- ERJ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Embraer (ERJ) 6-KCurrent report (foreign)

Filed: 1 Nov 21, 4:51pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2021

Commission File Number: 001-15102

Embraer S.A.

Avenida Dra. Ruth Cardoso, 8501,

30th floor (part), Pinheiros, São Paulo, SP, 05425-070, Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

ANNEXES

ANNEX I – INFORMATION ABOUT THE APPRAISAL EXPERTS

Annex I.3. – Engagement letter and compensation of the recommended appraisal experts

ANNEX II – INFORMATION ON THE PARTIAL SPIN-OFF OF YABORÃ WITH TRANSFER OF THE SPUN-OFF PORTION TO EMBRAER

Annex II.1. – Protocol and Justification

Annex II.6. – Minutes of all meetings of the board of directors, fiscal council and special committees in which the Transaction was discussed

Annex II.9. – Financial statements used for transaction purposes

1. Message from the Chairman of the Board of Directors

São José dos Campos, October 29, 2021

Dear Shareholder,

We are pleased to invite you to attend, on first call, the Extraordinary General Shareholders’ Meeting (“ESM” or “Meeting”) of Embraer S.A. (“Embraer” or “Company”), to be held on November 30, 2021, at 10:30 am, exclusively by digital means.

The subject-matter of this ESM is the partial spin-off of Yaborã Indústria Aeronáutica S.A. (“Yaborã”) with transfer of the spun-off portion to Embraer (“Transaction”). The purpose of the Transaction is for the commercial aviation business to be developed directly by Embraer again, resulting in a reduction in operating, systemic, administrative and tax expenses.

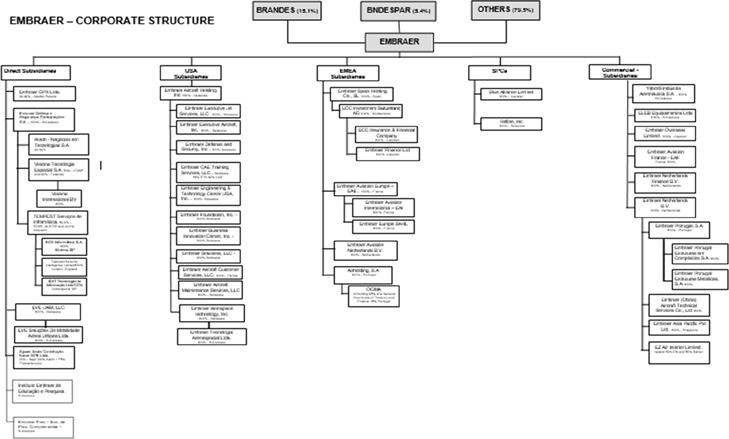

Embraer’s shares have been listed on B3 S.A. - Brasil, Bolsa, Balcão (“B3”) since 1989, and on the New York Stock Exchange (NYSE) since July 2000, through American Depositary Receipts (ADRs).

Since the corporate restructuring that took place in 2006, Embraer’s capital stock has been exclusively comprised of common shares, as well as one golden share held by the Brazilian Federal Government, without a control group or a controlling shareholder. Since then, Embraer’s shares have been included in the Novo Mercado segment of B3, the highest level of corporate governance that a company can have in Brazil.

In the ESM, you will be invited to review and resolve on the matters included in the Call Notice, in accordance with item 3 below. Embraer’s Management presented proposals related to the matters on which to be voted, which are included in this Manual.

For the ESM to take place on first call, the attendance of shareholders representing at least 25% of the voting capital stock is required, pursuant to Article 125 of the Brazilian Corporations Law.

Considering the legal and statutory requirements related to the quorum for these resolutions, I emphasize the importance of your vote on the matters presented herein.

Embraer’s relationship with its shareholders is based on the disclosure of information with transparency, clarity and respect for legal and ethical principles, which allows the consolidation and maintenance of Embraer’s image of leadership and innovation in the capital markets. We hope that the information contained herein, prepared in this spirit, will clarify the matters on the agenda and motivate you to attend the ESM.

We encourage your attendance in the Meeting, in the best interest of Embraer. Remember, your vote is very important to us.

We appreciate your attention,

Alexandre Gonçalves Silva

Chairman of the Board of Directors

4

2. Information and Guidelines for Attendance at the Meeting

Each common share shall be entitled to one vote on the resolutions of the Meeting, subject to the following limits set forth in the Company’s Bylaws:

a) no shareholder, or Shareholder Group (as defined below), Brazilian or foreign, may cast votes in excess of 5% of the shares of the Company’s capital stock; and

b) the Foreign Shareholders (as defined below) and Foreign Shareholder Groups (as defined below) may not cast votes in excess of 2/3 of the total votes that may be exercised by the Brazilian Shareholders (as defined below) in attendance.

The above limitations apply, jointly and successively, to Foreign Shareholders and Foreign Shareholder Groups.

The votes of the Brazilian Shareholders and the Foreign Shareholders on the resolutions of the Meeting will be calculated separately. To that end, the Chairman of the Meeting shall, upon becoming Chairman, determine and communicate the total number of votes that may be cast by the Brazilian Shareholders and by the Foreign Shareholders, observing the voting limits set forth in the Company’s Bylaws. If the total number of votes of the Foreign Shareholders exceeds 2/3 of the votes that may be cast by the Brazilian Shareholders, the number of votes of each Foreign Shareholder, including those received by means of distance voting ballot (boletim de voto à distância) sent directly to the Company or through a third party, shall be proportionately reduced by the percentage of such excess, so that the total number of votes of the Foreign Shareholders does not exceed the limit of 40% the votes that may be cast in the Meeting.

For purposes of applying the restriction on the maximum number of votes attributed to each shareholder, you must take into account the following definitions set forth in Embraer’s Bylaws:

Shareholder Group – Shareholder Groups are two or more shareholders: (i) that are parties to a voting agreement, either directly or through companies that are subsidiaries, parent companies or companies under common control; (ii) where one shareholder is, directly or indirectly, a controlling shareholder or a controlling parent company of the other shareholder or shareholders; (iii) that are companies directly or indirectly controlled by the same person, or group of persons, who may or may not be shareholders themselves; or (iv) that are companies, associations,

5

foundations, cooperatives and trusts, investment funds or portfolios, universal rights or any other form of organization or undertaking with the same administrators or managers, or, whose administrators or managers are companies that are directly or indirectly controlled by the same person, or group of persons, which may or may not be shareholders.

As regards to investment funds, only funds with a common administrator, whose policies of investments and exercise of voting rights provides the administrator with full authority to decide and resolve at shareholders’ meetings, will be considered to be a member of a Shareholder Group.

The holders of securities issued under the Company’s Depositary Receipts program are not considered a Shareholder Group, unless they meet any of the criteria set forth in items (i) through (iv) above.

attorney in fact, shall be deemed members of the same Shareholder Group in the Meeting, except in the case of holders of securities issued in connection with the Company’s Depositary Receipts program, when represented by the respective Depositary Bank.

In the event of shareholders’ agreements that govern the exercise of voting rights, all signatories thereto shall be considered members of the same Shareholder Group for purposes of the limitation on the number of votes described above.

Foreign Shareholder Group – A Shareholder Group will be considered foreign whenever one or more of its members is a Foreign Shareholder.

Brazilian Shareholders – The following are Brazilian Shareholders: (i) individuals born or naturalized in Brazil, residing in Brazil or abroad; (ii) legal entities organized under Brazilian private law and having their management based in Brazil, and which: a) have no foreign controlling shareholder or foreign parent company, unless the latter falls under item “b” of this definition; b) are controlled, directly or indirectly, by one or more individuals referred to in item (i) of this definition; and (iii) investment funds or clubs organized under the laws of Brazil and having their management based in Brazil and whose administrators and/or majority unitholders are persons referred to in items (i) and (ii) of this definition.

Foreign Shareholders – Foreign Shareholders are individuals, legal entities, investment funds or clubs and any other entities not included in the definition of Brazilian Shareholders, and those that fail to prove that they meet the requirements to be registered as Brazilian Shareholders, pursuant to paragraph 2 of Section 10 of the Company’s Bylaws.

6

2.2. Participation through electronic remote participation system in the Meeting

The Meeting will be held exclusively by digital means and, therefore, the Company shall provide an electronic remote participation system (Microsoft Teams) that will enable shareholders to participate, voice and vote in the Meeting without being physically present.

This remote participation system is in line with CVM Instruction 481 and allows, among other things: (i) discussion and simultaneous access to documents presented during the Meeting that have not been previously made available; (ii) the complete recording of the Meeting by the Company; and (iii) communication between shareholders.

Through this platform, the shareholder shall have real-time access to the audio and video of the presiding officers and the other shareholders, being able to voice and exercise all the rights to which they may be entitled under the applicable regulation.

Shareholders wishing to participate in the Meeting, directly or represented by proxies, shall state their intent to the Company by email to investor.relations@embraer.com.br, at least 48 hours before the Meeting, and such statement shall be duly accompanied by all the shareholders’ documentation to participate in the Meeting, as described below, and the shareholder shall be liable for the truthfulness of such documents.

The shareholder shall also inform the email address to which instructions for participating in the Meetings shall be sent.

The Company shall send instructions only to shareholders who have expressed their interest within the term and conditions above, and whose documentation has been validated by the Company. It is important to note that, pursuant to paragraph 3 of article 5 of CVM Instruction 481, shareholders who fail to state their intent and send the required documentation for digital participation within the aforementioned period will not be able to participate in the Meeting.

In the event the shareholder who has duly expressed his/her interest in participating in the Meeting does not receive from the Company the email with instructions for accessing and participating in the Meeting by 10:30 am on November 28, 2021, the shareholder shall contact the Company’s Investor Relations Department, through the telephone no. (11) 3040-8445, until 6 pm on November 28, 2021.

7

The shareholder or his/her/its accredited legal representative: (i) may use the link and instructions to be sent by the Company solely and exclusively to participate in the Meeting by digital means, (ii) is not authorized to transfer or disclose the link, in whole or in part, to any third party, whether shareholder or otherwise, as it is nontransferable, and (iii) is not authorized to record or reproduce, in whole or in part, nor to transfer to any third party, whether shareholder or otherwise, the content or any information transmitted by digital means during the Meeting.

The technical requirements for participating in Meeting are: (a) for participating by computer: (i) have a web browser compatible with Microsoft Teams installed; (ii) broadband Internet connection; (iii) built-in webcam or external USB camera, microphone and speakers compatible with Microsoft Teams; and (iv) minimum processor and other requirements recommended by the platform vendor (//microsoft.teams.com); and (b) for participating by mobile device: (i) have the Microsoft Teams app installed; (ii) have a broadband Internet connection; and (iii) have a camera, microphone and speakers compatible with Microsoft Teams.

The Company recommends that, on the date of the Meeting, accredited shareholders access the digital participation system at least 30 minutes before the time scheduled for the Meeting, that is, at 10:00 am on November 30, 2021, in order to allow, in an organized, efficient and timely manner, the validation of access and the proper identification and accreditation of the shareholder through the submission of his/her identity document with photo via webcam to the Company’s hosts.

The Company also recommends that the accredited shareholders be previously acquainted with the use of the Microsoft Teams electronic platform, and that they ensure the compatibility of their electronic devices with the use of the referred platform - via chat, audio and video.

We emphasize that, when accessing the link to participate in the Meeting, the attending shareholders shall activate the camera on their computer or mobile device, as the case may be, and, unless they are required by a Company representative, for any reason, to disconnect their video functionality, they shall keep their cameras on throughout the Meeting. The attending shareholders shall also, for the sake of sound quality, keep their microphones turned off, activating them only when they need to speak.

We note that, for purposes of optimizing time, the voting procedure adopted by the Company will only require shareholders to express themselves orally for any contrary votes or abstentions, and in the event of difficulties in the communication of the shareholder by audio, the contrary vote or abstention shall be accepted through chat.

8

The Company shall not be responsible for any operational or connection problems that any shareholder, legal representative or proxy may have, as well as for any other event or situation that is not under the Company’s control, which may hinder or prevent their participation in the Meeting by digital means.

In order to attend the Meeting directly or by proxy, we request that you submit to Embraer, at least 48 (forty-eight) hours prior to the date of the Meeting, the following documents:

a) power of attorney with special powers for representation at the Meeting, in the case of a proxy;

b) for shareholders with shares held in deposit in the fungible custody of shares, a statement provided by the custodian institution confirming their respective shareholdings; and

c) evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, (x) presenting a valid identification document or (y) submitting to the Company a certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company shall waive the presentation of the certificate by a holder of book-entry shares included in the list of shareholders provided by the depositary financial institution), as set forth in Section 20 of the Company’s Bylaws.

For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also inform the Company, at least 48 (forty-eight) hours before the Meeting, whether you belong to a Shareholder Group.

The Company also informs that notarized powers of attorney shall not be required for this Meeting, also as a manner of facilitating the verification of powers in light of the current circumstances.

The aforementioned documents shall be delivered only through the e-mail investor.relations@embraer.com.br.

2.3. Participation through Distance Voting Ballot (Boletim de Voto à Distância)

If the shareholder wishes to send a distance voting ballot directly to the Company, the shareholder shall send the following documents, exclusively in electronic format, to the addresses below:

9

| (i) | a digital copy of the original distance voting ballot, available on the websites of the Company (ri.embraer.com.br), the Brazilian Securities Commission (Comissão de Valores Mobiliários - CVM) (www.cvm.gov.br) and the Brazilian Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão) (www.b3.com.br) duly filled in, initialed on all pages and signed at the end; |

| (ii) | for purposes of evidencing that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, (x) a digital copy of the original identity document, or (y) the certificate issued by the depositary financial institution evidencing the shares in book-entry form or in custody, pursuant to Section 40 of Law No. 6,404/76 (the Company shall waive the presentation of the certificate by a holder of book-entry shares included in the list of shareholders provided by the depositary financial institution); and |

| (iii) | a digital copy of the original of the following documents: |

For individuals:

| • | identity document with a photograph of the shareholder; |

For legal entities:

| • | current bylaws or consolidated articles of association and corporate documents that evidence the legal representation of the shareholder; and |

| • | identity document with a photograph of the legal representative. |

For investment funds:

| • | the fund’s current consolidated governing document; |

| • | bylaws or articles of association of its administrator or manager, as the case may be, according to the voting policy of the fund, and corporate documents evidencing the powers of representation; and |

| • | the legal representative’s identity document with photo. |

The above distance voting ballots and documents shall be received by no later than seven days before the date of the Meeting and those received after such date shall be disregarded.

The Company waives the authentication or notarization of the signature and legalization of the document for acceptance of the distance voting ballot. The Company will not require the sworn translation of documents that have been originally written in Portuguese, English or Spanish, or that are delivered jointly with the respective translation to such languages. The following identity documents shall be accepted, provided they include a photograph: identity card (RG), national registry of foreigners (RNE), driver’s license (CNH), passport or officially recognized professional identification.

10

Under the terms of the current regulations, the Company shall inform the shareholder, within 3 days, (i) whether the distance voting ballot has been received, as well as whether the documents received are sufficient for the vote to be deemed valid; or (ii) the need to rectify or resend the distance voting ballot or any accompanying documents, describing the procedures and deadlines required for the distance voting ballot to be valid.

As an alternative to sending the distance voting ballot directly to the Company, shareholders holding shares issued by the Company may send voting instructions regarding completion of the distance voting ballot by means of: (i) their respective custody agents, in the case of shares that are held in a central depository; or (ii) the financial institution engaged by the Company to provide securities bookkeeping services, in the case of shares that are not held in a central depository.

The Company requests that the above documents be sent to the attention of its Investor Relations Department, exclusively to: investor.relations@embraer.com.br.

If you have any questions regarding the procedure and deadlines described in this item 2, we ask that you contact the Investor Relations Department at (11) 3040-8445, or by e-mail at investor.relations@embraer.com.br

11

(The Call Notice will be published in the newspapers O Vale, Valor Econômico and Official Gazette of the State of São Paulo in the editions dated October 29 and 30 and November 4, 2021)

EMBRAER S.A.

PUBLICLY HELD COMPANY

CNPJ/ME No. 07.689.002/0001-89

NIRE 35.300.325.761

Call Notice

We invite the shareholders of EMBRAER S.A. (“Company”) to attend an Extraordinary General Shareholders’ Meeting to be held on November 30, 2021, at 10:30 am, exclusively by digital means, as detailed below, to be deemed as having been held, for the purposes of CVM Instruction No. 481/2009, as amended (“ICVM 481”) at the Company’s headquarters, in the city of São José dos Campos, State of São Paulo, at Avenida Brigadeiro Faria Lima 2170, Building F-100, to review and resolve on the following agenda:

| 1. | the terms and conditions of the “Protocol and Justification for Partial Spin-off of Yaborã Indústria Aeronáutica S.A., with transfer of the spun-off portion to Embraer S.A.” (“Protocol and Justification”), entered into by the management of the Company and its wholly-owned subsidiary Yaborã Indústria Aeronáutica S.A. (“Yaborã” and “Transaction”, respectively); |

| 2. | the ratification of the engagement of specialized company Pricewaterhousecoopers Auditores Independentes, enrolled with the Taxpayers’ Registry (CNPJ/ME) under no. 61.562.112/0011-00 (“PwC”), to prepare the appraisal report on the spun-off portion of Yaborã to be transferred to the Company, at book value, based on Yaborã’s balance sheet prepared as of July 31, 2021 (“Appraisal Report”); |

| 3. | the Appraisal Report; |

| 4. | the Transaction, under the terms and conditions set forth in the Protocol and Justification, without capital increase or issue of new shares and effective as of January 1, 2022; and |

| 5. | the granting of authorization for the Company’s management to perform any acts required for the implementation of the Transaction, as well as ratify the acts that have already been performed. |

12

Pursuant to Paragraph 6 of Article 124 of Law 6,404/76, the documents that are the subject matter of the resolutions of the Meeting hereby called, including those mentioned in Article 20-A of ICVM 481, are available to shareholders at the Company’s headquarters and on the Internet at the Company’s website (ri.embraer.com.br), at the Brazilian Securities Commission’s (Comissão de Valores Mobiliários – CVM) website (www.cvm.gov.br) and at the Brazilian Stock Exchange’s (B3 S.A. – Brasil, Bolsa, Balcão) website (www.b3.com.br).

General Instructions:

| a) | Shareholders may participate in the Meeting through distance voting ballot (boletim de voto à distância) or through the electronic remote participation system provided by the Company. |

| b) | To participate in the Meeting directly, through a legal representative or proxy, we request that you submit to the Company, at least 48 hours prior to the date of the Meeting, the following documents: (i) power of attorney with special powers for representation at the Meeting, in the case of a proxy; (ii) for shareholders with shares held in deposit in the fungible custody of shares, a statement provided by the custodian institution confirming their respective shareholdings; and (iii) evidence that such shareholder qualifies as a Brazilian Shareholder or a Foreign Shareholder, as provided for in Section 20 of the Company’s Bylaws. For purposes of verifying the limit of votes that may be cast at the Meeting, you shall also inform the Company, at least 48 hours prior to the Meeting, whether you belong to a Shareholder Group (as defined in Section 12 of the Company’s Bylaws). |

| c) | The documents mentioned in item “b” above shall be sent to the attention of the Investor Relations Department, to investor.relations@embraer.com.br. |

Additional Information regarding participation in the Meeting:

ELECTRONIC PARTICIPATION SYSTEM: The Shareholders who choose to participate in the Shareholders’ Meeting through an electronic remote participation system shall do so using the Microsoft Teams electronic platform, provided that the guidelines and data for connection in the electronic environment shall be sent to the Shareholders or, if

13

applicable, their legal representatives or proxies, who express their interest in participating in the Meeting through an e-mail to investor.relations@embraer.com.br, sent by November 28, 2021, which shall also include the documents required for such shareholder’s participation in the Meeting as detailed in the Management’s Proposal.

The electronic participation system to be made available by the Company will enable Shareholders registered within the aforementioned period to make statements and vote at the Meeting without being physically present, as set forth in ICVM 481.

Detailed rules and guidelines, as well as the procedures and additional information for Shareholder’s participation in the Meeting by means of the electronic participation system are contained in the item of the Management Proposal available on the Internet at the Company’s website (ri.embraer.com.br), at the Brazilian Securities Commission’s (Comissão de Valores Mobiliários – CVM) website (www.cvm.gov.br) and at the Brazilian Stock Exchange’s (B3 S.A. – Brasil, Bolsa, Balcão) website (www.b3.com.br).

DISTANCE VOTING BALLOT: to participate in the Meeting through distance voting ballot (boletim de voto à distância), shareholders shall send a distance voting ballot directly to the Company or through third parties, according to the instructions contained in the Manual for the Meeting published on the date hereof and available on the websites specified above.

Any questions regarding this Call Notice shall be submitted to the Company’s Investor Relations Department, at investor.relations@embraer.com.br.

São José dos Campos, October 29, 2021.

Alexandre Gonçalves Silva

Chairman of the Board of Directors

14

4. Management’s Proposals on the Agenda

4.1. To approve the terms and conditions of the “Protocol and Justification for Partial Spin-off of Yaborã Indústria Aeronáutica S.A. with transfer of the spun-off portion to Embraer S.A.”, entered into by the Company’s and Yaborã’s management (“Protocol and Justification”).

Embraer’s Management recommends that its shareholders carefully examine the terms and conditions of the Protocol and Justification for the Transaction and, if the shareholders agree, approve the aforementioned Protocol and Justification.

It should be noted that, on the date hereof and at the time of the Transaction, the Company is and shall continue to be the owner of 100% of the shares representing Yaborã’s capital stock and that such transaction, therefore, reflects only a corporate reorganization aimed at reducing operational, systemic, administrative and tax expenses. The transfer of Yaborã’s spun-off portion will not result in an increase or decrease in the Company’s shareholders’ equity, given that 100% of the shares representing Yaborã’s capital stock are owned by the Company, and, insofar as Yaborã’s shareholders’ equity is already fully reflected in the Company’s shareholders’ equity, as a result of the application of the equity method.

4.2. To ratify the engagement of specialized company Pricewaterhousecoopers Auditores Independentes, enrolled with the Taxpayers’ Registry (CNPJ/ME) under no. 61.562.112/0011-00 (“PwC”), to prepare the appraisal report on the spun-off portion of Yaborã to be transferred to the Company, at book value, based on Yaborã’s balance sheet prepared as of July 31, 2021 (“Appraisal Report”).

In accordance with the provisions of Articles 227 and 8 of Law No. 6,404/76, Embraer’s Management proposes the ratification of the engagement of specialized company Pricewaterhousecoopers Auditores Independentes, enrolled with the Taxpayers’ Registry (CNPJ/ME) under no. 61.562.112/0011-00 (“PwC”) to carry out the appraisal of the spun-off portion of Yaborã to be transferred to Embraer, at book value, based on Yaborã’s analytical balance sheet prepared as of the Reference Date, in functional currency and converted to reais on the balance sheet date, in accordance with the applicable accounting standards, the result of which is the subject-matter of the Appraisal Report.

Pursuant to Article 21 of CVM Instruction No. 481/09, we provide the required information in Annex I hereto.

15

4.3. To approve the Appraisal Report.

Embraer’s Management proposes that the Appraisal Report be approved. Regarding the appraisal report’s preparation requirement set forth in Article 264, Paragraph 1, of the Brazilian Corporations Law, at a meeting held on 02.15.2018, in the scope of SEI proceeding no. 19957.011351/2017-21, the Collegiate of the Brazilian Securities and Exchange Commission unanimously decided that the aforementioned article is not applicable in the merger of a wholly-owned subsidiary into a publicly-held parent company, since, due to the inexistence of non-controlling shareholders of the mergee, the essential condition set forth in such provision would not be present. Therefore, for the purposes of transfer of the spun-off portion of Yaborã to the Company, the aforementioned appraisal report’s preparation requirement does not apply.

4.4. To approve the Partial Spin-off, under the terms and conditions established in the Protocol and Justification, without capital increase or issuance of new shares and effective as of January 1, 2022.

Embraer’s Management proposes the partial spin-off of Yaborã and subsequent transfer of the spun-off portion to the Company, under the terms and conditions established in the Protocol and Justification, without capital increase or issuance of new shares, effective as of January 1, 2022.

Pursuant to Section 20-A of CVM Instruction 481/09, we provide the main terms of the Transaction in Annex II hereto.

4.5. To authorize the Company’s management to perform any acts required for the implementation of the Transaction, as well as ratify the acts that have already been performed.

Embraer’s Management proposes to authorize the Company’s management to perform any acts required for the implementation of the Transaction, as well as ratify the acts that have already been performed.

16

Annex I – INFORMATION ABOUT THE APPRAISAL EXPERTS

(Pursuant to Annex 21 to ICVM 481/09)

1. List the appraisal experts recommended by the management.

Pricewaterhousecoopers Auditores Independentes, enrolled with the Taxpayers’ Register (CNPJ/ME) under No. 61.562.112/0011-00, with headquarters in the capital of the State of São Paulo and branch office in the city of São José dos Campos, State of São Paulo, at Rua Carlos Maria Auricchio 70, suites 1401, 1403, 1404, 1406, 1407, 1409 and 1412, 14th floor, Condomínio Costa, Norte Offices Royal Park, Bairro Royal Park.

2. Describe the qualifications of the recommended appriasal experts.

PricewaterhouseCoopers Auditores Independentes is originally registered with the Regional Accounting Council of the State of São Paulo under No. 2SP000160/O-5, with its Articles of Association registered with the 4th Registry of Deeds and Documents and Civil Registry of Legal Entities of São Paulo - SP, and amendments thereto registered with the 2nd Registry of Deeds and Documents and Civil Registry of Legal Entities of São Paulo - SP.

In the country for over 100 years, PricewaterhouseCoopers has around 4,000 professionals, distributed in 15 offices in all regions of Brazil, in addition to being present in numerous other countries.

PwC values transparency, engagement, and combines experience in auditing, tax and compliance with increased capacity in specialized areas such as cybersecurity, data privacy, ESG and artificial intelligence, in addition to expertise in digital services, people and organization, taxes, mergers and acquisitions and business reorganization.

3. Provide a copy of the engagement letter and the compensation of the recommended appraisal experts.

See engagement letter attached as Annex I.3 hereto.

4. Describe any relevant relationship over the past three (3) years between the recommended appraisal experts and the company’s related parties, as defined by the accounting standards concerning this matter.

17

PricewaterhouseCoopers Auditores Independentes is not a related party of Yaborã Indústria Aeronáutica S.A. or Embraer S.A. as defined by Technical Standard CPC 05 – Related Parties. The referred appraisal experts, in the last 3 years, provided accounting auditing and advisory services for both entities and for other subsidiaries of Embraer S.A. The services provided and related fees for the year ended December 31, 2020 are detailed below:

(i) external audit services referring to the review of individual and consolidated ITRs and the audit of Financial Statements;

(ii) audit-related services, mainly referring to compliance services provided to the Company, regarding the documents filed with regulatory and governmental agencies; and

(iii) tax services fees, related to tax compliance services for some of Embraer’s subsidiaries.

In the year ended December 31, 2020, the appraisal experts received fees in the amount of R$ 23,005.0 thousand, of which R$ 19,661.0 thousand refer to external audit services, R$ 2,910.0 thousand to audit-related services, R$ 203.0 thousand related to tax service fees and R$203.0 thousand to other fees.

18

Annex I.3.

Engagement letter and compensation of the recommended appraisal experts

19

www.pwc.com.br

Embraer S.A. and Yaborã Indústria Aeronáutica S.A. |

Engagement letter for professional services

October 2021 |

Attn: Management

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

Av Brigadeiro Faria Lima, 2170

São José dos Campos - SP

October 4, 2021

Dear Sirs,

| 1 | PricewaterhouseCoopers Auditores Independentes, with headquarters in the capital of the State of São Paulo and branch office in the city of São José dos Campos, São Paulo, at Rua Carlos Maria Auricchio, 70, 14th Floor, Edifício Royal Park, enrolled with the Corporate Taxpayers’ Register (CNPJ/MF) under No. 61.562.112/0011-00 (“PwCAI”), thank you for the opportunity of performing the audit services. The purpose of this letter is to confirm our understanding with respect to our and your responsibilities in connection with our engagement as auditors of Yaborã Indústria Aeronáutica S.A. (“Company”), for the year ended July 31, 2021, for issuance of the report on the shareholders’ equity consisting of certain assets and liabilities of Yaborã Indústria Aeronáutica S.A. based on the accounting records on July 31, 2021, for purposes of merger of the Company into Embraer S.A. (“Embraer”), pursuant to Articles 226 et seq. of Law6404/76 (“shareholders’ equity” and “appraisal report on the shareholders’ equity”). The terms of this letter shall remain effective until modified in writing with the consent of both parties. |

| 2 | We will issue the appraisal report on the shareholders’ equity based on the accounting records of Yaborã Indústria Aeronáutica S.A. on July 31, 2021 and its corresponding annexes, prepared in accordance with the accounting practices adopted in Brazil. Our report will be based on audit procedures applied to the Company’s balance sheet. |

Upon completion of our audit, we will issue and provide to the Company an appraisal report on the shareholders’ equity, in Portuguese, which should be delivered on September 20, 2021. In addition, the person responsible for preparing the appraisal report shall attend the Extraordinary General Shareholders’ Meeting of Embraer S.A. that approves the merger of the Company, for purposes of clarifying any matters, in accordance with Law 6404/76.

| 3 | We will discuss with you a timetable for our work, which will include a final visit after the balance sheet is delivered to us for audit. We expect to deliver a draft of our appraisal report for your review approximately 1 week after completion of our field work, as well as to issue our final report as soon as we receive the management representation letter. Compliance with the above deadlines is directly related to the timely delivery by Yaborã Indústria Aeronáutica S.A. of all documents, information and representation letter required for the performance of our services. |

| 4 | Our appraisal report on the shareholders’ equity will express our conclusion on the Company’s shareholders’ equity, at book value, including any adjustments identified during our audit. |

In addition, our report may include an emphasis paragraph or a paragraph on other matters, in the circumstances also set forth in the auditing standards.

2 of 12

PricewaterhouseCoopers Auditores Independentes, Rua Carlos Maria Auricchio, 70, 14º, Ed. Royal Park ,São José dos Campos, SP, Brasil, 12246-876, T: (12) 3519-3900, www.pwc.com/br

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 5 | Our audit shall be conducted in accordance with Brazilian and International auditing standards, issued by the Federal Accounting Council (Conselho Federal de Contabilidade - CFC) and the International Auditing and Assurance Standards Board (IAASB), respectively. These standards require the auditor to comply with the relevant ethical requirements set forth in the Code of Professional Ethics and Professional Standards, issued by the CFC, and that the audit be planned and performed with the objective of obtaining reasonable assurance about whether the financial statements are free from material misstatements. An audit involves performing procedures to obtain audit evidence regarding the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. The risks of not detecting a material misstatement resulting from fraud are higher than those arising from error, as fraud may involve intentional acts of circumventing internal controls, collusion, forgeries, omissions or false presentations and representations. An audit also includes evaluating the appropriateness of accounting practices used and the reasonableness of accounting estimates made by management. |

| 6 | Reasonable assurance means an increased level of assurance, but not a guarantee that an audit carried out in accordance with the Brazilian and International standards on auditing will always detect any existing material misstatements. Misstatements may result from fraud or error and are considered material when, individually or as a whole, they may influence, within a reasonable perspective, the economic decisions made by users based on the related financial statements. |

| 7 | Due to the limitations inherent to the audit and to the internal control structure, there is an unavoidable risk that some material misstatements may not be detected, even if the audit is properly planned and performed in accordance with auditing standards. In our risk assessment, we will consider internal controls that are relevant for preparing of the Company’s balance sheet, for planning audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal controls. However, we will report in writing any significant deficiencies in the internal control structure that may be relevant for the audit of the balance sheet that we identify during the audit procedures. This report is intended solely for use by the management. |

| 8 | The balance sheet to be audited is the management’s responsibility. Management is responsible for the properly preparation and presentation of the balance sheet in accordance with practices adopted in Brazil, as the case may be, and for the internal control structure required for the balance sheet to be free of material misstatements, whether due to fraud or error. The procurement of balance sheet audit services and the issuance of the appraisal report on the shareholders’ equity do not relieve management of this responsibility. Management is also responsible for making available to the auditor all relevant information of which management is aware for preparing the balance sheet, such as records, documentation and other matters, as well as additional information that may be requested from management for audit purposes and for providing unrestricted access to Company personnel as the auditor may deem necessary to obtain audit evidence. |

| 9 | As required by auditing standards, we will make specific inquiries of management and others at the Company about the representations embodied in the balance sheet and the effectiveness of internal controls associated with transactions, records and financial reporting. The auditing standards also require that we obtain a representation letter from senior management, including the CEO, covering material matters and basic representations in relation to the appraisal report on the shareholders’ equity. In addition, |

3 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| management agrees to inform us of facts that may affect the appraisal report on the shareholders’ equity of which it may have become aware during the period between the date of the appraisal report on the shareholders’ equity and the date on which the report was is published. The results of our audit tests, the responses to our inquiries and the written representations of management shall constitute the evidence upon which we intend to rely in forming our opinion expressed in the appraisal report on the shareholders’ equity. |

| 10 | Company’s management is primarily responsible for preventing and detecting errors and fraud. In this context, an effective internal control structure reduces the possibility that errors and fraud may occur or, at the very least, contributes to their being detected, both by management and by the independent auditors. |

| 11 | Consequently, although we cannot guarantee their detection, our work is planned and executed to obtain reasonable, but not absolute, assurance that any errors or fraud that could have a material effect on the balance sheet are detected. The audit is based on the concept of selective testing of the data under examination and, as such, is subject to limitations; therefore, errors and fraud that may have direct effects on the balance sheet may eventually go undetected. |

Furthermore, consideration of existing control systems will not be sufficient to enable us to provide assurance regarding the reliability and effectiveness of the internal controls related to transactions, records and financial reporting.

| 12 | Our audit according to the auditing standards does not include a detailed audit of transactions to the extent necessary to detect errors and fraud that do not have a material effect on the shareholders’ equity. However, we will inform you of any such matters that come to our attention. In this context, the concept of materiality is considered in relation to the shareholders’ equity and not for its absolute or isolated effect. |

| 13 | Except for the purposes for which the report on shareholders’ equity is proposed and for its respective disclosure on the website and filing with regulatory bodies, if you intend to publish or reproduce our appraisal report on the shareholders’ equity or otherwise make reference to PwCAI in a document that contains other information, it is hereby mutually agreed that the draft of said document will be provided to PwCAI to read, review and approve before it is distributed to third parties and the report is included therein. We emphasize that our report shall always be reproduced in full, including its annexes. |

4 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 14 | Notwithstanding the foregoing, in the event that you decide to include our appraisal report on the shareholders’ equity in public offering documents or other form of document, if applicable, you agree to obtain our prior consent or authorization. Likewise, no reference to PwCAI may be included in such documents without our prior consent. Any work in connection with these types of documents should be procured separately. |

| 15 | Regulations established by some countries include the requirement that the auditor be registered in that country if the Company makes an offer or filing of financial information with the appraisal report on the shareholders’ equity. The potential consequences of non-compliance with this requirement for timely auditor registration can be severe for both PwCAI and the Company. The Company agrees that our appraisal report on the shareholders’ equity, or reference to us, will not be included in an offer document in a regulatory body, or equivalent, domiciled abroad without our prior written consent. Any agreement to perform services related to an offer, including our consent, shall be subject to a separate services agreement. |

| 16 | The Company agrees to provide, in a timely manner, a copy of correspondences, notices or requests issued by the regulatory bodies to which the Company is subject and that are directly or indirectly related to the referred appraisal report and, therefore, may be of interest to the independent auditors. The Company further agrees, in cases not prohibited by law, to immediately inform PwCAI of the receipt of any official communication, letter, notice, assessment notice, court order or request (“communications” or “notices”) from authorities requiring the submission of information and/or clarifications regarding fraud or alleged fraud, or non-compliance with laws or regulations. The Company also undertakes to provide PwCAI with a copy of the statements, answers, considerations and other communications sent to such authorities in response to the communications received. |

| 17 | The audit will be conducted with the main objective of issuing an appraisal report on the shareholders’ equity, in connection with the merger of the Company into Embraer and will not be planned or conducted to meet other transaction requirements or specific expectations of any third parties; therefore, matters of possible private interest to third parties may not be specifically addressed. There may be matters that would be assessed differently by third parties, possibly in connection with another specific transaction. |

| 18 | PricewaterhouseCoopers refers to the global group of PricewaterhouseCoopers firms, each of which constitutes a fully autonomous and independent legal entity, organized as a network of companies. PwCAI may, at its discretion, use and/or subcontract the resources of other PwC firms, and/or third parties (hereinafter “PwC Subcontractors”), within or outside Brazil, in connection with the provision of the services and/or for internal, administrative and/or regulatory compliance purposes. Each PwC Subcontractor is subject to confidentiality requirements substantially similar to those of PwCAI. Thus, you agree that PwCAI may provide information, which PwCAI receives in connection with this agreement, to PwC Subcontractors for such purposes. PwCAI shall be solely responsible for the provision of the services (including those performed by PwC Subcontractors) and for the protection of the information provided to PwC Subcontractors. |

5 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 19 | Notwithstanding the contents of the previous paragraph, during the performance of the audit services, PwCAI may, at its discretion, use resources of other entities and companies comprising the global PricewaterhouseCoopers network (“Other PricewaterhouseCoopers Firm(s)”). However, the responsibility for preparing and issuing reports relating to this engagement letter is and will continue to be exclusively that of PwCAI. Any professionals of Other PricewaterhouseCoopers Firm(s) involved in the rendering of the services set forth in this engagement letter will act only on behalf of PwCAI. PwCAI assumes full and exclusive responsibility for the actions of professionals of Other PricewaterhouseCoopers Firm(s) involved in the execution of the services provided for herein. |

| 20 | The following items are intended to regulate the processing of personal data by the parties pursuant to Law No. 13,709/2018 (General Data Protection Law or LGPD), with the specific and limited purpose of carrying out the activities set forth in this proposed letter. In this context, PwCAI shall act solely and exclusively as PROCESSOR, processing the personal data transmitted by the Company, which, in turn, will act as CONTROLLER, in accordance with the definitions set forth in the General Data Protection Law. The parties hereto agree that: |

| (a) | The CONTROLLER is liable for the legitimacy of all personal data of data subjects that shall be processed by the PROCESSOR, including those that require the holder’s consent, and for the accuracy of these data, and is also responsible for excluding sensitive personal data and informing the PROCESSOR of any changes that may affect the duties of the data subject whose data is being processed. |

| (b) | The PROCESSOR shall not process any personal data that is not duly in line with the scope of this proposed letter, unless required as a result of a legal obligation, and shall keep the appropriate records of the personal data processing operations carried out. Requests for compliance with the rights of the data subject, informed by the CONTROLLER, shall only be fulfilled if they do not conflict with independent legal grounds or professional standards of the PROCESSOR. |

| (c) | The PROCESSOR confirms the adoption of security, technical and administrative measures aimed at protecting personal data from: a) unauthorized access, b) accidental or unlawful situations, c) destruction, loss, alteration, communication or any form of inappropriate or unlawful processing. The PROCESSOR undertakes to notify the CONTROLLER, in compliance with LGPD requirements, of the occurrence of any event that results in unauthorized access or inadequate data processing. |

| (d) | Upon termination of this Agreement, the PROCESSOR shall delete or destroy all personal data processed to comply with this Agreement, except for methodologies, tools and working papers and files created, which are kept by the PROCESSOR, based on legal grounds resulting from applicable professional standards. |

| 21 | As you are aware, several anti-money laundering laws and related provisions are in force, including Laws 9,613/98 and 12,683/12, which provide that auditors, advisors and accounting, tax and business consultants are required to report to the Financial Activities Control Board (COAF) the occurrence of any of the circumstances described in the aforementioned laws and regulations approved by COAF and/or other regulators of professional activities performed by PwCAI. The parties undertake to strictly comply with these laws, as well as Law 12,846/2013 (“Anti-Corruption Law”). Any circumstances reported to meet the obligations of PwCAI under these laws do not and will not constitute a breach of PwCAI ‘s professional and/or contractual obligation of confidentiality. |

6 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 22 | In the course of our activities, it is common for us to develop software, including spreadsheets, documents, databases and other electronic tools as support material for our work. In some cases, we may make these instruments, as well as data and documents, available to the Company upon formal request. Considering that these tools were specifically developed to meet our own goals, without taking into account, therefore, any other purposes for which the Company may use them, they will be made available in a non-customized basis, for the Company’s exclusive use, and shall not be provided to or shared with third parties. Thus, we cannot be held responsible for the adequacy or suitability of the software tools for any purpose for which the Company may use them. Any specific software tool developed for Yaborã Indústria Aeronáutica S.A. shall be subject to a separate engagement letter. |

| 23 | Methodologies, tools, working papers and files created by us in the course of our audit, including electronic documents and files, are the exclusive property of PwCAI, in accordance with the rules governing our professional activities. |

| 24 | In addition, aiming at the greatest possible agility and objectivity in the provision of our professional services, we may use electronic messages (e-mail), which may be intercepted, corrupted, lost, destroyed, delivered late or incompletely or otherwise be adversely altered by third parties, notwithstanding our measures to protect our electronic communication systems against breaches. |

| 25 | Our fee estimates are based on the time required by the professionals assigned to the audit. Individual hourly rates vary depending on the level of responsibility involved and the experience and skill required. |

| 26 | We estimate that our fees for this audit will be R$ 530,000.00 (five hundred and thirty thousand reais), in addition to the expenses we may incur. This estimate takes into account the agreed-upon level of preparation and assistance from the Company’s personnel; should this assistance not be provided or should any other circumstances arise which may cause actual time to exceed the estimate, we will bring such fact to the management’s attention. |

7 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

In addition to the amounts above, the fees to be invoiced by PwCs abroad are as follows:

PwC country | Original currency | Original currency amount | ||||||||

Embraer Estruturas Metalicas | PwC Portugal (*) | EUR | ||||||||

Embraer Estruturas em Composto | PwC Portugal (*) | EUR | 7,500.00 | |||||||

Embraer Portugal Holding SGPS | PwC Portugal (*) | EUR | ||||||||

Embraer Aviation France | PwC France (*) | EUR | 12,000.00 | |||||||

(*) amounts will be billed by our offices located abroad to the above-described subsidiaries.

| 27 | The fees billed by PwC Brazil shall be paid in a lump sum within 30 days after authorization of payment by the management; as for the fees billed by PwC abroad, payment shall occur within 60 days. |

| 28 | The assignment or transfer of the rights and obligations arising from this proposed letter to any third party is prohibited without the prior and express authorization of the other party, except in the event of assignment, by PwCAI, of the credit right for payments with maturity date exceeding 45 (forty-five) days, through bank-issued invoices on behalf of the financial institution to which the right was assigned, in the amounts and within the terms agreed upon in this proposed letter. |

| 29 | Our fees take the following into consideration: |

| (a) | Support from the Company’s personnel for prior preparation of analyzes (requests for analysis) and account reconciliations, which are necessary for the process of closing the accounts and preparing the balance sheets, and critical for the audit, as well as the identification and separation of documents on file and the supply of information in response to our inquiries. |

We emphasize that the correct and complete filling of the analysis requests (to be delivered in advance), in a timely manner, is critical for our work to be carried out efficiently and within the proposed budgeted hours. Our process of requesting our clients to prepare these analyzes and statements is actually advantageous and cost-effective, since our time is exclusively dedicated to the review of information and data relating to the accounts, rather than their compilation.

| (b) | The application of our audit procedures and the corresponding documentation of our work are carried out in electronic apps and tools that essentially depend on a permanent connection to the Internet. Thus, you undertake to provide, during our field work, minimum conditions for internet connection for the correct operation of these apps and tools. If such provision is not possible, we will use alternative solutions, the related expenses of which will be presented to you in advance. |

| (c) | Additional consultations involving our specialized departments or special services will be invoiced separately from the aforementioned fees, after your analysis and prior approval. |

8 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| (d) | Expenses such as (air or land) transportation, lodging, meals, telephone calls, fax, ground transportation tickets, mileage, etc. are included in the fees described in paragraph 26 above. |

| (e) | Fees shall be subject to revision by the parties whenever there is a contractual imbalance due to changes in the country’s economic and financial environment or in the event of an increase in the scope of the services hereby procured, which shall be previously approved by Embraer. Such revision shall be formalized in writing by means of an addendum executed by both parties. |

| (f) | Our fees, as established herein, include taxes, charges, contributions and other fees that are levied on the services hereby procured in accordance with the legislation in force on the date of issuance of this engagement letter. |

| (g) | It is hereby mutually agreed by the parties that any changes that entail an increase in the tax burden on services, such as the creation of new taxes, increase in rates, levying of ISSQN in a manner other than the one carried out at the time of execution of this engagement letter, changes in practices repeatedly observed by the relevant tax authorities, administrative and/or judicial decisions or change in the interpretation of the applicable tax legislation, shall result in a corresponding change in the fees agreed herein, in the same amount as the increase in rates or new taxes levied. PwCAI will notify, in writing, the change, its impact on fees and the effective date of the respective change. |

| 30 | The Company will make the payments by the maturity date. In the event of late payment, the Company, by operation of law, will be deemed to be in default, and the outstanding balance will accrue a fine of 2% (two percent), interest in arrears of 1% (one percent) per month, as well as inflation indexation on a pro rata die basis based on the General Market Price Index (IGPM), published by the Getulio Vargas Foundation. At PwCAI’s discretion, and without prejudice to the possibility of termination of this engagement, PwCAI may suspend the provision of services until the payment is settled, upon express notice to the Company. Such event shall not give rise to any basis for a claim by the Company for delays in meeting the contractual dates, which shall be extended for the same number of days as payment is delayed. |

| 31 | Any additional services that you may requested and that we agree to provide shall be the subject of separate written agreements. |

| 32 | It is our desire to provide you at all times with a high quality service that meet your needs. If, at any time, you would like to discuss with our professionals how our services could be improved or if you do not agree with any aspect of our services, we kindly request that you immediately raise the matter with the partner in charge. If, for any reason, you prefer to discuss these aspects with someone other than that partner, please contact Mauricio Moraes, audit leader in the countryside of São Paulo, through the telephone number (19) 3794-5400. In this manner, we are able to ensure that your concerns are dealt with carefully and promptly. |

| 33 | Please note that PwCAI has a customer satisfaction monitoring system, which includes interviews and surveys, presented by sampling each year. |

9 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 34 | Confidentiality. The Parties undertake to (i) use confidential information solely for the purpose of performing the procured Services and (ii) treat the content of all information and data to which the Parties may have access under this Agreement as strictly confidential, undertaking not to disclose them, in whole or in part, to any third parties; such obligation shall survive, regardless of the expiration or termination of this Agreement, until the information becomes public domain, except as a result of a court order or order of any relevant administrative authority, and provided that the Party that is required to make such disclosure, within the legal limits, helps the Party to which the Confidential Information belongs to limit the disclosure to that which is strictly necessary to comply with the law or order and notifies the owning Party of such disclosure so that the owning Party can take appropriate measures to defend its rights. |

34.1 The Contractor also undertakes not to mention, disclose or use, in any form, and prevent its personnel from disclosing or using the corporate name (or any part thereof), products, corporate information or trademarks of Embraer, without the prior and express authorization of Embraer.

34.2 Without prejudice to the responsibility of each Party with respect to the confidential information of the other Party, the Parties undertake to maintain an internal confidentiality policy applicable to their employees and agents and/or enter into non-disclosure agreement with their respective employees, agents, as well as with third parties who may have access to the confidential information.

34.3 The following shall not be deemed as confidential information: information that is already in the public domain on the date of its conveyance and information that is proven to have been developed by one of the Parties independently of the confidential information of the other party.

| 35 | Anti-Corruption Clause: |

aa. Each Party represents and warrants to the other Party that, in connection with this Letter (including its negotiation, execution or performance), it will not violate the “ABC Laws”.

bb. “ABC Laws” means (a) the United Nations Convention against Corruption (which is the subject of General Resolution 58/4); (b) the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions; (c) the general principles of the US Foreign Corruption Bribery Act (FCPA), the current version of the general principles of the United Kingdom Bribery Act (UKBA); and (d) any anti-money laundering laws and regulations applicable in relation to a Party, and any legislation enacted in the country in which that Party is established or where the Party shall carry out activities related to this Letter, which addresses the prevention of corruption, for example, the Brazilian Clean Company Law (Lei da Empresa Limpa).

cc. Each Party confirms the establishment of policies and procedures designed and implemented to comply with the ABC Laws (including, but not limited to, a code of ethics (or equivalent document) and a corruption prevention policy (or equivalent document)). Each Party undertakes to strictly comply with such policies and procedures.

10 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

dd. In addition, each Party represents that, in connection with this Letter, it has not offered, promised or authorized, nor will offer, make, authorize or promise, either directly or indirectly, any improper or corrupt payment (nor will it otherwise provide or have provided, in a corrupt or improper manner, any valuables) to anyone, including third parties. This includes offering, making, promising or authorizing any benefit or advantage, directly or indirectly, to any employee, executive, officer, agent or representative of the other Party, to any actual or potential customer of either Party, or to any “ Government Official”. For purposes of this Letter, “Government Official” means (a) an official or employee of any national, regional, local government or other government of any country, (b) an official or employee of any government department, agency or instrumentality, including any elected or appointed official in any branch (executive, legislative or judiciary), (c) an official or employee of a government-owned or controlled company or enterprise or who performs a government function, (d) an official or employee of a state-sponsored or public university or research organization, (e) an official or employee of a public international organization, (f) a candidate for a political office, (g) a political party or political party official, (h) a member of a royal family or military team, (i) an individual categorized as a Government Official under applicable local laws, and (j) any other person, individual or entity that suggests, requests or directs or for the benefit of any other person acting in an official capacity to any of the persons described in items (a) to (i) above or on their behalf.

ee. Each Party agrees to prepare, keep and maintain accurate and detailed financial records and books regarding its performance and payments made in connection with this Letter. Each Party shall develop and maintain a system of internal accounting controls that is sufficient to meet accounting requirements and comply with the laws of the country in which it is incorporated.

ff. Each Party shall inform the other Party, to the extent permitted by applicable laws, of any events that come to their knowledge which may result in a breach of this law compliance clause.

| 36 | The agreement formalized in this letter shall be governed and construed in accordance with the laws of the Federative Republic of Brazil and is hereby irrevocably agreed and accepted that the courts of São José dos Campos/SP shall have exclusive jurisdiction to settle any claim, dispute or controversy, including, without limitation, claims for compensation or counterclaims that may arise out of or in connection to this agreement. Each party irrevocably waives the right to any claim that the action was filed in an inapplicable forum or that such courts do not have jurisdiction. |

| 37 | We kindly request that you acknowledge receipt of this letter and express your “in agreement” with the terms set forth herein by signing the enclosed copy of the letter in the space provided below and return it to us. If your “in agreement” cannot be provided within the next 30 days, we reserve the right to review the terms, provisions and other conditions of this engagement letter. |

11 de 12

Embraer S.A. and Yaborã Indústria Aeronáutica S.A.

October 4, 2021

| 38 | If you require any further information or wish to discuss the terms of our engagement further, we are at your disposal for any necessary clarification. |

| 39 | This engagement letter is entered into with retroactive effect to August 31, 2021, and all acts performed by the parties hereto as of that date are ratified by them. |

Sincerely,

| PricewaterhouseCoopers | Rafael Alvim Guimarães | |||

| Auditores Independentes | Contador CRC 1RJ104572/O-0 | |||

| CRC 2SP000160/O-5 | ||||

| In agreement: | ||||

Embraer S.A. |

Antonio Carlos Garcia | |||

Embraer S.A. |

Fabiana Klajner Leschziner | |||

Yaborã Indústria Aeronáutica S.A. |

Antonio Carlos Garcia | |||

Yaborã Indústria Aeronáutica S.A. |

Fabiana Klajner Leschziner | |||

| Witnesses: | ||||

José Nestor Gava Filho |

Rafael Albano Pereira de Oliveira | |||

| CPF: 223.699.668-31 | CPF: 224.271.078-8 | |||

12 de 12

Annex II – INFORMATION ABOUT THE PARTIAL SPIN-OFF OF YABORÃ WITH TRANSFER OF THE SPUN-OFF PORTION TO EMBRAER

(Pursuant to Annex 20-A of ICVM 481/09)

1. Protocol and justification of the transaction, pursuant to articles 224 and 225 of Law No. 6,404, of 1976.

The protocol and justification for partial spin-off of Yaborã Indústria Aeronáutica S.A. (“Yaborã”) and subsequent transfer of the spun-off portion to Embraer S.A. (“Embraer” or “Company”) is attached as Annex II.1 hereto (“Protocol and Justification”).

2. Other agreements, contracts and pre-contracts governing the exercise of voting rights or the transfer of shares issued by the subsisting companies or companies resulting from the transaction, filed at the company’s headquarters or to which the company’s controlling shareholder is a party.

There are no other agreements, contracts or pre-contracts.

3. Description of the transaction, including:

(a) Terms and conditions:

The corporate reorganization comprises the partial spin-off of Yaborã with transfer of the spun-off portion to Embraer, for the commercial aviation business to be merged into Embraer, so that all assets and liabilities of Yaborã listed in the Appraisal Report attached to the Protocol and Justification as Annex 2.2 (“Spun-off Portion”) are transferred to Embraer, as recorded and reflected in the accounts in Yaborã’s balance sheet prepared as of July 31, 2021, in functional currency and converted to reais on the balance sheet date, in according with the applicable accounting standards (“Reference Date”), effective as of January 1, 2022, with no joint and several liability between the Parties, pursuant to the sole paragraph of article 233 of Law 6,404/76 (“Transaction”).

20

On the date hereof, Embraer directly owns 100% of Yaborã’s shares. Therefore, the transfer of the spun-off portion will not result in any increase or decrease in Embraer’s shareholders’ equity, considering that 100% of Yaborã’s shares are owned by Embraer and insofar as Yaborã’s shareholders’ equity is already fully reflected in Embraer’s shareholders’ equity, as a result of application of the equity method.

In addition, in substitution for the shares that are currently recorded in Embraer’s consolidated financial statements, the shareholders’ equity that comprises the spun-off portion, after the Transaction, will be directly recorded in Embraer’s financial statements. Thus, as a result of the Transaction, the investment account related to Embraer’s equity interest in Yaborã’s capital stock will be replaced in Embraer’s accounting by the assets and liabilities contained in Yaborã’s balance sheet, without any change to Embraer’s capital stock account.

The partial spin-off, followed by transfer of the spun-off portion to Embraer, will result in a reduction of Yaborã’s capital stock by R$ 2,648,928,198.01 (two billion, six hundred and forty-eight million, nine hundred and twenty-eight thousand, one hundred and ninety-eight reais and one cent) - composed by R$2,395,131,119.01 (two billion, three hundred and ninety five million, one hundred and thirty one thousand, one hundred and nineteen reais and one cent) corresponding to accrued losses and R$253,797,079.00 (two hundred, fifty three million, seven hundred and ninety seven thousand, seventy nine reais) corresponding to the spun-off portion of Yaborã - from R$ 4,933,102,244.80 (four billion, nine hundred and thirty-three million, one hundred and two thousand, two hundred and forty-four reais and eighty cents), divided into 4,933,102,244 (four billion, nine hundred and thirty-three million, one hundred and two thousand, two hundred and forty-four) common shares, all registered and without par value, to R$ R$ 2,284,174,046.79 (two billion, two hundred and eighty-four million, one hundred and seventy-four thousand, forty-six reais and seventy-nine cents), without any change in the number of Yaborã’s shares, with resulting amendment to Article 5 of its bylaws. The other corresponding entries for the Transaction for transfer of the Spun-off Portion shall be carried out directly in Yaborã’s shareholders’ equity accounts.

Embraer’s capital stock will remain unchanged, and there will be no issuance of new shares, as Embraer controls 100% of the investment in Yaborã and the transfer of the Spun-off Portion will not result in an increase or decrease in Embraer’s shareholders’ equity, as set forth above.

Changes in equity related to the items of the Spun-off Portion, determined between the Reference Date and the date in which the Partial Spin-off is carried out, shall be allocated to Embraer, making the necessary entries and changes in the Parties’ accounting records.

Lastly, Embraer will continue, after the Transaction, to dedicate itself to the development, manufacture and sale of aircraft and aerospace materials in the various segments in which Embraer operates, maintaining its registration as a publicly held company. Yaborã, on the other hand, after the Transaction, will continue with the same corporate purpose, and has no intention of obtaining registration as a securities issuer.

21

(b) Obligations to indemnify: (i) the members of management of any of the companies involved; (ii) if the transaction does not take place.

There are no obligations to indemnify.

(c) Comparative table of the rights, advantages and restrictions of the shares of the companies involved or arising from the transaction, before and after the transaction.

Before and after the Transaction, there will be common shares of Embraer and Yaborã that shall remain with the same rights and advantages, without any change as a result of the transaction, which are listed below.

Embraer:

| Entitled to dividends: | Common Shares: All common shares issued by Embraer are entitled to dividends, except shares that are held in treasury. The portion corresponding to 25% of the adjusted net income is allocated to shareholders, as a mandatory minimum annual dividend. | |

| Voting rights: | Restricted. | |

| Description of the restricted vote: | Common Shares: I - no shareholder, or Shareholder Group (as defined in the bylaws), Brazilian or foreign, may exercise votes in a number greater than 5% of the number of shares in which the Company’s capital stock is divided; II - the group of Foreign Shareholders (as defined in the articles of incorporation) may not exercise, in each Shareholders’ Meeting, a number of votes greater than 2/3 of the total votes that can be exercised by the Brazilian Shareholders present (as defined in the bylaws). | |

| Convertibility: | No. | |

| Convertibility condition and effects on capital stock: | Not applicable. | |

| Right to reimbursement of capital: | Yes. | |

22

| Description of the characteristics of the capital repayment: | None. | |

| Transfer restriction: | No. | |

| Description of the constraint: | Not applicable. | |

| Redeemable: | No. | |

| Conditions for changing the rights ensured by such securities: | Approval of the Federal Government, as holder of the golden share, for certain matters, including characterization of Brazilian or foreign shareholders. | |

| Other relevant features: | The content of other relevant characteristics of the common share, as well as the golden share, is described in Item 18.12 of Embraer’s Annual Report (Formulário de Referência). | |

Yaborã:

| Entitled to dividends: | Common Shares: All common shares issued by Yaborã are entitled to dividends, except shares that are held in treasury. The portion corresponding to 25% of the adjusted net income is allocated to shareholders, as a mandatory minimum annual dividend. | |

| Voting rights: | Each common share shall be entitled to one vote in each resolution adopted by the Company’s shareholders. | |

| Convertibility: | No. | |

| Convertibility condition and effects on capital stock: | Not applicable. | |

| Right to reimbursement of capital: | Yes. | |

| Description of the characteristics of the capital repayment: | None. | |

| Transfer restriction: | No. | |

| Description of the constraint: | Not applicable. | |

| Redeemable: | No. | |

| Conditions for changing the rights ensured by such securities: | Approval by the Company’s shareholders. | |

| Other relevant features: | No. | |

23

(d) Possible need for approval by debenture holders or other creditors.

The companies’ management shall take all necessary measures so that, at the time of the Transaction, the authorizations and consents of third parties required to avoid non-compliance and/or early maturity of any obligations of the Companies have already been obtained, including as set forth in Paragraph 1 of Article 231 of Law 6,404/76.

(e) Assets and liabilities that will comprise each portion of equity, in the event of a spin-off.

The assets and liabilities that will comprise Yaborã’s spun-off portion to be transferred to Embraer are those listed in the Appraisal Report, which is an integral part of the Protocol and Justification as Annex 2.2.

(f) The resulting companies’ intention as to obtaining registration as a security issuer.

Embraer is already registered as a Category A publicly held company and Yaborã has no intention of obtaining registration as a security issuer.

4. Plans for conducting corporate business, notably with regard to specific corporate events that are intended to be carried out.

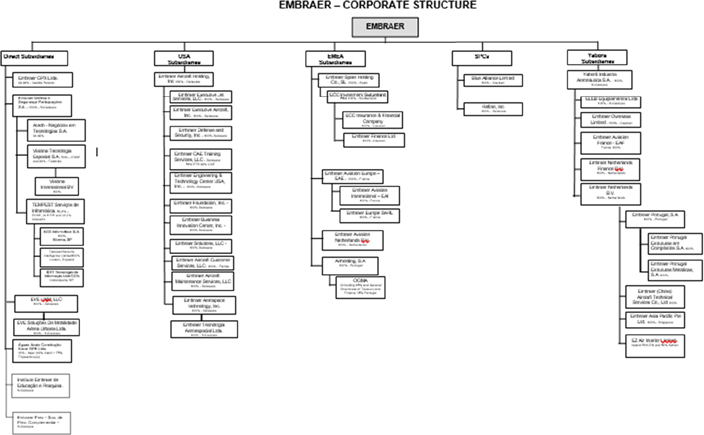

Yaborã is a wholly-owned subsidiary of Embraer, which originally held the aforementioned commercial aviation business, having transferred it to Yaborã on January 1, 2020. After the Transaction, the commercial aviation business will again be developed directly by Embraer, and Embraer will continue to dedicate itself to the development, manufacture and sale of aircraft and aerospace materials in the various segments in which Embraer operates, maintaining its registration as a publicly held company. Embraer’s corporate purpose will also remain unchanged, due to the fact that Embraer and Yaborã have similar corporate purposes and that Yaborã does not carry out any activities other than those already included in Embraer’s corporate purpose. Yaborã’s corporate purpose will also remain unchanged.

24

5. Analysis of the following aspects of the transaction:

(a) Description of the main expected benefits, including: (i) Synergies, (ii) Tax benefits; and (iii) Strategic advantages.