GREENSPRING INCOME

OPPORTUNITIES FUND

ANNUAL REPORT

SEPTEMBER 30, 2023

This report is intended for shareholders of the

Greenspring Income Opportunities Fund and may not be

used as sales literature unless preceded or

accompanied by a current prospectus.

Greenspring Income Opportunities Fund (Unaudited)

Dear Fellow Shareholder,

The Annual Report for the Greenspring Income Opportunities Fund (“GRIOX” or the “Fund”) covers the period from September 30, 2022 through September 30, 2023. During this period, GRIOX returned 7.68%, compared to 7.48% for the Fund’s benchmark, the ICE BofA 1-3 Year US Cash Pay High Yield Index. The broader fixed income market, as measured by the Bloomberg US Agg Total Return Index, returned just 0.64% over the same time period. GRIOX generated strong positive returns through a conservative approach to the high-yield bond market, with a focus on securities with short expected durations and attractive risk-adjusted returns. The combination of the Fund’s short duration, higher average coupon, and our targeted security-specific selection process has buffered the portfolio from the large price declines suffered by holders of long duration securities during periods of rising interest rates. Importantly, having preserved our shareholders’ capital well, we are now able to benefit from the higher yields currently available in the market. As of September 30, 2023, GRIOX had a duration of 1.99 years, an average coupon of 5.92%, and a subsidized SEC yield of 6.23%.

In managing the Fund’s portfolio, we are currently taking advantage of the inverted yield curve and relatively flat corporate credit curves to often earn similar, if not greater, yields on short-term bonds than the yield available for longer maturities of the same company. This allows us to limit interest rate and credit spread volatility. We are finding many opportunities in short-dated bonds trading at discounts to par, a condition made possible by the rise in the market’s interest rate above many bonds’ coupon rates. Many of these bonds offer what we consider to be attractive yields to maturity…with additional, and often times considerable, upside total returns possible, if a bond is redeemed prior to maturity. In fact, several of the Fund’s largest positive contributors to performance during the annual period were bonds that were redeemed prior to maturity. In general, early redemptions can occur due to company specific catalysts, M&A activity, or by corporate actions undertaken to redeem securities before they become current liabilities.

| Greenspring Income Opportunities Fund |

| Performance for the |

| Periods Ended September 30, 2023 |

| Quarter | 0.77% |

| Year to Date | 4.22% |

| 1 Year | 7.68% |

| Since inception on 12/15/21* | 1.91% |

| Expense Ratio** | 0.86% |

| 30-Day SEC Yield (unsubsidized) | 6.17% |

| * | | annualized. |

| ** | | The net expense ratio is 0.86%, as stated in the Fund’s Prospectus dated January 31, 2023. The Fund’s investment adviser has contractually agreed to waive a portion of its fees and reimburse certain expenses for the Fund to limit the total annual fund operating expenses (excluding taxes, Rule 12b-1 fees, shareholder servicing fees, extraordinary expenses, brokerage commissions, interest and acquired fund fees and expenses) to 0.75% through December 15, 2024. Absent advisory fee reductions and expense reimbursements, the expense ratio (gross) would be 0.95% for the Fund’s current fiscal year. The net expense ratio is applicable to investors. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-366-3863 or by visiting www.greenspringfunds.com.

As of September 30, 2023, the Fund’s sector allocation was well diversified and driven by security-specific fundamental analysis. The largest positive contributions to performance during the period came from the Metals & Mining industry group, followed by Trading Companies & Distributors, Retail, and Software & Services. The largest

Greenspring Income Opportunities Fund (Unaudited)

| Greenspring Income | | % of Net |

| Opportunities Fund | | Assets |

| Top 10 Holdings | | as of |

| | | | 9/30/23 |

| 1. | Triton Container International Ltd. | | |

| | 1.150% 6/7/24(a) | | 1.4% |

| 2. | First Quantum Minerals Ltd. | | |

| | 7.500% 4/1/25(a) | | 1.3% |

| 3. | Gates Global LLC | | |

| | 6.250% 1/15/26(a) | | 1.3% |

| 4. | Signet UK Finance PLC | | |

| | 4.700% 6/15/24 | | 1.2% |

| 5. | Enact Holdings, Inc. | | |

| | 6.500% 8/15/25(a) | | 1.2% |

| 6. | Avient Corp. | | |

| | 5.750% 5/15/25(a) | | 1.2% |

| 7. | Dana Financing Luxembourg | | |

| | 5.750% 4/15/25(a) | | 1.2% |

| 8. | EnPro Industries, Inc. | | |

| | 5.75% 10/15/2026(a) | | 1.2% |

| 9. | Caesars Entertainment, Inc. | | |

| | 6.250% 7/1/25(a) | | 1.2% |

| 10. | Dave & Buster’s, Inc. | | |

| | 7.625% 11/1/25(a) | | 1.1% |

| (a) | 144A Securities available only to qualified institutional buyers, issued by a publicly-traded entity or parent. |

Fund holdings and sector allocations do not reflect last day of month securities transactions and are subject to change at any time and should not be considered a recommendation to buy or sell any security.

negative contributor to performance for the period was from the Telecommunications Services industry group. The portfolio’s largest underweights versus the benchmark include more economically cyclical and volatile industry groups such as automotive, energy, airlines, and financials. In general, while we employ a bottom-up security selection process, we prefer businesses with more stable earnings profiles, which is reflected in our sector positioning.

Market Commentary

During the period from September 30, 2022 through September 30, 2023 the Federal Reserve continued on its monetary tightening campaign, raising the Upper Bound of the Federal Funds Target rate an additional 225 basis points, from 3.25% to 5.50% at the July 2023 meeting. At the most recent September FOMC meeting, the Federal Reserve kept interest rates unchanged, but the wording of the Fed’s statement strongly indicated that rates would remain near current levels or slightly higher for an extended period. Although the Fed has repeatedly stated their intention to keep rates “higher for longer” to bring inflation down to target levels, many market participants had expected that a pivot to rate cuts would be coming in the near future. However, continued strong economic data, a tight labor market, and sticky inflation have extended market expectations for the timing of future rate cuts. The Fed’s September meeting appears to have been a wake-up call for many in the fixed income markets, resulting in a rapid sell off in longer-duration fixed income assets. The Bloomberg US Agg Index posted yet another decline, -3.2% in the third quarter of 2023, and has now declined -14.8% cumulatively over the last three years! Despite the move higher in long-term rates, the Treasury curve remains inverted with the 2-year Treasury yielding almost 50 basis points more than the 10-year Treasury at quarter end. We continue to see value in short-dated high-yield corporate bonds that benefit in part from this positioning on the yield curve.

With the evolving interest rate backdrop, we remain excited about the potential equity-like return opportunities in short-duration high-yield securities. We are able to purchase many short-duration bonds at very attractive spreads to Treasury securities of similar maturity. But, importantly and in contrast to the period several years ago, most short-duration bonds in our universe now sell at discounts to par, and we have the potential to achieve even better total returns, if the bonds are redeemed prior to maturity – a feature not available with Treasuries. The balance sheets of many companies within the high-yield universe remain relatively healthy, with manageable near-term debt maturities and significant cash flow cushions, providing some flexibility to absorb higher interest rates

Greenspring Income Opportunities Fund (Unaudited)

going forward. As we look into the end of 2023 and beyond, we are mindful that higher rates may weaken the fundamentals of certain companies; therefore, we remain focused on risk mitigation in the portfolio by employing our rigorous security-specific selection process designed to maintain attractive risk-adjusted returns by avoiding those securities that may face growing challenges in a “higher for longer” environment.

We thank you for your continued trust and support of the Greenspring Income Opportunities Fund.

Respectfully,

|  |  |

| Charles vK. Carlson, CFA | Michael J. Pulcinella | George A. Truppi, CFA |

| Portfolio Manager | Portfolio Manager | Portfolio Manager |

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities are subject to credit, interest rate, call or prepayment, liquidity and extension risks. Investments in debt securities that are rated below investment grade present a greater risk of loss to principal and interest than higher-rated securities.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

ICE BofA 1-3 Year BB U.S. Cash Pay High Yield Index is a subset of ICE BofA U.S. Cash Pay High Yield Index including all securities with a remaining term to final maturity less than 3 years and rated BB1 through BB3, inclusive. The Bloomberg U.S. Aggregate Bond Index is a benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market and includes Treasuries, government-related and corporate securities, MBS, ABS, and CMBS. It is not possible to invest directly in an index.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration. An inverted yield curve shows that long-term interest rates are less than short-term interest rates. With an inverted yield curve, the yield decreases the farther away the maturity date is and has proven in the past to be a reliable indicator of a recession. Yield to maturity is the total rate of return that will have been earned by a bond when it makes all interest payments and repays the original principal.

The 30-day SEC yield or 30-day yield (subsidized) is based on dividends and interest earned by the Fund, and not on the dividends paid by the Fund, which may differ and are subject to change. This is a standard yield calculation developed by the SEC for bond funds. The yield is calculated by dividing the net investment income per share earned during the 30-day period by the maximum offering price per share on the last day of the period. The yield figure reflects the dividends and interest earned during the 30-day period, after the deduction of the fund’s expenses. The 30-day SEC yield (unsubsidized) is a 30-day yield without applicable waivers or reimbursements, whenever the Fund is subsidizing all or a portion of the Fund’s expenses as of the current reporting period. Absent such waivers or reimbursements, the returns would have been lower. Waivers and/or reimbursements may be discontinued at any time

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectuses contain this and other information about the Fund, and may be obtained by calling 1-800-366-3863 or visiting www.greenspringfunds.com. Please read the Fund’s Prospectus carefully before investing.

Distributed by Quasar Distributors, LLC

Greenspring Income Opportunities Fund

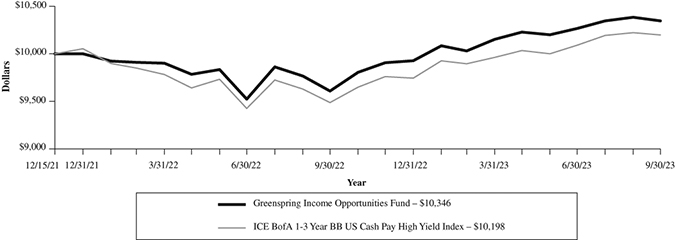

Growth of a $10,000 Investment in the Greenspring Income Opportunities Fund

| Average Annual Total Return | | Since Inception |

| Periods Ended September 30, 2023: | 1 Year | (12/15/2021) |

| Greenspring Income Opportunities Fund | 7.68% | 1.91% |

| ICE BofA 1-3 Year BB US Cash Pay High Yield Index | 7.48% | 1.09% |

Expense Ratios*: Gross 1.14%, Net 0.86%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-497-2960.

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund on December 15, 2021, the Fund’s inception date. Returns reflect the reinvestment of dividends and capital gain distributions. The performance data and expense ratios shown reflect a contractual fee waiver made by the Advisor, currently, through December 15, 2024. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on dividends, capital gain distributions, or redemption of Fund shares. This chart does not imply any future performance.

* The expense ratios presented are from the most recent prospectus.

Greenspring Income Opportunities Fund

EXPENSE EXAMPLE For the Period Ended September 30, 2023 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) and redemption fees, if applicable; and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the period from April 1, 2023 to September 30, 2023, for the Institutional Shares.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is charged to the account annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | Beginning | Ending | Expenses Paid |

| | | | Account Value | Account Value | During Period(1) |

| | | | 4/1/2023(1) | 9/30/2023 | 4/1/2023-9/30/2023 |

| | Actual | | | | |

| | Institutional Shares | | $1,000.00 | $1,019.10 | $4.30 |

| | Hypothetical | | | | |

| | (5% return before expenses) | | | | |

| | Institutional Shares | | $1,000.00 | $1,020.81 | $4.31 |

(1) | Expenses are equal to the Institutional Shares’ annualized net expense ratios of 0.85% multiplied by the average account value over the period, multiplied by 183/365 (to reflect the prior 6 months of operation). |

Greenspring Income Opportunities Fund

ALLOCATION OF PORTFOLIO ASSETS at September 30, 2023 (Unaudited) |

Percentages represent market value as a percentage of net assets.

Note: For Presentation purposes, the Fund has grouped some of the industry categories for purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 |

| | | Par Value | | | Value | |

| CORPORATE BONDS – 92.2% | | | | | | |

| | | | | | | |

| COMMUNICATIONS – 4.5% | | | | | | |

| | | | | | | |

| Cable & Satellite – 1.0% | | | | | | |

| CCO Holdings LLC | | | | | | |

| 5.50%, 05/01/2026 (a) | | $ | 600,000 | | | $ | 580,189 | |

| 5.13%, 05/01/2027 (a) | | | 554,000 | | | | 516,750 | |

| Videotron Ltd. | | | | | | | | |

| 5.38%, 06/15/2024 (a) | | | 618,000 | | | | 613,285 | |

| | | | | | | | 1,710,224 | |

| Media & Entertainment – 2.3% | | | | | | | | |

| Belo Corp. | | | | | | | | |

| 7.75%, 06/01/2027 | | | 920,000 | | | | 916,150 | |

| Cinemark USA, Inc. | | | | | | | | |

| 8.75%, 05/01/2025 (a) | | | 1,269,000 | | | | 1,278,132 | |

| Nexstar Media, Inc. | | | | | | | | |

| 5.63%, 07/15/2027 (a) | | | 1,484,000 | | | | 1,322,497 | |

| TEGNA, Inc. | | | | | | | | |

| 4.63%, 03/15/2028 | | | 404,000 | | | | 350,975 | |

| | | | | | | | 3,867,754 | |

| Transportation – 1.1% | | | | | | | | |

| Uber Technologies, Inc. | | | | | | | | |

| 7.50%, 05/15/2025 (a) | | | 1,100,000 | | | | 1,108,112 | |

| 8.00%, 11/01/2026 (a) | | | 828,000 | | | | 838,574 | |

| | | | | | | | 1,946,686 | |

| Wireless Telecommunication Services – 0.1% | | | | | | | | |

| T-Mobile U.S., Inc. | | | | | | | | |

| 7.13%, 06/15/2024 | | | 100,000 | | | | 100,695 | |

| TOTAL COMMUNICATIONS | | | | | | | 7,625,359 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY – 27.8% | | | | | | | | |

| | | | | | | | | |

| Auto Components – 2.9% | | | | | | | | |

| Adient Global Holdings Ltd. | | | | | | | | |

| 7.00%, 04/15/2028 (a) | | | 1,600,000 | | | | 1,588,756 | |

| Dana Financing Luxembourg | | | | | | | | |

| 5.75%, 04/15/2025 (a) | | | 2,045,000 | | | | 2,002,765 | |

| Dana, Inc. | | | | | | | | |

| 5.63%, 06/15/2028 | | | 100,000 | | | | 91,642 | |

| Goodyear Tire & Rubber Co. | | | | | | | | |

| 9.50%, 05/31/2025 | | | 1,166,000 | | | | 1,184,651 | |

| | | | | | | | 4,867,814 | |

| Automobiles – 1.1% | | | | | | | | |

| Jaguar Land Rover Automotive PLC | | | | | | | | |

| 7.75%, 10/15/2025 (a) | | | 1,812,000 | | | | 1,817,735 | |

| | | | | | | | | |

| Automobiles Wholesalers – 0.3% | | | | | | | | |

| Openlane, Inc. | | | | | | | | |

| 5.13%, 06/01/2025 (a) | | | 524,000 | | | | 507,528 | |

| | | | | | | | | |

| Building Products – 0.9% | | | | | | | | |

| Griffon Corp. | | | | | | | | |

| 5.75%, 03/01/2028 | | | 1,378,000 | | | | 1,252,416 | |

| JELD-WEN, Inc. | | | | | | | | |

| 4.63%, 12/15/2025 (a) | | | 298,000 | | | | 286,458 | |

| | | | | | | | 1,538,874 | |

| Casinos & Gaming – 3.2% | | | | | | | | |

| Boyd Gaming Corp. | | | | | | | | |

| 4.75%, 12/01/2027 | | | 675,000 | | | | 622,661 | |

| Caesars Entertainment, Inc. | | | | | | | | |

| 6.25%, 07/01/2025 (a) | | | 1,973,000 | | | | 1,947,731 | |

| Las Vegas Sands Corp. | | | | | | | | |

| 3.20%, 08/08/2024 | | | 1,279,000 | | | | 1,238,182 | |

| MGM Resorts International | | | | | | | | |

| 6.75%, 05/01/2025 | | | 1,595,000 | | | | 1,588,203 | |

| | | | | | | | 5,396,777 | |

| Chemicals – 0.1% | | | | | | | | |

| Scotts Miracle-Gro Co. | | | | | | | | |

| 5.25%, 12/15/2026 | | | 250,000 | | | | 232,194 | |

| | | | | | | | | |

| Commercial Services & Supplies – 1.0% | | | | | | | | |

| Matthews International Corp. | | | | | | | | |

| 5.25%, 12/01/2025 (a) | | | 1,742,000 | | | | 1,673,409 | |

| | | | | | | | | |

| Consumer Products – 0.9% | | | | | | | | |

| American Greetings Corp. | | | | | | | | |

| 8.75%, 04/15/2025 (a) | | | 1,500,000 | | | | 1,486,418 | |

| | | | | | | | | |

| Consumer Services – 3.4% | | | | | | | | |

| Aramark Services, Inc. | | | | | | | | |

| 6.38%, 05/01/2025 (a) | | | 1,377,000 | | | | 1,398,949 | |

| Graham Holdings Co. | | | | | | | | |

| 5.75%, 06/01/2026 (a) | | | 1,910,000 | | | | 1,848,078 | |

| Prime Security Services Borrower LLC | | | | | | | | |

| 5.25%, 04/15/2024 (a) | | | 1,546,000 | | | | 1,536,995 | |

| 6.25%, 01/15/2028 (a) | | | 1,000,000 | | | | 927,319 | |

| | | | | | | | 5,711,341 | |

| Homebuilding – 1.0% | | | | | | | | |

| Beazer Homes USA, Inc. | | | | | | | | |

| 6.75%, 03/15/2025 | | | 1,000,000 | | | | 1,000,320 | |

| Century Communities, Inc. | | | | | | | | |

| 6.75%, 06/01/2027 | | | 685,000 | | | | 673,888 | |

| | | | | | | | 1,674,208 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 (Continued) |

| | | Par Value | | | Value | |

| CORPORATE BONDS – 92.2% (Continued) | | | | | | |

| | | | | | | |

| CONSUMER DISCRETIONARY – 27.8% (Continued) | | | | | | |

| | | | | | | |

| Household Durables – 1.0% | | | | | | |

| Newell Brands, Inc. | | | | | | |

| 4.88%, 06/01/2025 | | $ | 950,000 | | | $ | 911,262 | |

| 4.70%, 04/01/2026 | | | 500,000 | | | | 471,671 | |

| 6.38%, 09/15/2027 | | | 250,000 | | | | 239,277 | |

| | | | | | | | 1,622,210 | |

| Leisure – 2.3% | | | | | | | | |

| Cedar Fair LP | | | | | | | | |

| 5.50%, 05/01/2025 (a) | | | 452,000 | | | | 443,028 | |

| 5.38%, 04/15/2027 | | | 750,000 | | | | 703,169 | |

| 6.50%, 10/01/2028 | | | 335,000 | | | | 317,189 | |

| Life Time, Inc. | | | | | | | | |

| 5.75%, 01/15/2026 (a) | | | 1,500,000 | | | | 1,454,775 | |

| Six Flags Theme Parks, Inc. | | | | | | | | |

| 7.00%, 07/01/2025 (a) | | | 180,000 | | | | 179,713 | |

| Vail Resorts, Inc. | | | | | | | | |

| 6.25%, 05/15/2025 (a) | | | 740,000 | | | | 736,729 | |

| | | | | | | | 3,834,603 | |

| Lodging – 2.7% | | | | | | | | |

| Arrow Bidco LLC | | | | | | | | |

| 9.50%, 03/15/2024 (a) | | | 1,635,000 | | | | 1,636,593 | |

| Hilton Domestic Operating Co., Inc. | | | | | | | | |

| 5.38%, 05/01/2025 (a) | | | 375,000 | | | | 369,399 | |

| Hilton Worldwide Finance LLC | | | | | | | | |

| 4.88%, 04/01/2027 | | | 125,000 | | | | 119,030 | |

| Marriott Ownership Resorts, Inc. | | | | | | | | |

| 4.75%, 01/15/2028 | | | 137,000 | | | | 120,048 | |

| Travel & Leisure Co. | | | | | | | | |

| 5.65%, 04/01/2024 | | | 1,150,000 | | | | 1,143,664 | |

| 6.63%, 07/31/2026 (a) | | | 1,300,000 | | | | 1,266,005 | |

| | | | | | | | 4,654,739 | |

| Restaurants – 2.7% | | | | | | | | |

| Brinker International, Inc. | | | | | | | | |

| 5.00%, 10/01/2024 (a) | | | 1,757,000 | | | | 1,715,274 | |

| Dave & Buster's, Inc. | | | | | | | | |

| 7.63%, 11/01/2025 (a) | | | 1,860,000 | | | | 1,861,054 | |

| New Red Finance, Inc. | | | | | | | | |

| 5.75%, 04/15/2025 (a) | | | 1,000,000 | | | | 993,326 | |

| | | | | | | | 4,569,654 | |

| Retail – 4.3% | | | | | | | | |

| Academy Ltd. | | | | | | | | |

| 6.00%, 11/15/2027 (a) | | | 1,500,000 | | | | 1,419,458 | |

| NMG Holding Co., Inc. | | | | | | | | |

| 7.13%, 04/01/2026 (a) | | | 1,600,000 | | | | 1,503,099 | |

| Nordstrom, Inc. | | | | | | | | |

| 2.30%, 04/08/2024 | | | 1,412,000 | | | | 1,383,944 | |

| Sally Holdings LLC | | | | | | | | |

| 5.63%, 12/01/2025 | | | 952,000 | | | | 928,741 | |

| Signet UK Finance PLC | | | | | | | | |

| 4.70%, 06/15/2024 | | | 2,148,000 | | | | 2,096,663 | |

| | | | | | | | 7,331,905 | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 46,919,409 | |

| | | | | | | | | |

| CONSUMER STAPLES – 3.3% | | | | | | | | |

| | | | | | | | | |

| Food & Beverage – 0.3% | | | | | | | | |

| Darling Ingredients, Inc. | | | | | | | | |

| 5.25%, 04/15/2027 (a) | | | 518,000 | | | | 494,065 | |

| | | | | | | | | |

| Food & Staples Retailing – 0.9% | | | | | | | | |

| Albertsons Cos., Inc. | | | | | | | | |

| 7.50%, 03/15/2026 (a) | | | 700,000 | | | | 710,488 | |

| 5.88%, 02/15/2028 (a) | | | 808,000 | | | | 778,560 | |

| | | | | | | | 1,489,048 | |

| Household & Personal Products – 2.1% | | | | | | | | |

| Coty, Inc. | | | | | | | | |

| 5.00%, 04/15/2026 (a) | | | 1,450,000 | | | | 1,394,508 | |

| 6.50%, 04/15/2026 (a) | | | 835,000 | | | | 831,664 | |

| Spectrum Brands, Inc. | | | | | | | | |

| 5.00%, 10/01/2029 (a) | | | 1,480,000 | | | | 1,342,782 | |

| | | | | | | | 3,568,954 | |

| TOTAL CONSUMER STAPLES | | | | | | | 5,552,067 | |

| | | | | | | | | |

| ENERGY – 5.5% | | | | | | | | |

| | | | | | | | | |

| Energy Equipment & Services – 0.5% | | | | | | | | |

| Oceaneering International, Inc. | | | | | | | | |

| 4.65%, 11/15/2024 | | | 920,000 | | | | 909,158 | |

| | | | | | | | | |

| Energy Midstream – 3.7% | | | | | | | | |

| Antero Midstream Partners LP | | | | | | | | |

| 7.88%, 05/15/2026 (a) | | | 1,250,000 | | | | 1,260,075 | |

| Genesis Energy LP | | | | | | | | |

| 6.50%, 10/01/2025 | | | 1,000,000 | | | | 983,794 | |

| New Fortress Energy, Inc. | | | | | | | | |

| 6.75%, 09/15/2025 (a) | | | 1,200,000 | | | | 1,146,871 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 (Continued) |

| | | Par Value | | | Value | |

| CORPORATE BONDS – 92.2% (Continued) | | | | | | |

| | | | | | | |

| ENERGY – 5.5% (Continued) | | | | | | |

| | | | | | | |

| Energy Midstream – 3.7% (Continued) | | | | | | |

| NGL Energy Partners LP | | | | | | |

| 6.13%, 03/01/2025 | | $ | 1,855,000 | | | $ | 1,823,109 | |

| Targa Resources Partners LP | | | | | | | | |

| 6.50%, 07/15/2027 | | | 1,044,000 | | | | 1,053,093 | |

| | | | | | | | 6,266,942 | |

| Exploration & Production – 1.3% | | | | | | | | |

| Chesapeake Energy Corp. | | | | | | | | |

| 5.50%, 02/01/2026 (a) | | | 1,044,000 | | | | 1,011,222 | |

| PDC Energy, Inc. | | | | | | | | |

| 5.75%, 05/15/2026 | | | 263,000 | | | | 262,257 | |

| SM Energy Co. | | | | | | | | |

| 5.63%, 06/01/2025 | | | 1,010,000 | | | | 989,436 | |

| | | | | | | | 2,262,915 | |

| TOTAL ENERGY | | | | | | | 9,439,015 | |

| | | | | | | | | |

| FINANCIALS – 10.6% | | | | | | | | |

| | | | | | | | | |

| Consumer Finance – 2.8% | | | | | | | | |

| Credit Acceptance Corp. | | | | | | | | |

| 5.13%, 12/31/2024 (a) | | | 725,000 | | | | 706,878 | |

| 6.63%, 03/15/2026 | | | 1,136,000 | | | | 1,096,353 | |

| PRA Group, Inc. | | | | | | | | |

| 7.38%, 09/01/2025 (a) | | | 1,905,000 | | | | 1,857,234 | |

| Springleaf Finance Corporation Glbl Nt24 | | | | | | | | |

| 8.25%, 10/01/2023 | | | 40,000 | | | | 40,000 | |

| 6.13%, 03/15/2024 | | | 420,000 | | | | 419,067 | |

| 6.88%, 03/15/2025 | | | 569,000 | | | | 565,030 | |

| | | | | | | | 4,684,562 | |

| Financial Services – 0.8% | | | | | | | | |

| Burford Capital Global Finance LLC | | | | | | | | |

| 6.25%, 04/15/2028 (a) | | | 1,544,000 | | | | 1,429,381 | |

| | | | | | | | | |

| Investment Banking & Brokerage – 0.7% | | | | | | | | |

| StoneX Group, Inc. | | | | | | | | |

| 8.63%, 06/15/2025 (a) | | | 1,253,000 | | | | 1,264,647 | |

| | | | | | | | | |

| Mortgage REITs – 1.7% | | | | | | | | |

| Starwood Property Trust, Inc. | | | | | | | | |

| 5.50%, 11/01/2023 (a) | | | 1,392,000 | | | | 1,390,545 | |

| 3.75%, 12/31/2024 (a) | | | 1,625,000 | | | | 1,548,791 | |

| | | | | | | | 2,939,336 | |

| Real Estate Investment Trust – 2.5% | | | | | | | | |

| Iron Mountain, Inc. | | | | | | | | |

| 4.88%, 09/15/2027 (a) | | | 1,663,000 | | | | 1,535,781 | |

| MPT Operating Partnership LP | | | | | | | | |

| 5.25%, 08/01/2026 | | | 1,194,000 | | | | 1,018,684 | |

| RHP Hotel Properties LP | | | | | | | | |

| 7.25%, 07/15/2028 (a) | | | 1,000,000 | | | | 983,433 | |

| SBA Communications Corp. | | | | | | | | |

| 3.88%, 02/15/2027 | | | 696,000 | | | | 638,361 | |

| | | | | | | | 4,176,259 | |

| Real Estate Management & Services – 0.3% | | | | | | | | |

| Newmark Group, Inc. | | | | | | | | |

| 6.13%, 11/15/2023 | | | 550,000 | | | | 549,508 | |

| | | | | | | | | |

| Specialty Insurance – 1.8% | | | | | | | | |

| Enact Holdings, Inc. | | | | | | | | |

| 6.50%, 08/15/2025 (a) | | | 2,070,000 | | | | 2,040,905 | |

| Radian Group, Inc. | | | | | | | | |

| 4.50%, 10/01/2024 | | | 1,000,000 | | | | 972,450 | |

| | | | | | | | 3,013,355 | |

| TOTAL FINANCIALS | | | | | | | 18,057,048 | |

| | | | | | | | | |

| HEALTH CARE – 5.4% | | | | | | | | |

| | | | | | | | | |

| Healthcare Equipment & Supplies – 0.3% | | | | | | | | |

| Teleflex, Inc. | | | | | | | | |

| 4.63%, 11/15/2027 | | | 550,000 | | | | 505,236 | |

| | | | | | | | | |

| Healthcare Providers & Services – 4.0% | | | | | | | | |

| Acadia Healthcare Co., Inc. | | | | | | | | |

| 5.50%, 07/01/2028 (a) | | | 1,660,000 | | | | 1,545,642 | |

| AdaptHealth LLC | | | | | | | | |

| 6.13%, 08/01/2028 (a) | | | 1,897,000 | | | | 1,639,709 | |

| Encompass Health Corp. | | | | | | | | |

| 5.75%, 09/15/2025 | | | 1,409,000 | | | | 1,387,332 | |

| Select Medical Corp. | | | | | | | | |

| 6.25%, 08/15/2026 (a) | | | 1,594,000 | | | | 1,558,718 | |

| Tenet Healthcare Corp. | | | | | | | | |

| 4.88%, 01/01/2026 | | | 839,000 | | | | 804,613 | |

| | | | | | | | 6,936,014 | |

| Life Sciences Tools & Services – 1.1% | | | | | | | | |

| Avantor Funding, Inc. | | | | | | | | |

| 4.63%, 07/15/2028 (a) | | | 500,000 | | | | 456,382 | |

| IQVIA, Inc. | | | | | | | | |

| 5.00%, 10/15/2026 (a) | | | 1,395,000 | | | | 1,335,135 | |

| | | | | | | | 1,791,517 | |

| TOTAL HEALTH CARE | | | | | | | 9,232,767 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 (Continued) |

| | | Par Value | | | Value | |

| CORPORATE BONDS – 92.2% (Continued) | | | | | | |

| | | | | | | |

| INDUSTRIALS – 15.7% | | | | | | |

| | | | | | | |

| Aerospace & Defense – 2.3% | | | | | | |

| Rolls-Royce PLC | | | | | | |

| 3.63%, 10/14/2025 (a) | | $ | 1,477,000 | | | $ | 1,388,380 | |

| TransDigm, Inc. | | | | | | | | |

| 6.25%, 03/15/2026 (a) | | | 1,038,000 | | | | 1,020,827 | |

| 7.50%, 03/15/2027 | | | 1,500,000 | | | | 1,504,377 | |

| | | | | | | | 3,913,584 | |

| Commercial Services & Supplies – 1.6% | | | | | | | | |

| Ritchie Bros Holdings, Inc. | | | | | | | | |

| 6.75%, 03/15/2028 (a) | | | 1,057,000 | | | | 1,055,890 | |

| Stericycle, Inc. | | | | | | | | |

| 5.38%, 07/15/2024 (a) | | | 1,753,000 | | | | 1,732,339 | |

| | | | | | | | 2,788,229 | |

| Engineering & Construction – 2.0% | | | | | | | | |

| Pike Corp. | | | | | | | | |

| 5.50%, 09/01/2028 (a) | | | 2,000,000 | | | | 1,751,742 | |

| William Scotsman International, Inc. | | | | | | | | |

| 6.13%, 06/15/2025 (a) | | | 1,600,000 | | | | 1,585,704 | |

| | | | | | | | 3,337,446 | |

| Environmental Services – 1.3% | | | | | | | | |

| Clean Harbors, Inc. | | | | | | | | |

| 4.88%, 07/15/2027 (a) | | | 900,000 | | | | 849,098 | |

| GFL Environmental, Inc. | | | | | | | | |

| 4.25%, 06/01/2025 (a) | | | 750,000 | | | | 721,519 | |

| 5.13%, 12/15/2026 (a) | | | 750,000 | | | | 715,199 | |

| | | | | | | | 2,285,816 | |

| Machinery – 2.8% | | | | | | | | |

| EnPro Industries, Inc. | | | | | | | | |

| 5.75%, 10/15/2026 | | | 2,085,000 | | | | 2,001,193 | |

| Gates Global LLC | | | | | | | | |

| 6.25%, 01/15/2026 (a) | | | 2,190,000 | | | | 2,136,614 | |

| Hillenbrand, Inc. | | | | | | | | |

| 5.75%, 06/15/2025 | | | 697,000 | | | | 687,545 | |

| | | | | | | | 4,825,352 | |

| Metals & Mining – 0.8% | | | | | | | | |

| GrafTech Global Enterprises, Inc. | | | | | | | | |

| 9.88%, 12/15/2028 (a) | | | 1,500,000 | | | | 1,423,125 | |

| | | | | | | | | |

| Trading Companies & Distributors – 3.0% | | | | | | | | |

| Herc Holdings, Inc. | | | | | | | | |

| 5.50%, 07/15/2027 (a) | | | 1,639,000 | | | | 1,551,468 | |

| Triton Container International Ltd. | | | | | | | | |

| 1.15%, 06/07/2024 (a) | | | 2,451,000 | | | | 2,359,152 | |

| WESCO Distribution, Inc. | | | | | | | | |

| 7.13%, 06/15/2025 (a) | | | 594,000 | | | | 596,032 | |

| 7.25%, 06/15/2028 (a) | | | 650,000 | | | | 653,797 | |

| | | | | | | | 5,160,449 | |

| Transportation – 1.9% | | | | | | | | |

| XPO Escrow Sub LLC | | | | | | | | |

| 7.50%, 11/15/2027 (a) | | | 350,000 | | | | 354,454 | |

| XPO, Inc. | | | | | | | | |

| 6.25%, 05/01/2025 (a) | | | 1,842,000 | | | | 1,811,284 | |

| 6.25%, 06/01/2028 (a) | | | 1,000,000 | | | | 969,425 | |

| | | | | | | | 3,135,163 | |

| TOTAL INDUSTRIALS | | | | | | | 26,869,164 | |

| | | | | | | | | |

| MATERIALS – 11.3% | | | | | | | | |

| | | | | | | | | |

| Building Products – 0.7% | | | | | | | | |

| Advanced Drainage Systems, Inc. | | | | | | | | |

| 5.00%, 09/30/2027 (a) | | | 1,330,000 | | | | 1,243,888 | |

| | | | | | | | | |

| Chemicals – 3.6% | | | | | | | | |

| Avient Corp. | | | | | | | | |

| 5.75%, 05/15/2025 (a) | | | 2,065,000 | | | | 2,029,458 | |

| Axalta Coating Systems LLC | | | | | | | | |

| 4.75%, 06/15/2027 (a) | | | 1,300,000 | | | | 1,209,302 | |

| Celanese US Holdings LLC | | | | | | | | |

| 5.90%, 07/05/2024 | | | 1,000,000 | | | | 998,112 | |

| HB Fuller Co. | | | | | | | | |

| 4.25%, 10/15/2028 | | | 1,347,000 | | | | 1,190,007 | |

| Minerals Technologies, Inc. | | | | | | | | |

| 5.00%, 07/01/2028 (a) | | | 699,000 | | | | 641,923 | |

| | | | | | | | 6,068,802 | |

| Construction Materials – 0.9% | | | | | | | | |

| Summit Materials LLC | | | | | | | | |

| 6.50%, 03/15/2027 (a) | | | 1,570,000 | | | | 1,534,598 | |

| | | | | | | | | |

| Metals & Mining – 2.7% | | | | | | | | |

| Allegheny Ludlum LLC | | | | | | | | |

| 6.95%, 12/15/2025 | | | 750,000 | | | | 752,831 | |

| Cleveland-Cliffs, Inc. | | | | | | | | |

| 6.75%, 03/15/2026 (a) | | | 1,086,000 | | | | 1,084,030 | |

| 5.88%, 06/01/2027 | | | 500,000 | | | | 476,565 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 (Continued) |

| | | Par Value | | | Value | |

| CORPORATE BONDS – 92.2% (Continued) | | | | | | |

| | | | | | | |

| MATERIALS – 11.3% (Continued) | | | | | | |

| | | | | | | |

| Metals & Mining – 2.7% (Continued) | | | | | | |

| First Quantum Minerals Ltd. | | | | | | |

| 7.50%, 04/01/2025 (a) | | $ | 2,185,000 | | | $ | 2,183,602 | |

| | | | | | | | 4,497,028 | |

| Packaging & Containers – 3.4% | | | | | | | | |

| Berry Global, Inc. | | | | | | | | |

| 4.50%, 02/15/2026 (a) | | | 785,000 | | | | 744,720 | |

| 4.88%, 07/15/2026 (a) | | | 677,000 | | | | 648,732 | |

| Crown Americas LLC | | | | | | | | |

| 4.75%, 02/01/2026 | | | 350,000 | | | | 336,522 | |

| Crown Cork & Seal Co., Inc. | | | | | | | | |

| 7.38%, 12/15/2026 | | | 500,000 | | | | 508,048 | |

| Graphic Packaging International LLC | | | | | | | | |

| 4.13%, 08/15/2024 | | | 450,000 | | | | 440,610 | |

| Mauser Packaging Solutions Holding Co. | | | | | | | | |

| 7.88%, 08/15/2026 (a) | | | 1,780,000 | | | | 1,719,267 | |

| Pactiv Evergreen Group Issuer, Inc. | | | | | | | | |

| 4.00%, 10/15/2027 (a) | | | 250,000 | | | | 222,150 | |

| Pactiv LLC | | | | | | | | |

| 7.95%, 12/15/2025 | | | 1,176,000 | | | | 1,172,330 | |

| | | | | | | | 5,792,379 | |

| TOTAL MATERIALS | | | | | | | 19,136,695 | |

| | | | | | | | | |

| TECHNOLOGY – 5.8% | | | | | | | | |

| | | | | | | | | |

| Professional Services – 1.1% | | | | | | | | |

| Camelot Finance SA | | | | | | | | |

| 4.50%, 11/01/2026 (a) | | | 2,000,000 | | | | 1,848,618 | |

| | | | | | | | | |

| Software & Services – 3.7% | | | | | | | | |

| ACI Worldwide, Inc. | | | | | | | | |

| 5.75%, 08/15/2026 (a) | | | 1,056,000 | | | | 1,024,869 | |

| Consensus Cloud Solutions, Inc. | | | | | | | | |

| 6.00%, 10/15/2026 (a) | | | 1,499,000 | | | | 1,381,619 | |

| Gen Digital, Inc. | | | | | | | | |

| 5.00%, 04/15/2025 (a) | | | 989,000 | | | | 967,111 | |

| 6.75%, 09/30/2027 (a) | | | 1,260,000 | | | | 1,236,400 | |

| Open Text Corp. | | | | | | | | |

| 3.88%, 02/15/2028 (a) | | | 1,400,000 | | | | 1,224,335 | |

| PTC, Inc. | | | | | | | | |

| 3.63%, 02/15/2025 (a) | | | 500,000 | | | | 481,030 | |

| | | | | | | | 6,315,364 | |

| Technology Hardware & Equipment – 1.0% | | | | | | | | |

| Arrow Electronics, Inc. | | | | | | | | |

| 6.13%, 03/01/2026 | | | 1,287,000 | | | | 1,282,266 | |

| CDW Finance Corp. | | | | | | | | |

| 4.13%, 05/01/2025 | | | 253,000 | | | | 244,730 | |

| CDW LLC | | | | | | | | |

| 4.25%, 04/01/2028 | | | 125,000 | | | | 114,083 | |

| | | | | | | | 1,641,079 | |

| TOTAL TECHNOLOGY | | | | | | | 9,805,061 | |

| | | | | | | | | |

| UTILITIES – 2.3% | | | | | | | | |

| | | | | | | | | |

| Utilities – 2.3% | | | | | | | | |

| NextEra Energy Operating Partners LP | | | | | | | | |

| 4.25%, 07/15/2024 (a) | | | 731,000 | | | | 716,145 | |

| NRG Energy, Inc. | | | | | | | | |

| 6.63%, 01/15/2027 | | | 1,797,000 | | | | 1,762,061 | |

| Vistra Operations Co. LLC | | | | | | | | |

| 5.50%, 09/01/2026 (a) | | | 752,000 | | | | 717,856 | |

| 5.63%, 02/15/2027 (a) | | | 750,000 | | | | 711,939 | |

| | | | | | | | 3,908,001 | |

| TOTAL UTILITIES | | | | | | | 3,908,001 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $159,050,977) | | | | | | | 156,544,586 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

SCHEDULE OF INVESTMENTS at September 30, 2023 (Continued) |

| | | Principal | | | | |

| | | Amount | | | Value | |

| CONVERTIBLE BONDS – 0.8% | | | | | | |

| | | | | | | |

| Household & Personal Products – 0.3% | | | | | | |

| Herbalife Ltd. | | | | | | |

| 2.63%, 03/15/2024 | | $ | 500,000 | | | $ | 489,250 | |

| | | | | | | | | |

| Healthcare Equipment & Supplies – 0.3% | | | | | | | | |

| Haemonetics Corp. | | | | | | | | |

| 0.00%, 03/01/2026 (b) | | | 510,000 | | | | 444,975 | |

| | | | | | | | | |

| Utilities – 0.2% | | | | | | | | |

| NextEra Energy Partners LP | | | | | | | | |

| 0.00%, 06/15/2024 (a)(b) | | | 500,000 | | | | 475,500 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $1,407,411) | | | | | | | 1,409,725 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENTS – 5.2% | | | | | | | | |

| | | | | | | | | |

| Money Market Funds – 5.2% | | | | | | | | |

| First American Treasury | | | | | | | | |

| Obligations Fund – Class X, 5.27% (c) | | | 6,620,445 | | | | 6,620,445 | |

| Invesco Treasury Portfolio – Class | | | | | | | | |

| Institutional, 5.26% (c) | | | 2,233,721 | | | | 2,233,721 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $8,854,166) | | | | | | | 8,854,166 | |

| TOTAL INVESTMENTS – 98.2% | | | | | | | | |

| (Cost $169,312,554) | | | | | | | 166,808,477 | |

| Other Assets in Excess of Liabilities – 1.8% | | | | | | | 3,044,618 | |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 169,853,095 | |

Percentages are stated as a percent of net assets.

PLC Public Limited Company

| (a) | Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of September 30, 2023, the value of these securities total $111,844,690 or 65.8% of the Fund’s net assets. |

| (b) | Zero-coupon bond. |

| (c) | The rate shown represents the 7-day effective yield as of September 30, 2023. |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

STATEMENT OF ASSETS AND LIABILITIES at September 30, 2023 |

| | Assets: | | | |

| | Investments, at value (cost of $169,312,554) | | $ | 166,808,477 | |

| | Receivables: | | | | |

| | Fund shares sold | | | 1,129,327 | |

| | Dividends and interest | | | 2,805,334 | |

| | Prepaid expenses | | | 16,625 | |

| | Total assets | | | 170,759,763 | |

| | | | | | |

| | Liabilities: | | | | |

| | Payables: | | | | |

| | Distributions to shareholders | | | 4,348 | |

| | Securities purchased | | | 495,656 | |

| | Fund shares redeemed | | | 260,612 | |

| | Net Advisory fee | | | 64,166 | |

| | Administration and fund accounting fees | | | 25,867 | |

| | Audit Fees | | | 19,984 | |

| | Compliance expense | | | 2,088 | |

| | Reports to shareholders | | | 5,481 | |

| | Registration Fees | | | 6,910 | |

| | Service fees | | | 13,078 | |

| | Transfer Agent Fees | | | 5,666 | |

| | Custody Expenses | | | 989 | |

| | Other Expenses | | | 1,823 | |

| | Total liabilities | | | 906,668 | |

| | | | | | |

| | Net assets | | $ | 169,853,095 | |

| | | | | | |

| | Net assets consist of: | | | | |

| | Paid in capital | | $ | 172,486,209 | |

| | Total accumulated loss | | | (2,633,114 | ) |

| | Net assets | | $ | 169,853,095 | |

| | | | | | |

| | Institutional Shares: | | | | |

| | Net assets applicable to outstanding Institutional Shares | | | 169,853,095 | |

| | Shares issued (Unlimited number of beneficial interest authorized, $0.01 par value) | | | 17,746,172 | |

| | Net asset value, offering price and redemption price per share | | $ | 9.57 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

STATEMENT OF OPERATIONS For the Year Ended September 30, 2023 |

| | Investment income: | | | |

| | Interest | | $ | 7,841,385 | |

| | Total investment income | | | 7,841,385 | |

| | | | | | |

| | Expenses: | | | | |

| | Investment advisory fees (Note 4) | | | 761,857 | |

| | Administration and fund accounting fees (Note 4) | | | 138,200 | |

| | Service fees (Note 5) | | | | |

| | Service fees – Institutional Shares | | | 122,476 | |

| | Federal and state registration fees | | | 41,227 | |

| | Transfer agent fees and expenses | | | 38,674 | |

| | Legal fees | | | 28,755 | |

| | Audit fees | | | 19,984 | |

| | Trustees’ fees and expenses | | | 19,099 | |

| | Compliance expense | | | 12,410 | |

| | Reports to shareholders | | | 11,046 | |

| | Custody fees | | | 7,188 | |

| | Other | | | 10,870 | |

| | Total expenses before reimbursement from advisor | | | 1,211,786 | |

| | Expense reimbursement from advisor (Note 4) | | | (136,988 | ) |

| | Net expenses | | | 1,074,798 | |

| | Net investment income | | $ | 6,766,587 | |

| | | | | | |

| | Realized and unrealized gain (loss): | | | | |

| | Net realized loss on transactions from: | | | | |

| | Investments | | $ | (44,270 | ) |

| | Net change in unrealized appreciation on investments | | | 1,671,952 | |

| | Net realized and unrealized gain | | | 1,627,682 | |

| | Net increase in net assets resulting from operations | | $ | 8,394,269 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | | Fiscal Year Ended | | | Fiscal Period Ended | |

| | | | September 30, 2023 | | September 30, 2022* |

| | Operations: | | | | | | |

| | Net investment income | | $ | 6,766,587 | | | $ | 1,791,043 | |

| | Net realized loss on investments | | | (44,270 | ) | | | (84,146 | ) |

| | Net change in unrealized appreciation (depreciation) on investments | | | 1,671,952 | | | | (4,176,029 | ) |

| | Net increase (decrease) in net assets resulting from operations | | | 8,394,269 | | | | (2,469,132 | ) |

| | | | | | | | | | |

| | Distributions: | | | | | | | | |

| | From distributable earnings | | | (6,767,214 | ) | | | (1,791,037 | ) |

| | Total distributions | | | (6,767,214 | ) | | | (1,791,037 | ) |

| | | | | | | | | | |

| | Capital Share Transactions: | | | | | | | | |

| | Proceeds from shares sold | | | 104,165,500 | | | | 110,954,241 | |

| | Proceeds from shares issued to holders in reinvestment of dividends | | | 6,729,070 | | | | 1,775,153 | |

| | Cost of shares redeemed | | | (35,951,141 | ) | | | (15,186,614 | ) |

| | Net increase in net assets from capital share transactions | | | 74,943,429 | | | | 97,542,780 | |

| | | | | | | | | | |

| | Total increase in net assets | | | 76,570,484 | | | | 93,282,611 | |

| | | | | | | | | | |

| | Net Assets: | | | | | | | | |

| | Beginning of period | | | 93,282,611 | | | | — | |

| | End of period | | $ | 169,853,095 | | | $ | 93,282,611 | |

| | | | | | | | | | |

| | Changes in Shares Outstanding: | | | | | | | | |

| | Shares sold | | | 10,841,127 | | | | 11,332,501 | |

| | Shares issued to holders in reinvestment of dividends | | | 699,701 | | | | 185,191 | |

| | Shares redeemed | | | (3,745,024 | ) | | | (1,567,324 | ) |

| | Net increase in shares outstanding | | | 7,795,804 | | | | 9,950,368 | |

| * | The Greenspring Income Opportunities Fund commenced operations on December 15, 2021. |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period |

Institutional Shares

| | | | Fiscal Year ended | | | December 15, 2021 | |

| | | | September 30, | | | Through | |

| | | | 2023 | | September 30, 2022* |

| | Net Asset Value – Beginning of Period | | $ | 9.37 | | | $ | 10.00 | |

| | | | | | | | | | |

| | Income from Investment Operations: | | | | | | | | |

| | Net investment income1 | | | 0.51 | | | | 0.28 | |

| | Net realized and unrealized gain (loss) on investments | | | 0.20 | | | | (0.66 | ) |

| | Total from investment operations | | | 0.71 | | | | (0.38 | ) |

| | | | | | | | | | |

| | Less Distributions: | | | | | | | | |

| | Dividends from net investment income | | | (0.51 | ) | | | (0.25 | ) |

| | Total distributions | | | (0.51 | ) | | | (0.25 | ) |

| | Net Asset Value – End of Period | | $ | 9.57 | | | $ | 9.37 | |

| | Total Return2 | | | 7.68 | % | | (3.82 | )%^ |

| | | | | | | | | | |

| | Ratios and Supplemental Data: | | | | | | | | |

| | Net assets, end of period (thousands) | | $ | 169,853 | | | $ | 93,283 | |

| | Ratio of operating expenses to average net assets: | | | | | | | | |

| | Before reimbursements | | | 0.95 | % | | | 1.13 | %+ |

| | After reimbursements | | | 0.85 | % | | | 0.85 | %+ |

| | Ratio of net investment income to average net assets: | | | | | | | | |

| | Before reimbursements | | | 5.22 | % | | | 3.66 | %+ |

| | After reimbursements | | | 5.32 | % | | | 3.38 | %+ |

| | Portfolio turnover rate | | | 32 | % | | 34 | %^ |

| * | Commencement of operations for Institutional Shares was December 15, 2021. |

| + | Annualized |

| ^ | Not Annualized |

| 1 | The net investment income per share was calculated using the average shares outstanding method. |

| 2 | Total investment return is calculated assuming a purchase of shares on the first day and a sale of shares on the last day of each period reported and includes reinvestment of dividends and distributions, if any. |

The accompanying notes are an integral part of these financial statements.

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 |

The Greenspring Income Opportunities Fund (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and was organized as a Delaware statutory trust on April 4, 2006. The Fund is an open-end investment management company and is a diversified series of the Trust. The Fund commenced operations on December 15, 2021. Corbyn Investment Management, Inc. (the “Advisor”) serves as the investment advisor to the Fund. The investment objective of the Fund is to provide investors with a high level of current income and the potential for capital appreciation through a total return approach to investing.

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies including FASB Accounting Standard Update ASU 2013-08.

| A. | Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| | |

| B. | Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required. |

| | |

| | The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken or expected to be taken on a tax return. The tax return for the Fund for the current fiscal period is open for examination. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. Management of the Funds are required to determine whether a tax position taken by the Funds is more likely than not to be sustained upon examination by the applicable taxing authority. Based on its analysis, Management has concluded that the Funds do not have any unrecognized tax benefits or uncertain tax positions that would require a provision for income tax. Accordingly, the Funds did not incur any interest or penalties for the period ended September 30, 2023. |

| | |

| C. | Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized using the yield to worst call and yield to best put methods. |

| | |

| | The Fund distributes substantially all of its net investment income, if any, which is declared daily as a dividend and paid monthly. Any net capital gain realized by the Fund will be distributed annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which differ from GAAP. To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment. |

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

| | The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are typically allocated among the funds in the Trust proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s respective net assets, or by other equitable means. |

| | |

| D. | Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates. |

| | |

| E. | Redemption Fees: The Fund does not charge redemption fees to shareholders. |

| | |

| F. | Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. |

| | |

| G. | Events Subsequent to the Fiscal Period End: In preparing the financial statements as of September 30, 2023 and through the date the financial statements were available to be issued, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements and had concluded that no additional disclosures are necessary. |

| NOTE 3 – SECURITIES VALUATION |

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period, and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Debt Securities: Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate market observable data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 2 of the fair value hierarchy.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Short-Term Debt Securities: Short-term debt instruments having a maturity of less than 60 days are valued at the evaluated mean price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. In the absence of prices from a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term debt securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities.

In the absence of prices from a pricing service or in the event that market quotations are not readily available, fair value will be determined under the Fund’s valuation procedures adopted pursuant to Rule 2a-5. Pursuant to those procedures, the Board has appointed the Advisor as the Fund’s valuation designee (the “Valuation Designee”) to perform all fair valuations of the Fund’s portfolio investments, subject to the Board’s oversight. As the Valuation Designee, the Advisor has established procedures for its fair valuation of the Fund’s portfolio investments. These procedures address, among other things, determining when market quotations are not readily available or reliable and the methodologies to be used for determining the fair value of investments, as well as the use and oversight of third-party pricing services for fair valuation.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the fair valuation hierarchy of the Fund’s securities as of September 30, 2023:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 156,544,586 | | | $ | — | | | $ | 156,544,586 | |

| Convertible Bonds | | | — | | | | 1,409,725 | | | | — | | | | 1,409,725 | |

| Short-Term Investments | | | 8,854,166 | | | | — | | | | — | | | | 8,854,166 | |

| Total Investments in Securities | | $ | 8,854,166 | | | $ | 157,954,311 | | | $ | — | | | $ | 166,808,477 | |

| NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES |

For the fiscal year ended September 30, 2023, the Advisor provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee at an annual rate of 0.60% from the Fund based upon the average daily net assets of the Fund. For the fiscal year ended September 30, 2023, the Fund incurred $761,857 in advisory fees. Net advisory fees payable on September 30, 2023, for the Fund were $64,166.

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive its management fees and/or absorb expenses of the Fund to ensure that the total annual operating expenses excluding front-end or contingent deferred loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage, interest, brokerage commissions and other transactional expenses, expenses in connection with a merger or reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses (collectively, “Excludable Expenses”) do not exceed 0.75% of the average daily net assets for the Institutional Shares.

For the fiscal year ended September 30, 2023, the Advisor reduced its fees and absorbed Fund expenses in the amount of $136,988 for the Fund. The waivers and reimbursements will remain in effect through December 15, 2024 unless terminated sooner by, or with the consent of, the Board.

The Advisor may request recoupment of previously waived fees and paid expenses in any subsequent month in the three-year period from the date of the management fee reduction and expense payment if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the management fee reduction and expense payment; or (2) the expense limitation in place at the time of the reimbursement. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is made. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses. Cumulative expenses subject to recapture pursuant to the aforementioned conditions expire as follows:

| | Amount | | Expiration | |

| | $ | 136,611 | | 09/30/2025 | |

| | $ | 136,988 | | 09/30/2026 | |

| | $ | 273,599 | | | |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant, transfer agent, and Chief Compliance Officer to the Fund. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. For the fiscal year ended September 30, 2023, the Fund incurred the following expenses for administration, fund accounting, transfer agency and custody fees:

| | Administration and fund accounting | $138,200 | |

| | Custody | $ 7,188 | |

| | Transfer agency | $ 38,674 | |

| | Compliance | $ 12,410 | |

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

At September 30, 2023, the Fund had payables due to Fund Services for administration, fund accounting and transfer agency fees and to U.S. Bank N.A. for custody fees in the following amounts:

| | Administration and fund accounting | $25,867 | |

| | Custody | $ 989 | |

| | Transfer agency | $ 5,666 | |

| | Compliance | $ 2,088 | |

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares.

Certain officers of the Fund are employees of the Administrator and are not paid any fees by the Fund for serving in such capacities.

| NOTE 5 – SHAREHOLDER SERVICING FEE |

The Fund has adopted a shareholder servicing plan (the “Plan”) on behalf of the Greenspring Income Opportunities Fund’s Institutional Share Class. Under the Plan, the Institutional Share Class is authorized to pay an annual shareholder servicing fee of up to 0.10% of its average daily net assets. This fee is used to finance certain activities related to servicing and maintaining shareholder accounts. Payments made under the Plan may not be used to pay for any services in connection with the distribution and sale of the Institutional Shares.

Payments to the Advisor under the Plan may reimburse the Advisor for payments it makes to selected brokers, dealers and administrators which have entered into service agreements with the Advisor for services provided to Institutional Class shareholders of the Fund. The services provided by such intermediaries are primarily designed to assist Institutional Class shareholders of the Fund and include the furnishing of office space and equipment, telephone facilities, personnel, and assistance to the Fund in servicing such shareholders. Services provided by such intermediaries also include the provision of support services to the Fund and include establishing and maintaining shareholders’ accounts and record processing, purchase and redemption transactions, answering routine client inquiries regarding the Fund, and providing such other personal services to shareholders as the Fund may reasonably request. For the fiscal year ended September 30, 2023, the Fund incurred, under the Agreement, shareholder servicing fees of $122,476. As of September 30, 2023, the Fund had a payable due for shareholder servicing fees in the amount of $13,078.

| NOTE 6 – SECURITIES TRANSACTIONS |

For the fiscal year ended September 30, 2023, the cost of purchases and the proceeds from sales of securities, excluding short-term securities, were as follows:

| | Purchases | | |

| | Other | $107,606,119 | |

| | | | |

| | Sales | | |

| | Other | $ 38,172,365 | |

There were no purchases or sales of long-term U.S. Government securities.

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

| NOTE 7 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS |

As of September 30, 2023, the Fund’s most recent fiscal year end, the components of accumulated earnings/(losses) on a tax basis were as follows:

| | Cost of investments(a) | | $ | 169,317,002 | | |

| | Gross unrealized appreciation | | | 274,937 | | |

| | Gross unrealized depreciation | | | (2,783,462 | ) | |

| | Net unrealized depreciation | | | (2,508,525 | ) | |

| | Undistributed ordinary income | | | 3,727 | | |

| | Undistributed long-term capital gain | | | — | | |

| | Total distributable earnings | | | 3,727 | | |

| | Other accumulated gains/(losses) | | | (128,316 | ) | |

| | Total accumulated earnings/(losses) | | $ | (2,633,114 | ) | |

| (a) | The difference between the book basis and tax basis net unrealized appreciation and cost is attributable primarily to wash sales. |

As of September 30, 2023, the Fund had long-term tax basis capital losses to offset future capital gains in the amount of $123,968.

The tax character of distributions paid during the fiscal period ended September 30, 2023 was as follows:

| | | Year Ended | Period Ended |

| | | September 30, 2023 | September 30, 2022 |

| | Ordinary income | $6,767,214 | $1,791,037 |

The following is a list of certain risks that may apply to your investment in the Fund. Further information about investment risks is available in the Fund’s Statement of Additional Information.

Credit Risk: Credit risk is the risk that an issuer will not make timely payments of principal and interest. A credit rating assigned to a particular debt security is essentially the opinion of a nationally recognized statistical rating organization (“NRSRO”) as to the credit quality of an issuer and may prove to be inaccurate.

Fixed Income Securities Risk: The value of investments in fixed income securities fluctuates with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of fixed income securities owned indirectly by the Fund. On the other hand, if rates fall, the value of the fixed income securities generally increases. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to those initiatives. Below are several specific risks associated with investments in fixed income securities.

Interest Rate Risk: Interest rates may go up resulting in a decrease in the value of the securities held by the Fund. Debt securities subject to prepayment can offer less potential for gains during a declining interest rate environment.

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

Management Risk: Investment strategies employed by the Advisor in selecting investments for the Fund may not result in an increase in the value of your investment or in overall performance equal to other investments.

General Market Risk; Recent Market Events: The market value of a security may move up or down, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. U.S. and international markets have experienced volatility in recent months and years due to a number of economic, political and global macro factors, including rising inflation, the war between Russia and Ukraine and the impact of the coronavirus (COVID-19) global pandemic. While U.S. and global economies are recovering from the effects of COVID-19, labor shortages and the inability to meet consumer demand have restricted growth. Uncertainties regarding the level of central banks’ interest rate increases, political events, the Russia-Ukraine conflict, trade tensions and the possibility of a national or global recession have also contributed to market volatility.

Global economies and financial markets are increasingly interconnected, which increases the possibility that conditions in one country or region might adversely impact issuers in a different country or region. Continuing market volatility as a result of recent market conditions or other events may have adverse effects on the Fund’s returns. The Adviser will monitor developments and seek to manage the Fund in a manner consistent with achieving the Fund’s investment objective, but there can be no assurance that they will be successful in doing so.

Call or Prepayment Risk: During periods of declining interest rates, a bond issuer may “call” or repay its high yielding bonds before their maturity dates. In times of declining interest rates, the Fund’s higher yielding securities may be prepaid, and the Fund may have to replace them with securities having a lower yield.

U.S. Government Agencies and Instrumentalities Securities Risk: Securities issued by U.S. Government agencies and instrumentalities have different levels of U.S. Government credit support. Some are backed by the full faith and credit of the U.S. Government, while others are supported by only the discretionary authority of the U.S. Government or only by the credit of the agency or instrumentality. No assurance can be given that the U.S. Government will provide financial support to U.S. Government-sponsored instrumentalities because they are not obligated to do so by law. Guarantees of timely prepayment of principal and interest do not assure that the market prices and yields of the securities are guaranteed nor do they guarantee the net asset value or performance of the Fund, which will vary with changes in interest rates, the Advisor’s success and other market conditions.

| NOTE 9 – GUARANTEES AND INDEMNIFICATION |

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

| NOTE 10 – CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of September 30, 2023, National Financial Services LLC held 39% of the outstanding Institutional Shares of the Fund and Charles Schwab & Co., Inc. held 55% of the outstanding Institutional Shares of the Fund. The Fund has no knowledge as to whether all or any portion of the shares owned of record by National Financial Services LLC or by Charles Schwab & Co., Inc. are also owned beneficially.

Greenspring Income Opportunities Fund

NOTES TO FINANCIAL STATEMENTS September 30, 2023 (Continued) |

| NOTE 11 – TAILORED SHAREHOLDER REPORTS |

In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Greenspring Income Opportunities Fund

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Manager Directed Portfolios

and the Shareholders of Greenspring Income Opportunities Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Greenspring Income Opportunities Fund (the “Fund”), a series of Manager Directed Portfolios, as of September 30, 2023, the related statements of operations and changes in net assets, the related notes, and the financial highlights for the year then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2023, the results of its operations, the changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.