UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21864

WisdomTree Trust

(Exact name of registrant as specified in charter)

250 West 34th Street, 3rd Floor

New York, NY 10119

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (866) 909-9473

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| | (a) | The Reports to Shareholders are attached hereto. |

WisdomTree Trust

Annual Report

March 31, 2022

WisdomTree U.S. AI Enhanced Value Fund (AIVL)

(formerly, WisdomTree U.S. Dividend ex-Financials Fund (DTN))

WisdomTree U.S. ESG Fund (RESP)

WisdomTree U.S. Growth & Momentum Fund (WGRO)

WisdomTree U.S. High Dividend Fund (DHS)

WisdomTree U.S. LargeCap Dividend Fund (DLN)

WisdomTree U.S. LargeCap Fund (EPS)

WisdomTree U.S. MidCap Dividend Fund (DON)

WisdomTree U.S. MidCap Fund (EZM)

WisdomTree U.S. Multifactor Fund (USMF)

WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

WisdomTree U.S. SmallCap Dividend Fund (DES)

WisdomTree U.S. SmallCap Fund (EES)

WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS)

WisdomTree U.S. Total Dividend Fund (DTD)

WisdomTree U.S. Value Fund (WTV)

(formerly, WisdomTree U.S. Quality Shareholder Yield Fund (QSY))

Table of Contents

“WisdomTree” is a registered mark of WisdomTree Investments, Inc. and is licensed for use by the WisdomTree Trust.

Market Environment Overview

(unaudited)

U.S. equity markets, as measured by the S&P 500 Index, returned 15.65% in U.S. dollar terms for the 12-month fiscal period ending March 31, 2022 (the “period”).

U.S. equities moved higher for most of the period as the global economy continued its recovery from the onset of the COVID-19 pandemic in 2020. Vaccine accessibility established confidence in markets as the U.S. economy steadily began to reopen, promoting a revival in cyclical sectors that had been suppressed the year prior. The pace of economic growth accelerated during 2021, along with inflation rates, amid a backdrop of accommodative monetary policy. U.S. real gross domestic product (“GDP”) grew 5.7%, while inflation increased nearly 5% year-over-year during 2021.

During the second quarter of 2021, U.S. markets steadily increased as vaccines became widely approved and accessible for most demographics. The S&P 500 earned over 8.5%, while U.S. small-cap stocks (proxied by the Russell 2000 Index), favored by risk-on investors, returned roughly 4.3% as the economic recovery continued. Real GDP grew 6.7% during the quarter.

The third quarter of 2021 was more tempered than the previous quarter. The S&P 500 was flat during the quarter, as early summertime optimism faded when new and potentially more infectious COVID-19 variants appeared and spread throughout the country. This ignited fear of renewed “lockdowns”, prompting questions of vaccine efficacy, and threatened the ongoing economic recovery. U.S. small-cap stocks suffered during the risk-off quarter, falling about 4.36%, while the U.S. economy briefly sputtered, growing only about 2.3% in real terms (i.e., net of inflation effects).

Entering the fourth quarter of 2021, investors’ concerns quickly abated, and markets regained their footing. The U.S. economy continued to grow and the ongoing monetary policy support from the U.S. Federal Reserve (the “Fed”) helped boost markets. The S&P 500 returned over 11% to finish the 2021 calendar year, while U.S. small-cap stocks fluctuated and managed to hang on to 2.14% gains. As 2021 concluded, investors acknowledged that the economy had recovered quickly and efficiently, and feared that 2022 would likely see the end of the accommodative monetary policies that helped strengthen equity markets. The U.S. unemployment rate fell below 4% by the end of 2021, approaching pre-pandemic lows. Real GDP grew nearly 7% during the quarter.

With 2021 in rearview, investors began 2022 with several concerns that led to risk-off sentiments in the first quarter of 2022. At the forefront were concerns about runaway inflation, and the expectation that the Fed would have to quickly intervene with restrictive monetary policy actions to temper rising inflation. Interest rates rose quickly as bonds sold-off, and the Fed raised its target federal funds rate for the first time since slashing it to 0% at the onset of the COVID-19 pandemic.

Inflationary and interest rate concerns temporarily took a backseat halfway through the first quarter of 2022, as geopolitical tensions between Russia and Ukraine escalated into war. Investor risk-on sentiment deteriorated, and equities declined for several weeks as markets assessed the developments and prospects for resolution.

As a result, U.S. equities sold off in the first quarter of 2022, owing to the near certainty of several upcoming interest rate hikes amid a tightening cycle and geopolitical tensions between Russia and Ukraine. Though the unemployment rate continued to fall, landing at 3.6%, inflation marched higher to 8.5% year-over-year. The S&P 500 fell 4.60% while U.S. small-cap stocks declined over 7.5%.

Many of these risk factors remain paramount, and U.S. financial market performance will be heavily dependent on developments in the war between Russia and Ukraine, economic data, and upcoming central bank activity.

Each WisdomTree Fund’s performance as set forth in “Management’s Discussion of Funds’ Performance” in the pages that follow should also be viewed in light of the foregoing market environment.

Information about Performance and Shareholder Expense Examples (unaudited)

Performance

The performance tables on the following pages are provided for comparative purposes and represent the period noted. Each Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market price return is based on the market price per share of the Fund. The price used to calculate market price returns is the midpoint of the bid and ask price for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market price returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other exchange traded funds (“ETFs”), NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities.

Fund shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Fund NAV returns are calculated using a Fund’s daily 4:00 p.m. eastern time NAV. Market price returns reflect the midpoint of the bid and ask price as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. Total returns for a period of less than one year are cumulative.

Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end performance information visit www.wisdomtree.com.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and an index is not available for direct investment. In comparison, the Funds’ performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions. Past performance is no guarantee of future results.

Shareholder Expense Examples

Each Fund’s performance table is accompanied by a shareholder expense example. As a shareholder of a WisdomTree Fund, you incur two types of cost: (1) transaction costs, including brokerage commissions on purchases and sales of your Fund shares and (2) ongoing costs, including management fees and other Fund expenses. The examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2021 to March 31, 2022. Except where noted, expenses are calculated using each Fund’s annualized expense ratio (after the effect of contractual or voluntary fee waivers, if any), multiplied by the average account value for the period, multiplied by 182/365 (to reflect the one-half year period). The annualized expense ratio does not include acquired fund fees and expenses (“AFFEs”), which are fees and expenses incurred indirectly by a Fund through its investments in certain underlying investment companies.

Actual expenses

The first line in the shareholder expense example table shown on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during the period.

Hypothetical example for comparison purposes

The second line in the shareholder expense example table shown on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

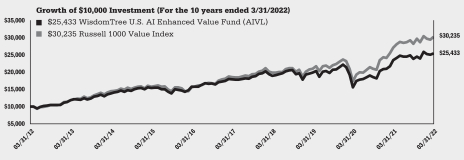

WisdomTree U.S. AI Enhanced Value Fund (AIVL)

(formerly, WisdomTree U.S. Dividend ex-Financials Fund (DTN))

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 21.1% | |

Health Care | | | 17.5% | |

Industrials | | | 16.0% | |

Information Technology | | | 12.7% | |

Consumer Staples | | | 10.2% | |

Materials | | | 7.2% | |

Utilities | | | 5.2% | |

Consumer Discretionary | | | 4.4% | |

Communication Services | | | 2.8% | |

Energy | | | 2.1% | |

Real Estate | | | 0.4% | |

Investment Company | | | 0.1% | |

Other Assets less Liabilities‡ | | | 0.3% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Automatic Data Processing, Inc. | | | 3.5% | |

Roper Technologies, Inc. | | | 2.9% | |

Medtronic PLC | | | 2.5% | |

Mondelez International, Inc., Class A | | | 2.5% | |

Keurig Dr. Pepper, Inc. | | | 2.3% | |

Becton Dickinson and Co. | | | 2.3% | |

CME Group, Inc. | | | 2.3% | |

Intercontinental Exchange, Inc. | | | 2.2% | |

Genpact Ltd. | | | 1.9% | |

Arthur J. Gallagher & Co. | | | 1.8% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree U.S. AI Enhanced Value Fund (the “Fund”) seeks income and capital appreciation by investing primarily in equity securities selected from a universe of U.S. equities that exhibit value characteristics based on the selection results of a proprietary, quantitative artificial intelligence (“AI”) model developed by the Fund’s sub-adviser, Voya Investment Management Co., LLC. Prior to January 18, 2022, Fund performance reflects the investment objective of the Fund when it was the WisdomTree U.S. Dividend ex-Financials Fund and tracked the price and yield performance, before fees and expenses, of the WisdomTree U.S. Dividend ex-Financials Index (the “Former Index”). In seeking to track the Former Index, the Fund invested in high-dividend-yielding companies in the U.S. excluding the financials sector.

The Fund returned 8.19% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from a reduced relative weight in the Healthcare sector and increased relative weight in the Real Estate and Utilities sectors, as well as stock selection within Financials. Lower relative weight to Information Technology and stock selection within that sector detracted from Fund performance. Lower relative weight to non-dividend paying companies and negative earners also benefited Fund performance.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,066.80 | | | | 0.38 | % | | $ | 1.96 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

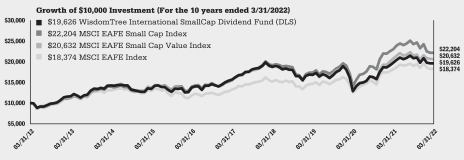

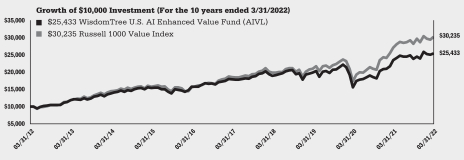

Fund NAV Returns1 | | | 8.19 | % | | | 8.57 | % | | | 7.27 | % | | | 9.78 | % |

Fund Market Price Returns1 | | | 8.08 | % | | | 8.60 | % | | | 7.28 | % | | | 9.78 | % |

Russell 1000® Value Index | | | 11.67 | % | | | 13.02 | % | | | 10.29 | % | | | 11.70 | % |

| 1 | The Fund’s investment objective changed effective January 18, 2022. Prior to January 18, 2022, the Fund’s investment objective sought to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Dividend ex-Financials Index. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

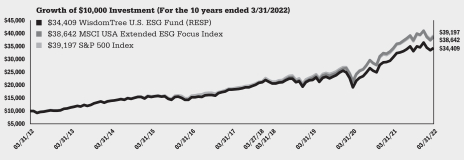

WisdomTree U.S. ESG Fund (RESP)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 30.1% | |

Health Care | | | 13.6% | |

Consumer Discretionary | | | 12.4% | |

Financials | | | 11.5% | |

Communication Services | | | 9.9% | |

Industrials | | | 8.3% | |

Consumer Staples | | | 6.0% | |

Real Estate | | | 2.8% | |

Materials | | | 2.7% | |

Utilities | | | 2.6% | |

Other Assets less Liabilities‡ | | | 0.1% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 7.2% | |

Microsoft Corp. | | | 6.0% | |

Alphabet, Inc., Class A | | | 5.1% | |

Amazon.com, Inc. | | | 3.0% | |

Tesla, Inc. | | | 1.9% | |

Visa, Inc., Class A | | | 1.5% | |

MasterCard, Inc., Class A | | | 1.2% | |

JPMorgan Chase & Co. | | | 0.9% | |

Johnson & Johnson | | | 0.9% | |

UnitedHealth Group, Inc. | | | 0.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

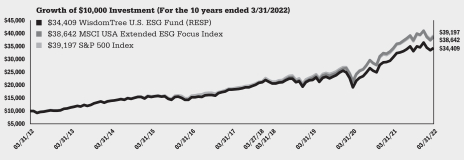

The WisdomTree U.S. ESG Fund (the “Fund”) seeks capital appreciation. The Fund is actively managed using a model-based approach. The Fund seeks to achieve its investment objective by investing primarily in U.S. equity securities that exhibit certain characteristics believed to be indicative of positive future returns as well as incorporating favorable environmental, social, and governance (“ESG”) characteristics.

The Fund returned 11.73% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Materials, Health Care, and Communication Services, primarily due to stock selection effects within each sector. Positions in the Energy, Information Technology, and Consumer Discretionary sectors weighed on performance for the Fund, due to a combination of allocation effects within Energy and stock selection effects within Consumer Discretionary and Information Technology. When analyzing performance by market capitalization, the Fund’s exposure to mid and large cap companies weighed on performance. Mid caps did not perform as poorly as large caps, however, and would have buffered performance on the downside if there had been a larger mid cap allocation.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,037.70 | | | | 0.28 | % | | $ | 1.42 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns1 | | | 11.73 | % | | | 16.17 | % | | | 13.57 | % | | | 13.15 | % |

Fund Market Price Returns1 | | | 11.76 | % | | | 16.25 | % | | | 13.63 | % | | | 13.16 | % |

MSCI USA Extended ESG Focus Index2 | | | 12.93 | % | | | 19.45 | % | | | N/A | | | | N/A | |

S&P 500® Index | | | 15.65 | % | | | 18.92 | % | | | 15.99 | % | | | 14.64 | % |

| 1 | The Fund’s name, investment objective and strategies changed effective March 16, 2020. Prior to March 16, 2020, Fund performance reflects the investment objective of the Fund when it was known as the WisdomTree U.S. Total Market Fund (EXT) and tracked the performance, before fees and expenses, of the WisdomTree U.S. Total Market Index. |

| 2 | The MSCI USA Extended ESG Focus Index began on March 27, 2018, and the line graph for the Index begins at the same value as the Fund on that date. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. Growth & Momentum Fund (WGRO)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 41.1% | |

Financials | | | 16.3% | |

Consumer Discretionary | | | 13.0% | |

Industrials | | | 11.1% | |

Health Care | | | 6.9% | |

Communication Services | | | 4.0% | |

Materials | | | 3.9% | |

Real Estate | | | 3.6% | |

Other Assets less Liabilities‡ | | | 0.1% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

EPAM Systems, Inc. | | | 2.4% | |

Tesla, Inc. | | | 2.1% | |

Alphabet, Inc., Class A | | | 2.1% | |

Arista Networks, Inc. | | | 2.1% | |

Choice Hotels International, Inc. | | | 2.1% | |

Moderna, Inc. | | | 2.0% | |

WESCO International, Inc. | | | 2.0% | |

Marvell Technology, Inc. | | | 2.0% | |

SeaWorld Entertainment, Inc. | | | 2.0% | |

Accenture PLC, Class A | | | 2.0% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

The WisdomTree U.S. Growth & Momentum Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the O’Neil Growth Index (the “Index”), which is comprised of mid- and large capitalization companies that provide exposure to high growth and momentum U.S. listed stocks. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -11.34% at net asset value (“NAV”) for the period from June 24, 2021 through March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from a higher relative weight in the Financials sector. Stock selection in Health Care, Information Technology, and Communication Services detracted from the Fund’s overall performance during the period. Stock selection within the lowest earnings yield, or more expensive, sector of the market detracted from Fund performance.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 890.80 | | | | 0.55 | % | | $ | 2.59 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,022.19 | | | | 0.55 | % | | $ | 2.77 | |

Performance

| | | | |

| | |

| | | Cumulative Total Return | |

| |

| | | Since Inception1 | |

Fund NAV Returns | | | -11.34 | % |

Fund Market Price Returns | | | -11.11 | % |

O’Neil Growth Index | | | -10.94 | % |

Russell 1000® Growth Index | | | 4.41 | % |

MSCI USA Momentum Index | | | -0.49 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on June 24, 2021. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

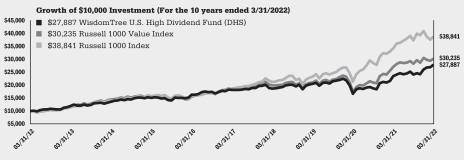

WisdomTree U.S. High Dividend Fund (DHS)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Health Care | | | 18.7% | |

Energy | | | 18.2% | |

Consumer Staples | | | 17.1% | |

Financials | | | 14.7% | |

Utilities | | | 12.3% | |

Communication Services | | | 4.5% | |

Real Estate | | | 4.5% | |

Information Technology | | | 3.0% | |

Industrials | | | 3.0% | |

Materials | | | 2.6% | |

Consumer Discretionary | | | 0.9% | |

Investment Company | | | 0.2% | |

Other Assets less Liabilities‡ | | | 0.3% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Exxon Mobil Corp. | | | 6.5% | |

Chevron Corp. | | | 5.4% | |

AbbVie, Inc. | | | 5.0% | |

Pfizer, Inc. | | | 4.9% | |

Coca-Cola Co. | | | 4.6% | |

Philip Morris International, Inc. | | | 4.5% | |

Altria Group, Inc. | | | 4.3% | |

Verizon Communications, Inc. | | | 4.0% | |

Merck & Co., Inc. | | | 2.9% | |

Cisco Systems, Inc. | | | 2.3% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

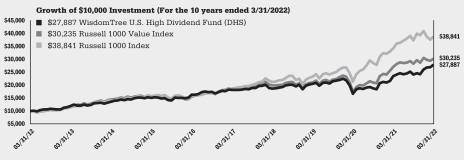

The WisdomTree U.S. High Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. High Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in high dividend yielding companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 18.96% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Energy and Information Technology, mainly due to allocation effects within Energy and stock selection effects within Health Care and Information Technology. Positions in the Financials, Communication Services and Consumer Staples sectors weighed on performance for the Fund, primarily due to stock selection effects within each sector. When analyzing performance by dividend yield attribution, the 5th and 3rd quintiles of companies ranked by dividend yield weighed on performance the most, though their impacts were still positive. The Fund had no exposure to the 5th quintile, which represents the companies with the lowest dividend yields, which was additive. The 3rd quintile’s impact was primarily due to stock selection despite the Fund having minimal exposure to this group. The companies within the 1st quintile, representing those with the highest dividend yield, and a minimal exposure to companies with zero dividend yield were top contributors due to allocation and stock selection.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,159.10 | | | | 0.38 | % | | $ | 2.05 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 18.96 | % | | | 10.76 | % | | | 8.97 | % | | | 10.80 | % |

Fund Market Price Returns | | | 18.95 | % | | | 10.80 | % | | | 9.00 | % | | | 10.81 | % |

WisdomTree U.S. High Dividend Index | | | 19.52 | % | | | 11.20 | % | | | 9.39 | % | | | 11.21 | % |

Russell 1000® Value Index | | | 11.67 | % | | | 13.02 | % | | | 10.29 | % | | | 11.70 | % |

Russell 1000® Index | | | 13.27 | % | | | 18.71 | % | | | 15.82 | % | | | 14.53 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

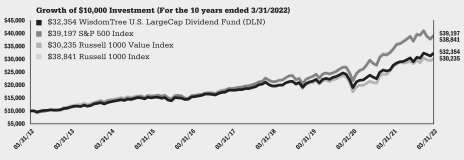

WisdomTree U.S. LargeCap Dividend Fund (DLN)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 16.6% | |

Health Care | | | 16.3% | |

Consumer Staples | | | 15.0% | |

Financials | | | 13.8% | |

Energy | | | 9.4% | |

Industrials | | | 7.8% | |

Utilities | | | 5.8% | |

Real Estate | | | 5.3% | |

Consumer Discretionary | | | 4.9% | |

Communication Services | | | 2.7% | |

Materials | | | 2.1% | |

Investment Company | | | 0.1% | |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Microsoft Corp. | | | 4.5% | |

Apple, Inc. | | | 3.9% | |

Exxon Mobil Corp. | | | 3.4% | |

Johnson & Johnson | | | 3.1% | |

JPMorgan Chase & Co. | | | 2.5% | |

Chevron Corp. | | | 2.4% | |

AbbVie, Inc. | | | 2.3% | |

Pfizer, Inc. | | | 2.2% | |

Procter & Gamble Co. | | | 2.2% | |

Coca-Cola Co. | | | 2.1% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

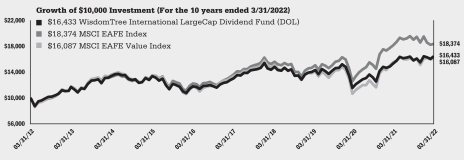

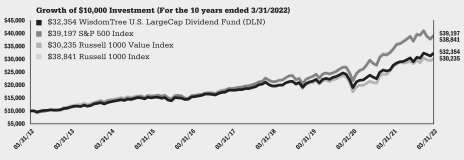

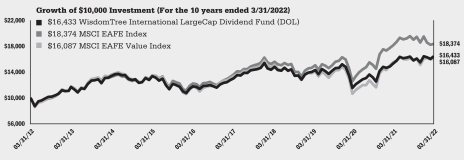

The WisdomTree U.S. LargeCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. LargeCap Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying large-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 17.16% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Information Technology, Industrials and Health Care, due to stock selection effects within each sector. Positions in Financials and Materials weighed on performance, primarily due to stock selection. When analyzing performance by dividend yield attribution, only the 3rd quintile of companies ranked by dividend yield weighed on performance, due to stock selection effects, while all other quintiles were additive. The Fund’s avoidance of companies with zero dividend yield, or representing non-dividend payers, was also additive.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,112.70 | | | | 0.28 | % | | $ | 1.47 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 17.16 | % | | | 14.61 | % | | | 12.51 | % | | | 12.46 | % |

Fund Market Price Returns | | | 17.13 | % | | | 14.66 | % | | | 12.54 | % | | | 12.47 | % |

WisdomTree U.S. LargeCap Dividend Index | | | 17.67 | % | | | 15.00 | % | | | 12.87 | % | | | 12.79 | % |

S&P 500® Index | | | 15.65 | % | | | 18.92 | % | | | 15.99 | % | | | 14.64 | % |

Russell 1000® Value Index | | | 11.67 | % | | | 13.02 | % | | | 10.29 | % | | | 11.70 | % |

Russell 1000® Index | | | 13.27 | % | | | 18.71 | % | | | 15.82 | % | | | 14.53 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. LargeCap Fund (EPS)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 24.7% | |

Financials | | | 15.5% | |

Health Care | | | 14.9% | |

Communication Services | | | 11.4% | |

Consumer Discretionary | | | 10.2% | |

Consumer Staples | | | 6.5% | |

Industrials | | | 6.4% | |

Energy | | | 3.4% | |

Materials | | | 2.8% | |

Utilities | | | 2.5% | |

Real Estate | | | 1.5% | |

Investment Company | | | 0.1% | |

Other Assets less Liabilities‡ | | | 0.1% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 6.0% | |

Microsoft Corp. | | | 5.1% | |

Alphabet, Inc., Class A | | | 4.6% | |

Amazon.com, Inc. | | | 3.9% | |

Meta Platforms, Inc., Class A | | | 2.2% | |

JPMorgan Chase & Co. | | | 2.1% | |

Berkshire Hathaway, Inc., Class B | | | 1.6% | |

AbbVie, Inc. | | | 1.5% | |

Tesla, Inc. | | | 1.5% | |

Johnson & Johnson | | | 1.4% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

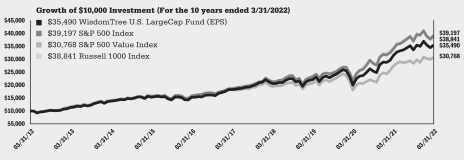

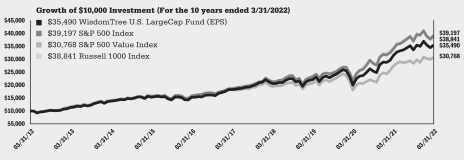

The WisdomTree U.S. LargeCap Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. LargeCap Index (the “Index”). In seeking to track the Index, the Fund invests in earnings-generating large-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 13.19% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Industrials and Materials, primarily due to stock selection effects within each sector. Positions in the Information Technology, Financials and Communication Services sectors weighed on performance for the Fund, as a result of stock selection. When analyzing performance by earnings yield attribution, the 1st and 3rd quintiles of companies ranked by earnings yield detracted from performance, as a result of allocation effects in the former and poor stock selection in the latter. The Fund’s avoidance of companies with negative earnings yield was additive for performance, while an underweight to the 5th quintile, representing the lowest earnings yield, was also beneficial.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,057.30 | | | | 0.08 | % | | $ | 0.41 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,024.53 | | | | 0.08 | % | | $ | 0.40 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 13.19 | % | | | 17.12 | % | | | 14.29 | % | | | 13.50 | % |

Fund Market Price Returns | | | 13.16 | % | | | 17.20 | % | | | 14.33 | % | | | 13.52 | % |

WisdomTree U.S. LargeCap Index | | | 13.30 | % | | | 17.26 | % | | | 14.50 | % | | | 13.77 | % |

S&P 500® Index | | | 15.65 | % | | | 18.92 | % | | | 15.99 | % | | | 14.64 | % |

S&P 500® Value Index | | | 12.58 | % | | | 14.12 | % | | | 11.14 | % | | | 11.89 | % |

Russell 1000® Index | | | 13.27 | % | | | 18.71 | % | | | 15.82 | % | | | 14.53 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. MidCap Dividend Fund (DON)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 24.0% | |

Industrials | | | 11.5% | |

Consumer Discretionary | | | 11.3% | |

Utilities | | | 10.3% | |

Materials | | | 10.0% | |

Real Estate | | | 9.8% | |

Energy | | | 8.2% | |

Consumer Staples | | | 4.9% | |

Information Technology | | | 3.6% | |

Communication Services | | | 3.1% | |

Health Care | | | 3.1% | |

Investment Company | | | 0.0% | * |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

| * | Represents less than 0.1%. |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Evergy, Inc. | | | 1.4% | |

Fidelity National Financial, Inc. | | | 1.3% | |

Omnicom Group, Inc. | | | 1.3% | |

Cardinal Health, Inc. | | | 1.2% | |

Conagra Brands, Inc. | | | 1.1% | |

Continental Resources, Inc. | | | 1.0% | |

Coterra Energy, Inc. | | | 1.0% | |

OGE Energy Corp. | | | 0.9% | |

Antero Midstream Corp. | | | 0.9% | |

Organon & Co. | | | 0.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

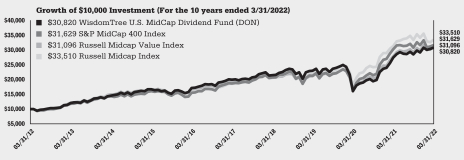

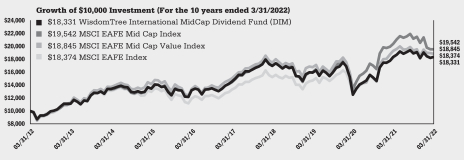

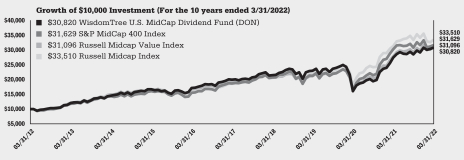

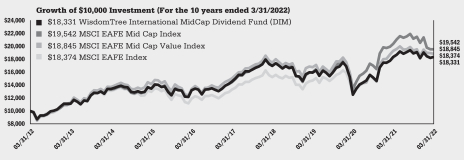

The WisdomTree U.S. MidCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. MidCap Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying mid-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 12.17% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Communication Services, Industrials and Health Care, due to selection effects within each sector. Positions in the Financials, Consumer Discretionary and Consumer Staples sectors weighed on performance for the Fund, attributable to stock selection. When analyzing performance by dividend yield attribution, the companies within the 4th and 1st quintiles weighed on performance the most, as a result of stock selection within both. The Fund’s near lack of exposure to companies with zero dividend yield was additive, while an overweight to the 3rd quintile was beneficial due to allocation effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,080.90 | | | | 0.38 | % | | $ | 1.97 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 12.17 | % | | | 10.28 | % | | | 9.06 | % | | | 11.91 | % |

Fund Market Price Returns | | | 11.76 | % | | | 10.32 | % | | | 9.09 | % | | | 11.92 | % |

WisdomTree U.S. MidCap Dividend Index | | | 12.69 | % | | | 10.67 | % | | | 9.44 | % | | | 12.28 | % |

S&P MidCap 400® Index | | | 4.59 | % | | | 14.14 | % | | | 11.10 | % | | | 12.20 | % |

Russell Midcap Value Index | | | 11.45 | % | | | 13.69 | % | | | 9.99 | % | | | 12.01 | % |

Russell Midcap Index | | | 6.92 | % | | | 14.89 | % | | | 12.62 | % | | | 12.85 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. MidCap Fund (EZM)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 20.0% | |

Consumer Discretionary | | | 16.2% | |

Industrials | | | 13.9% | |

Information Technology | | | 12.3% | |

Materials | | | 9.0% | |

Health Care | | | 8.4% | |

Energy | | | 5.5% | |

Real Estate | | | 4.4% | |

Utilities | | | 3.5% | |

Communication Services | | | 3.3% | |

Consumer Staples | | | 3.1% | |

Investment Company | | | 0.3% | |

Other Assets less Liabilities‡ | | | 0.1% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Cleveland-Cliffs, Inc. | | | 1.4% | |

Ovintiv, Inc. | | | 0.9% | |

United States Steel Corp. | | | 0.9% | |

Alcoa Corp. | | | 0.8% | |

DISH Network Corp., Class A | | | 0.8% | |

NRG Energy, Inc. | | | 0.8% | |

Organon & Co. | | | 0.8% | |

APA Corp. | | | 0.8% | |

Jefferies Financial Group, Inc. | | | 0.7% | |

Kohl’s Corp. | | | 0.7% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

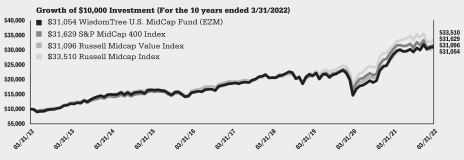

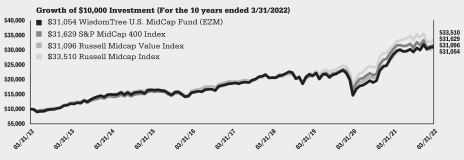

The WisdomTree U.S. MidCap Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. MidCap Index (the “Index”). In seeking to track the Index, the Fund invests in earnings-generating mid-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 8.93% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Communication Services, Materials and Health Care, mainly due to stock selection. Positions in Financials, Information Technology, and Consumer Staples weighed on performance, also due to stock selection within each sector. When analyzing performance by earnings yield attribution, the 3rd and 4th quintiles of companies weighed on performance the most, almost entirely due to stock selection. The Fund’s lack of exposure to companies with negative earnings yield was additive due to allocation effects, while the 1st quintile was also beneficial due to a combination of allocation and stock selection effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,056.60 | | | | 0.38 | % | | $ | 1.95 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 8.93 | % | | | 13.40 | % | | | 10.77 | % | | | 12.00 | % |

Fund Market Price Returns | | | 8.30 | % | | | 13.41 | % | | | 10.74 | % | | | 11.99 | % |

WisdomTree U.S. MidCap Index | | | 9.30 | % | | | 13.79 | % | | | 11.15 | % | | | 12.33 | % |

S&P MidCap 400® Index | | | 4.59 | % | | | 14.14 | % | | | 11.10 | % | | | 12.20 | % |

Russell Midcap Value Index | | | 11.45 | % | | | 13.69 | % | | | 9.99 | % | | | 12.01 | % |

Russell Midcap Index | | | 6.92 | % | | | 14.89 | % | | | 12.62 | % | | | 12.85 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. Multifactor Fund (USMF)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 29.1% | |

Health Care | | | 13.3% | |

Financials | | | 11.4% | |

Consumer Discretionary | | | 11.4% | |

Communication Services | | | 9.6% | |

Industrials | | | 7.8% | |

Consumer Staples | | | 5.9% | |

Energy | | | 3.5% | |

Real Estate | | | 2.8% | |

Materials | | | 2.6% | |

Utilities | | | 2.5% | |

Other Assets less Liabilities‡ | | | 0.1% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Jack Henry & Associates, Inc. | | | 1.4% | |

International Business Machines Corp. | | | 1.4% | |

SS&C Technologies Holdings, Inc. | | | 1.4% | |

Akamai Technologies, Inc. | | | 1.3% | |

FleetCor Technologies, Inc. | | | 1.3% | |

VeriSign, Inc. | | | 1.2% | |

Cognizant Technology Solutions Corp., Class A | | | 1.2% | |

Microsoft Corp. | | | 1.2% | |

Liberty Media Corp.—Liberty Formula One, Class C | | | 1.2% | |

Verizon Communications, Inc. | | | 1.2% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

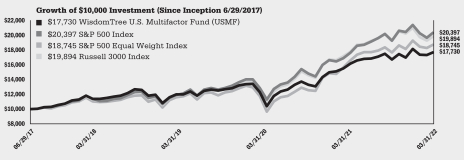

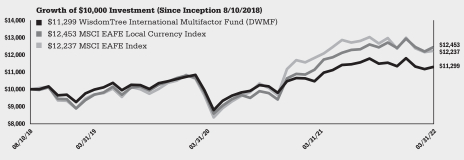

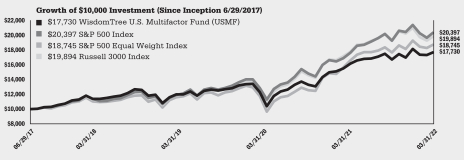

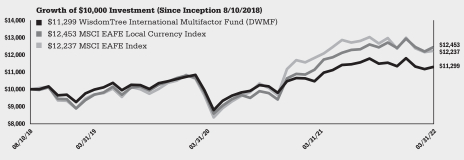

The WisdomTree U.S. Multifactor Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Multifactor Index (the “Index”). In seeking to track the Index, the Fund invests in U.S. companies with the highest composite scores based on two fundamental factors, value and quality measures, and two technical factors, momentum and correlation. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 9.68% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Materials, Real Estate and Energy, due to stock selection effects within each sector. Positions in the Information Technology, Communication Services and Consumer Discretionary sectors weighed on performance for the Fund, due to a combination of allocation and stock selection effects. Information Technology had the most negative impact almost entirely due to poor stock selection. When analyzing performance by market capitalization, large caps had a negative impact due to poor stock selection while mid caps had a negative impact due to allocation effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,059.70 | | | | 0.28 | % | | $ | 1.44 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

Performance

| | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | |

| | | 1 Year | | | 3 Year | | | Since Inception1 | |

Fund NAV Returns | | | 9.68 | % | | | 13.93 | % | | | 12.80 | % |

Fund Market Price Returns | | | 9.35 | % | | | 13.95 | % | | | 12.79 | % |

WisdomTree U.S. Multifactor Index | | | 10.03 | % | | | 14.15 | % | | | 12.96 | % |

S&P 500® Index | | | 15.65 | % | | | 18.92 | % | | | 16.17 | % |

S&P 500® Equal Weight Index | | | 13.11 | % | | | 16.97 | % | | | 14.12 | % |

Russell 3000® Index | | | 11.92 | % | | | 18.24 | % | | | 15.56 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the Cboe BZX Exchange, Inc. on June 29, 2017. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. Quality Dividend Growth Fund (DGRW)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Information Technology | | | 23.6% | |

Consumer Staples | | | 19.4% | |

Industrials | | | 17.7% | |

Health Care | | | 17.1% | |

Consumer Discretionary | | | 9.8% | |

Financials | | | 4.9% | |

Communication Services | | | 2.4% | |

Materials | | | 2.2% | |

Energy | | | 1.6% | |

Real Estate | | | 0.8% | |

Utilities | | | 0.3% | |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Apple, Inc. | | | 5.2% | |

Johnson & Johnson | | | 4.9% | |

Microsoft Corp. | | | 4.7% | |

Procter & Gamble Co. | | | 3.4% | |

Coca-Cola Co. | | | 3.3% | |

Philip Morris International, Inc. | | | 3.2% | |

Merck & Co., Inc. | | | 3.2% | |

Altria Group, Inc. | | | 3.2% | |

Cisco Systems, Inc. | | | 2.5% | |

UnitedHealth Group, Inc. | | | 2.5% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

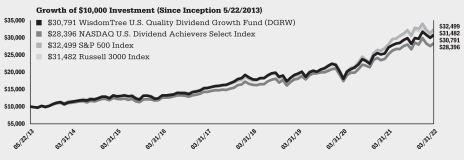

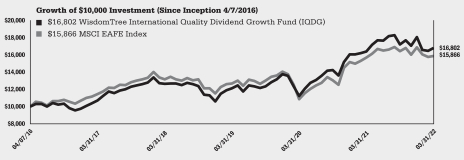

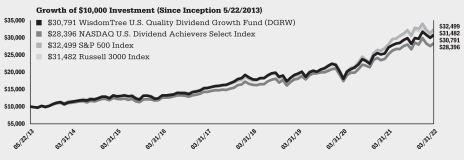

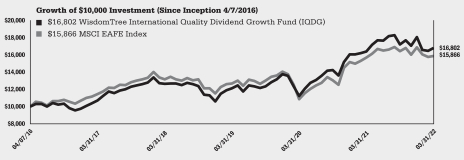

The WisdomTree U.S. Quality Dividend Growth Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Quality Dividend Growth Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying large-cap companies with growth characteristics in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 13.36% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Financials and Industrials, primarily due to stock selection effects within each sector. Positions in the Energy, Information Technology, and Consumer Discretionary sectors weighed on performance for the Fund, due to a combination of allocation and stock selection effects. When analyzing performance by return-on-equity (“ROE“) attribution, the 1st and 2nd quintiles of companies ranked by ROE weighed on performance the most, as a result of stock selection effects. The 3rd Quintile and those companies with negative ROE were top performance contributors due to allocation and stock selection effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,090.20 | | | | 0.28 | % | | $ | 1.46 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since Inception1 | |

Fund NAV Returns | | | 13.36 | % | | | 16.35 | % | | | 14.82 | % | | | 13.53 | % |

Fund Market Price Returns | | | 13.30 | % | | | 16.39 | % | | | 14.85 | % | | | 13.55 | % |

WisdomTree U.S. Quality Dividend Growth Index | | | 13.68 | % | | | 16.70 | % | | | 15.17 | % | | | 13.86 | % |

NASDAQ U.S. Dividend AchieversTM Select Index | | | 12.48 | % | | | 16.12 | % | | | 14.74 | % | | | 12.50 | % |

S&P 500® Index | | | 15.65 | % | | | 18.92 | % | | | 15.99 | % | | | 14.22 | % |

Russell 3000® Index | | | 11.92 | % | | | 18.24 | % | | | 15.40 | % | | | 13.81 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on May 22, 2013. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. SmallCap Dividend Fund (DES)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 24.4% | |

Industrials | | | 17.0% | |

Utilities | | | 10.5% | |

Real Estate | | | 10.3% | |

Consumer Discretionary | | | 10.1% | |

Consumer Staples | | | 6.5% | |

Materials | | | 6.1% | |

Information Technology | | | 5.1% | |

Communication Services | | | 3.8% | |

Energy | | | 3.6% | |

Health Care | | | 2.1% | |

Investment Company | | | 0.1% | |

Other Assets less Liabilities‡ | | | 0.4% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Cogent Communications Holdings, Inc. | | | 1.3% | |

South Jersey Industries, Inc. | | | 1.2% | |

Xerox Holdings Corp. | | | 1.1% | |

New Jersey Resources Corp. | | | 1.0% | |

Spire, Inc. | | | 1.0% | |

ONE Gas, Inc. | | | 1.0% | |

MSC Industrial Direct Co., Inc., Class A | | | 0.9% | |

Vector Group Ltd. | | | 0.9% | |

Greif, Inc., Class A | | | 0.9% | |

NorthWestern Corp. | | | 0.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

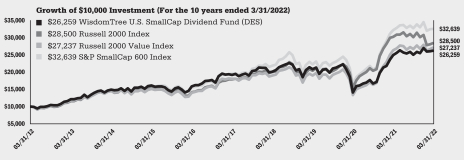

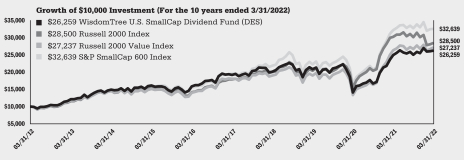

The WisdomTree U.S. SmallCap Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. SmallCap Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying small-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 5.18% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Financials and Real Estate, due to stock selection effects within each sector. Health Care in particular was also beneficial due to a strong allocation effect from minimal exposure. Positions in the Energy and Consumer Discretionary sectors weighed on performance, due to allocation and stock selection effects. Energy in particular had nearly identical negative impacts from both allocation and stock selection. When analyzing performance by dividend yield attribution, the 4th and 5th quintiles of companies weighed on performance the most, owing primarily to stock selection effects. The Fund’s minimal exposure to companies with zero dividend yield was additive, while the 1st quintile was a strong, positive contributor due to allocation effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,048.20 | | | | 0.38 | % | | $ | 1.94 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 5.18 | % | | | 8.01 | % | | | 6.44 | % | | | 10.14 | % |

Fund Market Price Returns | | | 4.61 | % | | | 8.02 | % | | | 6.48 | % | | | 10.12 | % |

WisdomTree U.S. SmallCap Dividend Index | | | 5.58 | % | | | 8.45 | % | | | 6.83 | % | | | 10.38 | % |

Russell 2000® Index | | | -5.79 | % | | | 11.74 | % | | | 9.74 | % | | | 11.04 | % |

Russell 2000® Value Index | | | 3.32 | % | | | 12.73 | % | | | 8.57 | % | | | 10.54 | % |

S&P SmallCap 600® Index | | | 1.23 | % | | | 13.58 | % | | | 10.89 | % | | | 12.56 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. SmallCap Fund (EES)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 24.8% | |

Consumer Discretionary | | | 16.2% | |

Industrials | | | 16.2% | |

Information Technology | | | 10.1% | |

Health Care | | | 10.0% | |

Consumer Staples | | | 4.8% | |

Materials | | | 4.6% | |

Energy | | | 4.0% | |

Communication Services | | | 4.0% | |

Real Estate | | | 3.5% | |

Utilities | | | 1.6% | |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Mr. Cooper Group, Inc. | | | 0.9% | |

Boise Cascade Co. | | | 0.7% | |

Flagstar Bancorp, Inc. | | | 0.6% | |

CNX Resources Corp. | | | 0.6% | |

Whiting Petroleum Corp. | | | 0.6% | |

Atlas Air Worldwide Holdings, Inc. | | | 0.6% | |

Ironwood Pharmaceuticals, Inc. | | | 0.6% | |

Sage Therapeutics, Inc. | | | 0.6% | |

B. Riley Financial, Inc. | | | 0.5% | |

Genworth Financial, Inc., Class A | | | 0.5% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

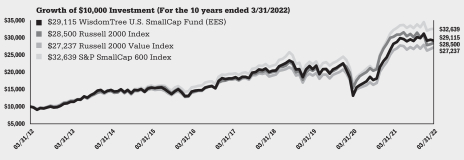

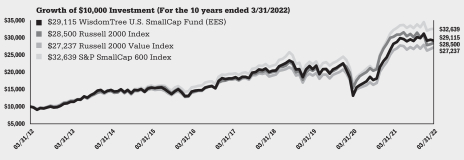

The WisdomTree U.S. SmallCap Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. SmallCap Index (the “Index”). In seeking to track the Index, the Fund invests in earnings-generating small-cap companies in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 3.11% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Financials and Industrials, due to allocation and stock selection effects within each sector. Overall, Health Care contributed the most to Fund performance. Positions in the Energy, Consumer Discretionary and Real Estate sectors weighed on performance for the Fund, almost entirely due to allocation effects. When analyzing performance by earnings yield attribution, the 4th and 5th quintiles of companies ranked by earnings yield weighed on performance the most, owing primarily to allocation effects. The Fund’s lack of exposure to companies with negative earnings yield was additive, while the 1st quintile was a top contributor almost entirely due to allocation effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized Net

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,002.50 | | | | 0.38 | % | | $ | 1.90 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 3.11 | % | | | 11.64 | % | | | 9.88 | % | | | 11.28 | % |

Fund Market Price Returns | | | 2.41 | % | | | 11.66 | % | | | 9.88 | % | | | 11.26 | % |

WisdomTree U.S. SmallCap Index | | | 3.51 | % | | | 11.99 | % | | | 10.20 | % | | | 11.52 | % |

Russell 2000® Index | | | -5.79 | % | | | 11.74 | % | | | 9.74 | % | | | 11.04 | % |

Russell 2000® Value Index | | | 3.32 | % | | | 12.73 | % | | | 8.57 | % | | | 10.54 | % |

S&P SmallCap 600® Index | | | 1.23 | % | | | 13.58 | % | | | 10.89 | % | | | 12.56 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Industrials | | | 24.0% | |

Financials | | | 21.0% | |

Consumer Discretionary | | | 12.8% | |

Utilities | | | 10.5% | |

Materials | | | 8.4% | |

Information Technology | | | 6.4% | |

Consumer Staples | | | 5.7% | |

Health Care | | | 3.5% | |

Real Estate | | | 3.3% | |

Communication Services | | | 2.3% | |

Energy | | | 1.7% | |

Other Assets less Liabilities‡ | | | 0.4% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

EPR Properties | | | 2.4% | |

Xerox Holdings Corp. | | | 2.1% | |

Spire, Inc. | | | 1.9% | |

Artisan Partners Asset Management, Inc., Class A | | | 1.9% | |

ONE Gas, Inc. | | | 1.8% | |

Mercury General Corp. | | | 1.7% | |

MSC Industrial Direct Co., Inc., Class A | | | 1.7% | |

ALLETE, Inc. | | | 1.6% | |

Avista Corp. | | | 1.6% | |

Flowserve Corp. | | | 1.4% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

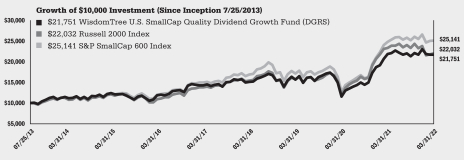

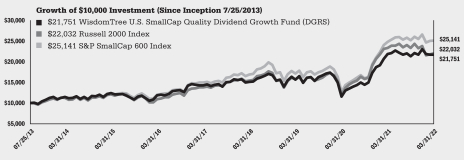

The WisdomTree U.S. SmallCap Quality Dividend Growth Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. SmallCap Quality Dividend Growth Index (the “Index”). In seeking to track the Index, the Fund invests in dividend-paying small-cap companies with growth characteristics in the U.S. equity market. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned -0.45% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Health Care, Utilities and Financials, primarily due to allocation and stock selection effects within each sector. Positions in the Consumer Discretionary, Energy, and Materials sectors weighed on performance for the Fund, primarily due to stock selection. When analyzing performance by return-on-equity (“ROE“) attribution, the 2nd and 1st quintiles of companies ranked by ROE weighed on performance the most, as a result of a combination of allocation and stock selection effects. The companies within the 4th and 3rd quintiles were top performance contributors due to allocation effects in the latter and stock selection in the former.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,018.50 | | | | 0.38 | % | | $ | 1.91 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.04 | | | | 0.38 | % | | $ | 1.92 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since Inception1 | |

Fund NAV Returns | | | -0.45 | % | | | 11.48 | % | | | 8.80 | % | | | 9.36 | % |

Fund Market Price Returns | | | -1.03 | % | | | 11.50 | % | | | 8.78 | % | | | 9.34 | % |

WisdomTree U.S. SmallCap Quality Dividend Growth Index | | | -0.02 | % | | | 11.90 | % | | | 9.16 | % | | | 9.66 | % |

Russell 2000® Index | | | -5.79 | % | | | 11.74 | % | | | 9.74 | % | | | 9.52 | % |

S&P SmallCap 600® Index | | | 1.23 | % | | | 13.58 | % | | | 10.89 | % | | | 11.20 | % |

| 1 | Total returns are calculated based on the commencement of Fund trading on the NASDAQ on July 25, 2013. |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. Total Dividend Fund (DTD)

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 15.8% | |

Information Technology | | | 15.2% | |

Health Care | | | 14.8% | |

Consumer Staples | | | 14.0% | |

Energy | | | 9.2% | |

Industrials | | | 8.4% | |

Utilities | | | 6.4% | |

Consumer Discretionary | | | 5.6% | |

Real Estate | | | 4.8% | |

Communication Services | | | 2.9% | |

Materials | | | 2.7% | |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Microsoft Corp. | | | 4.0% | |

Apple, Inc. | | | 3.5% | |

Exxon Mobil Corp. | | | 3.0% | |

Johnson & Johnson | | | 2.8% | |

JPMorgan Chase & Co. | | | 2.3% | |

Chevron Corp. | | | 2.2% | |

AbbVie, Inc. | | | 2.0% | |

Pfizer, Inc. | | | 2.0% | |

Procter & Gamble Co. | | | 1.9% | |

Coca-Cola Co. | | | 1.9% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

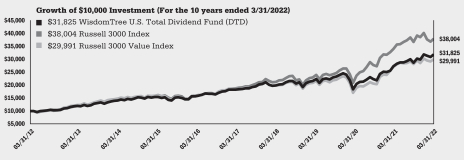

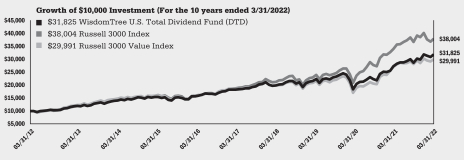

The WisdomTree U.S. Total Dividend Fund (the “Fund”) seeks to track the price and yield performance, before fees and expenses, of the WisdomTree U.S. Dividend Index (the “Index”). In seeking to track the Index, the Fund invests in U.S. equities from a broad range of dividend-paying companies. The Fund generally uses a representative sampling strategy to achieve its investment objective, meaning it generally will invest in a sample of securities in the Index.

The Fund returned 16.73% at net asset value (“NAV”) for the fiscal year ended March 31, 2022 (for more complete performance information please see the table below). The Fund benefited from its positions in Information Technology, Industrials and Health Care, primarily due to stock selection effects within each sector. Positions in Financials and Materials detracted, almost entirely due to stock selection effects. When analyzing performance by dividend yield attribution, all quintiles were beneficial. The 3rd and 2nd quintiles of companies had the least overall impact, while the companies within the 4th quintile were the strongest contributors. The Fund mostly avoided companies with zero dividend yield, which enhanced performance due to allocation effects.

Shareholder Expense Example (for the six-month period ended March 31, 2022)

| | | | | | | | | | | | | | | | |

| | | | | |

| | | Beginning

Account Value | | | Ending

Account Value | | | Annualized

Expense Ratio | | | Expenses Paid

During the

Period | |

Actual | | $ | 1,000.00 | | | $ | 1,110.40 | | | | 0.28 | % | | $ | 1.47 | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,023.54 | | | | 0.28 | % | | $ | 1.41 | |

Performance

| | | | | | | | | | | | | | | | |

| | |

| | | Average Annual Total Return | |

| | | | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

Fund NAV Returns | | | 16.73 | % | | | 13.81 | % | | | 11.83 | % | | | 12.27 | % |

Fund Market Price Returns | | | 16.66 | % | | | 13.84 | % | | | 11.87 | % | | | 12.28 | % |

WisdomTree U.S. Dividend Index | | | 17.06 | % | | | 14.17 | % | | | 12.15 | % | | | 12.60 | % |

Russell 3000® Index | | | 11.92 | % | | | 18.24 | % | | | 15.40 | % | | | 14.28 | % |

Russell 3000® Value Index | | | 11.10 | % | | | 12.99 | % | | | 10.16 | % | | | 11.61 | % |

Performance is historical and does not guarantee future results. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Management’s Discussion of Funds’ Performance

as of March 31, 2022 (unaudited)

WisdomTree U.S. Value Fund (WTV)

(formerly, WisdomTree U.S. Quality Shareholder Yield Fund (QSY))

Sector Breakdown†

| | | | |

| |

| Sector | | % of Net Assets | |

Financials | | | 28.8% | |

Consumer Discretionary | | | 12.9% | |

Health Care | | | 12.1% | |

Information Technology | | | 10.9% | |

Industrials | | | 10.7% | |

Communication Services | | | 8.6% | |

Materials | | | 7.1% | |

Energy | | | 6.2% | |

Consumer Staples | | | 2.0% | |

Utilities | | | 0.5% | |

Other Assets less Liabilities‡ | | | 0.2% | |

Total | | | 100.0% | |

| † | The Fund’s sector breakdown is expressed as a percentage of net assets and may change over time. In addition, a sector may be comprised of several industries. |

| ‡ | Other assets less liabilities may include investment of cash collateral for securities on loan and/or receivables/payables on derivatives (if any). |

Top Ten Holdings*

| | | | |

| |

| Description | | % of Net Assets | |

Credit Acceptance Corp. | | | 1.7% | |

eBay, Inc. | | | 1.6% | |

Lumen Technologies, Inc. | | | 1.6% | |

Allstate Corp. | | | 1.5% | |

Apple, Inc. | | | 1.5% | |

DaVita, Inc. | | | 1.4% | |

Oracle Corp. | | | 1.4% | |

Berkshire Hathaway, Inc., Class B | | | 1.3% | |

Goldman Sachs Group, Inc. | | | 1.3% | |

Cigna Corp. | | | 1.3% | |

| * | The ten largest holdings are subject to change, and there are no guarantees the Fund will remain invested in any particular company. Excludes derivatives and investment of cash collateral for securities on loan (if any). |

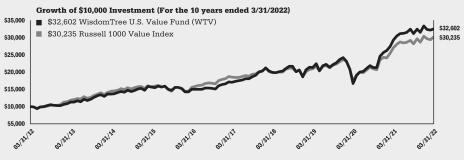

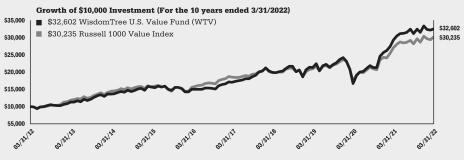

The WisdomTree U.S. Value Fund (the “Fund”) is actively managed using a model-based approach seeking income and capital appreciation by investing primarily in U.S. equity securities that provide a high total shareholder yield with favorable relative quality characteristics. Prior to January 2, 2022, the Fund was known as the WisdomTree U.S. Quality Shareholder Yield Fund (QSY).