1 Validus Holdings, Ltd. Investor Presentation – Fourth Quarter 2016

2 This presentation may include forward-looking statements, both with respect to us and our industry, that reflect our current views with respect to future events and financial performance. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” “may” and similar statements of a future or forward-looking nature identify forward-looking statements. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. We believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) rating agency actions; 3) adequacy of Validus Holdings, Ltd.’s (“Validus” or the “Company”) risk management and loss limitation methods; 4) cyclicality of demand and pricing in the insurance and reinsurance markets; 5) statutory or regulatory developments including tax policy, reinsurance and other regulatory matters; 6) Validus’ ability to implement its business strategy during “soft” as well as “hard” markets; 7) adequacy of Validus’ loss reserves; 8) continued availability of capital and financing; 9) retention of key personnel; 10) competition; 11) potential loss of business from one or more major insurance or reinsurance brokers; 12) Validus’ ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 13) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 14) the integration of businesses Validus may acquire or new business ventures Validus may start; 15) the effect on Validus’ investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 16) acts of terrorism or outbreak of war; and 17) availability of reinsurance and retrocessional coverage, as well as management’s response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the Risk Factors included in our most recent reports on Form 10-K and Form 10-Q and other documents on file with the Securities and Exchange Commission. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations. We undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Cautionary Note Regarding Forward-looking Statements

3 • Since its founding in 2005, Validus has expanded its platform to include a U.S. specialty insurer, Lloyd’s syndicate, third party reinsurance asset manager and global reinsurer • The diversified portfolio as measured by gross premium written is comprised of 43% insurance and 57% reinsurance for the year ended December 31, 2016 • Business plan since formation has been to focus on short-tail lines with strategic diversification into select longer-tail classes • Maintained a focus on underwriting profits in conjunction with a strong balance sheet • Profitable in all 11 years of operation, 2006 through 2016 • Delivered outstanding financial results since 2007 IPO as measured by growth in book value per diluted common share plus accumulated dividends • Active capital management, returning $3.88 billion to investors through repurchases and dividends from Validus’ 2007 IPO through February 8, 2017 Validus – Key Accomplishments

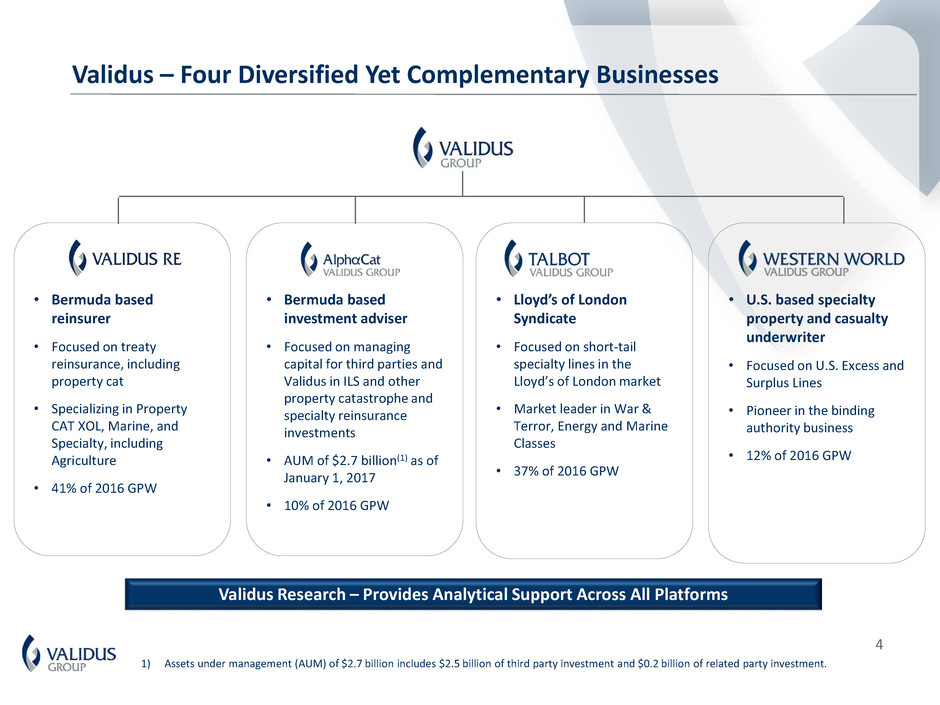

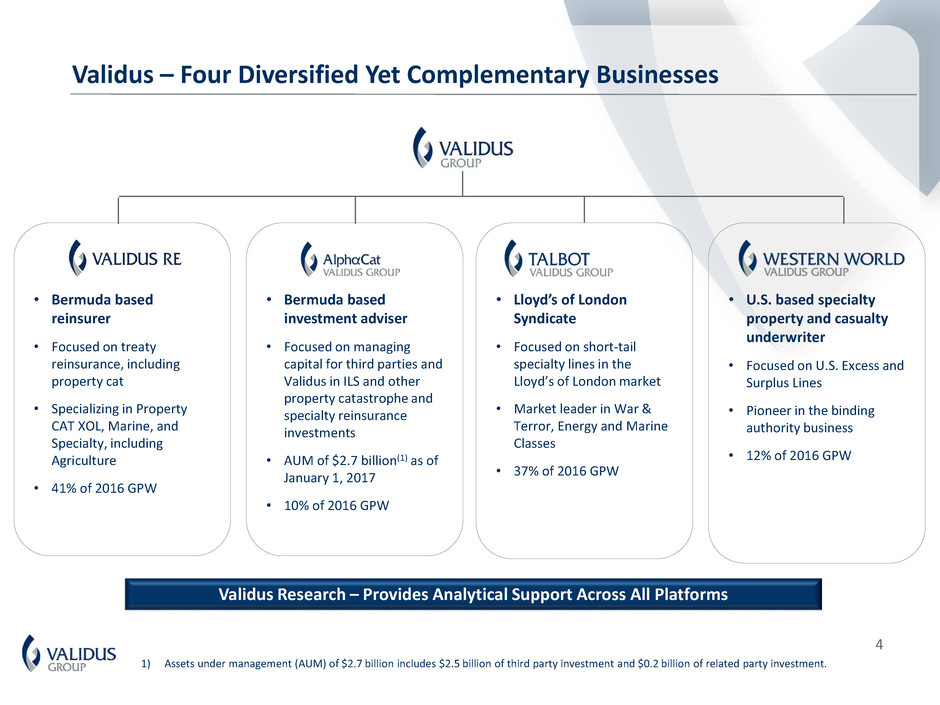

4 Validus – Four Diversified Yet Complementary Businesses • U.S. based specialty property and casualty underwriter • Focused on U.S. Excess and Surplus Lines • Pioneer in the binding authority business • 12% of 2016 GPW • Bermuda based investment adviser • Focused on managing capital for third parties and Validus in ILS and other property catastrophe and specialty reinsurance investments • AUM of $2.7 billion(1) as of January 1, 2017 • 10% of 2016 GPW • Lloyd’s of London Syndicate • Focused on short-tail specialty lines in the Lloyd’s of London market • Market leader in War & Terror, Energy and Marine Classes • 37% of 2016 GPW • Bermuda based reinsurer • Focused on treaty reinsurance, including property cat • Specializing in Property CAT XOL, Marine, and Specialty, including Agriculture • 41% of 2016 GPW Validus Research – Provides Analytical Support Across All Platforms 1) Assets under management (AUM) of $2.7 billion includes $2.5 billion of third party investment and $0.2 billion of related party investment.

5 Validus Research - Depth of Resources • Research – Validus Group’s thought leader in catastrophe risk quantification and model development – Post-Doctoral expertise in physical and data sciences including seismology, atmospheric sciences, hydrology, structural engineering, and statistics – Responsibility for the Validus View of Risk – derived from independent research/validation with the agility to reflect latest science and experience in a responsive way • Catastrophe Modeling – Rigorous analyses/investigations of insurance/reinsurance transactions with a heavy focus on exposure data quality – Over 60 years of combined catastrophe modeling experience applying and evolving industry best practice • Software Engineering – Continuous evolution of our core underwriting, portfolio and risk management systems, including the Validus Capital Allocation and Pricing System (VCAPS)

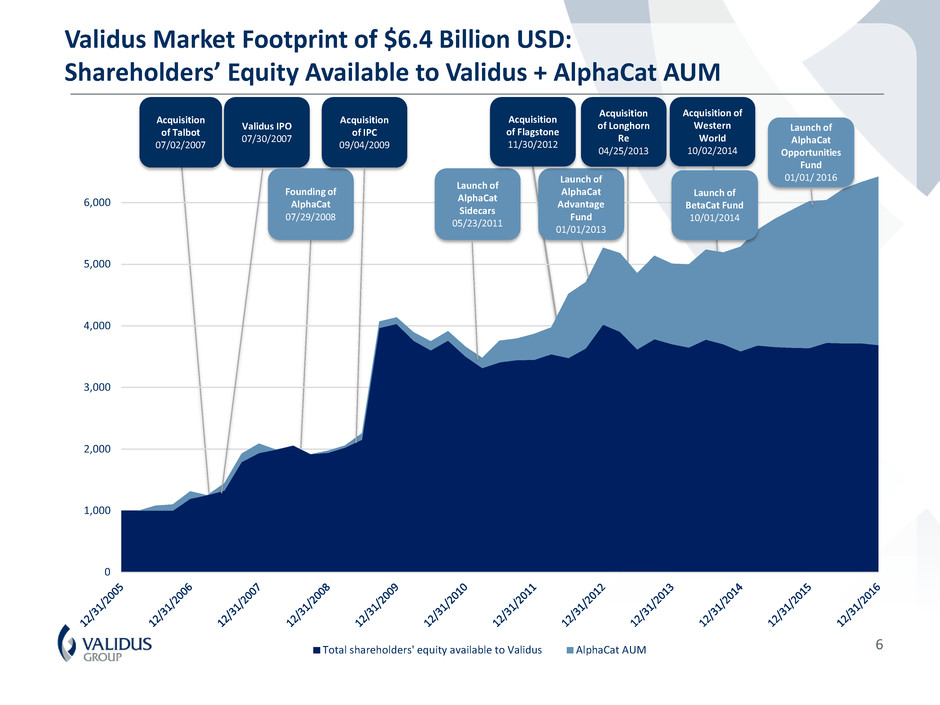

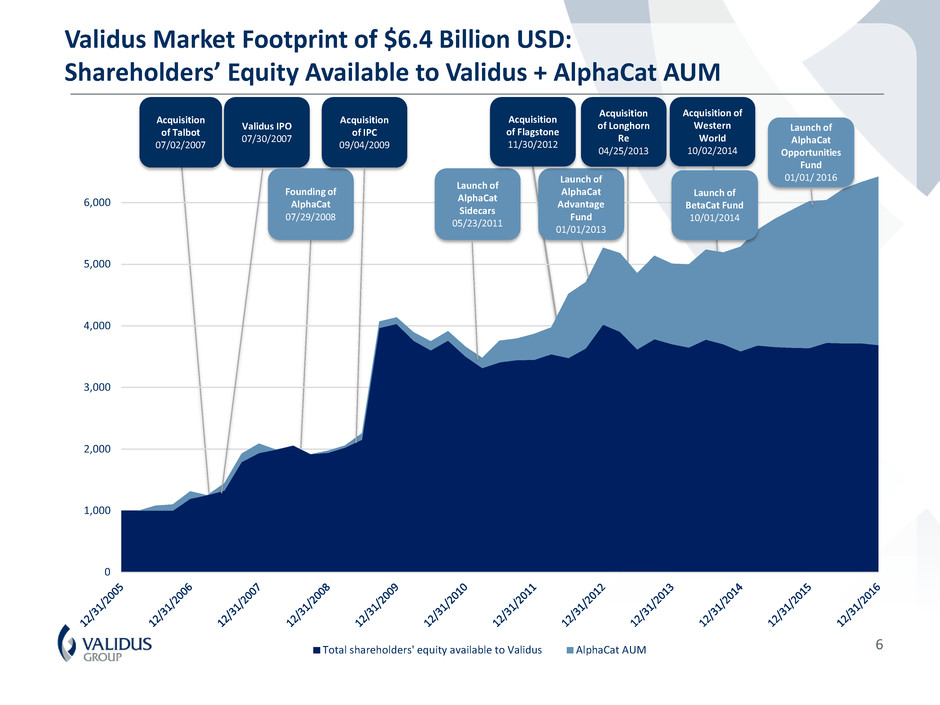

0 1,000 2,000 3,000 4,000 5,000 6,000 Total shareholders' equity available to Validus AlphaCat AUM Validus Market Footprint of $6.4 Billion USD: Shareholders’ Equity Available to Validus + AlphaCat AUM 6 Acquisition of Talbot 07/02/2007 Validus IPO 07/30/2007 Founding of AlphaCat 07/29/2008 Acquisition of IPC 09/04/2009 Launch of AlphaCat Sidecars 05/23/2011 Launch of AlphaCat Advantage Fund 01/01/2013 Acquisition of Longhorn Re 04/25/2013 Launch of AlphaCat Opportunities Fund 01/01/ 2016 Acquisition of Western World 10/02/2014 Acquisition of Flagstone 11/30/2012 Launch of BetaCat Fund 10/01/2014

New York Waterloo Parsippany Hamilton Miami Santiago London Dubai Singapore Boston Sydney Scottsdale Labuan Zurich Atlanta Validus Global Operating Platform 6 Global operations with offices in Bermuda, United States, United Kingdom, Australia, Canada, Chile, Malaysia, Singapore, Switzerland and United Arab Emirates

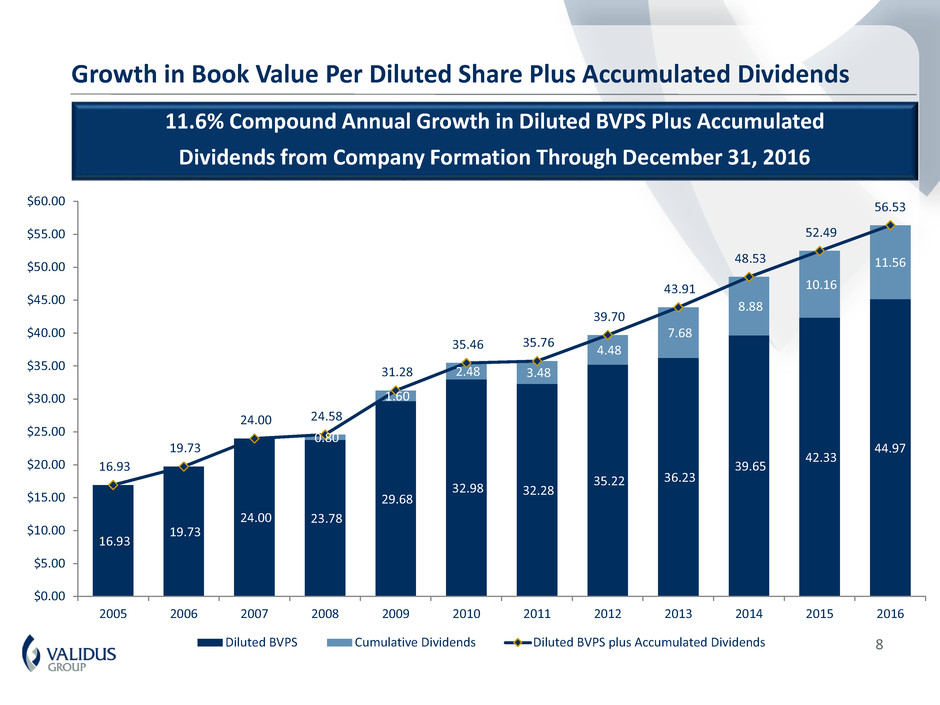

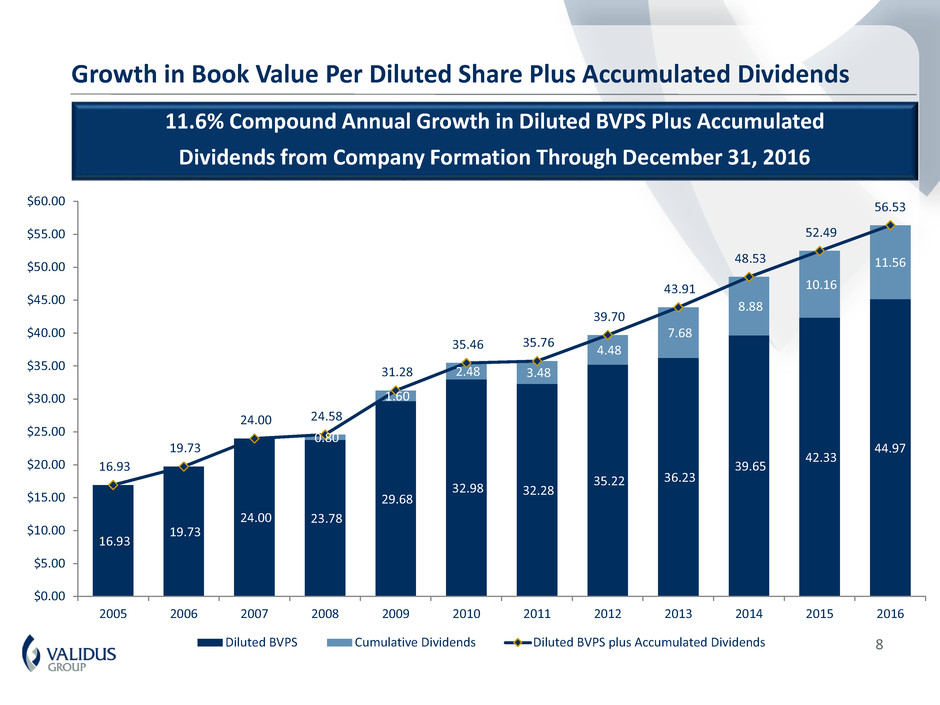

8 11.6% Compound Annual Growth in Diluted BVPS Plus Accumulated Dividends from Company Formation Through December 31, 2016 Growth in Book Value Per Diluted Share Plus Accumulated Dividends 16.93 19.73 24.00 23.78 29.68 32.98 32.28 35.22 36.23 39.65 42.33 44.97 0.80 1.60 2.48 3.48 4.48 7.68 8.88 10.16 11.56 16.93 19.73 24.00 24.58 31.28 35.46 35.76 39.70 43.91 48.53 52.49 56.53 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 $55.00 $60.00 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Diluted BVPS Cumulative Dividends Diluted BVPS plus Accumulated Dividends

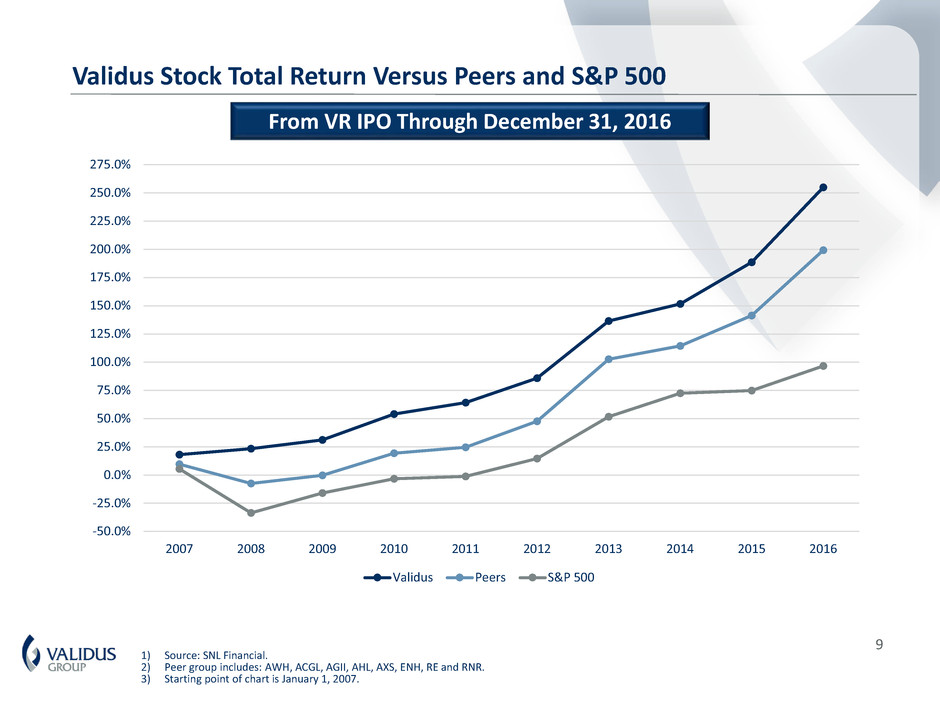

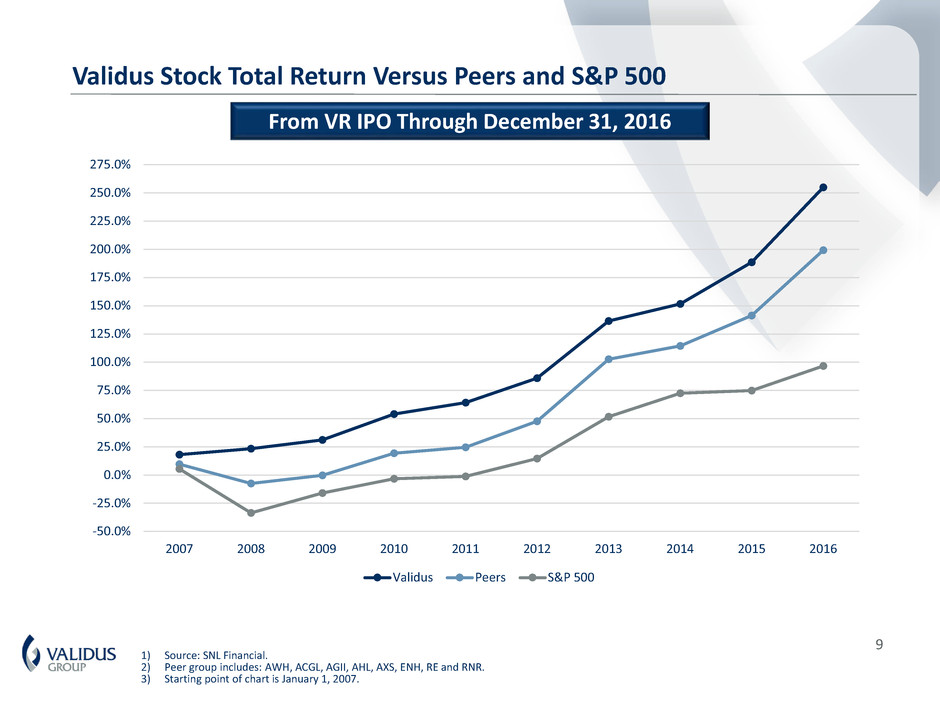

9 1) Source: SNL Financial. 2) Peer group includes: AWH, ACGL, AGII, AHL, AXS, ENH, RE and RNR. 3) Starting point of chart is January 1, 2007. From VR IPO Through December 31, 2016 Validus Stock Total Return Versus Peers and S&P 500 -50.0% -25.0% 0.0% 25.0% 50.0% 75.0% 100.0% 125.0% 150.0% 175.0% 200.0% 225.0% 250.0% 275.0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Validus Peers S&P 500

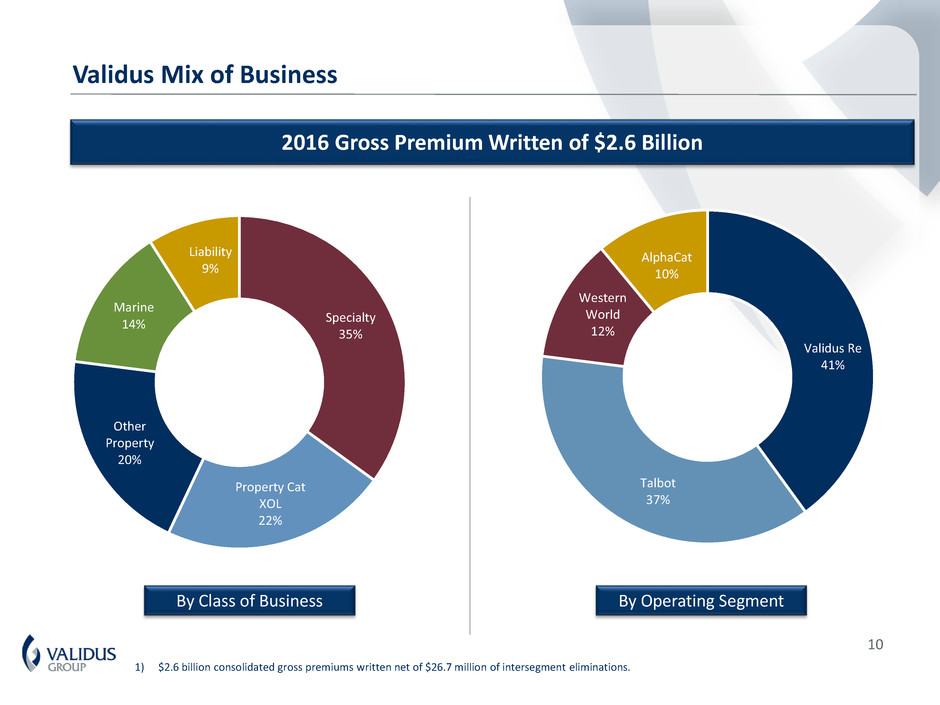

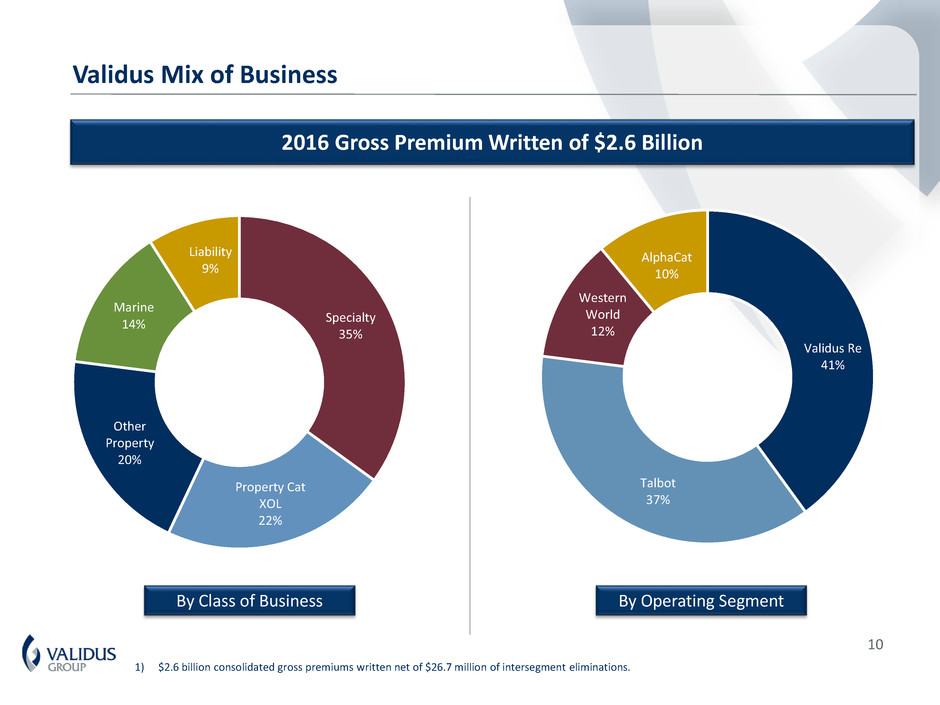

10 2016 Gross Premium Written of $2.6 Billion 1) $2.6 billion consolidated gross premiums written net of $26.7 million of intersegment eliminations. By Operating SegmentBy Class of Business Validus Re 41% Talbot 37% Western World 12% AlphaCat 10% Validus Mix of Business Specialty 35% Property Cat XOL 22% Other Property 20% Marine 14% Liability 9%

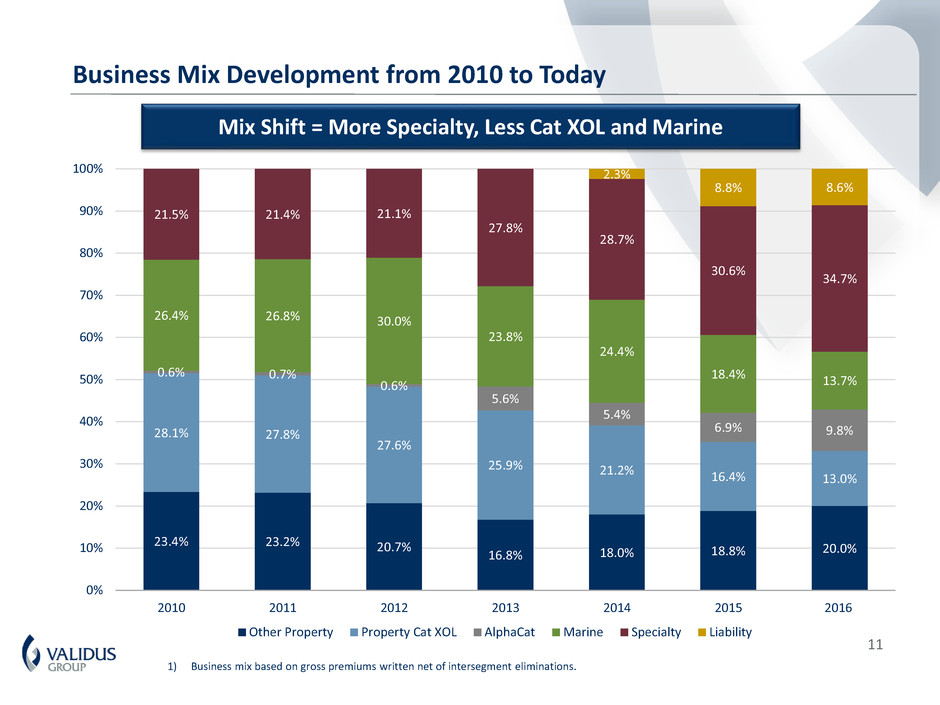

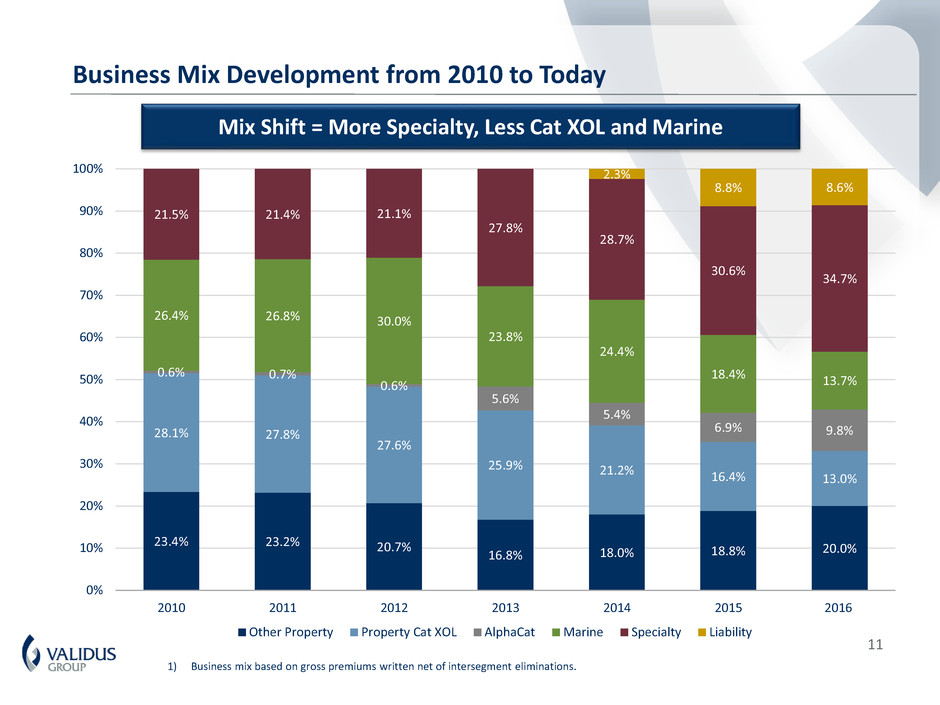

11 Business Mix Development from 2010 to Today 1) Business mix based on gross premiums written net of intersegment eliminations. Mix Shift = More Specialty, Less Cat XOL and Marine 23.4% 23.2% 20.7% 16.8% 18.0% 18.8% 20.0% 28.1% 27.8% 27.6% 25.9% 21.2% 16.4% 13.0% 0.6% 0.7% 0.6% 5.6% 5.4% 6.9% 9.8% 26.4% 26.8% 30.0% 23.8% 24.4% 18.4% 13.7% 21.5% 21.4% 21.1% 27.8% 28.7% 30.6% 34.7% 2.3% 8.8% 8.6% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2010 2011 2012 2013 2014 2015 2016 Other Property Property Cat XOL AlphaCat Marine Specialty Liability

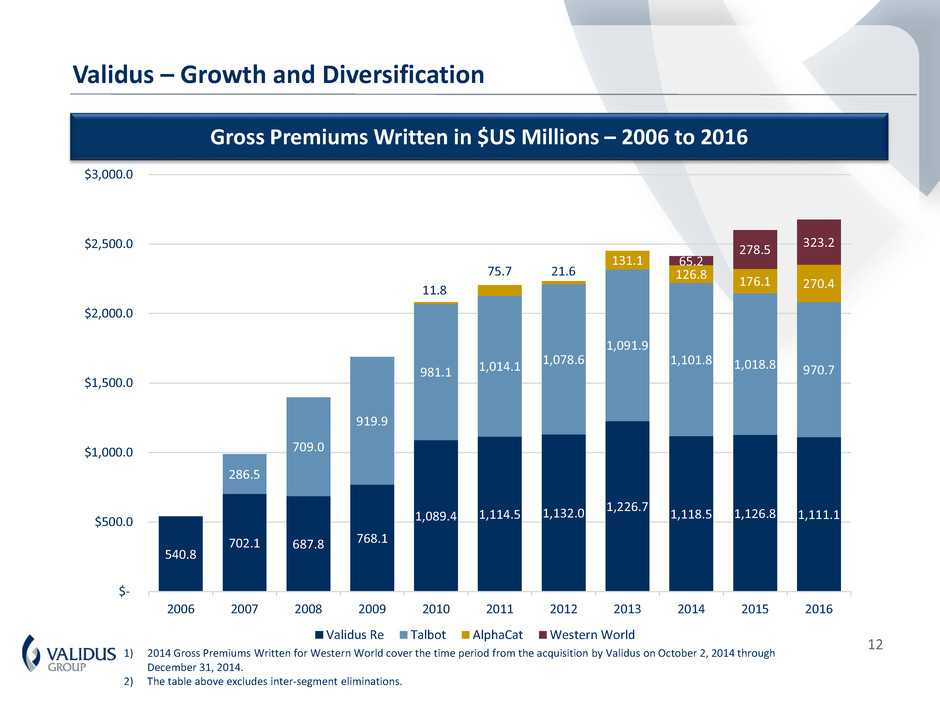

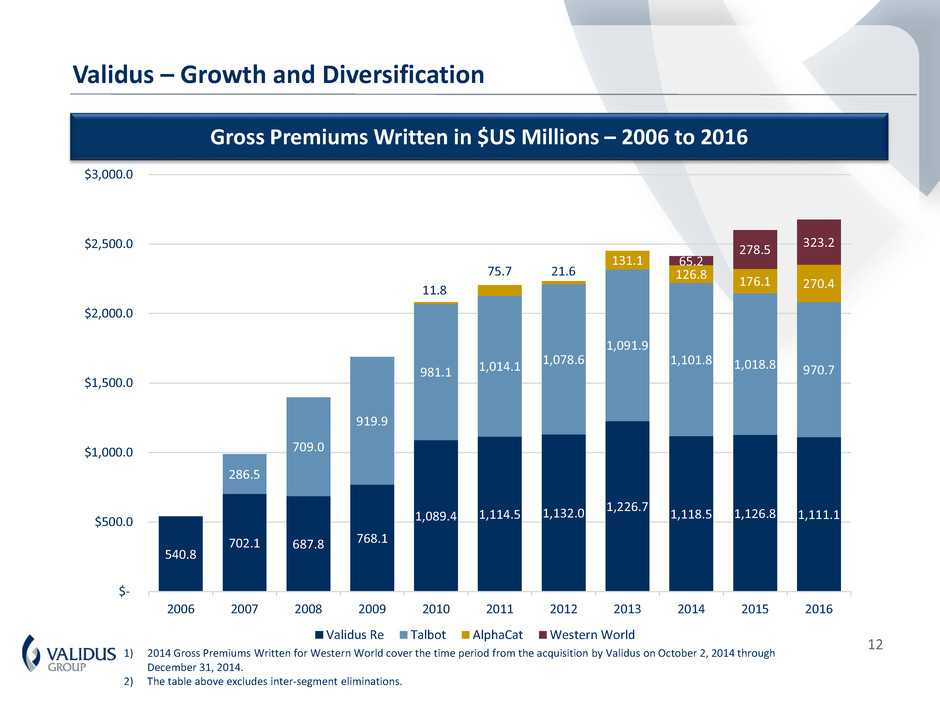

12 Validus – Growth and Diversification Gross Premiums Written in $US Millions – 2006 to 2016 1) 2014 Gross Premiums Written for Western World cover the time period from the acquisition by Validus on October 2, 2014 through December 31, 2014. 2) The table above excludes inter-segment eliminations. 540.8 702.1 687.8 768.1 1,089.4 1,114.5 1,132.0 1,226.7 1,118.5 1,126.8 1,111.1 286.5 709.0 919.9 981.1 1,014.1 1,078.6 1,091.9 1,101.8 1,018.8 970.7 11.8 75.7 21.6 131.1 126.8 176.1 270.4 65.2 278.5 323.2 $- $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 $3,000.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Validus Re Talbot AlphaCat Western World

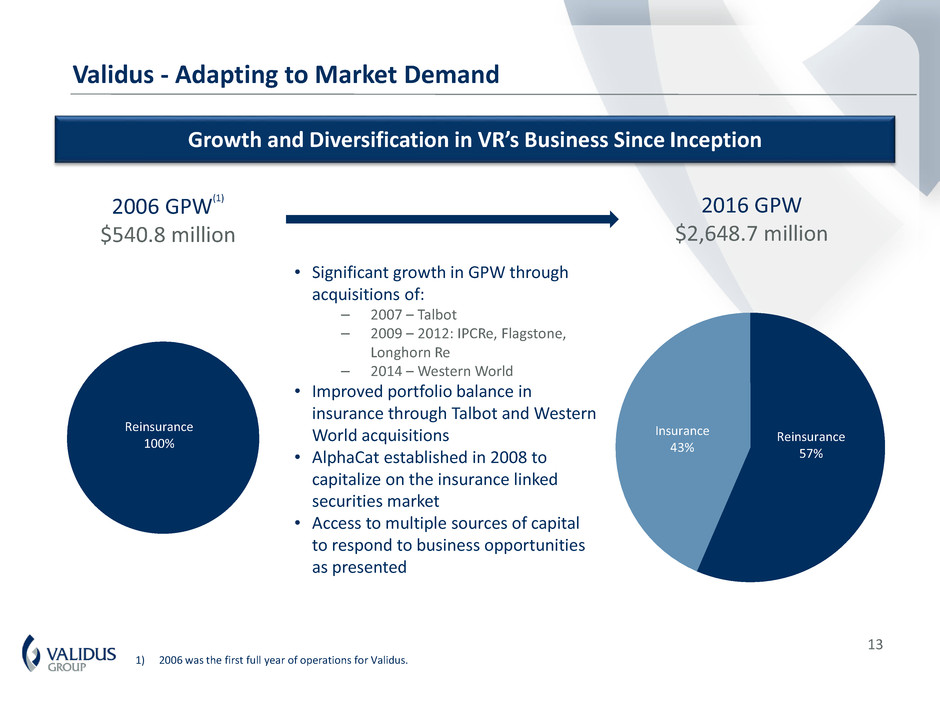

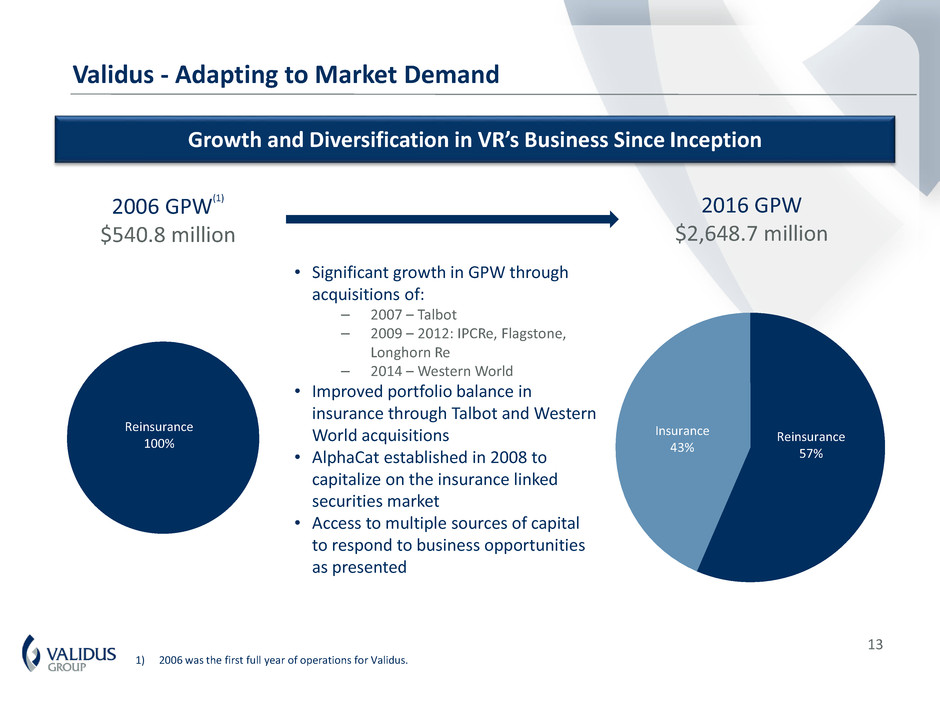

13 Validus - Adapting to Market Demand 1) 2006 was the first full year of operations for Validus. Growth and Diversification in VR’s Business Since Inception Reinsurance 100% 2006 GPW(1) $540.8 million 2016 GPW $2,648.7 million • Significant growth in GPW through acquisitions of: – 2007 – Talbot – 2009 – 2012: IPCRe, Flagstone, Longhorn Re – 2014 – Western World • Improved portfolio balance in insurance through Talbot and Western World acquisitions • AlphaCat established in 2008 to capitalize on the insurance linked securities market • Access to multiple sources of capital to respond to business opportunities as presented Reinsurance 57% Insurance 43%

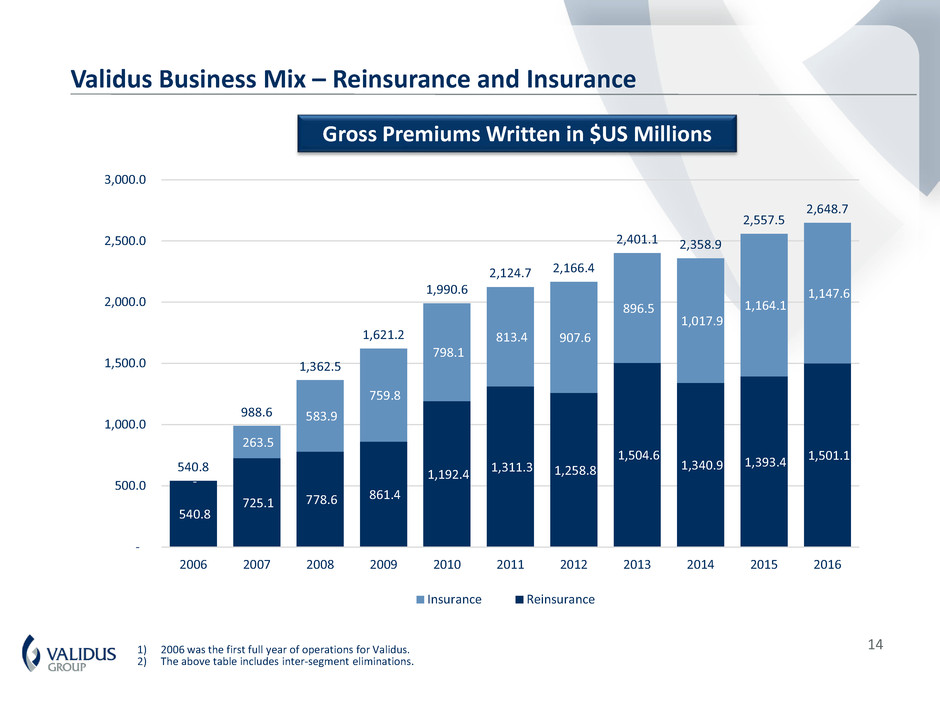

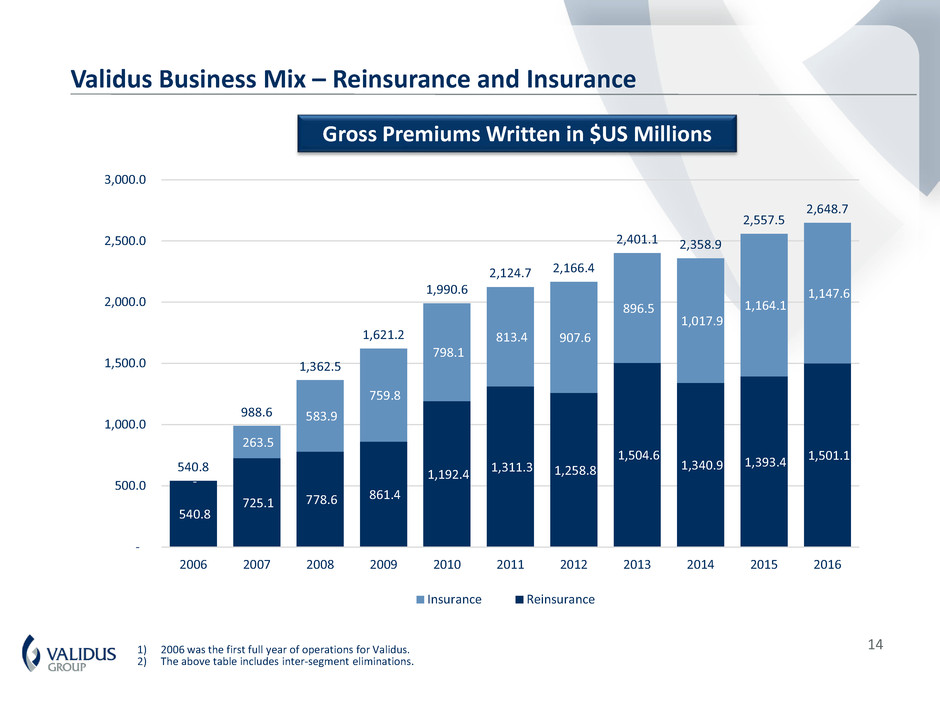

14 Validus Business Mix – Reinsurance and Insurance 1) 2006 was the first full year of operations for Validus. 2) The above table includes inter-segment eliminations. Gross Premiums Written in $US Millions 540.8 725.1 778.6 861.4 1,192.4 1,311.3 1,258.8 1,504.6 1,340.9 1,393.4 1,501.1 - 263.5 583.9 759.8 798.1 813.4 907.6 896.5 1,017.9 1,164.1 1,147.6 540.8 988.6 1,362.5 1,621.2 1,990.6 2,124.7 2,166.4 2,401.1 2,358.9 2,557.5 2,648.7 - 500.0 1,000.0 1,500.0 2,000.0 2,500.0 3,000.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Insurance Reinsurance

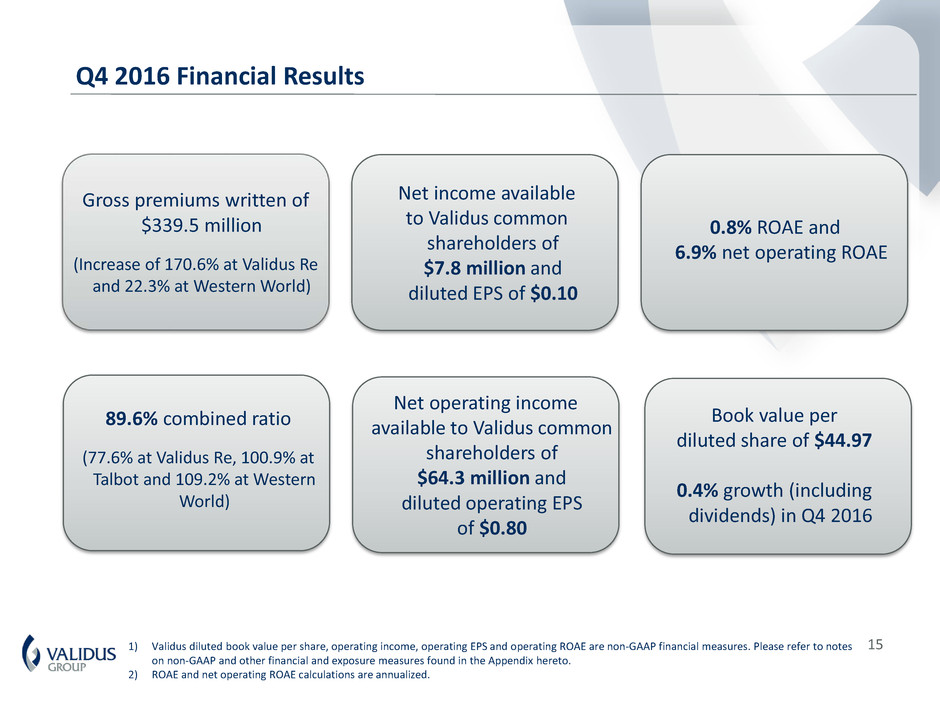

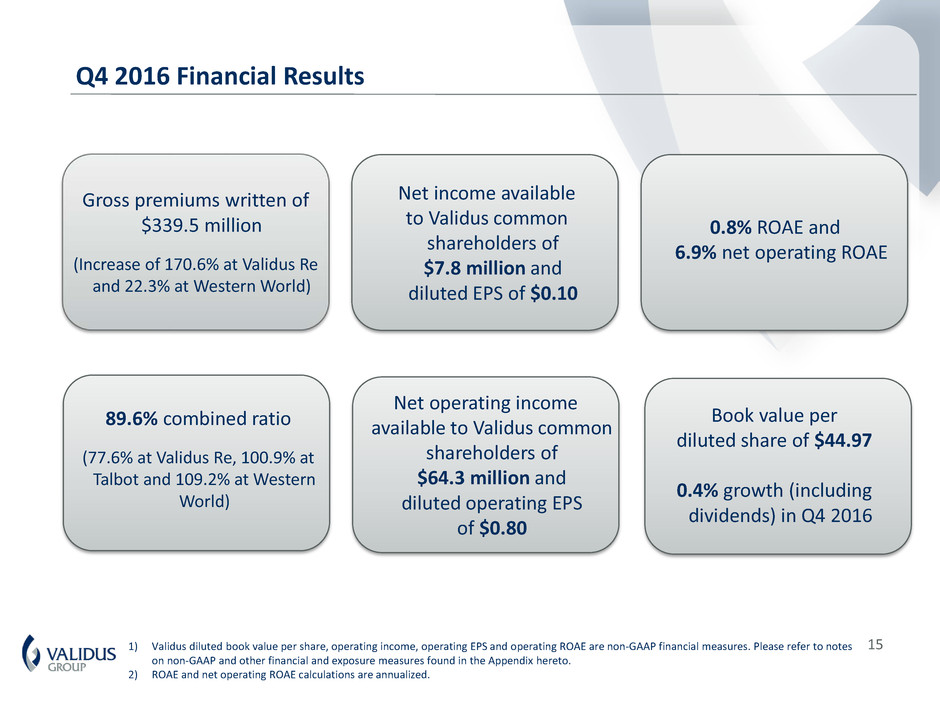

15 Gross premiums written of $339.5 million (Increase of 170.6% at Validus Re and 22.3% at Western World) 0.8% ROAE and 6.9% net operating ROAE 1) Validus diluted book value per share, operating income, operating EPS and operating ROAE are non-GAAP financial measures. Please refer to notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 2) ROAE and net operating ROAE calculations are annualized. 89.6% combined ratio (77.6% at Validus Re, 100.9% at Talbot and 109.2% at Western World) Net income available to Validus common shareholders of $7.8 million and diluted EPS of $0.10 Book value per diluted share of $44.97 0.4% growth (including dividends) in Q4 2016 Q4 2016 Financial Results Net operating income available to Validus common shareholders of $64.3 million and diluted operating EPS of $0.80

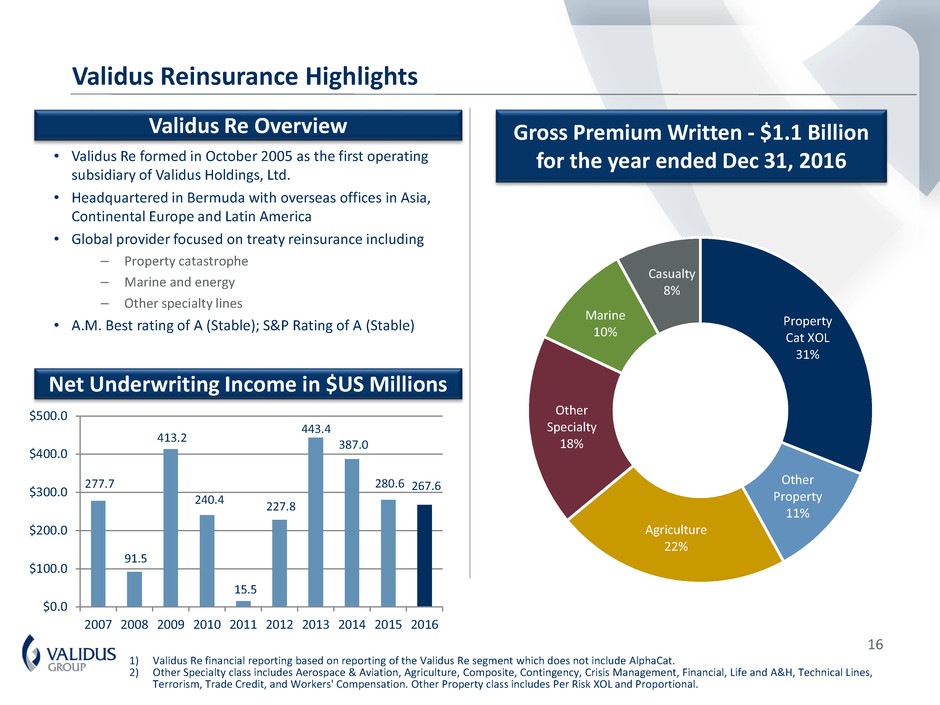

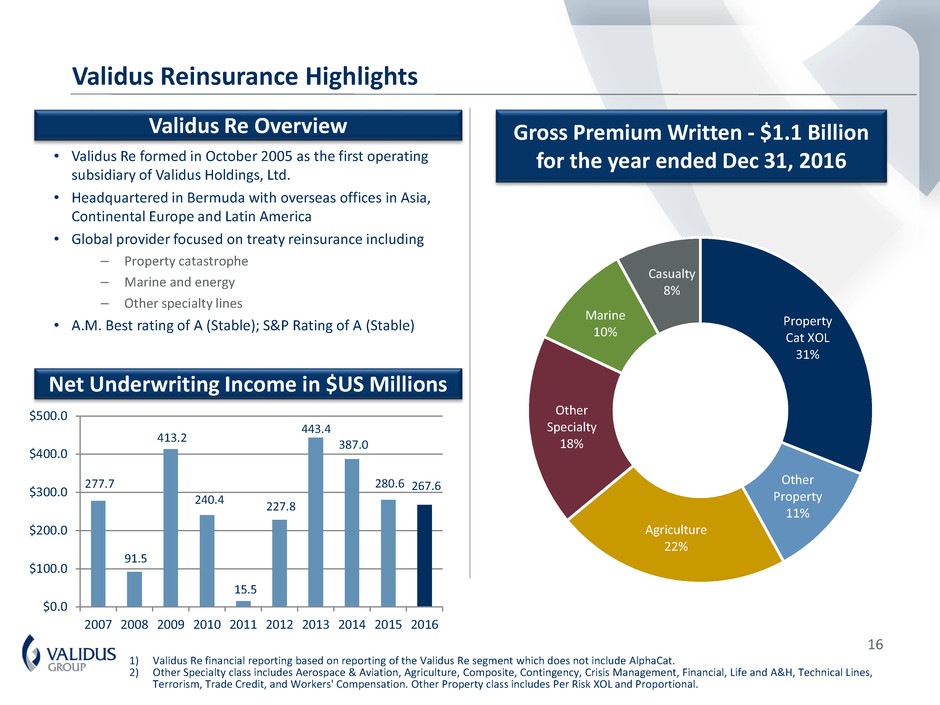

16 Validus Reinsurance Highlights Gross Premium Written - $1.1 Billion for the year ended Dec 31, 2016 Validus Re Overview 1) Validus Re financial reporting based on reporting of the Validus Re segment which does not include AlphaCat. 2) Other Specialty class includes Aerospace & Aviation, Agriculture, Composite, Contingency, Crisis Management, Financial, Life and A&H, Technical Lines, Terrorism, Trade Credit, and Workers' Compensation. Other Property class includes Per Risk XOL and Proportional. Net Underwriting Income in $US Millions • Validus Re formed in October 2005 as the first operating subsidiary of Validus Holdings, Ltd. • Headquartered in Bermuda with overseas offices in Asia, Continental Europe and Latin America • Global provider focused on treaty reinsurance including – Property catastrophe – Marine and energy – Other specialty lines • A.M. Best rating of A (Stable); S&P Rating of A (Stable) 277.7 91.5 413.2 240.4 15.5 227.8 443.4 387.0 280.6 267.6 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Property Cat XOL 31% Other Property 11% Agriculture 22% Other Specialty 18% Marine 10% Casualty 8%

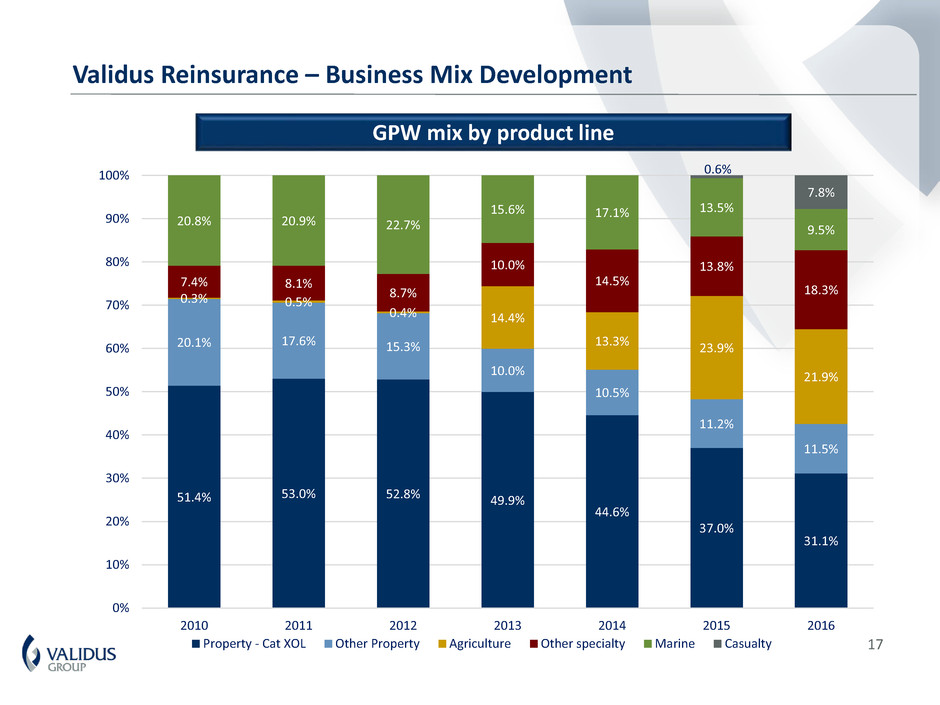

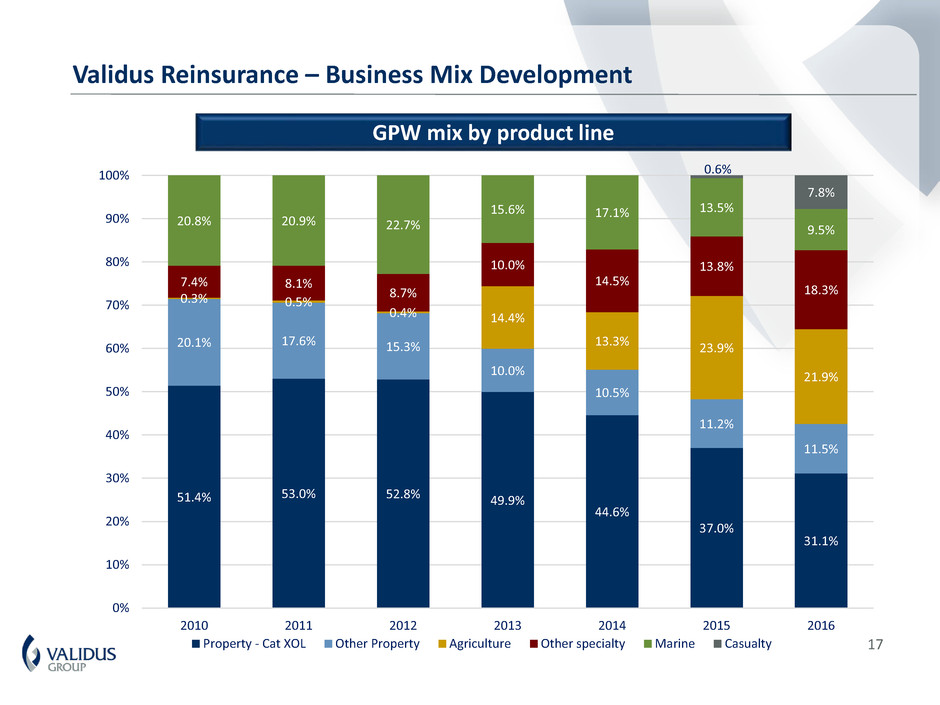

17 Validus Reinsurance – Business Mix Development GPW mix by product line 51.4% 53.0% 52.8% 49.9% 44.6% 37.0% 31.1% 20.1% 17.6% 15.3% 10.0% 10.5% 11.2% 11.5% 0.3% 0.5% 0.4% 14.4% 13.3% 23.9% 21.9% 7.4% 8.1% 8.7% 10.0% 14.5% 13.8% 18.3% 20.8% 20.9% 22.7% 15.6% 17.1% 13.5% 9.5% 0.6% 7.8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2010 2011 2012 2013 2014 2015 2016 Property - Cat XOL Other Property Agriculture Other specialty Marine Casualty

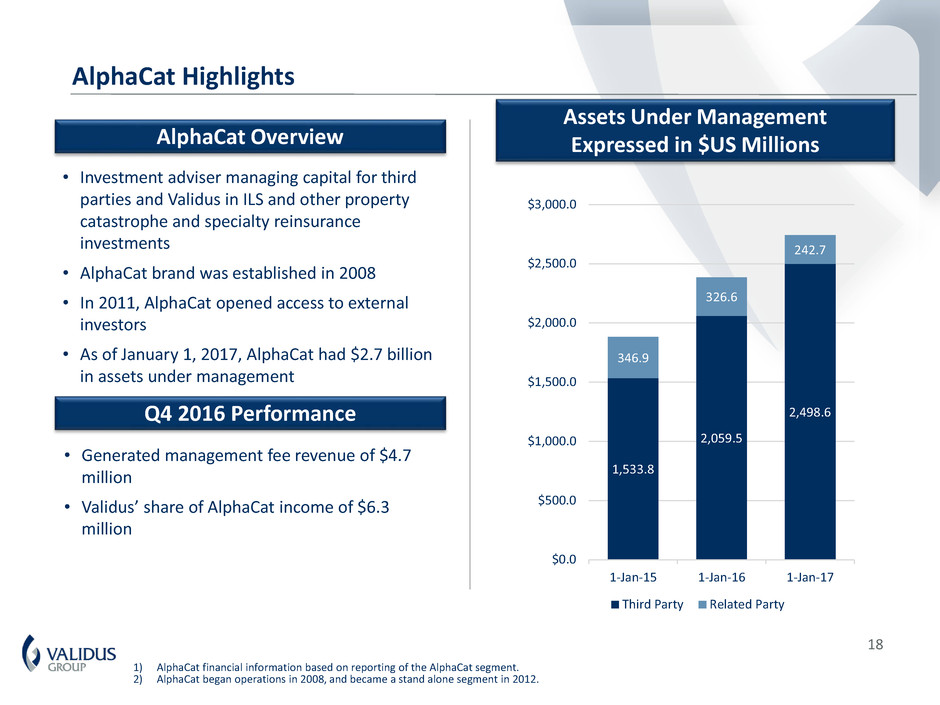

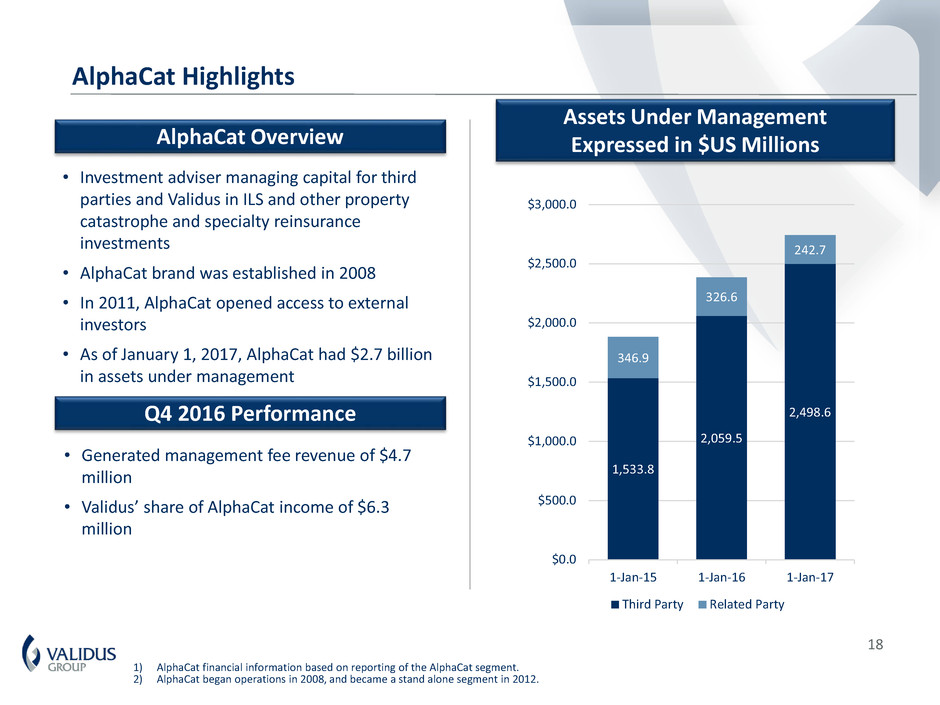

18 AlphaCat Highlights AlphaCat Overview Assets Under Management Expressed in $US Millions 1) AlphaCat financial information based on reporting of the AlphaCat segment. 2) AlphaCat began operations in 2008, and became a stand alone segment in 2012. Q4 2016 Performance • Generated management fee revenue of $4.7 million • Validus’ share of AlphaCat income of $6.3 million • Investment adviser managing capital for third parties and Validus in ILS and other property catastrophe and specialty reinsurance investments • AlphaCat brand was established in 2008 • In 2011, AlphaCat opened access to external investors • As of January 1, 2017, AlphaCat had $2.7 billion in assets under management 1,533.8 2,059.5 2,498.6 346.9 326.6 242.7 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 $3,000.0 1-Jan-15 1-Jan-16 1-Jan-17 Third Party Related Party

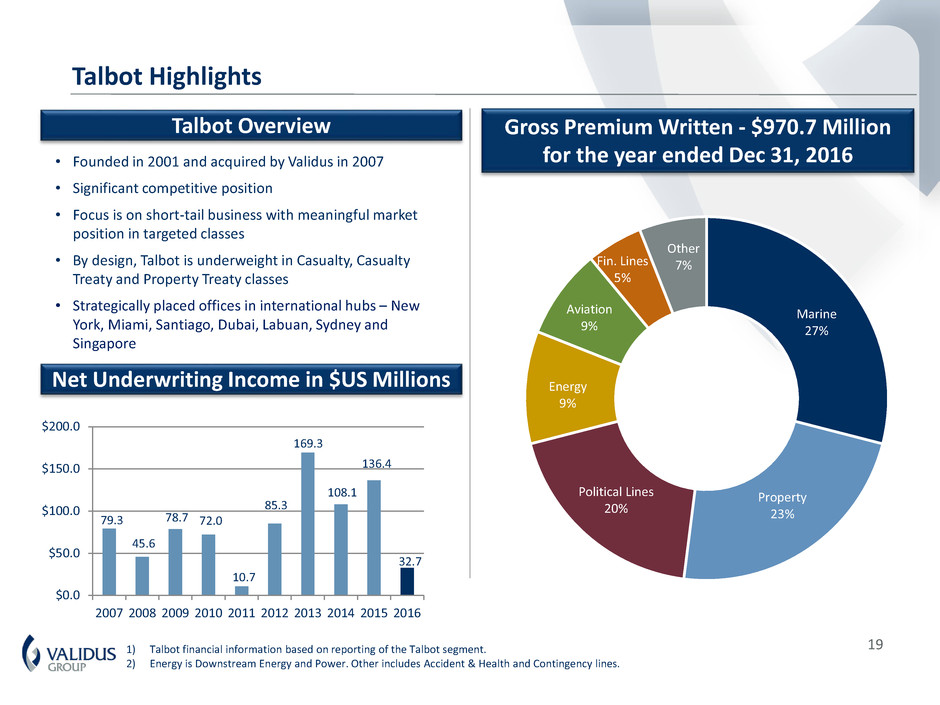

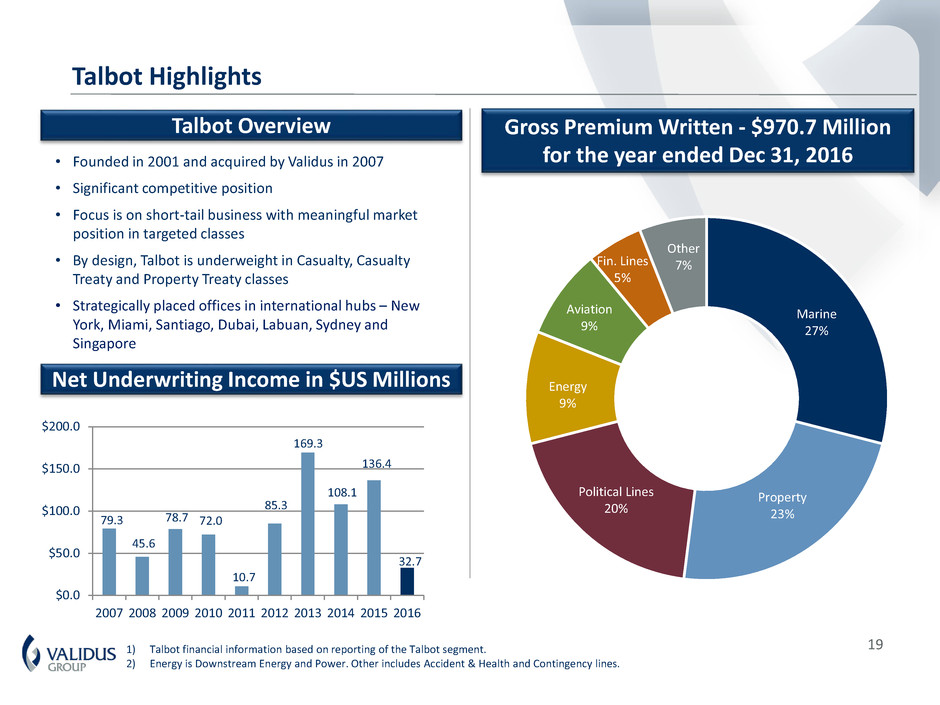

19 Talbot Highlights Gross Premium Written - $970.7 Million for the year ended Dec 31, 2016 Talbot Overview Net Underwriting Income in $US Millions • Founded in 2001 and acquired by Validus in 2007 • Significant competitive position • Focus is on short-tail business with meaningful market position in targeted classes • By design, Talbot is underweight in Casualty, Casualty Treaty and Property Treaty classes • Strategically placed offices in international hubs – New York, Miami, Santiago, Dubai, Labuan, Sydney and Singapore 1) Talbot financial information based on reporting of the Talbot segment. 2) Energy is Downstream Energy and Power. Other includes Accident & Health and Contingency lines. Marine 27% Property 23% Political Lines 20% Energy 9% Aviation 9% Fin. Lines 5% Other 7% 79.3 45.6 78.7 72.0 10.7 85.3 169.3 108.1 136.4 32.7 $0.0 $50.0 $100.0 $150.0 $200.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

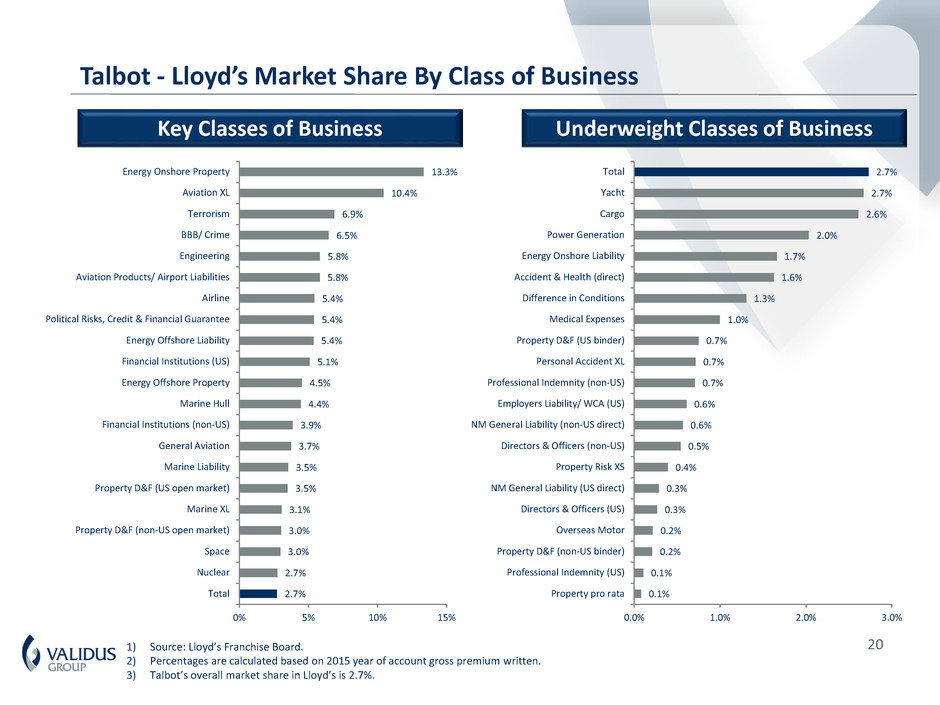

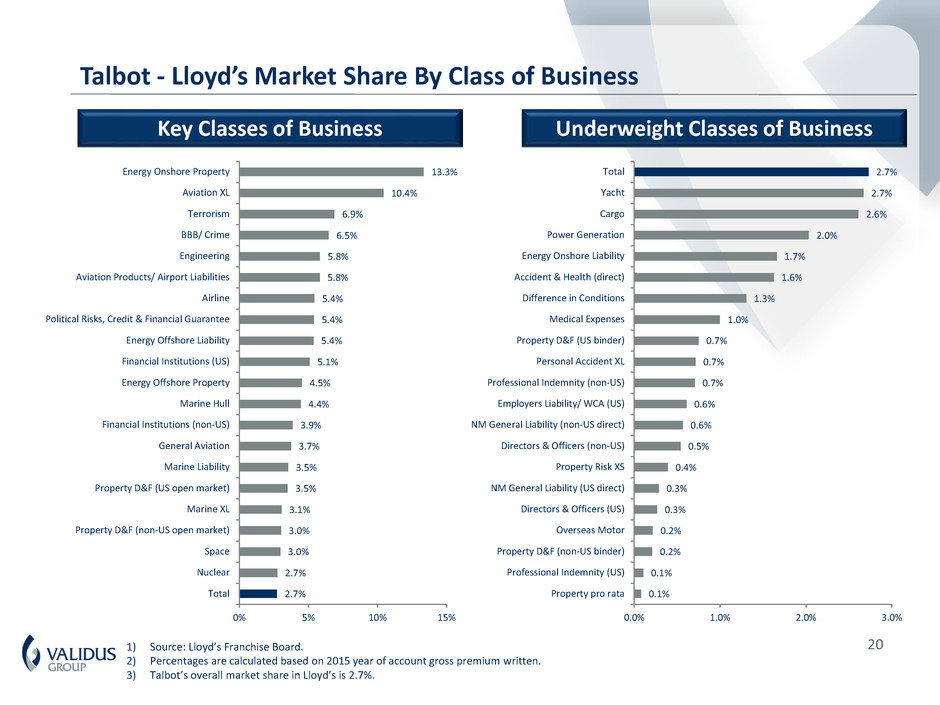

20 Talbot - Lloyd’s Market Share By Class of Business 1) Source: Lloyd’s Franchise Board. 2) Percentages are calculated based on 2015 year of account gross premium written. 3) Talbot’s overall market share in Lloyd’s is 2.7%. Key Classes of Business Underweight Classes of Business 2.7% 2.7% 3.0% 3.0% 3.1% 3.5% 3.5% 3.7% 3.9% 4.4% 4.5% 5.1% 5.4% 5.4% 5.4% 5.8% 5.8% 6.5% 6.9% 10.4% 13.3% 0% 5% 10% 15% Total Nuclear Space Property D&F (non-US open market) Marine XL Property D&F (US open market) Marine Liability General Aviation Financial Institutions (non-US) Marine Hull Energy Offshore Property Financial Institutions (US) Energy Offshore Liability Political Risks, Credit & Financial Guarantee Airline Aviation Products/ Airport Liabilities Engineering BBB/ Crime Terrorism Aviation XL Energy Onshore Property 0.1% 0.1% 0.2% 0.2% 0.3% 0.3% 0.4% 0.5% 0.6% 0.6% 0.7% 0.7% 0.7% 1.0% 1.3% 1.6% 1.7% 2.0% 2.6% 2.7% 2.7% 0.0% 1.0% 2.0% 3.0% Property pro rata Professional Indemnity (US) Property D&F (non-US binder) Overseas Motor Directors & Officers (US) NM General Liability (US direct) Property Risk XS Directors & Officers (non-US) NM General Liability (non-US direct) Employers Liability/ WCA (US) Professional Indemnity (non-US) Personal Accident XL Property D&F (US binder) Medical Expenses Difference in Conditions Accident & Health (direct) Energy Onshore Liability Power Generation Cargo Yacht Total

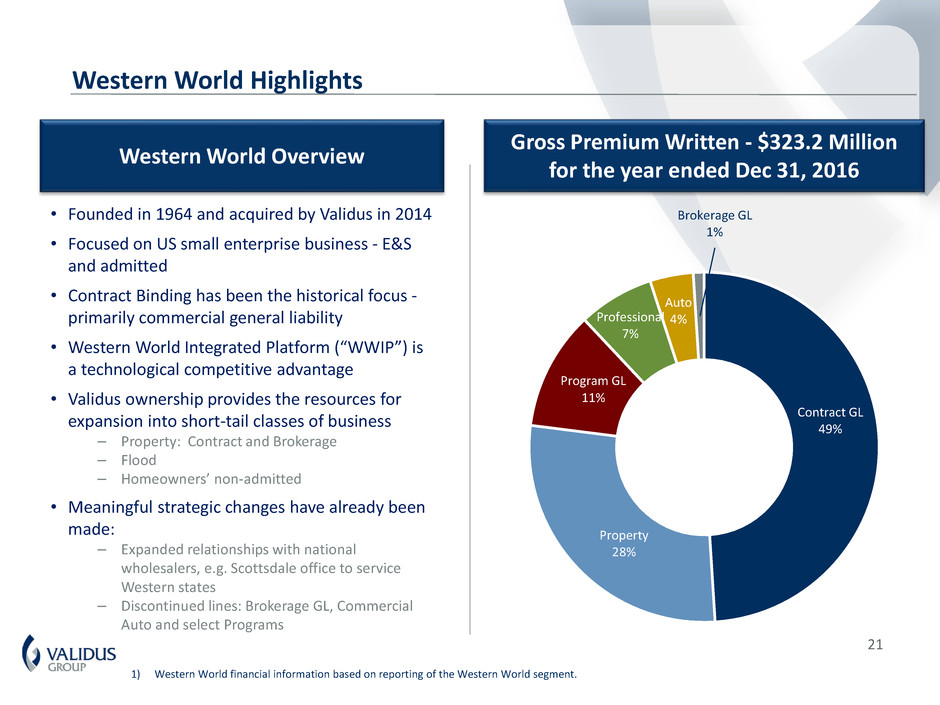

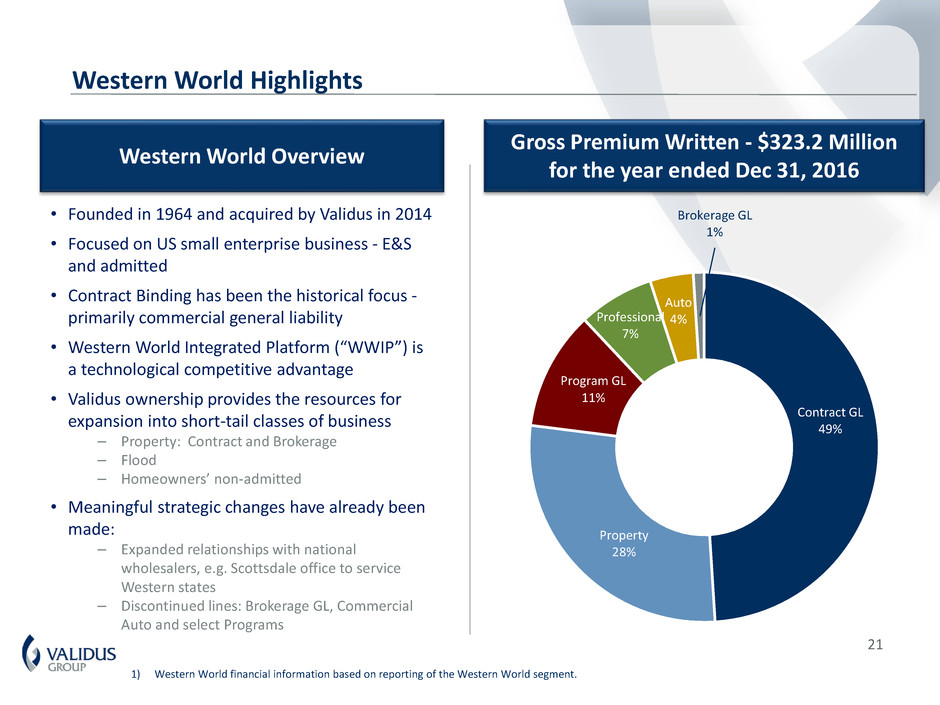

21 Western World Highlights Gross Premium Written - $323.2 Million for the year ended Dec 31, 2016 Western World Overview 1) Western World financial information based on reporting of the Western World segment. • Founded in 1964 and acquired by Validus in 2014 • Focused on US small enterprise business - E&S and admitted • Contract Binding has been the historical focus - primarily commercial general liability • Western World Integrated Platform (“WWIP”) is a technological competitive advantage • Validus ownership provides the resources for expansion into short-tail classes of business – Property: Contract and Brokerage – Flood – Homeowners’ non-admitted • Meaningful strategic changes have already been made: – Expanded relationships with national wholesalers, e.g. Scottsdale office to service Western states – Discontinued lines: Brokerage GL, Commercial Auto and select Programs Contract GL 49% Property 28% Program GL 11% Professional 7% Auto 4% Brokerage GL 1%

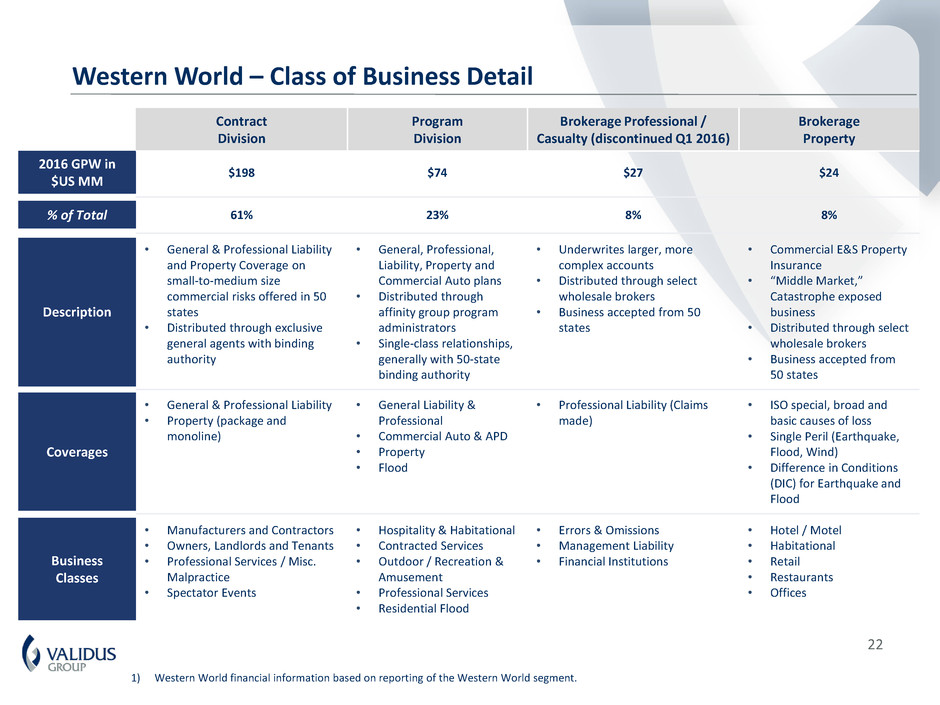

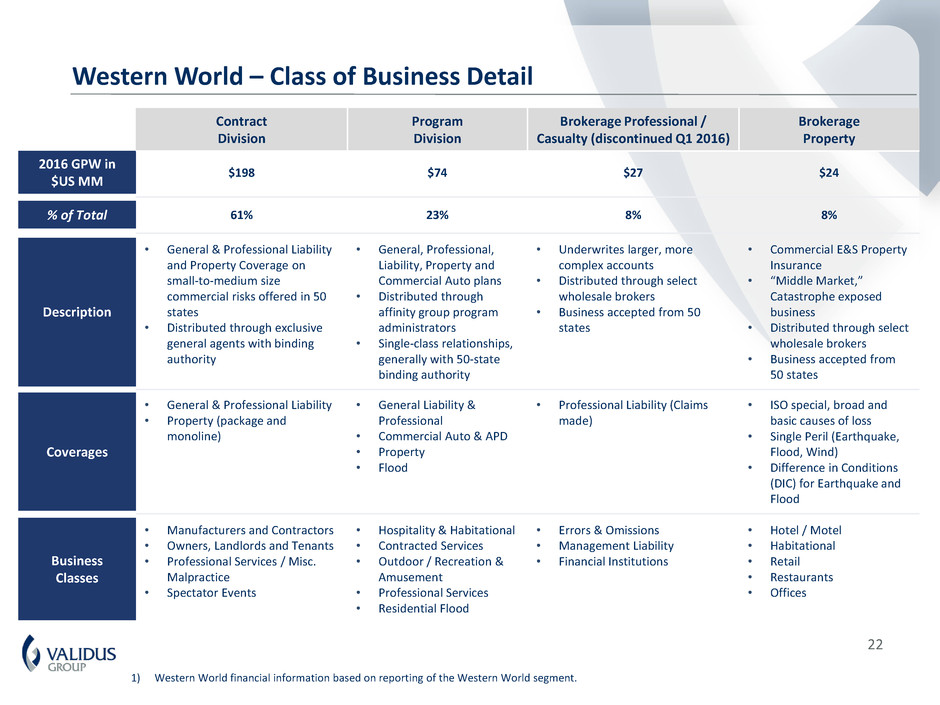

22 Western World – Class of Business Detail 1) Western World financial information based on reporting of the Western World segment. Contract Division Program Division Brokerage Professional / Casualty (discontinued Q1 2016) Brokerage Property 2016 GPW in $US MM $198 $74 $27 $24 % of Total 61% 23% 8% 8% Description • General & Professional Liability and Property Coverage on small-to-medium size commercial risks offered in 50 states • Distributed through exclusive general agents with binding authority • General, Professional, Liability, Property and Commercial Auto plans • Distributed through affinity group program administrators • Single-class relationships, generally with 50-state binding authority • Underwrites larger, more complex accounts • Distributed through select wholesale brokers • Business accepted from 50 states • Commercial E&S Property Insurance • “Middle Market,” Catastrophe exposed business • Distributed through select wholesale brokers • Business accepted from 50 states Coverages • General & Professional Liability • Property (package and monoline) • General Liability & Professional • Commercial Auto & APD • Property • Flood • Professional Liability (Claims made) • ISO special, broad and basic causes of loss • Single Peril (Earthquake, Flood, Wind) • Difference in Conditions (DIC) for Earthquake and Flood Business Classes • Manufacturers and Contractors • Owners, Landlords and Tenants • Professional Services / Misc. Malpractice • Spectator Events • Hospitality & Habitational • Contracted Services • Outdoor / Recreation & Amusement • Professional Services • Residential Flood • Errors & Omissions • Management Liability • Financial Institutions • Hotel / Motel • Habitational • Retail • Restaurants • Offices

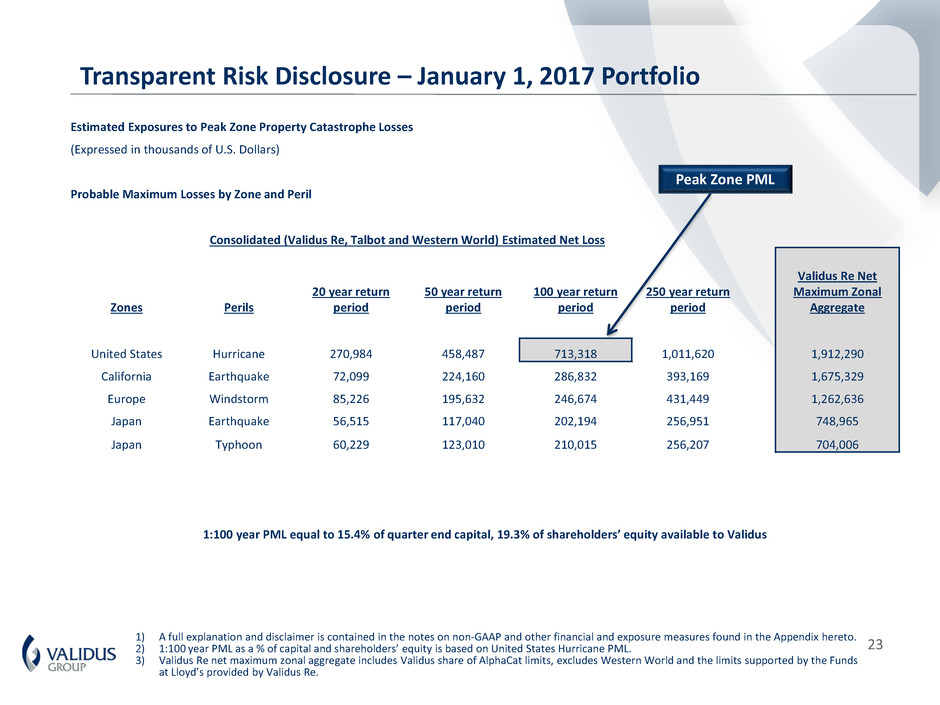

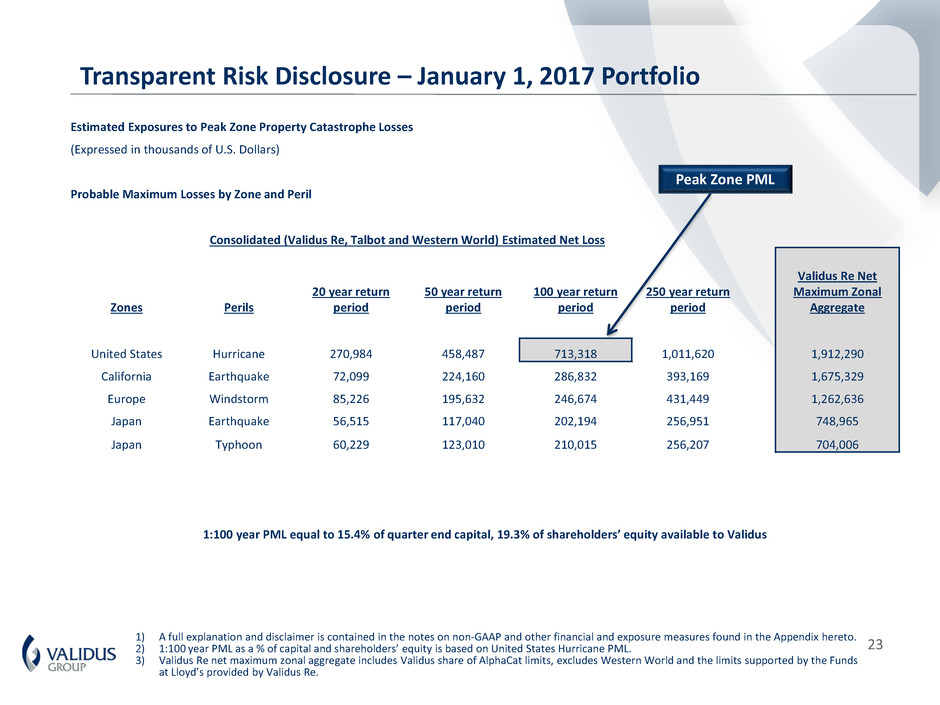

231) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto.2) 1:100 year PML as a % of capital and shareholders’ equity is based on United States Hurricane PML. 3) Validus Re net maximum zonal aggregate includes Validus share of AlphaCat limits, excludes Western World and the limits supported by the Funds at Lloyd’s provided by Validus Re. Transparent Risk Disclosure – January 1, 2017 Portfolio Peak Zone PML Estimated Exposures to Peak Zone Property Catastrophe Losses (Expressed in thousands of U.S. Dollars) Probable Maximum Losses by Zone and Peril Consolidated (Validus Re, Talbot and Western World) Estimated Net Loss Zones Perils 20 year return period 50 year return period 100 year return period 250 year return period Validus Re Net Maximum Zonal Aggregate United States Hurricane 270,984 458,487 713,318 1,011,620 1,912,290 California Earthquake 72,099 224,160 286,832 393,169 1,675,329 Europe Windstorm 85,226 195,632 246,674 431,449 1,262,636 Japan Earthquake 56,515 117,040 202,194 256,951 748,965 Japan Typhoon 60,229 123,010 210,015 256,207 704,006 1:100 year PML equal to 15.4% of quarter end capital, 19.3% of shareholders’ equity available to Validus

24 Net Probable Maximum Loss (1:100) by Zone and Peril Compared to Total Capitalization Substantial Capital Margin Above Risk Appetites 1) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 2) Consolidated (Validus Re, Talbot and Western World) estimated net loss 1:100 year PML as a % of total capitalization and shareholder’s equity available to common shareholders. 3) Total capitalization equals total shareholder's equity less noncontrolling interests plus Senior Notes and Junior Subordinated Deferrable Debentures. 4) All data points are as at January 1st. 1:100 PML Internal Risk Appetite 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2012 2013 2014 2015 2016 2017 United States Hurricane California Earthquake Europe Windstorm Japan Earthquake Japan Typhoon

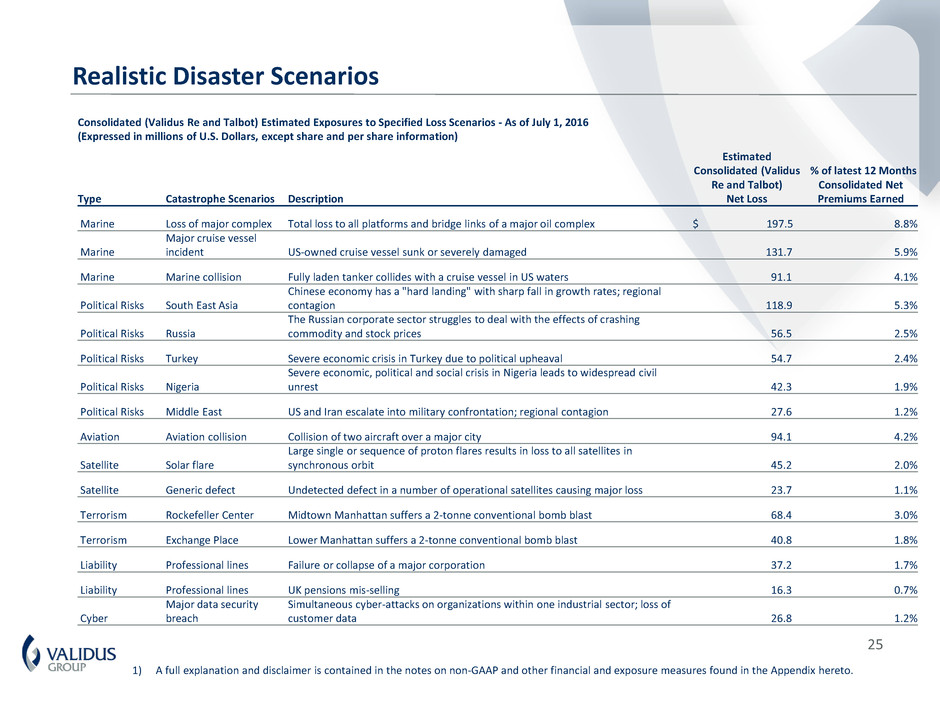

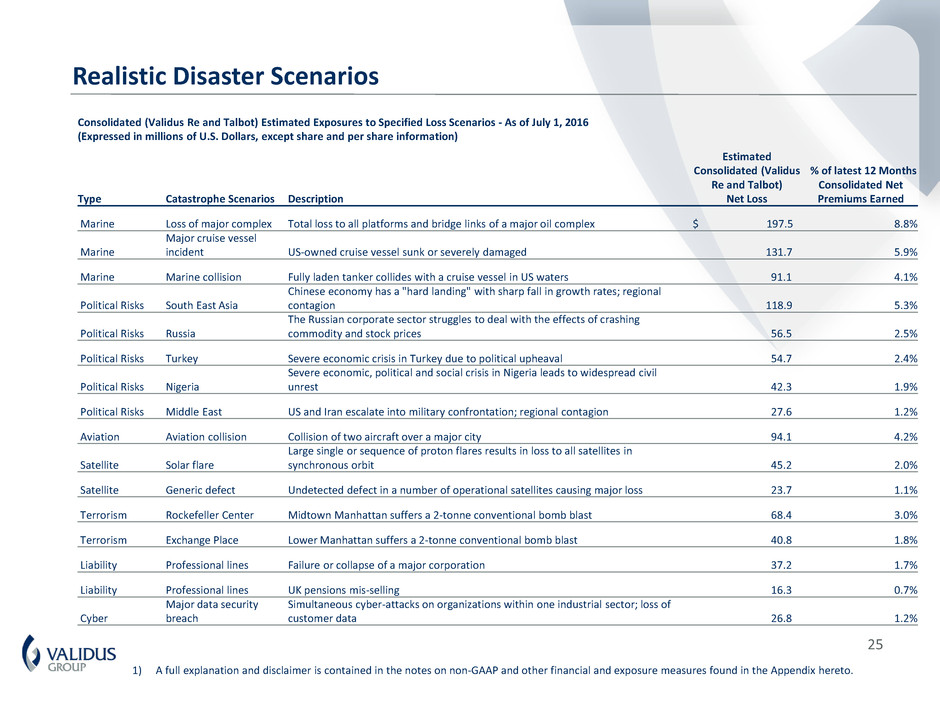

25 1) A full explanation and disclaimer is contained in the notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. Realistic Disaster Scenarios Consolidated (Validus Re and Talbot) Estimated Exposures to Specified Loss Scenarios - As of July 1, 2016 (Expressed in millions of U.S. Dollars, except share and per share information) Type Catastrophe Scenarios Description Estimated Consolidated (Validus Re and Talbot) Net Loss % of latest 12 Months Consolidated Net Premiums Earned Marine Loss of major complex Total loss to all platforms and bridge links of a major oil complex $ 197.5 8.8% Marine Major cruise vessel incident US-owned cruise vessel sunk or severely damaged 131.7 5.9% Marine Marine collision Fully laden tanker collides with a cruise vessel in US waters 91.1 4.1% Political Risks South East Asia Chinese economy has a "hard landing" with sharp fall in growth rates; regional contagion 118.9 5.3% Political Risks Russia The Russian corporate sector struggles to deal with the effects of crashing commodity and stock prices 56.5 2.5% Political Risks Turkey Severe economic crisis in Turkey due to political upheaval 54.7 2.4% Political Risks Nigeria Severe economic, political and social crisis in Nigeria leads to widespread civil unrest 42.3 1.9% Political Risks Middle East US and Iran escalate into military confrontation; regional contagion 27.6 1.2% Aviation Aviation collision Collision of two aircraft over a major city 94.1 4.2% Satellite Solar flare Large single or sequence of proton flares results in loss to all satellites in synchronous orbit 45.2 2.0% Satellite Generic defect Undetected defect in a number of operational satellites causing major loss 23.7 1.1% Terrorism Rockefeller Center Midtown Manhattan suffers a 2-tonne conventional bomb blast 68.4 3.0% Terrorism Exchange Place Lower Manhattan suffers a 2-tonne conventional bomb blast 40.8 1.8% Liability Professional lines Failure or collapse of a major corporation 37.2 1.7% Liability Professional lines UK pensions mis-selling 16.3 0.7% Cyber Major data security breach Simultaneous cyber-attacks on organizations within one industrial sector; loss of customer data 26.8 1.2%

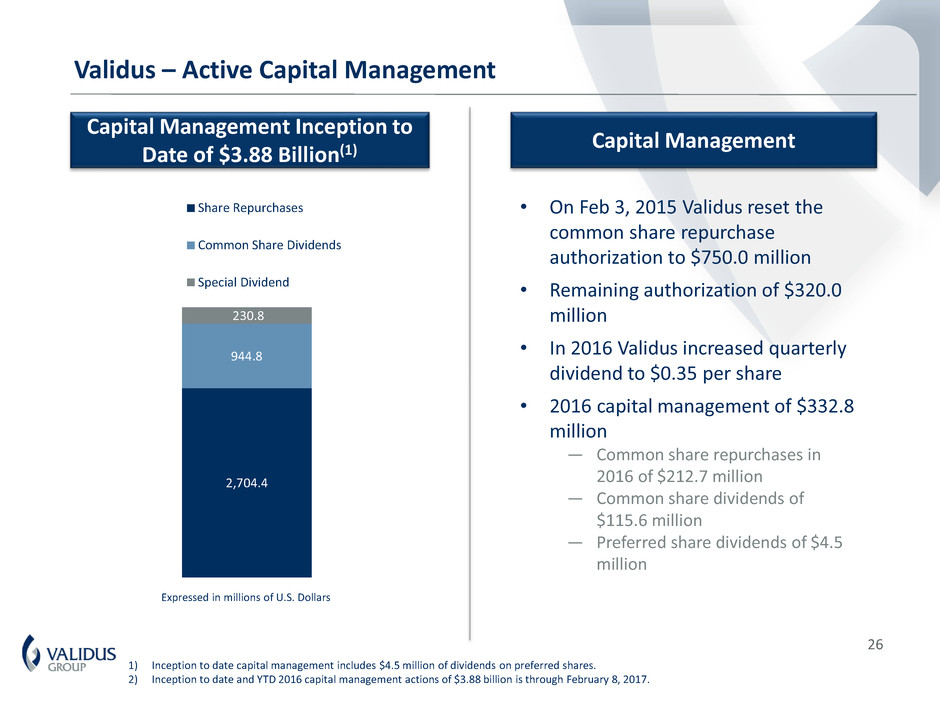

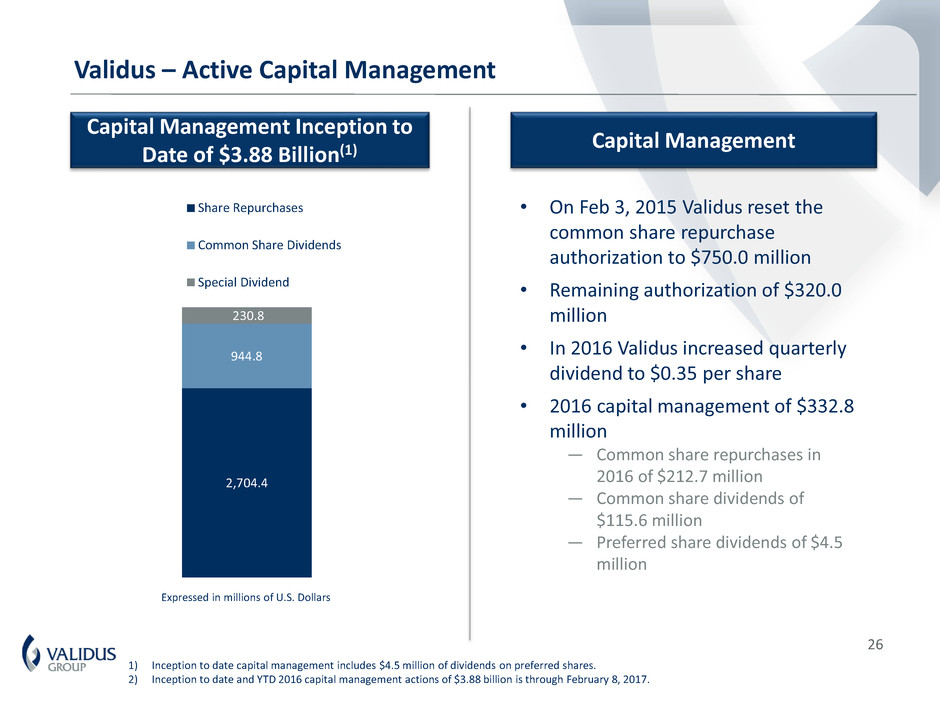

26 Validus – Active Capital Management Expressed in millions of U.S. Dollars 1) Inception to date capital management includes $4.5 million of dividends on preferred shares. 2) Inception to date and YTD 2016 capital management actions of $3.88 billion is through February 8, 2017. Capital Management Inception to Date of $3.88 Billion(1) • On Feb 3, 2015 Validus reset the common share repurchase authorization to $750.0 million • Remaining authorization of $320.0 million • In 2016 Validus increased quarterly dividend to $0.35 per share • 2016 capital management of $332.8 million ― Common share repurchases in 2016 of $212.7 million ― Common share dividends of $115.6 million ― Preferred share dividends of $4.5 million Capital Management 2,704.4 944.8 230.8 Share Repurchases Common Share Dividends Special Dividend

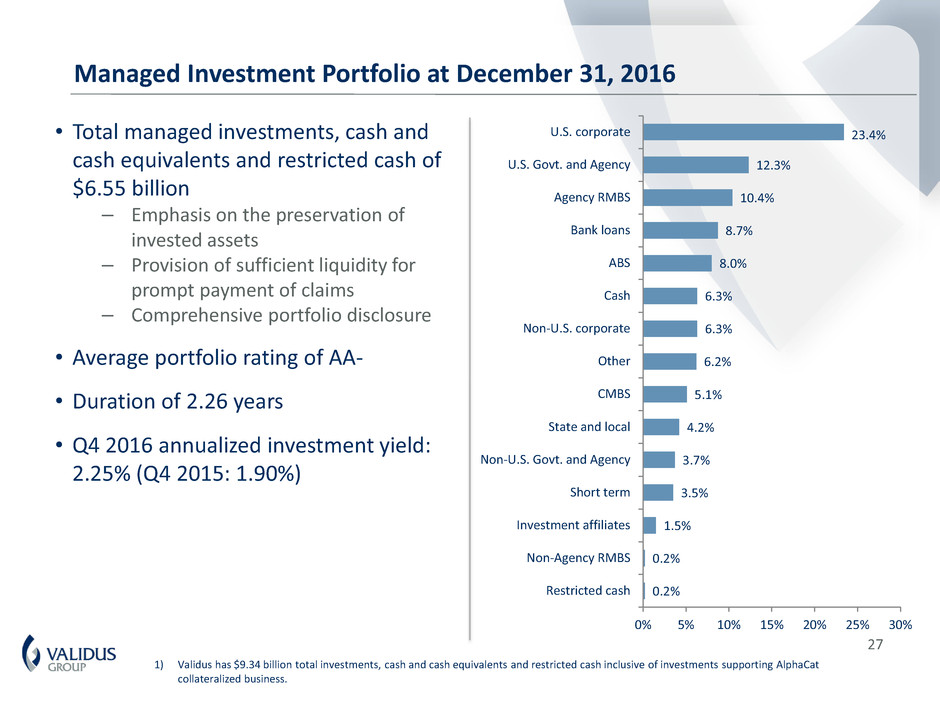

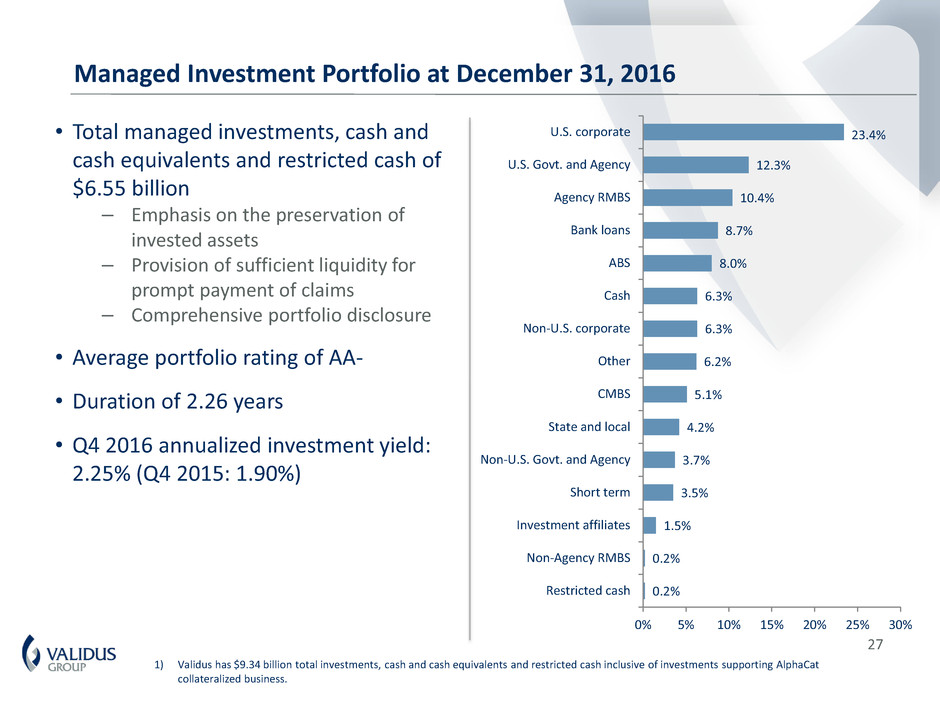

27 Managed Investment Portfolio at December 31, 2016 • Total managed investments, cash and cash equivalents and restricted cash of $6.55 billion – Emphasis on the preservation of invested assets – Provision of sufficient liquidity for prompt payment of claims – Comprehensive portfolio disclosure • Average portfolio rating of AA- • Duration of 2.26 years • Q4 2016 annualized investment yield: 2.25% (Q4 2015: 1.90%) 1) Validus has $9.34 billion total investments, cash and cash equivalents and restricted cash inclusive of investments supporting AlphaCat collateralized business. 23.4% 12.3% 10.4% 8.7% 8.0% 6.3% 6.3% 6.2% 5.1% 4.2% 3.7% 3.5% 1.5% 0.2% 0.2% 0% 5% 10% 15% 20% 25% 30% U.S. corporate U.S. Govt. and Agency Agency RMBS Bank loans ABS Cash Non-U.S. corporate Other CMBS State and local Non-U.S. Govt. and Agency Short term Investment affiliates Non-Agency RMBS Restricted cash

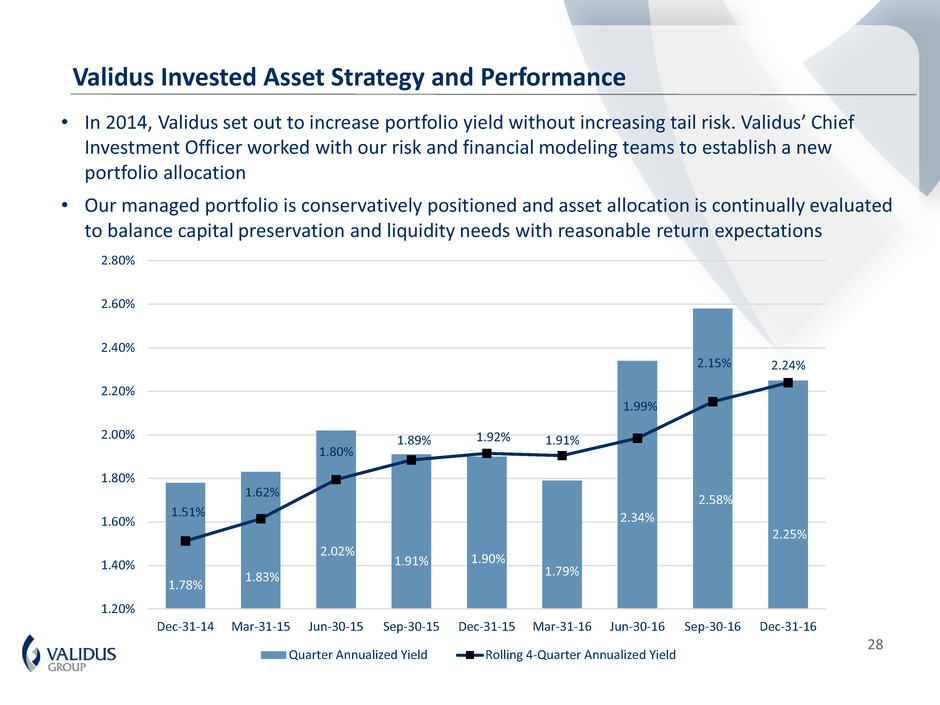

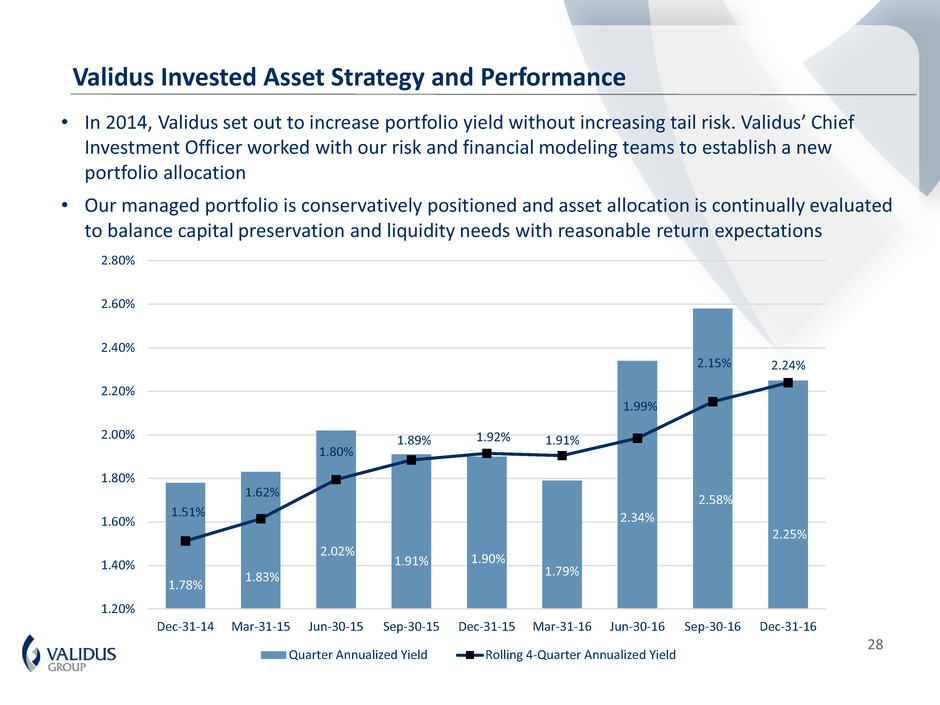

28 Validus Invested Asset Strategy and Performance • In 2014, Validus set out to increase portfolio yield without increasing tail risk. Validus’ Chief Investment Officer worked with our risk and financial modeling teams to establish a new portfolio allocation • Our managed portfolio is conservatively positioned and asset allocation is continually evaluated to balance capital preservation and liquidity needs with reasonable return expectations 1.78% 1.83% 2.02% 1.91% 1.90% 1.79% 2.34% 2.58% 2.25% 1.51% 1.62% 1.80% 1.89% 1.92% 1.91% 1.99% 2.15% 2.24% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 2.80% Dec-31-14 Mar-31-15 Jun-30-15 Sep-30-15 Dec-31-15 Mar-31-16 Jun-30-16 Sep-30-16 Dec-31-16 Quarter Annualized Yield Rolling 4-Quarter Annualized Yield

29 Validus Loss Reserves at December 31, 2016 • Gross reserves for losses and loss expenses of $3.00 billion • $2.56 billion net of reinsurance • Q4 2016 notable losses included Hurricane Matthew of $27.4 million and New Zealand Earthquake of $22.3 million • No non-notable losses in Q4 2016 • Favorable reserve development during Q4 2016: – Validus Re: $28.9 million – AlphaCat: $1.1 million – Talbot: $16.1 million – Western World: $0.6 million Net Favorable Reserve Development Expressed in $US Millions Validus Gross Reserve Mix 1) Q4 notable losses relate to Validus’ share of net losses and loss expenses less reinstatement premiums. 2) Notable loss events are loss events which aggregate to over $30.0 million on a consolidated basis. Non-notable loss events are loss events which aggregate to over $15.0 million but less than $30.0 million on a consolidated basis. Case Reserves 41% IBNR Reserves 59% 208.4 246.3 71.4 56.3 32.6 41.5 50.8 59.8 (17.7) 6.5 20.3 5.3 -$50.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 2014 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Non-event Event

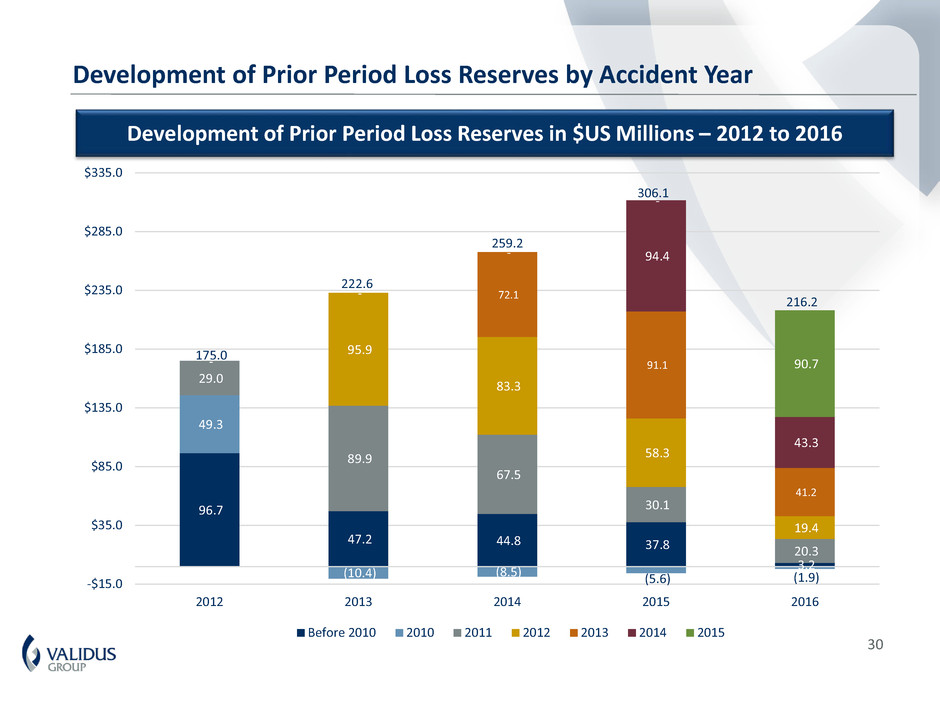

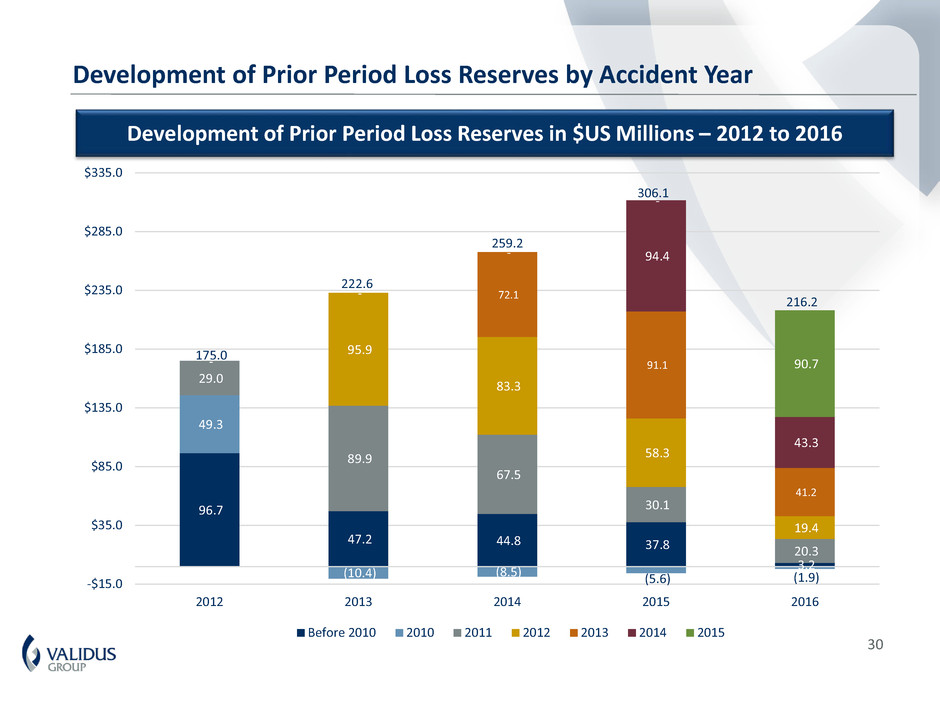

30 Development of Prior Period Loss Reserves by Accident Year Development of Prior Period Loss Reserves in $US Millions – 2012 to 2016 96.7 47.2 44.8 37.8 3.2 49.3 (10.4) (8.5) (5.6) (1.9) 29.0 89.9 67.5 30.1 20.3 - 95.9 83.3 58.3 19.4 - 72.1 91.1 41.2 - 94.4 43.3 - 90.7 175.0 222.6 259.2 306.1 216.2 -$15.0 $35.0 $85.0 $135.0 $185.0 $235.0 $285.0 $335.0 2012 2013 2014 2015 2016 Before 2010 2010 2011 2012 2013 2014 2015

31 • Global insurance and reinsurance business • Size and scale to compete effectively in targeted markets • Four distinct yet complementary operating segments • Focused on short-tail lines with strategic diversification into select longer-tail classes • Profitable in all 11 years of operation • Short duration, highly liquid, conservative balance sheet • Transparent risk disclosure Conclusion – Continue to be Well Positioned for 2017 and Beyond

APPENDIX ONE Investor Presentation

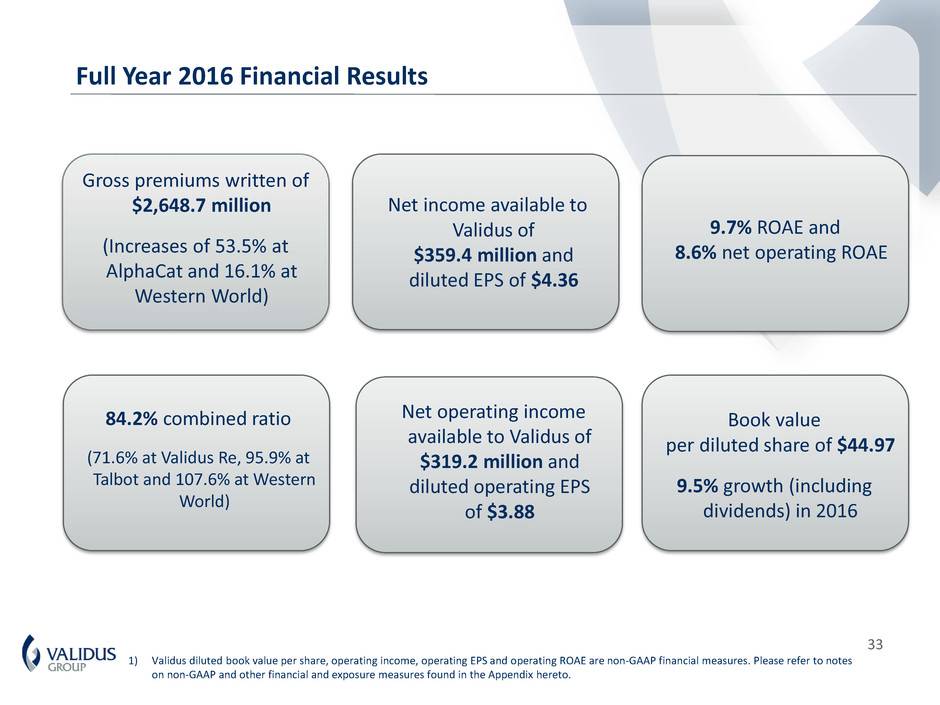

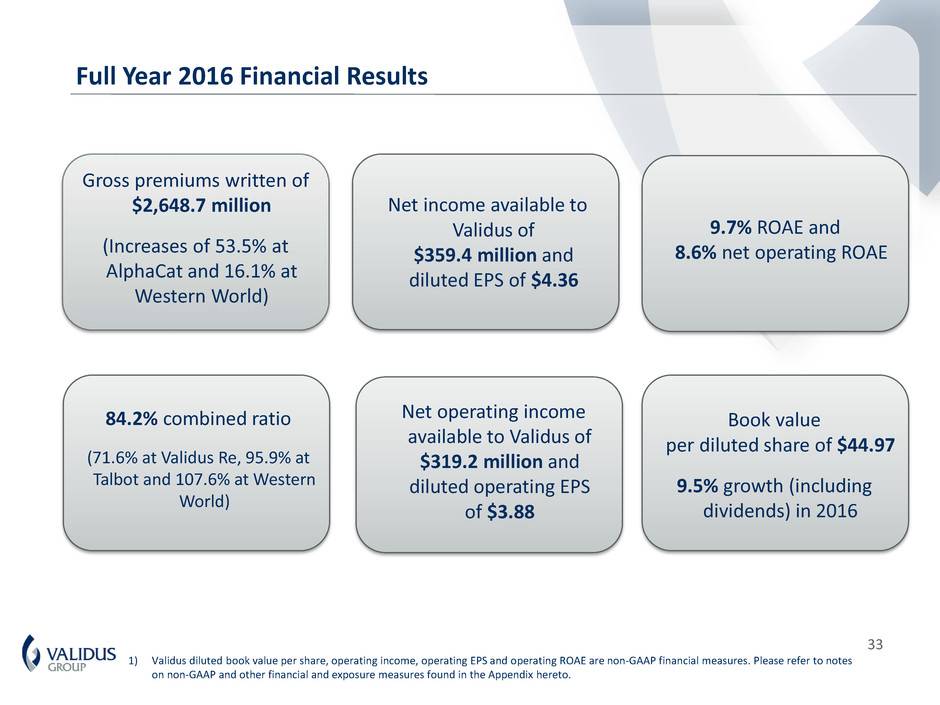

33 Gross premiums written of $2,648.7 million (Increases of 53.5% at AlphaCat and 16.1% at Western World) 9.7% ROAE and 8.6% net operating ROAE 1) Validus diluted book value per share, operating income, operating EPS and operating ROAE are non-GAAP financial measures. Please refer to notes on non-GAAP and other financial and exposure measures found in the Appendix hereto. 84.2% combined ratio (71.6% at Validus Re, 95.9% at Talbot and 107.6% at Western World) Net income available to Validus of $359.4 million and diluted EPS of $4.36 Book value per diluted share of $44.97 9.5% growth (including dividends) in 2016 Full Year 2016 Financial Results Net operating income available to Validus of $319.2 million and diluted operating EPS of $3.88

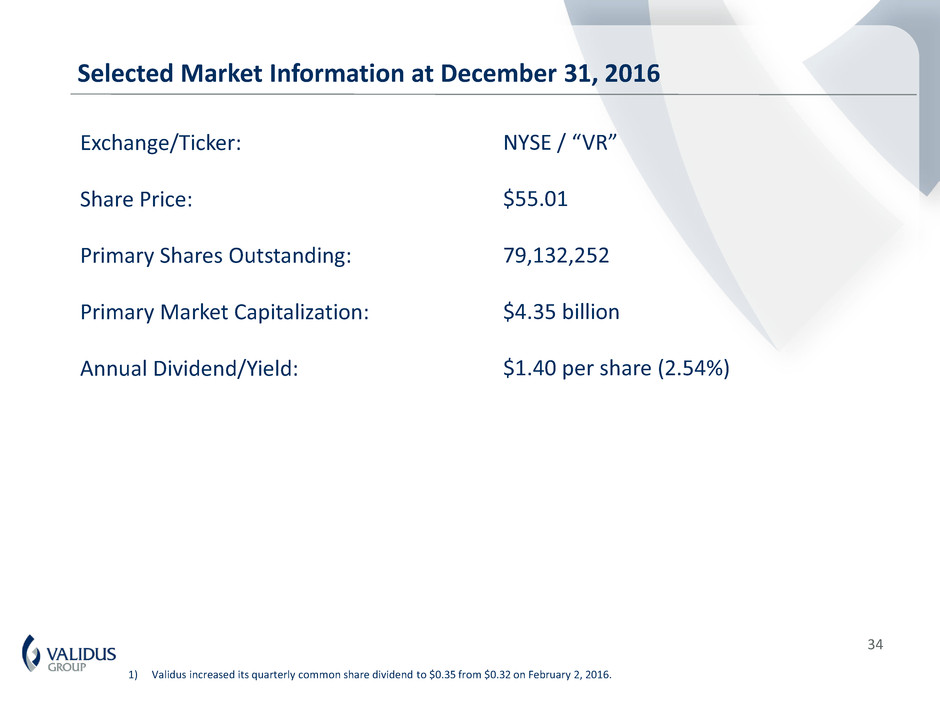

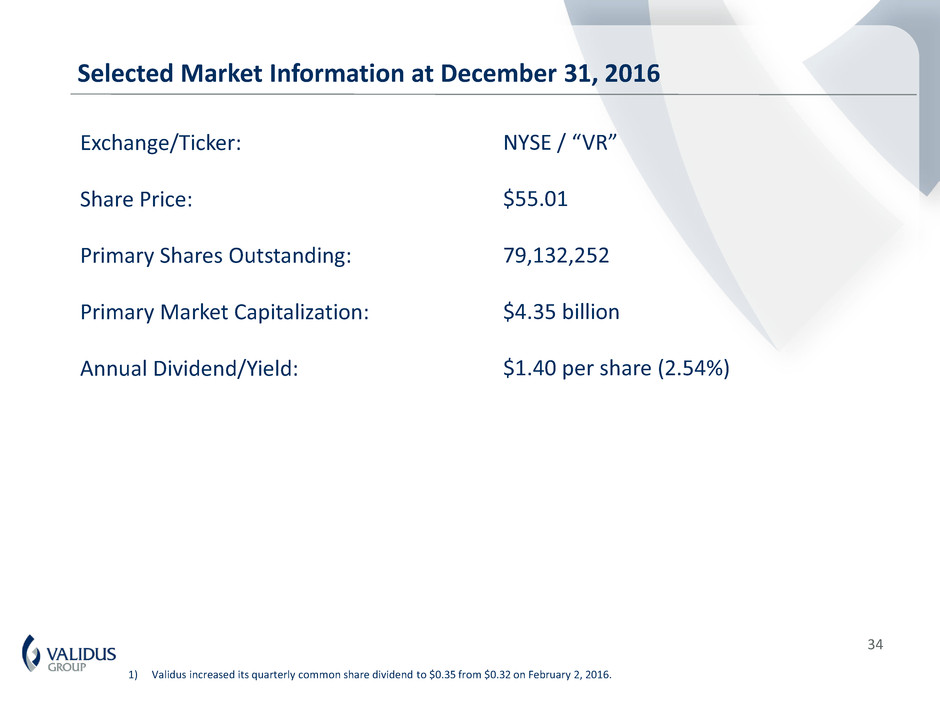

34 Selected Market Information at December 31, 2016 Exchange/Ticker: Share Price: Primary Shares Outstanding: Primary Market Capitalization: Annual Dividend/Yield: NYSE / “VR” $55.01 79,132,252 $4.35 billion $1.40 per share (2.54%) 1) Validus increased its quarterly common share dividend to $0.35 from $0.32 on February 2, 2016.

35 Talbot Composite Rate Index – The Benefits of Cycle Management 1) Rate index reflects the whole account rate change, as adjusted for changes in exposure, inflation, attachment point and terms and conditions. 2) All data points are as of December 31st. 100% 126% 187% 208% 206% 204% 217% 207% 197% 209% 209% 215% 221% 220% 211% 198% 186% 75% 100% 125% 150% 175% 200% 225% 250% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

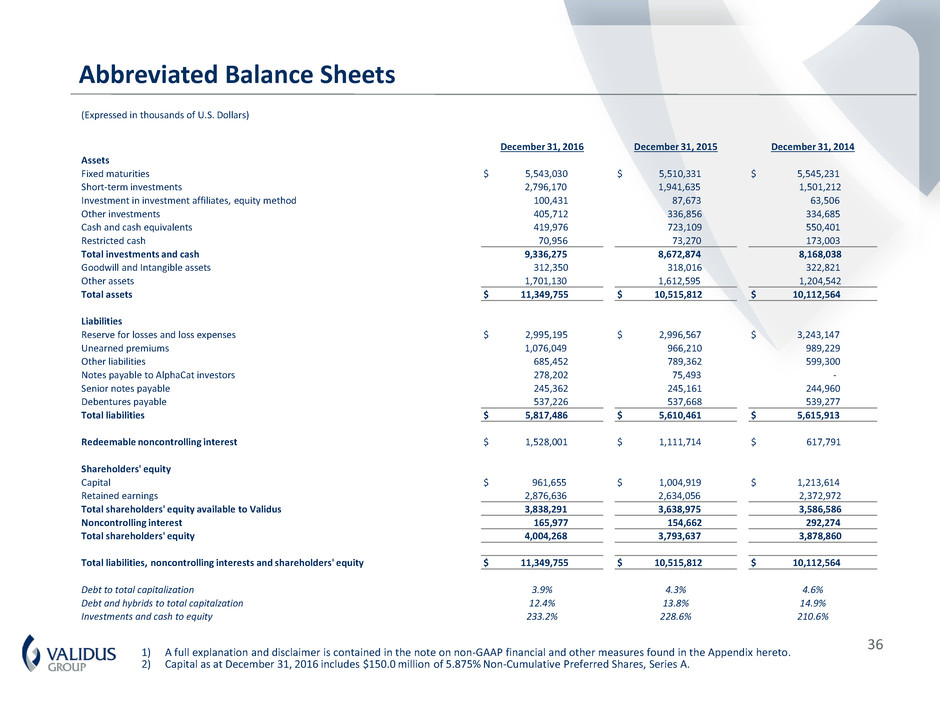

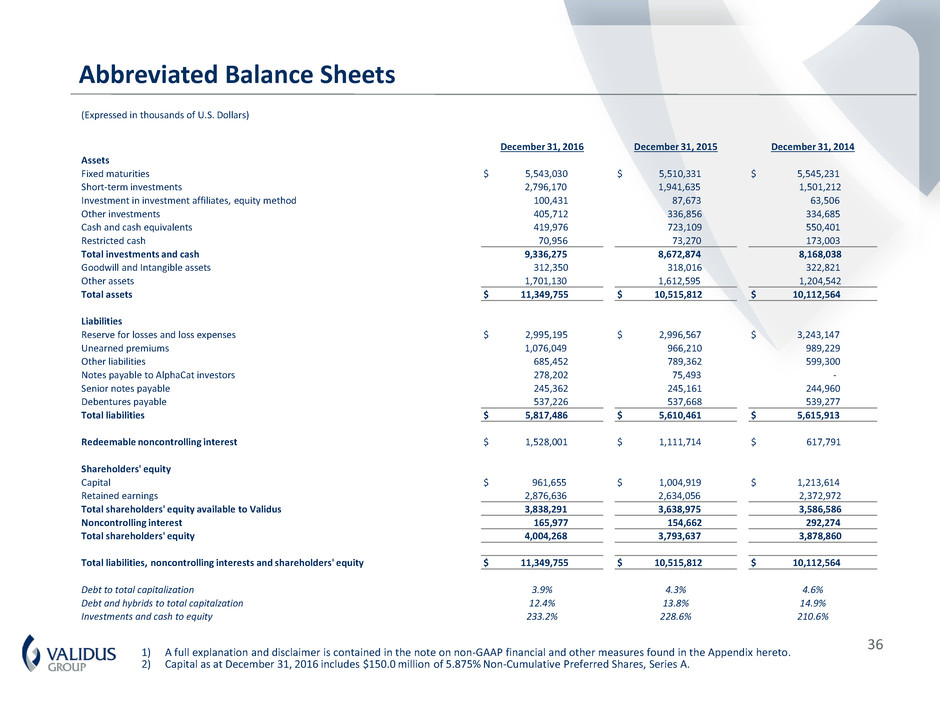

36 Abbreviated Balance Sheets 1) A full explanation and disclaimer is contained in the note on non-GAAP financial and other measures found in the Appendix hereto. 2) Capital as at December 31, 2016 includes $150.0 million of 5.875% Non-Cumulative Preferred Shares, Series A. (Expressed in thousands of U.S. Dollars) December 31, 2016 December 31, 2015 December 31, 2014 Assets Fixed maturities $ 5,543,030 $ 5,510,331 $ 5,545,231 Short-term investments 2,796,170 1,941,635 1,501,212 Investment in investment affiliates, equity method 100,431 87,673 63,506 Other investments 405,712 336,856 334,685 Cash and cash equivalents 419,976 723,109 550,401 Restricted cash 70,956 73,270 173,003 Total investments and cash 9,336,275 8,672,874 8,168,038 Goodwill and Intangible assets 312,350 318,016 322,821 Other assets 1,701,130 1,612,595 1,204,542 Total assets $ 11,349,755 $ 10,515,812 $ 10,112,564 Liabilities Reserve for losses and loss expenses $ 2,995,195 $ 2,996,567 $ 3,243,147 Unearned premiums 1,076,049 966,210 989,229 Other liabilities 685,452 789,362 599,300 Notes payable to AlphaCat investors 278,202 75,493 - Senior notes payable 245,362 245,161 244,960 Debentures payable 537,226 537,668 539,277 Total liabilities $ 5,817,486 $ 5,610,461 $ 5,615,913 Redeemable noncontrolling interest $ 1,528,001 $ 1,111,714 $ 617,791 Shareholders' equity Capital $ 961,655 $ 1,004,919 $ 1,213,614 Retained earnings 2,876,636 2,634,056 2,372,972 Total shareholders' equity available to Validus 3,838,291 3,638,975 3,586,586 Noncontrolling interest 165,977 154,662 292,274 Total shareholders' equity 4,004,268 3,793,637 3,878,860 Total liabilities, noncontrolling interests and shareholders' equity $ 11,349,755 $ 10,515,812 $ 10,112,564 Debt to total capitalization 3.9% 4.3% 4.6% Debt and hybrids to total capitalzation 12.4% 13.8% 14.9% Investments and cash to equity 233.2% 228.6% 210.6%

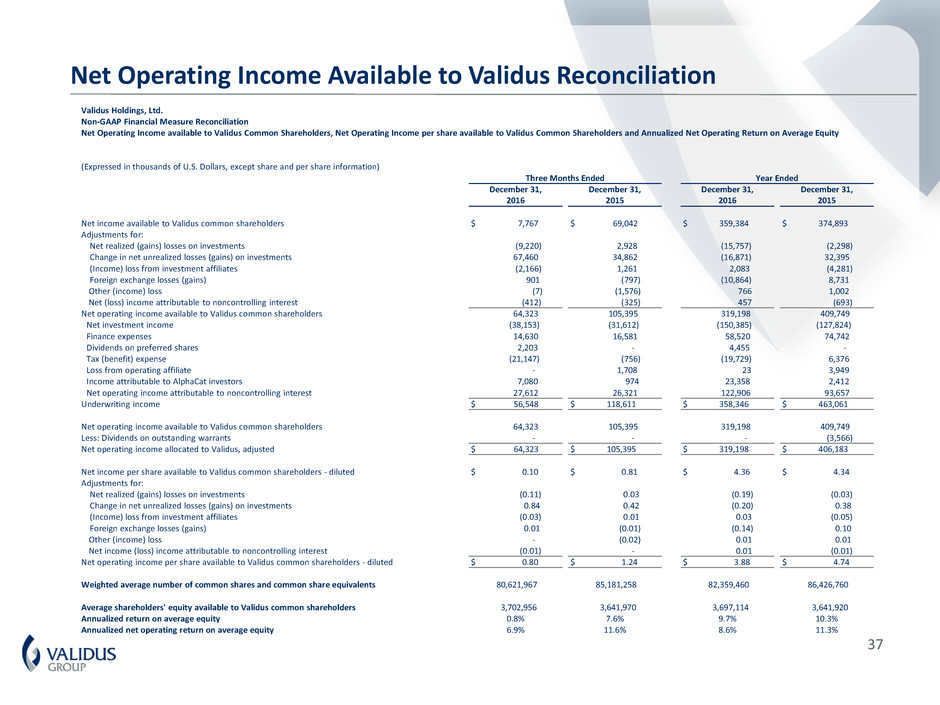

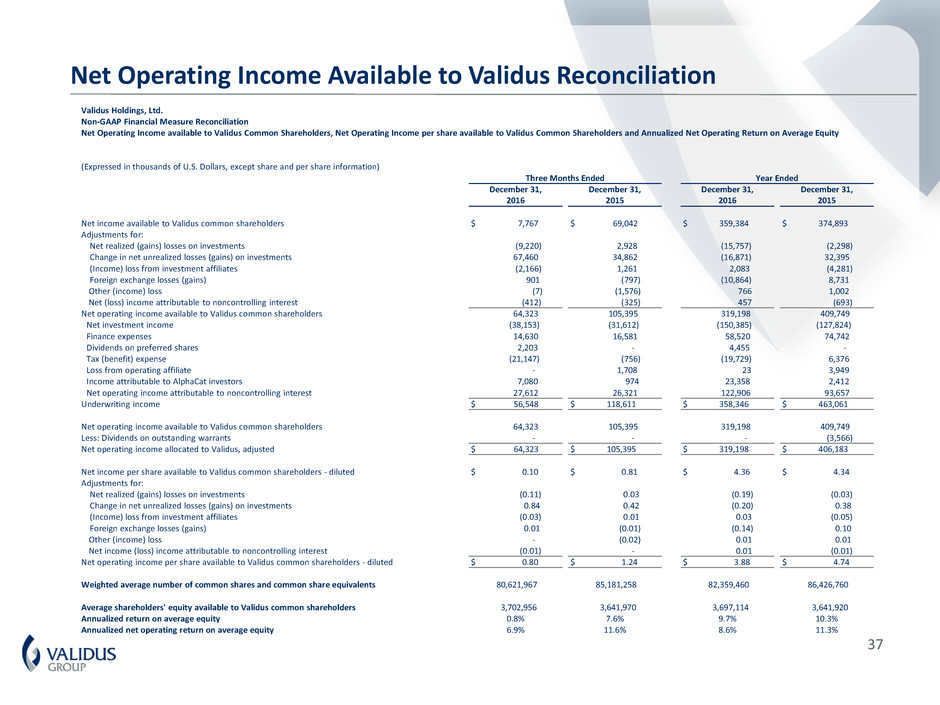

37 Net Operating Income Available to Validus Reconciliation Validus Holdings, Ltd. Non-GAAP Financial Measure Reconciliation Net Operating Income available to Validus Common Shareholders, Net Operating Income per share available to Validus Common Shareholders and Annualized Net Operating Return on Average Equity (Expressed in thousands of U.S. Dollars, except share and per share information) Three Months Ended Year Ended December 31, 2016 December 31, 2015 December 31, 2016 December 31, 2015 Net income available to Validus common shareholders $ 7,767 $ 69,042 $ 359,384 $ 374,893 Adjustments for: Net realized (gains) losses on investments (9,220) 2,928 (15,757) (2,298) Change in net unrealized losses (gains) on investments 67,460 34,862 (16,871) 32,395 (Income) loss from investment affiliates (2,166) 1,261 2,083 (4,281) Foreign exchange losses (gains) 901 (797) (10,864) 8,731 Other (income) loss (7) (1,576) 766 1,002 Net (loss) income attributable to noncontrolling interest (412) (325) 457 (693) Net operating income available to Validus common shareholders 64,323 105,395 319,198 409,749 Net investment income (38,153) (31,612) (150,385) (127,824) Finance expenses 14,630 16,581 58,520 74,742 Dividends on preferred shares 2,203 - 4,455 - Tax (benefit) expense (21,147) (756) (19,729) 6,376 Loss from operating affiliate - 1,708 23 3,949 Income attributable to AlphaCat investors 7,080 974 23,358 2,412 Net operating income attributable to noncontrolling interest 27,612 26,321 122,906 93,657 Underwriting income $ 56,548 $ 118,611 $ 358,346 $ 463,061 Net operating income available to Validus common shareholders 64,323 105,395 319,198 409,749 Less: Dividends on outstanding warrants - - - (3,566) Net operating income allocated to Validus, adjusted $ 64,323 $ 105,395 $ 319,198 $ 406,183 Net income per share available to Validus common shareholders - diluted $ 0.10 $ 0.81 $ 4.36 $ 4.34 Adjustments for: Net realized (gains) losses on investments (0.11) 0.03 (0.19) (0.03) Change in net unrealized losses (gains) on investments 0.84 0.42 (0.20) 0.38 (Income) loss from investment affiliates (0.03) 0.01 0.03 (0.05) Foreign exchange losses (gains) 0.01 (0.01) (0.14) 0.10 Other (income) loss - (0.02) 0.01 0.01 Net income (loss) income attributable to noncontrolling interest (0.01) - 0.01 (0.01) Net operating income per share available to Validus common shareholders - diluted $ 0.80 $ 1.24 $ 3.88 $ 4.74 Weighted average number of common shares and common share equivalents 80,621,967 85,181,258 82,359,460 86,426,760 Average shareholders' equity available to Validus common shareholders 3,702,956 3,641,970 3,697,114 3,641,920 Annualized return on average equity 0.8% 7.6% 9.7% 10.3% Annualized net operating return on average equity 6.9% 11.6% 8.6% 11.3%

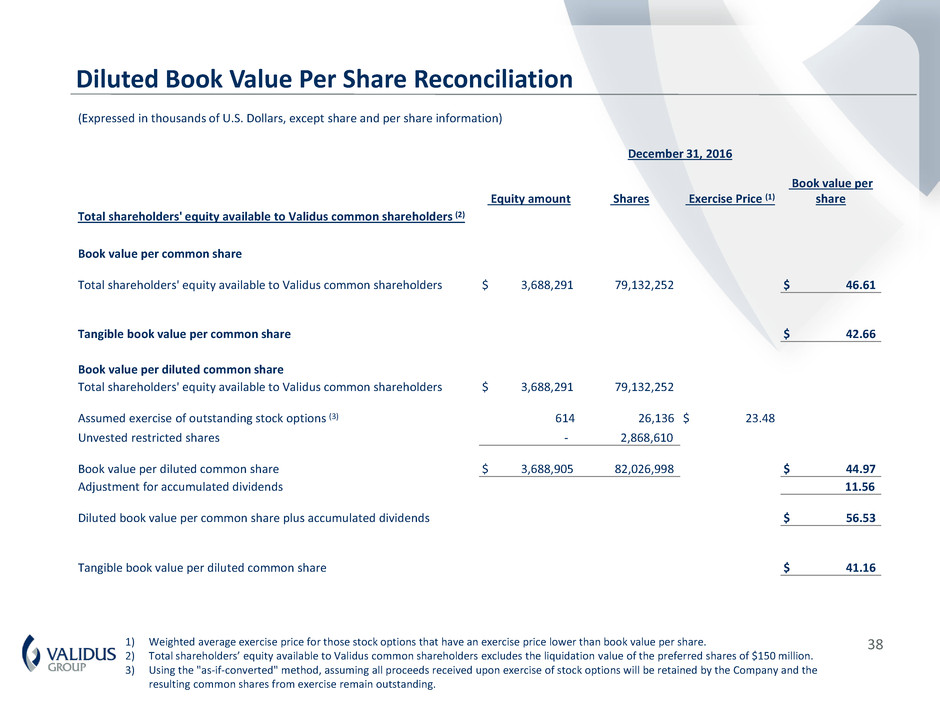

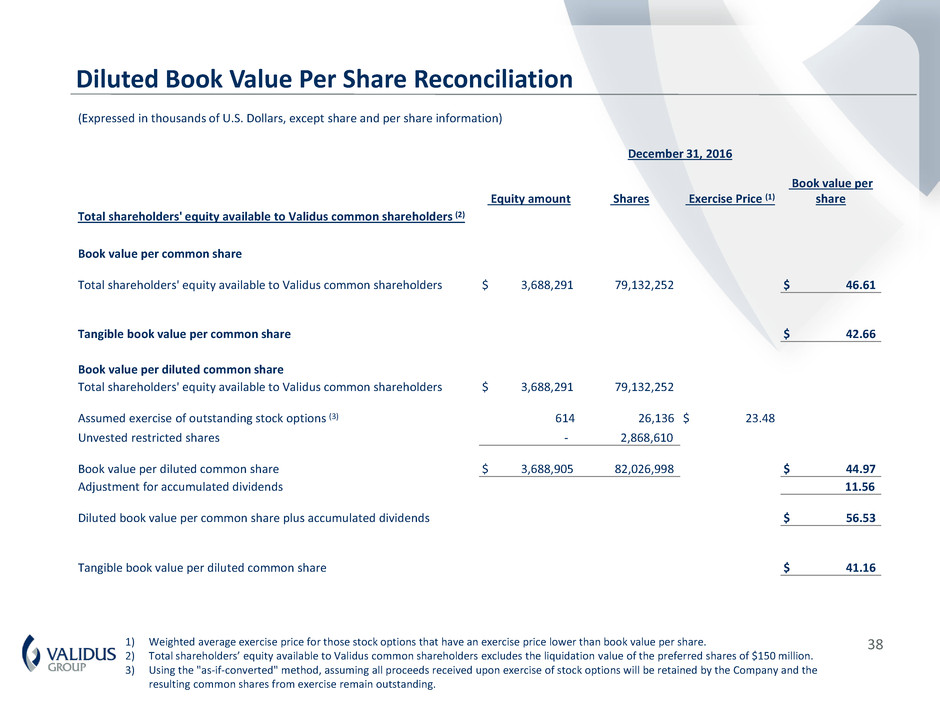

381) Weighted average exercise price for those stock options that have an exercise price lower than book value per share. 2) Total shareholders’ equity available to Validus common shareholders excludes the liquidation value of the preferred shares of $150 million. 3) Using the "as-if-converted" method, assuming all proceeds received upon exercise of stock options will be retained by the Company and the resulting common shares from exercise remain outstanding. Diluted Book Value Per Share Reconciliation (Expressed in thousands of U.S. Dollars, except share and per share information) December 31, 2016 Equity amount Shares Exercise Price (1) Book value per share Total shareholders' equity available to Validus common shareholders (2) Book value per common share Total shareholders' equity available to Validus common shareholders $ 3,688,291 79,132,252 $ 46.61 Tangible book value per common share $ 42.66 Book value per diluted common share Total shareholders' equity available to Validus common shareholders $ 3,688,291 79,132,252 Assumed exercise of outstanding stock options (3) 614 26,136 $ 23.48 Unvested restricted shares - 2,868,610 Book value per diluted common share $ 3,688,905 82,026,998 $ 44.97 Adjustment for accumulated dividends 11.56 Diluted book value per common share plus accumulated dividends $ 56.53 Tangible book value per diluted common share $ 41.16

39 In presenting the Company’s results herein, management has included and discussed certain schedules containing underwriting income (loss), net operating income (loss) available (attributable) to Validus, annualized return on average equity and diluted book value per common share that are not calculated under standards or rules that comprise U.S. GAAP. Such measures are referred to as non-GAAP. Non-GAAP measures may be defined or calculated differently by other companies. We believe that these measures are important to investors and other interested parties. These measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. The AlphaCat segment information is presented as an asset manager view and therefore is considered non-GAAP. Underwriting income indicates the performance of the Company's core underwriting segments, excluding revenues and expenses such as net investment income (loss), finance expenses, net realized and change in unrealized gains (losses) on investments, foreign exchange gains (losses), other income (loss) and transaction expenses. The Company believes the reporting of underwriting income enhances the understanding of our results by highlighting the underlying profitability of the Company's core insurance and reinsurance business. Underwriting profitability is influenced significantly by earned premium growth, adequacy of the Company's pricing and loss frequency and severity. Net operating income (loss), a non-GAAP financial measure, is defined as net income (loss) excluding net realized and change in net unrealized gains (losses) on investments, income (loss) from investment affiliate, foreign exchange gains (losses), other income (loss) and non-recurring items. This measure focuses on the underlying fundamentals of our operations without the influence of gains (losses) from the sale of investments, translation of non-U.S.$ currencies and non-recurring items. Gains (losses) from the sale of investments are driven by the timing of the disposition of investments, not by our operating performance. Gains (losses) arising from translation of non-U.S.$ denominated balances are unrelated to our underlying business. Net operating income (loss) available (attributable) to Validus common shareholders is defined as above, but excludes operating income (loss) available (attributable) to noncontrolling interest and dividends on preference shares. Diluted book value per share is calculated based on total shareholders’ equity available to Validus common shareholders plus the assumed proceeds from the exercise of outstanding stock options, divided by the sum of unvested restricted shares, stock options and share equivalents outstanding (assuming their exercise). Reconciliations to the most comparable GAAP measure for net operating income and diluted book value per share can be found on pages 41 and 42, respectively. Net loss estimates and zonal aggregates are before income tax, net of reinstatement premiums, and net of reinsurance and retrocessional recoveries. The estimates set forth herein are based on an Occurrence basis on assumptions that are inherently subject to significant uncertainties and contingencies. These uncertainties and contingencies can affect actual losses and could cause actual losses to differ materially from those expressed above. In particular, modeled loss estimates do not necessarily accurately predict actual losses, and may significantly mis-estimate actual losses. Such estimates, therefore, should not be considered as a representation of actual losses. Notes on Non-GAAP and Other Financial and Exposure Measures

40 The Company has developed the estimates of losses expected from certain catastrophes for its portfolio of property, marine, workers’ compensation, and personal accident contracts using commercially available catastrophe models such as RMS, AIR and EQECAT, which are applied and adjusted by the Company. These estimates include assumptions regarding the location, size and magnitude of an event, the frequency of events, the construction type and damageability of property in a zone, policy terms and conditions and the cost of rebuilding property in a zone, among other assumptions. These assumptions will evolve following any actual event. Accordingly, if the estimates and assumptions that are entered into the risk model are incorrect, or if the risk model proves to be an inaccurate forecasting tool, the losses the Company might incur from an actual catastrophe could be materially higher than its expectation of losses generated from modeled catastrophe scenarios. In addition, many risks such as second-event covers, aggregate excess of loss, or attritional loss components cannot be fully evaluated using the vendor models. Further, there can be no assurance that such third party models are free of defects in the modeling logic or in the software code. Commencing in January 2012, the Company incorporated RMS version 11 as part of its vendor models. The Company has presented the Company Realistic Disaster Scenarios for non-natural catastrophe events. Twice yearly, Lloyds' syndicates, including the Company's Talbot Syndicate 1183, are required to provide details of their potential exposures to specific disaster scenarios. Lloyds' makes its updated Realistic Disaster Scenarios (RDS) guidance available to the market annually. The RDS scenario specification document for 2012 can be accessed at the RDS part of the Lloyd's public website: http://www.lloyds.com/The-Market/Tools-and-Resources/Research/Exposure-Management/Realistic-Disaster-Scenarios The Consolidated Net Premiums Earned used in the calculation represents the net premiums earned for the year ended December 31, 2016. Modeling catastrophe threat scenarios is a complex exercise involving numerous variables and is inherently subject to significant uncertainties and contingencies. These uncertainties and contingencies can affect actual losses and could cause actual losses incurred by the Company to differ materially from those expressed above. Should an event occur, the modeled outcomes may prove inadequate, possibly materially so. This may occur for a number of reasons including, legal requirements, model deficiency, non-modeled risks or data inaccuracies. A modeled outcome of net loss from a single event also relies in significant part on the reinsurance and retrocession arrangements in place, or expected to be in place at the time of the analysis, and may change during the year. Modeled outcomes assume that the reinsurance and retrocession in place responds as expected with minimal reinsurance failure or dispute. Reinsurance is purchased to match the original exposure as far as possible, but it is possible for there to be a mismatch or gap in cover which could result in higher than modeled losses to the Company. In addition, many parts of the reinsurance program are purchased with limited reinstatements and, therefore, the number of claims or events which may be recovered from second or subsequent events is limited. It should also be noted that renewal dates of the reinsurance program do not necessarily coincide with those of the inwards business written. Where original business is not protected by risks attaching reinsurance or retrocession programs, the programs could expire resulting in an increase in the possible net loss retained by the Company. Investors should not rely on the information set forth in this presentation when considering an investment in the Company. The information contained in this presentation has not been audited nor has it been subject to independent verification. The estimates set forth herein speak only as of the date of this presentation and the Company undertakes no obligation to update or revise such information to reflect the occurrence of future events. The events presented reflect a specific set of prescribed calculations and do not necessarily reflect all events that may impact the Company. Notes on Non-GAAP and Other Financial and Exposure Measures – Continued

Street Address: 29 Richmond Road Pembroke, Bermuda Mailing Address: Suite 1790 48 Par-la-Ville Road Hamilton, Bermuda HM 11 Telephone: +1-441-278-9000 Email: investor.relations@validusholdings.com For more information on our company, products and management team please visit our website at: www.validusholdings.com