Exhibit 99.20

INTER-CITIC MINERALS INC.

60 Columbia Way, Suite 501

Markham, Ontario

Canada L3R 0C9

(905) 479-5072

MANAGEMENT INFORMATION CIRCULAR AS AT March 13, 2007

SOLICITATION OF PROXIES

THIS MANAGEMENT INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY AND ON BEHALF OF THE MANAGEMENT OF INTER-CITIC MINERALS INC. (“the Corporation”) for use at the Annual and Special Meeting of shareholders of the Corporation (the “Meeting”) to be held on Thursday April 12, 2007, at The Quebec Room, The Royal York Hotel, 100 Front Street W., Toronto, Ontario, at 4:30 p.m., and any adjournments thereof, for the purposes set forth in the attached Notice of Meeting. Except where otherwise indicated, the information contained herein is stated as of March 13, 2007.

All costs of this solicitation will be borne by the Corporation. In addition to the solicitation of proxies by mail, directors, officers and some regular employees may solicit proxies personally, by telephone or telegraph, but will not receive compensation for so doing.

APPOINTMENT OF PROXYHOLDER

The persons named as proxyholders in the accompanying form of proxy were designated by the management of the Corporation (“Management Proxyholder”). A shareholder has the right to appoint a person other than the Management Proxyholder to represent the shareholder at the Meeting (“Alternate Proxyholder”) and may do so by inserting such other person’s name in the space indicated or by completing another proper form of proxy. A person appointed as proxyholder need not be a shareholder of the Corporation. All completed proxy forms must be deposited with Computershare Investor Services, Proxy Department, 9th Floor – 100 University Avenue, Toronto Ontario M5J 2Y1, not less than forty-eight (48) hours, excluding Saturdays, Sundays, and holidays, before the time of the meeting.

REVOCATION OF PROXY

Every proxy may be revoked by an instrument in writing

| | (a) | executed by the shareholder or by the shareholder’s attorney authorized in writing or, where the shareholder is a corporation, by a duly authorized officer, or attorney, of the corporation; and |

| | (b) | delivered either to the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting or any adjournment of it, at which the proxy is to be used, or to the chairman of the Meeting on the day of the Meeting or any adjournment thereof., |

or in any other manner provided by law.

NON-REGISTERED HOLDERS OF THE CORPORATION’S SHARES

Only registered holders of common shares of the Corporations (the “Shares”), or duly appointed proxyholders, are permitted to vote at the Meeting. Most shareholders of the corporation are “non-registered” shareholders because the Shares they own are not registered in their names but instead are registered in the name of the brokerage firm, bank or trust company through which they purchased their Shares. A person is not a registered shareholder (a “Non-Registered Holder”) in respect of Shares which are held either (i) in the name of an intermediary (an “Intermediary”) (including banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans) that the Non-Registered Holder deals with in respect of the Shares, or (ii) in the name of a clearing agency (such as The Canadian Depository for Securities Limited), of which the Intermediary is a participant.

Non-Registered Holders who have not object to their Intermediary disclosing certain ownership information about them to the Corporation are referred to as “NOBOs”. Those Non-Registered Holders who have objected to their Intermediary disclosing ownership information about themselves to the Corporation are referred to as “OBOs”.

In accordance with the requirements of National Instrument 54-101, the Corporation has distributed copies of the notice of meeting, this Management Information Circular and the proxy (collectively, the “Meeting Materials”) to the clearing agencies and intermediaries for onward distribution to non-registered Holders. Intermediaries are required to forward the Meeting Materials to Non-registered Holders unless a Non-registered Holder has waived the right to receive them.

By choosing to send the Meeting Materials to the NOBOs directly, the Corporation (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to the NOBOs, and (ii) executing their proper voting instructions.

The Meeting Materials are being sent to both registered shareholders and Non-Registered Holders. If you are a Non-Registered Holder, and the Corporation or its agent has sent the Meeting Materials to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding on your behalf.

Meeting materials sent to NOBOs directly are accompanied by a request for voting instructions (a “VIF”). This form is instead of a proxy. By returning a VIF in accordance with the instructions noted on it, a Non-Registered Holder is able to instruct the registered shareholder how to vote on behalf of the Non-Registered Holder. The VIF should be completed and returned in accordance with the specific instructions noted on the VIF.

Intermediaries are required to forward the Meeting Materials to OBOs unless the particular Non-Registered Holder has waived their right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, OBOs who have not waived the right to receive Meeting Materials will either:

| | (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Holder, but which is otherwise uncompleted. This form of proxy need not be signed by the Non-Registered Holder. In this case, the Non-Registered Holder who wishes to submit a proxy should properly complete the applicable form of proxy and submit it to Computershare Investor Services, Proxy Department, 9th Floor – 100 University Avenue, Toronto Ontario M5J 2Y1, with respect to the share beneficially owned by such Non-Registered Holder, in accordance with the instructions elsewhere in this Information Circular; or |

| | (b) | More typically, be given a form of proxy which is not signed by the Intermediary and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute authority and instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the Non-Registered Holder will be given a page of instructions which contains a removable label containing a bar-code or other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

In either case the purpose of this procedure is to permit the Non-Registered Holder to direct the voting of the shares he or she beneficially owns.

A Non-Registered Holder may revoke a proxy authorization form (voting instructions) or a waiver of the right to receive meeting materials and to vote given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary is not required to act on a revocation of proxy authorization form (voting instructions) or of a waiver of the right to receive materials and to vote that is not received by the Intermediary at least seven days prior to the Meeting.

3

Should a Non-Registered Holder who receives a form of proxy (including a VIF or proxy authorization form) wish to vote at the Meeting in person, the Non-Registered Holder should strike out the persons named in the proxy and insert the Non-Registered Holder’s name in the blank space provided.

Please return your voting instructions as specified in the applicable form of proxy. Non-Registered Holders should carefully follow the instructions set out in the applicable form of proxy, including those regarding when and where the form is to be delivered.

EXERCISE OF DISCRETION BY PROXYHOLDER

Shares represented by properly executed proxies will be voted or withheld from voting in accordance with the instructions of the shareholders on any ballot that may be called for and if the shareholder specifies a choice with respect to any matters to be acted upon, the Shares will be voted accordingly. Where there is no choice specified, Shares represented by properly executed proxies in favour of persons designated in the printed portion of the enclosed form of proxy will be voted for each of the matters to be voted on by shareholders as described in this Management Information Circular. In the absence of any direction as to how to vote the Shares, an Alternate Proxyholder has discretion to vote them as he or she chooses.

The enclosed form of proxy confers discretionary authority upon the proxyholder with respect to amendments or variations to matters identified in the Notice of Meeting and other matters that may properly come before the Meeting. At present, the management of the Corporation knows of no such amendments, variations or other matters. However, if any other matters which at present are not known to management of the Corporation should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgement of the proxyholders.

INTEREST OF CERTAIN PERSONS AND COMPANIES IN MATTERS TO BE ACTED UPON

The Corporation’s stock option plan (the “2003 Stock Option Plan”) currently reserves for issuance Shares upon the exercise of options granted pursuant to the 2003 Stock Option Plan equal to 10% of all of the issued and outstanding Shares of the Corporation. At the Meeting, shareholders will be asked to approve amendments to the 2003 Stock Option Plan in accordance with the rules of the TSX. 2,805,000 stock options issued under the 2003 Stock Option Plan have been issued are held by persons who have been a director or executive officer of the Corporation at any time since the beginning of the Corporation’s last financial year; by proposed nominees for election as a director of the Corporation and by each of their associates and affiliates. Shares reserved for issuance pursuant to the 2003 Stock Option Plan, if approved, may be granted to the proposed directors and executive officers and their associates and affiliates subject to the limitations on issuance set forth in the 2003 Stock Option Plan regarding the number of Shares reserved for issuance or issued to the Corporation’s directors, senior officers and other insiders. The Corporation’s directors and executive officers at any time since the beginning of the Corporation’s last financial year now are, and are expected to continue to be (with the exception of Sherman Hsiao Ming Hong who is currently a director but will not be standing for re-election), Scott C. Dorey, Mark R. Frederick, Adrian Pedro K.H. Ho, Carlos K. H. Ho, James J. Moore, Peter Tang, Abe Schwartz, Rick Van Nieuwenhuyse, Stephen Lautens and Lou Pasubio. For the identities of the nominees to the board of directors, see “Election of Directors”. For further details on the approval of the amendments to the 2003 Stock Option Plan, see “Amendments to 2003 Stock Option Plan.”

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The authorized capital of the Corporation consists of 98,500,000 Shares. On March 13, 2007 there were 61,236,295 Shares issued and outstanding, each Share carrying the right to one vote.

The directors of the Corporation have fixed March 9, 2007, as the Record Date for the Meeting. Registered holders of Shares at the close of business on March 9, 2007, shall be entitled to attend the Meeting and vote thereat on the basis of one vote for each Share held, except to the extent that a registered shareholder has transferred the ownership of any Shares and the transferee of those Shares produces properly endorsed share certificates, or otherwise establishes that he or she owns the Shares, and demands, not later than 10 days before the Meeting, that his or her name be included in the shareholder list before the Meeting, in which case the transferee shall be entitled to vote his or her Shares at the Meeting.

4

To the knowledge of the Directors or executive officers of the Corporation, the only persons or companies beneficially owning, directly or indirectly, or exercising control or direction over Shares carrying more than 10% of the outstanding voting rights are:

| | | | |

Name and Address | | Approximate Number of Shares | | Percentage of Total Issued and Outstanding |

Main Eagle Limited (Hong Kong) | | 6,482,100 | | 10.59% |

MATTERS TO BE ACTED UPON AT THE MEETING

Under the Articles of the Corporation, the number of directors of the Corporation can range from a minimum of three (3) to a maximum of fifteen (15) and directors are empowered to determine, from time to time, by resolution the number of directors to be elected at the annual meeting of shareholders within this range.

At the Corporation’s last annual meeting of shareholders held on May 18, 2006, nine individuals were elected as directors of the Corporation. In October, 2006, pursuant to the Articles of the Corporation, the Board of Directors appointed Donald Brown as an additional director to hold office for a term expiring at the date of this annual meeting.

Sherman Hong, a current director, will not be standing for re-election as a director at the Meeting. The number of directors to be elected at the Meeting has been fixed by resolution of the Board of Directors at eight.

Each Director will hold office until the next Annual Meeting, unless his office is earlier vacated. Management does not contemplate that any of the nominees will be unable to serve as a director. In the event that prior to the Meeting any vacancies occur in the slate of nominees herein listed, it is intended that discretionary authority shall be exercised by the person named in the proxy as nominee to vote the Shares represented by proxy for the election of any other person or persons as directors.

The table below sets out the names of the Management nominees and their province or state and country of residence; the period or periods during which each director has served as a director; their positions and offices in the Corporation; the number of Shares which each beneficially owns or over which control or direction is exercised and principal occupations. Six (6) of the nominees for director are residents of Canada.

| | | | | | | | |

Name, Province or State and Country of Residence | | Director Since | | Position(s) with Corporation (first and last only) | | # of Shares

Beneficially Owned,

Directly or Indirectly, or Over Which Control or Direction is Exercised at the Date of this Information Circular | | Principal Occupation, Name and Principal Business of Employer |

Donald W. Brown[1] Ontario, Canada | | October 2006 | | Director | | 5,000 | | Managing Director, Catalyst Strategies Inc., Business Consulting Firm. |

| | | | |

Scott C. Dorey [7] New York, USA | | March 2003 | | Director | | 208,500 | | Vice-President of Lehman Brothers Inc., Investment Banking. |

5

| | | | | | | | |

Mark R. Frederick[2] [3] Ontario, Canada | | March 2000 | | Chairman of the Board of Directors | | Nil | | Barrister & Solicitor, Miller Thomson LLP, Law Firm. |

| | | | |

Adrian Pedro K.H. Ho [2] Hong Kong | | May 2004 | | Director | | Nil | | Investment Banker, Kuentai Investors Limited, Investment Bank. |

| | | | |

Carlos K. H. Ho [1] [3] [6] Hong Kong | | December 2002 | | Director | | Nil | | Henderson (China) Investment Co., Ltd., Special Assistant to the Chairman, Asian Developer, Kuentai Investors Limited, Investment Banker, Investment Bank. |

| | | | |

James J. Moore [4] [5] Ontario, Canada | | May 1997 | | President, CEO and Director | | 131,111 | | President, CEO and Director of Inter-Citic Minerals Inc. |

| | | | |

Peter Tang [1] [5] British Columbia, Canada | | June 1993 | | Director | | 10,000 | | Certified Accountant, Director, SSAB Swedish Steel, Ltd., Manufacturing Company. |

| | | | |

Abe Schwartz [2] [3] Ontario, Canada | | June 2004 | | Director | | 100,000 | | President, Schwartz Technologies Corporation, Technology Company |

| | | | |

Rick Van Nieuwenhuyse British Columbia, Canada | | June 2004 | | Director | | Nil | | President, CEO and Director of Nova Gold Resources Inc., Mining Company. |

| [1] | Member of Audit Committee. |

| [2] | Member of Governance and Nominating Committee. |

| [3] | Member of Compensation Committee. |

| [4] | Director of the following subsidiaries of the Corporation: Bay Roberts Resources Ltd., Techmat (USA) Corporation and Yangzhong Zhonghai Techmat Co., Ltd. |

| [5] | Director of Bay Roberts Resources Ltd., a subsidiary of the Corporation. |

| [6] | Director of the following subsidiaries of the Company: Inter-Citic Holdings Ltd. |

| [7] | These Shares are registered in the name of The Bayswater Group Corporation, which is 100% owned by Scott Dorey. |

NOTES:

| | (a) | The information as to the shareholdings has been furnished by the respective nominees. |

| | (b) | Each of the above nominees is now a director of the Corporation and was so elected at the last Annual Meeting other than Donald Brown, who was appointed in October 2006. |

| | (c) | Each of the above nominees has held the principal occupation set forth opposite his name for the past five years except for Abe Schwartz who, prior to March 2006 was the President, CEO and Director of Cedera Software Inc., a medical technologies company. |

| 2. | APPOINTMENT OF AUDITORS |

Management is recommending that shareholders vote for the appointment of PriceWaterhouseCoopers, Chartered Accountants, 145 King Street West, Toronto, Ontario M5H 1V8 as Auditors for the Corporation and to authorise the Directors to fix their remuneration.

6

| 3. | AMENDMENTS TO THE 2003 STOCK OPTION PLAN |

The Corporation currently has in place a stock option plan first approved by the shareholders on May 13, 2003 (the “2003 Stock Option Plan”). The purpose of this 2003 Stock Option Plan is to provide incentive to employees, directors, officers, management companies and consultants who provide services to the Corporation and reduce the cash compensation the Corporation would otherwise be required to pay.

In 2006, the Toronto Stock Exchange (“TSX”) introduced new rules affecting stock option plans. The Board of Directors of the Corporation has approved, subject to required acceptance by the TSX and the shareholders of the Corporation, amendments to the 2003 Stock Option Plan to reflect the introduction of these new rules. The Board has also made certain other amendments to the 2003 Stock Option Plan, in part to evidence the fact that the listing of the Corporation’s shares was transferred in 2006 from the TSX Venture Exchange to the TSX.

Annexed as Schedule A is the 2007 Stock Option Plan.

At the Meeting, the shareholders will be asked to consider and, if thought advisable, to pass a resolution amending the 2003 Stock Option Plan (the “Amendment Resolution”) to:

| | (a) | include a detailed amendment provision to permit the Corporation to make changes to the 2003 Stock Option Plan, without shareholder approval; and |

| | (b) | include the other change to the 2003 Stock Option Plan described in Section B below. |

| A. | New Amendment Provision |

On June 6, 2006, the TSX published a Staff Notice respecting security based compensation arrangements such as the Corporation’s 2003 Stock Option Plan relating to amendment procedures. The TSX strongly advised that stock option plans have detailed provisions that outline the type of amendments that require shareholder approval and those a listed company can make without shareholder approval. The Corporation proposes to change the 2003 Stock Option Plan to specify those amendments that can be made by the Board of Directors without the approval of the Corporation’s shareholders (other than the approval at the Meeting to incorporate this amendment provision into the 2003 Stock Option Plan). The amendments that can be made without shareholder approval are set out in Section 9.1 of the 2007 Stock Option Plan, including:

| | (a) | to change the vesting provisions of an Option or the Plan; |

| | (b) | to change the termination provisions of an Option or the Plan, including extending the Option beyond the original Expiry Date, provided that the term of any Option shall not be more than ten years from the date of grant; |

| | (c) | to add a cashless exercise feature, payable in cash or securities, whether or not the feature provides for a full deduction of the number of underlying securities from the reserved Shares under the Plan; |

| | (d) | to add a deferred or restricted share unit or any other provision which results in Optionees receiving securities while no cash consideration is received by the Company; |

| | (e) | to change the persons who are eligible for the grant of Options; |

| | (f) | to vary the authority of the Board in respect of the grant of Options; |

| | (g) | to change the procedure for the tendering of a notice of exercise of Options and the exercise of Options; |

| | (h) | to vary the acceleration of vesting and the exercise of Options in the event of a takeover bid; |

7

| | (i) | to increase the Option Price of an Option; |

| | (j) | to purchase the outstanding Options by the Corporation in the event of a take-over bid; or |

| | (k) | any other matter which does not expressly require the approval of shareholders of the Corporation as described below. |

Shareholder approval will be required for the following type of amendments to the 2003 Stock Option Plan:

| | (a) | the limitations on grants of Options to Insiders and the number of Shares that may be reserved for issuance to Insiders; |

| | (b) | the maximum number of Shares reserved for issuance upon exercise of Options available under the Plan; |

| | (c) | A reduction in the exercise price of Options benefiting an insider; or, |

| | (d) | An extension of a term of Options benefiting an insider. |

The Board of Directors considers that the flexibility afforded by the proposed change will enable the 2003 Stock Option Plan to better achieve its purpose by enabling amendments to the 2003 Stock Option Plan and options granted thereunder to be made on an expeditious basis which would enable the 2003 Stock Option Plan to efficiently address future regulatory and commercial requirements.

| B. | Other Changes to the 2003 Stock Option Plan |

The other material changes made to the 2003 Stock Option Plan include the following:

| | (a) | upon expiry of an option, or in the event an option is otherwise terminated for any reason, without having been exercised in full, the number of shares in respect of the expired or terminated option will again be available for the purposes of the 2007 Stock Option Plan. Shares covered by an option that have been exercised are available again for an option grant. |

| | (b) | the exercise price of any options granted under the 2007 Stock Option Plan will be determined by the Board of Directors, but shall not be less than the Market Price on the date on which the grant of the options is approved by the Board; |

| | (c) | the 2007 Stock Option Plan limits the exercise price of any option grant to ten (10) years from the date of grant, or such lesser period as determined by the directors of the Corporation; |

| | (d) | if an option holder ceases to be an employee (other than for cause) or contractor of the Corporation, then the option granted will expire no later than one hundred and eighty (180) days following the date that the option holder ceases to be employed or a contractor, as applicable. If an option holder dies, then the option granted will expire within one (1) year of the date of death; |

| | (e) | options may be transferred to certain permitted assigns (including corporations controlled by the option holder, a registered retirement savings plan, a registered retirement income fund, a spouse or other permitted assigns as defined in Section 2.22 of the 2007 Stock Option Plan); |

| | (f) | no options may be granted if such grant could result at any time in: |

| | (i) | the number of Shares issuable to Insiders under all Share Compensation Arrangements exceeding ten percent (10%) of the issued and outstanding Shares; |

| | (ii) | the issuance to Insiders, within any one (1) year period of a number of Shares exceeding ten percent (10%) of the issued and outstanding Shares; |

8

| | (iii) | the number of Shares reserved for issuance under all Share Compensation Arrangements with any one Eligible Individual, together with such Eligible Individual’s Permitted Assigns, exceeding five percent (5%) of the issued and outstanding Shares; |

| | (iv) | a grant of more than two percent (2%) of the issued and outstanding Shares to any one Contractor in any one (1) year period. |

| | (g) | Pursuant to the requirements of the TSX, all unallocated options under the Plan must be re-approved by the shareholders and directors of the Corporation every three (3) years. |

| C. | Purpose of 2007 Stock Option Plan and Board of Directors’ Recommendation |

The 2007 Stock Option Plan is intended to benefit the shareholders of the Corporation as it aligns the optionees interests with those of the shareholders of the Corporation. It enables the Corporation to attract and retain personnel of the highest calibre on a cost-effective basis by offering an opportunity for them to participate with shareholders in any increase in value of the Common Shares resulting from their efforts and thereby contribute to the Corporation’s success and shareholder value. The Board of Directors of the Corporation has concluded that the proposed amendments to the 2003 Stock Option Plan are in the best interests of the shareholders of the Corporation.

The rules of the TSX require that the Amendment Resolution be approved by the affirmative vote of the majority of the votes cast at the Meeting. The persons named in the enclosed form of proxy intend to vote at the Meeting in favour of this resolution, unless the shareholder has specified in the form of proxy that his or her Common Shares are to be voted against the resolution.

The text of the Amendment Resolution to be put before the shareholders at the Meeting is as follows:

“BE IT HEREBY RESOLVED AS AN ORDINARY RESOLUTION THAT:

| | (a) | Subject to regulatory approval, the 2007 Stock Option Plan of the Corporation, in the form attached as Schedule “A” to the Circular delivered by the Board of Directors of the Corporation in connection with this annual and special meeting of shareholders held on April 12, 2007, be and the same is hereby ratified and approved. |

| | (b) | Any one director or officer of the Corporation be and is hereby authorized to execute and deliver in the name and on behalf of the Corporation and under its corporate seal or otherwise, all such certificates, instruments, agreements and other documents and do all such other acts and things as such person many deem necessary or desirable in connection with the foregoing resolution.” |

As of the date of this Information Circular, Management knows of no other matters to be acted upon at this Annual and Special Meeting. However, should any other matters properly come before the Meeting; the Shares represented by the proxy solicited hereby will be voted on such matters in accordance with the best judgment of the persons voting the Shares represented by the proxy.

STATEMENT OF EXECUTIVE COMPENSATION

For the purposes of this section:

“Chief Executive Officer” or “CEO” means each individual who served as chief executive officer of the Corporation or acted in a similar capacity during the most recently completed financial year.

“Chief Financial Officer” or “CFO” means each individual who served as chief financial officer of your Corporation or acted in a similar capacity during the most recently completed financial year.

9

“executive officer” of the Corporation means an individual who at any time during the year was the chairman or a vice-chairman of the board of directors, where such person performed the functions of such office on a full-time basis, the president, any vice-president in charge of a principal business unit such as sales, finance or production, or any officer of the Corporation or of a subsidiary or other person who performed a policy-making function in respect of the Corporation.

“LTIP” or “long term incentive plan” means a plan providing compensation intended to motivate performance over a period greater than one financial year, but does not include option or SAR plans or plans for compensation through shares or units that are subject to restrictions on resale.

“SAR” or “stock appreciation right” means a right granted by the Corporation or any of its subsidiaries, as compensation for services rendered or otherwise in connection with office or employment, to receive a payment of cash or an issue or transfer of securities based wholly or in part on changes in the trading price of its securities; and

The following table provides a summary of the compensation paid to the chief executive officer of the Corporation, the chief financial officer and each executive officer who earned over $150,000 in total salary and bonus during the three most recently completed financial years (the “Named Executive Officers”), for services rendered to the Corporation or a subsidiary of the Corporation.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Annual Compensation | | Long Term Compensation |

| | Year | | Salary

($) | | | Bonus

($) | | Other

Annual

Compensation

($) | | Awards | | Payouts |

| | | | | | Securities

Under

Options/

SARs

Granted

(#) | | Shares or

Units

subject to

resale

restrictions

($) | | LTIP

Payouts

($) | | All Other

Compensation

($) |

| (a) | | (b) | | (c) | | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) |

James J. Moore President & CEO | | 2006 | | $ | 188,250 | | | $ | 220,000 | | Nil | | Nil | | Nil | | Nil | | Nil |

| | 2005 | | $ | 180,000 | | | | Nil | | Nil | | Nil | | Nil | | Nil | | Nil |

| | 2004 | | $ | 180,000 | [1] | | | Nil | | Nil | | 575,000 | | Nil | | Nil | | Nil |

| | | | | | | | |

Lou Pasubio, C.A. Vice-President, Finance & CFO | | 2006 | | $ | 160,000 | | | $ | 39,000 | | Nil | | 110,000 | | Nil | | Nil | | Nil |

| | 2005 | | $ | 160,000 | | | | Nil | | Nil | | Nil | | Nil | | Nil | | Nil |

| | 2004 | | $ | 160,000 | | | | Nil | | Nil | | 300,000 | | Nil | | Nil | | Nil |

| [1] | These amounts were paid to 1224921 Ontario Limited, a private company wholly owned by Mr. Moore. |

OPTION/SAR GRANTS DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR

| | | | | | | | | | | | | |

Name | | Securities

Under

Options/SARs

Granted | | % of Total

Options /SARs

Granted to

Employees in

Financial

Year | | | Exercise Or

Base Price

($/Security) | | Market Value

of Securities

Underlying

Options/SARs

on the Date of

Grant

($/Security) | | Expiration Date |

| (a) | | (b) | | (c) | | | (d) | | (e) | | (f) |

Lou Pasubio, C.A. | | 110,000/Nil | | 81 | % | | $ | 0.95 | | $ | 0.95 | | January 27, 2011 |

10

AGGREGATED OPTION/SAR EXERCISES DURING THE MOST RECENTLY COMPLETED FINANCIAL YEAR AND FINANCIAL YEAR-END OPTION/SAR VALUES

| | | | | | | | | |

Name | | Securities

Acquired on

Exercise (#) | | Aggregate

Value Realized

($) | | Unexercised

Options/SARs at

FY-End

(#)

Exercisable/

Unexercisable | | Value of

Unexercised in-

the-Money

Options/SARs at

FY-End

($)

Exercisable/

Unexercisable |

| (a) | | (b) | | (c) | | (d) | | (e) |

James J. Moore | | Nil | | Nil | | 915,000 /Nil | | $ | 14,000/Nil |

Lou Pasubio, C.A. | | Nil | | Nil | | 510,000/Nil | | $ | 8,000/Nil |

All exercisable options are for common shares of the Corporation issuable upon the exercise of stock options in accordance with the Corporation’s Stock Option Plan.

EMPLOYMENT CONTRACTS

Except as discussed below, the Corporation does not currently have any compensatory plans or arrangements with respect to compensation of the Named Executive Officers as a result of the resignation, retirement or other termination of employment or from a change of control of the Company, or any other employment contracts with the Named Executive Officers.

The Corporation entered into a written employment contract with James Moore, the President and Chief Executive Officer of the Corporation, on November 1, 2006 which entitles Mr. Moore to a monthly base salary of $15,000 ($180,000 per annum) and annual increases in compensation of five percent (5%) of previous year’s compensation. Mr. Moore is also entitled to receive an annual incentive bonus in an amount of not less than twenty percent (20%) and not greater than one hundred and fifty percent (150%) of his base annual salary, with the performance criteria and the amount of such bonus to be determined by the Compensation Committee and approved by the Board of Directors. The Corporation has further agreed to provide a term life insurance policy in an amount of $1,000,000 payable to Mr. Moore’s spouse or designate. The employment agreement provides that in the event of termination without cause, Mr. Moore shall be entitled to receive from the Corporation a severance payment equal to twelve (12) times his base monthly salary plus his base monthly salary for each year of service (to a maximum of twenty-four (24) times the base monthly salary); he is also entitled to a proportionate portion of his incentive bonus. The employment agreement further provides that if there is a change in control of the Corporation resulting in the resignation of Mr. Moore, he shall be entitled to receive a lump sum equal to twenty-four (24) times his base monthly salary. Upon Mr. Moore’s termination by the Corporation without cause, all vested options then held by Mr. Moore may be exercised until the earlier of the date of expiry of the options and the first anniversary of the termination of employment. Upon Mr. Moore’s death, all unvested options vest within two (2) years of the date of death and his personal representatives may exercise vested options until the earlier of the date of expiry of the options and the second anniversary of the date of death.

COMPENSATION OF DIRECTORS

During the fiscal year ended November 30, 2006 the Corporation did not pay any fees to Directors. The Corporation paid $18,905 to Carlos K. H. Ho and $12,000 to Peter Tang for consulting services.

Directors are entitled to reimbursement for out-of-pocket expenses incurred in connection with attending meetings of the Board of Directors of the Corporation, and any committee thereof, and are eligible for participation in the Corporation’s Stock Option Plan. An aggregate of 100,000 stock options were granted during this period to Directors. Certain particulars of these options are set out below:

| | | | | | | | | | |

Name | | Securities

Under Options

Granted | | Exercise Or

Base Price

($/Security) | | Market Value

of Securities

Underlying

Options on the

Date of Grant

($/Security) | | Expiration Date |

| (a) | | (b) | | (d) | | (e) | | (f) |

Donald W. Brown | | 100,000 | | $ | 0.88 | | $ | 0.61 | | October 11, 2008 |

11

STOCK OPTION PLAN

At the Corporation’s Annual General Meeting held on May 13, 2003, shareholders approved the adoption of a formal stock option plan (the “2003 Stock Option Plan”). The purpose of the Stock Option Plan is to provide incentive to employees, directors, officers, management companies and consultants who provide services to the Corporation and reduce the cash compensation the Corporation would otherwise be required to pay. The Corporation will be seeking shareholder approval at the Meeting to amend the 2003 Stock Option Plan. See “MATTERS TO BE ACTED UPON AT THE MEETING – AMENDMENTS TO 2003 STOCK OPTION PLAN” above.

As at November 30, 2006 options to purchase an aggregate of 3,310,000 Shares are outstanding under the Corporation’s Stock Option Plan, as follows:

| | | | | | | |

Plan Category | | Number of Securities to

be Issued Upon

Exercise of

Outstanding Options | | Weighted

Average

Exercise Price | | Number of

Securities

Remaining for

Future Issuance |

| | | (a) | | (b) | | (c) |

Stock Option Plan (previously approved by Shareholders) [1] | | 3,310,000 | | $ | 0.92 | | 2,653,768 |

| [1] | The Corporation has no equity compensation plan other than its Stock Option Plan. |

MANAGEMENT CONTRACTS

The management functions of the Corporation are not performed by parties other than the directors and executive officers of the Corporation, and the Corporation is not a party to a management contract with anyone other than Directors or Executive Officers of the Corporation.

Report on Executive Compensation

Composition of the Compensation Committee

Messrs. Mark R. Frederick, Carlos K. H. Ho and Abe Schwartz are members of the Compensation Committee (the “Committee”) of the Board of Directors of the Corporation. The Committee reviews and provides recommendations to the Board of Directors with respect to compensation policies relating to the executive officers of the Corporation and its subsidiaries. None of the members of the Committee are, or have been, officers or employees of the Corporation.

12

The Corporation’s executive compensation is reviewed by the Committee and recommendations are made to the Board of Directors for approval. The Committee is responsible for reviewing the structure and competitiveness of the Corporation’s compensation program.

Components of Compensation

The compensation of the executive officers currently consists of a base salary, options and a performance related bonus. The Committee reviews executive compensation and makes recommendations to the Board for approval. The components of the Corporation’s compensation policy have been designed to attract and retain highly qualified people and align their interests with those of the shareholders of the Corporation.

Compensation of Chief Executive Officer

Mr. James J. Moore has been employed by the Corporation since 1999 as President and Chief Executive Officer. Mr. Moore was paid an annual base salary of $188,250 and a bonus in the amount of $220,000 in 2006 and owns directly and indirectly, or exercises control over, 131,111 Common Shares of the Corporation.

Submitted by the Compensation and Corporate Governance Committee of the Board of Directors.

Mark R. Frederick, (Chairman, Compensation Committee)

Carlos K. H. Ho

Abe Schwartz

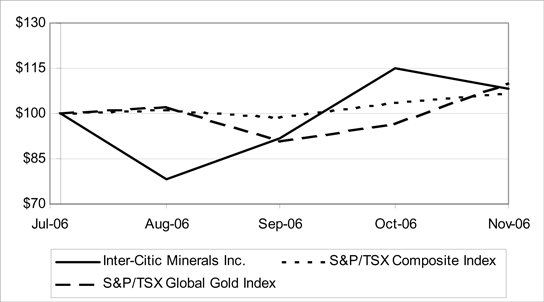

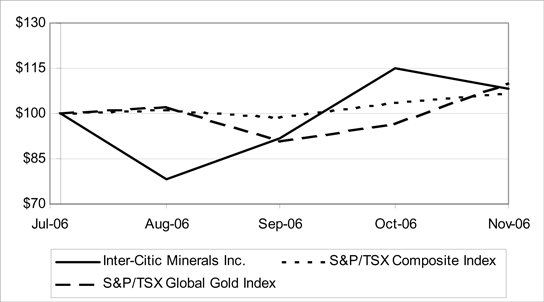

Performance Graph

The following chart compares the total cumulative investment return for $100 invested in the common shares of the Corporation with the total cumulative shareholder return of the S&P/TSX Composite Index and the total cumulative return of the TSX Global Gold Index for the period commencing August 3, 2006 (the date that the Corporation’s shares commenced trading on the TSX) and November 30, 2006 (the fiscal year-end of the Corporation):

13

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

To the knowledge of the directors and officers of the Corporation, no director or executive officer of the Corporation or any subsidiary of the Corporation, no person or company who beneficially owns, directly or indirectly, voting securities of the Corporation or who exercises control or direction over voting securities of the Corporation or a combination of both carrying more than 10% of the voting rights attached to all outstanding voting securities of the Corporation, no director or officer of any such person or company, no proposed director of the Corporation and no associate or affiliate of the any of the foregoing has or had any material interest, direct or indirect, in any transaction since the commencement of the Corporation’s last financial year or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

REPORT ON CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

The Canadian securities administrators have adopted National Instrument 58-101 Disclosure of Corporate Governance Practices (the “Disclosure Instrument”) and National Policy 58-201 Corporate Governance Guidelines (the “Guidelines”), both of which came into force as of June 30, 2005 and effectively replaced the corporate governance guidelines and disclosure policies of the Toronto Stock Exchange. The Disclosure Instrument requires issuers such as the Corporation to disclose the corporate governance practices that they have adopted, while the Guidelines provide guidance on corporate governance practices. In this regard, a brief description of the Corporation’s system of corporate governance, with reference to the items set out in the Disclosure Instrument and the Guidelines, is set forth below.

The Board and management of the Corporation recognize that effective corporate governance is important to the direction and operation of the Corporation in a manner which ultimately enhances shareholder value. As a result, the Corporation has developed and implemented, and continues to develop, implement and refine formal policies and procedures which reflect its ongoing commitment to good corporate governance. The Corporation believes that the corporate governance practices and procedures described below and in Schedule A are appropriate for a company such as the Corporation.

Board of Directors

The Board of Directors is currently composed of nine Directors, seven of the Directors are independent and two are not independent. The Board of Directors is responsible for determining whether or not each director is an independent director. To do this, the Board analyzes all the relationships of the Directors with the Corporation and its subsidiaries. Based on the definition of independence in NI 58-101 and the Board of Directors’ analysis of the relationships between the Corporation and the Directors, the Corporation has determined that Messrs. Dorey, Adrian Ho, Carlos Ho, Hong, Schwartz, Tang and Nieuwenhuyse are all independent directors of the Corporation. Mr. Tang has been an independent director since November, 2006, when he left the position of the corporate Secretary of the Corporation. Mr. Moore is not an independent director since he is employed as the President and C.E.O. of the Corporation. Mark Frederick, the Chair of the Board of Directors, is not an independent director, as he is a partner in the law firm of Miller Thomson LLP, which provides legal services to the Corporation. Independence of the Board from management is achieved with seven of the nine current and nominated directors being outside and independent directors.

The independent directors do not hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. To facilitate open and candid discussion among its independent directors, the Board of Directors has appointed Abe Schwartz, an independent director, to act as “lead director”. The role of the lead director is to provide leadership for the independent directors of the Corporation.

The Board of Directors adopted a mandate on May 18, 2006. The text of the Board of Directors mandate is set out below.

14

The Board is responsible to shareholders.

The role of the Board is to focus on governance and stewardship. Its role is to review corporate direction (strategy), assign responsibility to management for achievement of that direction, establish executive limitations, and monitor performance against those objectives. In fulfilling this role, the Board will regularly review management’s strategic plans so that they continue to be responsive to the changing business environment in which the Corporation operates.

Directors shall exercise their business judgment in a manner consistent with their fiduciary duties. In particular, directors are required to act honestly and in good faith, with a view to the best interests of the Corporation and to exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances.

The Board discharges its responsibility for supervising the management of the business and affairs of the Corporation by delegating the day-to-day management of the Corporation to senior officers. The Board relies on senior officers to keep it appraised of all significant developments affecting the Corporation and its operations.

The Board discharges its responsibilities directly and through delegation to its Committees.

The Board’s responsibilities shall include:

| | (a) | Define Shareholder Expectations for Corporate Performance Through Effective Communication with Shareholders |

| | • | | Satisfy itself that there is effective communication between the Board and the Corporation’s shareholders, other stakeholders, and the public. |

| | • | | Determine, from time to time, the appropriate criteria against which to evaluate performance, and set corporate strategic goals and objectives within this context. |

| | (b) | Establish Strategic Goals, Performance Objectives and Operational Policies |

The Board will review and approve broad strategic corporate objectives and establish corporate values against which corporate performance will be measured. In this regard, the Board will:

| | • | | Approve long-term strategies. |

| | • | | Review and approve management’s strategic and operational plans so that they are consistent with long-term goals. |

| | • | | Approve strategic and operational policies within which management will operate. |

| | • | | Set targets against which to measure corporate and executive performance. |

| | • | | Satisfy itself that a portion of executive compensation is linked appropriately to corporate performance. |

| | • | | Satisfy itself that a process is in place with respect to the appointment, development, evaluation and succession of senior management. |

15

| | • | | Adopting a strategic planning process pursuant to which management develops and proposes, and the Board reviews and approves, significant corporate strategies and objectives, taking into account the opportunities and risks of the business. |

| | • | | Reviewing and approving all major acquisitions, dispositions and investments and all significant financings and other significant matters outside the ordinary course of the Corporation’s business. |

| | (C) | Delegate Management Authority to the Officers |

| | • | | Delegate to the Chairman and President the authority to manage and supervise the business of the Corporation, decisions regarding the Corporation’s ordinary course of business and operations that are not specifically reserved to the Board. |

| | • | | Through the actions of the Board and its individual directors and through Board’s interaction with and expectations of senior officer, promoting a culture of integrity throughout the Corporation consistent with the Corporation’s Code of Business Conduct and Ethics, taking appropriate steps to, to the extent feasible, satisfy itself as to the integrity of the CE and other executive officers of the Corporation, and that the CEO and other executive officers create a culture of integrity throughout the Corporation. |

| | • | | Determine what, if any, executive limitations may be required in the exercise of the authority delegated to management. |

| | • | | Ensuring that the Board receives from senior officers the information and input required to enable the Board to effectively perform its duties. |

| | (d) | Monitor Corporate Performance |

| | • | | Understand, assess and monitor the principal risks of all aspects of the business in which the Corporation is engaged. |

| | • | | Monitor corporate performance against both short-term and long-terns strategic plans and annual performance targets, and monitor compliance with Board policies and the effectiveness of risk management practices. |

| | (e) | Financial and Risk Matters |

| | • | | Overseeing the reliability and integrity of accounting principles and practices followed by management, of the financial statements and other publicly reported financial information, and of the disclosure principles and practices followed by management. |

| | • | | Overseeing the integrity of the Corporation’s internal controls and management information systems by adopting appropriate internal and external audit and control systems. |

| | • | | Reviewing and discussing with management the processes utilized by management with respect to risk assessment and risk management, including for the identification by management of the principal risk of the business of the Corporation, including financial risks, and the implementation by management of appropriate systems to deal with such risks. |

| | (f) | Develop Board Processes |

| | • | | Develop procedures relating to the conduct of the Board’s business and the fulfillment of the Board’s responsibilities. |

16

Directorships

The following Director currently serves on the board of the reporting issuer(s) listed below:

| | |

Name | | Reporting Issuers for which Director currently sits on Board |

Rick Van Nieuwenhuyse | | NovaGold Resources Inc., Alexco Resource Corp., Etruscan Resources Incorporated., Ivana Ventures Inc. |

Meetings Held and Attendance of Directors at Meetings

| | | | | | | | |

Director | | Board of Directors (3 Meetings) | | Audit Committee (2 Meetings) | | Governance and Nominationg

Committee [2](0 Meetings) | | Compensation Committee (3 Meetings) |

Donald W. Brown [1] | | 1 | | 2 | | N/A | | N/A |

Scott C Dorey | | 2 | | N/A | | N/A | | 3 |

Mark R. Frederick | | 3 | | 1 | | N/A | | 3 |

Adrian Pedro K. H. Ho | | 3 | | N/A | | N/A | | N/A |

Carols K. H. Ho | | 3 | | 2 | | N/A | | 3 |

Sherman Hong | | 3 | | N/A | | N/A | | N/A |

James J. Moore | | 3 | | 1 | | N/A | | N/A |

Peter Tang | | 3 | | 2 | | N/A | | 3 |

Abe Schwartz | | 3 | | N/A | | N/A | | 3 |

Rick Van Nieuwenhuyse | | 0 | | N/A | | N/A | | N/A |

Total Attendance Rate | | 86% | | 80% | | N/A | | 100% |

Notes:

| (1) | Mr Brown was appointed to the Board of Directors in October 2006. |

| (2) | There were no meetings of the Governance and Nominating Committee during the year. Governance functions for the past year were undertaken by the full board. |

17

Position Descriptions

The Board of directors has developed written policy descriptions for the chair and the chair of each Board of Directors committee.

Orientation and Continuing Education

The Corporation has not historically provided an orientation or education program for new and continuing directors, but instead provides necessary education (through management and outside professional advisers) on specific issues as they arise. Each new director brings a different skill set and professional background, and with this information, the Board of Directors is able to determine what orientation to the nature and operations of the Corporation’s business will be necessary and relevant to each new director. The Executive Committee is examining the issues of formalized orientation and education of new directors and continuing directors.

Ethical Business Conduct

In 2006 the Board of Directors adopted a written code of Business Conduct and Ethics for the members of the Board, the officers and the employees. In adopting a written code of Business Conduct and Ethics the Board of Directors and the Corporation has reaffirmed its commitment to conduct its business in compliance with applicable laws and regulations and in accordance with the highest ethical principles. This commitment helps to ensure the Corporation’s reputation for honesty, quality and integrity. The Corporation requires that all employees respect and obey all applicable laws. Although not all employees are expected to know the details of these laws, it is important to know enough to determine when to seek advice from supervisors, managers or other appropriate personnel.

Directors and officers are expected to act in a manner that avoids even the appearance of conflict between their personal interests and those of the Corporation. The Directors and officers owe a duty to the Corporation to advance its legitimate interests when the opportunity to do so arises. The Corporation’s policy is to compete aggressively and successfully in today’s competitive business climate and to do so at all times in compliance with all applicable laws in all the markets in which it operates.

A person or company may obtain a copy of the code by writing to the Secretary of the Corporation at 60 Columbia Way, Suite 501, Markham, Ontario L3R 0C9

Nomination of Directors

The Board of Directors considers the appropriate size of the Board each year when it considers the number of directors to recommend to shareholders for election at the annual meeting, taking into account the number of members required to carry out its duties effectively and to maintain a diversity of views and experience.

The Governance and Nominating Committee determines the identity of new nominees and makes recommendations to the Board. New candidates for board nomination are identified through referrals, business relationships with directors and company executives, and direct contact with leaders within the industry. New nominees must have a track record in business management, special expertise in an area of strategic interest to the company, the ability to devote the time required and a willingness to serve. The only member of the Governance and Nominating Committee who is not independent are Mark Frederick who is not an employee of the Corporation.

Compensation

The Corporation has adopted a policy to compensate its executives in a manner keeping with current industry practice for companies of similar size and stature sufficient to attract and retain well qualified and experienced individuals but not to pay excessively. The Board of Directors has determined that the Directors and Named

18

Executive Officers should be compensated in a form and amount which is appropriate for comparative organizations, having regard for such matters as time commitment, responsibility and trends in director and executive compensation. The Board administers the Corporation’s executive compensation policy with advice from the Compensation Committee. The Corporation’s compensation policy is based on cash compensation and incentive stock options.

The only member of the Compensation Committee who is not independent is Mark Frederick who is not an employee of the Corporation. For further information regarding the compensation paid to Directors and Named Executive Officers, please the disclosure under the heading “Statement of Executive Compensation”.

Board Committees

The committees of the Board of Directors include the Audit Committee, the Governance and Nominating Committee and the Compensation Committee.

The Board of Directors and the Audit Committee adopted the Audit Committee Charter in March 16, 2005. As part of the annual audit process, including the preparation of the management discussion and analysis of financial conditions and results of operations contained in the annual report to shareholders, the Audit Committee receives recommendations from management and the auditor appointed by the shareholders of the Corporation. The Committee examines the recommendations and advises the Board of Directors concerning activities that should be taken. The current members of the Audit Committee are Messrs. Brown, C. K. H. Ho, and Tang. Further disclosure regarding the Audit Committee is set for the below under the heading “Audit Committee”.

The Governance and Nominating Committee is responsible for the review and recommendation of corporate governance practices generally, and with specific reference to National Instrument 58-101. It is also responsible for the identification and evaluation of prospective members of the Board. Members of the Governance and Nominating Committee are Messrs. Frederick, Pedro K. H. Ho, and Schwartz.

The Compensation Committee is responsible for recommending to the Board of Directors the compensation of the Directors and executive officers of the Corporation. The members of the Compensation Committee are Messrs. Frederick, Carlos K. H. Ho, and Schwartz.

Assessments

Currently, the Board of Directors takes responsibility for monitoring and assessing its effectiveness and the performance of individual directors, its committees, including reviewing the Board of Directors’ decision-making process and quality and adequacy of information provided by management.

AUDIT COMMITTEE

Overview

The Audit Committee of the Corporation’s Board of Directors is principally responsible for:

| • | | recommending to the Corporation’s Board of Directors the external auditor to be nominated for election by the Corporation’s shareholders at each annual general meeting and negotiating the compensation of such external auditor; |

| • | | overseeing the work of the external auditor; |

| • | | reviewing the Corporation’s annual and interim financial statements, Management Discussion & Analysis (MD&A) and press releases regarding earnings before they are reviewed and approved by the Board of Directors and publicly disseminated by the Corporation; and |

19

| • | | reviewing the Corporation’s financial reporting procedures to ensure adequate procedures are in place for the Corporation’s public disclosure of financial information extracted or derived from its financial statements, other than disclosure described in the previous paragraph. |

The Audit Committee’s Charter

The Corporation’s Board of Directors have adopted a Charter for the Audit Committee which sets out the Committee’s mandate, organization, powers and responsibilities. The complete Charter is attached as an Appendix B to this Information Circular.

Composition of the Audit Committee

The Audit Committee consists of three directors. The following table sets out their names and whether they are ‘independent’ and ‘financially literate’.

| | | | |

Name of Member | | Independent [1] | | Financially Literate[2] |

Donald W. Brown | | Yes | | Yes |

| | |

Carlos K. H. Ho | | Yes | | Yes |

| | |

Peter Tang | | Yes | | Yes |

| (1) | To be considered to be independent, a member of the Committee must not have any direct or indirect ‘material relationship’ with the Corporation. A material relationship is a relationship which could, in the view of the Board of Directors of the Corporation, reasonably interfere with the exercise of a member’s independent judgment. |

| (2) | To be considered financially literate, a member of the Committee must have the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. |

Relevant Education and Experience

In addition to each member’s general business experience, the education and experience of each Audit Committee member relevant to the performance of his responsibilities as an Audit Committee member is as follows:

Donald W. Brown was a Partner at KPMG from 1977 to 1998 Mr. Brown. He served as the managing partner of four locations and lead partner in Entrepreneurial Services practices from 1986 to 1991. Prior to leaving public accounting in 1998, he was Practice Leader for the Industrial Products and Automotive Industries sector of the KPMG Greater Toronto Area Manufacturing, Retail & Distribution Group. He is currently the Managing Director of Catalyst Strategies Inc., a private investment and consulting company, and serves as Chief Financial Officer for a privately-owned group of investment and real estate companies. Mr. Brown has wide-ranging experience in manufacturing, distribution, financial services, real estate and construction, technology, and various service businesses. These have been primarily privately-owned Canadian operations, ranging in size from start-up to volumes of hundreds of millions of dollars. Mr. Brown holds a Bachelor of Commerce degree from the University of Toronto (1969) and qualified as a Chartered Accountant in 1972 and a Certified Financial Planner in 1998.

Carlos K. H. Ho has a B.S. in Business Administration from Boston University (1998). He is Assistant to the Managing Director of Henderson (China) Investment Limited, which is a member of the Hong Kong based Henderson Land Group, which also included five entities that are listed on the Main Board of The Stock Exchange of Hong Kong Limited, namely, Henderson Land Development Company Limited, Henderson Investment Limited, The Hong Kong and China Gas Company Limited, Miramar Hotel and Investment Company, Limited and Hong Kong Ferry (Holdings) Company Limited. Henderson Land Development Company Limited and The Hong Kong and China Gas Company Limited are also constituent stocks in the Hang

20

Seng Index. Mr. Ho is also Director and Compliance Officer of Kuentai Securities Co. Ltd., a member of the Hong Kong Stock Exchange, where he is responsible for the operations of the company. Mr. Ho has extensive experience in the fund management sector in both the US and Hong Kong.

Peter Tang has been a controller with SSAB Swedish Steel Ltd. (formerly Q & T Plate Sales Ltd.) since 1989 and as a company director since 1998. SSAB Canada is a member of the SSAB Svenskt Stål AB Group in Sweden and is the biggest Nordic manufacturer of heavy steel plate. The distribution network covers more than forty countries. Mr. Tang also has fifteen years of experience as an accountant working in public practice in London, England and Vancouver, British Columbia. He graduated from the University of London, England with a Bachelor of Science degree and postgraduate diploma in Accounting and Business Economics from Middlesex Business School in England. He is a Fellow member of the Association of Chartered Certified Accountants (U.K.) and a member of the Certified General Accountants of British Columbia. Mr. Tang has been a director with Inter-Citic Minerals Inc. since 1993.

Audit Committee Oversight

Since the commencement of the Corporation’s most recently completed financial year, there has not been a recommendation of the Audit Committee to nominate or compensate an external auditor which was not adopted by the Corporation’s Board of Directors.

Pre-Approval Policies and Procedures

The Audit Committee has adopted specific policies and procedures for the engagement of non-audit services as described in section III.B “Powers and Responsibilities – Performance & Completion by Auditor of its Work” of the Charter.

External Auditor Service Fees (By Category)

The following table discloses the fees billed to the Corporation by its external auditor during the last two financial years.

| | | | | | | | | | | |

Financial Year Ending | | Audit Fees (1) | | Audit Related Fees (2) | | Tax Fees (3) | | All Other Fees (4) |

November 30, 2006 | | $ | 60,000 | | Nil | | $ | 1,200 | | $ | 100,000 |

November 30, 2005 | | $ | 45,000 | | Nil | | | Nil | | | Nil |

| (1) | The aggregate fees billed for audit services. |

| (2) | The aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Corporation’s financial statements and are not disclosed in the ‘Audit Fees’ column. |

| (3) | The aggregate fees billed for tax compliance, tax advice, and tax planning services. |

| (4) | The aggregate fees billed for professional services other than those listed in the other three columns. |

ADDITIONAL INFORMATION

Additional information relating to the Corporation can be found at SEDAR at www.sedar.com. Shareholders wishing to obtain copies of the Corporation’s financial statements and MD&A, may make such a request in writing to the Corporation at 60 Columbia Way, Suite 501, Markham, Ontario L3R 0C9. Financial information relating to the Corporation is provided in the Corporation’s comparative financial statements and MD&A for its most recently completed financial year.

21

APPROVAL

The contents and sending of this Management Information Circular have been approved by the Directors of the Corporation.

Dated at Toronto, Ontario this 13th day of March, 2007.

James Moore - President

22