UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registranto Filed by a Party other than the Registrantþ

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

þ Definitive Additional Materials;

o Soliciting Material Pursuant to §240.14a-12

THE PHOENIX COMPANIES, INC.

(Name of the Registrant as Specified In Its Charter)

OLIVER PRESS PARTNERS, LLC

OLIVER PRESS INVESTORS, LLC

AUGUSTUS K. OLIVER

CLIFFORD PRESS

DAVENPORT PARTNERS, L.P.

JE PARTNERS, L.P.

OLIVER PRESS MASTER FUND, L.P.

JOHN CLINTON

CARL SANTILLO

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: N/A |

| | (2) | Aggregate number of securities to which transaction applies: N/A |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | (4) | Proposed maximum aggregate value of transaction: N/A |

| | (5) | Total fee paid: N/A |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: N/A |

| | (2) | Form, Schedule or Registration Statement No.: N/A |

| | (3) | Filing Party: N/A |

| | (4) | Date Filed: N/A |

| |

Oliver Press Partners, LLC

Raise the Phoenix |

| Welcome to RaiseThePhoenix.com. As one of the largest shareholders of The Phoenix Companies, we have developed this website to keep fellow shareholders informed of our effort to help Phoenix realize what we believe could be its full potential. For over six years as a public company, the Company’s Board of Directors has presided over a falling stock price, a series of ratings downgrades, low return on equity, high operating expenses and what we believe is excessive management compensation. It is time for a new voice in the Board room to speak up for your interests. | |  |

Therefore, we have nominated three individuals who we think are highly qualified to serve on the Phoenix Board. If elected, we expect our nominees to immediately seek a complete strategic review of all the Company’s businesses, to push for steps to deal with the Company’s high operating cost structure, and to provide for more rigorous oversight of the Company’s compensation practices. We need your support for this effort. When our proxy is available, we hope that you will vote for our nominees to help protect your investment.

We encourage you to read all of the materials on this website and to continue to visit often as it will be updated frequently.

By using this website (including by accessing any information provided on or through this website), you indicate that you have read and agree to the terms

and conditions set forth in ourTerms of Use,Legal Disclaimers andPrivacy Policy.

Oliver Press Partners, LLC

Raise the Phoenix

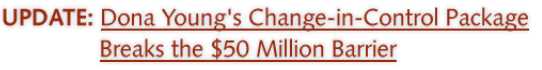

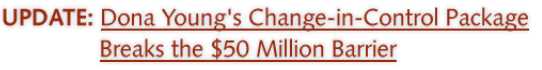

Total Retirement and Change-in-Control Package Calculator

* Calculated at $11.87 per share, the price that was used n Phoenix’s 2008 proxy statement for calculating the value of RSUs.

close window view footnotes

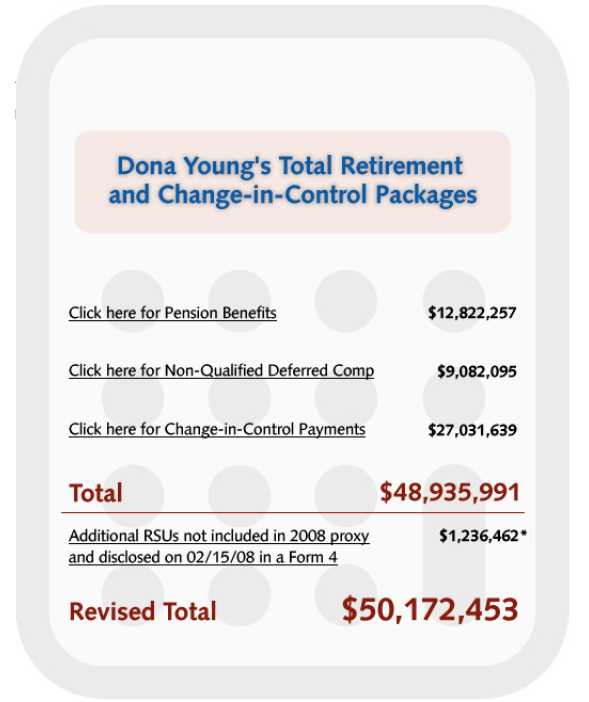

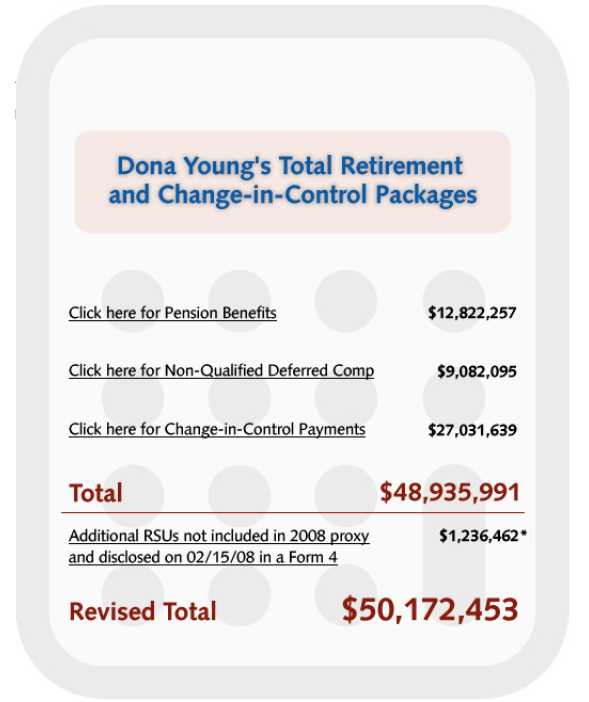

(4) The Restricted Stock Units ("RSUs") represent a portion of the Reporting Person's 2008 long-term incentive award, and each RSU represents one share of stock. The RSUs vest on the earlier of (a) February 13, 2011 or (b) a change of control and a termination of the Reporting Person's employment other than for cause. In the event the RSUs vest, the underlying shares of stock will immediately become deliverable, without consideration. Thereafter, the terms of the Reporting Person's employment will require the Reporting Person to retain a fixed percentage of the shares in accordance with the ownership levels applicable to the Reporting Person under the Company's stock ownership and retention guidelines. Additionally, pro rata vesting would apply in the event of involuntary termination other than for cause or termination due to death, disability or approved retirement.

(5) The options represent a portion of the Reporting Person's 2008 long-term incentive award and vest in approximately three equal installments on each of the first three anniversaries of the grant.

(6) Pursuant to a Restricted Stock Unit Agreement, Mrs. Young has elected to receive 82,321.46 restricted stock units ("RSUs") in lieu of a cash award to which she was entitled under the Company's 1997-1999 Long Term Incentive Plan, the payment of which award was mandatorily deferred until June 26, 2003. Pursuant to such Agreement, each RSU represents the right to receive one share of common stock, and the RSUs will be convertible into the shares underlying the RSUs, without consideration, on the 15th business day after termination of Mrs. Young's employment (or, if such day is not a business day, the next business day).

(7) Pursuant to the terms of Mrs. Young's employment agreement, she received 394,736.8421 restricted stock units ("RSUs"), each representing one share of common stock. Underlying shares of common stock will be deliverable, without consideration, on a specified period of time following the termination of her employment.

(8) Pursuant to the terms of Mrs. Young's employment, she received 90,901 Restricted Stock Units ("RSUs"), each representing one share of stock. The RSUs vest on the earlier of (a) May 18, 2008; or (b) a change in control; or (c) a termination of Mrs. Young's employment by the Company other than for cause or by Mrs. Young for good reason. In the event the RSUs vest, the underlying shares of common stock will become deliverable, without consideration, within a specified period of time following her termination of employment. This award does not include certain other restricted stock units that Mrs. Young has the opportunity to earn in connection with her employment upon achievement of performance criteria unrelated to the price of the underlying securities. Such units are not "derivative securities" under Rule 16a-1(c). See Equifax, Inc. (January 5, 1993).

(9) Pursuant to the terms of Mrs. Young's employment, she received 217,969.000 restricted stock units ("RSUs"), each representing one share of stock. The underlying shares of common stock became deliverable, without consideration, on June 26, 2006. Pursuant to a previous election, Mrs. Young received shares of stock for 50 percent of such RSUs and deferred receipt of shares for the remaining RSUs.

(10) The options vested in approximately three equal installments on each of the first three anniversaries of the grant.

close window view chart