Exhibit 99.11

Auditors’ Report

To the Shareholders of

Inter-Citic Minerals Inc.

We have audited the consolidated balance sheets of Inter-Citic Minerals Inc. as at November 30, 2006 and 2005 and the consolidated statements of operations and deficit and cash flows for the years then ended. These financial statements are the responsibility of the company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the company as at November 30, 2006 and 2005 and the results of its operations and its cash flows for the years then ended in accordance with Canadian generally accepted accounting principles.

Chartered Accountants

Toronto, Canada

PricewaterhouseCoopers refers to the Canadian firm of PricewaterhouseCoopers LLP and the other member firms of PricewaterhouseCoopers International Limited, each of which is a separate and independent legal entity.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

(All figures in Canadian dollars)

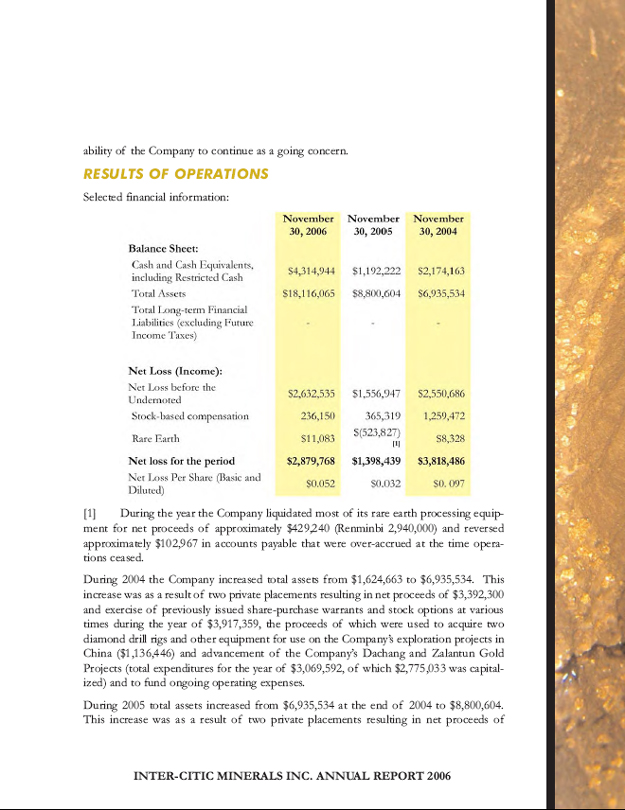

| | | | | | | | |

| | | November 30,

2006 | | | November 30,

2005 | |

ASSETS | | | | | | | | |

| | |

Current | | | | | | | | |

Cash and cash equivalents | | $ | 2,258,967 | | | $ | 417,731 | |

Amounts receivable | | | 184,929 | | | | 87,735 | |

Prepaid expenses | | | 38,969 | | | | 46,800 | |

| | | | | | | | |

| | | 2,482,865 | | | | 552,266 | |

| | |

Restricted cash (Note 3) | | | 2,055,977 | | | | 774,491 | |

Investments (Note 4) | | | 17,755 | | | | 18,665 | |

Investment in associated company (Note 5) | | | 1 | | | | 1 | |

Resource properties (Note 6, 13) | | | 12,302,216 | | | | 6,496,216 | |

Property, plant and equipment (Note 7) | | | 1,257,251 | | | | 958,965 | |

| | | | | | | | |

| | $ | 18,116,065 | | | $ | 8,800,604 | |

| | | | | | | | |

| | |

LIABILITIES | | | | | | | | |

| | |

Current | | | | | | | | |

Accounts payable and accrued liabilities | | $ | 1,026,000 | | | $ | 551,476 | |

| | | | | | | | |

| | | 1,026,000 | | | | 551,476 | |

| | |

Future income taxes (Note 12) | | | 1,904,000 | | | | 1,042,000 | |

| | | | | | | | |

| | | 2,930,000 | | | | 1,593,476 | |

| | |

SHAREHOLDERS’ EQUITY | | | | | | | | |

| | |

Share capital (Note 11 (b)) | | | 40,118,632 | | | | 30,859,013 | |

Share-purchase warrants (Note 11 (c)) | | | 1,928,784 | | | | 1,387,890 | |

Contributed surplus (Note 11 (e)) | | | 3,657,769 | | | | 2,599,577 | |

Deficit | | | (30,519,120 | ) | | | (27,639,352 | ) |

| | | | | | | | |

| | | 15,186,065 | | | | 7,207,128 | |

| | | | | | | | |

| | $ | 18,116,065 | | | $ | 8,800,604 | |

| | | | | | | | |

COMMITMENTS (Note 6, 10)

Approved by the Board of Directors:

| | | | |

| |  | | |

| Mark R. Frederick | | James J. Moore | | |

| Director | | Director | | |

The accompanying Notes to Financial Statements are an integral part of these financial statements.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS AND DEFICIT

(All figures in Canadian dollars)

| | | | | | | | |

| | | For the year ended

November 30,

2006 | | | For the year ended

November 30,

2005 | |

Expenses | | | | | | | | |

Executive compensation | | $ | 638,155 | | | $ | 369,202 | |

Corporate relations | | | 637,366 | | | | 280,743 | |

Travel and accommodation | | | 506,295 | | | | 232,920 | |

Office and rent | | | 427,515 | | | | 234,857 | |

Professional fees | | | 291,196 | | | | 133,344 | |

Stock-based compensation (Note 11 (d)) | | | 236,150 | | | | 365,319 | |

Salaries and benefits | | | 142,762 | | | | 136,115 | |

Depreciation and amortization | | | 96,105 | | | | 173,147 | |

Consulting | | | 81,118 | | | | 53,880 | |

Foreign exchange | | | (28,307 | ) | | | (36,456 | ) |

| | | | | | | | |

| | | 3,028,355 | | | | 1,943,071 | |

| | |

Other expenses (income) | | | | | | | | |

Other loss (income), net (Note 13 (c)) | | | 11,083 | | | | (523,827 | ) |

Unrealized loss on marketable securities (Note 4) | | | 910 | | | | 3,980 | |

Interest | | | (160,580 | ) | | | (24,785 | ) |

| | | | | | | | |

| | | (148,587 | ) | | | (544,632 | ) |

| | | | | | | | |

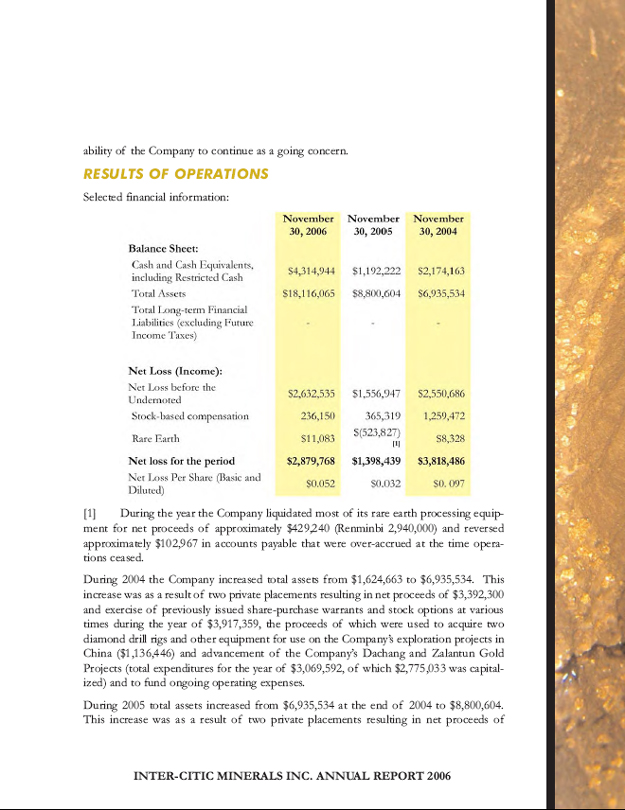

Loss for the year | | | 2,879,768 | | | | 1,398,439 | |

| | |

Deficit, beginning of year | | | 27,639,352 | | | | 26,240,913 | |

| | | | | | | | |

Deficit, end of year | | $ | 30,519,120 | | | $ | 27,639,352 | |

| | | | | | | | |

Net loss per share—basic and diluted | | $ | 0.05 | | | $ | 0.03 | |

| | | | | | | | |

Weighted average common shares outstanding | | | 55,715,002 | | | | 43,461,788 | |

| | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of these financial statements.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(All figures in Canadian dollars)

| | | | | | | | |

| | | For the year ended

November 30,

2006 | | | For the year ended

November 30,

2005 | |

Operating activities | | | | | | | | |

Loss for the year | | $ | (2,879,768 | ) | | $ | (1,398,439 | ) |

Adjustments for: | | | | | | | | |

Depreciation and amortization | | | 96,105 | | | | 173,147 | |

Stock-based compensation (Note 11 (d)) | | | 236,150 | | | | 365,319 | |

Gain on sale of property, plant and equipment (Note 13) | | | — | | | | (429,240 | ) |

Unrealized loss on marketable securities (Note 4) | | | 910 | | | | 3,980 | |

| | | | | | | | |

| | | (2,546,603 | ) | | | (1,285,233 | ) |

Changes in non-cash working capital balances | | | 385,161 | | | | (489,675 | ) |

| | | | | | | | |

| | | (2,161,442 | ) | | | (1,774,908 | ) |

| | | | | | | | |

| | |

Financing activities | | | | | | | | |

Bank advances (Note 8) | | | — | | | | (430,500 | ) |

Issuance of shares and warrants (Note 11) | | | 10,622,555 | | | | 3,003,496 | |

| | | | | | | | |

| | | 10,622,555 | | | | 2,572,996 | |

| | | | | | | | |

| | |

Investing activities | | | | | | | | |

Restricted cash (Note 3) | | | (1,281,486 | ) | | | (516,308 | ) |

Resource properties (Note 6, 13) | | | (4,808,055 | ) | | | (2,347,735 | ) |

Sale of rare earth processing equipment (Note 7, 13) | | | — | | | | 429,240 | |

Property, plant and equipment | | | (530,336 | ) | | | (119,717 | ) |

| | | | | | | | |

| | | (6,619,877 | ) | | | (2,554,520 | ) |

| | | | | | | | |

Increase/(decrease) in cash for the year | | | 1,841,236 | | | | (1,756,432 | ) |

| | |

Cash and cash equivalents, beginning of year | | | 417,731 | | | | 2,174,163 | |

| | | | | | | | |

Cash and cash equivalents, end of year | | $ | 2,258,967 | | | $ | 417,731 | |

| | | | | | | | |

| | |

Supplemental Information: | | | | | | | | |

Income taxes paid during the period | | $ | — | | | $ | — | |

Interest paid during the period (Note 8, 13 (c)) | | $ | — | | | $ | 17,201 | |

The accompanying Notes to Financial Statements are an integral part of these financial statements.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

1. Nature of Operations and Basis of Presentation

Inter-Citic Minerals Inc. (the “Company”), is a development stage company engaged in the acquisition, exploration and development of exploration-stage mineral properties. The Company has entered into joint venture agreements to acquire two exploration properties, the Dachang Gold Project in the Province of Qinghai, and the Zalantun Gold Project in the Inner Mongolia Autonomous Region, in the People’s Republic of China (“China” or the “PRC”). To date the Company has not found any proven reserves or engaged in any production on any of its properties, and there is no guarantee that this will occur in the future.

These financial statements have been prepared using Canadian generally accepted accounting principles (“Canadian GAAP”) applicable to a going concern, which assumes continuity of operations and realization of assets and settlement of liabilities in the normal course of business. However, the Company is in the development stage and is subject to the risks and challenges similar to other companies in a comparable stage of development. These risks include, but are not limited to, dependence on key individuals, successful development and the ability to secure adequate financing to meet the minimum capital required to successfully develop economically recoverable reserves, complete the project and continue as a going concern.

There is no assurance that these initiatives will be successful and as a result there may be substantial doubt regarding the going concern assumption. These financial statements do not reflect the adjustments to the carrying values of assets and liabilities and the reported expenses and balance sheet classifications that would be necessary were the going concern assumption inappropriate. These adjustments could be material.

2. Summary of Significant Accounting Policies

Principles of Consolidation

These consolidated financial statements include the accounts of the Company and its subsidiaries as follows:

(a) Inter-Citic Holdings Ltd. (100% owned), a company incorporated in the Cayman Islands

(b) Techmat Inc. (100% owned), a company incorporated in the Republic of Mauritius

(c) TechMat (USA) Corporation (100% owned), a company incorporated in Nevada, USA

(d) Bay Roberts Resources Ltd. (98% owned), a company incorporated in British Columbia, Canada

(e) Yangzhong Zhonghai Techmat Co., Ltd. (80% owned), a company incorporated in the People’s Republic of China

All material inter-company transactions and balances have been eliminated.

The consolidated financial statements of the Company have been prepared by management in accordance with Canadian generally accepted accounting principles. The preparation of financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets, liabilities, revenues and expenses and the disclosure of contingent liabilities as at the date of the consolidated financial statements. Actual results could differ from those estimates.

Foreign Currency Translation

All of the Company’s balances and transactions are translated into the Company’s measurement currency, the Canadian dollar, as follows. Monetary assets and liabilities are translated at the exchange rates in effect at the balance sheet dates; non-monetary assets and liabilities are translated at rates prevailing at the respective transaction dates. Revenues and expenses are translated at average rates prevailing during the year, except for depreciation and amortization related to assets, which are translated at historical exchange rates. Translation gains and losses are reflected in the consolidated statements of operations and deficit.

Cash and Cash Equivalents

Cash and cash equivalents comprise cash, term deposits and other interest bearing instruments with original maturity dates of less than 90 days.

Investments

Investments are recorded at cost less a write-down for a decline in value that is other than temporary.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, amounts receivable, restricted cash, investments, and accounts payable and accrued liabilities. Unless otherwise noted, it is management’s opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments and the fair value of these financial instruments, unless otherwise noted, approximates their carrying values due to their short term nature.

Resource Properties

The Company considers its exploration costs to have the characteristics of property, plant and equipment. Costs associated with acquisition, direct exploration and development of resource properties are capitalized pending commencement of production, at which time they will be amortized. If capitalized expenditures on individual resource properties exceed the estimated net recoverable amount, the properties are written down to the estimated fair value. Costs relating to properties abandoned are written off when the decision to abandon is made.

The Company is in the process of exploring its property interests. Amounts reflected in the financial statements reflect cost to date and may not represent future value to the Company. No mineral reserves have been determined to exist on these properties. Therefore, the recoverability of the amounts reflected is dependent on future successful exploration and development of the properties.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost less depreciation and amortization calculated as follows:

| | | | |

| Leasehold improvements | | Three years, straight-line | | |

| Buildings | | 5% reducing-balance | | |

| Equipment | | 10%-33% reducing-balance | | |

| Exploration equipment | | 20%-30% reducing-balance | | |

The Company has a long-term land lease in China that has been prepaid but was written down to $1 during 2003 (Note 13).

Income Taxes

Future income tax assets and liabilities are established where the accounting net book value of assets and liabilities differs from the corresponding tax basis. The benefit of future income tax assets is only recognized where their realization is judged to be more likely than not. Future income taxes are recognized for the future income tax consequences attributable to differences between the carrying values of assets and liabilities and their respective income tax bases. Future income tax liabilities are measured using substantively enacted income tax rates expected to apply to taxable income in the years in which temporary differences are expected to be recovered or settled. The effect on future income tax liabilities of a change in rates is included in the period that includes the substantively enacted dates.

Stock-based Compensation Plan

The Company has one stock-based compensation plan, which is described in Note 11. The Company accounts for stock-based compensation in accordance with CICA 3870 (Stock-based Compensation and Other Stock-based Payments) and has chosen to recognize stock-based compensation based on the fair value method of accounting. Under this method, the fair value of stock-based compensation is determined based on the Black-Scholes valuation model and is recognized based on vesting of options granted under the stock option plan. Amounts recognized are credited to Contributed Surplus. Consideration paid on exercise of stock options is credited to Share Capital.

Per Share Amounts

Net loss per share has been computed by dividing net loss applicable to common shareholders by the weighted-average number of common shares outstanding during the respective periods.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

3. Restricted Cash

Restricted cash relates to advances held in China and committed to continuing exploration of the Dachang Gold Project (Note 6).

4. Investments

The Company holds marketable securities in the form of common shares as follows:

| | | | | | | | | | | | | | |

| | | | | November 30, 2006 | | November 30, 2005 |

| | | Number | | Market

Value | | Book

Value | | Market

Value | | Book

Value |

Pearl River Holdings Ltd. | | 374,625 | | $ | 67,433 | | $ | 14,985 | | $ | 14,985 | | $ | 14,985 |

Jaguar Nickel Inc. | | 10,000 | | | 2,650 | | | 2,100 | | | 2,100 | | | 2,100 |

Talware Networx Inc. | | 100,000 | | | 550 | | | 550 | | | 1,400 | | | 1,400 |

Persifal Holdings Inc. | | 2,000 | | | 120 | | | 120 | | | 180 | | | 180 |

| | | | | | | | | | | | | | |

| | | | $ | 70,753 | | $ | 17,755 | | $ | 18,665 | | $ | 18,665 |

| | | | | | | | | | | | | | |

During the year ended November 30, 2006, the Company recorded an unrealized loss of $910 (2005—$3,980) to reflect a decline in value of marketable securities held.

It is the Company’s intention to hold the marketable securities for greater than one year.

5. Investment in Associated Company

Investment in associated company is carried on an equity basis.

| | | | | | | | |

| | | November 30,

2006 | | | November 30,

2005 | |

Ideal e-Commerce Limited | | | | | | | | |

Equity—50% ownership (a) | | $ | 1 | | | $ | 1 | |

Shareholder loan (b) | | | 250,000 | | | | 250,000 | |

Accumulated equity in net loss | | | (250,000 | ) | | | (250,000 | ) |

| | | | | | | | |

| | $ | 1 | | | $ | 1 | |

| | | | | | | | |

| (a) | Investment in associated company represents the Company’s 50% interest in Ideal e-Commerce Limited, a Hong Kong company formed in a 50/50 joint venture between the Company and Henderson China Holdings Ltd., of Hong Kong, in March, 2000 for the development of a business-to-business online metals trading portal through its 48% ownership in China Metals Net Company Ltd. (“China Metals Net”), of Hong Kong. |

52% of the shares of China Metals Net are owned by China National Non-Ferrous Industrial Trading Group Company (“CNIT”), formerly Minmetals International Non-Ferrous Metals Trading Company, of Beijing. CNIT has agreed to utilize the services of China Metals Net on an exclusive basis to conduct all of its non-ferrous metals trading business activities through the business-to-business online metals trading portal.

The Company does not plan to make any further investment in this enterprise for the foreseeable future.

| (b) | The Hong Kong dollar denominated shareholder loan (HK$1,224,999; 2005—HK$1,224,999) is unsecured, bears no interest and has no terms of repayment. |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

6. Resource Properties

The Company is involved in exploration in China through earn-in agreements in the form of joint venture contracts whereby it provides 100% of the funding in order to earn a controlling interest in certain projects. As at November 30, 2006, the Company had entered into two such agreements, as follows:

(a) The Dachang Gold Project

On November 14, 2003, the Company entered into an agreement with the Qinghai Geological Survey Institute regarding the Dachang Gold Project in the Province of Qinghai, China. Under the terms of this joint venture agreement, the Company can earn an 83% interest in the joint venture by contributing the equivalent of approximately $5,162,500 (Renminbi 32,830,000) over three years and making a cash payment of the equivalent of approximately $1,572,327 (Renminbi 10,000,000) upon the issuance of a mining license required to bring the project into production. As at November 30, 2006, the Company has advanced $5,162,500 (Renminbi 32,830,000) of this amount.

The Company also has the option to acquire an additional 7% interest in the joint venture based on the valuation of any potential mining project contained in a pre-feasibility report, for a total interest of 90%. The Qinghai Geological Survey Institute will retain a carried interest in the joint venture. As part of the agreement, the Company also has a right of first refusal on any mineral exploration project for which the Qinghai Geological Survey Institute seeks foreign investment.

(b) The Zalantun Gold Project

On October 30, 2003, the Company entered into an agreement with the Beijing Institute of Geology for Mineral Resources regarding the Zalantun Gold Project in the Autonomous Region of Inner Mongolia, China. Under the terms of this joint venture agreement, the Company can earn an 85% interest in the joint venture by contributing the equivalent of approximately $2,173,862 (Renminbi 15,002,500) over three years. Minimum contributions are staged as to the equivalent of approximately $579,600 (Renminbi 4,000,000) within 30 days of the organization of the joint venture; the equivalent of approximately $579,600 (Renminbi 4,000,000) within seven to twelve months of the date of the first contribution; the equivalent of approximately $579,600 (Renminbi 4,000,000) within thirteen to eighteen months of the date of the first contribution; and the equivalent of approximately $435,062 (Renminbi 3,002,500) within nineteen to twenty-four months of the date of the first contribution. To date, the Company has not made any capital contributions, pending the organization of the joint venture. The Company also has the ability to acquire an additional 5% interest in the joint venture for the equivalent of approximately $255,749 (Renminbi 1,765,000), for a total interest of 90%. The Beijing Institute of Geology for Mineral Resources will retain a carried interest in the joint venture. As part of this agreement, the Company also has a right of first refusal on any mineral exploration project for which Beijing Institute of Geology for Mineral Resources seeks foreign investment. To date, the Company has not made any financial contributions relating to this joint venture agreement.

7. Property, Plant and Equipment

| | | | | | | | | | | | | | | | | | | | |

| | | November 30, 2006 | | November 30, 2005 |

| | | Cost | | Accumulated

Depreciation and

Amortization | | | Net Book

Value | | Cost | | Accumulated

Depreciation and

Amortization | | | Net Book

Value |

Prepaid land lease | | $ | 1 | | $ | — | | | $ | 1 | | $ | 1 | | $ | — | | | $ | 1 |

Buildings | | | 1 | | | — | | | | 1 | | | 1 | | | — | | | | 1 |

Rare earth processing equipment | | | 1 | | | — | | | | 1 | | | 1 | | | — | | | | 1 |

Leasehold improvements | | | 37,000 | | | (24,151 | ) | | | 12,849 | | | 37,000 | | | (11,819 | ) | | | 25,181 |

Office equipment | | | 74,668 | | | (45,268 | ) | | | 29,400 | | | 62,966 | | | (36,673 | ) | | | 26,293 |

Exploration equipment | | | 1,715,195 | | | (500,196 | ) | | | 1,214,999 | | | 1,196,561 | | | (289,073 | ) | | | 907,488 |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 1,826,866 | | $ | (569,615 | ) | | $ | 1,257,251 | | $ | 1,296,530 | | $ | (337,565 | ) | | $ | 958,965 |

| | | | | | | | | | | | | | | | | | | | |

Prepaid land lease, buildings and rare earth processing equipment are held through the Company’s 80% interest in Yangzhong Zhonghai Techmat Co., Ltd., in China. During the year ended November 30, 2005 the Company liquidated rare earth processing equipment for net proceeds equivalent to approximately $429,240 (Renminbi 2,940,000) and used the proceeds to repay outstanding bank advances (Note 8, 13 (c)).

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

8. Bank Advances

During 2005 the Company repaid three one-year term loans that bore interest at a rate of 6.903% and that were secured by a fixed charge against land and buildings in the amount of $430,500 (Renminbi 3,000,000). These loans had been borrowed by an 80%-owned Chinese subsidiary of the Company, Yangzhong Zhonghai Techmat Co., Ltd. and were repaid by the Company out of proceeds from the liquidation of rare earth processing equipment that had previously been written down to $1 in these financial statements (Note 13 (c)).

During 2005, the Company paid interest of $17,201 related to these loans.

9. Related Party Transactions

The Company paid or accrued management compensation to three directors of $439,155 during the year (2005—$202,202). This compensation is in the normal course of operations and is measured at the exchange amount, which is the amount of consideration established and agreed to by the parties.

10. Lease Commitment

The Company has entered into a lease for office space to the year 2009 with minimum lease payments as follows:

| | | |

2007 | | $ | 86,355 |

2008 | | $ | 86,355 |

2009 | | $ | 21,589 |

11. Share Capital, Share-Purchase Warrants, Stock-based Compensation Plan and Contributed Surplus

(a) Authorized

98,500,000 common shares, without par value.

(b) Issued and Outstanding

| | | | | | | | | | | | | | |

| | | November 30, 2006 | | | November 30, 2005 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Balance—beginning of year | | 46,669,174 | | | $ | 30,992,036 | | | 42,195,878 | | | $ | 28,007,846 | |

Issued by private placement | | 12,284,975 | | | | 8,545,898 | | | 3,353,333 | | | | 1,809,907 | |

Exercise of share-purchase warrants | | 333,333 | | | | 294,692 | | | 710,963 | | | | 814,363 | |

Exercise of options | | 350,200 | | | | 419,029 | | | 409,000 | | | | 359,920 | |

| | | | | | | | | | | | | | |

| | 59,637,682 | | | | 40,251,655 | | | 46,669,174 | | | | 30,992,036 | |

Investment in own shares | | (116,500 | ) | | | (133,023 | ) | | (116,500 | ) | | | (133,023 | ) |

| | | | | | | | | | | | | | |

Balance—end of year | | 59,521,182 | | | $ | 40,118,632 | | | 46,552,674 | | | $ | 30,859,013 | |

| | | | | | | | | | | | | | |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

(i) Private Placement (March, 2006)

On March 22, 2006, the Company completed a brokered private placement financing for gross proceeds of $11,056,478, made up of 12,284,975 special warrants of the Company (the “Special Warrants”) issued at a price of $0.90 per Special Warrant. Each Special Warrant entitled the holder thereof, upon exercise or deemed exercise of the Special Warrants and without payment of any additional consideration, to receive one common share of the Company (the “Special Warrant Shares”) and one-half of one share-purchase warrant (the “Underlying Warrants”). Each whole Underlying Warrant entitled the holder to purchase one additional common share of the Company (the “Underlying Warrant Shares”) at a price of $1.20 until March 22, 2008.

The Company paid a cash commission of $663,389 and issued 737,098 share-purchase warrants to brokers (the “Brokers’ Special Warrants”) in connection with this financing. Each Broker’s Special Warrant entitled the holder thereof, upon exercise or deemed exercise of the Brokers’ Special Warrants and without payment of any additional consideration, to receive one share-purchase warrant of the Company (the “Brokers’ Warrants”). Each Broker’s Warrant entitled the holder to purchase one additional common share of the Company (the “Brokers’ Warrant Shares”) at a price of $1.00 until March 22, 2008.

The Special Warrants were issued under and were governed by an indenture dated March 22, 2006 between the Company and Computershare Trust Company of Canada. The Company agreed to use its best efforts to obtain a decision document in respect of a prospectus (the “Decision Document”), which definitively evidenced that the Special Warrant Shares, Underlying Warrant Shares and Brokers’ Warrant Shares to be issued upon the exercise or deemed exercise of the Special Warrants, the Underlying Warrants or Brokers’ Warrants have been qualified for the purposes of distribution in the provinces of Canada within which the holders of the Special Warrants, the Underlying Warrants or Brokers’ Warrants are resident on or before April 30, 2006. The Company was successful in obtaining the Decision Document on April 28, 2006 and all of the Special Warrants and the Brokers’ Special warrants were deemed to have been exercised at that time.

The Company evaluated the fair value of the Underlying Warrants and the Brokers’ Warrants using the Black-Scholes model with the following valuation assumptions: expected life—24 months, expected volatility—69.10%, risk-free interest rate—3.95%, dividend rate—0%.

Consideration received, after fees and commissions of $881,539 and the estimated fair value of Brokers’ Warrants of $257,984, has been allocated to common shares and the Underlying Warrants in the amounts of $8,074,209 and $1,371,057, respectively.

(ii) Private Placement (October, 2005)

In October of 2005 the Company completed a private placement for proceeds of $533,500 representing 485,000 units of the Company at a price of $1.10 per unit. Each unit consisted of one common share and one half of one share-purchase warrant. Each share-purchase warrant entitles the holder to purchase one additional common share at $1.45 for a period of eighteen months from the date of issue. The Company evaluated the fair value of share-purchase warrants using the Black-Scholes model with the following valuation assumptions: expected life—18 months, expected volatility—68.28%, risk-free interest rate—2.96%, dividend rate—0%.

As part of this financing transaction, the Company paid finders’ fees of $31,020 in cash and 47,000 share-purchase warrants. Each share-purchase warrant entitles the holder to purchase one additional common share at $1.10 for a period of twelve months from the date of issue. The Company evaluated the fair value of share-purchase warrants using the Black-Scholes model with the following valuation assumptions: expected life—12 months, expected volatility—68.08%, risk-free interest rate—2.88%, dividend rate—0%.

Consideration received has been allocated to the common shares after deducting the finders’ fees paid in cash of $31,020 and the estimated fair value of the share-purchase warrants of $76,680.

(iii) Private Placement (July, 2005)

In July of 2005 the Company completed a private placement in three tranches for proceeds of $1,721,000 representing 2,868,333 units of the Company at a price of $0.60 per unit. Each unit consisted of one common share and one half of one share-purchase warrant. Each share-purchase warrant entitles the holder to purchase one additional common share at $0.80 for a period of eighteen months from the date of issue. The Company evaluated the fair value of share-purchase warrants using the Black-Scholes model with the following valuation assumptions: expected life—18 months, expected volatility—63.38%, risk-free interest rate—2.75%, dividend rate—0%.

As part of this financing transaction, the Company paid cash finders’ fees of $100,200.

Consideration received has been allocated to the common shares after deducting the finders’ fees paid in cash of $100,200 and the estimated fair value of the share-purchase warrants of $236,693.

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

(c) Share-Purchase Warrants

The following is a summary of the Company’s outstanding share-purchase warrants:

| | | | | | | | | | | | | | | | | | | | |

| | | November 30, 2006 | | November 30, 2005 |

| | | Number | | | Value | | | Weighted-

average

Exercise Price | | Number | | | Value | | | Weighted-

average

Exercise Price |

Balance—beginning of year | | 4,856,499 | | | $ | 1,387,890 | | | $ | 0.99 | | 5,741,877 | | | $ | 1,816,646 | | | $ | 0.99 |

Issued | | 6,879,585 | | | | 1,629,041 | | | | 1.18 | | 1,723,666 | | | | 313,373 | | | | 0.90 |

Exercised | | (333,333 | ) | | | (94,692 | ) | | | 0.60 | | (710,963 | ) | | | (294,067 | ) | | | 0.73 |

Expired | | (2,846,500 | ) | | | (993,455 | ) | | | 1.10 | | (1,898,081 | ) | | | (448,062 | ) | | | 1.00 |

| | | | | | | | | | | | | | | | | | | | |

Balance—end of year | | 8,556,251 | | | $ | 1,928,784 | | | $ | 1.12 | | 4,856,499 | | | $ | 1,387,890 | | | $ | 0.99 |

| | | | | | | | | | | | | | | | | | | | |

The weighted-average remaining contractual life is 1.09 years (2005—0.85 years).

(d) Stock-based Compensation Plan

The Company has one stock-based compensation plan as at November 30, 2006, a common share-purchase option plan for directors, officers, employees and consultants of the Company (the “Plan”). Options under the Plan are typically granted in such numbers as to reflect the level of responsibility of the particular optionee and his or her contribution to the business and activities of the Company, typically vest immediately and have a five-year term. Except in specified circumstances, options are not assignable and terminate upon the optionee ceasing to be employed by or associated with the Company.

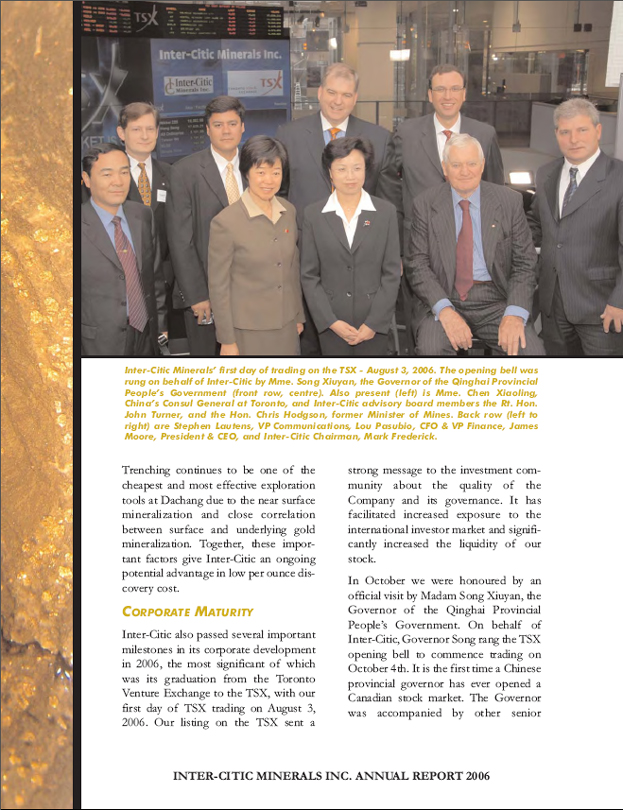

On August 3, 2006, the Company’s common shares were listed on the Toronto Stock Exchange (prior to August 3, 2006, the Company’s common shares were listed on the TSX Ventures Exchange) and are traded in Canadian dollars. The following is a summary of the Company’s outstanding stock options:

| | | | | | | | | | | | |

| | | November 30, 2006 | | November 30, 2005 |

| | | Number | | | Weighted-

average

Exercise Price | | Number | | | Weighted-

average

Exercise Price |

Options outstanding—beginning of year | | 3,735,200 | | | $ | 0.87 | | 3,794,200 | | | $ | 0.86 |

Options granted | | 535,000 | | | | 0.92 | | 425,000 | | | | 0.97 |

Options exercised | | (350,200 | ) | | | 0.71 | | (409,000 | ) | | | 0.88 |

Options expired | | (550,000 | ) | | | 0.76 | | (75,000 | ) | | | 0.67 |

Options terminated | | (60,000 | ) | | | 0.80 | | — | | | | — |

| | | | | | | | | | | | |

Options outstanding—end of year | | 3,310,000 | | | $ | 0.92 | | 3,735,200 | | | $ | 0.87 |

| | | | | | | | | | | | |

Exercisable options | | 3,310,000 | | | $ | 0.92 | | 3,735,200 | | | $ | 0.87 |

| | | | | | | | | | | | |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

| | | | | | | | | | | | | | |

| | | Number

outstanding

November 30,

2006 | | Weighted

average

remaining

contractual life | | Weighted

average

exercise price | | Number

outstanding

November 30,

2005 | | Weighted

average

remaining

contractual life | | Weighted

average

exercise price |

Price range per option | | | | | | | | | | | | | | |

Less than $ 0.60 | | 100,000 | | 1.32 | | $ | 0.58 | | 175,200 | | 2.32 | | $ | 0.58 |

From $0.61 to $ 0.80 | | 585,000 | | 1.87 | | $ | 0.73 | | 1,470,000 | | 1.81 | | $ | 0.73 |

From $0.81 to $ 1.00 | | 2,500,000 | | 2.72 | | $ | 0.97 | | 1,965,000 | | 3.54 | | $ | 0.98 |

From $1.01 to $ 1.15 | | 125,000 | | 3.01 | | $ | 1.15 | | 125,000 | | 4.01 | | $ | 1.15 |

| | | | | | | | | | | | | | |

Overall | | 3,310,000 | | 2.54 | | $ | 0.92 | | 3,735,200 | | 2.82 | | $ | 0.87 |

| | | | | | | | | | | | | | |

Prior to listing its shares on the Toronto Stock Exchange, the Company occasionally issued options with an exercise price that was below the market price of the stock on the grant date, as was permitted by the TSX Ventures Exchange. In addition, the Company may issue options with an exercise price that is higher than the market price of the stock on the grant date. The following is a summary of weighted average exercise prices and weighted average fair values for options whose exercise price equals, exceeds or is less than the market price of the stock on the grant date.

| | | | | | | | | | | | | | | | |

| | | November 30, 2006 | | November 30, 2005 |

| | | Number

Outstanding | | Weighted

average

exercise price | | Weighted

average

fair value | | Number

Outstanding | | Weighted

average

exercise price | | Weighted

average

fair value |

Exercise Price Exceeds Market | | 200,000 | | $ | 0.88 | | $ | 0.19 | | — | | $ | — | | $ | — |

Exercise Price Equals Market | | 2,400,000 | | $ | 0.96 | | $ | 0.58 | | 2,165,000 | | $ | 0.96 | | $ | 0.55 |

Exercise Price is Below Market | | 710,000 | | $ | 0.81 | | $ | 0.63 | | 1,570,200 | | $ | 0.76 | | $ | 0.51 |

| | | | | | | | | | | | | | | | |

| | 3,310,000 | | $ | 0.92 | | $ | 0.57 | | 3,735,200 | | $ | 0.87 | | $ | 0.53 |

| | | | | | | | | | | | | | | | |

During the year the Company recognized $236,150 (2005—$365,319) as stock-based compensation expense and included this amount in Contributed Surplus.

The fair value of options issued was estimated on the date of grant using the Black-Scholes option pricing model based on the following weighted-average valuation assumptions for each period:

| | | | | | |

| | | November 30,

2006 | | | November 30,

2005 | |

Expected life: | | 3.9-years | | | 5.0-years | |

Expected volatility: | | 70.57 | % | | 71.42 | % |

Risk-free interest rate: | | 4.09 | % | | 3.30 | % |

Dividend rate: | | 0 | % | | 0 | % |

Under these assumptions, the fair value of options issued during these periods was $0.44 and $0.59, respectively.

(e) Contributed Surplus

The following is a summary of transactions in the Contributed Surplus account:

| | | | | | | |

| | | November 30,

2006 | | | November 30,

2005 |

Balance—beginning of year | | $ | 2,599,577 | | | $ | 1,786,196 |

Stock-based compensation | | | 236,150 | | | | 365,319 |

Stock-options exercised | | | (171,413 | ) | | | — |

Share-purchase warrants expired | | | 993,455 | | | | 448,062 |

| | | | | | | |

Balance—end of year | | $ | 3,657,769 | | | $ | 2,599,577 |

| | | | | | | |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

12. Income Taxes

The Company’s provision for recovery of income tax has been calculated as follows:

| | | | | | | | |

| | | November 30,

2006 | | | November 30,

2005 | |

Loss for the year | | $ | 2,879,768 | | | $ | 1,398,439 | |

| | | | | | | | |

Income tax recovery at Canadian federal and provincial statutory rates | | $ | 1,040,173 | | | $ | 505,116 | |

Permanent differences | | | (264,716 | ) | | | (212,873 | ) |

Increase in valuation allowance | | | (775,457 | ) | | | (292,243 | ) |

| | | | | | | | |

Provision for recovery of income tax | | $ | — | | | $ | — | |

| | | | | | | | |

Significant components of the Company’s future income tax assets and liabilities as at November 30, 2006 and 2005 are as follows:

| | | | | | | | |

| | | November 30,

2006 | | | November 30,

2005 | |

Future income tax assets: | | | | | | | | |

| | |

Capital assets | | $ | 393,000 | | | $ | 346,000 | |

Non-capital losses carried forward | | | 4,780,000 | | | | 4,149,000 | |

Share issue costs | | | 1,098,000 | | | | 560,000 | |

Other temporary differences | | | 28,000 | | | | 30,000 | |

| | | | | | | | |

Gross future income tax asset | | | 6,299,000 | | | | 5,085,000 | |

Valuation allowance | | | (6,299,000 | ) | | | (5,085,000 | ) |

| | | | | | | | |

Net future income tax asset | | | — | | | | — | |

| | | | | | | | |

Future income tax liability: | | | | | | | | |

| | |

Deferred acquisition and exploration costs | | | 1,904,000 | | | | 1,042,000 | |

| | | | | | | | |

Gross future income tax liability | | | 1,904,000 | | | | 1,042,000 | |

| | | | | | | | |

Net future income tax liability | | $ | 1,904,000 | | | $ | 1,042,000 | |

| | | | | | | | |

The Company recorded full valuation allowances in respect of its Canadian losses and other attributes as at November 30, 2006 and 2005 because management believes that future income tax assets have not met the “more likely than not” recognition threshold. For certain payments in relation to mineral property interests the Company records a future income tax liability and a corresponding adjustment to the related asset carrying amounts. During the year the Company recorded a future income tax liability and corresponding adjustment to resource properties of $862,000 and restated the November 30, 2005 similarly by $1,042,000.

The Company has available losses of approximately $14,484,000 that may be carried forward to reduce future years’ income for tax purposes, as follows:

| | | |

2007 | | $ | 664,000 |

2008 | | $ | 925,000 |

2009 | | $ | 1,252,000 |

2010 | | $ | 3,185,000 |

2014 | | $ | 3,037,000 |

2015 | | $ | 1,767,000 |

2026 | | $ | 3,654,000 |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

13. Segmented Information

The Company’s activities are in one reportable operating segment, being acquisition of exploration stage resource properties and exploration and development of those properties.

(a) Resource Properties and Property, Plant and Equipment by Geographic Region

| | | | | | |

| | | November 30,

2006 | | November 30,

2005 |

China | | $ | 13,517,218 | | $ | 7,403,707 |

Canada | | | 42,249 | | | 51,474 |

| | | | | | |

| | $ | 13,559,467 | | $ | 7,455,181 |

| | | | | | |

(b) Acquisition and Exploration Costs by Resource Property

| | | | | | | | | | | | | |

| | | For the year ended November 30, 2006 |

| | | Balance as at

November 30,

2005 | | Additions

during the

year | | Expensed

during the

year | | | Balance as at

November 30,

2006 |

(i) Dachang Gold Project | | | | | | | | | | | | | |

| | | | |

Acquisition: | | | | | | | | | | | | | |

| | | | |

Consulting | | $ | 131,732 | | $ | — | | $ | — | | | $ | 131,732 |

Professional fees | | | 112,204 | | | — | | | — | | | | 112,204 |

Dues and fees | | | 17,909 | | | — | | | — | | | | 17,909 |

Administrative and other | | | 15,573 | | | — | | | — | | | | 15,573 |

Travel and accommodation | | | 5,311 | | | — | | | — | | | | 5,311 |

| | | | | | | | | | | | | |

| | | 282,729 | | | — | | | — | | | | 282,729 |

| | | | | | | | | | | | | |

| | | | |

Exploration and other: | | | | | | | | | | | | | |

| | | | |

Drilling | | | 1,840,423 | | | 2,360,831 | | | — | | | | 4,201,254 |

Consulting | | | 755,684 | | | 630,284 | | | — | | | | 1,385,968 |

Camp | | | 485,295 | | | 474,058 | | | — | | | | 959,353 |

Trenching | | | 389,360 | | | 410,485 | | | — | | | | 799,845 |

Assays and metallurgy | | | 265,807 | | | 425,749 | | | — | | | | 691,556 |

Travel and accommodation | | | 416,328 | | | 304,801 | | | (171,473 | ) | | | 549,656 |

Geochemical | | | 268,320 | | | 44,247 | | | — | | | | 312,567 |

Depreciation | | | 134,276 | | | 135,945 | | | — | | | | 270,221 |

Administrative and other | | | 40,271 | | | 236,759 | | | (21,150 | ) | | | 255,880 |

Geophysical | | | 253,986 | | | — | | | — | | | | 253,986 |

Mapping | | | 137,543 | | | 39,440 | | | — | | | | 176,983 |

Professional fees | | | 92,369 | | | 74,024 | | | — | | | | 166,393 |

| | | | | | | | | | | | | |

| | | 5,079,662 | | | 5,136,623 | | | (192,623 | ) | | | 10,023,662 |

| | | | | | | | | | | | | |

Future tax liability | | | 1,042,000 | | | 862,000 | | | — | | | | 1,904,000 |

| | | | | | | | | | | | | |

| | | 6,404,391 | | | 5,998,623 | | | (192,623 | ) | | | 12,210,391 |

| | | | | | | | | | | | | |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

| | | | | | | | | | | | | |

(ii) Zalantuan Gold Project | | | | | | | | | | | | | |

| | | | |

Acquisition: | | | | | | | | | | | | | |

| | | | |

Professional fees | | | 13,860 | | | — | | | — | | | | 13,860 |

| | | | | | | | | | | | | |

| | | 13,860 | | | — | | | — | | | | 13,860 |

| | | | | | | | | | | | | |

| | | | |

Exploration and other: | | | | | | | | | | | | | |

| | | | |

Consulting | | | 51,800 | | | — | | | — | | | | 51,800 |

Travel and accommodation | | | 15,003 | | | — | | | — | | | | 15,003 |

Mapping | | | 10,921 | | | — | | | — | | | | 10,921 |

Administrative and other | | | 241 | | | — | | | — | | | | 241 |

| | | | | | | | | | | | | |

| | | 77,965 | | | — | | | — | | | | 77,965 |

| | | | | | | | | | | | | |

| | | 91,825 | | | — | | | — | | | | 91,825 |

| | | | | | | | | | | | | |

All resource properties | | $ | 6,496,216 | | $ | 5,998,623 | | $ | (192,623 | ) | | $ | 12,302,216 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | For the year ended November 30, 2005 |

| | | Balance as at

November 30,

2004 | | Additions

during the

year | | Expensed

during the

year | | | Balance as at

November 30,

2005 |

| (iii) Dachang Gold Project | | | | | | | | | | | | | |

| | | | |

Acquisition: | | | | | | | | | | | | | |

| | | | |

Consulting | | $ | 131,732 | | $ | — | | $ | — | | | $ | 131,732 |

Professional fees | | | 112,204 | | | — | | | — | | | | 112,204 |

Dues and fees | | | 17,909 | | | — | | | — | | | | 17,909 |

Administrative and other | | | 15,573 | | | — | | | — | | | | 15,573 |

Travel and accommodation | | | 5,199 | | | 112 | | | — | | | | 5,311 |

| | | | | | | | | | | | | |

| | | 282,617 | | | 112 | | | — | | | | 282,729 |

| | | | | | | | | | | | | |

| | | | |

Exploration and other: | | | | | | | | | | | | | |

| | | | |

Drilling | | | 1,213,034 | | | 627,389 | | | — | | | | 1,840,423 |

Consulting | | | 320,545 | | | 435,139 | | | — | | | | 755,684 |

Camp | | | 225,919 | | | 259,376 | | | — | | | | 485,295 |

Travel and accommodation | | | 275,530 | | | 295,641 | | | (154,843 | ) | | | 416,328 |

Trenching | | | 14,807 | | | 374,553 | | | — | | | | 389,360 |

Geochemical | | | 212,962 | | | 55,358 | | | — | | | | 268,320 |

Assays and metallurgy | | | 3,976 | | | 261,831 | | | — | | | | 265,807 |

Geophysical | | | 253,986 | | | — | | | — | | | | 253,986 |

Mapping | | | 25,417 | | | 112,126 | | | — | | | | 137,543 |

Depreciation | | | 71,896 | | | 62,380 | | | — | | | | 134,276 |

Professional fees | | | 34,952 | | | 57,417 | | | — | | | | 92,369 |

Administrative and other | | | 16,635 | | | 36,526 | | | (12,890 | ) | | | 40,271 |

| | | | | | | | | | | | | |

| | | 2,669,659 | | | 2,577,736 | | | (167,733 | ) | | | 5,079,662 |

| | | | | | | | | | | | | |

Future tax liability | | | — | | | 1,042,000 | | | — | | | | 1,042,000 |

| | | | | | | | | | | | | |

| | | 2,952,276 | | | 3,619,848 | | | (167,733 | ) | | | 6,404,391 |

| | | | | | | | | | | | | |

INTER-CITIC MINERALS INC.

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED NOVEMBER 30, 2006

| | | | | | | | | | | | | |

(iv) Zalantun Gold Project | | | | | | | | | | | | | |

| | | | |

Acquisition: | | | | | | | | | | | | | |

| | | | |

Professional fees | | | 13,860 | | | — | | | — | | | | 13,860 |

| | | | | | | | | | | | | |

| | | 13,860 | | | — | | | — | | | | 13,860 |

| | | | | | | | | | | | | |

| | | | |

Exploration and other: | | | | | | | | | | | | | |

| | | | |

Consulting | | | 51,800 | | | — | | | — | | | | 51,800 |

Travel and accommodation | | | 15,003 | | | — | | | — | | | | 15,003 |

Mapping | | | 10,921 | | | — | | | — | | | | 10,921 |

Administrative and other | | | 241 | | | — | | | — | | | | 241 |

| | | | | | | | | | | | | |

| | | 77,965 | | | — | | | — | | | | 77,965 |

| | | | | | | | | | | | | |

| | | 91,825 | | | — | | | — | | | | 91,825 |

| | | | | | | | | | | | | |

All resource properties | | $ | 3,044,101 | | $ | 3,619,848 | | $ | (167,733 | ) | | $ | 6,496,216 |

| | | | | | | | | | | | | |

(c) Other Loss (Income), Net

During 2005 the Company liquidated most of its rare earth processing equipment for net proceeds of approximately $429,240 (Renminbi 2,940,000), the proceeds of which were used to repay amounts owing to the Bank of China (Note 8). In addition, the Company reversed approximately $102,967 in accounts payable that were over-accrued at the time operations ceased.

The Company continues to incur expenses associated with security and maintenance of the land, buildings and remaining equipment in China. During the year, the net amount of these costs were $11,083 (2005—$8,380) and are net of recovery of bad debts, sale of inventory previously written off, liquidation of property, plant and equipment, exchange gains and losses for the period and other related income or expenses as applicable.

14. Exercise of Warrants

Subsequent to year end, in January of 2007, the Company received proceeds of $1,147,333 further to the exercise of 1,434,166 share-purchase warrants that were previously issued in connection with a private placement in July of 2005 (Note 11 (b) (iii)).

15. Comparative Figures

Certain comparative figures have been reclassified to conform with the presentation of the current year.