UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | | |

| [X] | | ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED: DECEMBER 31, 2011 |

| [ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

STW RESOURCES HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada | | 20-3678799 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

619 West Texas Avenue, Suite 126, Midland, Texas 79701

(Address of principal executive offices) (Zip Code)

(432) 686-7777

(Registrant's telephone number)

(Former Name, Former Address and Former Fiscal Year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None | | |

Securities registered pursuant to section 12(g) of the Act:

Title of class: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | | Accelerated filer | [ ] |

Non-accelerated filer (Do not check if a smaller reporting company) | [ ] | | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2011 was $0.8 million computed by reference to the closing price of the registrant’s common stock as quoted on the OTC Pink on June 30, 2011, which was $0.025. For purposes of the above statement only, all directors, executive officers and 10% shareholders are assumed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of October 10, 2012 the registrant had 85,558,598 shares of common stock, par value $0.001 per share outstanding.

STW RESOURCES HOLDING CORP. FORM 10-K

INDEX

| | | Page |

| PART I | | |

| | | |

| ITEM 1. | | 1 |

| ITEM 1A. | | 7 |

| ITEM 1B. | | 12 |

| ITEM 2. | | 12 |

| ITEM 3. | | 12 |

| ITEM 4. | | 12 |

| | | |

| PART II | | |

| | | |

| ITEM 5. | | 13 |

| ITEM 6. | | 14 |

| ITEM 7. | | 14 |

| ITEM 7A. | | 22 |

| ITEM 8. | | 23 |

| ITEM 9. | | 23 |

| ITEM 9A. | | 24 |

| ITEM 9B. | | 26 |

| | | |

| PART III | | |

| | | |

| ITEM 10. | | 27 |

| ITEM 11. | | 30 |

| ITEM 12. | | 31 |

| ITEM 13. | | 31 |

| ITEM 14. | | 32 |

| | | |

| PART IV | | |

| | | |

| ITEM 15. | | 33 |

| | | |

| 35 |

| F-1 |

This Annual Report on Form 10-K for the fiscal year ended December 31, 2011 filed by STW Resources Holding Corp. (f/k/a Woozyfly Inc. and STW Global, Inc.) with the Securities and Exchange Commission (the “SEC”) contains forward looking statements and information that are based upon beliefs of, and information currently available to, the Company's management as well as estimates and assumptions made by the Company's management. When used in the filings the words "anticipate", "believe", "estimate", "expect", "future", "intend", "plan" or the negative of these terms and similar expressions as they relate to the Company’s or Company’s management identify forward looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled "Risk Factors") relating to the Company’s industry, the Company’s operations and results of operations and any businesses that may be acquired by the Company. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Company’s management believes that the expectations reflected in the forward looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Company's consolidated financial statements and the related notes filed with this Annual Report on Form 10-K.

In this Annual Report on Form 10-K, references to "we," "our," "us," the "Company," “STW”, refer to STW Resources Holding Corp. (f/k/a Woozyfly Inc. and STW Global, Inc.), a Nevada corporation.

Corporate History

The Company was organized September 11, 2003 under the laws of the State of Nevada, as GPP Diversified, Inc. The business of the Company was to sell pet products via the Internet. We were initially authorized to issue 25,000,000 shares of no par value common stock. On November 9, 2005, we amended our articles of incorporation to increase our authorized capital to 100,000,000 shares with a par value of $0.001. Concurrently, we changed our name from GPP Diversified, Inc. to Pet Express Supply, Inc. On July 28, 2008, Pet Express Supply, Inc. entered into an Exchange Agreement with each of the shareholders of CJ Vision Enterprises, Inc., a Delaware corporation doing business as Woozyfly.com, pursuant to which we changed our corporate name to Woozyfly, Inc. , authorized the issuance of 10,000,000 blank check preferred shares and effectuated a 6:1 stock split. On January 15, 2009, we ceased operations.

On May 12, 2009, the Company filed a voluntary petition in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”) seeking reorganization relief under the provisions of Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”). The Chapter 11 case was being administered under the caption In re Woozyfly, Inc. Case No. 09-13022 (JMP) (the “Chapter 11 Case”). The Company continued to operate its business as debtor in possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. In connection with the Chapter 11 Case, the Bankruptcy Court approved the arrangement pursuant to which MKM Opportunity Master Fund Ltd agreed to provide a DIP loan in the amount up to $100,000 (the “DIP Loan”).

The filing of the Chapter 11 Case constituted an event of default or otherwise triggered repayment obligations under the Company's 6% Secured Convertible Notes due June 30, 2011 ("Convertible Notes"). As a result, all indebtedness outstanding under these facilities and the notes became automatically due and payable, subject to an automatic stay of any action to collect, assert, or recover a claim against the Company and the application of applicable bankruptcy law.

On January 17, 2010, we entered into an Agreement and Plan of Merger (“Merger Agreement”) with STW Acquisition, Inc. (“Acquisition Sub”), a wholly owned subsidiary of STW Resources, Inc. (“STWR” ) and certain shareholders of STWR controlling a majority of the issued and outstanding shares of STWR. Pursuant to the Merger Agreement, STWR merged into the Acquisition Sub resulting in an exchange of all of the issued and outstanding shares of STWR for shares of the Company on a one for one basis. At such time, STWR became a wholly owned subsidiary of the Company.

On February 9, 2010, the Court entered an order confirming the Second Amended Plan of Reorganization (the “Plan”) pursuant to which the Plan and the Merger Agreement were approved. The Plan was effective February 19, 2010 (the “Effective Date”). The principal provisions of the Plan were as follows:

| ● | MKM, the DIP Lender, received 400,000 shares of common stock and 2,140,000 shares of preferred stock; |

| ● | the holders of the Convertible Notes received 1,760,000 shares of common stock; |

| ● | general unsecured claims received 100,000 shares of common stock; and |

| ● | the Company’s equity interest was extinguished and cancelled. |

On February 12, 2010, pursuant to the terms of the Merger Agreement, STWR merged with and into Acquisition Sub, which became a wholly-owned subsidiary of the Company (the “Merger”). In consideration for the Merger and STWR becoming a wholly-owned subsidiary of the Company, the Company issued an aggregate of 31,780,004 (the “STW Acquisition Shares”) shares of common stock to the shareholders of STWR at the closing of the Merger and all derivative securities of STWR as of the Merger became derivative securities of the Company including options and warrants to acquire 12,613,002 shares of common stock at an exercise price ranging from $3.00 to $8.00 with an exercise period ranging from July 31, 2011 through November 12, 2014 and convertible debentures in the principal amount of $1,467,903 with a conversion price of $0.25 and maturity dates ranging from April 24, 2010 through November 12, 2010.

The par value of the exchanged shares changed from $0.00001 to $0.001. All share amounts presented throughout this document reflect this change in par value.

Considering that, following the Merger, the shareholders of STWR control the majority of our outstanding voting common stock, and effectively succeeded our otherwise minimal operations to those that are theirs, STWR is considered the accounting acquirer in this reverse-merger transaction. Accordingly the Company has not recognized any goodwill or other intangible assets in connection with this reverse merger transaction.

Effective March 1, 2010, the Company changed its name to STW Global, Inc. in accordance with the Bankruptcy proceeding. On March 3, 2010, the Company changed its name to STW Resources Holding Corp. The name change was accomplished by merging a wholly owned subsidiary of the Company into the Company resulting in the Company being the surviving Company and changing the name of the Company.

The Company was the surviving and continuing entity of the Merger and the historical financials following the Merger are those of STWR. The Company was a "shell company" (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) immediately prior to its acquisition of STWR pursuant to the terms of the Merger Agreement. As a result of such acquisition, the Company’s operations are now focused on the provision of customized water reclamation services. Consequently, management believes that the Merger has caused the Company to cease to be a shell company as it no longer has nominal operations.

Overview

The Company, based in Midland, Texas, provides customized water reclamation services. STW’s core expertise is an understanding of water chemistry and its application to the analysis and remediation of complex water reclamation issues. STW provides a complete solution throughout all phases of a water reclamation project including analysis, design, evaluation, implementation and operations.

STW’s expertise is applicable to several market segments including:

| ● | Gas shale hydro-fracturing flowback; |

| ● | Oil and gas produced water; |

| ● | Acid mine drainage (“AMD”); |

| ● | Desalination; |

| ● | Brackish water; and |

| ● | Municipal wastewater. |

Understanding water chemistry is the foundation of STW’s expertise. STW will provide detailed chemical analysis of the input stream and of the process output that conforms to the various environmental and legal requirements and the needs of the customer. STW becomes an integral part of the water management process and provides a customized solution that encompasses analysis, design, and operations including pretreatment and transportation. Simultaneously, STW evaluates the economic impact of this process to the customer. These processes will use technologies that fit our customer’s needs: fixed, mobile or portable; reverse-osmosis, membrane technology, chemical, other technologies, and any necessary pre-treatment, post-treatment. STW will also supervise construction, testing, and operation of these systems. Our keystone is determining and optimizing the most appropriate technology to effectively and economically address our customers’ particular requirements. As an independent solutions provider STW is manufacturer-agnostic and is committed to the use of the right technology demanded by the design process.

Market Opportunities

Gas shale fracturing flowback water

STW is actively pursuing opportunities in all the major shale formations in the United States. The initial focus, in this sector, is the shale activity in the Permian and Delaware basins of west Texas.

Unconventional tight oil and gas shales such as the Wolfcamp Shale in West Texas require millions of gallons of fresh water to drill and stimulate a new well. The water returns during the fracture flowback (“frac”) and production (“production”) with salts or total dissolved solids (“TDS”) at levels unfit for human consumption. This flowback or produced water is typically disposed of through various means such as controlled injection into disposal wells. STW will target the frac water market in the tight oil and gas formations first, and approach the produced water market for oil and gas production subsequently.

Oil and gas reservoirs are usually found in porous rocks, which also contain saltwater. Cross linked gel fracture fluids with high “proppant” loading (additives that prop open fissures in the geological formation caused by hydraulic fracturing) have been utilized to fracture these zones in order to gain permeability, allowing the oil and gas to flow to the well bore. The unconventional shale formations have been common knowledge for decades, but the cost of gas production was always considered to be uneconomical. The wells were drilled and fractured with the same crossed linked system as discussed above.

All of the wells were vertical and required stimulation about every three years with a new fracture. Around 2001, the “slick water fracture” technique was developed. This change required larger volumes of fresh water (1.2 million gallons per fracture on a well) to be used in the fracturing process, a friction reducing polymer additive, and low concentrations of a proppant in the hydraulic fracture fluid. Wells using this modified technique now can economically produce oil and gas for over eight years without re-stimulation. The fresh water is believed to dissolve salts from the shale over time and open up the natural fractures and fissures in the rock, allowing more oil and gas to be produced. In 2003, horizontal drilling rigs were brought into the Barnett Shale and the slick water fracture volume increased from one to eight plus million gallons per well. The slick water fracture technique has become the standard for most of the shale formations for stimulation of the wells.

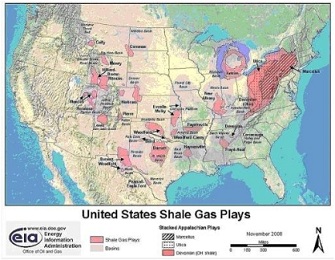

This map illustrates the location of the major shale formations that are discussed below:

The Permian and Delaware Basins in West Texas

Producers in West Texas are facing the same water related problems as other producers are nationwide - a shortage of fresh water due to drought and municipality expansion. There are over 450 drilling rigs working in West Texas using approximately 8+ million gallons of fresh water monthly. The formations are shale and the discovery of several new shale formations, West Texas is considered to be one of the largest and most active oil and gas areas in the United States.

Eagle Ford Shale Formation

The Eagle Ford Shale is a recently discovered formation located in South Texas. The development stage of the field is being done with thousands of wells to be drilled and completed annually. This area has limited supplies of fresh water, leading the Company to believe water reclamation will be a required solution in order for producers to access a sufficient supply of frac water in this market. Production of natural gas has been reported at levels in excess of 10 million cubic feet (“Mcf”) per day, and hundreds of barrels of condensate at some of the wells. The Company expects to intensify its efforts to address this market opportunity.

Produced Water

Shale zones are typically dry geological formations devoid of any formation or connate water, and hence the fracture flowback water comprises most of water that returns following gas production. Outside of shale formations, where most gas and oil production occurs, there is typically a reservoir of connate water in the production zone that generates “produced” water. Produced water is primarily salty water trapped in the reservoir rock and brought up along with oil and/or gas during production, and is the most common oil field waste. The quality of produced water varies significantly in different parts of the world depending on the geology of the underlying formation.

In a large number of the oil fields in the USA, secondary or tertiary means of handling produced water storage, such as water floods and steam floods, are typically utilized. These are operations where the produced water is used to maintain reservoir pressure, prevent subsidence, and sweep the zone to remove the oil. Most of these water floods utilize a fresh water source as a supply so that sufficient volumes are available. As these fields age, less water is required for the flood, so excess contaminated brines concentrate and require disposal. As this water could be reclaimed with STW proprietary systems believes that the market for reclaiming produced water outside the shale reclamation projects represents a considerable opportunity for the Company.

Texas is the largest oil and gas production state in the nation and the produced water is unfit for use, poses a threat to the environment and is typically injected into deep injection wells. In accordance with Texas Railroad Commission regulations, water placed in these disposal wells is rendered permanently unavailable for re-use or consumption. The reclaimed water would available for many beneficial uses, including agricultural and environmental applications, as well as re-use in hydraulic fracturing operations. Deep injection well practices in every gas and oil producing region in the world pose the same detrimental environmental and resource conservation issues. The water reclamation products and services offered by the Company could provide a significant part of the solution to all constituencies concerned.

In the steam floods of California, a large portion of the water is recycled through the water treatment facility and converted back to steam. There are some fields that there is excess water in the millions of gallons per day that is low in TDS and could very economically be converted back to environmentally usable water.

Brackish Water

World-wide, there are brackish water zones that contain large volumes of water. The water contains dissolved salts in the 0.5 to 2% (5,000 to 20,000 mg/l TDS) range and hence unfit for human use. This water can be treated to reduce the TDS below 500 mg/l or 0.05% TDS making the water fit for human consumption. Factors such as decreasing supplies of fresh ground and surface water, increased competition for surface water resources, and changes in population/demand centers are driving the need for brackish water for water supply. STW’s potential customers are private companies and municipalities serving fast growing metropolitan areas where demand for water is outpacing the available supply. For example, aquifers in the Texas Gulf Coast contain a large volume of brackish water (less than 10,000 ppm TDS) that, with desalinization, will help meet increasing demand in the region.

There are more than 450 drilling rigs operating in West Texas and each one will use approximately 8+ millions gallons of fresh water per month for drilling and fracking wells. In its current form, brackish water is unsuitable for oilfield use. By cleaning it in an economical way with STW technology, it may be used in the oilfield, thus reducing the strain on current fresh water supplies.

STW is also involved in several projects that will be cleaning brackish water for municipal and golf course use. This helps in the conservation of our fresh water resources.

With one of the worst droughts in our history, the use of treated brackish water is extremely popular and STW has successfully designed and engineered a system capable of processing this water very economically.

Legislative and Regulatory:

Progressively tighter regulations are demanding a thorough review of the entire water-use cycle in industrial applications with the ultimate goal of encouraging and/or mandating reclamation and re-use of water. STW works closely with Federal, State and local regulators and environmental agencies to share our expertise and knowledge on this complex issue and discuss our views on potential solutions. The Company’s intimate knowledge of this process is a key tool to assist their customers to better understand the legislative and regulatory elements related to water management and advise them of various alternatives.

Process

STW’s proprietary systems and processes are predicated upon a thorough understanding of the customer’s water needs and related issues. This understanding is developed through a series of interactive discussions with the customer. The next phase is data gathering and analysis. STW collects samples at various locations and at different time intervals which are then tested at independent laboratories and analyzed by STW. Based upon this analysis, STW would recommend a solution using the most appropriate technologies and negotiate the acquisition and financing of these technologies as well as contracts with engineering procurement construction (“EPC”). Finally, STW oversees the EPC process and operates the facility.

STW’s processes are based upon a fundamental understanding of the core issue and developing an appropriate solution using our experience and expertise. It includes sampling and testing, analysis, design and as required by customers, implementation and operation. Some of the steps involved are described below:

| ● | The inlet water quality must be determined and measurement of Total Dissolved Solids (TDS), hardness, barium, strontium, bromine, sulfate and hydrocarbon concentrations are critical. |

| ● | Multiple samples over time are taken to ensure consistency and accuracy of inlet water quality measurement. |

| ● | An understanding and analysis of potential uses for the reclaimed water. |

| ● | A site inspection to determine the various vessels needed such as tanks, pumps, pits, truck off loading racks, and engineering testing of the land. |

| ● | An analysis of fluid volumes and their variability over time. |

| ● | Length of time the water needs to be reclaimed at this site. |

| ● | Determination of appropriate technology: fixed or mobile, evaporation, reverse osmosis or other. |

| ● | Permitting as needed |

| ● | An investigation of the handling of the concentrated brines and any other residue from the reclamation process. |

| ● | Disposal options on the residue including potential use of the by-products. |

Technology

STW has developed relationships with a number of manufacturers that offer best-of-class technologies applicable to its customer base. These technologies include thermal evaporation, membrane technology and reverse osmosis and are available as fixed or mobile units with varying capacities. Various pre and post-treatment options are available as necessary including crystallizers that process very high TDS (>150,000 mg/l).

Thermal Evaporation: This process is capable of handling waters that contain up to 150,000 mg/l TDS, with fresh water recovery rates from 50 to 90% or greater depending on inlet water quality. The recovered fresh water, or “distillate”, is highly purified water from the evaporative process and has multiple re-use applications. It is particularly applicable in the gas shale and oil production facilities for reclaiming frac and produced waters.

The technology is scalable and can be deployed as mobile units that can process 72,000 gallons per day (“gpd”), or as portable units that can process 216,000 gpd, or as fixed central units capable of processing up to 2,880,000 gpd.

Residual brine concentrate can, depending on local conditions and producer’s priorities, either be disposed off in deep injection wells or be treated further through a Crystallizer that reduces it into distillate and commercially valuable salt residuals.

Reverse Osmosis: Waters that are below 34,000 mg/l of total dissolved solids and contain low levels of barium, strontium, bromine, and sulfate can be reclaimed through a reverse osmosis unit (RO). Reverse osmosis is the process of forcing a solvent from a region of high solute concentration through a semi-permeable membrane to a region of low solute concentration by applying a pressure in excess of the osmotic pressure. The membranes used for reverse osmosis are generally designed to allow only water to pass through while preventing the passage of solutes (such as salt ions). This process is best known for its use in desalination (removing the salt from sea water to get fresh water), but it has also been used to purify fresh water for medical, industrial and domestic applications. Recovery rates for seawater to drinking water are about 50%.

A stream of concentrated brine or higher TDS is the by-product. This brine can be properly disposed of or utilized as a feed solution to a brine concentrator or crystallizer. The latter ensures higher quality water with lower TDS levels for industrial Uses.

Most oilfield waters cannot be processed through an RO membrane since they contain barium, strontium, or bromine. The barium and strontium are very large molecules and they plug the membrane and create damage or permanent fouling of the membrane. Bromine and other such halogens react with the membrane and destroy its integrity. There are few oil field waters that could be processed through this technology but a thorough study is required to ensure success. STW Resources will utilize this technology where the water chemistry can be processed through RO membranes.

Membrane Bioreactor: A Membrane BioReactor (“MBR”) is a combination of biological and ultrafiltration technologies. The biological area provides the same process utilized in all sewage treatment facilities. Bacteria are maintained in an aerobic condition which cause decay in all of the organic materials contained in the water, and oxidizing these organic materials into low molecular weight acids, usually acetic acid. Maintaining the bacteria in an oxygen rich environment prevents mutatation or growth of any anaerobic bacteria, which would produce inorganic acids such as hydrogen sulfide.

A filter membrane removes the water fraction from the unit. The membrane provides filtration in the 0.01 microns or lower range which is sufficient enough to remove viruses, bacteria, and other colloidal materials. The water exiting the units is potable water and safe for human consumption.

Marketing & Sales

STW’s business proposition is to provide comprehensive, necessary water treatment solutions. We work closely with our customers to evaluate their water treatment needs, understand how these may change over time, assess the regulatory and economic factors and then design an optimal solution. STW offers a broad array of technical solutions coupled with a service suite and financial structuring options that provide our customers with the ability to obtain a turnkey solution to their waste water disposal challenges.

Oil and Gas Shales: Most of the oil and gas producers in each of the shale formations are already well known to the Company. STW personnel have developed many, and in some cases, long standing relationships with key personnel responsible for well completion and remedial operations at each gas producer. STW monitors production plans at the producer level, the acreage acquisitions at the shale formations and trends that relate to the demand for water reclamation by region. In addition, the Company maintains detailed databases that monitor drilling permits, rig counts and other key statistics that forecast gas production rates by geography. These activities allow the Company to anticipate demand for its services and to prioritize its sales calling effort on those producers for whom fresh water supply is an issue or where shale water disposal pose the greatest challenges.

The foundation of the Company’s sales strategy is to become an integral part of its customer’s water management function. This involves identifying and finding solutions to customer needs through a multi–step, consultative approach:

| ● | Evaluate drilling program and production expansion plans. |

| ● | Identify and define fracture water supply needs and waste brine generation levels. |

| ● | Study the flowback water volumes and chemistry over time. |

| ● | Generate economic models jointly with producers, with full consideration of all costs of obtaining, utilizing, and disposing of the water. |

| ● | Evaluate various water reclamation options, from equipment to logistics, and develop financial models for all the options. |

| ● | Provide a customized presentation comparing present practices to all of the options of water reclamation available to the customer, for buy-in to the best scenarios. |

| ● | Jointly develop a presentation of the best scenarios for water management (present and future) for use by upper management. Support the presentation as required. |

| ● | Review and determine optimal system design, location and financial structure. |

| ● | Develop a time line for water reclamation implementation. |

| ● | Execute definitive off-take and/or other agreements satisfactory to all parties. |

STW is able to facilitate this part of the sales process through its detailed knowledge of the oil and gas drilling, fracking and production process and economics, shale formation geology, frac water chemistry, well completion techniques and logistics and regional regulatory landscapes. This expertise reduces the time required during the evaluative stage of the sales process and fosters a positive working relationship with our customers. STW then works together with its engineering and manufacturing partners to complete the technical solution, develop ancillary system requirements (balance of plant) evaluate cost and operating data, model the financial performance of the system and define remaining project parameters and an installation timeline.

Water reclamation is a new paradigm for oil and gas producers. Educating them about the economic, environmental and political benefits is key to long-term adoption.

Competition

In the oil and gas industry, current fracturing and produced water disposal methods – deep injection wells and surface water disposal – represent the Company’s greatest source of competition.

Brine Discharge / Deep Injection Wells

In many gas shale fields, disposal through a deep injection well offers a cost-effective (though environmentally questionable) alternative to water reclamation. If suitable geology exists, high TDS flowback waters can be disposed by injection into a deep discharge well. There are operative brine discharge wells in each of the major shale formations.

Number of Employees

As of October 10, 2012, other than our one executive officer, presently we do not have any full time employees.

Our Website

Our website address is www.stwresources.com. Information found on our website is not incorporated by reference into this report.

You should carefully consider the following risk factors and the other information included in this annual report on Form 10-K, as well as the information included in other reports and filings made with the SEC, before investing in our common stock. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose part or all of your investment.

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We did not begin operations of our business until February 2008. We have a limited operating history and have generated limited revenue. As a consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Reliance on the historical results may not be representative of the results we will achieve, particularly in our combined form. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

The report of our independent registered public accounting firm on our 2011 consolidated financial statements contains a going concern modification, and we will need additional financing to execute our business plan, fund our operations and to continue as a going concern, which additional financing may not be available on a timely basis, or at all.

We have limited remaining funds to support our operations. We have prepared our consolidated financial statements in this Form 10-K on a going-concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. We will not be able to execute our current business plan, fund our business operations or continue as a going concern long enough to achieve profitability unless we are able to secure additional funds. The Report of Independent Registered Public Accounting Firm on our December 31, 2011 consolidated financial statements includes an explanatory paragraph stating that the recurring losses incurred from operations and a working capital deficiency raise substantial doubt about our ability to continue as a going concern. However, in order to sustain and improve operations, we will need to secure additional funds. If adequate financing is not available, we will not be able to sustain operations. In addition, if one or more of the risks discussed in these risk factors occur or our expenses exceed our expectations, we may be required to raise further additional funds sooner than anticipated.

We will be required to pursue sources of additional capital to fund our operations through various means, including equity or debt financing, funding from a corporate partnership or licensing arrangement or any similar financing. However, we may be unable to obtain such financings on reasonable terms, or at all. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have additional dilutive effects. In addition, if we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish potentially valuable rights to our product candidates or proprietary technologies, or grant licenses on terms that are not favorable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial results. As a result, there can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. If we are unable to raise funds to satisfy our capital needs prior to the end of 2013, we may be required to cease operations.

STW’s results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

STW has a deficit accumulated since January 28, 2008 (Inception) through December 31, 2011 of $13,723,704. In addition, as of December 31, 2011, STW had total liabilities of $7,937,569 and total assets of $34,007.

Our management is developing plans to alleviate the negative trends and conditions described above. Our business plan is speculative and unproven. There is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan, that we will be able to curtail our losses now or in the future. Further, as we are a new enterprise, we expect that net losses will continue and our working capital deficiency will exacerbate.

We depend upon key personnel and need additional personnel.

Our success depends on the continuing services of Stanley Weiner, our chief executive officer and director. The loss of Mr. Weiner could have a material and adverse effect on our business operations. Additionally, the success of the Company’s operations will largely depend upon its ability to successfully attract and maintain competent and qualified key management personnel. As with any company with limited resources, there can be no guaranty that the Company will be able to attract such individuals or that the presence of such individuals will necessarily translate into profitability for the Company. Our inability to attract and retain key personnel may materially and adversely affect our business operations.

We must effectively manage the growth of our operations, or our company will suffer.

To manage our growth, we believe we must continue to implement and improve our operational and marketing departments. We may not have adequately evaluated the costs and risks associated with this expansion, and our systems, procedures, and controls may not be adequate to support our operations. In addition, our management may not be able to achieve the rapid execution necessary to successfully offer our products and services and implement our business plan on a profitable basis. The success of our future operating activities will also depend upon our ability to expand our support system to meet the demands of our growing business. Any failure by our management to effectively anticipate, implement, and manage changes required to sustain our growth would have a material adverse effect on our business, financial condition, and results of operations.

Our business requires substantial capital, and if we are unable to maintain adequate financing sources our profitability and financial condition will suffer and jeopardize our ability to continue operations.

We require substantial capital to support our operations. If we are unable to maintain adequate financing or other sources of capital are not available, we could be forced to suspend, curtail or reduce our operations, which could harm our revenues, profitability, financial condition and business prospects.

Our operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on us.

Our operations are subject to federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Various permits from government bodies are required for our operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, provincial, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages. We generally maintain insurance coverage customary to the industry; however, we are not fully insured against all possible environmental risks. To date, we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

Risks associated with the collection, treatment and disposal of wastewater may impose significant costs.

Our wastewater collection, treatment and disposal operations of our subsidiaries are subject to substantial regulation and involve significant environmental risks. If collection systems fail, overflow or do not operate properly, untreated wastewater or other contaminants could spill onto nearby properties or into nearby streams and rivers, causing damage to persons or property, injury to aquatic life and economic damages, which may not be recoverable in rates. Liabilities resulting from such damage could adversely and materially affect our business, results of operations and financial condition. Moreover, in the event that we are deemed liable for any damage caused by overflow, our losses might not be covered by insurance policies, and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

We will require significant capital requirements for equipment, commercialization and overall success.

We will require additional financing for our operations, to purchase equipment and to establish a customer base. We anticipate that we will require a minimum of $3.0 to $5.0 million in additional capital over the next six months to pursue our business plan. We cannot assure you that we will obtain any additional financing through any other means. Additional financing may not be available to us on acceptable terms, if at all. Unless we raise additional financing, we will not have sufficient funds to complete the purchase of equipment and commercialization of our services. As of the date of the Annual Report, we have no firm commitments for additional capital.

Our additional financing requirements could result in dilution to existing stockholders.

We will require additional financings obtained through one or more transactions which effectively dilute the ownership interests of holders of our Common Stock. We have the authority to issue additional shares of Common Stock and Preferred Stock as well as additional classes or series of ownership interests or debt obligations which may be convertible into any class or series of ownership interests in the Company. The Company is authorized to issue 100,000,000 shares of Common Stock and 10,000,000 shares of Preferred Stock. Such securities may be issued without the approval or other consent of the holders of the Common Stock.

A small number of existing shareholders own a significant amount of our Common Stock, which could limit your ability to influence the outcome of any shareholder vote.

Our executive officers, directors and shareholders holding in excess of 5% of our issued and outstanding shares, beneficially own over 80.7% of our common stock as of October 10, 2012. Under our Articles of Incorporation and Nevada law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these individuals will be able to significantly influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers or other significant corporate transactions.

We face competition.

We face competition from existing companies in reclamation of oil and gas waste water space that provide similar services to the Company’s. Our competitors may have longer operating histories, greater name recognition, broader customer relationships and industry alliances and substantially greater financial, technical and marketing resources than we do. Our competitors may be able to respond more quickly than we can to new or emerging technologies and changes in customer requirements.

We rely on confidentiality agreements that could be breached and may be difficult to enforce.

Although we believe that we take reasonable steps to protect our intellectual property, including the use of agreements relating to the non-disclosure of our confidential information to third parties, as well as agreements that provide for disclosure and assignment to us of all rights to the ideas, developments, discoveries and inventions of our employees and consultants while we employ them, such agreements can be difficult and costly to enforce. Although we generally seek to enter into these types of agreements with our consultants, advisors and research collaborators, to the extent that such parties apply or independently develop intellectual property in connection with any of our projects, disputes may arise concerning allocation of the related proprietary rights. If a dispute were to arise enforcement of our rights could be costly and the result unpredictable. In addition, we also rely on trade secrets and proprietary know-how that we seek to protect, in part, through confidentiality agreements with our employees, consultants, advisors or others.

Despite the protective measures we employ, we still face the risk that: agreements may be breached; agreements may not provide adequate remedies for the applicable type of breach; our trade secrets or proprietary know-how may otherwise become known; our competitors may independently develop similar technology; or our competitors may independently discover our proprietary information and trade secrets.

There has not been an active public market for our common stock so the price of our common stock could be volatile and could decline at a time when you want to sell your holdings.

Our common stock is traded on the OTC Pink under the symbol STWS. Our common stock is not actively traded and the price of our common stock may be volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include:

| • | | expiration of lock-up agreements; |

| • | | our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; |

| • | | changes in financial estimates by us or by any securities analysts who might cover our stock; |

| • | | speculation about our business in the press or the investment community; |

| • | | significant developments relating to our relationships with our customers or suppliers; |

| • | | stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in the oil and gas industry; |

| • | | customer demand for our products; |

| • | | investor perceptions of the oil and gas industry in general and our company in particular; |

| • | | the operating and stock performance of comparable companies; |

| • | | general economic conditions and trends; |

| • | | major catastrophic events; |

| • | | announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; |

| • | | changes in accounting standards, policies, guidance, interpretation or principles; |

| • | | sales of our common stock, including sales by our directors, officers or significant stockholders; and |

| • | | additions or departures of key personnel. |

Securities class action litigation is often instituted against companies following periods of volatility in their stock price. This type of litigation could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our company at a time when you want to sell your interest in us.

Our Common Stock is subject to the “penny stock” rules of the Securities and Exchange Commission.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| • | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| • | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

| • | obtain financial information and investment experience objectives of the person; and |

| • | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| | • | sets forth the basis on which the broker or dealer made the suitability determination; and |

| | • | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions requiring stockholder approval.

Our directors, executive officers and principal stockholders, and their respective affiliates, will beneficially own approximately 80.7% of our outstanding shares of common stock as of October 10, 2012. As a result, these stockholders, acting together, would have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, these stockholders, acting together, would have the ability to control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market price of our common stock by:

| | • | | delaying, deferring or preventing a change in corporate control; |

| | • | | impeding a merger, consolidation, takeover or other business combination involving us; or |

| | • | | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us. |

Any adjustment in the conversion price of our convertible notes or the exercise price of our warrants could have a depressive effect on our stock price and the market for our stock.

If we are required to adjust the warrant exercise price pursuant to any of the adjustment provisions of the agreements relating to any of our prior financing transaction, the adjustment or the perception that an adjustment may be required, may have a depressive effect on both our stock price and the market for our common stock.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and operating results and stockholders could lose confidence in our financial reporting.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our operating results could be harmed. Failure to achieve and maintain an effective internal control environment, regardless of whether we are required to maintain such controls, could also cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

The Company’s management assessed the design and operating effectiveness of internal control over financial reporting as of December 31, 2011 based on the framework set forth in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. In connection with the assessment described above, management identified the control deficiencies that represent material weaknesses at December 31, 2011. See "Item 9 Controls and Procedures" for more detailed discussion.

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members.

We recently became a public company and subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, the Sarbanes-Oxley Act. Prior to February 2010, we had not operated as a public company and the requirements of these rules and regulations will likely increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition. Prior to the date of this annual report, we had not filed our annual report for the fiscal year ended December 31, 2012 and we have not filed a quarterly report for the first and second quarters ended March 31, and June 30, 2012. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls for financial reporting. For example, Section 404 of the Sarbanes-Oxley Act of 2002 requires that our management report on, the effectiveness of our internal controls structure and procedures for financial reporting. Section 404 compliance may divert internal resources and will take a significant amount of time and effort to complete. We may not be able to successfully complete the procedures and certification and attestation requirements of Section 404 by the time we will be required to do so. If we fail to do so, or if in the future our chief executive officer and chief financial officer determines that our internal controls over financial reporting are not effective as defined under Section 404, we could be subject to sanctions or investigations by the SEC or other regulatory authorities. Furthermore, investor perceptions of our company may suffer, and this could cause a decline in the market price of our common stock. Irrespective of compliance with Section 404, any failure of our internal controls could have a material adverse effect on our stated results of operations and harm our reputation. If we are unable to implement these changes effectively or efficiently, it could harm our operations, financial reporting or financial results. The Company’s management assessed the design and operating effectiveness of internal control over financial reporting as of December 31, 2011 based on the framework set forth in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. In connection with the assessment described above, management identified the control deficiencies that represent material weaknesses at December 31, 2011. See "Item 9. Controls and Procedures" for more detailed discussion. Notwithstanding the foregoing, management reviewed the financial statements and underlying information included in this annual report on Form 10-K and believes the procedures performed are adequate to fairly present our financial position, results of operations and cash flows for the periods presented in all material respects.

In order to achieve effective internal controls, we may need to hire a number of additional employees with public accounting and disclosure experience in order to meet our ongoing obligations as a public company, which will increase costs. Our management team and other personnel will need to devote a substantial amount of time to new compliance initiatives and to meeting the obligations that are associated with being a public company, which may divert attention from other business concerns, which could have a material adverse effect on our business, financial condition and results of operations.

If securities or industry analysts do not publish research or reports about our business, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts publish about us or our business. We do not currently have and may never obtain research coverage by industry or financial analysts. If no or few analysts commence coverage of us, the trading price of our stock would likely decrease. Even if we do obtain analyst coverage, if one or more of the analysts who cover us downgrade our stock, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not Applicable.

ITEM 2. PROPERTIES

Our principal offices are located at 619 West Texas Avenue, Suite 126, Midland, Texas 79701, which includes 1,250 square feet in office space. We pay $1,200 per month in rent and our lease is month to month.

ITEM 3. LEGAL PROCEEDINGS

From time to time, the Company may become a party to litigation or other legal proceedings that it considers to be a part of the ordinary course of its business. The Company is not involved currently in legal proceedings that could reasonably be expected to have a material adverse affect on its business, prospects, financial condition or results of operations. The Company may become involved in material legal proceedings in the future.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUERS PURCHASES OF EQUITY SECURITES

Our common stock qualified for quotation on the Over-the-Counter Bulletin Board under the symbol “STWS” on November 19, 2010. The stock currently trades on the OTC Pink under the symbol “STWS”. The quotations reflect inter-dealer prices, without retail mark-ups, mark-downs, or commissions and may not necessarily represent actual transactions.

The closing price of our common stock on the OTC Pink on October 10, 2012, was $0.05 per share.

The following table sets forth the range of high and low bid quotations as reported on the OTC Bulletin Board and the OTC Pink for the periods indicated.

| Year Ended December 31, 2011 | | High | | Low |

| Quarter ended March 31 | | $ | 0.75 | | $ | 0.12 |

| Quarter ended June 30 | | | 0.23 | | | 0.02 |

| Quarter ended September 30 | | | 0.13 | | | 0.01 |

| Quarter ended December 31 | | | 0.06 | | | 0.01 |

| | | | | | | |

| Year Ended December 31, 2010 | | High | | Low |

| Quarter ended December 31 | | | 1.00 | | | 0.50 |

Holders of Common Stock

As of October 10, 2012, we had 221 holders of record of our common stock.

Dividends

We have never paid any cash dividends on our common stock and do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain any future earnings to fund the development and growth of our business. There are no restrictions in our certificate of incorporation or by-laws on declaring dividends.

Recent Sales of Unregistered Securities

On September 1, 2011, the Company entered into a note modification (see Note 4 in the accompanying consolidated financial statements) with a holder of $100,000 of the 2010 12% Convertible Notes that had previously matured. The agreement called for issuance of 2,000,000 shares of the Company's common stock to the note holder who will sell these shares for which the proceeds will reduce the Company's liability to the Holder. On March 20, 2012, the Company issued an additional 3,000,000 shares of its common stock to the note holder.

On March 23, 2012, the Board of Directors agreed to exchange their accrued compensation for shares of the Company’s common stock. Total accrued compensation as of that date was $1,473,900 which was converted at a price per share of $0.05, and 29,478,000 shares were issued. Furthermore, for consulting services to the Company, the Board authorized the issuance of 16,950,000 shares of common stock to various consultants, of which, 5,000,000 shares have been issued to Mr. Stan Weiner, the Company’s Chief Executive Officer. On March 23, 2012, the Board authorized the issuance of 425,000 shares of the Company’s common stock to its Advisory Board members and an additional 18,750 shares to a consultant.

Between June and September 2012, the Company issued to certain accredited investors, new 14% Convertible Notes with a principal amount of $200,000. These notes have the same terms as the 14% Notes issued in 2011 (see Note 4 in the accompanying consolidated financial statements). In addition, the investors also received warrants to purchase 500,000 shares of the Company’s common stock at an exercise price of $0.20 and exercisable for a period of two years from the date of issuance. The Company incurred cash fees of $20,000 and issued 50,000 warrants under the same terms.

All other sales of unregistered securities have been previously reported in a Form 8-K.

Equity Compensation Information

The following table summarizes information about our equity compensation plans as of December 31, 2011.

| | | | | | | | Remaining Available | |

| | | Number of | | | | | for Number of | |

| | | Shares of | | | | | Future Issuance | |

| | | Common Stock | | | Weighted- | | Under Equity | |

| | | to be issued | | | Average | | Compensation Plans | |

| | | upon Exercise of | | | Price of | | (excluding securities | |

| Plan Category | | Outstanding Options (a) | | | Outstanding Options | | reflected in column (a)) c) | |

| | | | | | | | | |

| Equity Compensation Plans Approved by Stockholders | | | - | | | $ | - | | | | - | |

| Equity Compensation Plans Not Approved by Stockholders | | | | | | | | | | | - | |

| | | | | | | | | | | | | |

| Total | | | - | | | $ | - | | | | - | |

ITEM 6. SELECTED FINANCIAL DATA

Not Applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following information should be read in conjunction with STW Resources Holding Corp. (f/k/a/ Woozyfly, Inc.) (the “Company”) consolidated audited financial statements and the notes thereto contained elsewhere in this report. Information in this Item 2, "Management's Discussion and Analysis of Financial Condition and Results of Operations," and elsewhere in this Form 10-K that does not consist of historical facts, are "forward-looking statements." Statements accompanied or qualified by, or containing words such as "may," "will," "should," "believes," "expects," "intends," "plans," "projects," "estimates," "predicts," "potential," "outlook," "forecast," "anticipates," "presume," and "assume" constitute forward-looking statements, and as such, are not a guarantee of future performance. The statements involve factors, risks and uncertainties including those discussed in the “Risk Factors” section included herein, the impact or occurrence of which can cause actual results to differ materially from the expected results described in such statements. Risks and uncertainties can include, among others, fluctuations in general business cycles and changing economic conditions; changing product demand and industry capacity; increased competition and pricing pressures; advances in technology that can reduce the demand for the Company's products, as well as other factors, many or all of which may be beyond the Company's control. Consequently, investors should not place undue reliance on forward-looking statements as predictive of future results. The Company disclaims any obligation to update the forward-looking statements in this report.

Overview

The Company is a development stage corporation formed to utilize state of the art water reclamation technologies to reclaim fresh water from highly contaminated oil and gas hydraulic fracture flow-back salt water that is produced in conjunction with the production of oil and gas. The Company has been working to establish contracts with oil and gas operators for the deployment of multiple water reclamation systems throughout Texas, Arkansas, Louisiana and the Appalachian Basin of Pennsylvania and West Virginia. The Company, in conjunction with energy producers, operators, various state agencies and legislators, is working to create an efficient and economical solution to this complex problem. The Company is also evaluating the deployment of similar technology in the municipal wastewater industry.

The Company’s operations are located at 619 W. Texas Ave Ste 126, Midland, TX 79701.

On January 17, 2010, the Company entered into an Agreement and Plan of Merger (“Merger Agreement”) with STW Acquisition, Inc. (“Acquisition Sub”), a wholly owned subsidiary of STW Resources, Inc. (“STWR”) and certain shareholders of STWR controlling a majority of the issued and outstanding shares of STWR. Pursuant to the Merger Agreement, STWR merged into Acquisition Sub resulting in an exchange of all of the issued and outstanding shares of STWR for shares of the Company on a one for one basis. At such time, STWR became a wholly owned subsidiary of the Company.

On February 9, 2010, the Court entered an order confirming the Second Amended Plan of Reorganization (the “Plan”) pursuant to which the Plan and the Merger Agreement were approved. The Plan was effective February 19, 2010 (the “Effective Date”). The principal provisions of the Plan were as follows:

| ● | MKM, the DIP Lender, received 400,000 shares of common stock and 2,140,000 shares of preferred stock; |

| ● | the holders of the Convertible Notes received 1,760,000 shares of common stock; |

| ● | general unsecured claims received 100,000 shares of common stock; and |

| ● | the Company’s equity interest was extinguished and cancelled. |

On February 12, 2010, pursuant to the terms of the Merger Agreement, STWR merged with and into Acquisition Sub, which became a wholly-owned subsidiary of the Company (the “Merger”). In consideration for the Merger and STWR becoming a wholly-owned subsidiary of the Company, the Company issued an aggregate of 31,780,004 shares of common stock ("the STW Acquisition Shares") to the shareholders of STWR at the closing of the merger and all derivative securities of STWR as of the Merger became derivative securities of the Company including options and warrants to acquire 12,613,002 shares of common stock at an exercise price ranging from $3.00 to $8.00 with an exercise period ranging from July 31, 2011 through November 12, 2014 and convertible debentures in the principal amount of $1,467,903 with a conversion price of $0.25 and maturity dates ranging from April 24, 2010 through November 12, 2010.

Considering that, following the Merger, the shareholders of STWR control the majority of our outstanding voting common stock and we effectively succeeded our otherwise minimal operations to those that are theirs, STWR is considered the accounting acquirer in this reverse-merger transaction. Accordingly, we have not recognized any goodwill or other intangible assets in connection with this Merger. STW is the surviving and continuing entities and the historical financials following the reverse merger transaction will be those of STWR. We were a "shell company" (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended) immediately prior to our acquisition of STW pursuant to the terms of the Merger Agreement. As a result of such acquisition, our operations our now focused on the provision of customized water reclamation services. Consequently, we believe that acquisition has caused us to cease to be a shell company as we no longer have nominal operations.

The Report of Independent Registered Public Accounting Firm to our December 31, 2011 consolidated financial statements includes an explanatory paragraph stating that the recurring losses and negative cash flows from operations since inception and our working capital deficiency at December 31, 2011 raise substantial doubt about our ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Recent Developments

On or about May 22, 2008, STWR, a predecessor company of the Company entered into a Teaming Agreement, as amended, with GE Ionics, Inc., a Massachusetts corporation (“GE”) (STWR and GE are collectively referred to as the “Parties”). On or about April 4, 2008 STWR and GE entered into a Purchase Order (the “Purchase Order”), pursuant to which there was due and unpaid a debt by STWR to GE in the amount of $11,239,437 as of August 31 2010, (the “Original Debt”).

On August 31, 2010, the Parties entered into a Settlement Agreement pursuant to which GE permitted the Company to substitute for STWR as to all rights and obligations under the Purchase Order (including the Original Debt) and Teaming Agreement, and such that to fully discharge STWR’s financial obligations to GE under the Purchase Order, the Company shall pay GE $1,400,000 pursuant to a senior promissory note (the “Note”). The Note bears interest at a rate of the WSJ Prime Rate (as published daily in the Wall Street Journal) plus two percent (2%) per annum. Under the terms of the Note, the Company has thirteen months to pay off the Note plus all accrued interest thereon. In addition, upon the consummation of a debt or equity financing following the execution of the Note, the Company shall pay GE thirty percent (30%) of the gross proceeds of any equity investments in or loans to the Company or any affiliated entity until the Note is paid in full, including all accrued interest thereon.

On September 29, 2011, the Parties agreed to extend the maturity date of the Note from September 30, 2011 to October 30, 2011.

On October 30, 2011, the Parties entered into an amendment to the settlement agreement, effective October 1, 2011, pursuant to which, among other things, the Parties agreed as follows: (i) the Company will have until September 1, 2013 to pay GE $2,100,000 plus interest accrued after October 1, 2011 under the Note in accordance with its terms, (ii) upon the consummation and closing of a debt or equity financing following the execution of the Note, the Company shall pay GE thirty percent (30%) of any and all tranches (“Tranches” being defined as the cash receipts of the proceeds of any equity investments in or loans to the Company or any affiliated entity by third parties, but excluding any conversions of pre-existing debt to equity by any of the Company’s then current convertible note holders or creditors) until the Note is paid in full, including all accrued interest, provided the Company shall not be obligated to pay GE upon, among other things, the following: (a) short term commercial paper of $200,000 or less, up to a cumulative maximum of $500,000 through December 31, 2012, (b) commercial equipment leasing whereby GE is taking a secured interest in the purchased equipment, (c) proceeds from project, lease and equipment funding to any subsidiary of the Company provided the Company does not receive any proceeds of such funding and (d) a one-time general exception for $1,500,000 of new equity financing of the Company, (iii) the Company shall begin making a regular series of installment payments as follows: (a) $10,000 per month beginning on January 1, 2012, and (b) $15,000 per month beginning on June 1, 2012 through the maturity date of the note and (iv) the Company shall be able to prepay the Note, without interest, on or before the maturity date. As of the date of this filing, no payments have been made, the Company is in default and GE has the right to accelerate the maturity of the note and demand immediate payment.

In November 2011, the Company commenced an offer to exchange the outstanding principal and accrued interest on the 12% Convertible Notes with new 14% Convertible Notes (the “2011 14% Convertible Notes”). The holders of the 12% Convertible Notes were also offered an opportunity to purchase additional 2011 14% Convertible Notes for cash. Each 2011 14% Convertible Note is convertible, at any time at the option of the holder, into shares of the Company’s common stock, at an initial conversion price of $0.08 per share (the “14% Note Conversion Price”). The 2011 14% Convertible Notes bear interest at 14% per annum (6% cash interest and 8% paid-in-kind “PIK” interest) and mature 24 months from the date of issuance. Warrants associated with the 12% Convertible Notes (the “12% Warrants”) were exchanged for new warrants to purchase three times the number of common shares of the Company that could be purchased with the 12% Warrants. The new warrants are exercisable for a period of two years from the date of issuance at an exercise price of $0.20 per share. Through December 31, 2011, the Company had issued a total of $2,481,235 face value of its 14% Convertible Notes in exchange for $235,000 cash, $1,657,903 of principal of the 12% Notes, $125,000 of short-term notes payable, $463,332 of accrued interest and other expenses.