UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21852 |

|

Columbia Funds Series Trust II |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | November 30, 2016 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

November 30, 2016

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

Dear Shareholders,

Dear Shareholders,

While emotions have run high following the outcome of the U.S. Presidential election, it remains unclear how the Trump presidency will unfold in terms of policy. We have a sense of the priorities espoused by the president-elect over the past eighteen months, but campaign priorities are not always realized and are often never pursued. What seems certain is that, while some investors have already priced expectations into the market, others have retreated, preferring instead a wait and see approach. The outcome of such behaviors appears to have created conditions ripe for ongoing market volatility.

While volatility in the financial markets can be stressful, volatility itself is not a new phenomenon. Other factors that have been at the root cause of recent volatility include uncertainty following the United Kingdom's vote to exit the European Union (Brexit), speculation around the Federal Reserve's decision to increase interest rates, divergent central bank policy and geopolitical unrest. The point is, financial markets have fluctuated for years and may be expected to continue to fluctuate — sometimes wildly. If anything, such volatility seems to be the new normal, perhaps exacerbated by access to information and development of technological tools which have enabled investors to react rapidly to real and perceived change. So what can you do?

Position your portfolio for the reality of market volatility

That there is a historical precedent for market volatility, or even an acceptance that it may persist, offers little comfort. A measured and strategic approach remains the best strategy for investors to stay on track in achieving their investment goals.

Step 1: Review your investment goals

Take this opportunity to review your investment goals and the strategies you are pursuing to achieve those goals in order to remain focused on what's important to you. It is entirely possible that your goals have changed in response either to your life situation or to changes in the market. Accept what you can't control — volatility, and focus on what you can — your investment goals and strategies.

Step 2: Reassess your risk tolerance

Sit down with your financial advisor to discuss your investment goals and strategies, as well as any changes to your tolerance for risk. Consider your investment horizon. Increased market volatility and a new investment horizon may impact the strategies that can best help you achieve your investment goals. Remember, achieving your investment goals may require a certain amount of risk. Ultimately, you must maintain vigilance in reassessing your risk tolerance and the strategies you have selected in pursuit of your investment goals, and awareness of how those strategies may react to market volatility.

Step 3: Remain calm and focus on your long-term plan

Remember, investing is about the long game. Short term events are not necessarily evidence of a longer term reality. Investors who attempt to time the market too often end up reacting to a down turn by selling low and then compounding the problem by waiting on the sidelines, ultimately missing the right opportunity to reinvest.

As long as there is a market, there will be volatility. How you respond to that volatility can make a big difference in the measure of your success as an investor. Talk to your financial advisor about how working with Columbia Threadneedle Investments may help you position your portfolio for the reality of ongoing volatility and, perhaps, even turn such volatility into investment opportunity.

Best regards,

Christopher O. Petersen

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit investor.columbiathreadneedleus.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2017 Columbia Management Investment Advisers, LLC. All rights reserved.

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

Performance Overview | | | 2 | | |

Portfolio Overview | | | 3 | | |

Understanding Your Fund's Expenses | | | 4 | | |

Portfolio of Investments | | | 5 | | |

Statement of Assets and Liabilities | | | 10 | | |

Statement of Operations | | | 12 | | |

Statement of Changes in Net Assets | | | 13 | | |

Financial Highlights | | | 16 | | |

Notes to Financial Statements | | | 27 | | |

Approval of Management Agreement | | | 34 | | |

Important Information About This Report | | | 37 | | |

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit investor.columbiathreadneedleus.com or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PERFORMANCE OVERVIEW

(Unaudited)

Performance Summary

n Columbia Diversified Equity Income Fund (the Fund) Class A shares returned 8.19% excluding sales charges for the six-month period that ended November 30, 2016.

n The Fund underperformed its benchmark, the Russell 1000 Value Index, which returned 8.63% during the same time period.

Average Annual Total Returns (%) (for period ended November 30, 2016)

| | | Inception | | 6 Months

Cumulative | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 10/15/90 | | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 8.19 | | | | 9.24 | | | | 12.95 | | | | 5.25 | | |

Including sales charges | | | | | | | 1.99 | | | | 2.97 | | | | 11.63 | | | | 4.63 | | |

Class B | | 03/20/95 | | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 7.76 | | | | 8.40 | | | | 12.11 | | | | 4.45 | | |

Including sales charges | | | | | | | 2.76 | | | | 3.59 | | | | 11.85 | | | | 4.45 | | |

Class C | | 06/26/00 | | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | | | 7.72 | | | | 8.36 | | | | 12.11 | | | | 4.46 | | |

Including sales charges | | | | | | | 6.72 | | | | 7.40 | | | | 12.11 | | | | 4.46 | | |

Class I | | 03/04/04 | | | 8.34 | | | | 9.54 | | | | 13.41 | | | | 5.70 | | |

Class K | | 03/20/95 | | | 8.14 | | | | 9.25 | | | | 13.06 | | | | 5.39 | | |

Class R* | | 12/11/06 | | | 7.94 | | | | 8.86 | | | | 12.65 | | | | 4.94 | | |

Class R4* | | 12/11/06 | | | 8.24 | | | | 9.44 | | | | 13.15 | | | | 5.29 | | |

Class R5* | | 12/11/06 | | | 8.27 | | | | 9.53 | | | | 13.35 | | | | 5.64 | | |

Class W* | | 12/01/06 | | | 8.16 | | | | 9.12 | | | | 12.92 | | | | 5.25 | | |

Class Y* | | 11/08/12 | | | 8.39 | | | | 9.57 | | | | 13.34 | | | | 5.43 | | |

Class Z* | | 09/27/10 | | | 8.24 | | | | 9.45 | | | | 13.21 | | | | 5.42 | | |

Russell 1000 Value Index | | | | | | | 8.63 | | | | 12.02 | | | | 14.69 | | | | 5.70 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

The Russell 1000 Value Index, an unmanaged index, measures the performance of those stocks in the Russell 1000 Index with lower price-to-book ratios and lower forecasted growth values.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

Semiannual Report 2016

2

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OVERVIEW

(Unaudited)

Top Ten Holdings (%)

(at November 30, 2016) | |

Exxon Mobil Corp. | | | 4.4 | | |

JPMorgan Chase & Co. | | | 3.9 | | |

Berkshire Hathaway, Inc., Class B | | | 3.6 | | |

Wells Fargo & Co. | | | 3.5 | | |

Johnson & Johnson | | | 3.0 | | |

Citigroup, Inc. | | | 2.8 | | |

Cisco Systems, Inc. | | | 2.3 | | |

Merck & Co., Inc. | | | 2.2 | | |

Philip Morris International, Inc. | | | 2.2 | | |

Medtronic PLC | | | 1.9 | | |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Portfolio Breakdown (%)

(at November 30, 2016) | |

Common Stocks | | | 97.9 | | |

Convertible Bonds | | | 0.5 | | |

Money Market Funds | | | 1.6 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

Equity Sector Breakdown (%)

(at November 30, 2016) | |

Consumer Discretionary | | | 6.7 | | |

Consumer Staples | | | 8.0 | | |

Energy | | | 14.4 | | |

Financials | | | 27.8 | | |

Health Care | | | 10.6 | | |

Industrials | | | 8.8 | | |

Information Technology | | | 11.0 | | |

Materials | | | 2.0 | | |

Real Estate | | | 4.6 | | |

Telecommunication Services | | | 1.5 | | |

Utilities | | | 4.6 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total equity investments. The Fund's portfolio composition is subject to change.

Portfolio Management

Hugh Mullin, CFA

Russell Bloomfield, CFA, CAIA

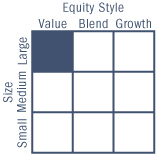

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

©2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Semiannual Report 2016

3

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

June 1, 2016 – November 30, 2016

| | | Account Value at the Beginning

of the Period ($) | | Account Value at the End of the

Period ($) | | Expenses Paid During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,081.90 | | | | 1,019.90 | | | | 5.38 | | | | 5.22 | | | | 1.03 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,077.60 | | | | 1,016.14 | | | | 9.27 | | | | 9.00 | | | | 1.78 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,077.20 | | | | 1,016.14 | | | | 9.27 | | | | 9.00 | | | | 1.78 | | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,083.40 | | | | 1,021.86 | | | | 3.34 | | | | 3.24 | | | | 0.64 | | |

Class K | | | 1,000.00 | | | | 1,000.00 | | | | 1,081.40 | | | | 1,020.26 | | | | 5.01 | | | | 4.86 | | | | 0.96 | | |

Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,079.40 | | | | 1,018.65 | | | | 6.67 | | | | 6.48 | | | | 1.28 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,082.40 | | | | 1,021.11 | | | | 4.12 | | | | 4.00 | | | | 0.79 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,082.70 | | | | 1,021.51 | | | | 3.71 | | | | 3.60 | | | | 0.71 | | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,081.60 | | | | 1,019.85 | | | | 5.43 | | | | 5.27 | | | | 1.04 | | |

Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,083.90 | | | | 1,021.76 | | | | 3.45 | | | | 3.35 | | | | 0.66 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,082.40 | | | | 1,021.11 | | | | 4.12 | | | | 4.00 | | | | 0.79 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

Semiannual Report 2016

4

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OF INVESTMENTS

November 30, 2016 (Unaudited)

(Percentages represent value of investments compared to net assets)

Common Stocks 97.7%

Issuer | | Shares | | Value ($) | |

CONSUMER DISCRETIONARY 6.6% | |

Auto Components 1.0% | |

Magna International, Inc. | | | 570,448 | | | | 23,074,622 | | |

Household Durables 0.8% | |

Toll Brothers, Inc.(a) | | | 667,821 | | | | 19,807,571 | | |

Media 2.3% | |

Comcast Corp., Class A | | | 394,141 | | | | 27,396,741 | | |

DISH Network Corp., Class A(a) | | | 443,822 | | | | 25,497,574 | | |

Total | | | | | 52,894,315 | | |

Multiline Retail 0.8% | |

Macy's, Inc. | | | 459,100 | | | | 19,374,020 | | |

Specialty Retail 1.7% | |

Foot Locker, Inc. | | | 306,880 | | | | 21,994,089 | | |

Home Depot, Inc. (The) | | | 130,207 | | | | 16,848,786 | | |

Total | | | | | 38,842,875 | | |

Total Consumer Discretionary | | | | | 153,993,403 | | |

CONSUMER STAPLES 7.8% | |

Beverages 1.2% | |

PepsiCo, Inc. | | | 282,059 | | | | 28,234,106 | | |

Food & Staples Retailing 1.2% | |

SYSCO Corp. | | | 509,553 | | | | 27,133,697 | | |

Food Products 2.1% | |

Mondelez International, Inc., Class A | | | 651,074 | | | | 26,850,291 | | |

Tyson Foods, Inc., Class A | | | 396,506 | | | | 22,525,506 | | |

Total | | | | | 49,375,797 | | |

Tobacco 3.3% | |

Altria Group, Inc. | | | 419,384 | | | | 26,811,219 | | |

Philip Morris International, Inc. | | | 573,602 | | | | 50,637,585 | | |

Total | | | | | 77,448,804 | | |

Total Consumer Staples | | | | | 182,192,404 | | |

ENERGY 14.1% | |

Energy Equipment & Services 1.2% | |

Halliburton Co. | | | 538,411 | | | | 28,584,240 | | |

Oil, Gas & Consumable Fuels 12.9% | |

| BP PLC, ADR | | | 713,034 | | | | 24,963,320 | | |

Cimarex Energy Co. | | | 167,745 | | | | 23,128,681 | | |

ConocoPhillips | | | 597,415 | | | | 28,986,576 | | |

Devon Energy Corp. | | | 572,353 | | | | 27,661,821 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

EOG Resources, Inc. | | | 316,922 | | | | 32,490,843 | | |

Exxon Mobil Corp. | | | 1,147,143 | | | | 100,145,584 | | |

Hess Corp. | | | 550,521 | | | | 30,807,155 | | |

Valero Energy Corp. | | | 541,396 | | | | 33,328,338 | | |

Total | | | | | 301,512,318 | | |

Total Energy | | | | | 330,096,558 | | |

FINANCIALS 27.1% | |

Banks 14.3% | |

Citigroup, Inc. | | | 1,154,869 | | | | 65,123,063 | | |

Fifth Third Bancorp | | | 1,243,056 | | | | 32,344,317 | | |

JPMorgan Chase & Co. | | | 1,109,143 | | | | 88,919,994 | | |

PNC Financial Services Group, Inc. (The) | | | 360,281 | | | | 39,825,462 | | |

SunTrust Banks, Inc. | | | 537,710 | | | | 27,934,034 | | |

Wells Fargo & Co. | | | 1,533,092 | | | | 81,131,229 | | |

Total | | | | | 335,278,099 | | |

Capital Markets 5.5% | |

Charles Schwab Corp. (The) | | | 757,849 | | | | 29,298,442 | | |

Intercontinental Exchange, Inc. | | | 490,825 | | | | 27,191,705 | | |

Invesco Ltd. | | | 1,009,950 | | | | 31,621,535 | | |

Morgan Stanley | | | 968,981 | | | | 40,077,054 | | |

Total | | | | | 128,188,736 | | |

Diversified Financial Services 3.5% | |

Berkshire Hathaway, Inc., Class B(a) | | | 527,998 | | | | 83,128,005 | | |

Insurance 3.8% | |

Aon PLC | | | 202,180 | | | | 23,068,738 | | |

Chubb Ltd. | | | 294,858 | | | | 37,741,824 | | |

MetLife, Inc. | | | 511,454 | | | | 28,135,085 | | |

Total | | | | | 88,945,647 | | |

Total Financials | | | | | 635,540,487 | | |

HEALTH CARE 10.4% | |

Biotechnology 1.0% | |

AbbVie, Inc. | | | 381,323 | | | | 23,184,439 | | |

Health Care Equipment & Supplies 1.8% | |

Medtronic PLC | | | 584,239 | | | | 42,655,289 | | |

Health Care Providers & Services 1.9% | |

Aetna, Inc. | | | 227,358 | | | | 29,747,521 | | |

Cardinal Health, Inc. | | | 213,880 | | | | 15,187,619 | | |

Total | | | | | 44,935,140 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

5

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OF INVESTMENTS (continued)

November 30, 2016 (Unaudited)

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Pharmaceuticals 5.7% | |

Jazz Pharmaceuticals PLC(a) | | | 102,357 | | | | 10,607,256 | | |

Johnson & Johnson | | | 628,686 | | | | 69,972,752 | | |

Merck & Co., Inc. | | | 834,682 | | | | 51,074,191 | | |

Total | | | | | 131,654,199 | | |

Total Health Care | | | | | 242,429,067 | | |

INDUSTRIALS 8.6% | |

Aerospace & Defense 1.2% | |

Northrop Grumman Corp. | | | 106,366 | | | | 26,554,272 | | |

Air Freight & Logistics 1.0% | |

United Parcel Service, Inc., Class B | | | 207,027 | | | | 23,998,570 | | |

Airlines 1.5% | |

United Continental Holdings, Inc.(a) | | | 506,496 | | | | 34,922,899 | | |

Industrial Conglomerates 1.1% | |

Carlisle Companies, Inc. | | | 225,530 | | | | 25,297,700 | | |

Machinery 2.6% | |

Cummins, Inc. | | | 204,059 | | | | 28,931,485 | | |

Ingersoll-Rand PLC | | | 439,207 | | | | 32,738,490 | | |

Total | | | | | 61,669,975 | | |

Road & Rail 1.2% | |

Norfolk Southern Corp. | | | 265,616 | | | | 28,277,479 | | |

Total Industrials | | | | | 200,720,895 | | |

INFORMATION TECHNOLOGY 10.7% | |

Communications Equipment 2.2% | |

Cisco Systems, Inc. | | | 1,766,325 | | | | 52,671,811 | | |

IT Services 1.4% | |

Leidos Holdings, Inc. | | | 323,598 | | | | 16,568,218 | | |

MasterCard, Inc., Class A | | | 165,241 | | | | 16,887,630 | | |

Total | | | | | 33,455,848 | | |

Semiconductors & Semiconductor Equipment 3.6% | |

Intel Corp. | | | 931,165 | | | | 32,311,425 | | |

Lam Research Corp. | | | 183,783 | | | | 19,484,674 | | |

ON Semiconductor Corp.(a) | | | 1,500,729 | | | | 17,678,588 | | |

Skyworks Solutions, Inc. | | | 180,899 | | | | 13,902,088 | | |

Total | | | | | 83,376,775 | | |

Software 1.5% | |

Activision Blizzard, Inc. | | | 460,054 | | | | 16,842,577 | | |

Microsoft Corp. | | | 313,082 | | | | 18,866,321 | | |

Total | | | | | 35,708,898 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Technology Hardware, Storage & Peripherals 2.0% | |

Apple, Inc. | | | 268,857 | | | | 29,714,076 | | |

Western Digital Corp. | | | 263,788 | | | | 16,792,744 | | |

Total | | | | | 46,506,820 | | |

Total Information Technology | | | | | 251,720,152 | | |

MATERIALS 2.0% | |

Chemicals 1.1% | |

Eastman Chemical Co. | | | 346,056 | | | | 25,995,727 | | |

Metals & Mining 0.9% | |

Freeport-McMoRan, Inc.(a) | | | 1,329,218 | | | | 20,403,496 | | |

Total Materials | | | | | 46,399,223 | | |

REAL ESTATE 4.5% | |

Equity Real Estate Investment Trusts (REITs) 4.5% | |

Alexandria Real Estate Equities, Inc. | | | 261,331 | | | | 28,639,264 | | |

American Tower Corp. | | | 242,101 | | | | 24,759,669 | | |

AvalonBay Communities, Inc. | | | 128,620 | | | | 21,156,704 | | |

Duke Realty Corp. | | | 1,178,249 | | | | 29,962,872 | | |

Total | | | | | 104,518,509 | | |

Total Real Estate | | | | | 104,518,509 | | |

TELECOMMUNICATION SERVICES 1.5% | |

Diversified Telecommunication Services 1.5% | |

Verizon Communications, Inc. | | | 697,296 | | | | 34,795,070 | | |

Total Telecommunication Services | | | | | 34,795,070 | | |

UTILITIES 4.4% | |

Electric Utilities 3.1% | |

Edison International | | | 414,429 | | | | 28,500,283 | | |

NextEra Energy, Inc. | | | 199,901 | | | | 22,834,691 | | |

Xcel Energy, Inc. | | | 576,618 | | | | 22,493,868 | | |

Total | | | | | 73,828,842 | | |

Multi-Utilities 1.3% | |

Ameren Corp. | | | 610,792 | | | | 30,002,103 | | |

Total Utilities | | | | | 103,830,945 | | |

Total Common Stocks

(Cost: $1,862,447,212) | | | | | 2,286,236,713 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

6

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OF INVESTMENTS (continued)

November 30, 2016 (Unaudited)

Convertible Bonds 0.5%

Issuer | | Coupon

Rate | | Principal

Amount ($) | | Value ($) | |

Cable and Satellite 0.5% | |

DISH Network Corp.(b)

08/15/26 | | | 3.375 | % | | | | | | | 9,732,000 | | | | 10,893,125 | | |

Total Convertible Bonds

(Cost: $9,732,000) | | | | | | | | | 10,893,125 | | |

Money Market Funds 1.6%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.480%(c)(d) | | | 38,584,257 | | | | 38,587,861 | | |

Total Money Market Funds

(Cost: $38,584,257) | | | | | 38,587,861 | | |

Total Investments

(Cost: $1,910,763,469) | | | | | 2,335,717,699 | | |

Other Assets & Liabilities, Net | | | | | 5,681,549 | | |

Net Assets | | | | | 2,341,399,248 | | |

Notes to Portfolio of Investments

(a) Non-income producing investment.

(b) Represents privately placed and other securities and instruments exempt from SEC registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid. Private placements may be determined to be liquid under guidelines established by the Fund's Board of Trustees. At November 30, 2016, the value of these securities amounted to $10,893,125 or 0.47% of net assets.

(c) The rate shown is the seven-day current annualized yield at November 30, 2016.

(d) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company's outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the period ended November 30, 2016 are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From Sales ($) | | Realized

Gain (Loss) ($) | | Ending

Cost ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia Short-Term

Cash Fund | | | 34,470,263 | | | | 157,351,529 | | | | (153,236,263 | ) | | | (1,272 | ) | | | 38,584,257 | | | | 85,980 | | | | 38,587,861 | | |

Abbreviation Legend

ADR American Depositary Receipt

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset's or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

7

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OF INVESTMENTS (continued)

November 30, 2016 (Unaudited)

Fair Value Measurements (continued)

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value (NAV) per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Columbia Short-Term Cash Fund prices its shares with a floating NAV and no longer seeks to maintain a stable NAV.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

8

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

PORTFOLIO OF INVESTMENTS (continued)

November 30, 2016 (Unaudited)

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at November 30, 2016:

| | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Significant

Unobservable Inputs ($) | | Total ($) | |

Investments | |

Common Stocks | |

Consumer Discretionary | | | 153,993,403 | | | | — | | | | — | | | | 153,993,403 | | |

Consumer Staples | | | 182,192,404 | | | | — | | | | — | | | | 182,192,404 | | |

Energy | | | 330,096,558 | | | | — | | | | — | | | | 330,096,558 | | |

Financials | | | 635,540,487 | | | | — | | | | — | | | | 635,540,487 | | |

Health Care | | | 242,429,067 | | | | — | | | | — | | | | 242,429,067 | | |

Industrials | | | 200,720,895 | | | | — | | | | — | | | | 200,720,895 | | |

Information Technology | | | 251,720,152 | | | | — | | | | — | | | | 251,720,152 | | |

Materials | | | 46,399,223 | | | | — | | | | — | | | | 46,399,223 | | |

Real Estate | | | 104,518,509 | | | | — | | | | — | | | | 104,518,509 | | |

Telecommunication Services | | | 34,795,070 | | | | — | | | | — | | | | 34,795,070 | | |

Utilities | | | 103,830,945 | | | | — | | | | — | | | | 103,830,945 | | |

Total Common Stocks | | | 2,286,236,713 | | | | — | | | | — | | | | 2,286,236,713 | | |

Convertible Bonds | | | — | | | | 10,893,125 | | | | — | | | | 10,893,125 | | |

Investments measured at net asset value | |

Money Market Funds | | | — | | | | — | | | | — | | | | 38,587,861 | | |

Total Investments | | | 2,286,236,713 | | | | 10,893,125 | | | | — | | | | 2,335,717,699 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets.

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

9

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2016 (Unaudited)

Assets | |

Investments, at value | |

Unaffiliated issuers (identified cost $1,872,179,212) | | $ | 2,297,129,838 | | |

Affiliated issuers (identified cost $38,584,257) | | | 38,587,861 | | |

Total investments (identified cost $1,910,763,469) | | | 2,335,717,699 | | |

Receivable for: | |

Investments sold | | | 19,959,301 | | |

Capital shares sold | | | 493,200 | | |

Dividends | | | 5,107,349 | | |

Interest | | | 103,098 | | |

Foreign tax reclaims | | | 14,261 | | |

Prepaid expenses | | | 7,671 | | |

Other assets | | | 26,785 | | |

Total assets | | | 2,361,429,364 | | |

Liabilities | |

Payable for: | |

Investments purchased | | | 16,536,225 | | |

Capital shares purchased | | | 2,855,025 | | |

Management services fees | | | 40,446 | | |

Distribution and/or service fees | | | 16,949 | | |

Transfer agent fees | | | 215,086 | | |

Plan administration fees | | | 8,026 | | |

Compensation of board members | | | 219,212 | | |

Chief compliance officer expenses | | | 168 | | |

Other expenses | | | 138,979 | | |

Total liabilities | | | 20,030,116 | | |

Net assets applicable to outstanding capital stock | | $ | 2,341,399,248 | | |

Represented by | |

Paid-in capital | | $ | 1,865,962,011 | | |

Undistributed net investment income | | | 7,499,790 | | |

Accumulated net realized gain | | | 42,983,217 | | |

Unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | | | 424,950,626 | | |

Investments — affiliated issuers | | | 3,604 | | |

Total — representing net assets applicable to outstanding capital stock | | $ | 2,341,399,248 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

10

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF ASSETS AND LIABILITIES (continued)

November 30, 2016 (Unaudited)

Class A | |

Net assets | | $ | 2,151,834,889 | | |

Shares outstanding | | | 162,095,695 | | |

Net asset value per share | | $ | 13.28 | | |

Maximum offering price per share(a) | | $ | 14.09 | | |

Class B | |

Net assets | | $ | 15,716,322 | | |

Shares outstanding | | | 1,180,202 | | |

Net asset value per share | | $ | 13.32 | | |

Class C | |

Net assets | | $ | 65,879,905 | | |

Shares outstanding | | | 4,976,971 | | |

Net asset value per share | | $ | 13.24 | | |

Class I | |

Net assets | | $ | 2,722 | | |

Shares outstanding | | | 205 | | |

Net asset value per share(b) | | $ | 13.25 | | |

Class K | |

Net assets | | $ | 36,190,272 | | |

Shares outstanding | | | 2,724,648 | | |

Net asset value per share | | $ | 13.28 | | |

Class R | |

Net assets | | $ | 5,666,650 | | |

Shares outstanding | | | 429,456 | | |

Net asset value per share | | $ | 13.19 | | |

Class R4 | |

Net assets | | $ | 7,379,451 | | |

Shares outstanding | | | 555,992 | | |

Net asset value per share | | $ | 13.27 | | |

Class R5 | |

Net assets | | $ | 33,532,213 | | |

Shares outstanding | | | 2,524,739 | | |

Net asset value per share | | $ | 13.28 | | |

Class W | |

Net assets | | $ | 2,542 | | |

Shares outstanding | | | 191 | | |

Net asset value per share(b) | | $ | 13.30 | | |

Class Y | |

Net assets | | $ | 436,441 | | |

Shares outstanding | | | 32,550 | | |

Net asset value per share | | $ | 13.41 | | |

Class Z | |

Net assets | | $ | 24,757,841 | | |

Shares outstanding | | | 1,867,024 | | |

Net asset value per share | | $ | 13.26 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 5.75%.

(b) Net asset value per share rounds to this amount due to fractional shares outstanding.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

11

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF OPERATIONS

Six Months Ended November 30, 2016 (Unaudited)

Net investment income | |

Income: | |

Dividends — unaffiliated issuers | | $ | 32,512,476 | | |

Dividends — affiliated issuers | | | 85,980 | | |

Interest | | | 103,098 | | |

Foreign taxes withheld | | | (42,784 | ) | |

Total income | | | 32,658,770 | | |

Expenses: | |

Management services fees | | | 7,383,172 | | |

Distribution and/or service fees | |

Class A | | | 2,674,488 | | |

Class B | | | 91,259 | | |

Class C | | | 322,288 | | |

Class R | | | 14,194 | | |

Class W | | | 3 | | |

Transfer agent fees | |

Class A | | | 1,342,697 | | |

Class B | | | 11,455 | | |

Class C | | | 40,450 | | |

Class K | | | 9,335 | | |

Class R | | | 3,563 | | |

Class R4 | | | 4,576 | | |

Class R5 | | | 7,977 | | |

Class W | | | 2 | | |

Class Z | | | 14,250 | | |

Plan administration fees | |

Class K | | | 46,547 | | |

Compensation of board members | | | 29,065 | | |

Custodian fees | | | 9,131 | | |

Printing and postage fees | | | 144,589 | | |

Registration fees | | | 69,215 | | |

Audit fees | | | 15,282 | | |

Legal fees | | | 15,635 | | |

Chief compliance officer expenses | | | 168 | | |

Other | | | 40,483 | | |

Total expenses | | | 12,289,824 | | |

Expense reductions | | | (100 | ) | |

Total net expenses | | | 12,289,724 | | |

Net investment income | | | 20,369,046 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | | | 65,812,754 | | |

Investments — affiliated issuers | | | (1,272 | ) | |

Net realized gain | | | 65,811,482 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | | | 95,149,221 | | |

Investments — affiliated issuers | | | 3,604 | | |

Net change in unrealized appreciation | | | 95,152,825 | | |

Net realized and unrealized gain | | | 160,964,307 | | |

Net increase in net assets resulting from operations | | $ | 181,333,353 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

12

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | Six Months Ended

November 30, 2016

(Unaudited) | | Year Ended

May 31,

2016 | |

Operations | |

Net investment income | | $ | 20,369,046 | | | $ | 31,235,632 | | |

Net realized gain | | | 65,811,482 | | | | 47,102,801 | | |

Net change in unrealized appreciation (depreciation) | | | 95,152,825 | | | | (123,241,674 | ) | |

Net increase (decrease) in net assets resulting from operations | | | 181,333,353 | | | | (44,903,241 | ) | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (13,091,919 | ) | | | (42,828,996 | ) | |

Class B | | | (46,105 | ) | | | (359,903 | ) | |

Class C | | | (155,173 | ) | | | (775,943 | ) | |

Class I | | | (21 | ) | | | (63 | ) | |

Class K | | | (245,563 | ) | | | (958,207 | ) | |

Class R | | | (27,869 | ) | | | (103,819 | ) | |

Class R4 | | | (52,824 | ) | | | (182,217 | ) | |

Class R5 | | | (246,081 | ) | | | (673,644 | ) | |

Class W | | | (14 | ) | | | (48 | ) | |

Class Y | | | (3,373 | ) | | | (8,161 | ) | |

Class Z | | | (164,974 | ) | | | (405,344 | ) | |

Net realized gains | |

Class A | | | — | | | | (226,187,014 | ) | |

Class B | | | — | | | | (2,895,297 | ) | |

Class C | | | — | | | | (6,760,372 | ) | |

Class I | | | — | | | | (285 | ) | |

Class K | | | — | | | | (4,452,412 | ) | |

Class R | | | — | | | | (631,570 | ) | |

Class R4 | | | — | | | | (749,241 | ) | |

Class R5 | | | — | | | | (3,103,883 | ) | |

Class W | | | — | | | | (265 | ) | |

Class Y | | | — | | | | (35,518 | ) | |

Class Z | | | — | | | | (1,898,379 | ) | |

Total distributions to shareholders | | | (14,033,916 | ) | | | (293,010,581 | ) | |

Increase (decrease) in net assets from capital stock activity | | | (171,549,632 | ) | | | 5,143,312 | | |

Total decrease in net assets | | | (4,250,195 | ) | | | (332,770,510 | ) | |

Net assets at beginning of period | | | 2,345,649,443 | | | | 2,678,419,953 | | |

Net assets at end of period | | $ | 2,341,399,248 | | | $ | 2,345,649,443 | | |

Undistributed net investment income | | $ | 7,499,790 | | | $ | 1,164,660 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

13

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Six Months Ended November 30, 2016

(Unaudited) | | Year Ended May 31, 2016 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(a) | | | 3,140,116 | | | | 39,753,499 | | | | 9,672,641 | | | | 120,428,010 | | |

Distributions reinvested | | | 1,016,934 | | | | 12,833,059 | | | | 22,145,402 | | | | 264,453,403 | | |

Redemptions | | | (16,867,622 | ) | | | (213,641,698 | ) | | | (27,780,236 | ) | | | (351,776,878 | ) | |

Net increase (decrease) | | | (12,710,572 | ) | | | (161,055,140 | ) | | | 4,037,807 | | | | 33,104,535 | | |

Class B shares | |

Subscriptions | | | 3,084 | | | | 39,680 | | | | 13,038 | | | | 171,679 | | |

Distributions reinvested | | | 3,619 | | | | 45,739 | | | | 268,622 | | | | 3,213,674 | | |

Redemptions(a) | | | (486,794 | ) | | | (6,202,557 | ) | | | (1,708,113 | ) | | | (22,267,855 | ) | |

Net decrease | | | (480,091 | ) | | | (6,117,138 | ) | | | (1,426,453 | ) | | | (18,882,502 | ) | |

Class C shares | |

Subscriptions | | | 175,733 | | | | 2,222,282 | | | | 475,802 | | | | 5,975,209 | | |

Distributions reinvested | | | 12,081 | | | | 151,826 | | | | 622,517 | | | | 7,389,450 | | |

Redemptions | | | (472,661 | ) | | | (5,968,927 | ) | | | (900,515 | ) | | | (11,437,591 | ) | |

Net increase (decrease) | | | (284,847 | ) | | | (3,594,819 | ) | | | 197,804 | | | | 1,927,068 | | |

Class K shares | |

Subscriptions | | | 158,563 | | | | 1,998,206 | | | | 425,762 | | | | 5,350,619 | | |

Distributions reinvested | | | 19,453 | | | | 245,563 | | | | 451,758 | | | | 5,410,619 | | |

Redemptions | | | (550,691 | ) | | | (6,967,898 | ) | | | (1,922,119 | ) | | | (24,698,432 | ) | |

Net decrease | | | (372,675 | ) | | | (4,724,129 | ) | | | (1,044,599 | ) | | | (13,937,194 | ) | |

Class R shares | |

Subscriptions | | | 21,167 | | | | 265,454 | | | | 61,832 | | | | 777,717 | | |

Distributions reinvested | | | 2,177 | | | | 27,313 | | | | 60,556 | | | | 718,018 | | |

Redemptions | | | (57,171 | ) | | | (717,275 | ) | | | (201,171 | ) | | | (2,615,271 | ) | |

Net decrease | | | (33,827 | ) | | | (424,508 | ) | | | (78,783 | ) | | | (1,119,536 | ) | |

Class R4 shares | |

Subscriptions | | | 86,926 | | | | 1,098,736 | | | | 150,464 | | | | 1,890,414 | | |

Distributions reinvested | | | 4,184 | | | | 52,789 | | | | 77,663 | | | | 930,873 | | |

Redemptions | | | (106,188 | ) | | | (1,353,541 | ) | | | (394,928 | ) | | | (5,188,243 | ) | |

Net decrease | | | (15,078 | ) | | | (202,016 | ) | | | (166,801 | ) | | | (2,366,956 | ) | |

Class R5 shares | |

Subscriptions | | | 166,402 | | | | 2,116,875 | | | | 633,730 | | | | 8,022,571 | | |

Distributions reinvested | | | 19,500 | | | | 246,081 | | | | 316,270 | | | | 3,777,327 | | |

Redemptions | | | (242,522 | ) | | | (3,036,143 | ) | | | (459,671 | ) | | | (5,768,259 | ) | |

Net increase (decrease) | | | (56,620 | ) | | | (673,187 | ) | | | 490,329 | | | | 6,031,639 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

14

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Six Months Ended November 30, 2016

(Unaudited) | | Year Ended May 31, 2016 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity (continued) | |

Class Y shares | |

Subscriptions | | | 4,933 | | | | 63,360 | | | | 8,356 | | | | 107,905 | | |

Distributions reinvested | | | 263 | | | | 3,354 | | | | 3,594 | | | | 43,364 | | |

Redemptions | | | (4,976 | ) | | | (63,951 | ) | | | (4,787 | ) | | | (63,708 | ) | |

Net increase | | | 220 | | | | 2,763 | | | | 7,163 | | | | 87,561 | | |

Class Z shares | |

Subscriptions | | | 1,131,179 | | | | 14,211,873 | | | | 336,053 | | | | 4,292,802 | | |

Distributions reinvested | | | 12,324 | | | | 155,355 | | | | 178,071 | | | | 2,126,116 | | |

Redemptions | | | (718,090 | ) | | | (9,128,686 | ) | | | (487,016 | ) | | | (6,120,221 | ) | |

Net increase | | | 425,413 | | | | 5,238,542 | | | | 27,108 | | | | 298,697 | | |

Total net increase (decrease) | | | (13,528,077 | ) | | | (171,549,632 | ) | | | 2,043,575 | | | | 5,143,312 | | |

(a) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

15

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund's portfolio turnover rate may be higher.

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class A | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value,

beginning of period | | $ | 12.35 | | | $ | 14.26 | | | $ | 14.25 | | | $ | 12.29 | | | $ | 9.76 | | | $ | 8.53 | | | $ | 9.03 | | |

Income from

investment

operations: | |

Net investment

income | | | 0.11 | | | | 0.17 | | | | 0.23 | | | | 0.15 | | | | 0.19 | | | | 0.11 | | | | 0.12 | | |

Net realized and

unrealized

gain (loss) | | | 0.90 | | | | (0.44 | ) | | | 1.05 | | | | 1.97 | | | | 2.55 | | | | 1.20 | | | | (0.49 | ) | |

Total from

investment

operations | | | 1.01 | | | | (0.27 | ) | | | 1.28 | | | | 2.12 | | | | 2.74 | | | | 1.31 | | | | (0.37 | ) | |

Less distributions

to shareholders: | |

Net investment

income | | | (0.08 | ) | | | (0.25 | ) | | | (0.17 | ) | | | (0.16 | ) | | | (0.21 | ) | | | (0.08 | ) | | | (0.13 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions

to shareholders | | | (0.08 | ) | | | (1.64 | ) | | | (1.27 | ) | | | (0.16 | ) | | | (0.21 | ) | | | (0.08 | ) | | | (0.13 | ) | |

Net asset value,

end of period | | $ | 13.28 | | | $ | 12.35 | | | $ | 14.26 | | | $ | 14.25 | | | $ | 12.29 | | | $ | 9.76 | | | $ | 8.53 | | |

Total return | | | 8.19 | % | | | (1.34 | %) | | | 9.34 | % | | | 17.45 | % | | | 28.46 | % | | | 15.31 | % | | | (4.32 | %) | |

Ratios to average

net assets(b) | |

Total gross

expenses | | | 1.03 | %(c) | | | 1.04 | % | | | 1.05 | % | | | 1.09 | % | | | 1.14 | %(d) | | | 1.10 | %(c) | | | 1.13 | % | |

Total net expenses(e) | | | 1.03 | %(c)(f) | | | 1.04 | %(f) | | | 1.05 | %(f) | | | 1.08 | %(f) | | | 1.08 | %(d)(f) | | | 1.10 | %(c) | | | 1.13 | %(f) | |

Net investment

income | | | 1.76 | %(c) | | | 1.31 | % | | | 1.61 | % | | | 1.16 | % | | | 1.77 | % | | | 1.66 | %(c) | | | 1.20 | % | |

Supplemental data | |

Net assets, end of

period (in thousands) | | $ | 2,151,835 | | | $ | 2,159,152 | | | $ | 2,434,631 | | | $ | 2,454,495 | | | $ | 2,480,865 | | | $ | 2,320,419 | | | $ | 3,197,508 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

16

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class B | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of

period | | $ | 12.39 | | | $ | 14.30 | | | $ | 14.28 | | | $ | 12.32 | | | $ | 9.79 | | | $ | 8.56 | | | $ | 9.05 | | |

Income from investment

operations: | |

Net investment income | | | 0.07 | | | | 0.08 | | | | 0.11 | | | | 0.05 | | | | 0.11 | | | | 0.06 | | | | 0.04 | | |

Net realized and unrealized

gain (loss) | | | 0.89 | | | | (0.45 | ) | | | 1.07 | | | | 1.98 | | | | 2.55 | | | | 1.21 | | | | (0.49 | ) | |

Total from investment

operations | | | 0.96 | | | | (0.37 | ) | | | 1.18 | | | | 2.03 | | | | 2.66 | | | | 1.27 | | | | (0.45 | ) | |

Less distributions to

shareholders: | |

Net investment income | | | (0.03 | ) | | | (0.15 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.04 | ) | | | (0.04 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to

shareholders | | | (0.03 | ) | | | (1.54 | ) | | | (1.16 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.04 | ) | | | (0.04 | ) | |

Net asset value, end of

period | | $ | 13.32 | | | $ | 12.39 | | | $ | 14.30 | | | $ | 14.28 | | | $ | 12.32 | | | $ | 9.79 | | | $ | 8.56 | | |

Total return | | | 7.76 | % | | | (2.08 | %) | | | 8.58 | % | | | 16.54 | % | | | 27.38 | % | | | 14.82 | % | | | (5.01 | %) | |

Ratios to average

net assets(b) | |

Total gross expenses | | | 1.78 | %(c) | | | 1.79 | % | | | 1.80 | % | | | 1.84 | % | | | 1.88 | %(d) | | | 1.87 | %(c) | | | 1.88 | % | |

Total net expenses(e) | | | 1.78 | %(c)(f) | | | 1.79 | %(f) | | | 1.80 | %(f) | | | 1.83 | %(f) | | | 1.83 | %(d)(f) | | | 1.87 | %(c) | | | 1.88 | %(f) | |

Net investment income | | | 1.03 | %(c) | | | 0.58 | % | | | 0.74 | % | | | 0.39 | % | | | 1.03 | % | | | 0.93 | %(c) | | | 0.43 | % | |

Supplemental data | |

Net assets, end of period

(in thousands) | | $ | 15,716 | | | $ | 20,574 | | | $ | 44,132 | | | $ | 69,741 | | | $ | 108,589 | | | $ | 138,560 | | | $ | 142,429 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

17

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class C | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of

period | | $ | 12.32 | | | $ | 14.22 | | | $ | 14.21 | | | $ | 12.26 | | | $ | 9.74 | | | $ | 8.52 | | | $ | 9.02 | | |

Income from investment

operations: | |

Net investment income | | | 0.06 | | | | 0.07 | | | | 0.12 | | | | 0.05 | | | | 0.11 | | | | 0.06 | | | | 0.04 | | |

Net realized and unrealized

gain (loss) | | | 0.89 | | | | (0.43 | ) | | | 1.05 | | | | 1.97 | | | | 2.54 | | | | 1.20 | | | | (0.49 | ) | |

Total from investment

operations | | | 0.95 | | | | (0.36 | ) | | | 1.17 | | | | 2.02 | | | | 2.65 | | | | 1.26 | | | | (0.45 | ) | |

Less distributions to

shareholders: | |

Net investment income | | | (0.03 | ) | | | (0.15 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.04 | ) | | | (0.05 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to

shareholders | | | (0.03 | ) | | | (1.54 | ) | | | (1.16 | ) | | | (0.07 | ) | | | (0.13 | ) | | | (0.04 | ) | | | (0.05 | ) | |

Net asset value, end of period | | $ | 13.24 | | | $ | 12.32 | | | $ | 14.22 | | | $ | 14.21 | | | $ | 12.26 | | | $ | 9.74 | | | $ | 8.52 | | |

Total return | | | 7.72 | % | | | (2.02 | %) | | | 8.55 | % | | | 16.54 | % | | | 27.46 | % | | | 14.80 | % | | | (5.07 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 1.78 | %(c) | | | 1.79 | % | | | 1.80 | % | | | 1.84 | % | | | 1.89 | %(d) | | | 1.85 | %(c) | | | 1.88 | % | |

Total net expenses(e) | | | 1.78 | %(c)(f) | | | 1.79 | %(f) | | | 1.80 | %(f) | | | 1.83 | %(f) | | | 1.83 | %(d)(f) | | | 1.85 | %(c) | | | 1.88 | %(f) | |

Net investment income | | | 1.01 | %(c) | | | 0.56 | % | | | 0.87 | % | | | 0.41 | % | | | 1.02 | % | | | 0.95 | %(c) | | | 0.44 | % | |

Supplemental data | |

Net assets, end of period

(in thousands) | | $ | 65,880 | | | $ | 64,809 | | | $ | 72,010 | | | $ | 69,633 | | | $ | 61,178 | | | $ | 55,775 | | | $ | 54,238 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

18

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class I | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 12.33 | | | $ | 14.24 | | | $ | 14.23 | | | $ | 12.28 | | | $ | 9.76 | | | $ | 8.52 | | | $ | 9.02 | | |

Income from investment operations: | |

Net investment income | | | 0.14 | | | | 0.22 | | | | 0.29 | | | | 0.19 | | | | 0.24 | | | | 0.14 | | | | 0.16 | | |

Net realized and unrealized gain (loss) | | | 0.88 | | | | (0.43 | ) | | | 1.05 | | | | 1.98 | | | | 2.54 | | | | 1.20 | | | | (0.49 | ) | |

Total from investment operations | | | 1.02 | | | | (0.21 | ) | | | 1.34 | | | | 2.17 | | | | 2.78 | | | | 1.34 | | | | (0.33 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.10 | ) | | | (0.31 | ) | | | (0.23 | ) | | | (0.22 | ) | | | (0.26 | ) | | | (0.10 | ) | | | (0.17 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (0.10 | ) | | | (1.70 | ) | | | (1.33 | ) | | | (0.22 | ) | | | (0.26 | ) | | | (0.10 | ) | | | (0.17 | ) | |

Net asset value, end of period | | $ | 13.25 | | | $ | 12.33 | | | $ | 14.24 | | | $ | 14.23 | | | $ | 12.28 | | | $ | 9.76 | | | $ | 8.52 | | |

Total return | | | 8.34 | % | | | (0.93 | %) | | | 9.84 | % | | | 17.90 | % | | | 28.92 | % | | | 15.76 | % | | | (3.88 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.64 | %(c) | | | 0.63 | % | | | 0.62 | % | | | 0.63 | % | | | 0.66 | %(d) | | | 0.63 | %(c) | | | 0.67 | % | |

Total net expenses(e) | | | 0.64 | %(c) | | | 0.63 | % | | | 0.62 | % | | | 0.63 | % | | | 0.66 | %(d) | | | 0.63 | %(c) | | | 0.67 | % | |

Net investment income | | | 2.14 | %(c) | | | 1.72 | % | | | 2.04 | % | | | 1.46 | % | | | 2.19 | % | | | 2.13 | %(c) | | | 1.63 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 3 | | | $ | 3 | | | $ | 3 | | | $ | 3 | | | $ | 45,330 | | | $ | 39,849 | | | $ | 79,024 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

19

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class K | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 12.36 | | | $ | 14.27 | | | $ | 14.26 | | | $ | 12.30 | | | $ | 9.77 | | | $ | 8.53 | | | $ | 9.04 | | |

Income from investment operations: | |

Net investment income | | | 0.12 | | | | 0.18 | | | | 0.24 | | | | 0.16 | | | | 0.20 | | | | 0.12 | | | | 0.14 | | |

Net realized and unrealized gain (loss) | | | 0.88 | | | | (0.44 | ) | | | 1.06 | | | | 1.98 | | | | 2.56 | | | | 1.20 | | | | (0.50 | ) | |

Total from investment operations | | | 1.00 | | | | (0.26 | ) | | | 1.30 | | | | 2.14 | | | | 2.76 | | | | 1.32 | | | | (0.36 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.08 | ) | | | (0.26 | ) | | | (0.19 | ) | | | (0.18 | ) | | | (0.23 | ) | | | (0.08 | ) | | | (0.15 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (0.08 | ) | | | (1.65 | ) | | | (1.29 | ) | | | (0.18 | ) | | | (0.23 | ) | | | (0.08 | ) | | | (0.15 | ) | |

Net asset value, end of period | | $ | 13.28 | | | $ | 12.36 | | | $ | 14.27 | | | $ | 14.26 | | | $ | 12.30 | | | $ | 9.77 | | | $ | 8.53 | | |

Total return | | | 8.14 | % | | | (1.24 | %) | | | 9.46 | % | | | 17.60 | % | | | 28.61 | % | | | 15.51 | % | | | (4.23 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.96 | %(c) | | | 0.96 | % | | | 0.95 | % | | | 0.94 | % | | | 0.94 | %(d) | | | 0.93 | %(c) | | | 0.97 | % | |

Total net expenses(e) | | | 0.96 | %(c) | | | 0.96 | % | | | 0.95 | % | | | 0.94 | % | | | 0.94 | %(d) | | | 0.93 | %(c) | | | 0.97 | % | |

Net investment income | | | 1.85 | %(c) | | | 1.39 | % | | | 1.68 | % | | | 1.24 | % | | | 1.88 | % | | | 1.87 | %(c) | | | 1.36 | % | |

Supplemental data | |

Net assets, end of period

(in thousands) | | $ | 36,190 | | | $ | 38,278 | | | $ | 59,092 | | | $ | 72,165 | | | $ | 168,438 | | | $ | 202,741 | | | $ | 189,510 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

20

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class R | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 12.28 | | | $ | 14.18 | | | $ | 14.18 | | | $ | 12.23 | | | $ | 9.72 | | | $ | 8.50 | | | $ | 8.99 | | |

Income from investment operations: | |

Net investment income | | | 0.10 | | | | 0.14 | | | | 0.19 | | | | 0.12 | | | | 0.17 | | | | 0.09 | | | | 0.09 | | |

Net realized and unrealized gain (loss) | | | 0.87 | | | | (0.43 | ) | | | 1.04 | | | | 1.96 | | | | 2.53 | | | | 1.20 | | | | (0.48 | ) | |

Total from investment operations | | | 0.97 | | | | (0.29 | ) | | | 1.23 | | | | 2.08 | | | | 2.70 | | | | 1.29 | | | | (0.39 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.06 | ) | | | (0.22 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.19 | ) | | | (0.07 | ) | | | (0.10 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (0.06 | ) | | | (1.61 | ) | | | (1.23 | ) | | | (0.13 | ) | | | (0.19 | ) | | | (0.07 | ) | | | (0.10 | ) | |

Net asset value, end of period | | $ | 13.19 | | | $ | 12.28 | | | $ | 14.18 | | | $ | 14.18 | | | $ | 12.23 | | | $ | 9.72 | | | $ | 8.50 | | |

Total return | | | 7.94 | % | | | (1.52 | %) | | | 9.04 | % | | | 17.16 | % | | | 28.05 | % | | | 15.14 | % | | | (4.46 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 1.28 | %(c) | | | 1.29 | % | | | 1.30 | % | | | 1.34 | % | | | 1.39 | %(d) | | | 1.35 | %(c) | | | 1.38 | % | |

Total net expenses(e) | | | 1.28 | %(c)(f) | | | 1.29 | %(f) | | | 1.30 | %(f) | | | 1.33 | %(f) | | | 1.33 | %(d)(f) | | | 1.35 | %(c) | | | 1.38 | %(f) | |

Net investment income | | | 1.51 | %(c) | | | 1.07 | % | | | 1.36 | % | | | 0.90 | % | | | 1.53 | % | | | 1.46 | %(c) | | | 0.95 | % | |

Supplemental data | |

Net assets, end of period

(in thousands) | | $ | 5,667 | | | $ | 5,688 | | | $ | 7,687 | | | $ | 8,004 | | | $ | 9,859 | | | $ | 10,976 | | | $ | 10,114 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Ratios include line of credit interest expense which is less than 0.01%.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Semiannual Report 2016

21

COLUMBIA DIVERSIFIED EQUITY INCOME FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Six Months Ended

November 30, 2016 | | Year Ended May 31, | | Year Ended

September 30, | |

Class R4 | | (Unaudited) | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of

period | | $ | 12.35 | | | $ | 14.26 | | | $ | 14.24 | | | $ | 12.28 | | | $ | 9.75 | | | $ | 8.51 | | | $ | 9.02 | | |

Income from investment

operations: | |

Net investment income | | | 0.13 | | | | 0.20 | | | | 0.26 | | | | 0.18 | | | | 0.20 | | | | 0.11 | | | | 0.11 | | |

Net realized and unrealized

gain (loss) | | | 0.88 | | | | (0.43 | ) | | | 1.06 | | | | 1.97 | | | | 2.54 | | | | 1.20 | | | | (0.50 | ) | |

Total from investment operations | | | 1.01 | | | | (0.23 | ) | | | 1.32 | | | | 2.15 | | | | 2.74 | | | | 1.31 | | | | (0.39 | ) | |

Less distributions to shareholders: | |

Net investment income | | | (0.09 | ) | | | (0.29 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.21 | ) | | | (0.07 | ) | | | (0.12 | ) | |

Net realized gains | | | — | | | | (1.39 | ) | | | (1.10 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (0.09 | ) | | | (1.68 | ) | | | (1.30 | ) | | | (0.19 | ) | | | (0.21 | ) | | | (0.07 | ) | | | (0.12 | ) | |

Net asset value, end of period | | $ | 13.27 | | | $ | 12.35 | | | $ | 14.26 | | | $ | 14.24 | | | $ | 12.28 | | | $ | 9.75 | | | $ | 8.51 | | |

Total return | | | 8.24 | % | | | (1.07 | %) | | | 9.69 | % | | | 17.71 | % | | | 28.46 | % | | | 15.37 | % | | | (4.52 | %) | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.79 | %(c) | | | 0.79 | % | | | 0.80 | % | | | 0.84 | % | | | 1.02 | %(d) | | | 1.18 | %(c) | | | 1.21 | % | |

Total net expenses(e) | | | 0.79 | %(c)(f) | | | 0.79 | %(f) | | | 0.80 | %(f) | | | 0.83 | %(f) | | | 0.99 | %(d) | | | 1.18 | %(c) | | | 1.21 | % | |

Net investment income | | | 2.01 | %(c) | | | 1.56 | % | | | 1.81 | % | | | 1.37 | % | | | 1.91 | % | | | 1.63 | %(c) | | | 1.06 | % | |

Supplemental data | |

Net assets, end of period

(in thousands) | | $ | 7,379 | | | $ | 7,052 | | | $ | 10,520 | | | $ | 13,093 | | | $ | 22,154 | | | $ | 53,739 | | | $ | 53,617 | | |

Portfolio turnover | | | 15 | % | | | 43 | % | | | 48 | % | | | 74 | % | | | 43 | % | | | 16 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from October 1, 2011 to May 31, 2012. During the period, the Fund's fiscal year end was changed from September 30 to May 31.