9. Investment Transactions

For the nine months ended August 31, 2009, the Company purchased (at cost) securities in the amount of $3,774,157 and sold securities (proceeds received) in the amount of $21,081,654 (excluding short-term debt securities). For the nine months ended August 31, 2008, the Company purchased (at cost) securities in the amount of $14,915,626 and sold securities (proceeds received) in the amount of $14,339,011 (excluding short-term debt securities).

On July 17, 2008, LONESTAR Midstream Partners LP (LONESTAR) closed a transaction with Penn Virginia Resource Partners, L.P. (NYSE: PVR) for the sale of its gas gathering and transportation assets. LONESTAR distributed substantially all of the initial sales proceeds to its limited partners but did not redeem partnership interests. On July 24, 2008, the Company received a distribution of $10,476,511 in cash, 468,001 newly issued unregistered common units of PVR, and 59,503 unregistered common units of Penn Virginia GP Holdings, L.P. (NYSE: PVG). On July 24, 2008, the Company recorded the cash and the unregistered PVR and PVG common units it received at a cost basis equal to the fair value on the date of receipt, less a discount for illiquidity. The Company reduced its basis in LONESTAR by $20,427,674, approximately 82 percent of the respective relative value of the entire transaction, resulting in a realized gain of $1,104,244. The Company also reduced its basis in LSMP GP, LP by $403,488, approximately 71 percent of the respective relative value of the entire transaction, resulting in a realized gain of $1,007,962.

On February 3, 2009, the Company received a distribution of 37,305 freely tradable common units of PVR and 4,743 freely tradable common units of PVG. The Company recorded the PVR and PVG common units it received at a cost basis equal to the fair value on the date of receipt. The Company reduced its basis in LONESTAR by $746,180, approximately 3 percent of the respective relative value of the entire transaction, resulting in a realized loss of $184,201. The Company also reduced its basis in LSMP GP, LP by $14,996, approximately 3 percent of the respective relative value of the entire transaction, resulting in a realized gain of $11,057.

On July 17, 2009, the Company received a distribution of 37,304 freely tradable common units of PVR and 4,744 freely tradable common units of PVG. The Company recorded the PVR and PVG common units it received at a cost basis equal to the fair value on the date of receipt. The Company reduced its basis in LONESTAR by $746,180, approximately 3 percent of the respective relative value of the entire transaction, resulting in a realized loss of $179,731. The Company also reduced its basis in LSMPGP, LP by $14,996, approximately 3 percent of the respective relative value of the entire transaction, resulting in a realized gain of $14,303.

The Company anticipates receiving a cash distribution from LONESTAR of approximately $1,038,090 payable on December 31, 2009. There are also two future contingent payments due LONESTAR which are based on the achievement of specific revenue targets by or before June 30, 2013. No payments are due if these revenue targets are not achieved. If received, the Company’s expected portion would total approximately $9,638,829, payable in cash or common units of PVR (at PVR’s election). The fair value of the LONESTAR and LSMP GP, LP units as of August 31, 2009 is based on unobservable inputs related to the potential receipt of these future payments relative to the sales transaction.

On October 1, 2008, Millennium sold its partnership interests to Eagle Rock Energy Partners, L.P. (EROC) for approximately $181,000,000 in cash and approximately four million EROC unregistered common units. In exchange for its Millennium partnership interests, the Company received $13,687,081 in cash and 373,224 EROC unregistered common units with an aggregate basis of $5,044,980 for a total implied value at closing of approximately $18,732,061. In addition, approximately 212,404 units with an aggregate cost basis of 2,920,555 were placed in escrow for 18 months from the date of the transaction. This includes a reserve the Company placed against the units held in the escrow for estimated post-closing adjustments. The Company originally invested $17,500,000 in Millennium (including common units and incentive distribution rights), and had an adjusted cost basis at closing of $15,161,125 (after reducing its basis for cash distributions received since investment that were treated as return of capital). At the transaction closing, the Company recorded a realized gain for book purposes of $6,491,491, including a reserve the Company placed against the restricted cash and units held in the escrow for estimated post-closing adjustments. Subsequent to November 30, 2008, the Company increased the reserve against the units held in escrow for additional post-closing adjustments, resulting in a realized loss for the nine months ended August 31, 2009 of $540,925. The Company also recorded an additional $277,724 in realized loss related to the reclassification of investment income and return of capital recognized based on the 2008 tax reporting information received from Millennium (see Note 2D—Security Transactions and Investment Income for additional information). For purposes of the capital gain incentive fee, the realized gain totals approximately $3,611,691, which excludes that portion of the fee that would be due as a result of cash distributions which were characterized as return of capital. Pursuant to the Investment Advisory Agreement, the capital gain incentive fee is paid annually only if there are realization events and only if the calculation defined in the agreement results in an amount due. No capital gain incentive fees have been paid to date.

20

10. Credit Facility

On April 25, 2007, the Company entered into a committed credit facility with U.S. Bank, N.A. as a lender, agent and lead arranger. On March 21, 2008, the Company secured an extension to its revolving credit facility and on March 28, 2008, amended the credit agreement to increase the total credit facility to $50,000,000. The revolving credit facility had a variable annual interest rate equal to the one-month LIBOR plus 1.75 percent, a non-usage fee equal to an annual rate of 0.375 percent of the difference between the total credit facility commitment and the average outstanding balance at the end of each day for the preceding fiscal quarter. The credit facility contains a covenant precluding the Company from incurring additional debt.

On March 20, 2009, the Company entered into a 90-day extension of its amended credit facility. Terms of the extension provided for a secured revolving credit facility of up to $25,000,000. Effective June 20, 2009, the Company entered into a 60-day extension of its amended credit facility. The terms of the extension provided for a secured revolving credit facility of up to $11,700,000. The credit agreement, as extended, had a termination date of August 20, 2009. Terms of these extensions required the Company to apply 100 percent of the proceeds from any private investment liquidation and 50 percent of the proceeds from the sale of any publicly traded portfolio assets to the outstanding balance of the facility. In addition, each prepayment of principal of the loans under the amended credit facility would permanently reduce the maximum amount of the loans under the amended credit agreement to an amount equal to the outstanding principal balance of the loans under the amended credit agreement immediately following the prepayment. During these extensions, outstanding loan balances accrued interest at a variable rate equal to the greater of (i) one-month LIBOR plus 3.00 percent, and (ii) 5.50 percent.

On August 20, 2009, the Company entered into a six-month extension of its amended credit facility through February 20, 2010. Terms of the extension provide for a secured revolving facility of up to $5,000,000. The amended credit facility requires the Company to apply 100 percent of the proceeds from the sale of any investment to the outstanding balance of the facility. In addition, each prepayment of principal of the loans under the amended credit facility will permanently reduce the maximum amount of the loans under the amended credit agreement to an amount equal to the outstanding principal balance of the loans under the amended credit agreement immediately following the prepayment. During this extension, outstanding loan balances generally will accrue interest at a variable rate equal to the greater of (i) one-month LIBOR plus 3.00 percent, and (ii) 5.50 percent.

Under the terms of the amended credit facility, the Company must maintain asset coverage required under the 1940 Act. If the Company fails to maintain the required coverage, it may be required to repay a portion of an outstanding balance until the coverage requirement has been met. As of August 31, 2009, the Company was in compliance with the terms of the amended credit facility.

For the nine months ended August 31, 2009, the average principal balance and interest rate for the period during which the credit facility was utilized were $17,675,912 and 4.25 percent, respectively. As of August 31, 2009, the principal balance outstanding was $5,000,000 at a rate of 5.50 percent.

11. Common Stock

The Company has 100,000,000 shares authorized and 9,028,301 shares outstanding at August 31, 2009.

| Shares at November 30, 2008 | 8,962,147 |

| Shares issued through reinvestment of distributions | 66,154 |

| Shares at August 31, 2009 | 9,028,301 |

12. Warrants

At August 31, 2009, the Company had 945,594 warrants issued and outstanding. The warrants became exercisable on February 7, 2007 (the closing date of the Company’s initial public offering of common shares), subject to a lock-up period with respect to the underlying common shares. Each warrant entitles the holder to purchase one common share at the exercise price of $15.00 per common share. Warrants were issued as separate instruments from the common shares and are permitted to be transferred independently from the common shares. The warrants have no voting rights and the common shares underlying the unexercised warrants will have no voting rights until such common shares are received upon exercise of the warrants. All warrants will expire on February 6, 2013.

| Warrants outstanding at November 30, 2008 and August 31, 2009 | 945,594 |

21

13. Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share:

| For the three | | For the three | | For the nine | | For the nine |

| months ended | | months ended | | months ended | | months ended |

| August 31, 2009 | | August 31, 2008 | | August 31, 2009 | | August 31, 2008 |

| Net increase (decrease) in net assets applicable to | | | | | | | | | | | | | | |

| common stockholders resulting from operations | $ | (97,507 | ) | | $ | (356,496 | ) | | $ | (6,096,705 | ) | | $ | 3,571,791 |

| Basic weighted average shares | | 9,014,094 | | | | 8,893,866 | | | | 8,997,031 | | | | 8,876,079 |

| Average warrants outstanding(1) | | — | | | | — | | | | — | | | | — |

| Diluted weighted average shares | | 9,014,094 | | | | 8,893,866 | | | | 8,997,031 | | | | 8,876,079 |

| Basic and diluted net increase (decrease) in net assets | | | | | | | | | | | | | | |

| applicable to common stockholders resulting from | | | | | | | | | | | | | | |

| operations per common share | $ | (0.01 | ) | | $ | (0.04 | ) | | $ | (0.68 | ) | | $ | 0.40 |

| (1) | | Warrants to purchase shares of common stock at $15.00 per share were outstanding during the periods reflected in the table above, but were not included in the computation of diluted earnings per share because the warrants’ exercise price was greater than the average market value of the common shares, and therefore, the effect would be anti-dilutive. |

14. Subsequent Events

Effective August 31, 2009, the Company adopted Statement of Financial Accounting Standards No. 165 (“SFAS No. 165”), Subsequent Events. SFAS No. 165 requires an entity to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the balance sheet. SFAS No. 165 is intended to establish general standards of accounting and for disclosure of events that occur after the balance sheet date, but before the financial statements are issued or are available to be issued. The Company has performed an evaluation of subsequent events through October 9, 2009, which is the date the financial statements were issued.

On September 1, 2009, the Company paid a distribution in the amount of $0.13 per common share, for a total of $1,173,679. Of this total, the dividend reinvestment amounted to $150,140.

On September 15, 2009, the Company entered into a new Investment Advisory Agreement with the Adviser in connection with the September 15, 2009 closing of the transaction previously announced by the Adviser on June 3, 2009. Upon the closing of this transaction, which resulted in a change in control of the Adviser, the previous Investment Advisory Agreement with the Adviser automatically terminated. The terms of the new Investment Advisory Agreement are substantially identical to the previous Investment Advisory Agreement, except for the effective and termination dates, and simply continue the relationship between the Company and the Adviser.

On September 15, 2009, effective upon consummation of the transaction resulting in the change in control of the Adviser, Terry Matlack resigned from the Board of Directors of the Company in order to comply with a safe harbor under Section 15(f) of the 1940 Act. Mr. Matlack will remain a member of the Adviser’s Investment Committee and as Chief Financial Officer of the Company.

On October 1, 2009, Quest Midstream Partners, L.P. declared a special pro rata dividend on its common units. The distribution is payable in additional common units to all record holders outstanding on that date, for which the Company will receive 35,935 common units. On October 6, 2009, Quest Resources Corp. (NASDAQ: QRCP) and Quest Energy Partners L.P. (NASDAQ: QELP) filed a Form S-4 Registration Statement to recombine with Quest Midstream Partners, L.P. as the newly formed PostRock Energy Corporation, which is expected to be listed on the NASDAQ under the symbol “PSTR.” The recombination is subject to the satisfaction of a number of conditions.

On October 5, 2009, Abraxas Petroleum Corporation (NASDAQ: AXAS) (“Abraxas Petroleum”) announced that it closed the merger with Abraxas Energy Partners, L.P. (“Abraxas Energy”). A special meeting of Abraxas Petroleum stockholders was held and the holders of a majority of the shares voting at the special meeting approved the issuance of Abraxas Petroleum common stock to the holders of common units of Abraxas Energy not held by a wholly-owned subsidiary of Abraxas Petroleum in connection with the merger. The unitholders of Abraxas Energy will receive 4.25 shares of Abraxas Petroleum common stock for each common unit of Abraxas Energy. A total of 26.2 million shares of Abraxas Petroleum common stock will be issued in connection with the merger. The shares are subject to an initial 90 day lock-up period followed by a multi-year staggered lock-up period.

22

ADDITIONAL INFORMATION(Unaudited)

Director and Officer Compensation

The Company does not compensate any of its directors who are “interested persons” (as defined in Section 2 (a) (19) of the 1940 Act) or any of its officers. For the nine months ended August 31, 2009, the aggregate compensation paid by the Company to the independent directors was $78,000. The Company did not pay any special compensation to any of its directors or officers.

Forward-Looking Statements

This report contains “forward-looking statements.” By their nature, all forward-looking statements involve risk and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements.

Certifications

The Company’s Chief Executive Officer submitted to the New York Stock Exchange the annual CEO certification as required by Section 303A.12(a) of the NYSE Listed Company Manual.

The Company has filed with the SEC the certification of its Chief Executive Officer and Chief Financial Officer required by Section 302 of the Sarbanes-Oxley Act.

Proxy Voting Policies

A description of the policies and procedures that the Company uses to determine how to vote proxies relating to portfolio securities owned by the Company is available to stockholders (i) without charge, upon request by calling the Company at (913) 981-1020 or toll-free at (866) 362-9331 and on the Company’s Web site at www.tortoiseadvisors.com/tto.cfm; and (ii) on the SEC’s Web site at www.sec.gov.

Privacy Policy

The Company is committed to maintaining the privacy of its stockholders and safeguarding their non-public personal information. The following information is provided to help you understand what personal information the Company collects, how the Company protects that information and why, in certain cases, the Company may share information with select other parties.

Generally, the Company does not receive any non-public personal information relating to its stockholders, although certain non-public personal information of its stockholders may become available to the Company. The Company does not disclose any non-public personal information about its stockholders or a former stockholder to anyone, except as required by law or as is necessary in order to service stockholder accounts (for example, to a transfer agent).

The Company restricts access to non-public personal information about its stockholders to employees of its Adviser with a legitimate business need for the information. The Company maintains physical, electronic and procedural safeguards designed to protect the non-public personal information of its stockholders.

23

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Statements contained herein, other than historical facts, may constitute “forward-looking statements.” These statements may relate to, among other things, future events or our future performance or financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,” “might,” “believe,” “will,” “provided,” “anticipate,” “future,” “could,” “growth,” “plan,” “intend,” “expect,” “should,” “would,” “if,” “seek,” “possible,” “potential,” “likely” or the negative of such terms or comparable terminology. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any anticipated results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. For a discussion of factors that could cause our actual results to differ from forward-looking statements contained herein, please see the discussion under the heading “Risk Factors” in Part I, Item 1A. of our most recent Annual Report filed on Form 10-K.

We may experience fluctuations in our operating results due to a number of factors, including the return on our equity investments, the interest rates payable on our debt investments, the default rates on such investments, the level of our expenses, variations in and the timing of the recognition of realized and unrealized gains or losses, the degree to which we encounter competition in our markets and general economic conditions. As a result of these factors, results for any period should not be relied upon as being indicative of performance in future periods.

Overview

We have elected to be regulated as a business development company (“BDC”) and we are classified as a non-diversified closed-end management investment company under the Investment Company Act of 1940. As a BDC, we are subject to numerous regulations and restrictions. Unlike most investment companies, we are, and intend to continue to be, taxed as a general business corporation under the Internal Revenue Code of 1986.

We seek to invest in companies operating in the U.S. energy infrastructure sector, primarily in privately-held and micro-cap public companies focused on the midstream and downstream segments, and to a lesser extent the upstream and coal and aggregates segments. Companies in the midstream segment of the energy infrastructure sector engage in the business of transporting, processing or storing natural gas, natural gas liquids, crude oil, refined petroleum products and renewable energy resources. Companies in the downstream segment of the energy infrastructure sector engage in distributing or marketing such commodities, and companies in the upstream segment of the energy infrastructure sector engage in exploring, developing, managing or producing such commodities. The energy infrastructure sector also includes producers and processors of coal and aggregates, two business segments that also are eligible for master limited partnership (“MLP”) status. We seek to invest in companies in the energy infrastructure sector that generally produce stable cash flows as a result of their fee-based revenues and proactive hedging programs which help to limit direct commodity price risk.

Performance Review and Investment Outlook

Our third quarter produced mixed results. From a market value perspective, our stock price improved, closing at $5.74 per share on August 31, 2009 compared to $4.45 per share at May 31, 2009. Our total return for the nine months ended August 31, 2009 based on market value, assuming reinvestment of quarterly distributions, was 20.55 percent.

Our net asset value, however, declined this quarter from $8.91 per share at May 31, 2009 to $8.76 per share at August 31, 2009. The fair value of High Sierra Energy, LP and International Resource Partners LP, increased this quarter due in part to improved operating performance and/or peer multiples. The fair value of Mowood, LLC also increased this quarter, and the company continues to explore strategic alternatives based on growth opportunities at its Timberline subsidiary. The fair value of Abraxas Energy Partners, L.P. (“Abraxas Energy”), Quest Midstream Partners, L.P. (“Quest Midstream”) and VantaCore Partners, L.P. (“VantaCore”) decreased this quarter due to company and/or market-specific issues. The fair value of VantaCore was adversely affected by its decision to reduce its quarterly cash distribution to common unitholders and to suspend its distribution to certain subordinated unitholders in light of reduced distributable cash flow projections in 2009. Quest Midstream and Abraxas announced intentions to merge or recombine with their respective affiliated public entities, which would likely provide liquidity for our investments in the future. On October 6, 2009, Quest Resources Corp. (NASDAQ: QRCP) and Quest Energy Partners, L.P. (NASDAQ: QELP) filed a Form S-4 Registration Statement to recombine with Quest Midstream as the newly formed PostRock Energy Corporation, which is expected to be listed on the NASDAQ under the symbol “PSTR.” The recombination is subject to the satisfaction of a number of conditions, including the arrangement of one or more satisfactory credit lines for the newly formed company, the approval of the transaction by the unitholders of the three existing entities, and consents from each entity’s existing lenders. On October 5, 2009, Abraxas Petroleum Corp. (NASDAQ: AXAS) (“Abraxas Petroleum”) closed the merger with Abraxas Energy. Under the terms of the merger agreement, we will receive 4.25 shares of Abraxas Petroleum in exchange for each common unit of Abraxas Energy we own, which equates to approximately 1,946,377 Abraxas Petroleum shares. These shares are subject to an initial 90 day lock-up period followed by a multi-year staggered lock-up period.

24

This quarter we continued the liquidation of publicly-traded securities to pay down our line of credit, including certain securities previously held in escrow related to the Millennium and Lonestar transactions. On August 20, 2009, we announced a six-month extension to our line of credit through February 20, 2010. The outstanding balance on our line of credit was reduced from $18.8 million at May 31, 2009 to $5.0 million at August 31, 2009. We do not expect any future leverage reductions to materially impact our distribution paying capacity.

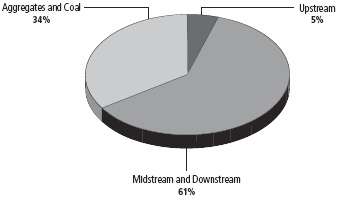

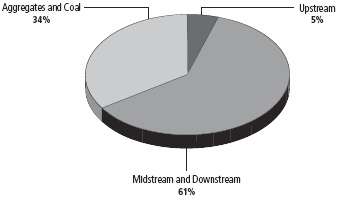

As of August 31, 2009, the value of our investment portfolio (excluding short-term investments) was $78,274,585 including equity investments of $69,474,585 and debt investments of $8,800,000 across the following segments of the energy infrastructure sector:

Allocation of Portfolio Assets

August 31, 2009 (Unaudited)

(Percentages based on fair value of total investment portfolio, excluding short-term investments)

Name of Portfolio

Company (Segment) | | Nature of its

Principal Business | | Securities

Held by Us | | Amount

Invested

(in millions) | | Fair Value

(in millions)(1) | | Current

Yield on

Amount

Invested(2) |

Abraxas Energy Partners, L.P.

(Upstream)(3) | | Natural gas and oil exploitation and development in the Rocky Mountain, Mid-Continent, Permian Basin and Gulf Coast regions of the United States | | Common Units | | $ | 7.6 | | $ | 2.3 | | 0.0 | % |

| | | | | | | | | | | | | |

Eagle Rock Energy Partners, L.P.

(Upstream/Midstream) | | Gatherer and processor of natural gas in north, south and east Texas and Louisiana and producer and developer of upstream and mineral assets located in 17 states | | Common Units

(Freely Tradable and

Restricted) | | | 2.1 | | | 0.5 | | 0.7 | |

| | | | | | | | | | | | | |

| EV Energy Partners, L.P. (Upstream) | | Acquirer, producer and developer of oil and gas properties in the Appalachian Basin, the Monroe field in Louisiana, Michigan, the Austin Chalk, South Central Texas, the Permian Basin, the San Juan Basin and the Mid-continent area | | Common Unit | | | 2.7 | | | 1.7 | | 8.7 | |

| | | | | | | | | | | | | |

| High Sierra Energy, LP (Midstream) | | Marketing, processing, storage and transportation of hydrocarbons and processing and disposal of oilfield produced water with operations primarily in Colorado, Wyoming, Oklahoma, Florida and Mississippi | | Common Units | | | 24.8 | | | 22.9 | | 10.6 | |

| | | | | | | | | | | | | |

High Sierra Energy GP, LLC

(Midstream)(4) | | General Partner of High Sierra Energy, LP | | Equity Interest | | | 2.0 | | | 1.7 | | 2.8 | |

25

Name of Portfolio

Company (Segment) | | Nature of its

Principal Business | | Securities

Held by Us | | Amount

Invested

(in millions) | | Fair Value

(in millions)(1) | | Current

Yield on

Amount

Invested(2) |

International Resource Partners LP

(Coal) | | Operator of both metallurgical and steam coal mines and related assets in Central Appalachia | | Class A Units | | | 10.0 | | | 9.8 | | 8.0 |

| | | | | | | | | | | | |

LONESTAR Midstream Partners, LP

(Midstream)(5) | | LONESTAR Midstream Partners, LP sold its assets to Penn Virginia Resource Partners, L.P (PVR) in July 2008. LONESTAR has no continuing operations, but currently holds rights to receive future payments from PVR relative to the sale | | Class A Units | | | 3.0 | | | 1.9 | | N/A |

| | | | | | | | | | | | |

| LSMP GP, LP (Midstream)(5) | | Indirectly owns General Partner of LONESTAR Midstream Partners, LP | | GP LP Units | | | 0.1 | | | 0.3 | | N/A |

| | | | | | | | | | | | |

Mowood, LLC (Midstream/

Downstream)(6) | | Natural gas distribution in central Missouri and landfill gas to energy projects | | Equity interest | | | 5.0 | | | 7.5 | | 9.0 |

| | | | | | | | | | | | |

| | | | Subordinated Debt | | | 8.8 | | | 8.8 | | 9.0 |

| | | | | | | | | | | | |

Quest Midstream Partners, L.P.

(Midstream)(3) | | Operator of natural gas gathering pipelines in the Cherokee Basin and interstate natural gas transmission pipelines in Oklahoma, Kansas and Missouri | | Common Units | | | 22.2 | | | 4.4 | | 0.0 |

| | | | | | | | | | | | |

VantaCore Partners LP

(Aggregates) | | Acquirer and operator of aggregate companies, with quarry and asphalt operations in Clarksville, Tennessee and sand and gravel operations located near Baton Rouge, Louisiana | | Common Units and

Incentive Distribution

Rights | | | 18.4 | | | 16.5 | | 9.6 |

| | | | | | | | | | | | |

| | | | | | $ | 106.7 | | $ | 78.3 | | |

| (1) | | Fair value as of August 31, 2009. |

| (2) | | The current yield has been calculated by annualizing the most recent distribution during the period and dividing by the amount invested in the underlying security. Actual distributions to us are based on each company’s available cash flow and are subject to change. |

| (3) | | Currently non-income producing. |

| (4) | | Includes original purchase of 3 percent equity interest, sale of 0.6274 percent equity interest in July 2007 and subsequent capital calls. |

| (5) | | LONESTAR Midstream Partners, LP sold its assets to Penn Virginia Resource Partners, L.P in July 2008. LONESTAR has no continuing operations, but currently holds rights to receive future payments from PVR relative to the sale. The cost basis and the fair value of the LONESTAR and LSMP GP, LP units as of August 31, 2009 are related to the potential receipt of those future payments. Since this investment is not deemed to be “active”, the yield is not meaningful and we have excluded it from our weighted average yield to cost on investments as described below in Results of Operations. |

| (6) | | Current yield represents an equity distribution on our invested capital. We expect that, pending cash availability, such equity distributions will recur on a quarterly basis at or above such yield. |

Portfolio Company Monitoring

Our Adviser monitors each portfolio company to determine progress relative to meeting the company’s business plan and to assess the company’s strategic and tactical courses of action. This monitoring may be accomplished by attendance at Board of Directors meetings, ad hoc communications with company management, the review of periodic operating and financial reports, an analysis of relevant reserve information and capital expenditure plans, and periodic consultations with engineers, geologists, and other experts. The performance of each private portfolio company is also periodically compared to performance of similarly sized companies with comparable assets and businesses to assess performance relative to peers. Our Adviser’s monitoring activities are expected to provide it with information that will enable us to monitor compliance with existing covenants, to enhance our ability to make qualified valuation decisions, and to assist our evaluation of the nature of the risks involved in each individual investment. In addition, these monitoring activities should enable our Adviser to diagnose and manage the common risk factors held by our total portfolio, such as sector concentration, exposure to a single financial sponsor, or sensitivity to a particular geography.

As part of the monitoring process, our Adviser continually assesses the risk profile of each of our private investments. We intend to disclose, as appropriate, those risk factors that we deem most relevant in assessing the risk of any particular investment. Such factors may include, but are not limited to, the investment’s current cash distribution status, compliance with loan covenants, operating and financial performance, changes in the regulatory environment or other factors that we believe are useful in determining overall investment risk.

26

Abraxas Energy Partners, L.P. (“Abraxas”)

Abraxas is a private company that operates long-lived, low-decline natural gas and oil reserves. The company’s assets consist primarily of producing and non-producing properties located in the Rocky Mountain, Mid-Continent, Permian Basin and Gulf Coast regions of the United States. Abraxas was formed by Abraxas Petroleum Corporation (NASDAQ: AXAS), an independent publicly-traded energy company primarily engaged in the development and production of oil and gas. We hold a seat on Abraxas’ board of directors.

On June 30, 2009, Abraxas entered into a definitive merger agreement with Abraxas Petroleum Corp. The merger is expected to result in a borrowing base sufficient for one tranche of debt, eliminating Abraxas’ second lien debt. However, the merger is expected to result in the permanent discontinuation of distributions as well as a more exploration oriented risk profile. Abraxas Petroleum Corp. has scheduled a special meeting of stockholders on October 5, 2009 to vote on the proposed merger. If approved, the merger is anticipated to be completed in the third quarter of 2009. However, the merger is subject to various conditions set forth in the Merger Agreement and it is possible that certain factors could result in the merger being completed at a later time, or not at all. If the merger is not completed, Abraxas, under its current loan agreements, would be faced with significant debt amortization payments due to the maturity of its second lien debt which would most likely preclude its ability to pay distributions until the second lien debt was paid off or refinanced. See Recent Developments for a discussion of the results of the special meeting of stockholders held on October 5, 2009.

High Sierra Energy, LP (“High Sierra”)

High Sierra is a holding company with diversified midstream energy assets focused on the processing, transportation, storage and marketing of hydrocarbons. The company’s businesses include a natural gas liquids logistics and transportation business in Colorado, natural gas gathering and processing operations in Louisiana, a natural gas storage facility in Mississippi, an ethanol terminal in Nevada, crude and natural gas liquids trucking businesses in Kansas and Colorado, businesses providing crude oil gathering, transportation and marketing services, primarily focused in the Mid-Continent, Western and Gulf Coast regions, water treatment transportation and disposal businesses serving oil and gas producers in Wyoming and Oklahoma, and two asphalt processing, packaging and distribution terminals in Florida. We hold board of directors’ observation rights for High Sierra.

High Sierra increased its quarterly cash distribution from $0.61 per unit to $0.63 per unit this quarter. Through June 2009, year-to-date overall performance against budgeted EBITDA (before mark-to-market gains and losses and before minority interests) has been mixed by operating segment, but is near budget in the aggregate, enabling High Sierra to increase its distribution and maintain a strong cash position. Depressed natural gas prices and high basis differentials in certain of the areas served by the company’s water handling operations have continued to dampen drilling and production activities, thereby resulting in revenues and EBITDA for these segments that is below budget. Shortfalls in the water operations have been partially offset however, by the strong performance of the company’s energy marketing businesses, including the natural gas and natural gas liquids segments. Monroe Gas Storage, High Sierra’s Mississippi-based natural gas storage facility joint venture, continues to make progress toward completion. The storage facility is offering limited injection and withdrawal services as it continues development activities. In August 2009, High Sierra extended its marketing segment’s revolving credit facility which, together with the earlier expansion of its corporate revolver, further reduces our concerns regarding the company’s liquidity position.

International Resource Partners LP (“IRP”)

IRP ’s surface and underground coal mine operations in southern West Virginia are comprised of metallurgical and steam coal reserves, a coal washing and preparation plant, rail load-out facilities and a sales and marketing subsidiary. We hold board of director’s observation rights for IRP.

While metallurgical coal pricing and demand have shown some improvement, they remain below levels seen in 2008. IRP’s operating results continue to exceed budgeted levels. Year-to-date EBITDA through July 31, 2009 was ahead of budget, largely on the strength of results posted by the company’s sales and marketing arm. This, combined with the company’s strong cash position resulting from last year’s record results, enabled the company to maintain a stable balance sheet position in spite of the challenging coal environment. Metallurgical coal markets showed some improvement during the quarter, as North American and certain overseas steel production increased over the prior quarter. Because steam coal demand has continued to be depressed due to a moderate cooling season and reduced industrial electricity demand, management remains focused on prudently reducing its production costs where possible, and dynamically adjusting its mining plan to suit current conditions. IRP remains in compliance with its bank covenants.

Mowood, LLC (“Mowood”)

Mowood is a holding company whose assets include Omega Pipeline, LLC (“Omega”) and Timberline Energy, LLC (“Timberline”). Omega is a natural gas local distribution company located on the Fort Leonard Wood military base in south central Missouri. Omega serves the natural gas and propane needs of Fort Leonard Wood and other customers in the surrounding area. Timberline is an owner and developer of projects that convert landfill gas to energy. We currently hold a seat on Mowood’s board of directors.

27

Through July 2009, Omega has slightly outperformed its budget and is expected to continue to post strong results during the year as expansion projects at Fort Leonard Wood enhance results. Omega’s contracts have been structured to minimize commodity exposure. Timberline has performed moderately below budget for the year-to-date period as a result of startup operational issues. Timberline has been working to resolve its operational issues and to expand capacity at its existing locations which management believes should result in improved performance. Timberline has structured its off-take contracts to eliminate or minimize commodity exposure in an effort to create more predictable performance. Mowood continues to explore strategic alternatives based on growth opportunities at its Timberline subsidiary. Mowood remains in compliance with all bank covenants.

Quest Midstream Partners, L.P. (“Quest”)

Quest was formed by the spin-off of Quest Resource Corporation’s (NASDAQ: QRCP) midstream coal bed methane natural gas gathering assets in the Cherokee Basin. Quest owns more than 2,000 miles of natural gas gathering pipelines (primarily serving Quest Energy Partners, L.P (NASDAQ: QELP)., an affiliate) and over 1,100 miles of interstate natural gas transmission pipelines in Oklahoma, Kansas and Missouri. We hold a seat on Quest’s board of directors.

On July 6, 2009, Quest announced it entered into a definitive merger agreement pursuant to which it would recombine with Quest Resources Corp and Quest Energy Partners. The transaction would result in a new publicly-traded company which is not expected to pay distributions. Under the terms of the merger agreement, current Quest equity holders would own approximately 44 percent of the new company. The new company’s strategy will be to pursue efficient development of unconventional resource plays, including coalbed methane in the Cherokee Basin of southeast Kansas and northeast Oklahoma and the Marcellus Shale in the Appalachian Basin. The merger would change the risk profile of our investment from primarily a gathering company to an integrated company that has increased drilling risk and commodity exposure. If the recombination does not close, we believe Quest would be able to operate profitably for the remainder of 2009, but would face significant operational risk created by a lower gathering rate in 2010 and significant financial pressures on QELP, its primary customer, and QRCP. Quest remains in compliance with its bank covenants. See Recent Developments for an update on the recombination.

VantaCore Partners LP (“VantaCore”)

VantaCore was formed to acquire companies in the aggregate industry and currently owns a quarry and asphalt plant in Clarksville, Tennessee and sand and gravel operations located near Baton Rouge, Louisiana. We hold a seat on VantaCore’s board of directors.

VantaCore reduced its quarterly cash distribution to $0.475 per unit, the minimum quarterly distribution, a decrease of five percent from the prior quarter and from last year. In our view, the distribution reduction, together with a suspension in the quarterly distribution to certain of the subordinated unit holders, was a prudent and proactive step taken in view of the difficult operating environment in certain of VantaCore’s markets. VantaCore’s business is closely linked to the level of commercial construction and infrastructure spending in the two major territories it serves. Due to the weakened economy and difficult credit environment, base line construction spending in these sectors has been significantly reduced, resulting in lower than anticipated revenues. In Clarksville, the lower level of baseline activity has been partially offset by some major projects, including the new Dow/Hemlock semiconductor plant. Vantacore’s Southern Aggregates division, which serves parts of Louisiana, has been slower to recover, in part due to significant regional price competition. Vantacore has responded to these challenges by implementing cost saving initiatives, prudently reducing capital spending and making the aforementioned adjustments to its distribution. VantaCore remains in compliance with its bank covenants.

Results of Operations

Comparison of the Three and Nine Months Ended August 31, 2009 and August 31, 2008

Investment Income:Investment income totaled $777,486 and $1,095,539 for the three and nine months ended August 31, 2009, respectively. This represents an increase of $330,750 as compared to the three months ended August 31, 2008, and a decrease of $1,203,007 as compared to the nine months ended August 31, 2008. The increase as compared to the three months endedAugust 31, 2008 is generally attributable to a smaller percentage of return of capital on distributions from investments. The year-over-year decrease is primarily related to a reduction in distributions received from investments this fiscal year. The weighted average yield to cost on our investment portfolio (excluding short-term investments) as of August 31, 2009 was 6.5 percent, as compared to 8.8 percent at August 31, 2008. The decrease in the weighted average yield to cost is related to the suspension or reduction of distributions from portfolio companies this fiscal year, most notably Abraxas and Quest.

Net Expenses:Net expenses totaled $669,570 and $2,160,252 for the three and nine months ended August 31, 2009. This represents a decrease of $143,197 and $2,165,686, respectively, as compared to the three and nine months ended August 31, 2008. The decrease is primarily related to elimination of the capital gain incentive fee accrual, a decrease in leverage costs and a decrease in base management fees payable to the Adviser as a result of the lower value of the investment portfolio.

Distributable Cash Flow:Our portfolio generates cash flow to us from which we pay distributions to stockholders. When our Board of Directors determines the amount of any distribution we expect to pay our stockholders, it reviews distributable cash flow (“DCF”). DCF is distributions received from investments less our total expenses. The total distributions received from our investments include the amount received by us as cash distributions from equity investments, paid-in-kind distributions, and

28

dividend and interest payments. Total expenses include current or anticipated operating expenses, leverage costs and current income taxes on our operating income. Total expenses do not include deferred income taxes or accrued capital gain incentive fees. We do not include in distributable cash flow the value of distributions received from portfolio companies which are paid in stock as a result of credit constraints, market dislocation or other similar issues.

We disclose DCF in order to provide supplemental information regarding our results of operations and to enhance our investors’ overall understanding of our core financial performance and our prospects for the future. We believe that our investors benefit from seeing the results of DCF in addition to GAAP information. This non-GAAP information facilitates management’s comparison of current results with historical results of operations and with those of our peers. This information is not in accordance with, or an alternative to, GAAP and may not be comparable to similarly titled measures reported by other companies.

The following table represents DCF for the three and nine months ended August 31, 2009 as compared to the three and nine months ended August 31, 2008:

| | For the three | | For the three | | For the nine | | For the nine |

| | months ended | | months ended | | months ended | | months ended |

| Distributable Cash Flow | | August 31, 2009 | | August 31, 2008 | | August 31, 2009 | | August 31, 2008 |

| Total from Investments | | | | | | | | | | | | | | | | |

| Distributions from investments | | $ | 1,635,662 | | | $ | 2,734,812 | | | $ | 6,179,444 | | | $ | 8,129,460 | |

| Distributions paid in stock(1) | | | — | | | | 621,122 | | | | — | | | | 1,558,842 | |

| Interest income from investments | | | 201,918 | | | | 269,235 | | | | 605,916 | | | | 884,588 | |

| Dividends from money market mutual funds | | | 304 | | | | 3,643 | | | | 1,449 | | | | 6,770 | |

| Other income | | | 15,000 | | | | — | | | | 45,000 | | | | 28,987 | |

| Total from Investments | | | 1,852,884 | | | | 3,628,812 | | | | 6,831,809 | | | | 10,608,647 | |

| |

| Operating Expenses Before Leverage Costs | | | | | | | | | | | | | | | | |

| Advisory fees (net of expense reimbursement | | | | | | | | | | | | | | | | |

| by Adviser) | | | 267,982 | | | | 504,109 | | | | 877,111 | | | | 1,483,483 | |

| Other operating expenses (excluding capital gain | | | | | | | | | | | | | | | | |

| incentive fees) | | | 266,601 | | | | 253,236 | | | | 720,196 | | | | 766,032 | |

| Total Operating Expenses | | | 534,583 | | | | 757,345 | | | | 1,597,307 | | | | 2,249,515 | |

| Distributable cash flow before leverage costs | | | 1,318,301 | | | | 2,871,467 | | | | 5,234,502 | | | | 8,359,132 | |

| Leverage Costs | | | 134,987 | | | | 395,791 | | | | 562,945 | | | | 1,329,289 | |

| Distributable Cash Flow | | $ | 1,183,314 | | | $ | 2,475,676 | | | $ | 4,671,557 | | | $ | 7,029,843 | |

| | | | | | | | | | | | | | | | | |

| Distributions paid on common stock | | $ | 1,173,679 | | | $ | 2,356,874 | | | $ | 4,405,226 | | | $ | 6,901,553 | |

| |

| Payout percentage for period(2) | | | 99 | % | | | 95 | % | | | 94 | % | | | 98 | % |

| |

| DCF/GAAP Reconciliation | | | | | | | | | | | | | | | | |

| Distributable Cash Flow | | $ | 1,183,314 | | | $ | 2,475,676 | | | $ | 4,671,557 | | | $ | 7,029,843 | |

| Adjustments to reconcile to Net Investment Income, | | | | | | | | | | | | | | | | |

| before Income Taxes | | | | | | | | | | | | | | | | |

| Distributions paid in stock(1) | | | — | | | | (621,122 | ) | | | 56,514 | | | | (1,558,842 | ) |

| Pro Forma distribution on new investment(3) | | | — | | | | (254,215 | ) | | | — | | | | (254,215 | ) |

| Return of capital on distributions received from | | | | | | | | | | | | | | | | |

| equity investments | | | (1,075,398 | ) | | | (2,306,739 | ) | | | (5,792,784 | ) | | | (6,497,044 | ) |

| Capital gain incentive fees | | | — | | | | 340,369 | | | | — | | | | (747,134 | ) |

| Net Investment Income (Loss), before Income Taxes | | $ | 107,916 | | | $ | (366,031 | ) | | $ | (1,064,713 | ) | | $ | (2,027,392 | ) |

| (1) | | The only distributions paid in stock for the nine months ended August 31, 2009 were from Abraxas Energy Partners, L.P. which were paid in stock as a result of credit constraints and therefore were not included in DCF. Distributions paid in stock for the three and nine months ended August 31, 2008 include shares received from High Sierra Energy, LP as a distribution received in lieu of cash. |

| (2) | | Distributions paid as a percentage of Distributable Cash Flow. |

| (3) | | Consists of $254,215 as pro forma distribution on new investment in VantaCore partners, LP common units. |

29

Distributions: The following table sets forth distributions for the nine months ended August 31, 2009 as compared to the nine months ended August 31, 2008.

| Record Date | | Payment Date | | Amount |

| August 24, 2009 | | September 1, 2009 | | $ | 0.1300 |

| May 22,2009 | | June 1, 2009 | | $ | 0.1300 |

| February 23, 2009 | | March 2, 2009 | | $ | 0.2300 |

| | | | | | |

| August 21, 2008 | | September 2, 2008 | | $ | 0.2650 |

| May 22, 2008 | | June 2, 2008 | | $ | 0.2625 |

| February 21, 2008 | | March 3, 2008 | | $ | 0.2500 |

Net Investment Income (Loss): Net investment income totaled $81,183 for the three months ended August 31, 2009, and net investment loss totaled $1,184,346 for the nine months ended August 31, 2009. For the three and nine months ended August 31, 2008, net investment loss totaled $226,941 and $1,256,984, respectively. The variance in net investment income (loss) is primarily related to a decrease in net investment income and corresponding decreases in net expenses during the current fiscal periods as described above.

Net Realized and Unrealized Gain (Loss):We had net unrealized appreciation of $12,046,028 and $15,768,051 (after deferred taxes) for the three and nine months ended August 31, 2009, respectively, as compared to net unrealized depreciation of $1,508,873 (after deferred taxes) for the three months ended August 31, 2008 and net unrealized appreciation of $3,449,457 (after deferred taxes) for the nine months ended August 31, 2008. We had realized losses for the three and nine months ended August 31, 2009 of $12,224,718 and $20,680,410 (after deferred taxes), respectively. These realized losses are primarily attributable to the sales of publicly-traded securities for which proceeds were used to pay down debt. We had realized gains for the three and nine months ended August 31, 2008 of $1,379,318 (after deferred taxes).

Liquidity and Capital Resources

We may raise additional capital to support our future growth through equity offerings, rights offerings, and issuances of senior securities or future borrowings to the extent permitted by the 1940 Act and our current credit facility and subject to market conditions. We generally may not issue additional common shares at a price below our net asset value (net of any sales load (underwriting discount)) without first obtaining approval of our stockholders and Board of Directors. We are restricted in our ability to incur additional debt by the terms of our credit facility.

Total leverage outstanding on our credit facility at August 31, 2009 was $5,000,000, representing approximately 6 percent of total assets, including our deferred tax asset. We are, and intend to remain, in compliance with our asset coverage ratios under the Investment Company Act of 1940 and our basic maintenance covenants under our credit facility.

Contractual Obligations

The following table summarizes our significant contractual payment obligations as of August 31, 2009.

| | | | | | Payments Due By Period | | |

| | Total | | Less Than 1 Year | | 1-3 Years | | 3-5 Years | | More Than 5 Years |

| Secured revolving credit facility(1) | | $ | 5,000,000 | | — | | $ | 5,000,000 | | — | | — |

| | $ | 5,000,000 | | — | | $ | 5,000,000 | | — | | — |

| (1) | | At August 31, 2009, the outstanding balance under the credit facility was $5,000,000, with a maturity date of February 20, 2010. |

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources.

Borrowings

For the nine months ended August 31, 2009, the average principal balance and interest rate for the period during which the credit facility was utilized were $17,675,912 and 4.25 percent, respectively. As of August 31, 2009, the principal balance outstanding was $5,000,000 at a rate of 5.50 percent.

Effective June 20, 2009, we entered into a 60-day extension of our amended credit facility. The terms of the extension provided for a secured revolving credit facility of up to $11,700,000. The credit agreement, as extended, had a termination date ofAugust 20, 2009. Terms of the extensions required us to apply 100 percent of the proceeds from any private investment liquidation and 50 percent of the proceeds from the sale of any publicly traded portfolio assets to the outstanding balance of the facility. In

30

addition, each prepayment of principal of the loans under the amended credit facility would permanently reduce the maximum amount of the loans under the amended credit agreement to an amount equal to the outstanding principal balance of the loans under the amended credit agreement immediately following the prepayment. During these extensions, outstanding loan balances accrued interest at a variable rate equal to the greater of (i) one-month LIBOR plus 3.00 percent, and (ii) 5.50 percent.

On August 20, 2009, we entered into a six-month extension of our amended credit facility through February 20, 2010. Terms of the extension provide for a secured revolving facility of up to $5,000,000. The amended credit facility requires us to apply 100 percent of the proceeds from the sale of any investment to the outstanding balance of the facility. In addition, each prepayment of principal of the loans under the amended credit facility will permanently reduce the maximum amount of the loans under the amended credit agreement to an amount equal to the outstanding principal balance of the loans under the amended credit agreement immediately following the prepayment. During this extension, outstanding loan balances generally will accrue interest at a variable rate equal to the greater of (i) one-month LIBOR plus 3.00 percent, and (ii) 5.50 percent.

Recent Developments

On September 1, 2009, we paid a distribution in the amount of $0.13 per common share, for a total of $1,173,679. Of this total, the dividend reinvestment amounted to $150,140.

On September 15, 2009, we entered into a new Investment Advisory Agreement with our Adviser in connection with the September 15, 2009 closing of the transaction previously announced by our Adviser on June 3, 2009. Upon the closing of this transaction, which resulted in a change in control of the Adviser, our previous Investment Advisory Agreement with our Adviser automatically terminated. The terms of the new Investment Advisory Agreement are substantially identical to the previous Investment Advisory Agreement, except for the effective and termination dates, and simply continue the relationship between us and the Adviser.

On September 15, 2009, effective upon consummation of the transaction resulting in the change in control of our Adviser, Terry Matlack resigned from our Board of Directors in order to comply with a safe harbor under Section 15(f) of the 1940 Act. Mr. Matlack will remain a member of our Adviser’s Investment Committee and as our Chief Financial Officer.

On October 1, 2009, Quest Midstream Partners, L.P. declared a special pro rata dividend on its common units. The distribution is payable in additional common units to all record holders outstanding on that date, for which we will receive 35,935 common units. On October 6, 2009, Quest Resources Corp. (NASDAQ: QRCP) and Quest Energy Partners L.P. (NASDAQ: QELP) filed a Form S-4 Registration Statement to recombine with Quest Midstream Partners, L.P. as the newly formed PostRock Energy Corporation, which is expected to be listed on the NASDAQ under the symbol “PSTR.” The recombination is subject to the satisfaction of a number of conditions.

On October 5, 2009, Abraxas Petroleum Corporation (NASDAQ: AXAS) (“Abraxas Petroleum”) announced that it closed the merger with Abraxas Energy Partners, L.P. (“Abraxas Energy”). A special meeting of Abraxas Petroleum stockholders was held and the holders of a majority of the shares voting at the special meeting approved the issuance of Abraxas Petroleum common stock to the holders of common units of Abraxas Energy not held by a wholly-owned subsidiary of Abraxas Petroleum in connection with the merger. Under the terms of the merger agreement, we will receive 4.25 shares of Abraxas Petroleum common stock in exchange for each common unit of Abraxas Energy we own, which equates to approximately 1,946,377 Abraxas Petroleum shares. These shares are subject to an initial 90 day lock-up period followed by a multi-year staggered lock-up period.

Critical Accounting Policies

The financial statements included in this report are based on the selection and application of critical accounting policies, which require management to make significant estimates and assumptions. Critical accounting policies are those that are both important to the presentation of our financial condition and results of operations and require management’s most difficult, complex or subjective judgments. While our critical accounting policies are discussed below, Note 2 in the Notes to Financial Statements included in this report provides more detailed disclosure of all of our significant accounting policies.

Valuation of Portfolio Investments

We invest primarily in illiquid securities including debt and equity securities of privately-held companies. These investments generally are subject to restrictions on resale, have no established trading market and are fair valued on a quarterly basis. Because of the inherent uncertainty of valuation, the fair values of such investments, which are determined in accordance with procedures approved by our Board of Directors, may differ materially from the values that would have been used had a ready market existed for the investments.

Securities Transactions and Investment Income Recognition

Securities transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on an identified cost basis. Distributions received from our equity investments generally are comprised of ordinary income, capital gains and return of capital from the portfolio company. We record investment income and returns of capital based on estimates made at the time such distributions are received. Such estimates are based on information available from each portfolio company and/or other industry sources. These estimates may subsequently be revised based on information received from the portfolio companies after their tax reporting periods are concluded, as the actual character of these distributions are not known until after our fiscal year end.

31

Federal and State Income Taxation

We, as a corporation, are obligated to pay federal and state income tax on our taxable income. Our tax expense or benefit is included in the Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Our business activities contain elements of market risk. We consider fluctuations in the value of our equity securities and the cost of capital under our credit facility to be our principal market risk.

We carry our investments at fair value, as determined by our Board of Directors. The fair value of securities is determined using readily available market quotations from the principal market if available. The fair value of securities that are not publicly traded or whose market price is not readily available is determined in good faith by our Board of Directors. Because there are no readily available market quotations for most of the investments in our portfolio, we value substantially all of our portfolio investments at fair value as determined in good faith by our Board of Directors under a valuation policy and a consistently applied valuation process. Due to the inherent uncertainty of determining the fair value of investments that do not have readily available market quotations, the fair value of our investments may differ significantly from the fair values that would have been used had a ready market quotation existed for such investments, and these differences could be material.

As of August 31, 2009, the fair value of our investment portfolio (excluding short-term investments) totaled $78,274,585. We estimate that the impact of a 10 percent increase or decrease in the fair value of these investments, net of capital gain incentive fees and related deferred taxes, would increase or decrease net assets applicable to common stockholders by approximately $4,853,024.

Debt investments in our portfolio may be based on floating or fixed rates. Loans bearing a floating interest rate are usually based on LIBOR and, in most cases, a spread consisting of additional basis points. The interest rates for these debt instruments typically have one to six-month durations and reset at the current market interest rates. As of August 31, 2009, we had no floating rate debt investments outstanding.

We consider the management of risk essential to conducting our businesses. Accordingly, our risk management systems and procedures are designed to identify and analyze our risks, to set appropriate policies and limits and to continually monitor these risks and limits by means of reliable administrative and information systems and other policies and programs.

ITEM 4. CONTROLS AND PROCEDURES

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934) as of the end of the period covered by this report. Based upon such evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective and provided reasonable assurance that information required to be disclosed by us in the reports we file or submit under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure.

There have been no changes in our internal control over financial reporting (identified in connection with the evaluation required by Rules 13a-15(d) or 15d-15 of the Securities Exchange Act of 1934) during the fiscal quarter ended August 31, 2009, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

32

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not currently subject to any material legal proceeding, nor, to our knowledge, is any material legal proceeding threatened against us.

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should carefully consider the factors discussed in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended November 30, 2008, which could materially affect our business, financial condition or operating results. The risks described in our Annual Report on Form 10-K are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

We did not sell any securities during the three months ended August 31, 2009 that were not registered under the Securities Actof 1933.

We did not repurchase any of our common shares during the three months ended August 31, 2009.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

Not applicable.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not applicable.

ITEM 5. OTHER INFORMATION

Not applicable

ITEM 6. EXHIBITS

| Exhibit | | Description |

| 10.1 | | Seventh Amendment to Credit Agreement dated as of August 20, 2009 by and among Tortoise Capital Resources Corporation and U.S. Bank National Association, which is attached as Exhibit 10.1 to the Form 8-K filed on August 25, 2009, is hereby incorporated by reference as Exhibit 10.1. |

| |

| 10.2 | | Investment Advisory Agreement dated as of September 15, 2009 by and between Tortoise Capital Resources Corporation and Tortoise Capital Advisors, L.L.C., which is attached as Exhibit 10.1 to the Form 8-K filed on September 18, 2009, is hereby incorporated by reference as Exhibit 10.2 |

| |

| 31.1 | | Certification by Chief Executive Officer pursuant to Exchange Act Rule 13a-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, is filed herewith. |

| |

| 31.2 | | Certification by Chief Financial Officer pursuant to Exchange Act Rule 13a-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, is filed herewith. |

| |

| 32.1 | | Certification by Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, is furnished herewith. |

All other exhibits for which provision is made in the applicable regulations of the Securities and Exchange Commission are not required under the related instruction or are inapplicable and therefore have been omitted.

33

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | TORTOISE CAPITAL RESOURCES CORPORATION |

| |

| |

| Date: October 9, 2009 | By: | | /s/ Terry Matlack |

| | | | Terry Matlack |

| | | | Chief Financial Officer |

| | | | (Principal Financial Officer) |

34