united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-21872 |

| Mutual Fund Series Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450, Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

| The Corporation Trust Company |

| 1300 EAST NINTH STREET, CLEVELAND, OH 44114 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 866-447-4228 | |

| Date of fiscal year end: | 3/31 | |

| | | |

| Date of reporting period: | 9/30/24 | |

Item 1. Reports to Stockholders.

(a)

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Income Opportunities Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $107 | 2.11%Footnote Reference* |

| Net Assets | $303,588,432 |

| Number of Portfolio Holdings | 91 |

| Advisory Fee (net of waivers) | $1,823,689 |

| Portfolio Turnover | 4% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 3.2% |

| Non-Agency Residential Mortgage Backed Securities | 96.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 3.2% |

| CMO | 14.6% |

| ABS | 81.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Carrington Mortgage Loan Trust Series 2006-FRE1, 1.126%, 07/25/36 | 10.8% |

| CIT Mortgage Loan Trust 2007-1, 6.061%, 10/25/37 | 10.7% |

| Option One Mortgage Loan Trust 2007-CP1, –%, 03/25/37 | 4.7% |

| Towd Point Mortgage Trust 2019-4, 4.161%, 10/25/59 | 4.3% |

| Seasoned Credit Risk Transfer Trust Series 2018-3, 0.944%, 08/25/57 | 4.2% |

| Citigroup Mortgage Loan Trust 2007-AHL1, 4.535%, 12/25/36 | 3.6% |

| CIT Mortgage Loan Trust 2007-1, 5.567%, 10/25/37 | 3.5% |

| Carrington Mortgage Loan Trust Series 2007-RFC1, 4.178%, 12/25/36 | 3.4% |

| RAAC Series 2007-SP3 Trust, 7.642%, 09/25/47 | 3.0% |

| Nationstar Home Equity Loan Trust 2007-B, 4.479%, 04/25/37 | 2.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Income Opportunities Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $145 | 2.86%Footnote Reference* |

| Net Assets | $303,588,432 |

| Number of Portfolio Holdings | 91 |

| Advisory Fee (net of waivers) | $1,823,689 |

| Portfolio Turnover | 4% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 3.2% |

| Non-Agency Residential Mortgage Backed Securities | 96.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 3.2% |

| CMO | 14.6% |

| ABS | 81.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Carrington Mortgage Loan Trust Series 2006-FRE1, 1.126%, 07/25/36 | 10.8% |

| CIT Mortgage Loan Trust 2007-1, 6.061%, 10/25/37 | 10.7% |

| Option One Mortgage Loan Trust 2007-CP1, –%, 03/25/37 | 4.7% |

| Towd Point Mortgage Trust 2019-4, 4.161%, 10/25/59 | 4.3% |

| Seasoned Credit Risk Transfer Trust Series 2018-3, 0.944%, 08/25/57 | 4.2% |

| Citigroup Mortgage Loan Trust 2007-AHL1, 4.535%, 12/25/36 | 3.6% |

| CIT Mortgage Loan Trust 2007-1, 5.567%, 10/25/37 | 3.5% |

| Carrington Mortgage Loan Trust Series 2007-RFC1, 4.178%, 12/25/36 | 3.4% |

| RAAC Series 2007-SP3 Trust, 7.642%, 09/25/47 | 3.0% |

| Nationstar Home Equity Loan Trust 2007-B, 4.479%, 04/25/37 | 2.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Income Opportunities Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $95 | 1.86%Footnote Reference* |

| Net Assets | $303,588,432 |

| Number of Portfolio Holdings | 91 |

| Advisory Fee (net of waivers) | $1,823,689 |

| Portfolio Turnover | 4% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 3.2% |

| Non-Agency Residential Mortgage Backed Securities | 96.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.5% |

| Money Market Funds | 3.2% |

| CMO | 14.6% |

| ABS | 81.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Carrington Mortgage Loan Trust Series 2006-FRE1, 1.126%, 07/25/36 | 10.8% |

| CIT Mortgage Loan Trust 2007-1, 6.061%, 10/25/37 | 10.7% |

| Option One Mortgage Loan Trust 2007-CP1, –%, 03/25/37 | 4.7% |

| Towd Point Mortgage Trust 2019-4, 4.161%, 10/25/59 | 4.3% |

| Seasoned Credit Risk Transfer Trust Series 2018-3, 0.944%, 08/25/57 | 4.2% |

| Citigroup Mortgage Loan Trust 2007-AHL1, 4.535%, 12/25/36 | 3.6% |

| CIT Mortgage Loan Trust 2007-1, 5.567%, 10/25/37 | 3.5% |

| Carrington Mortgage Loan Trust Series 2007-RFC1, 4.178%, 12/25/36 | 3.4% |

| RAAC Series 2007-SP3 Trust, 7.642%, 09/25/47 | 3.0% |

| Nationstar Home Equity Loan Trust 2007-B, 4.479%, 04/25/37 | 2.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Income Opportunities Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Life Sciences and Healthcare Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $86 | 1.65%Footnote Reference* |

| Net Assets | $82,912,827 |

| Number of Portfolio Holdings | 68 |

| Advisory Fee (net of waivers) | $392,050 |

| Portfolio Turnover | 80% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 91.1% |

| Money Market Funds | 8.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Industrials | 1.5% |

| Money Market Funds | 8.8% |

| Health Care | 88.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 8.8% |

| Harmony Biosciences Holdings, Inc. | 4.7% |

| Galapagos N.V. | 3.8% |

| Merck & Company, Inc. | 3.3% |

| Neurocrine Biosciences, Inc. | 3.1% |

| Argenx S.E. | 2.9% |

| Indivior plc | 2.9% |

| BioMarin Pharmaceutical, Inc. | 2.8% |

| Sarepta Therapeutics, Inc. | 2.7% |

| Dynavax Technologies Corporation | 2.7% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Life Sciences and Healthcare Fund”. Also effective November 1, 2024, Kennedy Capital Management LLC (“KCM”) replaced LifeSci Fund Management LLC (“LifeSci”) as the sub-advisor of the Fund and Ryan Dunnegan, CPA and Portfolio Manager of KCM replaced Mark G. Charest as Portfolio Manager of the Fund.

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Life Sciences and Healthcare Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $125 | 2.40%Footnote Reference* |

| Net Assets | $82,912,827 |

| Number of Portfolio Holdings | 68 |

| Advisory Fee (net of waivers) | $392,050 |

| Portfolio Turnover | 80% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 91.1% |

| Money Market Funds | 8.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Industrials | 1.5% |

| Money Market Funds | 8.8% |

| Health Care | 88.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 8.8% |

| Harmony Biosciences Holdings, Inc. | 4.7% |

| Galapagos N.V. | 3.8% |

| Merck & Company, Inc. | 3.3% |

| Neurocrine Biosciences, Inc. | 3.1% |

| Argenx S.E. | 2.9% |

| Indivior plc | 2.9% |

| BioMarin Pharmaceutical, Inc. | 2.8% |

| Sarepta Therapeutics, Inc. | 2.7% |

| Dynavax Technologies Corporation | 2.7% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Life Sciences and Healthcare Fund”. Also effective November 1, 2024, Kennedy Capital Management LLC (“KCM”) replaced LifeSci Fund Management LLC (“LifeSci”) as the sub-advisor of the Fund and Ryan Dunnegan, CPA and Portfolio Manager of KCM replaced Mark G. Charest as Portfolio Manager of the Fund.

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Life Sciences and Healthcare Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $73 | 1.40%Footnote Reference* |

| Net Assets | $82,912,827 |

| Number of Portfolio Holdings | 68 |

| Advisory Fee (net of waivers) | $392,050 |

| Portfolio Turnover | 80% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 91.1% |

| Money Market Funds | 8.9% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 1.2% |

| Industrials | 1.5% |

| Money Market Funds | 8.8% |

| Health Care | 88.5% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 8.8% |

| Harmony Biosciences Holdings, Inc. | 4.7% |

| Galapagos N.V. | 3.8% |

| Merck & Company, Inc. | 3.3% |

| Neurocrine Biosciences, Inc. | 3.1% |

| Argenx S.E. | 2.9% |

| Indivior plc | 2.9% |

| BioMarin Pharmaceutical, Inc. | 2.8% |

| Sarepta Therapeutics, Inc. | 2.7% |

| Dynavax Technologies Corporation | 2.7% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Life Sciences and Healthcare Fund”. Also effective November 1, 2024, Kennedy Capital Management LLC (“KCM”) replaced LifeSci Fund Management LLC (“LifeSci”) as the sub-advisor of the Fund and Ryan Dunnegan, CPA and Portfolio Manager of KCM replaced Mark G. Charest as Portfolio Manager of the Fund.

AlphaCentric Life Sciences and Healthcare Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Premium Opportunity Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $114 | 2.24%Footnote Reference* |

| Net Assets | $62,328,951 |

| Number of Portfolio Holdings | 55 |

| Advisory Fee (net of waivers) | $509,860 |

| Portfolio Turnover | 0% |

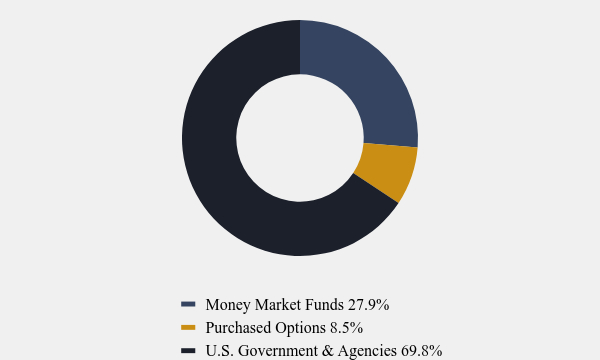

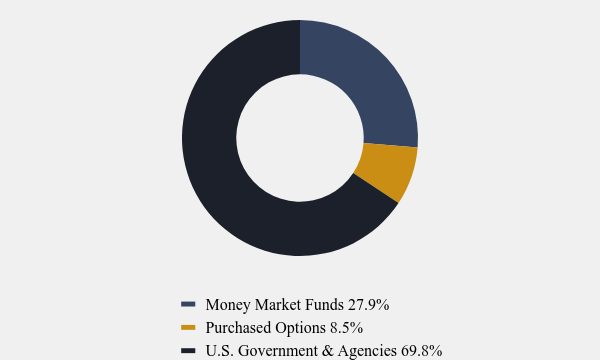

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 27.9% |

| Purchased Options | 8.5% |

| U.S. Government & Agencies | 69.8% |

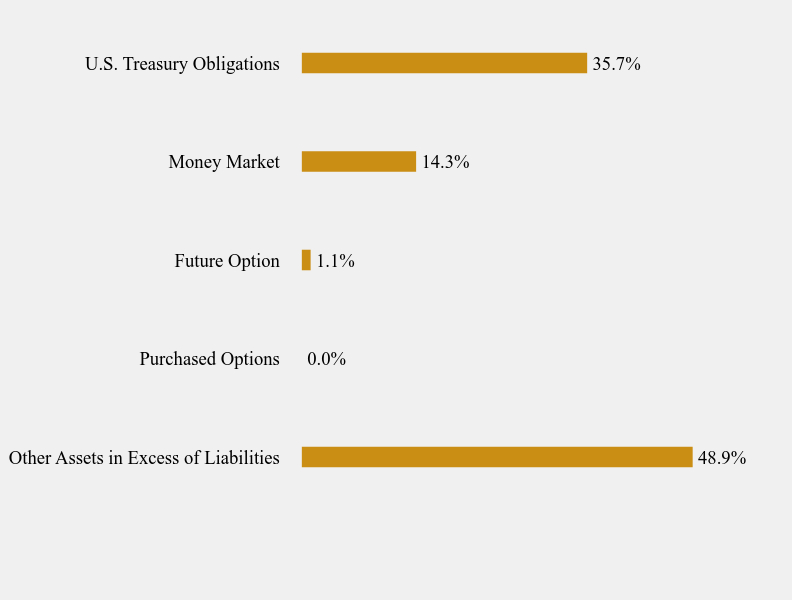

What did the Fund invest in?

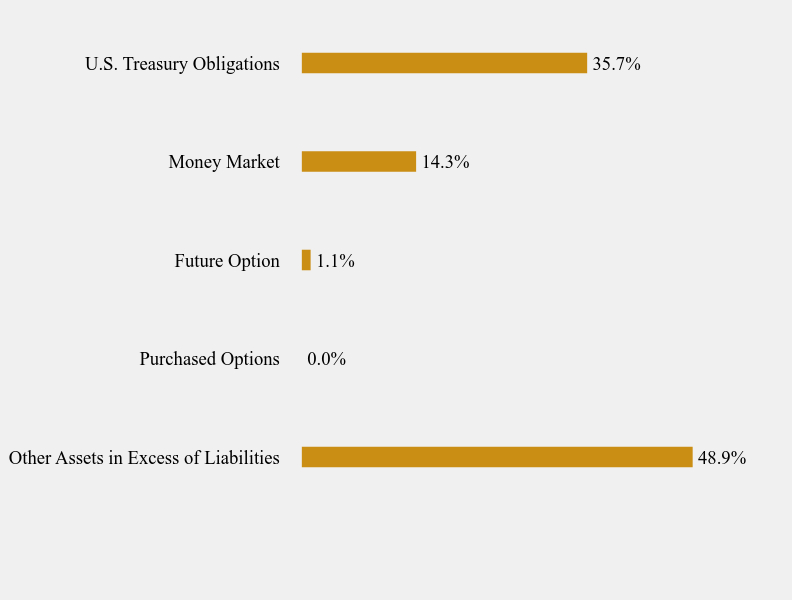

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 48.9% |

| Purchased Options | 0.0% |

| Future Option | 1.1% |

| Money Market | 14.3% |

| U.S. Treasury Obligations | 35.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 11/29/24 | 15.9% |

| United States Treasury Bill, 01/23/25 | 15.8% |

| First American Treasury Obligations Fund | 7.4% |

| Fidelity Government Portfolio | 6.9% |

| United States Treasury Note | 4.0% |

| S&P500 Emini Option, 10/31/24 5800.0 Call | 1.1% |

| S&P Emini 3rd Week, 11/15/24 5800.0 Call | 1.0% |

| S&P500 Emini Option, 11/29/24 5900.0 Call | 0.7% |

| S&P Emini 3rd Week, 10/18/24 5800.0 Call | 0.4% |

| S&P Emini 3rd Week, 10/18/24 5825.0 Call | 0.4% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Premium Opportunity Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $151 | 2.99%Footnote Reference* |

| Net Assets | $62,328,951 |

| Number of Portfolio Holdings | 55 |

| Advisory Fee (net of waivers) | $509,860 |

| Portfolio Turnover | 0% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 27.9% |

| Purchased Options | 8.5% |

| U.S. Government & Agencies | 69.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 48.9% |

| Purchased Options | 0.0% |

| Future Option | 1.1% |

| Money Market | 14.3% |

| U.S. Treasury Obligations | 35.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 11/29/24 | 15.9% |

| United States Treasury Bill, 01/23/25 | 15.8% |

| First American Treasury Obligations Fund | 7.4% |

| Fidelity Government Portfolio | 6.9% |

| United States Treasury Note | 4.0% |

| S&P500 Emini Option, 10/31/24 5800.0 Call | 1.1% |

| S&P Emini 3rd Week, 11/15/24 5800.0 Call | 1.0% |

| S&P500 Emini Option, 11/29/24 5900.0 Call | 0.7% |

| S&P Emini 3rd Week, 10/18/24 5800.0 Call | 0.4% |

| S&P Emini 3rd Week, 10/18/24 5825.0 Call | 0.4% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Premium Opportunity Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $101 | 1.99%Footnote Reference* |

| Net Assets | $62,328,951 |

| Number of Portfolio Holdings | 55 |

| Advisory Fee (net of waivers) | $509,860 |

| Portfolio Turnover | 0% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Money Market Funds | 27.9% |

| Purchased Options | 8.5% |

| U.S. Government & Agencies | 69.8% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 48.9% |

| Purchased Options | 0.0% |

| Future Option | 1.1% |

| Money Market | 14.3% |

| U.S. Treasury Obligations | 35.7% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| United States Treasury Bill, 11/29/24 | 15.9% |

| United States Treasury Bill, 01/23/25 | 15.8% |

| First American Treasury Obligations Fund | 7.4% |

| Fidelity Government Portfolio | 6.9% |

| United States Treasury Note | 4.0% |

| S&P500 Emini Option, 10/31/24 5800.0 Call | 1.1% |

| S&P Emini 3rd Week, 11/15/24 5800.0 Call | 1.0% |

| S&P500 Emini Option, 11/29/24 5900.0 Call | 0.7% |

| S&P Emini 3rd Week, 10/18/24 5800.0 Call | 0.4% |

| S&P Emini 3rd Week, 10/18/24 5825.0 Call | 0.4% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Premium Opportunity Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Robotics and Automation Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $91 | 1.85%Footnote Reference* |

| Net Assets | $13,646,594 |

| Number of Portfolio Holdings | 25 |

| Advisory Fee (net of waivers) | $9,661 |

| Portfolio Turnover | 22% |

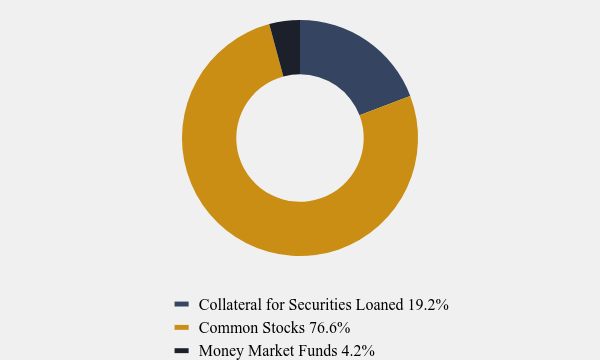

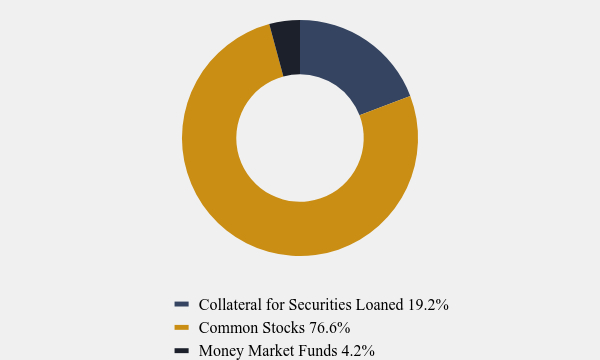

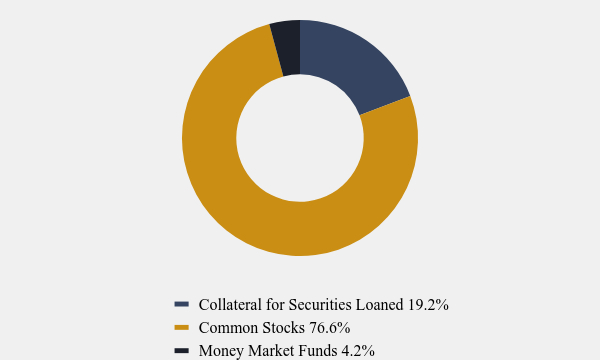

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateral for Securities Loaned | 19.2% |

| Common Stocks | 76.6% |

| Money Market Funds | 4.2% |

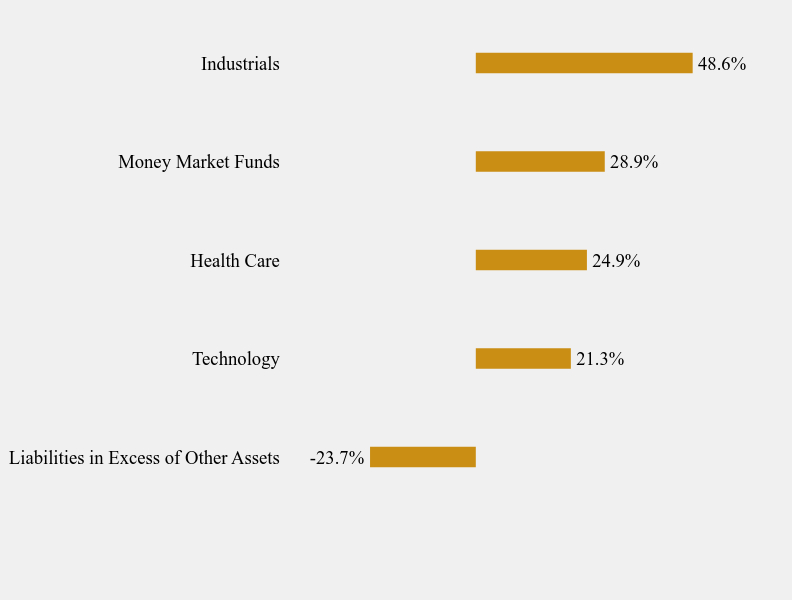

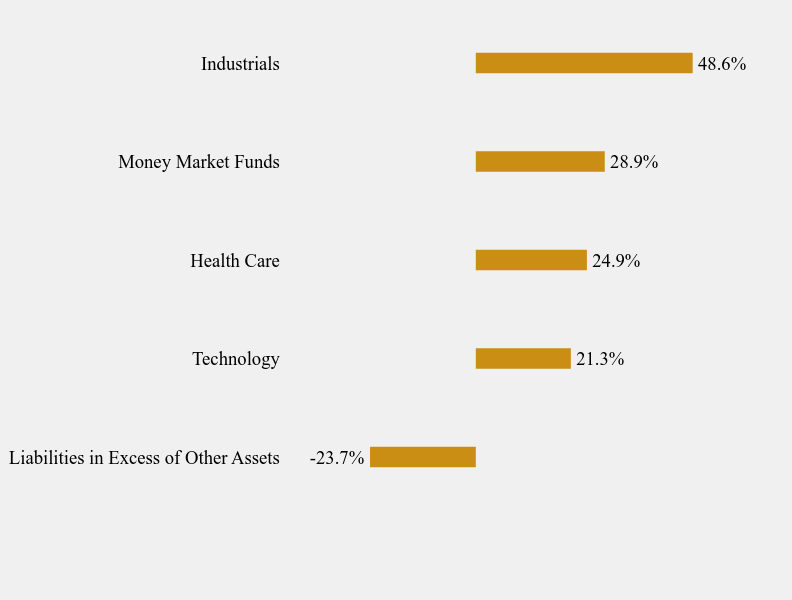

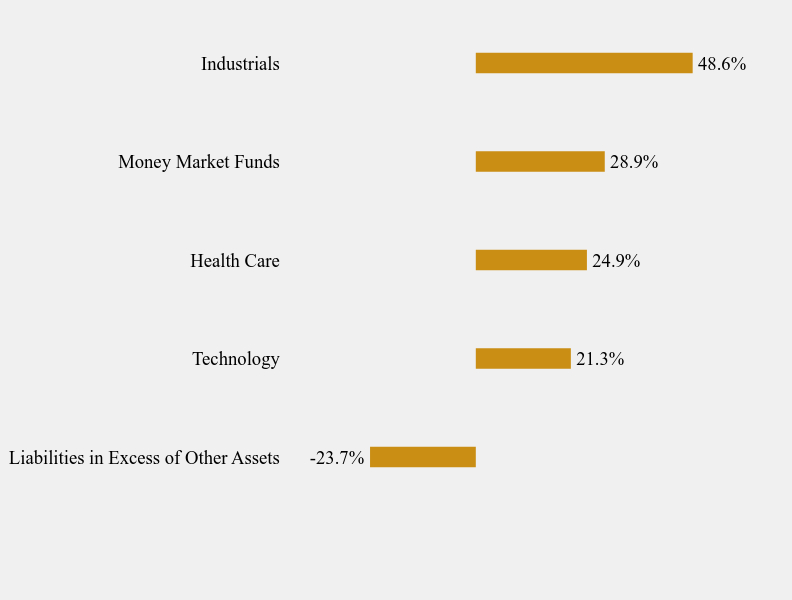

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -23.7% |

| Technology | 21.3% |

| Health Care | 24.9% |

| Money Market Funds | 28.9% |

| Industrials | 48.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Mount Vernon Liquid Assets Portfolio | 23.7% |

| Stereotaxis, Inc. | 9.0% |

| Keyence Corporation | 7.0% |

| Infineon Technologies A.G. | 6.4% |

| FANUC Corporation | 5.3% |

| Doosan Robotics, Inc. | 5.3% |

| First American Treasury Obligations Fund, Class X | 5.2% |

| Kraken Robotics, Inc. | 4.8% |

| PROCEPT BioRobotics Corporation | 4.7% |

| Accuray, Inc. | 4.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Robotics and Automation Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $128 | 2.60%Footnote Reference* |

| Net Assets | $13,646,594 |

| Number of Portfolio Holdings | 25 |

| Advisory Fee (net of waivers) | $9,661 |

| Portfolio Turnover | 22% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateral for Securities Loaned | 19.2% |

| Common Stocks | 76.6% |

| Money Market Funds | 4.2% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -23.7% |

| Technology | 21.3% |

| Health Care | 24.9% |

| Money Market Funds | 28.9% |

| Industrials | 48.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Mount Vernon Liquid Assets Portfolio | 23.7% |

| Stereotaxis, Inc. | 9.0% |

| Keyence Corporation | 7.0% |

| Infineon Technologies A.G. | 6.4% |

| FANUC Corporation | 5.3% |

| Doosan Robotics, Inc. | 5.3% |

| First American Treasury Obligations Fund, Class X | 5.2% |

| Kraken Robotics, Inc. | 4.8% |

| PROCEPT BioRobotics Corporation | 4.7% |

| Accuray, Inc. | 4.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Robotics and Automation Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $79 | 1.60%Footnote Reference* |

| Net Assets | $13,646,594 |

| Number of Portfolio Holdings | 25 |

| Advisory Fee (net of waivers) | $9,661 |

| Portfolio Turnover | 22% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Collateral for Securities Loaned | 19.2% |

| Common Stocks | 76.6% |

| Money Market Funds | 4.2% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -23.7% |

| Technology | 21.3% |

| Health Care | 24.9% |

| Money Market Funds | 28.9% |

| Industrials | 48.6% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Mount Vernon Liquid Assets Portfolio | 23.7% |

| Stereotaxis, Inc. | 9.0% |

| Keyence Corporation | 7.0% |

| Infineon Technologies A.G. | 6.4% |

| FANUC Corporation | 5.3% |

| Doosan Robotics, Inc. | 5.3% |

| First American Treasury Obligations Fund, Class X | 5.2% |

| Kraken Robotics, Inc. | 4.8% |

| PROCEPT BioRobotics Corporation | 4.7% |

| Accuray, Inc. | 4.6% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Robotics and Automation Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Real Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $91 | 1.74%Footnote Reference* |

| Net Assets | $59,181,192 |

| Number of Portfolio Holdings | 82 |

| Advisory Fee (net of waivers) | $251,872 |

| Portfolio Turnover | 9% |

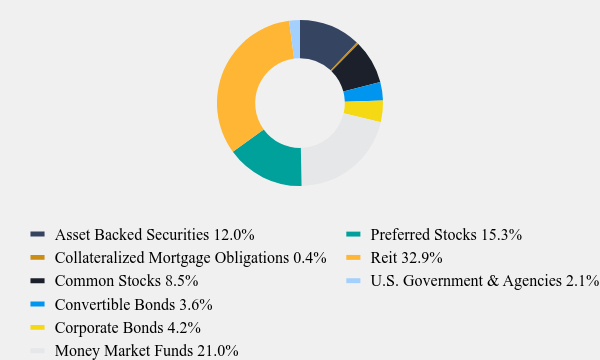

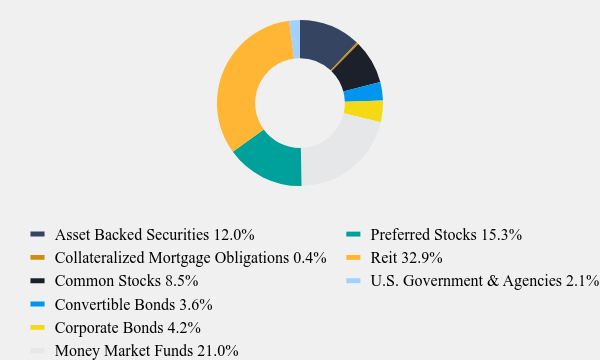

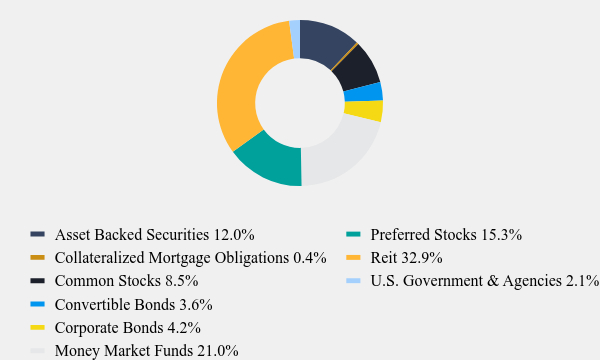

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 12.0% |

| Collateralized Mortgage Obligations | 0.4% |

| Common Stocks | 8.5% |

| Convertible Bonds | 3.6% |

| Corporate Bonds | 4.2% |

| Money Market Funds | 21.0% |

| Preferred Stocks | 15.3% |

| Reit | 32.9% |

| U.S. Government & Agencies | 2.1% |

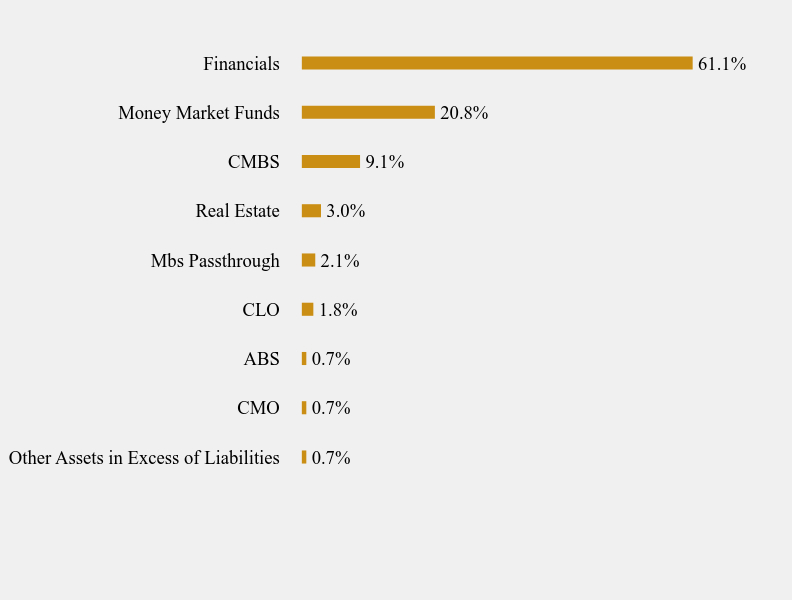

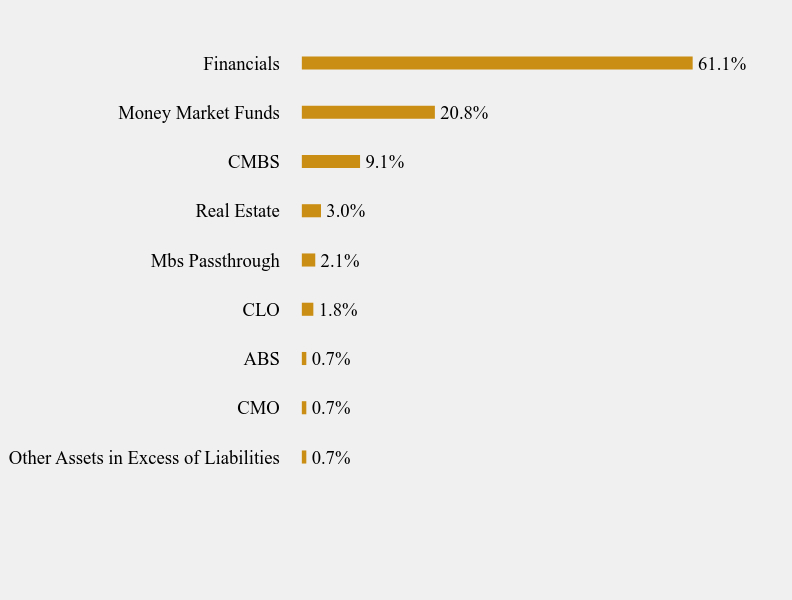

What did the Fund invest in?

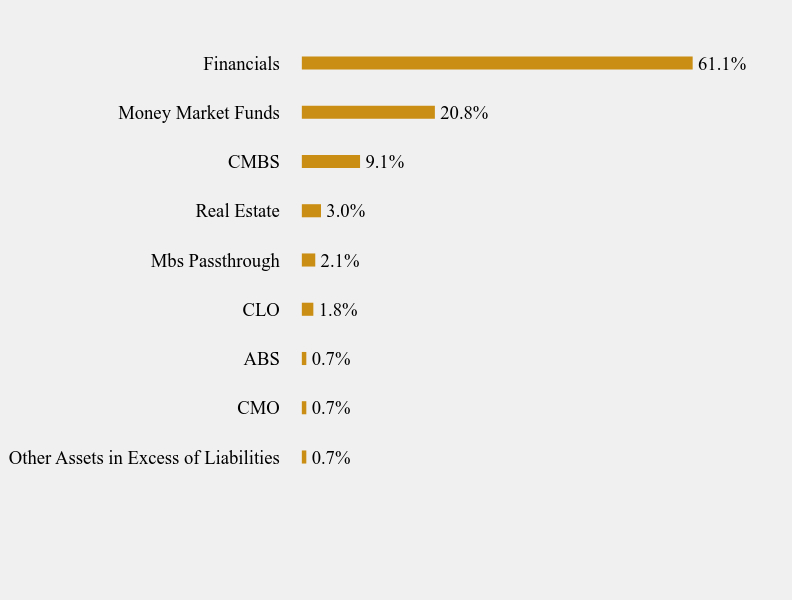

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| CMO | 0.7% |

| ABS | 0.7% |

| CLO | 1.8% |

| Mbs Passthrough | 2.1% |

| Real Estate | 3.0% |

| CMBS | 9.1% |

| Money Market Funds | 20.8% |

| Financials | 61.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 20.8% |

| Rithm Capital Corporation | 7.3% |

| Ellington Financial, Inc. | 4.4% |

| MGIC Investment Corporation | 4.3% |

| Dynex Capital, Inc. | 3.9% |

| Redwood Trust, Inc. | 3.8% |

| MFA Financial, Inc. | 3.6% |

| AG Mortgage Investment Trust, Inc. | 2.7% |

| PHH Mortgage Corporation | 2.7% |

| Enact Holdings, Inc. | 2.6% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Real Income Fund”. Also effective November 1, 2024, CrossingBridge Advisors, LLC (“CrossingBridge”) replaced Goshen Rock Capital, LLC (“GRC”) as the sub-advisor of the Fund. David K. Sherman, Founder and Chief Investment Officer of CrossingBridge, T. Kirk Whitney, CFA and Assistant Portfolio Manager of CrossingBridge, and Spencer Rolfe, Assistant Portfolio Manager of CrossingBridge, replaced David Gregory and Alex Cigolle, CFA, as Portfolio Managers of the Fund.

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Real Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $130 | 2.49%Footnote Reference* |

| Net Assets | $59,181,192 |

| Number of Portfolio Holdings | 82 |

| Advisory Fee (net of waivers) | $251,872 |

| Portfolio Turnover | 9% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 12.0% |

| Collateralized Mortgage Obligations | 0.4% |

| Common Stocks | 8.5% |

| Convertible Bonds | 3.6% |

| Corporate Bonds | 4.2% |

| Money Market Funds | 21.0% |

| Preferred Stocks | 15.3% |

| Reit | 32.9% |

| U.S. Government & Agencies | 2.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| CMO | 0.7% |

| ABS | 0.7% |

| CLO | 1.8% |

| Mbs Passthrough | 2.1% |

| Real Estate | 3.0% |

| CMBS | 9.1% |

| Money Market Funds | 20.8% |

| Financials | 61.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 20.8% |

| Rithm Capital Corporation | 7.3% |

| Ellington Financial, Inc. | 4.4% |

| MGIC Investment Corporation | 4.3% |

| Dynex Capital, Inc. | 3.9% |

| Redwood Trust, Inc. | 3.8% |

| MFA Financial, Inc. | 3.6% |

| AG Mortgage Investment Trust, Inc. | 2.7% |

| PHH Mortgage Corporation | 2.7% |

| Enact Holdings, Inc. | 2.6% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Real Income Fund”. Also effective November 1, 2024, CrossingBridge Advisors, LLC (“CrossingBridge”) replaced Goshen Rock Capital, LLC (“GRC”) as the sub-advisor of the Fund. David K. Sherman, Founder and Chief Investment Officer of CrossingBridge, T. Kirk Whitney, CFA and Assistant Portfolio Manager of CrossingBridge, and Spencer Rolfe, Assistant Portfolio Manager of CrossingBridge, replaced David Gregory and Alex Cigolle, CFA, as Portfolio Managers of the Fund.

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Real Income Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637. This report describes changes to the Fund that occurred during the reporting period.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $78 | 1.49%Footnote Reference* |

| Net Assets | $59,181,192 |

| Number of Portfolio Holdings | 82 |

| Advisory Fee (net of waivers) | $251,872 |

| Portfolio Turnover | 9% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Asset Backed Securities | 12.0% |

| Collateralized Mortgage Obligations | 0.4% |

| Common Stocks | 8.5% |

| Convertible Bonds | 3.6% |

| Corporate Bonds | 4.2% |

| Money Market Funds | 21.0% |

| Preferred Stocks | 15.3% |

| Reit | 32.9% |

| U.S. Government & Agencies | 2.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.7% |

| CMO | 0.7% |

| ABS | 0.7% |

| CLO | 1.8% |

| Mbs Passthrough | 2.1% |

| Real Estate | 3.0% |

| CMBS | 9.1% |

| Money Market Funds | 20.8% |

| Financials | 61.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 20.8% |

| Rithm Capital Corporation | 7.3% |

| Ellington Financial, Inc. | 4.4% |

| MGIC Investment Corporation | 4.3% |

| Dynex Capital, Inc. | 3.9% |

| Redwood Trust, Inc. | 3.8% |

| MFA Financial, Inc. | 3.6% |

| AG Mortgage Investment Trust, Inc. | 2.7% |

| PHH Mortgage Corporation | 2.7% |

| Enact Holdings, Inc. | 2.6% |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus dated August 1, 2024 or call us at 1-844-223-8637. Effective November 1, 2024, the Fund’s name changed to “AlphaCentric Real Income Fund”. Also effective November 1, 2024, CrossingBridge Advisors, LLC (“CrossingBridge”) replaced Goshen Rock Capital, LLC (“GRC”) as the sub-advisor of the Fund. David K. Sherman, Founder and Chief Investment Officer of CrossingBridge, T. Kirk Whitney, CFA and Assistant Portfolio Manager of CrossingBridge, and Spencer Rolfe, Assistant Portfolio Manager of CrossingBridge, replaced David Gregory and Alex Cigolle, CFA, as Portfolio Managers of the Fund.

AlphaCentric Real Income Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Symmetry Strategy Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $94 | 1.85%Footnote Reference* |

| Net Assets | $40,878,273 |

| Number of Portfolio Holdings | 241 |

| Advisory Fee (net of waivers) | $196,465 |

| Portfolio Turnover | 130% |

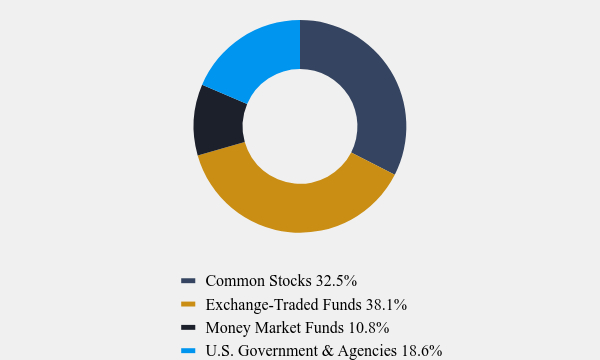

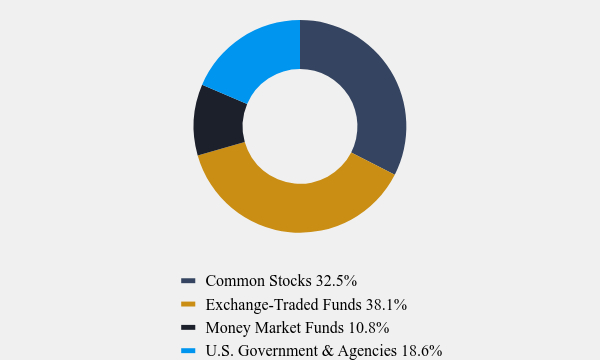

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 32.5% |

| Exchange-Traded Funds | 38.1% |

| Money Market Funds | 10.8% |

| U.S. Government & Agencies | 18.6% |

What did the Fund invest in?

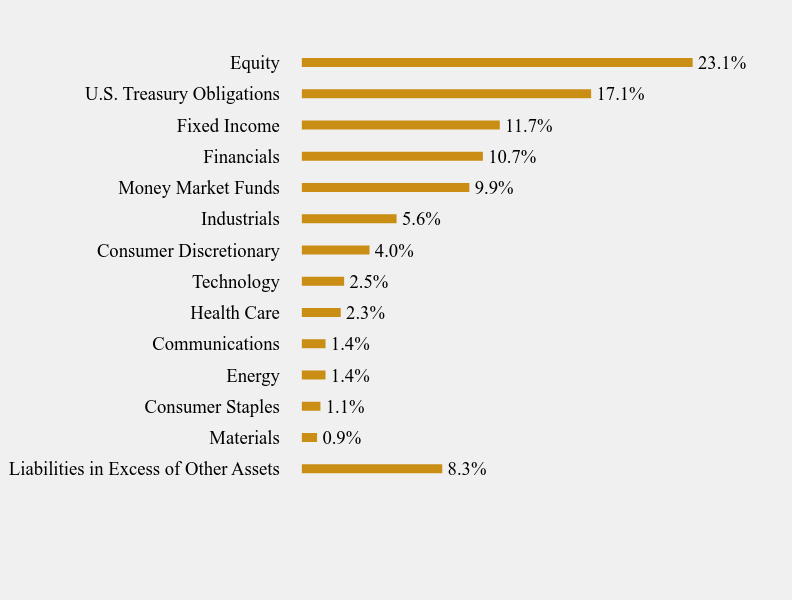

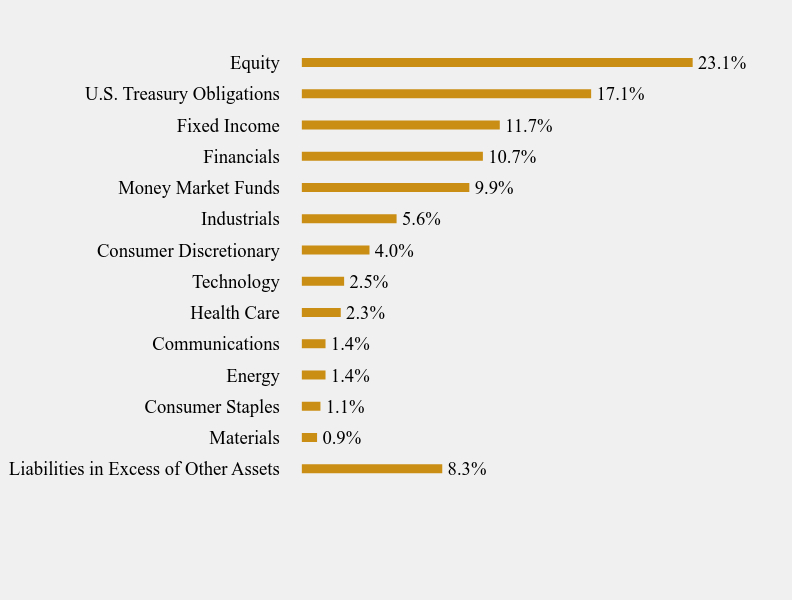

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | 8.3% |

| Materials | 0.9% |

| Consumer Staples | 1.1% |

| Energy | 1.4% |

| Communications | 1.4% |

| Health Care | 2.3% |

| Technology | 2.5% |

| Consumer Discretionary | 4.0% |

| Industrials | 5.6% |

| Money Market Funds | 9.9% |

| Financials | 10.7% |

| Fixed Income | 11.7% |

| U.S. Treasury Obligations | 17.1% |

| Equity | 23.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 9.9% |

| Invesco QQQ Trust Series 1 | 5.0% |

| Invesco Nasdaq 100 ETF | 5.0% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 2.4% |

| Hartford Financial Services Group, Inc. (The) | 1.3% |

| iShares MSCI Australia ETF | 1.3% |

| JPMorgan BetaBuilders Japan ETF | 1.2% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Symmetry Strategy Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class C | $132 | 2.60%Footnote Reference* |

| Net Assets | $40,878,273 |

| Number of Portfolio Holdings | 241 |

| Advisory Fee (net of waivers) | $196,465 |

| Portfolio Turnover | 130% |

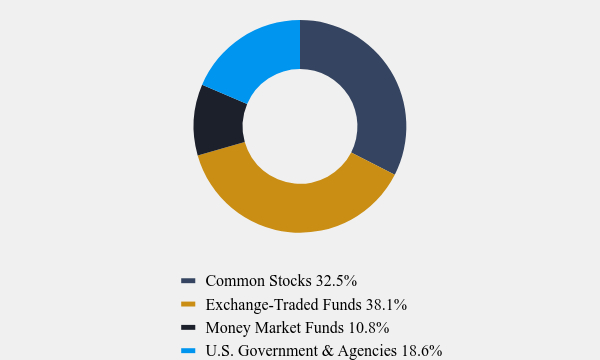

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 32.5% |

| Exchange-Traded Funds | 38.1% |

| Money Market Funds | 10.8% |

| U.S. Government & Agencies | 18.6% |

What did the Fund invest in?

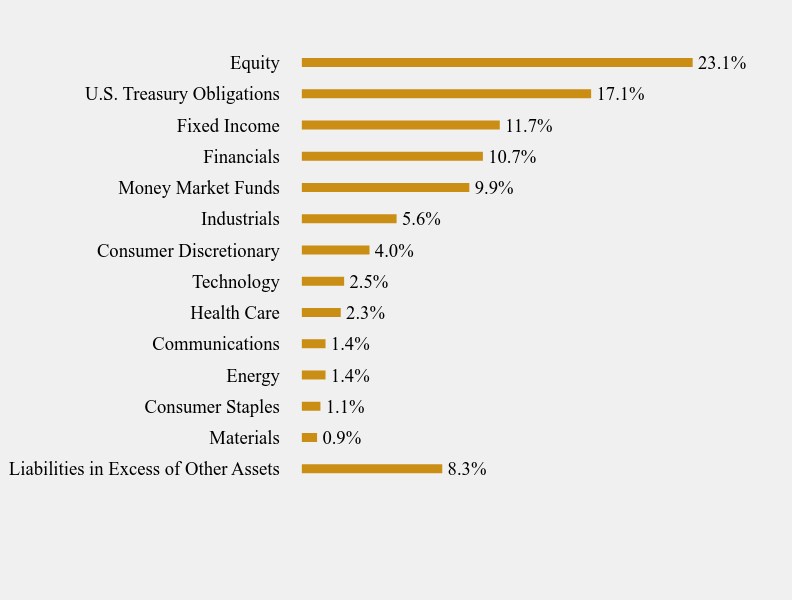

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | 8.3% |

| Materials | 0.9% |

| Consumer Staples | 1.1% |

| Energy | 1.4% |

| Communications | 1.4% |

| Health Care | 2.3% |

| Technology | 2.5% |

| Consumer Discretionary | 4.0% |

| Industrials | 5.6% |

| Money Market Funds | 9.9% |

| Financials | 10.7% |

| Fixed Income | 11.7% |

| U.S. Treasury Obligations | 17.1% |

| Equity | 23.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 9.9% |

| Invesco QQQ Trust Series 1 | 5.0% |

| Invesco Nasdaq 100 ETF | 5.0% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 2.4% |

| Hartford Financial Services Group, Inc. (The) | 1.3% |

| iShares MSCI Australia ETF | 1.3% |

| JPMorgan BetaBuilders Japan ETF | 1.2% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

This semi-annual shareholder report contains important information about AlphaCentric Symmetry Strategy Fund for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at https://alphacentricfunds.com/mutual-funds/. You can also request this information by contacting us at 1-844-223-8637.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class I | $81 | 1.60%Footnote Reference* |

| Net Assets | $40,878,273 |

| Number of Portfolio Holdings | 241 |

| Advisory Fee (net of waivers) | $196,465 |

| Portfolio Turnover | 130% |

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 32.5% |

| Exchange-Traded Funds | 38.1% |

| Money Market Funds | 10.8% |

| U.S. Government & Agencies | 18.6% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | 8.3% |

| Materials | 0.9% |

| Consumer Staples | 1.1% |

| Energy | 1.4% |

| Communications | 1.4% |

| Health Care | 2.3% |

| Technology | 2.5% |

| Consumer Discretionary | 4.0% |

| Industrials | 5.6% |

| Money Market Funds | 9.9% |

| Financials | 10.7% |

| Fixed Income | 11.7% |

| U.S. Treasury Obligations | 17.1% |

| Equity | 23.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| First American Treasury Obligations Fund, Class X | 9.9% |

| Invesco QQQ Trust Series 1 | 5.0% |

| Invesco Nasdaq 100 ETF | 5.0% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 4.9% |

| United States Treasury Bill | 2.4% |

| Hartford Financial Services Group, Inc. (The) | 1.3% |

| iShares MSCI Australia ETF | 1.3% |

| JPMorgan BetaBuilders Japan ETF | 1.2% |

No material changes occurred during the period ended September 30, 2024.

AlphaCentric Symmetry Strategy Fund

Semi-Annual Shareholder Report - September 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( https://alphacentricfunds.com/mutual-funds/ ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

(b) Not applicable

Item 2. Code of Ethics. Not applicable.

Item 3. Audit Committee Financial Expert. Not applicable.

Item 4. Principal Accountant Fees and Services. Not applicable.

Item 5. Audit Committee of Listed Companies. Not applicable to open-end investment companies.

Item 6. Schedule of Investments. The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

Semi-Annual Financial Statements

AlphaCentric Income Opportunities Fund

Class A: IOFAX Class C: IOFCX Class I: IOFIX

AlphaCentric Premium Opportunity Fund

Class A: HMXAX Class C: HMXCX Class I: HMXIX

AlphaCentric Robotics and Automation Fund

Class A: GNXAX Class C: GNXCX Class I: GNXIX

AlphaCentric Symmetry Strategy Fund

Class A: SYMAX Class C: SYMCX Class I: SYMIX

AlphaCentric Life Science and Healthcare Fund

(formerly known as AlphaCentric LifeSci Healthcare Fund)

Class A: LYFAX Class C: LYFCX Class I: LYFIX

AlphaCentric Real Income Fund

(formerly known as AlphaCentric Strategic Income Fund)

Class A: SIIAX Class C: SIICX Class I: SIIIX

September 30, 2024

AlphaCentric Advisors LLC

53 Palmeras Street, Suite 601

San Juan, PR 00901

1-844-223-8637

| ALPHACENTRIC INCOME OPPORTUNITIES FUND (IOFAX, IOFCX, IOFIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | NON-AGENCY RESIDENTIAL MORTGAGE BACKED SECURITIES - 96.3% | | | | | | | | | | |

| | 1,290,228 | | | ABFS Mortgage Loan Trust 2003-2 Series 2003-2 B(a),(b) | | | | 6.1760 | | 04/25/34 | | $ | 659,219 | |

| | 39,963 | | | ACE Securities Corp Home Equity Loan Trust Series Series 2004-FM2 M3(c) | | TSFR1M + 2.139% | | 0.0001 | | 06/25/34 | | | 33,654 | |

| | 315,832 | | | ACE Securities Corp Home Equity Loan Trust Series Series 2004-RM2 M4(c) | | TSFR1M + 1.434% | | 3.4940 | | 01/25/35 | | | 312,917 | |

| | 4,535,817 | | | ACE Securities Corp Home Equity Loan Trust Series Series 2005-HE2 M7(c) | | TSFR1M + 1.959% | | 1.2910 | | 04/25/35 | | | 3,182,024 | |

| | 4,883,482 | | | ACE Securities Corp Home Equity Loan Trust Series Series 2006-ASP4 M1(c) | | TSFR1M + 0.549% | | 3.1300 | | 08/25/36 | | | 4,606,211 | |

| | 5,784,808 | | | Adjustable Rate Mortgage Trust 2005-2 Series 2005-2 6M3(c) | | TSFR1M + 1.464% | | 2.5670 | | 06/25/35 | | | 4,569,476 | |

| | 41,982 | | | Adjustable Rate Mortgage Trust 2005-3 Series 2005-3 1A2(b) | | | | 4.5930 | | 07/25/35 | | | 39,377 | |

| | 1,286,219 | | | Alternative Loan Trust 2006-OA22 Series 2006-OA22 A3(c) | | TSFR1M + 0.594% | | 4.4990 | | 02/25/47 | | | 1,084,140 | |

| | 4,124,922 | | | American Home Mortgage Investment Trust 2006-1 Series 2006-1 1A2(c) | | TSFR1M + 0.494% | | 5.7720 | | 03/25/46 | | | 3,564,014 | |

| | 1,037,239 | | | Ameriquest Mort Sec Inc Ass Bk Pas Thr Certs Ser Series 2002-2 M4(c) | | TSFR1M + 3.414% | | 4.4570 | | 08/25/32 | | | 937,093 | |

| | 1,296,315 | | | Ameriquest Mortgage Securities Asset-Backed Series 2005-R10 M7(c) | | TSFR1M + 2.289% | | 0.0001 | | 01/25/36 | | | 1,926,127 | |

| | 2,788 | | | Amresco Residential Securities Corp Mort Loan Series 1999-1 M2(c) | | TSFR1M + 1.464% | | 0.0001 | | 11/25/29 | | | 2,534 | |

| | 2,369,765 | | | Banc of America Mortgage 2004-K Trust Series 2004-K B1(b) | | | | 5.2990 | | 12/25/34 | | | 1,928,697 | |

| | 1,290,333 | | | Bear Stearns ALT-A Trust 2004-11 Series 2004-11 1M2(c) | | TSFR1M + 1.689% | | 4.9610 | | 11/25/34 | | | 1,213,933 | |

| | 9,804 | | | Bear Stearns ARM Trust 2003-8 Series 2003-8 1A2(b) | | | | 6.2490 | | 01/25/34 | | | 9,248 | |

| | 162,664 | | | Bear Stearns ARM Trust 2004-7 Series 2004-7 1A1(b) | | | | 0.0001 | | 10/25/34 | | | 125,605 | |

| | 1,753,617 | | | Bear Stearns Asset Backed Securities I Trust Series 2007-HE7 M2(c) | | TSFR1M + 1.864% | | 4.3140 | | 10/25/37 | | | 1,655,185 | |

| | 45,368,500 | | | Carrington Mortgage Loan Trust Series 2006-FRE1 Series 2006-FRE1 M1(c) | | TSFR1M + 0.414% | | 1.1260 | | 07/25/36 | | | 32,643,780 | |

| | 8,846,246 | | | Carrington Mortgage Loan Trust Series 2006-NC4 Series 2006-NC4 M1(c) | | TSFR1M + 0.414% | | 3.8100 | | 10/25/36 | | | 5,648,594 | |

| | 14,438,454 | | | Carrington Mortgage Loan Trust Series 2007-RFC1 Series 2007-RFC1 M1(c) | | TSFR1M + 0.374% | | 4.1780 | | 12/25/36 | | | 10,451,833 | |

| | 58,269 | | | Centex Home Equity Loan Trust 2004-B Series 2004-B M7(c) | | TSFR1M + 2.439% | | 5.7840 | | 03/25/34 | | | 2,553 | |

| | 14,454,834 | | | CIT Mortgage Loan Trust 2007-1 Series 2007-1 2M3(a),(c) | | TSFR1M + 1.864% | | 5.5670 | | 10/25/37 | | | 10,565,141 | |

| | 42,560,754 | | | CIT Mortgage Loan Trust 2007-1 Series 2007-1 1M3(a),(c) | | TSFR1M + 1.864% | | 6.0610 | | 10/25/37 | | | 32,456,772 | |

| | 4,771,429 | | | Citigroup Mortgage Loan Trust 2006-WMC1 Series 2006-WMC1 M2(c) | | TSFR1M + 0.729% | | 3.8750 | | 12/25/35 | | | 3,445,229 | |

| | 10,937,923 | | | Citigroup Mortgage Loan Trust 2007-AHL1 Series 2007-AHL1 M2(c) | | TSFR1M + 0.519% | | 4.5350 | | 12/25/36 | | | 10,869,611 | |

| | 541,772 | | | Citigroup Mortgage Loan Trust, Inc. Series 2005-OPT1 M8(c) | | TSFR1M + 2.049% | | 0.0001 | | 02/25/35 | | | 458,337 | |

| | 3,701,057 | | | Countrywide Asset-Backed Certificates Series 2007-BC2 M1(c) | | TSFR1M + 0.454% | | 4.4670 | | 06/25/37 | | | 2,242,655 | |

| | 4,008,172 | | | Countrywide Asset-Backed Certificates Series 2007-2 M1(c) | | TSFR1M + 0.334% | | 0.0001 | | 08/25/37 | | | 3,567,489 | |

| | 1,324,066 | | | Credit Suisse First Boston Mortgage Securities Series 2001-HE22 M1(c) | | TSFR1M + 1.614% | | 5.5140 | | 02/25/32 | | | 2,254,829 | |

| | 3,645,987 | | | Credit-Based Asset Servicing and Securitization, Series 2007-SP2 M7(a),(d) | | | | 3.8410 | | 03/25/46 | | | 1,299,711 | |

| | 1,395,018 | | | Delta Funding Home Equity Loan Trust 1997-3 Series 1997-3 B1F | | | | 7.6500 | | 10/25/28 | | | 1,327,274 | |

| | 1,188,267 | | | Delta Funding Home Equity Loan Trust 1998-1 Series 1998-1 M1F(c) | | TSFR1M + 0.939% | | 0.0001 | | 05/25/30 | | | 1,073,232 | |

| | 856,347 | | | Delta Funding Home Equity Loan Trust 1999-1 Series 1999-1 B(b) | | | | 4.3420 | | 03/15/28 | | | 779,513 | |

| | 1,722,206 | | | Delta Funding Home Equity Loan Trust 1999-2 Series 1999-2 M1 | | | | 2.8660 | | 08/15/30 | | | 1,417,140 | |

| | 5,666,067 | | | EMC Mortgage Loan Trust 2005-B Series 2005-B M2(a),(c) | | TSFR1M + 2.364% | | 4.8330 | | 04/25/42 | | | 5,628,036 | |

See accompanying notes to financial statements.

| ALPHACENTRIC INCOME OPPORTUNITIES FUND (IOFAX, IOFCX, IOFIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | NON-AGENCY RESIDENTIAL MORTGAGE BACKED SECURITIES - 96.3% (Continued) | | | | | | | | | | |

| | 1,997,012 | | | First Franklin Mortgage Loan Trust 2006-FF7 Series 2006-FF7 M1(c) | | TSFR1M + 0.489% | | 0.0001 | | 05/25/36 | | $ | 1,735,666 | |

| | 8,315,722 | | | First Franklin Mortgage Loan Trust 2006-FF9 Series 2006-FF9 M1(c) | | TSFR1M + 0.489% | | 5.0220 | | 06/25/36 | | | 6,756,664 | |

| | 1,975,222 | | | Fremont Home Loan Trust 2004-3 Series 2004-3 M5(c) | | TSFR1M + 1.989% | | 0.0001 | | 11/25/34 | | | 1,343,654 | |

| | 7,110 | | | GSR Mortgage Loan Trust 2005-7F Series 2005-7F 3A1(c) | | TSFR1M + 0.614% | | 5.8920 | | 09/25/35 | | | 6,974 | |

| | 940,308 | | | GSRPM Mortgage Loan Trust Series 2004-1 Series 2004-1 B2(a),(c) | | TSFR1M + 5.364% | | 2.9380 | | 09/25/42 | | | 881,329 | |

| | 1,149,872 | | | HarborView Mortgage Loan Trust 2006-12 Series 2006-12 2A2B(c) | | TSFR1M + 0.614% | | 3.4780 | | 01/19/38 | | | 1,717,685 | |

| | 18,650 | | | IndyMac INDX Mortgage Loan Trust 2004-AR6 Series 2004-AR6 6A2(b) | | | | 5.8740 | | 10/25/34 | | | 17,370 | |

| | 1,009,939 | | | IXIS Real Estate Capital Trust 2005-HE2 Series 2005-HE2 M6(c) | | TSFR1M + 1.149% | | 6.4270 | | 09/25/35 | | | 1,262,151 | |

| | 274,865 | | | MAFI II Remic Trust 1998-A Series 1998-AX B2 | | | | 6.0000 | | 02/20/27 | | | 247,408 | |

| | 295,776 | | | MASTR Alternative Loan Trust 2002-2 Series 2002-2 B3(b) | | | | 7.1420 | | 10/25/32 | | | 3 | |

| | 1,497,751 | | | Mastr Asset Backed Securities Trust 2004-HE1 Series 2004-HE1 M10(c) | | TSFR1M + 5.364% | | 0.0001 | | 09/25/34 | | | 1,289,547 | |

| | 4,790,954 | | | Mastr Asset Backed Securities Trust 2007-HE1 Series 2007-HE1 M1(c) | | TSFR1M + 0.414% | | 3.1800 | | 05/25/37 | | | 4,052,005 | |

| | 1,462,000 | | | Mastr Specialized Loan Trust Series 2005-3 M2(a),(c) | | TSFR1M + 1.989% | | 3.6960 | | 11/25/35 | | | 1,015,082 | |

| | 6,128,255 | | | Mastr Specialized Loan Trust Series 2006-1 M2(a),(c) | | TSFR1M + 2.514% | | 3.3850 | | 01/25/36 | | | 4,295,892 | |

| | 13,370 | | | Merrill Lynch Mortgage Investors Trust MLMI Series Series 2003-A1 2A(c) | | TSFR12M + 2.340% | | 6.6250 | | 12/25/32 | | | 13,344 | |

| | 42,101 | | | Merrill Lynch Mortgage Investors Trust MLMI Series Series 2003-A2 2A2(c) | | TSFR6M + 1.928% | | 6.9960 | | 02/25/33 | | | 40,290 | |

| | 186,782 | | | Merrill Lynch Mortgage Investors Trust Series MLCC Series 2005-A B2(c) | | TSFR1M + 1.119% | | 6.3970 | | 03/25/30 | | | 137,311 | |

| | 2,879,193 | | | Merrill Lynch Mortgage Investors Trust Series MLCC Series 2006-1 M1(b) | | | | 1.4970 | | 02/25/36 | | | 2,133,091 | |

| | 3,179,059 | | | Mill City Mortgage Loan Trust 2018-3 Series 3 B6(a),(b) | | | | 1.2210 | | 08/25/58 | | | 1,525,948 | |

| | 7,043,983 | | | Mill City Mortgage Loan Trust 2018-3 Series 3 B3(a),(b) | | | | 3.2500 | | 08/25/58 | | | 4,467,377 | |

| | 3,522,491 | | | Mill City Mortgage Loan Trust 2018-3 Series 3 B5(a),(b) | | | | 3.6960 | | 08/25/58 | | | 1,827,950 | |

| | 7,464,280 | | | Mill City Mortgage Loan Trust 2018-4 Series 4 B5(a),(b) | | | | 3.0700 | | 04/25/66 | | | 4,168,690 | |

| | 317,872 | | | Morgan Stanley A.B.S Capital I Inc Trust 2004-WMC3 Series 2004-WMC3 M6(c) | | TSFR1M + 1.764% | | 3.5370 | | 01/25/35 | | | 402,132 | |

| | 5,792,397 | | | Morgan Stanley A.B.S Capital I Inc Trust 2005-WMC5 Series 2005-WMC5 B1(c) | | TSFR1M + 1.914% | | 0.6000 | | 06/25/35 | | | 4,620,493 | |

| | 4,668,895 | | | Morgan Stanley A.B.S Capital I Inc Trust 2007-HE6 Series 2007-HE6 M1(c) | | TSFR1M + 0.374% | | 0.0001 | | 05/25/37 | | | 5,932,163 | |

| | 34,853 | | | Morgan Stanley Mortgage Loan Trust 2004-7AR Series 2004-7AR 2A7(b) | | | | 6.2080 | | 09/25/34 | | | 34,418 | |

| | 6,852,005 | | | Nationstar Home Equity Loan Trust 2007-B Series 2007-B M2(c) | | TSFR1M + 0.584% | | 4.4790 | | 04/25/37 | | | 7,882,733 | |

| | 3,710,983 | | | New Century Home Equity Loan Trust 2006-2 Series 2006-2 M1(c) | | TSFR1M + 0.579% | | 0.0001 | | 08/25/36 | | | 3,068,459 | |

| | 16,451 | | | Nomura Asset Acceptance Corp Alternative Loan Series 2003-A1 A5 | | | | 7.0000 | | 04/25/33 | | | 16,739 | |

| | 4,061 | | | Nomura Asset Acceptance Corp Alternative Loan Series 2003-A1 A2 | | | | 6.0000 | | 05/25/33 | | | 4,085 | |

| | 3,126,335 | | | NovaStar Mortgage Funding Trust Series 2003-1 Series 2003-1 M2(c) | | TSFR1M + 3.114% | | 3.6100 | | 05/25/33 | | | 2,681,014 | |

| | 3,000,925 | | | Option One Mortgage Loan Trust 2005-5 Series 2005-5 M4(c) | | TSFR1M + 0.984% | | 3.6120 | | 12/25/35 | | | 2,553,774 | |

| | 15,091,440 | | | Option One Mortgage Loan Trust 2007-CP1 Series 2007-CP1 M1(c) | | TSFR1M + 0.414% | | 0.0001 | | 03/25/37 | | | 14,186,597 | |

| | 3,611,830 | | | Park Place Securities Inc Asset-Backed Series 2004-WHQ2 M7(c) | | TSFR1M + 2.739% | | 2.5640 | | 02/25/35 | | | 2,273,649 | |

| | 3,986,611 | | | RAAC Series 2006-RP2 Trust Series 2006-RP2 M2(a),(c) | | TSFR1M + 1.364% | | 6.6420 | | 02/25/37 | | | 3,518,084 | |

See accompanying notes to financial statements.

| ALPHACENTRIC INCOME OPPORTUNITIES FUND (IOFAX, IOFCX, IOFIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Principal | | | | | | | Coupon | | | | | |

| Amount ($) | | | | | Spread | | Rate (%) | | Maturity | | Fair Value | |

| | | | | NON-AGENCY RESIDENTIAL MORTGAGE BACKED SECURITIES - 96.3% (Continued) | | | | | | | | | | |

| | 12,745,036 | | | RAAC Series 2007-SP3 Trust Series 2007-SP3 M1(c) | | TSFR1M + 2.364% | | 7.6420 | | 09/25/47 | | $ | 9,036,179 | |

| | 2,988,458 | | | RASC Series 2006-EMX1 Trust Series 2006-EMX1 M3(c) | | TSFR1M + 0.584% | | 0.0001 | | 01/25/36 | | | 2,203,807 | |

| | 316,541 | | | Renaissance Home Equity Loan Trust 2003-2 Series 2003-2 M2F(d) | | | | 3.8420 | | 08/25/33 | | | 260,249 | |

| | 7,003,670 | | | Renaissance Home Equity Loan Trust 2005-1 Series 2005-1 M2(d) | | | | 5.9050 | | 05/25/35 | | | 795,594 | |

| | 5,783,013 | | | Renaissance Home Equity Loan Trust 2005-2 Series 2005-2 M2(d) | | | | 5.6010 | | 08/25/35 | | | 1,329,590 | |

| | 107,303 | | | SASCO Mortgage Loan Trust 2003-GEL1 Series 2003-GEL1 M3(c) | | TSFR1M + 4.614% | | 9.8920 | | 10/25/33 | | | 101,370 | |

| | 4,790,187 | | | Saxon Asset Securities Trust 2007-3 Series 2007-3 1M2(c) | | TSFR1M + 1.014% | | 0.5720 | | 09/25/47 | | | 5,166,021 | |

| | 35,084,212 | | | Seasoned Credit Risk Transfer Trust Series 2018-3 Series 3 BX(b) | | | | 0.9440 | | 08/25/57 | | | 12,780,131 | |

| | 7,050,472 | | | Sequoia Mortgage Trust 2004-10 Series 2004-10 XA(b) | | | | 0.0001 | | 11/20/34 | | | 71 | |

| | 494,327 | | | Sequoia Mortgage Trust 2004-10 Series 2004-10 B1(c) | | TSFR1M + 0.864% | | 6.0650 | | 11/20/34 | | | 296,956 | |

| | 372,690 | | | Soundview Home Loan Trust 2005-A Series 2005-A M6(c) | | TSFR1M + 1.464% | | 5.2510 | | 04/25/35 | | | 373,800 | |

| | 5,321,456 | | | Soundview Home Loan Trust 2005-OPT1 Series 2005-OPT1 M5(c) | | TSFR1M + 1.164% | | 3.7530 | | 06/25/35 | | | 3,932,048 | |

| | 2,250,659 | | | Structured Asset Investment Loan Trust 2005-HE3 Series 2005-HE3 M3(c) | | TSFR1M + 0.909% | | 0.0001 | | 09/25/35 | | | 1,649,447 | |

| | 93,742 | | | Structured Asset Mortgage Investments II Trust Series 2004-AR5 1A2(b) | | | | 4.5900 | | 10/19/34 | | | 81,397 | |

| | 673,393 | | | Structured Asset Mortgage Investments Trust Series 2002-AR4 A2(c) | | TSFR1M + 0.939% | | 6.2810 | | 02/19/33 | | | 566,139 | |

| | 2,323,000 | | | Towd Point Mortgage Trust 2018-5 Series 5 B4(a),(b) | | | | 3.4740 | | 07/25/58 | | | 1,474,015 | |

| | 16,964,000 | | | Towd Point Mortgage Trust 2019-4(a),(b) | | | | 4.1610 | | 10/25/59 | | | 13,156,055 | |

| | 757,000 | | | Truman Capital Mortgage Loan Trust Series 2005-1 M3(a),(c) | | TSFR1M + 5.364% | | 4.1970 | | 03/25/37 | | | 699,214 | |

| | 383,030 | | | WaMu Mortgage Pass-Through Certificates Series Series 2003-AR10 B2(b) | | | | 0.0001 | | 10/25/33 | | | 288,125 | |

| | 104,292 | | | WaMu Mortgage Pass-Through Certificates Series Series 2002-AR17 2B1(c) | | COF 11 + 1.250% | | 0.0001 | | 11/25/42 | | | 97,265 | |

| | | | | TOTAL NON-AGENCY RESIDENTIAL MORTGAGE BACKED SECURITIES (Cost $225,927,621) | | | | | | | | | 292,378,427 | |

See accompanying notes to financial statements.

| ALPHACENTRIC INCOME OPPORTUNITIES FUND (IOFAX, IOFCX, IOFIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENT - 3.2% | | | | |

| | | | | MONEY MARKET FUND - 3.2% | | | | |

| | 9,598,845 | | | First American Treasury Obligations Fund, Class X, 4.81% (Cost $9,598,845)(e) | | $ | 9,598,845 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 99.5% (Cost $235,526,466) | | $ | 301,977,272 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 0.5% | | | 1,611,160 | |

| | | | | NET ASSETS - 100.0% | | $ | 303,588,432 | |

| REMIC | - Real Estate Mortgage Investment Conduit |

| | |

| COF 11 | - Cost of Funds for the 11th District of San Francisco |

| | |

| TSFR12M | - Term Secured Overnight Financing Rate (SOFR) 1 month |

| | |

| TSFR1M | - Term Secured Overnight Financing Rate (SOFR) 6 month |

| | |

| TSFR6M | - Term Secured Overnight Financing Rate (SOFR) 12 month |

| (a) | Security exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2024 the total market value of 144A securities is $87,638,515 or 28.9% of net assets. |

| | |

| (b) | Variable rate security; the rate shown represents the rate on September 30, 2024. |

| | |

| (c) | Floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

| | |

| (d) | Step bond. Coupon rate is fixed rate that changes on a specified date. The rate shown is the current rate at September 30, 2024. |

| | |

| (e) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

See accompanying notes to financial statements.

| ALPHACENTRIC PREMIUM OPPORTUNITY FUND (HMXAX, HMXCX, HMXIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| September 30, 2024 |

Principal

Amount ($) | | | | | Yield Rate (%) | | Maturity | | Fair Value | |

| | | | | U.S. GOVERNMENT & AGENCIES — 35.7% | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | U.S. TREASURY BILLS — 31.7% | | | | | | | | |

| | 10,000,000 | | | United States Treasury Bill(a) | | 4.6900 | | 11/29/24 | | $ | 9,923,528 | |

| | 10,000,000 | | | United States Treasury Bill(a) | | 4.5000 | | 01/23/25 | | | 9,860,324 | |

| | | | | | | | | | | | 19,783,852 | |

| | | | | | | | | | | | | |

| | | | | | | Coupon Rate | | | | | | |

| | | | | | | (%) | | | | | | |

| | | | | U.S. TREASURY NOTES — 4.0% | | | | | | | | |

| | 2,500,000 | | | United States Treasury Note | | 2.8750 | | 06/15/25 | | | 2,477,534 | |

| | | | | | | | | | | | | |

| | | | | TOTAL U.S. GOVERNMENT & AGENCIES (Cost $22,239,484) | | | | | | | 22,261,386 | |

| | | | | | | | | | | | | |

| Shares | | | | | | | | | Fair Value | |

| | | | | SHORT-TERM INVESTMENTS - 14.3% | | | | | | | | |

| | | | | MONEY MARKET FUNDS – 14.3% | | | | | | | | |

| | 4,286,861 | | | Fidelity Government Portfolio, Institutional Class, 4.84%(b) | | | | | | | 4,286,861 | |

| | 4,610,315 | | | First American Treasury Obligations Fund, Class X, 4.81%(b) | | | | | | | 4,610,315 | |

| | | | | TOTAL SHORT-TERM INVESTMENTS (Cost $8,897,176) | | | | | | | 8,897,176 | |

| Contracts(c) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | INDEX OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED - 0.1% | | | | | | | | | | | | | | | | |

| | 200 | | | Chicago Board Options Exchange VIX (h) | | IB | | 10/16/2024 | | $ | 45 | | | $ | 900,000 | | | $ | 3,922 | |

| | 200 | | | Chicago Board Options Exchange VIX (h) | | IB | | 11/20/2024 | | | 25 | | | | 500,000 | | | | 26,000 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $35,377) | | | | | 29,922 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.0%(e) | | | | | | | | | | | | | | | | |

| | 200 | | | Chicago Board Options Exchange VIX (h) | | IB | | 10/16/2024 | | $ | 16 | | | $ | 320,000 | | | $ | 2,200 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $4,791) | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS PURCHASED (Cost - $40,168) | | | | | $ | 32,122 | |

| Contracts(d) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | FUTURE OPTIONS PURCHASED - 4.3% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED – 3.9% | | | | | | | | | | | | | | | | |

| | 65 | | | S&P Emini 3rd Week | | SXM | | 10/18/2024 | | $ | 5,800 | | | $ | 18,850,000 | | | $ | 239,687 | |

| | 75 | | | S&P Emini 3rd Week | | SXM | | 10/18/2024 | | | 5,825 | | | | 21,843,750 | | | | 219,375 | |

| | 20 | | | S&P Emini 3rd Week | | SXM | | 10/18/2024 | | | 5,900 | | | | 5,900,000 | | | | 26,750 | |

| | 100 | | | S&P Emini 3rd Week | | SXM | | 11/15/2024 | | | 5,800 | | | | 29,000,000 | | | | 648,750 | |

| | 50 | | | S&P Emini 3rd Week | | SXM | | 11/15/2024 | | | 6,000 | | | | 15,000,000 | | | | 94,375 | |

| | 150 | | | S&P500 Emini Option | | SXM | | 10/31/2024 | | | 5,800 | | | | 43,500,000 | | | | 691,875 | |

| | 100 | | | S&P500 Emini Option | | SXM | | 11/29/2024 | | | 5,900 | | | | 29,500,000 | | | | 436,250 | |

See accompanying notes to financial statements.

| ALPHACENTRIC PREMIUM OPPORTUNITY FUND (HMXAX, HMXCX, HMXIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Contracts(d) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | FUTURE OPTIONS PURCHASED - 4.3% (Continued) | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS PURCHASED – 3.9% (Continued) | | | | | | | | | | | | | | | | |

| | 15 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | $ | 6,000 | | | $ | 4,500,000 | | | $ | 69,188 | |

| | 10 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | | 6,200 | | | | 3,100,000 | | | | 15,125 | |

| | | | | TOTAL CALL OPTIONS PURCHASED (Cost - $1,080,450) | | | | | 2,441,375 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS PURCHASED - 0.4% | | | | | | | | | | | | | | | | |

| | 151 | | | Emini SP M Week Option | | SXM | | 10/07/2024 | | $ | 5,425 | | | $ | 40,958,750 | | | $ | 7,550 | |

| | 250 | | | S&P Emini 1st Week | | SXM | | 10/04/2024 | | | 5,350 | | | | 66,875,000 | | | | 5,000 | |

| | 50 | | | S&P Emini 3rd Week | | SXM | | 11/15/2024 | | | 5,150 | | | | 12,875,000 | | | | 45,625 | |

| | 102 | | | S&P Emini Thurs Week | | SXM | | 10/03/2024 | | | 5,450 | | | | 27,795,000 | | | | 1,530 | |

| | 60 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 4,550 | | | | 13,650,000 | | | | 150 | |

| | 50 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 4,600 | | | | 11,500,000 | | | | 125 | |

| | 110 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 5,225 | | | | 28,737,500 | | | | 550 | |

| | 1 | | | S&P500 Emini Option | | SXM | | 12/20/2024 | | | 5,425 | | | | 271,250 | | | | 3,238 | |

| | 50 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | | 5,475 | | | | 13,687,500 | | | | 179,375 | |

| | | | | TOTAL PUT OPTIONS PURCHASED (Cost - $275,522) | | | | | 243,143 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL FUTURE OPTIONS PURCHASED (Cost - $1,355,972) | | | | | 2,684,518 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 54.4% (Cost $32,532,800) | | | | $ | 33,875,202 | |

| | | | | CALL OPTIONS WRITTEN - (3.0)% (Proceeds received - $1,000,753) | | | | | (1,872,184 | ) |

| | | | | PUT OPTIONS WRITTEN - (0.2)% (Proceeds received - $131,097) | | | | | (102,745 | ) |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 48.8% | | | | | 30,428,678 | |

| | | | | NET ASSETS - 100.0% | | | | | $ | 62,328,951 | |

| Contracts(c) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | INDEX OPTIONS WRITTEN - (0.0)% (f) | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (0.0)%(f) | | | | | | | | | | | | | | | | |

| | 200 | | | Chicago Board Options Exchange VIX (h) | | IB | | 10/16/2024 | | $ | 25 | | | $ | 500,000 | | | $ | 11,146 | |

| | 200 | | | Chicago Board Options Exchange VIX (h) | | IB | | 11/20/2024 | | | 45 | | | | 900,000 | | | | 9,400 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $24,050) | | | | | 20,546 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL INDEX OPTIONS WRITTEN (Proceeds - $24,050) | | | | $ | 20,546 | |

| Contracts(d) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | FUTURE OPTIONS WRITTEN - (3.2)% | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (3.0)% | | | | | | | | | | | | | | | | |

| | 150 | | | Emini SP M Week Option | | SXM | | 10/07/2024 | | $ | 5,985 | | | $ | 44,887,500 | | | $ | 4,500 | |

| | 200 | | | Emini SP W Week Option | | SXM | | 10/02/2024 | | | 5,935 | | | | 59,350,000 | | | | 1,000 | |

| | 150 | | | S&P Emini 1st Week | | SXM | | 10/04/2024 | | | 5,975 | | | | 44,812,500 | | | | 2,625 | |

| | 150 | | | S&P Emini 3rd Week | | SXM | | 10/18/2024 | | | 5,950 | | | | 44,625,000 | | | | 99,375 | |

| | 115 | | | S&P Emini 3rd Week | | SXM | | 10/18/2024 | | | 6,000 | | | | 34,500,000 | | | | 33,925 | |

| | 165 | | | S&P Emini 3rd Week | | SXM | | 11/15/2024 | | | 5,900 | | | | 48,675,000 | | | | 620,813 | |

| | 10 | | | S&P Emini Thurs Week | | SXM | | 10/03/2024 | | | 5,965 | | | | 2,982,500 | | | | 75 | |

| | 100 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 5,935 | | | | 29,675,000 | | | | 250 | |

| | 225 | | | S&P500 Emini Option | | SXM | | 10/31/2024 | | | 5,900 | | | | 66,375,000 | | | | 444,375 | |

See accompanying notes to financial statements.

| ALPHACENTRIC PREMIUM OPPORTUNITY FUND (HMXAX, HMXCX, HMXIX) |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| September 30, 2024 |

| Contracts(d) | | | | | Broker/

Counterparty | | Expiration

Date | | Exercise

Price | | | Notional

Value | | | Fair Value | |

| | | | | FUTURE OPTIONS WRITTEN - (3.2)% (Continued) | | | | | | | | | | | | | | | | |

| | | | | CALL OPTIONS WRITTEN - (3.0)% (Continued) | | | | | | | | | | | | | | | | |

| | 190 | | | S&P500 Emini Option | | SXM | | 11/29/2024 | | $ | 6,025 | | | $ | 57,237,500 | | | $ | 380,000 | |

| | 1 | | | S&P500 Emini Option | | SXM | | 12/20/2024 | | | 6,000 | | | | 300,000 | | | | 3,200 | |

| | 50 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | | 6,050 | | | | 15,125,000 | | | | 179,375 | |

| | 30 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | | 6,100 | | | | 9,150,000 | | | | 82,125 | |

| | | | | TOTAL CALL OPTIONS WRITTEN (Proceeds - $976,703) | | | | | 1,851,638 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | PUT OPTIONS WRITTEN - (0.2)% | | | | | | | | | | | | | | | | |

| | 302 | | | Emini SP M Week Option | | SXM | | 10/07/2024 | | $ | 5,225 | | | $ | 78,897,500 | | | $ | 9,815 | |

| | 200 | | | Emini SP W Week Option | | SXM | | 10/02/2024 | | | 4,900 | | | | 49,000,000 | | | | 1,000 | |

| | 500 | | | S&P Emini 1st Week | | SXM | | 10/04/2024 | | | 5,100 | | | | 127,500,000 | | | | 7,500 | |

| | 100 | | | S&P Emini 3rd Week | | SXM | | 11/15/2024 | | | 4,750 | | | | 23,750,000 | | | | 40,750 | |

| | 204 | | | S&P Emini Thurs Week | | SXM | | 10/03/2024 | | | 5,150 | | | | 52,530,000 | | | | 1,530 | |

| | 220 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 4,900 | | | | 53,900,000 | | | | 550 | |

| | 100 | | | S&P Emini Tues Week | | SXM | | 10/01/2024 | | | 4,950 | | | | 24,750,000 | | | | 250 | |

| | 1 | | | S&P500 Emini Option | | SXM | | 12/20/2024 | | | 4,575 | | | | 228,750 | | | | 725 | |

| | 50 | | | S&P500 Emini Option | | SXM | | 12/31/2024 | | | 4,600 | | | | 11,500,000 | | | | 40,625 | |

| | | | | TOTAL PUT OPTIONS WRITTEN (Proceeds - $131,097) | | | | | 102,745 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | TOTAL FUTURE OPTIONS WRITTEN (Proceeds - $1,107,800) | | | | $ | 1,954,383 | |

| OPEN FUTURES CONTRACTS | |

| | | | | | | | | | | | |

Number of

Contracts | | | Open Long Futures Contracts | | Expiration | | Notional

Amount(g) | | | Value and

Unrealized

Appreciation

(Depreciation) | |

| | 151 | | | CBOE Volatility Index Future | | 10/16/2024 | | $ | 2,845,218 | | | $ | 41,577 | |