UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registranto Filed by a Party other than the Registrantþ

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

þ Definitive Additional Materials;

o Soliciting Material Pursuant to §240.14a-12

THE PHOENIX COMPANIES, INC.

(Name of the Registrant as Specified In Its Charter)

OLIVER PRESS PARTNERS, LLC

OLIVER PRESS INVESTORS, LLC

AUGUSTUS K. OLIVER

CLIFFORD PRESS

DAVENPORT PARTNERS, L.P.

JE PARTNERS, L.P.

OLIVER PRESS MASTER FUND, L.P.

JOHN CLINTON

CARL SANTILLO

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: N/A |

| | (2) | Aggregate number of securities to which transaction applies: N/A |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | (4) | Proposed maximum aggregate value of transaction: N/A |

| | (5) | Total fee paid: N/A |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: N/A |

| | (2) | Form, Schedule or Registration Statement No.: N/A |

| | (3) | Filing Party: N/A |

| | (4) | Date Filed: N/A |

| |

For Immediate Distribution

OLIVER PRESS PARTNERS URGES THE PHOENIX COMPANIES’

SHAREHOLDERS TO VOTE FOR NEW INDEPENDENT NOMINEES

Calls The Phoenix Companies’ Lagging Stock Price, High Operating Expense Ratio,

Sub-Par Return on Equity and Compensation Structure Unacceptable

Urges Strategic Review of All Businesses, Reduction of Cost Structure and

Monetization of Closed Block

________________________________________________________________________

NEW YORK, NY, March 26, 2008 – Oliver Press Partners, LLC, a New York based investment management firm whose funds own approximately 5% of The Phoenix Companies, Inc.’s (NYSE:PNX) common stock, today sent the following letter to the 225,000 shareholders of The Phoenix Companies urging shareholders to elect three new and independent director nominees at the Company's 2008 Annual Meeting of Stockholders, which has been scheduled for May 2, 2008.

Augustus K. Oliver of Oliver Press Partners said, “We continue to believe that The Phoenix Companies has great potential, but that the incumbent Board and management have failed to realize that potential. It is time, in our view, for the Board to focus on results for shareholders and policyholders rather than rewards for management. We believe our nominees will provide a new and independent expertise that will help unlock the Company’s potential and serve the interests that need to be served.”

Additional information can be found atwww.RaiseThePhoenix.com.

The full text of the letter follows:

| OLIVER PRESS PARTNERS, LLC | OLIVER PRESS PARTNERS, LLC

152 WEST 57TH STREET

46 FLOOR

NEW YORK, NEW YORK 10019

Telephone:(212) 277-5655 March 26, 2008 |

Dear Fellow Shareholder:

We are writing you again regarding the future of The Phoenix Companies, Inc. and how we believe you can best protect your investment in the Company and the security of your policy. No doubt the volume of materials that you are receiving about Phoenix is daunting, but we believe the issues at stake are clear and the corrective action to take is simple. We own approximately 5% of the outstanding Phoenix stock and we are proposing three nominees in opposition to management’s incumbent directors at the Company’s 2008 Annual Meeting.

WHAT HAS MANAGEMENT DELIVERED?

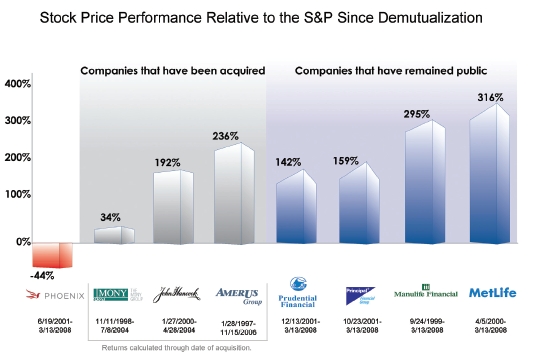

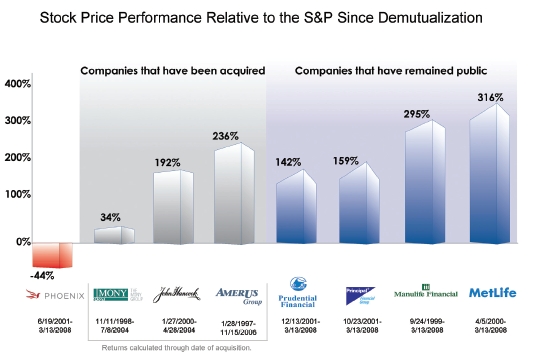

Stock Price

Financial Performance

An operatingexpense ratiothat ismore than doublemost of the Company’s peers1

Areturn on equitythat ismore than 50% belowmost of the Company’s peers

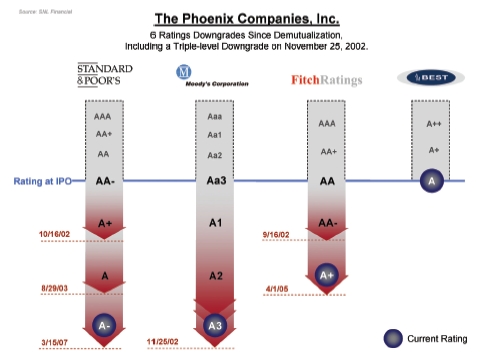

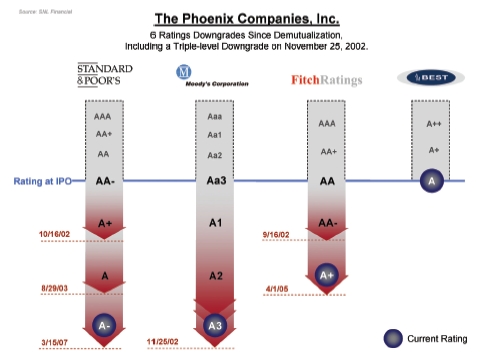

Six separate ratings downgrades by leading ratings agencies since the Company went public in 2001.

Phoenix has told you that it has achieved “A Record of Progress” despite six ratings downgrades and the loss of more than $500 million of shareholder value since its IPO in 2001. As a shareholder and policyholder, we believe you are entitled to ask how management's record has benefited you in light of the compensation that management has received.

WHAT HAS MANAGEMENT RECEIVED?

A compensation structure that, among other things, gave the senior management“performance” bonuses averaging over 210% of base salary in 2007plusmillions of dollars in accumulated pension benefits, deferred compensation, perquisites and other arrangements

Compensation arrangement for CEO Dona Youngthat included$27 millionof severance, other compensation, benefits and perquisites as a change-in-control package on top of$12.8 millionof accumulated pension benefits and$9.1 millionof deferred compensation, fora totalchange-in-control compensation package of$49 million2

1We believe its peers are Manulife Financial, Prudential Financial, Nationwide Financial, Lincoln Financial, Hartford Life, MetLife and Ameriprise Financial.

2A more complete description of the change-in-control package and its components is contained on page 6 of our proxy statement and its footnotes 1 and 2.

WHO ARE OUR NOMINEES?

Two of our nominees, John Clinton and Carl Santillo, have spent their careers in the insurance business. We believe they willbring an independent industry perspectiveto the Board

Our third nominee, Augustus K. Oliver, has spent his career as a lawyer and investment managerfocused on financial and strategic transactions

Our nominees would constitute only three out of thirteen directors, but they will benew independent and forceful advocatesfor your interests

WHAT DO WE EXPECT WILL RESULT FROM THE ELECTION OF OUR NOMINEES?

Management has argued that we offer no new ideas. If that is true, then it appears the incumbent Board and management have failed in putting the ‘old’ ideas to work. Shareholders and policyholders deserve more than ideas — they are entitled to results that serve their best interests.

When we notified the Company on January 25 that we intended to nominate our candidates to the Board, we wrote to Dona Young that we believed the Company should sell its asset management business. Just two weeks later the Company announced it would spin off that business. A coincidence? Or an ‘old’ idea that suddenly got new life?

Here are a few other ‘old’ ideas we believe the presence of our nominees will revive and turn into action:

First, we believe the Board should undertake afull strategic review of all the Company’s businesseswith the goal of deploying capital in the most productive manner possible

Second, we expect the participation of our nominees will encourage management totake aggressive steps to reduce the Company’s coststructure. Management claims millions in cost reductions over the past few years, yet the Company’s cost structure remains substantially higher and its return on equity correspondingly lower than its industry peers

Third, our nominees will bring new perspective needed for a comprehensive review of the options available to the Company tomonetize its closed block of insurance

Fourth, our nominees will providenew independent oversight of the Company’s executive compensationmeasures

We urge you to vote with us to support our nominees and to send a message to the Board of Directors that it is time for the best interests of shareholders and policyholders to come before the interests of management.

Sincerely yours,

Augustus K. Oliver |

Clifford Press |

IT IS TIME FOR CHANGE – VOTE AND RETURN YOUR WHITE PROXY CARD NOW

If you have previously returned a Blue proxy card, you can automatically revoke it by signing, dating and returning the enclosed WHITE proxy card in the accompanying envelope.

A Special Message for Policyholders, Agents and Former Employees

You have placed your trust in the Company to deliver a lifetime of financial strength and support for its products and benefit plans. We believe Phoenix should be run in a way that is deserving of that trust and we have laid out certain steps we believe management should take to restore Phoenix to the preeminence it once enjoyed. If you are a policyholder, agent or former employee, you may have particular questions about the implications of electing our nominees to the Board. We have sought to answer the most frequently asked questions (FAQ’s) and we encourage you to go to our website www.RaiseThePhoenix.com for the answers to those questions.

If you have any questions or require assistance in voting your WHITE proxy card, please call

MacKenzie Partners at the phone numbers listed below.

105 Madison Avenue

New York, NY 10016

phoenixproxy@mackenziepartners.com Call Collect: (212) 929-5500

or

Toll Free: (800) 322-2885 |

ADDITIONAL INFORMATION

Oliver Press Partners, LLC (“Oliver Press”) filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) on March 18, 2008. In addition, we have filed, and may file additional, other solicitation materials regarding this proxy solicitation. THE PHOENIX COMPANIES, INC.’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION. THE PROXY STATEMENT AND OTHER SOLICITATION MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV and on the website that we created, HTTP://WWW.RAISETHEP-HOENIX.COM. Shareholders may also obtain free copies of the proxy statement and other documents filed by Oliver Press in connection with the annual meeting by directing a request to: MacKenzie Partners, Inc. by calling Toll-Free (800) 322-2885 or by e-mail at phoenix-proxy@mackenziepartners.com.

OLIVER PRESS PARTICIPANT INFORMATION

INFORMATION REGARDING THE IDENTITY OF THE PERSONS WHO MAY, UNDER SEC RULES, BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF SHAREHOLDERS AND THEIR INTERESTS ARE SET FORTH IN THE DEFINITIVE PROXY STATEMENT THAT WAS FILED BY OLIVER PRESS WITH THE SEC