- TX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

CORRESP Filing

Ternium (TX) CORRESPCorrespondence with SEC

Filed: 12 Aug 14, 12:00am

| TERNIUM S.A. | |

| Société anonyme holding | ||

| Registered office: | ||

| 29, Avenue de la Porte-Neuve | ||

| L-2227 Luxembourg | ||

R.C.S. Luxembourg B 98 668 www.ternium.com |

August 12, 2014

Mr. Terence O’Brien,

Accounting Branch Chief,

Division of Corporation Finance,

Securities and Exchange Commission,

100 F Street, N.E.,

Washington, D.C. 20549-4631.

| Re: | Ternium S.A. |

| December 31, 2013 Form 20-F filed April 30, 2014 |

| File No. 1-32734 |

Dear Mr. O’ Brien:

Set out below are the responses of Ternium S.A. (“Ternium” or the “Company”), to the comment of the Staff of the United States Securities and Exchange Commission (the “Staff”) set forth in its letter dated July 23, 2014, to Mr. Pablo Brizzio, the Company’s Chief Financial Officer (the “Comment Letter”). The Staff’s comment is set forth below in boldface type, and the responses are included below the comment.

Note 14, page F-46

Usiminas (USIM3) shares declined 26% in the March 31, 2014 quarter and appear to have declined an additional 25% in the June 30, 2014 quarter. Consequently, it appears that the fair value of your equity method investment may be approximately $590 million less than your current carrying value. In assessing the materiality of this issue, we note that your reported earnings for the March 31, 2014 quarter was $188 million and was $592 million in the year ended December 31, 2013. The Usiminas March 31, 2014 earnings release reported no consolidated revenue growth and also reported substantial operating and free cash flow deficits. The adverse factors currently impacting operating results are also highlighted therein. Consequently, it remains unclear how you reasonably determined that “no substantial changes from December 31, 2013 had occurred” and that no March 31, 2014 impairment calculation was required. Paragraph 42 of IAS 28 states that the investment is tested for impairment “whenever application of IAS 39 indicates that the investment may be impaired.” Paragraph 61 of IAS 39 states that a significant or prolonged decline in fair value is an objective evidence of impairment. The decline in fair value of your investment has been generally consistent since the January 2012 acquisition and the specific decline occurring in the March 31, 2014 quarter was substantial. Under paragraph 42 of IAS 28, an investment’s value in use (using appropriate assumptions) should be consistent with “the present value of the estimated future cash flows expected to arise from dividends to be received from the investment and from its ultimate disposal.” Presumably such assumptions are embedded in the quoted stock price so it is not clear whether you are using assumptions that materially differ from market-based assumptions and if so, whether a reasonable basis exists to support any material disparity. Please provide additional details regarding your 2014 impairment testing so we can fully assess your compliance with the applicable guidance. We may have further comment.

| R: | We address below the Staff’s requests for clarification or additional information, as indicated above. |

| a) | Additional details related to Ternium’s assessment that no additional test for impairment was required. |

The Company advises the Staff that at March 31 and June 30, 2014, Usiminas’ EBITDA remained relatively in line with Ternium’s expectations under its recoverable amount estimation as of December 31, 2013. Usiminas adjusted EBITDA1 in the first half of 2014 reached an annualized USD1.1 billion, compared to an EBITDA estimation of USD1.2 billion for the full year 2014, as indicated in our June 16, 2014 response letter. Ternium has a long-term view with respect to its investment in Usiminas and, notwithstanding any differences that may exist from time to time between the Company’s assumptions and actual developments in the short-term, Ternium believes its long-term assumptions continue to be reasonable.

The different assumptions considered in the December 31, 2013 recoverable amount estimation had a mixed performance; actual net sales were lower than expected, but costs were also lower than anticipated, enabling an annualized actual EBITDA roughly in line with the original estimation for 2014.

The assumptions that showed a significant deviation against Ternium’s expectations were related to the mining business. Iron ore shipments in the first half of 2014 increased less than expected, as delays in the Sudeste port commissioning prevented Usiminas from increasing its iron ore exports. The Sudeste port is owned and managed by a third party with which Usiminas has a port services contract, and Usiminas has indicated its belief that the port will come into operation during 2014.

At the same time, average iron ore benchmark prices in the first half of 2014 were approximately $14 per ton, or 11%, lower than expected, and continued showing a high volatility level. It is worth noting that, at current iron ore production levels, the majority of Usiminas’ iron ore production is consumed internally by its steelmaking facilities and, as a result, the impact in consolidated EBITDA from fluctuations in iron ore benchmark prices will be limited until Usiminas is able to increase its iron ore sales to third parties through a planned expansion of mining production facilities currently under analysis.

From a macroeconomic perspective, the Brazilian economy could have a weaker-than-anticipated performance in 2014. The Brazilian central bank forecasts a 1.6% GDP growth in 20142 and market analysts anticipate around 1.0% growth, compared to the 2.0% level used in Ternium’s recoverable amount estimation, also based in market analysts’ forecasts. The increased uncertainty related to presidential elections to be held in Brazil in the second half of 2014 could have contributed to this decrease in growth expectations.

As part of a sensitivity analysis, Ternium evaluated the impact of an up to $30, or 23%, decrease in the iron ore benchmark price used in the recoverable amount estimation. In addition to the change in the iron ore price, Ternium adjusted iron ore and steel shipment volumes in 2014 to reflect actual figures in the first half of the year and the effects of weaker economic growth expectations, and updated other data as of June 2014. After giving effect to the aforementioned changes, the recoverable amount estimation remained higher than the carrying value of the Usiminas investment, and as a result Ternium concluded that its December 2013 impairment test calculation remained valid in this harsher scenario. The Company assesses the performance of its investment in Usiminas on a consolidated basis, taking into consideration the interactions between its mining and steel businesses, and will continue monitoring the performance of the assumptions considered in its December 31, 2013 recoverable amount estimation to identify the presence of any impairment indicators.

| 1 | As disclosed by Usiminas, adjusted EBITDA is calculated from net income (loss), reversing profit (loss) from discontinued operations, income tax and social contribution, financial result, depreciation, amortization and depletion, and equity in the results of Associate, Joint Subsidiary and Subsidiary Companies. The adjusted EBITDA includes the proportional participation of 70% of Unigal and others joint subsidiary companies. |

| 2 | Brazilian Central Bank – Relatório de Inflação – June 2014. |

2

| b) | Impairment indicators - Evaluation of applicable IAS 28 and 39 requirements. |

Ternium monitors impairment indicators on a regular basis, and specifically at the time of issuing its interim and year-end financial statements. At each such assessment, Ternium considers the guidance in IAS 28, par. 40 (“After application of the equity method, including recognizing the associate’s or joint venture’s losses in accordance with paragraph 38, entity applies IAS 39Financial Instruments: Recognition and Measurement to determine whether it is necessary to recognize any additional impairment loss with respect to its net investment in the associates or joint venture.”).

Ternium has evaluated the applicable IAS 39 requirements as follows:

IAS 39, par. 59, analysis

IAS 39, par.59 indicator | March 31 / June 30, 2014 | Comments | ||

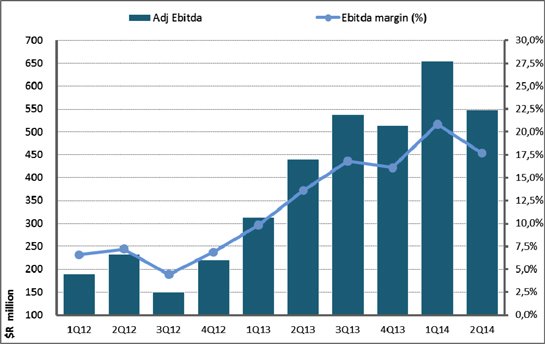

| (a) significant financial difficulty of the issuer or obligor | Not noted. A summary of financial indicators is included in the column “Comments.” A more complete set of information is included in Annex 1. | EBITDA: improved from an average quarterly EBITDA of BRL200 million in 2012 to a quarterly EBITDA of BRL600 million in 1H14 (see Annex 1)

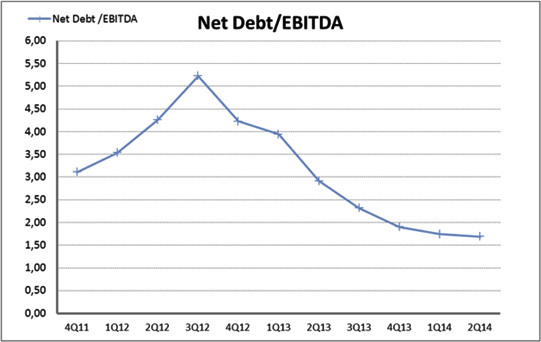

EBITDA ratio (Net Debt / EBITDA): improved from a higher than 4x quarterly ratio in 2012 to a 1.7x ratio in 1H14 (see Annex 1)

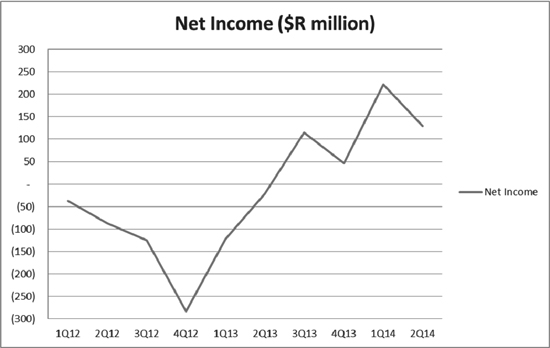

Net Income: improved from a quarterly average net loss of BRL (150) million in 2012 to a quarterly net gain of BRL 175 million in 1H14 (see Annex 1) | ||

| (b) a breach of contract, such as a default or delinquency in interest or principal payments | Not noted | No breach of contract had occurred by the end of either March or June 2014. | ||

| (c) the lender, for economic or legal reasons relating to the borrower’s financial difficulty, granting to the borrower a concession that the lender would not otherwise consider | Not noted | No debt restructuring had taken place or was expected in the near future. | ||

| (d) it becoming probable that the borrower will enter bankruptcy or other financial reorganization | Not noted | Usiminas has improved its financial condition since 2012, as evidenced in (a) above. | ||

| (e) the disappearance of an active market for that financial asset because of financial difficulties | Not noted | |||

| (f) observable data indicating that there is a measurable decrease in the estimated future cash flows from a group of financial assets | See comments beside (further analysis in Section a) above). | Iron ore price decreased in recent months and there are weaker expectations for economic growth in Brazil in 2014. A sensitivity analysis was | ||

3

IAS 39, par.59 indicator | March 31 / June 30, 2014 | Comments | ||

| since the initial recognition of those assets, although the decrease cannot yet be identified with the individual financial assets in the group, including (i) adverse changes in the payment status of borrowers in the group (for example, an increased number of delayed payments or an increased number of credit card borrowers who have reached their credit limit and are paying the minimum monthly amount); or (ii) national or local economic conditions that correlate with defaults on the assets in the group (for example, an increase in the unemployment rate in the geographical area of the borrowers, a decrease in property prices for mortgages in the relevant area, a decrease in oil prices for loan assets to oil producers, or adverse changes in industry conditions that affect the borrowers in the group): | performed and Ternium concluded its December 2013 impairment test calculation remained valid in this harsher scenario. |

IAS 39, par 61, analysis

IAS 39, par 61, indicator | March 31 / June 30, 2014 | Comments | ||

| Objective evidence of impairment for an investment in an equity instrument includes information about significant changes with an adverse effect that have taken place in the technological, market, economic or legal environment in which the issuer operates, and indicates that the cost of the investment in the equity instrument may not be recovered. | See comments in next column (further analysis included in Section a) above). | Iron ore price decreased in recent months and there are weaker expectations for economic growth in Brazil in 2014. A sensitivity analysis was performed and Ternium concluded its December 2013 impairment test calculation remained valid in a harsher scenario. | ||

| A significant or prolonged decline in the fair value of an investment in an equity instrument below its cost is also objective evidence of impairment | See comments in Section c) below. | |||

4

Based on the impairment indicator and sensitivity analyses presented above, Ternium concluded that no additional impairment of its investment in Usiminas was required subsequent to the impairment charge recorded in 2012. Ternium made its investment in Usiminas with a long-term view and believes that the fundamentals that led to this investment in 2012 remain valid and that its participation in the Usiminas’ control group contributed to achieve improvements in Usiminas’ financial condition, as demonstrated by the positive evolution of its EBITDA since 2012.

| c) | Usiminas market value fluctuations. |

Ternium also monitors the evolution of Usiminas’ market value on a regular basis. The price of Usiminas’ ordinary shares3 is significantly volatile, as can be seen in the following table.

| USIM3 share price (BRL/ordinary share) | ||||||||||||||||||||

| High | Low | Average | Last | Change in the period | ||||||||||||||||

1H 2012 | 20.2 | 7.6 | 15.4 | 7.7 | -55 | % | ||||||||||||||

2H 2012 | 14.1 | 6.6 | 10.8 | 13.7 | 77 | % | ||||||||||||||

1H 2013 | 14.7 | 7.7 | 10.6 | 7.7 | -44 | % | ||||||||||||||

2H 2013 | 12.8 | 6.8 | 10.4 | 12.4 | 62 | % | ||||||||||||||

1H 2014 | 12.7 | 6.8 | 9.1 | 6.9 | -44 | % | ||||||||||||||

As shown above, Usiminas’ share price varied significantly during the last years, and on many occasions it did so in periods as short as six months. The reasons for these fluctuations could be related to changes in business assumptions and/or to other factors not related to the company’s future cash flow expectations, such as market speculations over M&A activity, bid/offer imbalances caused by low market liquidity, or other special situations.

While Ternium cannot give any assurances as to the cause of any share movements, Ternium believes there is currently a special situation that could be affecting Usiminas’ share prices. A significant portion of Usiminas’ shares is held by Companhia Siderurgia Nacional (CSN), one of Usiminas’ main competitors in the Brazilian steel market. According to its latest 20-F filing, at the end of December 2013, CSN held 14% of Usiminas’ ordinary shares and 21% of Usiminas’ preferred shares. As a result of the incompatibilities arising from CSN’s dual role as shareholder and competitor, in April 2014 the Brazilian antitrust authority (CADE –Conselho Administrativo de Defensa Economica) ordered CSN to divest its holdings of Usiminas shares. The number of shares to be divested and the timeframe for such divestiture have not been disclosed, as they are part of a confidential arrangement between CSN and CADE. CSN’s mandatory divestment could constitute an overhang for both Usiminas ordinary and preferred share prices, although this effect could be more pronounced in the case of the ordinary shares (USIM3) as a result of their very low market liquidity, compared to the significant number of shares that CSN would be required to sell. Usiminas’ ordinary shares had an average daily trading volume of approximately 400,000 shares over the last 12 months. Assuming that CSN’s sales represent 30% of the USIM3’s daily trading volume, it would take CSN more than two years of continued daily selling to sell its entire stake of approximately 70 million ordinary shares. The recent underperformance of Usiminas shares against other Brazilian peers and the Brazilian shares index (see Annex 2) could be attributable to this peculiar situation.

* * * * *

| 3 | We refer to our June 30, 2014 letter for a description of the differences between the control group shares held by Ternium and Usiminas’ other ordinary shares. |

5

The Company acknowledges that it is responsible for the adequacy and accuracy of the disclosure in its filings. In addition, the Company acknowledges that the Staff’s comments or changes to the Company’s disclosure in response to the Staff’s comments do not foreclose the Commission from taking any action with respect to the Company’s filings and that the Company may not assert the Staff’s comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions relating to this letter, please feel free to call Robert S. Risoleo of Sullivan & Cromwell LLP at (202) 956-7510. He may also be reached by facsimile at (202) 956-6974 and bye-mail at risoleor@sullcrom.com.

| Very truly yours, |

/s/ Pablo Brizzio |

Pablo Brizzio Chief Financial Officer |

| cc: | Al Pavot |

| (Securities and Exchange Commission) |

| Mervyn Martins |

| (PricewaterhouseCoopers) |

| Cristian J. P. Mitrani |

| (Mitrani, Caballero, Ojam & Ruiz Moreno Abogados) |

| Robert S. Risoleo |

| (Sullivan & Cromwell LLP) |

6

Annex 1

Cash generation: Substantial increases in EBITDA and EBITDA margin

Net income evolution

7

Deleveraging: evolution of Net Debt / EBITDA ratio

8

Annex 2

Relative stock price performance – Divergence in last six months

9