0 Validus Agreed Acquisition of ADM Crop Risk Services January 30, 2017

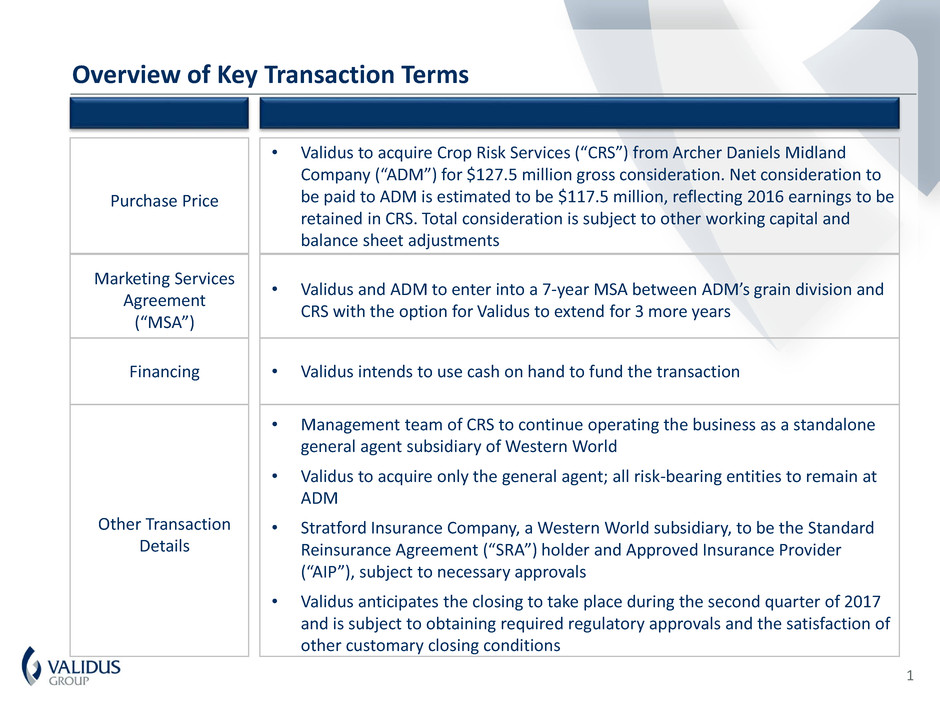

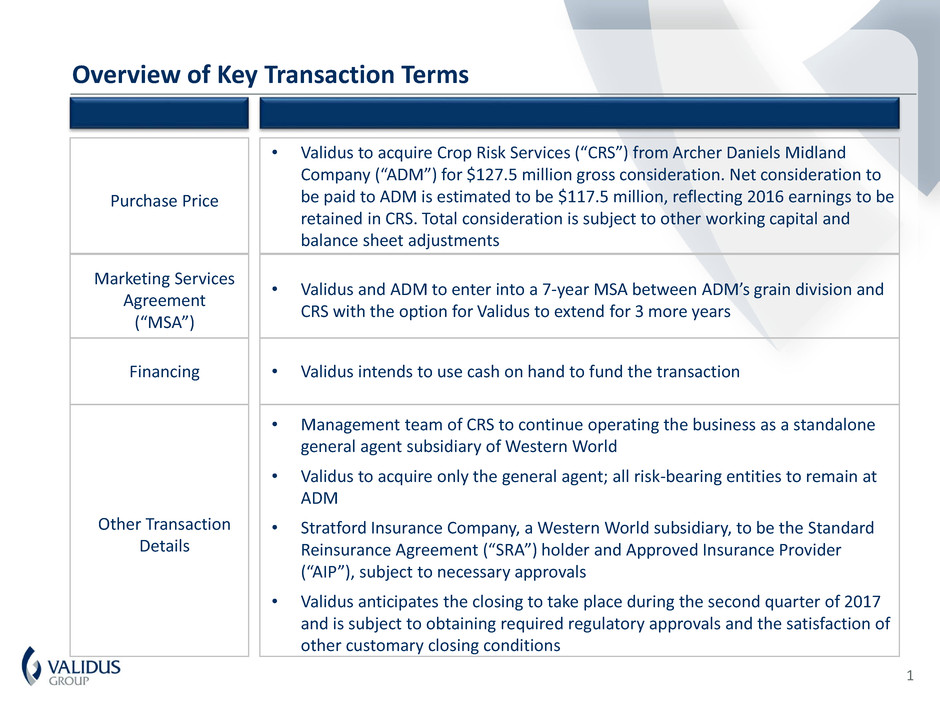

Overview of Key Transaction Terms Purchase Price • Validus to acquire Crop Risk Services (“CRS”) from Archer Daniels Midland Company (“ADM”) for $127.5 million gross consideration. Net consideration to be paid to ADM is estimated to be $117.5 million, reflecting 2016 earnings to be retained in CRS. Total consideration is subject to other working capital and balance sheet adjustments Marketing Services Agreement (“MSA”) • Validus and ADM to enter into a 7-year MSA between ADM’s grain division and CRS with the option for Validus to extend for 3 more years Financing • Validus intends to use cash on hand to fund the transaction Other Transaction Details • Management team of CRS to continue operating the business as a standalone general agent subsidiary of Western World • Validus to acquire only the general agent; all risk-bearing entities to remain at ADM • Stratford Insurance Company, a Western World subsidiary, to be the Standard Reinsurance Agreement (“SRA”) holder and Approved Insurance Provider (“AIP”), subject to necessary approvals • Validus anticipates the closing to take place during the second quarter of 2017 and is subject to obtaining required regulatory approvals and the satisfaction of other customary closing conditions 1

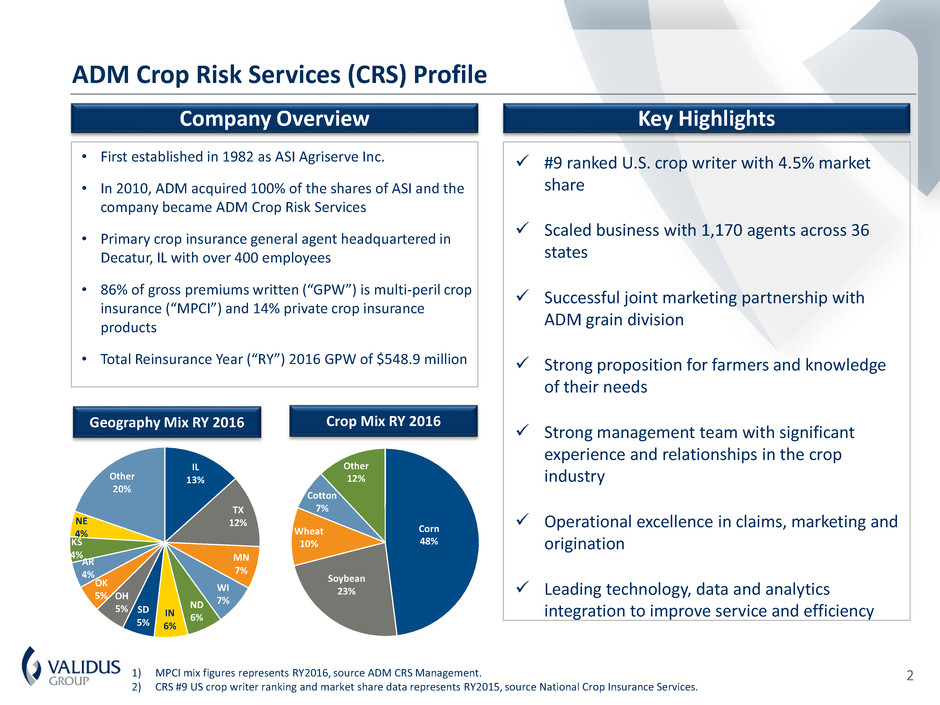

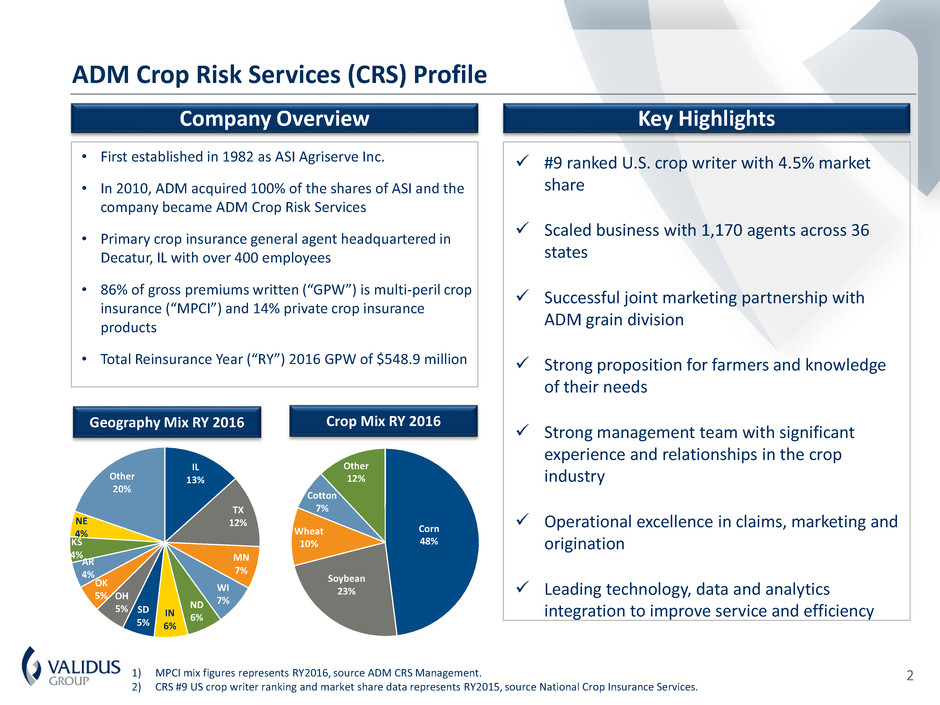

Key Highlights #9 ranked U.S. crop writer with 4.5% market share Scaled business with 1,170 agents across 36 states Successful joint marketing partnership with ADM grain division Strong proposition for farmers and knowledge of their needs Strong management team with significant experience and relationships in the crop industry Operational excellence in claims, marketing and origination Leading technology, data and analytics integration to improve service and efficiency 1) MPCI mix figures represents RY2016, source ADM CRS Management. 2) CRS #9 US crop writer ranking and market share data represents RY2015, source National Crop Insurance Services. Crop Mix RY 2016 Company Overview • First established in 1982 as ASI Agriserve Inc. • In 2010, ADM acquired 100% of the shares of ASI and the company became ADM Crop Risk Services • Primary crop insurance general agent headquartered in Decatur, IL with over 400 employees • 86% of gross premiums written (“GPW”) is multi-peril crop insurance (“MPCI”) and 14% private crop insurance products • Total Reinsurance Year (“RY”) 2016 GPW of $548.9 million Geography Mix RY 2016 2 ADM Crop Risk Services (CRS) Profile IL 13% TX 12% MN 7% WI 7%ND 6%IN 6% SD 5% OH 5% OK 5% AR 4% KS 4% NE 4% Other 20% Corn 48% Soybean 23% Wheat 10% Cotton 7% Other 12%

Transaction Rationale Crop insurance exhibits attractive industry fundamentals 1 2 3 4 6 5 Primary crop insurance complements Validus’ existing re/insurance portfolio Expands Validus presence in U.S. primary specialty lines Unique opportunity to enter into long-term partnership with ADM The addition of a primary crop insurance business has compelling strategic benefits Significant opportunity for growth and margin improvement 3

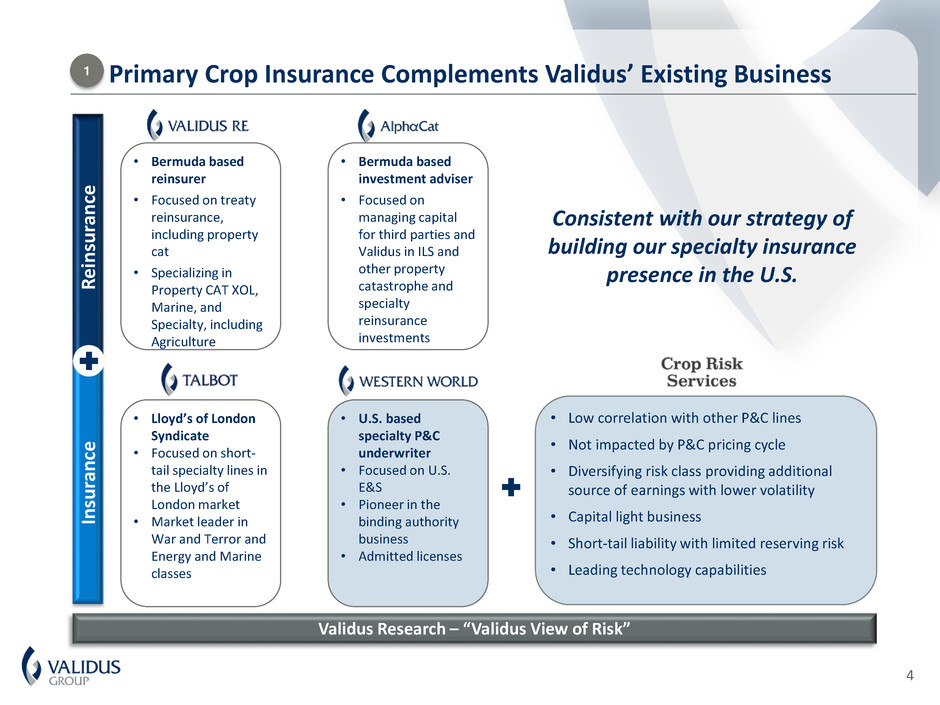

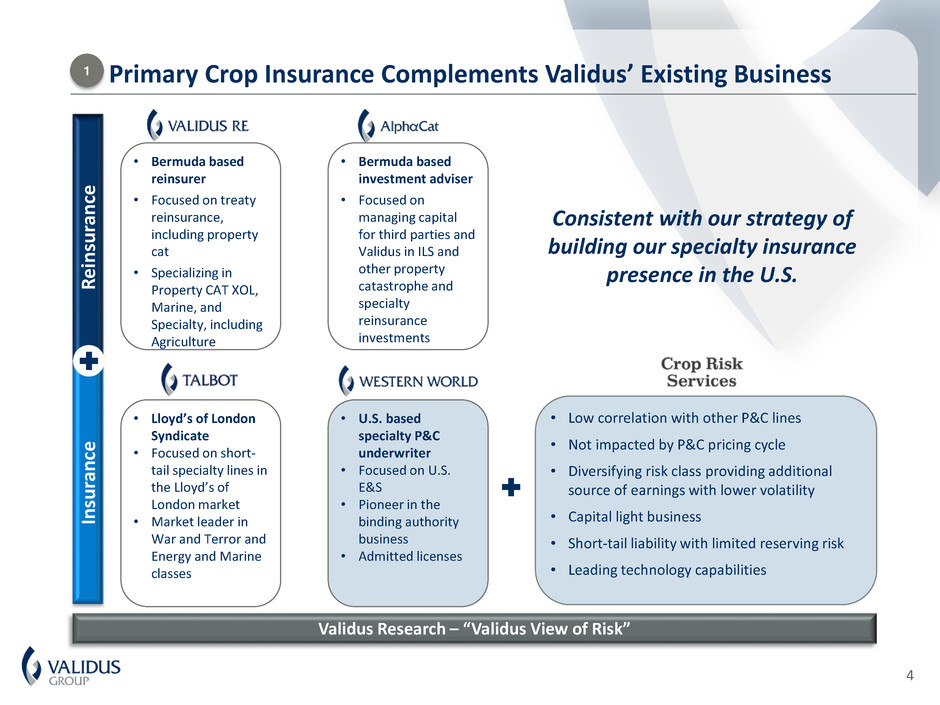

Primary Crop Insurance Complements Validus’ Existing Business • Bermuda based investment adviser • Focused on managing capital for third parties and Validus in ILS and other property catastrophe and specialty reinsurance investments • Bermuda based reinsurer • Focused on treaty reinsurance, including property cat • Specializing in Property CAT XOL, Marine, and Specialty, including Agriculture • Lloyd’s of London Syndicate • Focused on short- tail specialty lines in the Lloyd’s of London market • Market leader in War and Terror and Energy and Marine classes • U.S. based specialty P&C underwriter • Focused on U.S. E&S • Pioneer in the binding authority business • Admitted licenses • Low correlation with other P&C lines • Not impacted by P&C pricing cycle • Diversifying risk class providing additional source of earnings with lower volatility • Capital light business • Short-tail liability with limited reserving risk • Leading technology capabilities Validus Research – “Validus View of Risk” Consistent with our strategy of building our specialty insurance presence in the U.S.Re in su ra nc e In su ra nc e 1 4

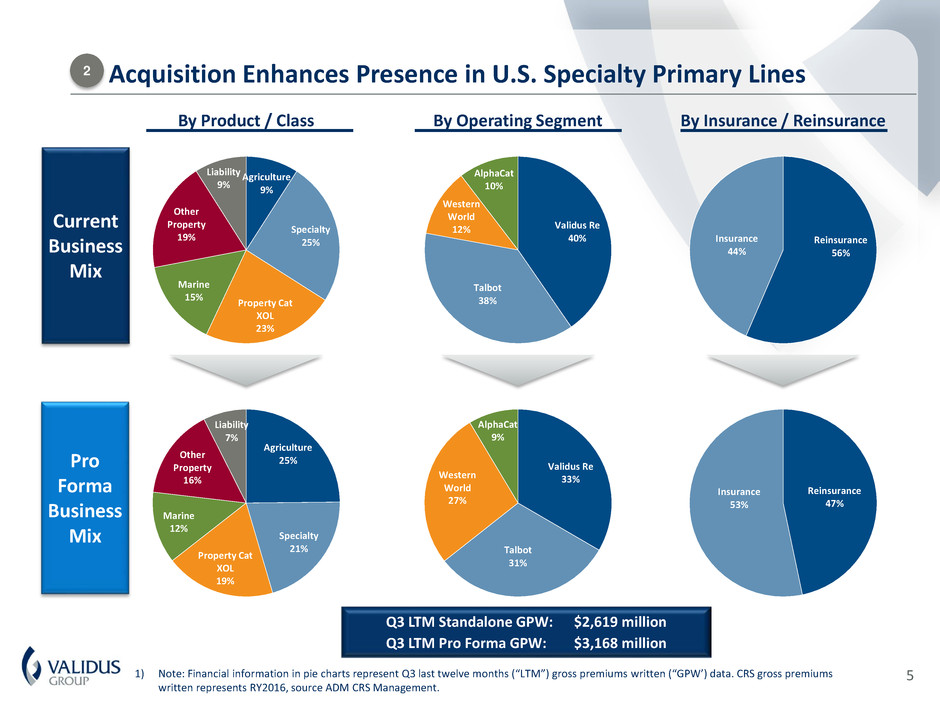

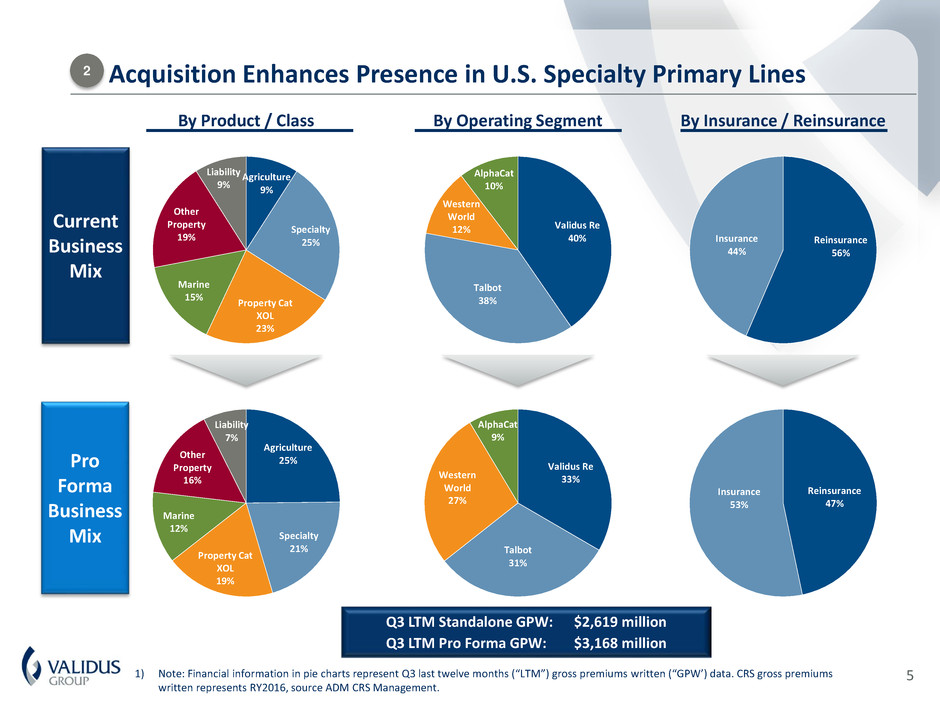

By Product / Class By Insurance / Reinsurance Q3 LTM Standalone GPW: $2,619 million Q3 LTM Pro Forma GPW: $3,168 million By Operating Segment 1) Note: Financial information in pie charts represent Q3 last twelve months (“LTM”) gross premiums written (“GPW’) data. CRS gross premiums written represents RY2016, source ADM CRS Management. 2 Pro Forma Business Mix Current Business Mix 5 Acquisition Enhances Presence in U.S. Specialty Primary Lines Agriculture 9% Specialty 25% Property Cat XOL 23% Marine 15% Other Property 19% Liability 9% Validus Re 40% Talbot 38% Western World 12% AlphaCat 10% Reinsurance 56% Insurance 44% Agriculture 25% Specialty 21% Property Cat XOL 19% Marine 12% Other Property 16% Liability 7% Validus Re 33% Talbot 31% Western World 27% AlphaCat 9% Reinsurance 47% Insurance 53%

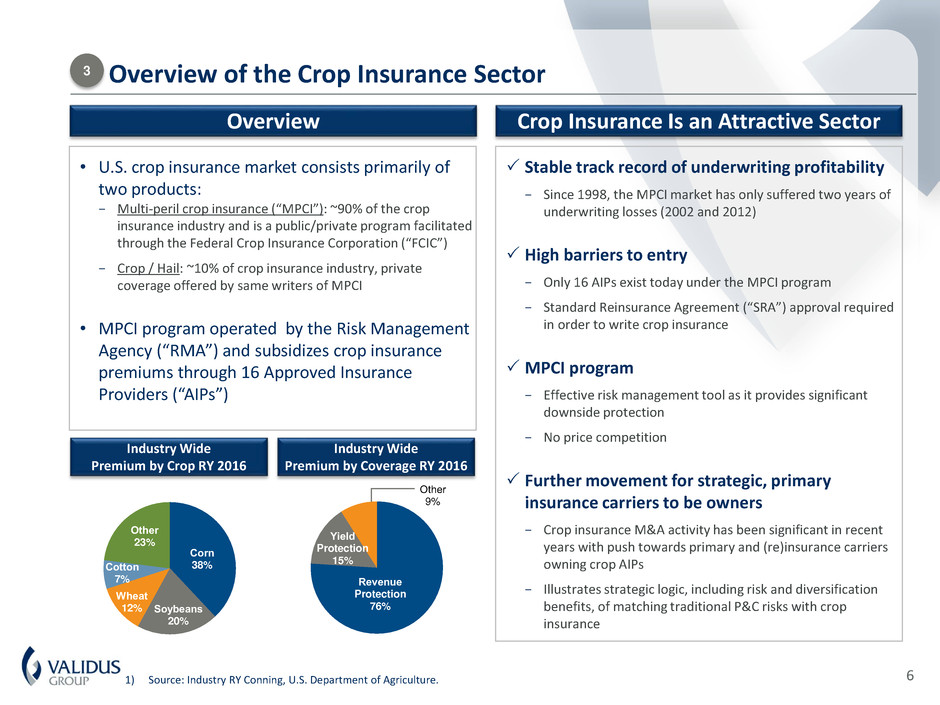

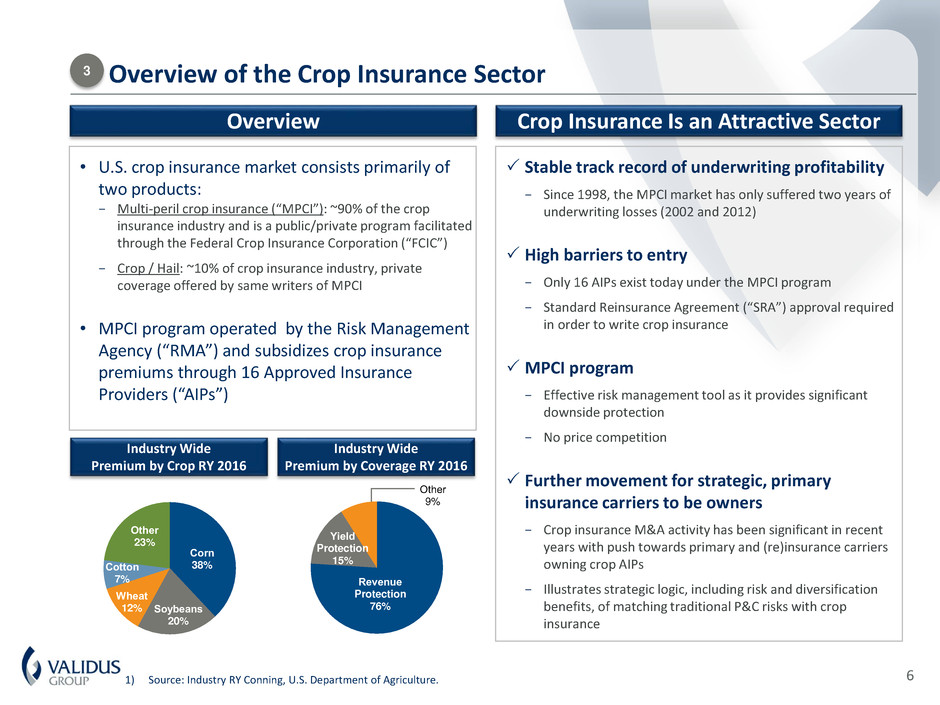

Revenue Protection 76% Yield Protection 15% Other 9% Overview Crop Insurance Is an Attractive Sector • U.S. crop insurance market consists primarily of two products: − Multi-peril crop insurance (“MPCI”): ~90% of the crop insurance industry and is a public/private program facilitated through the Federal Crop Insurance Corporation (“FCIC”) − Crop / Hail: ~10% of crop insurance industry, private coverage offered by same writers of MPCI • MPCI program operated by the Risk Management Agency (“RMA”) and subsidizes crop insurance premiums through 16 Approved Insurance Providers (“AIPs”) Stable track record of underwriting profitability − Since 1998, the MPCI market has only suffered two years of underwriting losses (2002 and 2012) High barriers to entry − Only 16 AIPs exist today under the MPCI program − Standard Reinsurance Agreement (“SRA”) approval required in order to write crop insurance MPCI program − Effective risk management tool as it provides significant downside protection − No price competition Further movement for strategic, primary insurance carriers to be owners − Crop insurance M&A activity has been significant in recent years with push towards primary and (re)insurance carriers owning crop AIPs − Illustrates strategic logic, including risk and diversification benefits, of matching traditional P&C risks with crop insurance 1) Source: Industry RY Conning, U.S. Department of Agriculture. Industry Wide Premium by Crop RY 2016 Industry Wide Premium by Coverage RY 2016 Corn 38% Soybeans 20% Wheat 12% Cotton 7% Other 23% 3 6 Overview of the Crop Insurance Sector

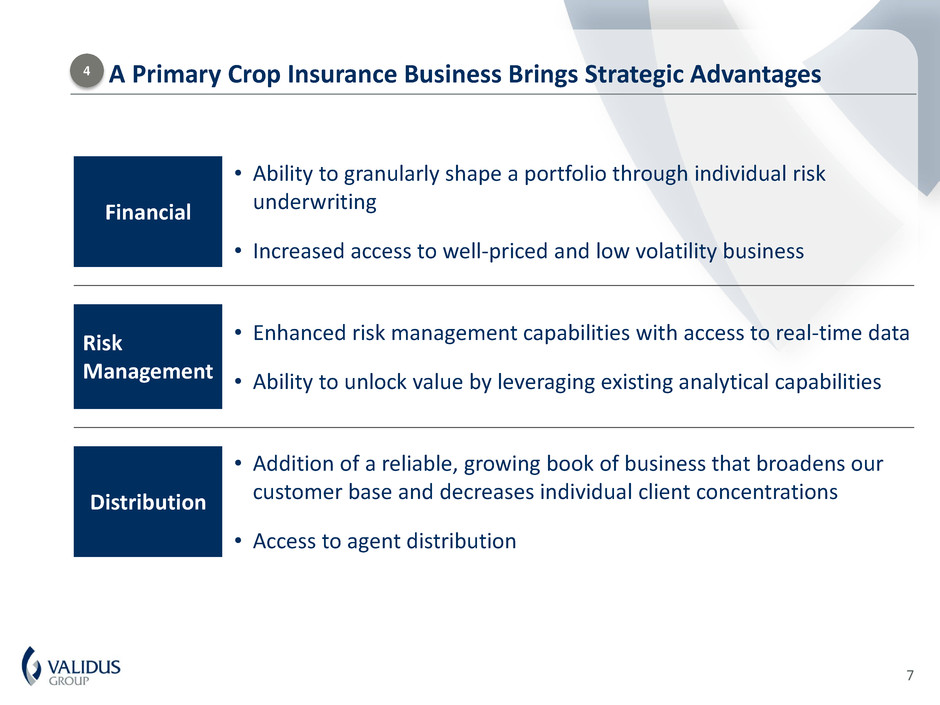

4 7 Financial • Ability to granularly shape a portfolio through individual risk underwriting • Increased access to well-priced and low volatility business Risk Management • Enhanced risk management capabilities with access to real-time data • Ability to unlock value by leveraging existing analytical capabilities Distribution • Addition of a reliable, growing book of business that broadens our customer base and decreases individual client concentrations • Access to agent distribution A Primary Crop Insurance Business Brings Strategic Advantages

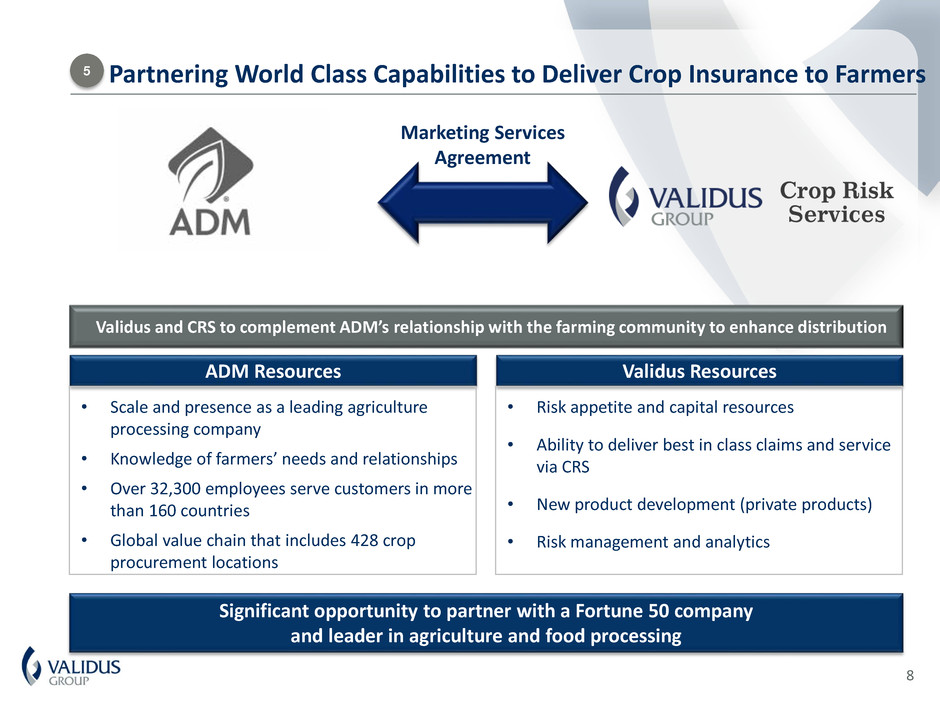

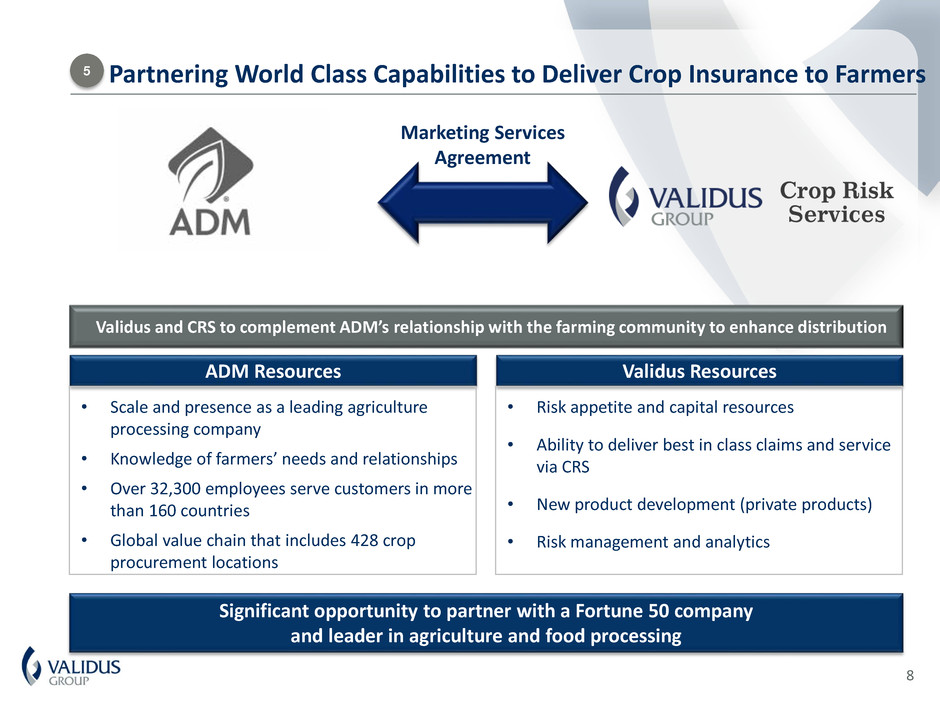

Validus ResourcesADM Resources • Scale and presence as a leading agriculture processing company • Knowledge of farmers’ needs and relationships • Over 32,300 employees serve customers in more than 160 countries • Global value chain that includes 428 crop procurement locations • Risk appetite and capital resources • Ability to deliver best in class claims and service via CRS • New product development (private products) • Risk management and analytics Significant opportunity to partner with a Fortune 50 company and leader in agriculture and food processing Validus and CRS to complement ADM’s relationship with the farming community to enhance distribution Marketing Services Agreement 8 5 Partnering World Class Capabilities to Deliver Crop Insurance to Farmers

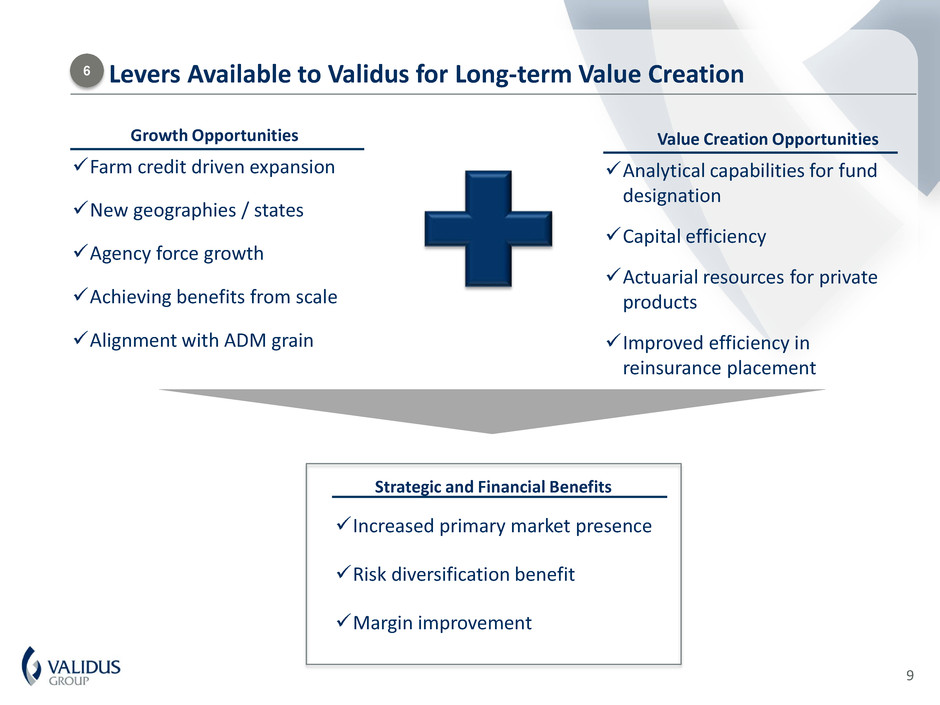

Increased primary market presence Risk diversification benefit Margin improvement Strategic and Financial Benefits Analytical capabilities for fund designation Capital efficiency Actuarial resources for private products Improved efficiency in reinsurance placement Value Creation Opportunities Farm credit driven expansion New geographies / states Agency force growth Achieving benefits from scale Alignment with ADM grain Growth Opportunities 9 6 Levers Available to Validus for Long-term Value Creation

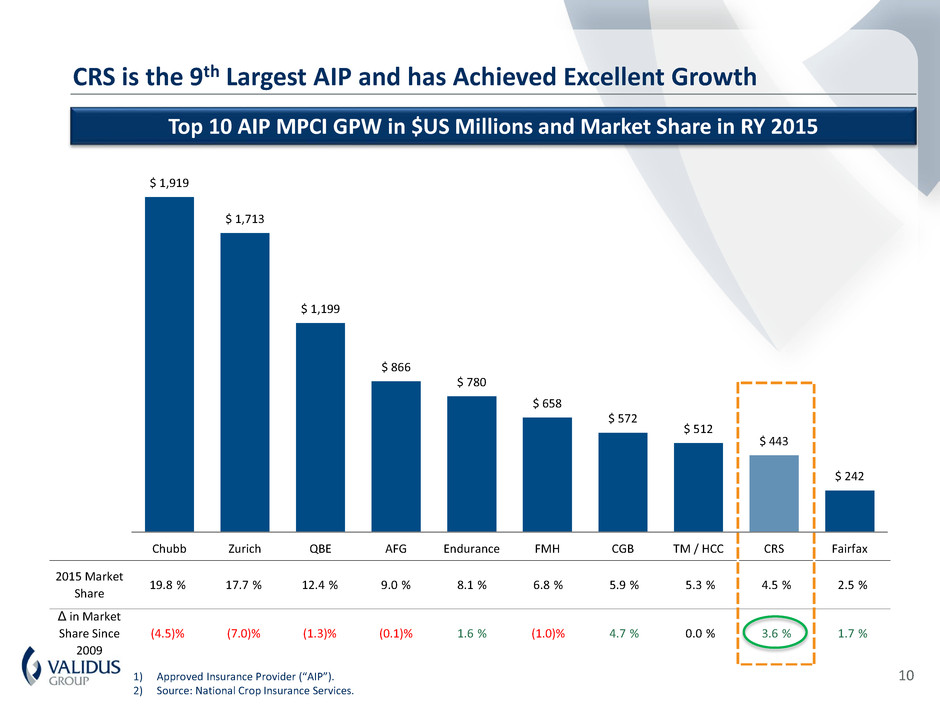

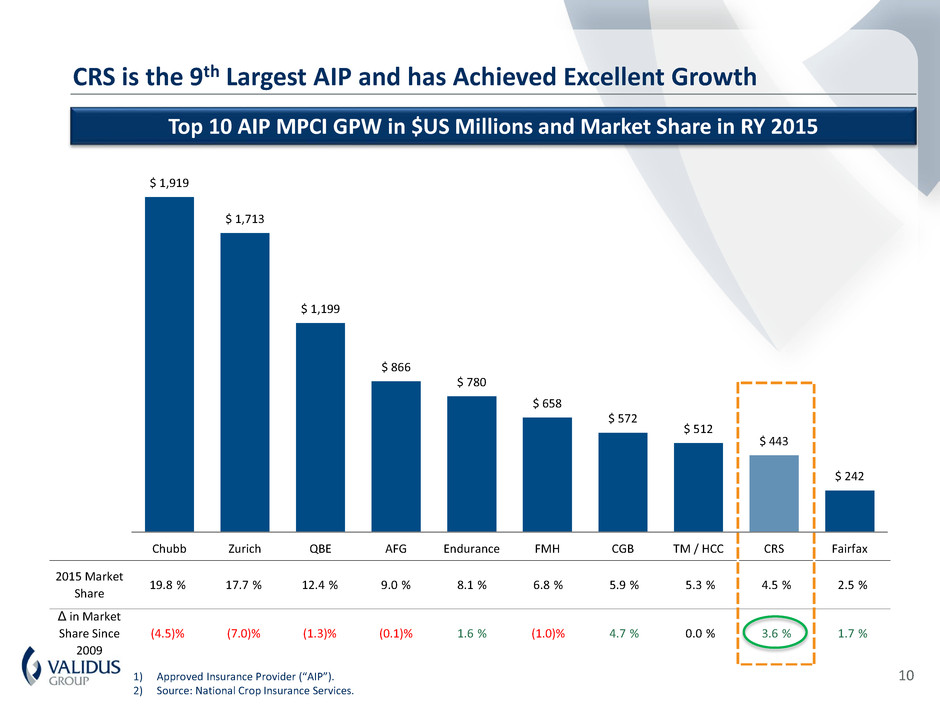

CRS is the 9th Largest AIP and has Achieved Excellent Growth Top 10 AIP MPCI GPW in $US Millions and Market Share in RY 2015 1) Approved Insurance Provider (“AIP”). 2) Source: National Crop Insurance Services. 2015 Market Share 19.8 % 17.7 % 12.4 % 9.0 % 8.1 % 6.8 % 5.9 % 5.3 % 4.5 % 2.5 % Δ in Market Share Since 2009 (4.5)% (7.0)% (1.3)% (0.1)% 1.6 % (1.0)% 4.7 % 0.0 % 3.6 % 1.7 % $ 1,919 $ 1,713 $ 1,199 $ 866 $ 780 $ 658 $ 572 $ 512 $ 443 $ 242 Chubb Zurich QBE AFG Endurance FMH CGB TM / HCC CRS Fairfax 10

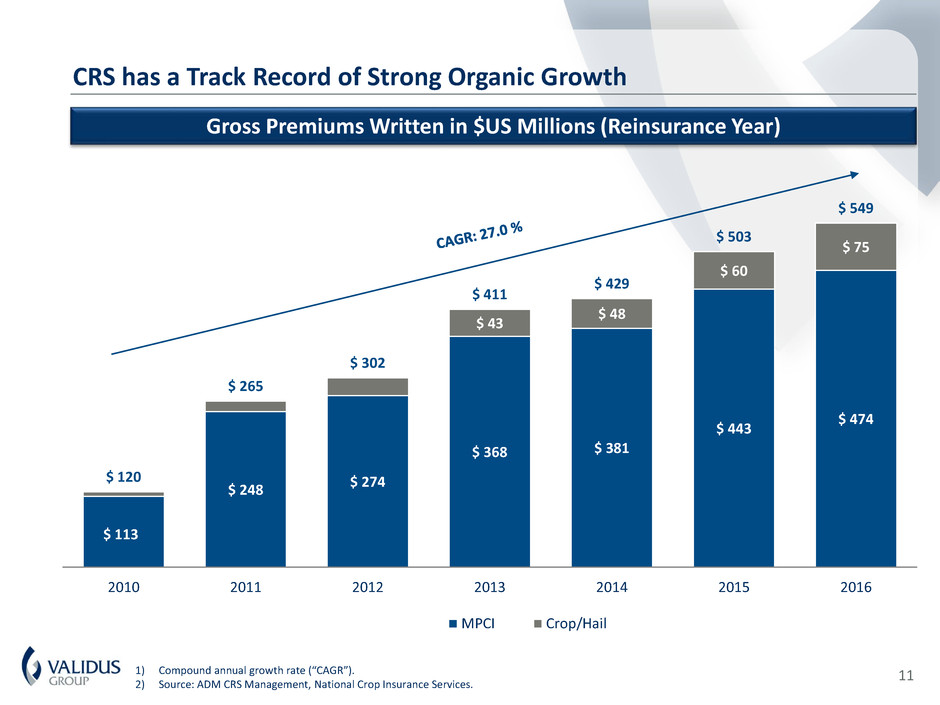

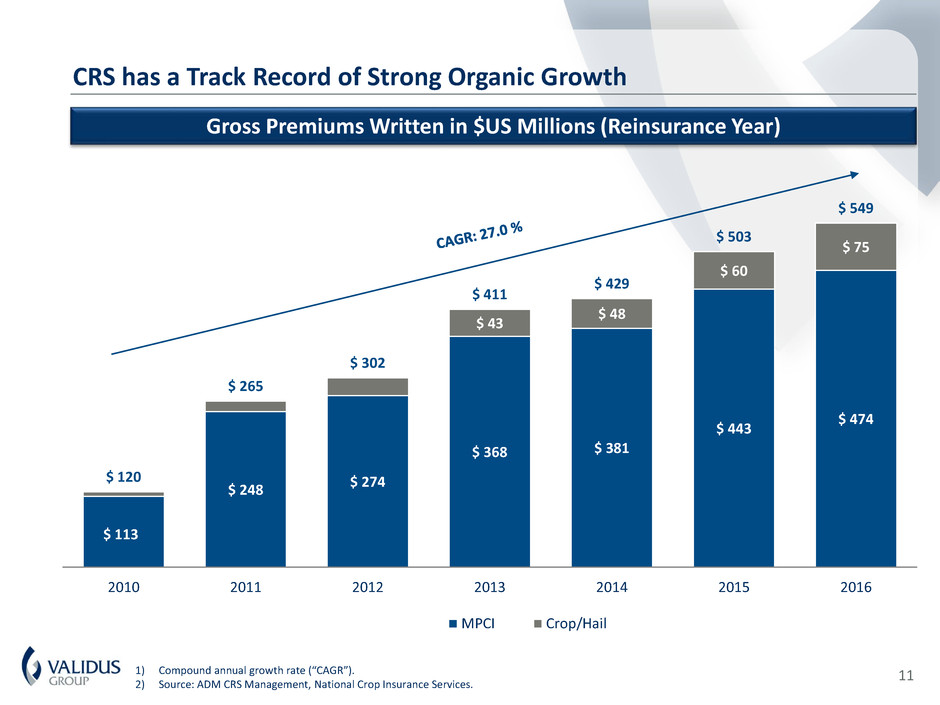

1) Compound annual growth rate (“CAGR”). 2) Source: ADM CRS Management, National Crop Insurance Services. Gross Premiums Written in $US Millions (Reinsurance Year) 11 CRS has a Track Record of Strong Organic Growth $ 113 $ 248 $ 274 $ 368 $ 381 $ 443 $ 474 $ 43 $ 48 $ 60 $ 75 $ 120 $ 265 $ 302 $ 411 $ 429 $ 503 $ 549 2010 2011 2012 2013 2014 2015 2016 MPCI Crop/Hail

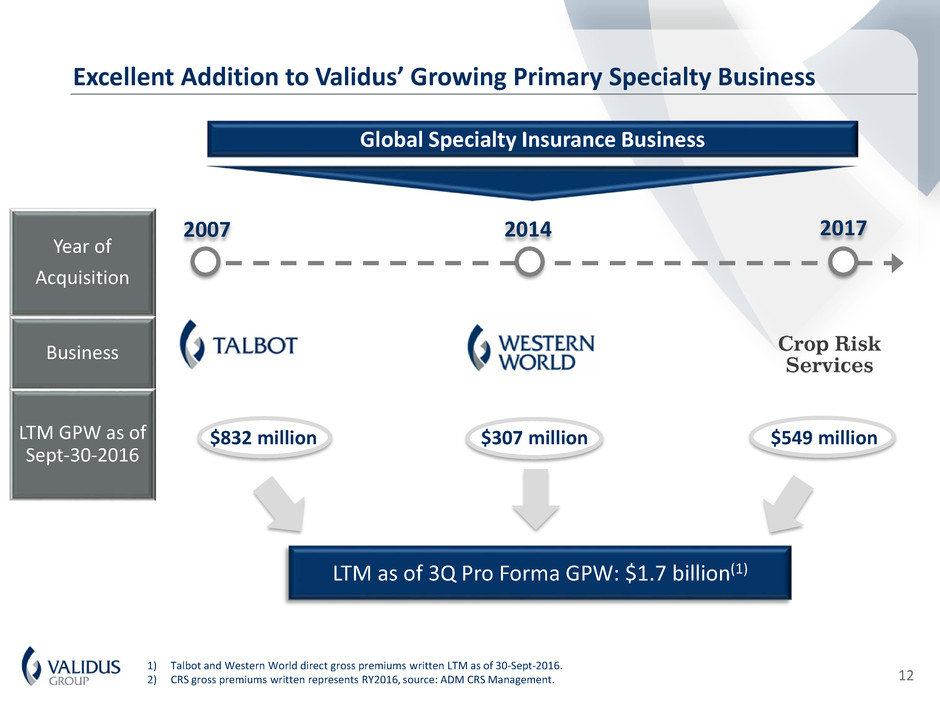

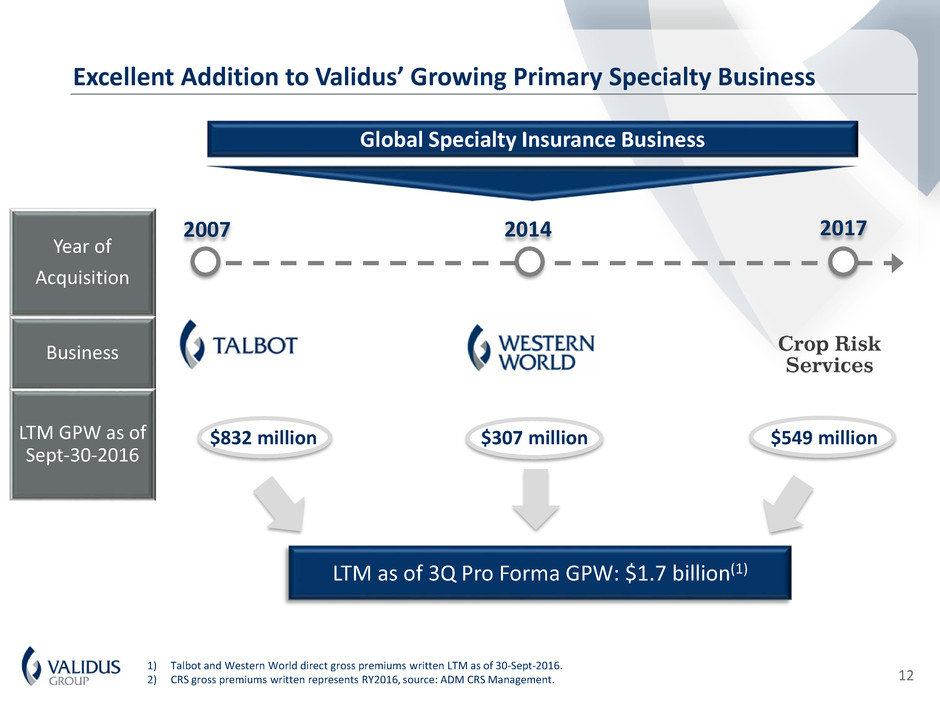

1) Talbot and Western World direct gross premiums written LTM as of 30-Sept-2016. 2) CRS gross premiums written represents RY2016, source: ADM CRS Management. LTM as of 3Q Pro Forma GPW: $1.7 billion(1) $832 million $307 million $549 million 2007 2014 2017 Global Specialty Insurance Business Year of Acquisition Business LTM GPW as of Sept-30-2016 12 Excellent Addition to Validus’ Growing Primary Specialty Business

Advantages of Operating CRS as Part of Western World Segment diversification from E&S into admitted specialty lines complements Western World strategy Oversight and business development capabilities to ensure a successful implementation of CRS business plans Utilize existing Western World infrastructure including IT systems, economic capital and human resources Validus’ proprietary research capabilities 13 Western World is an Ideal Partner for CRS

• Unique opportunity to acquire an industry-leading crop insurance business • Crop insurance is an attractive industry with favorable dynamics • Enhances position in U.S. specialty market • Long-term partnership with ADM, a Fortune 50 company with strong ties to the agriculture community • Participation in primary crop market brings compelling strategic benefits • Opportunities to leverage Validus’ analytical capabilities, capital efficiency and offshore jurisdiction to maximize the value of CRS • Proven ability to acquire and integrate high-performing businesses 14 Summary

Street Address: 29 Richmond Road Pembroke, Bermuda Mailing Address: Suite 1790 48 Par-la-Ville Road Hamilton, Bermuda HM 11 Telephone: +1-441-278-9000 Email: investor.relations@validusholdings.com For more information on our company, products and management team please visit our website at: www.validusholdings.com