December 21, 2021

VIA EDGAR

Ms. Ashley Vroman-Lee

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | WisdomTree Trust File Nos. 333-132380 and 811-21864 |

Dear Ms. Vroman-Lee:

This response is provided on behalf of WisdomTree Trust (the “Trust” or the “Registrant”) with respect to Staff comments received orally on December 13, 2021 regarding the Trust’s Post-Effective Amendment (“PEA”) No. 823, which was filed with the U.S. Securities and Exchange Commission (“SEC”) on October 25, 2021 for the purpose of reflecting changes to the principal investment strategies and principal risks of the WisdomTree Managed Futures Strategy Fund (the “Fund”). The Staff’s comments and the Trust’s responses are set forth below. Capitalized terms used, but not defined, herein have the same meaning given to them in the Trust’s registration statement.

Prospectus

| 1. | Comment: Please confirm that the WisdomTree Code of Ethics will require access persons to pre-clear their transactions in bitcoin and Bitcoin Futures investments. |

Response: We confirm that we have amended the WisdomTree Asset Management code of ethics (the “Code”) to require that Access Persons (each, a “Covered Access Person”) pre-clear transactions in bitcoin and Bitcoin Futures. A breach of the Code by a Covered Access Person is deemed a breach of the Trust’s Code of Ethics and will be reported in accordance with Rule 17j-1.

| 2. | Comment: Please outline discussions that have occurred with authorized participants (“APs”) and market makers regarding the ability to arbitrage the Fund’s anticipated Bitcoin Futures position in a manner expected to keep the secondary market trading price of the Fund’s shares in line with the Fund’s daily net asset value. Please disclose what instruments are expected to be used by APs and/or market makers to arbitrage. Please confirm if there is any impact from the inability of broker-dealers to custody physical bitcoin. |

WisdomTree Asset Management, Inc. 230 Park Avenue, New York, NY 10169 | 212-801-2080 Tel 212-801-2081 Fax

Response: WisdomTree employs a highly experienced capital markets team (including prior experience leading and/or working on ETF trading desks of APs and other market participants) that facilitates contact between market makers, APs and other liquidity providers, including those active in the Fund. WisdomTree does not believe that the Fund’s limited investment in Bitcoin Futures will adversely affect the effective operation of the Fund’s arbitrage mechanism. First and foremost, the Fund’s proposed exposure to bitcoin via Bitcoin Futures would be minimal – up to five percent of the Fund’s net assets – relative to the Fund’s other investment exposures. Thus, while WisdomTree believes that the exposure will be beneficial to the Fund’s overall diversification in non-correlated assets and performance potential, the performance of the Fund’s Bitcoin Futures investments, whether positive or negative, is not expected to materially affect the Fund’s overall performance and will be actively managed in the context of the Fund’s exposure to commodity futures. As a result, WisdomTree does not believe that the risk associated with such exposure would be a meaningful deterrent to APs’ willingness to transact with the Fund to ensure the effective operation of the Fund’s arbitrage mechanism. Discussions with APs and market makers during the past year have confirmed that view. Further, market makers have confirmed their anticipated ability to effectively hedge such Bitcoin Futures exposure, including through other regulated derivatives, such as CME Options on Bitcoin Futures. The fact that Bitcoin Futures are exchange traded with verifiable market prices further mitigates any reluctance on the part of APs or market makers over valuation concerns. Market participants also expressed that there would not be any material impact with respect to the inability of broker-dealers to custody physical bitcoin with respect to maintaining an effective arbitrage mechanism, particularly when viewed in the context of the Fund’s anticipated limited Bitcoin Futures exposure. If the market maker is also an AP or working with an agency AP, the Fund will create and redeem its shares in cash, so market participants have expressed no concerns with respect to the primary market function or ability to maintain an effective arbitrage mechanism.

| 3. | Comment: Please explain supplementally if the Fund’s listing exchange has any unique rules that will affect the Fund’s ability to achieve its investment objective with respect to its investment in Bitcoin Futures, the Fund’s operations, or its ability to interact with APs. |

Response: The Fund is not aware of any unique listing exchange rules that will affect the Fund’s ability to achieve its investment objective with respect to its investment in Bitcoin Futures. Moreover, the Fund’s exposure to Bitcoin Futures is limited and not expected to impact the continued listing of the Fund or the Fund’s operations.

| 4. | Comment: The Staff notes that the Fund changed its principal investment strategy on June 4, 2021, as described in supplements filed on April 1, 2021, and June 4, 2021. Please confirm that Fund performance prior to June 4, 2021 will continue to be reflected in the Fund’s performance presented in the Prospectus with appropriate disclosure noting the change in the Fund’s investment strategy as of that date. Please also provide the updated performance chart via correspondence. |

Response: Confirmed. The Fund’s performance prior to June 4, 2021 will continue to be reflected in the Fund’s performance chart consistent with the requirements of Form N-1A together with disclosure noting the change in the Fund’s investment strategy and its effect on Fund performance. Updated performance tables are set forth in Appendix A.

| 2 |

| 5. | Comment: In accordance with Form N-1A, in Item 9, please include a more robust description of the Fund’s Item 4 investment strategy disclosure. |

Response: The Registrant has included all pertinent information in its Item 4 description of the “Principal Investment Strategies of the Fund” and respectfully declines to duplicate this information in the Fund’s Item 9 disclosure. General Instruction C.3(a) of Form N-1A states that “[i]nformation that is included in response to Items 2 through 8 need not be repeated elsewhere in the prospectus.” Accordingly, the Registrant has not repeated the Fund’s principal investment strategies in the back half of the Prospectus. However, the Registrant has included supplemental information in Item 9 related to the Fund’s principal investment strategy, including information related to the Fund’s use of the WisdomTree Subsidiary, the Fund’s Rule 35d-1 80% policy, and the Fund’s ability to invest in “other investments that the Fund believes will help it achieve its investment objective, including cash and cash equivalents, as well as in shares of other investment companies (including affiliated investment companies, such as ETFs).”

* * * * *

Sincerely,

| /s/Joanne Antico | |

| Joanne Antico, Esq. | |

| Secretary |

| cc: | W. John McGuire, Esq. (Morgan, Lewis & Bockius LLP) Laura E. Flores, Esq. (Morgan, Lewis & Bockius LLP) K. Michael Carlton, Esq. (Morgan, Lewis & Bockius LLP) |

| 3 |

Appendix A

Fund Performance

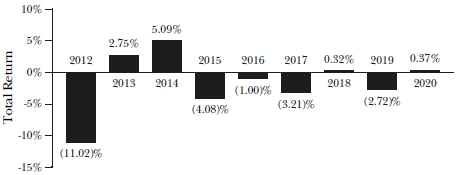

Historical Fund performance, which varies over time, can provide an indication of the risks of investing in the Fund. The bar chart that follows shows the annual total returns of the Fund for each full calendar year since the Fund commenced operations, or the past 10 calendar years, as applicable. The table that follows the bar chart shows the Fund’s average annual total returns, both before and after taxes. This table also shows how the Fund’s performance compares to that of a relevant broad-based securities index. In addition, performance is shown for additional indexes that also represent the asset classes in which the Fund invests. Index returns do not reflect deductions for fees, expenses or taxes. All returns assume reinvestment of dividends and distributions. If WisdomTree Asset Management, Inc. (“WisdomTree Asset Management” or the “Adviser”) had not waived certain fees during certain periods, the Fund’s returns would have been lower. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information for the Fund is available online on the Fund’s website at www.wisdomtree.com.

On June 4, 2021, the Fund’s principal investment strategies were revised; therefore, the performance and average annual total returns shown for periods prior to that date may have differed had the Fund’s current principal investment strategies been in effect during those periods. Fund performance prior to June 4, 2021, reflects the Fund's previous investment strategy when it sought to provide returns that corresponded to the performance of the WisdomTree Managed Futures Index.

The Fund’s year-to-date total return as of September 30, 2021 was 10.41%

Best and Worst Quarter Returns (for the periods reflected in the bar chart above)

| Return | Quarter/Year | |

| Highest Return | 6.35% | 4Q/2020 |

| Lowest Return | (7.96)% | 2Q/2012 |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown and are not relevant if you hold your shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

Average Annual Total Returns for the periods ending December 31, 2020

| WisdomTree Managed Futures Strategy Fund* | 1 Year | 5 Years | Since Inception January 5, 2011 |

| Return Before Taxes Based on NAV | 0.37% | (1.26)% | (2.27)% |

| Return After Taxes on Distributions | 0.17% | (1.71)% | (2.53)% |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.21% | (1.14)% | (1.76)% |

| S&P Diversified Trends Indicator Index (Reflects no deduction for fees, expenses or taxes) | 3.96% | 0.31% | (0.94)% |

| S&P 500 Index (Reflects no deduction for fees, expenses or taxes) | (4.38)% | 8.49% | 11.12% |

| S&P GSCI Index (Reflects no deduction for fees, expenses or taxes) | (23.72)% | (1.85)% | (8.73)% |

| Bloomberg U.S. Aggregate Index (Reflects no deduction for fees, expenses or taxes) | 0.01% | 2.52% | 2.88% |

| * | Prior to June 4, 2021, Fund performance reflects the strategies of the Fund when it sought to provide returns that correspond to the performance of the WisdomTree Managed Futures Index. |

WisdomTree Asset Management, Inc. 230 Park Avenue, New York, NY 10169 | 212-801-2080 Tel 212-801-2081 Fax