Talbot Underwriting Ltd FOURTH QUARTER 2013

Talbot Underwriting Ltd • One of the core operating businesses of Validus Holdings, Ltd. – Founded in 2002 – Acquired by Validus in 2007 • Significant competitive position – The 10th largest Syndicate at Lloyd’s – Leadership in non-reinsurance and non-casualty classes of business • Outstanding management team led by CEO Rupert Atkin – 30 years of experience in Lloyd’s – Chairman of the Lloyd’s Market Association, Member of Council of Lloyd’s – Deputy Chairman of Lloyd’s since February 2014 • Meaningful financial contribution and other benefits to Validus – Talbot has provided 24% of Validus net income from 2007-2013 – Lloyd’s platform allows for significant capital leverage – Lloyd’s provides global licensing for Validus expansion – London is a significant location for (re)insurance talent 1) 24% of net income is calculated based on the proportion of Talbot Segment net income over total Group net income as disclosed in the respective Investor Financial Supplements. 2

Talbot Underwriting Ltd – Underwriting Philosophy • Focus is on short tail business with significant market position in targeted classes – The ability to lead business is important • Maintain a balanced and diversified portfolio within targeted classes • Underwriting portfolio protected by a comprehensive reinsurance program • Talbot is a Lloyd’s market leader in the War & Terror, Energy and Marine classes of business • By design, Talbot is underweight the following classes: – Casualty – Casualty Treaty – Property Treaty 3

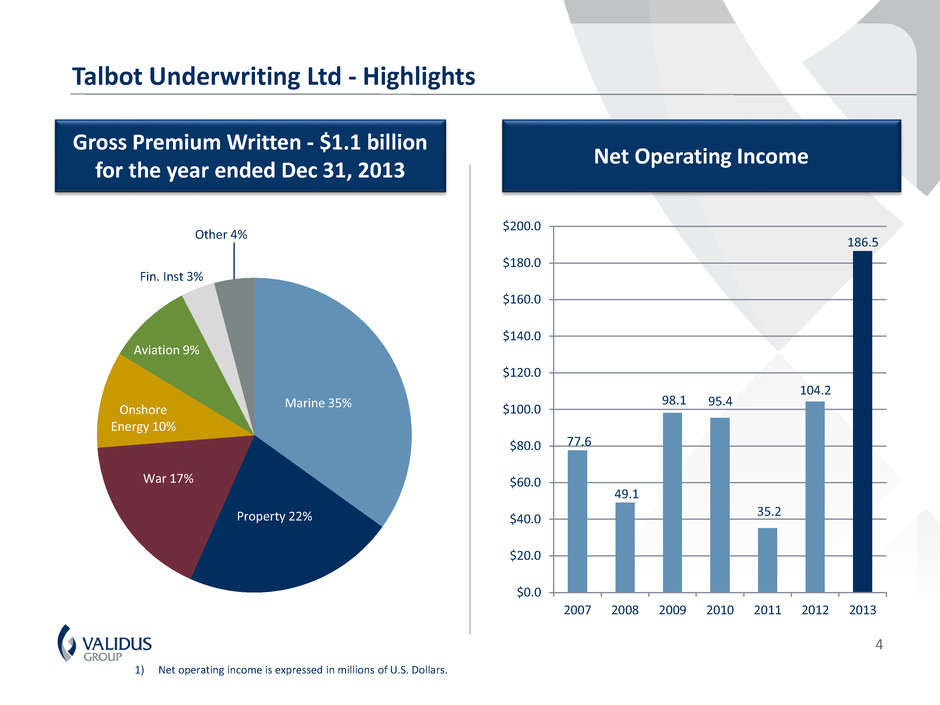

Gross Premium Written - $1.1 billion for the year ended Dec 31, 2013 Net Operating Income 1) Net operating income is expressed in millions of U.S. Dollars. Marine 35% Property 22% War 17% Onshore Energy 10% Aviation 9% Fin. Inst 3% Other 4% 77.6 49.1 98.1 95.4 35.2 104.2 186.5 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 2007 2008 2009 2010 2011 2012 2013 Talbot Underwriting Ltd - Highlights 4

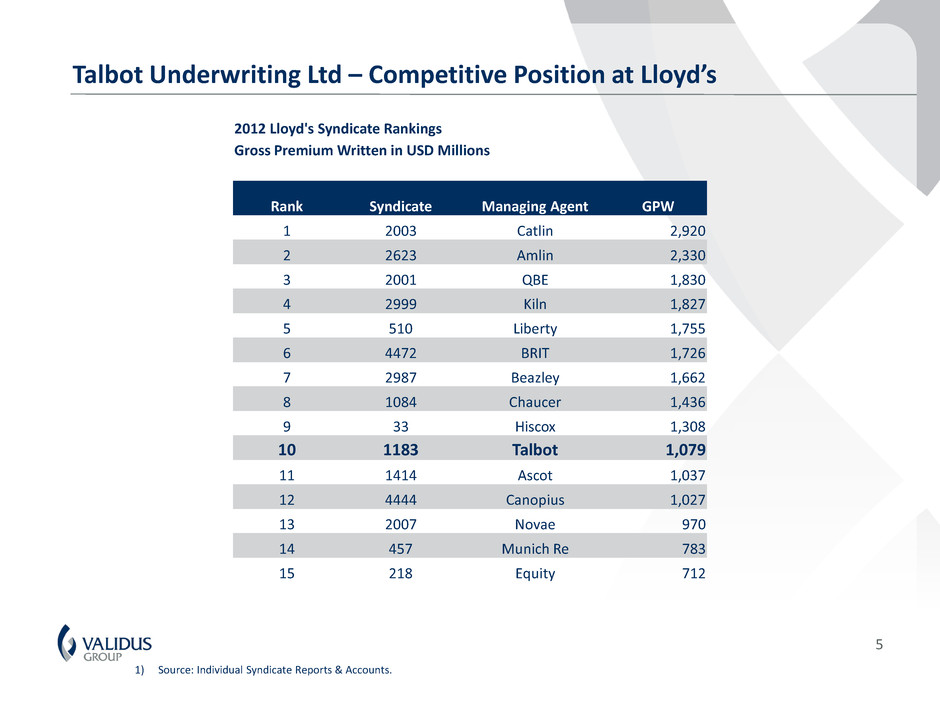

Talbot Underwriting Ltd – Competitive Position at Lloyd’s 5 1) Source: Individual Syndicate Reports & Accounts. 2012 Lloyd's Syndicate Rankings Gross Premium Written in USD Millions Rank Syndicate Managing Agent GPW 1 2003 Catlin 2,920 2 2623 Amlin 2,330 3 2001 QBE 1,830 4 2999 Kiln 1,827 5 510 Liberty 1,755 6 4472 BRIT 1,726 7 2987 Beazley 1,662 8 1084 Chaucer 1,436 9 33 Hiscox 1,308 10 1183 Talbot 1,079 11 1414 Ascot 1,037 12 4444 Canopius 1,027 13 2007 Novae 970 14 457 Munich Re 783 15 218 Equity 712

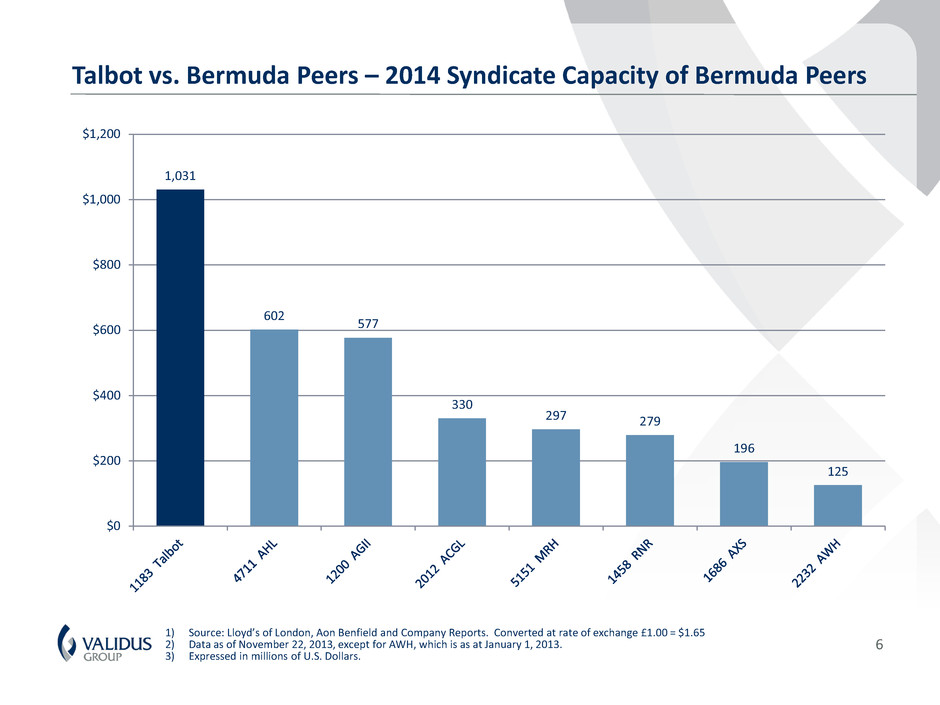

6 1) Source: Lloyd’s of London, Aon Benfield and Company Reports. Converted at rate of exchange £1.00 = $1.65 2) Data as of November 22, 2013, except for AWH, which is as at January 1, 2013. 3) Expressed in millions of U.S. Dollars. 1,031 602 577 330 297 279 196 125 $0 $200 $400 $600 $800 $1,000 $1,200 Talbot vs. Bermuda Peers – 2014 Syndicate Capacity of Bermuda Peers

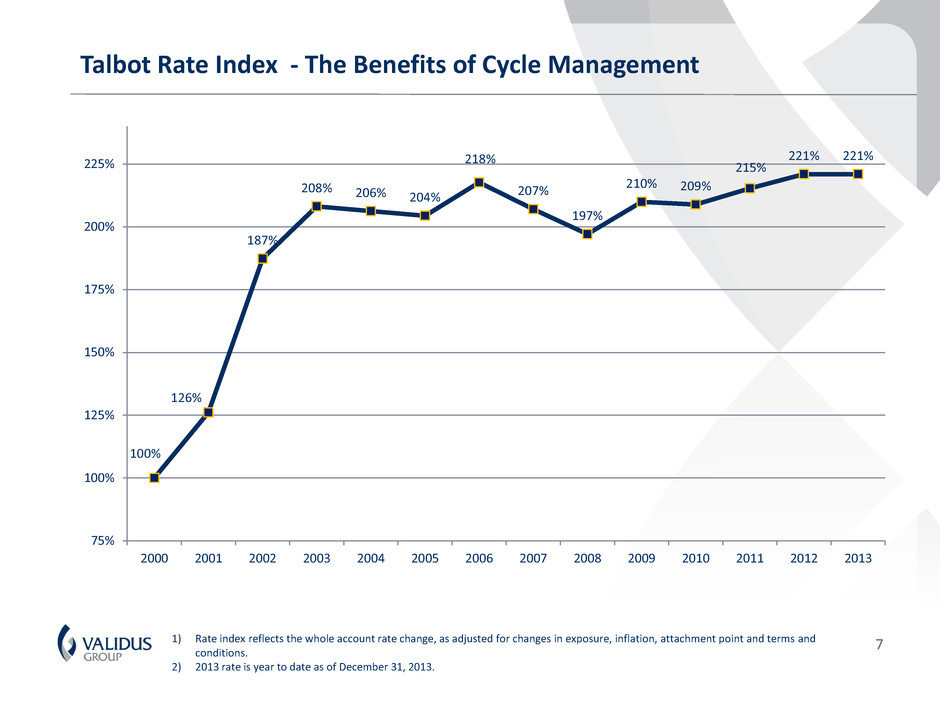

7 1) Rate index reflects the whole account rate change, as adjusted for changes in exposure, inflation, attachment point and terms and conditions. 2) 2013 rate is year to date as of December 31, 2013. Talbot Rate Index - The Benefits of Cycle Management 100% 126% 187% 208% 206% 204% 218% 207% 197% 210% 209% 215% 221% 221% 75% 100% 125% 150% 175% 200% 225% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

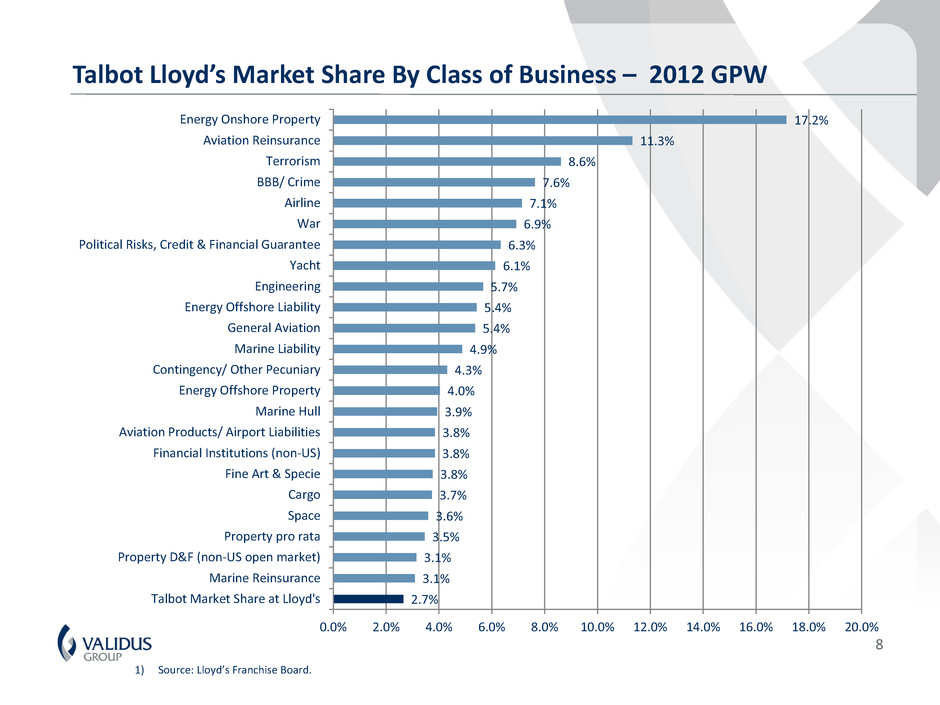

Talbot Lloyd’s Market Share By Class of Business – 2012 GPW 8 2.7% 3.1% 3.1% 3.5% 3.6% 3.7% 3.8% 3.8% 3.8% 3.9% 4.0% 4.3% 4.9% 5.4% 5.4% 5.7% 6.1% 6.3% 6.9% 7.1% 7.6% 8.6% 11.3% 17.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Talbot Market Share at Lloyd's Marine Reinsurance Property D&F (non-US open market) Property pro rata Space Cargo Fine Art & Specie Financial Institutions (non-US) Aviation Products/ Airport Liabilities Marine Hull Energy Offshore Property Contingency/ Other Pecuniary Marine Liability General Aviation Energy Offshore Liability Engineering Yacht Political Risks, Credit & Financial Guarantee War Airline BBB/ Crime Terrorism Aviation Reinsurance Energy Onshore Property 1) Source: Lloyd’s Franchise Board.

Talbot Lloyd’s Market Share By Class of Business – 2012 GPW (2) 9 0.0% 0.0% 0.1% 0.2% 0.3% 0.5% 0.6% 0.7% 0.8% 0.8% 0.9% 0.9% 1.1% 1.1% 1.2% 1.5% 1.6% 1.9% 2.2% 2.7% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% UK Motor Professional Indemnity (US) NM General Liability (US direct) Overseas Motor Property D&F (US binder) Personal Accident XL Property D&F (non-US binder) Property Risk XS Medical Expenses Energy Onshore Liability Employers Liability/ WCA (US) Livestock & Bloodstock Financial Institutions (US) Property Cat XL Nuclear Power Generation Difference in Conditions Accident & Health (direct) Property D&F (US open market) Talbot Market Share at Lloyd's 1) Source: Lloyd’s Franchise Board.

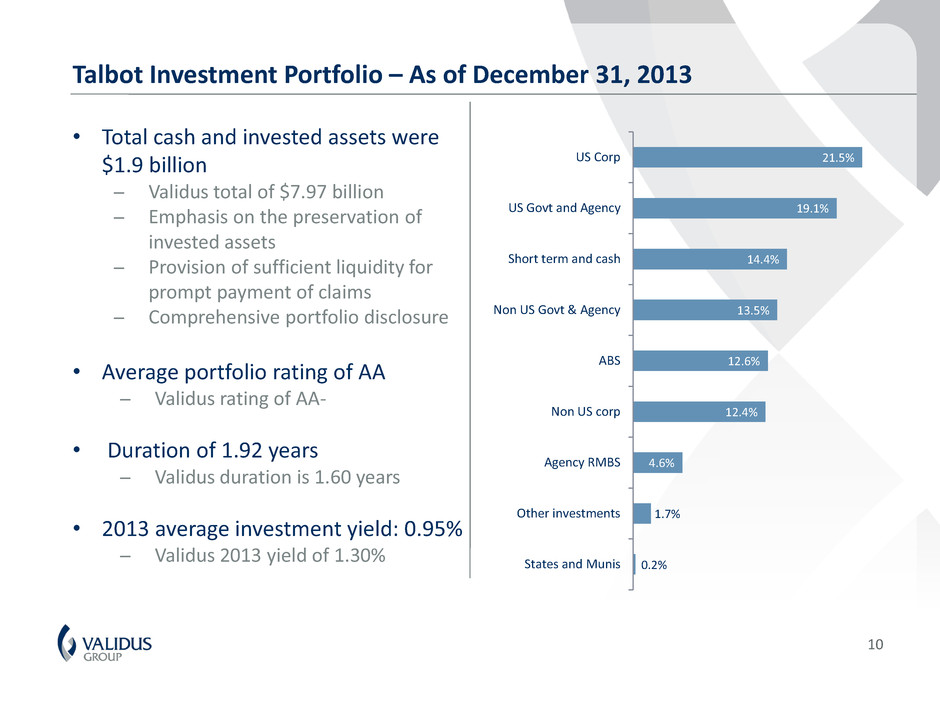

Talbot Investment Portfolio – As of December 31, 2013 • Total cash and invested assets were $1.9 billion ̶ Validus total of $7.97 billion ̶ Emphasis on the preservation of invested assets ̶ Provision of sufficient liquidity for prompt payment of claims ̶ Comprehensive portfolio disclosure • Average portfolio rating of AA ̶ Validus rating of AA- • Duration of 1.92 years ̶ Validus duration is 1.60 years • 2013 average investment yield: 0.95% ̶ Validus 2013 yield of 1.30% 10 0.2% 1.7% 4.6% 12.4% 12.6% 13.5% 14.4% 19.1% 21.5% States and Munis Other investments Agency RMBS Non US corp ABS Non US Govt & Agency Short term and cash US Govt and Agency US Corp

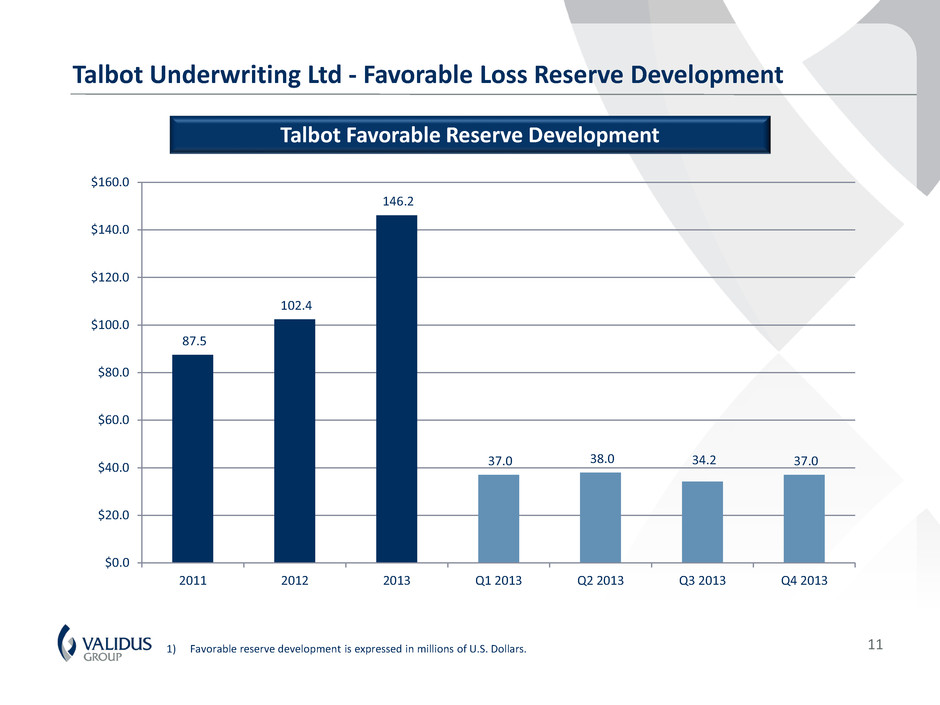

Talbot Underwriting Ltd - Favorable Loss Reserve Development 11 1) Favorable reserve development is expressed in millions of U.S. Dollars. Talbot Favorable Reserve Development 87.5 102.4 146.2 37.0 38.0 34.2 37.0 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 2011 2012 2013 Q1 2013 Q2 2013 Q3 2013 Q4 2013

Talbot Underwriting Ltd – Executive Team • Executive management team average more than 25 years of market experience • Rupert Atkin is the Chief Executive Officer of Talbot Underwriting Ltd and was the active underwriter for syndicate 1183 from 1991 until 2007. He is a member of the Council of Lloyd’s, was appointed Chairman of the Lloyd’s Market Association on 1 February 2012 and was named Deputy Chairman of Lloyd’s of London effective from 1 February 2014 • Talbot’s Executive Management Committee: – Rupert Atkin, Chief Executive Officer – Peter Bilsby, Managing Director – Jane Clouting, Head of Governance – Julian Ross, Chief Risk Officer – James Skinner, Director of Underwriting and Active Underwriter – Nigel Wachman, Chief Financial Officer 12