SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

May 22, 2007

IBERDROLA, S.A.

(Exact name of registrant as specified in its charter)

Cardenal Gardoqui, 8

48008 Bilbao

Spain

(Address of principal executive offices)

Copies to:

Michael S. Immordino

Latham & Watkins

99 Bishopsgate

London EC2M 3XF

United Kingdom

Tel: +44 20 7710 1000

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F: x Form 40-F: ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: ¨ No: x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable

Exhibit Index

| | |

Exhibit Number | | Description |

| Exhibit 99.1 | | Notice to the Spanish National Securities Market Commission dated May 22, 2007 regarding approval by Iberdrola’s Board of Directors of the commencement of preparatory work for a potential initial public offering of up to 20% of the share capital of its subsidiary Iberdrola Energías Renovables, S.A.U. |

| |

| Exhibit 99.2 | | Press release dated May 22, 2007 regarding approval by Iberdrola’s Board of Directors of the commencement of preparatory work for a potential initial public offering of up to 20% of the share capital of its subsidiary Iberdrola Energías Renovables, S.A.U. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | | | IBERDROLA, S.A. | | |

| | | | (Registrant) | | |

| | | | |

| | | | By | | /s/ JULIAN MARTINEZ-SIMANCAS | | |

| | | | | | Name: Julián Martínez-Simancas | | |

| | | | | | Title: General Secretary and Board Secretary | | |

| | | | |

| Date: May 22, 2007 | | | | | | | | |

Exhibit 99.1

To the National Securities Market Commission

Bilbao, May 22, 2007

Re:Resolutions adopted by the Board of Directors.

Dear Sirs,

We hereby inform you that, as of the date hereof, the Board of Directors of Iberdrola, S.A. (“IBERDROLA” or the “Company”) has been informed of and has approved the start of the preliminary preparatory work for a potential initial public offering of Iberdrola Energías Renovables, S.A.U. (“IBERENOVA”) of up to 20% of IBERENOVA’s share capital and the admission to listing on the Spanish stock exchanges (Bolsas de Valores) and to trading through the Automated Quotation System (Sistema de Interconexión Bursátil) of the shares of IBERENOVA. The objective of said transactions, that would take place, to the extent possible, in the last quarter of the year, would be to finance the growth of the IBERDROLA Group’s renewable energies business, consolidating and strengthening, at the same time, its financial position.

Likewise, the Board of Directors has been informed of and has expressed its support to the project for reorganising the renewable energies business, which is currently being designed and will be carried out before the potential initial public offering and listing of IBERENOVA’s shares on the Spanish stock exchanges, in order to consolidate into IBERENOVA all the companies of the IBERDROLA Group and the Scottish Power Group involved in the renewable energies business.

As always, we remain at your disposal to discuss any of the issues raised in this letter.

Yours faithfully,

Mr. Julián Martínez-Simancas Sánchez

IMPORTANT INFORMATION

This announcement is not an offer for sale of securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended. Iberdrola Energías Renovables, S.A.U. does not intend to register any portion of the offering of the securities in the United States or to conduct a public offering of the securities in the United States. Copies of this announcement are not being made and may not be distributed or sent into the United States.

Exhibit 99.2

PRESS release

22 May, 2007

| | |

| | The Board approves initial preparations to carry out the operation in the last quarter of this year IBERDROLA TO LIST SHARES IN 20% OF ITS RENEWABLE ENERGY SUBSIDIARY THROUGH INCREASE IN CAPITAL • IBERENOVA will thus obtain financing for future growth and development without affecting financial strength of the IBERDROLA group, thus meeting one of its key strategic objectives • The Company will first restructure this business area, incorporating all renewable energy-related IBERDROLA and ScottishPower units in its IBERENOVA subsidiary • As a result of the ScottishPower operation, the IBERDROLA group has more than 6,500 MW in operative renewable energy capacity, and a pipeline of almost 38,000 MW The Board of IBERDROLA today approved plans to sell up to 20% of shares in its renewable energy subsidiary IBERDROLA Energías Renovables (IBERENOVA) through a capital increase to be followed by an Initial Public Share Offer (IPO) to take place in the final quarter of this year. Meeting at the Villarino hydroelectric plant in Salamanca, the IBERDROLA Board approved initial preparations for the public share offer by this subsidiary, and also authorized a prior reorganization of this business area with the goal of incorporating all renewable-energy related susbidiaries of IBERDROLA and ScottishPower companies in IBERENOVA. The decision is fully consistent with IBERDROLA’s growth model, which aims to consolidate leadership in the wind energy sector, in the framework of its commitment to defending the environment and sustainable development, while conserving financial strength. |

Not for distribution in the United States.

Ø Communications

The listing of up to 20% of IBERENOVA will give the subsidiary increased visibility in the the markets and provide resources to finance growth, without affecting the financial strength of the IBERDROLA group, one of its key strategic priorities.

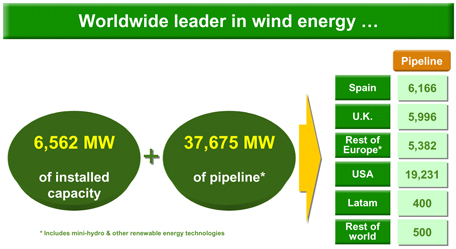

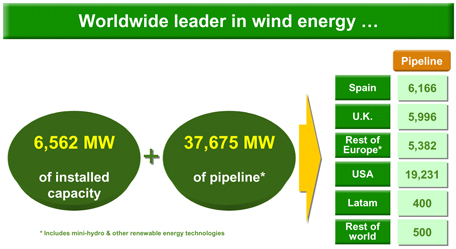

The IBERDROLA group currently has an operational renewable energy capacity of 6,562 megawatts (MW). In addition to the more than 4,500 MW in IBERDROLA capacity at the end of the first quarter, the Company in April incorporated more than 2,000 MW mostly from ScottishPower and its U.S. unit PPM.

IBERDROLA also has a project pipeline worldwide of approximately 38,000 MW: around 6,000 MW is in Spain and a similar amount in the UK, nearly 5,400 MW in the rest of the Europe, more than 19,200 MW in the U.S., 400 MW in Latin America and 500 MW in the rest of the world.

Not for distribution in the United States.

Ø Communications

| | |

| | IMPORTANT INFORMATION This announcement is not an offer for sale of securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended. Iberdrola Energías Renovables, S.A.U. does not intend to register any portion of the offering of the securities in the United States or to conduct a public offering of the securities in the United States. Copies of this announcement are not being made and may not be distributed or sent into the United States. FORWARD-LOOKING STATEMENTS This communication contains forward-looking information and statements about Iberdrola Energías Renovables, S.A.U. and otherwise, including financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, capital expenditures, synergies, products and services, and statements regarding future performance. Forward-looking statements are statements that are not historical facts and are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although Iberdrola, S.A. believes that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Iberdrola, S.A. shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Iberdrola, S.A., that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public documents sent by Iberdrola, S.A. to theComisión Nacional del Mercado de Valores. Forward-looking statements are not guarantees of future performance. They have not been reviewed by the auditors of Iberdrola, S.A. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date they were made. All subsequent oral or written forward-looking statements attributable to Iberdrola, S.A. or any of its members, directors, officers, employees or any persons acting on its behalf are expressly qualified in their entirety by the cautionary statement above. All forward-looking statements included herein are based on information available to Iberdrola, S.A. on the date hereof. Except as required by applicable law, Iberdrola, S.A. does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |

Not for distribution in the United States.

Ø Communications