 percent in Q1. |

| | ¡ | | In the fourth quarter of 2012, RevPAR at System-wide Comparable Hotels was also strong, up 7.2%%. |

| | ¡ | | In addition, trailing 12 month RevPAR from Comparable Hotels through March 31, 2013 was up 8.4% and April 2013 was up 11%. |

| • | | Improved margins on existing hotels:Margins at our owned hotels – which include Delano, Hudson, and Clift – were up over 1,000 basis points in Q1 2013; at all hotels, gross operating margins grew 570 basis points in Q1. |

| • | | High-single-digit increase in third-party fees: Gross fees from third parties, excluding one-time items, were up 9 percent in Q1. |

| • | | Improved productivity and expenses: Labor productivity improved 12.5% in rooms and 7.6% in Food and Beverage; total corporate expenses decreased by 3.5% excluding the Light Group; despite increases in revenues, management salaries declined 2.5% year-over-year. |

THE GOAL OF OUR STRATEGY IS TO MAXIMIZE THE COMPANY’S VALUE AND APPEAL

We are fully aware of the potential strategic and financial outcomes for a company like Morgans and have been focused on positioning the Company for the greatest amount of value creation possible.

Comparable transactions in the industry underscore the value creation opportunity in executing on our strategy. In October 2012, Marriott acquired the Gaylord brand and hotel management company for $210 million. The Gaylord acquisition included:

| | • | | A 10x multiple paid for Base Fees |

| | • | | An 8x multiple paid for Base plus estimated Incentive Fees |

| | • | | A bidding war among four major hotel operators |

We believe that the level of interest from potential buyers would increase if the deleveraging transaction were to be consummated. Our Board and management team believe that we need to address the complex balance sheet and capital structure in order to have the flexibility to pursue all available options to maximize shareholder value.

4

OTK IS RECKLESSLY IGNORING SERIOUS OBSTACLES TO GROWTH AND VALUE MAXIMIZATION THAT MUST BE ADDRESSED URGENTLY

Notwithstanding our success to date executing on our strategic plan, our balance sheet and risk profile still present serious obstacles to growth and value maximization. We have an over-levered balance sheet that restricts flexibility to finance new investments and grow the business.

| | • | | We have approximately $400 million of debt maturing in less than 18 months including key money obligations, which is an urgent and significant issue that restricts our ability to tap capital markets and grow our management business. |

| | • | | Yucaipa, our largest creditor and holder of preferred securities and warrants holds consent rights over selling the Company or substantially all of its assets in certain circumstances. The preferred shares are worth $100 million today, and will grow to $137 million in 2016, with the interest rate stepping up to 20% in 2016. |

| | • | | Importantly, if OTK’s slate of director nominees are elected and they do not put Yucaipa’s nominee on the Board, the interest rate on the preferred securities increases by another 400 basis points and would bring the balance of the preferred stock to $157 million in October 2016. |

| | • | | Yucaipa also holds outstanding warrants to purchase 12.5 million shares at $6 per share. |

| | • | | In addition, we currently need to raise equity capital to successfully and responsibly drive growth. |

Our Board and management know what needs to be done to address these challenges. Importantly, the Company needs to deal with Yucaipa, our largest creditor and the holder of preferred stock, the warrants and consent rights, to restructure our debt and simplify our capital structure.That is simply a fact that OTK cannot ignore. A special transaction committee of your Board explored alternatives and negotiated with Yucaipa for over 15 months to reach an agreement to address these issues. However, OTK has interfered with a proposed transaction that we believe offered the clearest and cleanest path to shareholder value creation.

Our Board and management have been and continue to be focused on addressing these issues and are best placed to pursue all alternatives to maximize value for all shareholders.

By contrast, OTK casually suggests that these debt maturities and other instruments can be dealt with at some undefined point in the future. OTK says it would explore strategic alternatives but has not explained how it would do so if it had not first addressed Yucaipa’s debt, securities and consent rights. Furthermore, OTK’s strategy of publicly attacking Yucaipa and its principals with vitriol and personal attacks does not strike us as a prudent business strategy knowing that the Company has to address many of the instruments that this significant debt holder possesses.

Our Board and management know from experience that it is not prudent to wait until the Company is little more than a year away from major debt maturities to address refinancing or restructuring.

5

MORGANS’ BOARD HAS BEEN FOCUSED ON EXPLORING OPTIONS TO ADDRESS THESE ISSUES AND DRIVE SHAREHOLDER VALUE

A special transaction committee, which consisted of directors who had no affiliation with Yucaipa - including OTK representative Jason Taubman Kalisman - was formed in December 2011 and considered a proposed deleveraging transaction with Yucaipa as well as other value-maximizing alternatives.

| • | | The special transaction committee retained its own independent financial and legal advisors. |

| • | | On the recommendation of the special transaction committee, the Company retained Jones Lang LaSalle, a leading real estate broker, to run a formal, broad marketing process to sell Delano South Beach. |

| • | | 180 potential investors were contacted during the Delano South Beach sale process. |

| • | | Offers received to buy Delano South Beach were significantly lower than the implied value of the hotel in the proposed deleveraging transaction, and significantly lower the $194 million that OTK suggests it could get in a sale. |

MORGANS ANNOUNCED A PROPOSED DELEVERAGING TRANSACTION THAT WOULD ADDRESS THESE BALANCE SHEET AND GOVERNANCE ISSUES

Upon completion of a 15-month review process by the special transaction committee, working with Greenhill & Co. as its independent financial advisor, we announced a proposed deleveraging transaction in April 2013 that has the potential to significantly reduce debt, improve flexibility and raise needed capital for growth.

| • | | Significantly reduce debt:It would reduce our consolidated debt and preferred securities, excluding capital leases, to $322 million from $557 million today, a reduction of $235 million. |

| • | | Significantly improve our maturity profile: It would eliminate $118 million of debt that would have matured in 2014 and $137 million of preferred stock and accrued dividends that would have effectively matured in 2016 by stepping up to a high dividend rate of 20 percent. This would include the elimination of $38 million in future accrued dividends. |

| • | | Eliminate potential share dilution:It would eliminate the overhang of potential share dilution by canceling long-term warrants to purchase 12.5 million common shares at $6 per share until April 2017, and also eliminating roughly 2 million shares convertible under The Light Group note at $9.50 per share. |

| • | | Eliminate corporate governance restrictions:Importantly, it would remove restrictive consent rights over certain major decisions, including a sale of the Company or substantially all of its assets, under certain circumstances, thereby increasing the Board’s critical flexibility to continue to pursue alternatives to enhance value for all shareholders. |

| • | | Secure long-term management agreement: As a part of the proposed transaction, Morgans would also receive a new long-term management contract on Delano South Beach. |

| • | | Raise capital for growth: The proposed rights offering would provide us with approximately $62 million of additional cash to execute our growth plan and also for working capital and general corporate purposes. |

6

INDEPENDENT WALL STREET ANALYSTS AGREE THE PROPOSED TRANSACTION WOULD SWIFTLY ADDRESS BALANCE SHEET ISSUES, PROVIDE CAPITAL FOR GROWTH AND CREATE SHAREHOLDER VALUE1

MKM Partners, May 28, 2013:

“Proposed Deleveraging Transaction is Positive. This deal has the power to be transformative and would represent a major step toward an asset light future with an improved leverage and simplified financials.”

JMP Securities, May 1, 2013:

“…Perhaps most importantly, the transaction will lift consent rights over decisions, including the sale of the entire company or asset2s. MHGC is proving that it is committed to building shareholder value; just two years ago, the company had 13 properties (~50% owned) operating under 11 different brands and a complicated balance sheet.”

Credit Suisse, April 30, 2013:

“We are constructive on the company’s proposed deleveraging transaction as we see MHGC getting fair value for Delano (including LT a management contract) and Light Group (a business that was likely non-core and served its purpose for the duration it was held)…ongoing shareholder litigation may delay this transaction…”

Sidoti, April 30, 2013:

“MHGC’s proposed Delano sale and rights offering would significantly improve the company’s debt load. The transaction also would eliminate warrants, simplifying MHGC’s capital structure and therefore making the shares more appealing to investors, in our view.”

MKM Partners, April 23, 2013:

“In the proposed Yucaipa transaction, Morgans Hotel Group trades the Delano…and TLG…for a simplified balance sheet, significantly reduced leverage.”

OTK IS LETTING PERSONAL EMOTIONS GET IN THE WAY OF SHAREHOLDER VALUE

OTK appears to oppose the proposed deleveraging transaction on the basis of the transaction counterparty rather than on any substantive basis. That OTK is against the proposed deleveraging transaction is clear. Its reasons for opposing the proposed transaction are unclear; its primary, if not sole, complaint seems to be that the proposed transaction is with Yucaipa, of which OTK appears deeply resentful for reasons that are unrelated to what is the best interests of the Company or our shareholders.

It is telling that OTK and Jason Taubman Kalisman threatened the proxy contest only after the Company did not agree to make Kalisman chairman of our Board upon his request. Before launching the proxy contest, Mr. Kalisman was lobbying the governance committee for a second seat on the board for OTK, as well to be named chairman of the Company. The governance committee was willing to recommend However, only when Mr. Kalisman was told that he would not get chairmanship of the Board did he and OTK threaten a proxy contest.

1 Permission to quote or use the statements herein has not been sought or obtained from any party.

7

OTK’s most recent claim is that Morgans is “swapping valuable assets at below-market prices, which only accelerates debt payments.” This assertion is not supported by the facts or the record. In addition, even though Jason Taubman Kalisman, OTK’s representative on the special transaction committee, was aware of the fundamentals of the proposed deleveraging transaction while the committee considered its options, OTK is only raising this supposedly below market-based allegation now. In fact, the implied valuation for the Delano hotel in the proposed deleveraging transaction has been reported by independent sell-side analysts at “one million dollars per key,” which is far in excess of the bids obtained by Jones Lang LaSalle, the broker hired in 2012 to market the Delano.

OTK’s main discontent appears to be directed at Yucaipa, and particularly OTK’s highly misleading claim regarding Yucaipa’s ability potentially to acquireup to 32% of our common stock in the proposed rights offering or after, which OTK equates to a sale of the Company.

However, there is no basis for assuming that Yucaipa will actually acquire anything close to 32% of Morgans common stock in the proposed rights offering or otherwise.

PROPOSED TRANSACTION AND RIGHTS OFFERING WAS DESIGNED TO REDUCE YUCAIPA’S CONTROL AND LIMIT YUCAIPA’S OWNERSHIP

The rights offering was specifically designed to reduce the likelihood and ability of Yucaipa acquiring a significant percentage of our common stock. As noted, Yucaipa does not get one share if the proposed rights offering is fully subscribed by our existing shareholders or other third parties who acquire rights. Even if Yucaipa does acquire a significant number of shares in the rights offering or afterward, it is likely to end up with much less than 32% of our common stock. The proposed rights offering is for $6 per share, below the recent trading prices for Morgans common stock. That fact, coupled with the features of the rights offering designed to increase participation in the rights offering—the 50% oversubscription feature and the transferability of the rights – makes it more likely that the rights offering would be significantly if not fully subscribed. Similarly, after the proposed rights offering, Yucaipa would have up to a year to purchase up to 32% of our common stock — a feat we believe is unlikely due to the trading blackout periods applicable to Yucaipa and our relatively low trading volumes. Any attempt by Yucaipa to buy such a large block in the open market during the year following the proposed rights offering would likely drive the trading price for Morgans common stock higher, benefitting all shareholders.

More importantly, OTK conveniently fails to mention that, as part of the proposed transaction, Yucaipa is relinquishing its extensive contractual rights it currently holds through its debt, preferred securities, warrants and other instruments. OTK also fails to acknowledge that Yucaipa agreed to contractual standstill provisions which prevent Yucaipa from controlling or attempting to gain control of Morgans – in contrast to OTK’s own attempt to take control of our Board.

Given the design of the rights offering and these restrictions on Yucaipa, it seems to us misleading at best to try to compare the proposed rights offering at $6 per share to a sale of the Company requiring a control premium, as OTK does in its recent press release. OTK has suggested that the proposed rights offering at $6 per share is itself a sale of control to Yucaipa at a discount to an informal non-binding $7.50 per share unsolicited proposal for the purchase of the entire Company. That assertion is preposterous. In fact, given recent trading levels, we believe it is more likely that OTK will be able to buy more shares in the rights offering than Yucaipa.

8

Further, on May 17, 2013, Yucaipa publicly proposed that OTK join in backstopping the proposed rights offering and suggested amending other terms of the proposed deleveraging transaction including to reduce the size of the offering and to allow OTK to buy shares in the rights offering before such shares would be available to Yucaipa, a proposal which the Board is currently reviewing. OTK has offered no response regarding this potentially constructive proposal, instead continuing to oppose the proposed transaction without offering any explanation, alternative or plan.

In addition to offering OTK participation in the backstop, it is important to clarify that Yucaipa has consistently said that the backstop was at the Company’s option, and if there were an alternative, it would be equally happy not to do it.

OTK DOES NOT HAVE A CREDIBLE PLAN TO CREATE VALUE FOR SHAREHOLDERS

While OTK is taking steps to block the proposed deleveraging transaction, OTK has not presented an alternative strategic financial plan to show how it would deal with the balance sheet and create value for shareholders. Its failure to present a plan demonstrates that its slate of nominees is not in a position to oversee the strategic development of Morgans for the benefit of all shareholders. While OTK seeks to prevent the proposed deleveraging transaction from being consummated, it has not presented to shareholders any credible plan, other than offering to use their “relationships” to meet the pressing challenges that Morgans faces.

OTK stated in its preliminary proxy statement that its slate of directors will evaluate strategic alternatives, but in the absence of consummation of the proposed deleveraging transaction, Morgans will continue to be constrained by its complex balance sheet and restrictive consent rights attached to Yucaipa’s preferred securities and warrants.

OTK’s own statements made on May 28, 2013 about the state of the Company’s balance sheet showcase their superficial understanding of the Company and simply do not add up. As of May 16, 2013, the Company had $557 million of debt and preferred securities excluding capital leases with $500 million due in the next three years. In addition, the Company has approximately $60 million of commitments to new projects and $37 million of future accrued dividends on the preferred securities due through 2016 (which increases to $57 million if Yucaipa does not have a board seat). OTK’s presentation suggests that they would sell assets they value at $608.5 million to deal with the maturities and obligations with no additional equity capital. There are several flaws with their analysis and incorrect assumptions:

| | • | | There is significant execution and market risk in selling luxury hotel assets. |

| | • | | There is a long lead time in selling luxury hotel assets. |

| | • | | A sale of substantially all assets may require Yucaipa’s consent under certain circumstances. |

| | • | | A sale of substantially all assets could trigger accelerated maturity of the $50.1 million of trust preferred securities under certain circumstances. |

| | • | | Their plan provides for no capital for growth. |

| | • | | Their plan provides for insufficient working capital. |

We believe OTK has not offered any credible solution to these challenges because it does not have a credible alternative. If in fact OTK and their family partnership would like to take control of the Company, we would encourage them to make an offer that is fair for all shareholders.

9

OTK’S OWN TRACK RECORD UNDERMINES ITS CREDIBILITY

OTK’s own track record of voting and actions highlights a series of unexplainable contradictions that undermine its credibility.

| • | | Jason Taubman Kalisman, OTK’s current representative on the Board, supported the Company’s strategy of transitioning to an asset-light business model. |

| • | | OTK was offered the opportunity to participate in the backstopping of the proposed rights offering associated with the proposed deleveraging transaction, but it chose not to do so. |

| • | | In March 2013, before the proposed deleveraging transaction was signed, Jason Taubman Kalisman, OTK’s representative on the Board and the special transaction committee, suggested he had a superior alternative to the transaction. The special transaction committee asked him urgently to describe his supposed alternative and he declined. |

| • | | While OTK now complains about Yucaipa’s presence on the Board and potential to become a significant shareholder, at a special shareholders meeting on January 28, 2010, OTK (along with 87% of our shareholders) voted to allow the original deal between Yucaipa and Morgans to proceed, including the full exercise of warrants by Yucaipa, up to a 39% level of ownership. |

| • | | Jason Taubman Kalisman, OTK’s representative on the Board, supported the Board’s decision to reject a November 2012 proposal to buy the Company for $7.50 per share. |

| • | | While OTK now complains about the Company’s compensation program, OTK voted in favor of the Company’s say-on-pay proposal in both 2011 and 2012. Importantly, during his entire tenure on the Board, Jason Taubman Kalisman voted in favor of all compensation decisions made by the Board. |

| • | | OTK claims in the first sentence of its letter to shareholders, dated May 23, 2013, that it has “never sold a single share” since it first bought stock at approximately $15.20 per share more than five years ago. However, its May 20, 2013, filing with the Securities and Exchange Commission reveals that the hedge fund owned by Parag Vora, one of OTK’s proposed directors, has been actively buying and selling, and frequently shorting, Morgans stock for the last two years. |

In addition, OTK entered Morgans stock at an average cost of approximately $15.20 per share, raising questions about 3whether its interests are aligned with other shareholders who may support a sale of the Company or other strategic transaction at a value below $15.20 per share. We are also concerned that OTK would not consider a sale at a price that would publicly show a large loss on its sole investment.

OTK’S PROPOSED SLATE IS AN INTERCONNECTED GROUP OF FAMILY, FAMILY EMPLOYEES AND FAMILY FRIENDS THAT IS DEEPLY CONFLICTED

Turning control of the Board over to OTK’s proposed slate of nominees risks turning control of the Board over to OTK and the Olshan and Taubman families. FIVE of the SEVEN hand-picked OTK nominees are closely affiliated with OTK and the families that control OTK: two are young Olshan family members (ages 30 and 33); one is a long-time employee of an Olshan family business; one is a young Taubman family member (age 34); and one is the owner of a hedge fund where the Taubmans are an important investor. This same hedge fund recently disclosed significant short-selling and trading in Morgans’ common stock. In fact, there is not one person on OTK’s proposed slate that does not have a prior personal, business or family relationship with someone else on their slate.

| • | | Michael Olshan, age30, isbrother of co-nominee Andrea Olshan andson of Morton and Carole Olshan. |

| | ¡ | | Michael Olshan is a manager of OTK and is also identified as an investor in OTK. |

10

| | ¡ | | Mr. Olshan has no prior public company experience. |

| • | | Andrea Olshan, age33, is thesister to co-nominee Michael Olshan and thedaughter of Morton and Carole Olshan. |

| | ¡ | | Ms. Olshan is also identified as an investor in OTK. |

| | ¡ | | Similar to her brother, Ms. Olshan has no public company experience, and her only listed employment experience is with the Olshan family mall business. |

| • | | Jason Taubman Kalisman, age34, is the current OTK representative on the Morgans Board. Hisgrandfather is A. Alfred Taubman, the founder of Taubman Centers, Inc. |

| | ¡ | | Jason Taubman Kalisman is described as a founder of OTK; however in reality he was beneficiary of a family trust that is a part owner of OTK. |

| • | | John Dougherty, age62, has been the Vice President and Director of Olshan Hotel Management, anOlshan family business that operates a small number of hotels, since 1986. |

| | ¡ | | Dougherty has several other affiliations with Olshan companies including: Dougherty was listed as the registered agent for Marco Beach Hotel Inc., a Florida company belonging to Morton Olshan and Dougherty was also listed as the vice president of hotels for Mall Properties on the company’s website. |

| • | | Parag Vora, age37, is the founder and portfolio manager of HG Vora Capital Management, a hedge fund that is an active trader and short-seller of Morgans stock. |

| | ¡ | | Mr. Vora has direct business ties to Mahmood Khimji, another OTK nominee. Mr. Khimji has been a minority shareholder of HG Vora since its formation, an investor in the HG Vora funds and a director of HG Vora funds from 2009 to 2012. |

| | ¡ | | The Taubman family is an investor in HG Vora. |

| | ¡ | | According to OTK’s proxy statement (disclosed in Annex B, pages B-2 and B-3), HG Vora executed more than 100 transactions in the Company’s stock including many day-trades and short-sells. |

| • | | Jonathan Langer, age43, a former Goldman, Sachs real estate executive formerly responsible for overseeing the firm’s proprietary real estate investment effort. |

| | ¡ | | Mr. Langer has business ties to Khimji and his firm Highgate Holidings as a previous director of ACEP, which had multiple related party dealings with Highgate. |

| | ¡ | | During previous employment, Langer also had extensive business dealings with Mahmood Khimji and Highgate. |

| | ¡ | | Langer’s sole public company board experience has been representing his then-employer, Goldman Sachs. His longest board tenure was at Colony Resorts LVH Acquisitions LLC, owner of the Las Vegas Hilton; he was a director from 2006 to fourth quarter 2009. |

| | ¡ | | The Whitehall Street Real Estate Funds, for which Mr. Langer had shared responsibility during his time with Goldman, announced a write down of $2.1 billion of the $3.7 billion invested between May 2007 and August 2008. American Casino & Entertainment Properties LLC, where Mr. Langer was a director (and the initial investment into which Mr. Langer had championed in February 2008), posted a net loss of $31.4 million in 2009. Mr. Langer departed Goldman soon after this loss in 2009 to “pursue other opportunities”. |

| • | | Mahmood Khimji, age52, co-founder and principal of Highgate Holdings, a private hotel company. |

| | ¡ | | Highgate previously made a proposal to take over the operations of Morgans hotel assets. |

| | ¡ | | In addition to being a shareholder, investor and director of HG Vora, Khimji has long-standing business ties to Jonathan Langer and currently shares office space with HG Vora. Mr. Khimji’s firm, Highgate Holdings, had consulting agreements with two public |

11

| | companies – American Casino & Entertainment Properties LLC and Colony Resorts LVH – while Langer was a director of these companies in 2009. |

The Olshan and Taubman families have been doing business and investing together for generations. According to an April 2013 Wall Street Journal article, “OTK’s origins go back four decades, when Mr. Olshan’s father, Mort Olshan, and Taubman family patriarch, A. Alfred Taubman, built the Fair Oaks Mall in Fairfax, Va. The next generation now oversees OTK, with Michael Olshan and Robert Taubman as managing principals.”

The family and business ties that crisscross OTK’s slate are astounding. It is hard to imagine how OTK even remotely characterizes this slate of nominees as “independent.” Whether or not they satisfy the definition of independence under Nasdaq rules, they hardly appear independent of their nominating shareholder, the owner of just 13.9% of our total outstanding shares.

Five of seven of OTK’S director nominees also have no public company board or executive experience – and no experience representing public (non-affiliated) shareholders.

Morgans’ Board does not believe turning control over to this slate of nominees, a majority of whom are closely affiliated with, or directly a part of, the Taubman and Olshan families, and none of whom have public company board experience other than when representing affiliated shareholders, is in the best interests of all shareholders.

12

OTK WANTS TO TAKE CONTROL OF MORGANS WITH THEIR FAMILY PARTNERSHIP…WITHOUT PAYING ANY PREMIUM TO SHAREHOLDERS

OTK is attempting to take control of the Company with a board that is beholden to their family partnership without paying a premium or any other compensation to shareholders.

By nominating a slate of seven directors, including a majority of four nominees that are either family members or employees of the families behind OTK, it is clear OTK is attempting to take control of the Company to achieve its own objectives but without appropriately compensating shareholders.

MORGANS’ SLATE OF QUALIFIED DIRECTORS WILL REMAIN FOCUSED ONMAXIMIZING VALUE FOR ALL SHAREHOLDERS

Our director nominees are focused on maximizing value for all shareholders through continuing to grow our higher-margin brand and management business and exploring strategic alternatives.

Our slate comprises six nominees, all currently serving on the Board, who have extensive experience in branding, lifestyle hospitality management and boutique hotels.

The Board will continue to explore opportunities to unlock the value of Morgans’ iconic real estate assets, right-size our balance sheet and re-allocate capital to our higher-margin brand and management business

| | | | | | |

Director | | Age | | Experience | | Brings to the Board |

Michael Gross | | 37 | | • Our CEO since 2011 • Under Mr. Gross’ leadership, Morgans has expanded its brand and management business in countries around the world, invested in the Company’s product, infrastructure and service offering, and sold real estate to strengthen the balance sheet • Prior research and investment experience including: Prentice Capital Management, S.A.C. Capital Advisors, LLC, Lehman Brothers Inc., Salomon Smith Barney and Granite Partners • B.S. from Cornell University’s School of Hotel Administration | | • Expertise in the real estate and investment industries, experience as an analyst of public companies in the retail, consumer and real estate industries • Public company board experience |

13

| | | | | | | | |

Ron Burkle | | | 60 | | | • Managing Partner and Founder of The Yucaipa Companies, a private investment firm | | • Experience as a successful businessman and investor, and founder of The Yucaipa Companies • Experienced real estate and hotel investor • Public company board experience |

Robert Friedman | | | 57 | | | • Numerous senior executive positions at communications and marketing companies, including AOL Time Warner • MBA from Columbia University | | • Experience in the media, communications and marketing industries, which provide a valuable resource to keep the Morgans brand competitive in the boutique hotel industry |

Jeffrey Gault | | | 67 | | | • Currently CEO of Americold, a privately-owned REIT • More than 30 years of experience in real estate development and investment activities including senior management roles • Licensed architect | | • Extensive background in architecture, real estate development and construction, including hotel projects, as well as his expertise in investment and financial accounting matters |

Thomas Harrison | | | 65 | | | • Current chairman of Diversified Agency Services (a division of Omnicom Group), which provides a broad range of marketing communication services • Previously served as co-chairman of the New York Chapter of the U.S. Olympic Committee | | • Financial expertise and a wealth of entrepreneurial experience in the communications and marketing industries |

Michael Malone | | | 59 | | | • Currently serves as a director of public companies: Nationstar Mortgage Holdings and Walker & Dunlop, Inc. • Managing Director of Fortress Investment Group LLC • Retired from Bank of American with over 24 years in investment banking, including real estate, gaming, lodging, leisure and the financial sponsors businesses | | • Valuable experience and expertise in the financial and real estate industries • Public company board experience |

YOUR VOTE IS IMPORTANT - NO MATTER HOW MANY SHARES YOU OWN - MAKE YOUR VOICE HEARD - PLEASE VOTE THE WHITE PROXY CARD TODAY

We are seeking your vote FOR the highly qualified and experienced Morgans director nominees. These nominees have a proven track record of executing on the Company’s strategy while at the same time actively pursuing options to maximize shareholder value.

14

Your vote is critical to ensure Morgans’ Board can maximize value forall shareholders.

Whether or not you plan to attend the Annual Meeting, you have the opportunity to protect your investment by promptly voting the WHITE PROXY CARD. We urge you to vote today by telephone, by Internet, or by signing, dating and returning the enclosed WHITE PROXY CARD in the postage-paid envelope provided.

On behalf of the Board of Directors, we thank you for your continued support.

Sincerely,

Michael Gross

Chief Executive Officer

ABOUT MORGANS HOTEL GROUP

Morgans Hotel Group Co. (NASDAQ: MHGC) is widely credited as the creator of the first “boutique” hotel and a continuing leader of the hotel industry’s boutique sector. Morgans Hotel Group operates Delano in South Beach and Marrakech, Mondrian in Los Angeles, South Beach and New York, Hudson in New York, Morgans and Royalton in New York, Shore Club in South Beach, Clift in San Francisco, Ames in Boston and Sanderson and St Martins Lane in London. Morgans Hotel Group has ownership interests or owns several of these hotels. Morgans Hotel Group has other property transactions in various stages of completion, including Delano properties in Las Vegas, Nevada; Cesme, Turkey and Moscow, Russia; Mondrian properties in London, England; Istanbul, Turkey; Doha, Qatar and Baha Mar in Nassau, The Bahamas; and a Hudson in London, England. Morgans Hotel Group also owns a 90% controlling interest in The Light Group, a leading lifestyle food and beverage company. For more information please visit www.morganshotelgroup.com.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

This press release may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, among other things, the operating performance of our investments and financing needs. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue” or other similar words or expressions. These forward-looking statements reflect our current views about future events, including the proposed deleveraging transaction, the proposed rights offering and related proposed transactions, and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ materially from those expressed in any forward-looking statement. Important risks and factors that could cause our actual results to differ materially from those expressed in any forward-looking statements include, but are not limited to economic, business, competitive market and regulatory conditions such as: a sustained downturn in economic and market conditions, both in the U.S. and internationally, particularly as it impacts demand for travel, hotels, dining and entertainment; our levels of debt, our ability to refinance our current outstanding debt, repay outstanding debt or make payments on guaranties as they may become due, our ability to access the capital markets and the ability of our joint ventures to do the foregoing; our history of losses; our ability to compete in the “boutique” or “lifestyle” hotel segments

15

of the hospitality industry and changes in the competitive environment in our industry and the markets where we invest; our ability to protect the value of our name, image and brands and our intellectual property; risks related to natural disasters, terrorist attacks, the threat of terrorist attacks and similar disasters; and other risk factors discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which was filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2013, as amended by the Form 10-K/A filed on April 30, 2013, and other documents filed by the Company with the SEC from time to time. In particular, on May 14, 2013, the Delaware Court of Chancery entered an order, among other things, prohibiting the Company from taking any steps to consummate the proposed deleveraging transaction until the earlier of a trial on the merits of the pending action or a decision by our Board of Directors with respect to the proposed deleveraging transaction made at a properly noticed meeting after due deliberation and after receiving a favorable recommendation from the special transaction committee. Given the Delaware Court’s ruling, there is substantial uncertainty as to the status of the agreements related to the proposed deleveraging transaction. We cannot provide any assurance as to whether, or when and on what terms, the proposed deleveraging transaction will be considered or consummated. See the Company’s definitive 2013 proxy statement, filed with the SEC on May 23, 2013, for more detail. All forward-looking statements in this press release are made as of the date hereof, based upon information known to management as of the date hereof, and the Company assumes no obligations to update or revise any of its forward-looking statements even if experience or future changes show that indicated results or events will not be realized.

IMPORTANT ADDITIONAL INFORMATION

On May 23, 2013, the Company filed a definitive proxy statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2013 Annual Meeting of Stockholders. Stockholders are strongly advised to read the Company’s 2013 proxy statement because it contains important information. Stockholders may obtain a free copy of the 2013 proxy statement and other documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at www.morganshotelgroup.com.

CONTACTS

Investors:

Richard Szymanski, Morgans Hotel Group Co., (212) 277-4188

Richard H. Grubaugh, D.F. King & Co., Inc., (212) 493-6950,RGRUBAUGH@dfking.com

Media:

Lex Suvanto or Neil Maitland, Abernathy MacGregor, (212) 371-5999LEX@abmac.com or NAM@abmac.com

# # #

16

Important Additional Information and Where to Find It

On May 23, 2013, the Company filed a definitive proxy statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2013 Annual Meeting of Stockholders. Stockholders are strongly advised to read the Company’s 2013 proxy statement because it contains important information. Stockholders may obtain a free copy of the 2013 proxy statement and other documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at www.morganshotelgroup.com.