UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-21852

COLUMBIA FUNDS SERIES TRUST II

(Exact name of registrant as specified in charter)

50606 Ameriprise Financial Center,

Minneapolis, Minnesota 55474

(Address of principal executive offices) (Zip code)

Scott R. Plummer—5228 Ameriprise Financial

Center, Minneapolis, MN 55474

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 671-1947

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Item 1. Reports to Stockholders.

Semiannual Report

Semiannual Report

Columbia

Absolute Return Currency and

Income Fund

Semiannual Report for the Period Ended April 30, 2012

Columbia Absolute Return Currency and Income Fund seeks to provide shareholders with positive absolute return.

Not FDIC insured ¡ No bank guarantee ¡ May lose value

| | | | |

| |

Your Fund at a Glance | | | 2 | |

| |

Fund Expense Example | | | 5 | |

| |

Portfolio of Investments | | | 7 | |

| |

Statement of Assets and Liabilities | | | 12 | |

| |

Statement of Operations | | | 14 | |

| |

Statement of Changes in Net Assets | | | 15 | |

| |

Financial Highlights | | | 17 | |

| |

Notes to Financial Statements | | | 23 | |

| |

Proxy Voting | | | 38 | |

| |

Approval of Investment Management Services Agreement | | | 38 | |

See the Fund’s prospectus for risks associated with investing in the Fund.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 1 | |

FUND SUMMARY

| > | | Columbia Absolute Return Currency and Income Fund (the Fund) Class A shares returned 2.61% (excluding sales charge) for the six months ended April 30, 2012. |

| > | | The Fund outperformed its benchmark, the Citigroup 3-month U.S. Treasury Bill Index, which rose 0.02% for the same timeframe. |

ANNUALIZED TOTAL RETURNS (for period ended April 30, 2012)

| | | | | | | | | | | | | | | | |

| | | 6 months* | | | 1 year | | | 5 years | | | Since

inception

06/15/06 | |

Columbia Absolute Return Currency and Income Fund (excluding sales charge) | | | +2.61% | | | | +0.89% | | | | +1.24% | | | | +2.45% | |

Citigroup 3-month U.S. Treasury Bill Index(1) (unmanaged) | | | +0.02% | | | | +0.04% | | | | +1.03% | | | | +1.60% | ** |

| ** | | Citigroup 3-month U.S. Treasury Bill Index is as of June 30, 2006. |

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiamanagement.com or calling 800.345.6611.

The 3.00% sales charge applicable to Class A shares of the Fund is not reflected in the table above. If reflected, returns would be lower than those shown. The performance of other classes may vary from that shown because of differences in fees and expenses. The Fund’s returns reflect the effect of fee waivers/expense reimbursements, if any. Without such waivers/reimbursements, the Fund’s returns would be lower. See the Average Annual Total Returns table for performance of other share classes of the Fund.

The index does not reflect the effects of sales charges, expenses and taxes. It is not possible to invest directly in an index.

| (1) | | The Citigroup 3-month U.S. Treasury Bill Index, an unmanaged index, represents the performance of three-month Treasury bills. The index reflects reinvestment of all distributions and changes in market prices. |

| | |

| 2 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | | | | | | | | | |

| at April 30, 2012 | | | | | | | | | | | | |

| Without sales charge | | 6 months* | | | 1 year | | | 5 years | | | Since

inception | |

Class A (inception 6/15/06) | | | +2.61% | | | | +0.89% | | | | +1.24% | | | | +2.45% | |

Class B (inception 6/15/06) | | | +2.16% | | | | +0.10% | | | | +0.52% | | | | +1.72% | |

Class C (inception 6/15/06) | | | +2.16% | | | | +0.10% | | | | +0.53% | | | | +1.72% | |

Class I (inception 6/15/06) | | | +2.77% | | | | +1.46% | | | | +1.71% | | | | +2.91% | |

Class W** (inception 12/1/06) | | | +2.52% | | | | +0.79% | | | | +1.20% | | | | +2.40% | |

Class Z** (inception 9/27/10) | | | +2.77% | | | | +1.37% | | | | +1.36% | | | | +2.54% | |

| | | | |

| With sales charge | | | | | | | | | | | | |

Class A (inception 6/15/06) | | | -0.49% | | | | -2.11% | | | | +0.62% | | | | +1.91% | |

Class B (inception 6/15/06) | | | -2.84% | | | | -4.90% | | | | +0.14% | | | | +1.56% | |

Class C (inception 6/15/06) | | | +1.16% | | | | -0.90% | | | | +0.53% | | | | +1.72% | |

The “Without sales charge” returns for Class A, Class B and Class C shares do not include applicable initial or contingent deferred sales charges. If included, returns would be lower than those shown. The “With sales charge” returns for Class A, Class B and Class C shares include: the maximum initial sales charge of 3.00% for Class A shares; the applicable contingent deferred sales charge (CDSC) for Class B shares (applied as follows: first year 5%; second year 4%; third and fourth years 3%; fifth year 2%; sixth year 1%; no sales charge thereafter); and a 1% CDSC for Class C shares sold within one year after purchase. The Fund’s other share classes are not subject to sales charges and have limited eligibility. See the Fund’s prospectuses for details.

| ** | The returns shown for periods prior to the share class inception date (including returns since inception, which are since Fund inception) include the returns of the Fund’s Class A shares. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-fund/appended-performance for more information. |

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 3 | |

| | |

| Your Fund at a Glance (continued) | | |

| | | | |

| PORTFOLIO BREAKDOWN(1) (at April 30, 2012) | | | |

Bonds | | | 8.3 | % |

Asset-Backed Securities — Agency | | | 2.1 | |

Commercial Mortgage-Backed Securities — Non-Agency | | | 2.6 | |

Corporate Bonds & Notes | | | 1.8 | |

Foreign Government Obligations | | | 1.8 | |

Short-Term Investments Segregated in Connection With Open Derivatives Contracts(2) | | | 91.7 | |

| (1) | | Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change. |

| (2) | | Includes investments in an affiliated money market fund (amounting to $103.4 million) which have been segregated to cover obligations relating to the Fund's investment in derivatives, which provides exposure to currencies. For a description of the Fund's investments in derivatives, see Investments in Derivatives following the Portfolio of Investments, and Note 2 to the financial statements. |

| | | | |

| QUALITY BREAKDOWN(1) (at April 30, 2012) | | | |

AAA rating | | | 75.9 | % |

AA rating | | | 23.6 | |

Non-investment grade | | | 0.5 | |

| (1) | | Percentages indicated are based upon total fixed income securities (excluding Investments of Cash Collateral Received for Securities on Loan and Money Market Funds). |

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from AAA (highest) to D (lowest), and are subject to change. The ratings shown are determined by using the middle rating of Moody’s, S&P, and Fitch after dropping the highest and lowest available ratings. When a rating from only two agencies is available, the lower rating is used. When a rating from only one agency is available, that rating is used. When a bond is not rated by one of these agencies, it is designated as Not rated. Credit ratings are subjective to opinions and not statements of fact.

| | |

| 4 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

(Unaudited)

Understanding your expenses

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 5 | |

| | |

| Fund Expense Example (continued) | | |

November 1, 2011 — April 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Account value at the

beginning of the

period ($) | | | Account value at the

end of the period ($) | | | Expenses paid

during the period ($) | | | Fund’s

annualized

expense

ratio (%) | |

| | | Actual | | | Hypothetical | | | Actual | | | Hypothetical | | | Actual | | | Hypothetical | | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.10 | | | | 1,017.85 | | | | 7.10 | | | | 7.07 | | | | 1.41 | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,021.60 | | | | 1,014.12 | | | | 10.86 | | | | 10.82 | | | | 2.16 | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,021.60 | | | | 1,014.17 | | | | 10.81 | | | | 10.77 | | | | 2.15 | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,027.70 | | | | 1,020.14 | | | | 4.79 | | | | 4.77 | | | | 0.95 | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,025.20 | | | | 1,016.16 | | | | 8.81 | | | | 8.77 | | | | 1.75 | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,027.70 | | | | 1,019.99 | | | | 4.94 | | | | 4.92 | | | | 0.98 | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as “acquired funds”), including affiliated and non-affiliated pooled investment vehicles (including mutual funds and exchange traded funds).

Columbia Management Investment Advisers, LLC and/or certain of its affiliates have contractually agreed to waive certain fees and to absorb certain expenses until February 28, 2013, unless sooner terminated at the sole discretion of the Fund’s Board, such that net expenses (excluding fees and expenses of acquired funds) will not exceed 1.32% for Class A, 2.07% for Class B, 2.07% for Class C, 0.87% for Class I, 1.32% for Class W and 1.07 for Class Z. Any amounts waived will not be reimbursed by the Fund. This change was effective January 1, 2012. If this change had been in place for the entire six month period ended April 30, 2012, the actual expenses paid would have been $6.65 for Class A, $10.40 for Class B, $10.40 for Class C, $4.39 for Class I, $6.65 for Class W and $5.39 for Class Z; the hypothetical expenses paid would have been $6.62 for Class A, $10.37 for Class B, $10.37 for Class C, $4.37 for Class I, $6.62 for Class W and $5.37 for Class Z.

| | |

| 6 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

Columbia Absolute Return Currency and Income Fund

April 30, 2012 (Unaudited)

(Percentages represent value of investments compared to net assets)

| | | | | | | | | | | | |

| Issuer | | Coupon

Rate | | | Principal

Amount | | | Value | |

| Corporate Bonds & Notes 1.8% | |

| | | | | | | | | | | | |

Agencies 1.8% | |

Bank of America Corp.

FDIC Government Guaranty(a) | |

06/22/12 | | | 0.674 | % | | | $2,000,000 | | | | $2,001,554 | |

Total Corporate Bonds & Notes | |

(Cost: $2,000,000) | | | | $2,001,554 | |

| | | | | | | | | | | | |

Commercial Mortgage-Backed

Securities - Non-Agency 2.6% | |

GS Mortgage Securities Corp. II(a)(b)(c)

Series 2007-EOP Class A2 | |

03/06/20 | | | 1.260 | % | | | $1,200,000 | | | | $1,183,469 | |

Series 2007-EOP Class A3 | |

03/06/20 | | | 1.456 | % | | | 1,770,000 | | | | 1,745,457 | |

Total Commercial Mortgage-Backed Securities - Non-Agency | |

(Cost: $2,926,031) | | | | $2,928,926 | |

| | | | | | | | | | | | |

Asset-Backed Securities -

Non-Agency 2.1% | |

Countrywide Home Equity Loan Trust

Series 2005-H Class 2A (FGIC)(a) | |

12/15/35 | | | 0.480 | % | | | $107,458 | | | | $48,504 | |

Northstar Education Finance, Inc.

Series 2007-1 Class A2(a) | |

01/29/46 | | | 1.216 | % | | | 750,000 | | | | 676,272 | |

SLM Student Loan Trust(a)

Series 2005-5 Class A2 | |

10/25/21 | | | 0.546 | % | | | 405,980 | | | | 404,145 | |

Series 2005-8 Class A2 | |

07/25/22 | | | 0.556 | % | | | 495,415 | | | | 494,005 | |

Series 2006-C Class A2 | |

09/15/20 | | | 0.524 | % | | | 194,492 | | | | 193,635 | |

Series 2007-2 Class A2 | |

07/25/17 | | | 0.466 | % | | | 579,502 | | | | 576,987 | |

Total Asset-Backed Securities - Non-Agency | |

(Cost: $2,515,417) | | | | $2,393,548 | |

| | | | | | | | | | | | |

| Issuer | | Coupon

Rate | | | Principal

Amount | | | Value | |

| Foreign Government Obligations 1.8% | |

| | | | | | | | | | | | |

UNITED KINGDOM 1.8% | |

Royal Bank of Scotland PLC (The)

Government Liquid Guaranteed(a)(c) | |

05/11/12 | | | 1.210 | % | | | $2,000,000 | | | | $2,000,391 | |

Total Foreign Government Obligations | |

(Cost: $2,000,000) | | | | $2,000,391 | |

| | | |

| | | | | | Shares | | | Value | |

| Money Market Funds 92.1% | |

Columbia Short-Term Cash Fund, 0.144%(d)(e) | | | | 103,424,843 | | | | $103,424,843 | |

Total Money Market Funds | |

(Cost: $103,424,843) | | | | $103,424,843 | |

Total Investments | |

(Cost: $112,866,291) | | | | $112,749,262 | |

Other Assets & Liabilities, Net | | | | (479,572 | ) |

Net Assets | | | | $112,269,690 | |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 7 | |

| | |

| Portfolio of Investments (continued) | | |

Investment in Derivatives

| | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts Open at April 30, 2012 | |

| Counterparty | | Exchange Date | | | Currency to

be Delivered | | | Currency to

be Received | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

| | | | | |

Goldman, Sachs & Co. | | | May 23, 2012 | | | | 20,545,000 (EUR | ) | | 26,839,988 (USD) | | | $— | | | | $(357,739 | ) |

State Street Bank & Trust Company | | | May 23, 2012 | | | | 6,691,000 (GBP | ) | | 10,597,540 (USD) | | | — | | | | (259,644 | ) |

HSBC Securities (USA), Inc. | | | May 23, 2012 | | | | 1,303,614,000 (JPY | ) | | 16,212,396 (USD) | | | — | | | | (118,556 | ) |

J.P. Morgan Securities, Inc. | | | May 23, 2012 | | | | 16,137,295 (USD | ) | | 93,555,000 (NOK) | | | 196,064 | | | | — | |

Citigroup Global Markets Inc. | | | May 23, 2012 | | | | 5,577,057 (USD | ) | | 6,893,000 (NZD) | | | 50,912 | | | | — | |

Citigroup Global Markets Inc. | | | May 23, 2012 | | | | 5,211,551 (USD | ) | | 6,376,000 (NZD) | | | — | | | | (5,701 | ) |

Morgan Stanley | | | May 23, 2012 | | | | 27,205,015 (USD | ) | | 183,136,000 (SEK) | | | 42,095 | | | | — | |

Total | | | | | | | | | | | | | $289,071 | | | | $(741,640 | ) |

| | |

| Notes to Portfolio of Investments |

| (a) | Variable rate security. The interest rate shown reflects the rate as of April 30, 2012. |

| (b) | The maturity dates shown represent the original maturity of the underlying obligation. Actual maturity may vary based upon prepayment activity on these obligations. Unless otherwise noted, the coupon rates presented are fixed rates. |

| (c) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2012, the value of these securities amounted to $4,929,317 or 4.39% of net assets. |

| (d) | The rate shown is the seven-day current annualized yield at April 30, 2012. |

| (e) | Investments in affiliates during the period ended April 30, 2012: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Beginning

Cost | | | Purchase

Cost | | | Sales Cost/

Proceeds

from Sales | | | Realized

Gain/Loss | | | Ending

Cost | | | Dividends

or

Interest

Income | | | Value | |

Columbia Short-Term Cash Fund | | | $132,263,114 | | | | $10,345,715 | | | | $(39,183,986 | ) | | | $— | | | | $103,424,843 | | | | $85,786 | | | | $103,424,843 | |

| | |

| Abbreviation Legend |

| FDIC | | Federal Deposit Insurance Corporation |

| FGIC | | Financial Guaranty Insurance Company |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 8 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | |

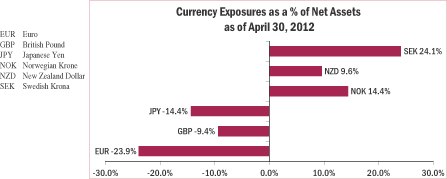

| Currency Legend |

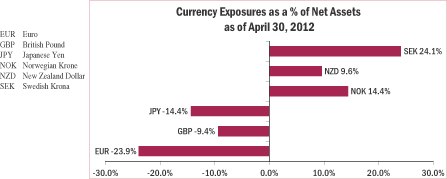

| EUR | | Euro |

| GBP | | British Pound |

| JPY | | Japanese Yen |

| NOK | | Norwegian Krone |

| NZD | | New Zealand Dollar |

| SEK | | Swedish Krona |

| USD | | US Dollar |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 9 | |

| | |

| Portfolio of Investments (continued) | | |

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| | Ÿ | | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments. |

| | Ÿ | | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| | Ÿ | | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 10 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | |

| Fair Value Measurements (continued) |

The following table is a summary of the inputs used to value the Fund’s investments as of April 30, 2012:

| | | | | | | | | | | | | | | | |

| | | Fair Value at April 30, 2012 | |

| Description | | Level 1

Quoted Prices

in Active

Markets for

Identical Assets | | | Level 2

Other

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

| Bonds | | | | | | | | | | | | | | | | |

Corporate Bonds & Notes | | | $— | | | | $2,001,554 | | | | $— | | | | $2,001,554 | |

Commercial Mortgage-Backed

Securities — Non-Agency | | | — | | | | 2,928,926 | | | | — | | | | 2,928,926 | |

Asset-Backed Securities — Non-Agency | | | — | | | | 2,393,548 | | | | — | | | | 2,393,548 | |

Foreign Government Obligations | | | — | | | | 2,000,391 | | | | — | | | | 2,000,391 | |

| Total Bonds | | | — | | | | 9,324,419 | | | | — | | | | 9,324,419 | |

| Other | | | | | | | | | | | | | | | | |

Money Market Funds | | | 103,424,843 | | | | — | | | | — | | | | 103,424,843 | |

| Total Other | | | 103,424,843 | | | | — | | | | — | | | | 103,424,843 | |

| Investments in Securities | | | 103,424,843 | | | | 9,324,419 | | | | — | | | | 112,749,262 | |

| Derivatives | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | 289,071 | | | | — | | | | 289,071 | |

Liabilities | | | | | | | | | | | | | | | | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (741,640 | ) | | | — | | | | (741,640 | ) |

| Total | | | $103,424,843 | | | | $8,871,850 | | | | $— | | | | $112,296,693 | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

There were no transfers of financial assets between Levels 1 and 2 during the period.

Derivative instruments are valued at unrealized appreciation (depreciation).

How to find information about the Fund’s quarterly portfolio holdings

| (i) | The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q; |

| (ii) | The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov; |

| (iii) | The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (information on the operations of the Public Reference Room may be obtained by calling 800.SEC.0330); and |

| (iv) | The Fund’s complete schedule of portfolio holdings, as filed on Form N-Q, can be obtained without charge, upon request, by calling 800.345.6611. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 11 | |

| | |

| Statement of Assets and Liabilities | | |

April 30, 2012 (Unaudited)

| | | | | |

Assets | |

Investments, at value | | | | | |

Unaffiliated issuers (identified cost $9,441,448) | | | $ | 9,324,419 | |

Affiliated issuers (identified cost $103,424,843) | | | | 103,424,843 | |

Total investments (identified cost $112,866,291) | | | | 112,749,262 | |

Cash | | | | 207,615 | |

Unrealized appreciation on forward foreign currency exchange contracts | | | | 289,071 | |

Receivable for: | | | | | |

Investments sold | | | | 49,724 | |

Capital shares sold | | | | 60,166 | |

Dividends | | | | 13,369 | |

Interest | | | | 9,891 | |

Expense reimbursement due from Investment Manager | | | | 2,450 | |

Prepaid expense | | | | 109 | |

Total assets | | | | 113,381,657 | |

Liabilities | | | | | |

Unrealized depreciation on forward foreign currency exchange contracts | | | | 741,640 | |

Payable for: | | | | | |

Investments purchased | | | | 3,551 | |

Capital shares purchased | | | | 253,757 | |

Investment management fees | | | | 8,218 | |

Distribution fees | | | | 1,241 | |

Transfer agent fees | | | | 54,270 | |

Administration fees | | | | 739 | |

Compensation of board members | | | | 9,953 | |

Other expenses | | | | 38,598 | |

Total liabilities | | | | 1,111,967 | |

Net assets applicable to outstanding capital stock | | | $ | 112,269,690 | |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 12 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

April 30, 2012 (Unaudited)

| | | | | |

Represented by | | | | | |

Paid-in capital | | | $ | 111,092,310 | |

Excess of distributions over net investment income | | | | (599,924 | ) |

Accumulated net realized gain | | | | 2,346,902 | |

Unrealized appreciation (depreciation) on: | | | | | |

Investments | | | | (117,029 | ) |

Forward foreign currency exchange contracts | | | | (452,569 | ) |

Total — representing net assets applicable to outstanding capital stock | | | $ | 112,269,690 | |

Net assets applicable to outstanding shares | | | | | |

Class A | | | $ | 35,036,206 | |

Class B | | | $ | 608,643 | |

Class C | | | $ | 2,926,258 | |

Class I | | | $ | 53,484,868 | |

Class W | | | $ | 11,130,045 | |

Class Z | | | $ | 9,083,670 | |

Shares outstanding | | | | | |

Class A | | | | 3,432,050 | |

Class B | | | | 61,267 | |

Class C | | | | 294,876 | |

Class I | | | | 5,147,798 | |

Class W | | | | 1,092,481 | |

Class Z | | | | 874,096 | |

Net asset value per share | | | | | |

Class A(a) | | | $ | 10.21 | |

Class B | | | $ | 9.93 | |

Class C | | | $ | 9.92 | |

Class I | | | $ | 10.39 | |

Class W | | | $ | 10.19 | |

Class Z | | | $ | 10.39 | |

| (a) | The maximum offering price per share for Class A is $10.53. The offering price is calculated by dividing the net asset value by 1.0 minus the maximum sales charge of 3.00%. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 13 | |

Six months ended April 30, 2012 (Unaudited)

| | | | | |

Net investment income | |

Income: | | | | | |

Interest | | | $ | 65,934 | |

Dividends from affiliates | | | | 85,786 | |

Total income | | | | 151,720 | |

Expenses: | | | | | |

Investment management fees | | | | 534,959 | |

Distribution fees | | | | | |

Class A | | | | 46,698 | |

Class B | | | | 3,256 | |

Class C | | | | 15,548 | |

Class W | | | | 20,126 | |

Transfer agent fees | | | | | |

Class A | | | | 38,907 | |

Class B | | | | 688 | |

Class C | | | | 3,112 | |

Class W | | | | 43,145 | |

Class Z | | | | 1,824 | |

Administration fees | | | | 48,086 | |

Compensation of board members | | | | 5,000 | |

Custodian fees | | | | 2,129 | |

Printing and postage fees | | | | 32,759 | |

Registration fees | | | | 29,856 | |

Professional fees | | | | 24,602 | |

Other | | | | 6,891 | |

Total expenses | | | | 857,586 | |

Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | | (113,121 | ) |

Total net expenses | | | | 744,465 | |

Net investment loss | | | | (592,745 | ) |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | | | | | |

Investments | | | | 21,537 | |

Forward foreign currency exchange contracts | | | | 4,278,338 | |

Net realized gain | | | | 4,299,875 | |

Net change in unrealized appreciation (depreciation) on: | | | | | |

Investments | | | | (29,688 | ) |

Forward foreign currency exchange contracts | | | | (430,338 | ) |

Net change in unrealized depreciation | | | | (460,026 | ) |

Net realized and unrealized gain | | | | 3,839,849 | |

Net increase in net assets resulting from operations | | | $ | 3,247,104 | |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 14 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | |

| Statements of Changes in Net Assets | | |

| | | | | | | | | | |

| | | Six months ended

April 30, 2012 | | Year ended

October 31, 2011 |

| | | (Unaudited) | | |

Operations | |

Net investment loss | | | $ | (592,745 | ) | | | $ | (2,286,684 | ) |

Net realized gain (loss) | | | | 4,299,875 | | | | | (1,650,824 | ) |

Net change in unrealized appreciation (depreciation) | | | | (460,026 | ) | | | | 1,981,432 | |

Net increase (decrease) in net assets resulting from operations | | | | 3,247,104 | | | | | (1,956,076 | ) |

Increase (decrease) in net assets from share transactions | | | | (33,673,441 | ) | | | | (25,367,036 | ) |

Total decrease in net assets | | | | (30,426,337 | ) | | | | (27,323,112 | ) |

Net assets at beginning of period | | | | 142,696,027 | | | | | 170,019,139 | |

Net assets at end of period | | | $ | 112,269,690 | | | | $ | 142,696,027 | |

Excess of distributions over net investment income | | | $ | (599,924 | ) | | | $ | (7,179 | ) |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 15 | |

| | |

| Statements of Changes in Net Assets (continued) | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

April 30, 2012

(Unaudited) | | Year ended

October 31, 2011 |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) |

Capital stock activity | | | | | | | | | | | | | | | | | | | | |

Class A shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions(a) | | | | 359,171 | | | | | 3,644,547 | | | | | 1,251,491 | | | | | 12,532,928 | |

Redemptions | | | | (1,022,389 | ) | | | | (10,329,947 | ) | | | | (3,375,910 | ) | | | | (33,903,777 | ) |

Net decrease | | | | (663,218 | ) | | | | (6,685,400 | ) | | | | (2,124,419 | ) | | | | (21,370,849 | ) |

Class B shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions | | | | 3,529 | | | | | 34,759 | | | | | 31,072 | | | | | 305,161 | |

Redemptions(a) | | | | (14,018 | ) | | | | (138,362 | ) | | | | (61,533 | ) | | | | (603,991 | ) |

Net decrease | | | | (10,489 | ) | | | | (103,603 | ) | | | | (30,461 | ) | | | | (298,830 | ) |

Class C shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions | | | | 23,629 | | | | | 233,248 | | | | | 81,907 | | | | | 804,381 | |

Redemptions | | | | (71,948 | ) | | | | (708,771 | ) | | | | (216,896 | ) | | | | (2,133,457 | ) |

Net decrease | | | | (48,319 | ) | | | | (475,523 | ) | | | | (134,989 | ) | | | | (1,329,076 | ) |

Class I shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions | | | | 314,078 | | | | | 3,239,463 | | | | | 12,643,001 | | | | | 128,114,306 | |

Redemptions | | | | (1,860,456 | ) | | | | (18,977,611 | ) | | | | (9,785,869 | ) | | | | (98,320,174 | ) |

Net increase (decrease) | | | | (1,546,378 | ) | | | | (15,738,148 | ) | | | | 2,857,132 | | | | | 29,794,132 | |

Class W shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions | | | | 215,872 | | | | | 2,173,350 | | | | | 1,817,360 | | | | | 18,226,039 | |

Redemptions | | | | (1,553,991 | ) | | | | (15,659,507 | ) | | | | (5,728,728 | ) | | | | (56,478,697 | ) |

Net decrease | | | | (1,338,119 | ) | | | | (13,486,157 | ) | | | | (3,911,368 | ) | | | | (38,252,658 | ) |

Class Z shares | | | | | | | | | | | | | | | | | | | | |

Subscriptions | | | | 427,896 | | | | | 4,411,482 | | | | | 703,290 | | | | | 7,134,897 | |

Redemptions | | | | (154,970 | ) | | | | (1,596,092 | ) | | | | (103,525 | ) | | | | (1,044,652 | ) |

Net increase | | | | 272,926 | | | | | 2,815,390 | | | | | 599,765 | | | | | 6,090,245 | |

Total net decrease | | | | (3,333,597 | ) | | | | (33,673,441 | ) | | | | (2,744,340 | ) | | | | (25,367,036 | ) |

| (a) | Includes conversions of Class B shares to Class A shares, if any. The line items from the prior year have been combined to conform to the current year presentation. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 16 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

The following tables are intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total returns assume reinvestment of all dividends and distributions. Total returns do not reflect payment of sales charges, if any, and are not annualized for periods of less than one year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended April 30,

2012 | | Year ended Oct. 31, |

| | | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | (Unaudited) | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | | $9.95 | | | | | $10.00 | | | | | $9.93 | | | | | $9.97 | | | | | $10.58 | | | | | $10.09 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | (0.06 | ) | | | | (0.15 | ) | | | | (0.12 | ) | | | | (0.08 | ) | | | | 0.15 | | | | | 0.41 | |

Net realized and unrealized gain (loss) | | | | 0.32 | | | | | 0.10 | | | | | 0.19 | | | | | 0.09 | | | | | (0.22 | ) | | | | 0.57 | |

Total from investment operations | | | | 0.26 | | | | | (0.05 | ) | | | | 0.07 | | | | | 0.01 | | | | | (0.07 | ) | | | | 0.98 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | — | | | | | — | | | | | — | | | | | (0.00 | )(a) | | | | (0.18 | ) | | | | (0.39 | ) |

Net realized gains | | | | — | | | | | — | | | | | — | | | | | (0.05 | ) | | | | (0.36 | ) | | | | (0.10 | ) |

Total distributions to shareholders | | | | — | | | | | — | | | | | — | | | | | (0.05 | ) | | | | (0.54 | ) | | | | (0.49 | ) |

Net asset value, end of period | | | | $10.21 | | | | | $9.95 | | | | | $10.00 | | | | | $9.93 | | | | | $9.97 | | | | | $10.58 | |

Total return | | | | 2.61% | | | | | (0.50% | ) | | | | 0.71% | | | | | 0.15% | | | | | (0.57% | ) | | | | 9.96% | (b) |

Ratios to average net assets(c) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses prior to fees waived or expenses reimbursed | | | | 1.60% | (d) | | | | 1.73% | | | | | 1.47% | | | | | 1.38% | | | | | 1.39% | | | | | 1.36% | |

Net expenses after fees waived or expenses reimbursed(e) | | | | 1.41% | (d) | | | | 1.73% | | | | | 1.47% | | | | | 1.38% | | | | | 1.39% | | | | | 1.36% | |

Net investment income (loss) | | | | (1.15% | )(d) | | | | (1.48% | ) | | | | (1.19% | ) | | | | (0.83% | ) | | | | 1.50% | | | | | 3.98% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | | $35,036 | | | | | $40,755 | | | | | $62,209 | | | | | $114,238 | | | | | $175,659 | | | | | $8,851 | |

Portfolio turnover | | | | 0% | | | | | 0% | | | | | 0% | | | | | 16% | | | | | 39% | | | | | 36% | |

Notes to Financial Highlights

| (a) | Rounds to less than $0.01. |

| (b) | During the year ended October 31, 2007, Ameriprise Financial reimbursed the Fund for a loss on a trading error. Had the Fund not received this reimbursement, total return would have been lower by 0.05%. |

| (c) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (e) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 17 | |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended April 30,

2012 | | | Year ended Oct. 31, | |

| | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Class B | | | | | | | | | | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $9.72 | | | | $9.85 | | | | $9.85 | | | | $9.96 | | | | $10.58 | | | | $10.09 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.09 | ) | | | (0.22 | ) | | | (0.19 | ) | | | (0.16 | ) | | | 0.04 | | | | 0.34 | |

Net realized and unrealized gain (loss) | | | 0.30 | | | | 0.09 | | | | 0.19 | | | | 0.10 | | | | (0.18 | ) | | | 0.59 | |

Total from investment operations | | | 0.21 | | | | (0.13 | ) | | | — | | | | (0.06 | ) | | | (0.14 | ) | | | 0.93 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.12 | ) | | | (0.34 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.36 | ) | | | (0.10 | ) |

Total distributions to shareholders | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.48 | ) | | | (0.44 | ) |

Net asset value, end of period | | | $9.93 | | | | $9.72 | | | | $9.85 | | | | $9.85 | | | | $9.96 | | | | $10.58 | |

Total return | | | 2.16% | | | | (1.32% | ) | | | 0.00% | (a) | | | (0.56% | ) | | | (1.35% | ) | | | 9.38% | (b) |

Ratios to average net assets(c) | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses prior to fees waived or

expenses reimbursed | | | 2.35% | (d) | | | 2.47% | | | | 2.23% | | | | 2.14% | | | | 2.16% | | | | 2.10% | |

Net expenses after fees waived or

expenses reimbursed(e) | | | 2.16% | (d) | | | 2.47% | | | | 2.23% | | | | 2.14% | | | | 2.16% | | | | 2.10% | |

Net investment income (loss) | | | (1.91% | )(d) | | | (2.21% | ) | | | (1.95% | ) | | | (1.59% | ) | | | 0.38% | | | | 3.26% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | $609 | | | | $698 | | | | $1,006 | | | | $2,026 | | | | $3,269 | | | | $11 | |

Portfolio turnover | | | 0% | | | | 0% | | | | 0% | | | | 16% | | | | 39% | | | | 36% | |

Notes to Financial Highlights

| (a) | Rounds to less than 0.01%. |

| (b) | During the year ended October 31, 2007, Ameriprise Financial reimbursed the Fund for a loss on a trading error. Had the Fund not received this reimbursement, total return would have been lower by 0.05%. |

| (c) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (e) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 18 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended April 30, 2012 | | Year ended Oct. 31, |

| | | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | (Unaudited) | | | | | | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | | $9.71 | | | | | $9.83 | | | | | $9.84 | | | | | $9.95 | | | | | $10.57 | | | | | $10.09 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | (0.09 | ) | | | | (0.22 | ) | | | | (0.19 | ) | | | | (0.16 | ) | | | | 0.06 | | | | | 0.34 | |

Net realized and unrealized gain (loss) | | | | 0.30 | | | | | 0.10 | | | | | 0.18 | | | | | 0.10 | | | | | (0.20 | ) | | | | 0.58 | |

Total from investment operations | | | | 0.21 | | | | | (0.12 | ) | | | | (0.01 | ) | | | | (0.06 | ) | | | | (0.14 | ) | | | | 0.92 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | — | | | | | — | | | | | — | | | | | — | | | | | (0.12 | ) | | | | (0.34 | ) |

Net realized gains | | | | — | | | | | — | | | | | — | | | | | (0.05 | ) | | | | (0.36 | ) | | | | (0.10 | ) |

Total distributions to shareholders | | | | — | | | | | — | | | | | — | | | | | (0.05 | ) | | | | (0.48 | ) | | | | (0.44 | ) |

Net asset value, end of period | | | | $9.92 | | | | | $9.71 | | | | | $9.83 | | | | | $9.84 | | | | | $9.95 | | | | | $10.57 | |

Total return | | | | 2.16% | | | | | (1.22% | ) | | | | (0.10% | ) | | | | (0.56% | ) | | | | (1.31% | ) | | | | 9.37% | (a) |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses prior to fees waived or expenses reimbursed | | | | 2.34% | (c) | | | | 2.48% | | | | | 2.22% | | | | | 2.14% | | | | | 2.15% | | | | | 2.12% | |

Net expenses after fees waived or expenses reimbursed(d) | | | | 2.15% | (c) | | | | 2.48% | | | | | 2.22% | | | | | 2.14% | | | | | 2.15% | | | | | 2.12% | |

Net investment income (loss) | | | | (1.89% | )(c) | | | | (2.23% | ) | | | | (1.94% | ) | | | | (1.60% | ) | | | | 0.66% | | | | | 3.42% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | | $2,926 | | | | | $3,333 | | | | | $4,703 | | | | | $7,609 | | | | | $9,463 | | | | | $220 | |

Portfolio turnover | | | | 0% | | | | | 0% | | | | �� | 0% | | | | | 16% | | | | | 39% | | | | | 36% | |

Notes to Financial Highlights

| (a) | During the year ended October 31, 2007, Ameriprise Financial reimbursed the Fund for a loss on a trading error. Had the Fund not received this reimbursement, total return would have been lower by 0.05%. |

| (b) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (d) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 19 | |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended April 30, 2012 | | Year ended Oct. 31, |

| | | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | | (Unaudited) | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | | $10.11 | | | | | $10.09 | | | | | $9.98 | | | | | $9.98 | | | | | $10.59 | | | | | $10.10 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | (0.04 | ) | | | | (0.08 | ) | | | | (0.08 | ) | | | | (0.04 | ) | | | | 0.21 | | | | | 0.44 | |

Net realized and unrealized gain (loss) | | | | 0.32 | | | | | 0.10 | | | | | 0.19 | | | | | 0.10 | | | | | (0.24 | ) | | | | 0.59 | |

Total from investment operations | | | | 0.28 | | | | | 0.02 | | | | | 0.11 | | | | | 0.06 | | | | | (0.03 | ) | | | | 1.03 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | — | | | | | — | | | | | — | | | | | (0.01 | ) | | | | (0.22 | ) | | | | (0.44 | ) |

Net realized gains | | | | — | | | | | — | | | | | — | | | | | (0.05 | ) | | | | (0.36 | ) | | | | (0.10 | ) |

Total distributions to shareholders | | | | — | | | | | — | | | | | — | | | | | (0.06 | ) | | | | (0.58 | ) | | | | (0.54 | ) |

Net asset value, end of period | | | | $10.39 | | | | | $10.11 | | | | | $10.09 | | | | | $9.98 | | | | | $9.98 | | | | | $10.59 | |

Total return | | | | 2.77% | | | | | 0.20% | | | | | 1.10% | | | | | 0.56% | | | | | (0.25% | ) | | | | 10.49% | (a) |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses prior to fees waived or expenses reimbursed | | | | 1.14% | (c) | | | | 1.05% | | | | | 1.07% | | | | | 1.01% | | | | | 1.03% | | | | | 1.07% | |

Net expenses after fees waived or expenses reimbursed(d) | | | | 0.95% | (c) | | | | 1.05% | | | | | 1.07% | | | | | 1.01% | | | | | 1.03% | | | | | 1.07% | |

Net investment income (loss) | | | | (0.70% | )(c) | | | | (0.84% | ) | | | | (0.79% | ) | | | | (0.40% | ) | | | | 2.10% | | | | | 4.30% | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | | $53,485 | | | | | $67,660 | | | | | $38,718 | | | | | $28,926 | | | | | $202,106 | | | | | $121,970 | |

Portfolio turnover | | | | 0% | | | | | 0% | | | | | 0% | | | | | 16% | | | | | 39% | | | | | 36% | |

Notes to Financial Highlights

| (a) | During the year ended October 31, 2007, Ameriprise Financial reimbursed the Fund for a loss on a trading error. Had the Fund not received this reimbursement, total return would have been lower by 0.05%. |

| (b) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (d) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 20 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months

ended April 30, 2012 | | | Year ended Oct. 31, | |

| | | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007(a) | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

Class W | | | | | | | | | | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $9.94 | | | | $9.99 | | | | $9.92 | | | | $9.97 | | | | $10.58 | | | | $10.13 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.08 | ) | | | (0.15 | ) | | | (0.12 | ) | | | (0.08 | ) | | | 0.11 | | | | 0.36 | |

Net realized and unrealized gain (loss) | | | 0.33 | | | | 0.10 | | | | 0.19 | | | | 0.08 | | | | (0.19 | ) | | | 0.55 | |

Total from investment operations | | | 0.25 | | | | (0.05 | ) | | | 0.07 | | | | — | | | | (0.08 | ) | | | 0.91 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.17 | ) | | | (0.36 | ) |

Net realized gains | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.36 | ) | | | (0.10 | ) |

Total distributions to shareholders | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.53 | ) | | | (0.46 | ) |

Net asset value, end of period | | | $10.19 | | | | $9.94 | | | | $9.99 | | | | $9.92 | | | | $9.97 | | | | $10.58 | |

Total return | | | 2.52% | | | | (0.50% | ) | | | 0.71% | | | | 0.04% | | | | (0.66% | ) | | | 9.21% | (b) |

Ratios to average net assets(c) | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses prior to fees waived or expenses reimbursed | | | 1.92% | (d) | | | 1.71% | | | | 1.51% | | | | 1.46% | | | | 1.50% | | | | 1.54% | (d) |

Net expenses after fees waived or expenses reimbursed(e) | | | 1.75% | (d) | | | 1.71% | | | | 1.51% | | | | 1.46% | | | | 1.50% | | | | 1.54% | (d) |

Net investment income (loss) | | | (1.51% | )(d) | | | (1.46% | ) | | | (1.23% | ) | | | (0.86% | ) | | | 1.09% | | | | 3.88% | (d) |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | $11,130 | | | | $24,171 | | | | $63,369 | | | | $87,000 | | | | $303,933 | | | | $5 | |

Portfolio turnover | | | 0% | | | | 0% | | | | 0% | | | | 16% | | | | 39% | | | | 36% | |

Notes to Financial Highlights

| (a) | For the period from December 1, 2006 (commencement of operations) to October 31, 2007. |

| (b) | During the year ended October 31, 2007, Ameriprise Financial reimbursed the Fund for a loss on a trading error. Had the Fund not received this reimbursement, total return would have been lower by 0.05%. |

| (c) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (e) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 21 | |

| | |

| Financial Highlights (continued) | | |

| | | | | | | | | | | | | | | |

| | | Six months

ended April 30, 2012 | | Year ended Oct. 31, |

| | | | 2011 | | 2010 (a) |

| | | (Unaudited) | | | | |

Class Z | | | | | | | | | | | | | | | |

Per share data | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | | $10.11 | | | | | $10.09 | | | | | $10.18 | |

Income from investment operations: | | | | | | | | | | | | | | | |

Net investment income (loss) | | | | (0.04 | ) | | | | (0.10 | ) | | | | (0.01 | ) |

Net realized and unrealized gain (loss) | | | | 0.32 | | | | | 0.12 | | | | | (0.08 | ) |

Total from investment operations | | | | 0.28 | | | | | 0.02 | | | | | (0.09 | ) |

Net asset value, end of period | | | | $10.39 | | | | | $10.11 | | | | | $10.09 | |

Total return | | | | 2.77% | | | | | 0.20% | | | | | (0.88% | ) |

Ratios to average net assets(b) | | | | | | | | | | | | | | | |

Expenses prior to fees waived or

expenses reimbursed | | | | 1.20% | (c) | | | | 1.15% | | | | | 1.54% | (c) |

Net expenses after fees waived or

expenses reimbursed(d) | | | | 0.98% | (c) | | | | 1.15% | | | | | 1.54% | (c) |

Net investment income (loss) | | | | (0.72% | )(c) | | | | (0.95% | ) | | | | (1.20% | )(c) |

Supplemental data | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | | $9,084 | | | | | $6,079 | | | | | $14 | |

Portfolio turnover | | | | 0% | | | | | 0% | | | | | 0% | |

Notes to Financial Highlights

| (a) | For the period from September 27, 2010 (commencement of operations) to October 31, 2010. |

| (b) | In addition to the fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios. |

| (d) | The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 22 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

| | |

| Notes to Financial Statements | | |

April 30, 2012 (Unaudited)

Columbia Absolute Return Currency and Income Fund (the Fund), a series of Columbia Funds Series Trust II (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

Fund Shares

The Trust may issue an unlimited number of shares (without par value). The Fund offers Class A, Class B, Class C, Class I, Class W and Class Z shares. All share classes have identical voting, dividend and liquidation rights. Each share class has its own expense structure and sales charges, as applicable.

Class A shares are subject to a maximum front-end sales charge of 3.00% based on the initial investment amount. Class A shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a contingent deferred sales charge (CDSC) if the shares are sold within 18 months of purchase, charged as follows: 1.00% CDSC if redeemed within 12 months of purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase.

Class B shares may be subject to a maximum CDSC of 5.00% based upon the holding period after purchase. Class B shares will generally convert to Class A shares eight years after purchase. The Fund no longer accepts investments by new or existing investors in the Fund’s Class B shares, except in connection with the reinvestment of any dividend and/or capital gain distributions in Class B shares of the Fund and exchanges by existing Class B shareholders of certain other funds within the Columbia Family of Funds.

Class C shares are subject to a 1.00% CDSC on shares redeemed within one year of purchase.

Class I shares are not subject to sales charges and are only available to the Columbia Family of Funds.

Class W shares are not subject to sales charges and are only available to investors purchasing through authorized investment programs managed by investment professionals, including discretionary managed account programs.

Class Z shares are not subject to sales charges, and are only available to certain investors, as described in the Fund’s prospectus.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 23 | |

| | |

| Notes to Financial Statements (continued) | | |

| Note | 2. Summary of Significant Accounting Policies |

Use of Estimates

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (GAAP) requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Security Valuation

All equity securities are valued at the close of business of the New York Stock Exchange (NYSE). Equity securities are valued at the last quoted sales price on the principal exchange or market on which they trade, except for securities traded on the NASDAQ Stock Market, which are valued at the NASDAQ official close price. Unlisted securities or listed securities for which there were no sales during the day are valued at the mean of the latest quoted bid and asked prices on such exchanges or markets.

Debt securities generally are valued by pricing services approved by the Board of Trustees (the Board) based upon market transactions for normal, institutional-size trading units of similar securities. The services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics and other data, as well as broker quotes. Debt securities for which quotations are readily available may also be valued based upon an over-the-counter or exchange bid quotation.

Asset and mortgage-backed securities are generally valued by pricing services, which utilize pricing models that incorporate the securities’ cash flow and loan performance data. These models also take into account available market data, including trades, market quotations, and benchmark yield curves for identical or similar securities. Factors used to identify similar securities may include, but are not limited to, issuer, collateral type, vintage, prepayment speeds, collateral performance, credit ratings, credit enhancement and expected life. Asset-backed securities for which quotations are readily available may also be valued based upon an over-the-counter or exchange bid quotation.

Foreign securities are valued based on quotations from the principal market in which such securities are normally traded. If any foreign share prices are not readily available as a result of limited share activity the securities are valued at the mean of the latest quoted bid and asked prices on such exchanges or markets.

| | |

| 24 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

Foreign currency exchange rates are generally determined at 4:00 p.m. Eastern (U.S.) time. However, many securities markets and exchanges outside the U.S. close prior to the close of the NYSE; therefore, the closing prices for securities in such markets or on such exchanges may not fully reflect events that occur after such close but before the close of the NYSE. In those situations, foreign securities will be fair valued pursuant to the policy adopted by the Board, including utilizing a third party pricing service to determine these fair values. The third party pricing service takes into account multiple factors, including, but not limited to, movements in the U.S. securities markets, certain depositary receipts, futures contracts and foreign exchange rates that have occurred subsequent to the close of the foreign exchange, to determine a good faith estimate that reasonably reflects the current market conditions as of the close of the NYSE. The fair value of a security is likely to be different from the quoted or published price, if available.

Investments in other open-end investment companies, including money market funds, are valued at net asset value.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates market value. The value of short-term securities originally purchased with maturities greater than 60 days is determined based on an amortized value to par upon reaching 60 days to maturity. Short-term securities maturing in more than 60 days from the valuation date are valued at the market price or approximate market value based on current interest rates.

Forward foreign currency exchange contracts are marked-to-market based upon foreign currency exchange rates provided by a pricing service.

Investments for which market quotations are not readily available, or that have quotations which management believes are not reliable, are valued at fair value as determined in good faith under consistently applied procedures established by and under the general supervision of the Board. If a security or class of securities (such as foreign securities) is valued at fair value, such value is likely to be different from the last quoted market price for the security. The determination of fair value often requires significant judgment. To determine fair value, management may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine value.

Foreign Currency Transactions and Translation

The values of all assets and liabilities denominated in foreign currencies are translated into U.S. dollars at that day’s exchange rates. Net realized and unrealized gains (losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange rates between

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 25 | |

| | |

| Notes to Financial Statements (continued) | | |

trade and settlement dates on securities transactions, gains (losses) arising from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes, the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains (losses) on investments in the Statement of Operations.

Derivative Instruments

The Fund invests in certain derivative instruments as detailed below to meet its investment objectives. Derivatives are instruments whose values depend on, or are derived from, in whole or in part, the value of one or more other assets, such as securities, currencies, commodities or indices. Derivative instruments may be used to maintain cash reserves while maintaining exposure to certain other assets, to offset anticipated declines in values of investments, to facilitate trading, to reduce transaction costs and to pursue higher investment returns. The Fund may also use derivative instruments to mitigate certain investment risks, such as foreign currency exchange rate risk, interest rate risk and credit risk. Derivatives may involve various risks, including the potential inability of the counterparty to fulfill its obligation under the terms of the contract, the potential for an illiquid secondary market and the potential for market movements which may expose the Fund to gains or losses in excess of the amount shown in the Statement of Assets and Liabilities.

The Fund and any counterparty are required to maintain an agreement that requires the Fund and that counterparty to monitor (on a daily basis) the net fair value of all derivatives entered into pursuant to the agreement between the Fund and such counterparty. If the net fair value of such derivatives between the Fund and that counterparty exceeds a certain threshold (as defined in the agreement), the Fund or the counterparty (as the case may be) is required to post cash and/or securities as collateral. Fair values of derivatives presented in the financial statements are not netted with the fair value of other derivatives or with any collateral amounts posted by the Fund or any counterparty.

Forward Foreign Currency Exchange Contracts

Forward foreign currency exchange contracts are agreements between two parties to buy and sell a currency at a set price on a future date. These contracts are intended to be used to minimize the exposure to foreign exchange rate fluctuations during the period between the trade and settlement dates of the contract. The Fund utilized forward foreign currency exchange contracts to shift investment exposure from one currency to another and to go long and short foreign currencies versus the U.S. dollars, as a way to generate returns.

| | |

| 26 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

The values of forward foreign currency exchange contracts fluctuate with changes in foreign currency exchange rates. The Fund will record a realized gain or loss when the forward foreign currency exchange contract is closed.

The use of forward foreign currency exchange contracts does not eliminate fluctuations in the prices of the Fund’s portfolio securities. The risks of forward foreign currency exchange contracts include movement in the values of the foreign currencies relative to the U.S. dollar (or other foreign currencies) and the possibility that counterparties will not complete their contractual obligations, which may be in excess of the amount reflected, if any, in the Statement of Assets and Liabilities.

Effects of Derivative Transactions in the Financial Statements

The following tables are intended to provide additional information about the effect of derivatives on the financial statements of the Fund, including: the fair value of derivatives by risk category and the location of those fair values in the Statement of Assets and Liabilities; the impact of derivative transactions on the Fund’s operations over the period including realized gains or losses and unrealized gains or losses. The derivative schedules following the Portfolio of Investments present additional information regarding derivative instruments outstanding at the end of the period, if any.

Fair Values of Derivative Instruments at April 30, 2012

| | | | | | | | | | | | |

Risk Exposure

Category | | Asset derivatives | | | Liability derivatives | |

| | Statement of Assets

and Liabilities

Location | | Fair Value | | | Statement of Assets

and Liabilities

Location | | Fair Value | |

| Foreign exchange contracts | | Unrealized appreciation on forward foreign currency exchange contracts | | $ | 289,071 | | | Unrealized depreciation on forward foreign currency exchange contracts | | $ | 741,640 | |

Effect of Derivative Instruments in the Statement of Operations

for the Six Months Ended April 30, 2012

| | | | |

| Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

| Risk Exposure Category | | Forward Foreign

Currency Exchange

Contracts | |

Foreign exchange contracts | | $ | 4,278,338 | |

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 27 | |

| | |

| Notes to Financial Statements (continued) | | |

| | | | |

| Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | |

| Risk Exposure Category | | Forward Foreign

Currency Exchange

Contracts | |

Foreign exchange contracts | | $ | (430,338 | ) |

Volume of Derivative Instruments for the Six Months Ended April 30, 2012

| | | | |

| | | Contracts

Opened | |

Forward Foreign Currency Exchange Contracts | | | 116 | |

Security Transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income Recognition

Interest income is recorded on the accrual basis. Market premium and discount are amortized and accreted, respectively, on all debt securities, unless otherwise noted. Original issue discount is accreted to interest income over the life of the security with a corresponding increase in the cost basis, if any. For convertible securities, premiums attributable to the conversion feature are not amortized.

Dividend income is recorded on the ex-dividend date.

Expenses

General expenses of the Trust are allocated to the Fund and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Fund are charged to the Fund. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of Class Net Asset Value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Fund on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal Income Tax Status

The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its tax exempt or taxable income (including net short-term

| | |

| 28 | | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT |

capital gains), if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Fund intends to distribute in each calendar year substantially all of its net investment income, capital gains and certain other amounts, if any, such that the Fund should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Foreign Taxes

The Fund may be subject to foreign taxes on income, gains on investments or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries, as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Realized gains in certain countries may be subject to foreign taxes at the Fund level, based on statutory rates. The Fund accrues for such foreign taxes on net realized and unrealized gains at the appropriate rate for each jurisdiction, as applicable.

Distributions to Shareholders

Distributions from net investment income are declared and paid monthly. Net realized capital gains, if any, are distributed along with the income dividend. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations which may differ from GAAP.

Guarantees and Indemnifications

Under the Trust’s organizational documents and, in some cases, by contract, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust or its funds. In addition, certain of the Fund’s contracts with its service providers contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Fund cannot be determined, and the Fund has no historical basis for predicting the likelihood of any such claims.

Recent Accounting Pronouncement

Fair Value Measurements and Disclosures

In May 2011, the Financial Accounting Standards Board (FASB) issued ASU No. 2011-04 modifying Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (IASB) issued International Financial Reporting Standard 13, Fair Value Measurement. The objective of the FASB and IASB is convergence of their guidance on fair value measurements and disclosures.

| | | | |

| COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND — 2012 SEMIANNUAL REPORT | | | 29 | |

| | |

| Notes to Financial Statements (continued) | | |

Specifically, ASU No. 2011-04 requires reporting entities to disclose i) the amounts of any transfers between Level 1 and Level 2, and the reasons for the transfers, ii) for Level 3 fair value measurements, a) quantitative information about significant unobservable inputs used, b) a description of the valuation processes used by the reporting entity and c) a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs if a change in those inputs might result in a significantly higher or lower fair value measurement. The effective date of ASU No. 2011-04 is for interim and annual periods beginning after December 15, 2011. At this time, management is evaluating the implications of this guidance and the impact it will have on the financial statement amounts and footnote disclosures, if any.

| Note | 3. Fees and Compensation Paid to Affiliates |

Investment Management Fees