UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21852

Columbia Funds Series Trust II

(Exact name of registrant as specified in charter)

50606 Ameriprise Financial Center

Minneapolis, MN 55474

(Address of principal executive offices) (Zip code)

Ryan Larrenaga

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 345-6611

Date of fiscal year end: October 31

Date of reporting period: April 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

SEMIANNUAL REPORT

April 30, 2016

COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND

PRESIDENT’S MESSAGE

Dear Shareholders,

Volatility comes with the territory for long-term investors. Some investors instinctively want to pull out of the market or sell underperforming investments at the first sign of increased volatility or perhaps even as soon as they perceive it on the horizon. But taking yourself out of the market could mean losing out on potential opportunities, and putting your longer-term investment goals at risk.

Cumulative return is not just about achieving high returns when markets are going up; it’s also about remaining invested and minimizing losses during weak or volatile markets so that you can participate on the upside. Developing a deeper understanding of the various risks your portfolio is subject to can help you balance these risks.

Diversification is critical in seeking to achieve that balance. We believe that most portfolios could be more effectively diversified either by introducing holdings with performance profiles

unrelated to existing holdings (like alternative products) or by rebalancing existing holdings with an eye toward risk allocation. Over time, distributing risk more evenly may produce a more pronounced diversification benefit and may improve portfolio efficiency. We believe market volatility can create significant opportunities and, in fact, these periods may be some of the very best times to invest.

With this in mind, I thought it important to highlight excerpts from a piece written by Colin Moore, Global Chief Investment Officer, in which he touches on some of these issues emphasizing the importance of a properly constructed portfolio in seeking to effectively manage volatility and to achieve consistency of returns. I encourage you to read the article in its entirety. To access the full article and for other insights on current market, please visit blog.columbiathreadneedleus.com/latest-perspectives.

You need investments that are designed to help you ease the impact of volatile market environments and keep the savings you have worked tirelessly to amass. Columbia Threadneedle Investments provides investment solutions to help you tackle financial challenges and achieve your desired outcome.

Best regards,

Christopher O. Petersen

President, Columbia Funds

Excerpts from:

Taking the scare out of the volatility bogeyman

By Colin Moore, Global Chief Investment Officer

Colin Moore is the global chief investment officer for Columbia Threadneedle Investments. His responsibilities include ensuring that a disciplined investment process is in place across all asset classes, including equity and fixed income. Mr. Moore joined one of the Columbia Threadneedle Investments legacy firms in 2002 as head of equity and was also head of fixed income and liquidity strategies from 2009-2010.

| n | | In today’s low growth, higher volatility world, the emphasis is shifting from maximization of returns to consistency of returns. |

| n | | Portfolios should represent the behavioral risk-return tradeoff of investors, remembering that they won’t stay invested to realize the return if we get the risk tolerance wrong. |

Semiannual Report 2016

PRESIDENT’S MESSAGE (continued)

| n | | Holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals. |

According to Wikipedia, “The bogeyman is a common allusion to a mythical creature in many cultures used to control behavior. This monster has no specific appearance, and conceptions about it can vary drastically from household to household within the same community; in many cases he has no set appearance in the mind of an adult or child, but is simply a non-specific embodiment of terror.” Different cultures have different names and physical representations for the bogeyman, and investors are no different. We have terrible monsters that we fear may destroy our portfolios, and we call one of the scariest of them volatility.

While the bogeyman is mythical (I hope!), volatility is real and can cause serious damage. To understand why investors have such a hard time coping with volatility, we first need to define three cognitive biases at work in today’s investment environment:

| | 1) | | Recency bias — something that has recently come to the forefront of our attention, regardless of how long established it is, suddenly seems to appear with improbable frequency. |

| | 2) | | Negativity bias — we tend to have a greater recall of unpleasant memories than positive memories. |

| | 3) | | Loss aversion — our dissatisfaction with losing money tends to be greater than our satisfaction with making money. |

The level of volatility varies dramatically, and so does investor fear and panic selling — waxing when volatility rises, waning when it falls. Recent studies have pointed to demographics as an important driver of panic selling. The theory is that as people get closer to retirement, the prospects of a large (20%-30%) loss in financial assets can have a much more pronounced effect on their sense of well-being. Wealth preservation instincts kick in much more quickly than for younger (and typically less wealthy) savers.

The reality is that there is little opportunity for return without volatility. Therefore, the bogeyman effect of holding long-term savings in cash to avoid volatility (the financial equivalent of hiding under the sheets) is detrimental to achieving long-term goals. This effect tends to be more pronounced during the episodic spikes in volatility. The significant spike in volatility in 2008 and 2009 led to significant withdrawals from long-term investment funds over the same period. Less pronounced effects can also be seen when comparing 2001-2003 and 2011-2012. Conversely, flows picked up when volatility returned to “normal” levels. Investor behavior of this type is consistent with the three behavioral biases.

I believe average volatility will be higher over the next 10 years than the last 10 years and episodic spikes will increase in frequency because sustainable economic growth will be structurally lower and geopolitical risk higher than any time since World War II. Low growth creates uncertainty while loss aversion will make investors fear that we are one economic mishap or geopolitical event away from no growth or recession. The result will be higher volatility on average. Negativity bias will tend to exacerbate “spike” reactions to event-driven geopolitical news, and the volatility bogeyman will appear more often. Assuming the behavioral biases continue, investor returns are likely to be very disappointing regardless of the total return generated by financial markets due to the bogeyman effect.

To mitigate this effect, we need to focus on portfolio construction and an improved understanding of diversification. I accept that equities are likely to offer the highest return over the next 10 years, but they also offer the highest volatility. Many portfolio construction optimization tools use historical average volatility, which is likely to underestimate the volatility investors will face. The bogeyman emerges when individual asset class volatility spikes and cross correlations rise, the combination of which increases overall portfolio volatility far beyond expectation. Diversification is meant to protect investors against volatility, but what’s the point of owning lots of investments if the volatility bogeyman has not been properly estimated?

Most importantly, portfolios should be constructed to properly represent the behavioral risk-return tradeoff of investors, remembering that they won’t stay invested to realize the return if we get the risk tolerance wrong. In a low growth, higher volatility world, the emphasis is shifting to return consistency rather than return maximization, and investors are

Semiannual Report 2016

PRESIDENT’S MESSAGE (continued)

best served through investment approaches that appreciate that distinction. Even though it’s a permanent feature of financial markets, volatility is less likely to be the bogeyman we all fear if portfolios are constructed with this understanding.

Please visit blog.columbiathreadneedleus.com/latest-perspectives to read the entire article.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit columbiathreadneedle.com/us. The prospectus should be read carefully before investing.

The views expressed are as of April 2016, may change as market or other conditions change, and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, will not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not account for individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors.

Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that the forecasts are accurate.

Diversification does not guarantee a profit or protect against loss.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved

Semiannual Report 2016

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

TABLE OF CONTENTS

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiathreadneedle.com/us or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Semiannual Report 2016

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

PERFORMANCE OVERVIEW

(Unaudited)

Performance Summary

| n | | Columbia Absolute Return Currency and Income Fund (the Fund) Class A shares returned 2.45% excluding sales charges for the six-month period that ended April 30, 2016. |

| n | | The Fund outperformed its benchmark, the Citi One-Month U.S. Treasury Bill Index, which returned 0.07% for the same time period. |

| | | | | | | | | | | | | | | | | | |

Average Annual Total Returns (%) (for period ended April 30, 2016) | |

| | | Inception | | 6 Months

Cumulative | | | 1 Year | | | 5 Years | | | Life | |

Class A | | 06/15/06 | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | 2.45 | | | | 4.84 | | | | 4.15 | | | | 3.47 | |

Including sales charges | | | | | -0.66 | | | | 1.68 | | | | 3.52 | | | | 3.15 | |

Class B | | 06/15/06 | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | 2.07 | | | | 4.02 | | | | 3.37 | | | | 2.72 | |

Including sales charges | | | | | -2.38 | | | | -0.51 | | | | 3.02 | | | | 2.72 | |

Class C | | 06/15/06 | | | | | | | | | | | | | | | | |

Excluding sales charges | | | | | 2.08 | | | | 4.03 | | | | 3.37 | | | | 2.72 | |

Including sales charges | | | | | 1.18 | | | | 3.12 | | | | 3.37 | | | | 2.72 | |

Class I | | 06/15/06 | | | 2.65 | | | | 5.15 | | | | 4.61 | | | | 3.92 | |

Class R4* | | 03/19/13 | | | 2.61 | | | | 5.03 | | | | 4.33 | | | | 3.56 | |

Class R5* | | 06/25/14 | | | 2.60 | | | | 5.18 | | | | 4.27 | | | | 3.53 | |

Class W* | | 12/01/06 | | | 2.46 | | | | 4.77 | | | | 4.09 | | | | 3.42 | |

Class Y* | | 02/28/13 | | | 2.66 | | | | 5.16 | | | | 4.40 | | | | 3.59 | |

Class Z* | | 09/27/10 | | | 2.54 | | | | 4.96 | | | | 4.45 | | | | 3.63 | |

Citi One-Month U.S. Treasury Bill Index** | | | | | 0.07 | | | | 0.08 | | | | 0.04 | | | | 0.89 | |

Returns for Class A are shown with and without the maximum initial sales charge of 3.00%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund’s other classes are not subject to sales charges and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/us or calling 800.345.6611.

| * | The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. Since the Fund launched more than one share class at its inception, Class A shares were used. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information. |

Effective July 1, 2015, the Fund compares its performance to that of the Citi One-Month U.S. Treasury Bill Index (the New Index). Prior to this date, the Fund compared its performance to that of the Citi Three-Month U.S. Treasury Bill Index (the Former Index). The Fund’s investment manager made this recommendation to the Fund’s Board of Trustees because the investment manager believes that the New Index provides a more appropriate basis for comparing the Fund’s performance. Information on the New Index and the Former Index will be included for a one-year transition period. Thereafter, only the New Index will be included.

The Citi One-Month U.S. Treasury Bill Index, an unmanaged index, is representative of the performance of one-month Treasury bills.

The Citigroup 3-month U.S. Treasury Bill Index, an unmanaged index, is representative of the performance of three-month Treasury bills.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

PORTFOLIO OVERVIEW

(Unaudited)

| | | | |

Portfolio Breakdown (%)

(at April 30, 2016) | |

Asset-Backed Securities — Non-Agency | | | 1.0 | |

Short-Term Investments Segregated in Connection with Open Derivatives Contracts(a) | | | 99.0 | |

Total | | | 100.0 | |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| (a) | Includes investments in Money Market Funds (amounting to $67.5 million) which have been segregated to cover obligations relating to the Fund’s investment in derivatives which provide exposure to multiple markets. For a description of the Fund’s investments in derivatives, see Investments in Derivatives following the Portfolio of Investments and Note 2 to the Notes to Financial Statements. |

| | | | |

Quality Breakdown (%)

(at April 30, 2016) | |

AAA rating | | | 100.0 | |

Total | | | 100.0 | |

Percentages indicated are based upon total fixed income investments (excluding Money Market Funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from highest to lowest credit quality, determined by using the middle rating of Moody’s, S&P and Fitch, after dropping the highest and lowest available ratings. When ratings are available from only two rating agencies, the lower rating is used. When a rating is available from only one rating agency, that rating is used. When a bond is not rated by any rating agency, it is designated as “Not rated.” Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change, including daily. The ratings assigned by credit rating agencies are but one of the considerations that the Investment Manager and/or Fund’s subadviser incorporates into its credit analysis process, along with such other issuer-specific factors as cash flows, capital structure and leverage ratios, ability to de-leverage (repay) through free cash flow, quality of management, market positioning and access to capital, as well as such security-specific factors as the terms of the security (e.g., interest rate and time to maturity) and the amount and type of any collateral.

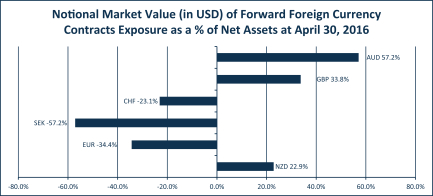

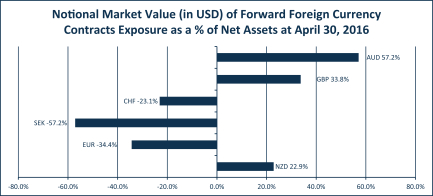

| | |

| AUD | | Australian Dollar |

| CHF | | Swiss Franc |

| EUR | | Euro |

| GBP | | British Pound |

| NZD | | New Zealand Dollar |

| SEK | | Swedish Krona |

Portfolio Management

Nicholas Pifer, CFA

Timothy Flanagan, CFA*

| * | Effective March 1, 2016, Mr. Flanagan was added as Portfolio Manager of the Fund. |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

UNDERSTANDING YOUR FUND’S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund’s Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Fund’s actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the “Actual” column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Fund’s actual return) and then applies the Fund’s actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare With Other Funds” below for details on how to use the hypothetical data.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

November 1, 2015 – April 30, 2016

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Account Value at the

Beginning of the

Period ($) | | | Account Value at the

End of the

Period ($) | | | Expenses Paid During

the Period ($) | | | Fund’s Annualized

Expense Ratio (%) | |

| | | | Actual | | | | Hypothetical | | | | Actual | | | | Hypothetical | | | | Actual | | | | Hypothetical | | | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,024.50 | | | | 1,016.66 | | | | 8.31 | | | | 8.27 | | | | 1.65 | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,020.70 | | | | 1,012.98 | | | | 12.01 | | | | 11.96 | | | | 2.39 | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,020.80 | | | | 1,012.93 | | | | 12.06 | | | | 12.01 | | | | 2.40 | |

Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.50 | | | | 1,018.60 | | | | 6.35 | | | | 6.32 | | | | 1.26 | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.10 | | | | 1,017.90 | | | | 7.05 | | | | 7.02 | | | | 1.40 | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.00 | | | | 1,018.35 | | | | 6.60 | | | | 6.57 | | | | 1.31 | |

Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,024.60 | | | | 1,016.71 | | | | 8.26 | | | | 8.22 | | | | 1.64 | |

Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,026.60 | | | | 1,018.60 | | | | 6.35 | | | | 6.32 | | | | 1.26 | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,025.40 | | | | 1,017.95 | | | | 7.00 | | | | 6.97 | | | | 1.39 | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from its investment in underlying funds, including affiliated and non-affiliated pooled investment vehicles, such as mutual funds and exchange-traded funds.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

PORTFOLIO OF INVESTMENTS

April 30, 2016 (Unaudited)

(Percentages represent value of investments compared to net assets)

| | | | | | | | | | | | |

| Asset-Backed Securities — Non-Agency 1.0% | |

| Issuer | | Coupon

Rate | | | Principal

Amount ($) | | | Value ($) | |

Northstar Education Finance, Inc.

Series 2007-1 Class A2(a) | |

01/29/46 | | | 1.384% | | | | 750,000 | | | | 696,731 | |

| | | | | | | | | | | | | |

Total Asset-Backed Securities — Non-Agency | | | | | |

(Cost: $746,953) | | | | | | | | 696,731 | |

| | | |

| | | | | | | | | | | | |

| | | | | | | | | | |

| Money Market Funds 98.1% | | | | | |

| | | Shares | | | Value ($) | |

Columbia Short-Term Cash Fund, 0.422%(b)(c) | | | 67,502,752 | | | | 67,502,752 | |

| | | | | | | | | | | |

Total Money Market Funds | | | | | |

(Cost: $67,502,752) | | | | 67,502,752 | |

| | | | | | | | | | | |

Total Investments | | | | | | | | | | |

(Cost: $68,249,705) | | | | | | | 68,199,483 | |

| | | | | | | | | | | |

Other Assets & Liabilities, Net | | | | | | | 635,358 | |

| | | | | | | | | | | |

Net Assets | | | | | | | | | 68,834,841 | |

| | | | | | | | | | | |

Investments in Derivatives

Forward Foreign Currency Exchange Contracts Open at April 30, 2016

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Exchange

Date | | | Currency to

be Delivered | | | Currency to

be Received | | | Unrealized

Appreciation ($) | | | Unrealized

Depreciation ($) | |

| | | | | |

Barclays | | | 05/25/2016 | | | | 256,892,000 SEK | | | | 31,623,704 USD | | | | — | | | | (391,331 | ) |

| | | | | |

Barclays | | | 05/25/2016 | | | | 62,844,000 SEK | | | | 7,736,170 USD | | | | — | | | | (95,732 | ) |

| | | | | |

Barclays | | | 05/25/2016 | | | | 12,647,126 USD | | | | 18,439,000 NZD | | | | 212,082 | | | | — | |

| | | | | |

Barclays | | | 05/25/2016 | | | | 3,094,050 USD | | | | 4,511,000 NZD | | | | 51,885 | | | | — | |

| | | | | |

Citi | | | 05/25/2016 | | | | 31,610,694 USD | | | | 40,981,000 AUD | | | | — | | | | (479,948 | ) |

| | | | | |

Citi | | | 05/25/2016 | | | | 16,842,000 EUR | | | | 19,043,998 USD | | | | — | | | | (253,535 | ) |

| | | | | |

Citi | | | 05/25/2016 | | | | 7,732,720 USD | | | | 10,025,000 AUD | | | | — | | | | (117,343 | ) |

| | | | | |

Citi | | | 05/25/2016 | | | | 4,120,000 EUR | | | | 4,655,376 USD | | | | — | | | | (65,312 | ) |

| | | | | |

HSBC | | | 05/25/2016 | | | | 12,321,000 CHF | | | | 12,778,893 USD | | | | — | | | | (76,939 | ) |

| | | | | |

HSBC | | | 05/25/2016 | | | | 3,014,000 CHF | | | | 3,126,011 USD | | | | — | | | | (18,821 | ) |

| | | | | |

Standard Chartered | | | 05/25/2016 | | | | 18,702,253 USD | | | | 13,110,000 GBP | | | | 454,483 | | | | — | |

| | | | | |

Standard Chartered | | | 05/25/2016 | | | | 4,590,037 USD | | | | 3,207,000 GBP | | | | 96,130 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | 814,580 | | | | (1,498,961 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Notes to Portfolio of Investments

| (a) | Variable rate security. |

| (b) | The rate shown is the seven-day current annualized yield at April 30, 2016. |

| (c) | As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the period ended April 30, 2016 are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Issuer | | Beginning

Cost ($) | | | Purchase

Cost ($) | | | Proceeds

From Sales ($) | | | Ending

Cost ($) | | | Dividends —

Affiliated

Issuers ($) | | | Value ($) | |

Columbia Short-Term Cash Fund | | | 54,228,924 | | | | 40,393,198 | | | | (27,119,370 | ) | | | 67,502,752 | | | | 107,787 | | | | 67,502,752 | |

Currency Legend

| | |

| AUD | | Australian Dollar |

| CHF | | Swiss Franc |

| EUR | | Euro |

| GBP | | British Pound |

| NZD | | New Zealand Dollar |

| SEK | | Swedish Krona |

| USD | | US Dollar |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

PORTFOLIO OF INVESTMENTS (continued)

April 30, 2016 (Unaudited)

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

| n | | Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments. |

| n | | Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). |

| n | | Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments). |

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Certain investments that have been measured at fair value using the net asset value per share (or its equivalent) are not categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to reconcile the fair value hierarchy to the amounts presented in the Portfolio of Investments. The Columbia Short-Term Cash Fund seeks to provide shareholders with maximum current income consistent with liquidity and stability of principal. Investments in Columbia Short-Term Cash Fund may be redeemed on a daily basis without restriction.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund’s Board of Trustees (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

PORTFOLIO OF INVESTMENTS (continued)

April 30, 2016 (Unaudited)

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund’s investments at April 30, 2016:

| | | | | | | | | | | | | | | | |

| | | Level 1 Quoted Prices in Active

Markets for Identical

Assets ($) | | | Level 2 Other Significant

Observable Inputs ($) | | | Level 3 Significant

Unobservable Inputs ($) | | | Total ($) | |

Investments | | | | | | | | | | | | | | | | |

| | | | |

Asset-Backed Securities — Non-Agency | | | — | | | | 696,731 | | | | — | | | | 696,731 | |

| | | | | | | | | | | | | | | | | |

Investments measured at net asset value | | | | | | | | | | | | | | | | |

| | | | |

Money Market Funds | | | — | | | | — | | | | — | | | | 67,502,752 | |

| | | | | | | | | | | | | | | | | |

Total Investments | | | — | | | | 696,731 | | | | — | | | | 68,199,483 | |

| | | | | | | | | | | | | | | | | |

Derivatives | | | | | | | | | | | | | | | | |

| | | | |

Assets | | | | | | | | | | | | | | | | |

| | | | |

Forward Foreign Currency Exchange Contracts | | | — | | | | 814,580 | | | | — | | | | 814,580 | |

| | | | |

Liabilities | | | | | | | | | | | | | | | | |

| | | | |

Forward Foreign Currency Exchange Contracts | | | — | | | | (1,498,961 | ) | | | — | | | | (1,498,961 | ) |

| | | | | | | | | | | | | | | | | |

Total | | | — | | | | 12,350 | | | | — | | | | 67,515,102 | |

| | | | | | | | | | | | | | | | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund’s assets assigned to the Level 2 input category are generally valued using the market approach, in which a security’s value is determined through reference to prices and information from market transactions for similar or identical assets.

Derivative instruments are valued at unrealized appreciation (depreciation).

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2016 (Unaudited)

| | | | |

Assets | |

| |

Investments, at value | | | | |

| |

Unaffiliated issuers (identified cost $746,953) | | | $696,731 | |

| |

Affiliated issuers (identified cost $67,502,752) | | | 67,502,752 | |

| |

Total investments (identified cost $68,249,705) | | | 68,199,483 | |

| |

Unrealized appreciation on forward foreign currency exchange contracts | | | 814,580 | |

| |

Receivable for: | | | | |

| |

Investments sold | | | 1,336,350 | |

| |

Capital shares sold | | | 81,785 | |

| |

Dividends | | | 22,870 | |

| |

Interest | | | 58 | |

| |

Prepaid expenses | | | 641 | |

| |

Other assets | | | 26,498 | |

| |

Total assets | | | 70,482,265 | |

| |

| |

Liabilities | | | | |

| |

Unrealized depreciation on forward foreign currency exchange contracts | | | 1,498,961 | |

| |

Payable for: | | | | |

| |

Investments purchased | | | 4,221 | |

| |

Capital shares purchased | | | 93,958 | |

| |

Investment management fees | | | 1,868 | |

| |

Distribution and/or service fees | | | 253 | |

| |

Transfer agent fees | | | 4,018 | |

| |

Compensation of board members | | | 23,952 | |

| |

Other expenses | | | 20,193 | |

| |

Total liabilities | | | 1,647,424 | |

| |

Net assets applicable to outstanding capital stock | | | $68,834,841 | |

| |

| |

Represented by | | | | |

| |

Paid-in capital | | | $67,292,262 | |

| |

Excess of distributions over net investment income | | | (384,854 | ) |

| |

Accumulated net realized gain | | | 2,662,036 | |

| |

Unrealized appreciation (depreciation) on: | | | | |

| |

Investments | | | (50,222 | ) |

| |

Forward foreign currency exchange contracts | | | (684,381 | ) |

| |

Total — representing net assets applicable to outstanding capital stock | | | $68,834,841 | |

| |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

STATEMENT OF ASSETS AND LIABILITIES (continued)

April 30, 2016 (Unaudited)

| | | | |

Class A | |

| |

Net assets | | | $23,816,089 | |

| |

Shares outstanding | | | 2,253,714 | |

| |

Net asset value per share | | | $10.57 | |

| |

Maximum offering price per share(a) | | | $10.90 | |

|

Class B | |

| |

Net assets | | | $49,908 | |

| |

Shares outstanding | | | 5,005 | |

| |

Net asset value per share | | | $9.97 | |

|

Class C | |

| |

Net assets | | | $3,132,605 | |

| |

Shares outstanding | | | 314,550 | |

| |

Net asset value per share | | | $9.96 | |

|

Class I | |

| |

Net assets | | | $26,603,119 | |

| |

Shares outstanding | | | 2,429,851 | |

| |

Net asset value per share | | | $10.95 | |

|

Class R4 | |

| |

Net assets | | | $498,213 | |

| |

Shares outstanding | | | 45,761 | |

| |

Net asset value per share | | | $10.89 | |

|

Class R5 | |

| |

Net assets | | | $393,689 | |

| |

Shares outstanding | | | 35,953 | |

| |

Net asset value per share | | | $10.95 | |

|

Class W | |

| |

Net assets | | | $74,022 | |

| |

Shares outstanding | | | 7,036 | |

| |

Net asset value per share | | | $10.52 | |

|

Class Y | |

| |

Net assets | | | $11,256 | |

| |

Shares outstanding | | | 1,030 | |

| |

Net asset value per share | | | $10.93 | |

|

Class Z | |

| |

Net assets | | | $14,255,940 | |

| |

Shares outstanding | | | 1,309,728 | |

| |

Net asset value per share | | | $10.88 | |

| |

| (a) | The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 3.00%. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

STATEMENT OF OPERATIONS

Six Months Ended April 30, 2016 (Unaudited)

| | | | |

Net investment income | | | | |

| |

Income: | | | | |

| |

Dividends — affiliated issuers | | | $107,787 | |

| |

Interest | | | 8,149 | |

| |

Total income | | | 115,936 | |

| |

| |

Expenses: | | | | |

| |

Investment management fees | | | 310,435 | |

| |

Distribution and/or service fees | | | | |

| |

Class A | | | 26,581 | |

| |

Class B | | | 264 | |

| |

Class C | | | 14,592 | |

| |

Class W | | | 98 | |

| |

Transfer agent fees | | | | |

| |

Class A | | | 14,353 | |

| |

Class B | | | 36 | |

| |

Class C | | | 1,970 | |

| |

Class R4 | | | 293 | |

| |

Class R5 | | | 93 | |

| |

Class W | | | 53 | |

| |

Class Z | | | 8,251 | |

| |

Compensation of board members | | | 6,066 | |

| |

Custodian fees | | | 2,576 | |

| |

Printing and postage fees | | | 9,985 | |

| |

Registration fees | | | 48,385 | |

| |

Audit fees | | | 15,274 | |

| |

Legal fees | | | 2,718 | |

| |

Other | | | 7,116 | |

| |

Total expenses | | | 469,139 | |

| |

Net investment loss | | | (353,203 | ) |

| |

| |

Realized and unrealized gain (loss) — net | | | | |

| |

Net realized gain (loss) on: | | | | |

| |

Investments | | | 26,860 | |

| |

Forward foreign currency exchange contracts | | | 2,473,124 | |

| |

Net realized gain | | | 2,499,984 | |

| |

Net change in unrealized appreciation (depreciation) on: | | | | |

| |

Investments | | | (7,274 | ) |

| |

Forward foreign currency exchange contracts | | | (502,338 | ) |

| |

Net change in unrealized depreciation | | | (509,612 | ) |

| |

Net realized and unrealized gain | | | 1,990,372 | |

| |

Net increase in net assets resulting from operations | | | $1,637,169 | |

| |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 10 | | Semiannual Report 2016 |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

April 30, 2016

(Unaudited) | | | Year Ended

October 31, 2015 | |

Operations | |

| | |

Net investment loss | | | $(353,203 | ) | | | $(651,183 | ) |

| | |

Net realized gain | | | 2,499,984 | | | | 10,571,998 | |

| | |

Net change in unrealized appreciation (depreciation) | | | (509,612 | ) | | | 269,802 | |

| | | | | | | | | |

Net increase in net assets resulting from operations | | | 1,637,169 | | | | 10,190,617 | |

| | | | | | | | | |

|

Distributions to shareholders | |

|

Net investment income | |

| | |

Class A | | | (861,210 | ) | | | — | |

| | |

Class B | | | (2,086 | ) | | | — | |

| | |

Class C | | | (109,871 | ) | | | — | |

| | |

Class I | | | (1,215,601 | ) | | | — | |

| | |

Class R4 | | | (17,685 | ) | | | — | |

| | |

Class R5 | | | (15,968 | ) | | | — | |

| | |

Class W | | | (3,542 | ) | | | — | |

| | |

Class Y | | | (566 | ) | | | — | |

| | |

Class Z | | | (419,730 | ) | | | — | |

|

Net realized gains | |

| | |

Class A | | | (1,727,785 | ) | | | — | |

| | |

Class B | | | (4,987 | ) | | | — | |

| | |

Class C | | | (262,698 | ) | | | — | |

| | |

Class I | | | (2,254,953 | ) | | | — | |

| | |

Class R4 | | | (33,743 | ) | | | — | |

| | |

Class R5 | | | (29,977 | ) | | | — | |

| | |

Class W | | | (7,106 | ) | | | — | |

| | |

Class Y | | | (1,051 | ) | | | — | |

| | |

Class Z | | | (799,217 | ) | | | — | |

| | | | | | | | | |

Total distributions to shareholders | | | (7,767,776 | ) | | | — | |

| | | | | | | | | |

Increase (decrease) in net assets from capital stock activity | | | 20,204,816 | | | | (5,825,475 | ) |

| | | | | | | | | |

Total increase in net assets | | | 14,074,209 | | | | 4,365,142 | |

| | |

Net assets at beginning of period | | | 54,760,632 | | | | 50,395,490 | |

| | | | | | | | | |

Net assets at end of period | | | $68,834,841 | | | | $54,760,632 | |

| | | | | | | | | |

Undistributed (excess of distributions over) net investment income | | | $(384,854 | ) | | | $2,614,608 | |

| | | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| Semiannual Report 2016 | | | 11 | |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

April 30, 2016 (Unaudited) | | | Year Ended

October 31, 2015 | |

| | | Shares | | | Dollars ($) | | | Shares | | | Dollars ($) | |

Capital stock activity | |

|

Class A shares | |

| | | | |

Subscriptions(a) | | | 1,069,960 | | | | 11,719,574 | | | | 604,105 | | | | 6,665,893 | |

| | | | |

Distributions reinvested | | | 245,434 | | | | 2,559,874 | | | | — | | | | — | |

| | | | |

Redemptions | | | (382,425 | ) | | | (4,019,009 | ) | | | (535,558 | ) | | | (5,702,700 | ) |

| | | | | | | | | | | | | | | | | |

Net increase | | | 932,969 | | | | 10,260,439 | | | | 68,547 | | | | 963,193 | |

| | | | | | | | | | | | | | | | | |

Class B shares | |

| | | | |

Subscriptions | | | — | | | | — | | | | 3,820 | | | | 39,479 | |

| | | | |

Distributions reinvested | | | 572 | | | | 5,647 | | | | — | | | | — | |

| | | | |

Redemptions(a) | | | (863 | ) | | | (8,942 | ) | | | (4,146 | ) | | | (42,901 | ) |

| | | | | | | | | | | | | | | | | |

Net decrease | | | (291 | ) | | | (3,295 | ) | | | (326 | ) | | | (3,422 | ) |

| | | | | | | | | | | | | | | | | |

Class C shares | |

| | | | |

Subscriptions | | | 114,223 | | | | 1,171,166 | | | | 192,991 | | | | 1,919,649 | |

| | | | |

Distributions reinvested | | | 36,986 | | | | 364,678 | | | | — | | | | — | |

| | | | |

Redemptions | | | (65,114 | ) | | | (642,882 | ) | | | (101,285 | ) | | | (1,050,592 | ) |

| | | | | | | | | | | | | | | | | |

Net increase | | | 86,095 | | | | 892,962 | | | | 91,706 | | | | 869,057 | |

| | | | | | | | | | | | | | | | | |

Class I shares | |

| | | | |

Subscriptions | | | 9,023 | | | | 98,589 | | | | 22,378 | | | | 245,309 | |

| | | | |

Distributions reinvested | | | 321,492 | | | | 3,468,903 | | | | — | | | | — | |

| | | | |

Redemptions | | | (177,089 | ) | | | (2,007,798 | ) | | | (718,243 | ) | | | (8,221,564 | ) |

| | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | 153,426 | | | | 1,559,694 | | | | (695,865 | ) | | | (7,976,255 | ) |

| | | | | | | | | | | | | | | | | |

Class R4 shares | |

| | | | |

Subscriptions | | | 11,642 | | | | 128,929 | | | | 30,862 | | | | 344,535 | |

| | | | |

Distributions reinvested | | | 4,639 | | | | 49,824 | | | | — | | | | — | |

| | | | |

Redemptions | | | (921 | ) | | | (9,940 | ) | | | (1,492 | ) | | | (17,533 | ) |

| | | | | | | | | | | | | | | | | |

Net increase | | | 15,360 | | | | 168,813 | | | | 29,370 | | | | 327,002 | |

| | | | | | | | | | | | | | | | | |

Class R5 shares | |

| | | | |

Subscriptions | | | 2,614 | | | | 27,875 | | | | 33,180 | | | | 369,400 | |

| | | | |

Distributions reinvested | | | 4,110 | | | | 44,345 | | | | — | | | | — | |

| | | | |

Redemptions | | | (2,542 | ) | | | (30,851 | ) | | | (2,431 | ) | | | (26,228 | ) |

| | | | | | | | | | | | | | | | | |

Net increase | | | 4,182 | | | | 41,369 | | | | 30,749 | | | | 343,172 | |

| | | | | | | | | | | | | | | | | |

Class W shares | |

| | | | |

Distributions reinvested | | | 869 | | | | 9,025 | | | | — | | | | — | |

| | | | |

Redemptions | | | (861 | ) | | | (9,068 | ) | | | (1,897 | ) | | | (20,366 | ) |

| | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | 8 | | | | (43 | ) | | | (1,897 | ) | | | (20,366 | ) |

| | | | | | | | | | | | | | | | | |

Class Z shares | |

| | | | |

Subscriptions | | | 1,339,951 | | | | 14,630,969 | | | | 1,088,930 | | | | 12,582,570 | |

| | | | |

Distributions reinvested | | | 81,839 | | | | 878,129 | | | | — | | | | — | |

| | | | |

Redemptions | | | (758,358 | ) | | | (8,224,221 | ) | | | (1,193,947 | ) | | | (12,910,426 | ) |

| | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | 663,432 | | | | 7,284,877 | | | | (105,017 | ) | | | (327,856 | ) |

| | | | | | | | | | | | | | | | | |

Total net increase (decrease) | | | 1,855,181 | | | | 20,204,816 | | | | (582,733 | ) | | | (5,825,475 | ) |

| | | | | | | | | | | | | | | | | |

| (a) | Includes conversions of Class B shares to Class A shares, if any. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 12 | | Semiannual Report 2016 |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS

The following tables are intended to help you understand the Fund’s financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund’s portfolio turnover rate may be higher.

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class A | | | (Unaudited) | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $11.83 | | | | $9.64 | | | | $9.75 | | | | $10.21 | | | | $9.95 | | | | $10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment loss | | | (0.07 | ) | | | (0.16 | ) | | | (0.14 | ) | | | (0.13 | ) | | | (0.12 | ) | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 0.34 | | | | 2.35 | | | | 0.03 | (a) | | | (0.09 | ) | | | 0.38 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.27 | | | | 2.19 | | | | (0.11 | ) | | | (0.22 | ) | | | 0.26 | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.51 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.53 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $10.57 | | | | $11.83 | | | | $9.64 | | | | $9.75 | | | | $10.21 | | | | $9.95 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.45 | % | | | 22.72 | % | | | (1.13 | %) | | | (2.28 | %) | | | 2.61 | % | | | (0.50 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total gross expenses | | | 1.65 | %(c) | | | 1.76 | % | | | 1.77 | % | | | 1.68 | % | | | 1.65 | % | | | 1.73 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total net expenses(d) | | | 1.65 | %(c) | | | 1.67 | % | | | 1.66 | % | | | 1.48 | % | | | 1.42 | % | | | 1.73 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (1.28 | %)(c) | | | (1.51 | %) | | | (1.50 | %) | | | (1.29 | %) | | | (1.18 | %) | | | (1.48 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in thousands) | | | $23,816 | | | | $15,622 | | | | $12,068 | | | | $20,050 | | | | $30,758 | | | | $40,755 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (d) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| Semiannual Report 2016 | | | 13 | |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class B | | | (Unaudited) | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $11.20 | | | | $9.19 | | | | $9.37 | | | | $9.90 | | | | $9.72 | | | | $9.85 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment loss | | | (0.10 | ) | | | (0.23 | ) | | | (0.20 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.22 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 0.32 | | | | 2.24 | | | | 0.02 | (a) | | | (0.09 | ) | | | 0.37 | | | | 0.09 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.22 | | | | 2.01 | | | | (0.18 | ) | | | (0.29 | ) | | | 0.18 | | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.43 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.45 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $9.97 | | | | $11.20 | | | | $9.19 | | | | $9.37 | | | | $9.90 | | | | $9.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.07 | % | | | 21.87 | % | | | (1.92 | %) | | | (3.08 | %) | | | 1.85 | % | | | (1.32 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total gross expenses | | | 2.39 | %(c) | | | 2.51 | % | | | 2.51 | % | | | 2.46 | % | | | 2.39 | % | | | 2.47 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total net expenses(d) | | | 2.39 | %(c) | | | 2.42 | % | | | 2.41 | % | | | 2.23 | % | | | 2.17 | % | | | 2.47 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (2.04 | %)(c) | | | (2.26 | %) | | | (2.25 | %) | | | (2.04 | %) | | | (1.93 | %) | | | (2.21 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in thousands) | | | $50 | | | | $59 | | | | $52 | | | | $189 | | | | $456 | | | | $698 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (d) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 14 | | Semiannual Report 2016 |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class C | | | (Unaudited) | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $11.19 | | | | $9.19 | | | | $9.36 | | | | $9.89 | | | | $9.71 | | | | $9.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment loss | | | (0.10 | ) | | | (0.23 | ) | | | (0.20 | ) | | | (0.20 | ) | | | (0.19 | ) | | | (0.22 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 0.32 | | | | 2.23 | | | | 0.03 | (a) | | | (0.09 | ) | | | 0.37 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.22 | | | | 2.00 | | | | (0.17 | ) | | | (0.29 | ) | | | 0.18 | | | | (0.12 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.43 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.45 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $9.96 | | | | $11.19 | | | | $9.19 | | | | $9.36 | | | | $9.89 | | | | $9.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.08 | % | | | 21.76 | % | | | (1.82 | %) | | | (3.08 | %) | | | 1.85 | % | | | (1.22 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total gross expenses | | | 2.40 | %(c) | | | 2.51 | % | | | 2.52 | % | | | 2.42 | % | | | 2.39 | % | | | 2.48 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total net expenses(d) | | | 2.40 | %(c) | | | 2.42 | % | | | 2.41 | % | | | 2.23 | % | | | 2.16 | % | | | 2.48 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (2.03 | %)(c) | | | (2.26 | %) | | | (2.25 | %) | | | (2.05 | %) | | | (1.92 | %) | | | (2.23 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in thousands) | | | $3,133 | | | | $2,556 | | | | $1,256 | | | | $2,374 | | | | $2,887 | | | | $3,333 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (d) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| Semiannual Report 2016 | | | 15 | |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class I | | | (Unaudited) | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | | | 2011 | |

Per share data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.22 | | | | $9.92 | | | | $10.00 | | | | $10.42 | | | | $10.11 | | | | $10.09 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment loss | | | (0.05 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.09 | ) | | | (0.07 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 0.35 | | | | 2.42 | | | | 0.03 | (a) | | | (0.09 | ) | | | 0.38 | | | | 0.10 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.30 | | | | 2.30 | | | | (0.08 | ) | | | (0.18 | ) | | | 0.31 | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | (0.55 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.57 | ) | | | — | | | | — | | | | (0.24 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $10.95 | | | | $12.22 | | | | $9.92 | | | | $10.00 | | | | $10.42 | | | | $10.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 2.65 | % | | | 23.18 | % | | | (0.80 | %) | | | (1.84 | %) | | | 3.07 | % | | | 0.20 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios to average net assets(b) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total gross expenses | | | 1.26 | %(c) | | | 1.34 | % | | | 1.32 | % | | | 1.16 | % | | | 1.14 | % | | | 1.05 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total net expenses(d) | | | 1.26 | %(c) | | | 1.29 | % | | | 1.26 | % | | | 1.08 | % | | | 0.91 | % | | | 1.05 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.90 | %)(c) | | | (1.13 | %) | | | (1.10 | %) | | | (0.90 | %) | | | (0.68 | %) | | | (0.84 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (in thousands) | | | $26,603 | | | | $27,817 | | | | $29,482 | | | | $65,238 | | | | $47,585 | | | | $67,660 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (b) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (d) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | |

| 16 | | Semiannual Report 2016 |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class R4 | | | (Unaudited) | | | | 2015 | | | | 2014 | | | | 2013(a) | |

Per share data | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.15 | | | | $9.87 | | | | $9.97 | | | | $10.28 | |

| | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | |

| | | | |

Net investment loss | | | (0.06 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) | | | 0.36 | | | | 2.42 | | | | 0.02 | (b) | | | (0.25 | ) |

| | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.30 | | | | 2.28 | | | | (0.10 | ) | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | |

| | | | |

Net investment income | | | (0.54 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.56 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $10.89 | | | | $12.15 | | | | $9.87 | | | | $9.97 | |

| | | | | | | | | | | | | | | | | |

Total return | | | 2.61 | % | | | 23.10 | % | | | (1.00 | %) | | | (3.02 | %) |

| | | | | | | | | | | | | | | | | |

Ratios to average net assets(c) | | | | | | | | | | | | | | | | |

| | | | |

Total gross expenses | | | 1.40 | %(d) | | | 1.52 | % | | | 1.54 | % | | | 1.19 | %(d) |

| | | | | | | | | | | | | | | | | |

Total net expenses(e) | | | 1.40 | %(d) | | | 1.43 | % | | | 1.41 | % | | | 1.19 | %(d) |

| | | | | | | | | | | | | | | | | |

Net investment loss | | | (1.03 | %)(d) | | | (1.26 | %) | | | (1.25 | %) | | | (1.03 | %)(d) |

| | | | | | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | | | | | |

| | | | |

Net assets, end of period (in thousands) | | | $498 | | | | $369 | | | | $10 | | | | $2 | |

| | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Based on operations from March 19, 2013 (commencement of operations) through the stated period end. |

| (b) | Calculation of the net gain (loss) per share (both realized and unrealized) does not correlate to the aggregate realized and unrealized gain (loss) presented in the Statement of Operations due to the timing of subscriptions and redemptions of Fund shares in relation to fluctuations in the market value of the portfolio. |

| (c) | In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund’s reported expense ratios. |

| (e) | Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable. |

The accompanying Notes to Financial Statements are an integral part of this statement.

| | | | |

| Semiannual Report 2016 | | | 17 | |

| | | | |

| | |

| | COLUMBIA ABSOLUTE RETURN CURRENCY AND INCOME FUND | | |

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | |

| |

| Six Months Ended

April 30, 2016 |

| | | Year Ended October 31, | |

Class R5 | | | (Unaudited) | | | | 2015 | | | | 2014(a) | |

Per share data | | | | | | | | | | | | |

Net asset value, beginning of period | | | $12.22 | | | | $9.92 | | | | $9.78 | |

| | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | |

| | | |

Net investment loss | | | (0.05 | ) | | | (0.13 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | |

Net realized and unrealized gain | | | 0.34 | | | | 2.43 | | | | 0.18 | (b) |

| | | | | | | | | | | | | |

Total from investment operations | | | 0.29 | | | | 2.30 | | | | 0.14 | |

| | | | | | | | | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | |

| | | |

Net investment income | | | (0.54 | ) | | | — | | | | — | |

| | | | | | | | | | | | | |

Net realized gains | | | (1.02 | ) | | | — | | | | — | |

| | | | | | | | | | | | | |

Total distributions to shareholders | | | (1.56 | ) | | | — | | | | — | |

| | | | | | | | | | | | | |

Net asset value, end of period | | | $10.95 | | | | $12.22 | | | | $9.92 | |

| | | | | | | | | | | | | |

Total return | | | 2.60 | % | | | 23.18 | % | | | 1.43 | % |

| | | | | | | | | | | | | |

Ratios to average net assets(c) | | | | | | | | | | | | |

| | | |

Total gross expenses | | | 1.31 | %(d) | | | 1.45 | % | | | 1.46 | %(d) |

| | | | | | | | | | | | | |

Total net expenses(e) | | | 1.31 | %(d) | | | 1.35 | % | | | 1.33 | %(d) |

| | | | | | | | | | | | | |

Net investment loss | | | (0.95 | %)(d) | | | (1.19 | %) | | | (1.08 | %)(d) |

| | | | | | | | | | | | | |

Supplemental data | | | | | | | | | | | | |

| | | |

Net assets, end of period (in thousands) | | | $394 | | | | $388 | | | | $10 | |

| | | | | | | | | | | | | |

Portfolio turnover | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | |

Notes to Financial Highlights

| (a) | Based on operations from June 25, 2014 (commencement of operations) through the stated period end. |