l

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-37785

Reata Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | |

Delaware | | 11-3651945 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

5320 Legacy Drive

Plano, Texas | | 75024 |

(Address of principal executive offices) | | (Zip Code) |

(972) 865-2219

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, Par Value $0.001 Per Share | | RETA | | NASDAQ Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, an emerging growth company, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer |

| ☒ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 5, 2023, the registrant had 33,036,126 shares of Class A common stock, $0.001 par value per share, and 4,515,316 shares of Class B common stock, $0.001 par value per share, outstanding.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. In this Quarterly Report on Form 10-Q, all statements, other than statements of historical or present facts, including statements regarding our future financial condition, future revenues, projected costs, prospects, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “might,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “project,” “model,” “should,” “would,” “plan,” “expect,” “predict,” “could,” “seek,” “goals,” “potential,” and similar terms or expressions that concern our expectations, strategy, plans, or intentions. These forward-looking statements include, but are not limited to, statements about:

•our plans and objectives for the commercialization of SKYCLARYS® and the timing thereof; including reimbursement, marketing costs, revenues, and licenses (if any);

•the potential market size and the size of the patient population for SKYCLARYS and the market opportunities for SKYCLARYS;

•our ability to successfully build our commercial infrastructure to manufacture, market and sell SKYCLARYS, including the successful development and implementation of our sales and marketing campaigns for SKYCLARYS;

•the ability of our third-party suppliers and contract manufacturers to manufacture SKYCLARYS at the required quality and quantities and in compliance with applicable laws and regulations;

•our expectations regarding the timing, costs, conduct, and outcome of our clinical trials, including statements regarding the timing of the initiation and availability of data from such trials;

•the timing and likelihood of regulatory filings and approvals for our product candidates;

•whether regulatory authorities determine that additional trials or data are necessary in order to accept a new drug application for review and/or approval;

•our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates;

•our plans to research, develop, and commercialize our product candidates;

•the manufacturing, supply, and commercialization of our product candidates, if approved;

•the rate and degree of market acceptance of our product candidates;

•our expectations regarding the potential market size and the size of the patient populations for our product candidates, if approved for commercial use, and the potential market opportunities for commercializing our product candidates;

•the success of competing therapies that are or may become available;

•our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates;

•the ability to license additional intellectual property relating to our product candidates and to comply with our existing license agreements;

•our ability to maintain and establish relationships with third parties, such as contract research organizations (CROs), contract manufacturing organizations, suppliers, and distributors;

•our ability to maintain and establish collaborators with development, regulatory, and commercialization expertise;

•our ability to attract and retain key scientific or management personnel;

•our ability to grow our organization and increase the size of our facilities to meet our anticipated growth;

1

•the accuracy of our estimates regarding expenses, future revenue, capital requirements, and needs for additional financing;

•our expectations related to the use of our available cash;

•our ability to develop, acquire, and advance product candidates into, and successfully complete, clinical trials;

•the initiation, timing, progress, and results of future preclinical studies and clinical trials, and our research and development programs;

•the impact of governmental laws and regulations and regulatory developments in the United States and foreign countries;

•developments and projections relating to our competitors and our industry;

•the impact of pandemics on our clinical trials, our supply chain, and our operations; and

•other risks and uncertainties, including those described under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K for the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (SEC) on February 24, 2023.

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this Quarterly Report on Form 10-Q and the documents that we have filed as exhibits to this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

2

DEFINED TERMS

Unless the context requires otherwise, references to “Reata,” “the Company,” “we,” “us,” or “our” in this Quarterly Report on Form 10-Q refer to Reata Pharmaceuticals, Inc. and its subsidiaries. We also have used several other terms in this Quarterly Report on Form 10-Q, most of which are explained or defined below.

| | |

Abbreviated Term | | Defined Term |

AbbVie | | AbbVie Inc. |

ADPKD | | Autosomal dominant polycystic kidney disease |

ALS | | Amyotrophic lateral sclerosis |

ATP | | Adenosine triphosphate |

bardoxolone | | Bardoxolone methyl |

BXLS | | Blackstone Life Sciences, LLC |

Cemdomespib | | Previously referred to as RTA 901 |

CKD | | Chronic kidney disease |

CRL | | Complete Response Letter |

CRO | | Contract research organization |

DPNP | | Diabetic peripheral neuropathic pain |

eGFR | | Estimated glomerular filtration rate |

EMA | | European Medicines Agency |

ESPP | | Reata Pharmaceuticals, Inc. 2022 Employee Stock Purchase Plan |

ESRD | | End stage renal disease |

Exchange Act | | Securities Exchange Act of 1934 |

FA | | Friedreich’s ataxia |

FDA | | United States Food and Drug Administration |

Kyowa Kirin | | Kyowa Kirin Co., Ltd. |

LTIP Plan | | Second Amended and Restated Long Term Incentive Plan |

MAA | | Marketing Authorization Application |

NDA | | New Drug Application |

PK | | Pharmacokinetic |

RSU | | Restricted Stock Unit |

SEC | | U.S. Securities and Exchange Commission |

U.S. GAAP | | Accounting principles generally accepted in the United States |

3

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

Reata Pharmaceuticals, Inc.

Consolidated Balance Sheets

(in thousands, except share data)

| | | | | | | | |

| | March 31, 2023 | | | December 31, 2022 | |

| | (unaudited) | | | | |

Assets | | | | | | |

Cash and cash equivalents | | $ | 84,940 | | | $ | 42,312 | |

Marketable debt securities | | | 236,019 | | | | 345,202 | |

Prepaid expenses and other current assets | | | 11,583 | | | | 10,256 | |

Total current assets | | | 332,542 | | | | 397,770 | |

Property and equipment, net | | | 11,060 | | | | 11,179 | |

Operating lease right-of-use-assets | | | 103,807 | | | | 105,258 | |

Inventory, noncurrent | | | 5,713 | | | | — | |

Other assets | | | 460 | | | | 284 | |

Total assets | | $ | 453,582 | | | $ | 514,491 | |

Liabilities and stockholders’ equity | | | | | | |

Accounts payable | | $ | 14,448 | | | $ | 18,706 | |

Accrued direct research liabilities | | | 19,445 | | | | 13,836 | |

Other current liabilities | | | 17,499 | | | | 24,267 | |

Operating lease liabilities, current | | | 3,206 | | | | 2,151 | |

Total current liabilities | | | 54,598 | | | | 58,960 | |

Operating lease liabilities, noncurrent | | | 114,727 | | | | 117,313 | |

Liability related to sale of future royalties, net | | | 414,930 | | | | 403,913 | |

Total noncurrent liabilities | | | 529,657 | | | | 521,226 | |

Commitments and contingencies | | | | | | |

Stockholders’ equity: | | | | | | |

Common stock A, $0.001 par value:

500,000,000 shares authorized; issued and outstanding – 33,010,817 and

31,762,052 at March 31, 2023 and December 31, 2022, respectively | | | 33 | | | | 32 | |

Common stock B, $0.001 par value:

150,000,000 shares authorized; issued and outstanding – 4,516,934 and

4,913,348 at March 31, 2023 and December 31, 2022, respectively | | | 5 | | | | 5 | |

Additional paid-in capital | | | 1,552,938 | | | | 1,501,800 | |

Accumulated deficit | | | (1,683,649 | ) | | | (1,567,532 | ) |

Total stockholders’ equity | | | (130,673 | ) | | | (65,695 | ) |

Total liabilities and stockholders’ equity | | $ | 453,582 | | | $ | 514,491 | |

See accompanying notes.

4

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except share and per share data)

| | | | | | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | | | 2022 | |

Collaboration revenue | | | | | | |

License and milestone | | $ | — | | | $ | 893 | |

Other revenue | | | 195 | | | | 21 | |

Total collaboration revenue | | | 195 | | | | 914 | |

Operating cost and expenses | | | | | | |

Research and development | | | 55,477 | | | | 39,804 | |

Selling, general and administrative | | | 54,885 | | | | 24,841 | |

Depreciation | | | 288 | | | | 308 | |

Total operating cost and expenses | | | 110,650 | | | | 64,953 | |

Other income (expense), net | | | (5,662 | ) | | | (9,772 | ) |

Loss from operations | | | (116,117 | ) | | | (73,811 | ) |

Benefit from (provision for) taxes on income | | | — | | | | (31 | ) |

Net loss | | $ | (116,117 | ) | | $ | (73,842 | ) |

Net loss per share—basic and diluted | | $ | (3.14 | ) | | $ | (2.03 | ) |

Weighted-average number of common shares used in

net loss per share basic and diluted | | | 36,948,063 | | | | 36,412,621 | |

See accompanying notes.

5

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Stockholders’ Equity

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2023 | |

| | Common Stock A | | | Common Stock B | | | Additional

Paid-In | | | Total

Accumulated | | | Total

Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

Balance at December 31, 2022 | | | 31,762,052 | | | $ | 32 | | | | 4,913,348 | | | $ | 5 | | | $ | 1,501,800 | | | $ | (1,567,532 | ) | | $ | (65,695 | ) |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (116,117 | ) | | | (116,117 | ) |

Compensation expense

related to stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 38,057 | | | | — | | | | 38,057 | |

Exercise of options | | | 519,224 | | | | 1 | | | | | | | — | | | | 13,080 | | | | — | | | | 13,081 | |

Issuance of common stock

upon vesting of restricted

stock units | | | 333,127 | | | | | | | — | | | | — | | | | 1 | | | | — | | | | 1 | |

Conversion of common

stock Class B to Class A | | | 396,414 | | | | — | | | | (396,414 | ) | | | — | | | | — | | | | — | | | | — | |

Balance at March 31, 2023 | | | 33,010,817 | | | $ | 33 | | | | 4,516,934 | | | $ | 5 | | | $ | 1,552,938 | | | $ | (1,683,649 | ) | | $ | (130,673 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2022 | |

| | Common Stock A | | | Common Stock B | | | Additional

Paid-In | | | Total

Accumulated | | | Total

Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Equity | |

Balance at December 31, 2021 | | | 31,478,197 | | | $ | 31 | | | | 4,919,249 | | | $ | 5 | | | $ | 1,441,584 | | | $ | (1,255,631 | ) | | $ | 185,989 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (73,842 | ) | | | (73,842 | ) |

Compensation expense

related to stock-based compensation | | | — | | | | — | | | | — | | | | — | | | | 15,444 | | | | — | | | | 15,444 | |

Exercise of options | | | — | | | | — | | | | 9,375 | | | | — | | | | 194 | | | | — | | | | 194 | |

Issuance of common stock

upon vesting of restricted

stock units | | | 35,107 | | | | | | | 2,835 | | | | — | | | | — | | | | — | | | | — | |

Conversion of common

stock Class B to Class A | | | 12,210 | | | | — | | | | (12,210 | ) | | | — | | | | — | | | | — | | | | — | |

Balance at March 31, 2022 | | | 31,525,514 | | | $ | 31 | | | | 4,919,249 | | | $ | 5 | | | $ | 1,457,222 | | | $ | (1,329,473 | ) | | $ | 127,785 | |

See accompanying notes.

6

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | | | 2022 | |

Operating activities | | | | | | |

Net loss | | $ | (116,117 | ) | | $ | (73,842 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

Depreciation | | | 288 | | | | 308 | |

Non-cash interest expense on liability related to sale of future royalty | | | 11,017 | | | | 9,871 | |

Stock-based compensation expense | | | 38,057 | | | | 15,444 | |

Amortization of discount (premium) on marketable debt securities | | | (1,954 | ) | | | — | |

Changes in operating assets and liabilities: | | | | | | |

Income tax receivable and payable | | | 9 | | | | — | |

Prepaid expenses, other current assets and other assets | | | (1,334 | ) | | | 877 | |

Inventory | | | (5,713 | ) | | | — | |

Accounts payable | | | (4,355 | ) | | | (4,525 | ) |

Accrued expenses, other current and long-term liabilities | | | (1,268 | ) | | | (8,914 | ) |

Operating lease obligations | | | (80 | ) | | | 3,489 | |

Deferred revenue | | | — | | | | (893 | ) |

Net cash used in operating activities | | | (81,449 | ) | | | (58,185 | ) |

Investing activities | | | | | | |

Purchases of property and equipment | | | (141 | ) | | | (288 | ) |

Purchases of marketable securities | | | (63,864 | ) | | | — | |

Maturity from marketable securities | | | 175,000 | | | | |

Net cash provided by (used in) investing activities | | | 110,995 | | | | (288 | ) |

Financing activities | | | | | | |

Exercise of options | | | 13,081 | | | | 194 | |

Issuance of common stock | | | 1 | | | | — | |

Net cash provided by financing activities | | | 13,082 | | | | 194 | |

Net increase (decrease) in cash and cash equivalents | | | 42,628 | | | | (58,279 | ) |

Cash and cash equivalents at beginning of year | | | 42,312 | | | | 590,258 | |

Cash and cash equivalents at end of period | | $ | 84,940 | | | $ | 531,979 | |

Non-cash activity: | | | | | | |

Right-of-use assets obtained in exchange for lease obligations | | $ | — | | | $ | 4,885 | |

Purchases of equipment in accounts payable, accrued expenses, other current, and long-term liabilities | | $ | 106 | | | $ | 2,258 | |

See accompanying notes.

7

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements

1. Description of Business

Reata Pharmaceuticals, Inc.’s (Reata, the Company, we, us, or our) mission is to identify, develop, and commercialize innovative therapies that change patients’ lives for the better. The Company focuses on small-molecule therapeutics with novel mechanisms of action for the treatment of severe, life-threatening diseases with few or no approved therapies. Our first product, SKYCLARYS® (omaveloxolone), is the first and only drug approved by U.S. Food and Drug Administration (FDA) for the treatment of Friedreich's ataxia (FA) in adults and adolescents aged 16 years and older. We have submitted a Marketing Authorization Application (MAA) for omaveloxolone for the treatment of FA to the European Medicines Agency (EMA) in Europe and the application is under review. We are also developing cemdomespib (previously referred to as RTA 901), the lead product candidate from our Hsp90 modulator program, in neurological indications.

Omaveloxolone activates the transcription factor Nrf2 to normalize mitochondrial function, restore redox balance, and resolve inflammation, in nonclinical models. Because mitochondrial dysfunction, oxidative stress, and inflammation are features of many diseases, we believe our Nrf2 activators have many potential clinical applications.

We possess exclusive, worldwide rights to develop, manufacture, and commercialize omaveloxolone. We are the exclusive licensee of cemdomespib and have worldwide commercial rights.

In May 2023, Kyowa Kirin reported results from the AYAME study, a Phase 3 trial which was conducted in Japan studying the safety and efficacy of bardoxolone in patients with diabetic kidney disease. Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the FALCON and EAGLE clinical trials. See Note 13, Subsequent Events, to our condensed consolidated financial statements for further details.

The Company’s consolidated financial statements include the accounts of all majority-owned subsidiaries. Accordingly, the Company’s share of net earnings and losses from these subsidiaries is included in the consolidated statements of operations. Intercompany profits, transactions, and balances have been eliminated in consolidation.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023. The consolidated balance sheet at December 31, 2022, has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information, refer to the annual consolidated financial statements and footnotes thereto of the Company.

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies that the Company adopts as of the specified effective date. Unless otherwise discussed below, the Company does not believe that the adoption of recently issued standards have or may have a material impact on its condensed consolidated financial statements and disclosures.

8

Summary of Significant Accounting Policies

The significant accounting policies used in the preparation of these condensed consolidated financial statements for the three months ended March 31, 2023 are consistent with those discussed in Note 2 to the consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, with the exception of the following:

Inventory

We capitalize inventory costs related to products to be sold in the ordinary course of business. We make a determination of capitalizing inventory costs for a product based on, among other factors, status of regulatory approval, information regarding safety, efficacy and expectations relating to commercial sales and recoverability of costs. Pre-launch inventory is held as an asset when there is a high probability of regulatory approval for the product and when there are probable future economic profits. Inventory may consist of raw materials, work in process and finished goods. We began capitalizing inventory related to SKYCLARYS in the quarter ended March 31, 2023, as we received approval of SKYCLARYS in February 2023, and the related costs were expected to be recoverable through the commercialization of SKYCLARYS. Prior to the start of capitalizing inventory, costs for commercially saleable product and materials of $39.2 million were incurred and included in research and development expenses. As a result, cost of product revenues related to SKYCLARYS will initially reflect a lower average per unit cost of materials over the next 35-40 months as previously expensed inventory is utilized for commercial production and sold to customers.

Inventories are valued under the specific identification method and are stated at the lower of cost or net realizable value. We measure inventory based on lot-based costing where inventory is valued at the purchase price for the specific lot. We assess recoverability of inventory each reporting period to determine any write down to net realizable value resulting from excess or obsolete inventories.

3. Collaboration Agreements

Subsequent to the 2019 reacquisition of certain rights originally licensed to AbbVie Inc. (AbbVie) (see “AbbVie,” below), the Company’s collaboration revenue and deferred revenue have been generated primarily from licensing fees and reimbursements for expenses received under our exclusive license with Kyowa Kirin (the Kyowa Kirin Agreement).

Kyowa Kirin

In December 2009, the Company entered into an exclusive license with Kyowa Kirin to develop and commercialize bardoxolone in the licensed territory. The terms of the agreement include payment to the Company of a nonrefundable, up-front license fee of $35.0 million and additional development and commercial milestone payments. As of March 31, 2023, the Company has received $50.0 million related to regulatory development milestone payments from Kyowa Kirin and has the potential in the future to achieve another $47.0 million from regulatory milestones and $140.0 million from commercial milestones. The Company also has the potential to achieve tiered royalties ranging from the low teens to the low 20 percent range, depending on the country of sale and the amount of annual net sales, on net sales by Kyowa Kirin in the licensed territory. The Company is participating on a joint steering committee with Kyowa Kirin to oversee the development and commercialization activities related to bardoxolone. Any future milestones and royalties received are subject to mid to lower single digit percent declining tiered commissions to certain consultants as compensation for negotiations of the Kyowa Kirin Agreement.

9

The Company regularly evaluates its remaining performance obligation under the Kyowa Kirin Agreement. Accordingly, revenue may fluctuate from period to period due to changes to its estimated performance obligation period and variable considerations. The Company began recognizing revenue related to the up-front payment upon execution of the Kyowa Kirin Agreement as the Company’s period of performance began. In March 2021, the Company’s performance obligation period under the Kyowa Kirin Agreement was extended to and completed in June 2022. On July 27, 2021, Kyowa Kirin submitted a New Drug Application (NDA) in Japan to the Ministry of Health, Labour and Welfare for bardoxolone for improvement of renal function in patients with Alport syndrome. Based on this submission, the Company earned a $5.0 million milestone payment, variable consideration previously considered constrained, under the Kyowa Kirin Agreement. As a result, the Company recorded $4.7 million in collaboration revenue, a cumulative catch-up for the portion of this milestone that was satisfied in prior periods, and $0.3 million in deferred revenue that was recognized over the remaining performance obligation period. Under the Kyowa Kirin Agreement, we will not recognize any deferred revenue subsequent to June 30, 2022.

In May 2023, Kyowa Kirin reported results from the AYAME study, a Phase 3 trial which was conducted in Japan studying the safety and efficacy of bardoxolone in patients with diabetic kidney disease. Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the FALCON and EAGLE clinical trials. See Note 13, Subsequent Events, to our condensed consolidated financial statements for further details.

AbbVie

In September 2010, the Company entered into a license agreement with AbbVie (the AbbVie License Agreement) for an exclusive license to develop and commercialize bardoxolone in the Licensee Territory (as defined in the AbbVie License Agreement).

In December 2011, the Company entered into a collaboration agreement with AbbVie (the Collaboration Agreement) to jointly research, develop, and commercialize the Company’s portfolio of second and later generation oral Nrf2 activators.

In October 2019, the Company and AbbVie entered into an Amended and Restated License Agreement (the Reacquisition Agreement) pursuant to which the Company reacquired the development, manufacturing, and commercialization rights concerning its proprietary Nrf2 activator product platform originally licensed to AbbVie in the AbbVie License Agreement and the Collaboration Agreement. In exchange for such rights, the Company agreed to pay AbbVie $330.0 million, all of which was subsequently paid. Additionally, the Company will pay AbbVie an escalating, low single-digit royalty on worldwide net sales, on a product-by-product basis, of omaveloxolone and certain next-generation Nrf2 activators. The execution of the Reacquisition Agreement ended our performance obligations under the Collaboration Agreement.

As of December 31, 2021, the Company has fully satisfied its payable to AbbVie, therefore no interest expense was recognized thereafter.

4. Liability Related to Sale of Future Royalties

On June 24, 2020, the Company closed on the Development and Commercialization Funding Agreement with an affiliate of Blackstone Life Sciences, LLC (BXLS), which provides funding for the development and commercialization of bardoxolone for the treatment of CKD caused by Alport syndrome, autosomal dominant polycystic kidney disease (ADPKD), and certain other rare CKD indications in return for future royalties (the Development Agreement). The Development Agreement includes a $300.0 million payment by an affiliate of BXLS in return for various percentage royalty payments on worldwide net sales of bardoxolone, once approved in the United States or certain specified European countries, by Reata and its licensees, other than Kyowa Kirin. The royalty percentage will initially be in the mid-single digits and, in future years, can vary between higher-mid single digit percentages to low-single digit percentages depending on various milestones, including indication approval dates, cumulative royalty payments, and cumulative net sales. Pursuant to the Development Agreement, we have granted BXLS a security interest in substantially all of our assets. After a bardoxolone product approval has been obtained by the Company, the Company is obligated to make certain minimum cumulative payment amounts in 2025 through 2033, but only until BXLS has achieved a certain internal rate of return target.

10

In addition, concurrent with the Development Agreement, the Company entered into a common stock purchase agreement (the Purchase Agreement) with affiliates of BXLS to sell an aggregate of 340,793 shares of the Company’s Class A common stock at $146.72 per share for a total of $50.0 million.

The Company concluded that there were two units of accounting for the consideration received, comprised of the liability related to the sale of future royalties and the common shares. The Company allocated the $300.0 million from the Development Agreement and $50.0 million from the Purchase Agreement between the two units of accounting on a relative fair value basis at the time of the transaction. The Company allocated $294.5 million, which includes $0.8 million in transaction costs incurred, in transaction consideration to the liability, and $55.5 million to the common shares. The Company determined the fair value of the common shares based on the closing stock price on June 24, 2020, the closing date of the Development Agreement. At inception, the effective interest rate under the Development Agreement, including transaction costs, was approximately 13.8%. During the first quarter of 2022, the Company reassessed the expected royalty payments and lowered our previous estimate of future sales for which royalties will be paid. Accordingly, we have prospectively adjusted and recognized lower non-cash interest expense using a 10.9% effective interest rate, as of March 31, 2023.

The following table shows the activity within the liability related to sale of future royalties for the three months ended March 31, 2023:

| | | |

| Liability Related to Sale of Future Royalties | |

| (in thousands) | |

Balance at December 31, 2022 | $ | 404,634 | |

Non-cash interest expense recognized | | 11,000 | |

Balance at March 31, 2023 | | 415,634 | |

Less: Unamortized transaction cost | | (704 | ) |

Carrying value at March 31, 2023 | $ | 414,930 | |

On May 4, 2023, we entered into an Amended and Restated Development and Commercialization Funding Agreement (the Amended Funding Agreement) with BXLS. See Note 13, Subsequent Events, to our condensed consolidated financial statements or further details.

5. Inventory

All of the Company’s inventories relate to the manufacturing of SKYCLARYS. The following table sets forth the Company’s inventories as of March 31, 2023:

| | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | |

| | (in thousands) | |

Raw materials | | $ | 3,446 | |

Work-in-process | | | 2,267 | |

Finished goods | | | — | |

Total | | $ | 5,713 | |

Inventory in excess of the amount expected to be sold within one year is classified as noncurrent inventory. At March 31, 2023, all of the Company’s inventories were classified as noncurrent inventory.

6. Marketable Debt Securities

During the quarter ended March 31, 2023, the Company invested its excess cash balances in marketable debt securities and, at each balance sheet date presented, the Company classified all of its investments in debt securities as held-to-maturity and as current assets as they mature within 12 months and represent the investment of funds available for current operations.

11

The Company considers all available evidence to evaluate if an impairment loss exists, and if so, marks the investment to market through a charge to the Company’s consolidated statements of operations and comprehensive loss. The Company did not record any impairment charges related to our marketable debt securities during the three months ended March 31, 2023.

The following tables summarize our marketable debt securities (in thousands), as of March 31, 2023:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized

Losses | | | Fair Value (1) | |

Marketable debt securities: | | | | | | | | | | | | |

U.S. treasury securities | | | 236,019 | | | | 17 | | | | (27 | ) | | | 236,009 | |

Total | | $ | 236,019 | |

| $ | 17 | | | $ | (27 | ) | | $ | 236,009 | |

(1) The fair value was determined using the three-tier fair value hierarchy for disclosure in accordance with Accounting Standards Codification 820-10. The Company’s investments in marketable securities are classified within Level 2 of the fair value hierarchy. The Company uses quoted prices for similar assets sourced from certain third-party pricing services. The third-party pricing services generally utilize industry standard valuation models for which all significant inputs are observable, either directly or indirectly, to estimate the price or fair value of the securities. The primary input generally includes reported trades of or quotes on the same or similar securities. The Company does not make additional judgments or assumptions made to the pricing data sourced from the third-party pricing services.

7. Other Income (Expense), Net

| | | | | | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | | | 2022 | |

| | (in thousands) | |

Other income (expense), net | | | | | | |

Investment income | | $ | 3,435 | | | $ | 132 | |

Non-cash interest expense on liability

related to sale of future royalty | | | (11,017 | ) | | | (9,871 | ) |

Other income (expense) | | | 1,920 | | | | (33 | ) |

Total other income (expense), net | | $ | (5,662 | ) | | $ | (9,772 | ) |

| | | | | | |

Investment Income

Interest income consists primarily of interest generated from our cash and cash equivalents and marketable debt securities.

Non-Cash Interest Expense on Liability Related to Sale of Future Royalties

Non-cash interest expense consists of recognition of interest expense based on the Company’s current estimate of future royalties expensed to be paid over the estimated term of the Development Agreement.

Other Income (Expense)

Other income (expense) consists primarily of gains and losses on foreign currency exchange, sales of assets, lease termination and employee retention credit.

In the three months ended March 31, 2023, other income included $2.0 million, related to the employee retention credit (ERC) under the CARES Act.

12

8. Leases

The Company headquarters is located in Plano, Texas, where it leases approximately 122,000 square feet of office space. The Company leases additional space located in Irving, Texas, where it leases approximately 34,890 square feet of office and laboratory space.

On February 4, 2022, the Company extended the lease for the office and laboratory space in Irving, Texas, to October 31, 2024, with an option to extend for a fixed 12-month period.

On March 8, 2022, the Company extended the lease for the Plano office to December 31, 2023.

The Company has an additional lease of a single-tenant, build-to-suit building of approximately 327,400 square feet of office and laboratory space located in Plano, Texas with an initial lease term of 16 years. The Company entered into the lease agreement on October 15, 2019 (the 2019 Lease Agreement), and at the Company’s option, it may renew the lease for two consecutive five-year renewal periods or one ten-year renewal period. On December 15, 2021, the Company obtained control of the space, and, accordingly, the Company recorded related right-of-use assets and the lease liabilities during the fourth quarter of 2021. The Company recorded the liability associated with the 2019 Lease Agreement at the present value of the lease payments not yet paid, using the discount rate as of the commencement date. As the discount rate implicit in the 2019 Lease Agreement was not readily determinable, the Company utilized its incremental borrowing rate. The renewals are not assumed in the determination of the lease term, since they are not deemed to be reasonably assured at the inception of the lease. At inception, the Company recorded $124.5 million as a right-of-use asset, which represented a lease liability of $133.2 million, net of $8.7 million of lease incentives recognized.

For the three months ended March 31, 2023, the Company paid $3.9 million for amounts included in the measurement of lease liabilities. During the three months ended March 31, 2023 and 2022, the Company recorded total rent expense of $4.3 million and $4.3 million, respectively.

Supplemental balance sheet and other information related to the Company’s operating leases is as follows:

| | | | | | | | | | |

| | | | As of March 31, | |

| | | | 2023 | | | 2022 | |

Weighted-average remaining lease term (in years) | | | 15.0 | | | | 15.6 | |

Weighted-average discount rate | | | | | 6.5 | % | | | 6.5 | % |

Maturities of lease liabilities by fiscal year for the Company’s operating leases:

| | | | |

| | As of March 31, 2023 | |

| | (in thousands) | |

2023 (remaining nine months) | | $ | 5,835 | |

2024 (1) | | | 6,457 | |

2025 | | | 11,777 | |

2026 | | | 12,007 | |

2027 | | | 12,241 | |

Thereafter | | | 143,829 | |

Total lease payments (1) | | | 192,146 | |

Less: Imputed interest | | | (74,213 | ) |

Present value of lease liabilities | | $ | 117,933 | |

(1) Above table includes one year rent abatement applied beginning in June 2023 following FDA approval of SKYCLARYS

13

9. Income Taxes

The following table summarizes income tax benefit expense and effective income tax rate:

| | | | | | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | | | 2022 | |

| | (in thousands, except for percentage data) | |

Benefit from (provision for) taxes on income | | $ | — | | | $ | (31 | ) |

Effective income tax rate | | | 0.0 | % | | | 0.0 | % |

The Company’s effective tax rate for the three months ended March 31, 2023, varies with the statutory rate primarily due to changes in the valuation allowance related to certain deferred tax assets generated or utilized in the applicable period.

Deferred tax assets are regularly reviewed for recoverability by jurisdiction and valuation allowances are established based on historical and projected future taxable losses and the expected timing of the reversals of existing temporary differences. The Company has recorded valuation allowances against the majority of its deferred tax assets as of March 31, 2023, and the Company expects to maintain these valuation allowances until there is sufficient evidence that future earnings can be achieved, which is uncertain at this time.

10. Stock-Based Compensation

In 2022, our stockholders approved the Reata Pharmaceuticals, Inc. 2022 Employee Stock Purchase Plan (the "ESPP"), pursuant to which 500,000 shares of common stock were authorized for issuance. Under the ESPP, each offering period is twelve months, with two six-month purchase periods. At the end of each purchase period the employees may purchase shares of common stock through payroll deductions made over the term of the purchase period. The per-share purchase price at the end of each purchase period is equal to the lesser of 85% of the closing price of the Company’s common stock at the beginning of the offering period or the purchase date. As of March 31, 2023, the Company has not issued any common stock in relation to the ESPP. The Company recorded approximately $0.2 million in compensation expense related to the ESPP during the three months ended March 31, 2023.

The following table summarizes time-based and performance-based stock compensation expense reflected in the consolidated statements of operations:

| | | | | | | | |

| | Three Months Ended | |

| | March 31 | |

| | 2023 | | | 2022 | |

| | (in thousands) | |

Research and development | | $ | 14,270 | | | $ | 7,606 | |

Selling, general and administrative | | | 23,787 | | | | 7,838 | |

Total stock compensation expense | | $ | 38,057 | | | $ | 15,444 | |

Restricted Stock Units (RSUs)

The following table summarizes RSUs as of March 31, 2023, and changes during the three months ended March 31, 2023, under the Second Amended and Restated Long Term Incentive Plan (LTIP Plan):

| | | | | | | | |

| | Number of

RSUs | | | Weighted-Average

Grant Date Fair

Value | |

Outstanding at January 1, 2023 | | | 1,151,656 | | | $ | 45.45 | |

Granted | | | 453,049 | | | | 40.03 | |

Vested | | | (352,042 | ) | | | 34.64 | |

Forfeited | | | (13,113 | ) | | | 50.56 | |

Outstanding at March 31, 2023 | | | 1,239,550 | | | $ | 46.48 | |

14

As of March 31, 2023, total unrecognized compensation expense related to RSU and performance-based RSU awards that were deemed probable of vesting was approximately $41.2 million, which excludes 36,500 shares of unvested performance-based RSUs that were deemed not probable of vesting totaling unrecognized stock-based compensation expense of $4.4 million.

Stock Options

The following table summarizes stock option activity as of March 31, 2023, and changes during the three months ended March 31, 2023, under the LTIP Plan and standalone option agreements:

| | | | | | | | |

| | Number of

Options | | | Weighted-

Average

Price | |

Outstanding at January 1, 2023 | | | 6,009,199 | | | $ | 65.92 | |

Granted | | | 1,784,222 | | | | 37.69 | |

Exercised | | | (519,224 | ) | | | 25.21 | |

Forfeited | | | (248,260 | ) | | | 188.95 | |

Expired | | | (44,033 | ) | | | 111.59 | |

Outstanding at March 31, 2023 | | | 6,981,904 | | | $ | 56.57 | |

Exercisable at March 31, 2023 | | | 3,376,690 | | | $ | 64.37 | |

As of March 31, 2023, total unrecognized compensation expense related to stock options and performance- based stock options that were deemed probable of vesting was approximately $92.1 million, which excludes 172,500 shares of unvested performance-based stock options that were deemed not probable of vesting totaling unrecognized stock-based compensation expense of $13.2 million.

The total intrinsic value of all outstanding options and exercisable options as of March 31, 2023 was $313.6 million and $141.1 million, respectively.

The number of weighted average options that were not included in the diluted earnings per share calculation because the effect would have been anti-dilutive represented 8,221,454 and 6,878,671 shares as of March 31, 2023 and 2022, respectively.

11. Employee Benefit Plans

In 2010, we adopted an Employee Investment Plan, qualified under Section 401(k) of the Internal Revenue Code, which is a retirement savings plan covering substantially all of our U.S. employees (the Plan). The Plan is administered under the “safe harbor” provision of ERISA. Under the Plan, an eligible employee may elect to contribute a percentage of their salary on a pre-tax basis, subject to federal statutory limitations. Beginning in January 2019, the Company implemented a discretionary employer matching contribution of $1.00 for every $1.00 contributed by a participating employee up to $7,000 annually in 2023 and 2022, which such matching contributions become fully vested after four years of service. The Company recorded expense of $1.4 million and $1.3 million for the three months ended March 31, 2023 and 2022, which includes the Company’s contributions and administrative costs.

12. Commitments and Contingencies

Litigation

From time to time, the Company is a party to legal proceedings in the course of its business, including the matters described below. The outcome of any such legal proceedings, regardless of the merits, is inherently uncertain. In addition, litigation and related matters are costly and may divert the attention of our management and other resources that would otherwise be engaged in other activities. If the Company were unable to prevail in any such legal proceedings, its business, results of operations, liquidity and financial condition could be adversely affected. The Company recognizes accruals for litigations to the extent that it can conclude that a loss is both probable and reasonably estimable and recognizes legal expenses as incurred.

15

Bardoxolone Securities Litigation

In late 2021 and early 2022, certain putative stockholders of the Company filed complaints in the United States District Court for the Eastern District of Texas alleging violations of the federal securities laws against the Company and certain of its executives, including its Chief Executive Officer; its Chief Operating Officer, Chief Financial Officer, and President; and its Chief Innovation Officer (in one of the suits). On April 22, 2022, the suits were consolidated, and a lead plaintiff was appointed. On June 21, 2022, the lead plaintiff filed a complaint against the Company, the aforementioned executives, certain current and former member of the Company’s Board of Directors, and underwriters in connection with secondary offerings of Company stock in 2019 and 2020. The complaint alleges, among other things, that the Company made false and misleading statements regarding the sufficiency of the Phase 2 and Phase 3 CARDINAL studies to support an NDA for bardoxolone in the treatment of CKD caused by Alport syndrome, and the Company’s interactions with the FDA concerning potential approval for bardoxolone. The complaint asserts claims under the Securities Act of 1933 and the Securities Exchange Act of 1934 (Exchange Act). The plaintiffs seek, among other things, a class action designation, an award of damages, and costs and expenses, including attorney fees and expert fees. The Company believes that the allegations contained in the complaint are without merit and intends to defend the case. The Company cannot predict at this point the length of time that this action will be ongoing or the liability, if any, which may arise therefrom.

Indemnifications

Accounting Standards Codification 460, Guarantees, requires that, upon issuance of a guarantee, the guarantor must recognize a liability for the fair value of the obligations it assumes under that guarantee.

As permitted under Delaware law and in accordance with the Company’s bylaws, officers and directors are indemnified for certain events or occurrences, subject to certain limits, while the officer or director is or was serving in such capacity. The maximum amount of potential future indemnification is unlimited; however, the Company has obtained director and officer insurance that limits its exposure and may enable recoverability of a portion of any future amounts paid. The Company believes the fair value for these indemnification obligations is minimal. Accordingly, the Company has not recognized any liabilities relating to these obligations as of March 31, 2023.

The Company has certain agreements with licensors, licensees, collaborators, and vendors that contain indemnification provisions. In such provisions, the Company typically agrees to indemnify the licensor, licensee, collaborator, or vendor against certain types of third-party claims. The Company accrues for known indemnification issues when a loss is probable and can be reasonably estimated. There were no accruals for expenses related to indemnification issues for any period presented.

13. Subsequent Events

AYAME Study

In May 2023, Kyowa Kirin reported results from the AYAME study, a Phase 3 trial which was conducted in Japan to evaluate the safety and efficacy of bardoxolone in patients with diabetic kidney disease. AYAME met its primary and key secondary endpoints, and no significant safety issues were noted. However, there was no separation in the occurrence of ESRD events between the bardoxolone and placebo groups after three years of treatment. Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the FALCON and EAGLE clinical trials. We are not expecting any material costs to be incurred in connection with the discontinuance of these ongoing studies.

Liability Related to Sale of Future Royalties

With the discontinuation of bardoxolone development, on May 4, 2023, we entered into an Amended and Restated Development and Commercialization Funding Agreement (the Amended Funding Agreement) with BXLS. The Amended Funding Agreement provides that all covenants in the Development and Commercialization Funding Agreement regarding commercialization of bardoxolone, restricting the incurrence of indebtedness, and restricting license and licensing transactions are removed and all prior security interests granted to BXLS are released.

16

In addition, the Amended Funding Agreement provides for a low, single digit royalty payment to BXLS on net sales of omaveloxolone for Friedreich's ataxia. Pursuant to the Amended Funding Agreement, to secure our payment obligations to BXLS, (i) we have granted BXLS a security interest in a segregated deposit account and (ii), subject to certain limitations as set forth in the Amended Funding Agreement, have agreed to maintain in such account an initial balance and thereafter an amount equal to the aggregate amount of Omav Royalty payments made for the immediately preceding two calendar quarter period.

We are currently evaluating the net impact on the liability related to sale of future royalties and any adjustments will be recorded in second quarter financial statements.

Term Loan

On May 5, 2023, the Company, entered into an agreement (the Term Loan) with BPCR Limited Partnership and BioPharma Credit Investments V (Master) LP, as Lenders, which are funds managed by Pharmakon Advisors, LP, and BioPharma Credit PLC, as the collateral agent for the Lenders, pursuant to which the Lenders agreed to make term loans to the Company in an aggregate principal amount of up to $275 million. The initial tranche of $75 million will be funded on May 12, 2023, the second tranche of $50 million is conditioned on meeting certain regulatory or product production criteria and two final tranches of $75 million each will be made available based on the achievement of certain commercial sales milestones; with the fourth tranche being optional to the Company. The Term Loan bears interest at 7.50% plus three-month SOFR per annum, with a SOFR floor of 2.50%. Repayment terms are quarterly interest-only payments for three years, then quarterly amortization over the following two years. The Term Loan is secured by substantially all of the assets of the Company, its U.S. subsidiaries, and its U.K., Swiss, and Irish subsidiaries.

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and related notes and other financial information appearing in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business, operations, and product candidates, includes forward-looking statements that involve risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, among other things, those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and discussed elsewhere in this Quarterly Report on Form 10-Q.

Overview

We are a biopharmaceutical company focused on identifying, developing, and commercializing innovative therapies that change patients’ lives for the better. We concentrate on small-molecule therapeutics with novel mechanisms of action for the treatment of serious or life-threatening diseases with few or no approved therapies and unmet need. Our first product, SKYCLARYS®(omaveloxolone), is the first and only drug approved by the U.S. Food and Drug Administration (FDA) for the treatment of Friedreich's ataxia (FA) in adults and adolescents aged 16 years and older. We have submitted a Marketing Authorization Application (MAA) for omaveloxolone for the treatment of FA to the European Medicines Agency (EMA) in Europe and the application is under review. We are also developing cemdomespib (previously referred to as RTA 901), the lead product candidate from our Hsp90 modulator program, in neurological indications and Nrf2 activators for neurological diseases.

Omaveloxolone activates the transcription factor Nrf2 to normalize mitochondrial function, restore redox balance, and resolve inflammation, in nonclinical models. Because mitochondrial dysfunction, oxidative stress, and inflammation are features of many diseases, we believe our Nrf2 activators have many potential clinical applications.

We possess exclusive, worldwide rights to develop, manufacture, and commercialize omaveloxolone and our Nrf2 activators. We are the exclusive licensee of cemdomespib and have worldwide commercial rights.

In May 2023, Kyowa Kirin reported results from the AYAME study, a Phase 3 trial which was conducted in Japan studying the safety and efficacy of bardoxolone in patients with diabetic kidney disease. Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the FALCON and EAGLE clinical trials. See Note 13, Subsequent Events, to our condensed consolidated financial statements for further details.

Recent Key Developments

Omaveloxolone for Friedreich’s Ataxia

In February 2023, we announced that the FDA approved SKYCLARYS, the first and only drug approved by the FDA for the treatment of FA in adults and adolescents 16 years of age and older. FA is a rare, inherited neurodegenerative disorder that is typically diagnosed during adolescence. Patients with FA experience progressive loss of coordination, muscle weakness, and fatigue, which commonly progresses to motor incapacitation and wheelchair reliance by their teens or early twenties, and eventually death. FA affects approximately 5,000 diagnosed patients in the U.S.

We are evaluating strategies to support global label expansion for younger pediatric patients. In the second quarter of 2023, we plan to request a meeting with the FDA to discuss possible label expansion for younger pediatric patients who are not included in the approved label. A pediatric pharmacokinetic study evaluating safety, tolerability, and pharmacokinetic profile (PK) of omaveloxolone in FA patients is planned to begin in the fourth quarter of 2023.

18

We have completed the final stages of SKYCLARYS drug product manufacturing and packaging. As previously reported, a process-related drug substance impurity above the reporting threshold was observed. This impurity is part of the omaveloxolone drug substance process chemistry that was previously at levels below the reporting threshold. An NDA supplement was submitted to the FDA to increase the drug substance specification for this impurity above the current specification. The approval of this supplement is required to release SKYCLARYs drug product to our specialty pharmacy. The FDA is reviewing the supplement as a Prior Approval Supplement under Priority Review with an approval target action date in mid-August. The FDA stated that the review of the supplement was prioritized and that the approval potentially should come earlier than the action date. We believe that the information provided in the NDA supplement, which was developed based upon FDA and international harmonized guidance, is sufficient to support the proposed change. Provided that there are no major review issues with the supplement, we believe that SKYCLARYS will be available through the specialty pharmacy no later than mid-August 2023.

We submitted an MAA for omaveloxolone for the treatment of patients with FA to the EMA in the fourth quarter of 2022 and the application is under review. We recently received the omaveloxolone MAA Day 120 List of Questions from the EMA. The EMA separates their questions into “major” and “other” categories. With respect to major questions on clinical efficacy, the EMA invited us to discuss the robustness of the efficacy results and suggested the discussion could include the impact of imbalances in baseline characteristics on the pivotal study results and extrapolation of the results to patients with advanced disease and patient groups not included in the pivotal trial. They also asked us to justify inclusion of the pes cavus population in the indication. With respect to major questions on clinical safety, the EMA asked us to discuss the similarities between Nrf2 activators with respect to chemical structure and safety and to discuss suitable contraindications and warnings for cardiac, renal, diabetic and other conditions taking into account the populations studied. With respect to major questions on drug product quality, the EMA requested us to clarify the information on the potential for nitrosamine formation and to provide further information on active substance control strategies. We believe that we have the data and analyses necessary to address the requests of the EMA, and we plan to provide responses to the EMA in the third quarter of 2023.

Cemdomespib for Neurological Indications, Including Diabetic Peripheral Neuropathic Pain

We are developing cemdomespib, a novel, once-daily, oral HSP90 modulator for patients with DPNP. We have finalized the design of a randomized, double-blind, placebo-controlled Phase 2 trial of cemdomespib in patients with diabetic peripheral neuropathic pain (DPNP) and plan to start the trial in the third quarter of 2023. We are the exclusive licensee of cemdomespib and have worldwide commercial rights.

AYAME Trial for Bardoxolone in Diabetic CKD Conducted by Kyowa Kirin

In May 2023, Kyowa Kirin reported results from the AYAME study, a Phase 3 trial which was conducted in Japan studying the safety and efficacy of bardoxolone in patients with diabetic kidney disease. AYAME met the primary and key secondary endpoints, and no significant safety issues were noted. However, there was no separation in the occurrence of ESRD events between the bardoxolone and placebo groups after three years of treatment.

Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the ongoing FALCON Phase 3 trial in patients with ADPKD and EAGLE open-label extension study in patients with Alport syndrome and ADPKD. We will be communicating these plans with regulators and our clinical trial sites immediately.

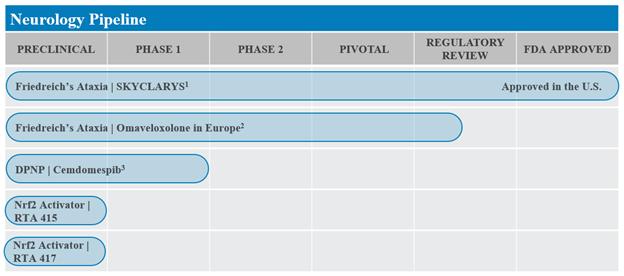

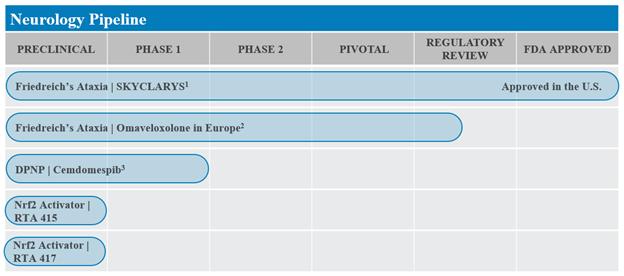

Background: Our Programs

The following chart outlines each of our programs by indication and phase of development:

19

1SKYCLARYS® (omaveloxolone) is indicated for the treatment of FA in adults and adolescents aged 16 years and older.

2MAA submitted in fourth quarter of 2022 and is currently under review.

3Plan to initiate a Phase 2 trial of cemdomespib in patients with DPNP in the third quarter of 2023.

Programs in Neurological Diseases

In February 2023, the FDA approved SKYCLARYS for the treatment of FA in adults and adolescents aged 16 years and older. FA is a rare, inherited neurodegenerative disorder that is typically diagnosed during adolescence and can lead to premature death. We are seeking approval for omaveloxolone for the treatment of FA in Europe and plan to seek approval in additional countries and regions outside the U.S. Because mitochondrial dysfunction is a key feature of many neurological diseases, we believe Nrf2 activators may be broadly applicable to treat neurological diseases by activating Nrf2 to normalize and improve mitochondrial function and adenosine triphosphate (ATP) production.

We are also developing cemdomespib for the treatment of neurological diseases. Cemdomespib is a highly potent and selective C-terminal modulator of Hsp90, which has a critical role in mitochondrial function, protein folding, and inflammation. Cemdomespib has demonstrated profound efficacy in a wide range of animal models of neurological disease, including diabetic neuropathy, neuroinflammation, and neuropathic pain. We have finalized the design of a randomized, double-blind, placebo-controlled Phase 2 trial of cemdomespib in patients with DPNP and plan to start the trial in the third quarter of 2023.

Omaveloxolone in Patients with Friedreich’s Ataxia

Patients with FA experience progressive loss of coordination, muscle weakness, and fatigue, that commonly progresses to motor incapacitation and wheelchair reliance. Diagnosis of FA typically occurs by genetic testing, and most people with FA are diagnosed in their teens and early twenties. Patients with FA typically require a wheelchair in their twenties and the mean age of death for patients with FA is in the mid-thirties. Childhood-onset FA can occur as early as age five, is more common than later onset FA, and normally involves more rapid disease progression. Based on literature and proprietary research, we believe FA affects approximately 6,000 patients in the United States and 22,000 individuals globally. According to a recent insurance claim analysis, we estimate that there are approximately 5,000 patients diagnosed with FA in the United States.

In February 2023, we announced FDA approval of our first product SKYCLARYS (omaveloxolone), the first drug indicated for the treatment of FA in adults and adolescents 16 years of age and older. With this approval, the FDA granted a rare pediatric disease priority review voucher.

We are evaluating strategies to support global label expansion for younger pediatric patients. In the second quarter of 2023, we plan to request a meeting with the FDA to discuss possible label expansion for younger pediatric patients who are not included in the approved label. A pediatric pharmacokinetic study evaluating safety, tolerability, and pharmacokinetic profile (PK) of omaveloxolone in FA patients is planned to begin in the fourth quarter of 2023.

20

Additional pediatric study plans will be finalized after receiving an opinion from EMA scientific advice (see Regulatory Interactions in Europe section) and FDA feedback.

We have agreed with the FDA on multiple post-marketing requirements. The first is to conduct a clinical drug-drug interaction study to determine the effect of concomitant administration of a moderate CYP3A4 inducer on the pharmacokinetics of SKYCLARYS in healthy volunteers. Second, we have committed to conduct a thorough QT study to assess the risk of QT prolongation with SKYCLARYS. We plan to initiate these studies in the second half of 2023. Third, we have committed to conduct a study to assess the concentration of SKYCLARYS in breast milk (milk only). Fourth, we have committed to conduct a global pregnancy and lactation surveillance program to collect prospective and retrospective data in women exposed to SKYCLARYS to assess risk of maternal and fetal/neonate complications. Finally, we have agreed to conduct additional non-clinical studies. We are on track with the agreed upon milestones.

Beyond our post-marketing requirements, we will sponsor a voluntary, post-marketing, prospective, observational, multinational registry study of patients treated commercially with SKYCLARYS. The primary objective of the registry is to evaluate the long-term safety of SKYCLARYS in FA patients in the real-world setting.

We have completed the final stages of SKYCLARYS drug product manufacturing and packaging. As previously reported, a process-related drug substance impurity above the reporting threshold was observed. This impurity is part of the omaveloxolone drug substance process chemistry that was previously at levels below the reporting threshold. An NDA supplement was submitted to the FDA to increase the drug substance specification for this impurity above the current specification. The approval of this supplement is required to release SKYCLARYs drug product to our specialty pharmacy. The FDA is reviewing the supplement as a Prior Approval Supplement under Priority Review with an approval target action date in mid-August. The FDA stated that the review of the supplement was prioritized and that the approval potentially should come earlier than the action date. We believe that the information provided in the NDA supplement, which was developed based upon FDA and international harmonized guidance, is sufficient to support the proposed change. Provided that there are no major review issues with the supplement, we believe that SKYCLARYS will be available through the specialty pharmacy no later than mid-August 2023.

Regulatory Interactions in Europe

We submitted an MAA for omaveloxolone for the treatment of patients with FA to the EMA in the fourth quarter of 2022 and the application is under review. We recently received the omaveloxolone MAA Day 120 List of Questions from the EMA. The EMA separates their questions into “major” and “other” categories. With respect to major questions on clinical efficacy, the EMA invited us to discuss the robustness of the efficacy results and suggested the discussion could include the impact of imbalances in baseline characteristics on the pivotal study results and extrapolation of the results to patients with advanced disease and patient groups not included in the pivotal trial. They also asked us to justify inclusion of the pes cavus population in the indication. With respect to major questions on clinical safety, the EMA asked us to discuss the similarities between Nrf2 activators with respect to chemical structure and safety and to discuss suitable contraindications and warnings for cardiac, renal, diabetic and other conditions taking into account the populations studied. With respect to major questions on drug product quality, the EMA requested us to clarify the information on the potential for nitrosamine formation and to provide further information on active substance control strategies. We believe that we have the data and analyses necessary to address the requests of the EMA, and we plan to provide responses to the EMA in the third quarter of 2023.

Prior to submission of the MAA, we received a positive opinion from the Pediatric Committee on our Pediatric Investigation Plan, and, as agreed in this plan, we have submitted a request for scientific advice seeking additional input on the protocol design.

Omaveloxolone and Our Other Nrf2 Activators for Other Neurological Indications

Because mitochondrial dysfunction is a key feature of many neurological and neuromuscular diseases, we believe Nrf2 activators may be broadly applicable to treat such diseases by activating Nrf2 to normalize and improve mitochondrial function and ATP production.

21

Based on our understanding of the pathophysiology of neurological diseases, characterized by mitochondrial dysfunction, inflammation, and oxidative stress, we believe our Nrf2 activators may be applicable to both rare diseases such as Huntington’s disease, progressive supranuclear palsy, frontotemporal dementia, primary progressive multiple sclerosis, and others, as well as non-rare diseases such as Parkinson’s disease, Alzheimer’s disease, epilepsy, and others. Consistent with this, we have observed promising activity of omaveloxolone and our other Nrf2 activators in preclinical models of many of these diseases. Our Nrf2 activators reduced seizure frequency in refractory, progressive epilepsy models and restored mitochondrial function in patient biopsy samples and preclinical models of FA, amyotrophic lateral sclerosis (ALS), familial and sporadic Parkinson’s disease, and frontotemporal dementia. In clinical trials, improvements in neuromuscular function have been observed in FA patients treated with omaveloxolone as assessed by the modified Friedreich’s Ataxia Rating Scale, and improvements in mitochondrial function, as measured by reductions in blood lactate and heart rate, have been observed in patients with primary mitochondrial disease. We have developed additional small molecule activators of Nrf2, including RTA 415 and RTA 417, which are currently in preclinical development. The non-clinical profiles of these to molecules support advancement to clinical studies and have shown broad activity in non-clinical models of inflammation, autoimmune disease, and neurodegeneration. Late Investigational New Drug (IND)-directed studies are currently underway or planned, and we anticipate IND filings in 2024 for both molecules. We are currently evaluating the impact of provisions of the Inflation Reduction Act (IRA) on our future development plans for omaveloxolone and our other Nrf2 activators.

Cemdomespib in Neurological Diseases

Cemdomespib is the lead product candidate from our Hsp90 modulator program, which includes highly potent and selective C-terminal modulators of Hsp90. We have observed favorable activity of cemdomespib in a range of preclinical models of neurological disease, including models of diabetic neuropathy, neuroinflammation, and neuropathic pain.

Historically, other companies have explored N-terminal Hsp90 inhibitors for cancer therapeutics; however, this approach has been associated with multiple adverse effects including peripheral neuropathy and ocular toxicity. Binding at the C-terminus of Hsp90 leads to increased transcription of Hsp70, a cytoprotective and molecular chaperone gene, which facilitates cell survival in response to stress without the deleterious activities of N-terminal inhibition.

In preclinical rodent disease models, we observed that cemdomespib administered orally once-daily rescued compromised nerve function, restored thermal and mechanical sensitivity, and improved nerve conductance velocity and mitochondrial function. These effects are dose-dependent, reversible, and HSP70-dependent.

We completed a Phase 1 SAD/MAD trial of oral, once daily cemdomespib in healthy adult volunteers to evaluate the safety, tolerability, and pharmacokinetic (PK) profile. The PK was approximately dose-proportional up to the highest doses evaluated with a half-life ranging from two to nine hours. Human exposures easily exceeded the exposures necessary for efficacy in multiple animal models. No safety or tolerability concerns were reported. In the third quarter of 2022, we completed additional Phase 1 clinical pharmacology studies of cemdomespib, including a drug-drug interaction study which demonstrated an acceptable profile.

We have finalized the design of a randomized, double-blind, placebo-controlled, two-part, 12-week Phase 2 trial of cemdomespib in patients with DPNP. The trial will assess pain using the numeric pain rating scale (NPRS). We plan to enroll 192 patients randomized in each part for a total of 384 patients. Patients are allowed to take up to one standard of care medication. In order for patients to enroll, they must not have achieved adequate pain control upon entry with a NPRS pain intensity score of at least 4 on a 0 to 10 point scale at screening. We will conduct an exposure-response analysis using Part 1 data to select doses for Part 2. The primary endpoint is the change in average pain intensity assessed by NPRS at Week 12. We plan to initiate the trial in the third quarter of 2023.

There are about four million patients with moderate to severe DPNP in the United States, and about two million adult patients diagnosed with DPNP seek treatment annually. We are the exclusive licensee of cemdomespib and have worldwide commercial rights.

Programs in Chronic Kidney Disease

We and Kyowa Kirin, our strategic collaborator in CKD in Japan, were developing bardoxolone for the treatment of CKD in multiple indications, including ADPKD, CKD caused by Alport syndrome, and type 1 and 2 diabetic CKD.

22

On February 25, 2022, we received a Complete Response Letter (CRL) from the FDA with respect to its review of our NDA for bardoxolone in the treatment of patients with CKD caused by Alport syndrome. The CRL indicated that the FDA cannot approve the NDA in its present form. Based on its review, the FDA concluded that it does not believe the submitted data demonstrates that bardoxolone is effective in slowing the loss of kidney function in patients with Alport syndrome and reducing the risk of progression to kidney failure and requested additional data to support the efficacy and safety of bardoxolone. Their conclusion was based on efficacy and safety concerns primarily set forth in the FDA’s briefing book and discussed at the Cardiovascular and Renal Drugs Advisory Committee meeting held on December 8, 2021.

We have been sponsoring FALCON, a Phase 3, international, multi-center, randomized, double-blind, placebo-controlled trial studying the safety and efficacy of bardoxolone in patients with ADPKD, a rare and serious hereditary form of CKD. In fourth quarter of 2022, we had received scientific advice from the EMA that the proposed Phase 3 clinical study cannot be used as a standalone study to support the indication of bardoxolone in ADPKD. The EMA recommended that we evaluate, in addition to the traditional endpoints, the effect of bardoxolone on total kidney volume in these patients and requested that we seek additional guidance on our program.

In May 2023, Kyowa Kirin reported results from the AYAME study, Phase 3 trial of bardoxolone in patients with diabetic kidney disease. The primary endpoint is time to onset of a ≥ 30% decrease in eGFR from baseline or ESRD. The secondary endpoints are time to onset of a ≥ 40% decrease in eGFR from baseline or ESRD, time to onset of a ≥ 53% decrease in eGFR from baseline or ESRD, time to onset of ESRD, and change in eGFR from baseline at each evaluation time point.

AYAME met the primary and key secondary endpoints and no significant safety issues were observed in patients receiving bardoxolone. However, there was no separation in the occurrence of ESRD events between the bardoxolone and placebo groups after three years of treatment.

Based on the results of AYAME and its potential regulatory impact, we and Kyowa Kirin have decided to discontinue our bardoxolone CKD programs, including the ongoing FALCON Phase 3 trial in patients with ADPKD and EAGLE open-label extension study in patients with Alport syndrome and ADPKD. We will be communicating these plans with regulators and our clinical trial sites immediately.

United States Commercial Launch