|

April 14, 2022

VIA EDGAR

Ms. Ashley Vroman-Lee

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | WisdomTree Trust |

File Nos. 333-132380 and 811-21864

Dear Ms. Vroman-Lee:

This response is provided on behalf of WisdomTree Trust (the “Trust” or the “Registrant”) with respect to Staff comments received orally on March 17, 2022, regarding the Trust’s Post-Effective Amendment (“PEA”) No. 847, which was filed with the U.S. Securities and Exchange Commission (“SEC”) on February 7, 2022, for the purpose of re-naming the WisdomTree Global ex-U.S. Real Estate Fund as the WisdomTree New Economy Real Estate Fund (the “Fund”) and making corresponding material changes to the Fund’s investment objective and principal investment strategies. The Staff’s comments and the Trust’s responses are set forth below. Capitalized terms used, but not defined, herein have the same meaning given to them in the Trust’s registration statement.

Prospectus

| 1. | Comment: Please update the Fund’s series and class identifier information, including the Fund’s name and ticker symbol, on EDGAR. |

Response: The Registrant will make the requested changes to its series and class identifier on EDGAR when it files the Fund’s final registration statement.

| 2. | Comment: Please define “new economy” and revise the Index criteria to indicate that the Index will select companies that derive at least 50% of their revenues or profits from, or invest at least 50% of their assets in, products or services related to the “new economy”. |

WisdomTree Asset Management, Inc. 230 Park Avenue, New York, NY 10169 | 212-801-2080 Tel 212-801-2081 Fax

Response: The Registrant has revised the first sentence of the third paragraph of the “Principal Investment Strategies of the Fund” section of the Prospectus as follows (new disclosure in bold):

The eligible constituents are then further screened based on a proprietary technology score (described below) and a leverage screening to identify REITs and companies identified as being significantly real estate related, which are exposed to the technology and science-related aspects of the “new economy”. The “new economy” is comprised of companies associated with cloud computing, logistics and supply chain management, and life sciences. The Index is comprised of companies that derive at least 50% of their revenues or profits from, or invest at least 50% of their assets in, products or services related to the new economy.

| 3. | Comment: In the second sentence of the fifth paragraph of the “Principal Investment Strategies of the Fund” section of the Prospectus, the Fund states that the investable universe has been “analyzed” and “constituents that are technology focused and have attractive growth and valuation characteristics are overweighted.” Please describe how the constituents are analyzed. Also, please explain what is meant by “technology focused” and “attractive growth”. Is “attractive” growth measured by a certain percentage of growth over a defined period? Lastly, how much are these constituents overweighted? |

Response: The Registrant has revised the fifth paragraph of the “Principal Investment Strategies of the Fund” section of the Prospectus as follows (new disclosure in bold):

The output of the above screening process creates the Index’s investable universe of securities. In accordance with its rules-based methodology, the Index selects the constituents with the highest technology scores for inclusion in the Index. The initial weights of the remaining constituents are determined by the free float market capitalizations of the securities. These weights are then adjusted using a formula that reweights the constituents based on a combination of the technology score described above and the constituent’s growth and valuation rank (collectively referred to as the “New Economy Score”). As a result, securities with strong growth and/or value characteristics, in accordance with the Index, are overweighted in the Index based on their New Economy Scores. The weight of any single security in the Index is limited to no more than 7.5% at the time of the Index rebalance.

| 4. | Comment: In the final sentence of the fifth paragraph of the “Principal Investment Strategies of the Fund” section of the Prospectus, the Fund states that the “weight of any single security in the Index is limited to no more than 7.5% at the time of the Index rebalance.” The Staff also notes that the initial weights of Index constituents are “determined by the free float market capitalizations of the securities.” Based on the Index constituents’ free float market capitalizations at the time of the Index’s initial weighting, will any of the Index constituents exceed the 7.5% weighting cap? |

Response: The Registrant confirms that none of the Index constituents will exceed the 7.5% weighting cap at the time of the Index’s initial weighting.

| 5. | Comment: In the first sentence of the final paragraph of the “Principal Investment Strategies of the Fund” section of the Prospectus, the Fund states that the “Index concentrates in REITs and companies in the real estate sector” and “companies in the [communication services sector] comprised a significant portion of the Index.” Should the bracketed language reference the real estate sector? Or is the Fund also concentrated in the communications services sector? Please revise the disclosure to clarify. |

| 2 |

Response: The Registrant notes that the Index currently concentrates in REITs and companies in the real estate sector only. As a result, the Registrant has revised the disclosure to remove the reference to the communication services sector.

| 6. | Comment: Please consider adding small capitalization investing risk. |

Response: The Registrant notes that small capitalization investing risk is not currently a principal risk of the Fund.

| 7. | Comment: Please provide, via correspondence, the Fund’s updated performance bar chart and average annual total returns table information. |

Response: The Fund’s updated performance bar chart and average annual total returns table are set forth in Appendix A attached hereto.

| 8. | Comment: The Staff notes that all of the Fund’s benchmark indices currently exclude the United States, however, the Fund now has the ability to invest in U.S. securities. Please explain why these benchmark indices are appropriate. |

Response: The Registrant notes that these benchmark indices (Dow Jones Global ex-U.S. Select Real Estate Securities Index and MSCI AC World ex-USA Index) were used by the Fund, prior to this restructure of the Fund, when the Fund sought to provide returns that corresponded to the performance of the WisdomTree Global ex-U.S. Real Estate Index. In accordance with Form N-1A, the Registrant will continue to include the performance of the prior benchmark indices for a period of one year after the Fund changes its tracking index. Going forward, the Fund will benchmark its performance to a more appropriate broad-based benchmark, the FTSE EPRA Nareit Developed Index, and will include this new benchmark in the “Average Annual Total Returns” table of the Fund’s next annual update.

| 9. | Comment: In accordance with Form N-1A, please include all applicable information that is required by Item 9(b), including a more robust description of the Fund’s Item 4 investment strategy disclosure. |

Response: The Registrant has provided additional information in Item 9 with respect to the Index and its methodology.

| 10. | Comment: The Staff notes that footnotes 1 and 6 are missing from the Fund’s Financial Highlights. In addition, please make each reference to footnote 4 superscript. |

Response: The Registrant has deleted footnotes 1 and 6 in the Financial Highlights as those footnotes did not apply to the Fund. In addition, the Registrant has made the requested changes regarding footnote 4.

| 3 |

Statement of Additional Information (“SAI”)

| 11. | Comment: The Staff notes that the last column of the table included under “Members of the Board and Officers of the Trust” in the “Management of the Trust” section of the SAI includes the phrase “During Past 5 Years.” The Staff further notes that Form N-1A does not ask for a trustee’s other directorships held “during the past five years.” Please revise the information in this column of the table in accordance with the instructions of Item 17(a)(1) of Form N-1A. |

Response: The Registrant has made the requested change.

| 12. | Comment: The Staff notes the inclusion of Victor Ugolyn’s membership on the Board of Governors of the Naismith Memorial Basketball Hall of Fame from 2001 to 2016 under the “Other Directorships” column of the table referenced in Comment 11 above. Please delete this information from the table given that Mr. Ugolyn is no longer a member of the Board of Governors and his service on that board is not responsive to the information requested by Item 17(a)(1) of Form N-1A. |

Response: The Registrant has made the requested change.

* * * * *

Sincerely,

| /s/Joanne Antico | |

| Joanne Antico, Esq. | |

| Secretary |

W. John McGuire, Esq. (Morgan, Lewis & Bockius LLP)

Laura E. Flores, Esq. (Morgan, Lewis & Bockius LLP)

K. Michael Carlton, Esq. (Morgan, Lewis & Bockius LLP)

| 4 |

Appendix A

Fund Performance

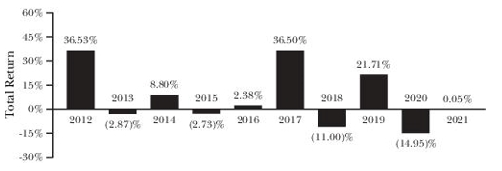

Historical Fund performance, which varies over time, can provide an indication of the risks of investing in the Fund. The bar chart that follows shows the annual total returns of the Fund for each full calendar year since the Fund commenced operations, or the past 10 calendar years, as applicable. The table that follows the bar chart shows the Fund’s average annual total returns, both before and after taxes. This table also shows how the Fund’s performance compares to the WisdomTree Global ex-U.S. Real Estate Index, the Fund’s underlying index prior to April 20, 2022, as well as a relevant broad-based securities market index and another index that represents the asset class in which the Fund invests. Index returns do not reflect deductions for fees, expenses or taxes. All returns assume reinvestment of dividends and distributions. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information for the Fund is available online on the Fund’s website at www.wisdomtree.com.

The Fund’s name, investment objective and strategies changed effective April 20, 2022. Fund performance prior to April 20, 2022 reflects the Fund’s investment objective and strategies when it sought to provide returns that corresponded to the performance of the WisdomTree Global ex-U.S. Real Estate Index.

Best and Worst Quarter Returns (for the periods reflected in the bar chart above)

| Return | Quarter/Year | |

| Highest Return | 15.85% | 1Q/2019 |

| Lowest Return | (29.32)% | 1Q/2020 |

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown and are not relevant if you hold your shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. In some cases, the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

| 5 |

Average Annual Total Returns for the periods ending December 31, 2021

| WisdomTree New Economy Real Estate Fund* | 1 Year | 5 Years | 10 Years |

| Return Before Taxes Based on NAV | 0.05% | 4.70% | 6.10% |

| Return After Taxes on Distributions | (2.39)% | 2.68% | 4.13% |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.08% | 3.03% | 4.18% |

| WisdomTree International Real Estate/Global ex-U.S. Real Estate Spliced Index** (Reflects no deduction for fees, expenses or taxes) | 0.12% | 4.90% | 6.33% |

| Dow Jones Global ex-U.S. Select Real Estate Securities Index (Reflects no deduction for fees, expenses or taxes) | 8.91% | 4.81% | 6.62% |

| MSCI AC World ex-USA Index (Reflects no deduction for fees, expenses or taxes) | 7.82% | 9.61% | 7.28% |

| * | Prior to April 20, 2022, the Fund’s performance reflects the strategies of the Fund when it sought to provide returns that correspond to the performance of the WisdomTree Global ex-U.S. Real Estate Index. |

| ** | Reflects performance of the WisdomTree International Real Estate Index prior to June 17, 2011 and the WisdomTree Global ex-U.S. Real Estate Index thereafter. |

6