EIP Growth and Income Fund

December 31, 2016 Annual Report

EIP Growth and Income Fund

TABLE OF CONTENTS

| | | 1 | |

| | | 4 | |

| | | 6 | |

| | | 7 | |

| | | 9 | |

| | | 10 | |

| | | 11 | |

| | | 12 | |

| | | 14 | |

| | | | |

| | | 23 | |

| | | 24 | |

This report is provided for the general information of the shareholders of the EIP Growth & Income Fund. This report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

EIP Growth and Income Fund

I am pleased to submit this Annual Report for the EIP Growth and Income Fund (the “Fund”) for the year ended December 31, 2016. For the year ended December 31, 2016, the Fund’s total return as measured by the Class I shares was +16.14%. For the year ended December 31, 2015, the Fund’s total return as measured by the Class I shares was -21.54%. The performance data quoted represents past performance and is no indication of future performance. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694.

The Fund seeks to provide a high level of total shareholder return adjusted for risk that is balanced between current income and growth. As a secondary objective, the Fund seeks low volatility. The Fund pursues its objectives by investing mainly in equity securities issued by Energy Companies that are primarily involved in steady fee-for-service infrastructure that support the production and delivery of natural gas, oil or electricity, but may also selectively invest in other energy corporations. The Fund may also own Energy Companies that have cyclical business exposure. The Fund may seek to hedge this exposure through short positions, which may include short sales or swaps that reflect an underlying short position. The level of dividends and the sustainability of dividend payments by Energy Companies tend to vary based on the type of the company and its underlying businesses. The types of companies the fund invests in include: (1) energy-related master limited partnerships or limited liability companies that are treated as partnerships (“MLPs”), (2) entities that control MLPs, that own general partner interests in an MLP or interests issued by MLP affiliates (such as I-Shares or i-units), (3) U.S. and Canadian energy yield corporations (“Yieldcos”), (4) U.S. and Canadian natural gas and electric utilities, and (5) other energy-related corporations with similar dividend policies The Fund concentrates its investments in the Energy Industry, and may invest without limit in Energy Companies of any market capitalization. While the Fund invests primarily in U.S. and Canadian Energy Companies, it may also invest in Energy Companies organized in other countries.

Benchmarks:

We believe the following benchmarks provide appropriate comparisons of the Fund’s performance:

| | | Total Return | |

| | | 1/1/16 – | |

| | | 12/31/16 | |

| S&P 500 Index | | | 11.93 | % |

| Wells Fargo Midstream MLP | | | | |

| Total Return Index | | | 19.87 | % |

| Alerian MLP Total Return Index | | | 18.31 | % |

| Bloomberg Barclays 1-3 Yr | | | | |

| Credit Total Return Index | | | 2.11 | % |

| | | Total Return | |

| | | 1/1/15 – | |

| | | 12/31/15 | |

| S&P 500 Index | | | 1.38 | % |

| Wells Fargo Midstream MLP | | | | |

| Total Return Index | | | -31.50 | % |

| Alerian MLP Total Return Index | | | -32.59 | % |

| Bloomberg Barclays 1-3 Yr | | | | |

| Credit Total Return Index | | | 0.85 | % |

S&P 500 Index. The S&P 500 Index is a capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Wells Fargo Midstream MLP Total Return Index (WCHWMIDT). The WCHWMIDT consists of 53 energy MLPs as of December 31, 2016 and represents the midstream sub-sector of the Wells Fargo MLP Composite Index.

Alerian MLP Total Return Index (AMZX). The AMZX is a composite of the most prominent energy master limited partnerships calculated by Standard & Poor’s using a float adjusted market capitalization methodology on a total return-return basis.

Bloomberg Barclays 1-3 Yr Credit Total Return Index. The Bloomberg Barclays 1-3 Yr Credit Total Return Index is an index of corporate and government related bonds with an average duration of about 1.9 years and an average credit quality between Moody’s assigned A1 and A2 ratings (Source: Barclays Capital Inc.).

The Fund underperformed the WCHWMIDT in 2016 as a recovery in the price of crude oil and natural gas helped drive cyclical companies in the index to outperform the Fund. As we have said numerous times, we believe the MLP structure and a high payout ratio is only suitable for a narrow set of long-lived assets that have stable non-cyclical cash flows, such as regulated pipelines or other infrastructure assets that are legal or natural monopolies. This was the primary driver to the Fund’s significant outperformance relative to the WCHWMIDT in 2015 when cyclical companies underperformed as oil and gas prices fell throughout the year. Over the past two years the Fund has outperformed the WCHWMIDT by 9.0% throughout volatile commodity markets as non-cyclical companies in the Fund have continued to grow the dividend. Over the last 12 months, the per-share cash distributions of energy-related MLPs has declined about 7.7% (Source: Alerian Capital Management). This compares to the weighted average distribution growth of approximately 1.5% for the portfolio.

Industry Review

The drop in oil and gas prices in 2014 through 2016 resulted in a severe decline in the prices of energy related securities. As commodity prices stabilized, so too did the prices of energy related securities. The longer term cost of the correction in commodity prices for MLPs can be seen in the roughly 20%

EIP Growth and Income Fund

decline in dividends from the MLPs in the Alerian MLP Index from their peak in November of 2014 through the end of 2016. Over this time the dividends in the Fund actually grew. This dividend performance is due to the Fund’s focus on energy infrastructure companies that are less dependent on commodity prices and more dependent on regulated or contractual tariffs that are not directly tied to commodity prices.

Over the long term, the total return proposition of owning non-cyclical energy related infrastructure MLPs, YieldCos and utilities has been and continues to be their yield plus their growth. In our opinion, the better positioned MLPs, YieldCos and utilities not only have noncyclical cash flows but also conservative balance sheets, modest and/ or flexible organic growth commitments and liquidity on their revolving lines of credit. Cyclical cash flows will always be unpredictable in our view, making them a poorer fit with a steady dividend obligation. Over the last few years, the majority of MLP IPOs were companies whose primary business is the production of oil and gas, shipping, refining or natural gas gathering and processing. While some of these MLPs have quality assets and competent management teams, they have more risk associated with the cyclical nature of their businesses. We have written about the dangers of this trend in the past, and remain vigilant about limiting our exposure to MLPs with cyclical cash flows.

Fund Updates

On 10/14/16, the Fund registered its shares under the Securities Act of 1933 and added a new class of shares, the Investor Class shares. We are hopeful that by increasing access to the Fund through retail platforms that new assets can be raised, benefiting all shareholders. Beginning in the first quarter of 2017, the Fund will pay out a dividend on a quarterly basis rather than annually. Also, in the first quarter of 2017, the Fund began utilizing a bond strategy that consists of buying U.S treasuries of one maturity and shorting bonds with a different maturity. For example, buying 4 year U.S. treasuries and shorting 5 year U.S. treasuries. This strategy serves two primary purposes. The first is to provide a hedge to the equity of the portfolio from changes in interest rates and the second for leverage purposes. As further disclosed in the Fund’s prospectus, the Fund may short U.S. Treasuries to a significant extent.

Sincerely,

James Murchie

President

EIP Growth and Income Fund

The views expressed in this commentary reflect those of the Fund’s portfolio management team as of December 31, 2016. Any such views are subject to change at any time based on market or other conditions, and the Fund disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or advice. Because investment decisions for the Fund are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of the Fund. The information contained herein has been prepared from sources believed to be reliable, but is not guaranteed by the Fund as to its accuracy or completeness. Past performance is not indicative of future results. Performance information provided above assumes the reinvestment of interest, dividends and other earnings. There is no assurance that the Fund’s investment objectives will be achieved.

The fund’s investment objective, risks, charges and expenses must be considered carefully before investing. The statutory prospectus may be obtained by calling (203) 349-8232 or emailing ir@energymlp.com and should be read carefully before investing as it contains this and other important information about the fund.

Mutual fund investing involves risks including loss of your entire investment. Because the Fund concentrates its investments in the Energy Industry, the Fund is subject to greater risk of loss as a result of adverse economic, business or other developments affecting industries within that sector than if its investments were more diversified across different industries. Energy Companies are highly sensitive to events relating to international politics, governmental regulatory policies, including energy conservation and tax policies, fluctuations in supply and demand, environmental liabilities, threats of terrorism and to changes in exchange rates or interest rates. MLPs are subject to various risks related to the underlying operating companies they control, including dependence upon specialized management skills and the risk that such companies may lack or have limited operating histories. The value of the Fund’s investment in an MLP will depend largely on the MLP’s treatment as a partnership for U.S. Federal Income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the fund which could result in a reduction of the fund’s value. Investments in Non-U.S. companies (including Canadian issuers) are subject to risks related to political, social and economic developments abroad, differences between U.S. and foreign regulatory and accounting requirements, tax risk and market practices, as well as fluctuations in foreign currencies. The Fund invests in Small and Mid-cap companies, which involves additional risks such as limited liquidity and greater volatility than larger companies. The Fund may invest in Fixed Income securities which typically decrease in value when interest rates rise, this risk is usually greater for longer-term debt securities. Investment in Lower-rated and Non-rated securities presents a greater risk

EIP Growth and Income Fund

of loss to principal and interest than higher-rated securities. The Fund may engage in Short Sales which are speculative and more risky than long positions (purchases) in securities because there is no maximum attainable price of the shorted security. Therefore, in theory, securities sold short have unlimited risk. Short selling will also result in higher transaction costs and may result in higher taxes. The Fund’s use of Derivatives could lead to substantial volatility and losses. Some derivatives are “leveraged,” which means they provide the Fund with investment exposure greater than the value of the Fund’s initial investment in the derivative instrument. As a result, these derivatives may magnify or otherwise increase losses to the Fund. Derivative instruments may not correlate well with the performance of the securities or asset class to which the Fund seeks exposure. Derivatives may be illiquid and difficult to price, and the counterparty to a derivatives contract may be unable or unwilling to fulfill its obligations to the Fund. The Fund’s use of leverage, via short sales or derivatives, may cause volatility in returns as it typically magnifies both gains and losses. When the Fund increases its investment exposure through the use of leverage, a relatively small market movement may result in significant losses to the Fund. This is not a complete outline of the risks involved in investing in the Fund. Investors are encouraged to read the prospectus carefully prior to investing.

EIP Growth and Income Fund

December 31, 2016

Investment Results (unaudited)

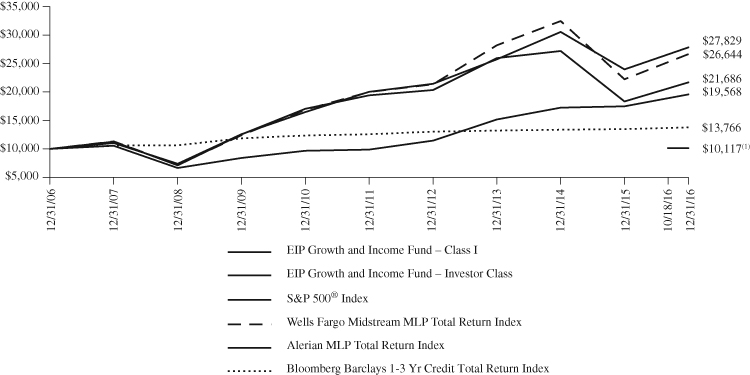

Results of a Hypothetical $10,000 Investment

The performance data quoted represents past performance and is no indication of future performance. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694 for the most recent month-end performance.

The chart above assumes an initial gross investment of $10,000 made on December 31, 2006. Returns shown include the reinvestment of all dividends, including capital gains. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. In the absence of fee waivers and reimbursements total return would be reduced. Index returns do not reflect the effects of fees or expenses. It is not possible to invest directly in an index.

S&P 500® Index – The S&P 500® Index is a capitalization-weighted index of 500 stocks. This Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Wells Fargo Midstream MLP Total Return Index – The Wells Fargo Midstream MLP Total Return Index consists of 53 energy MLPs as of December 31, 2016 and represents the midstream sub-sector of the Wells Fargo MLP Composite Index.

Alerian MLP Total Return Index – The Alerian MLP Total Return Index is a composite of the most prominent energy master limited partnerships calculated by Standard & Poor’s using a float adjusted market capitalization methodology on a total-return basis.

Bloomberg Barclays 1-3 Yr Credit Total Return Index – The Bloomberg Barclays 1-3 Yr Credit Total Return Index is an index of corporate and government related bonds with an average duration of about 1.9 years and an average credit quality between Moody’s assigned A1 and A2 ratings (Source: Barclays Capital Inc.). While slightly longer in duration and lower in credit quality, we believe that over time, this index is the best benchmark for how we run the bond portion of the portfolio, when applicable.

EIP Growth and Income Fund

December 31, 2016

Investment Results (unaudited) – continued

Returns For Year Ended 12/31/16

Average Annual Total Returns

| | One Year | Five Year | Ten Year | Since Inception(1) |

EIP Growth and Income Fund, Class I(7) | 16.14% | 6.80% | 10.78% | 10.97% |

EIP Growth and Income Fund, Investor Class(7) | N/A | N/A | N/A | 0.53%(6) |

S&P 500® Index | 11.96% | 14.66% | 6.95% | 7.68%(2) |

| Wells Fargo Midstream MLP Total Return Index | 19.87% | 5.91% | 10.20% | 10.95%(3) |

| Alerian MLP Total Return Index | 18.31% | 2.25% | 8.05% | 8.78%(4) |

Bloomberg Barclays 1-3 Yr Credit Total Return Index(5) | 2.11% | 1.84% | 3.25% | 3.33% |

| (1) | Inception date is 08/22/2006 for Class I and 10/18/2016 for Investor Class. The Fund was registered under the Investment Company Act of 1940 on August 22, 2006 and offered through a confidential private placement memorandum. On October 14, 2016, Fund shares were registered under the Securities Act of 1933. The Fund performance is net of actual fees and expenses incurred by the Fund. |

| (2) | The return shown for the S&P 500® Index is from the inception date of Class I. The S&P 500® Index cumulative return from the inception date of the Investor Class is 5.13%. |

| (3) | The return shown for the Wells Fargo Midstream MLP Total Return Index is from the inception date of Class I. The Wells Fargo Midstream MLP Total Return Index cumulative return from the inception date of the Investor Class is 4.24%. |

| (4) | The return shown for the Alerian MLP Total Return Index is from the inception date of Class I. The Alerian MLP Total Return Index cumulative return from the inception date of the Investor Class is 2.88%. |

| (5) | The return shown for the Bloomberg Barclays 1-3 Yr Credit Total Return index is from the inception date of Class I shares. The Bloomberg Barclays Capital 1-3 Yr Credit Total Return Index cumulative return from the inception of date of the Investor Class shares is -0.30%. Fund management has determined that the Bloomberg Barclays 1-3 Yr Credit Total Return Index is no longer an appropriate index for the Fund. |

| (6) | The return shown is cumulative from the inception date. |

| (7) | Class I share – gross expense ratio 3.59%; net expense ratio 2.14% |

| | Investor Class share – gross expense ratio 4.33%; net expense ratio 2.40% |

| | The contractual expense waiver is in effect until October 14, 2017. |

EIP Growth and Income Fund

December 31, 2016

Expense Example (unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. The following Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2016 to December 31, 2016.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Incurred During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | Beginning | Ending | Annualized | |

| | Account Value | Account Value | Expense Ratio | Expenses Incurred |

| | 07/01/16 | 12/31/16 | During Period | During Period(1) |

| Class I | | | | |

| Actual | $1,000.00 | $1,015.60 | 2.00% | $10.13 |

Hypothetical(2) | $1,000.00 | $1,015.08 | 2.00% | $10.13 |

| | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $1,005.30 | 2.40% | $ 4.93(3) |

Hypothetical(2) | $1,000.00 | $1,013.07 | 2.40% | $12.14 |

| (1) | Expenses are equal to the Class I annualized expense ratio, as indicated, multiplied by the average account value over the period, multiplied by 184/366 to reflect the most recent one-half year period. |

| (2) | Hypothetical assumes 5% annual return before expenses. |

| (3) | The Investor Class commenced operation on October 18, 2016. The amounts shown are equal to the Investor Class annualized expense ratio, as indicated, multiplied by the average account value over the period, multiplied by 75/366 to reflect the most recent period since the October 18, 2016 commencement of operations for the Investor Class shares. |

EIP Growth and Income Fund

December 31, 2016

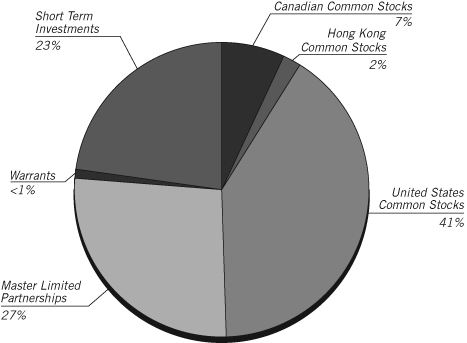

% of Total Investments. The chart shows the Fund’s current allocations as a percentage of the Fund’s total investments, and excludes exposure through derivative instruments. These percentages may vary from those shown in the Schedule of Investments, which are based on the Fund’s net assets. Holdings and allocations may vary over time.

| Shares | | | | Value | |

| | |

| CANADIAN COMMON STOCKS – 7.23% | |

| | | | | | |

| | | Energy – 1.25% | | | |

| | 10,100 | | Inter Pipeline Ltd., LP | | $ | 222,965 | |

| | | | | | | 222,965 | |

| | | | | | | | |

| | | | Utilities – 5.98% | | | | |

| | 3,400 | | Atco Ltd., Class I | | | 113,093 | |

| | 1,500 | | Canadian Utilities Ltd., Class A | | | 40,431 | |

| | 8,000 | | Emera, Inc. | | | 270,450 | |

| | 11,800 | | Enbridge Income Fund Holdings, Inc. | | | 305,579 | |

| | 1,500 | | Fortis, Inc. | | | 46,319 | |

| | 7,100 | | Hydro One Ltd. | | | 124,692 | |

| | 5,400 | | Keyera Corp. | | | 162,726 | |

| | | | | | | 1,063,290 | |

| | | | | | | | |

| | | | TOTAL CANADIAN COMMON STOCKS | | | | |

| | | | (Cost $1,319,731) | | | 1,286,255 | |

| | |

| HONG KONG COMMON STOCKS – 2.03% | |

| | | | | | | | |

| | | | Energy – 0.87% | | | | |

| | 17,600 | | Power Assets Holdings, LLC, ADR | | | 153,824 | |

| | | | | | | | |

| | | | Industrial – 1.16% | | | | |

| | 5,200 | | Cheung Kong Infrastructure | | | | |

| | | | Holdings Ltd., ADR | | | 206,910 | |

| | | | TOTAL HONG KONG COMMON STOCKS | | | | |

| | | | (Cost $363,748) | | | 360,734 | |

| | |

| UNITED STATES COMMON STOCKS – 40.05% | |

| | | | | | | | |

| | | | Energy – 16.04% | | | | |

| | 42,685 | | Enbridge Energy Management, LLC (a) | | | 1,105,536 | |

| | 3,800 | | Enbridge, Inc., ADR | | | 160,056 | |

| | 10,240 | | Kinder Morgan, Inc. | | | 212,070 | |

| | 10,000 | | Plains GP Holdings, LP | | | 346,800 | |

| | 1,300 | | Targa Resources Corp. | | | 72,891 | |

| | 13,400 | | The Williams Companies, Inc. | | | 417,276 | |

| | 11,900 | | TransCanada Corp. | | | 537,285 | |

| | | | | | | 2,851,914 | |

| | | | | | | | |

| | | | Financial – 0.57% | | | | |

| | 720 | | CorEnergy Infrastructure Trust Inc., REIT | | | 25,114 | |

| | 4,300 | | InfraREIT, Inc., REIT | | | 77,013 | |

| | | | | | | 102,127 | |

| | | | | | | | |

| | | | Utilities – 23.44% | | | | |

| | 4,000 | | Alliant Energy Corp. | | | 151,560 | |

| | 5,000 | | American Electric Power Co., Inc. | | | 314,800 | |

| | 700 | | American Water Works Co., Inc. | | | 50,652 | |

| | 1,400 | | Atmos Energy Corp. | | | 103,810 | |

| | 2,500 | | Chesapeake Utilities Corp. | | | 167,375 | |

| | 5,000 | | CMS Energy Corp. | | | 208,100 | |

| | 3,600 | | Duke Energy Corp. | | | 279,432 | |

| | 500 | | Edison International | | | 35,995 | |

| | 8,000 | | Eversource Energy | | | 441,840 | |

| | 5,000 | | Exelon Corp. | | | 177,450 | |

| | 1,100 | | IDACORP, Inc. | | | 88,605 | |

| | 3,600 | | National Grid PLC, Sponsored ADR | | | 209,988 | |

| | 4,800 | | New Jersey Resources Corp. | | | 170,400 | |

| | 3,400 | | NextEra Energy, Inc. | | | 406,164 | |

| | 6,000 | | Public Service Enterprise Group, Inc. | | | 263,280 | |

| | 4,000 | | SCANA Corp. | | | 293,120 | |

| | 3,450 | | Sempra Energy | | | 347,208 | |

| | 2,500 | | The Southern Co. | | | 122,975 | |

| | 2,100 | | UGI Corp. | | | 96,768 | |

| | 2,400 | | WEC Energy Group, Inc. | | | 140,760 | |

| | 2,400 | | Xcel Energy, Inc. | | | 97,680 | |

| | | | | | | 4,167,962 | |

| | | | TOTAL UNITED STATES COMMON STOCKS | | | | |

| | | | (Cost $6,711,860) | | | 7,122,003 | |

| | |

| MASTER LIMITED PARTNERSHIPS – 27.15% | |

| | | | | | | | |

| | | | Consumer Cyclicals – 1.18% | | | | |

| | 700 | | AmeriGas Partners, LP | | | 33,544 | |

| | 8,100 | | Westlake Chemical Partners, LP | | | 175,770 | |

| | | | | | | 209,314 | |

| | | | | | | | |

| | | | Energy – 25.97% | | | | |

| | 3,800 | | Alliance Holdings GP, LP | | | 106,780 | |

| | 8,000 | | Alliance Resource Partners, LP | | | 179,600 | |

| | 750 | | Buckeye Partners, LP | | | 49,620 | |

| | 1,600 | | Columbia Pipeline Partners, LP | | | 27,440 | |

| | 3,000 | | Dominion Midstream Partners, LP | | | 88,650 | |

| | 24,438 | | Enterprise Products Partners, LP | | | 660,803 | |

| | 6,000 | | EQT Midstream Partners, LP | | | 460,080 | |

| | 16,758 | | Holly Energy Partners, LP | | | 537,261 | |

| | 4,700 | | Magellan Midstream Partners, LP | | | 355,461 | |

| | 23,000 | | NextEra Energy Partners, LP (b) | | | 587,420 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

December 31, 2016

Schedule of Investments – continued

| Shares | | | | Value | |

| | | | | | |

| | | Energy – 25.97% – continued | | | |

| | 5,100 | | ONEOK Partners, LP | | $ | 219,351 | |

| | 3,800 | | Phillips 66 Partners, LP | | | 184,832 | |

| | 5,000 | | Shell Midstream Partners, LP | | | 145,450 | |

| | 11,400 | | Spectra Energy Partners, LP | | | 522,576 | |

| | 2,900 | | Tallgrass Energy Partners, LP | | | 137,605 | |

| | 5,009 | | TC PipeLines, LP | | | 294,730 | |

| | 1,400 | | TransMontaigne Partners, LP | | | 61,978 | |

| | | | | | | 4,619,637 | |

| | | | TOTAL MASTER LIMITED PARTNERSHIPS | | | | |

| | | | (Cost $4,664,070) | | | 4,828,951 | |

| | |

| WARRANTS – 0.00% | |

| | | | | | | | |

| | | | Energy – 0.00% | | | | |

| | 4,480 | | Kinder Morgan, Inc., Strike Price $40.00, | | | | |

| | | | Exp. 5/25/2017 (a) | | | 25 | |

| | | | TOTAL WARRANTS | | | | |

| | | | (Cost $8,534) | | | 25 | |

| | |

| SHORT TERM INVESTMENTS – 22.64% | |

| | | | | | | | |

| | | | Money Market Funds – 22.64% | | | | |

| | 4,025,750 | | First American Treasury Obligations – Class Z | | | | |

| | | | Effective Yield, 0.41% (c) | | | 4,025,750 | |

| | | | | | | | |

| | | | Total Short Term Investments | | | | |

| | | | (Cost $4,025,750) | | | 4,025,750 | |

| Total Investments | | | | |

| (Cost $17,093,693)* – 99.10% | | | 17,623,718 | |

| Other Assets in Excess of Liabilities – 0.90% | | | 159,928 | |

| NET ASSETS – 100.00% | | $ | 17,783,646 | |

| * | Aggregate cost for U.S. federal income tax purposes is $17,122,688. |

| (a) | Non-income producing security. |

| (b) | Organized as a limited partnership and has elected to be treated as a corporation for U.S. federal income tax purposes. |

| (c) | Seven-day yield as of December 31, 2016. |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

The amount of $85,000 in cash was segregated with the custodian to cover the following total return swaps outstanding at December 31, 2016:

BNP Paribas Prime Brokerage, Inc. is the counterparty to the below total return swaps.

| | | | | | | | Unrealized | |

| Long Total Return | | Expiration | | Notional | | | Appreciation | |

| Equity Swaps | Pay Rate | Date | | Amount1 | | | (Depreciation) | |

| Enterprise | 1 month | | | | | | | |

| Products | LIBOR + 110 | | | | | | | |

| Partners, LP | basis points | 02/21/2018 | | $ | 134,509 | | | $ | 691 | |

| Kinder | 1 month | | | | | | | | | |

| Morgan, Inc. | LIBOR + 110 | | | | | | | | | |

| | basis points | 02/21/2018 | | | 62,386 | | | | (256 | ) |

| Plains GP | 1 month | | | | | | | | | |

| Holdings, LP | LIBOR + 110 | | | | | | | | | |

| – Class A | basis points | 02/21/2018 | | | 207,480 | | | | 600 | |

| Williams | 1 month | | | | | | | | | |

| Partners, | LIBOR + 110 | | | | | | | | | |

| LP | basis points | 02/21/2018 | | | 56,930 | | | | 115 | |

| | | | | $ | 461,305 | | | $ | 1,150 | |

1 | The notional amount represents the U.S. dollar value of the contract as of the day of the opening of the transaction or latest contract reset date. |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

December 31, 2016

Statement of Assets and Liabilities

| ASSETS: | | | |

| Investments, at value (cost $17,093,693) | | $ | 17,623,718 | |

| Foreign currencies (cost $1,552) | | | 1,557 | |

| Restricted Cash | | | 85,000 | |

| Appreciation on swaps (premium paid $0) | | | 1,406 | |

| Receivables: | | | | |

| Dividends and interest | | | 20,680 | |

| Due from Manager (Note 3) | | | 12,021 | |

| Investment securities sold | | | 73,396 | |

| Prepaid expenses | | | 133,428 | |

| Total assets | | | 17,951,206 | |

| | | | | |

| LIABILITIES: | | | | |

| Depreciation on swaps (premium received $0) | | | 256 | |

| Payables: | | | | |

| Professional fees | | | 129,876 | |

| Accounting and administration fees (Note 3) | | | 18,675 | |

| Custodian fees | | | 2,503 | |

| Printing expense | | | 2,049 | |

| Trustees fees and related expenses (Note 3) | | | 551 | |

| Other accrued expenses | | | 13,650 | |

| Total liabilities | | | 167,560 | |

| NET ASSETS | | $ | 17,783,646 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Par value ($0.01 per share) | | $ | 11,245 | |

| Paid-in capital | | | 32,471,000 | |

| Accumulated net investment loss | | | (139,883 | ) |

| Accumulated net realized loss | | | (15,089,954 | ) |

| Net unrealized appreciation on: | | | | |

| Investments | | | 530,025 | |

| Foreign Currencies | | | 63 | |

| Swaps | | | 1,150 | |

| Total Net Assets | | $ | 17,783,646 | |

| | | | | |

| Class I | | | | |

| Shares outstanding (unlimited number of shares authorized) | | | 1,124,339 | |

| Net Assets | | | 17,781,117 | |

| Net Asset Value, offering and redemption price per share (net assets/shares outstanding) | | $ | 15.81 | |

| | | | | |

| Investor Class | | | | |

| Shares outstanding (unlimited number of shares authorized) | | | 160 | |

| Net Assets | | | 2,529 | |

| Net Asset Value, offering and redemption price per share (net assets/shares outstanding) | | $ | 15.82 | (a) |

| | | | | |

| (a) | Differences in actual and calculated Net Asset Value (“NAV”) shown are due to rounding. |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

Statement of Operations For the Year Ended December 31, 2016

| INVESTMENT INCOME: | | | |

| Dividends | | $ | 225,706 | |

| Less: foreign taxes withheld | | | (12,171 | ) |

| Interest | | | 8,701 | |

| Total investment income | | | 222,236 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (Note 3) | | | 169,320 | |

| Professional fees | | | 129,666 | |

| Administration fees (Note 3) | | | 98,335 | |

| Trustees fees and related expenses (Note 3) | | | 51,135 | |

| Transfer agent fees (Note 3) | | | 47,336 | |

| Insurance expense | | | 32,490 | |

| Miscellaneous expenses | | | 30,422 | |

| Offering costs | | | 15,824 | |

| Custodian fees | | | 13,375 | |

| Federal and state registration fees | | | 9,873 | |

| Printing expenses | | | 9,801 | |

| Distribution (12b-1) and service fees – Investor Class | | | 2 | |

| Total expenses | | | 607,579 | |

| Less: fees waived and expenses reimbursed by Advisor (Note 3) | | | (244,855 | ) |

| Net expenses | | | 362,724 | |

| NET INVESTMENT LOSS | | | (140,488 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN | | | | |

| NET REALIZED GAIN/(LOSS) ON: | | | | |

| Investments | | | 375,965 | |

| Swaps | | | 569,291 | |

| Futures contracts | | | (51,965 | ) |

| Foreign currency transactions | | | (2,049 | ) |

| Net realized gain/(loss) | | | 891,242 | |

| | | | | |

| NET CHANGE IN UNREALIZED APPRECIATION/DEPRECIATION ON: | | | | |

| Investments | | | 1,942,102 | |

| Swaps | | | (134,715 | ) |

| Futures contracts | | | (28,886 | ) |

| Foreign currency translations | | | 51 | |

| Net change in unrealized appreciation/depreciation | | | 1,778,552 | |

| NET REALIZED AND UNREALIZED GAIN | | | 2,669,794 | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 2,529,306 | |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

Statements of Changes in Net Assets

| | | Year Ended1 | | | Year Ended | |

| | | December 31, 2016 | | | December 31, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (140,488 | ) | | $ | (631,661 | ) |

| Net realized gain on investments, swaps, futures contracts | | | | | | | | |

| and foreign currency transactions | | | 891,242 | | | | 507,920 | |

| Net change in unrealized appreciation/depreciation on investments, | | | | | | | | |

| swaps, futures contracts and foreign currency translations | | | 1,778,552 | | | | (4,675,488 | ) |

| Net increase (decrease) in net assets from operations | | | 2,529,306 | | | | (4,799,229 | ) |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income – Class I | | | (137,307 | ) | | | (103,685 | ) |

| Net investment income – Investor Class | | | (18 | ) | | | — | |

| Total distributions | | | (137,325 | ) | | | (103,685 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from sales of Fund shares | | | 212,533 | | | | 14,238,677 | |

| Proceeds from reinvestment of distributions | | | 136,325 | | | | 103,262 | |

| Cost of Fund shares redeemed | | | (654,925 | ) | | | (17,964,737 | ) |

| Net decrease in net assets from capital share transactions | | | (306,067 | ) | | | (3,622,798 | ) |

| Investor Class | | | | | | | | |

| Proceeds from sales of Fund shares | | | 2,500 | | | | — | |

| Proceeds from reinvestment of distributions | | | 18 | | | | — | |

| Cost of Fund shares redeemed | | | — | | | | — | |

| Net increase in net assets from capital share transactions | | | 2,518 | | | | — | |

| Total increase (decrease) in net assets | | | 2,088,432 | | | | (8,525,712 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 15,695,214 | | | | 24,220,926 | |

| End of year | | $ | 17,783,646 | | | $ | 15,695,214 | |

| Accumulated net investment loss | | $ | (139,883 | ) | | $ | (395,882 | ) |

| | | | | | | | | |

| Changes in shares outstanding | | | | | | | | |

| Class I | | | | | | | | |

| Shares sold | | | 14,747 | | | | 1,000,393 | |

| Shares issued to holders in reinvestments of dividends | | | 8,778 | | | | 7,847 | |

| Shares redeemed | | | (42,500 | ) | | | (1,239,730 | ) |

| Net decrease | | | (18,975 | ) | | | (231,490 | ) |

| Investor Class | | | | | | | | |

| Shares sold | | | 159 | | | | — | |

| Shares issued to holders in reinvestments of dividends | | | 1 | | | | — | |

| Shares redeemed | | | — | | | | — | |

| Net increase | | | 160 | | | | — | |

1 | The Investor Class commenced operation on October 18, 2016. |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

The financial highlights table is intended to help you understand the Fund’s financial performance for the periods shown. Certain information reflects financial results for a share outstanding throughout each period. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

Class I

| | | Year Ended December 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Net asset value, beginning of year | | $ | 13.73 | | | $ | 17.62 | | | $ | 16.37 | | | $ | 14.51 | | | $ | 14.43 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (a) | | | (0.13 | ) | | | (0.50 | ) | | | (0.44 | ) | | | (0.29 | ) | | | (0.29 | ) |

| Net realized and unrealized gain (loss) on investments | | | 2.33 | | | | (3.30 | ) | | | 3.41 | | | | 3.16 | | | | 1.29 | |

| Total from investment operations | | | 2.20 | | | | (3.80 | ) | | | 2.97 | | | | 2.87 | | | | 1.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Distributions paid to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.12 | ) | | | (0.09 | ) | | | (1.72 | ) | | | (1.01 | ) | | | (0.92 | ) |

| Total from distributions | | | (0.12 | ) | | | (0.09 | ) | | | (1.72 | ) | | | (1.01 | ) | | | (0.92 | ) |

| Net increase (decrease) in net asset value | | | 2.08 | | | | (3.89 | ) | | | 1.25 | | | | 1.86 | | | | 0.08 | |

| Net asset value, end of year | | $ | 15.81 | | | $ | 13.73 | | | $ | 17.62 | | | $ | 16.37 | | | $ | 14.51 | |

| Total return | | | 16.14 | % | | | (21.54 | )% | | | 18.69 | % | | | 20.06 | % | | | 7.03 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 17,781 | | | $ | 15,695 | | | $ | 24,221 | | | $ | 35,037 | | | $ | 40,574 | |

| Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed^ | | | 3.59 | % | | | 4.95 | % | | | 3.87 | % | | | 2.90 | % | | | 2.84 | % |

| After fees waived and expenses reimbursed^ | | | 2.14 | % | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| Ratios of net investment loss to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before fees waived and expenses reimbursed^ | | | (2.28 | )% | | | (3.11 | )% | | | (2.47 | )% | | | (1.64 | )% | | | (1.92 | )% |

| After fees waived and expenses reimbursed^ | | | (0.83 | )% | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| Portfolio turnover rate | | | 53 | % | | | 49 | % | | | 25 | % | | | 102 | % | | | 51 | % |

_____________________

Portfolio turnover is calculated for the Fund as a whole.

| (a) | Per share investment loss has been calculated using the average shares method. |

| ^ | Effective February 1, 2016, the Investment Manager entered into a contractual agreement to waive fees and reimburse expenses so that the total annual operating expenses for the Fund do not exceed 2.00% of average daily net assets. See Note 3. Due to the contractual waiver not being effective in January 2016, the expense ratio for Class I shares is above 2.00% for the year ended December 31, 2016. |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

Financial Highlights

The financial highlights table is intended to help you understand the Fund’s financial performance for the periods shown. Certain information reflects financial results for a share outstanding throughout each period. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

Investor Class

| | | October 18, 2016(1) | |

| | | Through | |

| | | December 31, 2016 | |

| Net asset value, beginning of year | | $ | 15.75 | |

| | | | | |

| Income from investment operations: | | | | |

| Net investment loss (a) | | | (0.02 | ) |

| Net realized and unrealized gain on investments | | | 0.20 | |

| Total from investment operations | | | 0.18 | |

| | | | | |

| Distributions paid to shareholders from: | | | | |

| Net investment income | | | (0.11 | ) |

| Total from distributions | | | (0.11 | ) |

| Net increase (decrease) in net asset value | | | 0.07 | |

| Net asset value, end of year | | $ | 15.82 | |

| Total return | | | 0.53 | %(2) |

| | | | | |

| Ratios/Supplemental Data: | | | | |

| Net assets, end of year (in 000’s) | | $ | 3 | |

| Ratios of expenses to average net assets: | | | | |

| Before fees waived and expenses reimbursed | | | 4.33 | %(3) |

| After fees waived and expenses reimbursed | | | 2.40 | %(3) |

| Ratios of net investment loss to average net assets: | | | | |

| Before fees waived and expenses reimbursed | | | (2.56 | )%(3) |

| After fees waived and expenses reimbursed | | | (0.59 | )%(3) |

| Portfolio turnover rate | | | 53 | % |

_____________________

Portfolio turnover is calculated for the Fund as a whole.

| (a) | Per share investment loss has been calculated using the average shares method. |

| (1) | Commencement of operations. |

| (2) | Not Annualized. |

| (3) | Annualized. |

See accompanying Notes to Financial Statements.

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements

1. ORGANIZATION

EIP Growth and Income Fund (the “Fund”) is a diversified series of EIP Investment Trust (the “Trust”), a Delaware statutory trust. The Fund is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on August 22, 2006. The Fund offers two classes of shares: Class I and Investor Class. Energy Income Partners, LLC (the “Manager” or “Adviser”) serves as the Fund’s investment adviser.

The Fund’s primary investment objective is to seek a high level of total shareholder return that is balanced between current income and growth. As a secondary objective, the Fund will seek low volatility. Under normal market conditions, the Fund’s investments will be concentrated in the securities of one or more issuers conducting their principal business activities in the Energy Industry. The Energy Industry is defined as enterprises connected to the exploration, development, production, gathering, transportation, processing, storing, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, electricity, coal or other energy sources.

2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements and which are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for investment companies. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Security Valuation: For purposes of valuing investment securities, readily marketable portfolio securities listed on any exchange or the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) Global Market are valued, except as indicated below, at the last sale price or the NASDAQ Official Closing Price as determined by NASDAQ on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the most recent bid and asked price on such day. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day of which such value is being determined at the close of the exchange representing the principal market for such securities. Investments initially valued in currencies other than the U.S. dollar are converted to U.S. dollars using exchange rates obtained from third party pricing services (“pricing service”). As a result, the net asset value (“NAV”) of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside of the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the New York Stock Exchange (“NYSE”) is closed and an investor is not able to purchase or redeem shares.

Equity securities traded in the over-the-counter (“OTC”) market, but excluding securities trading on the NASDAQ Global Market, are valued at the last sale price in the OTC market if the security is traded on that day, or, if the OTC security does not trade on a particular day, the OTC security is valued at the mean between the last quoted bid and ask prices. Debt securities are priced based upon valuations provided by a pricing service. These pricing services may employ methodologies that utilize actual market transactions, broker-dealer supplied valuation, or other electronic data processing techniques. Such techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. If reliable market quotations are not readily available with respect to a portfolio security held by the Fund, including any illiquid securities, or if a valuation is deemed inappropriate, the fair value of such security will be determined under procedures adopted by the Board of Trustees of the Trust (the “Board”) in a manner designed to fairly reflect a fair market value of the security on the valuation date as described below.

The use of fair value pricing by the Fund indicates that a readily available market quotation is unavailable (such as when the exchange on which a security trades does not open for the day due to extraordinary circumstances and no other market prices are available or when events occur after the close of a relevant market and prior to the close of the NYSE that materially affect the value of an asset) and in such situations the Manager, acting pursuant to policies adopted by the Board, will estimate a fair value of a security using available information. In such situations, the values assigned to such securities may not necessarily represent the amounts which might be realized upon their sale. The use of fair value pricing by the Fund will be governed by valuation procedures adopted by the Trust’s Board, and in accordance with the provisions of the 1940 Act.

Financial futures contracts traded on exchanges are valued at their last sale price. Swap agreements are valued utilizing quotes received daily by the Fund’s pricing service. These pricing services may employ methodologies that utilize actual market transactions, broker-dealer supplied valuation, or other electronic data processing techniques.

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

Fair Value Measurement: The inputs and valuation techniques used to measure fair value of the Fund’s net assets are summarized into three levels as described in the hierarchy below:

| | • | Level 1 – | unadjusted quoted prices in active markets for identical securities |

| | | | |

| | • | Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, evaluation pricing, etc.) |

| | | | |

| | • | Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A summary of the values of each investment in each level as of December 31, 2016 is as follows:

| | | | | | | | | Level 2 | | | Level 3 | |

| | | Total | | | Level 1 | | | Significant | | | Significant | |

| | | Value at | | | Quoted | | | Observable | | | Unobservable | |

| | | 12/31/2016 | | | Price | | | Inputs | | | Inputs | |

| ASSETS | | | | | | | | | | | | |

| Canadian Common Stock | | $ | 1,286,255 | | | $ | 1,286,255 | | | $ | — | | | $ | — | |

| Hong Kong Common Stock | | | 360,734 | | | | 153,824 | | | | 206,910 | | | | — | |

| United States Common Stock | | | 7,122,003 | | | | 7,122,003 | | | | — | | | | — | |

| Master Limited Partnerships | | | 4,828,951 | | | | 4,828,951 | | | | — | | | | — | |

| Warrants | | | 25 | | | | 25 | | | | — | | | | — | |

| Short Term Investments | | | 4,025,750 | | | | 4,025,750 | | | | — | | | | — | |

| Cash and Restricted Cash | | | 85,000 | | | | 85,000 | | | | — | | | | — | |

| Derivatives* | | | | | | | | | | | | | | | | |

| Equity Contracts | | | 1,406 | | | | — | | | | 1,406 | | | | — | |

| Total | | $ | 17,710,124 | | | $ | 17,501,808 | | | $ | 208,316 | | | $ | — | |

| LIABILITIES | | | | | | | | | | | | | | | | |

| Derivatives* | | | | | | | | | | | | | | | | |

| Equity Contracts | | | (256 | ) | | | — | | | | (256 | ) | | | — | |

| Total | | $ | (256 | ) | | $ | — | | | $ | (256 | ) | | $ | — | |

| * | Derivative instruments, such as swaps, are reflected at the unrealized appreciation (depreciation) on the instrument. |

For further information regarding security characteristics, see the Schedule of Investments. The Fund did not have any transfers in or out of Levels 1, 2, or 3 during the year ended December 31, 2016. Transfers in and out of levels are recognized at market value at the end of the period.

The Fund held no securities or financial instruments during 2016, which were measured at fair value using Level 3 inputs.

At the end of each calendar quarter, management evaluates the Level 2 and Level 3 securities, if applicable, for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from pricing services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and Level 2 securities on a quarterly basis for changes in listings or delistings on national exchanges. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period.

Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

MLP Common Units: Master Limited Partnership (“MLP”) common units represent limited partnership interests in the MLP. Common units are generally listed and traded on U.S. securities exchanges or OTC with their value fluctuating predominantly based on the success of the MLP. Unlike owners of common stock of a corporation, owners of MLP common units have limited voting rights and have no ability to annually elect directors. MLPs generally distribute all available cash flow (cash flow from operations less maintenance capital expenditures) in the form of quarterly distributions. Common unit holders have first priority to receive quarterly cash distributions up to the minimum quarterly distribution and have arrearage rights. In the event of liquidation, common unit holders have

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

preference over subordinated units, but not debt holders or preferred unit holders, to the remaining assets of the MLP.

Restricted Cash: Restricted cash includes amounts required to be segregated with the Fund’s custodian or counterparties as collateral for the Fund’s derivatives as shown on the Schedule of Investments. Segregated cash collateral is recorded at its carrying amount which represents fair value.

Short Sales of Securities: The Fund intends to engage in short sales of U.S. Treasury securities in order to hedge the Fund’s exposure to increases in interest rates. The Fund may also engage in short sale transactions of equity and other fixed-income securities for investment, speculative, and hedging purposes. To effect such a transaction, the Fund must borrow the security it sells short (such as a U.S. Treasury security) to make delivery of that security to the buyer. The Fund is then obligated to replace, or cover, the security borrowed by purchasing it at the market price at or prior to the time of replacement. The price at such time may be more or less than the price at which the security was sold by the Fund. Until the security is replaced, the Fund is required to repay the lender any dividends or interest that accrues during the period of the loan. To borrow the security, the Fund also may be required to pay a premium, which would increase the cost of the security sold. The net proceeds of the short sale will be retained by the lender, to the extent necessary to meet the margin requirements, until the short position is closed out.

The Fund will incur a loss as a result of a short sale if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund generally will realize a gain if the price of the security declines in price between those dates.

The Fund did not enter into any short sale transactions during the year ended December 31, 2016.

Disclosures about Derivative Instruments and Hedging Activities: The following is a table summarizing the fair value of derivatives held at December 31, 2016 by primary risk exposure:

| | Asset Derivatives | | Liability Derivatives | |

| Derivatives not accounted for | | | | | | | | |

| as hedging instruments | | | | | | | | |

| | Statement of Assets | | | | Statement of Assets | | | |

| | and Liabilities Location | | Value | | and Liabilities Location | | Value | |

| Equity Contracts | Appreciation on swaps | | $ | 1,406 | | Depreciation on swaps | | $ | 256 | |

| Total | | | $ | 1,406 | | | | $ | 256 | |

The effect of Derivative Instruments on the Statement of Operations for the year ended December 31, 2016:

Derivatives not accounted for

as hedging instruments

| | | | Net Realized | | | Net Change in Unrealized | |

| | Location of Gain/(Loss) | | Gain/(Loss) | | | Appreciation/Depreciation | |

| | on Derivatives | | on Derivatives | | | on Derivatives | |

| Type of Derivative Risk | Recognized in Income | | Recognized in Income | | | Recognized in Income | |

| Foreign Currency | Net realized gain/(loss) on futures | | | | | | |

| Exchange Contracts | contracts/Net change in unrealized | | | | | | |

| | appreciation/depreciation | | | | | | |

| | on futures contracts | | $ | (51,965 | ) | | $ | (28,886 | ) |

| | | | | | | | | | |

| Equity Contracts | Net realized gain/(loss) on swaps/ | | | | | | | | |

| | Net change in unrealized | | | | | | | | |

| | appreciation/depreciation on swaps | | | 569,291 | | | | (134,715 | ) |

| Total | | | $ | 517,326 | | | $ | (163,601 | ) |

In order to better define its contractual rights and to secure rights that will help the Fund mitigate its counterparty risk, the Fund may enter into an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement with its derivative contract counterparties. An ISDA Master Agreement is a bilateral agreement between a Fund and a counterparty that governs OTC derivatives and foreign exchange contracts and typically contains, among other things, collateral posting terms and netting provisions that apply in the event of a default and/or

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

termination event. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain payables and/or receivables with collateral held and/or posted to create one single payment. The provisions of the ISDA Master Agreement typically permit a single net payment by the non-defaulting party in the event of default (close-out netting), including the bankruptcy or insolvency of the counterparty. Note, however, that bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy, insolvency or other events.

Margin requirements are established by the broker or clearing house for exchange traded and centrally cleared derivatives, such as futures contracts, or by agreement between the Fund and the counterparty in the case of OTC derivatives. For the Fund, its OTC swap counterparty required an initial collateral balance equaling 15% of the initial notional value of the swaps for the year ended December 31, 2016. Subsequent to December 31, 2016, the OTC swap counterparty increased its required initial collateral balance to 20% of the initial notional value of the swaps. Additional collateral requirements are calculated by netting the mark to market amount for each transaction and comparing that amount to the value of any collateral currently pledged by the Fund to the counterparty (and vice versa). In the case of exchange traded and centrally cleared derivatives, for which the broker or clearing house establishes minimum margin requirements, brokers can ask for margining in excess of the minimum established by the relevant clearing house in certain circumstances. For financial reporting purposes, cash collateral that has been pledged to cover obligations of the Fund and cash collateral received from the counterparty, if any, is reported separately on the Statement of Assets and Liabilities as Restricted Cash. In the case of OTC derivatives, generally the amount of collateral due from or to a party has to exceed a minimum threshold before a transfer is made. To the extent amounts due to the Fund from its counterparties are not fully collateralized, contractually or otherwise, the Fund bears the risk of loss from counterparty non-performance. See Note 6 “Counterparty Risk”. The Fund’s ISDA Master Agreement provides for the bilateral right of counterparties to terminate derivative contracts prior to maturity due to certain defined Events of Default (including but not limited to failure to pay or deliver or breach of agreement) or defined Termination Events (including but not limited to illegality, tax events or credit events), which could cause the Fund to accelerate payment of any net liability owed to the counterparty.

Offsetting of Financial Assets and Liabilities and Derivative Assets and Liabilities:

The following table, as of December 31, 2016, discloses both gross information and net information about instruments and transactions eligible for offset in the Statement of Assets and Liabilities, and instruments and transactions that are subject to a master netting agreement or an agreement similar to a master netting agreement as well as amounts related to collateral held at clearing brokers and counterparties. For financial reporting purposes, the Fund does not offset derivative assets and liabilities that are subject to netting arrangements in the Statement of Assets and Liabilities:

| | | | | | | | | Gross Amounts not offset in the | | | | |

| Assets | | | | | | | | Statement of Assets and Liabilities | | | | |

| | | Gross Amounts of | | | | | | | | | | | | | |

| | | Assets Presented | | | | | | Non-Cash | | | Cash | | | | |

| | | in Statement of | | | Derivatives | | | Collateral | | | Collateral | | | | |

| Description | | Assets and Liabilities | | | Available for Offset | | | Received | | | Received | | | Net Amounts1 | |

| Total Return Equity Swaps | | $ | 1,406 | | | $ | 256 | | | $ | — | | | $ | — | | | $ | 1,150 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | Gross Amounts not offset in the | | | | | |

| Liabilities | | | | | | | | | | Statement of Assets and Liabilities | | | | | |

| | | Gross Amounts of | | | | | | | | | | | | | | | | | |

| | | Assets Presented | | | | | | | Non-Cash | | | Cash | | | | | |

| | | in Statement of | | | Derivatives | | | Collateral | | | Collateral | | | | | |

| Description | | Assets and Liabilities | | | Available for Offset | | | Pledged | | | Pledged | | | Net Amounts2 | |

| Total Return Equity Swaps | | $ | 256 | | | $ | (256 | ) | | $ | — | | | $ | — | | | $ | — | |

1 | Net amount represents the net amount receivable from the counterparty in the event of default. |

2 | Net amount represents the net amount payable to the counterparty in the event of default. |

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

Futures Contracts: The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may purchase or sell futures contracts to hedge against foreign currency exchange risk or for any other purpose permitted by applicable law. The purchase of futures contracts may be more efficient or cost effective than actually buying the underlying securities or assets. A futures contract is an agreement between two parties to buy and sell an instrument at a set price on a future date and is exchange-traded. Upon entering into a futures contract, the Fund is required to pledge to the counterparty an amount of cash, U.S. Government securities or other high-quality debt securities equal to the minimum “initial margin” requirements of the exchange or the broker. Pursuant to a contract entered into with a futures commission merchant, the Fund agrees to receive from or pay to the firm an amount of cash equal to the cumulative daily fluctuation in the value of the contract. Such receipts or payments are known as “variation margin” and are recorded by the Fund as unrealized gains or losses. When the contract is closed, the Fund records a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund will cover its current obligations under futures contracts by the segregation of liquid assets or by entering into offsetting transactions or owning positions covering its obligations. The risks of entering into futures contracts include the possibility that there may be an illiquid market and that a change in the value of the contracts may not correlate with changes in the value of the underlying securities or assets. The Fund’s maximum foreign currency exchange rate risk on those futures contracts where the underlying currency is long is an amount equal to the notional amount of the related contracts. During the year ended December 31, 2016, the Fund held no futures contracts where the underlying currency is long. The Fund’s maximum foreign currency exchange rate risk on those futures contracts where the underlying currency is short is theoretically unlimited. However, if effectively hedged, any loss would be offset in unrealized foreign currency gains of securities denominated in the same currency. For the year ended December 31, 2016, the Fund’s average volume of futures activity was $1,625,888 based on the quarterly notional amount. The notional amount represents the U.S. dollar value of the contracts as of the day of the opening of the transaction.

Currency Hedging Transactions: The Fund may engage in certain transactions intended to hedge the Fund’s exposure to currency risks, including without limitation buying or selling options or futures, entering into forward foreign currency contracts, currency swaps or options on currency and currency futures and other derivative transactions. Hedging transactions can be expensive and have risks, including the imperfect correlation between the value of such instruments and the underlying assets, the possible default of the other party to the transaction or illiquidity of the derivatives instruments.

Foreign Currency Translations: The accounting records of the Fund are maintained in U.S. dollars. The Fund may purchase securities that are denominated in foreign currencies. Investment securities and other assets and liabilities denominated in foreign currency are translated into U.S. dollars at the current exchange rates. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the exchange rates on the dates of the respective transactions.

Although the net assets of the Fund are calculated using the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, these foreign exchange gains or losses are included in the reported net realized and unrealized gain (loss) on investments shown on the Statement of Operations.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from the holding of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net change in unrealized appreciation/depreciation on foreign currency transactions shown on the Statement of Operations.

Swap Agreements: The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may enter into swap agreements as a substitute for purchasing equity securities of issuers in the Energy Industry as defined in Note 1 above, to achieve the same exposure as it would by engaging in short sales transactions of energy securities, to hedge its currency exposure or for any other purpose permitted by applicable law. A swap is a financial instrument that typically involves the exchange of cash flows between two parties on specified dates (settlement dates) where the cash flows are based on agreed-upon prices, rates, etc. In a typical equity swap agreement, one party agrees to pay another party the return on a security or basket of securities in return for a specified interest rate. By entering into swaps, the Fund can gain exposure to a security without actually purchasing the underlying asset. Swap agreements involve both the risk associ-

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

ated with the investment in the security as well as the risk that the performance of the security, including any dividends, will not exceed the interest that the Fund will be committed to pay under the swap. Swaps are individually negotiated. Swap agreements may increase or decrease the overall volatility of the investments of the Fund and its net asset value. The performance of swap agreements may be affected by a change in the specific interest rate, security, currency, or other factors that determine the amounts of payments due to and from the Fund. The Fund will cover its current obligations under swap agreements by the segregation of liquid assets or by entering into offsetting transactions or owning positions covering its obligations. A swap agreement would expose the Fund to the same equity price risk as it would have if the underlying equity securities were purchased. The regulation of swaps and futures transactions in the United States is a rapidly changing area of law and is subject to modification by government and judicial action. The effect of any future regulatory change on the Fund is impossible to predict, but could be substantial and adverse. Gain or loss is recognized when the equity swap position is sold or when the contract resets.

The Fund’s maximum equity price risk to meet its future payments under long swap agreements outstanding as of December 31, 2016 is equal to the total notional amount as shown on the Schedule of Investments. The Fund’s maximum equity price risk to meet its future payments under short swap agreements outstanding is theoretically unlimited. For the year ended December 31, 2016, the average volume of long Total Return Equity Swaps was $1,442,909 based on the quarterly notional amount. For the year ended December 31, 2016, the Fund did not transact in short Total Return Equity Swaps. The notional amount represents the U.S. dollar value of the contracts as of the day of the opening of the transaction or latest contract reset date.

Options Contracts: The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may enter into option contracts in order to hedge against potential adverse price movements in the value of portfolio assets, as a temporary substitute for selling selected investments, to lock in the purchase price of a security or currency which it expects to purchase in the near future, as a temporary substitute for purchasing selected investments, to enhance potential gain, and for any other purpose permitted by applicable law. An option contract is a contract in which the writer of the option grants the buyer of the option the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, would require cash settlement by the Fund if the option is exercised.

The liability representing the Fund’s obligation under an exchange-traded written option or investment in a purchased option is valued at the composite mean price, which calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is principally traded. On the last trading day prior to expiration, expiring options may be priced at intrinsic value. Gain or loss is recognized when the option contract expires or is closed.

If the Fund writes a covered call option, the Fund forgoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. OTC options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund’s maximum equity price risk for purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund’s ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged. For the year ended December 31, 2016, the Fund did not transact in any option contracts.

Securities Transactions and Investment Income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the specific identified cost basis. Dividend income is recognized on the ex-dividend date. Dividend income on foreign securities is recognized as soon as the Fund is informed of the ex-dividend date. Distributions received in excess of income are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is recognized on the accrual basis. All discounts/premiums are accreted/amortized using the effective yield method.

Dividends and Distributions: The Fund intends to distribute all or substantially all of its investment company taxable income quarterly (computed without regard to the deduction for dividends paid), if any, and net capital gain annually, if any. The tax treatment and characterization of the Fund’s distributions may vary significantly from time to time because of the varied nature of the Fund’s investments. The Fund will reinvest distributions in additional shares of the Fund unless a shareholder has written to request distributions, in whole or in part, in cash.

The tax character of distributions paid during the calendar year ended December 31, 2016 was as follows:

| Ordinary Income | | $ | 137,325 | |

| Long-Term Capital Gains | | $ | — | |

EIP Growth and Income Fund

December 31, 2016

Notes to Financial Statements – continued

The tax character of distributions paid during the calendar year ended December 31, 2015 was as follows:

| Ordinary Income | | $ | 103,685 | |

| Long-Term Capital Gains | | $ | — | |

Prior to October 14, 2016 the Fund was considered a non-publicly offered regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). Thus, certain expenses of the Fund, including the investment advisory fee, are subject to special rules that can affect certain shareholders of the Fund (generally individuals and entities that compute their taxable income in the same manner as an individual). In particular, such a shareholder’s pro rata portion of the affected expenses for the calendar year (but generally reduced by the Fund’s net operating loss, if any, for its tax year ending within the calendar year), will be taxable to such shareholder as an additional dividend and such shareholder will be treated as having paid its pro rata share of the affected expenses itself. If such a shareholder itemizes its deductions, it generally should be entitled to take an offsetting deduction for its share of the affected expenses, subject, however, to the 2% “floor” on miscellaneous itemized deductions. These expenses will not be deductible for the purposes of calculating alternative minimum tax.

The Fund has a tax year end of June 30. As of June 30, 2016, the components of distributable earnings on a tax basis and other tax attributes were as follows:

| Undistributed Ordinary Income | | $ | 137,325 | |

| Capital Loss Carryforward | | $ | 15,089,965 | |

| Post October Loss – | | | | |

| Capital & Foreign Currency | | $ | 428 | |

Taxable income and capital gains are determined in accordance with U.S. federal income tax rules, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund.

Permanent book and tax accounting differences relating to the tax year ended June 30, 2016 have been reclassified to reflect a decrease in undistributed net investment loss of $533,812, an increase in accumulated net realized loss on investments of $75,642 and a decrease in paid-in-capital of $458,170. These differences are primarily due to passive loss limitations, pass through taxable income from investments and swap character reclasses. Net assets were not affected by this reclassification.

Capital Loss Carryforward: As of June 30, 2016, the following capital loss carryforwards are available to reduce taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Internal Revenue Code:

| Year of | | | | |

Expiration | | | Amount | |

| 2018 | | | $ | 14,874,804 | |

| Indefinite | | | | 215,161 | |

| Total | | | $ | 15,089,965 | |

During the tax year ended June 30, 2016, the Fund realized capital losses of $215,161 that will be carried over indefinitely.

Federal Income Tax: The Fund intends to qualify each year for taxation as a RIC eligible for treatment under the provisions of Subchapter M of the Code. If the Fund so qualifies and satisfies certain distribution requirements, the Fund will not be subject to federal income tax on income and gains distributed in a timely manner to its shareholders in the form of dividends or capital gain dividends.

As of December 31, 2016, the cost of securities and gross unrealized appreciation and depreciation for all securities on a tax basis was as follows: