UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21940

EIP Investment Trust

(Exact name of registrant as specified in charter)

c/o Energy Income Partners, LLC

49 Riverside Avenue

Westport, CT 06880

(Address of principal executive offices) (Zip code)

Linda Longville

c/o Energy Income Partners, LLC

49 Riverside Avenue

Westport, CT 06880

(Name and address of agent for service)

registrant’s telephone number, including area code: 203-349-8232

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

EIP Growth and Income Fund

December 31, 2012 Annual Report

EIP Growth and Income Fund

You should carefully consider the investment objectives, risks, charges, and expenses of the Fund before making an investment decision. The private placement memorandum contains this and other information - please read it carefully before investing or sending money. Except as noted, numbers in the private placement memorandum are unaudited. To obtain a copy of the private placement memorandum, please call (203) 349-8232.

EIP Growth and Income Fund

To Our Shareholders:

I am pleased to submit this Annual Report for the EIP Growth and Income Fund for the period ended December 31, 2012. For the year ended December 31, 2012, the Fund’s total return was +7.03%. For the year ended December 31, 2011, the Fund’s total return was +21.62%.

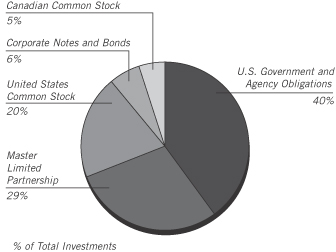

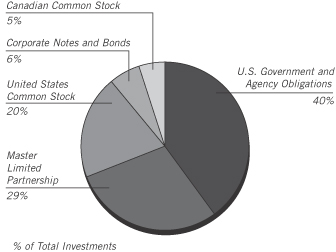

The Fund’s primary strategy is investing in publicly traded energy infrastructure companies with high dividend payouts that offer attractive yields and have the opportunity to grow. A large portion of our equity investment opportunities are publicly traded partnerships known as Master Limited Partnerships (“MLPs”). These securities represent just under 25% of the Fund’s assets, which is the maximum allowable for mutual funds. On average, about 25% of our assets are invested in securities with similar characteristics to the energy-related MLPs, such as MLP affiliates, Canadian income equities (formerly income trusts) in Canada and infrastructure and utility companies many of which have MLP or subsidiaries. We typically invest the remainder of the portfolio in high-quality corporate and agency bonds with a weighted average maturity of 18 months or less or a coupon that floats with prevailing interest rates. All of our corporate bonds must have an AA rating or better, or an equivalent rating from Moody’s or, if unrated, have been determined by Energy Income Partners, LLC to be of similar quality, at the time they are put into the portfolio unless they are issued by an energy company, in which case the bond must have an investment grade rating or higher. While the bond portfolio may generate a significant amount of income, the large allocation to bonds with short duration is expected over time to have a large dampening effect on the portfolio’s volatility. We employ leverage in an attempt to enhance the portfolio’s returns.

Benchmarks:

We believe the following benchmarks provide appropriate comparisons of the Fund’s performance:

| | | | |

| | | Total Return

1/1/12-

12/31/12 | |

| Wells Fargo Midstream MLP Index | | | 6.77% | |

| Barclays Capital Aggregate U.S. Credit Index (1-3 year) | | | 3.69% | |

| | | | |

| | | Total Return

1/1/11-

12/31/11 | |

| Wells Fargo Midstream MLP Index | | | 18.44% | |

| Barclays Capital Aggregate U.S. Credit Index (1-3 year) | | | 1.75% | |

Wells Fargo Midstream MLP Index. We believe the portion of our portfolio invested in MLPs, Canadian income equities and other energy equities may be compared to the Wells Fargo Midstream MLP Index. We use this index rather than a broader MLP index as our investment style tends to focus the portfolio in MLPs involved in pipeline transportation, storage, terminaling and processing of petroleum and natural gas. These activities are commonly known as “midstream” as opposed to oil and gas production (“upstream”) and refining and marketing (“downstream”). The upstream and downstream parts of the energy industry are the customers of the midstream companies. And while much of the equity portion of the portfolio is not invested in midstream MLPs per se, their business characteristics are similar: a heavy weighting in North American midstream operations and a high payout ratio.

Barclays Capital Aggregate U.S. Credit Index. The Barclays Capital Aggregate U.S. Credit Index (1-3 year) is an index of corporate bonds with an average duration of about 1.9 years and an average credit quality between Moody’s assigned A1 to A2 ratings (Source: Barclays Capital Inc.). While slightly longer in duration and lower in credit quality, we believe that over time, this index is the best benchmark for how we run the bond portion of our portfolio.

MLPs and Other Equities

As measured by the Wells Fargo Midstream MLP Index, the total return for MLPs over the year ended December 31, 2012 was about 6.77%. This return reflects an initial yield of about 5.5% and share appreciation of about 1.3%. While in the short-term, share price performance can be volatile, and subject to macro factors such as credit spreads, interest rates and overall market sentiment, we believe that over the long-term, share performance will approximate growth in per-share quarterly cash distributions paid by MLPs. Over the last 12 months, the average growth in per-share cash distributions of energy-related MLPs has grown about 6.6%. This compares to a ten-year average of about 6.8% (Source: Alerian Capital Management). MLPs and other portfolio companies engaged in infrastructure businesses such as pipelines,

terminals and storage receive fees and

Results of a Hypothetical $10,000 Investment

The Wells Fargo Midstream MLP Index consists of 35 energy MLPs and represents the Midstream sub-sector of the Wells Fargo MLP Composite Index. The index is calculated by S&P using a float-adjusted market capitalization methodology. Unlike the Fund, the index does not incur fees and expenses.

The Barclays Capital Aggregate U.S. Credit Index (1-3 year) is an index of corporate bonds with an average duration of about 1.9 years and an average credit quality of between Moody’s assigned A1 to A2 ratings. Unlike the Fund, the index does not incur fees and expenses.

EIP Growth and Income Fund

RETURNS FOR YEAR ENDED 12/31/12

Average Annual Total Returns

| | | | |

| One Year | | | 7.03% | |

| Five Years | | | 14.21% | |

| Since Inception | | | 13.71% | |

Inception Date 08/22/06

The performance data quoted represents past performance and does not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of the fund will fluctuate so that an investor’s shares, when sold, may be worth more or less than the original cost. Calculations do not reflect the deduction in taxes that a shareholder would pay on fund distributions or the redemption of shares. Calculations assume reinvestment of dividends and capital gain distributions. To obtain more recent performance data, please contact the Energy Income Partners Information Center at 1-203-349-8232.

EIP Growth and Income Fund

tariffs that are generally not directly related to commodity prices. Growth for these companies is driven by changes in demand for petroleum and natural gas, inflation-related escalations to their fees and tariffs and the accretion from new projects and acquisitions. We believe that the growth rate of the dividend stream from MLPs in these true infrastructure businesses is supported by the fundamentals of their underlying businesses.

Fixed Income

The Fund’s bond portfolio continues to provide income and stability to our overall portfolio returns. Bond performance was up about 99 basis points for the year. On average, the bonds are trading near par.

Our bond portfolio is made up entirely of corporate issues and US agency bonds. We do not hold any collateralized debt obligations or mortgage-backed securities or any other types of fixed income derivatives. In addition, our strategy is a “buy and hold” approach. So while the mark-to-market value of some of our bonds may experience volatility, we believe that if we hold them to maturity and there are no events of default, we should realize 100 cents on the dollar for these bonds as they mature. None of the bonds we have held have ever defaulted in their payments to the Fund. Of course, although not currently anticipated, if we sell these bonds before maturity, we may not realize 100 cents on the dollar for these bonds.

Outlook

Year-to-date through December 31, 2012, there have been 13 MLP IPOs which raised $3.3 billion of gross proceeds. There has also been a healthy level of secondary financing activity for MLPs during the reporting period as they continue to fund their ongoing investments in new pipelines, processing and storage facilities. In 2012, there have been 67 secondary equity offerings for MLPs that raised $25.0 billion. This compares to $14.2 billion raised in 2011. In the public debt market, $18.2 billion has been raised during the same time period. This compares to $15.6 billion in 2011 (Source: Barclays Capital).

In our opinion, the better positioned MLPs have non-cyclical cash flows, conservative balance sheets, modest and/or flexible organic growth commitments and liquidity on their revolving lines of credit. Cyclical cash flows will always be unpredictable in our view, making them a poorer fit with a steady dividend obligation. Over the last few years, the majority of MLP IPOs were companies whose primary business is the production of oil and gas, shipping, refining or natural gas gathering. While some of these MLPs have quality assets, competent management teams and the potential for higher growth, they have more risk associated with the cyclical nature of their businesses. We have written about the dangers of this trend in the past, and remain vigilant about limiting our exposure to MLPs with cyclical cash flows.

The total return proposition of owning energy-related infrastructure MLPs has been and continues to be their yield plus their growth. The yield of the MLPs, weighted by market capitalization, on December 31, 2012, was 6.6% based on the Alerian Index. The growth in the quarterly cash distributions that make up this yield has averaged between 6% and 7% annually over the last ten years (Source: Alerian Capital Management). For true infrastructure MLPs, we still expect dividend growth rates to average in the mid-single digits over the next few years. We believe this growth will continue to be driven by modest increases in underlying demand as the economy recovers, inflation and cost escalators in pipeline tariffs and contracts and accretion from profitable capital projects and acquisitions. The capital projects continue to be related to growth in areas such as the new natural gas shale resources, the need for more infrastructure related to bio fuels and other environmental requirements, and Canadian oil sands. Thus far, we believe the MLPs as a group have done a great job capitalizing on these opportunities.

Sincerely,

James Murchie

President

EIP Growth and Income Fund

The views expressed in this commentary reflect those of the Fund’s portfolio management team as of December 31, 2012. Any such views are subject to change at any time based on market or other conditions, and the Fund disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or advice. Because investment decisions for the Fund are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of the Fund. The information contained herein has been prepared from sources believed to be reliable, but is not guaranteed by the Fund as to its accuracy or completeness. Past performance is not indicative of future results. Performance information provided above assumes the reinvestment of interest, dividends and other earnings. There is no assurance that the Fund’s investment objectives will be achieved.

EIP Growth and Income Fund

December 31, 2012

Schedule of Investments

| | | | | | | | |

Par Value | | | | | Fair

Value | |

| | | | | | | | |

|

| | CORPORATE NOTES AND BONDS – 7.31%† | |

| | | | Credit - Miscellaneous Business – 7.31%† | |

| $ | 3,000,000 | | | General Electric Capital Corp., MTN | | | | |

| | | | 0.551%, 01/08/16 (a) (b) | | $ | 2,967,453 | |

| | | | | | | | |

| | | | Total Corporate Notes and Bonds | | | | |

| | | | (Cost $3,001,420) | | | 2,967,453 | |

| | | | | | | | |

|

| | U.S. GOVERNMENT AND AGENCY OBLIGATIONS – 53.02%† | |

| | | | Federal Farm Credit Bank – 12.33%† | |

| | 5,000,000 | | | Federal Farm Credit Bank | | | | |

| | | | 0.230%, 10/03/13 (a) | | | 5,002,820 | |

| | | | | | | | |

| | | | Federal Home Loan Bank – 19.74%† | |

| | 7,000,000 | | | Federal Home Loan Bank | | | | |

| | | | 0.270%, 01/23/14 (a) | | | 7,007,861 | |

| | 1,000,000 | | | Federal Home Loan Bank | | | | |

| | | | 1.625%, 03/20/13 (a) | | | 1,003,313 | |

| | | | | | | | |

| | | | | | | 8,011,174 | |

| | | | | | | | |

| | | | Federal Home Loan Mortgage – 20.95%† | |

| | 8,500,000 | | | Federal Home Loan Mortgage | | | | |

| | | | 0.165%, 02/04/13 (a) (b) | | | 8,500,102 | |

| | | | | | | | |

| | | | Total U.S. Government and Agency Obligations | |

| | | | (Cost $21,504,162) | | | 21,514,096 | |

| | | | | | | | |

| | | | | | | | |

|

| | MASTER LIMITED PARTNERSHIPS – 38.53%† | |

| | | | Consumer Cyclicals – 1.69%† | |

| | 17,700 | | | AmeriGas Partners, LP | | $ | 685,698 | |

| | | | | | | | |

| | | | Energy – 33.08%† | |

| | 6,000 | | | Access Midstream Partners, LP | | | 201,240 | |

| | 11,400 | | | Alliance Holdings GP, LP | | | 542,412 | |

| | 18,100 | | | Alliance Resource Partners, LP | | | 1,051,067 | |

| | 7,400 | | | El Paso Pipeline Partners, LP | | | 273,578 | |

| | 20,100 | | | Energy Transfer Equity, LP | | | 914,148 | |

| | 52,469 | | | Enterprise Products Partners, LP | | | 2,627,648 | |

| | 8,800 | | | EQT Midstream Partners, LP | | | 274,120 | |

| | 12,779 | | | Holly Energy Partners, LP | | | 840,603 | |

| | 1,000 | | | Magellan Midstream Partners, LP | | | 43,190 | |

| | 15,400 | | | MPLX, LP (c) | | | 480,326 | |

| | 25,750 | | | NuStar Energy, LP | | | 1,093,860 | |

| | 22,900 | | | NuStar GP Holdings, LLC | | | 634,101 | |

| | 5,700 | | | Oiltanking Partners, LP | | | 215,802 | |

| | 23,086 | | | ONEOK Partners, LP | | | 1,246,413 | |

| | 30,000 | | | Spectra Energy Partners, LP | | | 936,900 | |

| | 20,000 | | | Suburban Propane Partners, LP | | | 777,200 | |

| | 17,609 | | | TC Pipelines, LP | | | 710,699 | |

| | 10,900 | | | Transmontaigne Partners, LP | | | 413,873 | |

| | 3,000 | | | Williams Partners, LP | | | 145,980 | |

| | | | | | | | |

| | | | | | | 13,423,160 | |

| | | | | | | | |

| | | | Industrial – 2.24%† | |

| | 24,000 | | | Teekay LNG Partners, LP | | | 906,720 | |

| | | | | | | | |

| | | | Utilities – 1.52%† | |

| | 9,000 | | | Brookfield Renewable Energy Partners, LP | | | 265,829 | |

| | 15,000 | | | NGL Energy Partners, LP | | | 349,800 | |

| | | | | | | | |

| | | | | | | 615,629 | |

| | | | | | | | |

| | | | Total Master Limited Partnerships | |

| | | | (Cost $12,645,988) | | | 15,631,207 | |

| | | | | | | | |

|

| | UNITED STATES COMMON STOCKS – 25.59%† | |

| | | | Energy – 14.05%† | |

| | 83,773 | | | Enbridge Energy Management, LLC (c) | | | 2,420,202 | |

| | 19,782 | | | Kinder Morgan Management, LLC (c) | | | 1,492,750 | |

| | 34,961 | | | Kinder Morgan, Inc. | | | 1,235,172 | |

| | 15,000 | | | Wisconsin Energy Corp. | | | 552,750 | |

| | | | | | | | |

| | | | | | | 5,700,874 | |

| | | | | | | | |

| | | | Financial – 0.17%† | |

| | 11,500 | | | CorEnergy Infrastructure Trust | | | 69,345 | |

| | | | | | | | |

| | | | Utilities – 11.37%† | |

| | 10,000 | | | Dominion Resources, Inc. | | | 518,000 | |

| | 5,000 | | | Exelon Corp. | | | 148,700 | |

| | 1,000 | | | ITC Holdings Corp. | | | 76,910 | |

| | 15,000 | | | National Grid PLC, Sponsored ADR | | | 861,600 | |

| | 7,000 | | | NextEra Energy, Inc. | | | 484,330 | |

| | 10,000 | | | NiSource, Inc. | | | 248,900 | |

| | 4,000 | | | Northeast Utilities | | | 156,320 | |

| | 38,000 | | | Southern Co. | | | 1,626,780 | |

| | 15,000 | | | UGI Corp. | | | 490,650 | |

| | | | | | | | |

| | | | | | | 4,612,190 | |

| | | | | | | | |

| | | | Total United States Common Stocks | |

| | | | (Cost $9,392,981) | | | 10,382,409 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

3

EIP Growth and Income Fund

December 31, 2012

Schedule of Investments – continued

| | | | | | | | |

Shares | | | | | Fair

Value | |

| | | | | | | | |

|

| | CANADIAN COMMON STOCKS – 6.67%† | |

| | | | Energy – 0.78%† | |

| | 11,000 | | | Pembina Pipeline Corp. | | $ | 314,728 | |

| | | | | | | | |

| | | | Utilities – 5.89%† | |

| | 11,000 | | | Atco Ltd Canada, Class I | | | 892,651 | |

| | 8,000 | | | Emera, Inc. | | | 279,401 | |

| | 15,500 | | | Enbridge Income Fund Holdings, Inc. | | | 376,008 | |

| | 17,000 | | | Keyera Corp. | | | 841,369 | |

| | | | | | | | |

| | | | | | | 2,389,429 | |

| | | | | | | | |

| | | | Total Canadian Common Stocks | |

| | | | (Cost $1,947,267) | | | 2,704,157 | |

| | | | | | | | |

|

| | WARRANTS – 0.04%† | |

| | | | Energy – 0.04%† | |

| | 4,480 | | | Kinder Morgan, Inc., Strike Price $40.00, Exp. 05/25/17 (c) | | | 16,934 | |

| | | | | | | | |

| | | | Total Warrants | | | | |

| | | | (Cost $8,534) | | | 16,934 | |

| | | | | | | | |

| Total Investments – 131.16%† | | | | |

| (Cost $48,500,352)* | | | 53,216,256 | |

| | | | | | | | |

| | |

Principal | | | | | | |

|

| | REVERSE REPURCHASE AGREEMENTS (d) – (56.01)%† | |

| $ | (4,700,000) | | | With Credit Suisse for Federal Farm Credit Bank, 0.30% dated 12/31/12, to be repurchased at $4,700,078 on 01/02/13 | | | (4,700,000 | ) |

| | (6,600,000) | | | With Credit Suisse for Federal Home Loan Bank, 0.30% dated 12/31/12, to be repurchased at $6,600,110 on 01/02/13 | | | (6,600,000 | ) |

| | (950,000) | | | With Credit Suisse for Federal Home Loan Bank, 0.30% dated 12/31/12, to be repurchased at $950,016 on 01/02/13 | | | (950,000 | ) |

| | (8,073,652) | | | With Credit Suisse for Federal Home Loan Mortgage, 0.30% dated 12/31/12, to be repurchased at $8,073,787 on 01/02/13 | | | (8,073,652 | ) |

| | (2,400,000) | | | With Credit Suisse for General Electric Capital Corp., MTN, 0.75% dated 12/31/12, to be repurchased at $2,400,100 on 01/02/13 | | | (2,400,000 | ) |

| | | | | | | | |

| | | | Total Reverse Repurchase Agreements | | | | |

| | | | (Cost $(22,723,652)) | | | (22,723,652 | ) |

| | | | | | | | |

| Total Investments and Reverse Repurchase Agreements – 75.15%† | |

| (Cost $25,776,700) | | | 30,492,604 | |

| | | | | | | | |

| Other Assets in excess of Liabilities – 24.85%† | | | 10,081,505 | |

| | | | | | | | |

| Net Assets – 100.00%† | | $ | 40,574,109 | |

| | | | | | | | |

| | † | | Percentages are calculated based on net assets, inclusive of reverse repurchase agreements. |

| | * | | Aggregate cost for federal tax purposes is $48,936,152 |

| | (a) | | Segregated as collateral for Reverse Repurchase Agreements as of December 31, 2012. |

| | (b) | | Floating rate note. The interest rate shown reflects the rate in effect at December 31, 2012. |

| | (c) | | Non-income producing security. |

| | (d) | | A reverse repurchase agreement, although structured as a sale and repurchase obligation, acts as a financing transaction under which the Fund will effectively pledge certain assets as collateral to secure a short-term loan. Generally the other party to the agreement makes the loan in an amount equal to a percentage of the market value of the pledged collateral. At the maturity of the reverse repurchase agreement, the Fund will be required to repay the loan and interest and correspondingly receive back its collateral. While used as collateral, the assets continue to pay principal and interest which are for the benefit of the Fund. |

| | ADR | | American Depositary Receipt |

The amount of $118,538 in cash was segregated with the broker, Credit Suisse, to cover margin requirements for the following open futures contracts as of December 31, 2012:

| | | | | | | | | | |

Short Futures

Outstanding | | Number of

Contracts | | Notional

Amount** | | | Unrealized

Appreciation | |

| Canadian Dollar (03/13) | | 58 | | $ | 5,862,350 | | | $ | 40,658 | |

| | ** | | The notional amount represents the U.S. value of the contract as of the day of the opening of the transaction or latest contract reset date. |

The amount of $4,882,259 in cash was segregated with the custodian to cover the following total return swaps outstanding at December 31, 2012:

| | | | | | | | | | | | | | |

Long Total

Return Equity Swaps | | Pay

Rate | | Expiration

Date | | | Notional

Amount** | | | Unrealized

Appreciation

(Depreciation) | |

| Inter Pipeline Fund (Canada)*** | | 1 month

LIBOR + 40

basis points | | | 3/20/13 | | | $ | 1,483,976 | | | ($ | 25,608 | ) |

| El Paso Pipeline Partners, LP*** | | 1 month

LIBOR + 90

basis points | | | 12/24/13 | | | | 932,250 | | | | (8,345 | ) |

| Kinder Morgan Management, LLC*** | | 1 month

LIBOR + 50

basis points | | | 12/24/13 | | | | 1,390,954 | | | | 16,650 | |

| Magellan Midstream Partners*** | | 1 month

LIBOR + 56

basis points | | | 12/24/13 | | | | 1,495,650 | | | | 32,892 | |

| Plains All American Pipeline, LP*** | | 1 month

LIBOR + 50

basis points | | | 12/24/13 | | | | 893,200 | | | | 11,389 | |

| Williams Pipeline Partners, LP*** | | 1 month

LIBOR + 100

basis points | | | 12/24/13 | | | | 323,988 | | | | 14,554 | |

| Centerpoint Energy inc.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 297,600 | | | | (8,906 | ) |

| Dominion Resources, Inc.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 857,340 | | | | 5,904 | |

| Duke Energy Co.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 194,280 | | | | (2,916 | ) |

See accompanying Notes to Financial Statements.

4

EIP Growth and Income Fund

December 31, 2012

Schedule of Investments – continued

| | | | | | | | | | | | | | |

Long Total

Return Equity Swaps | | Pay

Rate | | Expiration

Date | | | Notional

Amount** | | | Unrealized

Appreciation

(Depreciation) | |

Enbridge, Inc.

(Canada)*** | | 1 month

LIBOR + 36

basis points | | | 1/21/14 | | | $ | 891,488 | | | $ | 9,400 | |

| Exelon Corp.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 389,090 | | | | (2,543 | ) |

| ITC Holdings Corp.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 1,013,740 | | | | (14,099 | ) |

| Nextera Energy, Inc.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 909,708 | | | | (17,327 | ) |

| Nisource Inc.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 1,123,320 | | | | 21,410 | |

| Northeast Utilities*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 471,240 | | | | 1,748 | |

| Questar Corp.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 813,850 | | | | (3,842 | ) |

| Sempra Energy*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 640,112 | | | | (10,680 | ) |

| Southern Co.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 83,106 | | | | (1,782 | ) |

TransCanada Corp.

(Canada)*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 624,574 | | | | 15,311 | |

| UGI Corp.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 1,011,357 | | | | 7,536 | |

| Williams Companies, Inc.*** | | 1 month

LIBOR + 35

basis points | | | 1/21/14 | | | | 1,441,428 | | | | 52,841 | |

| Wisconsin Energy Corp.*** | | 1 month

LIBOR + 34

basis points | | | 1/21/14 | | | | 263,690 | | | | (5,788 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | $ | 17,545,941 | | | $ | 87,799 | |

| | | | | | | | | | | | | | |

| | | | |

Short Total

Return Equity Swaps | | Pay

Rate | | Expiration

Date | | | Notional

Amount** | | | Unrealized

Depreciation | |

| Copano Energy, LLC*** | | 1 month

Libor - 300

basis points | | | 1/18/13 | | | $ | 455,850 | | | ($ | 19,024 | ) |

| Markwest Energy Partners, LP*** | | 1 month

Libor - 275

basis points | | | 1/18/13 | | | | 244,600 | | | | (10,657 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | $ | 700,450 | | | ($ | 29,681 | ) |

| | | | | | | | | | | | | | |

| | ** | | The notional amount represents the U.S. value of the contract as of the day of the opening of the transaction. |

| | *** | | Credit Suisse is the counterparty to the above total return swaps. |

See accompanying Notes to Financial Statements.

5

EIP Growth and Income Fund

December 31, 2012

Statement of Assets and Liabilities

| | | | |

| |

ASSETS: | | | | |

Investments, at value (Cost $48,500,352) | | $ | 53,216,256 | |

Cash and cash equivalents | | | 4,227,099 | |

Restricted cash | | | 5,000,797 | |

Swaps (premium paid $0) | | | 189,635 | |

Foreign currency (Cost $3,078) | | | 3,078 | |

Receivables: | | | | |

Investments sold | | | 950,120 | |

Dividends and interest | | | 50,526 | |

Due from broker—variation margin on futures contracts | | | 40,658 | |

Prepaid expenses | | | 53,253 | |

| | | | |

Total assets | | | 63,731,422 | |

| | | | |

| |

LIABILITIES: | | | | |

Reverse repurchase agreements | | | 22,723,652 | |

Swaps (premium received $0) | | | 131,517 | |

Payables: | | | | |

Interest expense | | | 35,660 | |

Investments purchased | | | 3,084 | |

Professional fees | | | 182,999 | |

Investment advisory fees (Note 3) | | | 35,350 | |

Accounting and administration fees (Note 3) | | | 17,255 | |

Transfer agent fees | | | 5,217 | |

Custodian fees | | | 3,836 | |

Printing expense | | | 8,316 | |

Trustee fees and related expenses (Note 3) | | | 1,181 | |

Other payables | | | 9,246 | |

| | | | |

Total liabilities | | | 23,157,313 | |

| | | | |

NET ASSETS | | $ | 40,574,109 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

Par value ($0.01 per share) | | $ | 27,963 | |

Paid in capital | | | 60,383,808 | |

Accumulated undistributed net investment loss | | | (545,984 | ) |

Accumulated net realized loss on investments, swap transactions, futures contracts and foreign currency transactions | | | (24,106,355 | ) |

Net unrealized appreciation on investments, swap transactions, futures contracts and foreign currency transactions | | | 4,814,677 | |

| | | | |

| | $ | 40,574,109 | |

| | | | |

Shares outstanding (unlimited number of shares authorized) | | | 2,796,344 | |

| | | | |

Net Asset Value, offering and redemption price per share (net assets/shares outstanding) | | $ | 14.51 | |

| | | | |

See accompanying Notes to Financial Statements.

6

EIP Growth and Income Fund

For the Year Ended December 31, 2012

Statement of Operations

| | | | |

| |

INVESTMENT INCOME: | | | | |

Dividends | | $ | 328,195 | |

Less: foreign taxes withheld | | | (16,675 | ) |

Interest | | | 90,250 | |

| | | | |

Total investment income | | | 401,770 | |

| | | | |

| |

EXPENSES: | | | | |

Interest expense (Note 2) | | | 81,596 | |

Investment advisory fees (Note 3) | | | 435,148 | |

Professional fees | | | 320,978 | |

Accounting and administration fees (Note 3) | | | 173,811 | |

Trustee fees and related expenses (Note 3) | | | 53,119 | |

Transfer agent fees (Note 3) | | | 58,682 | |

Custodian fees | | | 20,752 | |

Printing expenses | | | 14,212 | |

Other expenses | | | 79,540 | |

| | | | |

Total expenses | | | 1,237,838 | |

| | | | |

NET INVESTMENT LOSS | | | (836,068 | ) |

| | | | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

NET REALIZED GAIN/(LOSS) ON: | | | | |

Investments | | | 3,356,640 | |

Swap transactions | | | 2,895,036 | |

Futures contracts | | | (206,460 | ) |

Foreign currency transactions | | | (5,126 | ) |

| | | | |

Net realized gain | | | 6,040,090 | |

| | | | |

| |

NET CHANGE IN UNREALIZED APPRECIATION/(DEPRECIATION) ON: | | | | |

Investments | | | (2,089,768 | ) |

Swap transactions | | | (371,619 | ) |

Futures contracts | | | 80,618 | |

Foreign currency transactions | | | (54 | ) |

| | | | |

Net change in unrealized depreciation | | | (2,380,823 | ) |

| | | | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 3,659,267 | |

| | | | |

| |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 2,823,199 | |

| | | | |

See accompanying Notes to Financial Statements.

7

EIP Growth and Income Fund

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year ended

December 31,

2012 | | | Year ended

December 31,

2011 | |

OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (836,068 | ) | | $ | (859,987 | ) |

Net realized gain on investments, swaps, futures and foreign currency transactions | | | 6,040,090 | | | | 10,679,310 | |

Net change in unrealized depreciation on investments, swaps, futures and foreign currency transactions | | | (2,380,823 | ) | | | (2,034,063 | ) |

| | | | | | | | |

Net increase in net assets from operations | | | 2,823,199 | | | | 7,785,260 | |

| | | | | | | | |

| | |

Distributions to shareholders from: | | | | | | | | |

Net investment income | | | (2,492,987 | ) | | | (3,560,382 | ) |

| | | | | | | | |

Total distributions | | | (2,492,987 | ) | | | (3,560,382 | ) |

| | | | | | | | |

| | |

Capital share transactions: | | | | | | | | |

Proceeds from sales of shares | | | 4,881,000 | | | | 64,000 | |

Proceeds from reinvestment of distributions | | | 2,272,955 | | | | 3,163,017 | |

Cost of shares redeemed | | | (8,346,970 | ) | | | (4,335,000 | ) |

| | | | | | | | |

Net decrease in net assets from capital share transactions | | | (1,193,015 | ) | | | (1,107,983 | ) |

| | | | | | | | |

Total increase/(decrease) in net assets | | | (862,803 | ) | | | 3,116,895 | |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 41,436,912 | | | | 38,320,017 | |

End of year | | $ | 40,574,109 | | | $ | 41,436,912 | |

| | | | | | | | |

Undistributed net investment loss | | $ | (545,984 | ) | | $ | (541,083 | ) |

| | | | | | | | |

See accompanying Notes to Financial Statements.

8

EIP Growth and Income Fund

For the Year Ended December 31, 2012

Statement of Cash Flows

| | | | |

| |

Operating Activities | | | | |

Net increase in net assets from operations | | $ | 2,823,199 | |

| |

Adjustments to Net Increase in Net Assets from Operations | | | | |

Purchase of investment securities | | | (27,626,662 | ) |

Proceeds from disposition of investment securities | | | 30,091,816 | |

Net proceeds of short-term investment transactions | | | 2,500,000 | |

Net realized gain on investments | | | (3,356,640 | ) |

Net change in unrealized depreciation on investments | | | 2,089,768 | |

Net accretion of premium on bonds | | | 17,257 | |

Return of capital received from investments in MLPs | | | 974,080 | |

Increase in investments sold receivable | | | (864,965 | ) |

Decrease in investments purchased payable | | | (104,967 | ) |

Net increase in due from broker-variation margin on futures contracts | | | (80,618 | ) |

Net change in swap appreciation | | | 371,619 | |

Increase in professional fees payable | | | 7,832 | |

Increase in printing expense payable | | | 1,898 | |

Increase in investment advisory fees payable | | | 1,673 | |

Increase in transfer agent fees payable | | | 1,240 | |

Decrease in trustee fees and related expenses payable | | | (319 | ) |

Decrease in accounting and administration fees payable | | | (1,368 | ) |

Decrease in custodian fees payable | | | (1,969 | ) |

Increase in prepaid expenses | | | (2,908 | ) |

Decrease in interest expense payable | | | (6,378 | ) |

Decrease in other payables | | | (7,690 | ) |

Increase in dividends and interest receivable | | | (13,131 | ) |

Increase in restricted cash | | | (258,540 | ) |

| | | | |

Net cash provided by operating activities | | | 6,554,227 | |

| | | | |

| |

Cash Flows From Financing Activities | | | | |

Net decrease in reverse repurchase agreements | | | (6,480,000 | ) |

Proceeds from shares sold | | | 4,901,000 | |

Payment of shares redeemed | | | (8,346,970 | ) |

Cash distributions to shareholders | | | (220,032 | ) |

| | | | |

Net cash used in financing activities | | | (10,146,002 | ) |

| | | | |

Net decrease in unrestricted cash and foreign currency | | | (3,591,775 | ) |

Beginning of Year (1) | | $ | 7,821,952 | |

| | | | |

End of Year (1) | | $ | 4,230,177 | |

| | | | |

| |

Supplemental Disclosures: | | | | |

Cash paid for interest expense | | $ | 87,974 | |

| | | | |

| (1) | The amount represents an investment in a money market fund which is included in cash and cash equivalents, and foreign currency, if any, on the Statement of Assets and Liabilities. |

See accompanying Notes to Financial Statements.

9

EIP Growth and Income Fund

The financial highlights table is intended to help you understand the Fund’s financial performance for the periods shown of the Fund’s operations. Certain information reflects financial results for a share outstanding throughout each year. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

12/31/12 | | | Year

Ended

12/31/11 | | | Year

Ended

12/31/10 | | | Year

Ended

12/31/09 | | | Year

Ended

12/31/08 | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.43 | | | $ | 13.04 | | | $ | 11.43 | | | $ | 6.71 | | | $ | 11.22 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(a) | | | (0.29 | ) | | | (0.31 | ) | | | (0.29 | ) | | | (0.16 | ) | | | 0.05 | |

Net realized and unrealized gain/(loss)

on investments | | | 1.29 | | | | 3.05 | | | | 3.78 | | | | 4.88 | | | | (3.75 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.00 | | | | 2.74 | | | | 3.49 | | | | 4.72 | | | | (3.70 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Distributions paid to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.92 | ) | | | (1.35 | ) | | | (1.88 | ) | | | — | | | | (0.19 | ) |

Net realized gain on investments | | | — | | | | — | | | | — | | | | — | | | | (0.62 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from distributions | | | (0.92 | ) | | | (1.35 | ) | | | (1.88 | ) | | | — | | | | (0.81 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net increase/(decrease) in net asset value | | | 0.08 | | | | 1.39 | | | | 1.61 | | | | 4.72 | | | | (4.51 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 14.51 | | | $ | 14.43 | | | $ | 13.04 | | | $ | 11.43 | | | $ | 6.71 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 7.03 | % | | | 21.62 | % | | | 30.88 | % | | | 70.34 | % | | | (33.04 | )% |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 40,574 | | | $ | 41,437 | | | $ | 38,320 | | | $ | 58,983 | | | $ | 87,747 | |

Ratios of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

Operating expenses excluding interest

expense | | | 2.66 | % | | | 2.90 | % | | | 2.98 | % | | | 2.57 | % | | | 1.54 | % |

Operating expenses including interest

expense | | | 2.84 | % | | | 3.17 | % | | | 3.30 | % | | | 3.77 | % | | | 4.30 | % |

Ratios of net investment income/(loss) to

average net assets | | | (1.92 | )% | | | (2.21 | )% | | | (2.27 | )% | | | (1.89 | )% | | | 0.52 | % |

Portfolio turnover rate | | | 51 | % | | | 69 | % | | | 68 | % | | | 93 | % | | | 42 | % |

| (a) | Per share investment income has been calculated using the average shares method. |

See accompanying Notes to Financial Statements.

10

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements

1. ORGANIZATION

EIP Growth and Income Fund (the “Fund”) is a diversified, open-end management investment company. The Fund commenced operations on August 22, 2006. The Fund is currently the sole series of EIP Investment Trust (the “Trust”), a Delaware statutory trust. The Fund is managed by Energy Income Partners, LLC (the “Manager”). At this time, the Fund does not intend to publicly offer its shares. Fund shares are available only to certain unregistered investment companies through a “master/feeder” arrangement pursuant to Section 12(d)(1)(E) of the Investment Company Act of 1940, as amended (the “1940 Act”) and certain other accredited investors.

The Fund’s primary investment objective is to seek a high level of total shareholder return that is balanced between current income and growth. As a secondary objective, the Fund will seek low volatility. Under normal market conditions, the Fund’s investments will be concentrated in the securities of one or more issuers conducting their principal business activities in the Energy Industry. The Energy Industry is defined as enterprises connected to the exploration, development, production, gathering, transportation, processing, storing, refining, distribution, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products, electricity, coal or other energy sources.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements and which are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for investment companies. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation: For purposes of valuing investment securities, readily marketable portfolio securities listed on any exchange or the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) Global Market are valued, except as indicated below, at the last sale price or the NASDAQ official closing price as determined by NASDAQ on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean between the most recent bid and asked price on such day. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day of which such value is being determined at the close of the exchange representing the principal market for such securities. Investments initially valued in currencies other than the U.S. dollar are converted to U.S. dollars using exchange rates obtained from independent pricing services. As a result, the net asset value (“NAV”) of the Fund’s shares may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside of the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the New York Stock Exchange (“NYSE”) is closed and an investor is not able to purchase or redeem shares.

Equity securities traded in the over-the-counter (“OTC”) market, but excluding securities trading on the NASDAQ Global Market, are valued at the closing bid prices, if held long, or at the closing asked prices, if held short. Debt securities are priced based upon valuations provided by independent, third-party pricing agents. These third-party pricing agents may employ methodologies that utilize actual market transactions, broker-dealer supplied valuation, or other electronic data processing techniques. Such techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. If reliable market quotations are not readily available with respect to a portfolio security held by the Fund, including any illiquid securities, or if a valuation is deemed inappropriate, the fair value of such security will be determined under procedures adopted by the Board of Trustees of the Trust (the “Board”) in a manner that most fairly reflects market value of the security on the valuation date as described below.

The use of fair value pricing by the Fund indicates that a readily available market quotation is unavailable (such as when the exchange on which a security trades does not open for the day due to extraordinary circumstances and no other market prices are available or when events occur after the close of a relevant market and prior to the close of the NYSE that materially affect the value of an asset) and in such situations the Board (or the Manager, acting at the Board’s direction) will estimate the value of a security using available information. In such situations, the values assigned to such securities may not necessarily represent the amounts which might be realized upon their sale. The use of fair value pricing by the Fund will be governed by valuation procedures adopted by the Trust’s Board, and in accordance with the provisions of the 1940 Act. At December 31, 2012, there were no fair valued securities.

11

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

Financial futures contracts traded on exchanges are valued at their last sale price. Swap agreements are valued utilizing quotes received daily by the Fund’s pricing service.

Fair Value Measurement: The inputs and valuation techniques used to measure fair value of the Fund’s net assets are summarized into three levels as described in the hierarchy below:

| | • Level 1 – | unadjusted quoted prices in active markets for identical assets or liabilities |

| | • Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, evaluation pricing, etc.) |

| | • Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers in and out of levels are recognized at market value at the end of the period. A summary of the values of each investment in each level as of December 31, 2012 is as follows:

| | | | | | | | | | | | | | | | |

| | | Total Fair

Value at

12/31/12 | | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | |

ASSETS | | | | | | | | | | | | | | | | |

Corporate Notes and Bonds | | $ | 2,967,453 | | | $ | — | | | $ | 2,967,453 | | | $ | — | |

U.S. Government and Agency Obligations | | | 21,514,096 | | | | — | | | | 21,514,096 | | | | — | |

Master Limited Partnerships* | | | 15,631,207 | | | | 15,631,207 | | | | — | | | | — | |

United States Common Stocks* | | | 10,382,409 | | | | 10,382,409 | | | | — | | | | — | |

Canadian Common Stocks* | | | 2,704,157 | | | | 2,704,157 | | | | — | | | | — | |

Cash Equivalents | | | 4,227,099 | | | | 4,227,099 | | | | — | | | | — | |

Warrants | | | 16,934 | | | | 16,934 | | | | — | | | | — | |

Derivatives | | | | | | | | | | | | | | | | |

Equity Contracts | | | 189,635 | | | | — | | | | 189,635 | | | | — | |

Foreign Currency Exchange Contracts | | | 40,658 | | | | 40,658 | | | | — | | | | — | |

Total | | | 57,673,648 | | | | 33,002,464 | | | | 24,671,184 | | | | — | |

LIABILITIES | | | | | | | | | | | | | | | | |

Derivatives | | | | | | | | | | | | | | | | |

Equity Contracts | | | 131,517 | | | | — | | | | 131,517 | | | | — | |

Total | | $ | 131,517 | | | $ | — | | | $ | 131,517 | | | $ | — | |

| * | See Schedule of Investments detail for industry breakout. |

The Fund did not have any transfers in and out of Level 1 and Level 2 during the year.

The Fund held no securities or financial instruments during 2012, which were measured at fair value using Level 3 inputs.

At the end of each calendar quarter, management evaluates the Level 2 and 3 assets and liabilities, if applicable, for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period.

Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

The fair value of the Fund’s reverse repurchase agreements, which qualify as financial instruments under FASB Accounting Standards Codification (“ASC”) 820 “Disclosures about Fair Values of Financial Instruments”, approximates the carrying amounts presented in the Schedule of Investments and Statement of Assets and Liabilities.

MLP Common Units: Master Limited Partnership (“MLP”) common units represent limited partnership interests in the MLP. Common units are generally listed and traded on U.S. securities exchanges or OTC with their value fluctuating predominantly based on the success of the

12

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

MLP. Unlike owners of common stock of a corporation, owners of MLP common units have limited voting rights. MLPs generally distribute all available cash flow (cash flow from operations less maintenance capital expenditures) in the form of quarterly distributions. Common unit holders have first priority to receive quarterly cash distributions up to the minimum quarterly distribution and have arrearage rights. In the event of liquidation, common unit holders have preference over subordinated units, but not debt holders or preferred unit holders, to the remaining assets of the MLP.

Cash and Cash Equivalents: The Fund maintains cash in a bank deposit account that, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits. The Fund considers investments in money market funds and short-term highly liquid investments with maturities of 90 days or less (when acquired) to be cash equivalents. Cash equivalents are carried at cost. As of December 31, 2012, the Fund held $4,227,099 of PNC Bank Money Market included in cash and cash equivalents on the Statement of Assets and Liabilities.

Restricted Cash: Restricted cash includes amounts required to be segregated with the Fund’s custodian or brokers as collateral for the Fund’s derivatives as shown on the Schedule of Investments.

Reverse Repurchase Agreements: One method by which the Fund currently incurs leverage is through the use of reverse repurchase agreements. In a reverse repurchase agreement, the Fund sells securities to a bank, securities dealer or one of their respective affiliates and agrees to repurchase such securities on demand or on a specified future date and at a specified price, including an implied interest payment. During the period between the sale and the forward purchase, the Fund will continue to receive principal and interest payments on the securities sold and also have the opportunity to earn a return on the securities furnished by the counterparty. Reverse repurchase agreements involve the risk that the buyer of the securities sold by the Fund might be unable to deliver them when the Fund seeks to repurchase such securities. If the buyer of the securities under the reverse repurchase agreement files for bankruptcy or becomes insolvent, the buyer or a trustee or receiver may receive an extension of time to determine whether to enforce the Fund’s obligation to repurchase the securities, and the Fund’s use of the proceeds of the reverse repurchase agreement may effectively be restricted pending that decision. The Fund will segregate on its books assets in an amount at least equal to its obligations, marked to market daily, under any reverse repurchase agreement or take other permissible actions to cover its obligations. The use of leverage involves risks of increased volatility of the Fund’s investment portfolio, among others. In certain cases, the Fund may be required to sell securities with a value significantly in excess of the cash received by the Fund from the buyer. In certain reverse repurchase agreements, the buyer may require excess cover of the Fund’s obligation. If the buyer files for bankruptcy or becomes insolvent, the Fund may lose the value of the securities in excess of the cash received. In addition, many reverse repurchase agreements are short-term in duration (often overnight), and the counterparty may refuse to “roll over” the agreement to the next period, in which case the Fund may temporarily lose the ability to incur leverage through the use of reverse repurchase agreements and may need to dispose of a significant portion of its assets in a short time period.

| | | | |

| |

Maximum amount outstanding during the period | | $ | 29,203,652 | |

| |

Average amount outstanding during the period* | | $ | 26,093,871 | |

| |

Average shares outstanding during the period | | | 2,900,988 | |

| |

Average debt per share outstanding during the period | | | $8.99 | |

| * | The average amount outstanding during the period was calculated by adding the cash received under reverse repurchase agreements at the end of each day and dividing the sum by the number of days in the year ended December 31, 2012. |

The reverse repurchase agreements are executed daily based on the previous day’s terms. The accrued interest and maturity amounts are payable at the time the reverse repurchase agreement is not renewed or the terms of the agreement are renegotiated. Interest accrues on a daily basis from the initial opening date or last interest payment date, if an interest payment has been made for the respective repurchase agreement.

Interest rates ranged from 0.18% to 0.75% during the year ended December 31, 2012, on cash received under reverse repurchase agreements. Interest expense for the year ended December 31, 2012 aggregated $81,596, which is included in the Statement of Operations under “Interest Expense”.

Short Sales of Securities: The Fund may enter into short sale transactions. A short sale is a transaction in which the Fund sells securities it does not own (but has or may have borrowed) in anticipation of a decline in the market price of the securities. To complete a short sale, the Fund may arrange through a broker to borrow the securities to be delivered to the buyer. The proceeds received by the Fund for the short sale are retained by the broker until the Fund replaces the borrowed securities. In borrowing the securities to be delivered to the buyer, the Fund becomes obligated to replace the securities borrowed at their market price at the time of replacement, whatever that price may be. The Fund did not enter into any short sale transactions during the year ended December 31, 2012.

13

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

Disclosures about Derivative Instruments and Hedging Activities: The following is a table summarizing the fair value of derivatives held at December 31, 2012 by primary risk exposure:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivatives not accounted for

as hedging instruments | | | | | | | | | | | | |

| | | Statement of Assets

and Liabilities Location | | Fair Value | | | Statement of Assets

and Liabilities Location | | Fair Value | |

| Foreign Currency Exchange Contracts | | Due from broker- variation margin on futures contracts | | $ | 40,658 | | | — | | $ | — | |

| | | | |

Equity Contracts | | Swaps | | | 189,635 | | | Swaps | | | 131,517 | |

| | | | | | | | | | | | |

| | | | |

Total | | | | $ | 230,293 | | | | | $ | 131,517 | |

| | | | | | | | | | | | |

The Effect of Derivative Instruments on the Statement of Operations for the year ended December 31, 2012:

| | | | | | | | | | |

Derivatives not accounted for

as hedging instruments | | Location of Gain/(Loss)

on Derivatives

Recognized in Income | | Net Realized Gain/

(Loss) on Derivatives

Recognized in Income | | | Net Change in Unrealized

Appreciation/

(Depreciation) on

Derivatives

Recognized in Income | |

| | | |

Foreign Currency Exchange Contracts | | Net realized gain/(loss) on futures contracts/Net change in unrealized appreciation/(depreciation) on futures contracts | | $ | (206,460 | ) | | $ | 80,618 | |

| | | |

Equity Contracts | | Net realized gain/(loss) on swap transactions/Net change in unrealized appreciation/(depreciation) on swap transactions | | | 2,895,036 | | | | (371,619 | ) |

| | | | | | | | | | |

| | | |

Total | | | | $ | 2,688,576 | | | $ | (291,001 | ) |

| | | | | | | | | | |

Futures Contracts: The Fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The Fund may purchase or sell futures contracts to hedge against foreign currency exchange risk or for any other purpose permitted by applicable law. The purchase of futures contracts may be more efficient or cost effective than actually buying the underlying securities or assets. A futures contract is an agreement between two parties to buy and sell an instrument at a set price on a future date and is exchange-traded. Upon entering into a futures contract, the Fund is required to pledge to the broker an amount of cash, U.S. Government securities or other high-quality debt securities equal to the minimum “initial margin” requirements of the exchange or the broker. Pursuant to a contract entered into with a futures commission merchant, the Fund agrees to receive from or pay to the firm an amount of cash equal to the cumulative daily fluctuation in the value of the contract. Such receipts or payments are known as “variation margin” and are recorded by the Fund as unrealized gains or losses. When the contract is closed, the Fund records a gain or loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed. The Fund will cover its current obligations under futures contracts by the segregation of liquid assets or by entering into offsetting transactions or owning positions covering its obligations. The risks of entering into futures contracts include the possibility that there may be an illiquid market and that a change in the value of the contracts may not correlate with changes in the value of the underlying securities or assets. The Fund’s maximum foreign currency exchange rate risk on those futures contracts where the underlying currency is long is an amount equal to the notional amount of the related contracts. During the year ended December 31, 2012, the Fund held no futures contracts where the underlying currency is long. The Fund’s maximum foreign currency exchange rate risk on those futures contracts where the underlying currency is short is theoretically unlimited. However, if effectively hedged, any loss would be offset in unrealized foreign currency gains of securities denominated in the same currency. For the year ended December 31, 2012, the Fund’s average volume of futures activity was $5,543,730 based on the quarterly notional amount. The notional amount represents the U.S. value of the contracts as of the day of the opening of the transaction.

14

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

Currency Hedging Transactions: The Fund may engage in certain transactions intended to hedge the Fund’s exposure to currency risks, including without limitation buying or selling options or futures, entering into forward foreign currency contracts, currency swaps or options on currency and currency futures and other derivative transactions. Hedging transactions can be expensive and have risks, including the imperfect correlation between the value of such instruments and the underlying assets, the possible default of the other party to the transaction or illiquidity of the derivatives instruments.

Foreign Currency Translations: The accounting records of the Fund are maintained in U.S. dollars. The Fund may purchase securities that are denominated in foreign currencies. Investment securities and other assets and liabilities denominated in foreign currency are translated into U.S. dollars at the current exchange rates. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the exchange rates on the dates of the respective transactions.

Although the net assets of the Fund are calculated using the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, these foreign exchange gains or losses are included in the reported net realized and unrealized gain/(loss) on investments shown on the Statement of Operations.

Net realized gains or losses on foreign currency transactions represent net foreign exchange gains or losses from the holding of foreign currencies, currency gains or losses realized between the trade date and settlement date on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net change in unrealized appreciation/(depreciation) on foreign currency transactions shown on the Statement of Operations.

Swap Agreements: The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may enter into swap agreements as a substitute for purchasing equity securities of issuers in the Energy Industry as defined in Note 1 above, to achieve the same exposure as it would by engaging in short sales transactions of energy securities, to hedge its currency exposure or for any other purpose permitted by applicable law. A swap is a financial instrument that typically involves the exchange of cash flows between two parties on specified dates (settlement dates) where the cash flows are based on agreed-upon prices, rates, etc. In a typical equity swap agreement, one party agrees to pay another party the return on a security or basket of securities in return for a specified interest rate. By entering into swaps, the Fund can gain exposure to a security without actually purchasing the underlying asset. Swap agreements involve both the risk associated with the investment in the security as well as the risk that the performance of the security, including any dividends, will not exceed the interest that the Fund will be committed to pay under the swap. Swaps are individually negotiated. Swap agreements may increase or decrease the overall volatility of the investments of the Fund. The performance of swap agreements may be affected by a change in the specific interest rate, security, currency, or other factors that determine the amounts of payments due to and from the Fund. The Fund will cover its current obligations under swap agreements by the segregation of liquid assets or by entering into offsetting transactions or owning positions covering its obligations. A swap agreement would expose the Fund to the same equity price risk as it would have if the underlying equity securities were purchased. The regulation of swaps and futures transactions in the United States is a rapidly changing area of law and is subject to modification by government and judicial action. The effect of any future regulatory change on the Fund is impossible to predict, but could be substantial and adverse.

The Fund’s maximum equity price risk to meet its future payments under long swap agreements outstanding as of December 31, 2012 is equal to the total notional amount as shown on the Schedule of Investments. The Fund’s maximum equity price risk to meet its future payments under short swap agreements outstanding is theoretically unlimited. For the year ended December 31, 2012, the average volume of long Total Return Equity Swaps was $17,761,235 based on the quarterly notional amount. The average volume of short Total Return Equity Swaps for the year ended December 31, 2012, was $748,130 based on the quarterly notional amount. The notional amount represents the U.S. value of the contracts as of the day of the opening of the transaction or latest contract reset date.

Options Contracts: The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may enter into option contracts in order to hedge against potential adverse price movements

15

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

in the value of portfolio assets, as a temporary substitute for selling selected investments, to lock in the purchase price of a security or currency which it expects to purchase in the near future, as a temporary substitute for purchasing selected investments, to enhance potential gain, and for any other purpose permitted by applicable law. An option contract is a contract in which the writer of the option grants the buyer of the option the right to purchase from (call option), or sell to (put option), the writer a designated instrument at a specified price within a specified period of time. Certain options, including options on indices, would require cash settlement by the Fund if the option is exercised.

The liability representing the Fund’s obligation under an exchange-traded written option or investment in a purchased option is valued at the last sale price or, in the absence of a sale on such day, the mean between the closing bid and ask prices on such day or at the most recent asked price (bid for purchased options) if no bid and asked prices are available. OTC written or purchased options are valued using dealer supplied quotations. Gain or loss is recognized when the option contract expires or is closed.

If the Fund writes a covered call option, the Fund forgoes, in exchange for the premium, the opportunity to profit during the option period from an increase in the market value of the underlying security above the exercise price. If the Fund writes a put option it accepts the risk of a decline in the market value of the underlying security below the exercise price. OTC options have the risk of the potential inability of counterparties to meet the terms of their contracts. The Fund’s maximum equity price risk for purchased options is limited to the premium initially paid. In addition, certain risks may arise upon entering into option contracts including the risk that an illiquid secondary market will limit the Fund’s ability to close out an option contract prior to the expiration date and that a change in the value of the option contract may not correlate exactly with changes in the value of the securities or currencies hedged. For the year ended December 31, 2012, the Fund did not hold any option contracts.

Securities Transactions and Investment Income: Securities transactions are recorded on a trade date basis. Realized gain and loss from securities transactions are recorded on the specific identified cost basis. Dividend income is recognized on the ex-dividend date. Dividend income on foreign securities is recognized as soon as the Fund is informed of the ex-dividend date. Distributions received in excess of income are recorded as a reduction of cost of investments and/or as a realized gain. Interest income is recognized on the accrual basis. All discounts/premiums are accreted/amortized using the effective yield method.

Dividends and Distributions: At least annually, the Fund intends to distribute all or substantially all of its investment company taxable income (computed without regard to the deduction for dividends paid), if any, and net capital gain, if any. The tax treatment and characterization of the Fund’s distributions may vary significantly from time to time because of the varied nature of the Fund’s investments. The Fund will reinvest distributions in additional shares of the Fund unless a shareholder has written to request distributions, in whole or in part, in cash.

The tax character of distributions paid during the calendar year ended December 31, 2012 was as follows:

| | | | |

Ordinary Income | | $ | 2,492,987 | |

Long-Term Capital Gains | | $ | 0 | |

The tax character of distributions paid during the calendar year ended December 31, 2011 was as follows:

| | | | |

Ordinary Income | | $ | 3,560,382 | |

Long-Term Capital Gains | | $ | 0 | |

The Fund is considered a nonpublicly offered regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). Thus, certain expenses of the Fund, including the investment advisory fee, are subject to special rules that can affect certain shareholders of the Fund (generally individuals and entities that compute their taxable income in the same manner as an individual). In particular, such a shareholder’s pro rata portion of the affected expenses for the calendar year (but generally reduced by the Fund’s net operating loss, if any, for its tax year ending within the calendar year), will be taxable to such shareholder as an additional dividend and such shareholder will be treated as having paid its pro rata share of the affected expenses itself. If such a shareholder itemizes its deductions, it generally should be entitled to take an offsetting deduction for its share of the affected expenses, subject, however, to the 2% “floor” on miscellaneous itemized deductions. These expenses will not be deductible for the purposes of calculating alternative minimum tax.

The Fund has a tax year end of June 30. As of June 30, 2012, the components of distributable earnings on a tax basis and other tax attributes were as follows:

| | | | |

Undistributed Ordinary Income | | $ | 2,492,901 | |

Capital Loss Carryforward | | $ | 26,848,682 | |

Post October Loss – Capital & Foreign Currency | | $ | 0 | |

Taxable income and capital gains are determined in accordance with U.S. federal income tax rules, which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing

16

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

differences and differing characterization of distributions made by the Fund.

Permanent book and tax accounting differences relating to the tax year ended June 30, 2012 have been reclassified to reflect an increase in undistributed net investment income of $3,324,154, an increase in accumulated net realized loss on investments of $3,908,146 and an increase in paid-in-capital of $583,992. These differences are primarily due to passive loss limitations, pass through taxable income from investments and swap character reclasses. Net assets were not affected by this reclassification.

Capital Loss Carryforward: As of June 30, 2012, the following capital loss carryforwards are available to reduce taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Internal Revenue Code:

| | | | | | | | |

| Year of Expiration | | | | | | |

| | |

2017 | | 2018 | | | Total | |

| $7,205,915 | | $ | 19,642,767 | | | $ | 26,848,682 | |

During the tax year ended June 30, 2012, the Fund utilized $2,967,852 of capital loss carryforwards expiring in 2017.

Federal Income Tax: The Fund intends to qualify each year for taxation as a RIC eligible for treatment under the provisions of Subchapter M of the Code. If the Fund so qualifies and satisfies certain distribution requirements, the Fund will not be subject to federal income tax on income and gains distributed in a timely manner to its shareholders in the form of dividends or capital gain dividends.

As of December 31, 2012, the cost of securities and gross unrealized appreciation and depreciation for all securities on a tax basis was as follows:

| | | | |

Total Cost of Investments | | $ | 48,936,152 | |

| | | | |

Gross Unrealized Appreciation

on Investments | | $ | 4,782,241 | |

Gross Unrealized Depreciation

on Investments | | $ | (502,137 | ) |

| | | | |

Net Unrealized Appreciation

on Investments | | $ | 4,280,104 | |

| | | | |

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements.

The Fund files U.S. federal and Connecticut state tax returns. No income tax returns are currently under examination. The Fund’s U.S. federal tax returns and Connecticut state tax returns remain open for examination for the tax years ended June 30, 2012, June 30, 2011, June 30, 2010 and June 30, 2009.

Expenses: The Fund will pay all of its own expenses incurred in its operations.

Recently Issued Accounting Standards: In December 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-11, “Disclosures about Offsetting Assets and Liabilities”. ASU 2011-11 requires disclosures to make financial statements that are prepared under U.S. GAAP more comparable to those prepared under International Financial Reporting Standards. The new disclosure requirements mandate that entities disclose both gross and net information about instruments and transactions eligible for offset in the statement of assets and liabilities as well as instruments and transactions subject to an agreement similar to a master netting arrangement. In addition, ASU 2011-11 requires disclosure of collateral received and posted in connection with master netting agreements or similar arrangements. New disclosures are required for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. Management is evaluating the impact of ASU 2011-11 on the financial statements and disclosures.

3. INVESTMENT ADVISORY FEE, ADMINISTRATION FEE AND

OTHER RELATED PARTY TRANSACTIONS

Pursuant to an investment advisory agreement, Energy Income Partners, LLC, serves as the Fund’s investment manager with responsibility for the management of the Fund’s investment portfolio, subject to the supervision of the Board of Trustees of the Trust. For providing such services, the Fund pays to the Manager a fee, computed and paid monthly at the annual rate of 1% of the average daily net assets of the Fund.

The Bank of New York Mellon serves as custodian for the Fund and has custody of all securities and cash of the Fund and attends to the collection of principal and income and payment for and collection of proceeds of securities bought and sold by the Fund.

BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”) serves as the transfer agent, registrar, dividend disbursing agent and shareholder servicing agent for the Fund and provides certain clerical, bookkeeping, shareholder servicing and administrative services necessary for the operation of the Fund and maintenance of shareholder accounts.

BNY Mellon also provides certain accounting and administrative services to the Fund pursuant to an Administration and Accounting Services Agreement. For administrative and accounting services, the Fund pays BNY Mellon a fee equal to 0.07% of the Fund’s first

17

EIP Growth and Income Fund

December 31, 2012

Notes to Financial Statements – continued

$250 million of average gross assets, 0.05% of the Fund’s next $200 million of average gross assets and 0.03% of the Fund’s average gross assets in excess of $450 million, on a monthly basis, in addition to certain out-of-pocket expenses. The Fund is currently paying the minimum fee of $100,000/year ($8,333/month). For regulatory administration services, the Fund pays BNY Mellon a fee equal to 0.03% of the Fund’s first $250 million of average gross assets and 0.02% of the Fund’s average gross assets in excess of $250 million, on a monthly basis, in addition to certain other fees and expenses. The Fund is currently paying the minimum fee of $50,000/year ($4,167/month).

The Fund does not charge any sales load or fees pursuant to Rule 12b-1 of the 1940 Act. Currently, the Fund offers only a single class of shares. The Fund is self-distributed and does not have a principal underwriter or private placement agent.