Exhibit (c)-(2)

Confidential

Presentation to the

Board of Directors Regarding

Project MELODY

Presentation

January, 2012

Confidential Important Information

Important Information

Confidential Material Presented to the Special Committee of the Board of Directors of MELODY

The following pages contain material that was prepared by William Blair & Company, L.L.C. (“William Blair”) and provided to the Special Committee of the Board of Directors of MELODY (the “Company”) in connection with their consideration of a potential business combination between the Company and an affiliate to Mr. Yingjie Gao and certain members of the management. The accompanying material was compiled or prepared on a confidential basis for use by the Special Committee of the Board of Directors and not with a view toward public disclosure. The information utilized in preparing this presentation was obtained from the Company and other public sources. Any estimates and projections for the Company contained herein have been prepared by or approved by senior management, or based upon such estimates and projections, and involve numerous and significant subjective determinations, which may or may not prove to be correct. No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past or the future. Because this material was prepared for use in the context of an oral presentation to the Special Committee of the Board of Directors, which is familiar with the business and affairs of the Company, neither the Company nor William Blair nor any of their respective legal or financial advisors or accountants take any responsibility for the accuracy or completeness of any of the material if used by persons other than the Special Committee of the Board of Directors of the Company. Neither the Company nor William Blair undertakes any obligation to update or otherwise revise the accompanying materials. This presentation does not constitute an opinion and William Blair’s only opinion is the written opinion that is to be rendered to the Special Committee of the Board of Directors of the Company.

1

Confidential Table of Contents

Table of Contents

I. Executive Summary

II. MELODY Situation Overview III. Valuation Analysis

A. Summary of Transaction

B. Selected Public Companies Analysis

C. Selected M&A Transactions Analysis

D. Discounted Cash Flow Analysis

E. Premiums Paid Analysis Appendix

A. Supporting Financial Schedules

Confidential

Executive Summary

Confidential Executive Summary

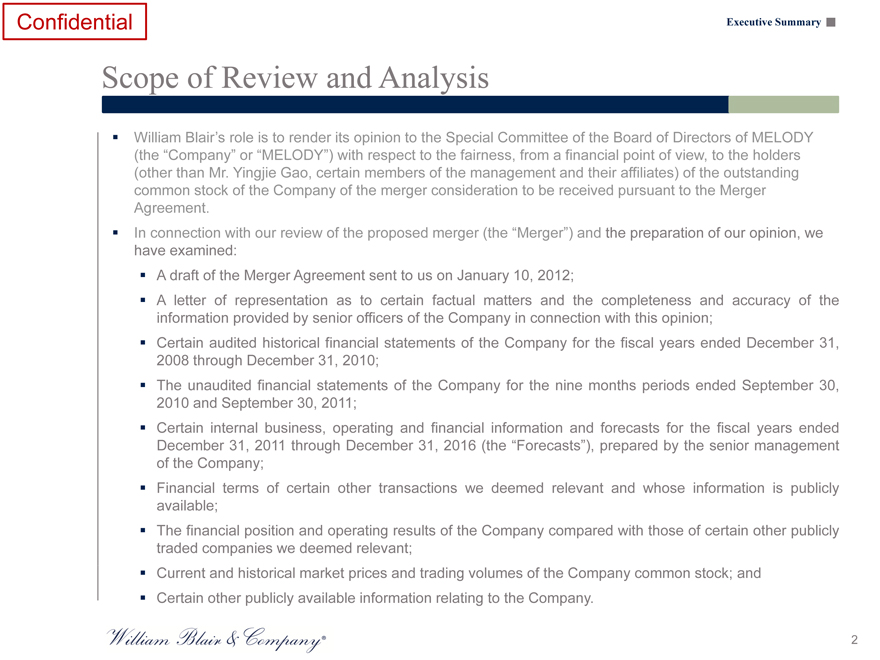

Scope of Review and Analysis

William Blair’s role is to render its opinion to the Special Committee of the Board of Directors of MELODY (the “Company” or “MELODY”) with respect to the fairness, from a financial point of view, to the holders (other than Mr. Yingjie Gao, certain members of the management and their affiliates) of the outstanding common stock of the Company of the merger consideration to be received pursuant to the Merger Agreement.

In connection with our review of the proposed merger (the “Merger”) and the preparation of our opinion, we have examined: ?A draft of the Merger Agreement sent to us on January 10, 2012; ?A letter of representation as to certain factual matters and the completeness and accuracy of the information provided by senior officers of the Company in connection with this opinion; ?Certain audited historical financial statements of the Company for the fiscal years ended December 31, 2008 through December 31, 2010; ?The unaudited financial statements of the Company for the nine months periods ended September 30, 2010 and September 30, 2011; ?Certain internal business, operating and financial information and forecasts for the fiscal years ended December 31, 2011 through December 31, 2016 (the “Forecasts”), prepared by the senior management of the Company; ?Financial terms of certain other transactions we deemed relevant and whose information is publicly available; ?The financial position and operating results of the Company compared with those of certain other publicly traded companies we deemed relevant; ?Current and historical market prices and trading volumes of the Company common stock; and ?Certain other publicly available information relating to the Company.

2

Confidential Executive Summary

Key Assumptions Underlying Our Review and Analysis

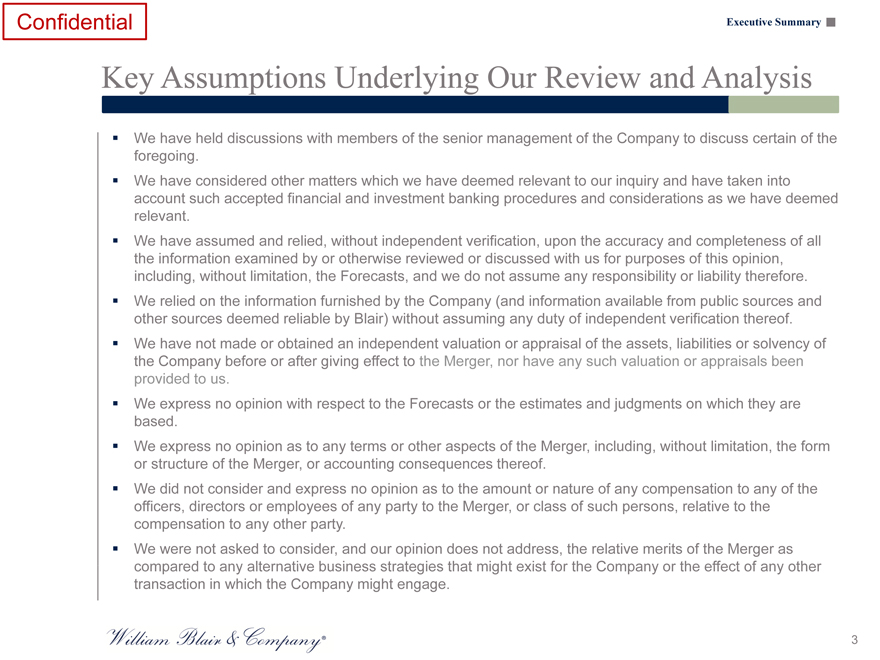

We have held discussions with members of the senior management of the Company to discuss certain of the foregoing.

We have considered other matters which we have deemed relevant to our inquiry and have taken into account such accepted financial and investment banking procedures and considerations as we have deemed relevant.

We have assumed and relied, without independent verification, upon the accuracy and completeness of all the information examined by or otherwise reviewed or discussed with us for purposes of this opinion, including, without limitation, the Forecasts, and we do not assume any responsibility or liability therefore. ??We relied on the information furnished by the Company (and information available from public sources and other sources deemed reliable by Blair) without assuming any duty of independent verification thereof. ??We have not made or obtained an independent valuation or appraisal of the assets, liabilities or solvency of the Company before or after giving effect to the Merger, nor have any such valuation or appraisals been provided to us.

We express no opinion with respect to the Forecasts or the estimates and judgments on which they are based.

We express no opinion as to any terms or other aspects of the Merger, including, without limitation, the form or structure of the Merger, or accounting consequences thereof.

We did not consider and express no opinion as to the amount or nature of any compensation to any of the officers, directors or employees of any party to the Merger, or class of such persons, relative to the compensation to any other party.

We were not asked to consider, and our opinion does not address, the relative merits of the Merger as compared to any alternative business strategies that might exist for the Company or the effect of any other transaction in which the Company might engage.

Confidential Executive Summary

Key Assumptions Underlying Our Review and Analysis

(Cont’d)

Our opinion herein is based upon economic, market, financial and other conditions existing on, and other information disclosed to us as of, the date hereof. It should be understood that, although subsequent developments may affect this opinion, we do not have any obligation to update, revise or reaffirm this opinion.

We have relied on the fact that each of the Company and the Committee has its own counsel, accountants and similar expert advisors for legal, accounting, tax and other similar advice and we have assumed that all such advice was correct and we express no opinion as to any of such advice.

We have also assumed that the executed Merger Agreement will conform in all material respects to the last draft reviewed by us.

In the ordinary course of our business, we may from time to time trade the securities of the Company for our own account and for the accounts of customers, and accordingly may at any time hold a long or short position in such securities.

We are expressing no opinion herein as to the price at which the Company will trade at any future time or as to the effect of the announcement of the Merger on the trading price of the Company.

We do not address the merits of the underlying decision by the Company to engage in the Merger and this opinion does not constitute a recommendation to any stockholder as to how such stockholder should vote with respect to the proposed Merger.

In connection with our engagement, we were not requested to approach, and did not hold discussions with, third parties to solicit indications of interest in a possible acquisition of the Company.

Confidential Executive Summary

Summary of Valuation Analysis

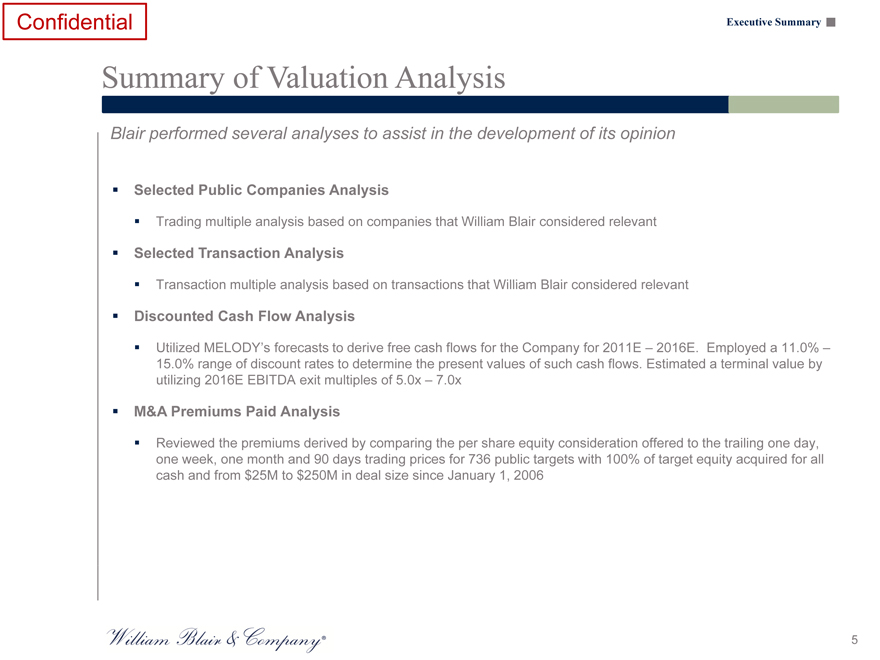

Blair performed several analyses to assist in the development of its opinion

Selected Public Companies Analysis

Trading multiple analysis based on companies that William Blair considered relevant

Selected Transaction Analysis

Transaction multiple analysis based on transactions that William Blair considered relevant

Discounted Cash Flow Analysis

Utilized MELODY’s forecasts to derive free cash flows for the Company for 2011E – 2016E. Employed a 11.0% –15.0% range of discount rates to determine the present values of such cash flows. Estimated a terminal value by utilizing 2016E EBITDA exit multiples of 5.0x – 7.0x

M&A Premiums Paid Analysis

Reviewed the premiums derived by comparing the per share equity consideration offered to the trailing one day, one week, one month and 90 days trading prices for 736 public targets with 100% of target equity acquired for all cash and from $25M to $250M in deal size since January 1, 2006

5

Confidential Executive Summary

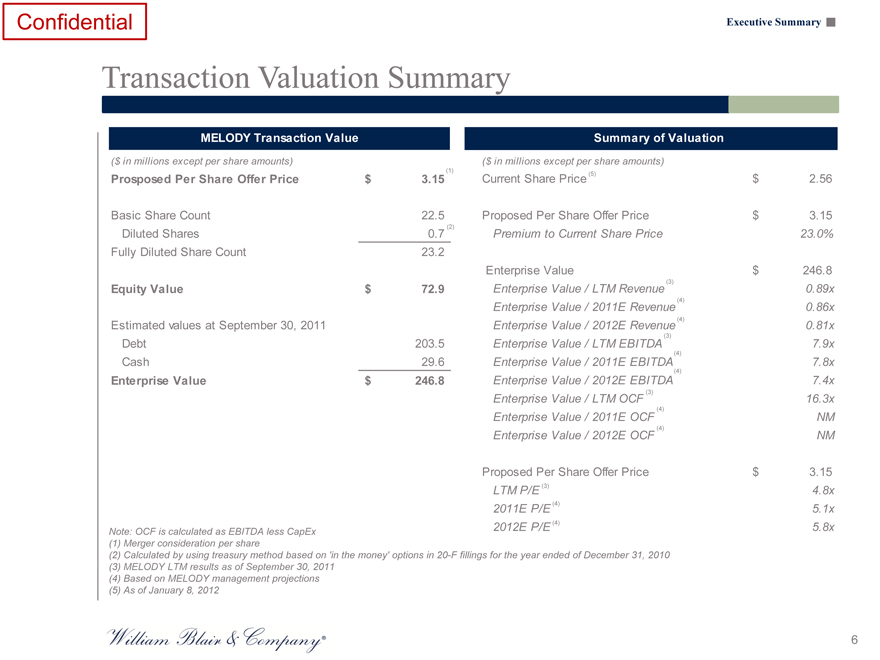

Transaction Valuation Summary

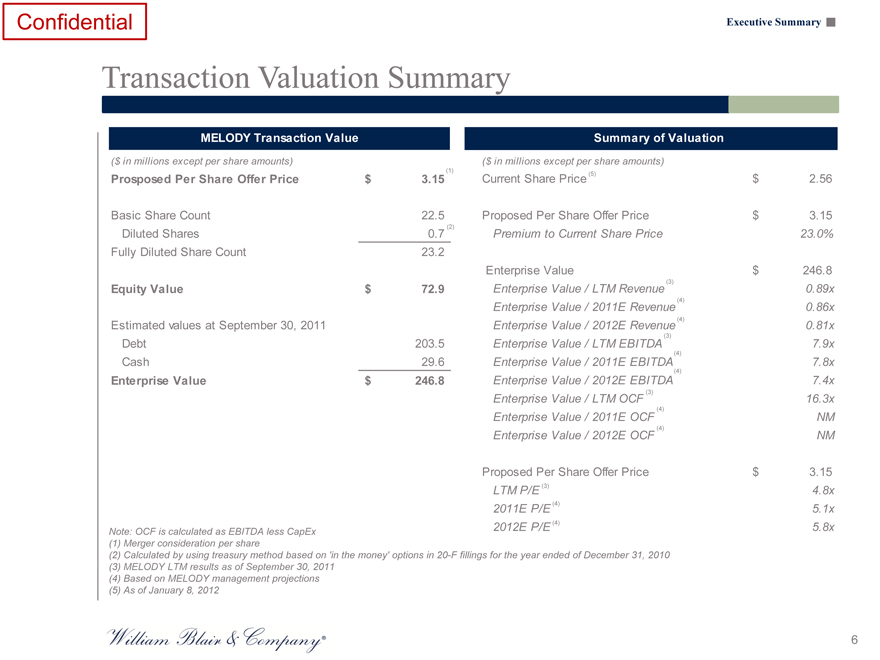

MELODY Transaction Value

($ in millions except per share amounts)

Prosposed Per Share Offer Price $ 3.15 (1)

Basic Share Count 22.5

Diluted Shares 0.7 (2)

Fully Diluted Share Count 23.2

Equity Value $ 72.9

Estimated values at September 30, 2011

Debt 203.5

Cash 29.6

Enterprise Value $ 246.8

Summary of Valuation

($ in millions except per share amounts)

Current Share Price (5) $ 2.56

Proposed Per Share Offer Price $ 3.15

Premium to Current Share Price 23.0%

Enterprise Value $ 246.8

Enterprise Value / LTM Revenue 0.89x

Enterprise Value / 2011E Revenue 0.86x

Enterprise Value / 2012E Revenue 0.81x

Enterprise Value / LTM EBITDA 7.9x Enterprise Value / 2011E EBITDA(4) 7.8x

Enterprise Value / 2012E EBITDA 7.4x

Enterprise Value / LTM OCF 16.3x

Enterprise Value / 2011E OCF NM

Enterprise Value / 2012E OCF NM

Proposed Per Share Offer Price $ 3.15

LTM P/E (3) 4.8x 2011E P/E (4) 5.1x 2012E P/E (4) 5.8x

Note: OCF is calculated as EBITDA less CapEx (1) Merger consideration per share

(2) Calculated by using treasury method based on ‘in the money’ options in 20-F fillings for the year ended of December 31, 2010 (3) MELODY LTM results as of September 30, 2011 (4) Based on MELODY management projections

(5) | | As of January 8, 2012 |

Confidential

MELODY Situation Overview

Confidential MELODY Situation Overview

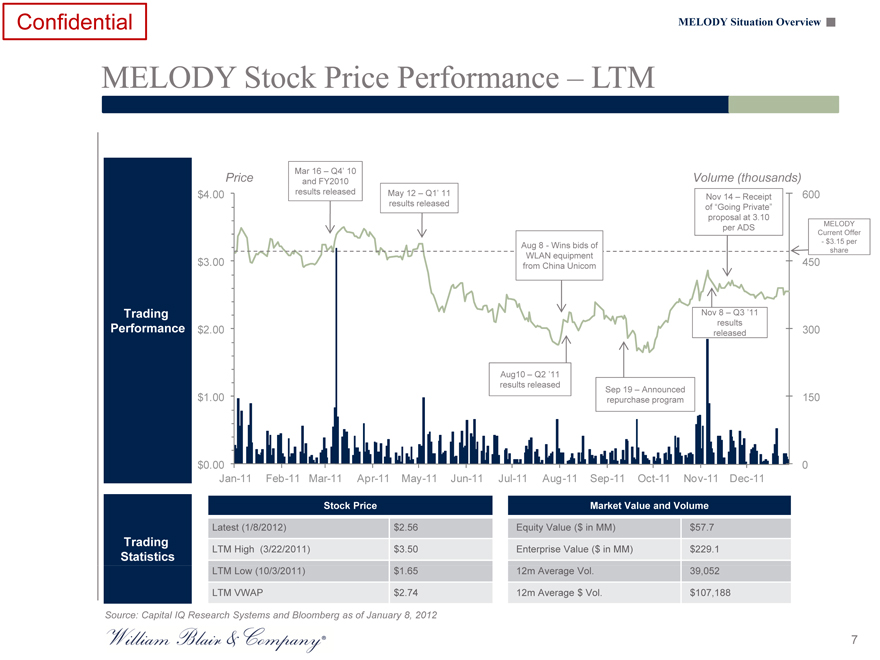

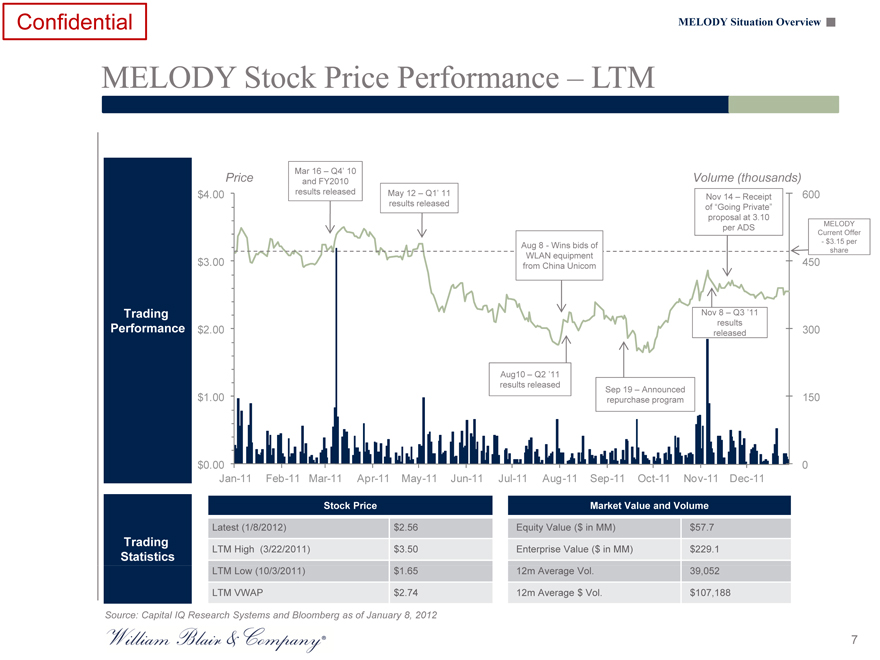

MELODY Stock Price Performance – LTM

Mar 16 – Q4’ 10

Price and FY2010 Volume (thousands)

$4.00 | | results released May 12 – Q1’ 11 Nov 14 – Receipt 600 |

results released of “Going Private”

proposal at 3.10

per ADS MELODY

Current Offer

Aug 8—Wins bids of—$3.15 per

share

WLAN equipment

$3.00 | | from China Unicom 450 |

Trading Nov 8 – Q3 ‘11

Performance $2.00 released results 300

Aug10 – Q2 ‘11

results released Sep 19 – Announced

$1.00 | | repurchase program 150 |

$0.00 0

Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11

Stock Price Market Value and Volume

Latest (1/8/2012) $2.56 Equity Value ($ in MM) $57.7

Trading

Statistics LTM High (3/22/2011) $3.50 Enterprise Value ($ in MM) $229.1

LTM Low (10/3/2011) $1.65 12m Average Vol. 39,052

LTM VWAP $2.74 12m Average $ Vol. $107,188

Source: Capital IQ Research Systems and Bloomberg as of January 8, 2012

Confidential MELODY Situation Overview

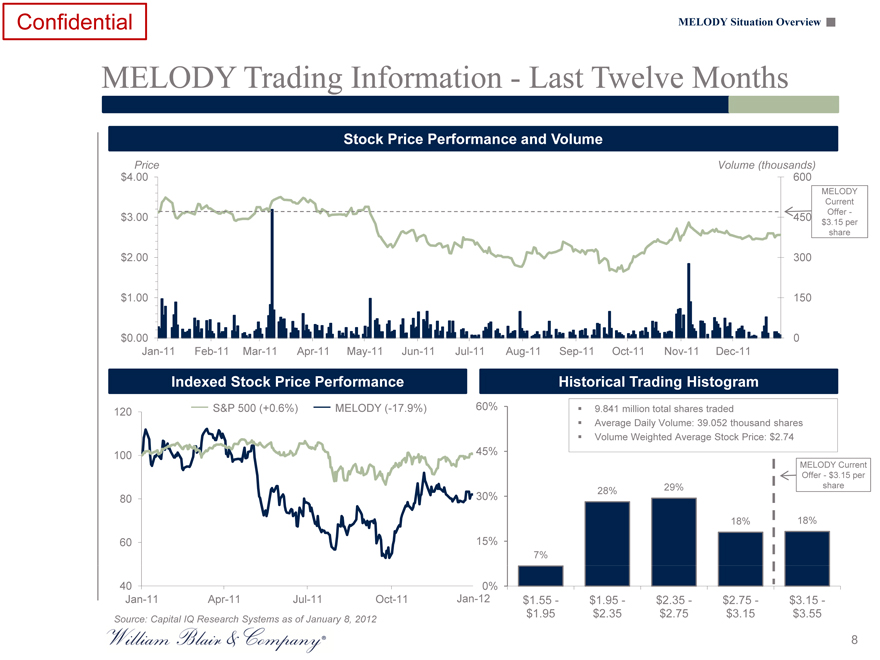

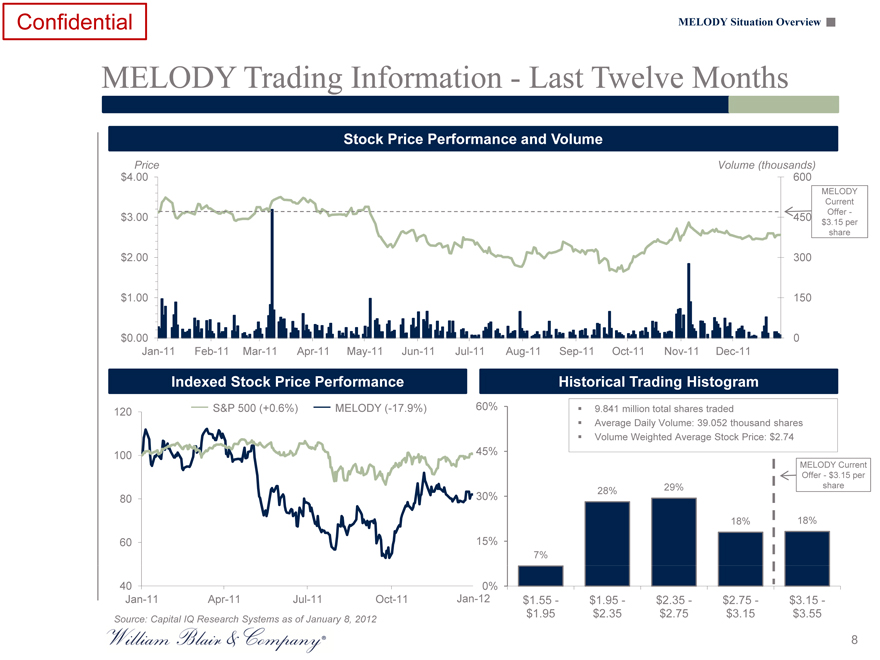

MELODY Trading Information—Last Twelve Months

Stock Price Performance and Volume

Price Volume (thousands)

MELODY

Current

share

$0.00 0

Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11

Indexed Stock Price Performance Historical Trading Histogram

120 S&P 500 (+0.6%) MELODY (-17.9%) 60% ? 9.841 million total shares traded

Average Daily Volume: 39.052 thousand shares

Volume Weighted Average Stock Price: $2.74

100 45%

MELODY Current

Offer—$3.15 per

28% 29% share

18% 18%

7%

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 $1.55—$1.95—$2.35—$2.75—$3.15 -

Source: Capital IQ Research Systems as of January 8, 2012 $1.95 $2.35 $2.75 $3.15 $3.55

Confidential MELODY Situation Overview

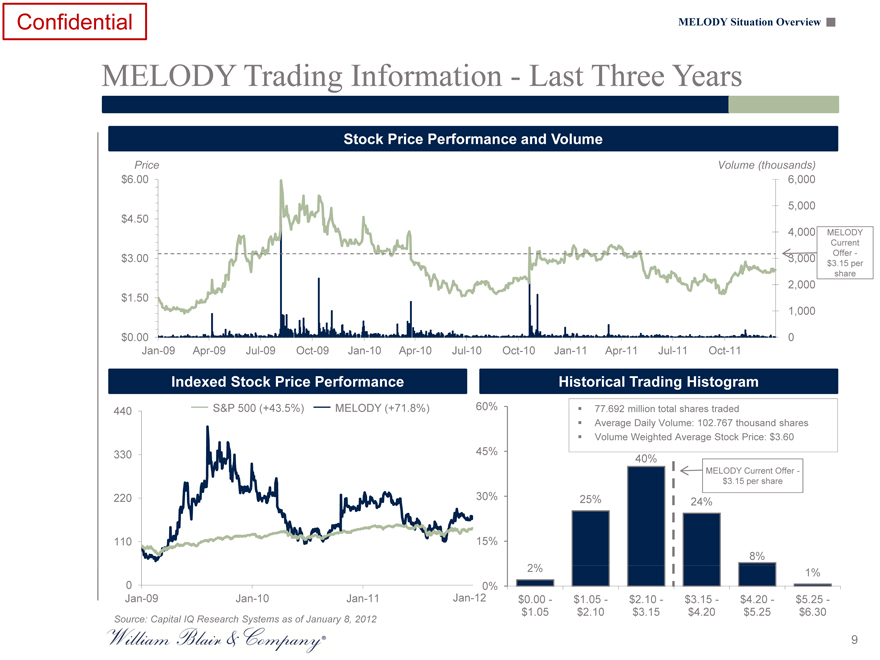

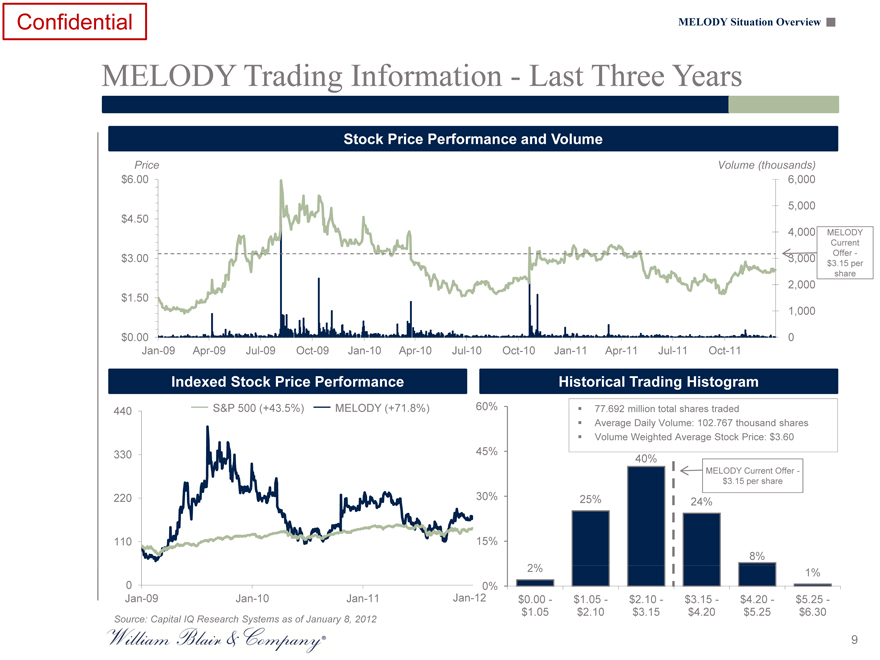

MELODY Trading Information—Last Three Years

Stock Price Performance and Volume

Price Volume (thousands)

5,000

$4.50

4,000 MELODY

Current

share

2,000

$1.50

1,000

$0.00 0

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11

Indexed Stock Price Performance Historical Trading Histogram

440 S&P 500 (+43.5%) MELODY (+71.8%) 60% ? 77.692 million total shares traded

Average Daily Volume: 102.767 thousand shares

Volume Weighted Average Stock Price: $3.60

330 45% 40%

MELODY Current Offer -

220 30% 25% 24%

110 15%

8%

2% 1%

0 0%

Jan-09 Jan-10 Jan-11 Jan-12 $0.00—$1.05—$2.10—$3.15—$4.20—$5.25 -

$1.05 | | $2.10 $3.15 $4.20 $5.25 $6.30 |

Source: Capital IQ Research Systems as of January 8, 2012

9

Confidential MELODY Situation Overview

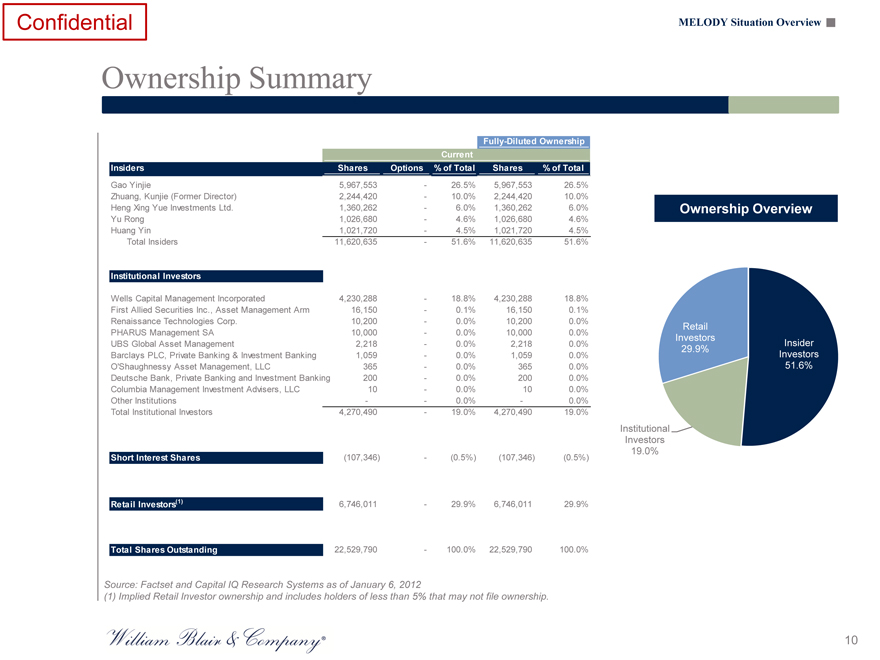

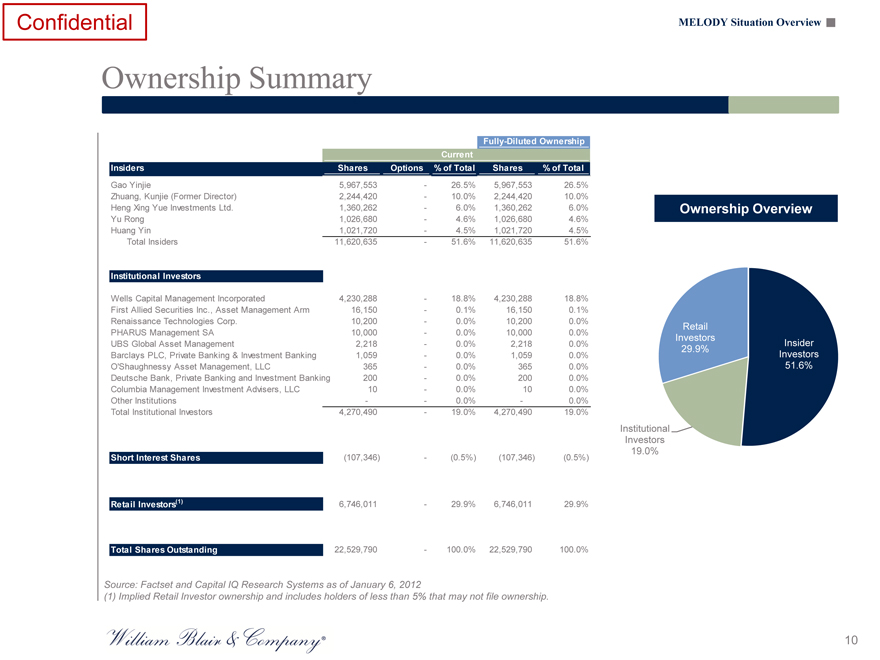

Ownership Summary

Fully-Diluted Ownership

Current

Insiders Shares Options % of Total Shares% of Total

Gao Yinjie 5,967,553—26.5% 5,967,553 26.5%

Zhuang, Kunjie (Former Director) 2,244,420—10.0% 2,244,420 10.0%

Heng Xing Yue Investments Ltd. 1,360,262—6.0% 1,360,262 6.0%

Yu Rong 1,026,680—4.6% 1,026,680 4.6%

Huang Yin 1,021,720—4.5% 1,021,720 4.5%

Total Insiders 11,620,635—51.6% 11,620,635 51.6%

Institutional Investors

Wells Capital Management Incorporated 4,230,288—18.8% 4,230,288 18.8%

First Allied Securities Inc., Asset Management Arm 16,150—0.1% 16,150 0.1%

Renaissance Technologies Corp. 10,200—0.0% 10,200 0.0%

PHARUS Management SA 10,000—0.0% 10,000 0.0%

UBS Global Asset Management 2,218—0.0% 2,218 0.0%

Barclays PLC, Private Banking & Investment Banking 1,059—0.0% 1,059 0.0%

O’Shaughnessy Asset Management, LLC 365—0.0% 365 0.0%

Deutsche Bank, Private Banking and Investment Bankin 200—0.0% 200 0.0%

Columbia Management Investment Advisers, LLC 10—0.0% 10 0.0%

Other Institutions—- 0.0%—0.0%

Total Institutional Investors 4,270,490—19.0% 4,270,490 19.0%

Short Interest Shares(107,346) -(0.5%)(107,346)(0.5%)

Retail Investors(1) 6,746,011—29.9% 6,746,011 29.9%

Total Shares Outstanding 22,529,790—100.0% 22,529,790 100.0%

Source: Factset and Capital IQ Research Systems as of January 6, 2012

(1) | | Implied Retail Investor ownership and includes holders of less than 5% that may not file ownership. |

Ownership Overview

Retail(1)

Investors Insider

51.6%

Institutional

Investors

19.0%

10

Confidential MELODY Situation Overview

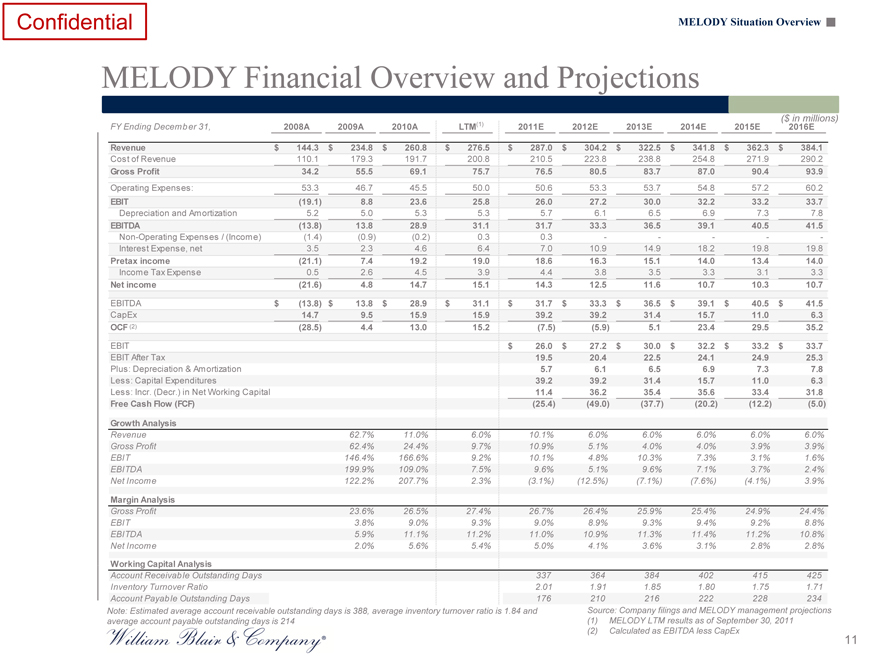

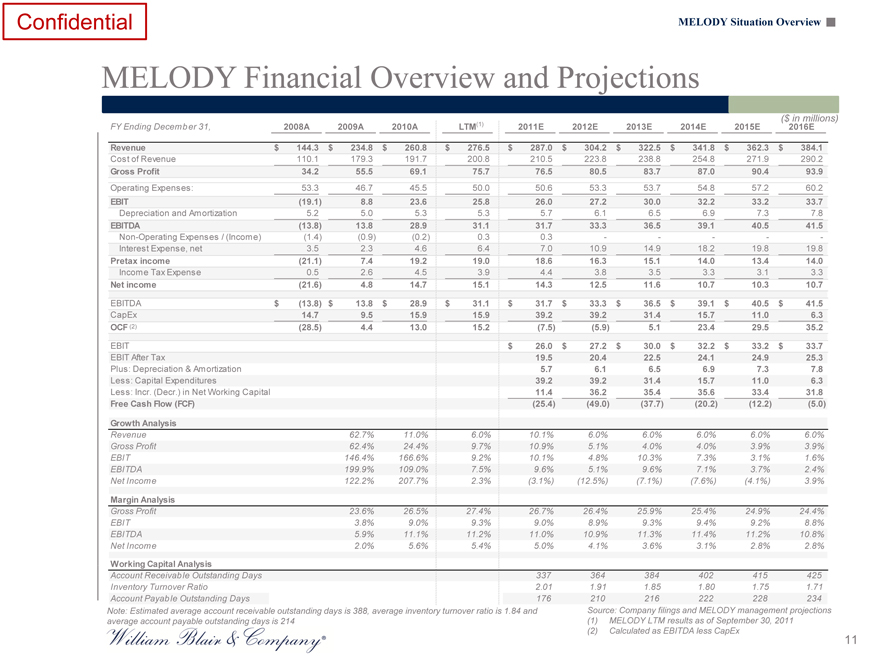

MELODY Financial Overview and Projections

($ in millions)

FY Ending December 31, 2008A 2009A 2010A LTM(1) 2011E 2012E 2013E 2014E 2015E 2016E

Revenue $ 144.3 $ 234.8 $ 260.8 $ 276.5 $ 287.0 $ 304.2 $ 322.5 $ 341.8 $ 362.3 $ 384.1

Cost of Revenue 110.1 179.3 191.7 200.8 210.5 223.8 238.8 254.8 271.9 290.2

Gross Profit 34.2 55.5 69.1 75.7 76.5 80.5 83.7 87.0 90.4 93.9

Operating Expenses: 53.3 46.7 45.5 50.0 50.6 53.3 53.7 54.8 57.2 60.2

EBIT(19.1) 8.8 23.6 25.8 26.0 27.2 30.0 32.2 33.2 33.7

Depreciation and Amortization 5.2 5.0 5.3 5.3 5.7 6.1 6.5 6.9 7.3 7.8

EBITDA(13.8) 13.8 28.9 31.1 31.7 33.3 36.5 39.1 40.5 41.5

Non-Operating Expenses / (Income)(1.4)(0.9)(0.2) 0.3 0.3———-

Interest Expense, net 3.5 2.3 4.6 6.4 7.0 10.9 14.9 18.2 19.8 19.8

Pretax income(21.1) 7.4 19.2 19.0 18.6 16.3 15.1 14.0 13.4 14.0

Income Tax Expense 0.5 2.6 4.5 3.9 4.4 3.8 3.5 3.3 3.1 3.3

Net income(21.6) 4.8 14.7 15.1 14.3 12.5 11.6 10.7 10.3 10.7

EBITDA $(13.8) $ 13.8 $ 28.9 $ 31.1 $ 31.7 $ 33.3 $ 36.5 $ 39.1 $ 40.5 $ 41.5

CapEx 14.7 9.5 15.9 15.9 39.2 39.2 31.4 15.7 11.0 6.3

OCF (2)(28.5) 4.4 13.0 15.2(7.5)(5.9) 5.1 23.4 29.5 35.2

EBIT $ 26.0 $ 27.2 $ 30.0 $ 32.2 $ 33.2 $ 33.7

EBIT After Tax 19.5 20.4 22.5 24.1 24.9 25.3

Plus: Depreciation & Amortization 5.7 6.1 6.5 6.9 7.3 7.8

Less: Capital Expenditures 39.2 39.2 31.4 15.7 11.0 6.3

Less: Incr. (Decr.) in Net Working Capital 11.4 36.2 35.4 35.6 33.4 31.8

Free Cash Flow (FCF)(25.4)(49.0)(37.7)(20.2)(12.2)(5.0)

Growth Analysis

Revenue 62.7% 11.0% 6.0% 10.1% 6.0% 6.0% 6.0% 6.0% 6.0%

Gross Profit 62.4% 24.4% 9.7% 10.9% 5.1% 4.0% 4.0% 3.9% 3.9%

EBIT 146.4% 166.6% 9.2% 10.1% 4.8% 10.3% 7.3% 3.1% 1.6%

EBITDA 199.9% 109.0% 7.5% 9.6% 5.1% 9.6% 7.1% 3.7% 2.4%

Net Income 122.2% 207.7% 2.3%(3.1%)(12.5%)(7.1%)(7.6%)(4.1%) 3.9%

Margin Analysis

Gross Profit 23.6% 26.5% 27.4% 26.7% 26.4% 25.9% 25.4% 24.9% 24.4%

EBIT 3.8% 9.0% 9.3% 9.0% 8.9% 9.3% 9.4% 9.2% 8.8%

EBITDA 5.9% 11.1% 11.2% 11.0% 10.9% 11.3% 11.4% 11.2% 10.8%

Net Income 2.0% 5.6% 5.4% 5.0% 4.1% 3.6% 3.1% 2.8% 2.8%

Working Capital Analysis

Account Receivable Outstanding Days 337 364 384 402 415 425

Inventory Turnover Ratio 2.01 1.91 1.85 1.80 1.75 1.71

Account Payable Outstanding Days 176 210 216 222 228 234

Note: Estimated average account receivable outstanding days is 388, average inventory turnover ratio is 1.84 and Source: Company filings and MELODY management projections

average account payable outstanding days is 214(1) MELODY LTM results as of September 30, 2011

(2) | | Calculated as EBITDA less CapEx |

11

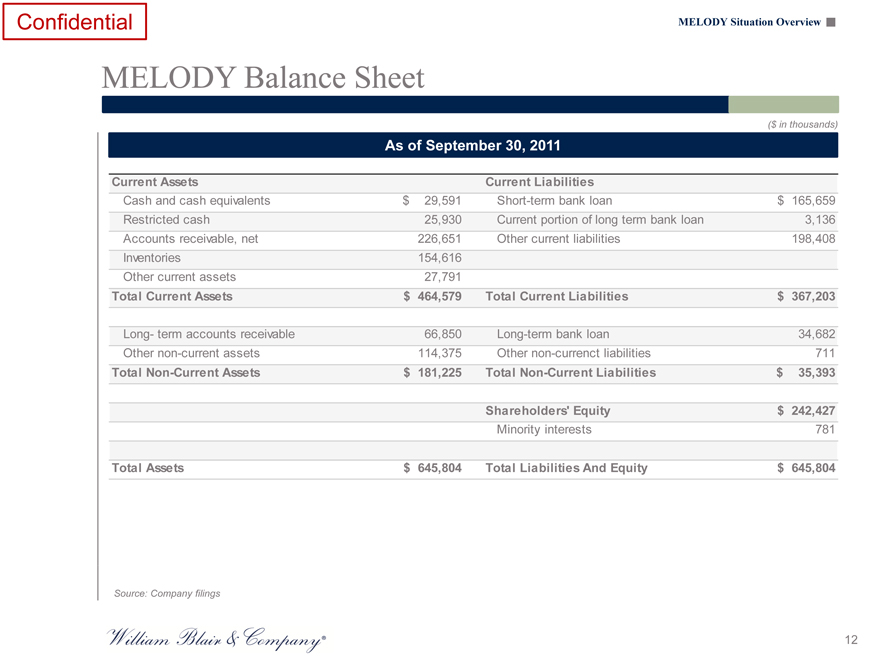

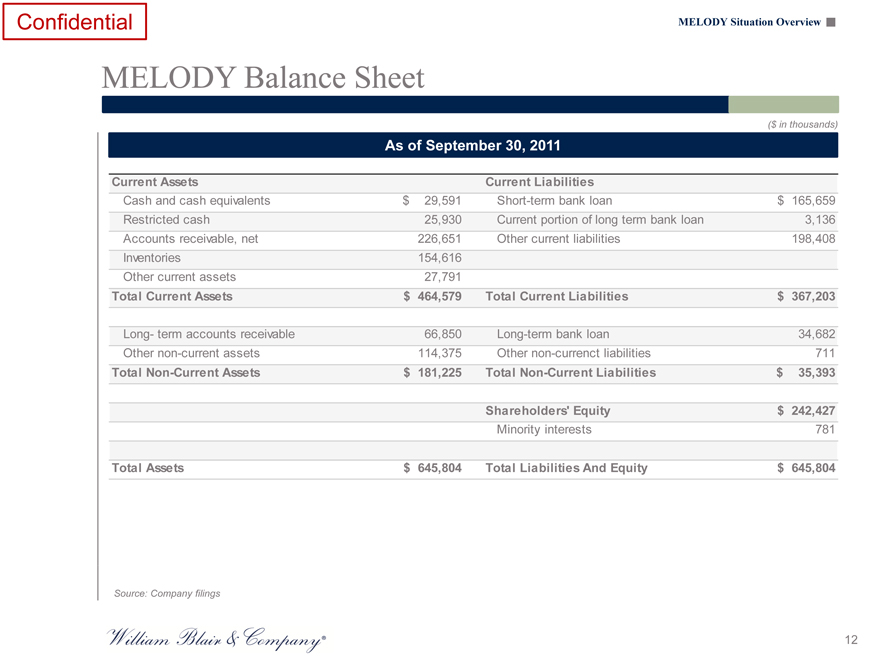

Confidential MELODY Situation Overview

MELODY Balance Sheet

($ in thousands)

As of September 30, 2011

Current Assets Current Liabilities

Cash and cash equivalents $ 29,591 Short-term bank loan $ 165,659

Restricted cash 25,930 Current portion of long term bank loan 3,136

Accounts receivable, net 226,651 Other current liabilities 198,408

Inventories 154,616

Other current assets 27,791

Total Current Assets $ 464,579 Total Current Liabilities $ 367,203

Long- term accounts receivable 66,850 Long-term bank loan 34,682

Other non-current assets 114,375 Other non-currenct liabilities 711

Total Non-Current Assets $ 181,225 Total Non-Current Liabilities $ 35,393

Shareholders’ Equity $ 242,427

Minority interests 781

Total Assets $ 645,804 Total Liabilities And Equity $ 645,804

Source: Company filings

12

Confidential

Valuation Analysis

Confidential

Summary of Transaction

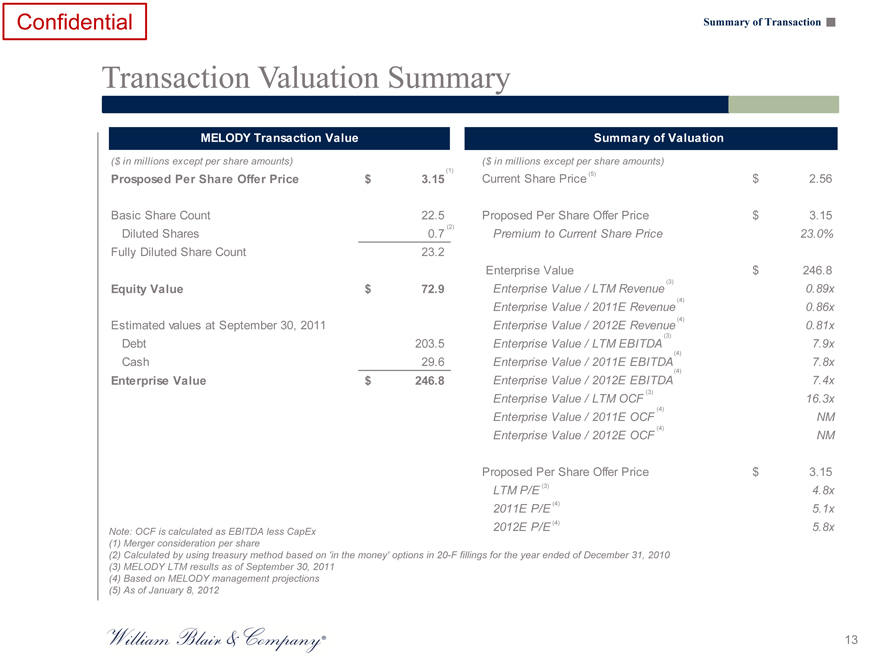

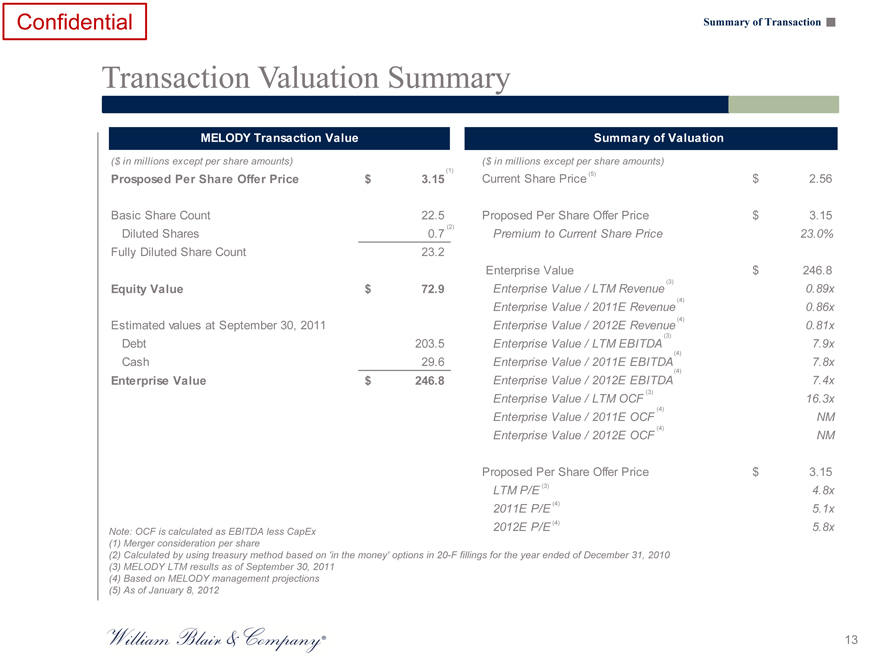

Confidential Summary of Transaction

Transaction Valuation Summary

MELODY Transaction Value

($ in millions except per share amounts)

Prosposed Per Share Offer Price $ 3.15 (1)

Basic Share Count 22.5

Diluted Shares 0.7 (2)

Fully Diluted Share Count 23.2

Equity Value $ 72.9

Estimated values at September 30, 2011

Debt 203.5

Cash 29.6

Enterprise Value $ 246.8

Summary of Valuation

($ in millions except per share amounts)

Current Share Price (5) $ 2.56

Proposed Per Share Offer Price $ 3.15

Premium to Current Share Price 23.0%

Enterprise Value $ 246.8

Enterprise Value / LTM Revenue (3) 0.89x

Enterprise Value / 2011E Revenue (4) 0.86x

Enterprise Value / 2012E Revenue (4) 0.81x

Enterprise Value / LTM EBITDA (3) 7.9x

Enterprise Value / 2011E EBITDA 7.8x

Enterprise Value / 2012E EBITDA 7.4x

Enterprise Value / LTM OCF (3) 16.3x

Enterprise Value / 2011E OCF (4) NM

Enterprise Value / 2012E OCF (4) NM

Proposed Per Share Offer Price $ 3.15

LTM P/E (3) 4.8x

2011E P/E (4) 5.1x

2012E P/E (4) 5.8x

Note: OCF is calculated as EBITDA less CapEx (1) Merger consideration per share

(2) Calculated by using treasury method based on ‘in the money’ options in 20-F fillings for the year ended of December 31, 2010 (3) MELODY LTM results as of September 30, 2011 (4) Based on MELODY management projections

(5) | | As of January 8, 2012 |

13

Confidential

Selected Public Companies Analysis

Confidential

Selected Public Companies Analysis

Selected Public Companies – Methodology

Blair selected three groups of publicly-traded companies it deemed relevant to MELODY The following companies were selected

U.S. Listed Chinese Wireless U.S. Listed Non-Chinese Wireless U.S. Listed Chinese Growth Companies

Infrastructure Companies Infrastructure Companies

Cogo Group, Inc. Alvarion Ltd. China Gerui Advanced Materials Jinpan International Ltd.

Telestone Technologies Corp. Anaren Inc. China Xiniya Fashion Limited ShangPharma Corporation

Aviat Networks, Inc Country Style Cooking Xueda Education Group

Restaurant Chain Co., Ltd.

Ceragon Networks Ltd. Zuoan Fashion Limited

Powerwave Technologies Inc

For these groups, Blair calculated the following multiples

Total Enterprise Value / LTM Revenue Total Enterprise Value / 2011E Revenue Total Enterprise Value / 2012E Revenue

Total Enterprise Value / LTM EBITDA Total Enterprise Value / 2011E EBITDA Total Enterprise Value / 2012E EBITDA

Total Equity Value / LTM Earning Total Equity Value / 2011E Earning Total Equity Value / 2012E Earning

Total Enterprise Value / LTM OCF Total Enterprise Value / 2011E OCF Total Enterprise Value / 2012E OCF

Note: No selected public company is identical or directly comparable to the Company

14

Confidential Selected Public Companies Analysis

Indexed Stock Price Performance

Last Twelve Months

(indexed price)

130

110

Jan-11 May-11 Sep-11 Jan-

MELODY (-17.9%)

U.S. Listed Chinese Wireless Infrastructure Companies (-73.2%)

U.S. Listed Non-Chinese Wireless Infrastructure Companies (-54.0%)

U.S. Listed Chinese Growth Companies (-47.3%)

S&P 500 (+0.6%)

Last Three Years

(indexed price)

700

600

500

400

300

200

100

0

Jan-09 Jan-10 Jan-11 Jan-12

MELODY (+71.8%)

U.S. Listed Chinese Wireless Infrastructure Companies (-11.3%)

U.S. Listed Non-Chinese Wireless Infrastructure Companies (-16.0%)

U.S. Listed Chinese Growth Companies (-40.3%)

S&P 500 (+43.5%)

Source: Capital IQ Research Systems as of January 8, 2012

U.S. Listed Chinese Wireless Infrastructure Companies include: Cogo Group,Inc, Telestone Technologies Corp

U.S. Listed Non-Chinese Wireless Infrastructure Companies include: Alvarion Ltd, Anaren Inc., Aviat Networks, Inc., Ceragon Networks Ltd., Powerwave Technologies Inc.

U.S. Listed Chinese Growth Companies include: China Gerui Advanced Materials, China Xiniya Fashion Limited, Country Style Cooking Restaurant Chain Co., Ltd., Jinpan International Ltd., ShangPharma Corporation, Xueda Education Group, Zuoan Fashion Limited

15

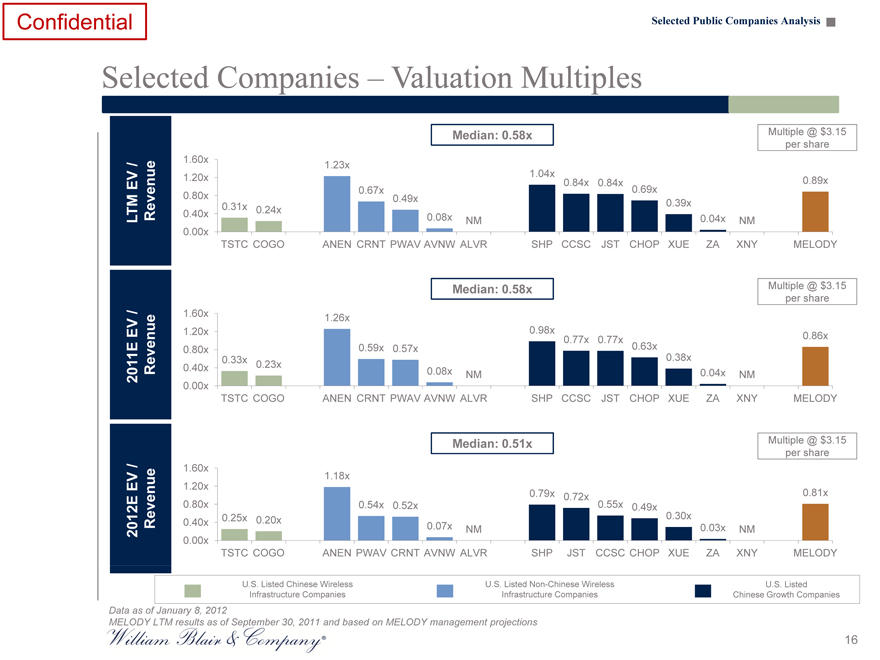

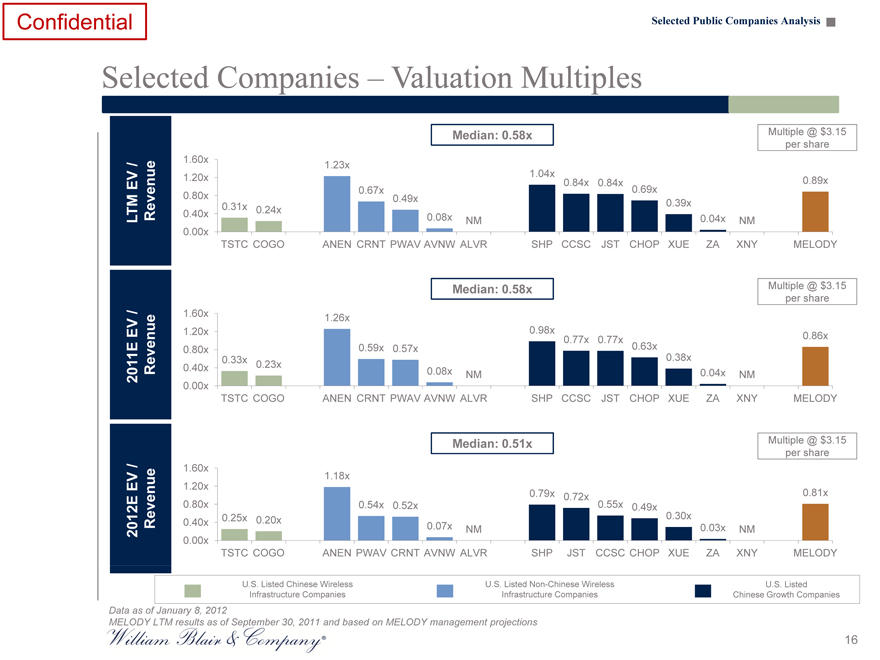

Confidential Selected Public Companies Analysis

Selected Companies – Valuation Multiples

Median: 0.58x Multiple @ $3.15

per share

1.60x

/ 1.23x

1.20x | | 1.04x 0.84x 0.84x 0.89x |

EV 0.67x 0.69x

LTM Revenue 0.40x 0.31x 0.24x 0.39x

0.00x

TSTC COGO ANEN CRNT PWAV AVNW ALVR SHP CCSC JST CHOP XUE ZA XNY MELODY

Median: 0.58x Multiple @ $3.15

per share

/ e 1.60x 1.26x

V 0.98x

E 1.20x 0.77x 0.77x 0.86x

2011E Revenu 0.40x 0.08x NM 0.04x NM

0.00x

TSTC COGO ANEN CRNT PWAV AVNW ALVR SHP CCSC JST CHOP XUE ZA XNY MELODY

Median: 0.51x Multiple @ $3.15

per share

/ 1.60x

1.18x

EV nue 1.20x

0.80x | | 0.54x 0.52x 0.55x 0.49x |

2012E Reve 0.07x NM 0.03x NM

0.00x

TSTC COGO ANEN PWAV CRNT AVNW ALVR SHP JST CCSC CHOP XUE ZA XNY MELODY

U.S. Listed Chinese Wireless U.S. Listed Non-Chinese Wireless U.S. Listed

Infrastructure Companies Infrastructure Companies Chinese Growth Companies

Data as of January 8, 2012

MELODY LTM results as of September 30, 2011 and based on MELODY management projections

16

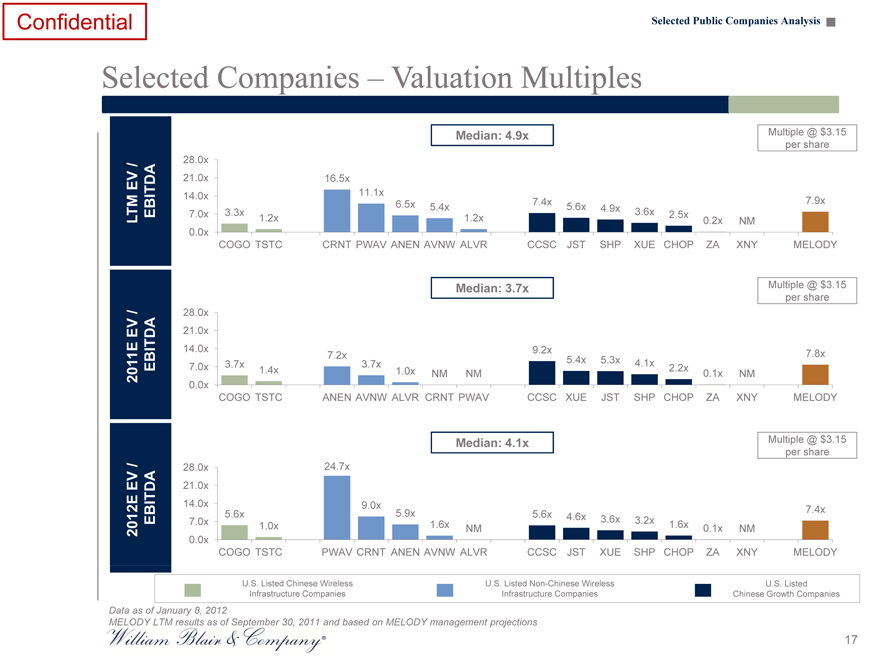

Confidential Selected Public Companies Analysis

Selected Companies – Valuation Multiples

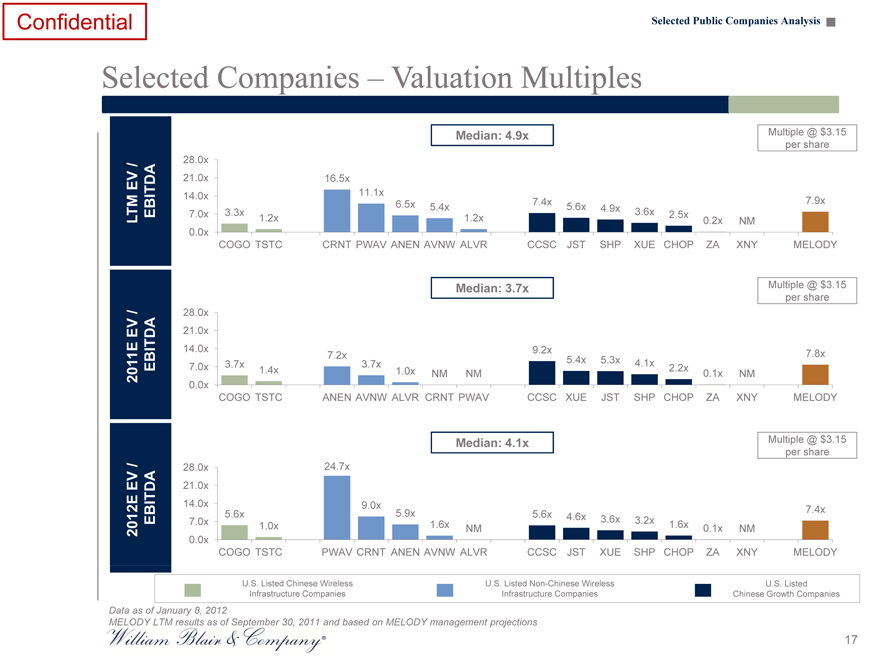

Median: 4.9x Multiple @ $3.15

per share

28.0x

/

EV 21.0x 16.5x

6.5x | | 5.4x 7.4x 5.6x 4.9x 7.9x |

LTM EBITDA 7.0x 3.3x 3.6x 2.5x

0.0x

COGO TSTC CRNT PWAV ANEN AVNW ALVR CCSC JST SHP XUE CHOP ZA XNY MELODY

Median: 3.7x Multiple @ $3.15

per share

/ 28.0x

V A

E 21.0x

7.0x | | 3.7x 3.7x 5.4x 5.3x 4.1x |

2011E EBITD 1.4x 1.0x NM NM 2.2x 0.1x NM

0.0x

COGO TSTC ANEN AVNW ALVR CRNT PWAV CCSC XUE JST SHP CHOP ZA XNY MELODY

Median: 4.1x Multiple @ $3.15

per share

/ 28.0x 24.7x

EV DA 21.0x

7.0x | | 5.6x 5.9x 5.6x 4.6x 3.6x 3.2x 7.4x |

2012E EBIT 1.0x 1.6x NM 1.6x 0.1x NM

0.0x

COGO TSTC PWAV CRNT ANEN AVNW ALVR CCSC JST XUE SHP CHOP ZA XNY MELODY

U.S. Listed Chinese Wireless U.S. Listed Non-Chinese Wireless U.S. Listed

Infrastructure Companies Infrastructure Companies Chinese Growth Companies

Data as of January 8, 2012

MELODY LTM results as of September 30, 2011 and based on MELODY management projections

17

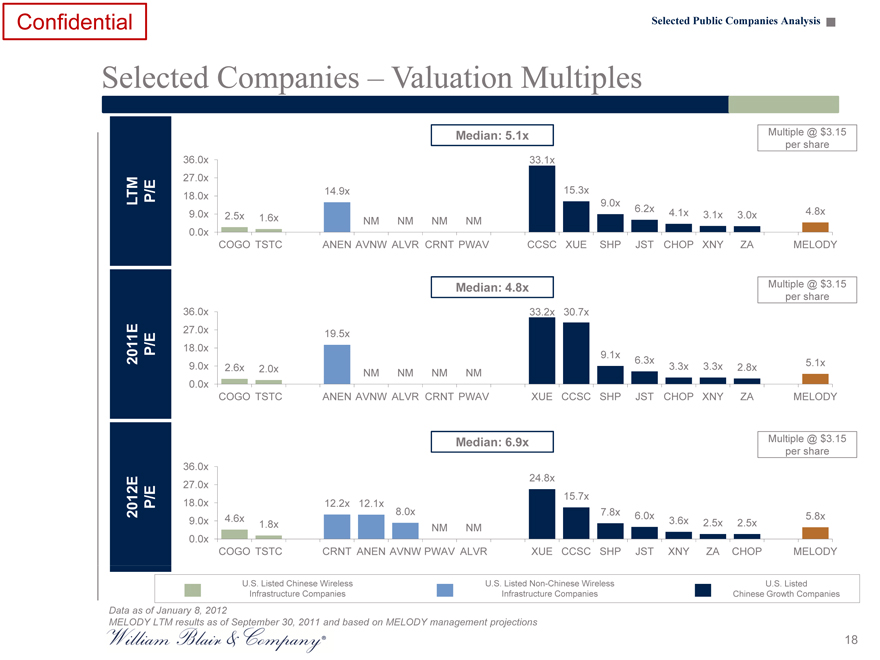

Confidential Selected Public Companies Analysis

Selected Companies – Valuation Multiples

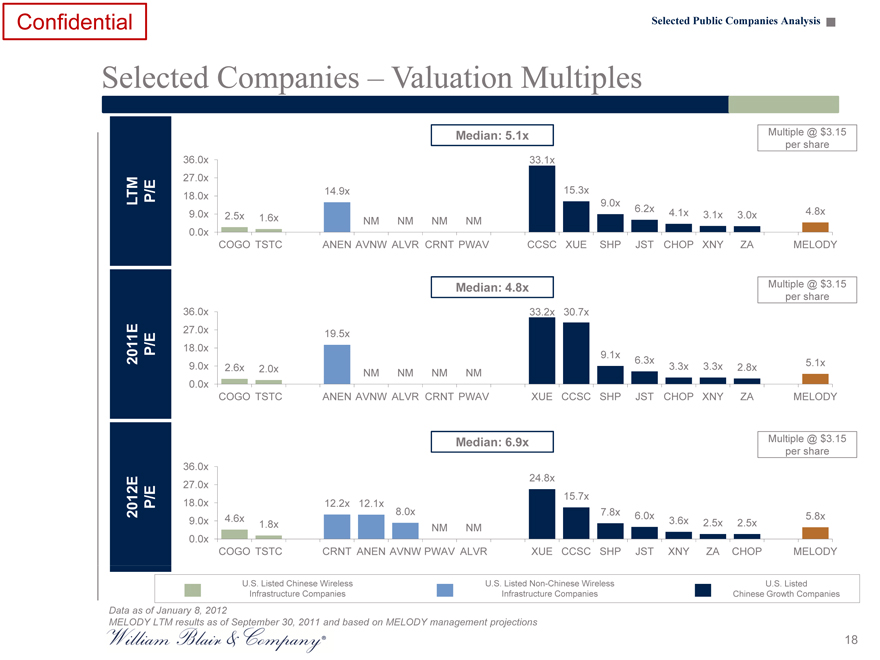

Median: 5.1x Multiple @ $3.15

per share

27.0x

LTM P/E 18.0x 14.9x 15.3x

9.0x | | 2.5x 1.6x NM NM NM NM 4.1x 3.1x 3.0x |

0.0x

COGO TSTC ANEN AVNW ALVR CRNT PWAV CCSC XUE SHP JST CHOP XNY ZA MELODY

Median: 4.8x Multiple @ $3.15

per share

2011E P/E 18.0x 9.1x

9.0x | | 2.6x 2.0x 6.3x 3.3x 3.3x 2.8x 5.1x |

NM NM NM NM

0.0x

COGO TSTC ANEN AVNW ALVR CRNT PWAV XUE CCSC SHP JST CHOP XNY ZA MELODY

Median: 6.9x Multiple @ $3.15

per share

36.0x

2E E 27.0x 24.8x

201 P/ 9.0x 4.6x 8.0x 7.8x 6.0x 3.6x 2.5x 2.5x 5.8x

0.0x

COGO TSTC CRNT ANEN AVNW PWAV ALVR XUE CCSC SHP JST XNY ZA CHOP MELODY

U.S. Listed Chinese Wireless U.S. Listed Non-Chinese Wireless U.S. Listed

Infrastructure Companies Infrastructure Companies Chinese Growth Companies

Data as of January 8, 2012

MELODY LTM results as of September 30, 2011 and based on MELODY management projections

18

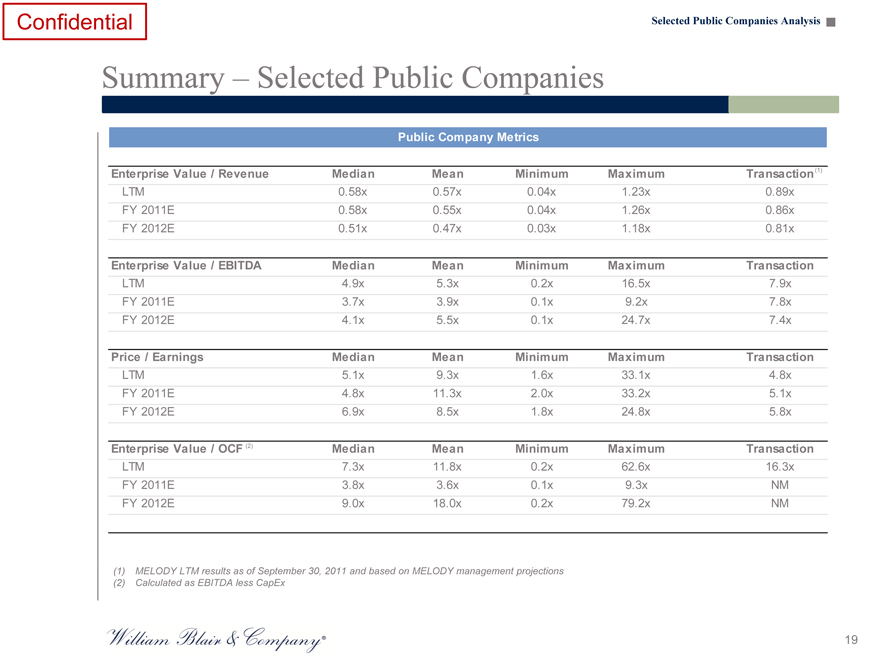

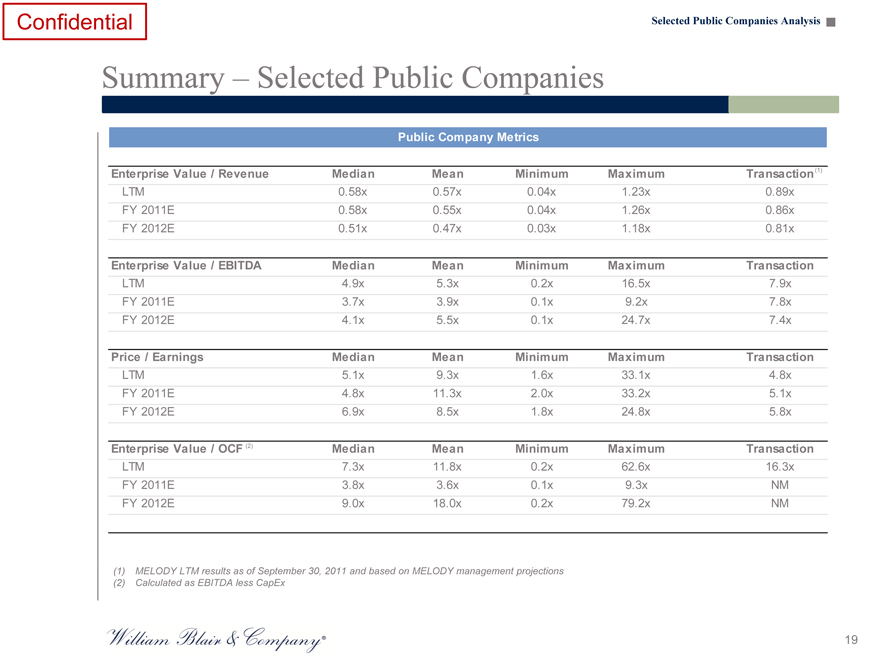

Confidential Selected Public Companies Analysis

Summary – Selected Public Companies

Public Company Metrics

Enterprise Value / Revenue Median Mean Minimum Maximum Transaction (1)

LTM 0.58x 0.57x 0.04x 1.23x 0.89x

FY 2011E 0.58x 0.55x 0.04x 1.26x 0.86x

FY 2012E 0.51x 0.47x 0.03x 1.18x 0.81x

Enterprise Value / EBITDA Median Mean Minimum Maximum Transaction

LTM 4.9x 5.3x 0.2x 16.5x 7.9x

FY 2011E 3.7x 3.9x 0.1x 9.2x 7.8x

FY 2012E 4.1x 5.5x 0.1x 24.7x 7.4x

Price / Earnings Median Mean Minimum Maximum Transaction

LTM 5.1x 9.3x 1.6x 33.1x 4.8x

FY 2011E 4.8x 11.3x 2.0x 33.2x 5.1x

FY 2012E 6.9x 8.5x 1.8x 24.8x 5.8x

Enterprise Value / OCF (2) Median Mean Minimum Maximum Transaction

LTM 7.3x 11.8x 0.2x 62.6x 16.3x

FY 2011E 3.8x 3.6x 0.1x 9.3x NM

FY 2012E 9.0x 18.0x 0.2x 79.2x NM

(1) | | MELODY LTM results as of September 30, 2011 and based on MELODY management projections |

(2) | | Calculated as EBITDA less CapEx |

19

Confidential

Selected M&A Transactions Analysis

Confidential Selected M&A Transactions Analysis

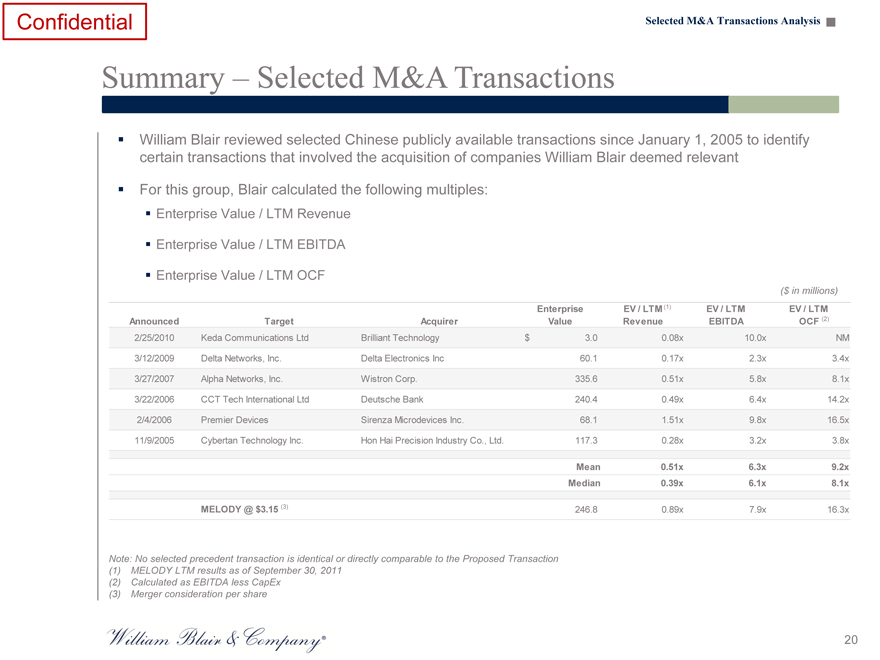

Summary – Selected M&A Transactions

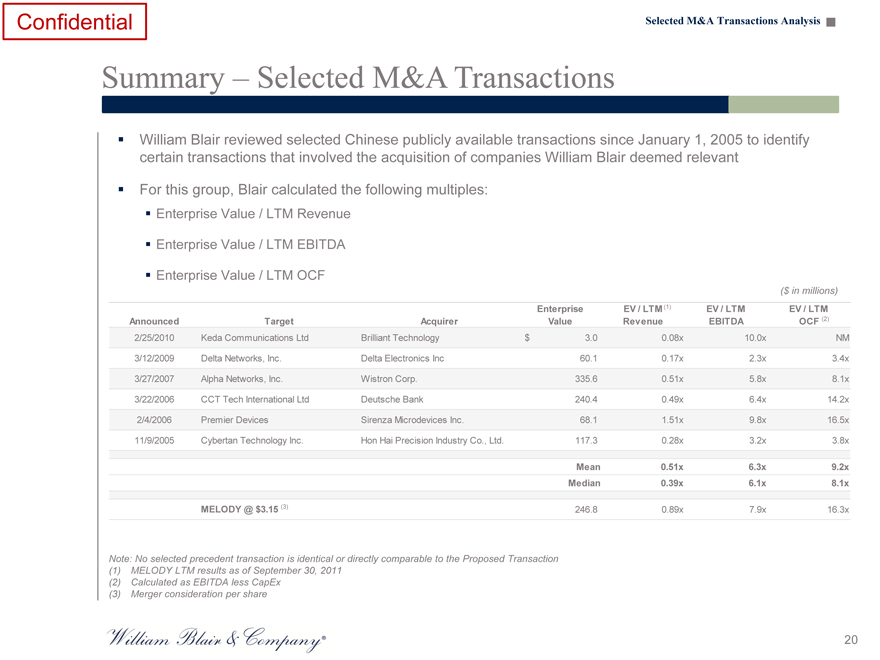

William Blair reviewed selected Chinese publicly available transactions since January 1, 2005 to identify certain transactions that involved the acquisition of companies William Blair deemed relevant

For this group, Blair calculated the following multiples: ?Enterprise Value / LTM Revenue

Enterprise Value / LTM EBITDA

Enterprise Value / LTM OCF

($ in millions)

Enterprise EV / LTM (1) EV / LTM EV / LTM

Announced Target Acquirer Value Revenue EBITDA OCF (2)

2/25/2010 Keda Communications Ltd Brilliant Technology $ 3.0 0.08x 10.0x NM

3/12/2009 Delta Networks, Inc. Delta Electronics Inc 60.1 0.17x 2.3x 3.4x

3/27/2007 Alpha Networks, Inc. Wistron Corp. 335.6 0.51x 5.8x 8.1x

3/22/2006 CCT Tech International Ltd Deutsche Bank 240.4 0.49x 6.4x 14.2x

2/4/2006 Premier Devices Sirenza Microdevices Inc. 68.1 1.51x 9.8x 16.5x

11/9/2005 Cybertan Technology Inc. Hon Hai Precision Industry Co., Ltd. 117.3 0.28x 3.2x 3.8x

Mean 0.51x 6.3x 9.2x

Median 0.39x 6.1x 8.1x

MELODY @ $3.15 (3) 246.8 0.89x 7.9x 16.3x

Note: No selected precedent transaction is identical or directly comparable to the Proposed Transaction (1) MELODY LTM results as of September 30, 2011 (2) Calculated as EBITDA less CapEx (3) Merger consideration per share

20

Confidential Selected M&A Transactions Analysis

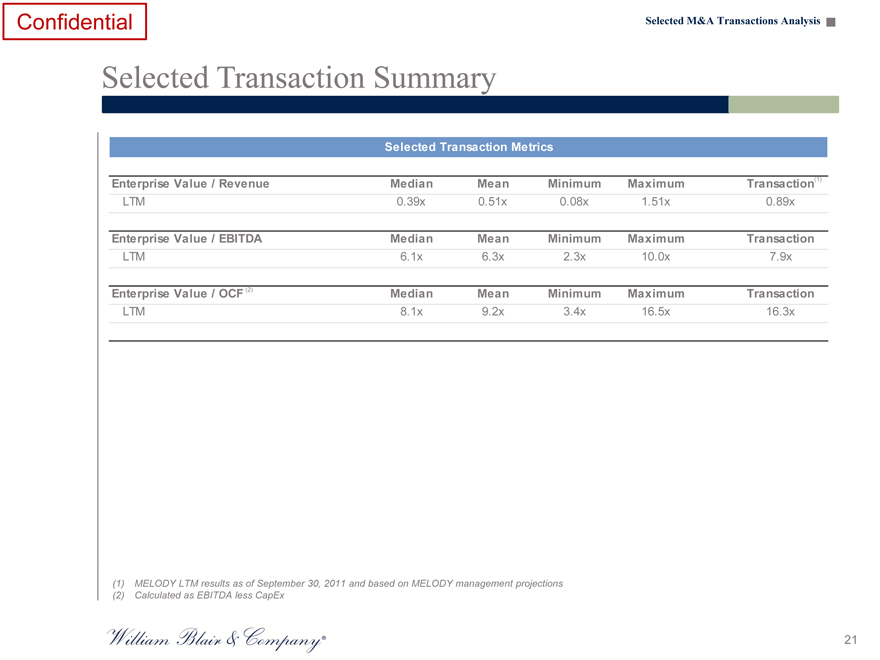

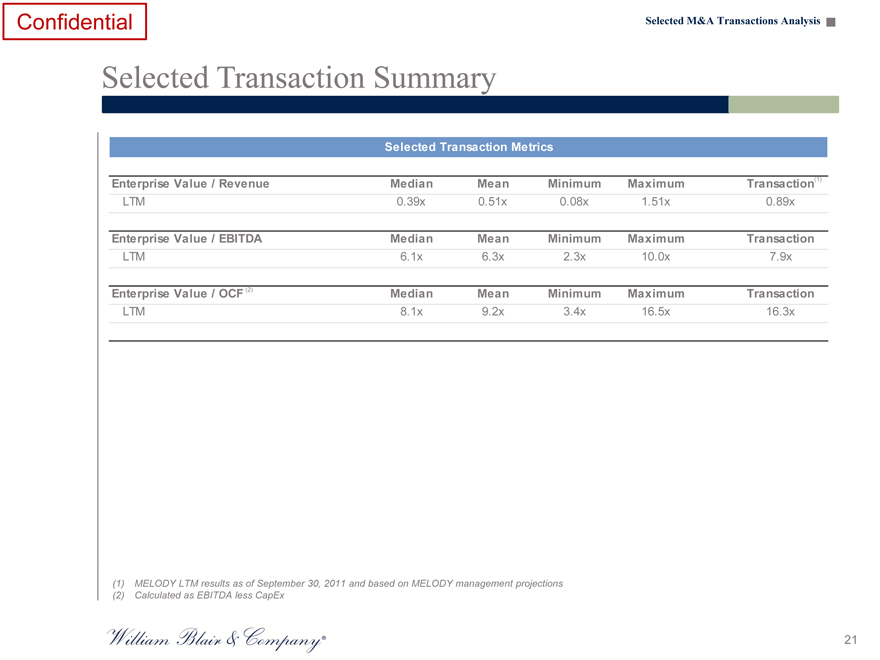

Selected Transaction Summary

Selected Transaction Metrics

Enterprise Value / Revenue Median Mean Minimum Maximum Transaction(1)

LTM 0.39x 0.51x 0.08x 1.51x 0.89x

Enterprise Value / EBITDA Median Mean Minimum Maximum Transaction

LTM 6.1x 6.3x 2.3x 10.0x 7.9x

Enterprise Value / OCF (2) Median Mean Minimum Maximum Transaction

LTM 8.1x 9.2x 3.4x 16.5x 16.3x

(1) MELODY LTM results as of September 30, 2011 and based on MELODY management projections (2) Calculated as EBITDA less CapEx

21

Confidential

Discounted Cash Flow Analysis

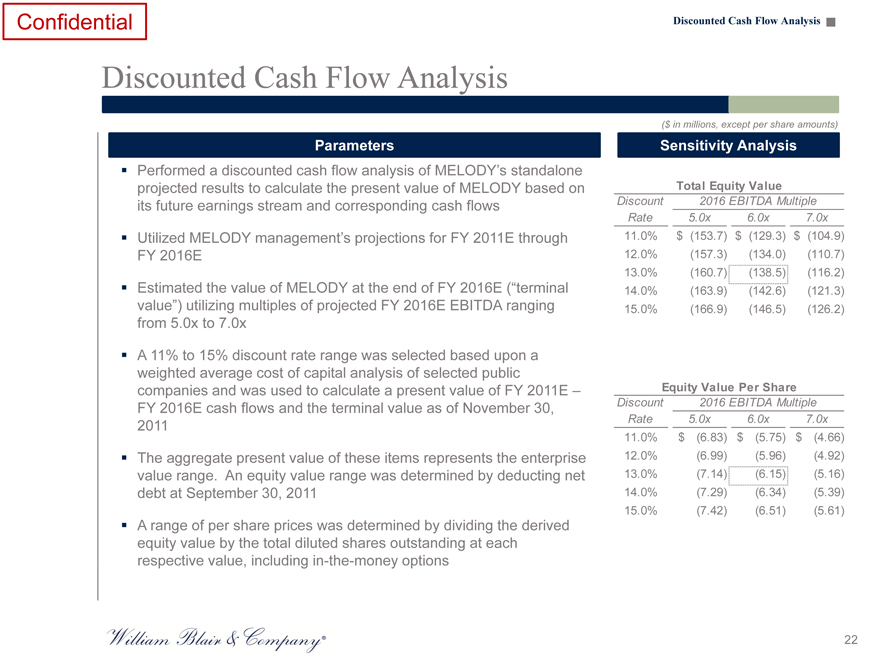

Confidential Discounted Cash Flow Analysis

Discounted Cash Flow Analysis

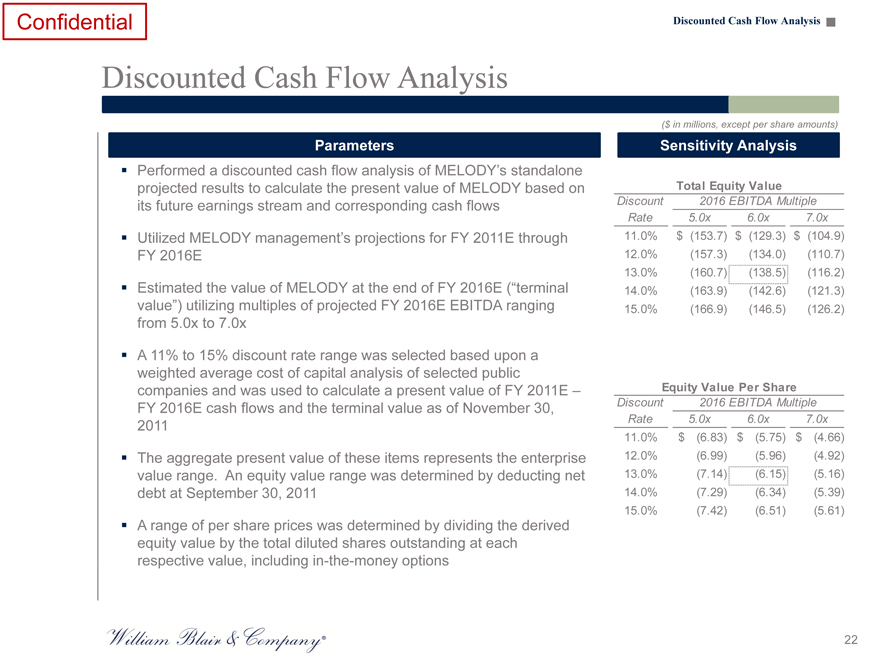

Parameters

Performed a discounted cash flow analysis of MELODY’s standalone projected results to calculate the present value of MELODY based on its future earnings stream and corresponding cash flows

Utilized MELODY management’s projections for FY 2011E through FY 2016E

Estimated the value of MELODY at the end of FY 2016E (“terminal value”) utilizing multiples of projected FY 2016E EBITDA ranging from 5.0x to 7.0x

A 11% to 15% discount rate range was selected based upon a weighted average cost of capital analysis of selected public companies and was used to calculate a present value of FY 2011E –

FY 2016E cash flows and the terminal value as of November 30, 2011

The aggregate present value of these items represents the enterprise value range. An equity value range was determined by deducting net debt at September 30, 2011

A range of per share prices was determined by dividing the derived equity value by the total diluted shares outstanding at each respective value, including in-the-money options

($ in millions, except per share amounts)

Sensitivity Analysis

Total Equity Value

Discount 2016 EBITDA Multiple

Rate 5.0x 6.0x 7.0x

11.0% | | $ (153.7) $(129.3) $(104.9) |

12.0%(157.3)(134.0)(110.7)

13.0%(160.7)(138.5)(116.2)

14.0%(163.9)(142.6)(121.3)

15.0%(166.9)(146.5)(126.2)

Equity Value Per Share

Discount 2016 EBITDA Multiple

Rate 5.0x 6.0x 7.0x

11.0% | | $ (6.83) $(5.75) $(4.66) |

12.0%(6.99)(5.96)(4.92)

13.0%(7.14)(6.15)(5.16)

14.0%(7.29)(6.34)(5.39)

15.0%(7.42)(6.51)(5.61)

22

Confidential

Premiums Paid Analysis

Confidential Preliminary Paid Analysis

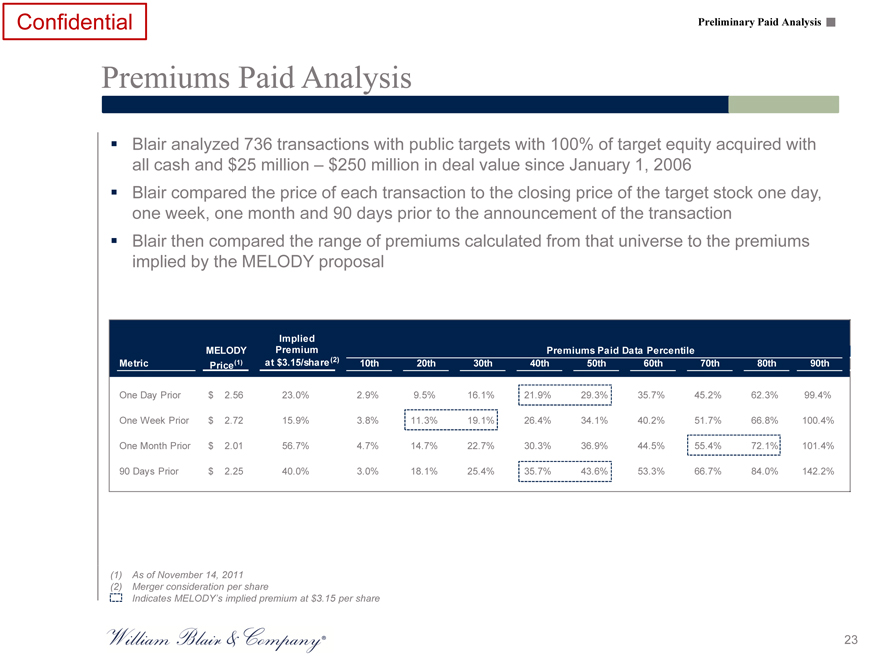

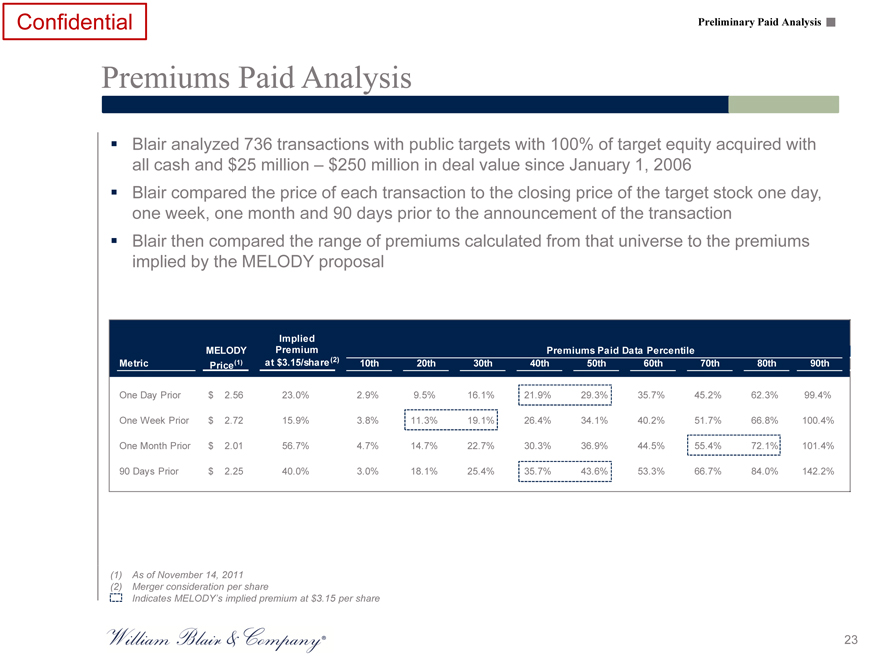

Premiums Paid Analysis

Blair analyzed 736 transactions with public targets with 100% of target equity acquired with all cash and $25 million – $250 million in deal value since January 1, 2006

Blair compared the price of each transaction to the closing price of the target stock one day, one week, one month and 90 days prior to the announcement of the transaction ??Blair then compared the range of premiums calculated from that universe to the premiums implied by the MELODY proposal

Implied

MELODY Premium Premiums Paid Data Percentile

Metric Price(1) at $3.15/share (2) 10th 20th 30th 40th 50th 60th 70th 80th 90th

One Day Prior $ 2.56 23.0% 2.9% 9.5% 16.1% 21.9% 29.3% 35.7% 45.2% 62.3% 99.4%

One Week Prior $ 2.72 15.9% 3.8% 11.3% 19.1% 26.4% 34.1% 40.2% 51.7% 66.8% 100.4%

One Month Prior $ 2.01 56.7% 4.7% 14.7% 22.7% 30.3% 36.9% 44.5% 55.4% 72.1% 101.4%

90 | | Days Prior $ 2.25 40.0% 3.0% 18.1% 25.4% 35.7% 43.6% 53.3% 66.7% 84.0% 142.2% |

(1) | | As of November 14, 2011 |

(2) | | Merger consideration per share |

Indicates MELODY’s implied premium at $3.15 per share

23

Confidential

Appendix

Confidential

Supporting Financial Schedules

Confidential Supporting Financial Schedules

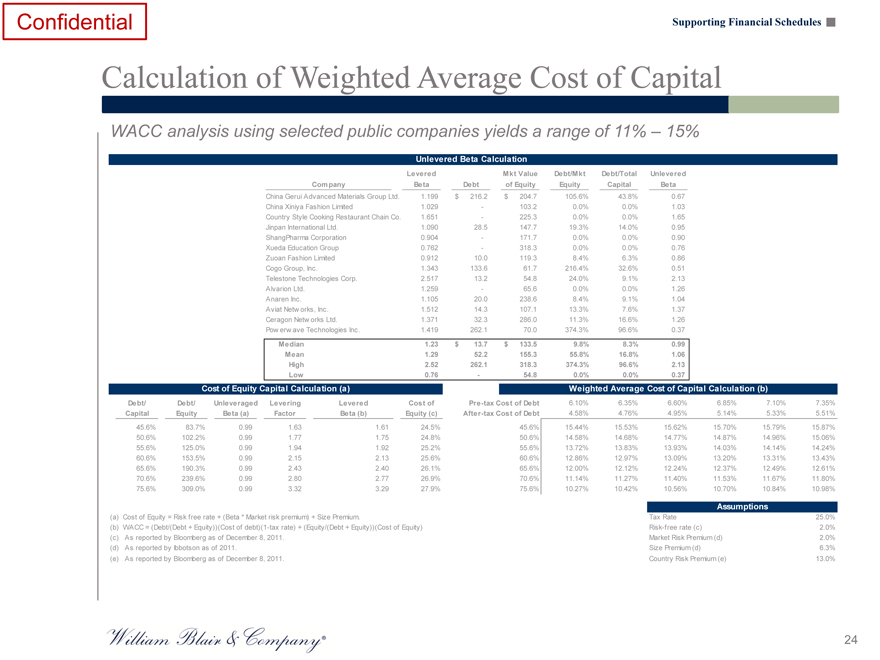

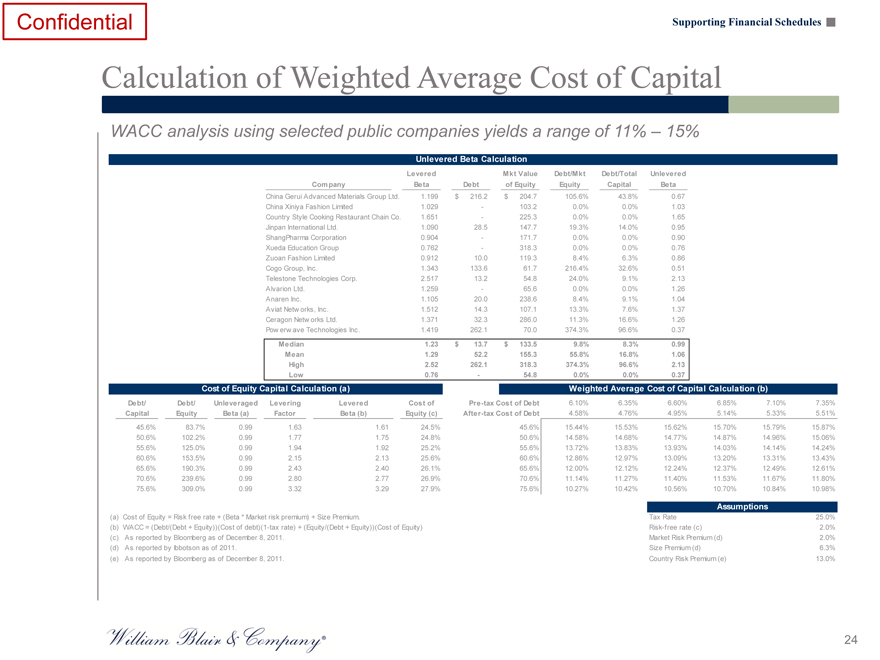

Calculation of Weighted Average Cost of Capital

WACC analysis using selected public companies yields a range of 11% – 15%

Unlevered Beta Calculation

Levered Mkt Value Debt/Mkt Debt/Total Unlevered

Company Beta Debt of Equity Equity Capital Beta

China Gerui Advanced Materials Group Ltd. 1.199 $ 216.2 $ 204.7 105.6% 43.8% 0.67

China Xiniya Fashion Limited 1.029—103.2 0.0% 0.0% 1.03

Country Style Cooking Restaurant Chain Co. 1.651—225.3 0.0% 0.0% 1.65

Jinpan International Ltd. 1.090 28.5 147.7 19.3% 14.0% 0.95

ShangPharma Corporation 0.904—171.7 0.0% 0.0% 0.90

Xueda Education Group 0.762—318.3 0.0% 0.0% 0.76

Zuoan Fashion Limited 0.912 10.0 119.3 8.4% 6.3% 0.86

Cogo Group, Inc. 1.343 133.6 61.7 216.4% 32.6% 0.51

Telestone Technologies Corp. 2.517 13.2 54.8 24.0% 9.1% 2.13

Alvarion Ltd. 1.259—65.6 0.0% 0.0% 1.26

Anaren Inc. 1.105 20.0 238.6 8.4% 9.1% 1.04

Aviat Netw orks, Inc. 1.512 14.3 107.1 13.3% 7.6% 1.37

Ceragon Netw orks Ltd. 1.371 32.3 286.0 11.3% 16.6% 1.26

Pow erw ave Technologies Inc. 1.419 262.1 70.0 374.3% 96.6% 0.37

Median 1.23 $ 13.7 $ 133.5 9.8% 8.3% 0.99

Mean 1.29 52.2 155.3 55.8% 16.8% 1.06

High 2.52 262.1 318.3 374.3% 96.6% 2.13

Low 0.76—54.8 0.0% 0.0% 0.37

Cost of Equity Capital Calculation (a) Weighted Average Cost of Capital Calculation (b)

Debt/ Debt/ Unleveraged Levering Levered Cost of Pre-tax Cost of Debt 6.10% 6.35% 6.60% 6.85% 7.10% 7.35%

Capital Equity Beta (a) Factor Beta (b) Equity (c) After-tax Cost of Debt 4.58% 4.76% 4.95% 5.14% 5.33% 5.51%

45.6% | | 83.7% 0.99 1.63 1.61 24.5% 45.6% 15.44% 15.53% 15.62% 15.70% 15.79% 15.87% |

50.6% | | 102.2% 0.99 1.77 1.75 24.8% 50.6% 14.58% 14.68% 14.77% 14.87% 14.96% 15.06% |

55.6% | | 125.0% 0.99 1.94 1.92 25.2% 55.6% 13.72% 13.83% 13.93% 14.03% 14.14% 14.24% |

60.6% | | 153.5% 0.99 2.15 2.13 25.6% 60.6% 12.86% 12.97% 13.09% 13.20% 13.31% 13.43% |

65.6% | | 190.3% 0.99 2.43 2.40 26.1% 65.6% 12.00% 12.12% 12.24% 12.37% 12.49% 12.61% |

70.6% | | 239.6% 0.99 2.80 2.77 26.9% 70.6% 11.14% 11.27% 11.40% 11.53% 11.67% 11.80% |

75.6% | | 309.0% 0.99 3.32 3.29 27.9% 75.6% 10.27% 10.42% 10.56% 10.70% 10.84% 10.98% |

(a) | | Cost of Equity = Risk free rate + (Beta * Market risk premium) + Size Premium. |

(b) WACC = (Debt/(Debt + Equity))(Cost of debt)(1-tax rate) + (Equity/(Debt + Equity))(Cost of Equity) (c) As reported by Bloomberg as of December 8, 2011.

(d) | | As reported by Ibbotson as of 2011. |

(e) | | As reported by Bloomberg as of December 8, 2011. |

Assumptions

Tax Rate 25.0% Risk-free rate (c) 2.0% Market Risk Premium (d) 2.0% Size Premium (d) 6.3% Country Risk Premium (e) 13.0%

24