December 2018

Thank You for a Great 10-Years

In September, we celebrated our achievement of 10 years of operations with our business partners, investors, community and employees. Our goals through our celebration were to provide a way to thank those who have been along for the ride to success, and give something back to the community. Beginning with our golf outing and celebration dinner and ending with our community pancake breakfast, we were able to do just that. In tandem with our celebration, we partnered with the emergency services of Union City, Indiana and Union City, Ohio in raising support for Squad One. In doing so, we actively expressed our commitment and pleasure to be part of the community.

Due to the generous donations from individuals, partners, vendors, volunteers, and a contribution from Cardinal, and through fundraising via a raffle, “boot drive”, and a silent and live auction, proceeds of $8,000 will be given to the Union City Emergency Services Initiative of Squad One.

Fiscal Year Ended September 30, 2018 Financial Results

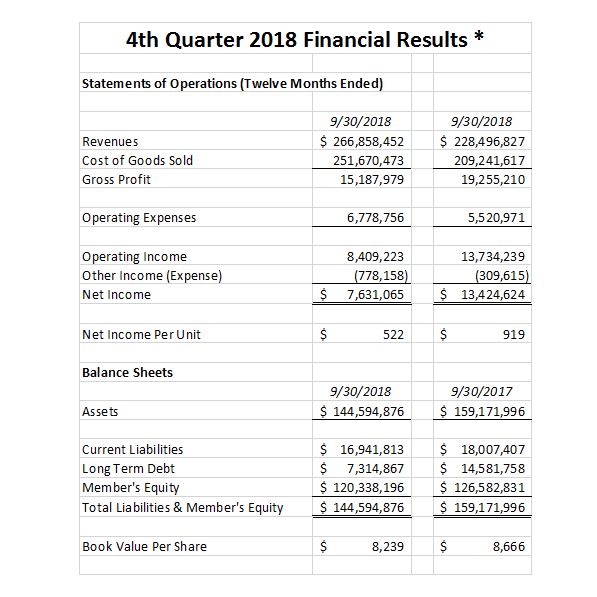

Below are the condensed income statements and balance sheets from our annual report filed on Form 10-K for the fiscal year ended September 30, 2018. Some of the highlights from the period include:

| |

| • | Net income was approximately $7.6 million or about $522 per unit for the fiscal year ended September 30, 2018. |

| |

| • | Distributions paid for the fiscal year ended September 30, 2018 totaled $950 per unit. |

| |

| • | The average price per gallon of ethanol sold for the fiscal year ended September 30, 2018 was approximately 12.7% lower than our average price per gallon of ethanol sold for the same period in 2017. This decrease is due to increased industry-wide production which was in excess of demand. |

| |

| • | Our revenues from DDGS increased in the fiscal year ended September 30, 2018 as compared to the same period in 2017. This increase is mainly a result of an increase in the average market price per ton of DDGS sold. Prices were up approximately 42.4% compared to the same period in 2017. |

| |

| • | Our revenues from corn oil sales increased slightly during the fiscal year ended September 30, 2018 as compared to the same period in 2017. This increase is a result of an approximate 15.6% increase in the number of pounds sold despite an $0.11 decrease in the average selling price for corn oil. |

| |

| • | We began operating the Trading Division in late September 2017. During the fiscal year ended September 30, 2018 the average price per bushel of soybeans sold was $9.61 based on sales of approximately 4.5 million bushels. |

| |

| • | We used approximately 1.9% more corn during the fiscal year ended September 30, 2018 to produce ethanol, DDGS, and corn oil as compared to the same period in 2017. |

| |

| • | Corn prices were approximately 2.9% lower this year compared to the same period in 2017. This decrease is primarily due to a plentiful 2017 harvest which kept corn prices low until concerns relating to planting conditions and domestic corn stocks led to increased volatility in corn prices in the late spring and early summer months. |

More detailed financials and financial footnotes, along with other information, can be found in our quarterly and annual reports filed with the Securities Exchange Commission (SEC). These are available by linking from our website to the SEC website; simply click on “Investors” then “SEC Info”. Please call our office if you need any assistance in obtaining or understanding the reports.

*This information has been derived from the audited Financial Statements and accompanying notes included in our Annual Report on Form 10-K, which is available at the SEC’s website at: www.sec.gov. You can also access the Annual and Quarterly Reports at Cardinal’s website: www.cardinalethanol.com.

Estimated Taxable Income Per Unit for Calendar Year 2018

As we’ve mentioned throughout the year in the Member Distribution letters, Cardinal Ethanol is a limited liability company that, for income tax purposes, passes its taxable income to its members. This means that each unit holder must report their prorated share of Cardinal’s taxable income on their own tax return.

As an aid to you for your 2018 tax planning, we are providing an ESTIMATE of company taxable income for the calendar year ending December 31, 2018. This ESTIMATE is not a guarantee of future results; it is only our best prediction and involves numerous assumptions, risks and uncertainties. Our actual results may differ.

Our tax year is a calendar year, unlike our fiscal (financial) year. Thus, we have only ten months of actual financial results to make our estimate. Based on our preliminary financial results though, we anticipate you may have approximately $500 to $1,000 per membership unit of taxable income reported to you on your 2018 K-1 form for those of you that have held your units for the entire year. To determine the amount of the taxable income from Cardinal Ethanol, you will multiply the number of membership units you own times the above estimate.

For example, 4 units x $500 per membership unit = $2,000 taxable income from Cardinal Ethanol.

If you owned your membership units or a portion of them for less than the entire calendar year, your share of company taxable income for those units will be pro-rated to you based on the number of days that you owned the units in 2018.

The tax law affecting limited liability companies can be complex. Also, each of you will have a different tax situation and the amount you may owe will depend on that situation. Thus, it is extremely important, and we recommend, that you engage a highly qualified tax professional with experience in the complexities of pass-through entities to assist you with your taxes.

This ESTIMATE of taxable income allocation does NOT represent the amount of the cash distribution you can expect.

Silo Damage

On November 6, 2018, we experienced an explosion in one of our DDGS silos. There were no injuries related to the incident and the damage was limited to the DDGS silos and the associated materials handling equipment. Operations at the plant were temporarily suspended pending an evaluation and assessment of the situation. The plant resumed operations within a few days of the incident. The extent of monetary damages related to the incident has not yet been fully determined. We are presently working with our insurance carrier and other experts to assess the amount of the damages.

Financial and Economic Outlook

Over the past few years, the ethanol industry has increased its ethanol production capacity significantly. While export demand has grown substantially too over this period, total ethanol production has still surpassed both it and domestic demand. The result has been an increase in ethanol inventory in the United States driving ethanol price lower, which has narrowed our ethanol to corn margin substantially. This is reflected in the financial results discussed above. Industry experts believe, and we concur, that ethanol prices will remain low until industry-wide production contracts or new international markets open to U.S. ethanol. Most experts believe the situation may last throughout most of fiscal 2019.

Distributions

Given the economic outlook for the ethanol industry for the next several months, as discussed above, on November 20, 2018, the board voted to defer additional distributions until complete information about the financial and tax results of calendar 2018 is known. While we estimate that Cardinal has likely issued sufficient distributions for 2018 to allow unit holders to cover taxes, the board will continue to monitor financial results in order to balance providing cash to unit holders for payment of tax with the need to retain an appropriate level of cash in reserve for 2019.

Cardinal’s Biggest Assets

This quarter’s spotlight is on our Commodities Department. The department is made up of nine highly skilled and hard-working men, half of which have been with Cardinal since the first couple years of operations. They work countless hours to ensure we are able to take grain as quickly as possible, even in the thick of harvest. They are also responsible for loading trains of ethanol and DDGS to meet our customer’s expectations and deadlines with the CSX Railroad. Cardinal has earned the CSX Railroad Chemical Safety Excellence Award for eight of the past nine years due to this group’s due diligence and commitment to their job. The Commodities Department has grown in size since the introduction of the soybean handling system and has taken on the new responsibilities without skipping a beat. They work hard to ensure our farmers and customers have a nice and smooth loading and unloading experience when they visit Cardinal.

Pictured from L-R: Brian White, Kolin Sanders, Chris Tucker (Commodity Supervisor), Kody Phenis, Mike Dahlstrom, Eric Hollopeter, Jared Sears, Jeff Bowling and Ryan Snyder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This communication contains forward looking statements regarding future events, future business operations or other future prospects. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the statements made. Cardinal Ethanol disclaims any intent or obligation to update its forward-looking statements, whether as a result of receiving new information, the occurrence of future events or otherwise. Certain of these risk and uncertainties are described in our filings with the SEC which are available at the SEC’s website at www.sec.gov.