Exhibit 99.2

Q3’21 Investor Presentation November 10, 2021

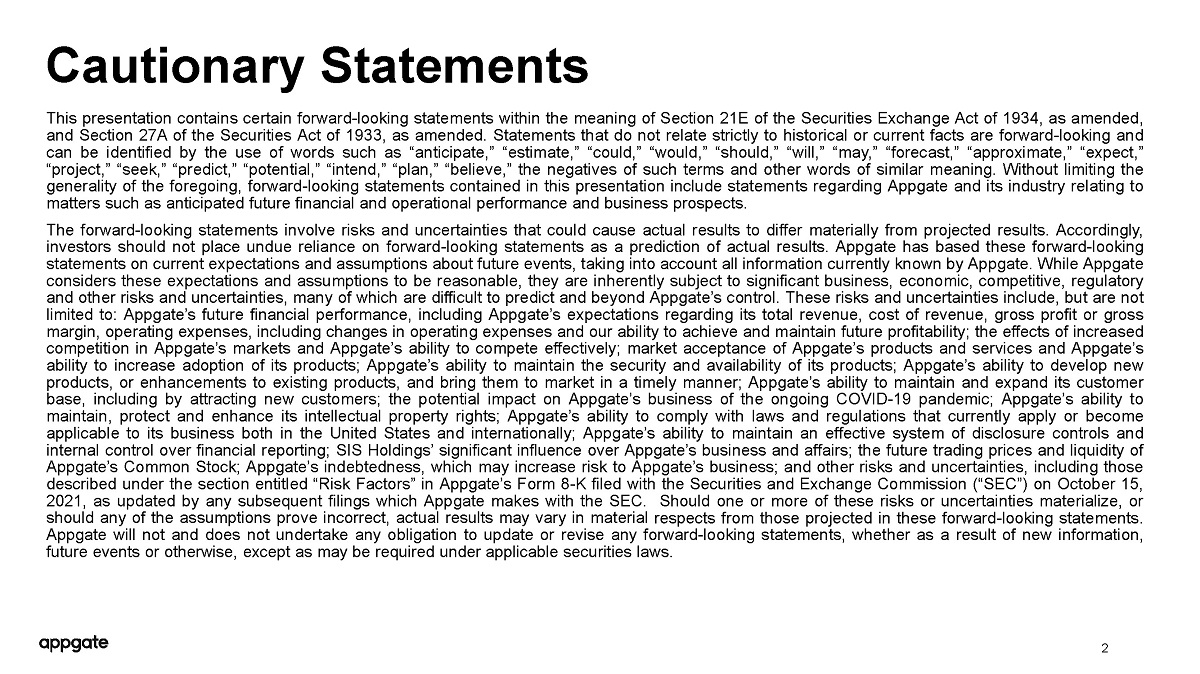

Cautionary Statements This presentation contains certain forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, and Section 27 A of the Securities Act of 1933 , as amended . Statements that do not relate strictly to historical or current facts are forward - looking and can be identified by the use of words such as “anticipate,” “estimate,” “could,” “would,” “should,” “will,” “may,” “forecast,” “approximate,” “expect,” “project,” “seek,” “predict,” “potential,” “intend,” “plan,” “believe,” the negatives of such terms and other words of similar meaning . Without limiting the generality of the foregoing, forward - looking statements contained in this presentation include statements regarding Appgate and its industry relating to matters such as anticipated future financial and operational performance and business prospects . The forward - looking statements involve risks and uncertainties that could cause actual results to differ materially from projected results . Accordingly, investors should not place undue reliance on forward - looking statements as a prediction of actual results . Appgate has based these forward - looking statements on current expectations and assumptions about future events, taking into account all information currently known by Appgate . While Appgate considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond Appgate’s control . These risks and uncertainties include, but are not limited to : Appgate’s future financial performance, including Appgate’s expectations regarding its total revenue, cost of revenue, gross profit or gross margin, operating expenses, including changes in operating expenses and our ability to achieve and maintain future profitability ; the effects of increased competition in Appgate’s markets and Appgate’s ability to compete effectively ; market acceptance of Appgate’s products and services and Appgate’s ability to increase adoption of its products ; Appgate’s ability to maintain the security and availability of its products ; Appgate’s ability to develop new products, or enhancements to existing products, and bring them to market in a timely manner ; Appgate’s ability to maintain and expand its customer base, including by attracting new customers ; the potential impact on Appgate’s business of the ongoing COVID - 19 pandemic ; Appgate’s ability to maintain, protect and enhance its intellectual property rights ; Appgate’s ability to comply with laws and regulations that currently apply or become applicable to its business both in the United States and internationally ; Appgate’s ability to maintain an effective system of disclosure controls and internal control over financial reporting ; SIS Holdings’ significant influence over Appgate’s business and affairs ; the future trading prices and liquidity of Appgate’s Common Stock ; Appgate’s indebtedness, which may increase risk to Appgate’s business ; and other risks and uncertainties, including those described under the section entitled “Risk Factors” in Appgate’s Form 8 - K filed with the Securities and Exchange Commission (“SEC”) on October 15 , 2021 , as updated by any subsequent filings which Appgate makes with the SEC . Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward - looking statements . Appgate will not and does not undertake any obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws . 2

To empower and protect how people work and connect OUR MISSION 3

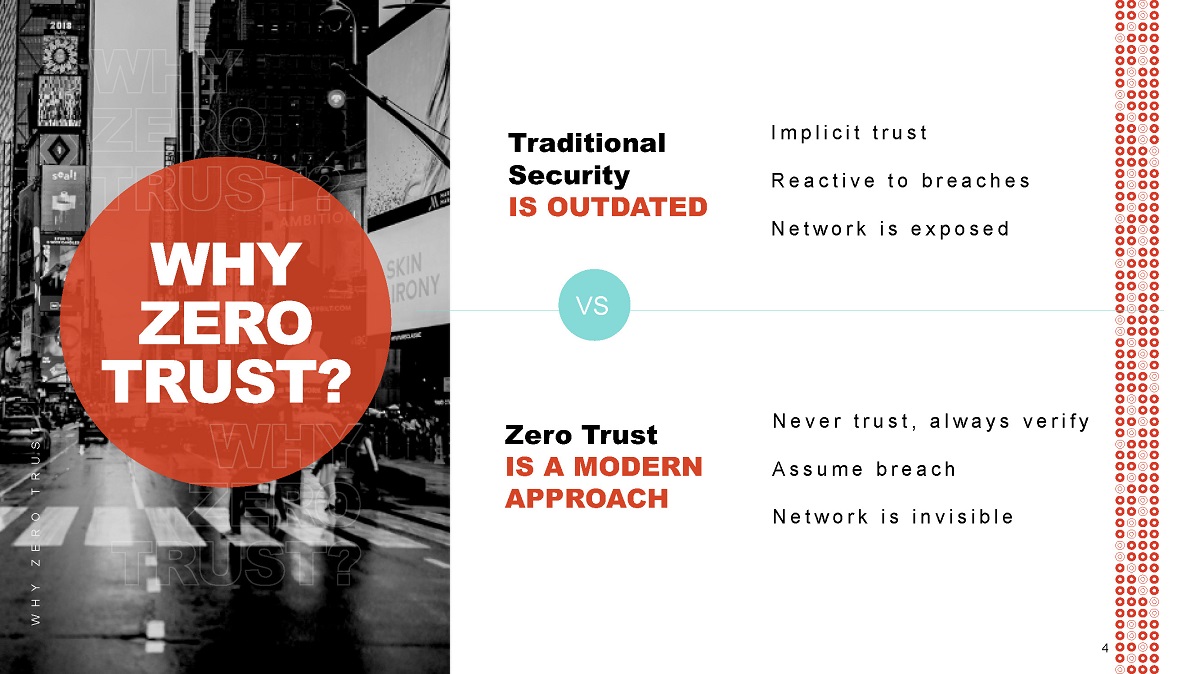

WHY ZERO TRUST WHY ZERO TRUST? Implicit trust Reactive to breaches Network is exposed Never trust, always verify Assume breach Network is invisible Traditional Security IS OUTDATED Zero Trust IS A MODERN APPROACH VS 4 4

Forrester New Wave: Zero Trust Network Access, Q3 2021 “Appgate is extremely granular in access control. It is very scalable and easy to deploy.” The Forrester New Wave Œ is copyrighted by Forrester Research, Inc. Forrester and Forrester Wave Œ are trademarks of Forrester Research, Inc. The Forrester New Wave Œ is a graphical representation of Forrester’s call on a market. Forrester does not endorse any vendor, product, or service depicted in the Forrester New Wave Œ . Information is based on best available resources. Opinions reflect judgment at the time and are subject to change. Named a ZTNA Leader 5 5

Zero Trust Network Access Secure Consumer Access Threat Advisory Services • Easily integrates with current architecture • Makes day - to - day easier for IT • Enables secure, anywhere, anytime access on any device • Ensures better overall experience for users • Intelligently permits risk - based access • Enhanced protection without compromising experience • Digital threat monitoring, warning and protection • Know where you’re vulnerable • Real - world adversary simulations • Advanced penetration testing What we do 6

Why Appgate PEOPLE - DEFINED SECURITY TRUSTED PARTNER BETTER USER EXPERIENCE FLEXIBLE & AGILE OPERATIONAL EFFICIENCY SIMPLE TO ADMINISTER PURPOSE - BUILT Start where you are 1 Accelerate your path forward 2 Future long - term success 3 7

Sports Nutrition Manufacturer PROBLEM TO SOLVE • Revamp/modernize network infrastructure by getting rid of the VPN. Seamlessly connect remote users to a hybrid environment. 8 USE CASE • Unified Cloud & On - Prem Access • VPN Replacement WHY WE WON • Single Packet Authorization (SPA) • Extensibility/Flexibility (APIs) • Multi - tunneling (Direct connect/non - cloud routed) • On - Premises/Hybrid (Unified Policy Framework) • Ease of use 8

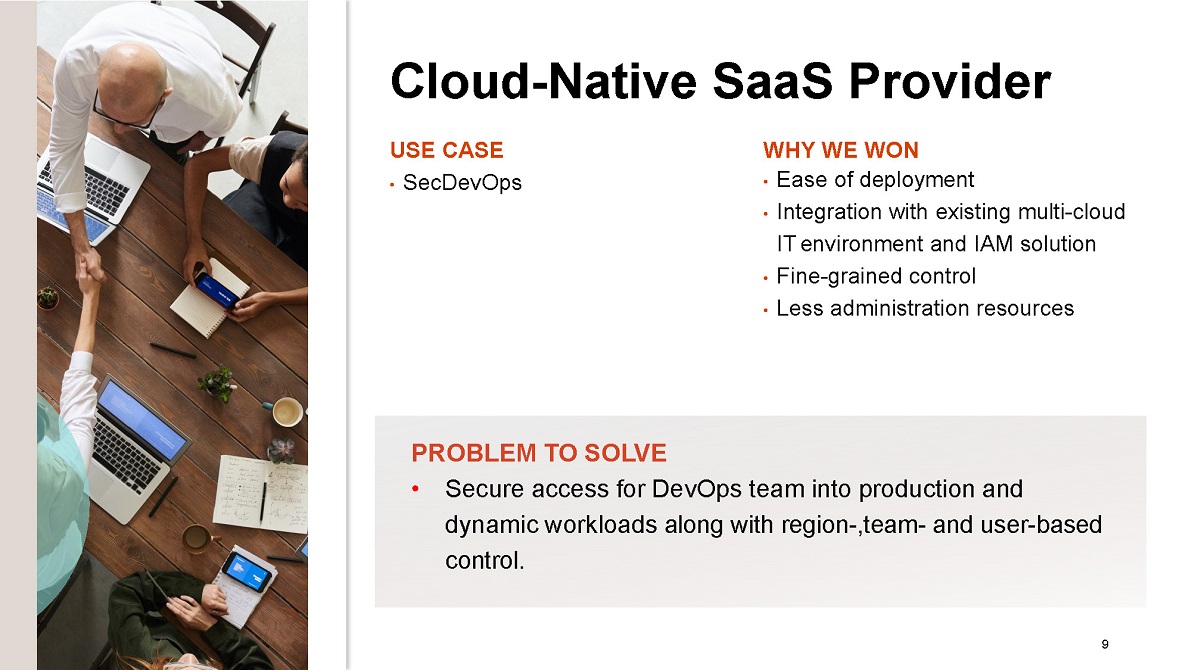

9 Cloud - Native SaaS Provider PROBLEM TO SOLVE • Secure access for DevOps team into production and dynamic workloads along with region - ,team - and user - based control. USE CASE • SecDevOps WHY WE WON • Ease of deployment • Integration with existing multi - cloud IT environment and IAM solution • Fine - grained control • Less administration resources 9

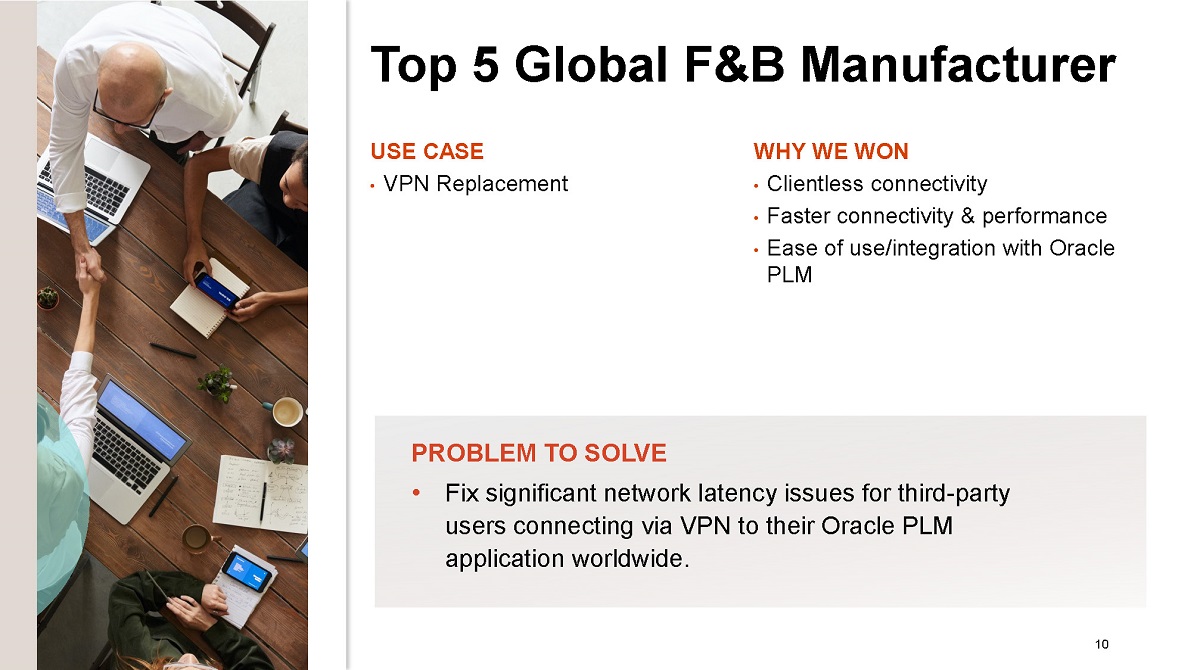

10 Top 5 Global F&B Manufacturer USE CASE • VPN Replacement WHY WE WON • Clientless connectivity • Faster connectivity & performance • Ease of use/integration with Oracle PLM PROBLEM TO SOLVE • Fix significant network latency issues for third - party users connecting via VPN to their Oracle PLM application worldwide.

MASTER AGENTS/REFERRAL FEDERAL INTEGRATORS SERVICE PROVIDER PARTNERS DISTRIBUTORS STRATEGIC ALLIANCES Channel Partners VALUE ADDED RESELLERS 11

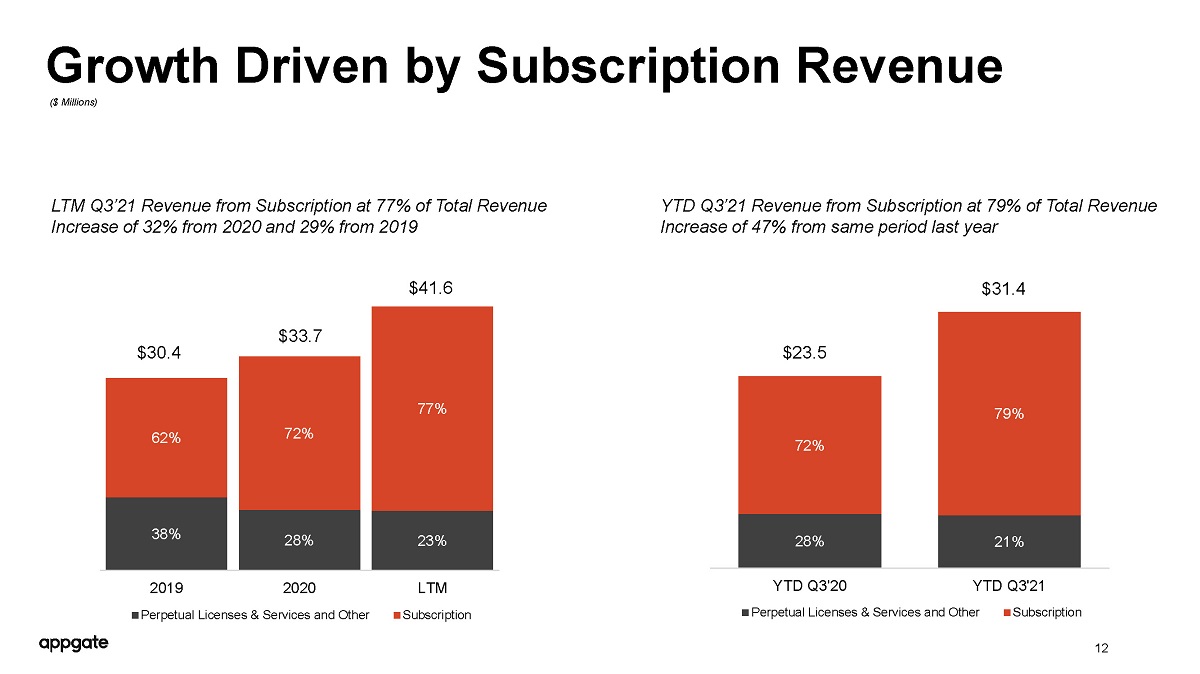

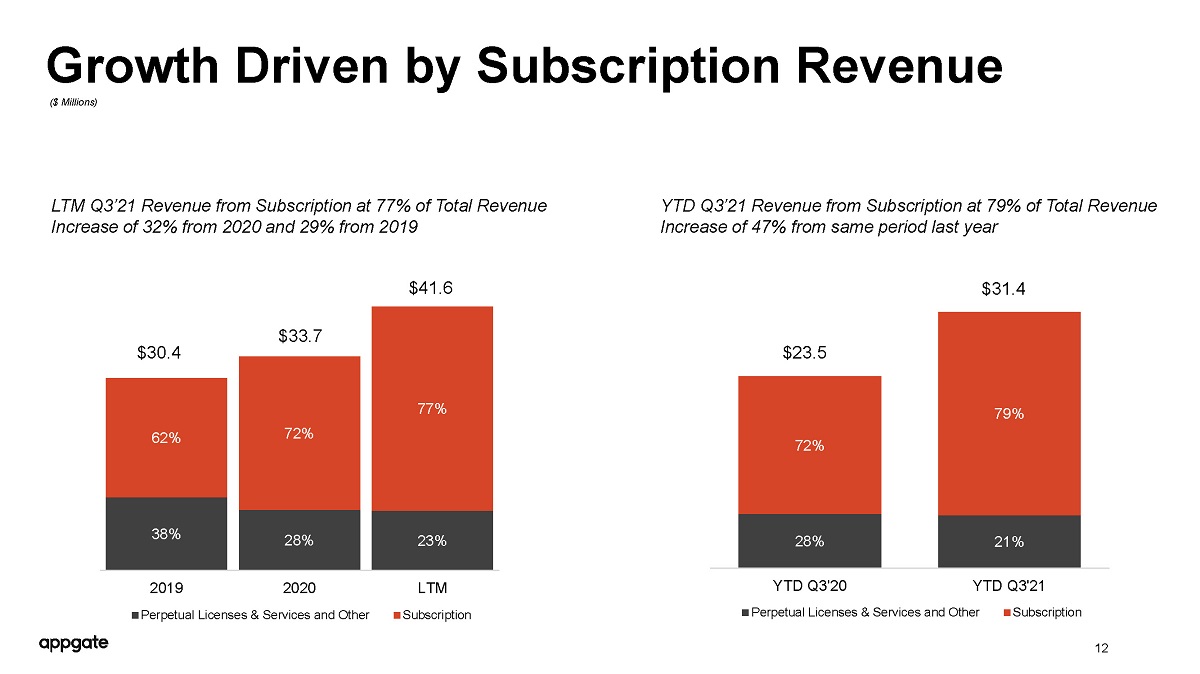

38% 28% 23% 62% 72% 77% 2019 2020 LTM Perpetual Licenses & Services and Other Subscription 28% 21% 72% 79% YTD Q3'20 YTD Q3'21 Perpetual Licenses & Services and Other Subscription Growth Driven by Subscription Revenue 12 ($ Millions) $30.4 $33.7 $31.4 $41.6 $23.5 LTM Q3’21 Revenue from Subscription at 77% of Total Revenue Increase of 32% from 2020 and 29% from 2019 YTD Q3’21 Revenue from Subscription at 79% of Total Revenue Increase of 47% from same period last year

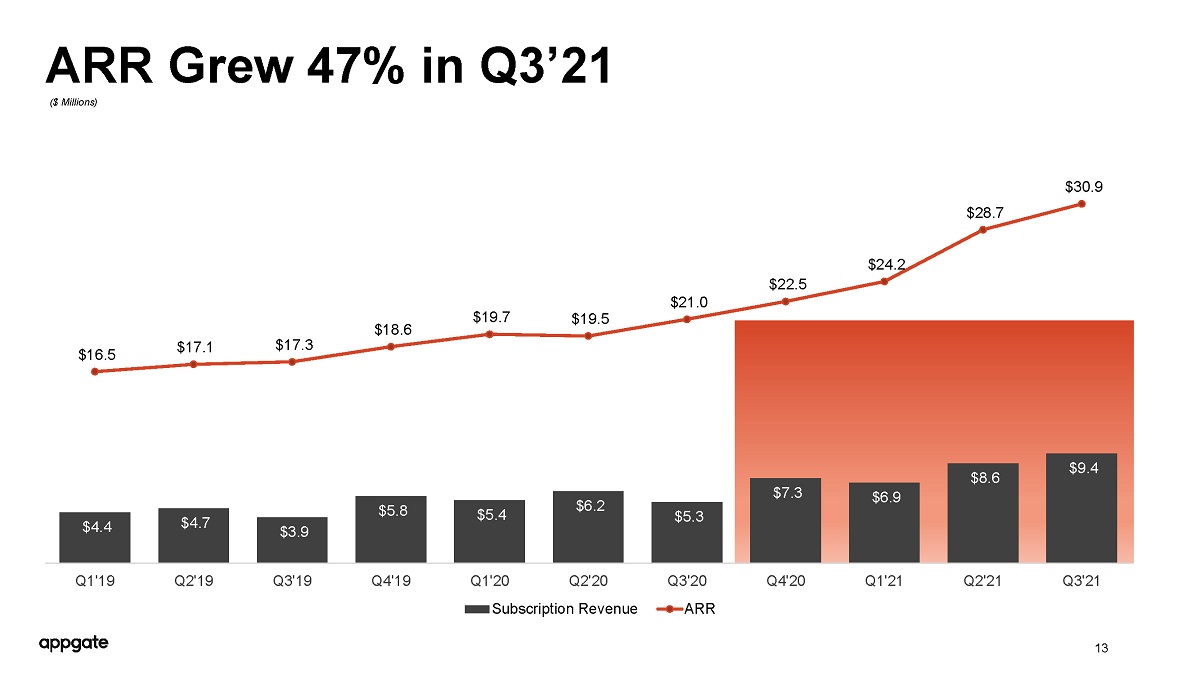

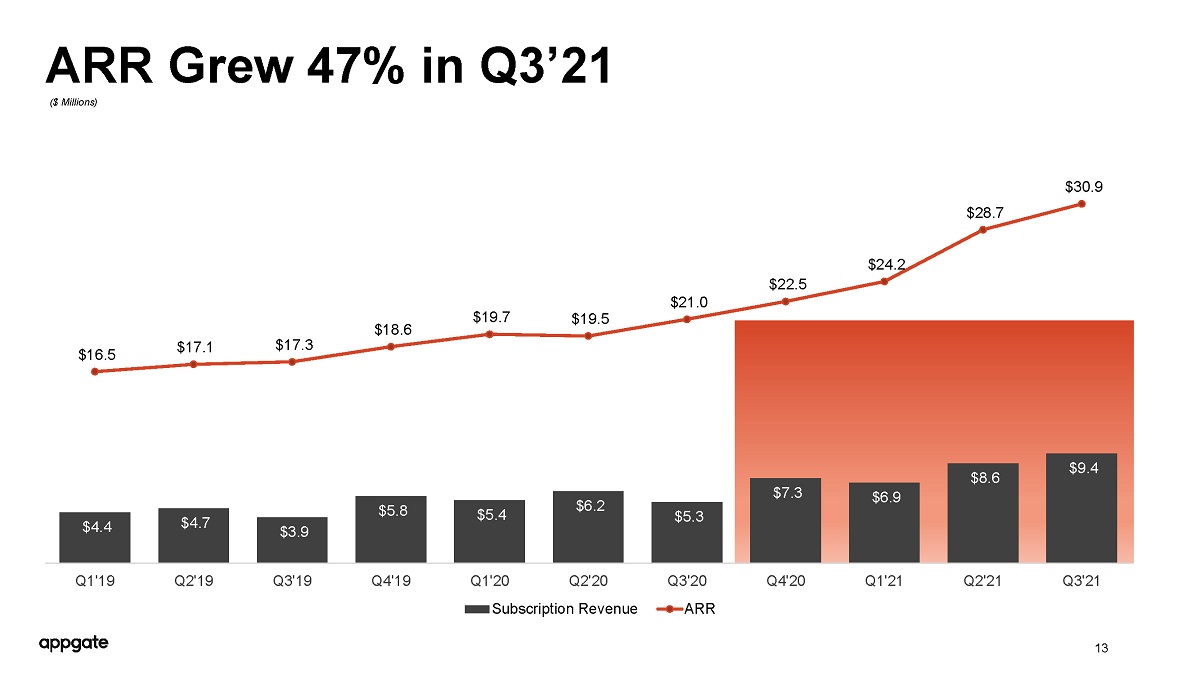

$4.4 $4.7 $3.9 $5.8 $5.4 $6.2 $5.3 $7.3 $6.9 $8.6 $9.4 $16.5 $17.1 $17.3 $18.6 $19.7 $19.5 $21.0 $22.5 $24.2 $28.7 $30.9 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Subscription Revenue ARR ARR Grew 47% in Q3’21 13 ($ Millions)

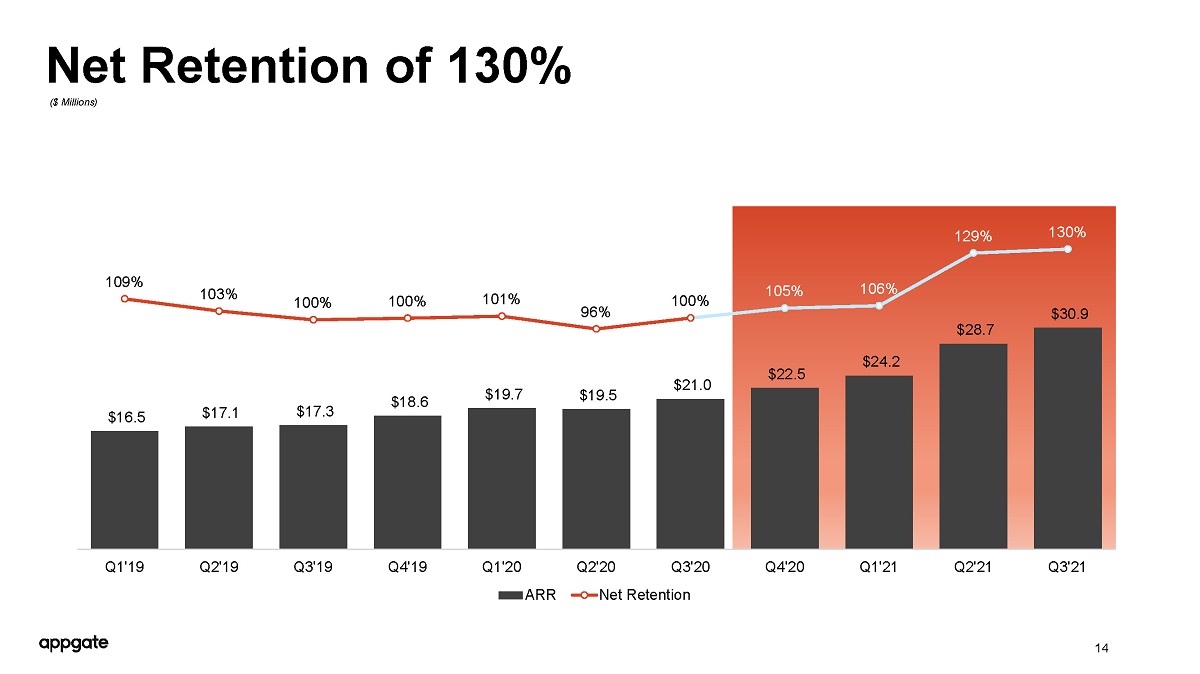

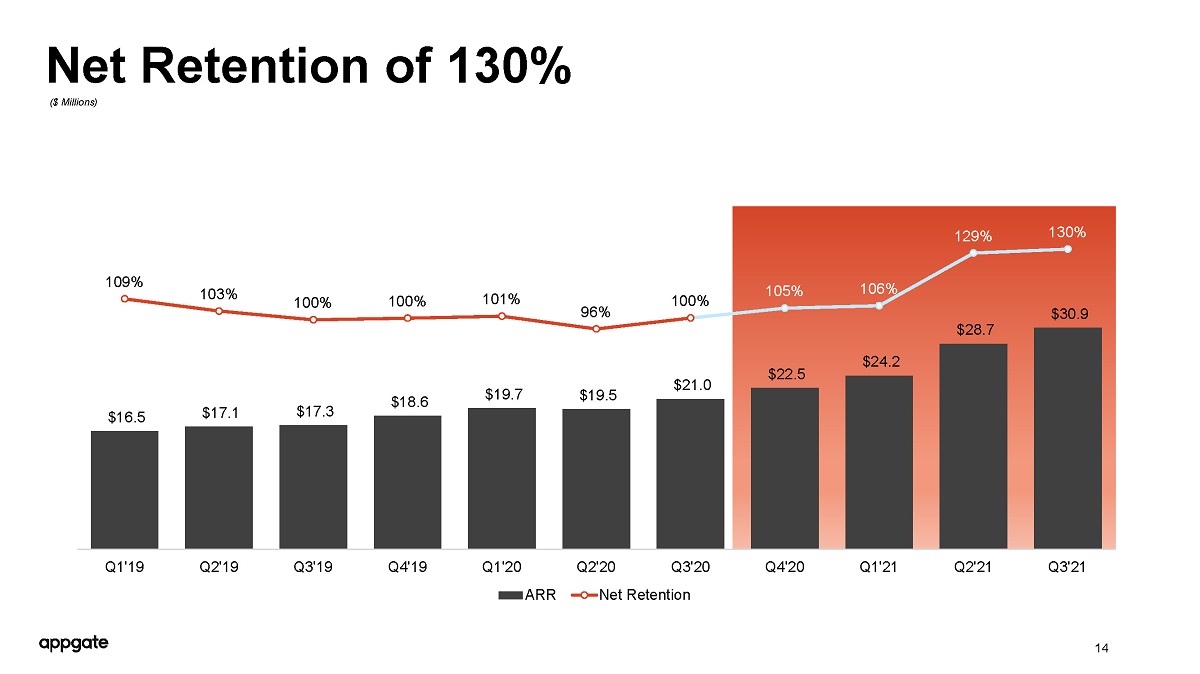

Net Retention of 130% 14 $16.5 $17.1 $17.3 $18.6 $19.7 $19.5 $21.0 $22.5 $24.2 $28.7 $30.9 109% 103% 100% 100% 101% 96% 100% 105% 106% 129% 130% 0% 20% 40% 60% 80% 100% 120% 140% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 ARR Net Retention ($ Millions)

Subscription Customers 15 $16.5 $17.1 $17.3 $18.6 $19.7 $19.5 $21.0 $22.5 $24.2 $28.7 $30.9 373 427 461 517 530 540 568 578 587 608 610 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 0 100 200 300 400 500 600 700 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 ARR Customers ($ Millions)

94% 47% 32% 39% 38% 29% 25% 24% 53% 75% 78% 82% 48% 54% 60% 63% 2019 2020 LTM 2021 YTD G&A R&D S&M Gross Margin LTM Q3’21 Operating Expenses as a % of Revenue 16 $72.3 $66.3 $73.1 $57.5 Increased investment in Sales and Marketing aligns with growth strategy G&A spend normalizing after spin out in 2019 Appgate currently has over 450 full - time employees YTD Q3’21 Revenue: $30.4 $33.7 $41.6 $31.4 ($ Millions)

Key Business Metrics Definitions Appgate’s management reviews a number of key performance indicators, each as described below, to evaluate the business of App gat e, measure its performance, identify trends affecting its business, formulate business plans and make strategic decisions. • Annual recurring revenue (ARR) is defined as the annualized value of active software - as - a - service (“SaaS”), subscription, and term - based license and maintenance contracts from Appgate’s recurring software products in effect at the end of a given period. • Dollar - based net retention rate (or net retention) reflects customer renewals, expansion, contraction, and customer attrition within its ARR base. Appgate calculates dollar - based net retention rate by dividing the numerator by the denominator as set forth below: • Denominator : As of the end of a reporting period, ARR from all active subscriptions as of the last day of the same reporting period in t he prior year. • Numerator : ARR for that same cohort of customers as of the end of the reporting period in the current year, including any expansion an d n et of contraction and customer attrition over the trailing 12 months, excluding ARR from new subscription customers in the current per iod. • Subscription customer is defined as a distinct organization that has entered into a distinct subscription agreement to access its software products for which the term has not ended or with which Appgate is negotiating a renewal contract. 17