united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-21872 |

| Mutual Fund Series Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| CT CORPORATION SYSTEM |

| 1300 EAST NINTH STREET, CLEVELAND, OH 44114 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 631-490-4300 | |

| Date of fiscal year end: | 9/30 | |

| | | |

| Date of reporting period: | 9/30/24 | |

Item 1. Reports to Stockholders.

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Empiric Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.empiricfunds.com/index.html. You can also request this information by contacting us at (888) 839-7424.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $245 | 2.18% |

How did the Fund perform during the reporting period?

For the year ended September 30, 2024, the Fund was up 25.00% while the MSCI U.S. Small Index was up 25.86% for the same period. The 4.88% cash held by the Fund negatively impacted performance as well as the Fund’s holdings of more profitable and established companies in an exuberant stock market environment. Stocks have been on a tear this year and last. Investor enthusiasm is as high as we have ever seen. Positive economic surprises currently driving up stocks include stronger-than-expected economic growth, cooling inflation, anticipated interest rate cuts by the Federal Reserve, robust corporate earnings, advancements in artificial intelligence (AI), and a generally stable labor market. These factors have been contributing to the perception that a recession is unlikely in the near term. In a brilliant article by James Mackintosh in the Wall Street Journal (“Simple Economic Explanations Keep Breaking Down”, Oct 22, 2024), he highlights that since the pandemic, the economic stories about the U.S. economy have been repeatedly wrong. He argues that the traditional narratives—government spending matters, monetary policy matters, and the natural link between growth, unemployment and inflation—are giving confusing signals. For instance: Most economists think huge government spending is inflationary, but deficits are still huge, and inflation is falling. The money supply expanded substantially then started shrinking. Many economists anticipated recession, but not so far. At approximately the same time, the Fed engineered one of the fastest and steepest increases in interest rates in U.S. history to soften demand and bring down inflation. Inflation has been cut by about two-thirds in the last two years, but demand is expanding as fast as it was before the pandemic. In the Fund, which constitutes most of your our wealth, we think the best path in an uncertain environment is to focus on the best companies we can find that are reasonably valued. We call them stable earners with high profitability. We appreciate you investing along with us.

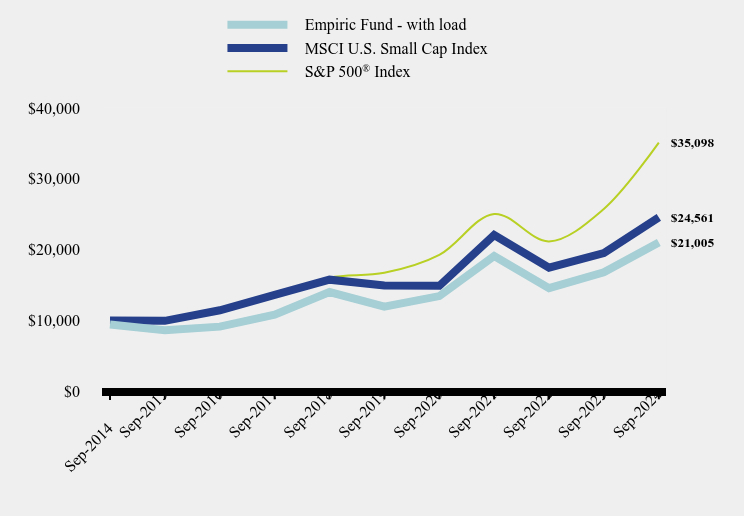

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Empiric Fund - with load | MSCI U.S. Small Cap Index | S&P 500® Index |

|---|

| Sep-2014 | $9,424 | $10,000 | $10,000 |

| Sep-2015 | $8,618 | $9,949 | $9,939 |

| Sep-2016 | $9,129 | $11,442 | $11,472 |

| Sep-2017 | $10,812 | $13,626 | $13,607 |

| Sep-2018 | $14,013 | $15,763 | $16,044 |

| Sep-2019 | $11,965 | $14,931 | $16,727 |

| Sep-2020 | $13,440 | $14,892 | $19,260 |

| Sep-2021 | $19,085 | $22,063 | $25,040 |

| Sep-2022 | $14,557 | $17,453 | $21,165 |

| Sep-2023 | $16,803 | $19,514 | $25,741 |

| Sep-2024 | $21,005 | $24,561 | $35,098 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Empiric Fund - Class A |

| Without Load | 25.00% | 11.91% | 8.34% |

| With Load | 17.81% | 10.60% | 7.70% |

| MSCI U.S. Small Cap Index | 25.86% | 10.47% | 9.40% |

S&P 500® Index | 36.35% | 15.98% | 13.38% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $25,400,497 |

| Number of Portfolio Holdings | 46 |

| Advisory Fee | $247,609 |

| Portfolio Turnover | 5% |

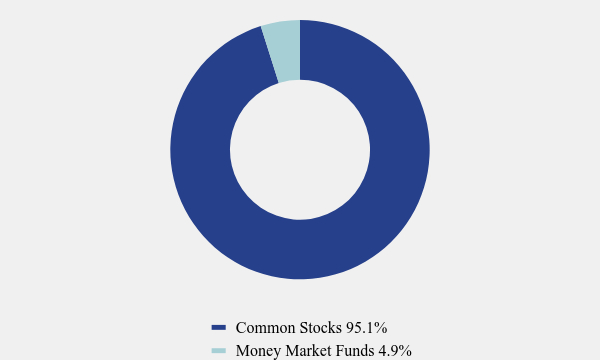

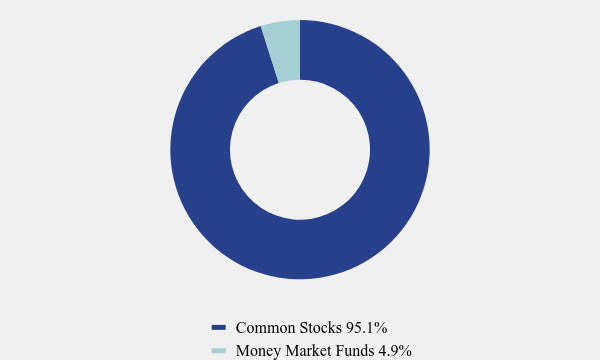

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.1% |

| Money Market Funds | 4.9% |

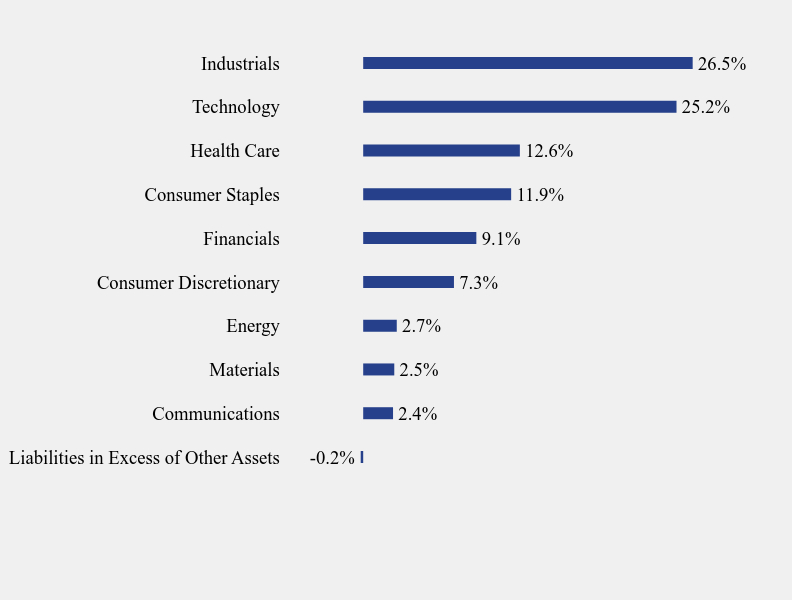

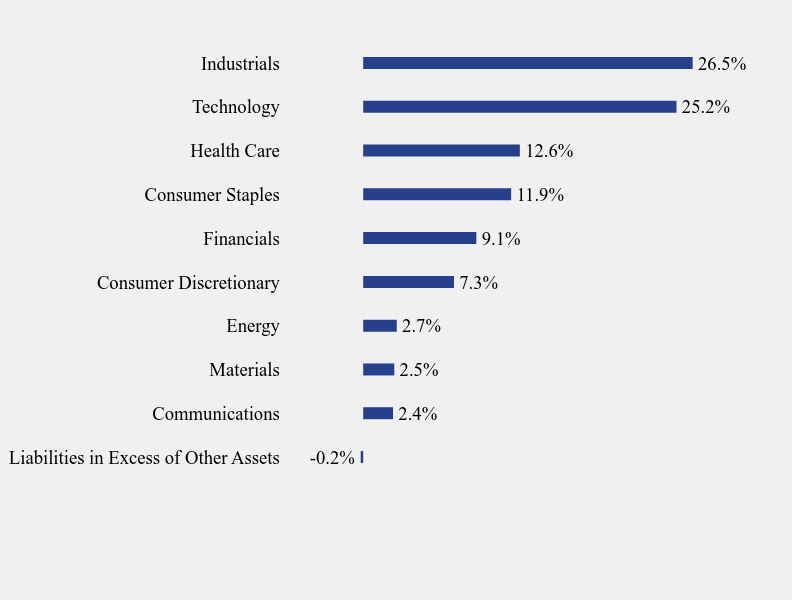

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| Communications | 2.4% |

| Materials | 2.5% |

| Energy | 2.7% |

| Consumer Discretionary | 7.3% |

| Financials | 9.1% |

| Consumer Staples | 11.9% |

| Health Care | 12.6% |

| Technology | 25.2% |

| Industrials | 26.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Coca-Cola Consolidated, Inc. | 6.8% |

| United Rentals, Inc. | 6.0% |

| Agilysys, Inc. | 5.7% |

| Fair Isaac Corporation | 5.7% |

| CommVault Systems, Inc. | 4.2% |

| Quanta Services, Inc. | 4.0% |

| LPL Financial Holdings, Inc. | 3.9% |

| Casey's General Stores, Inc. | 2.9% |

| Lincoln Electric Holdings, Inc. | 2.6% |

| Robert Half International, Inc. | 2.6% |

No material changes occurred during the year ended September 30, 2024.

Empiric Fund - Class A (EMCAX )

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.empiricfunds.com/index.html ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Empiric Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at https://www.empiricfunds.com/index.html. You can also request this information by contacting us at (888) 839-7424.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $328 | 2.93% |

How did the Fund perform during the reporting period?

For the year ended September 30, 2024, the Fund was up 24.08% while the MSCI U.S. Small Index was up 25.86% for the same period. The 4.88% cash held by the Fund negatively impacted performance as well as the Fund’s holdings of more profitable and established companies in an exuberant stock market environment. Stocks have been on a tear this year and last. Investor enthusiasm is as high as we have ever seen. Positive economic surprises currently driving up stocks include stronger-than-expected economic growth, cooling inflation, anticipated interest rate cuts by the Federal Reserve, robust corporate earnings, advancements in artificial intelligence (AI), and a generally stable labor market. These factors have been contributing to the perception that a recession is unlikely in the near term. In a brilliant article by James Mackintosh in the Wall Street Journal (“Simple Economic Explanations Keep Breaking Down”, Oct 22, 2024), he highlights that since the pandemic, the economic stories about the U.S. economy have been repeatedly wrong. He argues that the traditional narratives—government spending matters, monetary policy matters, and the natural link between growth, unemployment and inflation—are giving confusing signals. For instance: Most economists think huge government spending is inflationary, but deficits are still huge, and inflation is falling. The money supply expanded substantially then started shrinking. Many economists anticipated recession, but not so far. At approximately the same time, the Fed engineered one of the fastest and steepest increases in interest rates in U.S. history to soften demand and bring down inflation. Inflation has been cut by about two-thirds in the last two years, but demand is expanding as fast as it was before the pandemic. In the Fund, which constitutes most of your our wealth, we think the best path in an uncertain environment is to focus on the best companies we can find that are reasonably valued. We call them stable earners with high profitability. We appreciate you investing along with us.

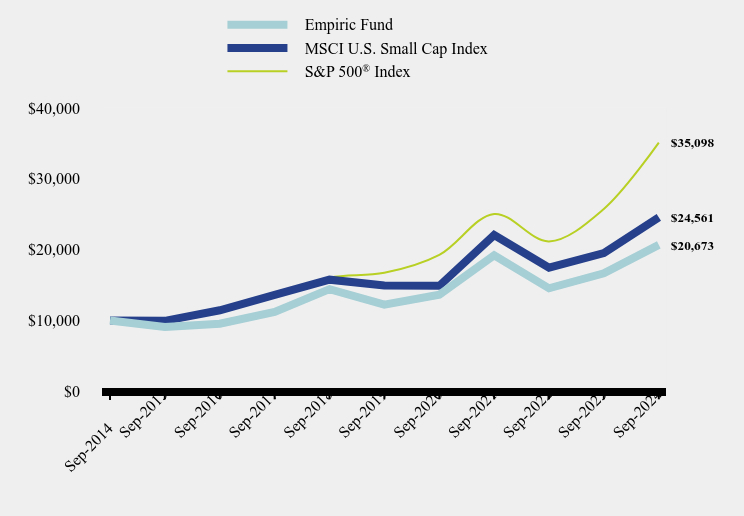

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Empiric Fund | MSCI U.S. Small Cap Index | S&P 500® Index |

|---|

| Sep-2014 | $10,000 | $10,000 | $10,000 |

| Sep-2015 | $9,079 | $9,949 | $9,939 |

| Sep-2016 | $9,541 | $11,442 | $11,472 |

| Sep-2017 | $11,218 | $13,626 | $13,607 |

| Sep-2018 | $14,427 | $15,763 | $16,044 |

| Sep-2019 | $12,227 | $14,931 | $16,727 |

| Sep-2020 | $13,631 | $14,892 | $19,260 |

| Sep-2021 | $19,210 | $22,063 | $25,040 |

| Sep-2022 | $14,542 | $17,453 | $21,165 |

| Sep-2023 | $16,661 | $19,514 | $25,741 |

| Sep-2024 | $20,673 | $24,561 | $35,098 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Empiric Fund - Class C | 24.08% | 11.07% | 7.53% |

| MSCI U.S. Small Cap Index | 25.86% | 10.47% | 9.40% |

S&P 500® Index | 36.35% | 15.98% | 13.38% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Net Assets | $25,400,497 |

| Number of Portfolio Holdings | 46 |

| Advisory Fee | $247,609 |

| Portfolio Turnover | 5% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 95.1% |

| Money Market Funds | 4.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.2% |

| Communications | 2.4% |

| Materials | 2.5% |

| Energy | 2.7% |

| Consumer Discretionary | 7.3% |

| Financials | 9.1% |

| Consumer Staples | 11.9% |

| Health Care | 12.6% |

| Technology | 25.2% |

| Industrials | 26.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Coca-Cola Consolidated, Inc. | 6.8% |

| United Rentals, Inc. | 6.0% |

| Agilysys, Inc. | 5.7% |

| Fair Isaac Corporation | 5.7% |

| CommVault Systems, Inc. | 4.2% |

| Quanta Services, Inc. | 4.0% |

| LPL Financial Holdings, Inc. | 3.9% |

| Casey's General Stores, Inc. | 2.9% |

| Lincoln Electric Holdings, Inc. | 2.6% |

| Robert Half International, Inc. | 2.6% |

No material changes occurred during the year ended September 30, 2024.

Empiric Fund - Class C (EMCCX )

Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://www.empiricfunds.com/index.html ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

| (a) | The registrant has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| | |

| (b) | Not applicable. |

| | |

| (c) | During the period covered by this report, there were no amendments to any provision of the code of ethics. |

| | |

| (d) | During the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics. |

| | |

| (e) | Not applicable. |

| | |

| (f) | See Item 19(a)(1) |

Item 3. Audit Committee Financial Expert.

(a)(1) The registrant’s board of trustees has determined that the registrant has at least one audit committee financial expert serving on the audit committee. (a)(2) Michael Schoonover is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Schoonover is independent for purposes of this Item. (a)(3) Not applicable. |

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the registrant’s principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are as follows: |

| Trust Series | | 2024 | | | 2023 | |

| Empiric Fund | | $ | 13,300 | | | $ | 12,000 | |

| (b) | Audit-Related Fees. There were no fees billed in each of the last two fiscal years for assurances and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| | |

| (c) | Tax Fees - The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance are as follows: |

| Trust Series | | 2024 | | | 2023 | |

| Empiric Fund | | $ | 3,000 | | | $ | 3,000 | |

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

| (d) | All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 and $0 for the fiscal years ended September 30, 2024 and 2023 respectively. |

| | |

| (e)(1) | The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| | |

| (e)(2) | There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | |

| (f) | Not applicable. |

| | |

| (g) | All non-audit fees billed by the registrant’s principal accountant for services rendered to the registrant for the fiscal years ended September 30, 2024 and 2023 respectively are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant’s principal accountant for the registrant’s adviser. |

| | |

| (h) | Not applicable. |

| | |

| (i) | Not applicable. |

| | |

| (j) | Not applicable. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

Annual Financial Statements

September 30, 2024

| EMPIRIC FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.3% | | | | |

| | | | | ADVERTISING & MARKETING - 2.4% | | | | |

| | 19,563 | | | Interpublic Group of Companies, Inc. (The)(a) | | $ | 618,778 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 3.8% | | | | |

| | 4,208 | | | LPL Financial Holdings, Inc. | | | 978,907 | |

| | | | | | | | | |

| | | | | BEVERAGES - 6.8% | | | | |

| | 1,307 | | | Coca-Cola Consolidated, Inc.(a) | | | 1,720,535 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 1.8% | | | | |

| | 8,166 | | | Halozyme Therapeutics, Inc.(a),(b) | | | 467,422 | |

| | | | | | | | | |

| | | | | CHEMICALS - 1.7% | | | | |

| | 1,988 | | | Avery Dennison Corporation | | | 438,871 | |

| | | | | | | | | |

| | | | | COMMERCIAL SUPPORT SERVICES - 6.6% | | | | |

| | 3,545 | | | AMN Healthcare Services, Inc.(a),(b) | | | 150,272 | |

| | 4,205 | | | Brink’s Company (The) | | | 486,266 | |

| | 9,910 | | | Robert Half International, Inc. | | | 668,033 | |

| | 3,836 | | | TriNet Group, Inc. | | | 371,977 | |

| | | | | | | | 1,676,548 | |

| | | | | CONTAINERS & PACKAGING - 0.8% | | | | |

| | 1,992 | | | Crown Holdings, Inc. | | | 190,993 | |

| | | | | | | | | |

| | | | | ELECTRICAL EQUIPMENT - 2.7% | | | | |

| | 2,529 | | | A O Smith Corporation(a) | | | 227,180 | |

| | 1,677 | | | Generac Holdings, Inc.(b) | | | 266,442 | |

| | 437 | | | Hubbell, Inc. | | | 187,189 | |

| | | | | | | | 680,811 | |

| | | | | ENGINEERING & CONSTRUCTION - 4.0% | | | | |

| | 3,412 | | | Quanta Services, Inc.(a) | | | 1,017,288 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 6.8% | | | | |

| | 435 | | | Chemed Corporation | | | 261,422 | |

| | 5,044 | | | Henry Schein, Inc.(a),(b) | | | 367,708 | |

See accompanying notes to financial statements.

| EMPIRIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.3% (Continued) | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 6.8% (Continued) | | | | |

| | 1,511 | | | Medpace Holdings, Inc.(b) | | $ | 504,372 | |

| | 1,705 | | | Molina Healthcare, Inc.(a),(b) | | | 587,475 | |

| | | | | | | | 1,720,977 | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 6.0% | | | | |

| | 1,880 | | | United Rentals, Inc. | | | 1,522,292 | |

| | | | | | | | | |

| | | | | INSURANCE - 0.3% | | | | |

| | 377 | | | Assurant, Inc. | | | 74,970 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 2.4% | | | | |

| | 860 | | | Domino’s Pizza, Inc.(a) | | | 369,920 | |

| | 1,394 | | | Vail Resorts, Inc.(a) | | | 242,960 | |

| | | | | | | | 612,880 | |

| | | | | MACHINERY - 5.6% | | | | |

| | 5,500 | | | Donaldson Company, Inc. | | | 405,350 | |

| | 3,496 | | | Lincoln Electric Holdings, Inc.(a) | | | 671,302 | |

| | 3,872 | | | Toro Company (The)(a) | | | 335,818 | |

| | | | | | | | 1,412,470 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 4.0% | | | | |

| | 8,068 | | | Bruker Corporation(a) | | | 557,176 | |

| | 6,429 | | | Globus Medical, Inc., Class A(b) | | | 459,931 | |

| | | | | | | | 1,017,107 | |

| | | | | OIL & GAS PRODUCERS - 2.7% | | | | |

| | 3,108 | | | Exxon Mobil Corporation | | | 364,320 | |

| | 640 | | | Murphy USA, Inc. | | | 315,437 | |

| | | | | | | | 679,757 | |

| | | | | RETAIL - CONSUMER STAPLES - 5.1% | | | | |

| | 6,800 | | | BJ’s Wholesale Club Holdings, Inc.(b) | | | 560,864 | |

| | 1,935 | | | Casey’s General Stores, Inc. | | | 726,999 | |

| | | | | | | | 1,287,863 | |

| | | | | RETAIL - DISCRETIONARY - 4.9% | | | | |

| | 140 | | | AutoZone, Inc.(b) | | | 441,006 | |

| | 400 | | | O’Reilly Automotive, Inc.(b) | | | 460,640 | |

See accompanying notes to financial statements.

| EMPIRIC FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 95.3% (Continued) | | | | |

| | | | | RETAIL - DISCRETIONARY - 4.9% (Continued) | | | | |

| | 2,250 | | | Williams-Sonoma, Inc.(a) | | $ | 348,570 | |

| | | | | | | | 1,250,216 | |

| | | | | SEMICONDUCTORS - 2.1% | | | | |

| | 4,064 | | | Teradyne, Inc. | | | 544,291 | |

| | | | | | | | | |

| | | | | SOFTWARE - 14.1% | | | | |

| | 13,376 | | | Agilysys, Inc.(b) | | | 1,457,583 | |

| | 6,153 | | | Calix, Inc.(b) | | | 238,675 | |

| | 6,938 | | | CommVault Systems, Inc.(b) | | | 1,067,411 | |

| | 5,650 | | | Fortinet, Inc.(b) | | | 438,157 | |

| | 2,250 | | | Paycom Software, Inc.(a) | | | 374,782 | |

| | | | | | | | 3,576,608 | |

| | | | | TECHNOLOGY SERVICES - 9.0% | | | | |

| | 1,630 | | | Automatic Data Processing, Inc. | | | 451,070 | |

| | 742 | | | Fair Isaac Corporation(b) | | | 1,442,092 | |

| | 800 | | | Mastercard, Inc., Class A | | | 395,040 | |

| | | | | | | | 2,288,202 | |

| | | | | TRANSPORTATION & LOGISTICS - 1.7% | | | | |

| | 2,160 | | | Landstar System, Inc. | | | 407,959 | |

| | 225 | | | XPO, Inc.(a),(b) | | | 24,190 | |

| | | | | | | | 432,149 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $10,539,986) | | | 24,209,935 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENTS — 28.0% | | | | |

| | | | | COLLATERAL FOR SECURITIES LOANED – 28.0% | | | | |

| | 7,108,774 | | | Mount Vernon Liquid Assets Portfolio, LLC, 4.95% (Cost $7,108,774)(c),(d) | | | 7,108,774 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 123.3% (Cost $17,648,760) | | $ | 31,318,709 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (23.3)% | | | (5,918,212 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 25,400,497 | |

| (a) | All or a portion of the security is on loan. The total fair value of the securities on loan as of September 30, 2024 was $6,957,657. |

| (b) | Non-income producing security. |

| (c) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

| (d) | Security was purchased with cash received as collateral for securities on loan at September 30, 2024. Total collateral had a value of $7,108,744 at September 30, 2024. |

See accompanying notes to financial statements.

| Empiric Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2024 |

| ASSETS | | | | |

| Investment securities: (a) | | | | |

| At cost | | $ | 17,648,760 | |

| At fair value | | $ | 31,318,709 | |

| Cash and cash equivalents | | | 1,243,294 | |

| Dividends and interest receivable | | | 11,297 | |

| Prepaid expenses and other assets | | | 51 | |

| TOTAL ASSETS | | | 32,573,351 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for collateral from securities loaned | | | 7,108,774 | |

| Investment advisory fees payable | | | 22,954 | |

| Distribution (12b-1) fees payable | | | 1,793 | |

| Payable to related parties | | | 21,333 | |

| Accrued expenses and other liabilities | | | 18,000 | |

| TOTAL LIABILITIES | | | 7,172,854 | |

| NET ASSETS | | $ | 25,400,497 | |

| | | | | |

| Composition of Net Assets: | | | | |

| Paid in capital | | $ | 11,872,387 | |

| Accumulated earnings | | | 13,528,110 | |

| NET ASSETS | | $ | 25,400,497 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| Class A Shares: | | | | |

| Net Assets | | $ | 24,083,235 | |

| Shares of beneficial interest outstanding (b) | | | 366,339 | |

| Net asset value (Net Assets÷ Shares Outstanding) and redemption price per share (c) | | $ | 65.74 | |

| Maximum offering price per share (net asset value plus maximum sales charge of 5.75%) | | $ | 69.75 | |

| | | | | |

| Class C Shares: | | | | |

| Net Assets | | $ | 1,317,262 | |

| Shares of beneficial interest outstanding (b) | | | 23,477 | |

| Net asset value (Net Assets÷ Shares Outstanding), offering price and redemption price per share | | $ | 56.11 | |

| (a) | Includes $6,957,657 of securities out on loan. |

| (b) | Unlimited number of shares of beneficial interest authorized, no par value. |

| (c) | Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 1.00% contingent deferred sales charge (“CDSC”) on shares redeemed within 12 months after the date of purchase (excluding shares purchased with reinvested dividends and/or distributions). |

See accompanying notes to financial statements.

| Empiric Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2024 |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 217,579 | |

| Interest | | | 121,459 | |

| Securities lending income - net | | | 6,547 | |

| TOTAL INVESTMENT INCOME | | | 345,585 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 247,609 | |

| Distribution (12b-1) fees: | | | | |

| Class A | | | 58,828 | |

| Class C | | | 12,295 | |

| Financial administration/fund accounting fees | | | 82,287 | |

| Legal administration/management services fees | | | 24,761 | |

| Compliance officer fees | | | 21,817 | |

| Legal fees | | | 21,557 | |

| Trustees fees and expenses | | | 15,544 | |

| Shareholder service fees | | | 15,043 | |

| Audit Fees | | | 13,637 | |

| Registration fees | | | 12,800 | |

| Printing and postage expenses | | | 10,847 | |

| Custodian fees | | | 3,561 | |

| Insurance expense | | | 824 | |

| Other expenses | | | 7,104 | |

| TOTAL EXPENSES | | | 548,514 | |

| | | | | |

| NET INVESTMENT LOSS | | | (202,929 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN FROM INVESTMENTS | | | | |

| Net realized gain from investments | | | 55,143 | |

| Net realized gain from redemptions in kind | | | 1,380,070 | |

| Net change in unrealized appreciation on investments | | | 4,271,647 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN FROM INVESTMENTS | | | 5,706,860 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 5,503,931 | |

See accompanying notes to financial statements.

| Empiric Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | September 30, 2024 | | | September 30, 2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment loss | | $ | (202,929 | ) | | $ | (265,147 | ) |

| Net realized gain from investments | | | 55,143 | | | | 481,214 | |

| Net realized gain from redemptions in-kind | | | 1,380,070 | | | | 235,155 | |

| Net change in unrealized appreciation on investments | | | 4,271,647 | | | | 2,936,425 | |

| Net increase in net assets resulting from operations | | | 5,503,931 | | | | 3,387,647 | |

| | | | | | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class A | | | 2,597,080 | | | | 588,857 | |

| Payments for shares redeemed: | | | | | | | | |

| Class A | | | (6,309,320 | ) | | | (2,245,938 | ) |

| Class C | | | (96,192 | ) | | | (134,012 | ) |

| Net decrease in net assets from shares of beneficial interest | | | (3,808,432 | ) | | | (1,791,093 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,695,499 | | | | 1,596,554 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Year | | | 23,704,998 | | | | 22,108,444 | |

| End of Year | | $ | 25,400,497 | | | $ | 23,704,998 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class A: | | | | | | | | |

| Shares Sold | | | 43,517 | | | | 11,174 | |

| Shares Redeemed | | | (106,146 | ) | | | (43,002 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (62,629 | ) | | | (31,828 | ) |

| | | | | | | | | |

| Class C: | | | | | | | | |

| Shares Redeemed | | | (1,851 | ) | | | (2,960 | ) |

| Net decrease in shares of beneficial interest outstanding | | | (1,851 | ) | | | (2,960 | ) |

See accompanying notes to financial statements.

| Empiric Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each of the Years Presented

| | | Class A | |

| | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | September 30, | | | September 30, | | | September 30, | | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 52.59 | | | $ | 45.56 | | | $ | 60.07 | | | $ | 45.46 | | | $ | 40.47 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (1) | | | (0.46 | ) | | | (0.55 | ) | | | (0.71 | ) | | | (0.68 | ) | | | (0.56 | ) |

| Net realized and unrealized gain (loss) on investments | | | 13.61 | | | | 7.58 | | | | (13.49 | ) | | | 19.24 | | | | 5.55 | |

| Total from investment operations | | | 13.15 | | | | 7.03 | | | | (14.20 | ) | | | 18.56 | | | | 4.99 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | — | | | | — | | | | (0.31 | ) | | | (3.95 | ) | | | — | |

| Total distributions | | | — | | | | — | | | | (0.31 | ) | | | (3.95 | ) | | | — | |

| Net asset value, end of year | | $ | 65.74 | | | $ | 52.59 | | | $ | 45.56 | | | $ | 60.07 | | | $ | 45.46 | |

| Total return (2) | | | 25.00 | % | | | 15.43 | % | | | (23.72 | )% | | | 42.05 | % | | | 12.33 | % |

| Net assets, at end of year (000s) | | $ | 24,083 | | | $ | 22,560 | | | $ | 20,992 | | | $ | 28,726 | | | $ | 22,865 | |

| Ratio of net expenses to average net assets (3) | | | 2.18 | % | | | 2.17 | % | | | 2.12 | % | | | 1.96 | % | | | 2.13 | % |

| Ratio of net investment loss to average net assets (3)(4) | | | (0.78 | )% | | | (1.05 | )% | | | (1.32 | )% | | | (1.17 | )% | | | (1.35 | )% |

| Portfolio Turnover Rate (5) | | | 5 | % | | | 8 | % | | | 5 | % | | | 21 | % | | | 119 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Total return in the above table is historical in nature and represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends and capital gains distributions, if any, and does not reflect the impact of sales charges. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (3) | The ratios of expenses to average net assets and net investment loss to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (4) | Recognition of net investment loss is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (5) | In-kind transactions are not included in calculation of turnover. |

See accompanying notes to financial statements.

| Empiric Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout each of the Years Presented

| | | Class C | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | September 30, | | | September 30, | | | September 30, | | | September 30, | | | September 30, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value, beginning of year | | $ | 45.22 | | | $ | 39.47 | | | $ | 52.48 | | | $ | 40.40 | | | $ | 36.24 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (1) | | | (0.78 | ) | | | (0.81 | ) | | | (0.98 | ) | | | (0.98 | ) | | | (0.78 | ) |

| Net realized and unrealized gain (loss) on investments | | | 11.67 | | | | 6.56 | | | | (11.72 | ) | | | 17.01 | | | | 4.94 | |

| Total from investment operations | | | 10.89 | | | | 5.75 | | | | (12.70 | ) | | | 16.03 | | | | 4.16 | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | | — | | | | — | | | | (0.31 | ) | | | (3.95 | ) | | | — | |

| Total distributions | | | — | | | | — | | | | (0.31 | ) | | | (3.95 | ) | | | — | |

| Net asset value, end of year | | $ | 56.11 | | | $ | 45.22 | | | $ | 39.47 | | | $ | 52.48 | | | $ | 40.40 | |

| Total return (2) | | | 24.08 | % | | | 14.57 | % | | | (24.30 | )% | | | 40.99 | % | | | 11.48 | % |

| Net assets, at end of year (000s) | | $ | 1,317 | | | $ | 1,145 | | | $ | 1,117 | | | $ | 1,548 | | | $ | 1,166 | |

| Ratio of net expenses to average net assets (3) | | | 2.93 | % | | | 2.92 | % | | | 2.87 | % | | | 2.71 | % | | | 2.88 | % |

| Ratio of net investment loss to average net assets (3)(4) | | | (1.54 | )% | | | (1.79 | )% | | | (2.07 | )% | | | (1.92 | )% | | | (2.10 | )% |

| Portfolio Turnover Rate (5) | | | 5 | % | | | 8 | % | | | 5 | % | | | 21 | % | | | 119 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Total return in the above table is historical in nature and represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends and capital gains distributions, if any. Had the adviser not waived a portion of the Fund’s expenses, total returns would have been lower. |

| (3) | The ratios of expenses to average net assets and net investment loss to average net assets do not reflect the expenses of the underlying investment companies in which the Fund invests. |

| (4) | Recognition of net investment loss is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (5) | In-kind transactions are not included in calculation of turnover. |

See accompanying notes to financial statements.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS

September 30, 2024

| (1) | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

Mutual Fund Series Trust (the “Trust”), was organized as an Ohio business trust on February 27, 2006. The Trust is registered as an open-end management investment company under the Investment Company Act of 1940, as amended, (“1940 Act”). These financial statements include the following series: Empiric Fund (the “Fund”) . The Trust currently consists of thirty-six series. The Fund is a separate diversified series of the Trust. Empiric Advisors, Inc. (the “Adviser”) acts as the investment advisor to the Fund.

The Fund offers two classes of shares: Class A and Class C shares. Each share class represents an interest in the same assets of the Fund, has the same rights and is identical in all material respects except that (i) each class of shares may bear different distribution fees; (ii) each class of shares may be subject to different (or no) sales charges; (iii) certain other class specific expenses will be borne solely by the class to which such expenses are attributable; and (iv) each class has exclusive voting rights with respect to matters relating to its own distribution arrangements. The Fund’s Class A shares commenced operations on November 6, 1995. The Fund’s Class C shares commenced operations on October 7, 2005. Prior to October 7, 2005, the shares of the Fund had no specific class designation. As of that date, all of the then outstanding shares were redesignated as Class A shares. The Fund’s investment objective is to achieve capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund which are in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the Investment Company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services - Investment Companies, including FASB Accounting Standards Update (“ASU”) 2013-08.

a) Securities Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ, at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale, such securities shall be valued at the last bid price on the day of valuation. The Fund may invest in portfolios of open-end or closed-end investment companies and exchange traded funds (the “underlying funds”). Open-end funds are valued at their respective net asset values as reported by such investment companies. The underlying funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the boards of the underlying funds. The shares of many closed-end investment companies and exchange traded funds, after their initial public offering, frequently trade at a price per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company or exchange traded fund purchased by the Fund will not change. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost, provided such valuations represent fair value.

In unusual circumstances, instead of valuing securities in the usual manner, the Fund may value securities at “fair value” as determined in good faith by the Board of Trustees (the “Board”), pursuant to the procedures (the “Procedures”) approved by the Board. The Board has designated the adviser as its valuation designee (the “Valuation Designee”) to execute these Procedures. The Procedures consider, among others, the following factors to determine a security’s fair value: the nature and pricing history (if any) of the security; whether any dealer quotations for the security are available; and possible valuation methodologies that could be used to determine the fair value of the security. Fair value may also be used by the Valuation Designee if extraordinary events occur after the close of the relevant world market but prior to the New York Stock Exchange close. The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, approval of which shall be based upon whether the Valuation Designee followed the Procedures.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

The Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs used as of September 30, 2024 for the Fund’s assets and liabilities measured at fair value:

Assets

| Security Classifications (a) | | Level 1 | | | Level 2 | | | Level 3 | | | Totals | |

| Common Stocks | | $ | 24,209,935 | | | $ | — | | | $ | — | | | $ | 24,209,935 | |

| Collateral for Securities Loaned (b) | | | — | | | | — | | | | — | | | | 7,108,774 | |

| Total | | $ | 24,209,935 | | | $ | — | | | $ | — | | | $ | 31,318,709 | |

| (a) | As of and during the year ended September 30, 2024 the Fund held no securities that were considered to be “Level 3” securities. Therefore, a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value is not applicable. |

| (b) | The Trust’s officers have elected to adopt ASU 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) — a consensus of the Emerging Issues Task Force issued, on May 1, 2015. In accordance with Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amount presented in this table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

b) Federal Income Tax – As of and during the year ended September 30, 2024, the Fund did not have a liability for any unrecognized tax expense. The Fund recognizes interest and penalties, if any, related to unrecognized tax expense as income tax expense in the Statement of Operations. As of September 30, 2024 the Fund did not incur any interest or penalties. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years September 30, 2021 - September 30, 2023, or expected to be taken in the Fund’s September 30, 2024, tax returns. The tax filings are open for examination by applicable taxing authorities, U.S. federal, Ohio and foreign jurisdictions. No examination of the Fund’s tax returns is presently in progress.

c) Distribution to Shareholders – Distributions of net investment income and capital gains to shareholders, which are determined in accordance with income tax regulations and may differ from GAAP, are recorded on the ex-dividend date and are distributed on an annual basis.

d) Multiple Class Allocations – Income, non-class specific expenses and realized or unrealized gains or losses are allocated to each class based on relative net assets. Distribution fees are charged to each respective share class in accordance with the distribution plan. Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

e) Other – Investment and shareholder transactions are recorded on the trade date. Interest income is recognized on an accrual basis. Discounts are accreted and premiums are amortized on debt securities using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

f) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

g) Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

h) Sales charges (loads) – A maximum sales charge of 5.75% is imposed on Class A shares of the Fund. Investments in Class A shares made at or above the $1 million breakpoint are not subject to an initial sales charge and may be subject to a 1.00% contingent deferred sales charge (“CDSC”) on shares redeemed within 12 months of purchase (excluding shares purchased with reinvested dividends and/or distributions). The respective shareholders pay such CDSC charges, which are not an expense of the Fund. For the year ended September 30, 2024 there were no CDSC fees paid.

i) Security Loans – The Fund has entered into a securities lending agreement with U.S. Bank National Association. The Fund receives compensation in the form of fees, or retains a portion of interest on the investment of any cash received as collateral. The cash collateral is invested in short-term investments. The Fund also continues to receive interest or dividends on the securities loaned. The loans are secured by collateral at least equal, at all times, to 102% of the market value of loaned securities. Gain or loss in the fair value of the securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. If the market value of the collateral falls below 102% of market value plus accrued interest of the loaned securities, the lender’s agent shall request additional collateral from the borrowers to bring the collateralization back to 102%. Under the terms of the securities lending agreement, the Fund is indemnified for such losses by the security lending agent. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities using the collateral in the open market. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering their securities and possible loss of income or value if the borrower fails to return them.

The Fund receives cash as collateral in return for securities lent as part of the securities lending program. The collateral is invested in the Mount Vernon Liquid Assets Portfolio, LLC of which the investment objective is to seek to maximize current income to the extent consistent with the preservation of capital and liquidity and to maintain a stable NAV of $1.00 per unit. The Fund held $7,108,774 in the Mount Vernon Liquid Assets Portfolio, LLC as of September 30, 2024. The remaining contractual maturity of all securities lending transactions is overnight and continuous. The income earned by the Fund on investments of cash collateral received from borrowers for the securities loaned to them, if any was received, would be reflected in the Fund’s Statement of Operations.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

The following table is a summary of the Fund’s securities loaned and related collateral which are subject to a netting agreement as of September 30, 2024:

| | | | | | | | | | | | | | | Gross Amounts Not Offset in the | |

| | | | | | | | | | | | | | | Statement of Assets & Liabilities | |

| | | | | | | | | Net Amounts of | | | | | | | | | | |

| | | | | | Gross Amounts | | | Assets | | | | | | | | | | |

| | | | | | Offset in the | | | Presented in the | | | | | | | | | | |

| | | Gross Amounts | | | Statement of | | | Statement of | | | Financial | | | Non-Cash | | | | |

| | | of Recognized | | | Assets & | | | Assets & | | | Instruments | | | Collateral | | | Net Amount of | |

| Assets: | | Assets | | | Liabilities | | | Liabilities | | | Pledged | | | Received * | | | Assets | |

| Empiric Fund | | | | | | | | | | | | | | | | | | | | | | | | |

| Description: | | | | | | | | | | | | | | | | | | | | | | | | |

| Securities Loaned | | $ | 6,957,657 | | | $ | — | | | $ | 6,957,657 | | | | | | | $ | 6,957,657 | * | | $ | — | |

| Total | | $ | 6,957,657 | | | $ | — | | | $ | 6,957,657 | | | $ | — | | | $ | 6,957,657 | | | $ | — | |

| * | The amount is limited to the asset balance and accordingly does not include excess collateral pledged. |

The fair value of the securities loaned for the Fund totaled $6,957,657 at September 30, 2024. The securities loaned are noted in the Schedule of Investments, and are all classified as common stocks. The fair value of the “Collateral for Securities Loaned” on the Schedule of Investments includes cash collateral received and reinvested that totaled $7,108,744 for the Fund at September 30, 2024. This amount is offset by a liability recorded as “Collateral on securities loaned.” The contractual maturity of securities lending transactions is on an overnight and continuous basis. The Fund cannot pledge or resell the collateral.

| (2) | INVESTMENT TRANSACTIONS |

For the year ended September 30, 2024, aggregate purchases and proceeds from sales of investment securities (excluding short-term investments) for the Fund were as follows:

| Purchases | | | Sales (a) | |

| $ | 1,182,625 | | | $ | 3,609,681 | * |

| (a) | The Fund may participate in a liquidity program operated by ReFlow Fund, LLC (“ReFlow”). The program is designed to provide an alternative liquidity source for mutual funds experiencing redemptions of their shares. In order to pay cash to shareholders who redeem their shares on a given day, a mutual fund typically must hold cash in its portfolio, liquidate portfolio securities, or borrow money, all of which impose certain costs on the Fund. ReFlow provides participating mutual funds with another source of cash by standing ready to purchase shares from a fund equal to the amount of the Fund’s net redemptions on a given day. ReFlow then generally redeems those shares when the Fund experiences net sales. In return for this service, the Fund will pay a fee to ReFlow at a rate determined by a daily auction with other participating mutual funds. The costs to the Fund for participating in ReFlow are expected to be influenced by and comparable to the cost of the other sources of liquidity, such as the Fund’s short-term lending arrangement or the costs of selling portfolio securities to meet redemptions. ReFlow will be prohibited from acquiring more than 3% of the outstanding voting shares of the Fund. The Fund will waive any redemption fee with respect to redemptions by ReFlow. When covering net sales for the Fund, ReFlow normally utilizes Redemptions In-Kind. For the year ended September 30, 2024, the Fund utilized ReFlow. ReFlow subscribed 40,785 shares of the Fund during the year. The resulting fee is recorded in other expenses on the Statement of Operations. |

| * | Proceeds from sales include $2,336,836 from redemptions in-kind sales. |

| (3) | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

The Trust, with respect to the Fund, has entered into an investment advisory agreement (the “Advisory Agreement”) with the Adviser, pursuant to which the Adviser receives a fee, computed daily, at an annual rate of 1.00% of the average daily net assets of the Fund. The Adviser pays expenses incurred by it in connection with acting as an investment adviser to the Fund other than costs (including taxes and brokerage commissions, borrowing costs, costs of investing in underlying funds and extraordinary expenses, if any) of securities purchased for the Fund and certain other expenses paid by the Fund (as detailed in the Advisory Agreement.) . The Adviser pays for all employees, office space and facilities required by it to provide services under the Advisory Agreement, with the exception of specific items of expense (as detailed in the Advisory Agreement). For the year ended September 30, 2024, investment advisory fees of $247,609 were incurred by the Fund.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

Pursuant to the Management Services Agreement between the Trust and Mfund Services LLC (“MFund”), MFund provides the Fund with various management and legal administrative services (the “Management Services Agreement”). For these services, the Fund pays MFund an annual asset-based fee in accordance with the following schedule applied at the Fund family level (i.e., all the Funds in the Trust advised by the Adviser): 0.10% of net assets up to $50 million; 0.07% of net assets from $50 million to $100 million; 0.05% of net assets from $100 million to $250 million; 0.04% of net assets from $250 million to $500 million; 0.03% of net assets from $500 million to $1 billion; 0.02% of net assets from $1 billion to $5 billion; and 0.01% of assets from $5 billion and above. In addition, the Fund reimburses MFund for any reasonable out of pocket expenses incurred in the performance of its duties under the Management Services Agreement. The amounts due to MFund for the Management Services Agreement are listed in the Statements of Assets and Liabilities under “Payable to related parties” and the amounts accrued for the year are shown in the Statements of Operations under “Legal administration/management services fees.”

Pursuant to the Compliance Services Agreement, MFund provides chief compliance officer services to the Funds. For these services, the Funds pay MFund $ 1,200 per month for the first fund in the fund family and $400 for each additional fund; $400 for each adviser and sub-adviser; and .0025% of the assets of each Fund. In addition, the Funds reimburse MFund for any reasonable out- of-pocket expenses incurred in the performance of its duties under the Compliance Services Agreement. The amounts due to MFund for chief compliance officer services are listed in the Statements of Assets and Liabilities under “Payable to related parties” and the amounts accrued for the year are shown in the Statements of Operations under “Compliance officer fees.”

A trustee is the controlling member of MFund and of AlphaCentric Advisors LLC and Catalyst Capital Advisors LLC (investment advisers to other series of the Trust) and is not paid any fees directly by the Trust for serving in such capacities. Trustees who are not “interested persons” as that term is defined in the 1940 Act, are paid a quarterly retainer and receive compensation for each special Board meeting and Risk and Compliance Committee meeting. The fees paid to the Independent Trustees for their attendance at a meeting will be shared equally by the funds of the Trust in which the meeting relates. The Lead Independent Trustee of the Trust and the Chairmen of the Board’s Audit Committee and Risk and Compliance Committee receive an additional quarterly retainer. The “interested persons” of the Trust receive no compensation from the Fund. The Trust reimburses each Trustee and Officer for his or her travel and other expenses related to attendance at such meetings.

Northern Lights Distributors, LLC, (“Distributor”) serves as the principal underwriter and national distributor for the shares of the Fund pursuant to an Underwriting Agreement with the Trust. For the year ended September 30, 2024, NLD received $2,684 in underwriter commissions from the sale of Class A shares of the Fund, of which they kept $353.

Ultimus Fund Solutions, LLC (“UFS”), an affiliate of the distributor, provides administrative, fund accounting, and transfer agency services to the Fund pursuant to agreements with the Trust, for which it receives from each Fund: (i) basis points in decreasing amounts as assets reach certain breakpoints; and (ii) any related out-of-pocket expenses.

Blu Giant, LLC (“Blu Giant” ) – Blu Giant, an affiliate of the Distributor and UFS, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

Certain Officers of the Trust are also employees of UFS, and are not paid any fees directly by the Fund for serving in such capacity.

The Trust has adopted a Distribution Plan pursuant to Rule 12b-1(the “Plan”), under the 1940 Act for Class A shares and Class C shares, that allows the Fund to pay distribution and shareholder servicing expenses of up to 0.25% per annum for the Class A shares and up to 1.00% for the Class C shares based on average daily net assets of each class. Class A shares are currently paying 0.25% per annum of 12b-1 fees. Class C shares are currently paying 1.00% per annum of 12b-1 fees. The fee may be used for a variety of purposes, including compensating dealers and other financial service organizations for eligible services provided by those parties to the Fund and its shareholders and to reimburse the Distributor and the Adviser for distribution related expenses.

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

| (4) | TAX COMPONENTS OF CAPITAL |

The Statement of Assets and Liabilities represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $17,649,182 for the Fund and differs from fair value by net unrealized appreciation (depreciation) of securities as follows:

| Unrealized appreciation: | | $ | 13,703,780 | |

| Unrealized depreciation: | | | (34,253 | ) |

| Net unrealized appreciation: | | $ | 13,669,527 | |

There were no Fund distributions for the year ended September 30, 2024 and September 30, 2023:

| | | Fiscal Year Ended | | | Fiscal Year Ended | |

| | | September 30, 2024 | | | September 30, 2023 | |

| Ordinary Income | | $ | — | | | $ | — | |

| Long-Term Capital Gain | | | — | | | | — | |

| Return of Capital | | | — | | | | — | |

| | | $ | — | | | $ | — | |

As of September 30, 2024, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation/ | | | Distributable Earnings | |

| Income | | | Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | /(Accumulated Deficit) | |

| $ | — | | | $ | 31,682 | | | $ | (173,099 | ) | | $ | — | | | $ | — | | | $ | 13,669,527 | | | $ | 13,528,110 | |

The difference between book basis and tax basis undistributed net investment income/(loss), accumulated net realized gain/(loss), and unrealized appreciation/(depreciation) from investments is primarily attributable to the tax deferral of losses on wash sales and adjustments for partnerships.

Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such late year losses of $173,099.

At September 30, 2024, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains, along with capital loss carryforwards utilized, as follows:

| Short-Term | | | Long-Term | | | Total | | | CLCF Utilized | |

| $ | — | | | $ | — | | | $ | — | | | $ | 23,468 | |

Permanent book and tax differences, primarily attributable to the book/tax basis treatment of realized gain (loss) on in-kind redemptions and net operating losses, resulted in reclassification for the year ended September 30, 2024, as follows:

| Paid | | | | |

| In | | | Distributable | |

| Capital | | | Earnings | |

| $ | 1,160,146 | | | $ | (1,160,146 | ) |

Empiric Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2024

Subsequent events occurring after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. The Trust’s officers have determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Empiric Fund and

Board of Trustees of Mutual Fund Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Empiric Fund (the “Fund”), a series of Mutual Fund Series Trust, as of September 30, 2024, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2024, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2024, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2018.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

November 26, 2024

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

Empiric Fund

ADDITIONAL INFORMATION (Unaudited)

September 30, 2024

Proxy Voting Policy and Portfolio Holdings

Reference is made to the Prospectus and the Statement of Additional Information for more detailed descriptions of the Advisory Agreement and Management Services Agreement Plan, tax aspects of the Fund and the calculation of the net asset value of shares of the Fund.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. Form N-PORT reports are available at the SEC’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the twelve month period ended June 30 as well as a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-888-839-7424; and on the Commission’s website at http://www.sec.gov.

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

None

Item 16. Controls and Procedures

(a) The registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of this report on Form N-CSR.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

(a) Not applicable.

(b) Not applicable.

Item 19. Exhibits.

(a)(1) Code of Ethics for Principal Executive and Senior Financial Officers.

(a)(2) Not applicable.

(a)(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto.

(a)(4) Not applicable.

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Mutual Fund Series Trust

| By | /s/ Michael Schoonover | |

| Michael Schoonover | |

| Principal Executive Officer/President | |

| Date: 12/2/2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Michael Schoonover | |

| Michael Schoonover |

| Principal Executive Officer/President |

| Date: 12/2/2024 |

| | | |

| By | /s/ Erik Naviloff | |

| Erik Naviloff |

| Principal Financial Officer/Treasurer |

| Date: 12/2/2024 |