UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Morgans Hotel Group Co.

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

On May 30, 2013, Morgans Hotel Group Co. (the “Company”) made a presentation to Institutional Shareholder Services. A copy of the presentation is set forth below.

COMMITTED TO DELIVERING SHAREHOLDER VALUE

May 2013

|

Forward Looking Information and Cautionary Statements |

MORGANS HOTEL GROUP

This presentation may contain certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, among other things, the operating performance of our investments and financing needs. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue” or other similar words or expressions. These forward-looking statements reflect our current views about future events, including the proposed Deleveraging Transaction, the proposed rights offering and related proposed transactions, and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ materially from those expressed in any forward-looking statement. Important risks and factors that could cause our actual results to differ materially from those expressed in any forward-looking statements include, but are not limited to economic, business, competitive market and regulatory conditions such as: a sustained downturn in economic and market conditions, both in the U.S. and internationally, particularly as it impacts demand for travel, hotels, dining and entertainment; our levels of debt, our ability to refinance our current outstanding debt, repay outstanding debt or make payments on guaranties as they may become due, our ability to access the capital markets and the ability of our joint ventures to do the foregoing; our history of losses; our ability to compete in the “boutique” or “lifestyle” hotel segments of the hospitality industry and changes in the competitive environment in our industry and the markets where we invest; our ability to protect the value of our name, image and brands and our intellectual property; risks related to natural disasters, terrorist attacks, the threat of terrorist attacks and similar disasters; and other risk factors discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, which was filed with the Securities and Exchange Commission (the “SEC”) on March 6, 2013, as amended by the Form 10-K/A filed on April 30, 2013, and other documents filed by the Company with the SEC from time to time. In particular, on May 14, 2013, the Delaware Court of Chancery entered an order, among other things, prohibiting the Company from taking any steps to consummate the proposed Deleveraging Transaction until the earlier of a trial on the merits of the pending action or a decision by our Board of Directors with respect to the proposed Deleveraging Transaction made at a properly noticed meeting after due deliberation and after receiving a favorable recommendation from the special transaction committee. Given the Delaware Court’s ruling, there is substantial uncertainty as to the status of the agreements related to the proposed Deleveraging Transaction. We cannot provide any assurance as to whether, or when and on what terms, the proposed Deleveraging Transaction will be considered or consummated. See the Company’s definitive 2013 proxy statement, filed with the SEC on May 23, 2013, for more detail. All forward-looking statements in this press release are made as of the date hereof, based upon information known to management as of the date hereof, and the Company assumes no obligations to update or revise any of its forward-looking statements even if experience or future changes show that indicated results or events will not be realized.

2

Table of Contents

MORGANS HOTEL GROUP

| | |

Chapter Title I. Executive Summary II. Clear and Demonstrated Path to Grow Value Clearly defined “asset-light” model Successful execution III. Steps Taken to Address Complicated Risk Profile Independent and thorough review process Proposed Deleveraging Transaction directly addresses risk profile IV. OTK Associates’ Director Nominees Not Aligned with Shareholder Interests OTK lacks a credible alternative to create shareholder value OTK Associates’ track record undermines its credibility OTK Associates’ slate is an interrelated group of families and friends OTK Associates is seeking to take control without paying a premium V. Morgans’ Slate of Qualified Directors Significant experience Our Board of Directors values good corporate governance and responsiveness to shareholders | | Page

4 5

13

20

33 |

3

MORGANS HOTEL GROUP

• Morgans’ Board and its management team are executing a focused strategic plan to position the Company for growth and increased profitability

• The Company recently explored and pursued the proposed “Deleveraging Transaction” to address a complex and over-levered balance sheet and significant corporate governance restrictions in order to enable the Company to explore all alternatives to maximize shareholder value

• The proposed Deleveraging Transaction provides a clear path forward, reducing the Company’s risk profile to enable the Company to achieve its growth plan and have the flexibility to maximize shareholder value

• OTK Associates, LLC (“OTK”) has launched a campaign to take complete control of the Company without a premium and has sought to block the Company’s ability to pursue the proposed Deleveraging Transaction

• OTK has failed to provide a credible and detailed plan to maximize shareholder value and is proposing a board to benefit the Olshan and Taubman families by nominating a slate of interrelated family, family employees, and family friends, including a day trader and short seller in Morgans’ stock

By initiating a proxy fight with no viable “plan,” OTK has sought to take control of the Company without paying a control premium and hamper the ability of the Company to successfully execute its strategic plan and restructure the balance sheet and corporate governance restrictions to position itself for the exploration of all alternatives to maximize shareholder value

4

II. Clear and Demonstrated Path to Grow Value

5

MORGANS HOTEL GROUP

In 2011, under the direction and supervision of the Board, our new management team articulated a clear strategic plan:

1. Expand our brand and management business globally in key gateway cities and luxury resort destinations under three core brands – Delano, Mondrian and Hudson

2. Invest in our product and service offerings to enhance operating performance at existing hotels and the attractiveness of our brands

3. Invest in our infrastructure and organization to create a scalable management business that can grow with minimal increase in our overhead cost base

4. Divest real estate assets to fund our expansion and to improve our risk profile

6

|

Successful Execution to Date |

MORGANS HOTEL GROUP

1. Expand our brand and management business globally

2. Invest to enhance operating performance and the attractiveness of our brands

3. Invest to create a scalable management business

4. Divest real estate to fund expansion and improve risk profile

Signed 8 management agreements over the past two years

Developed robust pipeline of new deals

Successfully completed the refurbishment of owned and managed hotels to bolster room rates and enhance asset values

Added operational infrastructure capable of supporting significantly larger management platform

Sold Mondrian Los Angeles, Royalton, Morgans and our 50% equity interests in the Sanderson and St. Martins Lane hotels – retaining long-term management contracts for each hotel

7

Highly Scalable Infrastructure Providing Significant Operating Leverage

MORGANS HOTEL GROUP

• Highly scalable infrastructure, providing significant operating leverage

• Fully-revamped marketing, sales, technology, F&B revenue management, HR and training platforms

• Upgraded senior operations team and global sales force

Through the above improvements in our infrastructure, 90% of incremental fees will flow through to the bottom line

Scalable Infrastructure

| | | | | | | | |

First Class Food & Beverage Platform | | Core Expertise in Design, Marketing and Special Events | | State of the Art Technology and Systems | | New Senior Operations Team | | Experienced Executive Leadership Team |

8

|

Creating Shareholder Value - Our Detailed Economic Model |

MORGANS HOTEL GROUP

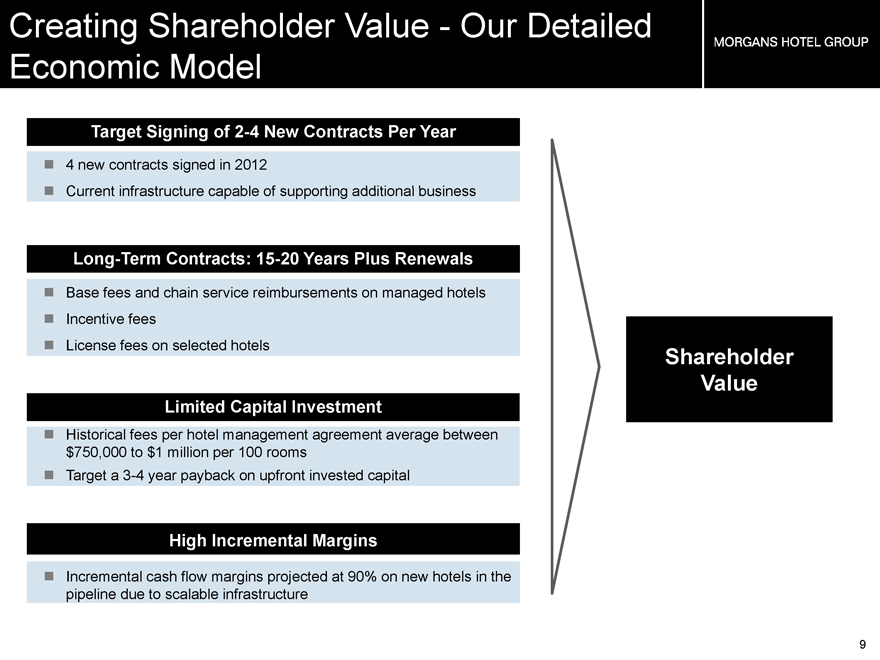

Target Signing of 2-4 New Contracts Per Year

• 4 new contracts signed in 2012

• Current infrastructure capable of supporting additional business

Long-Term Contracts: 15-20 Years Plus Renewals

• Base fees and chain service reimbursements on managed hotels• Incentive fees• License fees on selected hotels

Limited Capital Investment

• Historical fees per hotel management agreement average between $750,000 to $1 million per 100 rooms• Target a 3-4 year payback on upfront invested capital

High Incremental Margins

• Incremental cash flow margins projected at 90% on new hotels in the pipeline due to scalable infrastructure

Shareholder Value

9

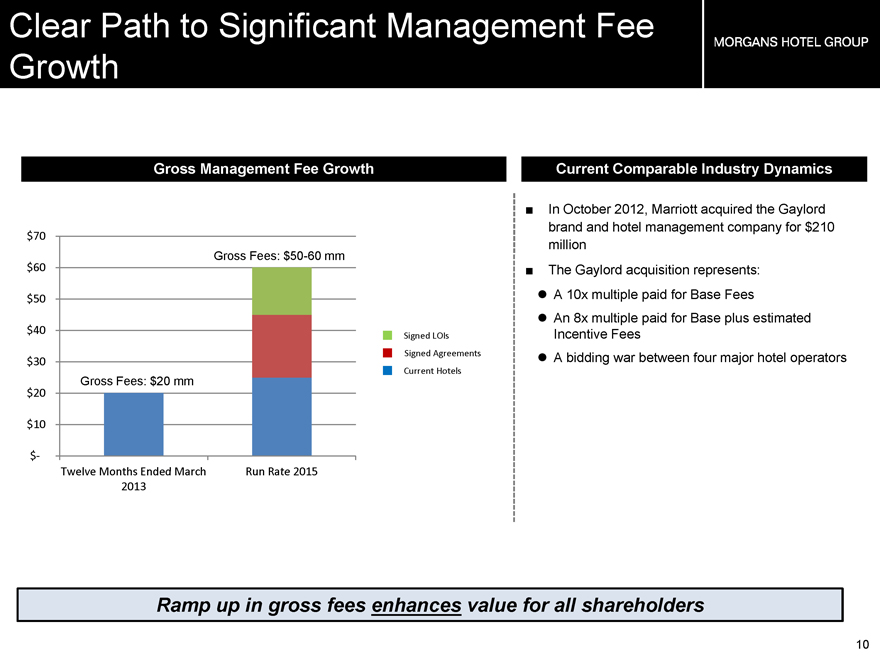

Clear Path to Significant Management Fee Growth

MORGANS HOTEL GROUP

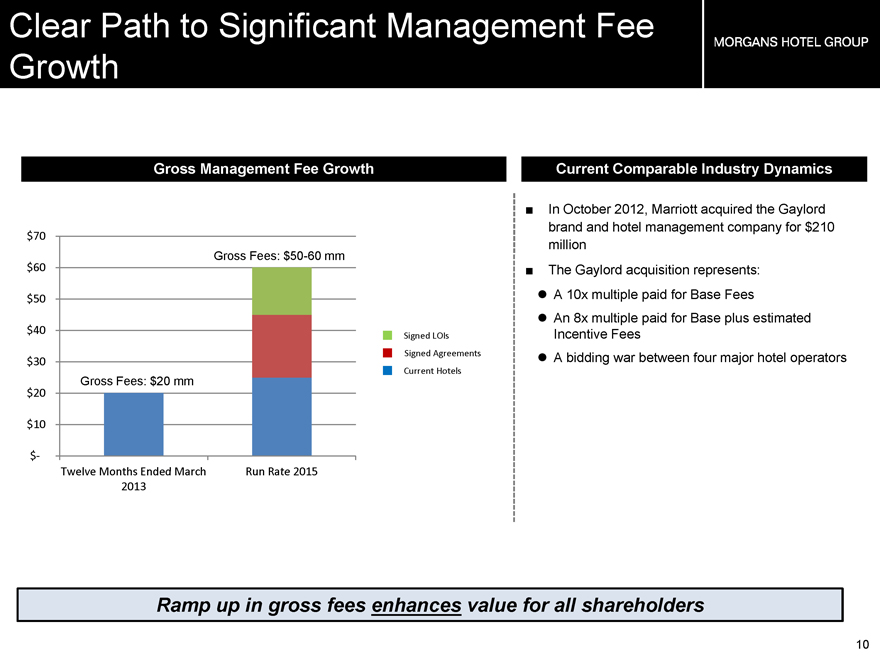

Gross Management Fee Growth

| | | | | | |

$ 70 $60 $50 $40 $30 1 $20 $10 | | Gross Fees: $20 mm | | Gross Fees: $50-60 mm | | Signed LOIs Signed Agreements Current Hotels |

$- Twelve Months Ended March 2013 Run Rate 2015 Current Comparable Industry Dynamics

• In October 2012, Marriott acquired the Gaylord brand and hotel management company for $210 million

• The Gaylord acquisition represents:

• A 10x multiple paid for Base Fees

• An 8x multiple paid for Base plus estimated Incentive Fees

• A bidding war between four major hotel operators

Ramp up in gross fees enhances value for all shareholders 10

|

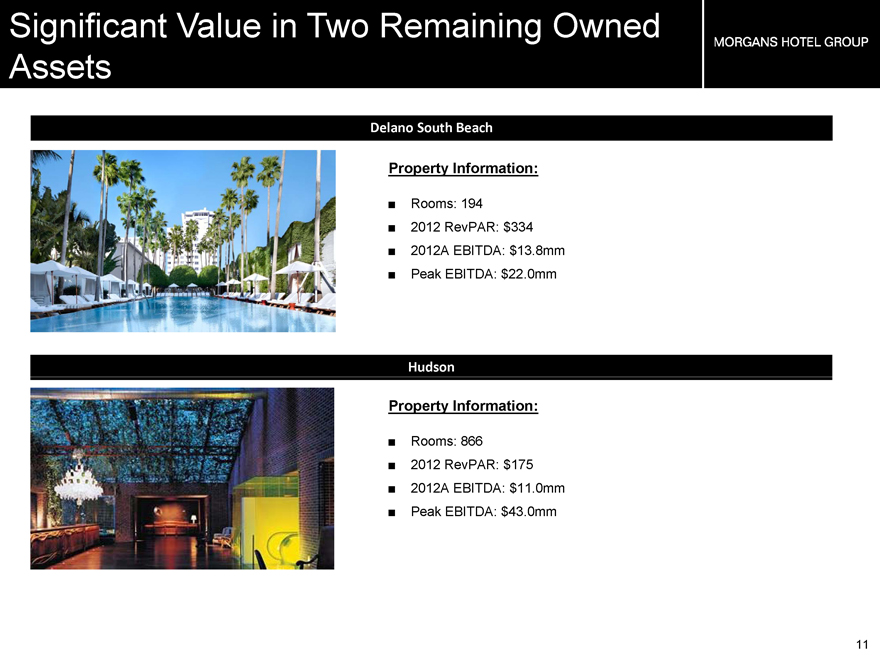

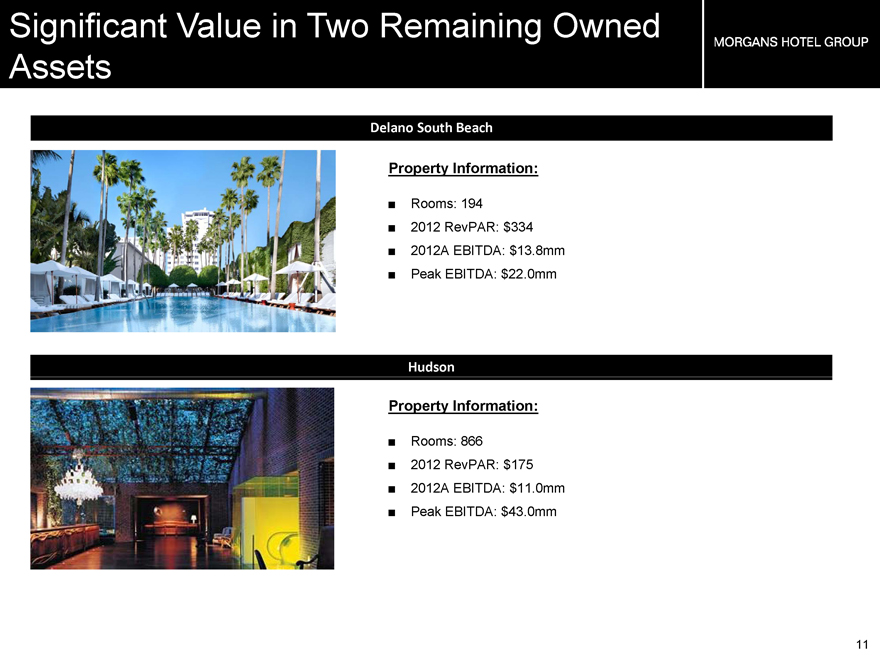

Significant Value in Two Remaining Owned Assets |

MORGANS HOTEL GROUP

Delano South Beach

Property Information:

• Rooms: 194

• 2012 RevPAR: $334

• 2012A EBITDA: $13.8mm

• Peak EBITDA: $22.0mm

Hudson

Property Information:

• Rooms: 866

• 2012 RevPAR: $175

• 2012A EBITDA: $11.0mm

• Peak EBITDA: $43.0mm

11

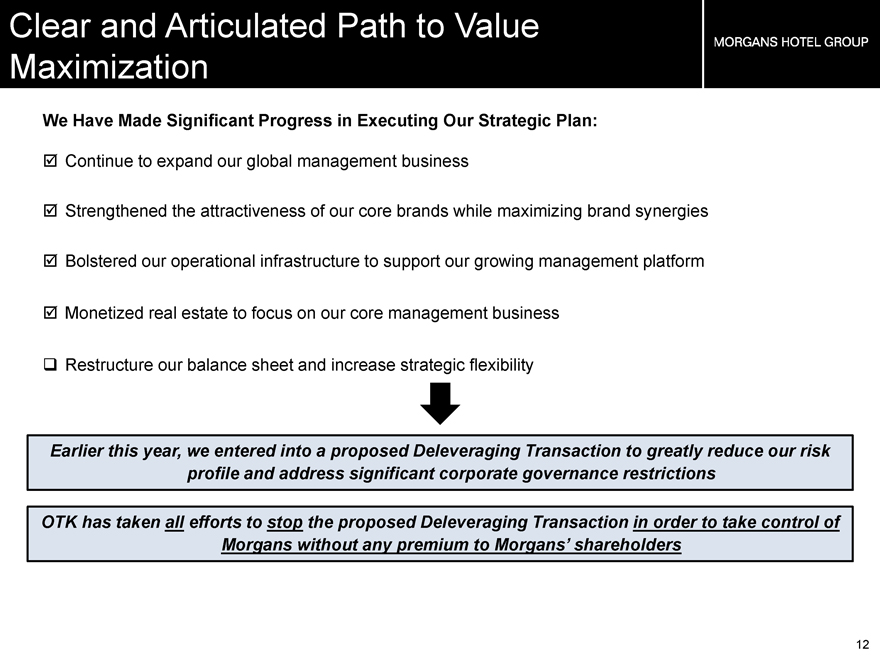

Clear and Articulated Path to Value Maximization

MORGANS HOTEL GROUP

We Have Made Significant Progress in Executing Our Strategic Plan:

Continue to expand our global management business

Strengthened the attractiveness of our core brands while maximizing brand synergies

Bolstered our operational infrastructure to support our growing management platform

Monetized real estate to focus on our core management business

Restructure our balance sheet and increase strategic flexibility

Earlier this year, we entered into a proposed Deleveraging Transaction to greatly reduce our risk profile and address significant corporate governance restrictions

OTK has taken all efforts to stop the proposed Deleveraging Transaction in order to take control of Morgans without any premium to Morgans’ shareholders

12

MORGANS HOTEL GROUP

III. Steps Taken to Address Complicated Risk Profile

13

Complicated Risk Profile

MORGANS HOTEL GROUP

Our Board is Focused on Addressing Complicated Corporate Risk Profile

Over-Levered Balance Sheet

Limits shareholders’ participation in anticipated EBITDA growth

Restricts flexibility to finance new investments and focus on core businesses

Corporate Governance Restrictions

Through its ownership in the preferred securities and warrants, Yucaipa has restrictive consent rights over certain major decisions, including a sale of the Company or substantially all of its assets, under certain circumstances

Additional Equity Capital to Successfully and Responsibly Drive Growth

Management business development requires capital to effectuate the growth plan (key money, cash flow guarantees, etc.)

Morgans’ current Board is best positioned to pursue all alternatives to maximize value for all shareholders

14

Board Focused on Enhancing Shareholder Value

MORGANS HOTEL GROUP

A special transaction committee of directors with no affiliation with Yucaipa, including OTK representative Jason Taubman Kalisman, was formed in December 2011 and considered the proposed Deleveraging Transaction and other value-maximizing alternatives

The special transaction committee was chaired by two independent Directors – Michael Malone and Tom Harrison – neither of whom had a prior relationship with Morgans’ current management team or Yucaipa

The special transaction committee retained its own independent financial advisor, Greenhill & Co., and independent legal advisor

On the recommendation of the special transaction committee, the Company retained Jones Lang LaSalle, a leading real estate broker, to run a formal, broad marketing process to sell Delano South Beach

180 potential investors were contacted during the Delano South Beach sale process

Several preliminary offers were received by LaSalle and reviewed with the special transaction committee

Preliminary offers received were significantly lower than the implied value of the hotel in the proposed Deleveraging Transaction and significantly lower than the $194mm that OTK suggested it could get in a sale

Greenhill & Co. rendered an opinion as to the fairness of the transaction

The implied valuation of Delano South Beach under the proposed Deleveraging Transaction is superior to all offers received in the marketing process and would address complicated balance sheet and corporate governance issues

15

Benefits of Proposed Deleveraging Transaction

MORGANS HOTEL GROUP

Significantly Reduce Debt

Through the proposed Deleveraging Transaction, Morgans would transfer Delano South Beach and The Light Group to Yucaipa in exchange for the elimination of:

$88 million of convertible notes due in 2014

All preferred stock and accrued dividends, with an aggregate value of $99 million – effectively maturing in 2016 by stepping up to a high dividend rate of 20%

Morgans’ obligations under the $18 million convertible promissory notes due to the minority owners of The Light Group and the related guarantee would be eliminated

Significantly improves the maturity profile

Eliminate Dilutive Warrants and Important Corporate Governance Restrictions

Yucaipa would surrender 12.5 million warrants to buy common stock at $6.00 per share, which expire in April 2017

Would eliminate Yucaipa’s consent rights (over certain major decisions, including a sale of the company or substantially all of its assets under certain circumstances)

Would significantly increase critical flexibility to continue to pursue alternatives to enhance value for all shareholders

OTK seeks to stop this value maximizing transaction and offers no alternative solution

16

Benefits of Proposed Deleveraging Transaction (cont.)

MORGANS HOTEL GROUP

Secure Long-Term Management Agreement

As part of the proposed Deleveraging Transaction, Morgans also would receive a new, long-term management contract on Delano South Beach and $6.5 million in cash

Rights Offering to Raise Capital for Growth

The proposed Deleveraging Transaction would include a rights offering through which existing shareholders can purchase their proportionate share of $100 million of new MHGC stock at $6.00 per share

Each right would carry a 50% over-subscription right and be transferrable

Yucaipa has agreed to fully backstop the Rights Offering at $6.00 per share with no fee

We would use approximately $40 million of proceeds to retire the Delano South Beach revolver, and the majority of the remaining $55 million to invest in new hotel agreements

Backstop unlikely to be significantly utilized due to current trading prices and design of the rights offering

OTK has not identified any plan to address Yucaipa’s consent rights regarding the exploration of strategic alternatives if it were to control Morgans

17

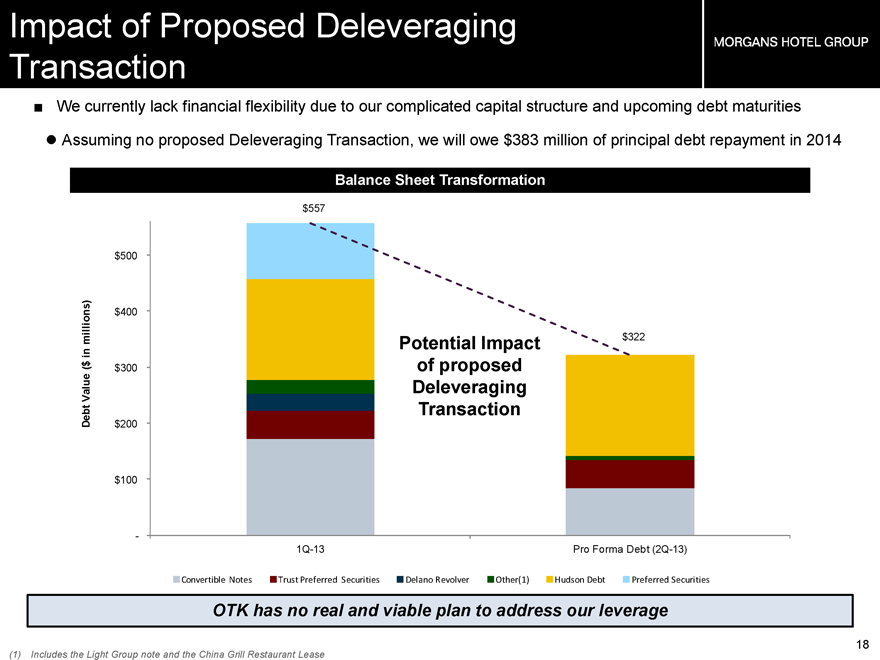

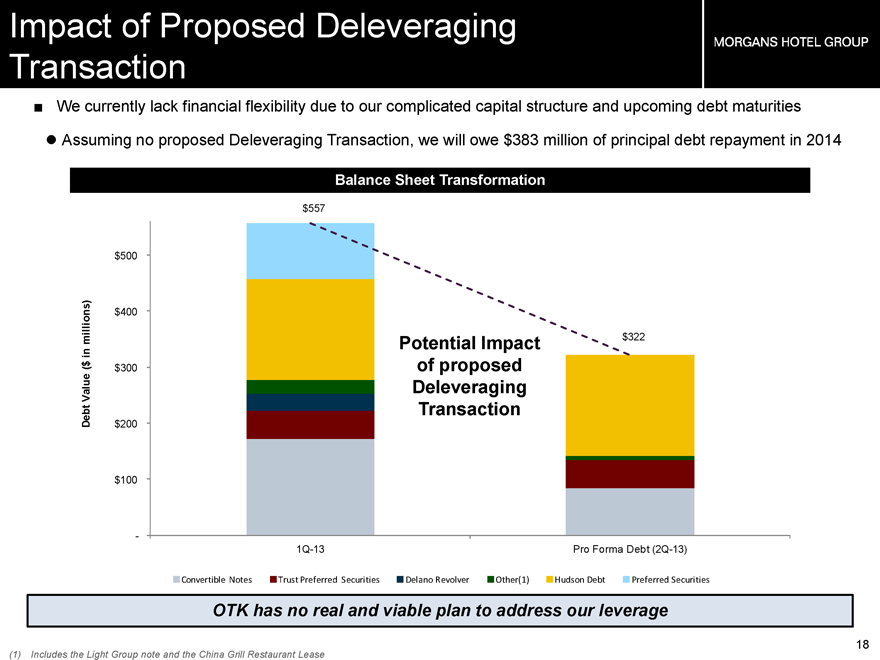

Impact of Proposed Deleveraging Transaction

MORGANS HOTEL GROUP

We currently lack financial flexibility due to our complicated capital structure and upcoming debt maturities

Assuming no proposed Deleveraging Transaction, we will owe $383 million of principal debt repayment in 2014

Balance Sheet Transformation

Debt Value ($ in millions)

$ 557

$500

$400

Potential Impact of proposed Deleveraging Transaction

$322

$300

$200

$100

-

1Q-13 Pro Forma Debt (2Q-13)

Convertible Notes Trust Preferred Securities Delano Revolver Other(1) Hudson Debt Preferred Securities

OTK has no real and viable plan to address our leverage

18

(1) Includes the Light Group note and the China Grill Restaurant Lease

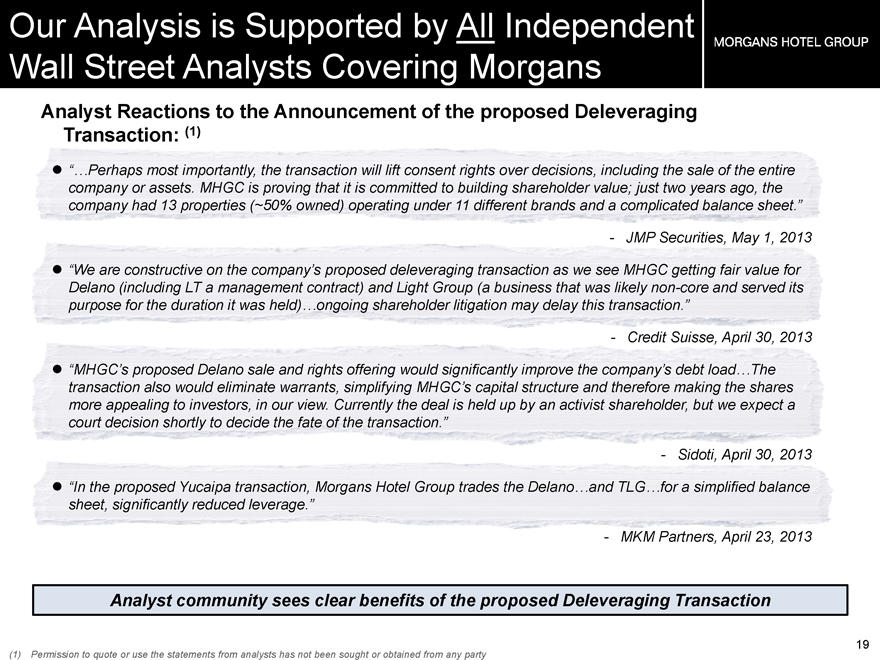

Our Analysis is Supported by All Independent Wall Street Analysts Covering Morgans

MORGANS HOTEL GROUP

Analyst Reactions to the Announcement of the proposed Deleveraging Transaction: (1)

“…Perhaps most importantly, the transaction will lift consent rights over decisions, including the sale of the entire company or assets. MHGC is proving that it is committed to building shareholder value; just two years ago, the company had 13 properties (~50% owned) operating under 11 different brands and a complicated balance sheet.”

- JMP Securities, May 1, 2013

“We are constructive on the company’s proposed deleveraging transaction as we see MHGC getting fair value for Delano (including LT a management contract) and Light Group (a business that was likely non-core and served its purpose for the duration it was held)…ongoing shareholder litigation may delay this transaction.”

- Credit Suisse, April 30, 2013

“MHGC’s proposed Delano sale and rights offering would significantly improve the company’s debt load…The transaction also would eliminate warrants, simplifying MHGC’s capital structure and therefore making the shares more appealing to investors, in our view. Currently the deal is held up by an activist shareholder, but we expect a court decision shortly to decide the fate of the transaction.”

- Sidoti, April 30, 2013

“In the proposed Yucaipa transaction, Morgans Hotel Group trades the Delano…and TLG…for a simplified balance sheet, significantly reduced leverage.”

- MKM Partners, April 23, 2013

Analyst community sees clear benefits of the proposed Deleveraging Transaction

19

(1) Permission to quote or use the statements from analysts has not been sought or obtained from any party

MORGANS HOTEL GROUP

IV. OTK Associates’ Director Nominees Not Aligned with Shareholder Interests

20

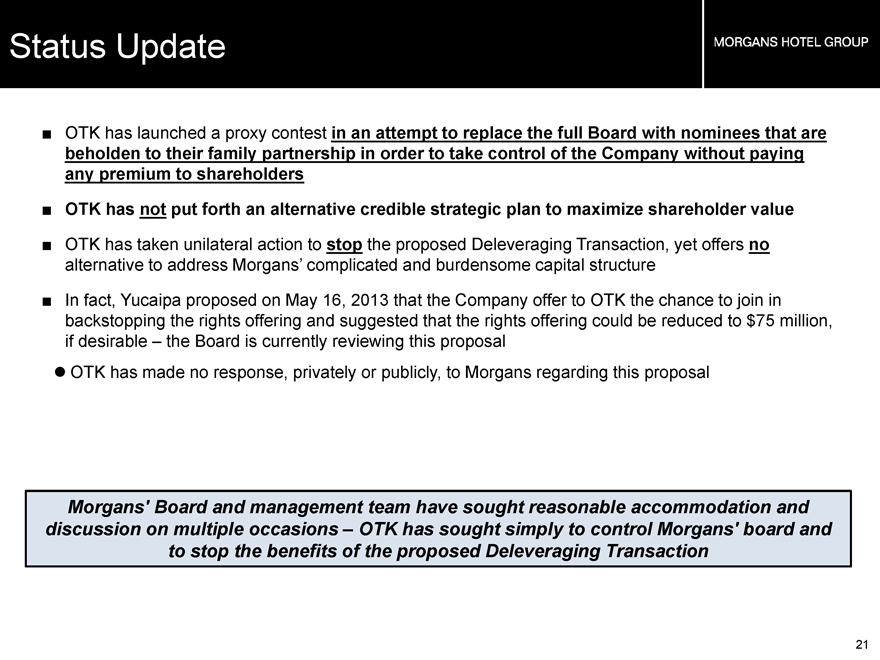

Status Update

MORGANS HOTEL GROUP

OTK has launched a proxy contest in an attempt to replace the full Board with nominees that are beholden to their family partnership in order to take control of the Company without paying any premium to shareholders

OTK has not put forth an alternative credible strategic plan to maximize shareholder value

OTK has taken unilateral action to stop the proposed Deleveraging Transaction, yet offers no alternative to address Morgans’ complicated and burdensome capital structure

In fact, Yucaipa proposed on May 16, 2013 that the Company offer to OTK the chance to join in backstopping the rights offering and suggested that the rights offering could be reduced to $75 million, if desirable – the Board is currently reviewing this proposal OTK has made no response, privately or publicly, to Morgans regarding this proposal

Morgans’ Board and management team have sought reasonable accommodation and discussion on multiple occasions – OTK has sought simply to control Morgans’ board and to stop the benefits of the proposed Deleveraging Transaction

21

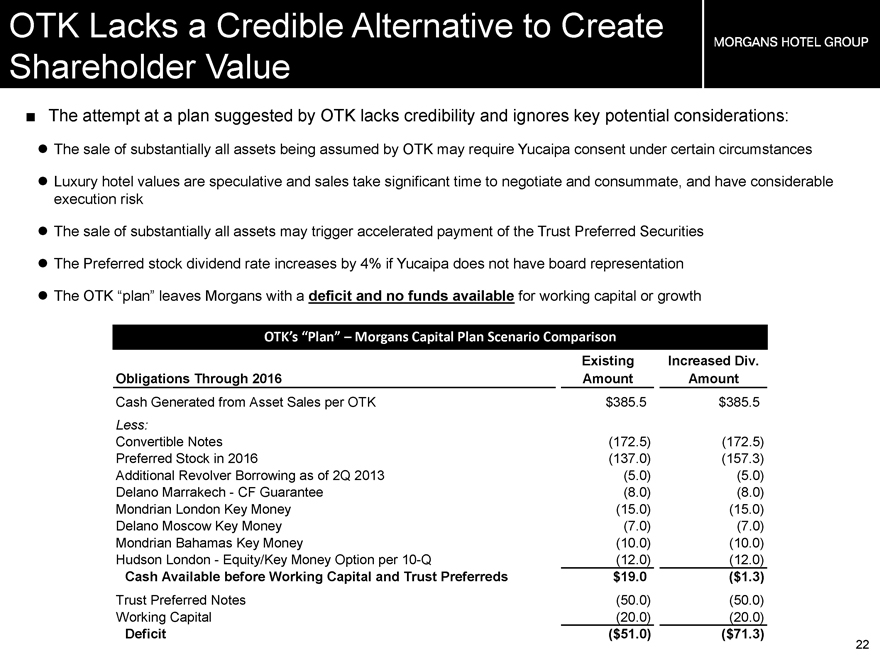

OTK Lacks a Credible Alternative to Create Shareholder Value

MORGANS HOTEL GROUP

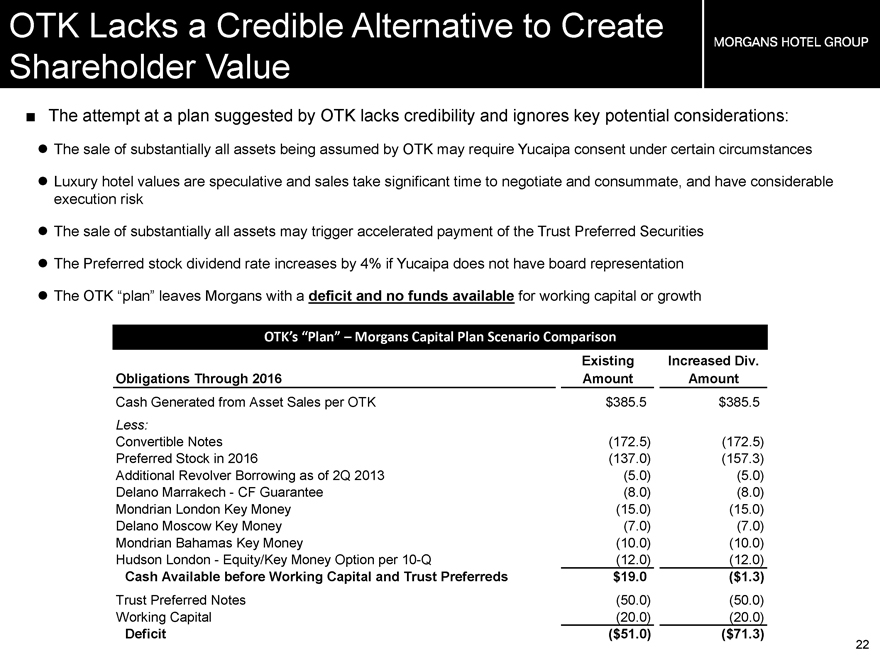

The attempt at a plan suggested by OTK lacks credibility and ignores key potential considerations:

The sale of substantially all assets being assumed by OTK may require Yucaipa consent under certain circumstances

Luxury hotel values are speculative and sales take significant time to negotiate and consummate, and have considerable execution risk

The sale of substantially all assets may trigger accelerated payment of the Trust Preferred Securities

The Preferred stock dividend rate increases by 4% if Yucaipa does not have board representation

The OTK “plan” leaves Morgans with a deficit and no funds available for working capital or growth

OTK’s “Plan” – Morgans Capital Plan Scenario Comparison

Obligations Through 2016 Existing Amount Increased Div. Amount

Cash Generated from Asset Sales per OTK $385.5 $385.5

Less:

Convertible Notes (172.5) (172.5)

Preferred Stock in 2016 (137.0) (157.3)

Additional Revolver Borrowing as of 2Q 2013 (5.0) (5.0)

Delano Marrakech - CF Guarantee (8.0) (8.0)

Mondrian London Key Money (15.0) (15.0)

Delano Moscow Key Money (7.0) (7.0)

Mondrian Bahamas Key Money (10.0) (10.0)

Hudson London - Equity/Key Money Option per 10-Q (12.0) (12.0)

Cash Available before Working Capital and Trust Preferreds $19.0 ($1.3)

Trust Preferred Notes (50.0) (50.0)

Working Capital (20.0) (20.0)

Deficit ($51.0) ($71.3)

22

OTK’s Own Track Record Undermines Its Credibility

MORGANS HOTEL GROUP

OTK’s own track record of voting and actions highlights a series of unexplainable contradictions that undermine its credibility:

Jason Taubman Kalisman, OTK’s current representative on the Board, supported the Company’s strategy of transitioning to an asset-light business model

OTK was offered the opportunity to participate in the backstopping of the proposed rights offering, but it chose not to do so

In March 2013, before the proposed Deleveraging Transaction was signed, Jason Taubman Kalisman suggested he had a superior alternative to the proposed Deleveraging Transaction – the special transaction committee asked him urgently to describe his supposed alternative and he declined

OTK voted to allow the original deal between Yucaipa and Morgans to proceed, including the full exercise of warrants by Yucaipa up to a 39% level of ownership, yet now complains of the possibility, highly unlikely in our view, that Yucaipa could become a 32% stockholder

Jason Taubman Kalisman supported the Board’s decision to reject a November 2012 proposal to buy the Company for $7.50 per share

23

OTK’s Own Track Record Undermines Its Credibility (cont.)

MORGANS HOTEL GROUP

OTK voted in favor of the Company’s say-on-pay proposal in both 2011 and 2012 – Jason Taubman Kalisman also voted in favor of all compensation decisions by the Board

The hedge fund owned by Parag Vora, one of OTK’s proposed directors, has been actively buying and selling – and frequently shorting – Morgans stock for the last two years

OTK entered Morgans stock at an average cost of $15.20 per share, raising questions about whether its interests would be aligned with other shareholders who may support a sale of the Company or other strategic transaction at a value below $15.20 per share

OTK’s and its Nominees’ actions undercut OTK’s stated positions in its campaign to take control of the Company

24

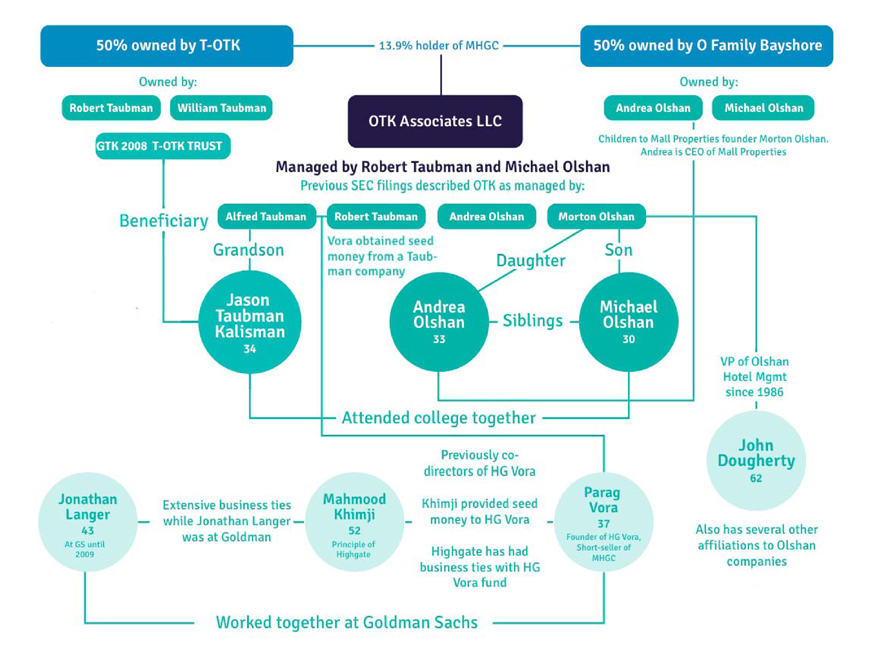

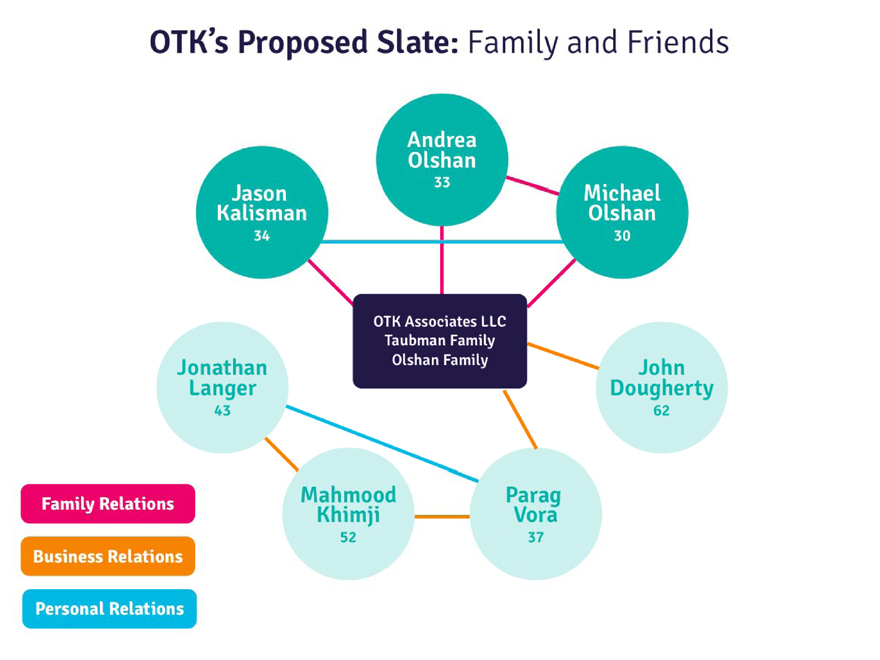

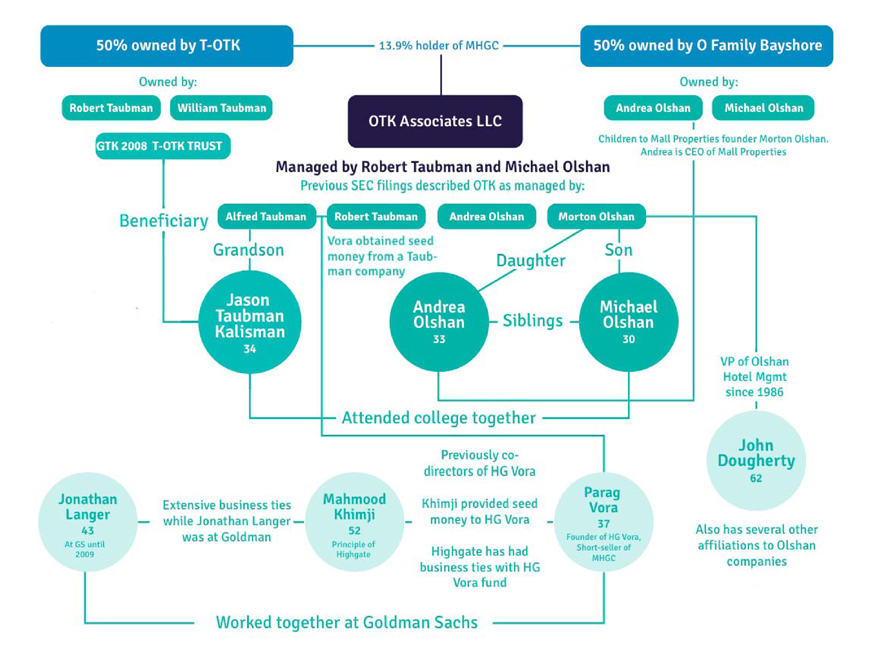

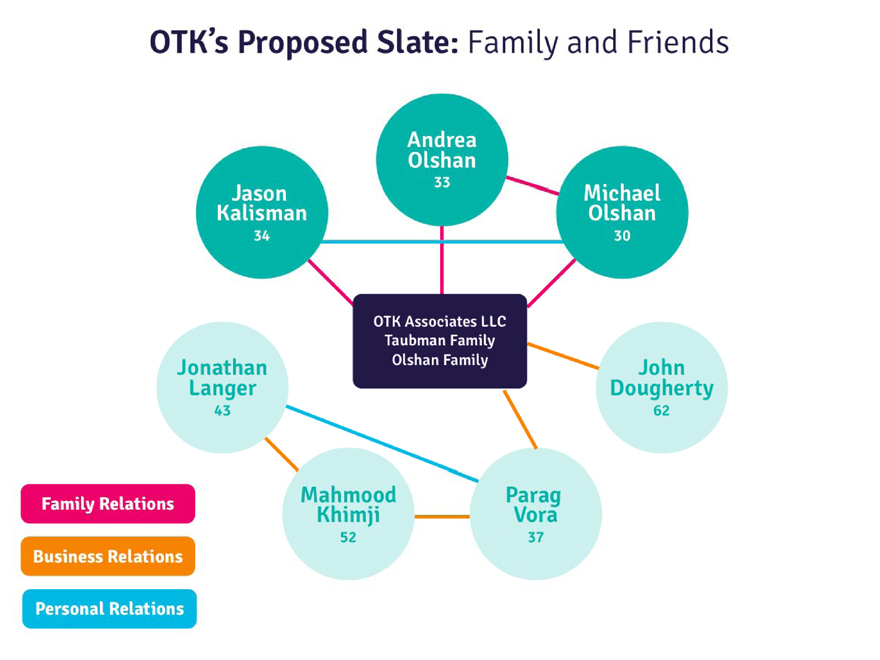

OTK’s Slate is a Conflicted Group of Family, Family Employees and Family Friends

MORGANS HOTEL GROUP

Turning control of the Board over to OTK’s proposed slate of nominees turns control of the Board over to OTK and the Olshan and Taubman families

Five of the seven hand-picked OTK nominees are closely affiliated with OTK and the families that control OTK

Two are young Olshan family members (ages 30 and 33)

One is an employee of an Olshan family business

One is a young Taubman family member (age 34)

One is a hedge fund owner where the Taubmans are an investor – this same hedge fund recently disclosed significant short-selling and trading in Morgans common stock

In fact, there is not one person on OTK’s proposed slate who does not have a prior personal, business or family relationship with someone else on their slate

25

OTK’s Slate is a Conflicted Group of Family, Family Employees and Family Friends (cont.)

MORGANS HOTEL GROUP

Michael Olshan, age 30, is the brother of co-nominee Andrea Olshan and son of Morton and Carol Olshan. Michael Olshan is a manager of OTK and is also identified as an investor in OTK. Mr. Olshan has no prior public company experience

Andrea Olshan, age 33, is the sister to co-nominee Michael Olshan and the daughter of Morton and Carol Olshan. Ms. Olshan is also identified as an investor in OTK. Similar to her brother, Ms. Olshan has no public company experience. Her only listed employment experience is with the Olshan family mall business

Jason Taubman Kalisman, age 34, is the current OTK representative on the Morgans Board. His grandfather is A. Alfred Taubman, the founder of Taubman Centers, Inc. Mr. Kalisman is also described as a founder of OTK; however, in reality he was a beneficiary of a family trust that is part owner of OTK

John Dougherty, age 62, has been the Vice President and Director of Olshan Hotel Management, an Olshan family business that operates a small number of hotels, since 1986.

Dougherty has several other affiliations with Olshan companies. Dougherty was listed as the registered agent for Marco Beach Hotel Inc., a Florida company belonging to Morton Olshan. Dougherty was also listed as the vice president of hotels for Mall Properties, the Olshan family mall business, on the company’s website

26

OTK’s Slate is a Conflicted Group of Family, Family Employees and Family Friends (cont.)

MORGANS HOTEL GROUP

• Parag Vora, age 37, is the Founder and Portfolio Manager of HG Vora Capital Management, a hedge fund that is a recent and active day-trader and short-seller of Morgans stock

• Mr. Vora has direct business ties to Mahmood Khimji. Mr. Khimji has been a minority shareholder of HG Vora since its formation, an investor in the HG Vora funds and a director of HG Vora funds from 2009 to 2012

• The Taubman family is an investor in HG Vora

• According to OTK’s proxy statement (disclosed in Annex B, pages B-2 and B-3), HG Vora executed more than 100 transactions in the Company’s stock, including many day trades and short sales

• Jonathan Langer, age 43, is a former Goldman Sachs real estate executive formerly responsible for overseeing the firm’s proprietary real estate investment effort

• Mr. Langer has business ties to Mahmood Khimji and Highgate as a previous director of ACEP, which had multiple related party dealings with Highgate

• Langer’s sole public company board experience has been representing his then-employer, Goldman Sachs

• The Whitehall Street Real Estate Funds, for which Mr. Langer had shared responsibility during his time with Goldman, announced a write down of $2.1 billion of the $3.7 billion invested between May 2007 and August 2008. American Casino & Entertainment Properties LLC, where Mr. Langer was a director (and the initial investment into which Mr. Langer had championed in February 2008), posted a net loss of $31.4 million in 2009. Mr. Langer departed Goldman soon after this loss in 2009 to “pursue other opportunities”

27

OTK’s Slate is a Conflicted Group of Family, Family Employees and Family Friends (cont.)

MORGANS HOTEL GROUP

• Mahmood Khimji, age 52, is the co-founder and principal of Highgate Holdings, a private hotel company

• Highgate previously made a proposal to take over the operations of Morgans’ hotel assets

• In addition to being a shareholder, investor and director of HG Vora, Khimji has long-standing business ties to Jonathan Langer. Mr. Khimji’s firm, Highgate Holdings, had consulting agreements with two public companies – American Casino & Entertainment Properties LLC and Colony Resorts LVH – while Langer was a director of these companies in 2009

OTK’s slate of nominees are not independent

28

OTK’s Slate is a Conflicted Group of Family, Family Employees and Family Friends (cont.)

MORGANS HOTEL GROUP

OTK’s director nominees also have limited public company board or executive experience – and no experience representing public (non-affiliated) shareholders

• Mr. Khimji has sat on two public company boards, but his firm Highgate Holdings had related party dealings with each company

• Mr. Langer has sat on several public company boards, always representing his then-employer Goldman Sachs, which provided financing to the companies

• Jason Taubman Kalisman’s only public company board experience has been as OTK’s representative on the Morgans Board

• Michael Olshan, Andrea Olshan, John Dougherty and Parag Vora have never been a director or officer of a publicly-traded company

OTK’s slate of nominees lack relevant experience

29

50% Owned by T-OTK

13.9% holder of MHGC

50% Owned by O Family Bayshore

Owned by:

Rober Taubman

William Taubman

OTK Associates LLC

Andrea Olshan

Michael Olshan

GTK 2008 T-OTK TRUST

Children to Mall Properties founder Morton Olshan.

Andrea is CEO of Mall Properties

Managed by Robert Taubman and Michael Olshan

Previous SEC filings described OTK as managed by:

| | | | | | | | |

Beneficiary | | Alfred Taubman | | Rober Taubman | | Andrea Olshan | | Morton Olshan |

| | | | | | |

Grandson | | Vora obtained seed money from a Taubman company | | Daughter | | Son |

| | | | | | |

Jason Taubman Kalisman 34 | | Andrea Olshan 33 | | Siblings | | Michael Olshan 30 |

VP of Olshan

Hotel Mgmt

since 1986

Attended college together

| | | | | | | | |

Jonathan Langer Extensive business ties while Jonathan Langer was at Goldman At GS until 2009 | | Mahmood Khimji 52 Principle of Highgate | | Previously co-directors of HG Vora Khimji provided seed money to HG Vora Highgate has had business ties with HG Vora fund | | Parag Vora 37 Founder of HG Vora, Short-seller of MHGC | | John Dougherty 62 Also has several other affiliations to Olshan companies |

Worked together at Goldman Sachs

OTK’s Proposed Slate: Family and Friends

Jason Kalisman 34

Andrea Olshan

33

Michael Olshan

30

OTK Associates LLC Taubman Family Olshan Family

Jonathan Langer

43

John Dougherty

62

Mahmood Khimji

52

Parag Vora

37

Family Relations

Business Relations

Personal Relations

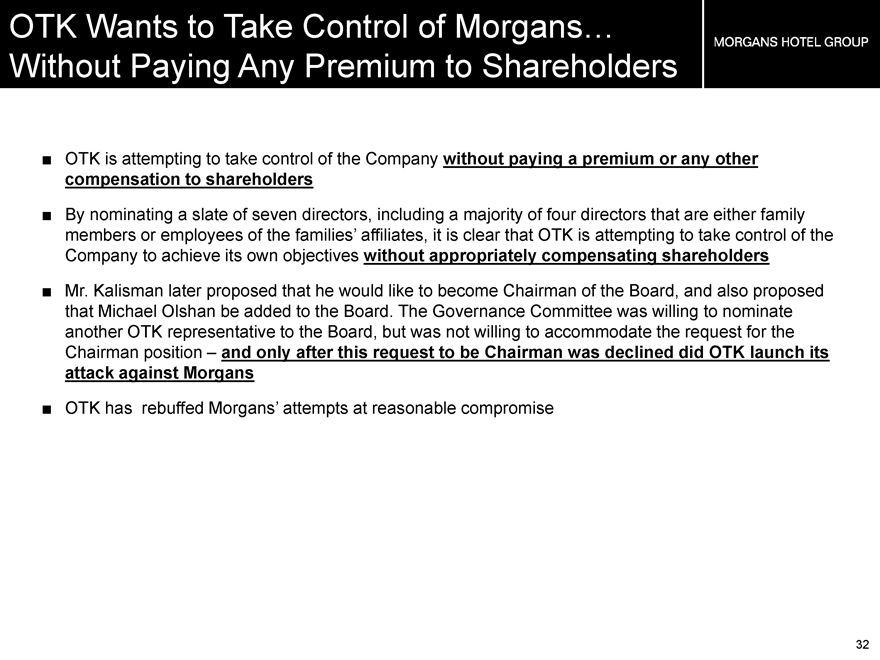

OTK Wants to Take Control of Morgans...

Without Paying Any Premium to Shareholders

MORGANS HOTEL GROUP

• OTK is attempting to take control of the Company without paying a premium or any other compensation to shareholders

• By nominating a slate of seven directors, including a majority of four directors that are either family members or employees of the families’ affiliates, it is clear that OTK is attempting to take control of the Company to achieve its own objectives without appropriately compensating shareholders

• Mr. Kalisman later proposed that he would like to become Chairman of the Board, and also proposed that Michael Olshan be added to the Board. The Governance Committee was willing to nominate another OTK representative to the Board, but was not willing to accommodate the request for the Chairman position – and only after this request to be Chairman was declined did OTK launch its attack against Morgans

• OTK has rebuffed Morgans’ attempts at reasonable compromise

32

MORGANS HOTEL GROUP

V. Morgans’ Slate of Qualified Directors

33

Morgans’ Slate of Qualified Directors Will Remain Focused on Maximizing Value for All Shareholders

MORGANS HOTEL GROUP

• Our director nominees are focused on maximizing value for all shareholders through continuing to grow our higher-margin brand and management business and exploring strategic alternatives

• We are receptive to shareholder proposals for nominees to the Board:

• We offered to re-nominate Mr. Kalisman to the Board this year, despite his participation in expensive litigation against our other directors and OTK’s current proxy contest

• We are nominating six directors for a seven-person Board to allow OTK to have one Board seat - in order to ensure that OTK would continue to have representation on the Board proportionate to its ownership (if its nominee consents to serve with our Board nominees)

• Our Corporate Governance and Nominating Committee also requested to meet with OTK’s nominees but OTK declined the invitation

• Our slate is comprised of six nominees, all currently serving on the Board, who offer skills and extensive experience in branding, lifestyle hospitality management and boutique hotels

The Board will continue to explore opportunities to unlock the value of our iconic real estate assets, right-size our balance sheet and re-allocate capital to our higher-margin brand and management business

34

Morgans’ Slate of Qualified Directors

MORGANS HOTEL GROUP

• We believe our director nominees have the experience, industry knowledge and commitment necessary to execute our strategic plan and position us to deliver value to our stockholders

• Each of the Board’s six director nominees is currently serving as a director of the Company

• Except for our CEO, all are independent directors under NASDAQ rules

• Our directors have a deep understanding of Morgans’ business and its unique brand position in the boutique hotel industry and bring a range of experience in business, finance, accounting, marketing, digital media, investing and real estate, with each director adding to the diversity and strength of the Board

Morgan’s board is experienced, has the requisite industry knowledge and is committed to shareholder value creation

35

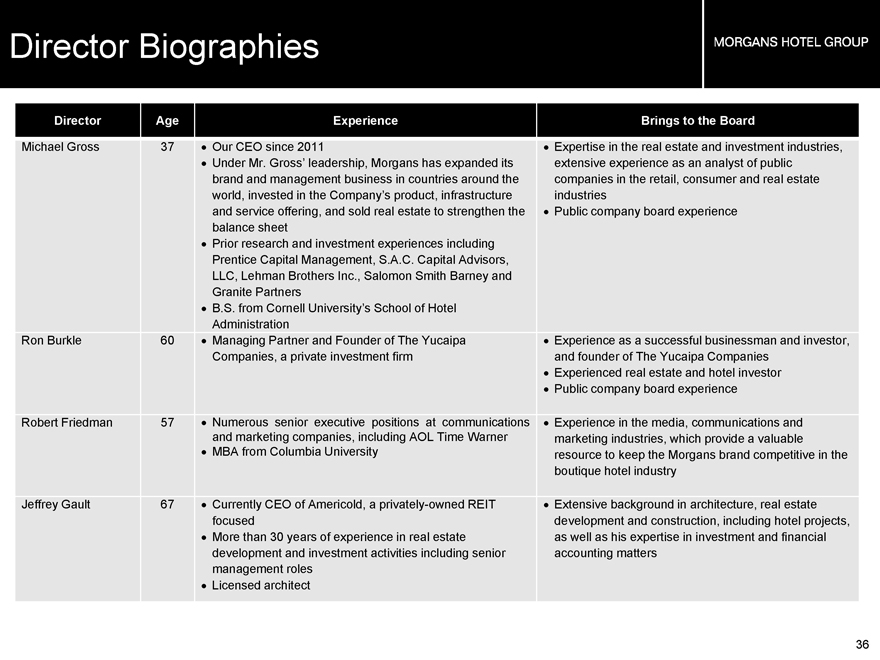

Director Biographies

MORGANS HOTEL GROUP

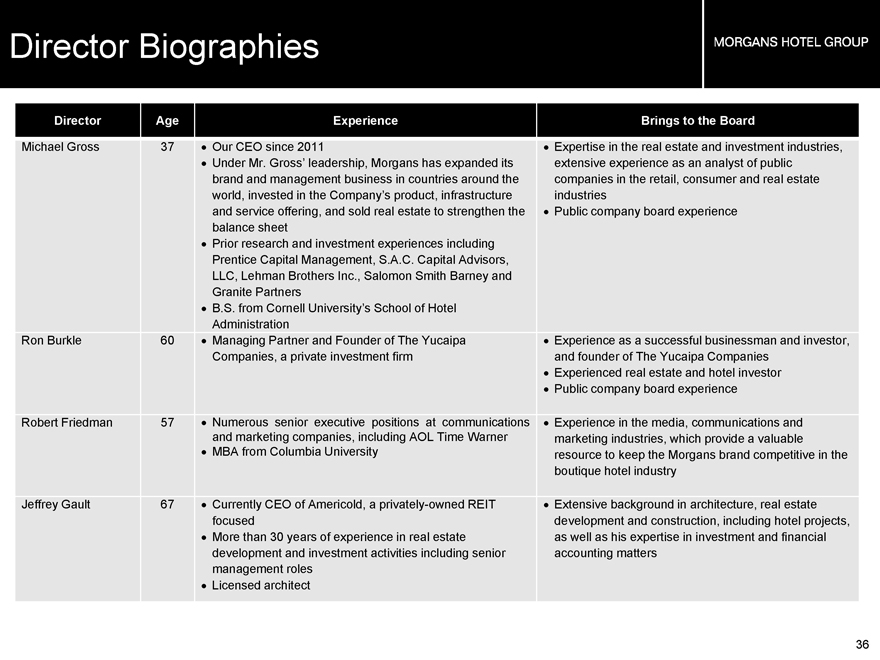

| | | | | | |

Director | | Age | | Experience | | Brings to the Board |

Michael Gross Ron Burkle | | 37 60 | | • Our CEO since 2011 • Under Mr. Gross’ leadership, Morgans has expanded its brand and management business in countries around the world, invested in the Company’s product, infrastructure and service offering, and sold real estate to strengthen the balance sheet • Prior research and investment experiences including Prentice Capital Management, S.A.C. Capital Advisors, LLC, Lehman Brothers Inc., Salomon Smith Barney and Granite Partners • B.S. from Cornell University’s School of Hotel Administration • Managing Partner and Founder of The Yucaipa Companies, a private investment firm | | • Expertise in the real estate and investment industries, extensive experience as an analyst of public companies in the retail, consumer and real estate industries • Public company board experience • Experience as a successful businessman and investor, and founder of The Yucaipa Companies • Experienced real estate and hotel investor • Public company board experience |

Robert Friedman | | 57 | | • Numerous senior executive positions at communications and marketing companies, including AOL Time Warner • MBA from Columbia University | | • Experience in the media, communications and marketing industries, which provide a valuable resource to keep the Morgans brand competitive in the boutique hotel industry |

Jeffrey Gault | | 67 | | • Currently CEO of Americold, a privately-owned REIT focused • More than 30 years of experience in real estate development and investment activities including senior management roles • Licensed architect | | • Extensive background in architecture, real estate development and construction, including hotel projects, as well as his expertise in investment and financial accounting matters |

36

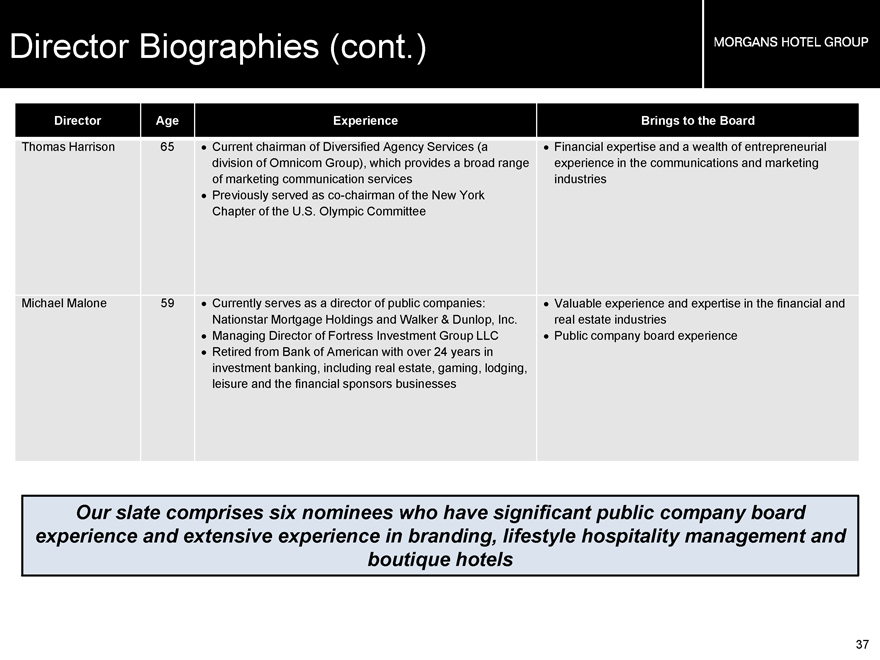

Director Biographies (cont.)

MORGANS HOTEL GROUP

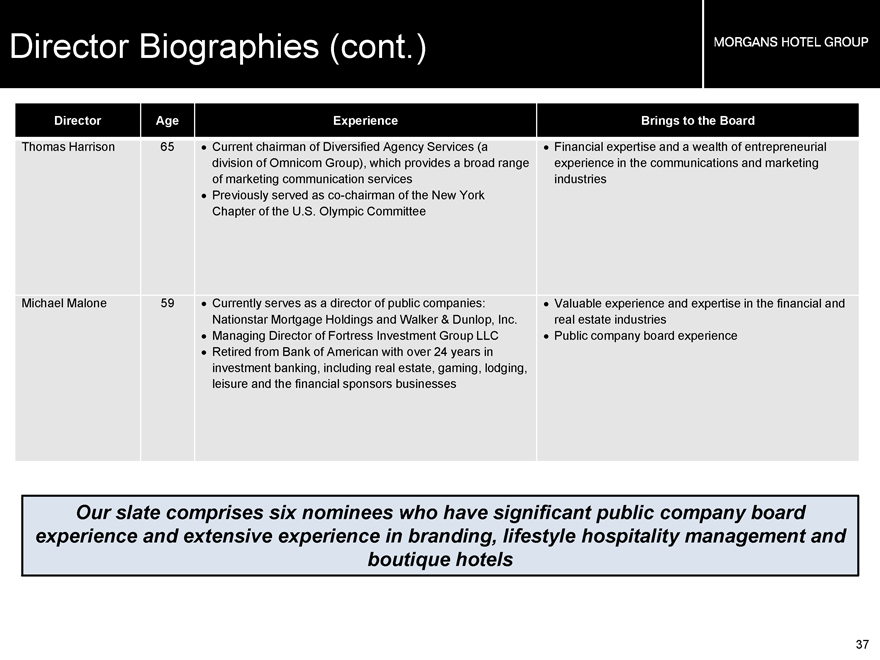

| | | | | | |

Director | | Age | | Experience | | Brings to the Board |

Thomas Harrison | | 65 | | • Current chairman of Diversified Agency Services (a division of Omnicom Group), which provides a broad range of marketing communication services • Previously served as co-chairman of the New York Chapter of the U.S. Olympic Committee | | • Financial expertise and a wealth of entrepreneurial experience in the communications and marketing industries |

Michael Malone | | 59 | | • Currently serves as a director of public companies: Nationstar Mortgage Holdings and Walker & Dunlop, Inc. • Managing Director of Fortress Investment Group LLC • Retired from Bank of American with over 24 years in investment banking, including real estate, gaming, lodging, leisure and the financial sponsors businesses | | • Valuable experience and expertise in the financial and real estate industries • Public company board experience |

Our slate comprises six nominees who have significant public company board experience and extensive experience in branding, lifestyle hospitality management and boutique hotels

37

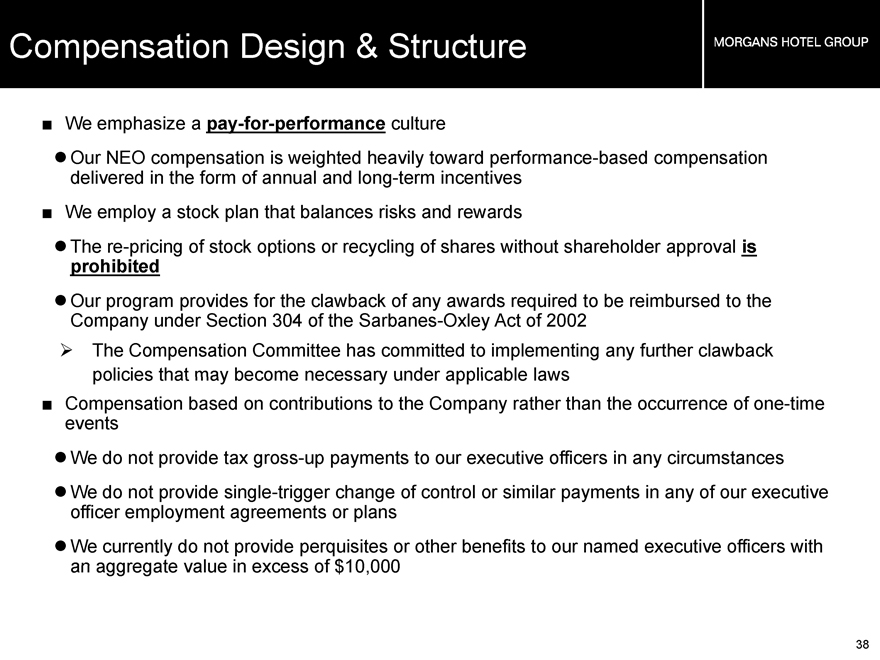

Compensation Design & Structure

MORGANS HOTEL GROUP

• We emphasize a pay-for-performance culture

• Our NEO compensation is weighted heavily toward performance-based compensation delivered in the form of annual and long-term incentives

• We employ a stock plan that balances risks and rewards

• The re-pricing of stock options or recycling of shares without shareholder approval is prohibited

• Our program provides for the clawback of any awards required to be reimbursed to the Company under Section 304 of the Sarbanes-Oxley Act of 2002

Ø The Compensation Committee has committed to implementing any further clawback policies that may become necessary under applicable laws

• Compensation based on contributions to the Company rather than the occurrence of one-time events

• We do not provide tax gross-up payments to our executive officers in any circumstances

• We do not provide single-trigger change of control or similar payments in any of our executive officer employment agreements or plans

• We currently do not provide perquisites or other benefits to our named executive officers with an aggregate value in excess of $10,000

38

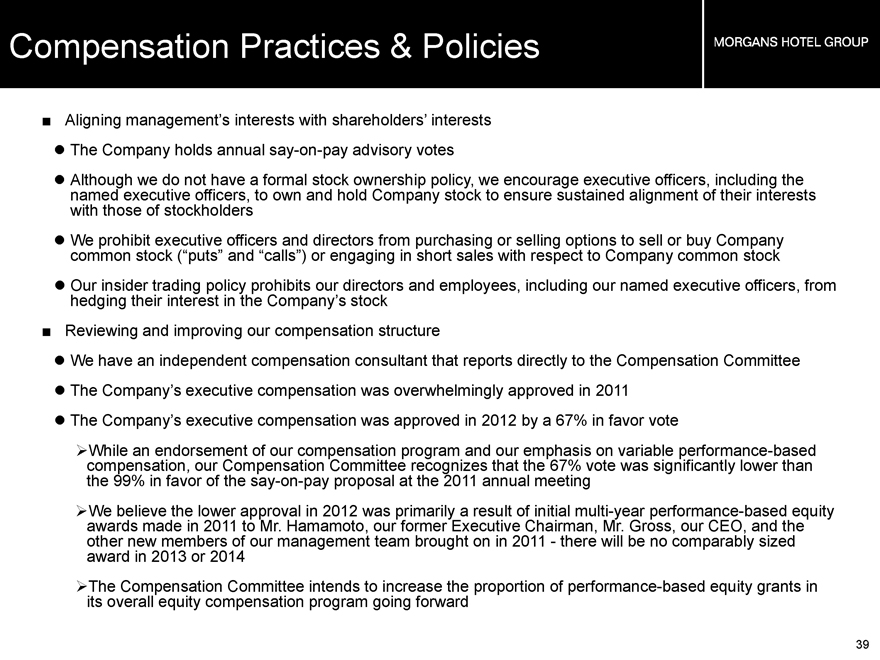

Compensation Practices & Policies

MORGANS HOTEL GROUP

• Aligning management’s interests with shareholders’ interests

• The Company holds annual say-on-pay advisory votes

• Although we do not have a formal stock ownership policy, we encourage executive officers, including the named executive officers, to own and hold Company stock to ensure sustained alignment of their interests with those of stockholders

• We prohibit executive officers and directors from purchasing or selling options to sell or buy Company common stock (“puts” and “calls”) or engaging in short sales with respect to Company common stock

• Our insider trading policy prohibits our directors and employees, including our named executive officers, from hedging their interest in the Company’s stock

• Reviewing and improving our compensation structure

• We have an independent compensation consultant that reports directly to the Compensation Committee

• The Company’s executive compensation was overwhelmingly approved in 2011

• The Company’s executive compensation was approved in 2012 by a 67% in favor vote

ØWhile an endorsement of our compensation program and our emphasis on variable performance-based compensation, our Compensation Committee recognizes that the 67% vote was significantly lower than the 99% in favor of the say-on-pay proposal at the 2011 annual meeting

ØWe believe the lower approval in 2012 was primarily a result of initial multi-year performance-based equity awards made in 2011 to Mr. Hamamoto, our former Executive Chairman, Mr. Gross, our CEO, and the other new members of our management team brought on in 2011 - there will be no comparably sized award in 2013 or 2014

ØThe Compensation Committee intends to increase the proportion of performance-based equity grants in its overall equity compensation program going forward

39

Committed to Strong Corporate Governance

MORGANS HOTEL GROUP

• Our Board of Directors values good corporate governance and responsiveness to shareholders

• Annual election of directors

• Annual say-on-pay vote

• Our Corporate Governance Guidelines are publicly available on our website at www.morganshotelgroup.com

• We strongly encourage stock ownership by directors and require that a substantial portion of director compensation be provided as equity-based compensation

• The Board recently announced the termination of its poison pill prior to October 3, 2013, on the one-year anniversary of its adoption

• The Board has also instituted a policy requiring any future poison pill to be approved by shareholders either prior to, or within one year of, adoption

• Termination of the poison pill is an additional significant step in addressing the Company’s corporate governance together with the removal of significant consent rights that would occur in the proposed Deleveraging Transaction

• Board composition

• All of our current directors except the CEO, and Andrew Sasson, are independent within the meaning of the Nasdaq rules

• All of our 2013 director nominees except the CEO are independent within the meaning of the Nasdaq rules

• Our CEO is not the Chairman of the Board of Directors

• Andrew Sasson, the member of our Board who had a poor attendance record in 2012 (<75%), was not re-nominated for election at the 2013 annual meeting

• Another Board member who has previously not attended 75% of Board meetings in a prior year has improved his attendance record (and this director has a contractual right to be on our Board)

40

Important Additional Information

MORGANS HOTEL GROUP

• On May 23, 2013, the Company filed a definitive proxy statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2013 Annual Meeting of Stockholders. Stockholders are strongly advised to read the Company’s 2013 proxy statement because it contains important information. Stockholders may obtain a free copy of the 2013 proxy statement and other documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at www.morganshotelgroup.com.

41

Important Additional Information and Where to Find It

On May 23, 2013, the Company filed a definitive proxy statement and WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2013 Annual Meeting of Stockholders. Stockholders are strongly advised to read the Company’s 2013 proxy statement because it contains important information. Stockholders may obtain a free copy of the 2013 proxy statement and other documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at www.morganshotelgroup.com.