UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

380 Madison Avenue, 21st Floor

New York, NY 10017

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866)-909-9473

Date of fiscal year end: March 31

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report(s) to Stockholders. |

The Trust’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

JOIN YOUR FELLOW WISDOMTREE INVESTORS

Help reduce impact to environment by going paperless

Sign up for eDelivery at www.wisdomtree.com

WisdomTree Trust

Domestic Dividend Funds

Annual Report

March 31, 2011

WisdomTree Total Dividend Fund (DTD)

WisdomTree Equity Income Fund (DHS)

WisdomTree LargeCap Dividend Fund (DLN)

WisdomTree Dividend ex-Financials Fund (DTN)

WisdomTree MidCap Dividend Fund (DON)

WisdomTree SmallCap Dividend Fund (DES)

Table of Contents

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the Trust.

Management’s Discussion of Funds’ Performance (unaudited)

Domestic Dividend Funds

Market Environment Overview

The U.S. equity market, measured by the S&P 500 Index returned 15.65% for the 12-month period ended March 31, 2011 (the “period”). These gains are a continuation of the equity market bounce back after the bear market bottom in March of 2009 and followed gains of nearly 50% for the previous 1-year period. Given the back to back annual gains, on a cumulative basis, the S&P 500 Index now remains just 15% below its October 2007 highs. Considering the painful bear market experienced in 2008 and early 2009, it is clear that the U.S. equity market has experienced a significant recovery.

During the period, investors regained confidence in the safety and soundness of major United States financial institutions. The markets enjoyed strong gains from the lows of March 2009 until May 2010. May 2010 was marked by several detrimental events, specifically the “Flash Crash” and the BP Oil spill. The Flash Crash occurred on May 6, 2010, when the market fell approximately 900 points or 9% in minutes, and then made up much of the losses only minutes later. These events were the first bout of heightened fear and volatility entering the markets since the lows of early 2009. Choppy sideways performance remained in place until late summer 2010, when the Federal Reserve, led by Chairman Benjamin Bernanke, announced it was considering a second round of quantitative easing (“QE2”). Through QE2 the Federal Reserve pledged to initiate a purchase program of medium to long maturity treasury securities in order to lower mortgage and other interest rates levels. QE2 was implemented in November 2010. The Federal Funds target interest rate remained near zero throughout the entire period. Unemployment, one of the most widely watched economic indicators in judging the effectiveness of both monetary and fiscal policy, went from 9.7% in March of 2010 to 8.8% in March of 2011.

Similar to the 12-month period ended March 31, 2010, mid and small cap stocks continued to outperform large cap stocks for the year ended March 31, 2011. Given the accommodative monetary policy of the Federal Reserve, as well as positive earnings reports and an improving economic picture, investors have been willing to take more investment risk. This environment led many investors to prefer small capitalization stocks over large capitalization stocks and more cyclical sectors over defensive sectors.

WisdomTree Funds’ Performance Overview

WisdomTree’s dividend weighted funds are designed to track indexes based on the dividend stream generated by the companies included in the underlying WisdomTree index. The dividend stream is defined as the sum of the dollar value of dividends indicated to be paid by each company. There are two primary factors that drive performance differential of the WisdomTree Funds and indexes versus market cap-weighted benchmarks. The first is aggregate exposure to one or more sectors. The second is stock selection within each sector. Both of these are determined as part of WisdomTree’s rules-based index methodology. These exposures are not subjectively determined. Rather, they are objectively determined at the index rebalancing dates based on the dividend stream.

The following table reflects the WisdomTree Fund performance versus capitalization-weighted benchmark index.

| | | | | | | | | | | | | | | | |

| TICKER | | WISDOMTREE FUND | | 1 YEAR

RETURN | | | CAPITALIZATION-WEIGHTED

BENCHMARK INDEX | | 1 YEAR

RETURN | | | 1 YEAR

RETURN

FUND

VS

INDEX | |

DTN | | WT Dividend ex-Financials Fund | | | 21.68 | % | | Dow Jones U.S. Select Dividend Index | | | 18.03 | % | | | 3.65 | % |

DON | | WT MidCap Dividend Fund | | | 20.60 | % | | S&P MidCap 400 Index | | | 26.95 | % | | | -6.35 | % |

DHS | | WT Equity Income Fund | | | 20.24 | % | | Russell 1000 Value Index | | | 15.15 | % | | | 5.09 | % |

DES | | WT SmallCap Dividend Fund | | | 18.96 | % | | Russell 2000 Index | | | 25.79 | % | | | -6.83 | % |

DTD | | WT Total Dividend Fund | | | 17.37 | % | | Russell 3000 Index | | | 17.41 | % | | | -0.04 | % |

DLN | | WT LargeCap Dividend Fund | | | 16.83 | % | | S&P 500 Index | | | 15.65 | % | | | 1.18 | % |

| | | | |

| WisdomTree Domestic Dividend Funds | | | 1 | |

Management’s Discussion of Funds’ Performance

(unaudited) (concluded)

All 10 sectors represented within the S&P 500 index experienced positive performance over the period. The best performing sector over the period was the Energy sector, spurred on by a jump in oil prices over $100 in early 2011. The other typically cyclical sectors (Industrials, Materials, Consumer Discretionary) also out-performed the broader markets while most of the less cyclical stocks under-performed the broader markets (notably, Health Care, Consumer Staples, and Utilities).

WisdomTree’s fund performance, when measured on a relative basis versus their cap-weighted benchmarks, was the worst in the mid and small cap sectors, where cap-weighted benchmark performance was the strongest. Strong gains in technology stocks, which are not typically dividend payers and tend to be underweighted in WisdomTree’s dividend funds had a negative impact on relative performance. In addition, poor performance from financial sector stocks, which were more heavily represented in these funds than their cap weighted benchmarks, also had a negative impact on performance.

The LargeCap Dividend Fund and the Dividend ex-Financials Fund had better relative performance than their cap-weighted benchmarks. These funds had a relatively smaller portion of their assets invested in the financial sector than their capitalization-weighted benchmarks. Since financials lagged, the WisdomTree funds performed better than their cap-weighted benchmarks which were more heavily exposed to the financial sector.

The views expressed in this report reflect those of WisdomTree Asset Management only through the end of the period of the report as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results.

Fund returns are shown at NAV. Please see Performance Summaries on the subsequent pages for more complete performance information. Please see page 10 for the list of index descriptions.

Fund performance assumes reinvestment of dividends and capital gain distributions. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results. For the most recent month end performance information visit www.wisdomtree.com.

| | |

| 2 | | WisdomTree Domestic Dividend Funds |

Performance Summary (unaudited)

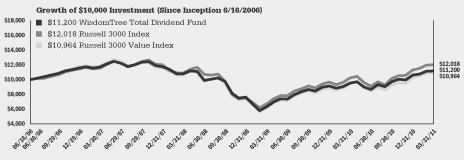

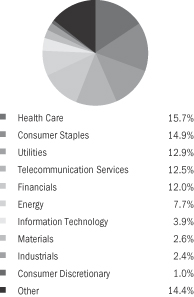

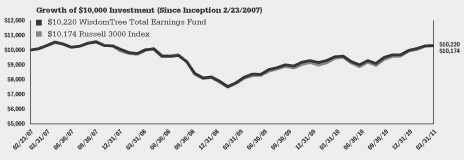

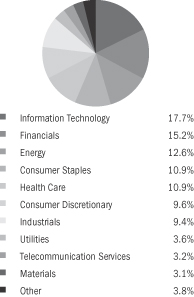

WisdomTree Total Dividend Fund (DTD)

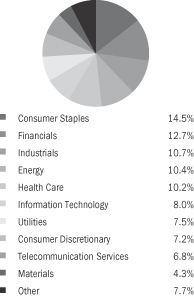

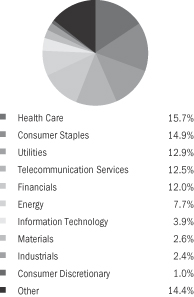

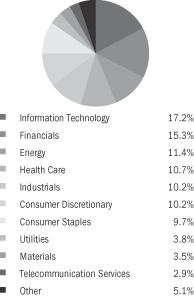

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 4.0% | |

Exxon Mobil Corp. | | | 4.0% | |

Chevron Corp. | | | 2.7% | |

Pfizer, Inc. | | | 2.6% | |

Verizon Communications, Inc. | | | 2.3% | |

General Electric Co. | | | 2.2% | |

Johnson & Johnson | | | 2.1% | |

Procter & Gamble Co. (The) | | | 2.0% | |

Philip Morris International, Inc. | | | 2.0% | |

Microsoft Corp. | | | 1.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

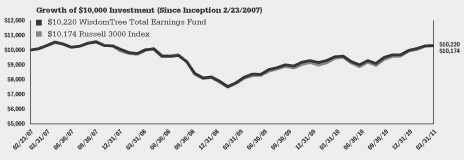

The WisdomTree Total Dividend Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree Dividend Index.

The Fund returned 17.37% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund’s performance benefited from its favorable stock selection within the Financials sector. Stock selection within the Information Technology sector contributed to a drag on the Fund’s performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.28%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | | | | | |

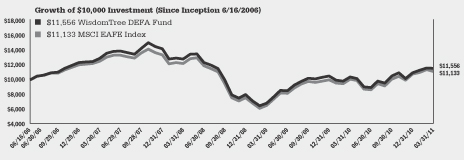

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Dividend Index | | | Russell 3000 Index | | | Russell 3000

Value Index | |

One Year | | | 17.37 | % | | | 18.25 | % | | | 18.32 | % | | | 17.41 | % | | | 15.60 | % |

Three Year | | | 1.30 | % | | | 1.35 | % | | | 1.93 | % | | | 3.42 | % | | | 1.09 | % |

Since Inception1 | | | 2.39 | % | | | 2.38 | % | | | 2.90 | % | | | 3.91 | % | | | 1.94 | % |

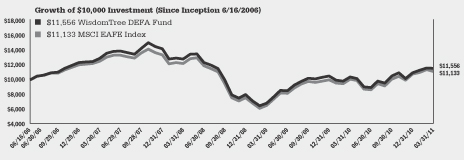

| 1 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 3 | |

Performance Summary (unaudited)

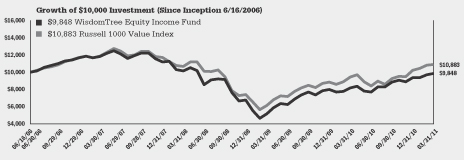

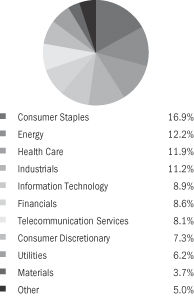

WisdomTree Equity Income Fund (DHS)

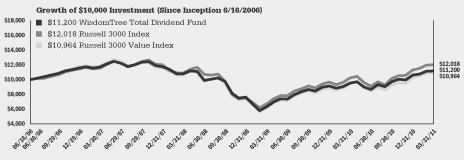

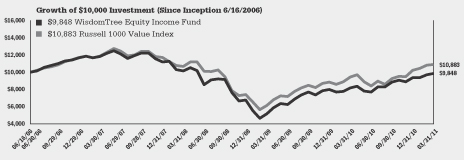

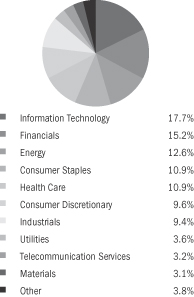

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 7.9% | |

Chevron Corp. | | | 5.4% | |

Pfizer, Inc. | | | 5.2% | |

Verizon Communications, Inc. | | | 4.7% | |

Johnson & Johnson | | | 4.3% | |

Procter & Gamble Co. (The) | | | 4.0% | |

Philip Morris International, Inc. | | | 3.9% | |

Merck & Co., Inc. | | | 3.2% | |

ConocoPhillips | | | 3.0% | |

Intel Corp. | | | 2.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

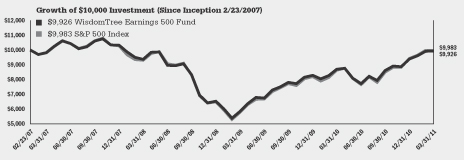

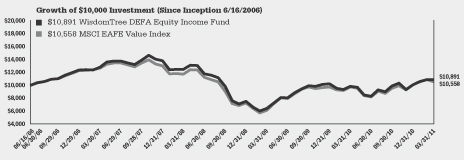

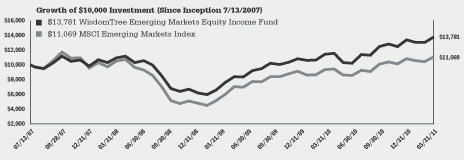

The WisdomTree Equity Income Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree Equity Income Index.

The Fund returned 20.24% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund benefited from its relative underweight in the Financials sector and favorable stock selection within the sector. The Fund’s exposure to the Health Care sector and its stock selection within the sector contributed to a drag on Fund performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.38%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Equity Income

Index | | | Russell 1000

Value Index | |

One Year | | | 20.24 | % | | | 21.62 | % | | | 20.76 | % | | | 15.15 | % |

Three Year | | | -0.99 | % | | | -0.98 | % | | | -0.60 | % | | | 0.60 | % |

Since Inception1 | | | -0.32 | % | | | -0.30 | % | | | -0.05 | % | | | 1.78 | % |

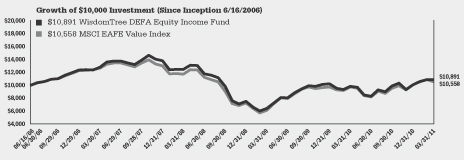

| 1 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | |

| 4 | | WisdomTree Domestic Dividend Funds |

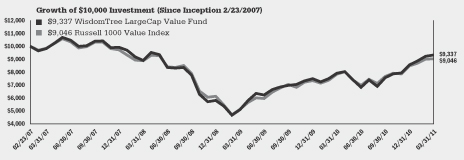

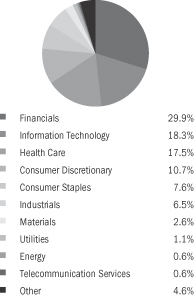

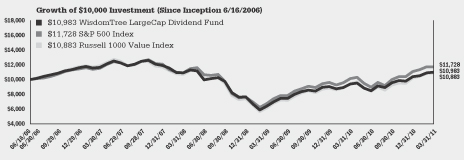

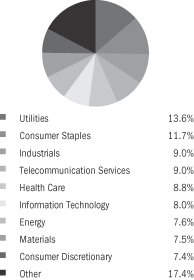

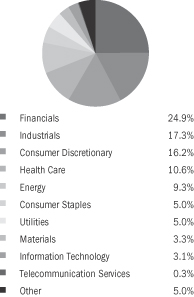

Performance Summary (unaudited)

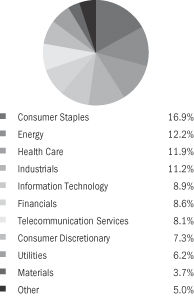

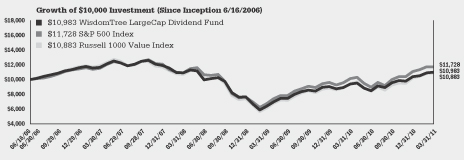

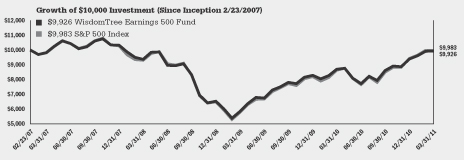

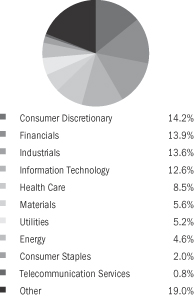

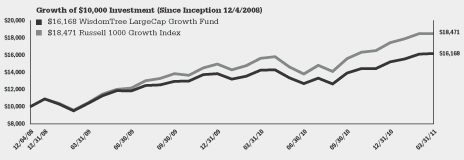

WisdomTree LargeCap Dividend Fund (DLN)

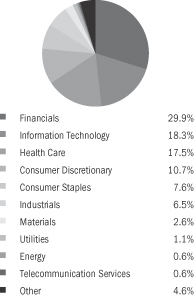

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 4.7% | |

Exxon Mobil Corp. | | | 4.7% | |

Chevron Corp. | | | 3.2% | |

Pfizer, Inc. | | | 3.1% | |

Verizon Communications, Inc. | | | 2.7% | |

General Electric Co. | | | 2.6% | |

Johnson & Johnson | | | 2.5% | |

Procter & Gamble Co. (The) | | | 2.3% | |

Philip Morris International, Inc. | | | 2.3% | |

Microsoft Corp. | | | 2.2% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

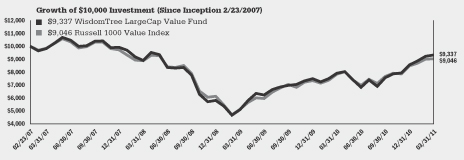

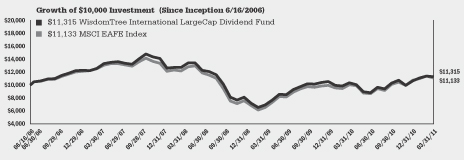

The WisdomTree LargeCap Dividend Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree LargeCap Dividend Index.

The Fund returned 16.83% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund benefited from its underweight to the Financials sector and favorable stock selection within the sector. The Consumer Discretionary sector, which had and underweight position, contributed to a drag on Fund performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.28%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund Net Asset Value | | | Fund

Market Price | | | WisdomTree

LargeCap

Dividend Index | | | S&P 500 Index | | | Russell 1000

Value Index | |

One Year | | | 16.83 | % | | | 17.53 | % | | | 17.16 | % | | | 15.65 | % | | | 15.15 | % |

Three Year | | | 0.19 | % | | | 0.22 | % | | | 0.83 | % | | | 2.35 | % | | | 0.60 | % |

Since Inception1 | | | 1.98 | % | | | 1.93 | % | | | 2.37 | % | | | 3.38 | % | | | 1.78 | % |

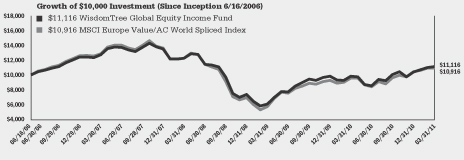

| 1 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 5 | |

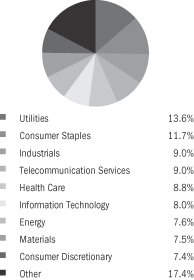

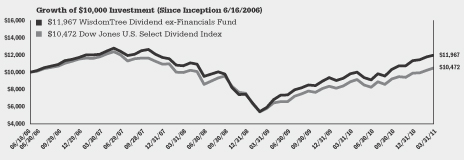

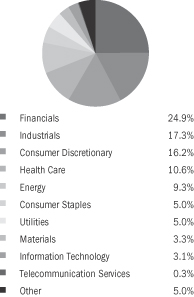

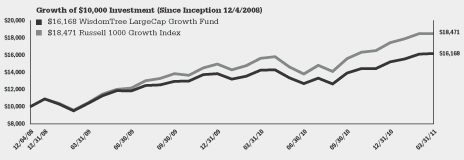

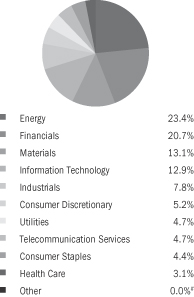

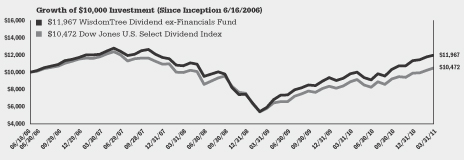

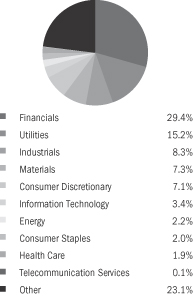

Performance Summary (unaudited)

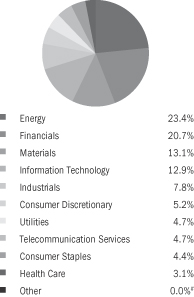

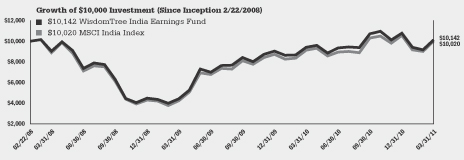

WisdomTree Dividend ex-Financials Fund (DTN)

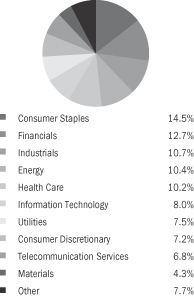

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

Frontier Communications Corp. | | | 2.1 | % |

Pitney Bowes, Inc. | | | 2.0 | % |

Reynolds American, Inc. | | | 2.0 | % |

Windstream Corp. | | | 2.0 | % |

Verizon Communications, Inc. | | | 1.9 | % |

Altria Group, Inc. | | | 1.9 | % |

Lorillard, Inc. | | | 1.8 | % |

FirstEnergy Corp. | | | 1.8 | % |

AT&T, Inc. | | | 1.8 | % |

CenturyLink, Inc. | | | 1.7 | % |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

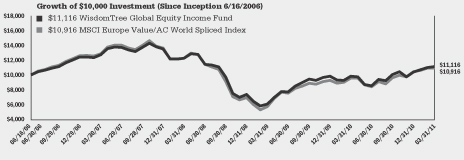

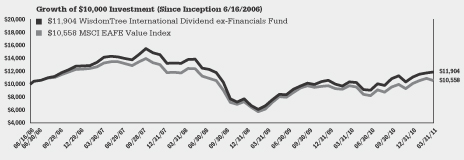

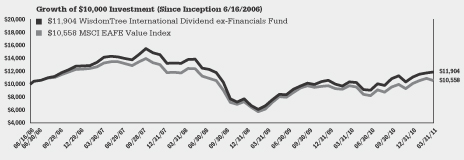

The WisdomTree Dividend ex-Financials Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree Dividend ex-Financials Index. The WisdomTree Dividend ex-Financials Index measures the performance of high dividend-yielding stocks outside the financial sector.

The Fund returned 21.68% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund’s favorable stock selection within the Consumer Staples sector contributed to the Fund’s positive performance. The Energy sector, which was relatively underweight, contributed to a drag on Fund performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.38%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Dividend Top 100/

Dividend ex-Financials

Spliced Index1 | | | Dow Jones

U.S. Select

Dividend Index | |

One Year | | | 21.68 | % | | | 22.61 | % | | | 22.25 | % | | | 18.03 | % |

Three Year | | | 3.64 | % | | | 3.70 | % | | | 4.17 | % | | | 1.63 | % |

Since Inception2 | | | 3.82 | % | | | 3.81 | % | | | 4.21 | % | | | 0.97 | % |

| 1 | WisdomTree Dividend Top 100 Index through May 7, 2009; Wisdomtree Dividend ex-Financials Index threrafter. |

| 2 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | |

| 6 | | WisdomTree Domestic Dividend Funds |

Performance Summary (unaudited)

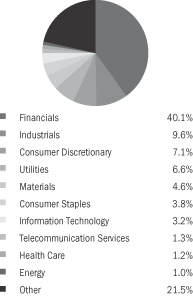

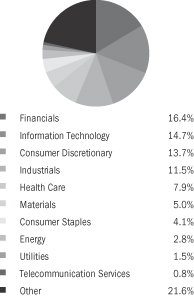

WisdomTree MidCap Dividend Fund (DON)

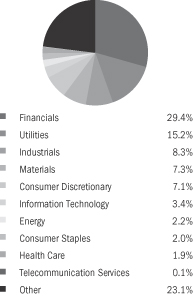

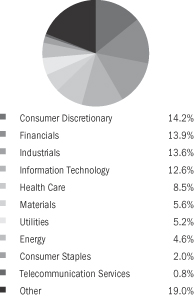

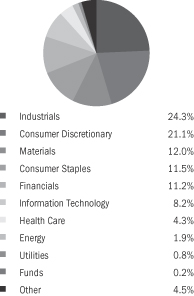

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

WisdomTree LargeCap Dividend Fund | | | 1.4 | % |

Plum Creek Timber Co., Inc. | | | 1.2 | % |

Pitney Bowes, Inc. | | | 1.1 | % |

Nationwide Health Properties, Inc. | | | 1.1 | % |

Macerich Co. (The) | | | 1.1 | % |

NiSource, Inc. | | | 1.0 | % |

Ares Capital Corp. | | | 1.0 | % |

Cincinnati Financial Corp. | | | 1.0 | % |

Oneok, Inc. | | | 0.9 | % |

Hudson City Bancorp, Inc. | | | 0.9 | % |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

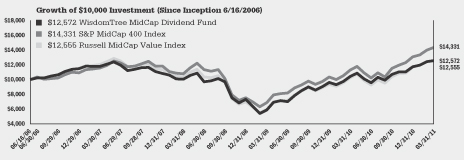

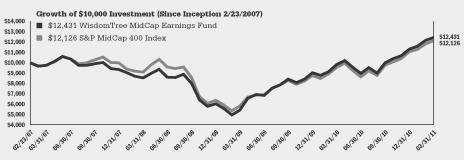

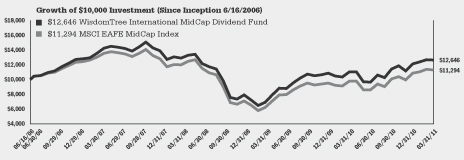

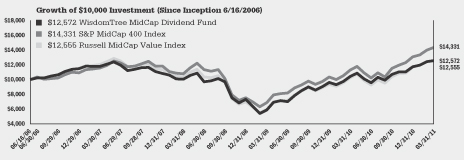

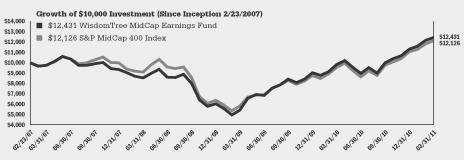

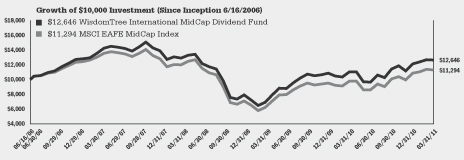

The WisdomTree MidCap Dividend Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree MidCap Dividend Index.

The Fund returned 20.60% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund benefited from its exposure to the Telecommunication Services sector. The Fund’s relatively overweight position in the Financials sector contributed to a drag on Fund performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.38%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

MidCap

Dividend Index | | | S&P MidCap

400 Index | | | Russell MidCap

Value Index | |

One Year | | | 20.60 | % | | | 21.37 | % | | | 21.34 | % | | | 26.95 | % | | | 22.26 | % |

Three Year | | | 7.69 | % | | | 7.69 | % | | | 7.99 | % | | | 10.00 | % | | | 6.61 | % |

Since Inception1 | | | 4.90 | % | | | 5.00 | % | | | 4.66 | % | | | 7.80 | % | | | 4.86 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 7 | |

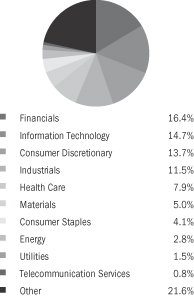

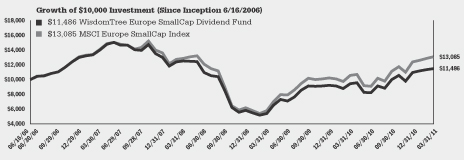

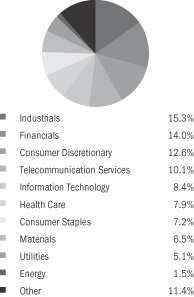

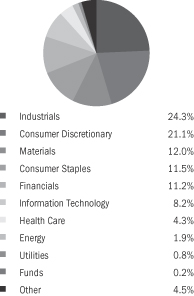

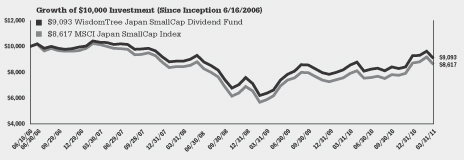

Performance Summary (unaudited)

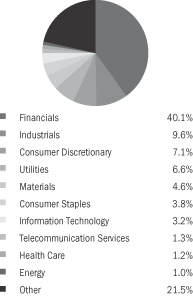

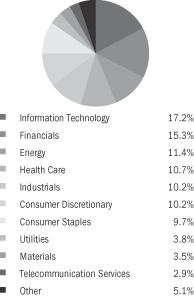

WisdomTree SmallCap Dividend Fund (DES)

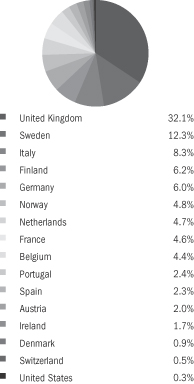

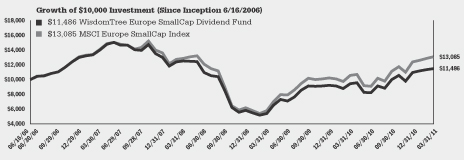

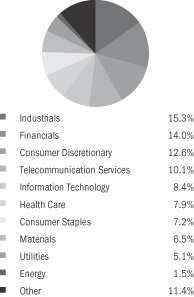

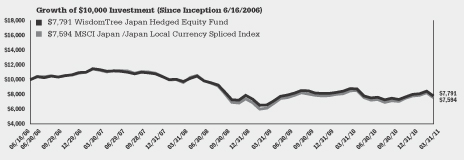

Sector Breakdown† as of 3/31/11‡

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/11

| | | | |

| |

| Description | | % of Net Assets | |

WisdomTree MidCap Dividend Fund | | | 1.5 | % |

Prospect Capital Corp. | | | 1.2 | % |

Vector Group Ltd. | | | 1.1 | % |

Potlatch Corp. | | | 1.0 | % |

Medical Properties Trust, Inc. | | | 1.0 | % |

Brandywine Realty Trust | | | 0.9 | % |

UIL Holdings Corp. | | | 0.9 | % |

Healthcare Realty Trust, Inc. | | | 0.9 | % |

Solar Capital Ltd. | | | 0.8 | % |

Fifth Street Finance Corp. | | | 0.8 | % |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

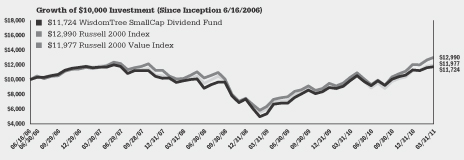

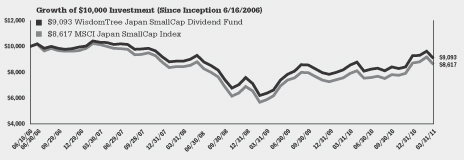

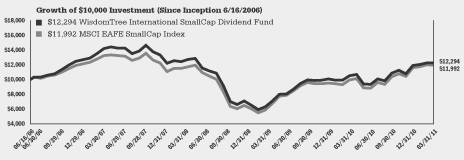

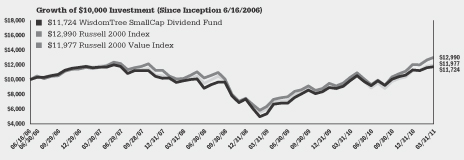

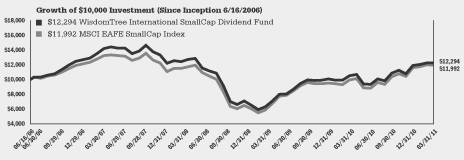

The WisdomTree SmallCap Dividend Fund (the “Fund”) seeks investment results that closely correspond to the price and yield performance, before fees and expenses, of the WisdomTree SmallCap Dividend Index.

The Fund returned 18.96% at net asset value (“NAV”) for the fiscal year ended March 31, 2011. The Fund benefited from its relative underweight to the Health Care sector and its favorable stock selection within the sector. Information Technology, a sector that had a significant underweight during the period, and unfavorable stock selection within the sector contributed to a drag on Fund performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. The annual expense ratio of the Fund is 0.38%.

Performance as of 3/31/11

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

SmallCap

Dividend Index | | | Russell 2000 Index | | | Russell 2000

Value Index | |

One Year | | | 18.96 | % | | | 19.65 | % | | | 19.17 | % | | | 25.79 | % | | | 20.63 | % |

Three Year | | | 6.06 | % | | | 6.03 | % | | | 6.82 | % | | | 8.57 | % | | | 6.76 | % |

Since Inception1 | | | 3.38 | % | | | 3.36 | % | | | 3.42 | % | | | 5.61 | % | | | 3.84 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on June 16, 2006. |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month-end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

| | |

| 8 | | WisdomTree Domestic Dividend Funds |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Cumulative Returns as of 3/31/11 | |

| | | | | | Total Return NAV (%) | | | Market Price (%) | |

| | | | | | 1-Year | | | 3-Year | | | Since

Inception | | | 1-Year | | | 3-Year | | | Since

Inception | |

WisdomTree Total Dividend Fund | | | DTD | | | | 17.37 | % | | | 3.94 | % | | | 12.00 | % | | | 18.25 | % | | | 4.11 | % | | | 11.94 | % |

Russell 3000 Index | | | | | | | 17.41 | % | | | 10.61 | % | | | 20.18 | % | | | 17.41 | % | | | 10.61 | % | | | 20.18 | % |

Russell 3000 Value Index | | | | | | | 15.60 | % | | | 3.30 | % | | | 9.64 | % | | | 15.60 | % | | | 3.30 | % | | | 9.64 | % |

WisdomTree Dividend Index | | | | | | | 18.32 | % | | | 5.90 | % | | | 14.69 | % | | | 18.32 | % | | | 5.90 | % | | | 14.69 | % |

WisdomTree Equity Income Fund | | | DHS | | | | 20.24 | % | | | -2.94 | % | | | -1.52 | % | | | 21.62 | % | | | -2.90 | % | | | -1.42 | % |

Russell 1000 Value Index | | | | | | | 15.15 | % | | | 1.82 | % | | | 8.83 | % | | | 15.15 | % | | | 1.82 | % | | | 8.83 | % |

WisdomTree Equity Income Index | | | | | | | 20.76 | % | | | -1.79 | % | | | -0.26 | % | | | 20.76 | % | | | -1.79 | % | | | -0.26 | % |

WisdomTree LargeCap Dividend Fund | | | DLN | | | | 16.83 | % | | | 0.57 | % | | | 9.83 | % | | | 17.53 | % | | | 0.65 | % | | | 9.61 | % |

S&P 500 Index | | | | | | | 15.65 | % | | | 7.23 | % | | | 17.28 | % | | | 15.65 | % | | | 7.23 | % | | | 17.28 | % |

Russell 1000 Value Index | | | | | | | 15.15 | % | | | 1.82 | % | | | 8.83 | % | | | 15.15 | % | | | 1.82 | % | | | 8.83 | % |

WisdomTree LargeCap Dividend Index | | | | | | | 17.16 | % | | | 2.52 | % | | | 11.89 | % | | | 17.16 | % | | | 2.52 | % | | | 11.89 | % |

WisdomTree Dividend ex-Financials Fund | | | DTN | | | | 21.68 | % | | | 11.33 | % | | | 19.67 | % | | | 22.61 | % | | | 11.51 | % | | | 19.63 | % |

Dow Jones U.S. Select Dividend Index | | | | | | | 18.03 | % | | | 4.96 | % | | | 4.72 | % | | | 18.03 | % | | | 4.96 | % | | | 4.72 | % |

Spliced WisdomTree Index (1) | | | | | | | 22.25 | % | | | 13.03 | % | | | 21.84 | % | | | 22.25 | % | | | 13.03 | % | | | 21.84 | % |

WisdomTree MidCap Dividend Fund | | | DON | | | | 20.60 | % | | | 24.88 | % | | | 25.72 | % | | | 21.37 | % | | | 24.88 | % | | | 26.30 | % |

S&P MidCap 400 Index | | | | | | | 26.95 | % | | | 33.11 | % | | | 43.31 | % | | | 26.95 | % | | | 33.11 | % | | | 43.31 | % |

Russell MidCap Value Index | | | | | | | 22.26 | % | | | 21.19 | % | | | 25.55 | % | | | 22.26 | % | | | 21.19 | % | | | 25.55 | % |

WisdomTree MidCap Dividend Index | | | | | | | 21.34 | % | | | 25.93 | % | | | 24.41 | % | | | 21.34 | % | | | 25.93 | % | | | 24.41 | % |

WisdomTree SmallCap Dividend Fund | | | DES | | | | 18.96 | % | | | 19.31 | % | | | 17.24 | %�� | | | 19.65 | % | | | 19.20 | % | | | 17.12 | % |

Russell 2000 Index | | | | | | | 25.79 | % | | | 27.96 | % | | | 29.90 | % | | | 25.79 | % | | | 27.96 | % | | | 29.90 | % |

Russell 2000 Value Index | | | | | | | 20.63 | % | | | 21.68 | % | | | 19.77 | % | | | 20.63 | % | | | 21.68 | % | | | 19.77 | % |

WisdomTree SmallCap Dividend Index | | | | | | | 19.17 | % | | | 21.87 | % | | | 17.50 | % | | | 19.17 | % | | | 21.87 | % | | | 17.50 | % |

Performance quoted represents past performance and past performance does not guarantee future results. Current performance may be higher or lower than the performance quoted. For the most recent month end performance information visit www.wisdomtree.com. Investment in the Fund poses investment risk including the possible loss of principal. The investment return and principal value of an investment will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period less than one year have not been annualized. Index returns do not reflect expenses paid by the Fund.

Please see page 10 for list of index descriptions.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 9 | |

Description of Terms and Indices (unaudited)

Below are descriptions of each index referenced in this Report:

The WisdomTree Dividend Index defines the dividend-paying portion of the U.S. stock market.

The WisdomTree LargeCap Dividend Index measures the performance of the large-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree MidCap Dividend Index measures the performance of the mid-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree SmallCap Dividend Index measures the performance of the small-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree Equity Income Index measures the performance of companies with high dividend yields, selected from the WisdomTree Dividend Index.

The WisdomTree Dividend ex-Financials Index measures the performance of high dividend-yielding stocks outside the financial sector.

The WisdomTree Dividend Top 100 Index measures the performance of the 100 highest dividend-yielding companies in the WisdomTree LargeCap Dividend Index.

The S&P 500 Index is a capitalization-weighted index of 500 stocks selected by Standard & Poor’s Index Committee, designed to represent the performance of the leading industries in the United States economy.

The S&P Midcap 400 Index is a capitalization-weighted index that measures the performance of the mid-capitalization range of the U.S. stock market, with stocks selected by the Standard & Poor’s Index Committee.

The Russell 2000 Index measures performance of the smallest 2,000 securities in the Russell 3000 Index.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies, based on total market capitalization.

The Russell 1000 Value Index is a measure of the large-capitalization value segment of the U.S. equity universe, selecting from the Russell 1000 Index.

The Russell 2000 Value Index is a capitalization weighted index that measures the small-cap value segment of the U.S. equity universe, selecting from the Russell 2000 Index.

The Russell 3000 Value Index is a capitalization weighted index that measures the performance of the value sector of the broad U.S. equity market. The index is a subset of the Russell 3000 Index and consists of those companies or portion of a company, with lower price-to-book ratios and lower forecasted growth within the Russell 3000 Index.

The Russell MidCap Value Index is a capitalization weighted index that measures the midcap value segment of the U.S. equity universe, selecting from the Russell Midcap Index.

The Dow Jones U.S. Select Dividend Index measures the performance of 100 U.S. dividend-paying companies.

WisdomTree Dividend Top 100/Dividend ex-Financials Spliced Index — WisdomTree Dividend Top 100 Index through May 7, 2009; WisdomTree Dividend ex-Financials Index thereafter.

Index performance information assumes the reinvestment of gross dividends and excludes management fees, transaction costs and expenses. You cannot directly invest in an index.

| | |

| 10 | | WisdomTree Domestic Dividend Funds |

Shareholder Expense Examples (unaudited)

As a shareholder of a WisdomTree Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2010 to March 31, 2011.

Actual expenses

The first line under each Fund in the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period 10/01/10 to 3/31/11” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under each Fund in the table on the next page provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 11 | |

Shareholder Expense Examples (unaudited) (concluded)

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

10/01/10 | | | Ending

Account Value

3/31/11 | | | Annualized

Expense Ratio

Based on the

Period

10/01/10 to

3/31/11 | | | Expenses Paid

During the

Period†

10/01/10 to

3/31/11 | |

WisdomTree Total Dividend Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,151.85 | | | | 0.28 | % | | $ | 1.50 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

WisdomTree Equity Income Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,113.30 | | | | 0.38 | % | | $ | 2.00 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

WisdomTree LargeCap Dividend Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,148.15 | | | | 0.28 | % | | $ | 1.50 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

WisdomTree Dividend ex-Financials Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,158.52 | | | | 0.38 | % | | $ | 2.04 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

WisdomTree MidCap Dividend Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,172.78 | | | | 0.38 | % | | $ | 2.06 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

WisdomTree SmallCap Dividend Fund | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,167.08 | | | | 0.38 | % | | $ | 2.05 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

| † | Expenses are calculated using each Fund’s annualized expense ratio, multipled by the average account value for the period, multipled by 182/365 (to reflect the one-half year period). |

| | |

| 12 | | WisdomTree Domestic Dividend Funds |

Schedule of Investments

WisdomTree Total Dividend Fund (DTD)

March 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

| COMMON STOCKS – 98.9% | | | | | | | | |

| Advertising – 0.1% | | | | | | | | |

Harte-Hanks, Inc. | | | 1,885 | | | $ | 22,432 | |

Omnicom Group, Inc. | | | 3,134 | | | | 153,754 | |

| | | | | | | | |

| Total Advertising | | | | | | | 176,186 | |

| Aerospace/Defense – 2.6% | | | | | | | | |

Alliant Techsystems, Inc. | | | 164 | | | | 11,590 | |

Boeing Co. (The) | | | 12,562 | | | | 928,709 | |

General Dynamics Corp. | | | 5,859 | | | | 448,565 | |

Goodrich Corp.(a) | | | 1,158 | | | | 99,044 | |

L-3 Communications Holdings, Inc. | | | 1,588 | | | | 124,356 | |

Lockheed Martin Corp. | | | 9,987 | | | | 802,955 | |

Northrop Grumman Corp. | | | 5,684 | | | | 356,443 | |

Raytheon Co. | | | 7,786 | | | | 396,074 | |

Rockwell Collins, Inc. | | | 1,787 | | | | 115,851 | |

United Technologies Corp. | | | 13,003 | | | | 1,100,704 | |

| | | | | | | | |

| Total Aerospace/Defense | | | | | | | 4,384,291 | |

| Agriculture – 4.2% | | | | | | | | |

Altria Group, Inc. | | | 83,612 | | | | 2,176,420 | |

Archer-Daniels-Midland Co. | | | 8,041 | | | | 289,556 | |

Lorillard, Inc. | | | 5,288 | | | | 502,413 | |

Philip Morris International, Inc. | | | 50,941 | | | | 3,343,258 | |

Reynolds American, Inc. | | | 23,182 | | | | 823,657 | |

Universal Corp. | | | 758 | | | | 33,003 | |

Vector Group Ltd.(a) | | | 4,547 | | | | 78,618 | |

| | | | | | | | |

| Total Agriculture | | | | | | | 7,246,925 | |

| Apparel – 0.4% | | | | | | | | |

Cherokee, Inc.(a) | | | 864 | | | | 14,913 | |

Coach, Inc. | | | 1,902 | | | | 98,980 | |

Columbia Sportswear Co.(a) | | | 415 | | | | 24,659 | |

Jones Group, Inc. (The) | | | 1 | | | | 14 | |

NIKE, Inc. Class B | | | 3,593 | | | | 271,990 | |

Polo Ralph Lauren Corp. | | | 87 | | | | 10,757 | |

VF Corp.(a) | | | 2,086 | | | | 205,534 | |

Wolverine World Wide, Inc. | | | 591 | | | | 22,032 | |

| | | | | | | | |

| Total Apparel | | | | | | | 648,879 | |

| Auto Manufacturers – 0.1% | | | | | | | | |

PACCAR, Inc.(a) | | | 2,091 | | | | 109,464 | |

| Auto Parts & Equipment – 0.2% | | | | | | | | |

Cooper Tire & Rubber Co. | | | 1,314 | | | | 33,836 | |

Douglas Dynamics, Inc. | | | 732 | | | | 10,438 | |

Johnson Controls, Inc. | | | 7,502 | | | | 311,858 | |

| | | | | | | | |

| Total Auto Parts & Equipment | | | | | | | 356,132 | |

| Banks – 3.0% | | | | | | | | |

1st Source Corp. | | | 909 | | | | 18,216 | |

Arrow Financial Corp. | | | 717 | | | | 17,739 | |

Associated Banc-Corp.(a) | | | 832 | | | | 12,355 | |

Bancfirst Corp. | | | 409 | | | | 17,456 | |

BancorpSouth, Inc.(a) | | | 2,916 | | | | 45,052 | |

Bank of America Corp. | | | 21,027 | | | | 280,290 | |

Bank of Hawaii Corp. | | | 1,061 | | | | 50,737 | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

Bank of New York Mellon Corp. (The) | | | 10,145 | | | $ | 303,031 | |

BB&T Corp.(a) | | | 10,567 | | | | 290,064 | |

BOK Financial Corp.(a) | | | 762 | | | | 39,380 | |

Capital One Financial Corp. | | | 1,569 | | | | 81,525 | |

Cathay General Bancorp | | | 593 | | | | 10,111 | |

Chemical Financial Corp. | | | 777 | | | | 15,486 | |

City Holding Co.(a) | | | 571 | | | | 20,191 | |

Comerica, Inc. | | | 934 | | | | 34,296 | |

Commerce Bancshares, Inc. | | | 1,500 | | | | 60,660 | |

Community Bank System, Inc.(a) | | | 1,049 | | | | 25,459 | |

Community Trust Bancorp, Inc. | | | 692 | | | | 19,148 | |

Cullen/Frost Bankers, Inc.(a) | | | 1,291 | | | | 76,195 | |

CVB Financial Corp. | | | 3,838 | | | | 35,732 | |

Fifth Third Bancorp | | | 1,847 | | | | 25,636 | |

First Busey Corp. | | | 2,096 | | | | 10,648 | |

First Commonwealth Financial Corp. | | | 1,392 | | | | 9,535 | |

First Financial Bancorp | | | 614 | | | | 10,248 | |

First Financial Bankshares, Inc.(a) | | | 411 | | | | 21,113 | |

First Financial Corp.(a) | | | 453 | | | | 15,058 | |

FirstMerit Corp. | | | 2,112 | | | | 36,031 | |

FNB Corp.(a) | | | 4,377 | | | | 46,134 | |

Fulton Financial Corp. | | | 1,129 | | | | 12,543 | |

Glacier Bancorp, Inc.(a) | | | 2,403 | | | | 36,165 | |

Goldman Sachs Group, Inc. (The) | | | 2,851 | | | | 451,798 | |

Hancock Holding Co.(a) | | | 484 | | | | 15,895 | |

Huntington Bancshares, Inc. | | | 4,220 | | | | 28,021 | |

Iberiabank Corp.(a) | | | 533 | | | | 32,049 | |

International Bancshares Corp. | | | 1,286 | | | | 23,585 | |

JPMorgan Chase & Co. | | | 12,501 | | | | 576,296 | |

KeyCorp | | | 3,524 | | | | 31,293 | |

M&T Bank Corp. | | | 2,712 | | | | 239,931 | |

Marshall & Ilsley Corp. | | | 1,679 | | | | 13,415 | |

MB Financial, Inc.(a) | | | 614 | | | | 12,869 | |

Morgan Stanley | | | 7,272 | | | | 198,671 | |

National Penn Bancshares, Inc.(a) | | | 2,269 | | | | 17,562 | |

NBT Bancorp, Inc. | | | 1,039 | | | | 23,679 | |

Northern Trust Corp. | | | 3,348 | | | | 169,911 | |

Old National Bancorp | | | 2,095 | | | | 22,458 | |

Park National Corp. | | | 718 | | | | 47,977 | |

Penns Woods Bancorp, Inc.(a) | | | 319 | | | | 12,419 | |

PNC Financial Services Group, Inc. | | | 2,408 | | | | 151,680 | |

Prosperity Bancshares, Inc. | | | 606 | | | | 25,919 | |

Regions Financial Corp.(a) | | | 6,896 | | | | 50,065 | |

S&T Bancorp, Inc.(a) | | | 643 | | | | 13,869 | |

S.Y. Bancorp, Inc. | | | 765 | | | | 19,247 | |

Sterling Bancshares, Inc. | | | 1,701 | | | | 14,646 | |

Suffolk Bancorp(a) | | | 906 | | | | 19,008 | |

Synovus Financial Corp. | | | 5,036 | | | | 12,086 | |

TCF Financial Corp. | | | 1,009 | | | | 16,003 | |

TrustCo Bank Corp. | | | 2,178 | | | | 12,915 | |

Trustmark Corp.(a) | | | 1,405 | | | | 32,905 | |

U.S. Bancorp | | | 9,880 | | | | 261,128 | |

UMB Financial Corp. | | | 785 | | | | 29,324 | |

Umpqua Holdings Corp. | | | 1,881 | | | | 21,519 | |

See Notes to Financial Statements.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 13 | |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

United Bankshares, Inc.(a) | | | 1,522 | | | $ | 40,363 | |

Univest Corp. of Pennsylvania | | | 479 | | | | 8,488 | |

Valley National Bancorp(a) | | | 5,505 | | | | 76,850 | |

Washington Trust Bancorp, Inc.(a) | | | 431 | | | | 10,232 | |

Wells Fargo & Co. | | | 23,101 | | | | 732,302 | |

WesBanco, Inc. | | | 826 | | | | 17,106 | |

Westamerica Bancorp. | | | 496 | | | | 25,479 | |

| | | | | | | | |

| Total Banks | | | | | | | 5,185,197 | |

| Beverages – 3.0% | | | | | | | | |

Brown-Forman Corp. Class A | | | 787 | | | | 53,406 | |

Brown-Forman Corp. Class B | | | 1,099 | | | | 75,062 | |

Coca-Cola Co. (The) | | | 41,141 | | | | 2,729,705 | |

Coca-Cola Enterprises, Inc. | | | 4,320 | | | | 117,936 | |

Dr. Pepper Snapple Group, Inc.(a) | | | 3,831 | | | | 142,360 | |

Molson Coors Brewing Co. Class B | | | 2,250 | | | | 105,502 | |

PepsiCo, Inc. | | | 30,416 | | | | 1,959,095 | |

| | | | | | | | |

| Total Beverages | | | | | | | 5,183,066 | |

| Building Materials – 0.1% | | | | | | | | |

Eagle Materials, Inc. | | | 466 | | | | 14,101 | |

Lennox International, Inc. | | | 639 | | | | 33,599 | |

Martin Marietta Materials, Inc. | | | 569 | | | | 51,022 | |

Masco Corp.(a) | | | 5,541 | | | | 77,131 | |

Simpson Manufacturing Co., Inc. | | | 487 | | | | 14,347 | |

| | | | | | | | |

| Total Building Materials | | | | | | | 190,200 | |

| Chemicals – 2.6% | | | | | | | | |

A. Schulman, Inc. | | | 343 | | | | 8,479 | |

Air Products & Chemicals, Inc. | | | 3,036 | | | | 273,786 | |

Airgas, Inc. | | | 964 | | | | 64,029 | |

Albemarle Corp. | | | 758 | | | | 45,306 | |

Arch Chemicals, Inc. | | | 485 | | | | 20,171 | |

Ashland, Inc. | | | 639 | | | | 36,909 | |

Cabot Corp. | | | 1,128 | | | | 52,215 | |

Celanese Corp. Series A | | | 443 | | | | 19,656 | |

CF Industries Holdings, Inc. | | | 77 | | | | 10,533 | |

Cytec Industries, Inc. | | | 1 | | | | 54 | |

Dow Chemical Co. (The) | | | 13,543 | | | | 511,248 | |

E.I. Du Pont de Nemours & Co. | | | 19,887 | | | | 1,093,188 | |

Eastman Chemical Co. | | | 1,098 | | | | 109,053 | |

Ecolab, Inc. | | | 1,948 | | | | 99,387 | |

FMC Corp.(a) | | | 428 | | | | 36,350 | |

Huntsman Corp. | | | 4,498 | | | | 78,175 | |

Innophos Holdings, Inc. | | | 472 | | | | 21,764 | |

International Flavors & Fragrances, Inc. | | | 1,270 | | | | 79,121 | |

Kronos Worldwide, Inc. | | | 766 | | | | 44,773 | |

Lubrizol Corp. | | | 625 | | | | 83,725 | |

Monsanto Co. | | | 6,351 | | | | 458,923 | |

Mosaic Co. (The) | | | 1,035 | | | | 81,506 | |

NewMarket Corp. | | | 94 | | | | 14,873 | |

Olin Corp. | | | 2,737 | | | | 62,732 | |

PPG Industries, Inc. | | | 2,909 | | | | 276,966 | |

Praxair, Inc. | | | 3,910 | | | | 397,256 | |

RPM International, Inc. | | | 3,211 | | | | 76,197 | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

Sensient Technologies Corp. | | | 914 | | | $ | 32,758 | |

Sherwin-Williams Co. (The)(a) | | | 1,320 | | | | 110,867 | |

Sigma-Aldrich Corp. | | | 747 | | | | 47,539 | |

Valhi, Inc.(a) | | | 1,743 | | | | 46,155 | |

Valspar Corp. | | | 1,342 | | | | 52,472 | |

Westlake Chemical Corp. | | | 404 | | | | 22,705 | |

| | | | | | | | |

| Total Chemicals | | | | | | | 4,368,871 | |

| Coal – 0.1% | | | | | | | | |

Arch Coal, Inc. | | | 1,595 | | | | 57,484 | |

Consol Energy, Inc. | | | 1,229 | | | | 65,911 | |

Massey Energy Co.(a) | | | 297 | | | | 20,303 | |

Peabody Energy Corp. | | | 1,073 | | | | 77,213 | |

Walter Energy, Inc.(a) | | | 193 | | | | 26,138 | |

| | | | | | | | |

| Total Coal | | | | | | | 247,049 | |

| Commercial Services – 1.3% | | | | | | | | |

ABM Industries, Inc. | | | 964 | | | | 24,476 | |

Advance America, Cash Advance Centers, Inc. | | | 2,098 | | | | 11,119 | |

Automatic Data Processing, Inc.(a) | | | 10,030 | | | | 514,639 | |

Deluxe Corp.(a) | | | 2,112 | | | | 56,052 | |

Equifax, Inc. | | | 1,356 | | | | 52,681 | |

H&R Block, Inc.(a) | | | 8,746 | | | | 146,408 | |

Healthcare Services Group, Inc. | | | 1,931 | | | | 33,947 | |

Hillenbrand, Inc. | | | 1,627 | | | | 34,981 | |

Iron Mountain, Inc. | | | 1,164 | | | | 36,352 | |

Landauer, Inc. | | | 328 | | | | 20,179 | |

Lender Processing Services, Inc. | | | 552 | | | | 17,769 | |

Lincoln Educational Services Corp. | | | 1,000 | | | | 15,890 | |

Manpower, Inc. | | | 858 | | | | 53,951 | |

Mastercard, Inc. Class A | | | 206 | | | | 51,854 | |

McGrath Rentcorp | | | 768 | | | | 20,943 | |

Moody’s Corp. | | | 2,495 | | | | 84,605 | |

Paychex, Inc. | | | 9,330 | | | | 292,589 | |

Pharmaceutical Product Development, Inc. | | | 2,029 | | | | 56,224 | |

R.R. Donnelley & Sons Co. | | | 7,649 | | | | 144,719 | |

Robert Half International, Inc.(a) | | | 1,848 | | | | 56,549 | |

Rollins, Inc. | | | 1,546 | | | | 31,384 | |

SEI Investments Co. | | | 1,032 | | | | 24,644 | |

Service Corp. International | | | 3,980 | | | | 44,019 | |

Strayer Education, Inc.(a) | | | 148 | | | | 19,313 | |

Total System Services, Inc. | | | 2,160 | | | | 38,923 | |

Visa, Inc. Class A | | | 2,439 | | | | 179,559 | |

Weight Watchers International, Inc. | | | 1,054 | | | | 73,885 | |

Western Union Co. (The) | | | 5,154 | | | | 107,049 | |

| | | | | | | | |

| Total Commercial Services | | | | | | | 2,244,703 | |

| Computers – 1.8% | | | | | | | | |

Computer Sciences Corp. | | | 1,100 | | | | 53,603 | |

Diebold, Inc. | | | 1,842 | | | | 65,317 | |

DST Systems, Inc. | | | 319 | | | | 16,850 | |

Hewlett-Packard Co. | | | 11,295 | | | | 462,756 | |

International Business Machines Corp. | | | 14,599 | | | | 2,380,659 | |

Jack Henry & Associates, Inc. | | | 847 | | | | 28,705 | |

| | | | | | | | |

| Total Computers | | | | | | | 3,007,890 | |

See Notes to Financial Statements.

| | |

| 14 | | WisdomTree Domestic Dividend Funds |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

| Cosmetics/Personal Care – 2.6% | | | | | | | | |

Alberto-Culver Co. | | | 765 | | | $ | 28,511 | |

Avon Products, Inc. | | | 8,194 | | | | 221,566 | |

Colgate-Palmolive Co. | | | 8,138 | | | | 657,225 | |

Estee Lauder Cos., Inc. (The) Class A | | | 885 | | | | 85,279 | |

Procter & Gamble Co. (The) | | | 55,025 | | | | 3,389,540 | |

| | | | | | | | |

| Total Cosmetics/Personal Care | | | | | | | 4,382,121 | |

| Distribution/Wholesale – 0.3% | | | | | | | | |

Fastenal Co.(a) | | | 1,446 | | | | 93,744 | |

Genuine Parts Co. | | | 3,414 | | | | 183,127 | |

Owens & Minor, Inc. | | | 871 | | | | 28,290 | |

Pool Corp.(a) | | | 902 | | | | 21,747 | |

W.W. Grainger, Inc. | | | 757 | | | | 104,224 | |

Watsco, Inc.(a) | | | 656 | | | | 45,730 | |

| | | | | | | | |

| Total Distribution/Wholesale | | | | | | | 476,862 | |

| Diversified Financial Services – 1.5% | | | | | | | | |

American Express Co. | | | 12,340 | | | | 557,768 | |

Ameriprise Financial, Inc. | | | 2,208 | | | | 134,865 | |

BGC Partners, Inc. Class A | | | 3,695 | | | | 34,327 | |

BlackRock, Inc. | | | 1,853 | | | | 372,472 | |

Charles Schwab Corp. (The)(a) | | | 10,727 | | | | 193,408 | |

CME Group, Inc. | | | 610 | | | | 183,945 | |

Discover Financial Services | | | 1,741 | | | | 41,993 | |

Eaton Vance Corp. | | | 1,727 | | | | 55,678 | |

Federated Investors, Inc. Class B(a) | | | 2,386 | | | | 63,825 | |

Franklin Resources, Inc.(a) | | | 1,205 | | | | 150,721 | |

GFI Group, Inc.(a) | | | 4,249 | | | | 21,330 | |

Greenhill & Co., Inc.(a) | | | 375 | | | | 24,671 | |

Jefferies Group, Inc. | | | 1,032 | | | | 25,738 | |

Legg Mason, Inc.(a) | | | 489 | | | | 17,648 | |

NYSE Euronext | | | 7,081 | | | | 249,039 | |

Raymond James Financial, Inc. | | | 1,399 | | | | 53,498 | |

T. Rowe Price Group, Inc. | | | 2,962 | | | | 196,736 | |

TD Ameritrade Holding Corp. | | | 3,676 | | | | 76,718 | |

Waddell & Reed Financial, Inc. Class A | | | 1,551 | | | | 62,986 | |

| | | | | | | | |

| Total Diversified Financial Services | | | | | | | 2,517,366 | |

| Electric – 6.9% | | | | | | | | |

ALLETE, Inc. | | | 1,495 | | | | 58,260 | |

Alliant Energy Corp. | | | 3,368 | | | | 131,116 | |

Ameren Corp. | | | 8,278 | | | | 232,363 | |

American Electric Power Co., Inc. | | | 15,912 | | | | 559,148 | |

Avista Corp. | | | 1,555 | | | | 35,967 | |

Black Hills Corp. | | | 1,440 | | | | 48,154 | |

Central Vermont Public Service Corp. | | | 947 | | | | 22,056 | |

CH Energy Group, Inc. | | | 598 | | | | 30,223 | |

Cleco Corp. | | | 1,518 | | | | 52,052 | |

CMS Energy Corp.(a) | | | 6,757 | | | | 132,707 | |

Consolidated Edison, Inc. | | | 9,077 | | | | 460,385 | |

Constellation Energy Group, Inc. | | | 4,332 | | | | 134,855 | |

Dominion Resources, Inc. | | | 16,691 | | | | 746,088 | |

DPL, Inc. | | | 3,427 | | | | 93,934 | |

DTE Energy Co. | | | 5,287 | | | | 258,851 | |

Duke Energy Corp. | | | 47,742 | | | | 866,517 | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

Edison International | | | 7,273 | | | $ | 266,119 | |

Empire District Electric Co. (The) | | | 2,230 | | | | 48,592 | |

Entergy Corp. | | | 5,468 | | | | 367,504 | |

Exelon Corp. | | | 21,970 | | | | 906,043 | |

FirstEnergy Corp.(a) | | | 14,084 | | | | 522,376 | |

Great Plains Energy, Inc. | | | 3,982 | | | | 79,720 | |

Hawaiian Electric Industries, Inc. | | | 3,772 | | | | 93,546 | |

IDACORP, Inc. | | | 1,223 | | | | 46,596 | |

Integrys Energy Group, Inc.(a) | | | 2,912 | | | | 147,085 | |

ITC Holdings Corp. | | | 801 | | | | 55,990 | |

MDU Resources Group, Inc. | | | 3,505 | | | | 80,510 | |

MGE Energy, Inc. | | | 815 | | | | 32,999 | |

NextEra Energy, Inc. | | | 10,579 | | | | 583,114 | |

Northeast Utilities | | | 4,148 | | | | 143,521 | |

NorthWestern Corp. | | | 1,452 | | | | 43,996 | |

NSTAR | | | 2,921 | | | | 135,155 | |

NV Energy, Inc. | | | 5,893 | | | | 87,747 | |

OGE Energy Corp. | | | 2,177 | | | | 110,069 | |

Otter Tail Corp. | | | 1,653 | | | | 37,573 | |

Pepco Holdings, Inc. | | | 8,837 | | | | 164,810 | |

PG&E Corp. | | | 9,703 | | | | 428,678 | |

Pinnacle West Capital Corp. | | | 3,428 | | | | 146,684 | |

PNM Resources, Inc. | | | 2,797 | | | | 41,731 | |

Portland General Electric Co. | | | 2,745 | | | | 65,249 | |

PPL Corp. | | | 17,162 | | | | 434,199 | |

Progress Energy, Inc. | | | 10,531 | | | | 485,900 | |

Public Service Enterprise Group, Inc. | | | 14,249 | | | | 448,986 | |

SCANA Corp.(a) | | | 3,579 | | | | 140,905 | |

Southern Co. | | | 26,445 | | | | 1,007,819 | |

TECO Energy, Inc. | | | 6,928 | | | | 129,969 | |

UIL Holdings Corp. | | | 1,653 | | | | 50,450 | |

Unisource Energy Corp. | | | 1,215 | | | | 43,898 | |

Unitil Corp. | | | 975 | | | | 22,971 | |

Westar Energy, Inc.(a) | | | 3,899 | | | | 103,012 | |

Wisconsin Energy Corp. | | | 4,112 | | | | 125,416 | |

Xcel Energy, Inc. | | | 13,090 | | | | 312,720 | |

| | | | | | | | |

| Total Electric | | | | | | | 11,804,328 | |

| Electrical Components & Equipment – 0.5% | | | | | | | | |

Acuity Brands, Inc. | | | 402 | | | | 23,513 | |

AMETEK, Inc. | | | 720 | | | | 31,586 | |

Emerson Electric Co. | | | 11,754 | | | | 686,786 | |

Hubbell, Inc. Class B | | | 902 | | | | 64,069 | |

Molex, Inc.(a) | | | 1,532 | | | | 38,484 | |

Molex, Inc. Class A | | | 2,595 | | | | 53,691 | |

| | | | | | | | |

| Total Electrical Components & Equipment | | | | | | | 898,129 | |

| Electronics – 0.1% | | | | | | | | |

AVX Corp. | | | 1,787 | | | | 26,644 | |

Brady Corp. Class A | | | 855 | | | | 30,515 | |

Gentex Corp. | | | 1,570 | | | | 47,493 | |

Jabil Circuit, Inc. | | | 3,205 | | | | 65,478 | |

National Instruments Corp. | | | 1,447 | | | | 47,418 | |

PerkinElmer, Inc. | | | 1,205 | | | | 31,655 | |

| | | | | | | | |

| Total Electronics | | | | | | | 249,203 | |

See Notes to Financial Statements.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 15 | |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

| Engineering & Construction – 0.1% | | | | | | | | |

Fluor Corp. | | | 1,032 | | | $ | 76,017 | |

Granite Construction, Inc.(a) | | | 438 | | | | 12,308 | |

KBR, Inc. | | | 947 | | | | 35,768 | |

| | | | | | | | |

| Total Engineering & Construction | | | | | | | 124,093 | |

| Entertainment – 0.1% | | | | | | | | |

Cinemark Holdings, Inc. | | | 4,007 | | | | 77,535 | |

International Game Technology | | | 2,635 | | | | 42,766 | |

National CineMedia, Inc. | | | 1,669 | | | | 31,160 | |

Regal Entertainment Group Class A(a) | | | 4,291 | | | | 57,929 | |

| | | | | | | | |

| Total Entertainment | | | | | | | 209,390 | |

| Environmental Control – 0.4% | | | | | | | | |

Mine Safety Appliances Co. | | | 847 | | | | 31,059 | |

Nalco Holding Co. | | | 574 | | | | 15,676 | |

Republic Services, Inc. | | | 6,641 | | | | 199,496 | |

U.S. Ecology, Inc. | | | 569 | | | | 9,918 | |

Waste Connections, Inc.(a) | | | 596 | | | | 17,159 | |

Waste Management, Inc. | | | 10,931 | | | | 408,163 | |

| | | | | | | | |

| Total Environmental Control | | | | | | | 681,471 | |

| Food – 2.8% | | | | | | | | |

B&G Foods, Inc. | | | 2,120 | | | | 39,792 | |

Campbell Soup Co.(a) | | | 7,159 | | | | 237,034 | |

ConAgra Foods, Inc. | | | 11,510 | | | | 273,362 | |

Corn Products International, Inc. | | | 708 | | | | 36,689 | |

Flowers Foods, Inc.(a) | | | 1,949 | | | | 53,071 | |

General Mills, Inc. | | | 12,644 | | | | 462,138 | |

H.J. Heinz Co.(a) | | | 7,586 | | | | 370,349 | |

Hershey Co. (The) | | | 3,020 | | | | 164,137 | |

Hormel Foods Corp. | | | 3,618 | | | | 100,725 | |

J.M. Smucker Co. (The) | | | 1,803 | | | | 128,716 | |

Kellogg Co. | | | 7,474 | | | | 403,447 | |

Kraft Foods, Inc. Class A | | | 41,658 | | | | 1,306,395 | |

Kroger Co. (The) | | | 7,983 | | | | 191,353 | |

Lancaster Colony Corp.(a) | | | 605 | | | | 36,663 | |

McCormick & Co., Inc. | | | 2,043 | | | | 97,717 | |

Ruddick Corp. | | | 607 | | | | 23,424 | |

Safeway, Inc. | | | 5,129 | | | | 120,737 | |

Sara Lee Corp.(a) | | | 12,179 | | | | 215,203 | |

Snyders-Lance, Inc. | | | 633 | | | | 12,565 | |

SUPERVALU, Inc.(a) | | | 5,177 | | | | 46,231 | |

Sysco Corp. | | | 13,712 | | | | 379,822 | |

Tyson Foods, Inc. Class A | | | 2,344 | | | | 44,981 | |

Weis Markets, Inc. | | | 655 | | | | 26,501 | |

| | | | | | | | |

| Total Food | | | | | | | 4,771,052 | |

| Forest Products & Paper – 0.2% | | | | | | | | |

International Paper Co. | | | 5,283 | | | | 159,441 | |

MeadWestvaco Corp. | | | 4,141 | | | | 125,596 | |

PH Glatfelter Co. | | | 834 | | | | 11,109 | |

| | | | | | | | |

| Total Forest Products & Paper | | | | | | | 296,146 | |

| Gas – 0.9% | | | | | | | | |

AGL Resources, Inc. | | | 2,154 | | | | 85,815 | |

Atmos Energy Corp. | | | 2,535 | | | | 86,444 | |

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

CenterPoint Energy, Inc. | | | 13,139 | | | $ | 230,721 | |

Chesapeake Utilities Corp. | | | 394 | | | | 16,398 | |

Energen Corp. | | | 620 | | | | 39,134 | |

Laclede Group, Inc. (The) | | | 970 | | | | 36,957 | |

National Fuel Gas Co. | | | 1,316 | | | | 97,384 | |

New Jersey Resources Corp.(a) | | | 836 | | | | 35,906 | |

Nicor, Inc. | | | 1,235 | | | | 66,319 | |

NiSource, Inc. | | | 9,692 | | | | 185,893 | |

Northwest Natural Gas Co. | | | 544 | | | | 25,095 | |

Piedmont Natural Gas Co., Inc.(a) | | | 1,608 | | | | 48,803 | |

Questar Corp. | | | 3,480 | | | | 60,726 | |

Sempra Energy | | | 4,590 | | | | 245,565 | |

South Jersey Industries, Inc.(a) | | | 576 | | | | 32,239 | |

Southern Union Co. | | | 2,222 | | | | 63,594 | |

Southwest Gas Corp. | | | 924 | | | | 36,008 | |

UGI Corp. | | | 2,089 | | | | 68,728 | |

Vectren Corp. | | | 2,745 | | | | 74,664 | |

WGL Holdings, Inc.(a) | | | 1,192 | | | | 46,488 | |

| | | | | | | | |

| Total Gas | | | | | | | 1,582,881 | |

| Hand/Machine Tools – 0.2% | | | | | | | | |

Kennametal, Inc. | | | 970 | | | | 37,830 | |

Lincoln Electric Holdings, Inc. | | | 553 | | | | 41,984 | |

Regal-Beloit Corp. | | | 421 | | | | 31,082 | |

Snap-On, Inc. | | | 946 | | | | 56,817 | |

Stanley Black & Decker, Inc. | | | 2,200 | | | | 168,520 | |

| | | | | | | | |

| Total Hand/Machine Tools | | | | | | | 336,233 | |

| Healthcare-Products – 3.2% | | | | | | | | |

Baxter International, Inc. | | | 8,950 | | | | 481,242 | |

Beckman Coulter, Inc. | | | 402 | | | | 33,394 | |

Becton Dickinson and Co. | | | 2,921 | | | | 232,570 | |

C.R. Bard, Inc.(a) | | | 469 | | | | 46,576 | |

DENTSPLY International, Inc.(a) | | | 576 | | | | 21,306 | |

Hill-Rom Holdings, Inc. | | | 602 | | | | 22,864 | |

Johnson & Johnson | | | 61,557 | | | | 3,647,252 | |

Medtronic, Inc. | | | 17,388 | | | | 684,218 | |

Meridian Bioscience, Inc.(a) | | | 1,308 | | | | 31,379 | |

Patterson Cos., Inc.(a) | | | 931 | | | | 29,969 | |

STERIS Corp. | | | 561 | | | | 19,377 | |

Stryker Corp.(a) | | | 2,776 | | | | 168,781 | |

Techne Corp. | | | 404 | | | | 28,926 | |

Teleflex, Inc. | | | 624 | | | | 36,180 | |

West Pharmaceutical Services, Inc. | | | 351 | | | | 15,714 | |

| | | | | | | | |

| Total Healthcare-Products | | | | | | | 5,499,748 | |

| Healthcare-Services – 0.3% | | | | | | | | |

Aetna, Inc. | | | 503 | | | | 18,827 | |

Lincare Holdings, Inc. | | | 1,771 | | | | 52,528 | |

Quest Diagnostics, Inc. | | | 933 | | | | 53,853 | |

UnitedHealth Group, Inc. | | | 9,916 | | | | 448,203 | |

| | | | | | | | |

| Total Healthcare-Services | | | | | | | 573,411 | |

| Holding Companies-Diversified – 0.0% | | | | | | | | |

Compass Diversified Holdings | | | 2,789 | | | | 41,110 | |

See Notes to Financial Statements.

| | |

| 16 | | WisdomTree Domestic Dividend Funds |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2011

| | | | | | | | |

| Investments | | Shares | | | Fair

Value | |

| | | | | | | | |

| Home Builders – 0.1% | | | | | | | | |

D.R. Horton, Inc. | | | 3,067 | | | $ | 35,731 | |

KB Home(a) | | | 888 | | | | 11,047 | |

Lennar Corp. Class A | | | 1,183 | | | | 21,436 | |

MDC Holdings, Inc. | | | 1,252 | | | | 31,738 | |

Ryland Group, Inc. | | | 634 | | | | 10,081 | |

Thor Industries, Inc.(a) | | | 296 | | | | 9,877 | |

| | | | | | | | |

| Total Home Builders | | | | | | | 119,910 | |

| Home Furnishings – 0.1% | | | | | | | | |

Whirlpool Corp. | | | 1,072 | | | | 91,506 | |

| Household Products/Wares – 0.8% | | | | | | | | |

American Greetings Corp. Class A | | | 406 | | | | 9,582 | |

Avery Dennison Corp. | | | 1,679 | | | | 70,451 | |

Church & Dwight Co., Inc. | | | 592 | | | | 46,969 | |

Clorox Co.(a) | | | 3,097 | | | | 217,007 | |

Fortune Brands, Inc. | | | 1,316 | | | | 81,447 | |

Jarden Corp. | | | 899 | | | | 31,977 | |

Kimberly-Clark Corp. | | | 11,192 | | | | 730,502 | |

Scotts Miracle-Gro Co. (The) Class A(a) | | | 654 | | | | 37,834 | |

Tupperware Brands Corp. | | | 1,018 | | | | 60,785 | |

| | | | | | | | |

| Total Household Products/Wares | | | | | | | 1,286,554 | |

| Housewares – 0.0% | | | | | | | | |

Newell Rubbermaid, Inc. | | | 2,437 | | | | 46,620 | |

Toro Co. (The) | | | 408 | | | | 27,018 | |

| | | | | | | | |

| Total Housewares | | | | | | | 73,638 | |

| Insurance – 2.7% | | | | | | | | |

Allstate Corp. (The) | | | 9,280 | | | | 294,918 | |

American Family Life Assurance Co., Inc. | | | 6,774 | | | | 357,532 | |

American Financial Group, Inc. | | | 1,582 | | | | 55,402 | |

American National Insurance Co. | | | 569 | | | | 45,048 | |

AON Corp. | | | 2,851 | | | | 150,989 | |

Arthur J. Gallagher & Co. | | | 3,187 | | | | 96,917 | |

Assurant, Inc. | | | 1,386 | | | | 53,375 | |

Baldwin & Lyons, Inc. Class B | | | 1,029 | | | | 24,099 | |

Brown & Brown, Inc. | | | 1,813 | | | | 46,775 | |

Chubb Corp. | | | 5,036 | | | | 308,757 | |

Cincinnati Financial Corp.(a) | | | 5,467 | | | | 179,318 | |

Delphi Financial Group, Inc. Class A | | | 320 | | | | 9,827 | |

Donegal Group, Inc. Class A | | | 1,596 | | | | 21,339 | |

Erie Indemnity Co. Class A | | | 1,081 | | | | 76,870 | |

Fidelity National Financial, Inc. Class A | | | 7,256 | | | | 102,527 | |

First American Financial Corp. | | | 829 | | | | 13,679 | |

Hanover Insurance Group, Inc. (The) | | | 616 | | | | 27,874 | |

Harleysville Group, Inc. | | | 963 | | | | 31,904 | |

Hartford Financial Services Group, Inc.(a) | | | 2,369 | | | | 63,797 | |

HCC Insurance Holdings, Inc. | | | 1,711 | | | | 53,571 | |