- SD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

SandRidge Energy (SD) 425Business combination disclosure

Filed: 2 Jul 10, 12:00am

Filed by SandRidge Energy, Inc.

pursuant to Rule 425 under the Securities

Act of 1933, as amended, and deemed filed

pursuant to Rule 14a-6 under the Securities

Exchange Act of 1934, as amended

Subject Company: Arena Resources, Inc.

Commission File No.: 001-31657

SandRidge Energy Merger with Arena Resources Investor Presentation July 2010 ********** ********** ********** ********** ********** ********** ********** ********** ********* |

2 Important Additional Information Filed with the SEC This presentation is being made in respect of the proposed business combination involving SandRidge Energy, Inc. (“SandRidge”) and Arena Resources, Inc. (“Arena”). In connection with the proposed transaction, SandRidge filed with the SEC a Registration Statement on Form S-4, as amended, on April 30, 2010 containing a joint proxy statement/prospectus, and a supplement to the joint proxy statement/prospectus on June 14, 2010, and each of SandRidge and Arena may file with the SEC other documents regarding the proposed transaction. The definitive joint proxy statement/prospectus was first mailed to stockholders of SandRidge and Arena on or about May 7, 2010, and the supplement to the joint proxy statement/prospectus was first mailed to stockholders on June 17, 2010. Investors and security holders of SandRidge and Arena are urged to read the joint proxy statement/prospectus, the supplement and other documents filed with the SEC carefully in their entirety because they contain important information about the proposed transaction. Investors and security holders may obtain free copies of the Registration Statement and the joint proxy statement/prospectus, the supplement and other documents filed with the SEC by SandRidge and Arena through the web site maintained by the SEC at www.sec.gov. Free copies of the Registration Statement and the joint proxy statement/prospectus, supplement and other documents filed with the SEC may also be obtained by directing a request to SandRidge Energy, Inc., 123 Robert S. Kerr Avenue, Oklahoma City, Oklahoma 73102, Attention: Investor Relations, or by directing a request to Arena Resources, Inc., 6555 South Lewis Avenue, Tulsa, Oklahoma 74136, Attention: Investor Relations. SandRidge, Arena and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding SandRidge's directors and executive officers is available in SandRidge's Annual Report on Form 10-K for the year ended December 31, 2009, which was filed with the SEC on March 1, 2010, and SandRidge's proxy statement for its 2010 annual meeting of stockholders, which was filed with the SEC on April 26, 2010. Information regarding Arena's directors and executive officers is available in Arena's Annual Report on Form 10- K for the year ended December 31, 2009, which was filed with the SEC on March 1, 2010, as amended by the Annual Report on Form 10-K/A for the year ended December 31, 2009, which was filed with the SEC and April 30, 2010, and Arena's proxy statement for its 2009 annual meeting of stockholders, which was filed with the SEC on October 29, 2009. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the joint proxy statement/prospectus, the supplement and other relevant materials filed with the SEC. Important Information Regarding the Preparation of this Presentation This presentation was prepared solely by SandRidge and Arena. Although some of the information in this presentation refers to analyses of Tudor, Pickering, Holt & Co. Securities, Inc. (“Tudor Pickering”), Tudor Pickering did not prepare any part of this presentation. Tudor Pickering rendered an opinion to the board of directors of Arena in connection with the merger described in this presentation on June 1, 2010. The opinion speaks only as of that date and is subject to a number of qualifications and limitations. The opinion does not reflect changes that may occur or may have occurred after June 1, 2010, which could significantly alter the value of Arena or SandRidge or the respective trading prices of their common stock. Tudor Pickering has not performed any further analysis of the merger following the date of its opinion. This presentation should not be consulted for, or construed as a summary of, Tudor Pickering’s opinion or the assumptions made, procedures followed, matters considered, and qualifications and limitations of the review undertaken by Tudor Pickering in rendering its opinion. For that information, investors should refer to the full text of the Tudor Pickering opinion, which is included with the supplement to the joint proxy statement/prospectus dated June 14, 2010 and the summary thereof included therein under the caption “Opinion of Arena’s Financial Advisor.” Tudor Pickering has advised that it believes that its analyses must be considered as a whole, and that selecting portions of its analyses and of the factors considered by it, without considering all analyses and factors in their entirety, could create a misleading or incomplete view of the evaluation process underlying its opinion. Safe Harbor Language on Forward Looking Statements: This presentation includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements express a belief, expectation or intention and are generally accompanied by words that convey projected future events or outcomes. We have based these forward-looking statements on our current expectations and assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate under the circumstances. However, whether actual results and developments will conform with our expectations and predictions is subject to a number of risks and uncertainties, including the ability to obtain governmental approvals of the merger on the proposed terms and schedule, the failure of SandRidge or Arena stockholders to approve the merger, the risk that the businesses will not be integrated successfully, credit conditions of global capital markets, changes in economic conditions, regulatory changes, and other factors, many of which are beyond our control. We refer you to the discussion of risk factors in Part I, Item 1A - "Risk Factors" of the Annual Report on Form 10-K filed by SandRidge with the SEC on March 1, 2010; Part II, Item 1A – "Risk Factors" of the Quarterly Report on Form 10-Q for the quarter ended March 31, 2010 filed by SandRidge with the SEC on May 7, 2010; and Part I, Item Safe Harbor Language on Forward Looking Statements: 1A -"Risk Factors" of the Annual Report on Form 10-K filed by Arena with the SEC on March 1, 2010. All of the forward-looking statements made in this communication are qualified by these cautionary statements. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on our company or our business or operations. Such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. We undertake no obligation to update or revise any forward-looking statements. |

3 SandRidge & Arena: Key Attributes of the Combination Complementary assets that will be maximized through the combined entity Strategic Rationale Merger has the unanimous support of both companies’ boards and management teams and ARD stock trades in tight range to implied offer price Strong Endorsement for Transaction Arena stockholders’ pro forma ownership significantly exceeds Arena’s relative operational contribution to the combined company (47.2% owned by ARD stockholders’ pro forma) Disproportionate Ownership for Arena Stockholders Arena trading among the best in peer group SandRidge is trading above the median of market peers Strong Post Announcement Trading Performance Acquisition premium exceeds market medians across sectors for similar mergers Transaction multiples are at the top of the range versus comparable transactions 2010E EBITDA (x): 8.6x Price/ 2010E Cash Flow (x): 8.5x Reserve Value ($ / Boe): $19.51 Production ($ / Mboe/d): $164.4 Top Quartile Transaction Multiples Breakup fee reduced below market norm 30-day ‘go-shop’ period from June 1 – July 1 to actively solicit competitive bids Go-Shop Provided Solid Market Test of Deal |

June 2, 2010: Transaction Terms are Amended 4 SandRidge & Arena: Merger Update Increased consideration payable to Arena stockholders – Cash consideration raised from $2.50 per share to $4.50 per share – Following the amendment, each outstanding share of Arena will be converted in the merger into the right to receive 4.7771 shares of SandRidge common stock plus $4.50 per share in cash Introduced a 30-day "go-shop" period, which commenced on June 1, 2010 and expired on July 1, 2010 – Permitted Arena to proactively solicit competing takeover proposals Reduced termination fee – From $50 million to $39 million, representing approximately 2.9% of the equity value of Arena under the revised merger terms at the time of the announcement 30-day "go-shop" period concluded on July 1, 2010 24 companies were contacted by SunTrust Robinson Humphrey, Inc. (financial advisor to Arena), after a thorough pre-screen of possible strategic acquirers based on: – Wherewithal for a sizable acquisition – Presence in the Permian Basin or other oil plays or an expressed interest in acquiring oil assets Despite wide-spread news and industry coverage of the “go-shop”, only two reverse inquiries were received—both from entities with smaller market capitalizations than Arena – Arena effectively put in play since initial announcement on April 4 While several parties expressed initial interest in Arena and its assets, none executed a confidentiality agreement or submitted a takeover proposal which could reasonably be expected to result in a Company Superior Proposal Market affirmed the merger with SandRidge as the best strategic transaction available to Arena stockholders Results of “Go- Shop” Period Updated terms represent a unanimously approved transaction supported by both management teams and boards of directors—includes a period of over 75 days where Arena has been "in play" with no other buyer interest |

Despite Q1’10 production growth, Arena is hitting inventory wall with a limited supply of reserve and acreage to develop and continues to face operational hurdles Standalone Arena would likely need to look for a complete and transformational acquisition to maintain its growth Combined entity offers over 14,000 drilling locations and over 11 Tcfe of inventory to support future growth – 100% of Arena standalone represents 2,700 drilling locations; 47.2% of combined entity represents 7,000 locations 5 Why This Deal, Now, for Arena? Merger fully recognizes the value Arena has created for its stockholders to date Arena stockholders receive 47.2% ownership stake in pro forma entity compared to an operational contribution from Arena of 27% (a) Transaction multiples are among the highest in peer trading levels and comparable transactions Arena has consistently communicated a clear rationale for merging with SandRidge and believes the results of the “Go-Shop” process further affirm the competitiveness of the SandRidge transaction Compelling Valuation Accelerated capital expenditures in the combined company will result in greater growth than Arena standalone Operational efficiencies from SandRidge rig fleet of $5.0-17.0MM per incremental rig (b) G&A savings present value of over $100MM (b) Increased hedging capacity to lock-in incremental $1.5-2.0 billion revenue for $3 billion total revenue hedged Proven access to the capital markets (a) Operational contribution percent is the average of the following metrics: 2009 SEC PV-10, 2009 12/31/09 Spot PV-10, 10-year Average NYMEX Strip PV-10, 2009 Proved Reserves, 2009 Proved Developed Reserves & Q1’10 Production (b) Based on constant NYMEX oil prices varying between $70 and $85/bbl and $4.50/MMBtu NYMEX gas escalating to $6.00 in 2014. Impact based on hypothetical Fuhrman-Mascho type curve. Assumes discount rate of 12%, $8.50/Boe operating costs, production and ad valorem taxes of 5.0% of revenue, production related G&A of $1.50/Boe, oil differential of ($5.00)/bbl and gas differential of $1.00/Mcf (due to liquids content) Superior Upside Strategic Fit Enhanced Management Depth Synergies Arena’s assets plug-in to SandRidge’s current oil portfolio SandRidge has extensive operational expertise to optimize Fuhrman-Mascho Added scope and diversity of asset base provides revenue generating insurance, cost competitive advantages and optionality around production mix SandRidge has proven team with complete complement of geological, operational and financial expertise – SandRidge brings a team of ~35 geologists and ~50 engineers to Arena’s team of 3 geologists – Although Arena’s board recognizes the need for a transformational acquisition, Arena has not historically purchased and integrated large scale acquisitions SandRidge team is vested and committed to the growth of the combined entity – Tom Ward, CEO, owns 12.6% of SandRidge; Insiders hold 20.7% on a standalone basis |

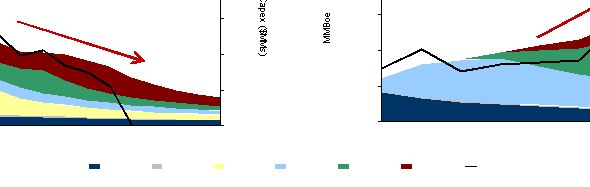

$0 $80 $160 $240 $320 $400 0 4,000 8,000 12,000 16,000 20,000 2010 2012 2014 2016 2018 2020 2022 2024 $0 $500 $1,000 $1,500 $2,000 $2,500 0 20,000 40,000 60,000 80,000 100,000 2010 2012 2014 2016 2018 6 Arena Gains Enhanced Growth Profile Arena’s reserve development is front-loaded with proved reserves peaking in 2012 As standalone entity, Arena would face pressure to replace drilling inventory for future growth; the Company would likely need to pursue strategic acquisitions or a merger in the next few years SandRidge has a significantly larger reserve base with significant growth opportunities through 2014 and beyond Strategic combination enables Arena to take advantage of existing premium valuation Arena has a strong portfolio of assets with significant near-term opportunities, but standalone sees a run-off of reserves over the next few years Arena 3P Production (a) SandRidge 3P Production (a) Standalone Arena Needs Future Source of Growth Arena’s 3P Reserves peak in 2014 SD has considerable running room with its inventory of reserves Source: SandRidge investor presentations & Company management (a) 3P Production and capital expenditures based on management expectations as of YE 2009 PDP PBP PNP PUD Prob Poss CAPX |

Q1'10 Production Proved Reserves Proved Dev. Reserves NYMEX PV-10 SEC PV-10 Drilling Locations 100% ARD Standalone ARD stockholders' 47.2% Stake in Combined Entity 7 Arena Stockholders Will Own Piece of Larger Pie The SandRidge transaction is accretive to ARD stockholders across all metrics 8.2MBoe/D 69.3 MMBoe 135.9 MMBoe 26.3 MMBoe 77.1 MMBoe 2,700 7,000 $1,121 MM $1,266 MM $1,820 MM $2,554 MM 27.3 MBoe/D Source: SandRidge investor presentations & Company management (a) ARD stockholders’ pro forma stake in combined entity calculated based on ARD stockholders’ 47.2% ownership in combined entity multiplied by pro forma metrics Arena stockholders receive 47.2% ownership stake in pro forma entity (a) A combination with SandRidge offers Arena’s stockholders greater exposure to oil assets and a significantly larger production and reserve base across both oil and gas Combined entity increases reserve base and drilling inventory substantially – Drilling Locations increase from 2,700 to over 14,000 (5,700 oil well drilling locations) – Proved developed reserves in increase from 26.3 MMBoe to 163.4 MMBoe |

$10.00 $11.91 $8.51 $0.00 $6.00 $12.00 $18.00 Analyst price targets (a) Future share price (peer mults) (b) Future share price (current mults) (b) SandRidge implied value per share 8 SandRidge Value Potential (a) Based on public information analysis (b) Future share prices of Arena and SandRidge calculated by multiplying 2013E cash flow per share by select multiples. The peer multiples used for Arena and SandRidge were 5.3x and 4.9x, respectively, and the current multiples for Arena and SandRidge were 6.3x and 3.5x, respectively. An equity discount rate of 13% was then used to discount the future share prices to the present (c) Utilizes Forest purchase multiple of $94.7 / MBoe / d less 2010 YTD capex of $70 million (d) Utilizes Arena purchase multiple of $164.4 / MBoe / d (based on Q1’10 production) less 2010 YTD capex of $70 million Source: Supplement to joint proxy statement/prospectus; Permian production per SandRidge management SandRidge Permian Production Rapid growth due to recent activity in new Permian assets acquired from Forest Oil Able to achieve growth on previously zero growth asset due to in place operational expertise – Put backup midstream processing partners in place – Installed redundant electrical systems SandRidge has substantial upside potential and a proven ability to enhance value through operational expertise Implied SandRidge Standalone Value Unlocking Additional Value Recently signed LOI for proposed $140MM Cana Shale divestiture highlights hidden asset value not recognized by the market – No associated proved reserves or current production Complementary geographic overlap in the Permian Basin and extending into the West Texas Overthrust Center of SandRidge’s oil field service operations (Ft. Stockton) within ~60 miles of all major assets of both SandRidge and Arena Immediate ability to employ inactive, owned rigs in the region SandRidge is currently one of the largest contractors in the region of pressure pumping, workover rigs, gas processing and storage, and infrastructure requirements Production Increase @ Forest Permian Multiple (c) @ Arena Permian Multiple (d) 2,440 Boe/d $161 million $331 million Value Creation Average standalone price: $10.14 Percent above current: 71% SD Price as of 6/1/10: $6.10 |

Liquids 57% Gas 43% PF Proved Reserves (YE 09) 9 Vision of Future Growth Arena benefits from significant synergy potential that can be realized as a result of the unique strategic fit for both companies (a) Production reflects December 2009 average for SD; 3/2/2010 for ARD (b) Based on constant NYMEX oil prices varying between $70 and $85/bbl and $4.50/MMBtu NYMEX gas escalating to $6.00 in 2014. Impact based on hypothetical Fuhrman-Mascho type curve. Assumes discount rate of 12%, $8.50/Boe operating costs, production and ad valorem taxes of 5.0% of revenue, production related G&A of $1.50/Boe, oil differential of ($5.00)/bbl and gas differential of $1.00/Mcf (due to liquids content) Source: SandRidge Company Presentation West Texas Asset Overlap Combined Company . . . .a Leading Permian Player Continued significant oil exposure through combined entity – SandRidge currently produces more oil than Arena. Q1’10 oil production was 1.2 MMBbls compared to Arena’s 0.6 MMBbls Creation of a leading Permian player with significant operational and basin expertise, 21.5 Mboe/d production and 183 Mmboe reserves within a combined company with 57.8 Mboe/d production (a) and reserves of 288 MMboe – Provides ownership in SandRidge’s desirable, recently acquired Forest Permian assets – Combined 5,700 potential oil well drilling locations Exposure to significant oil development potential from multiple assets SandRidge’s financial performance responds favorably to changes in both oil and gas prices – A $10 / bbl change in oil price represents an $8.9MM increase in 2010E EBITDA (b) – Similarly, a $1 / MMBtu change in gas prices represents a $9.1MM increase in 2010E EBITDA (b) SandRidge’s asset mix means that shareholders are able to capitalize on favorable long-term commodity trends—both oil & gas Liquids 58% Gas 42% PF Q1' 10 Revenue Liquids 82% Gas 18% PF PV-10 (YE 2009) |

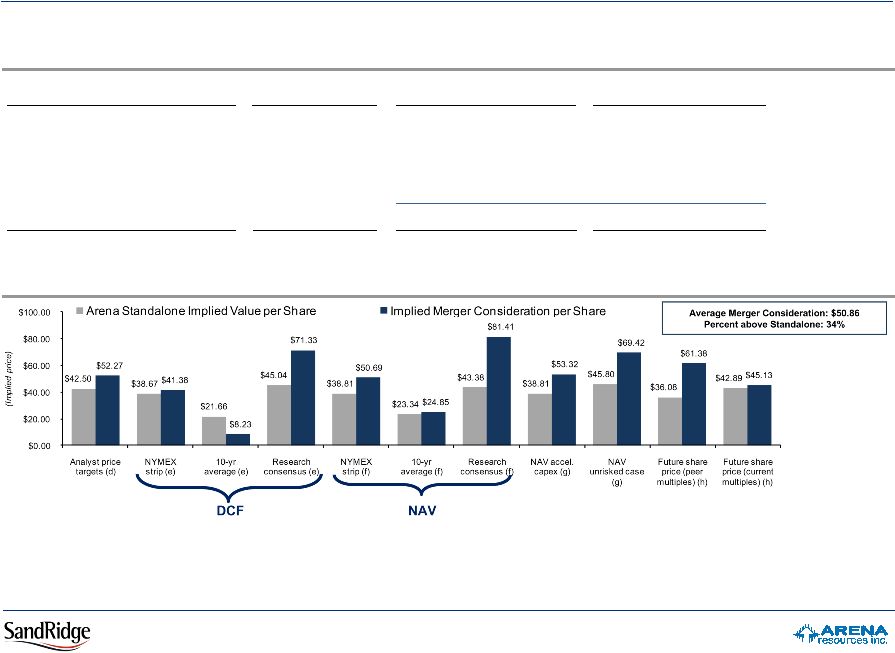

10 Attractive Valuation and Consideration to Arena Stockholders (a) Based on unaffected offer value as of June 1, 2010 (b) Deal value in excess of median utilizes proved reserves of 69.3 MMBoe, Q1 production of 8,217 Boe / d and FY + 1 EBITDA of $162 million (c) Corporate Transaction Multiples are North American precedent deals over $200MM in enterprise value with pro forma ownership between 43%-51% over the last 10 years (Source: Dealogic) (d) Based on public information analysis (e) Based on 6/1/10 Tudor Pickering DCF analysis of SandRidge and Arena using disclosed commodity price sensitivities (f) Based on 6/1/10 Tudor Pickering NAV analysis of SandRidge and Arena using disclosed commodity price sensitivities (g) Based on 6/1/10 Tudor Pickering NAV analysis – operating case using NYMEX strip as of 5/28/10 (h) Future share prices of Arena and SandRidge were calculated by multiplying 2013E cash flow per share by select multiples. The peer multiples used for Arena and SandRidge were 5.3x and 4.9x, respectively, and the current multiples for Arena and SandRidge were 6.3x and 3.5x, respectively. An equity discount rate of 13% was then used to discount the future share prices to the present Source: Supplement to joint proxy statement/prospectus. See “Opinion of Arena’s Financial Advisor” beginning on page S-40 thereof with respect to Tudor Pickering analysis Comparable Transaction Summary Implied Value per Share of the Merger Consideration vs. Arena Standalone Transaction metrics are attractive relative to peer medians and merger consideration exceeds Arena’s value on a standalone basis Transaction Metrics Peer Median Arena at Offer (a) Enterprise value / Boe $12.77 $19.51 Enterprise value / MBoe / d $58.5 $164.4 Enterprise value / FY + 1 EBITDA 5.8x 8.6x Transaction Premiums 10-yr Median (c) Initial Announcement (4/1/10) 1-day prior 5.8% 16.8% 1-week prior 8.3% 26.8% Deal Value in Excess of Median ($mm) (b) $467 $870 $454 Arena Transaction Unaffected Premiums Revised Terms (6/1/10) 7.3% 12.5% |

4.1% 3.4% 2.5% 2.1% -2.1% -3.6% -4.6% -5.6% -7.9% -12.4% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% CXO Gas ARD REN Oil CLR PXD WLL DNR BRY SandRidge & Peers Arena & Peers 11 Analysis of Trading Activity Since Amendment of Merger Terms Since the announcement of the amended merger terms on 6/2/10, SandRidge and Arena have performed better than their peers Note: Market data as of July 1, 2010; Oil & Gas commodity prices based on NYMEX 24-month strip; Median excludes commodities, SD & ARD Source: Capital IQ, Bloomberg Share Price Performance since June 1, 2010 (prior to amendment to merger terms) median 6.4% 5.3% 3.4% -2.1% -3.0% -3.4% -5.0% -5.6% -5.7% -8.8% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% PXP FST Gas Oil SD NFX COG XEC SM XCO |

Spread: ARD to Implied Offer Price (weekly averages) Source: Bloomberg, as of 7/1/10 The spread between Arena’s stock price and the implied offer price has continued to tighten Market Perspective 12 |

Appendix ********* ********* ********* ********* ********* ********* ********* ********* ********* ****** |

Strategic Fit “Arena management believes they need another leg to the story to continue to grow the Company, and efforts in acquiring new assets have been unsuccessful of late. The Company also expects economics in the Fuhrman Mascho may deteriorate as it begins to drill away from the core over the next few years. As a result, ARD believes that this transaction gives the Company the most potential upside as it is acquiring natural gas assets near a potential bottom in the commodity. ” RBC Capital Markets (April 6th, 2010) “The key asset of Arena is the Fuhrman Mascho play with low-risk San Andres wells at around 4,300 feet as well as Clear Fork potential at 6,000 feet. Though the stated reserves of Arena were 69 Mmboe with approximately 8,500 Boepd of net production as of early March, we believe SandRidge should be able to greatly ramp both rather quickly as the company has the resources to mitigate any midstream issues and has the assets to become more active with the properties.” Wunderlich Securities (June 22nd, 2010) Sales Process “From our perspective, the inclusion of a 30-day ‘go-shop’ period addresses one of the primary shareholder concerns in that it allows ARD shareholders a broader evaluation of potential options. While the amendment extends the near-term uncertainty overhang on SD shares, we do not see a higher bid as a significant risk given the robust transaction metrics associated with the current offer. ” Bank of America Merrill Lynch (June 3rd, 2010) Premium Valuation “The acquisition appears to be a good deal for ARD shareholders, as the deal price was struck at just above our target price.” C.K. Cooper & Company (April 5th, 2010) “Deal metrics point to attractive takeout price: Given the $1.57 billion acquisition price, we estimate the deal corresponds to $22.70 per proved BOE, $47 per PDP BOE, and $185,000 per flowing BOE/D. Management had been guiding to a 30% production growth in 2010.” UBS (April 5th, 2010) Research Analyst Commentary 14 Note: Permission to cite nor quote from the source report was neither sought nor obtained |

$164.4 5.8x $58.5 $12.77 8.6x $19.51 Proved Reserves ($/Boe) Daily Production ($/MBoe/d) 2010E EBITDA $164.4 6.6x 7.6x $95.0 $20.67 8.5x 8.6x $19.51 Proved Reserves ($/Boe) Daily Production ($/MBoe/d) 2010E EBITDA 2010E P / CF Comparable Company Analysis (a) (a) Comparable companies include: BRY, CXO, DNR, PXD, WLL Source: Supplement to joint proxy statement/prospectus. See “Opinion of Arena’s Financial Advisor” beginning on page S-40 thereof with respect to Tudor Pickering analysis Comparables Analysis Comparable Transaction Analysis Comparables Median Arena Merger Consideration Implied merger consideration represents a premium valuation to Arena stockholders across a variety of measures 15 |

Source: Supplement to joint proxy statement prospectus. See “Opinion of Arena’s Financial Advisor” beginning on page S-40 thereof with respect to Tudor Pickering analysis Transaction Metrics Attractive Relative to Relevant Industry Comparables Arena’s transaction multiples are significantly better than the median for comparable transactions across all standard metrics Transaction Value / Acquiror / Target Year of Announcement Proved Reserves ($/Boe) Daily Production ($/Mboe/d) EBITDA (year of announcement) EBITDA (year following announcement) Exxon Mobil / XTO Energy 2009 $17.63 $82.9 5.9x 6.7x Denbury / Encore 2009 21.21 105.1 9.4x 8.4x Plains Exploration / Pogo 2007 15.02 65.3 5.0x 5.8x Petrohawk / KCS 2006 24.37 72.3 5.3x 4.5x Occidental Petroleum / Vintage 2005 9.03 52.0 6.7x 5.0x Chevron / Unocal 2005 10.32 44.1 4.9x 5.0x Petrohawk / Mission Resources 2005 14.52 53.0 NA NA Cimarex Energy / Magnum Huner 2005 12.77 58.5 4.9x NA Noble Energy / Patina Oil & Gas 2004 13.30 60.3 8.5x 7.6x Pioneer Natural Resources / Evergreen 2004 8.02 79.9 10.2x 8.1x Kerr-McGee / Westport Resources 2004 11.68 37.7 5.7x 5.8x Plains Exploration / Nuevo Energy 2004 4.52 19.0 NA NA Whiting Petroleum / Equity Oil 2004 4.70 24.1 NA NA Median $12.77 $58.5 5.8x 5.8x Merger Consideration $19.51 $164.4 8.6x 6.9x 16 |

17 Transaction Premium in Excess of Comparables Precedent North American transactions (with target pro forma stockholder ownership >=43% and <=51%, >$200 million over the last 10 years) Source: Dealogic (a) Pro forma Arena stockholder ownership based supplement to joint proxy statement/prospectus Date Announced Target Acquiror Industry Deal Value ($mm) Target Ownership % Prior 1-day Prior 1-week 03/23/10 FNX Mining Co Inc Quadra Mining Ltd Materials 1,284 48.0% 1.8% 2.1% 11/02/09 The Black & Decker Corp The Stanley Works Consumer Staples 4,241 49.5% 22.1% 17.2% 07/29/08 Solana Resources Ltd Gran Tierra Energy Inc Energy and Power 617 49.0% 25.5% 11.4% 12/07/07 Gemstar-TV Guide Intl Inc Macrovision Corp Media and Entertainment 2,306 47.0% 10.7% 12.2% 11/13/07 Tutogen Medical Inc Regeneration Technologies Inc Healthcare 274 45.0% 26.7% 14.0% 02/05/07 Hanover Compressor Co Universal Compression Holdings Energy and Power 2,074 47.0% 2.4% 5.8% 01/29/07 Abitibi-Consolidated Inc Bowater Inc Materials 4,270 48.0% 1.4% 0.8% 11/01/06 Caremark Rx Inc CVS Corp Healthcare 25,093 45.5% 21.5% 20.3% 09/19/06 Denison Mines Inc International Uranium Corp Materials 386 50.0% 1.6% 8.1% 09/14/06 Cambior Inc IAMGold Corp Materials 1,233 43.0% 31.5% 24.1% 06/26/06 XM Satellite Radio Hldgs Inc Sirius Satellite Radio Inc Media and Entertainment 5,760 50.0% 26.5% 28.7% 04/21/06 KCS Energy Inc Petrohawk Energy Corp Energy and Power 1,879 50.0% 9.6% 18.7% 09/19/05 Acclaim Energy Trust StarPoint Energy Trust Financials 1,735 47.0% (1.5%) 3.5% 06/15/05 Integrated Circuit Systems Inc Integrated Device Tech Inc High Technology 1,610 46.0% 21.5% 16.3% 03/21/05 Mykrolis Corp Entegris Inc High Technology 474 44.0% 5.0% 2.8% 12/15/04 Nextel Communications Inc Sprint Corp Telecommunications 46,514 50.0% 16.7% 10.1% 08/12/04 Varco International Inc National-Oilwell Inc Energy and Power 2,944 49.0% 9.2% 10.0% 03/17/04 Apogent Technologies Inc Fisher Scientific Intl Inc Healthcare 3,669 43.0% 5.5% 4.7% 02/04/04 Cable Design Technologies Corp Belden Inc High Technology 508 45.0% (0.5%) (3.9%) 06/20/03 Biogen Inc IDEC Pharmaceuticals Corp Healthcare 6,059 49.5% 3.7% (3.0%) 02/19/03 Sports Authority Inc Gart Sports Co Retail 306 50.0% (0.5%) 5.2% 02/22/02 Visionics Corp Identix Inc High Technology 269 47.6% (7.3%) (9.7%) 01/27/02 Alberta Energy Co Ltd PanCanadian Energy Corp Energy and Power 9,233 46.0% 11.8% 16.7% 01/17/02 Proxim Inc Western Multiplex Corp Telecommunications 205 50.0% (9.0%) (28.1%) 11/18/01 Conoco Inc Phillips Petroleum Co Inc Energy and Power 24,786 43.4% (0.3%) (10.2%) 10/01/01 Virata Corp GlobeSpan Inc High Technology 391 47.5% (7.6%) (6.9%) 09/04/01 Global Marine Inc Santa Fe International Corp Energy and Power 3,818 50.6% 16.8% 9.5% 08/29/01 Westvaco Corp Mead Corp Materials 5,608 50.2% 5.8% 8.3% 05/23/01 Marine Drilling Cos Pride International Inc Energy and Power 1,996 44.0% 13.4% 16.2% 10-yr Median 5.8% 8.3% SandRidge Energy / Arena Resources transaction with unaffected share price as of 4/1/10 1,535 47.2% (a) 16.8% 26.8% SandRidge Energy / Arena Resources transaction with unaffected share price as of 6/1/10 1,285 47.2% (a) 7.3% 12.5% Premium to Target Price |