UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10

(Amendment No. 1)

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

BORNEO RESOURCE INVESTMENTS LTD.

(Exact name of registrant as specified in its charter)

| Nevada | 20-3724019 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 19125 North Creek Parkway, Suite 120 | |

| Bothell, Washington | 98011 |

| (Address of principal executive offices) | (Zip Code) |

(425) 329-2622

(Registrant’s telephone number, including area code)

Copies to:

Erick Richardson, Esq.

Peter DiChiara, Esq.

Richardson & Patel LLP

750 Third Avenue, 9th Floor

New York, New York 10017

Tel: (212) 869-7000

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act: Common Stock ($0.001 par value)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | | Smaller reporting company | x |

BORNEO RESOURCE INVESTMENTS LTD.

TABLE OF CONTENTS

| | | | Page |

| | | | |

| | | 2 |

| | | | |

| | | 7 |

| | | | |

| | | 12 |

| | | | |

| | | 18 |

| | | | |

| | | 19 |

| | | | |

| | | 21 |

| | | | |

| | | 22 |

| | | | |

| | | 23 |

| | | | |

| | | 24 |

| | | | |

| | | 24 |

| | | | |

| | | 26 |

| | | | |

| | | 26 |

| | | | |

| | | 27 |

| | | | |

| | | 28 |

| | | | |

| | | 28 |

| | | | |

| | | 29 |

EXPLANATORY NOTE

We are filing this General Form for Registration of Securities on Form 10 to register our common stock, par value $0.001 per share (the “Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

This registration statement became effective automatically on July 10, 2012, 60 days from the date of the original filing, pursuant to Section 12(g)(1) of the Exchange Act. As of the effective date we are subject to the requirements of Regulation 13(a) under the Exchange Act and are required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we are required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Unless otherwise noted, references in this registration statement to the “Company,” “we,” “our,” or “us” mean Borneo Resource Investments Ltd. and its wholly-owned subsidiary, Interich International Limited, a company organized in the British Virgin Islands. Our principal executive offices are located at 19125 North Creek Parkway, Suite 120, Bothell, Washington, 98011 and our telephone number is (425) 329-2622.

FORWARD-LOOKING STATEMENTS

This registration statement contains “forward-looking statements.” Forward-looking statements are based upon our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “approximately,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although the absence of these words does not necessarily mean that a statement is not forward-looking. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

Factors that may cause or contribute actual results to differ from these forward-looking statements include, but are not limited to, for example:

| ● | adverse economic conditions; |

| ● | the price of coal; |

| ● | a change in the estimate of coal on our concessions; |

| ● | an inability to extract the coal reserves; |

| ● | changes in Indonesian law; and |

| ● | other risks and uncertainties related to mining and our business strategy. |

This list is not exhaustive of the factors that may affect our forward-looking statements. All forward-looking statements speak only as of the date of this report. We undertake no obligation to update any forward-looking statements or other information contained herein. Stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements in this report are reasonable, we cannot assure stockholders and potential investors that these plans, intentions or expectations will be achieved. We disclose important factors that could cause our actual results to differ materially from expectations under “Risk Factors” and elsewhere in this current report. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

Business Development

Borneo Resource Investments Ltd., (“Borneo” or the “Company”) was organized on June 14, 2004 under the laws of the State of Nevada as “Acme Entertainment, Inc.” On July 21, 2005, the Company changed its name to “INQB8, Inc.” On November 4, 2005, in connection with a merger with Aventura Resorts, Inc., a privately held Washington company, the Company changed its name to “Aventura Resorts, Inc.” (“Aventura”).

Aventura’s business plan was to develop upscale resort communities for motorhome owners. The Company entered into several agreements to acquire resort properties. With the banking crisis in the United States and the downturn in real estate values, however, the Company was unable to complete either the attempted bank financing or equity transaction to complete the contemplated purchases.

On July 13, 2011, in anticipation of the merger, described below, with Interich International Limited (“Interich”), a British Virgin Islands Company, the Company changed its name to Borneo Resource Investments Ltd. On August 1, 2011 (the “Merger Date”), the Company was merged with Interich via a merger subsidiary the Company created for this transaction. From its inception, on September 22, 2009 until the date of the transaction, Interich was an inactive corporation with no significant assets or liabilities. The transaction has been accounted for as a reverse merger, and Interich is the acquiring company on the basis that Interich’s senior management became the entire senior management of the merged entity and there was a change of control of Borneo. While the transaction is accounted for using the purchase method of accounting, in substance the transaction was a recapitalization of Borneo’s capital structure.

In anticipation of the closing of the Interich transaction, on July 13, 2011, the Company amended its Articles of Incorporation to effect a 100-to-1 reverse stock split of its issued and outstanding shares of common stock. As a result of the reverse stock split, the Company had 3,167,269 shares outstanding before the merger. In addition, the authorized number of shares of common stock was amended to authorize the Company to issue a total of 500,000,000 shares of capital stock, each with a par value of $0.001, which consists of 400,000,000 shares of common stock and 100,000,000 shares of preferred stock.

In connection with the merger, Borneo issued 60,178,073 restricted common shares to stockholders of Interich. In addition, holders of convertible debt exchanged their notes for 6,154,860 of the Company’s common shares. The issued and outstanding number of common shares subsequent to the merger and the exchange of convertible debt was 69,500,205.

The Company is in the development stage as defined by Accounting Standards Codification subtopic 915-10 Development Stage Entities (“ASC 915-10”) with its efforts principally devoted to developing a platform of prime quality energy assets. To date, the Company, has not generated sales revenues, has incurred expenses and has sustained losses. Consequently, its operations are subject to all the risks inherent in the establishment of a new business enterprise. For the period from inception through December 31, 2011, the Company has accumulated losses of $1,103,766.

Our principal executive offices are located at 19125 North Creek Parkway, Suite 120, Bothell, Washington, 98011 and our telephone number is (425) 329-2622.

Our Business

Borneo’s mission is to develop a platform of prime quality energy assets in Borneo, Indonesia, one of the world largest areas of high grade thermal coal reserves, through acquisition of coal mining concessions and licenses. The Company, when presented with the opportunity to do so, will seek to acquire concessions in other regions of Indonesia. Further, Borneo is creating a trading platform for thermal coal concessions and individual coal deposits through arbitrage between Indonesia supply chains and major energy importing nations including India and China.

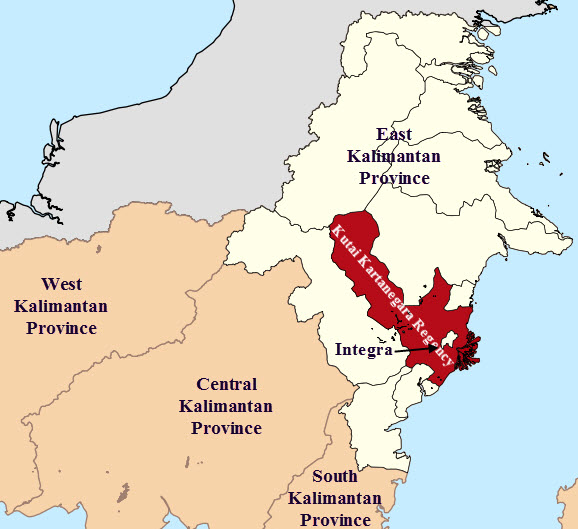

Kalimantan Province, situated in the island of Sumatra, Indonesia, is home to one of the richest deposits of steaming coal in the world. The Indonesian government has, for many years been awarding coal mining exploration and licenses to local indigenous groups. With strong connections to local licensees, through two of its executive officers, the Company has created preferential access to these concession opportunities.

Mining Concessions

Borneo has entered into agreements, primarily letters of intent and agreements of understanding, with concession holders in the Indonesian region. Borneo will, with any available cash, perform geological tests to determine the feasibility of mining each concession. If mining is feasible, Borneo may enter into a partnership to mine the concession or sell the concession to a mining company. None of the agreements entered into by Borneo require it to make any expenditures or payments. Each of the agreements call for further negotiations among the parties.

Prior to the merger between Borneo and Interich, Interich acquired in exchange for Interich stock an 80% interest in PT Chaya Meratus Primecoal, an Indonesian limited liability company, which is the holder of the exclusive exploration and development rights concession for up to 6,000 hectares in the Tanjung Area Basin of South East Kalimantan. Borneo will, with any available cash, perform geological tests to determine the feasibility of mining each concession.

Borneo also acquired exclusive rights to an exploration IUP covering approximately 1,300 hectares in Kalimantan through a Memorandum of Understanding, dated October 7, 2011, with the concession holder PT Integra Prime Coal (the “Integra MOU”). Pursuant to the Integra MOU, Borneo shall take over the exploration, exploitation and drilling on the IUP. Borneo does not have any commitments under the Integra MOU until it decides to continue exploration and mining activities. At that time, the parties will negotiate a price for the IUP.

Borneo signed a Share Sale Purchase Pre-Contract Agreement, dated March 15, 2012 (the “Pre Contract Agreement”) to acquire 75% of PT Batubaraselaruas Sapta (“BSS”), which is the holder of a 93,000 hectare concession in the province of East Kalimantan, Indonesia, with a prospective area of 68,360 hectares. The Pre-Contract Agreement provides that it is only a Memorandum of Understanding prior to due diligence and the negotiation and execution of a Share Sale Purchase Agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$225,000,000 to acquire 75% of BSS. The initial payment of US$2,250,000, which Borneo has not yet made, will provide Borneo a 1% interest in BSS and guarantee exclusivity for Borneo. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo signed an Agreement on Transfer of Shares, Coal Mining License and Its Management, dated March 23, 2012 (the “Berkat Bumi Agreement”) to acquire 80% of PT Berkat Bumi Waigeo (“Berkat Bumi”), which is the holder of a 9,600 hectare concession in the West Papua Province (island of New Guinea), Indonesia. The Berkat Bumi Agreement provides that it is only a memorandum of understanding prior to due diligence and the negotiation and execution of a final agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$9,000,000 to acquire 80% of Berkat Bumi. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo signed an Agreement on Transfer of Shares, Coal Mining License and Its Management, dated March 23, 2012 (the “Masanggu Agreement”), to acquire 90% of PT Berkat Banua Masanggu (“Masanggu”), which is the holder of an 8,800 hectare concession in the South Kalimantan Province, Indonesia. The Masanggu Agreement provides that it is only a memorandum of understanding prior to due diligence and the negotiation and execution of a final agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$6,000,000 to acquire 90% of Masanggu. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo is also negotiating with BT Bumi Energy Kalimantan (“BEK”) which is the holder of a 3,200 hectare mining concession in South East Kalimantan, Indonesia for the acquisition of BEK’s shares.

Much of the coal mined in Indonesia is exported to China. China's Indonesian coal imports are expected to reach 52 million metric tonnes in 2012, a rise of 20% on the 42.9 million metric tonnes of coal exported by Indonesia to China in 2010, according to Indonesian Coal Mining Association (“ICMA”). Indonesian coal exports to China have expanded at a rapid rate since registering at 1.4 million metric tonnes in 2004. Indonesia produced 325 million metric tonnes of coal in 2010, of which 265 million metric tonnes was exported and 60 million metric tonnes sold for domestic consumption. This information is public information developed by the ICMA and we did not pay anything for receipt of this information.

The Company’s strategy is to continue to acquire prime concessions and develop a “land bank” of assets to buy and sell assets and mine coal. It is the Company’s intention to select strategic partners to coordinate construction of coal mining infrastructure for concessions acquired. Ultimately, financing of mine development will be largely achieved through structured, limited recourse project financing.

Emerging Growth Company” Status under the Jumpstart Our Business Startups Act (“JOBS Act”)

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| · | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Competitive Factors

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration stage properties or properties containing coal reserves. Many of these companies have greater financial resources, operational experience and technical capabilities than us. It is our goal to develop a “land bank” of assets to buy and sell assets and mine coal. This will allow us to source coal from our properties to purchasers quickly and efficiently. It is the Company’s intention to select strategic partners to coordinate construction of coal mining infrastructure for concessions acquired. Ultimately, financing of mine development will be largely achieved through structured, limited recourse project financing. By working with select strategic partners and using limited recourse project financing, we anticipate we will be able to compete with larger companies with greater resources.

Raw Materials, Principal Suppliers and Customers

We are not dependent on any principal suppliers nor raw materials in our current business operations. We are not currently any revenue from any customers.

Government Regulations

On January 12, 2009, Law No 4 of 2009 on Mineral and Coal Mining (the “Mining Law”) came into effect. The Mining Law replaced Law No 11 of 1967 (the “Old Mining Law”) and made significant changes to Indonesia’s mining regulatory regime which operated for more than 40 years. Under the Old Mining Law, mining activities were permitted to be carried out under a mining authorization known as Kuasa Pertambangan (KP). There are a number of transitional issues relating to KPs issued under the Old Mining Law.

The Mining Law now provides for new forms of mining rights known as:

| | ● | Mining Business Permits (Izin Usaha Pertambangan – IUP) – basic permits for conducting a mining enterprise within a commercial mining area; and |

| | ● | Special Mining Business Permits (Izin Usaha Pertambangan Khusus – IUPK) – permits for conducting a mining enterprise within a state reserve area. |

State reserve areas will be determined by the government based on the government’s desire to reserve an area for national strategic needs or to conserve certain properties based on a need to protect the ecosystem or environment. The Company does not have any mining enterprises within a state reserve area.

For IUPs that are not "conversions" from KPs, every holder of an IUP will first need to obtain a Mining Business Permit Area (Wilayah Izin Usaha Pertambangan – WIUP) subject to prescribed minimum and maximum limits:

| | ● | An Exploration IUP, which authorizes the holder to conduct general survey, exploration and feasibility studies; and |

| | ● | Production Operation IUP, which authorizes the holder to conduct construction, mining, processing and purification, hauling and selling. |

Under the Mining Law, an IUP holder is only allowed to hold one IUP. However, transitional provisions in Government Regulation No 23 of 2010 allow mining concession holders who held more than one concession before the enforcement of Mining Law, to convert those concessions to IUPs and hold on to them until expiration (subject to compliance with the conditions of the IUPs and the prevailing laws and regulations). While a company can hold only one IUP, companies may have several different subsidiaries apply for several different IUPs. The Company may then, therefore, obtain new IUPs.

The current situation in relation to the Mining Law is that:

| | ● | KPs should have been converted to IUPs, as required under the implementing regulations; and |

| | ● | IUPs in relation to new work areas are not yet being issued. This is because the Government is still considering what mining areas will be opened up for tendering. |

We expect foreign investment in the Indonesian mining industry to increase on the back of continued efforts by the government to improve the country's regulatory framework as it seeks to increase revenues derived from mining activities. In compliance with Indonesian regulations the Company, through Indonesian counsel, is filing a foreign investment approval application for all concession acquisitions in Indonesia. We do not expect the Mining Law, and the changes enacted, to impact our operations.

Environmental Regulations

On October 3, 2009, the Indonesian Government passed Law No 32 of 2009 regarding Environmental Protection and Management (the “Environmental Law”), replacing Law No 23 of 1997 on Environmental Management (the “Old Environment Law”). Under the Environmental Law, every business activity having significant impact on the environment (like mining operations) is required to carry out an environmental impact assessment (known as an AMDAL). Based on the assessment of the AMDAL by the Commission of AMDAL Assessment, the Minister, Governor, or Mayor/Regent (in accordance with their respective authority) must specify a decree of environmental feasibility. The decree of environmental feasibility is used as the basis for the issuance of an environmental license by the Minister, Governor, or Mayor/Regent (as applicable). The environmental license is a pre-requisite to obtaining the relevant business license. One of the business activities that must have an AMDAL is the exploitation of mineral resources. The Minister for Environmental Affairs is responsible for issuing a list of the types of businesses which must produce an AMDAL as a pre-requisite to being licensed.

There are only a few implementing regulations that have been issued in relation to the Environmental Law. As a result, the implementing regulations of the Old Environment Law still apply in some circumstances, to the extent that they do not contradict the Environmental Law. Under the Old Environmental Law and its implementing regulations: (a) an AMDAL is not required to be prepared for general survey and exploration activities; and (b) an AMDAL must be prepared and approved in order for a business to enter into the exploitation (operation and production) phase. Projects (or sub-projects) which are not required to produce an AMDAL may nevertheless still be required to produce Environmental Management Efforts (UKL) and Environmental Monitoring Efforts (UPL). Technical guidelines announced by the Minister of Energy and Mineral Resources state that regional governments are responsible for approving AMDALs in their respective jurisdictions and for supervising environmental management and the monitoring efforts of an IUP holder.

Further details regarding AMDAL requirements are set out in Government Regulation No 27 of 1999 on Environmental Impact Assessment, which is the implementing regulation of the Old Environment Law. Under the Old Environment Law and its implementing regulations, an AMDAL consists of several components, namely: (a) a framework of reference document used to establish the framework for the AMDAL (KA-ANDAL); (b) an environmental impact analysis report (ANDAL); (c) an environmental management plan (RKL); and (d) an environmental monitoring plan (RPL). Although the components of an AMDAL have not been specified, the Environmental Law stipulates that an AMDAL document must contain the following: (a) an assessment of the impact of the business activities plan; (b) an evaluation of the activities in the area surrounding the location of the business; (c) feedback from the community on the business activities plan; (d) an estimation of the impact and significance of the impact that may occur if the business activities plan is implemented; (e) a holistic evaluation of the impact that may occur to determine the environmental feasibility; and (f) an environmental management and monitoring plan. In addition to the requirement to obtain an environmental license, every business and/or activity that has the potential to cause a significant impact on the environment, a threat to the ecosystem and life, and/or human health and safety must also conduct an environmental risk analysis. A number of other regulations also apply to mining operations, requiring operators to obtain licenses for the disposal of waste and toxic or hazardous materials.

We do not expect the Environmental Law, and the changes enacted, to impact our operations.

Employees

We retain our three officers, namely our Chief Executive Officer, Chief Operating Officer and Chief Financial Officer as independent contractors. Our officers spend approximately, and some weeks, in excess of 40 hours per week working on the Company’s operation. Other than our three officers, we have no employees. We have engaged a local Indonesian geologist as an independent consultant and plan to engage other independent contractors in connection with the exploration of our properties, such as drillers, geophysicists, geologists and other technical disciplines from time to time.

An investment in our securities is highly speculative and extremely risky. You should carefully consider the following risks, in addition to the other information contained in this registration statement, before deciding to invest in our securities.

Risks Related to Our Business

We have a limited operating history.

We have no history of revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our company has a limited operating history and must be considered in the development stage. The success of our company is significantly dependent on a successful acquisition, drilling, completion and production program. Our company’s operations will be subject to all the risks inherent in the establishment of a developing enterprise and the uncertainties arising from the absence of a significant operating history. We may be unable to locate recoverable reserves or operate on a profitable basis. We are in the development stage and potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

We do not expect positive cash flow from operations in the near term. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be required to scale back or curtail exploration operations.

We do not expect positive cash flow from operations in the near term. In particular, additional capital may be required in the event that drilling, exploration and completion costs for our properties increase beyond our expectations. We will depend almost exclusively on outside capital to pay for the acquisition and continued exploration and development of our properties. Such outside capital may include the sale of additional stock and/or commercial borrowing. We can provide no assurances that any financing will be successfully completed. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may be required to scale back or curtail operations for our business.

We will require additional funds which we plan to raise through the sales of our common stock.

We anticipate that our current cash will not be sufficient to complete our planned exploration program and acquisition of properties. Subsequent acquisition and exploration activities will require additional funding. Our only present means of funding is through the sale of our common stock and common stock equivalents. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock. If we are unable to raise additional funds in the future, our business will need to be curtailed.

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements have been prepared assuming that we will continue as a going concern. The general business strategy of the Company is to explore and research existing mineral properties and to potentially acquire further claims either directly or through the acquisition of operating entities. The continued operations of the Company depends upon the recoverability of mineral property reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development of these claims and upon the future profitable production of the claims. Management intends to raise additional capital through share issuances to finance its exploration although there can be no assurance that management will be successful in these efforts.

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying consolidated financial statement, the Company has incurred deficit accumulated during the development stage of $1,103,766, used $863,546 in cash for operating activities as of December 31, 2011. The ability of the Company to continue as a going concern is in doubt and dependent upon achieving a profitable level of operations and on the ability of the Company to obtain necessary financing to fund ongoing operations. Management believes that its current and future plans enable it to continue as a going concern for the next twelve months.

To meet these objectives, the Company continues to seek other sources of financing in order to support existing operations and expand the range and scope of its business. However, there are no assurances that any such financing can be obtained on acceptable terms and timely manner, if at all. The failure to obtain the necessary working capital would have a material adverse effect on the business prospects and, depending upon the shortfall, the Company may have to curtail or cease its operations.

Unfavorable global economic conditions may have a material adverse effect on us since raising capital to continue our operations could be more difficult.

Uncertainty and negative trends in global economic conditions, including significant tightening of credit markets and a general economic decline, have created a difficult operating environment for our business and other companies in our industry. Depending upon the ultimate severity and duration of any economic downturn, the resulting effects on our business could be materially adverse if we are unable to raise the working capital required to carry out our business plan.

The exploration and mining industry is highly competitive.

We face significant competition in our business of exploration and mining, a business in which we will compete with other coal resource exploration and development companies for financing and for the acquisition of new coal properties. Many of the coal resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of coal properties of merit, on exploration of their coal properties and on development of their coal properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of coal properties. This competition could result in competitors having coal properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our coal properties.

Our mineral exploration efforts are highly speculative; we have not yet established any proven or probable reserves.

Mineral exploration is highly speculative. It involves many risks and is often non-productive. Even if we believe we have found a valuable mineral deposit, it may be several years before production is possible. During that time, it may become no longer feasible to produce those minerals for economic, regulatory, political, or other reasons. Additionally, we may be required to make substantial capital expenditures and to construct mining and processing facilities. As a result of these costs and uncertainties, we may be unable to start, or if started, to finish our exploration activities. In addition, we have not to date established any proven or probable reserves on our mining properties and there can be no assurance that such reserves will ever be established.

Mining operations in general involve a high degree of risk, which we may be unable, or may not choose to insure against, making exploration and/or development activities we may pursue subject to potential legal liability for certain claims.

Our operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take adequate precautions to minimize these risks, and risks associated with equipment failure or failure of retaining dams which may result in environmental pollution, there can be no assurance that even with our precautions, damage or loss will not occur and that we will not be subject to liability which will have a material adverse effect on our business, results of operation and financial condition.

We have no known coal reserves and we cannot guarantee we will find any coal reserves or if we find coal, that production will be profitable.

Even if we find that there are coal reserves on our property, we cannot guaranty that we will be able to recover and market the coal. Even if we recover and market the coal reserves, we cannot guaranty that we will make a profit. If we cannot find coal reserves or it is not economical to recover these coal reserves, we will have to cease operations.

Weather interruptions in Indonesia may affect and delay our exploration operations.

The weather is a hot and humid tropical wet and dry climate according to the Köppen climate classification system. Despite being located relatively close to the equator, the area has distinct wet and dry seasons. Wet seasons in Kalimantan cover the majority of the year, running from November through June.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, such as explosives, and certain equipment such as bulldozers and excavators that we might need to conduct exploration. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

We will incur increased costs as a result of becoming a public company that reports to the Securities and Exchange Commission and our management will be required to devote substantial time to meet compliance obligations.

As a public company reporting to the Securities and Exchange Commission, we will incur legal, accounting and other expenses that we did not incur as a private company. We will be subject to reporting requirements of the Securities Exchange Act of 1934 and the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the Commission that impose significant requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. In addition, on July 21, 2010, the Dodd-Frank Wall Street Reform and Protection Act was enacted. There are also additional corporate governance and executive compensation-related provisions in the Dodd-Frank Act that are expected to increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and may also place undue strain on our personnel, systems and resources. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. In addition, we expect these rules and regulations to make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified people to serve on our board of directors, our board committees or as executive officers.

We are an "emerging growth company" under the JOBS Act of 2012 and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

Risks Related to Our Common Stock

We do not intend to pay dividends in the foreseeable future.

We have never declared or paid a dividend on our common stock. We intend to retain earnings, if any, for use in the operation and expansion of our business and, therefore, do not anticipate paying any dividends in the foreseeable future.

The trading price of our common stock may be volatile.

We currently anticipate that the market for our common stock will remain limited, sporadic, and illiquid until such time as we generate significant revenues, if ever, and that the market for our common stock will be subject to wide fluctuations in response to several factors, including, but not limited to the risk factors set forth in this report as well as the depth and liquidity of the market for our common stock, investor perceptions of the Company, and general economic and similar conditions. In addition, we believe that there are a small number of market makers that make a market in our common stock. The actions of any of these market makers could substantially impact the volatility of the Company’s common stock.

Substantial sales of our common stock could adversely affect our stock price.

We had 72,228,737 shares of common stock outstanding as of July 6 , 2012. Sales of a substantial number of shares of common stock, or the perception that such sales could occur, could adversely affect the market price of our common stock by introducing a large number of sellers to the market. Such sales could cause the market price of our common stock to decline. We cannot predict whether future sales of our common stock, or the availability of our common stock for sale, will adversely affect the market price for our common stock or our ability to raise capital by offering equity securities.

Our common stock is a penny stock.

Our common stock is classified as a penny stock, which is quoted in the OTC Pink Market. As a result, an investor may find it more difficult to dispose of or obtain accurate quotations as to the price of the shares of the common stock. In addition, the “penny stock” rules adopted by the Securities and Exchange Commission subject the sale of the shares of the common stock to certain regulations which impose sales practice requirements on broker-dealers. For example, broker-dealers selling such securities must, prior to effecting the transaction, provide their customers with a document that discloses the risks of investing in such securities. Furthermore, if the person purchasing the securities is someone other than an accredited investor or an established customer of the broker-dealer, the broker-dealer must also approve the potential customer’s account by obtaining information concerning the customer’s financial situation, investment experience and investment objectives. The broker-dealer must also make a determination whether the transaction is suitable for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the Commission’s rules may result in the limitation of the number of potential purchasers of the shares of the common stock. In addition, the additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in the Common Stock, which could severely limit the market of the Company’s common stock.

Risks Related to Doing Business in Indonesia

It is not possible to predict the impact new laws and regulations, in particular laws and regulations affecting mining may have on our future activities.

Changes in laws or regulations however may materially increase our cost of doing business and operating in Indonesia and thereby materially and adversely effect the Indonesian entities. In addition, it may be necessary to modify existing structures and operations to adhere to evolving laws or regulations.

In Indonesia, IUPs are subject to various conditions and compliance requirements.

Failure to comply with those conditions and compliance requirements, including periodically submitting annual reports and budget plans to the relevant regional government and the Indonesian Department of Energy and Mineral Resources ("DEMR"), and the payment of any required deposits, dead rent, government royalties, forestry fees, land and building tax and other levies to the Indonesian Government, or failure to comply with any applicable laws, could ultimately lead to termination of the IUPs and our loss of the rights to conduct mining activities under them.

While penalties and other civil or criminal sanctions are not applicable to breaches of IUP conditions, non-compliance activities may lead to loss of the IUPs. Non-compliance with applicable mining, environmental, health, safety and other laws or requirements, may also constitute breaches of laws, regulations or rules which by themselves may lead to penalties and other civil or criminal sanctions.

We cannot provide assurance that the IUPs will not be subject to challenge or that the Indonesian Government will not vary the terms applicable to the IUPs by new regulations.

We are subject to environmental laws in Indonesia

Due to the potential impact on the environment, mining activities are required to comply with various environmental standards and requirements set by Indonesian environmental law and regulations and to satisfy obligations under reclamation standards set by the Indonesian Government. The Indonesian Government may require the suspension or even ceasing of mining operations if there is evidence of failure to meet relevant environmental standards or reclamation obligations.

We are subject to jurisdiction of the courts in Indonesia which may prevent shareholders from collecting damages from our assets.

Decisions of courts in Indonesia on matters of Indonesian law are not mandatorily or customarily binding on lower courts or in the same court in any subsequent case. Indonesian judges have very broad fact-finding powers and a high level of discretion in relation to which of those powers are exercised. The judgments of Indonesian courts are not systematically published and it is not possible to ensure a complete understanding of points of Indonesian law as interpreted and applied by the courts in Indonesia or in particular courts. Judges are often unfamiliar with sophisticated commercial or financial transactions, leading in practice to a lack of certainty in the interpretation and application of Indonesian law. Litigation in Indonesia may be protracted.

In addition, judgments of courts outside Indonesia, including judgments predicated upon the civil liability provisions of the federal securities laws of the United States, are not enforceable in Indonesian courts due to the absence of any bilateral or multilateral treaties for reciprocal enforcement of judgments. Although judgments of courts outside Indonesia may be admissible as non-conclusive evidence of foreign law in proceedings before the Indonesian courts, the proceedings would need to be commenced anew in Indonesia. There is doubt as to whether Indonesian courts will enter judgments in original actions brought in Indonesian courts predicated solely upon the civil liability provisions of such foreign laws.

Although Indonesia is a party to the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, the enforcement of any international arbitration award in Indonesia must still comply with the requirements of specific matters relating to domestic law, as permitted under the New York Convention. These requirements include registration of the award in Indonesia and a finding by the Chief Judge of the Central Jakarta District Court that enforcement of the award would not violate public policy in Indonesia, in addition, Indonesian debtors have been known to contest enforcement of arbitration awards in Indonesia. As long as an arbitration award does not contain elements that contradict Indonesian public policy, opposition to enforcement is typically initiated by parties facing enforcement and not from the Indonesian administrative and/or judicial authorities.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Foreign companies, including some of our competitors, are not subject to these prohibitions.

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company and its subsidiary. The discussion and analysis that follows should be read together with our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this registration statement. Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control.

Overview

Borneo Resource Investments Ltd., (“Borneo” or the “Company”) was organized on June 14, 2004 under the laws of the State of Nevada as “Acme Entertainment, Inc.” On July 21, 2005, the Company changed its name to “INQB8, Inc.” On November 4, 2005, in connection with a merger with Aventura Resorts, Inc., a privately held Washington company, the Company changed its name to “Aventura Resorts, Inc.” (“Aventura”).

Aventura’s business plan was to develop upscale resort communities for motorhome owners. The Company entered into several agreements to acquire resort properties. With the banking crisis in the United States and the downturn in real estate values, however, the Company was unable to complete either the attempted bank financing or equity transaction to complete the contemplated purchases

In connection with the merger with Interich International Limited (“Interich”), a British Virgin Islands Company, on July 13, 2011, the company changed its name to Borneo Resource Investments, Ltd. On August 1, 2011, the Company was merged with Interich via a merger subsidiary the Company created for this transaction. From its inception, on September 22, 2009 until the date of the transaction, Interich was an inactive corporation with no significant assets or liabilities. The transaction has been accounted for as a reverse merger, and Interich is the acquiring company on the basis that Interich’s senior management became the entire senior management of the merged entity and there was a change of control of Borneo. While the transaction is accounted for using the purchase method of accounting, in substance the transaction was a recapitalization of Borneo’s capital structure.

In anticipation of the closing of the Interich transaction, on July 13, 2011, the Company amended its Articles of Incorporation to effect a 100-to-1 reverse stock split of its issued and outstanding shares of common stock. As a result of the reverse stock split, the Company had 3,167,269 shares outstanding before the merger. In addition, the authorized number of shares of common stock was amended to authorize the Company to issue a total of 500,000,000 shares of capital stock, each with a par value of $0.001, which consists of 400,000,000 shares of common stock and 100,000,000 shares of preferred stock.

In connection with the merger, Borneo issued 60,178,073 restricted common shares to stockholders of Interich. In addition, holders of convertible debt exchanged their notes for 6,154,860 common shares of the Company. The issued and outstanding number of common shares subsequent to the merger and the exchange of convertible debt was 69,500,205.

The Company is in the development stage as defined by Accounting Standards Codification subtopic 915-10 Development Stage Entities (“ASC 915-10”) with its efforts principally devoted to developing a platform of prime quality energy assets. To date, the Company, has not generated sales revenues, has incurred expenses and has sustained losses. Consequently, its operations are subject to all the risks inherent in the establishment of a new business enterprise. For the period from inception through December 31, 2011, the Company has accumulated losses of $1,103,766.

Results of Operations

We had no revenues in the years ended December 2011 and 2010 and the three months ended March 31, 2012. We reported a net loss of $1,008,587 during the year ended December 31, 2011 and a net loss of $515,958 during the three months ended March 31, 2012.

The following chart summarizes operating expenses and other income and expenses for the year ended December 31, 2011 and period ended March 31, 2012:

| | | December 31, 2011 | | | March 31, 2012 | |

| General and administrative expenses | | $ | 861,466 | | | $ | 320.819 | |

| Amortization of debt discount | | $ | 116,714 | | | $ | 20,070 | |

| Net interest expense | | $ | 30,407 | | | $ | 175,072 | |

General and administrative expenses were $861,466 for the year ended December 31, 2011. General and administrative consisted primarily of merger expenses and compensation for our officers and consultants. General and administrative expenses for the three months ended March 31, 2012 were 320,819. General and administrative consisted primarily of compensation for our officers and consultants.

During the year ended December 31, 2011, $116,714 was amortized and shown as amortization of discount expense. During the three months ended March 31, 2012, $20,070 was amortized and shown as amortization of discount expense. The convertible notes (the “Notes”) have a beneficial feature of $375,571 and the fair value of warrants at the date of grant was $649,429. In accordance with ASC 470-20, the Company allocated the proceeds from the issuance of the Notes to the warrants and the Notes based on their fair market values at the date of issuance using the Black-Scholes model. The value assigned to the warrants of $649,429 and $375,571 was assigned to beneficial conversion feature on debt. In total, $1,025,000 was recorded as an increase in additional paid-in capital and was netted with the Convertible Note value. The discount will be amortized over the original one-year term of the Notes as additional interest expense.

Liquidity and Capital Resources

Cash Flows for the year ended December 31, 2011

On December 31, 2011, we had working capital of $104,938 and stockholders’ equity of $110,354. We had cash equivalents of $231,565.

Cash used in operating activities was $863,546 for the year ended December 31, 2011 which was the result of a net loss of $1,008,587 offset by non-cash amortization of deferred debt discount on our convertible notes. Cash provided by investing activities were immaterial for the year ended December 31, 2011.

Cash provided by financing activities for the year ended December 31, 2011 was $1,095,000 due to the sale of the Notes and the sale of our common stock.

Cash Flows for the three months ended March 31, 2012

On March 31, 2012, we had a working deficit of $139,303 and stockholders’ deficit of $325,604. We had cash equivalents of $151,828. Cash used in operating activities was $159,737 for the three months ended March 31, 2012 which was the result of a net loss of $515,958 offset by non-cash amortization of deferred debt discount on our convertible notes. Cash provided by financing activities for the three months ended March 31, 2012 was $80,000 due to the sale of our common stock.

During June 2012, principal of $695,000 of the Notes plus accrued interest of $41,057 was converted into 2,453,532 shares of common stock as provided by the terms of the Notes at $0.30 per share, reducing the aggregate outstanding principal of the Notes to $330,000.

Our financial statements have been prepared assuming that we will continue as a going concern. The general business strategy of the Company is to explore and research existing mineral properties and to potentially acquire further claims either directly or through the acquisition of operating entities. The continued operations of the Company depends upon the recoverability of mineral property reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development of these claims and upon the future profitable production of the claims. While the Company has enough cash to pay all expenses for the next three months, there continues to be insufficient funds to provide enough working capital to fund ongoing operations for the next twelve months. Management intends to raise additional capital through share issuances to continue its operations and finance its exploration although there can be no assurance that management will be successful in these efforts. Other than the sale of securities, the Company does not have any lines of credit or other arrangements to provide an external source of additional funding at this time. The Company plans to sell coal from the mining concession under an arrangement with PT Integra Prime Coal. This mining concession has significant quantities of surface and "outcrop" coal that the Company will be able to access with relatively low infrastructure and production costs. There is no guarantee, however, that the Company will be able to generate revenue or reach an agreement with PT Integra Prime Coal to allow the Company to harvest and sell such coal.

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business. As shown in the accompanying consolidated financial statement, the Company has incurred deficit accumulated during the development stage of $1,103,766, used $863,546 in cash for operating activities as of December 31, 2011. The ability of the Company to continue as a going concern is in doubt and dependent upon achieving a profitable level of operations and on the ability of the Company to obtain necessary financing to fund ongoing operations.

To meet these objectives, the Company continues to seek other sources of financing in order to support existing operations and expand the range and scope of its business. However, there are no assurances that any such financing can be obtained on acceptable terms and timely manner, if at all. The failure to obtain the necessary working capital would have a material adverse effect on the business prospects and, depending upon the shortfall, the Company may have to curtail or cease its operations.

Commitments

Borneo has entered into agreements, primarily letters of intent and agreements of understanding, with concession holders in the Indonesian region. Borneo will, with any available cash, perform geological tests to determine the feasibility of mining each concession. If mining is feasible, Borneo may enter into a partnership to mine the concession or sell the concession to a mining company. None of the agreements entered into by Borneo require it to make any expenditures or payments. Each of the agreements call for further negotiations among the parties.

Prior to the merger between Borneo and Interich, Interich acquired in exchange for Interich stock an 80% interest in PT Chaya Meratus Primecoal, an Indonesian limited liability company, which is the holder of the exclusive exploration and development rights concession for up to 6,000 hectares in the Tanjung Area Basin of South East Kalimantan. Borneo will, with any available cash, perform geological tests to determine the feasibility of mining each concession.

Borneo also acquired exclusive rights to an exploration IUP covering approximately 1,300 hectares in Kalimantan through a Memorandum of Understanding, dated October 7, 2011, with the concession holder PT Integra Prime Coal (the “Integra MOU”). Pursuant to the Integra MOU, Borneo shall take over the exploration, exploitation and drilling on the IUP. Borneo does not have any commitments under the Integra MOU until it decides to continue exploration and mining activities. At that time, the parties will negotiate a price for the IUP.

Borneo signed a Share Sale Purchase Pre-Contract Agreement, dated March 15, 2012 (the “Pre Contract Agreement”) to acquire 75% of PT Batubaraselaruas Sapta (“BSS”), which is the holder of a 93,000 hectare concession in the province of East Kalimantan, Indonesia, with a prospective area of 68,360 hectares. The Pre-Contract Agreement provides that it is only a Memorandum of Understanding prior to due diligence and the negotiation and execution of a Share Sale Purchase Agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$225,000,000 to acquire 75% of BSS. The initial payment of US$2,250,000, which Borneo has not yet made, will provide Borneo a 1% interest in BSS and guarantee exclusivity for Borneo. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo signed an Agreement on Transfer of Shares, Coal Mining License and Its Management, dated March 23, 2012 (the “Berkat Bumi Agreement”) to acquire 80% of PT Berkat Bumi Waigeo (“Berkat Bumi”), which is the holder of a 9,600 hectare concession in the West Papua Province (island of New Guinea), Indonesia. The Berkat Bumi Agreement provides that it is only a memorandum of understanding prior to due diligence and the negotiation and execution of a final agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$9,000,000 to acquire 80% of Berkat Bumi. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo signed an Agreement on Transfer of Shares, Coal Mining License and Its Management, dated March 23, 2012 (the “Masanggu Agreement”), to acquire 90% of PT Berkat Banua Masanggu (“Masanggu”), which is the holder of an 8,800 hectare concession in the South Kalimantan Province, Indonesia. The Masanggu Agreement provides that it is only a memorandum of understanding prior to due diligence and the negotiation and execution of a final agreement. Under the terms of the Pre-Contract Agreement, Borneo will bear all of the costs for the due diligence and development of the BSS concession and, subject to its due diligence and the execution of a Share Sale Purchase Agreement, make a series payments totally US$6,000,000 to acquire 90% of Masanggu. Borneo shall perform due diligence procedures on this property with any available funds.

Borneo is also negotiating with BT Bumi Energy Kalimantan (“BEK”) which is the holder of a 3,200 hectare mining concession in South East Kalimantan, Indonesia for the acquisition of BEK’s shares.

Financing

From October 2011 to December 2011, the Company sold and issued convertible notes (the “Notes ”) and warrants to accredited investors. The Notes are secured by all assets of the Company and its subsidiaries. Maturity is one year from the closing of the offering, unless converted by the note holder prior to the maturity date into the Company’s common stock. The interest rate of the notes is 8% per annum, payable on a semi-annual basis, with the interest rate increasing to 14% per annum upon and so long as a default continues. Under the terms of the Notes, the Company is not in default as of December 31, 2011. The number of shares of common stock the note holder is entitled to is determined by dividing the aggregate principal amount and all accrued and then unpaid interest thereon by $0.30. In addition, under the terms of the private placement offering, for each dollar of principal amount of the Notes, the subscriber also received a warrant to purchase shares of the Company’s common stock at an exercise price of $.30 per share that has an exercise date that expires two years from the date of the closing of the private placement offering. The Company received $1,025,000 for the sale of $1,025,000 in principal amount of notes and issued 1,025,000 warrants in connection with this private placement.

The second private placement was for the sale of common stock. On November 17, 2011, the Company initiated a private placement offering under which it intends to sell 1,000,000 shares of the Company’s common stock for $1 per share. As of December 31, 2011, the company sold and issued 95,000 shares. Between December 31, 2011 and the date of this report, the Company had sold and issued an additional 180,000 shares, bringing the total sold and issued under the terms of this offering to 275,000 shares.

On November 1, 2011, the Company entered into Services Agreement with an independent Investor Relations consulting company. The initial term of the agreement is for six months and the company will pay $3,500 per month during the initial term. The agreement was amended on December 6, 2011 to shift the initial payment date to December and the due date of the last payment due on May 1, 2012. In addition, shares of the Company’s common stock were delivered to the consulting company by a shareholder of the Company. On November 1, 2011, the Company also entered into a Contract for Services with an independent company to create and implement investor targeted materials. Under the terms of the contract the Company paid the initial $50,000 and, as amended on December 7, 2011, the Company made two additional payments of $50,000 in January 2012 and February 2012. Both of these contracts have terminated.

Off-Balance Sheet Arrangements

We do not have any off balance sheet arrangements that are reasonably likely to have a current or future effect on our financial condition, revenues, and results of operations, liquidity or capital expenditures.

Critical Accounting Policies

Revenue Recognition

The Company will recognize revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing 605-25 on the Company's financial position and results of operations was not significant.

Use of Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenue and expenses during the reported period. Actual results could differ materially from the estimates.

Cash and Cash Equivalent

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. At December 31, 2011 cash consists of a checking account and money market account held by financial institutions.

Mine Exploration and Development Costs

The Company accounts for mine exploration costs in accordance with Accounting Standards Codification 932, Extractive Activities. All exploration expenditures are expensed as incurred. Mine development costs are capitalized until production, other than production incidental to the mine development process, commences and are amortized on a units of production method based on the estimated proven and probable reserves. Mine development costs represent costs incurred in establishing access to mineral reserves and include costs associated with sinking or driving shafts and underground drifts, permanent excavations, roads and tunnels. The end of the development phase and the beginning of the production phase takes place when construction of the mine for economic extraction is substantially complete. Coal extracted during the development phase is incidental to the mine’s production capacity and is not considered to shift the mine into the production phase. Amortization of capitalized mine development is computed based on the estimated life of the mine and commences when production, other than production incidental to the mine development process, begins. From September 22, 2009 (date of inception) through December 31, 2011, the Company had not incurred any mine development costs.

Mine Properties

The Company accounts for mine properties in accordance with Accounting Standard Codification 930, Extractive Activities-Mining. Costs of acquiring mine properties are capitalized by project area upon purchase of the associated claims. Mine properties are periodically assessed for impairment of value and any diminution in value. There were no mineral properties as of December 31, 2011

Income Taxes

The Company has adopted Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) which requires the recognition of deferred tax liabilities and assets for the expected future tax consequences of events that have been included in the financial statement or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Temporary differences between taxable income reported for financial reporting purposes and income tax purposes consist primarily of timing differences such as deferred officers’ compensation and stock compensation accounting versus tax differences.

Net Loss Per Share, basic and diluted

The Company has adopted Accounting Standards Codification Subtopic 260-10, Earnings Per Share (“ASC 260-10) specifying the computation, presentation and disclosure requirements of earning per share information. Basic loss per share has been computed by dividing net loss available to common shareholders by the weighted average number of common shares outstanding for the period. Shares issuable upon conversion of the notes payable and exercise of warrants has been excluded as a common stock equivalent in the diluted loss per share because their effect is anti-dilutive on the computation.

Foreign Currency Translation and Comprehensive Income (Loss)

The functional currency of Interich is the Hong Kong Dollar (“HKD”). For financial reporting purposes, HKD were translated into United States Dollars (“USD” or “$”) as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period.

Translation adjustments arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated other comprehensive income”. Gains and losses resulting from foreign currency transactions are included in the consolidated results of operations. There has been no significant fluctuation in the exchange rate for the conversion of HKD to USD after the balance sheet date.

The Company uses Accounting Standard Codification 220 “Comprehensive Income”. Comprehensive income is comprised of net income and all changes to the statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions to stockholders. Comprehensive income for the years ended December 31, 2011 consisted of net income and foreign currency translation adjustments.

Concentration and Credit Risk

The Company’s principal operations are all carried out in Indonesia. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in Indonesia, and by the general state of Indonesia’s economy. The Company’s operations in Indonesia are subject to specific considerations and significant risks not typically associated with companies in North America. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Financial instruments and related items, which potentially subject the Company to concentrations of credit risk, consist primarily of cash, cash equivalents and trade receivables. The Company places its cash and temporary cash investments with high credit quality institutions. At times, such investments may be in excess of the FDIC insurance limit.

Impact of New Accounting Standards

The Company has adopted the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 105-10, Generally Accepted Accounting Principles – Overall (“ASC 105-10”), which was formerly known as SFAS 168. ASC 105-10 establishes the FASB Accounting Standards Codification (the “Codification”) as the source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental entities in the preparation of financial statements in conformity with U.S. GAAP. Rules and interpretive releases of the Securities and Exchange Commission (the "SEC") under authority of federal securities laws are also sources of authoritative U.S. GAAP for SEC registrants. All guidance contained in the Codification carries an equal level of authority. The Codification superseded all existing non-SEC accounting and reporting standards and all other non-grandfathered, non-SEC accounting literature not included in the Positions or Emerging Issues Task Force Abstracts. Instead, it will issue Accounting Standards Updates (“ASUs”). The FASB will not consider ASUs as authoritative in their own right. ASUs will serve only to update the Codification, provide background information about the guidance and provide the basis of conclusions on the change(s) in the Codification. References made to FASB guidance throughout this document have been updated for the Codification.

The Company has reviewed all other recently issued, but not yet adopted, accounting standards in order to determine their effects, if any, on its results of operation, financial position or cash flows. Based on that review, the Company believes that none of these pronouncements will have a significant effect on its consolidated financial statements.

Emerging Growth Company

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| · | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |