UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

380 Madison Avenue, 21st Floor

New York, NY 10017

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866)-909-9473

Date of fiscal year end: March 31

Date of reporting period: March 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report(s) to Stockholders.

The Trust’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

WisdomTree Trust

Domestic Dividend Funds

Annual Report

March 31, 2012

WisdomTree Total Dividend Fund (DTD)

WisdomTree Equity Income Fund (DHS)

WisdomTree LargeCap Dividend Fund (DLN)

WisdomTree Dividend ex-Financials Fund (DTN)

WisdomTree MidCap Dividend Fund (DON)

WisdomTree SmallCap Dividend Fund (DES)

Table of Contents

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Management’s Discussion of Funds’ Performance

(unaudited)

Market Environment Overview

The U.S. equity market, as measured by the S&P 500 Index, returned 8.54% for the 12-month period ended March 31, 2012 (the “period”). After bottoming in March of 2009, the S&P 500 recorded its third straight year of gains. Measured from March 31, 2009 through March 31, 2012, the three year cumulative total return on the S&P 500 Index was 87.99%. This represents a substantial recovery in the equity market as earnings and dividend levels reached and surpassed previous records.

While the overall return for the period was positive, it was marked by several bouts of volatility. Investors had to deal with events domestically and abroad that impacted the U.S. market: as the S&P 500 Index fell for the first six months of the period and turned around significantly in the second half of the period.

Much of the volatility experienced in the market revolved around concerns over a debt crisis in the developed world. At home in the United States, politicians squabbled over raising the U.S. debt ceiling in the summer of 2011. After the market close on Friday, August 5, 2011, Standard & Poor’s downgraded the U.S. government from its AAA rating — the highest credit quality rating one can achieve — due to escalating debt levels, large deficits, and the lack of a coherent plan from U.S. politicians attacking these fiscal issues. The following Monday, the S&P 500 closed down 6.65% and many market participants shifted assets away from equities and risky assets to perceived safe havens. Paradoxically, there was a flight to the very bonds that were downgraded as many believed the problems in other parts of the world, such as Europe, were worse than those in the United States.

WisdomTree Funds’ Performance Overview

By the end of September 2011, investors had experienced market uncertainty due to the European debt crisis intensifying. This resulted in the worst quarterly performance for the S&P 500 since 2008 (down 13.87%). To support the economy and credit markets, on September 21, 2011, the Federal Reserve announced “Operation Twist,” which attempted to push down long-term interest rates by shifting the balance of the Treasury’s securities holdings towards longer-term securities and selling shorter-term investments. These Federal Reserve actions, known as a form of quantitative easing, or “QE”, helped support an environment in which many investors were willing to take on more risk. From September 22, 2011, the market rose more than 26% until the end of March 2012, erasing the negative effects of the previous volatility and leaving the U.S. market, as measured by the S&P 500 Index, up 8.54% for the period.

The following table reflects the WisdomTree Funds’ performance versus their capitalization-weighted benchmark indexes:

| | | | | | | | | | | | | | | | |

| Ticker | | WisdomTree Fund | | 1-Year

NAV

Return | | | Cap-Weighted Benchmark | | 1-Year

Return | | | Difference | |

DTD | | WisdomTree Total Dividend Fund | | | 11.81 | % | | Russell 3000® Index | | | 7.18 | % | | | 4.63 | % |

DHS | | WisdomTree Equity Income Fund | | | 14.66 | % | | Russell 1000® Value Index | | | 4.79 | % | | | 9.87 | % |

DLN | | WisdomTree LargeCap Dividend Fund | | | 12.82 | % | | S&P 500® Index | | | 8.54 | % | | | 4.28 | % |

DTN | | WisdomTree Dividend ex-Financials Fund | | | 12.99 | % | | Dow Jones U.S. Select Dividend IndexSM | | | 11.75 | % | | | 1.24 | % |

DON | | WisdomTree MidCap Dividend Fund | | | 6.99 | % | | S&P MidCap 400® Index | | | 1.98 | % | | | 5.01 | % |

DES | | WisdomTree SmallCap Dividend Fund | | | 4.50 | % | | Russell 2000® Index | | | -0.18 | % | | | 4.68 | % |

With all the volatility in the markets during the period, it may not be a surprise that equities considered to be more defensive in nature, such as large cap stocks, or dividend paying stocks fared better than mid cap and small cap stocks and more growth oriented strategies. While the S&P 500 Index was up 8.54%, the Russell 2000 Index, an index of small cap U.S. equities, experienced a decline of -0.18%.

WisdomTree’s dividend weighted Funds are designed to track indexes based on the dividend stream generated by the companies included in the underlying WisdomTree

| | | | |

| WisdomTree Domestic Dividend Funds | | | 1 | |

Management’s Discussion of Funds’ Performance

(unaudited) (concluded)

Index. The dividend stream is defined as the sum of the dollar value of dividends indicated to be paid by each company. There are two primary factors that drive performance differentials of the WisdomTree Funds and Indexes versus market cap-weighted benchmarks. The first is aggregate exposure to one or more sectors. The second is stock selection within each sector. Both of these are determined as part of WisdomTree’s rules-based index methodology. These exposures are not subjectively determined. Rather, they are objectively determined at the Index rebalancing dates based on the dividend stream.

Five of the ten sectors represented within the S&P 500 Index experienced positive performance over the period. The best performing sector over the period was the Information Technology sector. This was spurred by a lively initial public offering market and by earnings strength from some of its biggest components, such as Apple, Google, and IBM. Also, the more defensive sectors outpaced the market, such as Health Care, Consumer Staples, and Utilities. The Energy sector was the worst performing sector for the period, followed by Materials, as the commodities markets experienced a selloff over the period. Financials also lagged the broader market as questions arose about exposures to the European sovereign debt crisis.

The WisdomTree LargeCap Dividend Fund delivered a return of 12.82%, which was more than 4 percentage points ahead of the S&P 500 Index. This Fund, representative of the broader dividend approach, benefited from its focus on dividend paying stocks in the Utilities, Health Care, and Consumer Staples sectors. It also benefited from being underweight financial stocks, many of which had cut their dividends during the crisis and were therefore underweight in the Fund.

The performance of each WisdomTree Fund compared to its cap-weighted benchmarks was favorable for each Fund in the domestic dividend family over the period. This can be partially explained because the Consumer Staples sector experienced strong gains throughout the period. During the period, this sector was more heavily represented in WisdomTree Funds than in their corresponding cap-weighted benchmarks due to this sector’s relatively higher contributions to the dividend stream.

While the WisdomTree Domestic Dividend Funds outperformed their cap-weighted benchmarks for the period, there was a notable sector exposure that created relative drag on performance. The Information Technology sector experienced strong gains during the period. This sector has historically had relatively low dividend payers, which meant that cap-weighted benchmarks were relatively overweight this sector compared to the WisdomTree Dividend Funds during the period.

The WisdomTree Equity Income Fund outperformed its cap-weighted benchmark significantly over the period primarily because it was relatively overweight the Consumer Staples sector, which experienced positive gains over the period as a defensive sector. Additionally, the Fund was significantly underweight Financials, which lagged the broader market for the period.

Fund returns are shown at NAV. Please see Performance Summaries on the subsequent pages for more complete performance information. Please see page 9 for the list of index descriptions.

Fund performance assumes reinvestment of dividends and capital gain distributions. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results. For the most recent month end performance information visit www.wisdomtree.com.

| | |

| 2 | | WisdomTree Domestic Dividend Funds |

Performance Summary (unaudited)

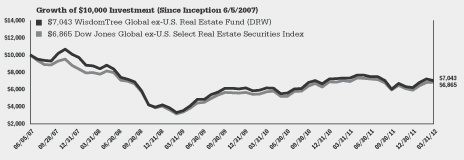

WisdomTree Total Dividend Fund (DTD)

Sector Breakdown† as of 3/31/12‡

| | | | |

Financials | | | 16.7% | |

Consumer Staples | | | 14.5% | |

Industrials | | | 11.3% | |

Health Care | | | 10.6% | |

Information Technology | | | 9.9% | |

Energy | | | 9.2% | |

Consumer Discretionary | | | 8.2% | |

Utilities | | | 6.6% | |

Telecommunication Services | | | 6.2% | |

Materials | | | 4.8% | |

Other | | | 2.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 3.5% | |

Exxon Mobil Corp. | | | 3.1% | |

Microsoft Corp. | | | 2.6% | |

General Electric Co. | | | 2.4% | |

Chevron Corp. | | | 2.2% | |

Pfizer, Inc. | | | 2.1% | |

Johnson & Johnson | | | 2.0% | |

Philip Morris International, Inc. | | | 2.0% | |

Procter & Gamble Co. (The) | | | 1.9% | |

Verizon Communications, Inc. | | | 1.8% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

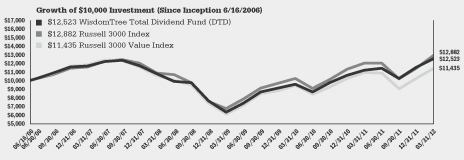

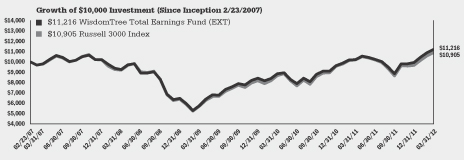

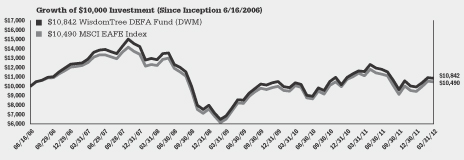

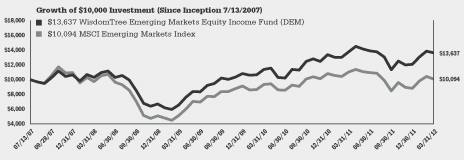

The WisdomTree Total Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dividend Index.

The Fund returned 11.81% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Consumer Staples sector. The Fund’s position in the Energy sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.28%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Dividend Index | | | Russell 3000®

Index | | | Russell 3000®

Value Index | |

One Year | | | 11.81 | % | | | 11.79 | % | | | 12.22 | % | | | 7.18 | % | | | 4.30 | % |

Three Year | | | 25.56 | % | | | 25.45 | % | | | 26.40 | % | | | 24.26 | % | | | 23.03 | % |

Five Year | | | 1.40 | % | | | 1.42 | % | | | 2.04 | % | | | 2.18 | % | | | -0.75 | % |

Since Inception1 | | | 3.96 | % | | | 3.95 | % | | | 4.45 | % | | | 4.47 | % | | | 2.34 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 3 | |

Performance Summary (unaudited)

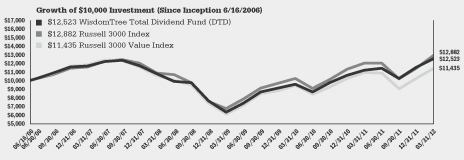

WisdomTree Equity Income Fund (DHS)

Sector Breakdown† as of 3/31/12‡

| | | | |

Health Care | | | 18.1% | |

Consumer Staples | | | 15.8% | |

Telecommunication Services | | | 13.5% | |

Utilities | | | 13.2% | |

Financials | | | 12.4% | |

Industrials | | | 8.5% | |

Materials | | | 5.5% | |

Information Technology | | | 4.5% | |

Energy | | | 4.0% | |

Consumer Discretionary | | | 1.4% | |

Other | | | 3.1% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 7.7% | |

General Electric Co. | | | 5.3% | |

Pfizer, Inc. | | | 4.6% | |

Johnson & Johnson | | | 4.5% | |

Philip Morris International, Inc. | | | 4.4% | |

Procter & Gamble Co. (The) | | | 4.2% | |

Verizon Communications, Inc. | | | 3.9% | |

Merck & Co., Inc. | | | 3.8% | |

Intel Corp. | | | 3.6% | |

ConocoPhillips | | | 2.7% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

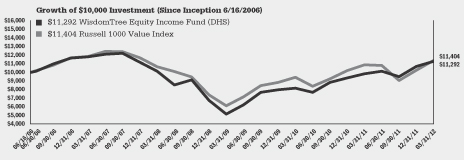

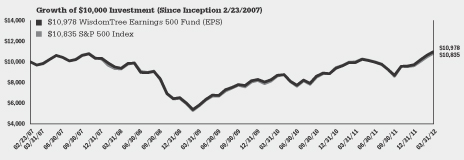

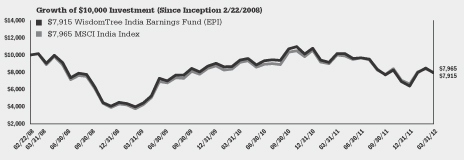

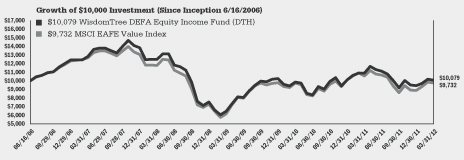

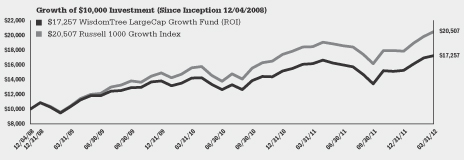

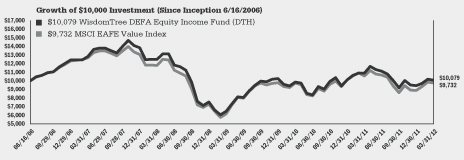

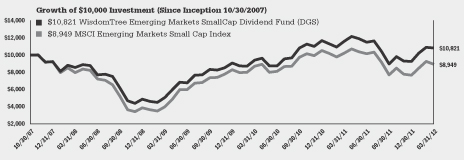

The WisdomTree Equity Income Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Equity Income Index.

The Fund returned 14.66% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Consumer Staples sector. The Fund’s position in the Energy sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.38%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Equity

Income Index | | | Russell 1000®

Value Index | |

One Year | | | 14.66 | % | | | 14.65 | % | | | 15.17 | % | | | 4.79 | % |

Three Year | | | 29.76 | % | | | 29.77 | % | | | 30.43 | % | | | 22.82 | % |

Five Year | | | -0.91 | % | | | -0.89 | % | | | -0.55 | % | | | -0.81 | % |

Since Inception1 | | | 2.12 | % | | | 2.14 | % | | | 2.42 | % | | | 2.29 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | |

| 4 | | WisdomTree Domestic Dividend Funds |

Performance Summary (unaudited)

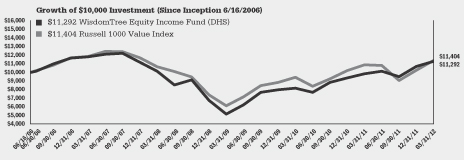

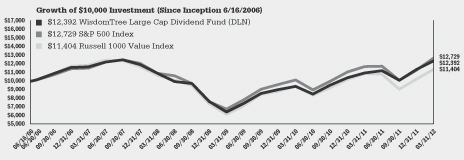

WisdomTree LargeCap Dividend Fund (DLN)

Sector Breakdown† as of 3/31/12‡

| | | | |

Consumer Staples | | | 16.6% | |

Financials | | | 12.7% | |

Health Care | | | 12.2% | |

Industrials | | | 11.4% | |

Information Technology | | | 10.9% | |

Energy | | | 10.6% | |

Consumer Discretionary | | | 7.8% | |

Telecommunication Services | | | 6.8% | |

Utilities | | | 5.8% | |

Materials | | | 4.4% | |

Other | | | 0.8% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

AT&T, Inc. | | | 4.0% | |

Exxon Mobil Corp. | | | 3.6% | |

Microsoft Corp. | | | 3.1% | |

General Electric Co. | | | 2.8% | |

Chevron Corp. | | | 2.5% | |

Pfizer, Inc. | | | 2.4% | |

Johnson & Johnson | | | 2.4% | |

Philip Morris International, Inc. | | | 2.3% | |

Procter & Gamble Co. (The) | | | 2.2% | |

Verizon Communications, Inc. | | | 2.1% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

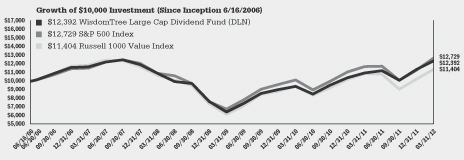

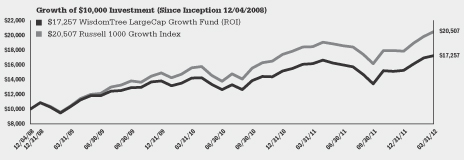

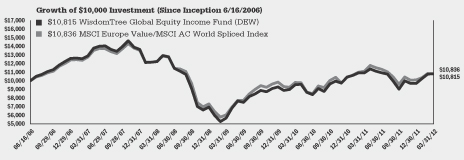

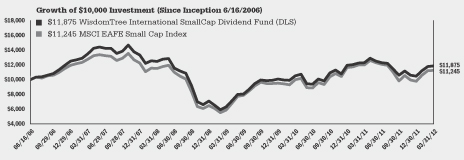

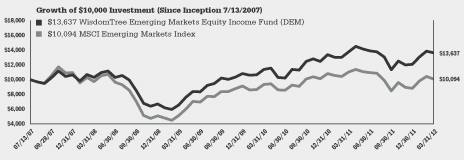

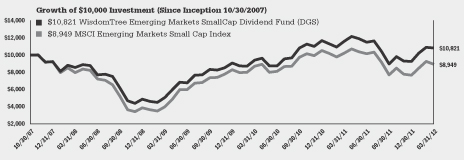

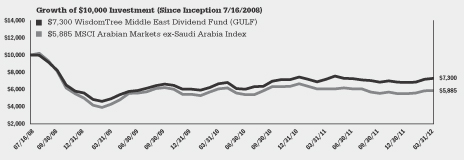

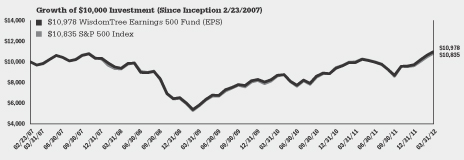

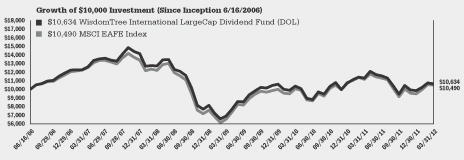

The WisdomTree LargeCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree LargeCap Dividend Index.

The Fund returned 12.82% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Consumer Staples sector. The Fund’s position in the Materials sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.28%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | | | | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

LargeCap

Dividend Index | | | S&P 500® Index | | | Russell 1000®

Value Index | |

One Year | | | 12.82 | % | | | 12.80 | % | | | 13.15 | % | | | 8.54 | % | | | 4.79 | % |

Three Year | | | 24.54 | % | | | 24.48 | % | | | 25.07 | % | | | 23.42 | % | | | 22.82 | % |

Five Year | | | 1.20 | % | | | 1.18 | % | | | 1.66 | % | | | 2.01 | % | | | -0.81 | % |

Since Inception1 | | | 3.77 | % | | | 3.73 | % | | | 4.16 | % | | | 4.25 | % | | | 2.29 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 5 | |

Performance Summary (unaudited)

WisdomTree Dividend ex-Financials Fund (DTN)

Sector Breakdown† as of 3/31/12‡

| | | | |

Utilities | | | 12.3% | |

Consumer Staples | | | 12.2% | |

Materials | | | 11.4% | |

Industrials | | | 10.6% | |

Telecommunication Services | | | 10.3% | |

Information Technology | | | 9.9% | |

Health Care | | | 9.8% | |

Consumer Discretionary | | | 9.3% | |

Energy | | | 8.9% | |

Other | | | 5.3% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

Frontier Communications Corp. | | | 3.0% | |

Southern Copper Corp. | | | 2.7% | |

Windstream Corp. | | | 2.4% | |

CenturyLink, Inc. | | | 2.3% | |

AT&T, Inc. | | | 1.7% | |

Avon Products, Inc. | | | 1.7% | |

Altria Group, Inc. | | | 1.6% | |

Lockheed Martin Corp. | | | 1.6% | |

Lorillard, Inc. | | | 1.5% | |

Reynolds American, Inc. | | | 1.5% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

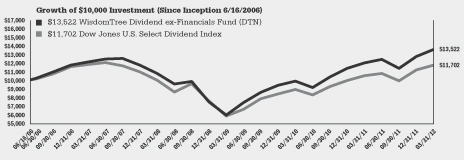

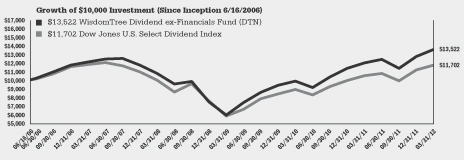

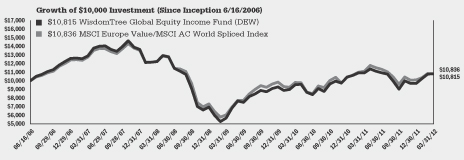

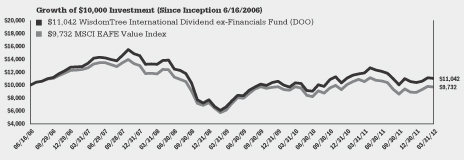

The WisdomTree Dividend ex-Financials Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree Dividend ex-Financials Index.

The Fund returned 12.99% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Consumer Staples sector. The Fund’s performance also benefited because it excludes investments in the Financials sector, which had negative returns for the period. The Fund’s position in the Telecommunication Services sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.38%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

Dividend Top 100/

Dividend ex-Financials

Spliced Index1 | | | Dow Jones

U.S. Select

Dividend IndexSM | |

One Year | | | 12.99 | % | | | 13.00 | % | | | 13.46 | % | | | 11.75 | % |

Three Year | | | 31.84 | % | | | 31.82 | % | | | 32.55 | % | | | 26.39 | % |

Five Year | | | 2.25 | % | | | 2.25 | % | | | 2.76 | % | | | -0.12 | % |

Since Inception2 | | | 5.35 | % | | | 5.35 | % | | | 5.75 | % | | | 2.75 | % |

| 1 | WisdomTree Dividend Top 100 Index through May 7, 2009; WisdomTree Dividend ex-Financials Index thereafter. |

| 2 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | |

| 6 | | WisdomTree Domestic Dividend Funds |

Performance Summary (unaudited)

WisdomTree MidCap Dividend Fund (DON)

Sector Breakdown† as of 3/31/12‡

| | | | |

Financials | | | 35.7% | |

Utilities | | | 13.5% | |

Consumer Discretionary | | | 11.2% | |

Industrials | | | 10.0% | |

Materials | | | 8.1% | |

Information Technology | | | 3.9% | |

Telecommunication Services | | | 3.3% | |

Consumer Staples | | | 2.5% | |

Energy | | | 2.1% | |

Health Care | | | 1.6% | |

Other | | | 8.1% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

Frontier Communications Corp. | | | 1.9% | |

Windstream Corp. | | | 1.6% | |

New York Community Bancorp, Inc. | | | 1.5% | |

Kimco Realty Corp. | | | 1.2% | |

Ares Capital Corp. | | | 1.0% | |

Plum Creek Timber Co., Inc. | | | 1.0% | |

Cincinnati Financial Corp. | | | 0.9% | |

NiSource, Inc. | | | 0.9% | |

Pitney Bowes, Inc. | | | 0.9% | |

Hospitality Properties Trust | | | 0.8% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

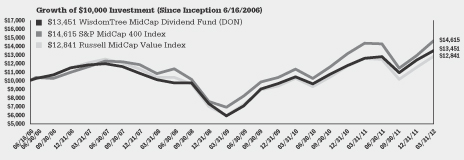

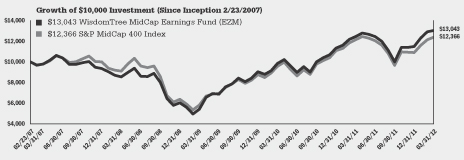

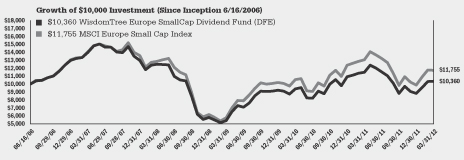

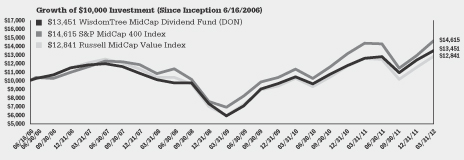

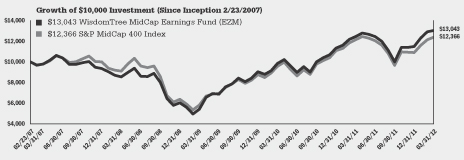

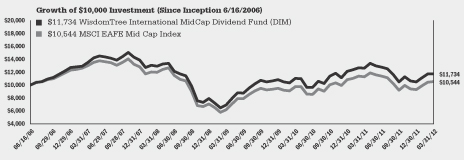

The WisdomTree MidCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree MidCap Dividend Index.

The Fund returned 6.99% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Utilities sector. The Fund’s position in the Energy sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.38%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

MidCap

Dividend Index | | | S&P MidCap 400®

Index | | | Russell MidCap

Value® Index | |

One Year | | | 6.99 | % | | | 7.04 | % | | | 7.34 | % | | | 1.98 | % | | | 2.28 | % |

Three Year | | | 31.77 | % | | | 31.70 | % | | | 32.51 | % | | | 28.55 | % | | | 29.18 | % |

Five Year | | | 2.70 | % | | | 2.72 | % | | | 2.58 | % | | | 4.78 | % | | | 1.26 | % |

Since Inception1 | | | 5.25 | % | | | 5.35 | % | | | 5.12 | % | | | 6.77 | % | | | 4.41 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 7 | |

Performance Summary (unaudited)

WisdomTree SmallCap Dividend Fund (DES)

Sector Breakdown† as of 3/31/12‡

| | | | |

Financials | | | 49.4% | |

Industrials | | | 11.0% | |

Consumer Discretionary | | | 9.1% | |

Utilities | | | 4.8% | |

Materials | | | 4.8% | |

Information Technology | | | 4.4% | |

Consumer Staples | | | 3.6% | |

Health Care | | | 1.9% | |

Telecommunication Services | | | 1.7% | |

Energy | | | 1.0% | |

Other | | | 8.3% | |

| † | The Fund’s sector breakdown is expressed as a percentage of total investments and may change over time. |

| ‡ | A sector may be comprised of several industries. |

Top Ten Holdings* as of 3/31/12

| | | | |

| |

| Description | | % of Net Assets | |

Apollo Investment Corp. | | | 1.9% | |

CommonWealth REIT | | | 1.4% | |

Prospect Capital Corp. | | | 1.2% | |

Corporate Office Properties Trust | | | 1.0% | |

Vector Group Ltd. | | | 1.0% | |

Healthcare Realty Trust, Inc. | | | 0.9% | |

Brandywine Realty Trust | | | 0.8% | |

WisdomTree MidCap Dividend Fund | | | 0.8% | |

TAL International Group, Inc. | | | 0.7% | |

Lexington Realty Trust | | | 0.7% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. |

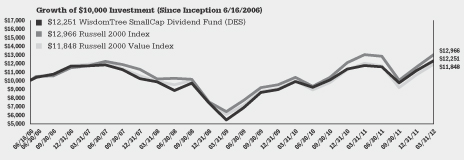

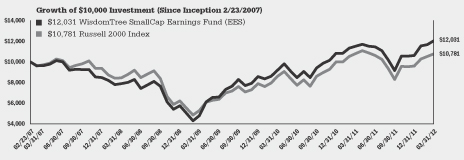

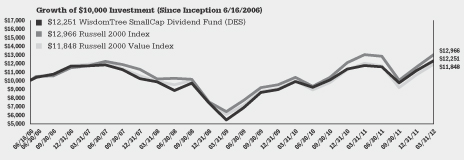

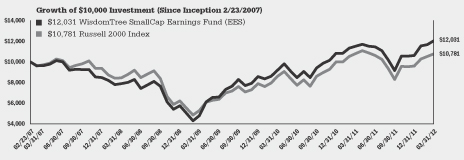

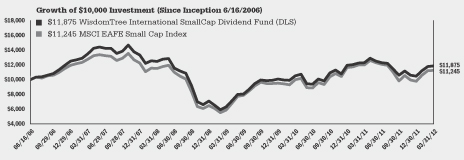

The WisdomTree SmallCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree SmallCap Dividend Index.

The Fund returned 4.50% at net asset value (“NAV”) for the fiscal year ended March 31, 2012 (for more complete performance information please see the chart below). The Fund’s performance benefited most from its position in the Financials sector. The Fund’s position in the Energy sector created the greatest drag on performance.

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and the index is not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions. As of the Fund’s current prospectus dated July 29, 2011, the Fund’s annual expense ratio was 0.38%.

Performance as of 3/31/12

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Fund

Net Asset Value | | | Fund

Market Price | | | WisdomTree

SmallCap

Dividend Index | | | Russell 2000®

Index | | | Russell 2000®

Value Index | |

One Year | | | 4.50 | % | | | 4.78 | % | | | 4.74 | % | | | -0.18 | % | | | -1.07 | % |

Three Year | | | 31.58 | % | | | 31.44 | % | | | 32.13 | % | | | 26.90 | % | | | 25.36 | % |

Five Year | | | 0.95 | % | | | 1.04 | % | | | 1.16 | % | | | 2.13 | % | | | 0.01 | % |

Since Inception1 | | | 3.57 | % | | | 3.60 | % | | | 3.65 | % | | | 4.59 | % | | | 2.97 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NYSE Arca, Inc. on June 16, 2006. |

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance data for the most recent month-end is available at www.wisdomtree.com. WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| | |

| 8 | | WisdomTree Domestic Dividend Funds |

Description of Indexes (unaudited)

Below are descriptions of each Index referenced in this Report:

The WisdomTree Dividend Index defines the dividend-paying portion of the U.S. stock market.

The WisdomTree LargeCap Dividend Index measures the performance of the large-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree MidCap Dividend Index measures the performance of the mid-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree SmallCap Dividend Index measures the performance of the small-capitalization segment of the U.S. dividend-paying market, selected from the WisdomTree Dividend Index.

The WisdomTree Equity Income Index measures the performance of companies with high dividend yields, selected from the WisdomTree Dividend Index.

The WisdomTree Dividend ex-Financials Index measures the performance of high dividend-yielding stocks outside the financial sector.

The WisdomTree Dividend Top 100 Index measures the performance of the 100 highest dividend-yielding companies in the WisdomTree LargeCap Dividend Index.

The S&P 500® Index is a capitalization-weighted index of 500 stocks selected by Standard & Poor’s Index Committee, designed to represent the performance of the leading industries in the United States economy.

The S&P MidCap 400® Index is a capitalization-weighted index that measures the performance of the mid-capitalization range of the U.S. stock market, with stocks selected by the Standard & Poor’s Index Committee.

The Russell 2000® Index is a capitalization-weighted index that measures the performance of the smallest 2,000 securities in the Russell 3000 Index, based on total market capitalization.

The Russell 3000® Index is a capitalization-weighted index that measures the performance of the 3,000 largest U.S. companies, based on total market capitalization.

The Russell 1000® Value Index is a capitalization-weighted index that measures the performance of the large-capitalization value segment of the U.S. equity universe, selecting from the Russell 1000 Index.

The Russell 2000® Value Index is a capitalization weighted index that measures the small-capitalization value segment of the U.S. equity universe, selecting from the Russell 2000 Index.

The Russell 3000® Value Index is a capitalization weighted index that measures the performance of the value sector of the broad U.S. equity market. The index is a subset of the Russell 3000 Index and consists of those companies or portion of a company, with lower price-to-book ratios and lower forecasted growth within the Russell 3000 Index.

The Russell MidCap Value® Index is a capitalization weighted index that measures the mid-capitalization value segment of the U.S. equity universe, selecting from the Russell Midcap Index.

The Dow Jones U.S. Select Dividend IndexSM measures the performance of 100 U.S. dividend-paying companies.

Index performance information assumes the reinvestment of net dividends and excludes management fees, transaction costs and expenses. You cannot directly invest in an index.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 9 | |

Shareholder Expense Examples (unaudited)

As a shareholder of a WisdomTree Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2011 to March 31, 2012.

Actual expenses

The first line under each Fund in the table on the next page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period 10/01/11 to 3/31/12” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under each Fund in the table on the next page provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| 10 | | WisdomTree Domestic Dividend Funds |

Shareholder Expense Examples (unaudited) (concluded)

| | | | | | | | | | | | | | |

| | | Beginning

Account Value

10/01/11 | | | Ending

Account Value

3/31/12 | | | Annualized

Expense Ratio

Based on the

Period

10/01/11 to

3/31/12 | | Expenses Paid

During the

Period†

10/01/11 to

3/31/12 | |

WisdomTree Total Dividend Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,226.80 | | | 0.28% | | $ | 1.56 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.60 | | | 0.28% | | $ | 1.42 | |

WisdomTree Equity Income Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,184.80 | | | 0.38% | | $ | 2.08 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.10 | | | 0.38% | | $ | 1.92 | |

WisdomTree LargeCap Dividend Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,225.10 | | | 0.28% | | $ | 1.56 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.60 | | | 0.28% | | $ | 1.42 | |

WisdomTree Dividend ex-Financials Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,190.80 | | | 0.38% | | $ | 2.08 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.10 | | | 0.38% | | $ | 1.92 | |

WisdomTree MidCap Dividend Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,235.90 | | | 0.38% | | $ | 2.12 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.10 | | | 0.38% | | $ | 1.92 | |

WisdomTree SmallCap Dividend Fund | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,263.60 | | | 0.38% | | $ | 2.15 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.10 | | | 0.38% | | $ | 1.92 | |

| † | Expenses are calculated using each Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 183/366 (to reflect the one-half year period). |

| | | | |

| WisdomTree Domestic Dividend Funds | | | 11 | |

Schedule of Investments

WisdomTree Total Dividend Fund (DTD)

March 31, 2012

| | | | | | | | |

| Investments | | Shares | | | Value | |

| | | | | | | | |

| UNITED STATES – 101.6% | |

| COMMON STOCKS – 99.6% | |

| Advertising – 0.1% | |

Harte-Hanks, Inc. | | | 2,479 | | | $ | 22,435 | |

Interpublic Group of Cos., Inc. (The) | | | 8,602 | | | | 98,149 | |

Omnicom Group, Inc.(a) | | | 4,683 | | | | 237,194 | |

| | | | | | | | |

| Total Advertising | | | | | | | 357,778 | |

| Aerospace/Defense – 2.4% | |

Alliant Techsystems, Inc. | | | 208 | | | | 10,425 | |

Boeing Co. (The) | | | 14,125 | | | | 1,050,476 | |

Curtiss-Wright Corp. | | | 488 | | | | 18,061 | |

General Dynamics Corp. | | | 8,017 | | | | 588,288 | |

Goodrich Corp. | | | 952 | | | | 119,419 | |

Kaman Corp. | | | 858 | | | | 29,129 | |

L-3 Communications Holdings, Inc. | | | 2,094 | | | | 148,192 | |

Lockheed Martin Corp. | | | 12,936 | | | | 1,162,429 | |

Northrop Grumman Corp. | | | 7,235 | | | | 441,914 | |

Raytheon Co. | | | 10,242 | | | | 540,573 | |

Rockwell Collins, Inc. | | | 2,097 | | | | 120,703 | |

United Technologies Corp. | | | 18,348 | | | | 1,521,783 | |

| | | | | | | | |

| Total Aerospace/Defense | | | | | | | 5,751,392 | |

| Agriculture – 4.0% | |

Altria Group, Inc. | | | 88,999 | | | | 2,747,399 | |

Archer-Daniels-Midland Co. | | | 12,816 | | | | 405,755 | |

Lorillard, Inc. | | | 4,856 | | | | 628,755 | |

Philip Morris International, Inc. | | | 54,265 | | | | 4,808,422 | |

Reynolds American, Inc. | | | 24,391 | | | | 1,010,763 | |

Universal Corp. | | | 1,000 | | | | 46,600 | |

Vector Group Ltd.(a) | | | 6,274 | | | | 111,175 | |

| | | | | | | | |

| Total Agriculture | | | | | | | 9,758,869 | |

| Apparel – 0.5% | |

Cherokee, Inc. | | | 1,128 | | | | 12,848 | |

Coach, Inc. | | | 3,310 | | | | 255,797 | |

Columbia Sportswear Co.(a) | | | 547 | | | | 25,955 | |

Jones Group, Inc. (The) | | | 1,548 | | | | 19,443 | |

NIKE, Inc. Class B | | | 4,360 | | | | 472,798 | |

Ralph Lauren Corp. | | | 256 | | | | 44,628 | |

VF Corp. | | | 1,916 | | | | 279,698 | |

Wolverine World Wide, Inc. | | | 767 | | | | 28,517 | |

| | | | | | | | |

| Total Apparel | | | | | | | 1,139,684 | |

| Auto Manufacturers – 0.1% | |

PACCAR, Inc. | | | 5,391 | | | | 252,461 | |

| Auto Parts & Equipment – 0.2% | |

Cooper Tire & Rubber Co. | | | 1,732 | | | | 26,361 | |

Douglas Dynamics, Inc. | | | 952 | | | | 13,090 | |

Johnson Controls, Inc. | | | 12,690 | | | | 412,172 | |

Lear Corp. | | | 984 | | | | 45,746 | |

Superior Industries International, Inc. | | | 1,341 | | | | 26,203 | |

| | | | | | | | |

| Total Auto Parts & Equipment | | | | | | | 523,572 | |

| Banks – 6.1% | |

1st Source Corp. | | | 1,195 | | | | 29,242 | |

Arrow Financial Corp. | | | 976 | | | | 23,814 | |

Associated Banc-Corp. | | | 1,096 | | | | 15,300 | |

| | | | | | | | |

BancFirst Corp. | | | 541 | | | $ | 23,566 | |

BancorpSouth, Inc. | | | 1,089 | | | | 14,669 | |

Bank of America Corp. | | | 59,456 | | | | 568,994 | |

Bank of Hawaii Corp. | | | 1,391 | | | | 67,255 | |

Bank of New York Mellon Corp. (The) | | | 24,676 | | | | 595,432 | |

Bank of the Ozarks, Inc. | | | 549 | | | | 17,162 | |

BB&T Corp. | | | 14,551 | | | | 456,756 | |

BOK Financial Corp.(a) | | | 1,004 | | | | 56,505 | |

Capital One Financial Corp. | | | 1,655 | | | | 92,250 | |

Cathay General Bancorp | | | 769 | | | | 13,611 | |

Chemical Financial Corp. | | | 1,213 | | | | 28,433 | |

Citigroup, Inc. | | | 3,428 | | | | 125,293 | |

City Holding Co. | | | 747 | | | | 25,936 | |

City National Corp. | | | 747 | | | | 39,195 | |

Comerica, Inc. | | | 1,754 | | | | 56,759 | |

Commerce Bancshares, Inc. | | | 1,717 | | | | 69,573 | |

Community Bank System, Inc. | | | 1,379 | | | | 39,688 | |

Community Trust Bancorp, Inc. | | | 912 | | | | 29,248 | |

Cullen/Frost Bankers, Inc. | | | 1,690 | | | | 98,341 | |

CVB Financial Corp. | | | 3,649 | | | | 42,839 | |

East West Bancorp, Inc. | | | 1,228 | | | | 28,355 | |

FNB Corp. | | | 5,757 | | | | 69,545 | |

Fifth Third Bancorp | | | 17,803 | | | | 250,132 | |

First Busey Corp. | | | 2,756 | | | | 13,615 | |

First Commonwealth Financial Corp. | | | 1,832 | | | | 11,212 | |

First Financial Bancorp | | | 3,223 | | | | 55,758 | |

First Financial Bankshares, Inc.(a) | | | 814 | | | | 28,661 | |

First Financial Corp. | | | 585 | | | | 18,574 | |

FirstMerit Corp. | | | 4,070 | | | | 68,620 | |

Fulton Financial Corp. | | | 3,778 | | | | 39,669 | |

Glacier Bancorp, Inc. | | | 3,151 | | | | 47,076 | |

Goldman Sachs Group, Inc. (The) | | | 5,631 | | | | 700,327 | |

Hancock Holding Co. | | | 2,030 | | | | 72,085 | |

Hudson Valley Holding Corp. | | | 806 | | | | 13,001 | |

Huntington Bancshares, Inc. | | | 19,510 | | | | 125,839 | |

Iberiabank Corp. | | | 709 | | | | 37,910 | |

Independent Bank Corp. | | | 656 | | | | 18,847 | |

International Bancshares Corp. | | | 1,682 | | | | 35,574 | |

JPMorgan Chase & Co. | | | 91,371 | | | | 4,201,239 | |

KeyCorp | | | 11,542 | | | | 98,107 | |

M&T Bank Corp. | | | 3,570 | | | | 310,162 | |

MB Financial, Inc. | | | 812 | | | | 17,044 | |

Morgan Stanley | | | 19,849 | | | | 389,834 | |

National Penn Bancshares, Inc. | | | 2,987 | | | | 26,435 | |

NBT Bancorp, Inc. | | | 1,369 | | | | 30,227 | |

Northern Trust Corp. | | | 5,152 | | | | 244,462 | |

Old National Bancorp | | | 2,755 | | | | 36,201 | |

PacWest Bancorp | | | 1,314 | | | | 31,930 | |

Park National Corp.(a) | | | 938 | | | | 64,881 | |

Penns Woods Bancorp, Inc.(a) | | | 429 | | | | 17,538 | |

PNC Financial Services Group, Inc. | | | 9,751 | | | | 628,842 | |

Prosperity Bancshares, Inc. | | | 804 | | | | 36,823 | |

Regions Financial Corp. | | | 15,379 | | | | 101,348 | |

Renasant Corp. | | | 1,207 | | | | 19,650 | |

See Notes to Financial Statements.

| | |

| 12 | | WisdomTree Domestic Dividend Funds |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2012

| | | | | | | | |

| Investments | | Shares | | | Value | |

| | | | | | | | |

S&T Bancorp, Inc.(a) | | | 841 | | | $ | 18,241 | |

S.Y. Bancorp, Inc. | | | 1,007 | | | | 23,362 | |

State Street Corp. | | | 6,606 | | | | 300,573 | |

SunTrust Banks, Inc. | | | 5,858 | | | | 141,588 | |

Susquehanna Bancshares, Inc. | | | 2,486 | | | | 24,562 | |

Synovus Financial Corp.(a) | | | 21,066 | | | | 43,185 | |

TCF Financial Corp.(a) | | | 3,020 | | | | 35,908 | |

Tompkins Financial Corp.(a) | | | 426 | | | | 17,066 | |

TrustCo Bank Corp.(a) | | | 6,708 | | | | 38,303 | |

Trustmark Corp. | | | 1,845 | | | | 46,088 | |

U.S. Bancorp | | | 26,774 | | | | 848,200 | |

UMB Financial Corp. | | | 1,027 | | | | 45,943 | |

Umpqua Holdings Corp. | | | 2,475 | | | | 33,561 | |

United Bankshares, Inc.(a) | | | 2,006 | | | | 57,893 | |

Univest Corp. of Pennsylvania | | | 1,207 | | | | 20,253 | |

Valley National Bancorp(a) | | | 7,600 | | | | 98,420 | |

Washington Trust Bancorp, Inc. | | | 563 | | | | 13,591 | |

Webster Financial Corp. | | | 947 | | | | 21,468 | |

Wells Fargo & Co. | | | 72,902 | | | | 2,488,874 | |

WesBanco, Inc. | | | 1,090 | | | | 21,953 | |

Westamerica Bancorp. | | | 650 | | | | 31,200 | |

| | | | | | | | |

| Total Banks | | | | | | | 14,789,616 | |

| Beverages – 2.9% | |

Beam, Inc. | | | 1,734 | | | | 101,560 | |

Brown-Forman Corp. Class A | | | 811 | | | | 66,064 | |

Brown-Forman Corp. Class B | | | 1,218 | | | | 101,569 | |

Coca-Cola Co. (The) | | | 48,905 | | | | 3,619,459 | |

Coca-Cola Enterprises, Inc. | | | 4,940 | | | | 141,284 | |

Dr. Pepper Snapple Group, Inc. | | | 5,478 | | | | 220,271 | |

Molson Coors Brewing Co. Class B | | | 3,663 | | | | 165,751 | |

PepsiCo, Inc. | | | 38,820 | | | | 2,575,707 | |

| | | | | | | | |

| Total Beverages | | | | | | | 6,991,665 | |

| Biotechnology – 0.4% | |

Amgen, Inc. | | | 12,278 | | | | 834,781 | |

PDL BioPharma, Inc. | | | 10,622 | | | | 67,450 | |

| | | | | | | | |

| Total Biotechnology | | | | | | | 902,231 | |

| Building Materials – 0.1% | |

Eagle Materials, Inc. | | | 620 | | | | 21,545 | |

Lennox International, Inc. | | | 837 | | | | 33,731 | |

Martin Marietta Materials, Inc.(a) | | | 745 | | | | 63,794 | |

Masco Corp. | | | 9,475 | | | | 126,681 | |

Simpson Manufacturing Co., Inc. | | | 641 | | | | 20,672 | |

| | | | | | | | |

| Total Building Materials | | | | | | | 266,423 | |

| Chemicals – 2.5% | |

A. Schulman, Inc. | | | 453 | | | | 12,240 | |

Air Products & Chemicals, Inc. | | | 4,557 | | | | 418,333 | |

Airgas, Inc. | | | 1,004 | | | | 89,326 | |

Albemarle Corp. | | | 1,000 | | | | 63,920 | |

Ashland, Inc. | | | 837 | | | | 51,107 | |

Cabot Corp. | | | 796 | | | | 33,973 | |

Celanese Corp. Series A | | | 575 | | | | 26,553 | |

CF Industries Holdings, Inc. | | | 565 | | | | 103,197 | |

| | | | | | | | |

Cytec Industries, Inc. | | | 432 | | | $ | 26,261 | |

Dow Chemical Co. (The) | | | 35,087 | | | | 1,215,414 | |

E.I. du Pont de Nemours & Co. | | | 26,823 | | | | 1,418,937 | |

Eastman Chemical Co. | | | 2,898 | | | | 149,798 | |

Ecolab, Inc. | | | 2,334 | | | | 144,054 | |

FMC Corp. | | | 403 | | | | 42,662 | |

H.B. Fuller Co. | | | 746 | | | | 24,491 | |

Huntsman Corp. | | | 9,403 | | | | 131,736 | |

Innophos Holdings, Inc. | | | 225 | | | | 11,277 | |

International Flavors & Fragrances, Inc. | | | 1,321 | | | | 77,411 | |

Kronos Worldwide, Inc.(a) | | | 3,157 | | | | 78,736 | |

Monsanto Co. | | | 7,432 | | | | 592,776 | |

Mosaic Co. (The) | | | 1,384 | | | | 76,521 | |

NewMarket Corp. | | | 116 | | | | 21,738 | |

Olin Corp. | | | 2,956 | | | | 64,293 | |

PolyOne Corp. | | | 1,529 | | | | 22,018 | |

PPG Industries, Inc. | | | 3,035 | | | | 290,753 | |

Praxair, Inc. | | | 4,518 | | | | 517,944 | |

RPM International, Inc. | | | 3,317 | | | | 86,872 | |

Sensient Technologies Corp. | | | 715 | | | | 27,170 | |

Sherwin-Williams Co. (The) | | | 1,401 | | | | 152,247 | |

Sigma-Aldrich Corp. | | | 989 | | | | 72,256 | |

Valhi, Inc. | | | 608 | | | | 32,254 | |

Valspar Corp. | | | 1,177 | | | | 56,837 | |

Westlake Chemical Corp. | | | 130 | | | | 8,423 | |

| | | | | | | | |

| Total Chemicals | | | | | | | 6,141,528 | |

| Coal – 0.1% | |

Arch Coal, Inc. | | | 6,344 | | | | 67,944 | |

Consol Energy, Inc. | | | 2,271 | | | | 77,441 | |

Peabody Energy Corp. | | | 2,319 | | | | 67,158 | |

Walter Energy, Inc. | | | 1,078 | | | | 63,829 | |

| | | | | | | | |

| Total Coal | | | | | | | 276,372 | |

| Commercial Services – 1.3% | |

ABM Industries, Inc. | | | 1,272 | | | | 30,910 | |

Advance America, Cash Advance Centers, Inc. | | | 2,758 | | | | 28,931 | |

Automatic Data Processing, Inc. | | | 11,603 | | | | 640,370 | |

Brink’s Co. (The) | | | 675 | | | | 16,112 | |

Corporate Executive Board Co. (The) | | | 535 | | | | 23,010 | |

Deluxe Corp. | | | 2,170 | | | | 50,821 | |

DeVry, Inc. | | | 481 | | | | 16,291 | |

Electro Rent Corp. | | | 1,178 | | | | 21,687 | |

Equifax, Inc. | | | 1,774 | | | | 78,517 | |

H&R Block, Inc. | | | 9,244 | | | | 152,249 | |

Healthcare Services Group, Inc. | | | 2,544 | | | | 54,111 | |

Insperity, Inc. | | | 678 | | | | 20,774 | |

Intersections, Inc. | | | 1,410 | | | | 18,020 | |

Iron Mountain, Inc. | | | 4,527 | | | | 130,378 | |

Landauer, Inc. | | | 438 | | | | 23,223 | |

Lender Processing Services, Inc. | | | 1,734 | | | | 45,084 | |

Lincoln Educational Services Corp. | | | 1,308 | | | | 10,346 | |

Manpower, Inc. | | | 1,122 | | | | 53,149 | |

Mastercard, Inc. Class A | | | 164 | | | | 68,968 | |

McGrath Rentcorp | | | 1,010 | | | | 32,431 | |

See Notes to Financial Statements.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 13 | |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2012

| | | | | | | | |

| Investments | | Shares | | | Value | |

| | | | | | | | |

Moody’s Corp. | | | 2,906 | | | $ | 122,343 | |

Paychex, Inc. | | | 12,270 | | | | 380,247 | |

Quad Graphics, Inc.(a) | | | 1,711 | | | | 23,783 | |

R.R. Donnelley & Sons Co.(a) | | | 10,061 | | | | 124,656 | |

Rent-A-Center, Inc. | | | 806 | | | | 30,426 | |

Robert Half International, Inc. | | | 2,420 | | | | 73,326 | |

Rollins, Inc. | | | 2,030 | | | | 43,198 | |

SEI Investments Co. | | | 1,362 | | | | 28,180 | |

Service Corp. International | | | 3,918 | | | | 44,117 | |

Sotheby’s | | | 611 | | | | 24,037 | |

Strayer Education, Inc.(a) | | | 398 | | | | 37,523 | |

Total System Services, Inc. | | | 2,842 | | | | 65,565 | |

Towers Watson & Co. Class A | | | 283 | | | | 18,698 | |

Visa, Inc. Class A | | | 3,560 | | | | 420,080 | |

Weight Watchers International, Inc.(a) | | | 725 | | | | 55,963 | |

Western Union Co. (The) | | | 8,726 | | | | 153,578 | |

| | | | | | | | |

| Total Commercial Services | | | | | | | 3,161,102 | |

| Computers – 1.7% | |

Computer Sciences Corp. | | | 3,573 | | | | 106,976 | |

Diebold, Inc. | | | 2,414 | | | | 92,987 | |

DST Systems, Inc. | | | 429 | | | | 23,265 | |

Hewlett-Packard Co. | | | 27,715 | | | | 660,448 | |

International Business Machines Corp. | | | 14,504 | | | | 3,026,260 | |

j2 Global, Inc.(a) | | | 1,255 | | | | 35,993 | |

Jack Henry & Associates, Inc. | | | 1,111 | | | | 37,907 | |

Lexmark International, Inc. Class A(a) | | | 1,665 | | | | 55,345 | |

MTS Systems Corp. | | | 430 | | | | 22,829 | |

| | | | | | | | |

| Total Computers | | | | | | | 4,062,010 | |

| Cosmetics/Personal Care – 2.4% | |

Avon Products, Inc. | | | 17,204 | | | | 333,069 | |

Colgate-Palmolive Co. | | | 9,668 | | | | 945,337 | |

Estee Lauder Cos., Inc. (The) Class A | | | 1,876 | | | | 116,200 | |

Procter & Gamble Co. (The) | | | 68,211 | | | | 4,584,461 | |

| | | | | | | | |

| Total Cosmetics/Personal Care | | | | | | | 5,979,067 | |

| Distribution/Wholesale – 0.3% | |

Fastenal Co. | | | 3,267 | | | | 176,745 | |

Genuine Parts Co. | | | 3,777 | | | | 237,007 | |

Owens & Minor, Inc. | | | 1,825 | | | | 55,498 | |

Pool Corp. | | | 1,188 | | | | 44,455 | |

United Stationers, Inc. | | | 704 | | | | 21,845 | |

W.W. Grainger, Inc. | | | 823 | | | | 176,789 | |

Watsco, Inc. | | | 854 | | | | 63,230 | |

| | | | | | | | |

| Total Distribution/Wholesale | | | | | | | 775,569 | |

| Diversified Financial Services – 1.8% | | | | | | | | |

American Express Co. | | | 13,709 | | | | 793,203 | |

Ameriprise Financial, Inc. | | | 3,529 | | | | 201,612 | |

Artio Global Investors, Inc. | | | 2,985 | | | | 14,238 | |

BGC Partners, Inc. Class A | | | 9,166 | | | | 67,737 | |

BlackRock, Inc. | | | 3,389 | | | | 694,406 | |

CBOE Holdings, Inc. | | | 1,260 | | | | 35,809 | |

Charles Schwab Corp. (The) | | | 20,844 | | | | 299,528 | |

CME Group, Inc. | | | 1,151 | | | | 333,019 | |

| | | | | | | | |

Cohen & Steers, Inc. | | | 1,111 | | | $ | 35,441 | |

Discover Financial Services | | | 4,203 | | | | 140,128 | |

Eaton Vance Corp.(a) | | | 3,003 | | | | 85,826 | |

Evercore Partners, Inc. Class A | | | 800 | | | | 23,256 | |

Federated Investors, Inc. Class B(a) | | | 5,323 | | | | 119,288 | |

Franklin Resources, Inc. | | | 1,752 | | | | 217,301 | |

GFI Group, Inc. | | | 5,588 | | | | 21,011 | |

Greenhill & Co., Inc. | | | 1,157 | | | | 50,492 | |

Horizon Technology Finance Corp. | | | 946 | | | | 15,713 | |

Interactive Brokers Group, Inc. Class A | | | 1,258 | | | | 21,386 | |

Janus Capital Group, Inc. | | | 5,332 | | | | 47,508 | |

Jefferies Group, Inc. | | | 3,630 | | | | 68,389 | |

Legg Mason, Inc. | | | 1,446 | | | | 40,387 | |

Medley Capital Corp. | | | 1,857 | | | | 20,928 | |

Nelnet, Inc. Class A | | | 649 | | | | 16,816 | |

NYSE Euronext | | | 9,309 | | | | 279,363 | |

Raymond James Financial, Inc. | | | 1,839 | | | | 67,179 | |

SLM Corp. | | | 10,844 | | | | 170,901 | |

T. Rowe Price Group, Inc. | | | 4,611 | | | | 301,098 | |

TD Ameritrade Holding Corp. | | | 6,453 | | | | 127,382 | |

Waddell & Reed Financial, Inc. Class A | | | 2,035 | | | | 65,954 | |

Walter Investment Management Corp. | | | 2,042 | | | | 46,047 | |

| | | | | | | | |

| Total Diversified Financial Services | | | | | | | 4,421,346 | |

| Electric – 5.8% | | | | | | | | |

ALLETE, Inc. | | | 1,461 | | | | 60,617 | |

Alliant Energy Corp. | | | 3,523 | | | | 152,616 | |

Ameren Corp. | | | 9,415 | | | | 306,741 | |

American Electric Power Co., Inc. | | | 17,935 | | | | 691,932 | |

Avista Corp. | | | 2,039 | | | | 52,158 | |

Black Hills Corp. | | | 1,263 | | | | 42,348 | |

Central Vermont Public Service Corp. | | | 496 | | | | 17,459 | |

CH Energy Group, Inc. | | | 579 | | | | 38,637 | |

Cleco Corp. | | | 1,447 | | | | 57,374 | |

CMS Energy Corp. | | | 7,959 | | | | 175,098 | |

Consolidated Edison, Inc. | | | 9,161 | | | | 535,186 | |

Dominion Resources, Inc. | | | 17,084 | | | | 874,872 | |

DTE Energy Co. | | | 5,925 | | | | 326,053 | |

Duke Energy Corp. | | | 48,792 | | | | 1,025,120 | |

Edison International | | | 8,368 | | | | 355,724 | |

Entergy Corp. | | | 6,355 | | | | 427,056 | |

Exelon Corp. | | | 28,606 | | | | 1,121,641 | |

FirstEnergy Corp. | | | 16,021 | | | | 730,397 | |

Great Plains Energy, Inc. | | | 4,408 | | | | 89,350 | |

Hawaiian Electric Industries, Inc. | | | 3,692 | | | | 93,592 | |

IDACORP, Inc. | | | 1,204 | | | | 49,508 | |

Integrys Energy Group, Inc. | | | 3,255 | | | | 172,482 | |

ITC Holdings Corp. | | | 821 | | | | 63,168 | |

MDU Resources Group, Inc. | | | 4,605 | | | | 103,106 | |

MGE Energy, Inc. | | | 770 | | | | 34,180 | |

National Fuel Gas Co. | | | 1,734 | | | | 83,440 | |

NextEra Energy, Inc. | | | 12,518 | | | | 764,599 | |

Northeast Utilities | | | 4,317 | | | | 160,247 | |

NorthWestern Corp. | | | 1,410 | | | | 49,999 | |

NSTAR | | | 2,924 | | | | 142,194 | |

See Notes to Financial Statements.

| | |

| 14 | | WisdomTree Domestic Dividend Funds |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2012

| | | | | | | | |

| Investments | | Shares | | | Value | |

| | | | | | | | |

NV Energy, Inc. | | | 6,414 | | | $ | 103,394 | |

OGE Energy Corp. | | | 2,189 | | | | 117,112 | |

Otter Tail Corp.(a) | | | 1,377 | | | | 29,881 | |

Pepco Holdings, Inc. | | | 9,793 | | | | 184,990 | |

PG&E Corp. | | | 13,703 | | | | 594,847 | |

Pinnacle West Capital Corp. | | | 3,890 | | | | 186,331 | |

PNM Resources, Inc. | | | 2,031 | | | | 37,167 | |

Portland General Electric Co. | | | 2,813 | | | | 70,269 | |

PPL Corp. | | | 21,569 | | | | 609,540 | |

Progress Energy, Inc. | | | 10,295 | | | | 546,767 | |

Public Service Enterprise Group, Inc. | | | 17,090 | | | | 523,125 | |

SCANA Corp.(a) | | | 4,387 | | | | 200,091 | |

Southern Co. (The) | | | 28,153 | | | | 1,264,914 | |

TECO Energy, Inc. | | | 7,926 | | | | 139,101 | |

UIL Holdings Corp. | | | 2,181 | | | | 75,812 | |

Unisource Energy Corp. | | | 1,211 | | | | 44,286 | |

Unitil Corp. | | | 681 | | | | 18,271 | |

Westar Energy, Inc. | | | 4,383 | | | | 122,417 | |

Wisconsin Energy Corp. | | | 5,410 | | | | 190,324 | |

Xcel Energy, Inc. | | | 15,140 | | | | 400,756 | |

| | | | | | | | |

| Total Electric | | | | | | | 14,256,289 | |

| Electrical Components & Equipment – 0.5% | | | | | | | | |

Acuity Brands, Inc. | | | 534 | | | | 33,551 | |

AMETEK, Inc. | | | 940 | | | | 45,599 | |

Emerson Electric Co. | | | 18,732 | | | | 977,436 | |

Hubbell, Inc. Class B | | | 1,188 | | | | 93,353 | |

Littelfuse, Inc. | | | 400 | | | | 25,080 | |

Molex, Inc. | | | 2,016 | | | | 56,690 | |

Molex, Inc. Class A | | | 3,409 | | | | 79,941 | |

| | | | | | | | |

| Total Electrical Components & Equipment | | | | | | | 1,311,650 | |

| Electronics – 0.6% | | | | | | | | |

American Science & Engineering, Inc. | | | 266 | | | | 17,835 | |

Amphenol Corp. Class A | | | 1,156 | | | | 69,094 | |

AVX Corp. | | | 2,353 | | | | 31,201 | |

Brady Corp. Class A | | | 1,119 | | | | 36,200 | |

FLIR Systems, Inc. | | | 1,030 | | | | 26,069 | |

Gentex Corp. | | | 2,057 | | | | 50,397 | |

Honeywell International, Inc. | | | 16,885 | | | | 1,030,829 | |

Jabil Circuit, Inc. | | | 2,746 | | | | 68,980 | |

National Instruments Corp. | | | 1,909 | | | | 54,445 | |

PerkinElmer, Inc. | | | 1,579 | | | | 43,675 | |

Woodward, Inc. | | | 398 | | | | 17,046 | |

| | | | | | | | |

| Total Electronics | | | | | | | 1,445,771 | |

| Energy-Alternate Sources – 0.0% | | | | | | | | |

FutureFuel Corp. | | | 1,369 | | | | 15,032 | |

| Engineering & Construction – 0.1% | | | | | | | | |

Fluor Corp. | | | 1,362 | | | | 81,774 | |

Granite Construction, Inc. | | | 570 | | | | 16,382 | |

KBR, Inc. | | | 1,249 | | | | 44,402 | |

| | | | | | | | |

| Total Engineering & Construction | | | | | | | 142,558 | |

| Entertainment – 0.1% | | | | | | | | |

Cinemark Holdings, Inc. | | | 4,462 | | | | 97,941 | |

| | | | | | | | |

International Game Technology | | | 3,468 | | | $ | 58,228 | |

National CineMedia, Inc. | | | 3,477 | | | | 53,198 | |

Regal Entertainment Group Class A(a) | | | 6,871 | | | | 93,446 | |

Speedway Motorsports, Inc. | | | 1,321 | | | | 24,676 | |

Vail Resorts, Inc. | | | 485 | | | | 20,976 | |

| | | | | | | | |

| Total Entertainment | | | | | | | 348,465 | |

| Environmental Control – 0.4% | | | | | | | | |

Covanta Holding Corp. | | | 2,547 | | | | 41,338 | |

Mine Safety Appliances Co. | | | 1,111 | | | | 45,640 | |

Republic Services, Inc. | | | 8,728 | | | | 266,728 | |

U.S. Ecology, Inc. | | | 745 | | | | 16,196 | |

Waste Connections, Inc. | | | 788 | | | | 25,634 | |

Waste Management, Inc. | | | 14,991 | | | | 524,085 | |

| | | | | | | | |

| Total Environmental Control | | | | | | | 919,621 | |

| Food – 2.5% | | | | | | | | |

B&G Foods, Inc. | | | 1,828 | | | | 41,148 | |

Campbell Soup Co. | | | 8,796 | | | | 297,745 | |

ConAgra Foods, Inc. | | | 12,195 | | | | 320,241 | |

Corn Products International, Inc. | | | 928 | | | | 53,499 | |

Flowers Foods, Inc. | | | 3,847 | | | | 78,363 | |

General Mills, Inc. | | | 15,176 | | | | 598,693 | |

H.J. Heinz Co. | | | 8,965 | | | | 480,076 | |

Harris Teeter Supermarkets, Inc. | | | 805 | | | | 32,280 | |

Hershey Co. (The) | | | 3,007 | | | | 184,419 | |

Hormel Foods Corp. | | | 4,266 | | | | 125,932 | |

J.M. Smucker Co. (The) | | | 2,190 | | | | 178,178 | |

Kellogg Co. | | | 9,825 | | | | 526,915 | |

Kraft Foods, Inc. Class A | | | 42,874 | | | | 1,629,641 | |

Kroger Co. (The) | | | 9,151 | | | | 221,729 | |

Lancaster Colony Corp. | | | 549 | | | | 36,487 | |

McCormick & Co., Inc. | | | 2,348 | | | | 127,802 | |

Safeway, Inc.(a) | | | 7,656 | | | | 154,728 | |

Sanderson Farms, Inc.(a) | | | 318 | | | | 16,863 | |

Sara Lee Corp. | | | 11,820 | | | | 254,485 | |

Snyders-Lance, Inc. | | | 1,768 | | | | 45,703 | |

SUPERVALU, Inc.(a) | | | 8,871 | | | | 50,653 | |

Sysco Corp. | | | 16,744 | | | | 499,976 | |

Tyson Foods, Inc. Class A | | | 1,918 | | | | 36,730 | |

Weis Markets, Inc. | | | 853 | | | | 37,191 | |

Whole Foods Market, Inc. | | | 1,112 | | | | 92,518 | |

| | | | | | | | |

| Total Food | | | | | | | 6,121,995 | |

| Forest Products & Paper – 0.2% | | | | | | | | |

International Paper Co. | | | 12,404 | | | | 435,380 | |

MeadWestvaco Corp. | | | 4,233 | | | | 133,721 | |

PH Glatfelter Co. | | | 1,098 | | | | 17,326 | |

| | | | | | | | |

| Total Forest Products & Paper | | | | | | | 586,427 | |

| Gas – 0.7% | | | | | | | | |

AGL Resources, Inc. | | | 2,779 | | | | 108,992 | |

Atmos Energy Corp. | | | 2,621 | | | | 82,457 | |

CenterPoint Energy, Inc. | | | 13,886 | | | | 273,832 | |

Chesapeake Utilities Corp. | | | 162 | | | | 6,661 | |

Laclede Group, Inc. (The) | | | 907 | | | | 35,391 | |

See Notes to Financial Statements.

| | | | |

| WisdomTree Domestic Dividend Funds | | | 15 | |

Schedule of Investments (continued)

WisdomTree Total Dividend Fund (DTD)

March 31, 2012

| | | | | | | | |

| Investments | | Shares | | | Value | |

| | | | | | | | |

New Jersey Resources Corp. | | | 1,100 | | | $ | 49,027 | |

NiSource, Inc. | | | 8,588 | | | | 209,118 | |

Northwest Natural Gas Co. | | | 720 | | | | 32,688 | |

Piedmont Natural Gas Co., Inc.(a) | | | 2,114 | | | | 65,682 | |

Questar Corp. | | | 4,580 | | | | 88,211 | |

Sempra Energy | | | 6,036 | | | | 361,919 | |

South Jersey Industries, Inc. | | | 752 | | | | 37,630 | |

Southwest Gas Corp. | | | 848 | | | | 36,244 | |

UGI Corp. | | | 3,354 | | | | 91,396 | |

Vectren Corp. | | | 3,188 | | | | 92,643 | |

WGL Holdings, Inc. | | | 1,566 | | | | 63,736 | |

| | | | | | | | |

| Total Gas | | | | | | | 1,635,627 | |

| Hand/Machine Tools – 0.2% | | | | | | | | |

Kennametal, Inc. | | | 1,278 | | | | 56,909 | |

Lincoln Electric Holdings, Inc. | | | 1,458 | | | | 66,077 | |

Regal-Beloit Corp. | | | 553 | | | | 36,249 | |

Snap-On, Inc. | | | 1,248 | | | | 76,091 | |

Stanley Black & Decker, Inc. | | | 3,368 | | | | 259,201 | |

| | | | | | | | |

| Total Hand/Machine Tools | | | | | | | 494,527 | |

| Healthcare-Products – 1.1% | | | | | | | | |

Baxter International, Inc. | | | 11,885 | | | | 710,485 | |

Becton Dickinson and Co. | | | 4,113 | | | | 319,374 | |

C.R. Bard, Inc. | | | 623 | | | | 61,503 | |

DENTSPLY International, Inc. | | | 752 | | | | 30,178 | |

Hill-Rom Holdings, Inc. | | | 800 | | | | 26,728 | |

Medtronic, Inc. | | | 22,116 | | | | 866,726 | |

Meridian Bioscience, Inc. | | | 1,726 | | | | 33,450 | |

Patterson Cos., Inc. | | | 1,217 | | | | 40,648 | |

St. Jude Medical, Inc. | | | 5,602 | | | | 248,225 | |

STERIS Corp. | | | 737 | | | | 23,304 | |

Stryker Corp. | | | 4,442 | | | | 246,442 | |

Techne Corp. | | | 536 | | | | 37,574 | |

Teleflex, Inc. | | | 822 | | | | 50,265 | |

West Pharmaceutical Services, Inc. | | | 461 | | | | 19,606 | |

| | | | | | | | |

| Total Healthcare-Products | | | | | | | 2,714,508 | |

| Healthcare-Services – 0.6% | | | | | | | | |

Aetna, Inc. | | | 3,884 | | | | 194,821 | |

Humana, Inc. | | | 1,384 | | | | 127,992 | |

Lincare Holdings, Inc. | | | 2,321 | | | | 60,067 | |

National Healthcare Corp. | | | 419 | | | | 19,090 | |

Quest Diagnostics, Inc. | | | 1,219 | | | | 74,542 | |

UnitedHealth Group, Inc. | | | 11,205 | | | | 660,423 | |

WellPoint, Inc. | | | 3,820 | | | | 281,916 | |

| | | | | | | | |

| Total Healthcare-Services | | | | | | | 1,418,851 | |

| Holding Companies-Diversified – 0.0% | | | | | | | | |

Leucadia National Corp. | | | 1,921 | | | | 50,138 | |

| Home Builders – 0.1% | | | | | | | | |

D.R. Horton, Inc. | | | 4,035 | | | | 61,211 | |

KB Home(a) | | | 3,254 | | | | 28,961 | |

Lennar Corp. Class A(a) | | | 1,557 | | | | 42,319 | |

MDC Holdings, Inc. | | | 1,648 | | | | 42,502 | |

Ryland Group, Inc. (The) | | | 832 | | | | 16,041 | |

| | | | | | | | |

Thor Industries, Inc. | | | 1,298 | | | $ | 40,965 | |

| | | | | | | | |

| Total Home Builders | | | | | | | 231,999 | |

| Home Furnishings – 0.1% | | | | | | | | |

Harman International Industries, Inc. | | | 470 | | | | 22,001 | |

Whirlpool Corp. | | | 2,426 | | | | 186,462 | |

| | | | | | | | |

| Total Home Furnishings | | | | | | | 208,463 | |

| Household Products/Wares – 0.6% | | | | | | | | |

American Greetings Corp. Class A | | | 538 | | | | 8,253 | |

Avery Dennison Corp. | | | 2,976 | | | | 89,667 | |

Church & Dwight Co., Inc. | | | 1,558 | | | | 76,638 | |

Clorox Co. (The) | | | 3,730 | | | | 256,437 | |

Ennis, Inc. | | | 1,275 | | | | 20,171 | |