Vert Global Sustainable Real Estate ETF

Semi-Annual Report

December 31, 2023

Vert Global Sustainable Real Estate ETF

Table of Contents

Sector & Country Allocations | 3 |

Schedule of Investments | 4 |

Statement of Assets and Liabilities | 10 |

Statement of Operations | 11 |

Statements of Changes in Net Assets | 12 |

Financial Highlights | 13 |

Notes to Financial Statements | 14 |

Expense Example | 27 |

Statement Regarding Liquidity Risk Management Program | 29 |

Approval of the Investment Advisory Agreement and Sub-Advisory Agreement | 30 |

Notice to Shareholders | 34 |

Privacy Notice | 35 |

Vert Global Sustainable Real Estate ETF

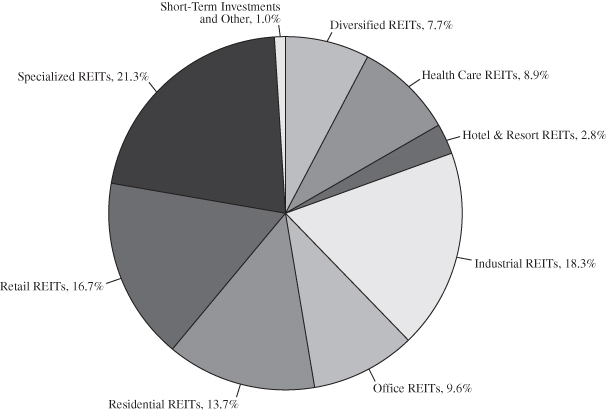

| SECTOR ALLOCATION OF PORTFOLIO ASSETS |

| at December 31, 2023 (Unaudited) |

| COUNTRY ALLOCATION OF PORTFOLIO ASSETS |

| at December 31, 2023 (Unaudited) |

| United States | | | 67.0 | % |

| Australia | | | 8.7 | % |

| Japan | | | 7.7 | % |

| United Kingdom | | | 5.3 | % |

| France | | | 3.2 | % |

| Singapore | | | 3.1 | % |

| Canada | | | 1.0 | % |

| Spain | | | 0.7 | % |

| Belgium | | | 0.7 | % |

| Mexico | | | 0.5 | % |

| South Africa | | | 0.4 | % |

| New Zealand | | | 0.4 | % |

| Netherlands | | | 0.3 | % |

| Guernsey | | | 0.1 | % |

| Italy | | | 0.0 | %1 |

| Short-Term Investments and Other | | | 0.9 | % |

Percentages represent market value as a percentage of net assets.

1 Rounds to zero.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS |

| at December 31, 2023 (Unaudited) |

| | | Number of | | | | |

| REAL ESTATE INVESTMENT TRUSTS – 99.1% | | Shares | | | Value | |

| Diversified REITs – 7.7% | | | | | | |

| Activia Properties, Inc. | | | 284 | | | $ | 781,980 | |

| Alexander & Baldwin, Inc. | | | 30,539 | | | | 580,852 | |

| American Assets Trust, Inc. | | | 20,869 | | | | 469,761 | |

| British Land Co. PLC | | | 365,297 | | | | 1,857,298 | |

| Charter Hall Long Wale REIT | | | 264,874 | | | | 679,329 | |

| Covivio SA | | | 17,880 | | | | 962,724 | |

| Cromwell EU REIT NPV (a) | | | 46,919 | | | | 73,560 | |

| Daiwa House REIT Investment Corp. | | | 888 | | | | 1,583,705 | |

| Dream Impact Trust | | | 2,075 | | | | 9,678 | |

| Empire State Realty Trust, Inc. – Class A | | | 52,847 | | | | 512,087 | |

| GPT Group | | | 754,434 | | | | 2,384,118 | |

| Growthpoint Properties Australia Ltd. | | | 99,262 | | | | 157,677 | |

| Growthpoint Properties Ltd. | | | 1,421,700 | | | | 908,022 | |

| Hulic, Inc. | | | 530 | | | | 560,490 | |

| ICADE | | | 12,591 | | | | 494,492 | |

| Land Securities Group PLC | | | 298,070 | | | | 2,675,309 | |

| Lar Espana Real Estate Socimi SA | | | 19,254 | | | | 130,805 | |

| Merlin Properties Socimi SA | | | 135,935 | | | | 1,510,261 | |

| Mirvac Group | | | 1,616,005 | | | | 2,302,014 | |

| Nomura Real Estate Master Fund, Inc. | | | 1,713 | | | | 2,003,699 | |

| NTT UD REIT Investment Corp. | | | 572 | | | | 505,579 | |

| Picton Property Income Ltd. | | | 141,659 | | | | 124,806 | |

| Redefine Properties Ltd. | | | 2,646,903 | | | | 557,823 | |

| Schroder Real Estate Investment Trust Ltd. | | | 162,778 | | | | 92,341 | |

| Sekisui House REIT, Inc. | | | 1,631 | | | | 891,050 | |

| Stockland | | | 959,028 | | | | 2,912,229 | |

| Suntec Real Estate Investment Trust | | | 860,100 | | | | 801,322 | |

| Tritax EuroBox PLC | | | 285,392 | | | | 217,562 | |

| | | | | | | | 26,740,573 | |

| Health Care REITs – 8.9% | | | | | | | | |

| Aedifica SA | | | 17,779 | | | | 1,250,363 | |

| Cofinimmo SA | | | 12,678 | | | | 999,763 | |

| Healthpeak Properties, Inc. (c) | | | 200,330 | | | | 3,966,534 | |

| Ventas, Inc. | | | 157,731 | | | | 7,861,313 | |

| Welltower, Inc. (c) | | | 186,605 | | | | 16,826,173 | |

| | | | | | | | 30,904,146 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| REAL ESTATE | | Number of | | | | |

| INVESTMENT TRUSTS – 99.1% (Continued) | | Shares | | | Value | |

| Hotel & Resort REITs – 2.8% | | | | | | |

| CapitaLand Ascott Trust | | | 1,008,000 | | | $ | 670,230 | |

| DiamondRock Hospitality Co. (c) | | | 87,299 | | | | 819,738 | |

| Hoshino Resorts REIT, Inc. | | | 100 | | | | 401,067 | |

| Host Hotels & Resorts, Inc. (c) | | | 266,598 | | | | 5,190,662 | |

| Japan Hotel REIT Investment Corp. | | | 1,920 | | | | 941,400 | |

| RLJ Lodging Trust | | | 62,650 | | | | 734,258 | |

| Sunstone Hotel Investors, Inc. | | | 73,375 | | | | 787,314 | |

| | | | | | | | 9,630,412 | |

| Industrial REITs – 18.3% | | | | | | | | |

| Advance Logistics Investment Corp. | | | 283 | | | | 254,307 | |

| Americold Realty Trust, Inc. | | | 108,478 | | | | 3,283,629 | |

| CapitaLand Ascendas REIT | | | 1,514,800 | | | | 3,474,502 | |

| Dream Industrial Real Estate Investment Trust | | | 54,019 | | | | 571,898 | |

| Frasers Logistics & Commercial Trust | | | 1,233,200 | | | | 1,074,116 | |

| GLP J-REIT | | | 1,867 | | | | 1,858,748 | |

| Goodman Group | | | 694,544 | | | | 11,973,689 | |

| Goodman Property Trust | | | 414,776 | | | | 598,765 | |

| Hannon Armstrong Sustainable | | | | | | | | |

| Infrastructure Capital, Inc. (c) | | | 43,594 | | | | 1,202,323 | |

| Industrial & Infrastructure Fund Investment Corp. | | | 837 | | | | 827,763 | |

| Japan Logistics Fund, Inc. | | | 349 | | | | 707,356 | |

| LaSalle Logiport REIT | | | 772 | | | | 831,357 | |

| Mitsubishi Estate Logistics REIT Investment Corp. | | | 191 | | | | 506,954 | |

| Nippon Prologis REIT, Inc. | | | 922 | | | | 1,773,057 | |

| Prologis Property Mexico SAB de CV | | | 268,584 | | | | 1,276,743 | |

| Prologis, Inc. | | | 137,047 | | | | 18,268,365 | |

| Rexford Industrial Realty, Inc. | | | 79,264 | | | | 4,446,710 | |

| Segro PLC | | | 449,167 | | | | 5,065,947 | |

| SOSiLA Logistics REIT, Inc. | | | 282 | | | | 240,037 | |

| STAG Industrial, Inc. (c) | | | 71,695 | | | | 2,814,746 | |

| TF Administradora Industrial S de RL de CV | | | 265,968 | | | | 570,745 | |

| Tritax Big Box REIT PLC | | | 784,508 | | | | 1,683,656 | |

| | | | | | | | 63,305,413 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| REAL ESTATE | | Number of | | | | |

| INVESTMENT TRUSTS – 99.1% (Continued) | | Shares | | | Value | |

| Office REITs – 9.6% | | | | | | |

| Alexandria Real Estate Equities, Inc. (c) | | | 66,188 | | | $ | 8,390,652 | |

| Allied Properties Real Estate Investment Trust | | | 24,600 | | | | 376,481 | |

| Boston Properties, Inc. (c) | | | 58,944 | | | | 4,136,100 | |

| Brandywine Realty Trust | | | 67,039 | | | | 362,011 | |

| Cromwell Property Group | | | 612,358 | | | | 175,227 | |

| Derwent London PLC | | | 38,018 | | | | 1,143,556 | |

| Dexus (a) | | | 433,517 | | | | 2,268,621 | |

| Dream Office Real Estate Investment Trust | | | 8,816 | | | | 70,068 | |

| Franklin Street Properties Corp. | | | 18,517 | | | | 47,404 | |

| Gecina SA | | | 18,540 | | | | 2,258,485 | |

| Global One Real Estate Investment Corp. | | | 406 | | | | 315,235 | |

| Great Portland Estates PLC | | | 84,606 | | | | 452,992 | |

| Hudson Pacific Properties, Inc. | | | 51,944 | | | | 483,599 | |

| Inmobiliaria Colonial Socimi SA | | | 113,169 | | | | 819,465 | |

| Japan Excellent, Inc. | | | 502 | | | | 446,004 | |

| Japan Real Estate Investment Corp. | | | 520 | | | | 2,151,523 | |

| JBG SMITH Properties (c) | | | 36,312 | | | | 617,667 | |

| Kilroy Realty Corp. (c) | | | 43,337 | | | | 1,726,546 | |

| Manulife US Real Estate Investment Trust | | | 752,209 | | | | 60,026 | |

| Nippon Building Fund, Inc. | | | 618 | | | | 2,675,631 | |

| NSI NV | | | 7,701 | | | | 159,590 | |

| Orix JREIT, Inc. | | | 1,151 | | | | 1,358,379 | |

| Precinct Properties New Zealand Ltd. | | | 539,151 | | | | 431,826 | |

| Societe de la Tour Eiffel | | | 402 | | | | 5,595 | |

| Vornado Realty Trust (c) | | | 64,235 | | | | 1,814,639 | |

| Workspace Group PLC | | | 52,043 | | | | 376,143 | |

| | | | | | | | 33,123,465 | |

| Residential REITs – 13.7% | | | | | | | | |

| Advance Residence Investment Corp. | | | 563 | | | | 1,260,905 | |

| Altarea SCA | | | 1,655 | | | | 146,534 | |

| AvalonBay Communities, Inc. | | | 55,508 | | | | 10,392,208 | |

| Comforia Residential REIT, Inc. | | | 307 | | | | 689,661 | |

| Dream Residential Real Estate Investment Trust | | | 2,600 | | | | 17,550 | |

| Equity LifeStyle Properties, Inc. (c) | | | 67,040 | | | | 4,729,002 | |

| Equity Residential | | | 138,553 | | | | 8,473,901 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| REAL ESTATE | | Number of | | | | |

| INVESTMENT TRUSTS – 99.1% (Continued) | | Shares | | | Value | |

| Residential REITs – 13.7% (Continued) | | | | | | |

| Essex Property Trust, Inc. | | | 25,284 | | | $ | 6,268,915 | |

| Home REIT PLC (d) | | | 255,956 | | | | 31,030 | |

| Killam Apartment Real Estate Investment Trust | | | 22,142 | | | | 301,585 | |

| Minto Apartment Real Estate Investment Trust | | | 11,500 | | | | 141,112 | |

| Nippon Accommodations Fund, Inc. | | | 210 | | | | 899,020 | |

| Sun Communities, Inc. | | | 47,733 | | | | 6,379,515 | |

| UDR, Inc. | | | 120,803 | | | | 4,625,547 | |

| UMH Properties, Inc. | | | 23,900 | | | | 366,148 | |

| UNITE Group PLC | | | 158,038 | | | | 2,099,535 | |

| Veris Residential, Inc. | | | 27,498 | | | | 432,544 | |

| | | | | | | | 47,254,712 | |

| Retail REITs – 16.7% | | | | | | | | |

| CapitaLand Integrated Commercial Trust | | | 2,104,512 | | | | 3,282,115 | |

| Carmila SA | | | 24,135 | | | | 415,917 | |

| Charter Hall Retail REIT | | | 212,034 | | | | 522,007 | |

| Choice Properties Real Estate Investment Trust | | | 64,534 | | | | 682,731 | |

| Eurocommercial Properties NV | | | 17,108 | | | | 419,796 | |

| Federal Realty Investment Trust | | | 28,736 | | | | 2,961,245 | |

| First Capital Real Estate Investment Trust | | | 42,825 | | | | 498,207 | |

| Frasers Centrepoint Trust | | | 404,700 | | | | 692,704 | |

| Hammerson PLC (a) | | | 1,635,676 | | | | 591,257 | |

| Immobiliare Grande Distribuzione SIIQ SpA | | | 20,822 | | | | 53,018 | |

| Japan Metropolitan Fund Invest | | | 2,992 | | | | 2,159,936 | |

| Kimco Realty Corp. | | | 240,448 | | | | 5,123,947 | |

| Kiwi Property Group Ltd. | | | 488,531 | | | | 270,650 | |

| Klepierre SA | | | 92,481 | | | | 2,526,405 | |

| Lendlease Global Commercial REIT | | | 774,196 | | | | 378,281 | |

| Macerich Co. | | | 89,682 | | | | 1,383,793 | |

| Mercialys SA | | | 40,403 | | | | 444,344 | |

| Regency Centers Corp. | | | 64,410 | | | | 4,315,470 | |

| RioCan Real Estate Investment Trust | | | 56,613 | | | | 799,434 | |

| Scentre Group | | | 2,068,980 | | | | 4,218,867 | |

| Shaftesbury Capital PLC | | | 561,615 | | | | 988,638 | |

| Simon Property Group, Inc. | | | 132,586 | | | | 18,912,067 | |

| Unibail-Rodamco-Westfield (a) | | | 49,769 | | | | 3,683,439 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| REAL ESTATE | | Number of | | | | |

| INVESTMENT TRUSTS – 99.1% (Continued) | | Shares | | | Value | |

| Retail REITs – 16.7% (Continued) | | | | | | |

| Vastned Belgium NV | | | 37 | | | $ | 1,259 | |

| Vastned Retail NV | | | 4,372 | | | | 97,130 | |

| Vicinity Ltd. | | | 1,533,279 | | | | 2,132,715 | |

| Wereldhave Belgium Comm VA | | | 447 | | | | 23,850 | |

| Wereldhave NV | | | 12,993 | | | | 207,694 | |

| | | | | | | | 57,786,916 | |

| Specialized REITs – 21.3% | | | | | | | | |

| American Tower Corp. | | | 84,690 | | | | 18,282,877 | |

| Big Yellow Group PLC | | | 72,871 | | | | 1,134,548 | |

| Charter Hall Social Infrastructure REIT | | | 145,024 | | | | 295,709 | |

| Digital Realty Trust, Inc. (c) | | | 121,525 | | | | 16,354,835 | |

| Equinix, Inc. | | | 19,246 | | | | 15,500,536 | |

| Extra Space Storage, Inc. | | | 85,522 | | | | 13,711,742 | |

| Iron Mountain, Inc. | | | 118,295 | | | | 8,278,284 | |

| | | | | | | | 73,558,531 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS | | | | | | | | |

| (Cost $319,659,639) | | | | | | | 342,218,425 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENTS – 0.3% | | | | | | | | |

| Money Market Funds – 0.3% | | | | | | | | |

| STIT Government & Agency Portfolio, 5.28% (b) | | | 849,735 | | | | 849,735 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $849,735) | | | | | | | 849,735 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| SCHEDULE OF INVESTMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| INVESTMENTS PURCHASED WITH | | Number of | | | | |

| PROCEEDS FROM SECURITIES LENDING – 13.3% | | Shares | | | Value | |

| Mount Vernon Liquid Assets Portfolio, LLC, 5.55% (b) | | | 45,983,023 | | | $ | 45,983,023 | |

| TOTAL INVESTMENTS PURCHASED WITH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING | | | | | | | | |

| (Cost $45,983,023) | | | | | | | 45,983,023 | |

| TOTAL INVESTMENTS – 112.6% | | | | | | | | |

| (Cost $366,492,397) | | | | | | | 389,051,183 | |

| Liabilities in Excess of Other Assets – (12.6)% | | | | | | | (43,580,923 | ) |

| TOTAL NET ASSETS – 100.0% | | | | | | $ | 345,470,260 | |

Percentages are stated as a percent of net assets.

PLC – Public Limited Company

REIT – Real Estate Investment Trust

SA – Societe Anyonyme

SCA – Societe en commandite par actions

SpA – Societe per azioni

| (a) | Non-income producing security. |

| (b) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

| (c) | All or a portion of this security is on loan as of December 31, 2023. The total market value of these securities was $44,377,537 which represented 12.8% of net assets. |

| (d) | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting through its Valuation Committee. These securities represented $31,030 or 0.01% of net assets as of December 31, 2023. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| STATEMENT OF ASSETS AND LIABILITIES |

| at December 31, 2023 (Unaudited) |

| Assets: | | | |

Investments, at value (cost of $336,492,397) | | $ | 389,051,183 | |

Foreign currencies, at value (cost $77,537) | | | 77,775 | |

Receivables: | | | | |

| Securities sold | | | 620,292 | |

| Dividends and interest | | | 1,848,194 | |

| Return of Capital | | | 9,413 | |

| Securities Lending Receivable | | | 6,838 | |

Prepaid expenses | | | 8,942 | |

| Total assets | | | 391,622,637 | |

| | | | | |

| Liabilities: | | | | |

Payables: | | | | |

| Payable upon return of securities loaned | | | 45,983,023 | |

| Advisory fee | | | 89,672 | |

| Administration and fund accounting fees | | | 42,437 | |

| Reports to shareholders | | | 1,759 | |

| Compliance expense | | | 3,394 | |

| Custody fees | | | 11,103 | |

| Transfer agent fees and expenses | | | 10,908 | |

| Other accrued expenses | | | 10,081 | |

| Total liabilities | | | 46,152,376 | |

| | | | | |

| Net assets | | $ | 345,470,260 | |

| | | | | |

| Net assets consist of: | | | | |

Paid in capital | | $ | 333,486,343 | |

Total accumulated earnings | | | 11,983,917 | |

| Net assets | | $ | 345,470,260 | |

| | | | | |

| Outstanding Shares: | | | | |

| Net assets applicable to outstanding Shares | | $ | 345,470,260 | |

| Shares issued (Unlimited number of beneficial | | | | |

| interest authorized, $0.01 par value) | | | 34,817,962 | |

| Net asset value, offering price and redemption price per share | | $ | 9.92 | |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| STATEMENT OF OPERATIONS |

For the Period Ended December 31, 2023(1) (Unaudited) |

| Investment income: | | | |

Dividends (net of foreign taxes withheld of $422,391) | | $ | 6,052,967 | |

Interest | | | 21,312 | |

Securities Lending | | | 36,011 | |

| Total investment income | | | 6,110,290 | |

| | | | | |

| Expenses: | | | | |

Investment advisory fees (Note 4) | | | 618,973 | |

Administration and fund accounting fees (Note 4) | | | 99,449 | |

Federal and state registration fees | | | 36,456 | |

Custody fees | | | 35,440 | |

Transfer agent fees and expenses | | | 29,167 | |

Legal fees | | | 15,390 | |

Trustees’ fees and expenses | | | 13,250 | |

Audit fees | | | 8,084 | |

Compliance expense | | | 6,452 | |

Reports to shareholders | | | 6,338 | |

Other | | | 9,122 | |

| Total expenses before reimbursement from advisor | | | 878,121 | |

| Expense reimbursement from advisor (Note 4) | | | (117,478 | ) |

| Net expenses | | | 760,643 | |

| Net investment income | | | 5,349,647 | |

| | | | | |

| Realized and unrealized gain (loss) on investments: | | | | |

| Net realized loss on transactions from: | | | | |

| Investments | | | (6,025,735 | ) |

| Foreign currency related transactions | | | (33,244 | ) |

| Net change in unrealized gain on: | | | | |

| Investments | | | 38,225,111 | |

| Foreign currency related translations | | | (339 | ) |

| Net realized and unrealized gain on investments | | | 32,165,793 | |

| Net increase in net assets resulting from operations | | $ | 37,515,440 | |

(1) | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on December 4, 2023. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | Six Months Ended | | | | |

| | | December 31, 2023(1) | | | Year Ended | |

| | | (Unaudited) | | | June 30, 2023 | |

| Operations: | | | | | | |

| Net investment income | | $ | 5,349,647 | | | $ | 6,577,808 | |

| Net realized loss on investments | | | (6,058,979 | ) | | | (6,274,396 | ) |

| Net change in unrealized | | | | | | | | |

| appreciation (depreciation) on investments | | | 38,224,772 | | | | (5,038,449 | ) |

| Net increase (decrease) in net asset | | | | | | | | |

| resulting from operations | | | 37,515,440 | | | | (4,735,037 | ) |

| | | | | | | | | |

| Distributions: | | | | | | | | |

| Distributed earnings | | | (9,120,718 | ) | | | (2,751,991 | ) |

| Total distributions | | | (9,120,718 | ) | | | (2,751,991 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold | | | 54,040,241 | | | | 179,294,885 | |

| Proceeds from shares issued to holders | | | | | | | | |

| in reinvestment of dividends | | | — | | | | 2,714,419 | |

| Cost of shares redeemed | | | (28,813,519 | ) | | | (42,029,899 | ) |

| Net increase in net assets from | | | | | | | | |

| capital share transactions | | | 25,226,722 | | | | 139,979,405 | |

| Total increase in net assets | | | 53,621,444 | | | | 132,492,377 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 291,848,816 | | | | 159,356,439 | |

| End of period | | $ | 345,470,260 | | | $ | 291,848,816 | |

| Changes in Shares Outstanding: | | | | | | | | |

| Shares sold | | | 6,011,661 | | | | 19,806,638 | |

| Proceeds from shares issued to holders | | | | | | | | |

| in reinvestment of dividends | | | — | | | | 292,187 | |

| Shares redeemed | | | (3,222,028 | ) | | | (4,634,699 | ) |

| Net increase in shares outstanding | | | 2,789,633 | | | | 15,464,126 | |

(1) | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on December 4, 2023. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

For a capital share outstanding throughout each period

ETF Shares

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | December 31, | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 20236 | | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | (Unaudited) | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Net Asset Value – | | | | | | | | | | | | | | | | | | |

| Beginning of Period | | $ | 9.11 | | | $ | 9.62 | | | $ | 11.39 | | | $ | 8.59 | | | $ | 10.45 | | | $ | 10.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income1 | | | 0.16 | | | | 0.30 | | | | 0.21 | | | | 0.19 | | | | 0.32 | | | | 0.28 | |

Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

gain (loss) on investments | | | 0.91 | | | | (0.67 | ) | | | (1.55 | ) | | | 2.76 | | | | (1.84 | ) | | | 0.38 | |

| Total from investment operations | | | 1.07 | | | | (0.37 | ) | | | (1.34 | ) | | | 2.95 | | | | (1.52 | ) | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.26 | ) | | | (0.04 | ) | | | (0.26 | ) | | | (0.15 | ) | | | (0.34 | ) | | | (0.33 | ) |

Distributions from net realized gains | | | — | | | | (0.10 | ) | | | (0.17 | ) | | | — | | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.26 | ) | | | (0.14 | ) | | | (0.43 | ) | | | (0.15 | ) | | | (0.34 | ) | | | (0.34 | ) |

Redemption Fees | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | 2 |

| Net Asset Value – End of Period | | $ | 9.92 | | | $ | 9.11 | | | $ | 9.62 | | | $ | 11.39 | | | $ | 8.59 | | | $ | 10.45 | |

| Market Price – End of Period | | $ | 9.96 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Total Return | | 11.79 | %^3,4 | | | (3.84 | )% | | | (12.41 | )% | | | 34.72 | % | | | (15.14 | )% | | 6.64 | %^ |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 345,470 | | | $ | 291,849 | | | $ | 159,356 | | | $ | 125,923 | | | $ | 50,637 | | | $ | 24,184 | |

Ratio of operating expenses | | | | | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before reimbursements | | | 0.57 | %+ | | | 0.62 | % | | | 0.67 | % | | | 0.80 | % | | | 1.12 | % | | | 1.92 | %+ |

| After reimbursements | | | 0.49 | %+ | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | % | | | 0.50 | %+ |

Ratio of net investment income (loss) | | | | | | | | | | | | | | | | | | | | | | | | |

to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Before reimbursements | | | 3.37 | %+ | | | 3.11 | % | | | 1.64 | % | | | 1.66 | % | | | 2.64 | % | | | 1.36 | %+ |

| After reimbursements | | | 3.45 | %+ | | | 3.23 | % | | | 1.80 | % | | | 1.96 | % | | | 3.26 | % | | | 2.78 | %+ |

Portfolio turnover rate | | 5 | %^5 | | | 9 | % | | | 11 | % | | | 19 | % | | | 18 | % | | 10 | %^ |

+ | Annualized |

| ^ | Not Annualized |

1 | The net investment income per share was calculated using the average shares outstanding method. |

2 | Amount is less than $0.01. |

3 | The Performance for the fund is on a NAV basis. |

4 | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and the redemption on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. |

5 | Excludes the impact of in-kind transactions. |

6 | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on December 4, 2023. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS |

| at December 31, 2023 (Unaudited) |

NOTE 1 – ORGANIZATION

The Vert Global Sustainable Real Estate ETF (the “Fund”) is a series of Manager Directed Portfolios (the “Trust”). The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and was organized as a Delaware statutory trust on April 4, 2006. The Fund is an open-end investment management company and is a diversified series of the Trust. The Fund commenced operations on October 31, 2017. Vert Asset Management, LLC (the “Advisor”) serves as the investment advisor to the Fund. Dimensional Fund Advisors LP (the “Sub-Advisor”) serves as the sub-advisor to the Fund. The investment objective of the Fund is to seek long term capital appreciation.

The Fund is the accounting and performance survivor of the Vert Global Sustainable Real Estate Fund (the “Target Fund”) following a reorganization (“Reorganization”), pursuant to an Agreement and Plan of Reorganization, which resulted in the conversion of the Target Fund organized as a mutual fund to an exchange-traded fund (“ETF”) on December 4, 2023. The Fund was established as a “shell” fund organized solely in connection with the Reorganization for the purpose of acquiring the assets and liabilities of the Target Fund and continuing the operations of the Target Fund as an ETF. The Fund had no performance history prior to the Reorganization.

Under a new operating expense limitation agreement for the Fund, the Advisor has agreed to waive its management fees and/or reimburse expenses to ensure that the total amount of the Fund’s operating expenses does not exceed 0.45% of the Fund’s average daily net assets, which is lower than the Target Fund’s total annual fund operating expenses after fee waivers and/or expense reimbursements of 0.50% of the Target Fund’s average daily net assets.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with U.S. generally accepted accounting principles (��GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies” including FASB Accounting Standard Update ASU 2013-08.

| | A. | Security Valuation: All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| | | |

| | B. | Federal Income Taxes: It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income or excise tax provisions are required. |

| | | |

| | | The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax |

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| | | authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions to be taken or expected to be taken on a tax return. The tax returns for the Fund for the prior three fiscal years are open for examination. The Fund identifies its major tax jurisdictions as U.S. Federal and the state of Delaware. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. Management of the Funds are required to determine whether a tax position taken by the Funds is more likely than not to be sustained upon examination by the applicable taxing authority. Based on its analysis, Management has concluded that the Funds do not have any unrecognized tax benefits or uncertain tax positions that would require a provision for income tax. Accordingly, the Funds did not incur any interest or penalties for the period ended December 31, 2023. |

| | | |

| | C. | Securities Transactions, Income and Distributions: Securities transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost. Interest income is recorded on an accrual basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. The fund invests in real estate investment trusts (REITs) which report information on the source of their distributions annually. The fund’s policy is to record all REIT distributions initially as dividend income on the ex-dividend date and then re-designate them as return of capital and/or capital gain distributions at the end of the reporting period based on information provided annually by each REIT, and management estimates such re-designations when actual information has not yet been reported. Income on REITs may be reclassified to realized gains or as an adjustment to cost in order to correctly recognize the true character of the distributions received by the Fund. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. |

| | | |

| | | The Fund distributes substantially all of its net investment income, if any, quarterly, and net realized capital gains, if any, annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. The amount of dividends and distributions to shareholders from net investment income and net realized capital gains is determined in accordance with federal income tax regulations, which may differ from GAAP (Generally Accepted Accounting Principles). To the extent these book/tax differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax treatment. |

| | | |

| | | The Fund is charged for those expenses that are directly attributable to it, such as investment advisory, custody and transfer agent fees. Expenses that are not attributable to a Fund are typically allocated among the funds in the Trust |

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| | | proportionately based on allocation methods approved by the Board of Trustees (the “Board”). Common expenses of the Trust are typically allocated among the funds in the Trust based on a fund’s respective net assets, or by other equitable means. |

| | | |

| | D. | Use of Estimates: The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets during the reporting period. Actual results could differ from those estimates. |

| | | |

| | E. | Reclassification of Capital Accounts: GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. |

| | | |

| | F. | Foreign Currency: Values of investments denominated in foreign currencies are converted into U.S. dollars using the spot market rate of exchange at the time of valuation. Purchases and sales of investments and income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The Fund does not isolate the portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from fluctuations resulting from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain/loss on investments. Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, government regulations, differences in accounting standards, and other factors. |

| | | |

| | G. | Events Subsequent to the Fiscal Period End: In preparing the financial statements as of December 31, 2023, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements and has concluded that no additional disclosures are necessary. |

NOTE 3 – SECURITIES VALUATION

The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the fiscal period, and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the date of measurement. |

| | | |

| | Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets |

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

| | | that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data). |

| | | |

| | Level 3 – | Significant unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities: Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds and real estate investment trusts (REITs), that are primarily traded on a national securities exchange shall be valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and asked prices. Securities primarily traded in the NASDAQ Global Market System for which market quotations are readily available shall be valued using the NASDAQ Official Closing Price (“NOCP”). If the NOCP is not available, such securities shall be valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and asked prices. Over-the-counter securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. Over-the-counter securities which are not traded in the NASDAQ Global Market System shall be valued at the mean between the bid and asked prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its net asset value (“NAV”) because most foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a security needs to be fair valued because it appears that the value of the security might have been materially affected by an event (a “Significant Event”) occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV. A Significant Event may relate to a single issuer or to an entire market sector, or even occurrences not tied directly to the securities markets, such as natural disasters, armed conflicts, or significant government actions.

Registered Investment Companies: Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

Short-Term Debt Securities: Debt securities, including short-term debt instruments having a maturity of less than 60 days, are valued at the evaluated mean price supplied by an approved pricing service. Pricing services may use various valuation methodologies including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. In the absence of prices from a pricing service, the securities will be priced in accordance with the procedures adopted by the Board. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities.

In the absence of prices from a pricing service or in the event that market quotations are not readily available, fair value will be determined under the Fund’s valuation procedures adopted pursuant to Rule 2a-5. Pursuant to those procedures, the Board has appointed the Advisor as the Fund’s valuation designee (the “Valuation Designee”) to perform all fair valuations of the Fund’s portfolio investments, subject to the Board’s oversight. As the Valuation Designee, the Advisor has established procedures for its fair valuation of the Fund’s portfolio investments. These procedures address, among other things, determining when market quotations are not readily available or reliable and the methodologies to be used for determining the fair value of investments, as well as the use and oversight of third-party pricing services for fair valuation.

Depending on the relative significance of the valuation inputs, fair valued securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The fair valuation of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. The Fund uses ICE Data Services (“ICE”) as a third party fair valuation vendor. ICE provides a fair value for foreign securities in the Fund based on certain factors and methodologies applied by ICE in the event that there is a movement in the U.S. markets that exceeds a specific threshold established by the Valuation Committee. The effect of using fair value pricing is that the Fund’s NAV will reflect the affected portfolio securities’ values as determined by the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from the foreign security’s most recent closing price and from the prices used by other investment companies to calculate their NAVs and are generally classified in Level 2 of the fair valuation hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when you will not be able to purchase or redeem your shares.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the fair valuation hierarchy of the Fund’s securities as of December 31, 2023:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| REITs | | | | | | | | | | | | |

Diversified REITs | | $ | 2,921,108 | | | $ | 23,819,465 | | | $ | — | | | $ | 26,740,573 | |

Health Care REITs | | | 28,654,020 | | | | 2,250,126 | | | | — | | | | 30,904,146 | |

Hotel & Resort REITs | | | 7,531,973 | | | | 2,012,696 | | | | — | | | | 9,544,669 | |

Industrial REITs | | | 33,033,925 | | | | 30,271,488 | | | | — | | | | 63,305,413 | |

Office REITs | | | 19,075,171 | | | | 14,048,294 | | | | — | | | | 33,123,465 | |

Residential REITs | | | 42,128,027 | | | | 5,095,655 | | | | 31,030 | | | | 47,254,712 | |

Retail REITs | | | 35,025,670 | | | | 22,761,246 | | | | — | | | | 57,786,916 | |

Specialized REITs | | | 72,128,274 | | | | 1,430,257 | | | | — | | | | 73,558,531 | |

| Total REITs | | | 240,498,168 | | | | 101,689,227 | | | | 31,030 | | | | 342,218,425 | |

Short-Term Investments | | | 849,735 | | | | — | | | | — | | | | 849,735 | |

Investments Purchased | | | | | | | | | | | | | | | | |

with Proceeds from | | | | | | | | | | | | | | | | |

Securities Lending* | | | — | | | | — | | | | — | | | | 45,983,023 | * |

| Total Investments | | | | | | | | | | | | | | | | |

| in Securities | | $ | 241,347,903 | | | $ | 101,689,227 | | | $ | 31,030 | | | $ | 389,051,183 | |

| * | Investment valued using the NAV per share practical expedient. In accordance with Topic 820, the investment is excluded from the fair value hierarchy. The investment is included in the total column for the purpose of reconciling the table to the schedule of investments. |

Level 3 Reconciliation Disclosure

The following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | | Investments | |

| | July 1, 2023 Market Value | | $ | 30,914 | |

| | Purchases | | | — | |

| | Sales proceeds (and/or rights exercised) | | | — | |

| | Accrued discounts/premiums net | | | — | |

| | Change in unrealized appreciation/(depreciation) | | | 116 | |

| | Transfer in and/or (out) of Level 3 | | | — | |

| | Balance as of December 31, 2023 | | $ | 31,030 | |

As of December 31, 2023, the change in unrealized depreciation on positions still held in the fund was $116 for Home REIT PLC.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

Significant Unobservable Inputs

The following table summarizes the significant unobservable inputs used to value the level 3 investments as of December 31, 2023.

The table is not intended to be all-inclusive but instead identifies the significant unobservable inputs relevant to the determination of fair values.

| | | Primary | | |

| Asset | Fair | Valuation | Unobservable | Weighted |

Category | Value | Technique | Inputs | Average(a) |

| REIT | $31,030 | Discount to last | Discount | 75% |

| | | quoted price | | |

(a) Weighted Averages are calculated based on Fair Value of investments.

NOTE 4 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

For the six months ended December 31, 2023, the Advisor provided the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee at an annual rate of 0.40% of the average daily net assets of the Fund. For the six months ended December 31, 2023, the Fund incurred $618,973 in advisory fees. The Advisor has hired Dimensional Fund Advisors LP as a sub-advisor to the Fund. The Advisor pays the Sub-Advisor fee for the Fund from its own assets and these fees are not an additional expense of the Fund.

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive a portion of its fees and reimburse certain expenses for the ETF to ensure that the total annual fund operating expenses excluding front-end or contingent deferred loads, Taxes, leverage, interest, brokerage commissions and other transactional expenses, expenses in connection with a merger or reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses (collectively, “Excludable Expenses”) do not exceed the following amounts of the average daily net assets of the ETF:

| Vert Global Sustainable Real Estate ETF | 0.45% |

For the six months ended December 31, 2023, the Advisor reduced its fees and absorbed Fund expenses in the amount of $117,478 for the Fund. The waivers and reimbursements will remain in effect through at least December 4, 2026, unless terminated sooner by, or with the consent of, the Board.

The Advisor may request recoupment of previously waived fees and paid expenses in any subsequent month in the three-year period from the date of the management fee

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

reduction and expense payment if the aggregate amount actually paid by the Fund toward the operating expenses for such fiscal year (taking into account the reimbursement) will not cause the Fund to exceed the lesser of: (1) the expense limitation in place at the time of the management fee reduction and expense payment; or (2) the expense limitation in place at the time of the reimbursement. Any such reimbursement is also contingent upon Board of Trustees review and approval at the time the reimbursement is made. Such reimbursement may not be paid prior to the Fund’s payment of current ordinary operating expenses. Cumulative expenses subject to recapture pursuant to the aforementioned conditions expire as follows:

6/30/2024 | 6/30/2025 | 6/30/2026 | 6/30/2027 | Total |

| $264,650 | $266,114 | $243,414 | $117,478 | $891,656 |

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, LLC (“Fund Services” or the “Administrator”) acts as the Fund’s Administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountants; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant, transfer agent to the Fund and Chief Compliance Officer to the Fund. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian.

For the six months ended December 31, 2023, the Fund incurred the following expenses for administration, fund accounting, transfer agency, custody, and compliance fees:

| Administration & fund accounting | $99,449 |

| Custody | $35,440 |

| Transfer agency | $29,167 |

| Compliance | $ 6,452 |

At December 31, 2023, the Fund had payables due to Fund Services for administration, fund accounting and transfer agency fees, compliance fees, and to U.S. Bank N.A. for custody fees in the following amounts:

| Administration & fund accounting | $42,437 |

| Custody | $11,103 |

| Transfer agency | $10,908 |

| Compliance | $ 3,394 |

Quasar Distributors, LLC (the “Distributor”) acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares.

Certain officers of the Fund are employees of the Administrator and are not paid any fees by the Fund for serving in such capacities.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

NOTE 5 – SECURITIES TRANSACTIONS

For the six months ended December 31, 2023, the cost of purchases and the proceeds from sales of securities, excluding short-term securities and in-kind transactions, were as follows:

Purchases | Sales |

| $37,640,403 | $15,365,275 |

There were no purchases or sales of long-term U.S. Government securities.

NOTE 6 – INCOME TAXES AND DISTRIBUTIONS TO SHAREHOLDERS

As of June 30, 2023, the Fund’s most recent fiscal year end, the components of accumulated earnings/(losses) on a tax basis were as follows:

| | Cost of investments (a) | | $ | 367,448,676 | |

| | Gross unrealized appreciation | | | 17,997,033 | |

| | Gross unrealized depreciation | | | (34,631,367 | ) |

| | Net unrealized depreciation | | | (16,634,334 | ) |

| | Undistributed ordinary income | | | 6,155,113 | |

| | Undistributed long-term capital gain | | | — | |

| | Total distributable earnings | | | 6,155,113 | |

| | Other accumulated gains/(losses) | | | (5,931,584 | ) |

| | Total accumulated deficit | | $ | (16,410,805 | ) |

| | (a) | The difference between the book basis and tax basis net unrealized appreciation and cost is attributable primarily to wash sales and passive foreign investment companies. |

As of June 30, 2023, the Fund had long term capital losses in the amount of $3,797,883 and short term capital losses in the amount of $2,128,134 to offset future capital gains.

For the fiscal year ended June 30, 2023, the effect of permanent “book/tax” reclassifications resulted in increases and decreases to components of the Fund’s net assets as follows:

| | | Total Accumulated | Paid in |

| | | Deficit | Capital |

| | Vert Global Sustainable Real Estate ETF | $(411,963) | $411,963 |

The tax character of distributions paid during the fiscal year ended June 30, 2023, and the fiscal year ended June 30, 2022, was as follows:

| | | | Year Ended | | | Year Ended | |

| | | | June 30, 2023 | | | June 30, 2022 | |

| | Ordinary income | | $ | 1,656,103 | | | $ | 3,685,700 | |

| | Long-term capital gains | | | 1,095,888 | | | | 2,235,736 | |

| | | | $ | 2,751,991 | | | $ | 5,921,436 | |

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

NOTE 7 – CREATION AND REDEMPTION TRANSACTIONS

The Fund offers and issues Shares at their NAV only in aggregations of a specified number of Shares (each, a “Creation Unit”). The Fund generally offers and issues Shares in exchange for a basket of securities (“Deposit Securities”) together with the deposit of a specified cash payment (“Cash Component”). The Trust reserves the right to permit or require the substitution of a “cash in lieu” amount (“Deposit Cash”) to be added to the Cash Component to replace any Deposit Security. Shares are listed on the Nasdaq Stock Market LLC (the “Exchange”) and trade on the Exchange at market prices that may differ from the Shares’ NAV. Shares are also redeemable only in Creation Unit aggregations, primarily for a basket of Deposit Securities together with a Cash Component. A Creation Unit of the Fund generally consists of 25,000 Shares, though this may change from time to time. As a practical matter, only institutions or large investors purchase or redeem Creation Units. Except when aggregated in Creation Units, Shares are not redeemable securities.

Shares may be issued in advance of receipt of Deposit Securities subject to various conditions, including a requirement to maintain on deposit with the Trust cash at least equal to a specified percentage of the value of the missing Deposit Securities, as set forth in the Participant Agreement (as defined below). The Trust may impose a transaction fee for each creation or redemption. In all cases, such fees will be limited in accordance with the requirements of the SEC applicable to management investment companies offering redeemable securities. As in the case of other publicly traded securities, brokers’ commissions on transactions in the secondary market will be based on negotiated commission rates at customary levels.

NOTE 8 – SECURITIES LENDING

The Fund participates in securities lending arrangements whereby it lends certain of its portfolio securities to brokers, dealers and financial institutions (not with individuals) in order to receive additional income and increase the rate of return of its portfolio. U.S. Bank, N.A. serves as the Fund’s securities lending agent.

U.S. Bank, N.A. oversees the securities lending process, which includes the screening, selection and ongoing review of borrowers, monitoring the availability of securities, negotiating rebates, daily marking to market of loans, monitoring and maintaining cash collateral levels, processing securities movements and reinvesting cash collateral as directed by the Adviser.

The Fund may lend securities pursuant to agreements that require the loans to be secured by collateral consisting of cash, securities of the U.S. Government or it agencies, or any combination of cash and such securities. At the time of loans, the collateral value should at least be equal to 102% of domestic securities and 105% of foreign securities. The value of loaned securities will then be marked-to-market daily and the collateral will be continuously secured by collateral equal to 100% of the market value of the loaned securities. Such loans will not be made if, as a result, the aggregate amount of all outstanding securities loans for the Fund exceeds one-third of the value of the Fund’s

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

total assets taken at fair market value. The Fund will earn interest on the investment of the cash collateral in U.S. Government securities, short-term money market instruments or such other approved vehicle. However, the Fund will normally pay lending fees to such broker-dealers and related expenses from the interest earned on invested collateral. There may be risks of delay in receiving additional collateral or risks of delay in recovery of the securities and even loss of rights in the collateral should the borrower of the securities fail financially. However, loans are made only to borrowers deemed by the adviser to be of good standing and when, in the judgment of the adviser, the consideration that can be earned currently from such securities loans justifies the attendant risk. Either party, upon reasonable notice to the other party, may terminate the loan.

As of December 31, 2023, the Fund had loaned securities that were collateralized by cash. The cash collateral received was invested in securities as listed in the Fund’s Schedule of Investments.

The following table presents the securities out on loan for the Fund, and the collateral delivered related to those securities, as of the end of the reporting period.

Securities Lending Transactions

| | Investment | | | |

| | Asset Class | Collateral | | |

| | of Securities | Proceeds from | Pledged | Net |

Overnight and Continuous | Purchased | Securities Lending | Counterparty^ | Exposure |

| Vert Global Sustainable | Money market | | | |

| Real Estate ETF | fund | $45,983,023 | $45,983,023 | $ — |

| ^ | As of the end of the reporting period, the value of the collateral pledged from the counterparty exceeded the value of the securities out on loan. Refer to the Fund’s Schedule of Investments for details on the securities out on loan. |

NOTE 9 – PRINCIPAL RISKS

Below are summaries of some, but not all, of the principal risks of investing in the Fund, each of which could adversely affect the Fund’s NAV, market price, yield, and total return. Further information about investment risks is available in the Fund’s prospectus and Statement of Additional Information.

General Market Risk; Recent Market Events: The value of the Fund’s shares will fluctuate based on the performance of the Fund’s investments and other factors affecting the securities markets generally. Certain investments selected for the Fund’s portfolio may be worth less than the price originally paid for them, or less than they were worth at an earlier time. The value of the Fund’s investments may go up or down, sometimes dramatically and unpredictably, based on current market conditions, such as real or perceived adverse political or economic conditions, inflation, changes in interest rates, lack of liquidity in the fixed income markets or adverse investor sentiment.

U.S. and international markets have experienced volatility in recent months and years due to a number of economic, political and global macro factors, including the impact of

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

the coronavirus (COVID-19) global pandemic, which has resulted in a public health crisis, business interruptions, growth concerns in the U.S. and overseas, layoffs, rising unemployment claims, changed travel and social behaviors and reduced consumer spending. The effects of COVID-19 may lead to a substantial economic downturn or recession in the U.S. and global economies, the recovery from which is uncertain and may last for an extended period of time.

Equity Market Risk: Equity securities are susceptible to general stock market fluctuations due to economic, market, political and issuer-specific considerations and to potential volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Foreign Securities and Currency Risk: Foreign securities are subject to risks relating to political, social and economic developments abroad and differences between U.S. and foreign regulatory requirements and market practices. Those risks are increased for investments in emerging markets. Securities that are denominated in foreign currencies are subject to further risk that the value of the foreign currency will fall in relation to the U.S. dollar and/or will be affected by volatile currency markets or actions of U.S. and foreign governments or central banks. Income earned on foreign securities may be subject to foreign withholding taxes.

Management Risk: The ability of the Fund to meet its investment objective is directly related to the Advisor’s and Sub-Advisor’s management of the Fund. The value of your investment in the Fund may vary with the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. If the investment strategies do not produce the expected results, the value of your investment could be diminished or even lost entirely.

Real Estate Investment Risk: The risks related to investments in real estate securities include, but are not limited to, adverse changes in general economic and local market conditions; adverse developments in employment; changes in supply or demand for similar or competing properties; unfavorable changes in applicable taxes, governmental regulations, or interest rates; operating or developmental expenses and lack of available financing.

REIT Risk: A REIT’s share price may decline because of adverse developments affecting the real estate industry, including changes in interest rates. The returns from REITs may trail returns from the overall market. The Fund’s investments in REITs may be subject to special tax rules, or a particular REIT may fail to qualify for the favorable federal income tax treatment applicable to REITs, the effect of which may have adverse tax consequences for the Fund and shareholders.

Real Estate-Related Securities Concentration Risk: The Fund could lose money due to the performance of real estate-related securities even if securities markets generally are experiencing positive results.

Vert Global Sustainable Real Estate ETF

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| at December 31, 2023 (Unaudited) |

NOTE 10 – GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

NOTE 11 – CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of December 31, 2023 Pershing LLC, held nearly 100% of the outstanding Shares of the ETF and the Fund has no knowledge as to whether all of any of the shares owned of record by Pershing LLC are also beneficially owned.

NOTE 12 – TAILORED SHAREHOLDER REPORTING

In October 2022, the Securities and Exchange Commission (the “SEC”) adopted a final rule relating to Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds; Fee Information in Investment Company Advertisements. The rule and form amendments will, among other things, require the Fund to transmit concise and visually engaging shareholder reports that highlight key information. The amendments will require that funds tag information in a structured data format and that certain more in-depth information be made available online and available for delivery free of charge to investors on request. The amendments became effective January 24, 2023. There is an 18-month transition period after the effective date of the amendment.

Vert Global Sustainable Real Estate ETF

| EXPENSE EXAMPLE |

| December 31, 2023 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs including sales charges (loads) and redemption fees, if applicable; and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other ETFs.

The Example is based on an investment of $1,000 invested at the beginning of the period indicated and held for the entire period from July 1, 2023 to December 31, 2023 for the Institutional Shares.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. There are some account fees that are charged to certain types of accounts, such as Individual Retirement Accounts (generally, a $15 fee is charged to the account annually) that would increase the amount of expenses paid on your account. The example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As noted above, there are some account fees that are charged to certain types of accounts that would increase the amount of expense paid on your account.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the information under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Vert Global Sustainable Real Estate ETF

| EXPENSE EXAMPLE (Continued) |

| December 31, 2023 (Unaudited) |

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period(1) |

| | 7/1/2023 | 12/31/2023 | 7/1/2023-12/31/2023 |

| Actual | $1,000.00 | $1,117.90 | $2.61 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,022.67 | $2.49 |

(1) | Expenses are equal to the ETF’s annualized expense ratio of 0.49% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the period). |

Vert Global Sustainable Real Estate ETF

| STATEMENT REGARDING LIQUIDITY RISK MANAGEMENT PROGRAM |

| (Unaudited) |

In accordance with Rule 22e-4 under the Investment Company Act of 1940, as amended, the Fund, a series of Manager Directed Portfolios (the “Trust”), has adopted and implemented a liquidity risk management program tailored specifically to the Fund (the “Program”). The Program seeks to promote effective liquidity risk management for the Fund and to protect Fund shareholders from dilution of their interests. The Board has designated the Fund’s investment adviser to serve as the administrator of the Program (the “Program Administrator”). Personnel of the Fund’s investment adviser conduct the day-to-day operation of the Program pursuant to policies and procedures administered by the Program Administrator. The Program Administrator is required to provide a written annual report to the Board and the chief compliance officer of the Trust regarding the adequacy and effectiveness of the Program, including the operation of the Fund’s highly liquid investment minimum, and any material changes to the Program.

Under the Program, the Program Administrator manages the Fund’s liquidity risk, which is the risk that the Fund could not meet shareholder redemption requests without significant dilution of remaining shareholders’ interests in the Fund. The Program assesses liquidity risk under both normal and reasonably foreseeable stressed market conditions. This risk is managed by monitoring the degree of liquidity of the Fund’s investments, limiting the amount of the Fund’s illiquid investments, and utilizing various risk management tools and facilities available to the Fund for meeting shareholder redemptions, among other means. The Program Administrator’s process of determining the degree of liquidity of the Fund’s investments is supported by one or more third-party liquidity assessment vendors.

On May 9, 2023, the Board reviewed the Program Administrator’s assessment of the operation and effectiveness of the Program for the period January 1, 2022 through December 31, 2022 (the “Report”). The Report noted that there were no breaches of the Fund’s restriction on holding illiquid investments exceeding 15% of its net assets during the review period. The Report confirmed that the Fund’s investment strategy was appropriate for an open-end management investment company.

The Program Administrator determined that the Fund is reasonably likely to be able to meet redemption requests without adversely affecting non-redeeming Fund shareholders through significant dilution. The Program Administrator concluded that the during the review period, the Program was adequately designed and effectively operating to monitor the liquidity risk to the Fund, taking into account the size of the Fund, the type of business conducted, and other relevant factors.

Vert Global Sustainable Real Estate ETF

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Unaudited) |

The Board of Trustees (the “Board”) of Manager Directed Portfolios (the “Trust”) met on August 17, 2023 to consider the approval of (i) the Investment Advisory Agreement (the “Advisory Agreement”) between the Trust, on behalf of the Vert Global Sustainable Real Estate ETF (the “Fund”), a series of the Trust, and the Fund’s investment adviser, Vert Asset Management, LLC (“Vert”), and (ii) the Investment Sub-Advisory Agreement (the “Sub-Advisory Agreement”) between Vert and Dimensional Fund Advisors LP (“DFA”). Prior to the meeting, the Trustees requested and received materials to assist them in considering the approval of the Advisory Agreement and the Sub-Advisory Agreement. The materials provided contained information with respect to the factors enumerated below, including copies of the Advisory Agreement and the Sub-Advisory Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing the Board’s fiduciary obligations and factors relevant to the renewal of the Advisory Agreement and the Sub-Advisory Agreement, comparative performance information, Vert’s and DFA’s Form ADV, due diligence materials provided by Vert and DFA, including information regarding each firm’s compliance program, personnel and financial condition, profitability information, and other pertinent information. The Board also reviewed (i) the advisory fee to be paid by the Fund under the Advisory Agreement; (ii) the sub-advisory fee to be paid by Vert to DFA; (iii) the proposed expense limitation agreement between Vert and the Trust, on behalf of the Fund; and (iv) comparative fee and expense information as reported by a third party analytics firm.

The Trustees met with the officers of the Trust and legal counsel to discuss the information provided and also met in executive session with legal counsel to the Independent Trustees to review their duties in considering the Advisory Agreement and Sub-Advisory Agreement and the information provided. The Trustees also met in person with Sam Adams, managing member of Vert and portfolio manager of the Fund, to discuss Vert’s proposal to convert the Vert Global Sustainable Real Estate Fund, a series of the Trust and the predecessor mutual fund managed by Vert (the “Predecessor Fund”), into the Fund so that the Fund can be operated as an exchange-traded fund. Mr. Adams also discussed investment strategy for the Fund, the Predecessor Fund’s performance, the services to be provided by Vert and DFA to the Fund, and various business, industry and marketing updates. The Board also took into account information routinely provided at quarterly meetings throughout the year regarding the quality of services provided by Vert and DFA, the performance of the Fund, brokerage and trading, Fund expenses, asset flows, compliance issues and related matters.

Based on their evaluation of the information provided at the meeting, as well as information provided over the course of the year, the Trustees, all of whom are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), approved the Advisory Agreement and the Sub-Advisory Agreement, each for an initial two-year term. Below is a summary of the material factors considered by the Board and the conclusions that formed the basis for the Board’s approval of the Advisory Agreement and Sub-Advisory Agreement.

Vert Global Sustainable Real Estate ETF

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Unaudited) (Continued) |

1. Nature, Extent and Quality of Services to be Provided to the Fund

The Trustees considered the nature, extent and quality of services to be provided by Vert, including research, security selection and screening for ESG considerations, as well as compliance monitoring, portfolio company engagement, marketing, shareholder servicing and oversight of DFA as the Fund’s sub-advisor. The Trustees also considered the nature, extent and quality of services to be provided by DFA, including day to day portfolio management, trading and proxy voting. The Trustees considered the qualifications and experience of key personnel at Vert and DFA who would be involved in the day-to-day activities of the Fund, including Mr. Adams of Vert and Mr. Collins-Dean, Mr. Pu and Mr. Fogdall, each of DFA, who would serve as the portfolio managers of the Fund and who currently serve as portfolio managers of the Predecessor Fund. The Trustees also noted the qualifications and experience of Mr. Hohn of DFA who would be added as a portfolio manager of the Fund following the conversion. The Trustees reviewed the information provided by Vert and DFA in response to the due diligence questionnaires, included in the August 17, 2023 meeting materials, as well as information provided by Mr. Adams as part of his presentation to the Board at the meeting. The Trustees considered the additional capital markets functions Vert would provide to the Fund following the conversion. The Trustees also considered information about each firm’s financial condition and the compliance programs maintained by Vert and DFA.

The Trustees concluded that the nature, extent and quality of services to be provided to the Fund by Vert and DFA were appropriate and that Vert and DFA were expected to provide a high level of services to the Fund under the Advisory Agreement and the Sub-Advisory Agreement, respectively.

2. Investment Performance of the Fund.

Because the Fund had not yet commenced operations and did not have its own performance history, the Trustees considered the historical performance of the Predecessor Fund, which is managed by Vert and DFA in identical respects as they will manage the Fund. The Trustees noted that the Fund will not commence operations until after the closing of the reorganization of the Predecessor Fund with and into the Fund, at which time the Fund will adopt the performance history of the Predecessor Fund.

The Trustees discussed the performance of the Fund for the one-year, three-year and five-year periods ended June 30, 2023 on an absolute basis and in comparison to (i) the Fund’s primary benchmark index, (ii) the Morningstar global real estate peer group and (iii) a peer group of funds constructed using Morningstar, Inc. data and presented by Barrington Partners, an independent third-party analytics firm (the “Barrington Cohort”).

The Trustees noted that Fund underperformed its benchmark, the S&P Global REIT Index, for the one-year, three-year and five-year periods ended June 30, 2023. The Trustees noted that the Fund underperformed the BP Cohort for the one-year period, outperformed the cohort for the three-year period and underperformed the cohort for the

Vert Global Sustainable Real Estate ETF

| APPROVAL OF THE INVESTMENT ADVISORY AGREEMENT |

| AND SUB-ADVISORY AGREEMENT (Unaudited) (Continued) |