UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant x | |

| Filed by a Party other than the Registrant ¨ | |

| Check the appropriate box: | |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

22nd Century Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| x No fee required. |

| ¨ Fee paid previously with preliminary materials. |

| ¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 25, 2022

Dear Fellow 22nd Century Group Stockholders,

It is my privilege to serve as your Board Chair and to provide key updates on some of the Board’s critical oversight responsibilities for the Company. The Board has been highly engaged during this exciting period of growth, but we remain very mindful of the ongoing pandemic and the challenging affects it continues to have on so many lives across the globe.

Enhanced Disclosure

This year our Proxy Statement reflects our commitment to provide enhanced disclosure to you, our valued stockholders. It is substantially overhauled to provide clearer and more transparent disclosure on a range of governance related topics, including executive compensation. We believe our enhanced disclosure is responsive to stockholder feedback to provide additional clarity on the Company’s compensation practices and the Compensation Committee’s decisions. The Board remains committed to continuing to develop and improve our disclosures.

Oversight Responsibility

The Board provided strong oversight of the processes that resulted in a year of significant achievements and milestones for our Company. In December, the Food and Drug Administration authorized the marketing of the Company’s reduced nicotine content cigarettes as modified risk tobacco products – the first ever authorized by the FDA. For the past several years, the Company has vigorously pursued our vision that a very low nicotine tobacco product could be scientifically engineered and developed to directly benefit millions of tobacco smokers that desire to quit smoking. The FDA’s authorization unleashed an incredible opportunity for our Company to have a positive impact on the health and well-being of millions of lives by reducing the harmful effects caused by smoking.

Beyond the groundbreaking achievements in tobacco, the Board is very excited about management’s accomplishment in expanding the broad plant biotech portfolio and the positive impact commercialization will have on the overall health of our society. Our plant science efforts are centered on delivering effective health and wellness products for life sciences, consumer products, and pharmaceutical end-use markets, and ultimately improving the lives of millions of people. We are proud to oversee management’s successful execution of the strategy during this very exciting time of growth and opportunity.

Board Succession and Refreshment

Throughout 2021, the Board continued to assess director succession planning and refreshment, as it strives to maintain an independent governing body comprised of individuals with broad and diverse experiences, qualifications, skills, and attributes to effectively oversee the strategic direction of the Company. When seeking new director candidates, we consider diverse perspectives and view diversity through a wide lens, including skills, gender, age, race, ethnicity, background, and professional experience. The Board is committed to continually assessing succession planning to ensure the Board is refreshed based on the evolving needs of the Company.

We were very excited to welcome Anthony Johnson as an independent member of the Board of Directors. Anthony is co-founder and President of Kodikaz Therapeutic Solutions, a next-generation non-viral gene therapy company. As further detailed on page 10 of this Proxy Statement, we nominated Anthony because we believe he will bring important experience to our Board, from biotech and life sciences to executive leadership and commercialization expertise. As a racial and ethnic minority, Anthony brings a valuable diverse perspective of thought and background to the Board. He serves on the Scientific Advisory, Finance, and Compensation Committees.

In early 2022, the Board was very pleased to announce the appointment of our CEO, Jim Mish, to the Board. Since joining the Company in 2020, Jim has demonstrated strong leadership and outstanding execution of the Company’s goals and objectives to advance our mission. We believe his outstanding track record for executing on life science

2022 PROXY STATEMENT | i

company strategies and his ability to attract and retain a strong committed management team will create long term value for our stakeholders. The Board is proud of the accomplishments of Jim and management and feel fortunate to have a team with such strong talent, commitment, and experience to successfully execute the Company’s long-term strategy. We are excited about the future of our young rapidly growing company.

Stockholder Engagement

During the past year, the Board also launched an active stockholder outreach program to engage with key stockholders. The Company reached out to each of its top institutional investors, and Board members and senior management engaged with two of its largest stockholders; we believe the results of those engagements were well received and very positive. Broad topics discussed included governance, compensation strategy and philosophy, and corporate responsibility. The Board recognizes the value and importance of ongoing stockholder engagement for informed direction on our policies and procedures.

Strong Governance and Board Independence

An important priority for the Board is to maintain strong independent governance practices and to ensure we provide effective oversight of the key risks faced by the Company. The Board believes it is fundamental to provide independent oversight and guidance for the execution of the Company’s strategy, and that such engagement is essential to the creation of long-term sustainable value for our stockholders. We are committed to exercising our independence and to focusing on the critical processes and governance practices that are essential to effectively perform our duties.

Environmental, Social and Sustainability

As we move forward, we expect to take further steps on environmental and social matters to meet the needs of our broader stakeholder community. As a young, fast-growing enterprise, we recognize sustainability is an important corporate responsibility and intend to make progress toward developing sustainability and climate impact policies, procedures, and practices.

On behalf of our Board, I thank you for your support and investment in 22nd Century Group. We remain committed to serving you and appreciate the trust you place in us to oversee your interests.

Sincerely,

Nora B. Sullivan

Independent Board Chair

2022 PROXY STATEMENT | ii

500 Seneca Street, Suite 507, Buffalo, New York 14204

Notice of 2022 Annual Meeting of Stockholders and Proxy Statement

TO THE HOLDERS OF COMMON STOCK:

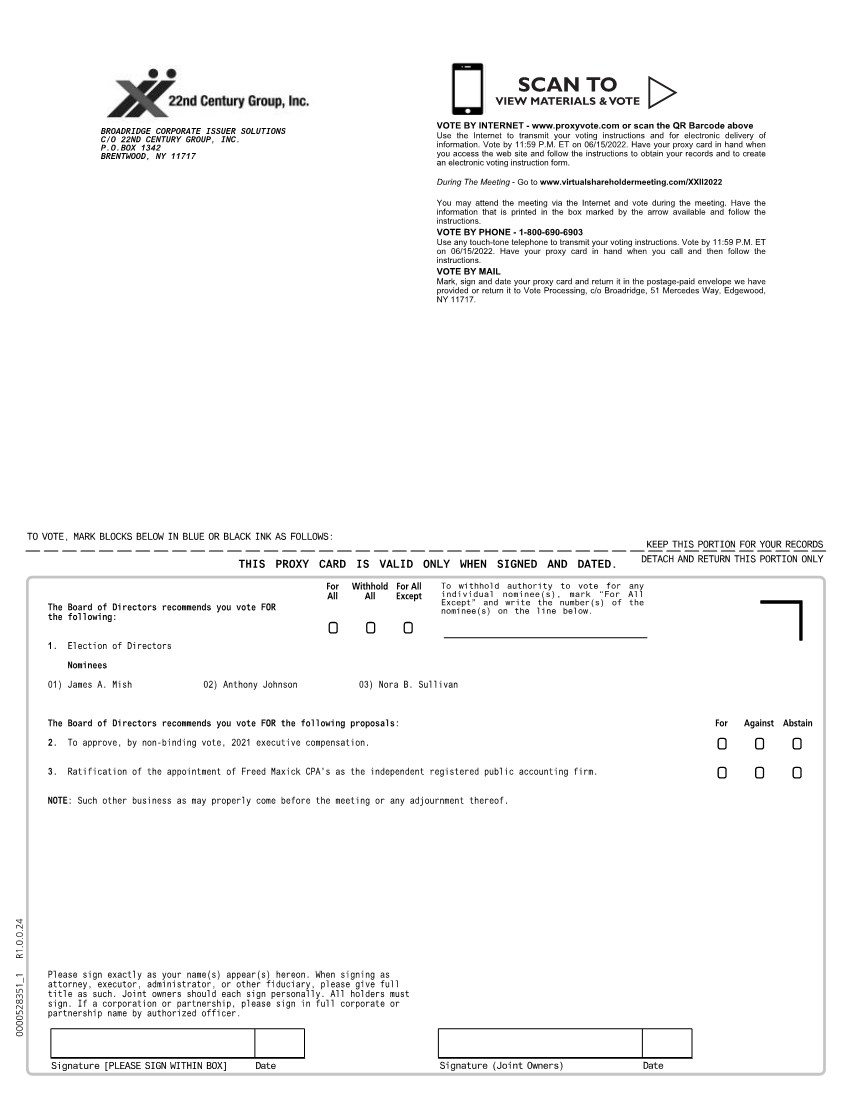

PLEASE TAKE NOTICE that the annual meeting of stockholders of 22nd Century Group, Inc. (the “Company”) will be held on Thursday, June 16, 2022, beginning at 10:00 A.M., Eastern Time. In light of the on-going COVID-19 pandemic, the annual meeting will be a completely virtual meeting conducted via live audio webcast.

You will be able to attend by using the following link www.virtualshareholdermeeting.com/xxii2022. In order to vote during the annual meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting. In structuring the virtual meeting, our goal is to provide stockholders the same opportunity to participate as they would have at an in-person meeting.

The meeting will be held for the following purposes:

| 1. | To elect as directors the three director nominees named in the attached proxy statement as Class II directors to serve for a three-year period until the annual meeting of stockholders in the year 2025 and, in each instance, until their respective successors have been elected and qualified. |

| 2. | To approve an advisory resolution approving executive compensation for fiscal year 2021. |

| 3. | To ratify the appointment of Freed Maxick CPAs, P.C. as our independent registered public accountants for fiscal year 2022. |

| 4. | To transact such other business as may properly come before the meeting or any adjournment. |

The stockholders of record at the close of business on April 21, 2022 will be entitled to vote at the annual meeting.

By Order of the Board of Directors,

Steven Przybyla

General Counsel and Corporate Secretary

Dated: April 25, 2022

MEETING INFORMATION: |

| DATE: | Thursday, June 16, 2022 |

| TIME: | 10:00 A.M., Eastern Time |

| PLACE: | The meeting will be available via live webcast at www.virtualshareholdermeeting.com/xxii2022 |

HOW TO VOTE:

Your vote is important. You are eligible to vote if you were a stockholder of record at the close of business on April 21, 2022.

|

| BY INTERNET www.proxyvote.com |

| BY PHONE Call 1.800.690.6903 |

| BY MAIL Complete, sign and return by free post |

| AT THE ANNUAL MEETING Attend the Annual Meeting Virtually |

2022 PROXY STATEMENT | iii

2022 PROXY STATEMENT | iv

Proxy Summary

| Proxy Summary |

Here we present an overview of information that you will find throughout this proxy statement. As this is only a summary, we encourage you to read the entire proxy statement for more information about these topics prior to voting.

| Annual Meeting of Stockholders | |

| Time and Date: | 10:00 A.M., Eastern Time, June 16, 2022 |

| Place: | You will be able to attend by using the following link www.virtualshareholdermeeting.com/xxii2022. In order to vote during the annual meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting. |

| Record Date: | April 21, 2022 |

This proxy statement and the accompanying form of proxy are first being sent or made available to our stockholders on or about April 25, 2022 in connection with the solicitation by our Board of Directors of proxies to be used at our 2022 Annual Meeting of Stockholders.

The following table summarizes the proposals to be voted on prior to or at our 2022 Annual Meeting of Stockholders and the Board’s voting recommendations with respect to each proposal.

| PROPOSAL | BOARD’S VOTING RECOMMENDATION | PAGE REFERENCE |

Proposal 1: Election of three directors to serve for a three-year period until the annual meeting of stockholders in the year 2025. | FOR each nominee | 9 |

Proposal 2: Advisory Approval on the Company’s 2021 Executive Compensation. | FOR | 23 |

Proposal 3: Ratification of Appointment of Freed Maxick CPAs, P.C. as the Company’s Independent Registered Public Accounting Firm for 2022. | FOR | 39 |

About 22nd Century Group, Inc.

22nd Century Group, Inc. (Nasdaq: XXII) is a leading agricultural biotechnology company focused on tobacco harm reduction, reduced nicotine tobacco and improving health and wellness through plant science. With dozens of patents allowing it to control nicotine biosynthesis in the tobacco plant, the Company has developed proprietary reduced nicotine content tobacco plants and cigarettes, which have become the cornerstone of the FDA’s

2022 PROXY STATEMENT | 1

Proxy Summary

Comprehensive Plan to address the widespread death and disease caused by smoking. The Company received the first and only FDA MRTP authorization of a combustible cigarette in December 2021. In tobacco, hemp/cannabis, and hop plants, 22nd Century uses modern plant breeding technologies, including genetic engineering, gene-editing, and molecular breeding to deliver solutions for the life science and consumer products industries by creating new, proprietary plants with optimized alkaloid and flavonoid profiles as well as improved yields and valuable agronomic traits.

Corporate Governance Highlights

Following are highlights of our key governance practices and policies:

Board Structure | ✓ Separate Chair and CEO

✓ Independent Board Chair

✓ 5 of 7 directors are independent

✓ Audit, Compensation and Corporate Governance & Nominating Committees each comprised entirely of independent directors

✓ Regular executive sessions of only independent directors

✓ Diverse Board with one female director (Chair) and one ethnically diverse director

✓ No familial relationships among Board members

✓ Limits on other board service to no more than two other public companies | |

Board Oversight | ✓ Structured oversight of the Company’s corporate strategy and risk management

✓ Corporate responsibility (ESG) strategy and initiatives and ethics and compliance program oversight by Corporate Governance & Nominating Committee

✓ Cybersecurity risk oversight by Audit Committee

✓ Review of compensation risk by Compensation Committee

✓ Annual self-assessment of Board and Board committee performance | |

Accountability | ✓ Annual say-on-pay advisory vote

✓ Robust stockholder outreach in 2021 and into 2022 regarding executive compensation practices

✓ Our Compensation Committee made no adjustments to executive compensation practices as a result of the COVID-19 pandemic

✓ Prohibition of hedging and pledging Company stock by officers and directors

✓ Code of Business Conduct and Ethics for directors, officers and employees | |

2022 PROXY STATEMENT | 2

Proxy Summary

Environmental, Social and Governance (ESG) Practices

| ||

We received USDA Organic Certification

|

The Board believes that our Environmental, Social and Governance (ESG) practices must be integrated into the way we conduct our business. In 2021 the Board adopted a global ESG policy related to ESG matters, including:

This policy is available on the Company’s website at https://www.xxiicentury.com/investors/corporate-governance.

Our Commitment to Corporate Sustainability

| We strive to be a force for positive change. As we serve our stakeholders and investors, we realize that in this service our actions impact our employees, business partners, suppliers, communities, governments and the world around us.

As we work to effect positive change in the world around us, our Board is committed to corporate sustainability: a commitment to growing our company in a strong and sustainable way; preserving and protecting our environment; valuing and challenging the talented men and women who comprise our workforce; and investing in and improving the communities where we live and work. We are committed to fostering a sustainable future.

|

2022 PROXY STATEMENT | 3

Proxy Summary

Highlights of Key Corporate Sustainability Practices:

| Public Health Impact and Responsible Marketing | · Our very low nicotine (VLN) products, and our reduced nicotine intellectual property, are intended to help smokers “smoke less.” It is our desire to sell the last cigarette, drastically lower the incidence of tobacco related lung cancer and improve the quality and longevity of life for our fellow citizens.

· We plan to ensure our that our products are responsibly marketed. We take our commitment to responsible, accurate and compliant marketing seriously: implementing internal processes to ensure that our communications with potential and existing customers are both true and accurate in nature, while complying with all relevant laws, guidelines and governance practices. | |

| Sustainable Agricultural Practices and Water Conservation | · We actively engage in a supplier vetting process for our agricultural products – meeting with each farmer who grows our VLN tobacco.

· We recognize the restorative impact of our hemp plant lines and its effect on sustainable agriculture. Hemp is a natural remediator of contaminated soil and can be used to convert otherwise contaminated, fallow farmland into airable soil ready for a new generation of crops. We believe that our continued investment in the development of our hemp franchise will yield new opportunities to develop sustainable agricultural practices across numerous industries beyond agriculture itself.

· We understand that water consumption and management is vital to ensuring the sustainability of our supply chain. While our East Coast tobacco farmers and Rocky Mountain hemp operations differ in terms of access to water, we believe that good water stewardship practices in our supply chain though water management planning will enhance our agricultural operations while ensuring these farmlands are viable for future generations.

· For our 2022 hemp crop, we will be implementing a water saving drip irrigation system at our farm in Crawford, Colorado. The new irrigation system will improve nutrient delivery, increase plant quality and yield and significantly decrease our overall water usage. | |

| Human Capital Management (including diversity and inclusion) | · We realize that our business runs on talented personnel – our most important assets. Our commitment to hiring a diverse workforce in both our corporate offices and our manufacturing facilities is one we take seriously. We work hard to continuously evaluate and improve our talent practices to ensure equal opportunity for all employees, including the following notable statistics and developments:

o Approximately 30% of our workforce is considered diverse. o We offer comprehensive benefit programs. o As our business grows, we strive to increase overall diversity of our senior and mid-level leaders.

· In addition to offering robust insurance coverage options and comprehensive benefit packages, we also provide an annual HSA subsidy to employees in our manufacturing facility to help offset co-pay and co-insurance expenses. | |

| Workplace Health and Safety | · We have robust safety procedures to ensure our manufacturing facility is a safe and compliant work environment for our associates. We provide regular employee safety training and resource programs which promote safe and compliant workplace activity.

· We have also been dynamic in our response to various COVID-19 rules and guidelines impacting our operations. With offices in five states, managing state and local guidelines application to our business operations continue to be a focus of our workplace health and safety efforts. | |

2022 PROXY STATEMENT | 4

Proxy Summary

Characteristics of Directors and Director Nominees

| Tenure of Directors | |||||

under 3 years | 4 directors | ||||

3 – 5 years | 1 director | 71% of our Board has tenure of less than 5 years. | |||

over 5 years | 2 directors | ||||

| We have added 4 new directors since 2020. | |||||

| Board Diversity Matrix (as of April 15, 2022) | ||

| Total Number of Directors | 7 | |

| Female | Male | |

| Part I: Gender Identity | ||

| Directors | 1 | 6 |

| Part II: Demographic Background | ||

| African American or Black | 0 | 1 |

| White | 1 | 5 |

| LGBTQ | None | |

2022 PROXY STATEMENT | 5

Proxy Summary

Our Directors and Director Nominees

You are being asked to vote on the election of the three director nominees listed below. Directors are elected by a plurality of the votes cast by the stockholders. Detailed information about each director and director nominee’s background, skills and expertise can be found under Proposal One: Election of Directors. Each director nominee is independent except for James A. Mish, our Chief Executive Officer. Upon election of these directors at the annual meeting of stockholders, the directors shall hold the committee memberships set forth below:

Director Nominees – Class II Director Nominees – Terms to Expire 2025

| Committee Membership | ||||||||

| Name and Primary Occupation | Age as of April 15, 2022 | Director Since | Independent Director | Audit | Compensation | Corporate Governance and Nominating | Finance | Scientific Advisory Board |

James A. Mish

Chief Executive Officer and Director of 22nd Century | 58 | 2022 | No | · | ||||

Anthony Johnson

President and CEO of Kodikaz Therapeutic Solutions | 46 | 2021 | Yes | · | · | · | ||

Nora B. Sullivan

President of Sullivan Capital Partners | 64 | 2015 | Yes | C | · | C | · | · |

· Member C Committee Chair  Financial Expert

Financial Expert

2022 PROXY STATEMENT | 6

Proxy Summary

Directors Continuing in Office - Class III Directors — Terms Expiring 2023

| Committee Membership | |||||||||

| Name and Primary Occupation | Age as of April 15, 2022 | Director Since | Independent Director | Audit | Compensation | Corporate Governance and Nominating | Finance | Scientific Advisory Board | |

Clifford B. Fleet

President and CEO of the Colonial Williamsburg Foundation | 52 | 2019 | No (1) | C | · | ||||

Roger D. O’Brien

President of O’Brien Associates, LLC | 73 | 2020 | Yes | · | · | · | · | · | |

· Member C Committee Chair  Financial Expert

Financial Expert

(1) Mr. Fleet is our former Chief Executive Officer.

2022 PROXY STATEMENT | 7

Proxy Summary

Directors Continuing in Office - Class I Directors — Terms Expiring 2024

| Committee Membership | |||||||||

| Name and Primary Occupation | Age as of April 15, 2022 | Director Since | Independent Director | Audit | Compensation | Corporate Governance and Nominating | Finance | Scientific Advisory Board | |

Richard M. Sanders

General Partner of Phase One Ventures, LLC | 69 | 2013 | Yes | · | C | · | · | · | |

Dr. Michael Koganov

President and Co-Founder of Intellebio LLC | 71 | 2020 | Yes | · | C | ||||

· Member C Committee Chair  Financial Expert

Financial Expert

2022 PROXY STATEMENT | 8

Proposal One: Election of Directors

Proposal One: Election of Directors

Director Nominees

The Company’s Board of Directors is classified into three classes of directors, with one class of directors being elected at each annual meeting of stockholders of the Company to serve for a term of three years or until the earlier of: (i) expiration of the term of their class of directors; or (ii) until their successors are elected and take office as provided below. To maintain the staggered terms of election of directors, stockholders of the Company are voting upon the election of three director nominees as Class II directors to serve for a three-year period until the Annual Meeting of Stockholders in the year 2025.

The Bylaws of the Company provide that the Board will determine the number of directors to serve on the Board. The number of authorized directors of the Company as of the date of this proxy statement is seven, with seven persons currently serving as directors (three Class II directors, two Class I directors and two Class III directors). Our Board has nominated Anthony Johnson, James A. Mish and Nora B. Sullivan to be elected as Class II directors. Information about each director nominee is set forth below.

The nominees for director have each indicated to the Company that they will be available to serve as a director. If a nominee named herein for election as a director should for any reason become unavailable to serve prior to the 2022 annual meeting of stockholders, then the Board may, prior to the annual meeting, (i) reduce the size of the Board to eliminate the position for which that person was nominated, (ii) nominate a new candidate in place of such person or (iii) leave the position vacant to be filled at a later time.

The individuals named as proxy voters in the accompanying proxy, or their substitutes, will vote “FOR” each of the director nominees with respect to all proxies we receive unless instructions to the contrary are provided. If any nominee for director becomes unavailable for any reason, the votes will be cast for a substitute nominee designated by our Board. We have no reason to believe that any nominee for director will be unable to serve if elected. We strongly encourage our directors to attend our 2022 annual meeting. All our continuing directors attended our 2021 Annual Meeting.

The following sets forth certain information, as of April 15, 2022, about the Board’s nominees for election at the annual meeting and each director whose term will continue after our annual meeting.

| Our Board of Directors recommends a vote “FOR” the election of each of its nominees. |

Nominees and Director Qualifications

The following biographies of our nominees contain information regarding the person’s service as a director, business experience, other director positions held currently or at any time during at least the last five years and information regarding involvement in certain legal or administrative proceedings, if applicable. The biographies reflect the committee memberships the nominees shall hold upon their election.

We believe that each nominee possesses the core competencies that are expected of all directors, namely, independence, integrity, sound business judgment and a willingness to represent the long-term interests of all stockholders. The experiences, qualifications, attributes and skills, as shown below, that caused the Corporate Governance and Nominating Committee and the Board to determine that the person should serve as a director of our Company are described in each nominee’s biography.

2022 PROXY STATEMENT | 9

Proposal One: Election of Directors

Director Nominees – Class II Director Nominees – Terms to Expire 2025

| James A. Mish Age: 58 Director Since: 2022 |

| Principal Occupation | |

| • | Our Chief Executive Officer since June 2020 |

| Recent Business Experience | |

| • | President and Chief Executive Officer of Purisys, Advanced Cannabinoids, a synthetic cannabinoid API, ingredients and solutions provider to pharmaceutical and consumer products companies, from 2019 to 2020. |

| • | President and Chief Executive Officer of Noramco, Inc., a global leader in the production of controlled substances for the pharmaceutical industry, from 2016 to 2019. |

| • | President of Ashland Specialty Ingredients, a division of Ashland Corporation, a premier, global specialty materials company serving customers in a wide range of consumer and industrial markets, from 2008 - 2016. |

| Education | |

| • | M.B.A. from The Wharton School of the University of Pennsylvania |

| • | Bachelor of Science in Physics and Chemistry from Pennsylvania State University |

| Board Committees | |

| • | None |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Strong leadership skills |

| • | Pharmaceutical and consumer products experience |

| Anthony Johnson Age: 46 Director Since: 2021 | |

| Principal Occupation | |

| • | Co-founder, President and CEO of Kodikaz Therapeutic Solutions, Inc., a world-class next-generation non-viral gene therapy company, since 2019 |

| Recent Business Experience | |

| • | Founding partner of Buffalo Biosciences in 2006, a life science strategic business management firm that supports the evaluation and commercialization of bioscience technologies from concept to market. |

| • | President and Chief Executive Officer of Empire Genetics, an oncology molecular testing company, from 2006 - 2019. |

| • | Aspen Institute Health Innovation Fellow and a member of the Aspen Global Leadership Network. |

| Education | |

| • | M.B.A. from Manchester Business School, Manchester, UK |

| • | Bachelor of Arts in Biology from Fisk University |

| Board Committees | |

| • | Compensation and Finance |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Experience commercializing bioscience technologies |

| • | Life sciences experience |

2022 PROXY STATEMENT | 10

Proposal One: Election of Directors

Director Nominees – Class II Director Nominees – Terms to Expire 2025

| Nora B. Sullivan Age: 64 Director Since: 2015 Independent Chair of the Board Since: 2020 | |

Principal Occupation | |

| • | President and Founder of Sullivan Capital Partners, a financial services company providing investment banking and consulting services, since 2004. |

| Recent Business Experience | |

| • | From 2000 to 2004, worked for Citigroup Private Bank, providing capital markets and wealth management services to high-net-worth individuals and institutional clients. |

| • | From 1995 to 1999, Executive Vice President of Rand Capital Corporation (NASDAQ: RAND), an investment management company providing capital and managerial expertise to small and mid-size businesses. |

| • | Member of the Boards of Directors of Evans Bancorp, Inc. (NYSE American: EVBN), Robinson Home Products, and Rosina Food Products. |

| • | Vice Chair of the Investment Committee and Board Member of the Patrick P Lee Foundation, Chairman of the Technology Transfer Committee of the Roswell Park Comprehensive Cancer Center, and a member of the Board of Directors of the Cortland College Foundation. |

| Education | |

| • | M.B.A. in Finance and International Business from Columbia University Graduate School of Business |

| • | Juris Doctor degree from the University of Buffalo School of Law |

| Board Committees | |

| • | Audit, Compensation, Corporate Governance & Nominating and Finance |

| Other Public Company Boards | |

| • | Evans Bancorp, Inc. (NYSE American: EVBN) |

| Key Qualifications for Service as a Director | |

| • | Expertise in finance and corporate governance |

| • | Experience with mergers and acquisitions |

| • | Status as an audit committee financial expert |

2022 PROXY STATEMENT | 11

Proposal One: Election of Directors

Directors Continuing in Office - Class III Directors — Terms Expiring 2023

| Clifford B. Fleet Age: 52 Director Since: 2019 | |

Principal Occupation | |

| • | President and CEO of the Colonial Williamsburg Foundation, the world’s largest living history museum and a national leader in American education, since 2019. |

| Recent Business Experience | |

| • | President and Chief Executive Officer of the Company from August 3, 2019 until December 13, 2019. Mr. Fleet also served as a strategic advisor consultant to the Company from December 2018 to August 3, 2019. |

| • | From 1995 to 2017 Mr. Fleet worked at Altria Group (NYSE: MO), serving in a variety of senior-level management positions in Finance, Investor Relations, Operations, Marketing, and Business Strategy and Development. |

| • | From 2013 to 2017, Mr. Fleet served as the President and CEO of Philip Morris USA, Altria’s largest subsidiary, when he ran Philip Morris USA, the nation’s largest tobacco company, and John Middleton, a leading machine-made cigar manufacturer. |

| • | Adjunct Professor at William & Mary. |

| Education | |

| • | Bachelor of Arts, Master of Arts, Master of Business Administration and Juris Doctor from the College of William & Mary |

| Board Committees | |

| • | Finance |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Deep experience in the tobacco industry |

| • | Service as our former chief executive officer |

| • | Prior public company experience |

| Roger D. O’Brien Age: 73 Director Since: 2020 | |

Principal Occupation | |

| • | President of O’Brien Associates, LLC, a general management consulting firm providing advisory and implementation services to companies in a variety of competitive industries, with special focus on general management, technology commercialization, marketing and strategy development, since 2000. |

| Recent Business Experience | |

| • | From 1998 to 1999, Mr. O’Brien served as the Chief Operating Officer of Ultralife Batteries, Inc. (Nasdaq: ULBI). |

| • | From 1991 to 1996, he was the Chief Executive Officer and a major shareholder of Holotek Ltd., a high-technology company with a proprietary position in the design, development, manufacture and sales of laser imaging systems worldwide. |

| • | Member of the Board of Directors of Innovative Technology Solutions and Bristol-ID Technologies, Inc. |

| • | Adjunct professor at the Rochester Institute of Technology, where he is a graduate instructor in Rochester, New York and in Croatia |

| Education | |

| • | Bachelor of Science in Nuclear Engineering from New York University |

| • | M.B.A. from The Wharton School of the University of Pennsylvania |

| Board Committees | |

| • | Audit, Compensation, Corporate Governance & Nominating and Finance |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Experience with strategic consulting and corporate governance |

| • | Prior public company experience |

2022 PROXY STATEMENT | 12

Proposal One: Election of Directors

Directors Continuing in Office - Class I Directors — Terms Expiring 2024

| Richard M. Sanders Age: 69 Director Since: 2013 | |

Principal Occupation | |

| • | General Partner of Phase One Ventures, LLC, a venture capital firm which focuses on nanotechnology and biotechnology start-up opportunities in New Mexico and surrounding states, since August 2009. |

| Recent Business Experience | |

| • | From January 2002 until June 2009, Mr. Sanders served as President and CEO of Santa Fe Natural Tobacco Company (“SFNTC”), a division of Reynolds American, Inc., which manufactures and markets the Natural American Spirit cigarette brand. While at SFNTC, he more than tripled sales and earnings and rapidly expanded the company’s international business. |

| • | Prior to directing SFNTC’s robust growth, Mr. Sanders worked for R.J. Reynolds Tobacco Company where he began his career in marketing in 1977. From 1987 to 2002, he served in a wide spectrum of executive positions including, among others, Senior Vice President of Marketing, Vice President of Marketing and Sales Operations, Vice President of Sales and President of Sports Marketing Enterprises. |

| Education | |

| • | Bachelor’s Degree in political science from Hamline University |

| • | M.B.A. in Marketing from Washington University in St. Louis, Missouri |

| Board Committees | |

| • | Audit, Compensation, Corporate Governance & Nominating and Finance |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Deep experience in the tobacco industry |

| • | Expertise in management and marketing |

| Dr. Michael Koganov Age: 71 Director Since: 2020 | |

Principal Occupation | |

| • | President and Co-Founder of Intellebio LLC, a consulting and testing firm focused on the development of novel technologies, advanced test methods, and breakthrough products in the life science field, since 2019. |

| Recent Business Experience | |

| • | Dr. Michael Koganov is recognized as a leading expert in the development of natural products using plant biotechnology and has achieved considerable accomplishments in physico-chemistry, bio-chemistry, bioelectrochemistry, and biotechnology. He has written more than 70 publications, secured over 100 granted patents, and is the author of two books. |

| • | From 2015 to 2018, served as the Vice President of Biomaterials at Ashland Global Holdings, Inc. |

| Education | |

| • | Master of Science in Biochemistry from the State University, Dnipropetrovsk, USSR |

| • | Ph.D. in Bioelectrochemistry from Institute of Chemical Technology, Dnipropetrovsk, USSR |

| • | Full Doctor of Sciences (Sc.D.) degree in biotechnology from the Higher Attestation Commission of the USSR’s Council of Ministers |

| Board Committees | |

| • | Finance |

| Other Public Company Boards | |

| • | None |

| Key Qualifications for Service as a Director | |

| • | Expertise in the area of plant biotechnology |

| • | Experience developing novel technologies |

2022 PROXY STATEMENT | 13

Proposal One: Election of Directors

Commitment to Corporate Governance

Our Board of Directors represents the best interests of our stockholders by overseeing the business and affairs of the Company. Members of the Board participate in quarterly board and committee meetings, engage with senior management of the Company, review and provide input in the Company’s strategic plan and principal issues, and discuss feedback from stockholders and other stakeholders.

Directors hold office for a term ending on the date of the third annual stockholders’ meeting following the annual meeting at which such director’s class was most recently elected until the earlier of their death, resignation, removal or until their successors have been duly elected and qualified. There are no family relationships among our directors. Our bylaws provide that the number of members of our Board of Directors may be changed from time to time by resolutions adopted by the Board of Directors. Our Board of Directors currently consists of seven (7) members with no vacancies.

Our Board of Directors has determined that Anthony Johnson, Dr. Michael Koganov, Roger D. O’Brien, Richard M. Sanders and Nora B. Sullivan are “independent” as defined by applicable Nasdaq Stock Market listing standards. Clifford Fleet is not considered independent under the Nasdaq Stock Market rules until January 2023 due to his prior service as our Chief Executive Officer. The Board annually reviews all business and other relationships of directors and determines whether directors meet these categorical independence tests.

Our Board of Directors do not have a policy on whether or not the roles of Chief Executive Officer and chairperson of the Board should be separate. Our Board reserves the right to assign the responsibilities of the Chief Executive Officer and chair position as determined by our Board to be in the best interest of our Company. In the circumstance where the responsibilities of the Chief Executive Officer and chair are vested in the same individual or in other circumstances when deemed appropriate, the Board will designate a lead independent director from among the independent directors to preside at the meetings of the non-employee director executive sessions. The positions of Chief Executive Officer and chair have been separate positions since October 25, 2014.

Since January 2020, Nora Sullivan has served as our independent Board Chair given her history with the Company, business, financial, accounting and legal expertise, while James Mish serves as Chief Executive Officer and as a member of the Board.

Our Board reviews our leadership structure annually and retains the authority to modify this structure to best address our Company’s unique circumstances as and when appropriate.

2022 PROXY STATEMENT | 14

Proposal One: Election of Directors

The Corporate Governance and Nominating Committee assists the Board in establishing criteria and qualifications for potential Board members. The Committee identifies individuals who meet such criteria and qualifications to become Board members and recommends to the Board such individuals as nominees for election to the Board. Since 2020, we have added 4 new directors – adding a wide range of skill sets and diverse viewpoints.

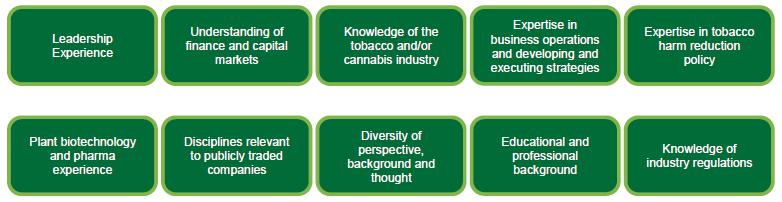

The Corporate Governance and Nominating Committee works with the Board of Directors to determine the appropriate characteristics, skills and experiences for both individual directors and the Board as a whole. The objective is to have a Board with diverse backgrounds and experience in relevant areas for the benefit of the Company. Characteristics expected of all directors include independence, highest personal and ethical standards, integrity, sound business judgment and willingness to represent the long-term interests of all stockholders. In evaluating the suitability of individuals as Board members, the Committee takes into account many factors but does not have a policy that focuses on any one factor. The factors considered by the Committee include:

In addition, the Committee will look for skills and experience that will complement and enhance the Board’s existing make-up including length of anticipated or possible service to assist with Board succession and transitions. The Committee evaluates each individual in the context of the Board as a whole, to recommend a group that can best perpetuate the success of our business. Currently, there are no age restrictions or mandatory retirements for director service.

Director Nominee Selection Process

Our Corporate Governance and Nominating Committee evaluates the specific personal and professional attributes of each director candidate versus those of existing Board members to ensure diversity of competencies, experience, personal history and background, thought, skills and expertise across the full Board. In the evaluation of director candidates, our Corporate Governance and Nominating Committee gives consideration to diversity in terms of gender, ethnic background, age and other similar attributes that could contribute to Board perspective and effectiveness. The Corporate Governance and Nominating Committee also assesses diversity through its annual assessment of Board structure and composition and annual Board and committee performance self-assessment process. We believe that fostering Board diversity best serves the needs of the Company and the interests of its stockholders, and it is one of the many factors considered when identifying individuals for Board membership. We believe that diversity with respect to gender, ethnicity, tenure, experience and expertise is important to provide both fresh perspectives and deep experience and knowledge of the Company.

When vacancies develop, the Corporate Governance and Nominating Committee solicits input regarding potential new candidates from a variety of sources, including existing directors and senior management. From time to time, we have used an executive search firm in search of candidates that have diversity in experience, skills and perspective. Through these and other means, the Board has continued to refresh the Board by adding directors who bring a sufficient range of different perspectives, generate appropriate challenge and discussion, and fulfill its oversight responsibilities to foster significant value creation for our stockholders. The Committee evaluates potential candidates based on their background, experiences and qualifications and also arranges personal interviews of qualified candidates by one or more committee members, other Board members and senior management.

2022 PROXY STATEMENT | 15

Proposal One: Election of Directors

Stockholder Recommendations for Potential Director Nominees

Nominations of persons for election to the Board at the annual meeting may also be made by any stockholder entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in our bylaws. Such nominations by any stockholder shall be made pursuant to timely notice in writing to the Secretary. To be timely, a stockholder’s notice shall be delivered to the Secretary at our principal executive offices not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made.

Meetings of Board of Directors

Our Board held five regular meetings and two special meetings during 2021. All directors attended at least 75% of all meetings of the Board and Board committees on which they served during 2021.

We do not have a formal policy requiring directors to attend annual meetings of stockholders. However, all of our directors attended our 2021 annual meeting and we anticipate that all of directors will attend the 2022 annual meeting.

All directors attended at least 75% of all meetings of the Board and Board committees on which they served during 2021.

Executive Sessions of Independent Directors

The independent directors hold regularly scheduled executive sessions of the Board and its committees without senior management present. The independent directors met in executive session at most of the regularly scheduled Board and committee meetings held in 2021.

Corporate Governance Guidelines

Our Board has adopted a set of Corporate Governance Guidelines, which describe the Board’s responsibility for oversight of the business and affairs of the Company as well as guidelines for determining director independence and consideration of potential nominees to the Board. The Board, directly and through its Corporate Governance and Nominating Committee, regularly reviews developments in corporate governance and best practices and annually reviews its Corporate Governance Guidelines, committee charters and other key governance documents, policies and practices. Our Corporate Governance Guidelines provide:

| · | Limits on Board Service. We do not allow “overboarding,” which refers to a director serving on an excessive number of public company boards. Excessive board commitments can lead to a director being unable to appropriately fulfill his or her duties to the Company and its shareholders. Our Corporate Governance Guidelines have long limited our directors to no more than two other public company boards. |

| · | Board Self-Assessment and Evaluation. We conduct an annual self-evaluation and assessment of our individual Board performance to help ensure that the Board and its committees function effectively and in the best interest of our stockholders. This process promotes good governance and helps set expectations about the relationship and interaction of and between the Board and management. |

Our Board of Directors currently has four standing committees: (i) an Audit Committee, (ii) a Compensation Committee, (iii) a Corporate Governance and Nominating Committee, and (iv) a Finance Committee. Each of these Board committees are described below. Members of these committees are elected annually by the Board. The

2022 PROXY STATEMENT | 16

Proposal One: Election of Directors

charters of each committee are each available on the investor relations section of our website at www.xxiicentury.com. In addition, we have a Scientific Advisory Board which is chaired by Michael Koganov.

| MEMBERS | KEY RESPONSIBILITIES | |||

Nora B. Sullivan*, Chair

Roger D. O’Brien

Richard M. Sanders

The Board has determined that each member of the audit committee is independent as defined under the applicable listing standards of the Nasdaq Stock Market and Rule 10A-3 under the Securities Exchange Act of 1934, as amended.

| ▪ | Assists the Board in monitoring the integrity of financial statements and our compliance with legal and regulatory requirements; | ||

| ▪ | Reviews the independence and performance of our internal and external auditors; | |||

| ▪ | Has the ultimate authority and responsibility to select, evaluate, terminate and replace our independent registered public accounting firm; | |||

| ▪ | Has oversight of the Company’s policies with respect to risk assessment and risk management; and | |||

| ▪ | Approves the Audit Committee Report as shown on page 38. The report further details the Audit Committee’s responsibilities. | |||

| *Audit Committee Financial Expert: Our Board has determined that Ms. Sullivan qualifies as an “audit committee financial expert” as defined by the rules of the Securities and Exchange Commission. Furthermore, all members of the Audit Committee meet the financial literacy requirements of the Nasdaq Stock Market and no members of the Audit Committee serves on the Audit Committee of more than three public companies. | ||||

The Committee met

| ||||

| MEMBERS | KEY RESPONSIBILITIES | |||

Richard M. Sanders, Chair

Anthony Johnson

Roger D. O’Brien

Nora B. Sullivan

The Board has determined that each member of the Compensation Committee is independent within the meaning of the Company’s independence standards and applicable listing standards of the Nasdaq Stock Market. | ▪ | Establishes and regularly reviews our compensation and benefits philosophy and program in a manner consistent with corporate financial goals and objectives; | ||

| ▪ | Approves compensation arrangements for senior management, including annual incentive and long-term compensation; | |||

| ▪ | Administers grants under our equity incentive plans; | |||

| ▪ | Evaluates our CEO’s performance; and | |||

| ▪ | Reviews leadership development and succession planning. | |||

| The Committee retains Willis Towers Watson (formerly Towers Watson) as its compensation consultant. | ||||

The Committee met eight times in 2021

| ||||

2022 PROXY STATEMENT | 17

Proposal One: Election of Directors

Corporate Governance and Nominating Committee

| MEMBERS | KEY RESPONSIBILITIES | |||

Nora B. Sullivan, Chair

Roger D. O’Brien

Richard M. Sanders

The Board has determined that each member of the Corporate Governance and Nominating Committee is independent within the meaning of the Company’s independence standards and applicable listing standards of the Nasdaq Stock Market. | ▪ | Assists our Board in establishing criteria and qualifications for potential Board members; | ||

| ▪ | Identifies high quality individuals who have the core competencies, characteristics and experience to become members of our Board; | |||

| ▪ | Establishes corporate governance practices in compliance with applicable regulatory requirements and consistent with the highest standards, and recommends to the Board the corporate governance guidelines applicable to us; | |||

| ▪ | Leads the Board in its annual review of the Board’s performance; | |||

| ▪ | Recommends nominees for each committee of the Board; and | |||

The Committee met six times in 2021

| ▪ | Oversees the Company’s Environmental Social and Governance (“ESG”) policies and practices. | ||

| MEMBERS | KEY RESPONSIBILITIES | |||

Clifford B. Fleet, Chair

Anthony Johnson

Dr. Michael Koganov

Roger D. O’Brien

Richard M. Sanders

Nora B. Sullivan | Advising the Board on financial matters relating to: | |||

| ▪ | budgets and financial plans, performance against budgets and financial plans, the sources and uses of cash; | |||

| ▪ | transactions, including mergers, acquisitions and divestitures, as well as joint ventures and other equity investments; | |||

| ▪ | the Company’s capital structure, including potential issuances of debt and equity securities, credit agreements and material changes thereto, and short-term investment policy; | |||

| ▪ | dividends, stock splits, and stock repurchases; and | |||

The Committee met six times in 2021 | ▪ | Investor relations activities | ||

2022 PROXY STATEMENT | 18

Proposal One: Election of Directors

| MEMBERS | KEY RESPONSIBILITIES | |||

Dr. Michael Koganov, Chair

Clifford B. Fleet

James A. Mish

Roger D. O’Brien

Anthony Johnson

Richard M. Sanders

Nora B. Sullivan | Provides advice and recommendations to the Board regarding: | |||

| ▪ | Company scientific research, technology and innovation strategies; | |||

| ▪ | opportunities including potential partnerships and M&A; and | |||

| ▪ | emerging science and technology issues and trends. | |||

| The Scientific Advisory Board met four times in 2021 | ||||

Code of Business Conduct and Corporate Ethics

Our Board of Directors has long maintained a Code of Ethics that applies to all our directors, officers and employees. A copy of our Code of Ethics is available on our website at http://www.xxiicentury.com.

Our directors, executive officers and employees are required to comply with the 22nd Century Group, Inc. Insider Trading Policy and may not engage in any transaction (such as short-selling) to hedge against the potential decline in value of any of our securities.

Our Board is actively involved in oversight of risks that could affect the Company. Our Board has assigned responsibility for addressing certain risks, and the steps management has taken to monitor, control and report such risk, to our Audit Committee, including risks relating to execution of our growth strategy, with appropriate reporting to the full Board. Our Board relies on our Compensation Committee to address significant risk exposures facing our Company with respect to compensation. Our Board receives reports by each committee chair regarding the applicable committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Compensation Policies and Practices and Risk Management

The Compensation Committee considers, in establishing and reviewing our compensation philosophy and programs, whether such programs encourage unnecessary or excessive risk taking. Base salaries are fixed in amount and consequently the Compensation Committee does not see them as encouraging risk taking. We also provide executive officers with equity awards to help further align their interests with those of our stockholders. The Compensation Committee believes that these awards do not encourage unnecessary or excessive risk taking since the awards are generally provided at the beginning of an employee’s tenure or at various intervals to award achievements or provide additional incentive to build long-term value and are subject to vesting schedules to help ensure that executives have significant value tied to our long-term corporate success and performance.

The Compensation Committee believes that our compensation philosophy and programs encourage employees to strive to achieve both short- and long-term goals that are important to our success and building stockholder value, without promoting unnecessary or excessive risk taking. The Compensation Committee has concluded that our compensation philosophy and practices are not reasonably likely to have a material adverse effect on us.

2022 PROXY STATEMENT | 19

Proposal One: Election of Directors

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, no member of the Compensation Committee had a relationship with us that required disclosure under Item 404 of Regulation S-K. During the past fiscal year, none of our executive officers served as a member of the Board of Directors or Compensation Committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who served as members of our Board of Directors or our Compensation Committee. None of the members of our Compensation Committee is an officer or employee of our Company, nor have they ever been an officer or employee of our Company.

2022 PROXY STATEMENT | 20

Compensation of Directors

Elements of 2021 Non-Employee Director Compensation

Non-employee directors are compensated for their service on our Board as shown below. Directors who are employees of the Company receive no additional compensation for serving as directors. The Compensation Committee periodically reviews the compensation of our non-employee directors and considers market practices. In February 2021, the Compensation Committee retained Korn Ferry (“KF”) to conduct an independent assessment of our director compensation versus the competitive market and the “fit” of our compensation program to our pay philosophy. To establish the competitive market for directors, KF identified a comparator group of 17 publicly traded companies in the United States and Canada within the biotechnology and pharmaceuticals industries with median revenues of $95 million and median market capitalizations of $1.2 billion. Our Compensation Committee expects to engage an independent compensation consultant to conduct a follow-up survey to review its non-employee director compensation program during 2022. Based on the KF review, the Compensation Committee recommended, and the Board approved, the following director compensation for 2021:

| Annual cash retainer: | $75,000 |

| Additional annual cash retainer for: | |

| Chair of the Board | $50,000 |

| Chair of a Board Committee | $20,000 |

| Member of a Board Committee | $10,000 |

| Annual RSU award value: | $135,000 |

As with many small cap companies, our stock price has been volatile historically. For example, between January 1, 2019 and December 31, 2021, our stock price ranged from a low of $0.55 per share to a high of $6.07 per share. In order to eliminate some of the volatility from our stock price when making equity awards, our Compensation Committee decided to implement a three-year policy to determine the number of RSUs to issue for annual awards by dividing the annual RSU award value approved by the Compensation Committee ($135,000) with the average closing stock price over the six months prior to the date of the award. As a result of this policy, the grant date fair value of our RSU awards reported in our Director Compensation table below will vary (up or down) from the annual RSU award value approved by the Compensation Committee depending on the closing market price on the date of the award and the average market price over the prior six months. Our Compensation Committee is committed to adhering to this policy for director RSU awards made during 2022 and 2023.

The Compensation Committee made an exception to the KF director compensation recommendation in awarding the company’s Board Chair, Nora B. Sullivan, with a special, one-time award of (i) 150,000 options to purchase shares of our common stock at $3.05 per share and (ii) 150,000 RSUs vesting annually over a period of three years. While recognizing that such a grant is highly unusual, the Board believed the award was merited in light of the truly extraordinary service rendered by her on behalf of stockholders during 2020. During this timeframe, we experienced unexpected and unprecedented turnover in our executive management team, having to replace two CEO’s, two CFOs and our General Counsel. Ms. Sullivan was highly engaged in the recruitment and interviewing of each of these critical positions as well as overseeing the recruitment and onboarding of two new independent directors to replace two departing directors, including one due to an unexpected passing. She was exceptional in her commitment to consistently provide critical guidance and support to the management team as needed on key issues relating to Corporate Strategy and capital markets matters. Ms. Sullivan provided a steady hand to the Board as we navigated successfully through this extraordinary period, which was further compounded by the unprecedented challenges of the COVID-19 pandemic. As a result of her enormous commitment of energy, time and counsel during this unparalleled time in the Company’s history, we were able to successfully engage an outstanding new management team, add two new, independent Board directors, broaden our capital market engagements and maintain the Company’s focus on our business. Our Compensation Committee and the full Board believed that it was both appropriate and justified given the circumstances and Ms. Sullivan’s leadership and response to make

2022 PROXY STATEMENT | 21

Compensation of Directors

this one-time equity award. We fully expect that Ms. Sullivan’s future compensation will be in line with the approved Board compensation levels.

NON-EMPLOYEE DIRECTOR COMPENSATION FOR 2021

Name | Fees earned or paid in cash |

|

Option Awards(1) |

|

Restricted Stock Unit Awards(2) |

|

All Other Compensation |

Total | ||||||

| Clifford B. Fleet | $ | 105,000 | $ | — | $ | 248,205 | $ | — | $ | 353,205 | ||||

| Anthony Johnson | $ | 43,750 | $ | — | $ | 152,400 | (3) | $ | — | $ | 196,150 | |||

| Michael Koganov | $ | 105,000 | $ | — | $ | 248,205 | $ | — | $ | 353,205 | ||||

| Roger D. O’Brien | $ | 131,667 | $ | — | $ | 248,205 | $ | — | $ | 379,872 | ||||

| Richard M. Sanders | $ | 135,000 | $ | — | $ | 248,205 | $ | — | $ | 383,205 | ||||

| Nora B. Sullivan | $ | 188,333 | $ | 259,200 | $ | 480,000 | $ | — | $ | 927,533 | ||||

| (1) | Represents the grant date fair value computed in accordance with FASB ASC 718. The assumptions used for the option awards are set forth in note 14 to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021. |

| (2) | The fair value of each restricted stock unit is based on the stock price of the Company’s common stock on the grant date of the award. |

| (3) | Represents a prorated restricted stock grant based on partial service in 2021. |

2022 PROXY STATEMENT | 22

Proposal Two: Advisory Vote on Executive Compensation

Proposal Two: Advisory Vote on Executive Compensation

We design our executive officer compensation programs with the intent to attract, motivate, and retain industry-leading executives who are capable of achieving our key strategic goals. Our compensation programs are designed to be competitive with comparable employers and to align the interests of management with long-term stockholders by creating incentives for the achievement of specific key objectives. We encourage you to closely review our “Compensation Discussion and Analysis” and “Executive Compensation” sections, including our stockholder outreach conducted during 2021 and 2022 in response to our say on pay voting results.

In accordance with SEC rules, you are being asked to approve an advisory resolution on the compensation of our named executive officers. This proposal, commonly known as a “say on pay” proposal, gives you the opportunity to endorse or not endorse our fiscal year 2021 compensation program and policies for our named executive officers. Although this advisory vote is non-binding, our Board and Compensation Committee will review and consider voting results in making future decisions about executive compensation programs.

| RESOLVED: | That the stockholders of 22nd Century Group, Inc. approve, on an advisory basis, the compensation paid to the Company’s named executive officers as described in this proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation.” |

Our Board recommends a vote “FOR” approval, on an advisory basis, the 2021 compensation of the Company’s named executive officers as described in this proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation.”

|

2022 PROXY STATEMENT | 23

Compensation Discussion and Analysis

Compensation Discussion and Analysis

This compensation discussion and analysis describes the material elements of compensation awarded to, earned by, or paid to each of our named executive officers, whom we refer to as our “NEOs,” during 2021 and describes our policies and decisions made with respect to the information contained in the following tables, related footnotes and narrative for 2021. The NEOs are identified below under “Our Named Executive Officers.” In this compensation discussion and analysis, we also describe various actions regarding NEO compensation taken before or after 2021 when we believe it enhances the understanding of our executive compensation program.

|  |  |  |

James A. Mish Chief Executive Officer |

Richard Fitzgerald Chief Financial Officer |

Michael Zercher President & Chief Operating Officer |

John Franzino Chief Administrative Officer |

For information with respect to Mr. Mish, please refer to the Election of Directors section.

Richard Fitzgerald, age 58, Chief Financial Officer. Mr. Fitzgerald has served as our Chief Financial Officer since November 2021. Mr. Fitzgerald currently is serving as Chief Financial Officer and Secretary of CleanTech Acquisition Corp, (Nasdaq: CLAQU), a SPAC focused on the CleanTech sector, since February of 2021. Mr. Fitzgerald recently served as Chief Financial Officer at Immunome, Inc. (Nasdaq: IMNM) a novel immunology therapeutics company that completed its IPO and Nasdaq listing in October 2020. Previously, Mr. Fitzgerald served as Chief Financial Officer for both Sesen Bio (Nasdaq: SESN), a late-stage clinical company advancing fusion protein therapies, and PAVmed Inc. (Nasdaq: PAVM), where he successfully completed the company’s IPO and Nasdaq listing. Mr. Fitzgerald has also held senior financial positions at TechPrecision Inc. (OTCBB: TPCS), Nucleonics Inc. (sold to Alnylam Pharmaceuticals Inc. (Nasdaq: ALNY)), and Exelon Corporation (NYSE: EXC). Mr. Fitzgerald received his B.S. in Business Administration and Accounting from Bucknell University. He previously served as Co-Chair of the Biotechnology Innovation Organization’s CFO/Tax Committee, which lobbied for capital markets and tax reforms in support of the life science industry. Mr. Fitzgerald is a member of the American and Pennsylvania Institutes of Public Accounting and a current Board member of the Bucknell University Alumni Association Board of Directors and serves on the Finance Committee of FORCE BLUE TEAM.ORG.

Michael J. Zercher, age 51, President and Chief Operating Officer. Mr. Zercher has served as our President since December 13, 2019, and he has served as our Chief Operating Officer since June 10, 2019. He previously served as the Company’s Vice President of Business Development since September 2016. Mr. Zercher was previously the head of Santa Fe Natural Tobacco Company’s international business operations based in Santa Fe, New Mexico and Zurich, Switzerland from January 2003 to August 2009. Subsequently, Mr. Zercher was a self-employed consultant to entrepreneurs and high-growth businesses in the United States and Europe from September 2009 to September 2016 and the founder and owner of Santa Fe Hard Cider, LLC based in Santa Fe, New Mexico from December 2012 to September 2016. Mr. Zercher has more than twenty-five years of experience in the tobacco industry and other consumer packaged goods industries in general management, marketing, sales, operations and business development in the United States, Europe and Asia.

John Franzino, age 65, Chief Administrative Officer. Mr. Franzino served as our Chief Financial Officer from June 3, 2020 until November 2021 when he transitioned to Chief Administrative Officer. He has a successful track record of strategic financial leadership in high-growth, highly regulated, consumer-facing industries as well as not-for-profit higher education organizations. Most recently, Mr. Franzino served as Chief Financial Officer of the West Point Association of Graduates, which supports the U.S. Military Academy at West Point. Prior to his experience in higher education, Mr. Franzino served as Chief Financial Officer of Santa Fe Natural Tobacco Company, a subsidiary of

2022 PROXY STATEMENT | 24

Compensation Discussion and Analysis

Reynolds American, Inc., and as Chief Financial Officer of Labatt USA, a subsidiary of Anheuser-Busch. In both roles, he was responsible for the financial planning and control function as well as information systems and technology. Mr. Franzino is a certified public accountant and holds a Master of Business Administration from Fairleigh Dickinson University and a Bachelor of Arts degree from the University of Maine at Farmington.

Our Executive Compensation Philosophy and Design

Our executive compensation programs are driven by a pay-for-performance philosophy that is directly linked to our business strategies and company-wide goals. Prior to the FDA’s authorization of the marketing of our VLN® King and VLN® Menthol King reduced nicotine content cigarettes as modified risk tobacco products (MRTPs) in December 2021, our business has historically been focused on developing products through research and development and securing regulatory approval to market and sell such products. While we have limited revenues through the sale of SPECTRUM® research cigarettes and contract manufacturing of cigarettes and filtered cigars, we believe the current primary driver of stockholder value is derived from the development of disruptive, plant-based solutions for the life science, consumer product, and pharmaceutical markets that we license to third parties and/or manufacture and sell. Accordingly, our compensation program is less focused on objective metrics that are typically applicable to other companies – such as EBITDA, revenues or other financial metrics – and instead focuses on the objective and subjective achievements of steps towards our business strategies and company-wide goals.

Our Compensation Committee strongly believes that our business demands the kind of executive officers who have the experience, temperament, talents and convictions to drive our future success. Our compensation programs are designed to:

| • | attract and retain high-caliber executives who we believe have the experience, temperament, talents, and convictions to contribute significantly to our future success; | |

| • | motivate our executives by providing compensation that is directly linked to both our short- and long-term performance; | |

| • | tightly align their incentives and economic interests with our stockholders to build long-term stockholder value by delivering a substantial portion of our executive officer’s compensation through equity awards; and | |

| • | ensure that our executive compensation program is designed and administered in a manner that appropriately manages risk to safeguard the interest of our stockholders, as well as our employees. |

We have designed our executive compensation program with specific features to help achieve these goals and to promote related objectives that are important to our long-term success.

Setting Executive Compensation

Our Compensation Committee has primary responsibility for, among other things, determining our compensation philosophy, evaluating the performance of our executive officers, setting the compensation and other benefits of our executive officers, overseeing the Company’s response to the outcome of the advisory votes of stockholders on executive compensation (as discussed below), assessing the relative enterprise risk of our compensation program and administering our incentive compensation plans.

Our Board, our Compensation Committee and our CEO each play a role in setting the compensation of our NEOs. Our Board appoints the members of our Compensation Committee and delegates to the Compensation Committee the direct responsibility for overseeing the design and administration of our executive compensation program. Our Board and our Compensation Committee value the opinions of our stockholders and are committed to ongoing engagement with our stockholders on executive compensation practices. As discussed below, the Compensation Committee specifically considers the results from the annual stockholder advisory vote on executive compensation in making compensation decisions.

In December 2020, our Compensation Committee engaged the compensation consulting firm of Willis Towers Watson (formerly Towers Watson) to provide an independent assessment of our executive compensation versus survey data (using a combination of three independent surveys) from life science companies in the U.S. and Canada

2022 PROXY STATEMENT | 25

Compensation Discussion and Analysis

with revenues under $500 million (the “Survey Group”). We generally targeted setting the total compensation for each NEO to the 50th percentile range of total compensation paid to each NEO position in our Survey Group.

To assure independence, the Compensation Committee pre-approves all other work unrelated to executive compensation proposed to be provided by Willis Towers Watson and considered all factors relevant to their independence from management, including but not limited to the following factors:

| • | The provision of other services that the consultant provides to us; | |

| • | The amount of fees received from us as a percentage of the consultant’s total revenue; | |

| • | The consultant’s policies and procedures designed to prevent conflicts of interest; | |

| • | Business or personal relationships of the consultant with our Compensation Committee members; | |

| • | The amount of our stock owned by the consultant; and | |

| • | Business or personal relationships of the consultant with our executive officers |

Our 2021 Vote; Stockholder Outreach

The Board and Compensation Committee are committed to soliciting feedback to inform the Board’s decisions and guide our compensation program. Our stockholder outreach in 2021 and into 2022 provided the Board with valuable insights into our stockholders’ perspectives on our executive compensation program and other matters of importance to them. We are committed to sound compensation and governance practices and will continue to enhance our compensation program as a result of any stockholder input.

We have followed a consistent approach to the design of our executive compensation program for many years. The history of our say-on-pay results before 2020 generally demonstrated stockholder support for our program over several years. At our 2021 Annual Meeting of Stockholders, approximately 6.1% of our outstanding shares voted against our 2020 executive compensation resolution. In response thereto, our Compensation Committee determined that it had not done an effective job in fully communicating the rationale behind its compensation programs to stockholders.

Following the 2021 Annual Meeting of Stockholders, the Compensation Committee engaged the firm of Morrow Sodali to assist with a stockholder outreach program. This outreach focused on better understanding the concerns and perspectives of our stockholders, including those who did not support our say-on-pay vote.

The executive compensation outreach initiative is in addition to our regular ongoing stockholder engagement.

By The Numbers: Stockholder Engagement in 2021

| We contacted 15 of our top institutional stockholders, representing over 26% of our shares outstanding, with invitations to meet with our management and directors. These institutional stockholders represent the vast majority of our institutional investors at this time. | Our Independent Board Chair and Chair of our Compensation Committee participated in all of the stockholder engagement meetings. |

2022 PROXY STATEMENT | 26

Compensation Discussion and Analysis

Feedback from Stockholder Engagement

We heard a range of perspectives on our executive compensation program from stockholders during our outreach, all of which were considered by our Compensation Committee and Board.

We received positive feedback about our overall outreach program and support for our management team and our Board in general. The addition of two new members to our Board broadening our bench strength, Anthony Johnson and Dr. Michael Koganov, was recognized and well-received. Additionally, our stockholders agreed on the importance of having a stable, senior leadership team with the knowledge and expertise to execute on our business strategy and priorities successfully over the long-term.

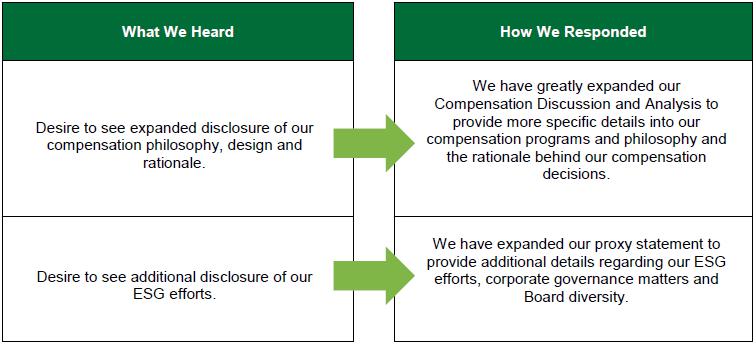

We also heard some common concerns about specific aspects of our executive compensation, in particular the lack of disclosure in the 2021 annual meeting proxy statement on details behind how compensation is measured and awarded. Our stockholders expressed a desire to see more specifics behind our plan design including, rationale, key performance indicators, and qualitative metrics that align to both the short, mid and long-term strategy of the Company. In addition, our stockholders expressed a desire to see additional disclosures around our ESG efforts, particularly where we are in our journey and what our plans are. A summary of what we heard and how we responded is set forth below:

Our work to solicit stockholder feedback into our executive compensation program continues into the future.

2022 PROXY STATEMENT | 27

Compensation Discussion and Analysis

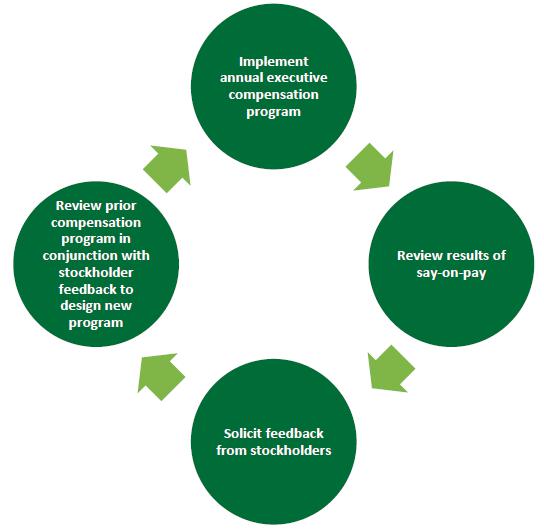

Following each annual meeting of stockholders, our Compensation Committee will review the say-on-pay results and engage with our stockholders to solicit feedback on our compensation program. Our Compensation Committee will use the stockholder feedback to inform and guide its compensation decisions for the following year. Our annual compensation cycle is generally as follows:

Elements of Executive Compensation

Our compensation program consists of the following three primary elements: