UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ | |

Check the appropriate box: | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

22nd Century Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box): |

☒ No fee required. |

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

(5) Total fee paid: |

☐ Fee paid previously with preliminary materials. |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: |

(2) Form, Schedule or Registration Statement No.: |

(3) Filing Party: |

(4) Date Filed: |

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

You are invited to attend the 2021 Annual Meeting of Stockholders (Annual Meeting) of 22nd Century Group, Inc. (the “Company”) on May 20, 2021, at 10:30 a.m. Eastern Time. The Annual Meeting will be a completely virtual meeting conducted via live audio webcast to allow our stockholders to participate from any location that is convenient to them. You will be able to attend by using the following link www.virtualshareholdermeeting.com/XXII2021. In order to vote during the annual meeting, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting.

We are holding the Annual Meeting for the following matters, which are described further in the proxy statement accompanying this Notice:

| (1) | The election of the two director nominees named in the attached proxy statement as Class I directors to serve for a three-year period until the annual meeting of stockholders in the year 2024 and, in each instance, until their respective successors have been elected and qualified; |

| (2) | The approval, on an advisory basis, of the 2020 compensation of the Company’s named executive officers; |

| (3) | The approval of the 22nd Century Group, Inc. 2021 Omnibus Incentive Plan; |

| (4) | The ratification of the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered certified public accounting firm for fiscal year 2021; and |

| (5) | The transaction of any other business as may properly come before the meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on March 26, 2021, are entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof.

Your vote is important. Whether or not you plan to attend the virtual meeting, we hope that you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet. You may also submit your proxy card by signing, dating and mailing your proxy card in the envelope provided.

Thank you for your continued investment in 22nd Century Group, Inc.

By Order of the Board of Directors, | |

/s/ James A. Mish | |

James A. Mish | |

Chief Executive Officer |

Dated: April 5, 2021

| |

1 | |

4 | |

5 | |

8 | |

12 | |

12 | |

21 | |

PROPOSAL NO. 2 ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION | 21 |

22 | |

34 | |

INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM FEES AND SERVICES | 34 |

35 | |

35 | |

36 |

i

22nd Century Group, Inc.

500 Seneca Street, Suite 507

Buffalo, New York 14204

PROXY STATEMENT

The Board of Directors of 22nd Century Group, Inc. (the “Company”) is soliciting proxies from its stockholders to be used at the annual meeting of stockholders to be held on May 20, 2021, beginning at 10:30 a.m. Eastern Time, and at any postponements or adjournments thereof. The Annual Meeting will be a completely virtual meeting conducted via live audio webcast to allow our stockholders to participate from any location that is convenient to them. You will be able to attend by using the following link: www.virtualshareholdermeeting.com/XXII2021. You must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting.

This proxy statement contains information related to the annual meeting. This proxy statement and the accompanying form of proxy are first being sent to stockholders on or about April 5, 2021.

Why did I receive these materials?

The Board of Directors of 22nd Century Group, Inc. is soliciting proxies for the 2021 Annual Meeting of Stockholders (Annual Meeting) to be held on May 20, 2021 via live audio webcast to allow our stockholders to participate from any location that is convenient to them. You are receiving a proxy statement because you owned shares of our common stock on March 26, 2021, and that entitles you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting. The proxy materials include this proxy statement for the Annual Meeting, an annual report to stockholders, including our Annual Report on Form 10-K for the year ended December 31, 2020, and a proxy card or voting instruction form for the Annual Meeting.

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, our Board, the compensation of directors and executive officers, and other information that the Securities and Exchange Commission requires us to provide annually to our stockholders.

Who is entitled to vote at the meeting?

Holders of common stock as of the close of business on the record date, March 26, 2021, will receive notice of, and be eligible to vote at, the annual meeting and at any adjournment or postponement of the annual meeting. At the close of business on the record date, we had outstanding and entitled to vote a total of 152,397,501 shares of common stock.

How many votes do I have?

Each outstanding share of our common stock you owned as of the record date will be entitled to one vote for each matter considered at the meeting. There is no cumulative voting.

Who can attend the meeting virtually?

Due to the public health impact of the coronavirus outbreak (i.e., COVID-19) and to support the health and well-being of our stockholders and other stakeholders, we have decided that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.virtualshareholdermeeting.com/XXII2021. To vote, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting.

1

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of one-third (33.33%) of the voting power of common stock issued and outstanding on the record date will constitute a quorum, permitting the conduct of business at the meeting. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of a quorum.

How do I vote if I am a stockholder of record?

If you are a stockholder of record (that is, you own your shares in your own name with our transfer agent and not through a broker, bank or other nominee that holds shares for your account in a “street name” capacity), you can vote via a virtual meeting or by proxy without attending the annual meeting. Due to the public health impact of the coronavirus outbreak (i.e., COVID-19) and to support the health and well-being of our stockholders and other stakeholders, we have decided that this year’s annual meeting will be a completely virtual meeting of stockholders, which will be conducted solely online via live webcast. You will be able to participate in the annual meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.virtualshareholdermeeting.com/XXII2021. To vote, you must enter the control number found on your proxy card, voting instruction form or notice you previously received. There is no physical location for the annual meeting. We urge you to vote by proxy even if you plan to attend the annual meeting virtually so that we will know as soon as possible that enough votes will be present for us to hold the meeting. If you attend the meeting virtually, as applicable, you may vote at the meeting and your proxy will not be counted. Our Board of Directors has designated James A. Mish, Chief Executive Officer, and Steven Przybyla, General Counsel, and each or any of them or their designees, as proxies to vote the shares of common stock solicited on its behalf. You can vote by proxy by any of the following methods.

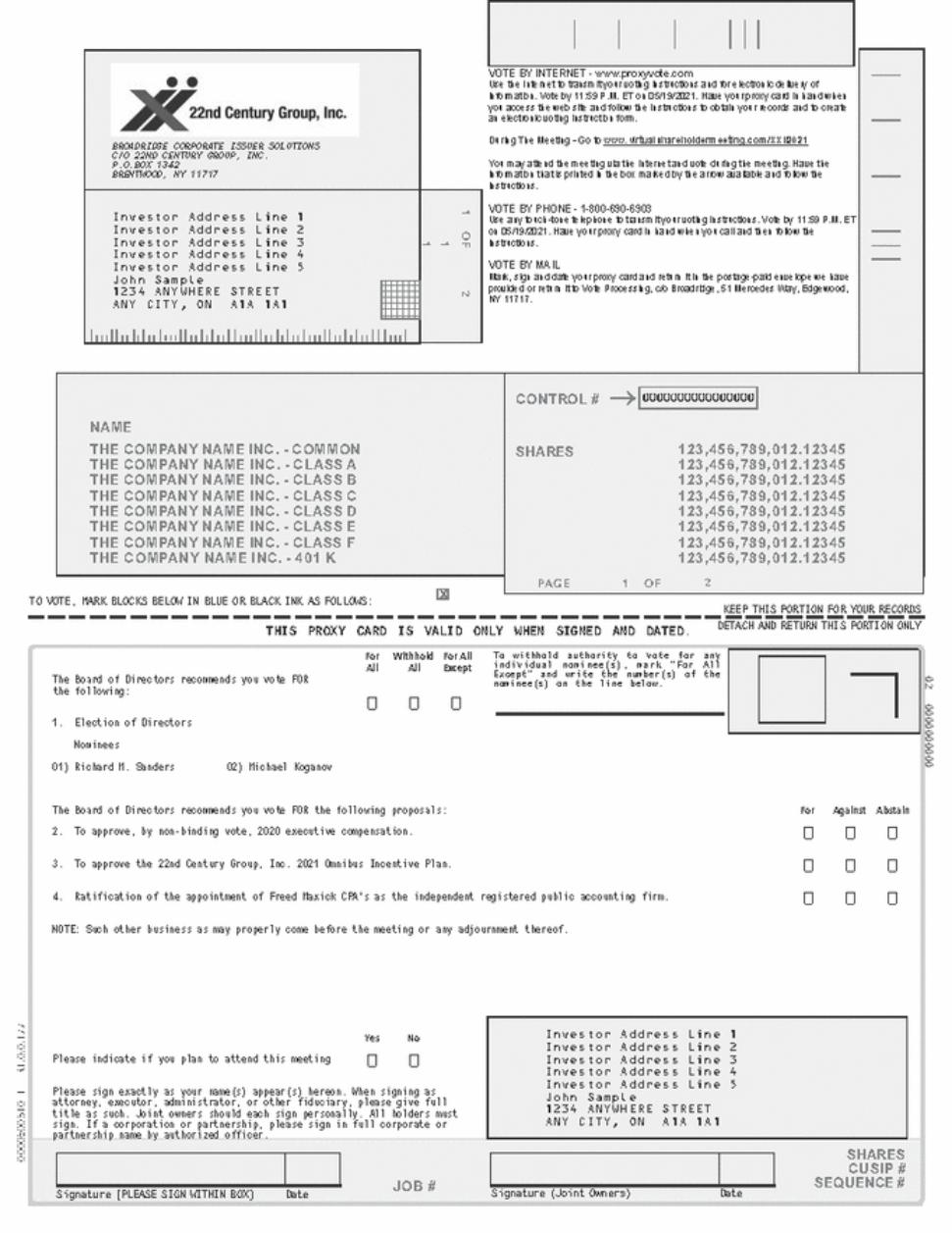

Voting by Telephone or Internet. If you are a stockholder of record, you may vote by proxy by telephone or internet. Proxies submitted by telephone or through the internet must be received by 11:59 p.m. EDT on May 19, 2021. Please see the proxy card for instructions on how to vote by telephone or internet.

Voting by Proxy Card. Each stockholder receiving proxy materials by mail may vote by proxy using the accompanying proxy card. When you return a proxy card that is properly signed and completed, the shares represented by your proxy will be voted as you specify on the proxy card.

How do I vote if I hold my shares in “street name”?

If you hold your shares in “street name,” we have supplied copies of our proxy materials for the 2021 Annual Meeting of Stockholders to the broker, trust, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. You must either direct the broker, trust, bank or other nominee as to how to vote your shares, or obtain a proxy from the bank, broker or other nominee to vote at the meeting. Please refer to the voter instruction cards used by your broker, trust, bank or other nominee for specific instructions on methods of voting, including by telephone or using the internet.

Can I change my vote?

Yes. You may revoke your proxy and change your vote at any time before the final vote at the meeting. If you are a stockholder of record, you may do this by: (i) signing and submitting a new proxy card with a later date; (ii) by voting by telephone, or by using the Internet—either of which must be completed by 11:59 p.m. Eastern Time on May 19, 2021 (when your latest telephone or Internet proxy is counted); or (iii) by attending the meeting and voting by ballot. Attending the meeting alone will not revoke your proxy unless you specifically request your proxy to be revoked. If you hold shares through a bank or brokerage firm, you must contact that bank or firm directly to revoke any prior voting instructions.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board of Directors and will pay all expenses associated with this solicitation. In addition to mailing these proxy materials, certain of our officers and other employees may, without

2

compensation other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means.

The Board of Directors has also retained Morrow Sodali as proxy solicitor. Proxy solicitation fees related to this engagement include a $7,500 retainer plus costs and disbursements incurred by the firm.

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

Will stockholders be asked to vote on any other matters?

To the knowledge of the Company and its management, stockholders will vote only on the matters described in this proxy statement. However, if any other matters properly come before the meeting, the persons named as proxies for stockholders will vote on those matters in the manner they consider appropriate.

What vote is required to approve each item?

The director nominees receiving the highest vote totals of the eligible shares of our common stock that are present, in person or by proxy, and entitled to vote at the meeting will be elected as our directors. The approval of the advisory resolution on executive compensation, the approval of the 22nd Century Group, Inc. 2021 Omnibus Incentive Plan (the “Plan”) and the approval of the ratification of the appointment of Freed Maxick CPAs, P.C. (“Freed”) require the affirmative vote of the majority of the votes present, in person or by proxy, and entitled to vote at the meeting.

How are votes counted?

With regard to the election of our director nominees, votes may be cast in favor or “withheld” and votes that are withheld will be excluded entirely from the vote and will have no effect. You may not cumulate your votes for the election of our director nominees.

For the approval of the advisory resolution on executive compensation, the approval of the Plan and the ratification of the appointment of Freed, you may vote “FOR,” “AGAINST” or “ABSTAIN” for such proposals. Abstentions are considered to be present and entitled to vote at the meeting and, therefore, will have the effect of a vote against each of the proposals.

If you hold your shares in “street name,” the Company has supplied copies of its proxy materials for its 2021 annual meeting of stockholders to the broker, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. Your broker, bank or other nominee that has not received voting instructions from you may not vote on any proposal other than the appointment of Freed as our independent registered certified public accounting firm for fiscal year 2021. These “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum but will not be considered in determining the number of votes necessary for approval of any of the proposals and will have no effect on the outcome of any of the proposals. Your broker, bank or other nominee is permitted to vote your shares on the appointment of Freed as our independent registered certified public accounting firm without receiving voting instructions from you.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card that you receive.

3

The following table sets forth information regarding the beneficial ownership of our common stock as of March 26, 2021, by (i) each person who, to our knowledge, owns more than 5% of our common stock, (ii) each of our current directors, director nominees and executive officers, and (iii) all our current directors, director nominees and executive officers as a group. Derivative securities exercisable or convertible into shares of our common stock within sixty (60) days of March 26, 2021 are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding securities but are not deemed outstanding for computing the percentage of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*). The address of named beneficial owners that are officers and/or directors of the Company is: c/o 22nd Century Group, Inc., 500 Seneca Street, Suite 507, Buffalo, New York 14204. The following table is based upon information supplied by officers and directors, and with respect to 5% or greater stockholders who are not officers or directors, information filed with the SEC.

| | | | | |

|

| Number of |

| |

|

| | Shares | | Percentage | |

| | Beneficially | | Beneficially | |

Name of Beneficial Owner |

| Owned |

| Owned (1) | |

Management and Directors: | | | |

| |

James A. Mish (2) |

| 100,000 |

| * | |

John Franzino (3) |

| 50,000 |

| * | |

Michael J. Zercher (4) |

| 1,112,947 |

| * | |

Nora B. Sullivan (5) |

| 598,623 |

| * | |

Richard M. Sanders (6) |

| 466,696 |

| * | |

Clifford B. Fleet (7) |

| 281,368 |

| * | |

Roger D. O'Brien (8) | | 179,223 | | * | |

Michael Koganov (9) |

| 50,000 |

| * | |

All directors, director nominees and executive officers as a group (8 persons) (2) - (9) |

| 2,838,857 |

| 1.8 | % |

5% Owners: |

|

|

|

| |

ETF Managers Group LLC (10) |

| 12,342,984 |

| 8.1 | % |

| (1) | Based on 152,397,501 shares of common stock issued and outstanding as of March 26, 2021. |

| (2) | Consists of (a) 100,000 shares of common stock held directly. 600,000 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (3) | Consists of (a) 50,000 shares of common stock held directly. 280,000 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (4) | Consists of (a) 317,072 shares of common stock held directly and (b) 795,875 shares of common stock issuable upon exercise of stock options. 85,000 shares of common stock issuable upon exercise of stock options and 771,060 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (5) | Consists of (a) 446,899 shares of common stock held directly and (b) 151,724 shares of common stock issuable upon exercise of stock options. 150,000 shares of common stock issuable upon exercise of stock options and 150,000 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (6) | Consists of (a) 314,972 shares of common stock held directly and (b) 151,724 shares of common stock issuable upon exercise of stock options. 77,564 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (7) | Consists of (a) 281,368 shares of common stock held directly. 77,564 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (8) | Consists of (a) 179,223 shares of common stock held directly. 77,564 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (9) | Consists of (a) 50,000 shares of common stock held directly. 77,564 restricted stock units are not included in the number of beneficially owned shares because they do not vest within 60 days of March 26, 2021. |

| (10) | Information is based on Schedule 13G filed on February 17, 2021 on behalf of (i) ETF Managers Group, LLC, an investment management company, and (ii) the ETFMG Alternative Harvest EFT, a series of the ETF Manager |

4

| Trust, which is managed by ETF Managers Group, LLC. The principal business address of ETF Managers Group, LLC is 30 Maple Street, Suite 2, Summit, New Jersey 07901. |

ELECTION OF DIRECTORS

General

The Company’s Board of Directors is classified into three classes of directors, with one class of directors being elected at each annual meeting of stockholders of the Company to serve for a term of three years or until the earlier of: (i) expiration of the term of their class of directors; or (ii) until their successors are elected and take office as provided below. To maintain the staggered terms of election of directors, stockholders of the Company are voting upon the election of two director nominees as Class I directors to serve for a three-year period until the Annual Meeting of Stockholders in the year 2024.

The Bylaws of the Company provide that the Board will determine the number of directors to serve on the Board. The number of authorized directors of the Company as of the date of this proxy statement is six (6), with five (5) persons currently serving as directors (one Class II director, two Class I directors and two Class III directors) and with one (1) vacancy on the Board. The Board previously appointed Michael Koganov to serve as a Class I director on September 11, 2020 to fill a prior vacancy in the Class I director position. The Bylaws of the Company require the stockholders of the Company to vote to approve the appointment of such directors by the Board at the next annual meeting of the stockholders after their appointment to serve on the Board. Our Board has nominated Richard M Sanders and Michael Koganov to be elected as Class I directors. Information about each director nominee is set forth below. Assuming the election of each of the director nominees, the Board will consist of five members (two Class I directors, one Class II director and two Class III directors) with one vacancy in Class II.

The nominees for director have each indicated to the Company that they will be available to serve as a director. If a nominee named herein for election as a director should for any reason become unavailable to serve prior to the 2021 annual meeting of stockholders, then the Board may, prior to the annual meeting, (i) reduce the size of the Board to eliminate the position for which that person was nominated, (ii) nominate a new candidate in place of such person or (iii) leave the position vacant to be filled at a later time.

The individuals named as proxy voters in the accompanying proxy, or their substitutes, will vote “FOR” each of the director nominees with respect to all proxies we receive unless instructions to the contrary are provided. If any nominee for director becomes unavailable for any reason, the votes will be cast for a substitute nominee designated by our Board. We have no reason to believe that any nominee for director will be unable to serve if elected. We strongly encourage our directors to attend our 2021 annual meeting. All our continuing directors attended our 2020 Annual Meeting.

The following sets forth certain information, as of March 26, 2021, about the Board’s nominees for election at the annual meeting and each director whose term will continue after our annual meeting.

Nominees for Election at the Annual Meeting

Class I Director — Term Expiring 2024

Richard M. Sanders. Mr. Sanders, age 68, has served as a director since December 9, 2013. Since August 2009, Mr. Sanders has served as a General Partner of Phase One Ventures, LLC, a venture capital firm which focuses on nanotechnology and biotechnology start-up opportunities in New Mexico and surrounding states. From January 2002 until June 2009, Mr. Sanders served as President and CEO of Santa Fe Natural Tobacco Company (“SFNTC”), a division of Reynolds American, Inc., which manufactures and markets the Natural American Spirit cigarette brand. During his 7-year tenure as head of SFNTC, Mr. Sanders tripled Natural American Spirit’s market share and SFNTC’s operating earnings and directed the successful expansion of Natural American Spirit into international markets in Western Europe and Asia. Prior to directing SFNTC’s robust growth, Mr. Sanders worked for R.J. Reynolds Tobacco Company where he began his career as a marketing assistant in 1977. From 1987 to 2002, he served in a wide spectrum of executive positions including,

5

among others, Senior Vice President of Marketing and Vice President of Sales. A native of Minneapolis, Mr. Sanders earned a Bachelor’s Degree in political science from Hamline University in St. Paul and an M.B.A. Degree in Marketing from Washington University in St. Louis, Missouri. Mr. Sanders’ extensive experience in management, including in the tobacco industry, led to our conclusion that he should serve as a director of our Company.

Michael Koganov. Dr. Koganov, age 70, has served as a director since September 11, 2020. Dr. Koganov is recognized as a leading expert in the development of natural products using plant biotechnology and has achieved considerable accomplishments in physico-chemistry, biochemistry, bioelectrochemistry, and biotechnology. He is credited with developing Electro-Membrane technology for the comprehensive processing of plants to produce protein concentrates and secondary metabolites. Dr. Koganov co-founded IBT LLC, which developed the proprietary and sustainable Zeta Fraction™ technology that selectively isolates efficacious components from living plants and marine sources to produce a wide range of biofunctional ingredients. After the award-winning technology was acquired by AkzoNobel and then Ashland Global Holdings Inc., Dr. Koganov directed the research, product development, and commercialization of patented multifunctional bioactive Zeta Fractions that are used as key, signature ingredients in numerous products of global companies in the OTC and personal care spaces; and various synergistic compositions of Zeta Fractions obtained from living plants from twelve major plant families. He is the President and Co-Founder of Intellebio LLC, a consulting and testing firm focused on the development of novel technologies, advanced test methods, and breakthrough products in the life science field. Dr. Koganov received his Master of Science degree in Biochemistry from the State University, Dnipropetrovsk, USSR; his Ph.D. in Bioelectrochemistry from Institute of Chemical Technology, Dnipropetrovsk, USSR; and Full Doctor of Sciences (Sc.D.) degree in biotechnology from the Higher Attestation Commission of the USSR’s Council of Ministers. He has written more than 70 publications, secured over 100 granted patents, and is the author of two books. Dr. Koganov’s expertise in the area of plant biotechnology led to our conclusion that he should serve as a director of our Company.

Our Board of Directors recommends a vote FOR the above director nominees.

6

Directors Continuing in Office

Class II Director — Term Expiring 2022

Nora B. Sullivan. Ms. Sullivan, age 63, has served as a director since May 18, 2015. Ms. Sullivan is also currently President of Sullivan Capital Partners, LLC, a financial services company providing investment banking and mergers and acquisitions services to companies seeking acquisitive growth, strategic partnerships and joint venture relationships. Her experience includes the development and advancement of strategic initiatives and the implementation of best practice governance policies. Prior to founding Sullivan Capital Partners in 2004, Ms. Sullivan worked for Citigroup Private Bank from 2000 to 2004, providing capital markets and wealth management services to high net worth individuals and institutional clients. From 1995 to 1999, Ms. Sullivan was Executive Vice President of Rand Capital Corporation (NASDAQ: RAND), a publicly traded closed-end investment management company providing capital and managerial expertise to small and mid-size businesses. Ms. Sullivan is also a member of the Boards of Directors of Evans Bancorp, Inc. (NYSE American: EVBN), Robinson Home Products, and Rosina Food Products. She is also a member of the Investment Committee of the Patrick P Lee Foundation, Chairman of the Technology Transfer Committee of the Roswell Park Comprehensive Cancer Center, and a member of the Board of Directors of the Cortland College Foundation. Ms. Sullivan holds an M.B.A. Degree in Finance and International Business from Columbia University Graduate School of Business and a Juris Doctor degree from the University of Buffalo School of Law. Ms. Sullivan’s experience with mergers and acquisitions and in governance matters led to our conclusion that she should serve as a director.

Class III Directors — Terms Expiring 2023

Clifford B. Fleet. Mr. Fleet, age 50, has served as a director since his appointment on August 3, 2019 by the Board to fill a vacancy in the Class I director position resulting from the resignation of Henry Sicignano, III as of July 26, 2019. Mr. Fleet also served as the President and Chief Executive Officer of the Company from August 3, 2019 until December 13, 2019, at which time he resigned, effective on December 31, 2019. Mr. Fleet also served as a strategic advisor consultant to the Company from December 2018 to August 3, 2019. Mr. Fleet currently serves as the President and CEO of the Colonial Williamsburg Foundation, the world’s largest living history museum and a national leader in American education. Prior to the Colonial Williamsburg Foundation, Mr. Fleet served as the President and CEO of 22nd Century Group. From 1995 to 2017 Mr. Fleet worked at Altria Group (NYSE: MO), serving in a variety of senior-level management positions in Finance, Operations, Marketing, and Business Strategy and Development. From 2013 to 2017, Mr. Fleet served as the President and CEO of Philip Morris USA, Altria’s largest subsidiary, when he ran Philip Morris USA, the nation’s largest tobacco company, and John Middleton, a leading machine-made cigar manufacturer. During his tenure he led both organizations to business success in highly regulated environments. In addition, Mr. Fleet is an adjunct professor at the College of William & Mary teaching in the business school. Mr. Fleet holds a Bachelor of Arts, Master of Arts, Master of Business Administration and Juris Doctor from the College of William & Mary. Mr. Fleet’s extensive experience in the tobacco industry led to our conclusion that he should serve as a director.

Roger D. O’Brien. Mr. O’Brien, age 72, has served as a director since his appointment on January 10, 2020 by the Board to fill a vacancy in the Class II director position resulting from the death of Dr. Joseph A. Dunn on November 30, 2019. Mr. O’Brien has served since 2000 as the President of O’Brien Associates, LLC, a general management consulting firm providing advisory and implementation services to companies in a variety of competitive industries, with special focus on general management, technology commercialization, marketing and strategy development. From 1998 to 1999, Mr. O’Brien served as the Chief Operating Officer of Ultralife Batteries, Inc. (NASDAQ: ULBI) and from 1991 to 1996, he was the Chief Executive Officer and a major shareholder of Holotek Ltd., a high-technology company with a proprietary position in the design, development, manufacture and sales of laser imaging systems worldwide. Previously, Mr. O’Brien served as a senior executive for Exxon Venture Capital, Tenneco Automotive and as an early officer of Sun Microsystems (NASDAQ: SUN) prior to the company’s acquisition by Oracle Corporation. Mr. O’Brien is currently a member of the Board of Directors of Innovative Technology Solutions and Bristol-ID Technologies, Inc. In addition, Mr. O’Brien is an adjunct professor at the Rochester Institute of Technology, where he is a graduate instructor in Rochester, New York and in Croatia. Mr. O’Brien holds a Bachelor of Science degree in Nuclear Engineering from New York University and an MBA degree from The Wharton School of the University of Pennsylvania. Mr. O’Brien’s experience with strategic advisory consulting and his prior public company experience led to our conclusion that he should serve as a director.

7

Board Composition

Directors hold office for a term ending on the date of the third annual stockholders’ meeting following the annual meeting at which such director’s class was most recently elected until the earlier of their death, resignation, removal or until their successors have been duly elected and qualified. There are no family relationships among our directors. Our bylaws provide that the number of members of our Board of Directors may be changed from time to time by resolutions adopted by the Board of Directors and/or the stockholders. Our Board of Directors currently consists of five (5) members with one (1) vacancy.

Board Leadership Structure

Our Board of Directors’ do not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate. Our Board reserves the right to assign the responsibilities of the Chief Executive Officer and Chair position as determined by our Board to be in the best interest of our Company. In the circumstance where the responsibilities of the Chief Executive Officer and Chair are vested in the same individual or in other circumstances when deemed appropriate, the Board will designate a lead independent director from among the independent directors to preside at the meetings of the non-employee director executive sessions.

The positions of Chief Executive Officer and Chair have been separate positions since October 25, 2014. Our Board retains the authority to modify this structure to best address our Company’s unique circumstances as and when appropriate.

Board Role in Risk Oversight

Our full Board is responsible for the oversight of our operational risk management process. Our Board has assigned responsibility for addressing certain risks, and the steps management has taken to monitor, control and report such risk, to our Audit Committee, including risks relating to execution of our growth strategy, with appropriate reporting to the full Board. Our Board relies on our Compensation Committee to address significant risk exposures facing our Company with respect to compensation. Our Compensation Committee periodically conducts a review of our compensation policies and practices to assess whether any risks arising from such policies and practices are reasonably likely to materially adversely affect our Company.

Number of Meetings of the Board of Directors

The Board held twelve (12) meetings during 2020. Directors are expected to attend Board meetings and to spend time needed to meet as frequently as necessary to properly discharge their responsibilities. Each director attended at least 75% of the aggregate number of meetings of the Board during 2020 while a member of the Board.

Director Independence

The Board has determined that each director qualifies as “independent” directors under the applicable definition of the listing standards of the New York Stock Exchange American market (“NYSE American”).

Stockholder Communications

Stockholders may send communications to the Company’s directors as a group or individually, by writing to those individuals or the group: c/o the Chief Executive Officer of 22nd Century Group, Inc., 500 Seneca Street, Suite 507 Buffalo, New York 14204. The Chief Executive Officer will review all correspondence received and will forward all correspondence that is relevant to the duties and responsibilities of the Board or the business of the Company to the intended director(s). Examples of inappropriate communication include business solicitations, advertising and communication that are frivolous in nature, relates to routine business matters or raises grievances that are personal to the person submitting the communication. Upon request, any director may review communication that is not forwarded to the directors pursuant to this policy.

8

Committees of the Board of Directors

Our Board of Directors currently has four standing committees: (i) a Corporate Governance and Nominating Committee, (ii) an Audit Committee, (iii) a Compensation Committee, and (iv) a Finance Committee. Each of these Board committees are described below. Members of these committees are elected annually at the regular Board meeting held in conjunction with the annual stockholders’ meeting. The charters of the Corporate Governance and Nominating Committee, Audit Committee, Compensation Committee, and Finance Committee are each available on the investor relations section of our website at www.xxiicentury.com. In addition, our Board of Directors has a Scientific Advisory Board which is chaired by Michael Koganov.

Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of Ms. Sullivan and Messrs. Sanders and O’Brien, with Mr. O’Brien serving as chair. The Corporate Governance and Nominating Committee is responsible for: (a) developing and recommending corporate governance principles and procedures applicable to our Board and employees; (b) recommending committee composition and assignments; (c) overseeing annual self-evaluations by the Board, its committees, individual directors and management with respect to their respective performance; (d) maintaining a process for the consideration of director candidates; (e) identifying and recommending individuals qualified to become directors; (f) assisting in succession planning; (g) recommending whether incumbent directors should be nominated for re-election to our Board; (h) reviewing the adequacy of the Corporate Governance and Nominating Committee charter on an annual basis; (i) maintaining a continuing education program for directors and (j) the Company’s Environmental Social and Governance (“ESG”) policies and practices. The Corporate Governance and Nominating Committee oversees the administration of the Company’s current ESG Policy, which was adopted by the Board on March 5, 2021. The Corporate Governance and Nominating Committee met seven (7) times during 2020.

Nominations of persons for election to the Board at the annual meeting may also be made by any stockholder entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in our bylaws. Such nominations by any stockholder shall be made pursuant to timely notice in writing to the Secretary. To be timely, a stockholder’s notice shall be delivered to the Secretary at our principal executive offices not later than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, notice by the stockholder must be so delivered not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made.

Audit Committee

The Audit Committee consists of Ms. Sullivan and Messrs. Sanders and O’Brien, with Ms. Sullivan serving as chair. Our Board has determined that Ms. Sullivan is the Audit Committee financial expert as defined under the rules of the SEC and that all Audit Committee members are independent under the applicable listing standards of the NYSE American and applicable rules of the SEC related to audit committee members. The Audit Committee, established in accordance with section 3(a)(58)(A) of the Exchange Act, oversees our accounting and financial reporting processes and the audits of our financial statements. The Audit Committee met four (4) times during 2020.

The Audit Committee has sole authority for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s assessment of the effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment and risk management and reviews the adequacy of the Audit Committee charter on an annual basis.

9

Compensation Committee

The Compensation Committee consists of Ms. Sullivan and Messrs. Sanders and O’Brien, with Mr. Sanders serving as chair. The Compensation Committee establishes, administers and reviews our policies, programs and procedures for compensating our executive officers and directors. The Compensation Committee met six (6) times during 2020.

The Compensation Committee is responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs, incentive compensation plans and equity-based plans, and determining executive compensation; and (b) reviewing the adequacy of the Compensation Committee charter on an annual basis.

Finance Committee

The Finance Committee consists of Ms. Sullivan and Messrs. Sanders, Fleet, O’Brien and Dr. Koganov with Mr. Fleet serving as chair. The Finance Committee reviews and assesses, and assists the Board in reviewing and assessing, budgets and financial plans, potential acquisitions, strategic investments, divestitures, financing and capital market activities related to XXII and its subsidiaries. The Finance Committee was formed by the Board on September 11, 2020 and met two (2) times during 2020.

The Finance Committee is responsible for (a) advising the Board on financial matters relating to: (1) budgets and financial plans, performance against budgets and financial plans, the sources and uses of cash; (2) transactions, including mergers, acquisitions and divestitures, as well as joint ventures and other equity investments; (3) the Company’s capital structure, including potential issuances of debt and equity securities, credit agreements and material changes thereto, and short-term investment policy; (4) dividends, stock splits, and stock repurchases; and Investor relations activities and (b) reviewing the adequacy of the Finance Committee charter on an annual basis.

Scientific Advisory Board

The Scientific Advisory Board consists of Ms. Sullivan and Messrs. Sanders, Fleet, O’Brien and Dr. Koganov with Dr. Koganov serving as chair. The Scientific Advisory Board provides advice and recommendations to the Board regarding Company scientific research, technology and innovation strategies and opportunities including potential partnerships and M&A as well as providing strategic advice to the Board regarding emerging science and technology issues and trends. The Scientific Advisory Board was formed by the Board on December 2, 2020 and met one (1) time during 2020.

Director Compensation

2020 Director Compensation

Our Director compensation philosophy is to appropriately compensate our independent directors for the time, expertise, effort, and knowledge required to serve as one of our directors and to appropriately align the interests of our directors with those of our long-term stockholders. From time to time, the Compensation Committee will retain an independent compensation consultant to conduct an assessment of our position versus the competitive market. The Compensation Committee considers all factors relevant to KF’s independence prior to any engagement.

In March 2020, each of our independent non-employee directors received an equity award of restricted stock units (“RSUs”) under our omnibus incentive plan. The awards for Ms. Sullivan, Mr. Sanders, Mr. O’Brien, and Mr. Fleet were each valued at $85,301 (equaling 126,823 units) that vested one year from the date of grant. Dr. Koganov was awarded 50,000 restricted stock units, due to his partial year of service for 2020, that vested in March 2021. In addition, each

10

independent non-employee director received cash amounts based on the following table below. Dr. Koganov’s 2020 compensation was prorated based on his partial year of service.

| | | |

Compensation Type |

| Amount | |

Annual Cash Retainer | | $ | 60,000 |

Board Committee Chair Annual Retainer | | $ | 10,000 |

Board Committee Non-Chair Annual Retainer | | $ | 5,000 |

Chair of the Board Annual Retainer | | $ | 50,000 |

For 2020, Ms. Sullivan received a special one-time cash retainer of $350,000. This special one-time award was in recognition of Ms. Sullivan’s extraordinary efforts in connection with the Company’s transition to the new management team and due to the significant taxes due with respect to vesting of restricted stock.

The following amounts were earned by our directors during the year ended December 31, 2020:

| | | | | | | | | | | | | | | | | |

|

| |

| Fees |

| | |

| Restricted |

| | | |

| | ||

| | | | earned | | | | Stock Unit | | | | | |

| |||

| | | | or paid in | | Option | | Awards | | All Other | | |

| ||||

Name |

| Year |

| cash |

| Awards |

| (1) |

| Compensation |

| Total | |||||

Richard M. Sanders |

| 2020 | | $ | 83,750 | | $ | — | | $ | 85,301 | | $ | — | | $ | 169,051 |

Nora B. Sullivan |

| 2020 | | $ | 483,750 | | $ | — | | $ | 85,301 | | $ | — | | $ | 569,051 |

Roger D. O'Brien |

| 2020 | | $ | 83,750 | | $ | — | | $ | 85,301 | | $ | — | | $ | 169,051 |

Clifford B. Fleet | | 2020 | | $ | 66,250 | | $ | — | | $ | 85,301 | | $ | — | | $ | 151,551 |

Michael Koganov | | 2020 | | $ | 35,000 | | $ | — | | $ | 36,345 | (2) | $ | — | | $ | 71,345 |

| (1) | Represents the grant date fair value computed in accordance with FASB ASC 718. The assumptions used for the restricted stock units is set forth in the notes to our financial statements included in our Annual Report on Form 10 K for the year ended December 31, 2020. |

| (2) | Represents a prorated restricted stock grant based on partial service in 2020. |

From time to time, the Compensation Committee will review and recommend updates to our director compensation program to the Board for approval. In February 2021, the Compensation Committee retained Korn Ferry (“KF”) to conduct an independent assessment of our director compensation versus the competitive market and the “fit” of our compensation program to our pay philosophy.

To establish the competitive market for directors, KF identified a comparator group of 55 publicly traded companies in the United States and Canada within the biotechnology and pharmaceuticals industries with market capitalizations approximating $1 billion.

Based on the KF review, the Compensation Committee recommended, and the Board approved, the following changes to director compensation for 2021:

| | | |

Compensation Type |

| Amount | |

Annual Cash Retainer | | $ | 75,000 |

Annual RSU Award | | $ | 135,000 |

Board Committee Chair Annual Retainer | | $ | 20,000 |

Board Committee Non-Chair Annual Retainer | | $ | 10,000 |

Chair of the Board Annual Retainer | | $ | 50,000 |

The Compensation Committee believes these changes position our director compensation more closely to the competitive market.

11

Certain information regarding our current executive officers as of March 26, 2021 is provided below:

| | | | |

Name |

| Age |

| Position |

James A. Mish | | 57 |

| Chief Executive Officer |

John Franzino | | 64 |

| Chief Financial Officer |

Michael J. Zercher | | 50 | | President and Chief Operating Officer |

James A. Mish, Chief Executive Officer. Mr. Mish has served as our Chief Executive Officer since June 22, 2020. He has an outstanding track record of delivering profitable growth at both privately-held and publicly-traded science-driven companies with a focus on pharmaceutical and consumer products commercialization. Prior to joining 22nd Century, he served as President and Chief Executive Officer of Purisys, a synthetic cannabinoid API, ingredients and solutions provider to pharmaceutical and consumer products companies, and Noramco, a global leader in the production of controlled substances for the pharmaceutical industry. There, Mr. Mish led the private equity carve out of Noramco from Johnson & Johnson/Janssen Pharmaceuticals and spearheaded the subsequent creation and spinoff of Purisys from Noramco. Mr. Mish began his career at Pfizer in research and development before holding positions of increasing responsibility at several companies including as President of Ashland Specialty Ingredients - Consumer Specialties, a major division of Ashland Corporation, a premier, global specialty materials company serving customers in a wide range of consumer and industrial markets.

John Franzino, Chief Financial Officer. Mr. Franzino has served as our Chief Financial Officer since June 3, 2020. He has a successful track record of strategic financial leadership in high-growth, highly regulated, consumer-facing industries as well as not-for-profit higher education organizations. Most recently, Mr. Franzino served as Chief Financial Officer of the West Point Association of Graduates, which supports the U.S. Military Academy at West Point. Prior to his experience in higher education, Mr. Franzino served as Chief Financial Officer of Santa Fe Natural Tobacco Company, a subsidiary of Reynolds American, Inc., and as Chief Financial Officer of Labatt USA, a subsidiary of Anheuser-Busch. In both roles, he was responsible for the financial planning and control function as well as information systems and technology. Mr. Franzino is a certified public accountant and holds a Master of Business Administration from Fairleigh Dickinson University and a Bachelor of Arts degree from the University of Maine at Farmington.

Michael J. Zercher, President and Chief Operating Officer. Mr. Zercher has served as our President since December 13, 2019, and he has served as our Chief Operating Officer since June 10, 2019. He previously served as the Company’s Vice President of Business Development since September 2016. Mr. Zercher was previously the head of Santa Fe Natural Tobacco Company’s international business operations based in Santa Fe, New Mexico and Zurich, Switzerland from January 2003 to August 2009. Subsequently, Mr. Zercher was a self-employed consultant to entrepreneurs and high-growth businesses in the United States and Europe from September 2009 to September 2016 and the founder and owner of Santa Fe Hard Cider, LLC based in Santa Fe, New Mexico from December 2012 to September 2016. Mr. Zercher has more than twenty-five years of experience in the tobacco industry and other consumer packaged goods industries in general management, marketing, sales, operations and business development in the United States, Europe and Asia.

Compensation Discussion and Analysis

This compensation discussion and analysis describes the material elements of compensation awarded to, earned by, or paid to each of our named executive officers, whom we refer to as our “NEOs,” during 2020 and describes our policies and decisions made with respect to the information contained in the following tables, related footnotes and narrative for 2020. The NEOs are identified below in the table titled “Summary Compensation Table.” In this compensation discussion and analysis, we also describe various actions regarding NEO compensation taken before or after 2020 when we believe it enhances the understanding of our executive compensation program.

12

Overview of Our Executive Compensation Philosophy and Design

We believe that a skilled, experienced and dedicated management team is essential to the future performance of our Company and to building stockholder value. We have sought to establish competitive compensation programs that enable us to attract and retain executive officers with these qualities. The other objectives of our compensation programs for our executive officers are the following:

| ● | to motivate our executive officers to achieve and create stockholder value; |

| ● | to attract and retain executive officers who we believe have the experience, temperament, talents, and convictions to contribute significantly to our future success; and |

| ● | to align the economic interests of our executive officers with the interests of our stockholders. |

Considering these objectives, we have sought to reward our NEOs for creating value for our stockholders and for loyalty and dedication to our Company.

Setting Executive Compensation

Our Compensation Committee has primary responsibility for, among other things, determining our compensation philosophy, evaluating the performance of our executive officers, setting the compensation and other benefits of our executive officers, overseeing the Company’s response to the outcome of the advisory votes of stockholders on executive compensation, assessing the relative enterprise risk of our compensation program and administering our incentive compensation plans.

Our Board of Directors, our Compensation Committee and our CEO each play a role in setting the compensation of our NEOs. Our Board of Directors appoints the members of our Compensation Committee and delegates to the Compensation Committee the direct responsibility for overseeing the design and administration of our executive compensation program. Our Board of Directors and our Compensation Committee value the opinions of our stockholders and are committed to ongoing engagement with our stockholders on executive compensation practices. The Compensation Committee specifically considers the results from the annual stockholder advisory vote on executive compensation. At the 2020 Annual Meeting of Stockholders, 62% of the votes cast on the stockholder advisory vote on executive compensation were in favor of our executive compensation.

Our Compensation Committee engaged the compensation consulting firm of Willis Towers Watson (formerly Towers Watson) in 2015 to provide broad executive compensation benchmarks based upon surveys of public and private companies which were similarly sized to us. Based upon these survey results, the Committee adopted a comprehensive executive compensation structure that it felt would best align the interests of our management with those of our stockholders. The Compensation Committee did not engage a compensation consultant in 2016, 2017 or 2019. However, the Committee engaged Willis Towers Watson in both 2018 and in 2020 to conduct a market analysis/survey of executive compensation trends at similar sized public companies. In 2020, the market analysis used published surveys as the sources of market data (including surveys published by Culpepper, Willis Towers Watson and Mercer) that utilized survey data of for-profit companies with revenues under $500 million. Data from the Culpepper survey, which reflected public companies in the life sciences sector with revenues under $500 million, was emphasized for the three NEOs. To assure independence, the Compensation Committee pre-approves all other work unrelated to executive compensation proposed to be provided by Willis Towers Watson. The Compensation Committee also considered all factors relevant to the consultant’s independence from management when it was engaged, including but not limited to the following factors:

| ● | The provision of other services that the consultant provides to us; |

| ● | The amount of fees received from us as a percentage of the consultant’s total revenue; |

| ● | The consultant’s policies and procedures designed to prevent conflicts of interest; |

| ● | Business or personal relationships of the consultant with our Compensation Committee members; |

| ● | The amount of our stock owned by the consultant; and |

| ● | Business or personal relationships of the consultant with our executive officers |

13

Elements of Executive Compensation

The key elements of our compensation structure are:

| ● | Provide a base salary for each NEO based on the job description and scope of responsibilities of that position. Each position is assigned a target annual salary and range, with minimum and maximum salaries established for each position. |

| ● | Provide annual discretionary cash incentive opportunities (bonuses) for each NEO. Annual incentive awards are based on a percentage of each position’s base salary and are tied to the achievement of several weighted, measurable objectives defined for that position in the relevant calendar year, as well as other discretionary considerations including the Company’s performance. |

| ● | Provide long-term incentive pay opportunities which provide for continuity of key management personnel through grants of stock incentives that align our executives’ interests with those of our stockholders. These incentives are designed to vest over multiple years and are determined in dollar amounts as a multiple of each executive’s base salary. |

| ● | Retirement and other benefits. |

Base Salary

We pay our NEOs a base salary to compensate them for services rendered and to provide them with a steady source of income for living expenses throughout the year. We determine the base salary of each NEO based on the job description and scope of responsibilities of that position. Each position is assigned a target annual salary and range, with minimum and maximum salaries established for each position.

The fiscal 2021 base salaries for our NEOs, as well as the percentage increase from the fiscal 2020 base salaries, are as follows:

| | | | | | |

|

| | |

| Percentage Increase Over Fiscal | |

Name |

| Fiscal 2021 Base Salary |

| 2020 Base Salary | ||

James A. Mish (1) | | $ | 450,000 |

| N/A | |

John Franzino (2) | | $ | 315,000 |

| 26 | % |

Michael J. Zercher (3) | | $ | 366,100 | | N/A | |

| (1) | Mr. Mish was appointed as the Chief Executive Officer of the Company on June 22, 2020 and was awarded an initial base salary for 2020 of $450,000. No base salary adjustments were made for 2021. |

| (2) | Mr. Franzino was appointed as the Chief Financial Officer of the Company on June 3, 2019 and was awarded an initial base salary for 2020 of $250,000. Mr. Franzino’s salary was increased to $315,000 based on compensation market studies performed by Willis Towers Watson. |

| (3) | Mr. Zercher will receive no base salary adjustments for 2021. |

Incentive Compensation

For 2020, our incentive compensation program consisted of (i) a discretionary annual cash bonus opportunity and (ii) long-term equity incentive compensation consisting of equity awards in the form of restricted stock units and/or stock options. We award annual discretionary incentive awards (bonuses) for each NEO that are based on a percentage of each position’s base salary and are tied to the achievement of several weighted, measurable objectives defined for that position in the upcoming calendar year, as well as other discretionary considerations including Company performance. We also provide for a long-term incentive pay program which provides for continuity of key management personnel through grants of stock incentives. These incentives are designed to vest over multiple years and are determined in dollar amounts as a multiple of each executive’s base salary.

The annual discretionary cash bonus opportunity and the long-term equity incentive compensation for 2020 are discussed in detail below.

14

Annual Discretionary Cash Bonus Opportunity

The Compensation Committee has the authority to award discretionary annual cash bonuses to our NEOs. The cash bonuses are intended to compensate NEOs for individual performance achievements and for achieving important goals and objectives, including those set out in performance reviews from the prior year. In addition to individual performance, determination of a NEO’s achievements generally considers such factors as our overall financial performance and improving our operations. Bonus levels vary depending on the individual executive and are not formulaic, but instead are based upon an objective and subjective evaluation of performance and other circumstances.

The Compensation Committee recommended, and the Board of Directors unanimously approved, the award of discretionary cash bonuses in 2021 in recognition of work performance in 2020 as follows: $675,000 for Mr. Mish, $125,000 for Mr. Franzino, and $366,100 for Mr. Zercher. Each NEO has voluntarily elected to defer payout of such earned bonus amounts at this time. In March 2021, the Compensation Committee also recommended, and the Board of Directors unanimously approved, an additional one-time discretionary cash bonus of $272,000 to Mr. Zercher, which he has voluntarily elected to defer payout at this time. We expect the officers to defer their respective cash bonuses until we receive approval from the Food and Drug Administration on a Modified Risk Tobacco Product application, although they are under no obligation to do so.

Long-Term Equity Incentive Compensation

Our Compensation Committee believes that equity awards enhance the alignment of the economic interests of our NEOs and the economic interest of our stockholders and provides our NEOs with incentives to remain in our employment. In 2020, we granted awards of restricted stock units to our NEOs to motivate and retain our NEOs while aligning their economic interest with our stockholders through potential long-term equity ownership.

For 2020, we awarded our NEOs with the following restricted stock units valued at $118,230 for Mr. Mish, $142,005 for Mr. Franzino, and $447,831 for Mr. Zercher—value was calculated based on the number of restricted stock units granted, multiplied by the Company’s stock price on the date of each respective grant. The restricted stock units vest over various time periods from the date of the grant, subject to continued employment with us.

The 2020 restricted stock unit (“RSU”) awards resulted in a total grant of the following number of shares to our NEOs (as described in more detail in the Grant of Plan-Based Awards section in this proxy statement) and vest subject to continued service with us.

| | |

Name |

| Restricted Stock Units (#) |

James A. Mish | | 150,000 |

John Franzino |

| 150,000 |

Michael J. Zercher | | 665,821 |

Retirement and Other Benefits

We are strongly committed to encouraging all employees to save for retirement. To provide employees with the opportunity to save for retirement on a tax-deferred basis, we sponsor a 401(k)-plan pursuant to which we make a safe harbor non-elective contribution of 3% of the employee’s annual compensation—subject to certain wage maximums. We also provide health and dental insurance, group-term life insurance, and long-term disability insurance to the employees. We do not maintain any pension or non-qualified deferred compensation plans.

Severance Arrangement

Effective May 29, 2020, Ms. Jentsch resigned as the Chief Financial Officer of the Company. In connection with the resignation, the Company and Ms. Jentsch agreed to severance benefits totaling $275,000, paid over a one year period, and reimbursement of health insurance premiums for one year. The compensation table below reflects 2020 salary and severance benefits.

15

Summary Compensation Table

The following table summarizes the compensation paid by the Company in each of the last two completed fiscal years for our NEOs:

| | | | | | | | | | | | | | | | | | | | |

|

| |

| | |

| | |

| |

| Stock |

| All Other |

| | | |||

| | | | | | | Bonus | | Option | | Awards | | Compensation | | | | ||||

Name and Principal Position |

| Year |

| Salary |

| (1) |

| Awards |

| (2) |

| (4) |

| Total | ||||||

James A. Mish | | 2020 | | $ | 241,093 | | $ | 675,000 | | $ | — | | $ | 118,230 | | $ | 8,760 | | $ | 1,043,083 |

John Franzino |

| 2020 | | $ | 158,213 | | $ | 125,000 | | $ | — | | $ | 142,005 | | $ | 10,030 | | $ | 435,248 |

Michael J. Zercher | | 2020 | | $ | 366,431 | | $ | 366,100 | | $ | — | | $ | 447,831 | | $ | 31,970 | | $ | 1,212,332 |

President and Chief Operating Officer |

| 2019 | | $ | 290,569 | | $ | 420,000 | | $ | — | | $ | 271,395 | | $ | 25,327 | | $ | 1,007,291 |

Andrea S. Jentsch |

| 2020 | | $ | 131,922 | | $ | — | | $ | — | | $ | 106,626 | (3) | $ | 183,600 | | $ | 422,148 |

Former Chief Financial Officer and Treasurer |

| 2019 | | $ | 88,654 | | $ | 50,000 | | $ | — | | $ | 115,000 | | $ | 7,532 | | $ | 261,186 |

| (1) | Each NEO has voluntarily elected to defer payout of such earned bonus amounts at this time. |

| (2) | Represents the grant date fair value computed in accordance with FASB ASC 718. The assumptions used for the restricted stock units is set forth in the notes to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020. |

| (3) | Upon Ms. Jentsch’s resignation on May 29, 2020, all 2020 granted awards were forfeited. |

| (4) | All Other Compensation consists of the following: |

| | | | | | | | | | | | | | |

|

| |

| | |

| | | | Employer |

| | | |

| | | | | | | | | | Contributions | | | | |

| | | | | | | | | | to Company | | All Other | ||

| | | | Fringe | | Severance | | 401(k) | | Compensation | ||||

Name |

| Year |

| Benefits * |

| Benefits** | | Plan |

| Total | ||||

James A. Mish |

| 2020 | | $ | 8,760 | | $ | — | | $ | — | | $ | 8,760 |

John Franzino |

| 2020 | | $ | 8,674 | | $ | — | | $ | 1,356 | | $ | 10,030 |

Michael J. Zercher |

| 2020 | | $ | 23,824 | | $ | — | | $ | 8,146 | | $ | 31,970 |

Andrea S. Jentsch |

| 2020 | | $ | 8,597 | | $ | 170,084 | | $ | 4,920 | | $ | 183,600 |

*Includes Company paid premiums for health insurance, dental insurance, group-term life insurance, and long-term disability insurance.

**Includes cash severance benefits and reimbursed health insurance premiums.

Grant of Plan-Based Awards

As described above in the Compensation Discussion and Analysis, we granted restricted stock units to our NEOs in 2020. The following table sets forth information regarding all such awards:

| | | | | | | | | |

|

| |

| |

| Restricted |

| | |

| | | | | | Stock Unit | | | |

| | | | | | Awards: | | Grant Date Fair Value | |

| | | | Date of | | Number of | | Restricted Stock Units, | |

| | | | Board | | Shares of | | Stock Awards and | |

Name |

| Grant Date |

| Action |

| Stock (#) |

| Option Awards ($) (6) | |

James A. Mish |

| 6/22/2020 | | 5/27/2020 |

| 150,000 | (1) | $ | 118,230 |

John Franzino |

| 6/8/2020 | | 6/8/2020 |

| 50,000 | (2) | $ | 47,985 |

|

| 4/30/2020 | | 4/30/2020 |

| 100,000 | (3) | $ | 94,020 |

Michael J. Zercher |

| 3/16/2020 |

| 3/16/2020 |

| 665,821 | (4) | $ | 447,831 |

Andrea S. Jentsch |

| 3/16/2020 |

| 3/16/2020 |

| 158,528 | (5) | $ | 106,626 |

| (1) | Represents RSUs which vest in one year on June 22, 2021. |

| (2) | Represents RSUs which vest in equal annual increments over two years on June 8, 2021 and June 8, 2022. |

| (3) | Represents RSUs which vest in equal annual increments over two years on April 30, 2021 and April 30, 2022. |

16

| (4) | Represents RSUs which vest in equal annual increments over three years on March 16, 2021, 2022, and 2023. Mr. Zercher forfeited 215,821 of such RSUs that were scheduled to vest in 2023. |

| (5) | Ms. Jentsch was awarded 158,528 RSUs which vested in equal annual increments over three years on March 16, 2021, 2022, and 2023. Upon her resignation, all RSUs were forfeited. |

| (6) | Represents the grant fair value computed in accordance with FASB ASC 718. The assumptions used for the restricted stock units is set forth in the notes to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2020. |

Outstanding Equity Awards at December 31, 2020

| | | | | | | | | | | | | | | |

|

| |

| |

| | |

| |

| | | Equity Incentive |

| |

| | | | | | | | | | | | | Plan Awards: |

| |

| | | | | | | | | | | | | Market or |

| |

| | | | | | | | | | | | | Payout Value of |

| |

| | Number of | | Number of | | | | | | | | | Unearned |

| |

| | Securities | | Securities | | | | | | | Equity Incentive Plan | | Shares, |

| |

| | Underlying | | Underlying | | | | | | | Awards: Number of | | Restricted Stock |

| |

| | Unexercised | | Unexercised | | | | | | | Unearned Shares, | | Units or Other |

| |

| | Options | | Options | | Option | | Option | | Restricted Stock Units or | | Rights That |

| ||

| | Exercisable | | Unexercisable | | Exercise | | Expiration | | Other Rights That Have | | Have Not Vested |

| ||

Name | | (#) | | (#) | | Price | | Date | | Not Vested (#) | | ($) (6) |

| ||

James A. Mish | | — | | — | | | — | | — | | 150,000 | | $ | 330,000 | (1) |

John Franzino |

| — |

| — | |

| — |

| — |

| 100,000 | | $ | 220,000 | (2) |

| | — |

| — | |

| — |

| — | | 50,000 | | $ | 110,000 | (3) |

Michael J. Zercher |

| 650,000 |

| — | | $ | 1.07 |

| 8/24/2026 |

| — | |

| — | |

|

| 68,000 |

| — | | $ | 1.39 |

| 5/4/2027 |

| — | | | — | |

|

| 51,916 |

| 25,959 | | $ | 2.76 |

| 3/6/2028 |

| — | | | — | |

|

| — |

| — | | | — |

| — |

| 75,000 | | $ | 165,000 | (4) |

|

| — |

| — | | | — |

| — |

| 665,821 | | $ | 1,464,806 | (5) |

| (1) | Represents RSUs which vest in one year on June 22, 2021. |

| (2) | Represents RSUs which vest in equal annual increments over two years on April 30, 2021 and April 30, 2022. |

| (3) | Represents RSUs which vest in equal annual increments over two years on June 8, 2021 and June 8, 2022. |

| (4) | Represents RSUs which vest on December 13, 2021. |

| (5) | Represents RSUs which vest in equal annual increments over three years on March 16, 2021, 2022, and 2023. Mr. Zercher forfeited 215,821 of such RSUs that were scheduled to vest in 2023 |

| (6) | The amounts in this column are based on the closing stock price of the Company’s common stock on December 31, 2020. These amounts do not reflect the actual amounts that may be realized. |

Option Exercise and Stock Vested for Fiscal 2020

| | | | | | | | | | | | |

|

| Option Awards | | Stock Awards | ||||||||

| | Number of | | | | | Number of | | | | ||

| | Shares | | Value | | Shares | | Value | ||||

| | Acquired on | | Realized on | | Acquired on | | Realized on | ||||

| | Exercise | | Exercise | | Vesting | | Vesting | ||||

Name |

| (#) |

| ($) |

| (#) |

| ($) (1) | ||||

Michael J. Zercher | | | — | | $ | — | | | 93,000 | | $ | 203,820 |

Andrea S. Jentsch | | | — | | $ | — | | | 25,000 | | $ | 24,250 |

| (1) | The value realized on vesting is based on the closing stock price of the Company’s common stock on the date of vesting or date of exercise. The amount does not reflect the actual amount that may be realized. |

17

Employment Agreements with Executive Officers

We have entered into employment agreements with each of our NEOs as follows:

James A. Mish. Pursuant to the employment agreement entered into between James A. Mish and the Company on May 22, 2020, Mr. Mish will earn an initial base salary of $450,000 and shall be eligible for future cash bonuses and awards of performance units as a percentage of base salary based on the achievement of performance targets to be established by the Company. As a one-time inducement, the Company agreed to an award of 150,000 RSUs, vesting on the one-year anniversary of the date of grant, subject to continued service.

If Mr. Mish’s employment is terminated by the Company without Cause or by such executive for Good Reason (as such terms are defined in the employment agreement), then he will be entitled to a severance benefit in the form of (i) a continuation of his then-base salary for a period ending on the earlier of 12 months or the remaining term of the employment agreement (plus continuing health care coverage during such period) and (ii) the payment of a pro-rated bonus award.

John Franzino. Pursuant to the employment agreement entered into between John Franzino and the Company dated April 8, 2020, Mr. Franzino earned an initial base salary of $250,000 (which has been increased to $315,000) and shall be eligible for future cash bonuses and equity awards. As a one-time inducement, the Company agreed to an award of 100,000 RSUs, with 50,000 RSUs vesting on the one-year anniversary of the date of grant and 50,000 RSUs vesting on the two-year anniversary of the grant date, subject to continued service.

If Mr. Franzino’s employment is terminated by the Company without Cause or by such executive for Good Reason (as such terms are defined in the employment agreement), then he will be entitled to a severance benefit in the form of (i) a continuation of his then-base salary for a period of 12 months and (ii) the payment of any earned but unpaid bonus award.

The employment agreement of Mr. Franzino also provides that in the event of a change in control (as defined in his employment agreement) of our Company, then during the three (3)-year period following such change in control if certain triggering events occur, such as if he is terminated other than for Cause (as defined in his employment agreement), death or disability, or if his responsibilities are diminished after the change in control as compared to his responsibilities prior to the change in control, or if his base salary or benefits are reduced, or he is required to relocate more than twenty-five (25) miles from his then current place of employment, then in any such events he will have the option, exercisable within ninety (90) days of the occurrence of such an event, to resign his employment with us, in which case he will be entitled to receive: (a) his base salary for twelve (12) months thereafter; and (b) the immediate vesting of all options and/or restricted stock grants previously granted or to be granted to him.

Michael J. Zercher. Mr. Zercher entered into an employment agreement with us as of September 9, 2019, which was effective as of June 10, 2019, for an initial term of three years that automatically renews on an annual basis thereafter unless terminated. If Mr. Zercher’s employment is terminated by the Company without Cause or by Mr. Zercher for Good Reason (as such terms are defined in his employment agreement), then Mr. Zercher will be entitled to a severance benefit in the form of a continuation of his then-base salary for twenty-four (24) months from the termination date as long as Mr. Zercher complies with restrictive covenants contained in his employment agreement.

The employment agreement of Mr. Zercher provides that in the event of a change in control (as defined in his employment agreement) of our Company, then during the three (3)-year period following such change in control if certain triggering events occur, such as if he is terminated other than for Cause (as defined in his employment agreement), death or disability, or if his responsibilities are diminished after the change in control as compared to his responsibilities prior to the change in control, or if his base salary or benefits are reduced, or he is required to relocate more than twenty-five (25) miles from his then current place of employment, then in any such events he will have the option, exercisable within ninety (90) days of the occurrence of such an event, to resign his employment with us, in which case he will be entitled to receive: (a) his base salary for twenty-four (24) months thereafter; and (b) the immediate vesting of all options and/or restricted stock grants previously granted or to be granted to him.

18