SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

June 26, 2007

IBERDROLA, S.A.

(Exact name of registrant as specified in its charter)

Cardenal Gardoqui, 8

48008 Bilbao

Spain

(Address of principal executive offices)

Copies to:

Michael S. Immordino

Latham & Watkins

99 Bishopsgate

London EC2M 3XF

United Kingdom

Tel: +44 20 7710 1000

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20-F: x Form 40-F: ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: ¨ No: x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| IBERDROLA, S.A. |

| (Registrant) |

| |

| By | | /s/ JULIAN MARTINEZ-SIMANCAS |

| | Name: Julián Martínez-Simancas |

| | Title: General Secretary and Board Secretary |

Date: June 26, 2007

Exhibit Index

| | |

| Exhibit Number | | Description |

| |

| Exhibit 99.1 | | Press Release issued by Iberdrola, S.A. on June 25, 2007, regarding its merger with Energy East Corporation |

| |

| Exhibit 99.2 | | Notification to the Spanish Securities and Exchange Commission dated June 25, 2007, regarding the authorization of the merger with Energy East Corporation by the board of directors of Iberdrola, S.A. |

| |

| Exhibit 99.3 | | Agreement and Plan of Merger dated as of June 25, 2007 by and among Iberdrola, S.A., Green Acquisition Capital, Inc. and Energy East Corporation |

| |

| Exhibit 99.4 | | Notification to the Spanish Securities and Exchange Commission dated June 26, 2007, regarding the third execution of the capital stock increase of Iberdrola, S.A. and the admission to listing of the new shares on the Bolsas de Valores |

| |

| Exhibit 99.5 | | Shareholder Information Pack dated May 2007 |

Exhibit 99.1

PRESS RELEASE

25 June 2007

The Board of Directors of the Spanish company unanimously endorsed the offer, which has already been approved by Energy East’s Board

IBERDROLA REACHES FRIENDLY AGREEMENT TO ACQUIRE 100% OF U.S.

UTILITY ENERGY EAST

KEY ASPECTS

Energy East operates in the distribution, generation and supply businesses in five U.S. States: New York, Maine, Massachusetts, New Hampshire and Connecticut

IBERDROLA will pay 3.4 billion euros in cash (28.50 US $ per share), as well as assume Energy East’s debt of 3 billion euros

The transaction, subject to approval by Energy East’s shareholders and to receipt of the necessary authorizations, is expected to close in 2008

IBERDROLA Chairman Ignacio Galán said “the transaction enhances our international expansion and consolidates our position as one of the world’s leading electricity companies”

IBERDROLA GROWTH

As a result of this transaction, for which contacts began in the summer of 2006, IBERDROLA will become one of the largest electricity operators in the world with an enterprise value, as of today, of approximately €83 billion

IBERDROLA will also increase its distributed energy volumes by 25%, with its customer base rising to over 27 million and will enhance its generating capacity to nearly 42,000 MW

Communications

The Boards of IBERDROLA and US company Energy East, meeting today in Madrid and New York, respectively, have agreed on the integration of Energy East in the Group IBERDROLA, whereby IBERDROLA will acquire 100% of Energy East. The Board of IBERDROLA has unanimously endorsed the proposal of its Chairman and CEO, Ignacio Galán, to make an offer for the US utility, immediately approved afterwards by Energy East’s Board.

For the purpose of integrating Energy East in the Group, IBERDROLA will provide the necessary financial resources to its subsidiary in the United States Green Acquisition Capital Inc.

This friendly transaction, which will be effected via a merger of Green Acquisition Capital Inc. into Energy East, values each Energy East share at 28.50 dollars (€21.08) and the ordinary share capital at approximately 4,500 million dollars (€3,400 million). This represents a premium of 20.2% over the average share price of the company over the past 30 days (27.4% over last Friday’s closing price). The transaction is valued at €3.4 billion, which added to a debt of €3 billion gives Energy East an enterprise value of €6.4 billion.

The Board of IBERDROLA, which today unanimously approved the transaction, praised the capacity of the Chairman and the management team not only in agreeing two consecutive friendly transactions in less than a year but also in improving the profile of the Company. The Board will analyze different financing alternatives for the transaction and select the one which best meets the Company’s requirements from the point of view of maintaining its financial solidity and ratings.

The IBERDROLA Board highlighted the achievements of a management team that has in a very few years succeeded in driving the Company’s transition from a Spanish group to a multinational company. From €12 billion in market capitalization it has grown to €50 billion with a more balanced mix of activities between regulated and non-regulated business and with a geographical diversity.

The agreement between IBERDROLA and Energy East, for which Banc of America Securities and ABN AMRO acted as advisers to IBERDROLA, is subject to approval by the Shareholders of Energy East. Due to the fact that Energy East and its subsidiaries operate in a regulated sector, the relevant authorizations will be required. This process is expected to be completed during 2008.

Platform for growth

IBERDROLA chairman Ignacio Galán said that “the transaction with Energy East fits with the philosophy of our Strategic Plan, will serve to enhance the international expansion we initiated several years ago, essentially in deregulated markets with stable growth, and consolidate our position as one of the world’s leading electricity companies.”

Communications

Galán said “the United States represent an important opportunity for growth, and the acquisition of Energy East is a step forward in our strategy of building an Atlantic platform.”

Galán said “the acquisition of Energy East will allow IBERDROLA to strengthen its commitment to shareholders, improving Group results, dividend and profitability. It will also enhance its commitment to customers, through improved quality of supply, and to society, contributing to sustainable development thanks to our world leadership in renewable energy and to increased investments devoted to reducing emissions”.

“IBERDROLA has a strong record of working with local communities to address their energy needs and reach their renewable targets; we welcome Energy East’s employees and look forward to leveraging our combined experience to help to address some of the most challenging energy and environmental issues in the Northeastern U.S.,” he said.

Wesley von Schack, Chairman and Chief Executive Officer of Energy East, said “this transaction is a unique opportunity to deliver enhanced value to Energy East’s shareholders, and to build a stronger future for our company, employees and the States we serve.”

“Policymakers now recognize the need for our industry to make significant investments in our energy infrastructure. Our objective is to team with the States in which we do business to help meet the goals they have established to increase renewable sources of energy, improve energy efficiency and invest in a secure and reliable energy infrastructure.” “We believe our combination with IBERDROLA will not only accelerate our progress but will transform the way we do business,” he said.

Von Schack added that “furthermore, while IBERDROLA is a global energy company, its operations are managed locally; I’m therefore delighted to assure Energy East’s 3 million customers that they can continue to rely on the same local people whom they’ve come to know and trust to provide exceptional customer service,” he said.

An integrated company

Energy East is a company incorporated under New York State law and its shares trade on the New York Stock Exchange. It is the parent company for a group of companies dedicated to production, distribution and sales of electricity and natural gas in five states in the northeast of the United States: New York, Maine, Massachusetts, New Hampshire and Connecticut.

Energy East has 1,825,000 electric points of supply, a transmission network of 13,243 kilometers and 125,613 kilometers in distribution, and in 2006 it distributed a total of 40,450 gigawatt hours (GWh). The company has a generation capacity of 555 megawatts (MW).

Communications

Energy East also carries out gas distribution, with 920,300 points of supply. It has a distribution network amounting to 39,657 kilometers and last year distributed 5.20 bcm. It also has a gas transport network of 295 kilometers.

Exceptional opportunity

The transaction accelerates the achievement of the internationalization objective in IBERDROLA’s Strategic Plan and fits with its objective of expanding its presence in the U.S. market, especially in the wind power sector, approved in October 2006. The acquisition of Energy East builds on the recent purchase of ScottishPower. Preliminary work related to the transaction began in early 2006 and contacts started last summer have continued until the present date due to the prior need to complete the acquisition of the Scottish company.

The integration of Energy East, with over three million customers, in the IBERDROLA group enhances the Spanish Company’s position in the world energy market and in the United States in particular, a country where the Company is already the second largest operator in wind energy, one of the most relevant agents in the gas storage business and with operations in thermal generation. Furthermore, it will strengthen IBERDROLA’s position in gas trading, as well as increase the number of electricity points of supply by 1,825,000 and gas points of supply by 920,300, while increasing the Group’s generating capacity.

The operation gives IBERDROLA an excellent opportunity to acquire a vertically integrated company with complementary capacities in the U.S. market and significant scope for future investment in generating capacity and in new networks. The agreement will allow IBERDROLA to diversify not only geographically (Spain, UK, North America and Latin America), but also in generating technologies (nuclear, coal, wind, hydro and gas), and will allow the Group to combine a better mix of regulated and non regulated businesses.

IBERDROLA believes that the friendly agreement with Energy East will be strategically attractive and contribute to the Company’s development in the U.S. market. Following the acquisition, the new IBERDROLA group will consolidate its position as one of the largest electricity operators in the world, with an enterprise value, as of today, of over 83 billion euros.

The Company will also increase its distributed energy to 210 terawatts hour (TWh) a year, an increase of 25% over the 170 TWh currently distributed, enhance its number of customers to 27 million worldwide: 24 million electricity customers (+8% from the 22 million currently) and three million gas customers (+40%), as well as increasing its electricity generating capacity to close to 42,000 MW.

The transaction will allow IBERDROLA the tax optimization of its current position in renewable energy in the U.S. With the integration of ScottishPower and the acquisition of other companies, IBERDROLA is the second largest wind energy operator in the United States with close to 1,700 MW of operating capacity and a pipeline in development of more than 19,000 MW in renewables.

Communications

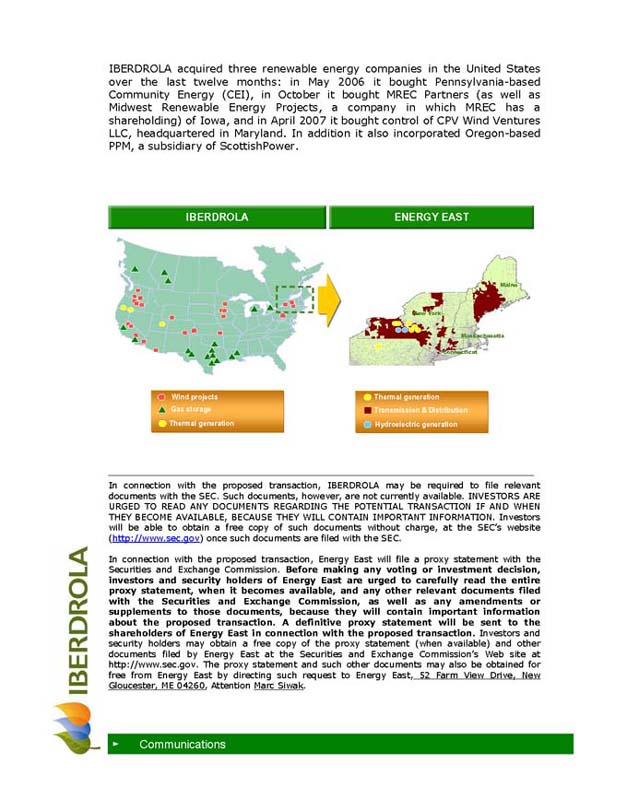

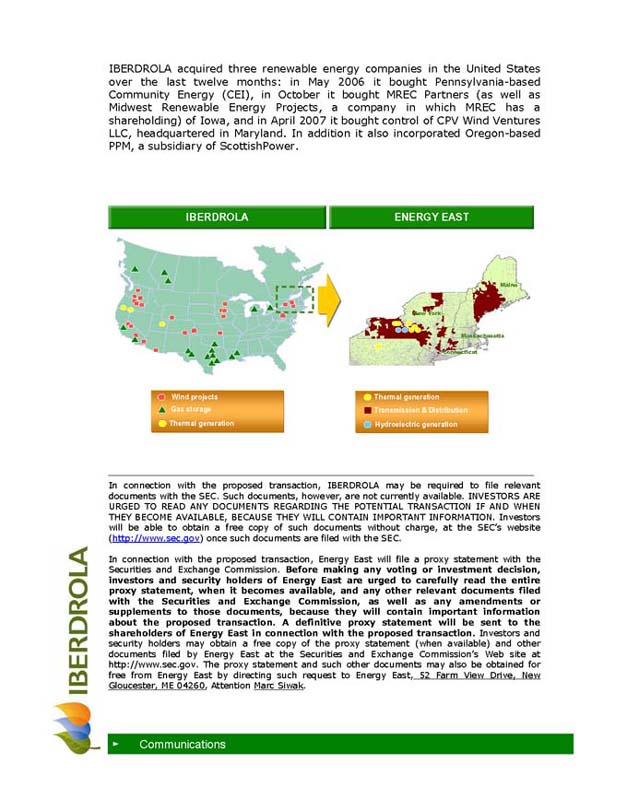

IBERDROLA acquired three renewable energy companies in the United States over the last twelve months: in May 2006 it bought Pennsylvania-based Community Energy (CEI), in October it bought MREC Partners (as well as Midwest Renewable Energy Projects, a company in which MREC has a shareholding) of Iowa, and in April 2007 it bought control of CPV Wind Ventures LLC, headquartered in Maryland. In addition it also incorporated Oregon-based PPM, a subsidiary of ScottishPower.

IBERDROLA ENERGY EAST

Maine

New York

Massachusetts Connecticut

Wind projects Gas storage

Thermal generation

Thermal generation Transmission & Distribution

Hydroelectric generation

In connection with the proposed transaction, IBERDROLA may be required to file relevant documents with the SEC. Such documents, however, are not currently available. INVESTORS ARE URGED TO READ ANY DOCUMENTS REGARDING THE POTENTIAL TRANSACTION IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain a free copy of such documents without charge, at the SEC’s website (http://www.sec.gov) once such documents are filed with the SEC.

In connection with the proposed transaction, Energy East will file a proxy statement with the Securities and Exchange Commission. Before making any voting or investment decision, investors and security holders of Energy East are urged to carefully read the entire proxy statement, when it becomes available, and any other relevant documents filed with the Securities and Exchange Commission, as well as any amendments or supplements to those documents, because they will contain important information about the proposed transaction. A definitive proxy statement will be sent to the shareholders of Energy East in connection with the proposed transaction. Investors and security holders may obtain a free copy of the proxy statement (when available) and other documents filed by Energy East at the Securities and Exchange Commission’s Web site at http://www.sec.gov. The proxy statement and such other documents may also be obtained for free from Energy East by directing such request to Energy East, 52 Farm View Drive, New Gloucester, ME 04260, Attention Marc Siwak.

Communications

Energy East, its directors, executive officers and other members of its management, employees, and certain other persons may be deemed to be participants in the solicitation of proxies from Energy East shareholders in connection with the proposed transaction. Information about the interests of Energy East’s participants in the solicitation is set forth in Energy East’s proxy statements and Annual Reports on Form 10-K, previously filed with the Securities and Exchange Commission, and in the proxy statement relating to the transaction when it becomes available

FORWARD LOOKING STATEMENTS

This communication contains forward-looking information and statements about Energy East and Iberdrola S.A. and their combined businesses after completion of the proposed transaction. Forward-looking statements are statements that are not historical facts. These statements include financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, products and services, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although the managements of Energy East Corporation and Iberdrola, S.A. believe that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Energy East Corporation and Iberdrola, S.A. shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Energy East Corporation and Iberdrola, S.A., that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public documents sent by Energy East and Iberdrola, S.A. to their regulators and under “Risk Factors” in their annual and quarterly reports filed with the SEC. Except as required by applicable law, neither Energy East nor Iberdrola, S.A. undertakes any obligation to update any forward-looking information or statements.

In addition to the risks and uncertainties set out in SEC reports or periodic reports, the proposed transaction described in this release could be affected by, among other things, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings that may be instituted against Energy East Corporation and others related to the merger agreement; failure to obtain shareholder approval or any other failure to satisfy other conditions required to complete the merger, including required regulatory approvals; risks that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; and the amount of the costs, fees, expenses and charges related to the merger.

About Iberdrola: Iberdrola is a global utility with activities in the full value chain of the electricity business from generation to distribution. The main markets where the company operates are Spain, the UK, the US, Mexico and Brazil. Globally the company has approximately 22 million electricity points of supply and almost 40,000 MW of generation capacity of which over 6,500 MW are from renewable energies, showing the strong commitment of the company to the environment.

About Energy East: Energy East Corporation is a respected super-regional energy services and delivery company serving about 3 million customers in the US throughout upstate New York and New England. By providing outstanding customer service and meeting customers’ energy requirements in an environmentally-responsible manner, Energy East will continue to be a valuable asset to the communities it serves.

Communications

Exhibit 99.2

COMISIÓN NACIONALDEL MERCADODE VALORES

Paseo de la Castellana, 19

28046 Madrid

Bilbao, June 25, 2007

NATIONAL SECURITIES MARKET COMMISSION – Significant Event

Dear Sirs:

Pursuant to the provisions of Section 82 of Law 24/1988, of July 28, on the Securities Market (Ley 24/1988, de 28 de julio, del Mercado de Valores) and related provisions, we hereby advise you that on June 25, 2007, the Boards of Directors of IBERDROLA, S.A. (hereinafter, “Iberdrola” or the “Company”) and of ENERGY EAST CORPORATION (“Energy East”) reached an agreement on the terms of an offer whereby Energy East will be combined with the Iberdrola group and Iberdrola will become the holder of all of the shares of Energy East (the “Transaction”). Pursuant to such agreement, the Board of Directors of Energy East will recommend the Transaction to its shareholders in accordance with the terms of the agreement.

| I. | Description of the Transaction |

Energy East is a U.S. company the shares of which are listed on the New York Stock Exchange (NYSE) (ticker: EAS), and that is the parent of a group of companies dedicated to the production, distribution and supply of electric power and natural gas.

As provided in the agreement reached with Energy East, Iberdrola will acquire 100% of the shares of Energy East and Energy East shareholders will receive, in consideration for their shares, a cash amount to be determined in accordance with the following equation:

| | |

For each share of Energy East: | | 28.50 U.S. dollars (21.08 euros1) |

Under the Transaction, each share of Energy East is valued at twenty-eight U.S. dollars with fifty cents 28.50 U.S. dollars (twenty-one euros with eight cents (21.08 euros)) and the common stock of Energy East is valued at, approximately, four thousand five hundred and sixty (4,560) million U.S. dollars (three thousand three hundred and seventy-three (3,373) million euros). Thus, these terms represent a premium:

| (i) | of twenty-seven point four (27.4) per cent. over the closing price of twenty-two U.S. dollars with thirty-seven cents (22.37 U.S. dollars) (sixteen euros with fifty-five cents (16.55 euros)) per share of Energy East as of June 22, 2007 (the last business day prior to the date of this notice of significant event); and |

1 | At an exchange rate of 1 U.S. dollar: 0.7397 euro cents. Such exchange rate (prevailing on May 29, 2007) has been used to convert amounts in euros and U.S. dollars in this notice of significant event. |

1

| (ii) | of twenty point two (20.2) per cent. over the average price per share of Energy East during the thirty days preceding June 22, 2007, which was twenty-three U.S. dollars with seventy cents (23.70 U.S. dollars) (seventeen euros with fifty-three cents (17.53 euros)) per share of Energy East. |

Iberdrola believes that the combination with Energy East is strategically attractive. The Transaction will contribute to Iberdrola’s development in the North American market. In particular, the combination of Energy East and Iberdrola will:

| - | reinforce Iberdrola’s leadership position in the electricity market in terms of enterprise value; |

| - | increase Iberdrola’s presence in the American market, with an additional 1,825,000 electricity supply points and 920,300 gas supply points; |

| - | increase total installed generating capacity by 555 MW; and |

| - | have a positive effect on earnings per share and cash flow per share before any possible savings or optimization stemming from the Transaction. |

| II. | Rationale and reasons for the Transaction |

The Transaction, which is in line with Iberdrola’s focus on international expansion and its interest in increasing its presence in the U.S. market, will accelerate the achievement of the objectives outlined in the Company’s 2007-2009 Strategic Plan, and will allow the tax optimization of Iberdrola’s current position in renewable energies in the U.S.

The combination of Energy East with the Iberdrola Group will:

| | • | | reaffirm Iberdrola’s position in the global energy market and in the U.S. market, where Iberdrola has operations in the areas of wind power, thermal generation and the gas trading and storage business; |

| | • | | strengthen Iberdrola’s position in the supply and acquisition of gas; |

| | • | | increase the number of electricity supply points by 1,825,000 (up to 23.7 million electricity supply points) and of gas supply points by 920,300; and |

| | • | | increase the generating capacity of the Iberdrola Group up to circa 40,000 MW, of which more than 6,500 will be from renewable energies. |

The proposed combination provides Iberdrola with an exceptional opportunity to acquire a vertically-integrated company, with complementary capabilities in the U.S. market and with significant opportunities for future investment in generating capacity and in new networks. The combination of Energy East with Iberdrola will allow the Iberdrola Group to increase its diversification in terms of:

| | • | | geographic scope (Spain, the United Kingdom, Central America, North America and South America); |

| | • | | generation’s technologies mix (nuclear, coal, wind, water and gas); and |

| | • | | business mix (regulated and non-regulated). |

Iberdrola will be able to draw upon the considerable experience of Energy East in regulated markets as well as upon its strong capabilities in retail sales and supply. Likewise, Energy East will benefit from Iberdrola’s highest-quality standards in the generation and supply business.

2

| III. | Structure of the Transaction |

Iberdrola and Energy East have executed a merger agreement (the “Merger Agreement”) setting forth the terms and conditions of the agreement reached by both companies and pursuant to which the Transaction will be carried out.

In order to carry out the combination of Energy East with the Iberdrola group, Iberdrola has incorporated a subsidiary in the United States (GREEN ACQUISITION CAPITAL, INC., “Green”) and will provide it with the financial resources needed to implement the Transaction. The acquisition of the shares of Energy East by Iberdrola will be carried out in accordance with the provisions of the Merger Agreement, by means of a merger of Green (merged company) into Energy East (merging company).

The above-mentioned merger, which will be governed by the laws of the State of New York (United States), will have the following effects, among others:

| (i) | it will extinguish the legal existence of Green; |

| (ii) | the assets of Green will be transferreden bloc to Energy East; |

| (iii) | the shares of Energy East that are outstanding at the time immediately prior to the merger will be cancelled, and will give their holders the right to receive twenty-eight U.S. dollars with fifty cents (28.50 U.S. dollars) (twenty-one euros with eight cents (21.08 euros)) in cash per share of Energy East so cancelled; and |

| (iv) | the shares of Green outstanding at the time immediately prior to the merger will be converted into shares of Energy East, such that Iberdrola will become the holder of one hundred (100) per cent. of the capital stock of Energy East. |

The Transaction, in which ABN AMRO CORPORATE FINANCE LIMITED and BANCOF AMERICA SECURITIES LLC act as Iberdrola’s advisors, is subject to approval by the General Shareholders’ Meeting of Energy East. Additionally, and given that Energy East and the companies within its group carry out their activities within an industry that is highly regulated and supervised by the federal authorities, the state authorities in each of the states in which the group operates (Maine, New York, Massachusetts, New Hampshire and Connecticut) and local authorities, it will be necessary to obtain the required authorizations from the competent authorities in order to complete the Transaction. In this regard, it is expected that such authorizations from the relevant authorities will be obtained during 2008.

| IV. | Information regarding Energy East |

Energy East is a company incorporated under the laws of the State of New York (United States), the shares of which are listed on the New York Stock Exchange (ticker: EAS). Energy East is the parent of a group of companies dedicated to the production, distribution and supply of electric power and natural gas. The Energy East group carries out its activities in the following states of the northeastern region of the United States: New York, Maine, Massachusetts, New Hampshire and Connecticut.

As regards the operating data on the electricity business of Energy East, it has 1,825,000 supply points, a transmission network of 13,243 km. and a supply network of 125,613 km. In 2006, the electricity supplied by Energy East came to 40,450 GWh. In addition, Energy East has a generating capacity of 555 MW.

3

Energy East also carries out gas supply activities, now having 920,300 supply points. It has a supply network of 39,657 km., and in 2006, the volume of gas supplied came to 5.20 bcm. In addition, it has a gas transmission network of 295 km.

The table below shows the supply points of Energy East by subsidiary:

| | | | |

Supply points | | Electricity | | Gas |

NYSEG | | 870,000 | | 257,000 |

RG&E | | 359,000 | | 297,000 |

SCG | | - | | 175,000 |

CMP | | 596,000 | | - |

Berkshire | | - | | 36,300 |

CNG | | - | | 155,000 |

| | | | |

TOTAL | | 1,825,000 | | 920,300 |

| | | | |

Legend:

“NYSEG”: New York State Electric & Gas Corporation

“RG&E”: Rochester Gas and Electric Corporation

“SCG”: The Southern Connecticut Gas Company

“CMP”: Central Maine Power Company

“Berkshire”: Berkshire Energy Resources

“CNG”: Connecticut Natural Gas Corporation

The contribution of the electricity business to the EBITDA, Net Income and Total Assets of Energy East is equal to approximately sixty-five (65) per cent. Below are the figures for each indicator by type of business (exclusive of the figures for the holding company and other non-regulated businesses):

| | | | | | | | | | | | |

Million euros | | Electricity | | | Gas | | | Total |

EBITDA | | 486 | | 66 | % | | 250 | | 34 | % | | 735 |

Net Income | | 167 | | 71 | % | | 68 | | 29 | % | | 234 |

| | | | | | | | | | | | |

Total Assets | | 4,952 | | 63 | % | | 2,851 | | 37 | % | | 7,804 |

| | | | | | | | | | | | |

| V. | Financing of the Transaction |

The total consideration that must be paid to the shareholders of Energy East in order for Iberdrola to acquire one hundred (100) per cent. of the capital stock of Energy East is four thousand five hundred and sixty (4,560) million U.S. dollars (three thousand three hundred and seventy-three (3,373) million euros).

The proceeds required to finance the Transaction will be obtained by means of the structure that best suits the needs of Iberdrola. In this regard, Iberdrola is currently analyzing different structures, including issues of debt, credit facilities, a capital increase or a combination of any of the foregoing.

4

| VI. | Terms and conditions of the Transaction |

The Merger Agreement contains the customary terms and conditions in this type of transaction.

In particular, Energy East has agreed to pay Iberdrola a termination fee of forty-five (45) million U.S. dollars (approximately thirty-three point twenty-nine (33.29) million euros) in the following events (among others):

| (a) | if, after the date of this notice, a proposed acquisition of Energy East by a third party is announced and after such announcement (provided that such proposed acquisition has not been withdrawn), Iberdrola and/or Energy East decide(s) to terminate the Merger Agreement because: |

| | - | the merger of Energy East with Green has not been consummated within twelve months following the date of this notice (provided that all of the conditions required for the closing of the Transaction other than obtaining the required authorizations have been met, neither party has extended the aforementioned twelve-month period for an additional period of six months for purposes of obtaining such authorizations and the party terminating the Merger Agreement has not breached its obligations thereunder); or |

| | - | the Transaction is not approved by the General Shareholders’ Meeting of Energy East, |

| | and during the twelve months following the termination of the Merger Agreement, Energy East reaches an agreement with the third party in question with respect to the proposed acquisition or during the three months following such termination, Energy East reaches an agreement related to a takeover proposal with any other person; or |

| (b) | if, after the date of this notice, a proposed acquisition of Energy East by a third party is announced and while such proposed acquisition has not been withdrawn, Iberdrola terminates the Merger Agreement as a result of (i) the lack of veracity of the representations and warranties of Energy East under the Merger Agreement; (ii) the breach by Energy East of its obligations under the Merger Agreement which may not be cured before the execution of the merger; |

| (c) | if Energy East does not recommend or does not confirm its recommendation to the shareholders regarding the offer made by Iberdrola, or recommends an offer made by a third party, pursuant to the terms and subject to the conditions of the Merger Agreement; or |

| (d) | if Energy East terminates the Merger Agreement as a result of the signing of an acquisition agreement with respect to an offer made by a third party that is higher than that of Iberdrola. |

Yours truly,

[Seal of IBERDROLA’s Secretary]

5

IMPORTANT INFORMATION

This communication does not constitute an offer to purchase, sell or exchange or the solicitation of an offer to purchase, sell or exchange any securities. The shares of IBERDROLA, S.A. may not be offered or sold in the United States of America except pursuant to an effective registration statement under the Securities Act or pursuant to a valid exemption from registration.

This communication contains forward-looking information and statements about IBERDROLA, S.A., including financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, capital expenditures, synergies, products and services, and statements regarding future performance. Forward-looking statements are statements that are not historical facts and are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions.

Although IBERDROLA, S.A. believes that the expectations reflected in such forward-looking statements are reasonable, investors and holders of IBERDROLA, S.A. shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of IBERDROLA, S.A., that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the public documents sent by IBERDROLA, S.A. to theCOMISIÓN NACIONALDEL MERCADODE VALORES.

Forward-looking statements are not guarantees of future performance. They have not been reviewed by the auditors of IBERDROLA, S.A. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date they were made. All subsequent oral or written forward-looking statements attributable to IBERDROLA, S.A. or any of its members, directors, officers, employees or any persons acting on its behalf are expressly qualified in their entirety by the cautionary statement above. All forward-looking statements included herein are based on information available to IBERDROLA, S.A. on the date hereof. Except as required by applicable law, IBERDROLA, S.A. does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In connection with a potential transaction involving ENERGY EAST CORPORATION, IBERDROLA, S.A. may be required to file relevant documents with the SEC. Such documents, however, are not currently available.INVESTORSAREURGEDTOREADANYDOCUMENTSREGARDINGTHEPOTENTIALTRANSACTIONIFANDWHENTHEYBECOMEAVAILABLE,BECAUSETHEYWILLCONTAINIMPORTANTINFORMATION. Investors will be able to obtain a free copy of such documents without charge, at the SEC’s website (http://www.sec.gov) once such documents are filed with the SEC. Copies of such documents may also be obtained from IBERDROLA, S.A., without charge, once they are filed with the SEC.

6

Exhibit 99.3

EXECUTION COPY

AGREEMENT AND PLAN OF MERGER

Dated as of June 25, 2007

among

IBERDROLA, S.A.,

GREEN ACQUISITION CAPITAL, INC.

and

ENERGY EAST CORPORATION

TABLE OF CONTENTS

i

ii

iii

iv

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF MERGER, dated as of June 25, 2007 (this “Agreement”), is among IBERDROLA, S.A., a corporation (sociedad anónima) organized under the Laws of the Kingdom of Spain (“Parent”), GREEN ACQUISITION CAPITAL, INC., a New York corporation and a wholly owned Subsidiary of Parent (“Merger Sub”), and ENERGY EAST CORPORATION, a New York corporation (the “Company”) (Parent, Merger Sub and the Company being hereinafter collectively referred to as the “Parties”). Certain terms used in this Agreement without definition shall have their meanings as defined inSection 7.11.

W I T N E S S E T H :

WHEREAS, the respective Boards of Directors or similar governing bodies of Parent, Merger Sub and the Company each deems it advisable that Parent acquire the Company on the terms and subject to the conditions provided for in this Agreement;

WHEREAS, in furtherance thereof it is proposed that such acquisition be accomplished by the merger of Merger Sub with and into the Company, with the Company as the surviving corporation, in accordance with the New York Business Corporation Law (the “NYBCL”), pursuant to which all of the shares of common stock, $0.01 par value, of the Company (“Company Common Stock”) issued and outstanding immediately prior to the Effective Time (each, a “Share” and, collectively, the “Shares”) (other than certain Shares as provided inSection 1.7(b)) will be converted into the right to receive the Merger Consideration, on the terms and subject to the conditions provided for in this Agreement (the “Merger”); and

WHEREAS, the respective Boards of Directors or similar governing bodies of Parent (on its own behalf and as the sole shareholder of Merger Sub), Merger Sub and the Company have each approved this Agreement and the Merger;

NOW, THEREFORE, in consideration of the representations, warranties, covenants and agreements contained in this Agreement, and intending to be legally bound hereby, Parent, Merger Sub and the Company hereby agree as follows:

ARTICLE I

THE MERGER

SECTION 1.1The Merger. Upon the terms and subject to the conditions set forth in this Agreement, and in accordance with the NYBCL, at the Effective Time, Merger Sub shall be merged with and into the Company, and the separate corporate existence of Merger Sub shall thereupon cease, and the Company shall be the surviving corporation in the Merger (the “Surviving Corporation”).

SECTION 1.2Closing. The closing of the Merger (the “Closing”) shall take place at 10:00 a.m. (New York time) on a date to be specified by the Parties (the “Closing Date”), which date shall be no later than the second (2nd) business day after satisfaction or waiver of the conditions set forth inArticle V (other than those conditions that by

1

their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions at such time), at the offices of Milbank, Tweed, Hadley & McCloy LLP, 1 Chase Manhattan Plaza, New York, New York 10005, unless another time, date or place is agreed to in writing by the Parties.

SECTION 1.3Effective Time. Subject to the provisions of this Agreement, the Company as the Surviving Corporation shall duly prepare and execute a certificate of merger in accordance with the relevant provisions of the NYBCL (the “Certificate of Merger”) and on the Closing Date file the Certificate of Merger with the Secretary of State of the State of New York. The Merger shall become effective upon such filing of the Certificate of Merger or at such later time as is agreed to by the Parties and specified in the Certificate of Merger (the time at which the Merger becomes effective being hereinafter referred to as the “Effective Time”).

SECTION 1.4Effects of the Merger. The Merger shall have the effects set forth in Section 906 of the NYBCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the properties, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in the Surviving Corporation, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Corporation.

SECTION 1.5Certificate of Incorporation and Bylaws of the Surviving Corporation. The certificate of incorporation and bylaws of Merger Sub, as in effect immediately prior to the Effective Time, shall be the certificate of incorporation and bylaws of the Surviving Corporation until thereafter amended as provided therein or by applicable Law (and subject toSection 4.9).

SECTION 1.6Directors and Officers of the Surviving Corporation.

(a) The directors of Merger Sub immediately prior to the Effective Time shall be the directors of the Surviving Corporation immediately following the Effective Time, until their respective successors are duly elected or appointed and qualified or their earlier death, resignation or removal in accordance with the certificate of incorporation and bylaws of the Surviving Corporation.

(b) The officers of the Company immediately prior to the Effective Time shall be the officers of the Surviving Corporation until their respective successors are duly appointed and qualified or their earlier death, resignation or removal in accordance with the certificate of incorporation and bylaws of the Surviving Corporation.

SECTION 1.7Conversion of Securities. At the Effective Time, by virtue of the Merger and without any action on the part of the holders of any securities of Merger Sub or the Company:

2

(a)Conversion of Merger Sub Common Stock. Each share of common stock, par value $0.01 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time shall be converted into and become one (1) validly issued, fully paid and nonassessable share of common stock, par value $0.01 per share, of the Surviving Corporation.

(b)Cancellation of Certain Company Capital Stock. Any shares of Company Common Stock that are owned by the Company as treasury stock and any Shares owned by Parent, Merger Sub, any Subsidiary of Parent or any Subsidiary of the Company shall be automatically canceled and retired and shall cease to exist and no consideration shall be delivered in exchange therefor.

(c)Merger Consideration. Each Share, including each restricted share of Company Common Stock granted under Company Plans (other than Shares to be canceled in accordance withSection 1.7(b)), shall automatically be converted into the right to receive $28.50 in cash, without interest (the “Merger Consideration”), payable to the holder of such shares of Company Common Stock in the manner provided inSection 1.8. All such Shares, when so converted, shall no longer be outstanding and shall automatically be canceled and retired and shall cease to exist, and each holder of a certificate which immediately prior to the Effective Time represented any such Shares shall cease to have any rights with respect thereto, except the right to receive the Merger Consideration therefor, without interest, in accordance with this Agreement.

(d)Adjustment to Prevent Dilution. If after the date hereof and on or prior to the Effective Time, the issued and outstanding shares of Company Common Stock or securities convertible or exchangeable into or exercisable for Company Common Stock shall be changed into a different number of shares or a different class by reason of any merger, issuer tender, exchange offer, consolidation or other business combination, reclassification, recapitalization, stock-split (including a reverse stock-split), split-up, combination or exchange of shares, or any dividend or distribution payable in stock or other securities is declared thereon with a record date within such period, or any similar event shall occur, the Merger Consideration will be adjusted accordingly to provide to the shareholders of the Company the same economic effect, including any premiums, as contemplated by this Agreement prior to such event.

SECTION 1.8Exchange of Certificates.

(a)Paying Agent. Prior to the Effective Time, Parent shall designate and enter into an agreement with a bank or trust company reasonably acceptable to the Company to act as agent for the holders of Shares in connection with the Merger (the “Paying Agent”) to receive, on terms reasonably acceptable to the Company, for the benefit of holders of Shares, the aggregate Merger Consideration to which holders of Shares shall become entitled pursuant toSection 1.7(c). Parent shall deposit, or cause to be deposited, such aggregate Merger Consideration with the Paying Agent prior to the Effective Time. Such aggregate Merger Consideration deposited with the Paying Agent shall, pending its disbursement to such holders, be invested by the Paying Agent in (i) direct obligations of the United States of America, (ii) obligations for which the full faith and credit of the United States of America is pledged to provide for the payment of principal and interest, (iii) commercial paper rated the highest quality by either Moody’s Investors Service, Inc. or Standard and Poor’s Ratings Services or (iv) money

3

market funds investing solely in a combination of the foregoing. Any interest and other income resulting from such investments shall be the property of, and shall be paid to, Parent. No such investment or loss thereon shall affect the Merger Consideration and Parent shall promptly replace any funds deposited with the Paying Agent lost through any investment made pursuant to thisclause (a).

(b)Exchange Procedures. Promptly after the Effective Time (but in no event more than three (3) business days thereafter), the Surviving Corporation shall cause the Paying Agent to (i) mail to each holder of Shares represented by book-entry on the records of the Company or the Company’s transfer agent on behalf of the Company (“Book-Entry Shares”), whose shares were converted pursuant toSection 1.7(c) into the right to receive the Merger Consideration, a check in the amount of the number of Shares held by such holder as Book-Entry Shares multiplied by the Merger Consideration and (ii) mail to each holder of record of a certificate or certificates, which immediately prior to the Effective Time represented outstanding Shares (the “Certificates”), whose shares were converted pursuant toSection 1.7(c) into the right to receive the Merger Consideration: (x) a letter of transmittal (which shall specify that delivery shall be effected, and risk of loss and title to the Certificates shall pass, only upon delivery of the Certificates to the Paying Agent, and which shall be in such form and shall have such other provisions as Parent may reasonably specify prior to the Effective Time); and (y) instructions for use in effecting the surrender of the Certificates in exchange for payment of the Merger Consideration to which such holder is entitled pursuant toSection 1.7(c). Upon surrender of a Certificate for cancellation to the Paying Agent, together with such letter of transmittal, duly completed and validly executed in accordance with the instructions thereto (and such other customary documents as may reasonably be required by the Paying Agent), the holder of such Certificate shall be entitled to receive in exchange therefor the Merger Consideration to which such holder has a right to receive pursuant toSection 1.7(c) (less any applicable withholding Taxes in accordance withSection 1.8(g)), without interest, for each Share formerly represented by such Certificate, and the Certificate so surrendered shall forthwith be canceled. If payment of the Merger Consideration is to be made to a Person other than the Person in whose name the surrendered Certificate is registered, it will be a condition of payment that (i) the Certificate so surrendered will be properly endorsed or will otherwise be in proper form for transfer and (ii) the Person requesting such payment will have paid to Parent or any agent designated by Parent any transfer and other Taxes required by reason of the payment of the Merger Consideration to a Person other than the registered holder of such Certificate surrendered or will have established to the reasonable satisfaction of the Surviving Corporation that such Tax either has been paid or is not payable. Until surrendered as contemplated by thisSection 1.8, each Certificate shall be deemed at any time from and after the Effective Time to represent only the right to receive the Merger Consideration in cash, without interest, as contemplated by thisArticle I. For the avoidance of doubt, no interest shall accrue or be paid on the amounts payable pursuant to thisSection 1.8 upon surrender of a Certificate.

(c)Transfer Books; No Further Ownership Rights in Company Stock. The Merger Consideration paid in respect of Shares upon the surrender for exchange of Certificates in accordance with the terms of thisArticle I, shall be deemed to have been paid in full satisfaction of all rights pertaining to the Shares previously represented by such Certificates, and at the close of business on the day on which the Effective Time occurs, the stock transfer books of the Company shall be closed and thereafter there shall be no further registration of transfers on

4

the stock transfer books of the Surviving Corporation of the Shares that were outstanding immediately prior to the Effective Time. From and after the Effective Time, the holders of Book-Entry Shares or Certificates that evidenced ownership of Shares outstanding immediately prior to the Effective Time shall cease to have any rights with respect to such shares, except as otherwise provided for herein or by applicable Law. Subject to the last sentence ofSection 1.8(e), if, at any time after the Effective Time, Certificates are presented to the Surviving Corporation or the Paying Agent for any reason, such Certificates shall be canceled and exchanged as provided in thisArticle I.

(d)Lost, Stolen or Destroyed Certificates. If any Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such Certificate to be lost, stolen or destroyed and, if required by the Surviving Corporation, the posting by such Person of a bond, in such reasonable amount as Parent may direct, as indemnity against any claim that may be made against it with respect to such Certificate, the Paying Agent will pay, in exchange for such lost, stolen or destroyed Certificate, the Merger Consideration to which the holder of the Shares formerly represented by such Certificate is entitled pursuant to thisArticle I.

(e)Termination of Fund. At any time following the first anniversary of the Effective Time, the Surviving Corporation shall be entitled to require the Paying Agent to deliver to it, upon demand, any funds (including any interest received with respect thereto) that had been made available to the Paying Agent and which have not been disbursed to holders of Certificates, and thereafter such holders shall be entitled to look only to the Surviving Corporation (subject to applicable abandoned property, escheat or other similar Laws) as general creditors thereof with respect to the payment of any Merger Consideration, without any interest thereon, that may be payable upon surrender of any Certificates held by such holders, as determined pursuant to this Agreement. Any amounts remaining unclaimed by such holders at such time at which such amounts would otherwise escheat to or become property of any Governmental Authority shall become, to the extent permitted by applicable Law, the property of the Surviving Corporation free and clear of all claims or interests of any Person previously entitled thereto.

(f)No Liability. Notwithstanding any provision of this Agreement to the contrary, none of the Parties, the Surviving Corporation or the Paying Agent shall be liable to any Person in respect of any Merger Consideration for any amount properly delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law.

(g)Withholding Taxes. Except as provided inSection 4.14, each of the Parties, the Surviving Corporation and the Paying Agent shall be entitled to deduct and withhold from the consideration otherwise payable to a holder of Shares pursuant to the Merger such amounts as they may be respectively required to deduct and withhold with respect to the making of such payment under the Internal Revenue Code of 1986, as amended, and the rules and regulations promulgated thereunder (the “Code”), or under any provision of applicable state, local or foreign Tax Law; provided however, that any such Taxes that are imposed as a result of or arising out of Parent not being a U.S. person (as such term is defined pursuant to Section 7701(a)(30) of the Code (and any similar provisions of state or local law)) or with respect to any transfer of funds between Parent and Merger Sub shall be solely the liability of Parent and neither Parent nor Merger Sub shall deduct any such amounts from the amounts paid for the

5

Shares. Subject to the above proviso, to the extent amounts are so withheld and paid over to the appropriate taxing authority, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the holder of the Shares in respect of which such deduction and withholding was made.

(h)Further Action. After the Effective Time, the officers and directors of Parent and the Surviving Corporation will be authorized to execute and deliver, in the name and on behalf of the Company and Merger Sub, any deeds, bills of sale, assignments or assurances and to take and do, in the name and on behalf of the Company and Merger Sub, any other actions and things to vest, perfect or confirm of record or otherwise in the Surviving Corporation any and all right, title and interest in, to and under any of the rights, properties or assets acquired or to be acquired by the Surviving Corporation as a result of, or in connection with, the Merger.

SECTION 1.9Effect on Company Equity Plans. As soon as practicable after the date hereof, the Company shall take all actions necessary to provide that:

(a)Stock Options. Each option or other right of any kind to acquire shares of Company Common Stock under the Company Stock Plans that is outstanding immediately prior to the Effective Time (whether or not then vested or exercisable), and the tandem stock appreciation rights issued with each such option (collectively, the “Company Employee Stock Options”) shall be terminated and converted at the Effective Time into the right to receive a cash amount equal to the Option Consideration for each share of Company Common Stock then subject to the Company Employee Stock Option. The Option Consideration shall be paid as soon after the Effective Time as shall be practicable, without interest. Notwithstanding the foregoing, Parent and the Company shall be entitled to deduct and withhold from the Option Consideration otherwise payable such amounts as may be required to be deducted and withheld with respect to the making of such payment under the Code, or any provision of applicable state, local or foreign Tax Law. For purposes of this Agreement, “Option Consideration” means, with respect to any share of Company Common Stock issuable under a particular Company Employee Stock Option, an amount equal to the excess, if any, of (i) the Merger Consideration over (ii) the exercise price payable in respect of such share of Company Common Stock issuable under such Company Employee Stock Option. From and after the Effective Time, no such Company Employee Stock Option shall be exercisable by the former holder thereof, but shall only entitle such holder to the payment of the Option Consideration, and prior to the payment of such Option Consideration, the Company shall obtain all necessary consents to ensure that former holders of such Company Employee Stock Options will have no rights other than the right to receive the Option Consideration by taking all actions determined by the Company Board (or, if appropriate, any committee thereof administering any Company Plan under which shares of Company Common Stock or equity-based awards may be issued) to be necessary or appropriate under the provisions of the relevant Company Stock Plans regarding termination of Company Employee Stock Options in connection with certain corporate transactions. As of the Effective Time, any Company Employee Stock Option with an exercise price equal to or greater than the Merger Consideration shall be canceled without consideration and be of no further force or effect. As soon as practicable after the Effective Time, Parent shall deliver or cause to be delivered to each holder of a canceled Company Employee Stock Option an appropriate notice setting forth such holder’s rights, if any, to receive cash payments with respect to such Company Employee Stock Options pursuant to the Company Plans and thisSection 1.9(a).

6

(b)Director Share Plan. Each Phantom Share outstanding immediately prior to the Effective Time under the Company’s Director Share Plan shall be converted into the right to receive the Merger Consideration in accordance withSection 1.8. Subject toSection 1.8(g), which shall apply to the Merger Consideration paid for a Phantom Share, all amounts payable pursuant to thisSection 1.9(b) shall be paid as promptly as practicable following the Effective Time, without interest, or to the extent of any elections made prior to the Effective Time, paid in accordance with the Company’s Deferred Compensation Plan—Director Share Plan.

(c)Restricted Stock. As of the Effective Time, each share of Company Common Stock outstanding immediately prior to the Effective Time that is subject to future vesting requirements, risk of forfeiture back to the Company, a right of repurchase by the Company or similar restrictions (each, a share of “Restricted Stock”) which have not lapsed immediately prior to the Effective Time shall become fully vested and free of all restrictions and converted at the Effective Time into the right to receive the Merger Consideration, without interest, in accordance withSection 1.8. Notwithstanding the foregoing, Parent, the Company and the Paying Agent shall be entitled to deduct and withhold from the Merger Consideration otherwise payable such amounts as may be required to be deducted and withheld with respect to the making of such payment under the Code, or any provision of applicable state, local or foreign Tax Law.

(d)Employee Stock Purchase Programs. With respect to each employee stock purchase plan maintained by the Company or any of its Subsidiaries (each, an “ESPP”), each participant’s accumulated payroll deductions shall be used to purchase shares of Company Common Stock immediately prior to the Effective Time in accordance with the terms of the relevant ESPP, and the shares of Company Common Stock purchased thereunder shall be canceled at the Effective Time and converted into the right to receive the Merger Consideration, without interest, in accordance withSection 1.8. Except as specified onSection 1.9(d) of the Company Disclosure Letter, the Company shall use its commercially reasonable efforts to cause all ESPPs to terminate at the Effective Time, so that no further purchase rights shall be granted or exercised under such ESPPs thereafter. Subject to applicable confidentiality, legal and regulatory requirements, the Company shall cooperate with and provide such information to Parent relating to all ESPPs as Parent reasonably requires in order to plan and make proposals to participants of the ESPPs and, if necessary, to communicate with such participants in respect to such proposals.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company represents and warrants to Parent and Merger Sub that except as set forth in (a) the letter, dated as of the date hereof, delivered by the Company to Parent simultaneously with the execution and delivery of this Agreement (the “Company Disclosure Letter”), with specific reference to the particular Section or clause of this Agreement to which the information set forth in such letter relates, (it being agreed that disclosure of any item in any section or subsection of the Company Disclosure Letter shall be deemed disclosure with respect to any other section or subsection to which the relevance of such

7

item is reasonably apparent), or (b) the Company SEC Documents filed by the Company with, or furnished by the Company to, the U.S. Securities and Exchange Commission (the “SEC”) at any time on or after January 1, 2004 through the date hereof and publicly available on the website of the SEC through the Electronic Data Gathering, Analysis and Retrieval System prior to the date hereof (the “Filed Company SEC Documents”), other than risk factor disclosure contained in any such Filed Company SEC Document under the headings “Risk Factors”, “Forward Looking Statements” or any similar sections and any other disclosure that is predictive or forward-looking in nature;provided,however, that nothing in the Filed Company SEC Documents shall be deemed to qualify, or be deemed to have been disclosed for the purposes of,Sections 2.2 or2.3:

SECTION 2.1Organization, Standing and Corporate Power.

(a) The Company is a corporation duly organized, validly existing and in good standing under the Laws of the State of New York and has all requisite corporate power and authority necessary to own, lease or operate all of its properties and assets and to carry on its business as it is being conducted as of the date hereof. The Company is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased or held under license by it makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect or to impair in any material respect the ability of the Company to perform its obligations hereunder or prevent or materially delay consummation of the Transactions.

(b) Each of the Company’s Subsidiaries is a corporation or other organization duly organized, validly existing and in good standing under the Laws of the jurisdiction of its organization. Each of the Company’s Subsidiaries is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased or held under license by it makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect.Section 2.1(b) of the Company Disclosure Letter sets forth a true and complete list of each such Subsidiary, the jurisdiction of incorporation or organization of such Subsidiary and the Company’s interest therein. All the outstanding shares of capital stock of, or other equity interests in, each such Subsidiary (except for directors’ qualifying shares or the like) are duly authorized, have been validly issued, are fully paid, nonassessable and free of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of applicable Law, the Company Charter Documents or any Contract to which such Subsidiary is a party or otherwise bound, and are owned directly or indirectly by the Company beneficially and of record free and clear of any and all liens, claims, mortgages, encumbrances, pledges, security interests, equities and charges of any kind or nature whatsoever (each a “Lien”) and transfer restrictions, except for such transfer restrictions of general applicability as may be provided under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”), and other applicable securities Laws and rules and regulations promulgated thereunder.

8

(c) Each Joint Venture of the Company or any of its Subsidiaries is a corporation or other organization duly organized, validly existing and in good standing under the Laws of the jurisdiction of its organization and has all requisite power and authority to own, lease and operate all of its properties and assets and to carry on its business as it is being conducted as of the date hereof. Each Joint Venture of the Company or any of its Subsidiaries is duly licensed or qualified to do business and is in good standing in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased or held under license by it makes such licensing or qualification necessary, except where the failure to be so licensed, qualified or in good standing would not, individually or in the aggregate, reasonably be expected to result in a Company Material Adverse Effect. To the Knowledge of the Company, all of the Shares of Capital Stock or other equity interests which the Company or any of its Subsidiaries owns in a Joint Venture are duly authorized, validly issued, fully paid and nonassessable.

(d) The Company has previously made available to Parent complete and correct copies of the certificate of incorporation and bylaws (or other comparable organizational documents) of the Company and each of its Subsidiaries, as amended to the date hereof (collectively, the “Company Charter Documents”).

SECTION 2.2Capitalization.

(a) The authorized capital stock of the Company consists solely of 300,000,000 shares of Company Common Stock and 10,000,000 shares of preferred stock, par value $0.01 per share (the “Company Preferred Stock”). At the close of business on June 20, 2007 (the “Measurement Date”): (i) 158,364,908 shares of Company Common Stock were issued and outstanding, of which (x) 134,198 shares of Company Common Stock were held by the Company in its treasury and (y) 1,010,204 shares were Restricted Stock; (ii) 7,238,225 shares of Company Common Stock were reserved and available for issuance under the Company Stock Plans, of which 3,847,549 shares of Company Common Stock were subject to outstanding Company Employee Stock Options; (iii) 124,034 Phantom Shares were outstanding under the Company’s Director Share Plan; (iv) no shares of Company Preferred Stock were issued or outstanding; and (v) no other shares of capital stock, or rights to acquire shares of capital stock, of the Company were outstanding, issuable or reserved for issuance. All Shares (including shares of Restricted Stock) and all shares of Company Common Stock reserved for issuance upon the exercise of the Company Employee Stock Options have been duly authorized. All Shares (including shares of Restricted Stock) are, and all shares of Company Common Stock reserved for issuance upon the exercise of the Company Employee Stock Options in accordance with their respective terms will upon issuance be, validly issued, fully paid, nonassessable and not subject to or issued in violation of any purchase option, call option, right of first refusal, preemptive right, subscription right or any similar right under any provision of the NYBCL, the Company Charter Documents or any Contract to which the Company is a party or otherwise bound.Section 2.2(a) of the Company Disclosure Letter sets forth a correct and complete list, as of the Measurement Date, of the outstanding Company Employee Stock Options, the number of shares of Company Common Stock underlying such Company Employee Stock Options, and the holders, exercise prices and expiration dates thereof. Since the Measurement Date, except as would be permissible underSection 4.1(a)(i) or as otherwise permitted by Parent in writing, no (i) shares of capital stock or other securities or equity interests of the Company (including

9

Restricted Stock and Phantom Shares) or any of its Subsidiaries, (ii) securities convertible into or exchangeable or exercisable for any shares of capital stock or other securities or equity interests of the Company (including Restricted Stock and Phantom Shares) or any of its Subsidiaries, or (iii) preemptive rights or other outstanding rights, options, warrants, redemption rights, repurchase rights, agreements, arrangements, calls, commitments or rights of any kind that obligate the Company or any of its Subsidiaries to issue or sell any shares of capital stock or other equity securities of the Company or any of its Subsidiaries or any securities or obligations convertible or exchangeable into or exercisable for, or giving any Person the right to subscribe for or acquire any equity securities of the Company or any of its Subsidiaries (collectively, “Options”), or stock appreciation rights, “phantom” stock rights, performance awards, dividend equivalent awards of the Company or any of its Subsidiaries, or other rights that are linked to the value of Company Common Stock were issued, reserved for issuance or granted or reserved for granting, other than issuances or grants of shares of Company Common Stock pursuant to the Company’s Investor Services Program, subject to the restrictions ofSection 4.18.

(b) Except for provisions in the Company Charter Documents, there are no outstanding contractual obligations of the Company or any of its Subsidiaries (i) restricting the transfer of, (ii) affecting the voting rights of, (iii) requiring the repurchase, redemption, acquisition or disposition of, or containing any right of first refusal with respect to, (iv) requiring the registration for sale of, or (v) granting any preemptive or anti-dilutive right with respect to, any shares of Company Common Stock or any capital stock or other securities or equity interests of the Company or any of its Subsidiaries. There are no bonds, debentures, notes or other indebtedness of the Company or any of its Subsidiaries having the right to vote (or convertible into or exchangeable for securities having the right to vote) on any matters on which holders of capital stock or other securities or equity interests of the Company or any such Subsidiary may vote.

(c) Except as set forth above inSection 2.2(a), there are (i) no Options to which the Company or any of its Subsidiaries is a party or by which any of them is bound obligating the Company or any of its Subsidiaries to issue, deliver or sell, or cause to be issued, delivered or sold, (A) shares of capital stock or other securities or equity interests of, or any security convertible or exercisable for or exchangeable into any capital stock or other securities or equity interests of, the Company or any of its Subsidiaries or (B) any Company Voting Debt, and (ii) no other rights, the value of which is in any way based on or derived from, or that give any Person the right to receive any economic benefit or right similar to or derived from the economic benefits and rights accruing to holders of capital stock or other securities or equity interests of the Company or any of its Subsidiaries.

SECTION 2.3Authority; Noncontravention; Voting Requirements.

(a) The Company has all necessary corporate power and authority to execute and deliver this Agreement and, subject to obtaining the Company Shareholder Approval, to perform its obligations hereunder and to consummate the Transactions. The execution, delivery and performance by the Company of this Agreement, and the consummation by it of the Transactions, have been duly authorized and approved by the Company Board, and except for obtaining the Company Shareholder Approval, no other corporate action on the part of the

10

Company is necessary to authorize the execution, delivery and performance by the Company of this Agreement and the consummation by it of the Transactions. This Agreement has been duly executed and delivered by the Company and, assuming due authorization, execution and delivery hereof by the other Parties, constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except that such enforceability (i) may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar Laws of general application affecting or relating to the enforcement of creditors’ rights generally, and (ii) is subject to general principles of equity, whether considered in a proceeding at Law or in equity (the “Bankruptcy and Equity Exception”).

(b) The Company Board, at a meeting duly called and held and by resolutions duly adopted at such meeting and not subsequently rescinded or modified in any way, has (i) determined that this Agreement and the Transactions are advisable and in the best interests of the Company and its shareholders, (ii) adopted this Agreement and, subject toSection 4.2, approved the Transactions (iii) directed, subject toSection 4.2, that this Agreement and the Transactions be submitted to the shareholders of the Company for their adoption and (iv) resolved, subject toSection 4.2, to recommend that the shareholders of the Company adopt this Agreement and approve the Transactions.

(c) Neither the execution and delivery of this Agreement by the Company nor the consummation by the Company of the Transactions, nor compliance by the Company with any of the terms or provisions hereof, will (i) conflict with, result in any violation of, or constitute a default (with or without notice or lapse of time or both) under, or give rise to a right of termination, amendment, cancellation or acceleration of any obligation or the loss of a material benefit under, or the creation of a Lien on any assets (any such conflict, violation, default, right of termination, amendment, cancellation or acceleration, loss or creation, a “Violation”) of any provision of the Company Charter Documents or (ii) assuming that the Permits, orders, registrations, declarations referred to inSection 2.4 and the Company Shareholder Approval are obtained and the notices and filings referred to inSection 2.4 are made, (x) violate any order, judgment, writ, decree or injunction of any Governmental Authority (collectively, “Order”) or Law applicable to the Company or any of its Subsidiaries or (y) constitute or result in a Violation under any of the terms, conditions or provisions of any Contract or Company Plan to which the Company or any of its Subsidiaries is a party or by which any of them or any of their respective properties or assets may be bound or affected, except, in the case ofsub-clause (ii), for such Violations as would not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect or to impair in any material respect the ability of the Company to perform its obligations hereunder or prevent or materially delay consummation of the Transactions.

(d) Assuming the accuracy of Parent’s representation and warranty contained inSection 3.10, the affirmative vote (in person or by proxy) of the holders of a majority of the outstanding shares of Company Common Stock in favor of the adoption of this Agreement is the only vote or approval of the holders of any class or series of capital stock of the Company which is necessary to adopt this Agreement and approve the Transactions (the “Company Shareholder Approval”).

11

SECTION 2.4Governmental Approvals. Except for (i) the filing with the SEC of the Proxy Statement in definitive form, and other filings required under, and compliance with other applicable requirements of, the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (the “Exchange Act”), the rules of the New York Stock Exchange (“NYSE”) and state securities or “blue sky” Laws (the “Blue Sky Laws”), (ii) the filing of the Certificate of Merger with the Secretary of State of the State of New York pursuant to the NYBCL, (iii) filings required under, and compliance with other applicable requirements of, the HSR Act and any other antitrust or competition Laws of any applicable jurisdiction, (iv) notices to, or consents, approvals or waivers from, to the extent required, (A) the Connecticut Department of Public Utility Control (“CTDPUC”), (B) the Maine Public Utilities Commission (“MPUC”), (C) the Massachusetts Department of Public Utilities (the “MDPU”), (D) the New Hampshire Public Utilities Commission (“NHPUC”) and (E) the New York Public Service Commission (“NYPSC”, and collectively with CTDPUC, MPUC, MDPU and NHPUC, the “Company PUC Consents”), (v) notices, consents, approvals or waivers required under, and compliance with applicable requirements of, the Federal Energy Regulatory Commission (the “FERC”) pursuant to Section 203 of the Federal Power Act, as amended, and the rules and regulations promulgated thereunder (the “Federal Power Act”), (vi) notices to, or consents, approvals or waivers from, and compliance with applicable requirements of, the United States Federal Communications Commission (“FCC”) in connection with a change of control and/or assignment of the holder of the FCC licenses of the Company and its Subsidiaries (the “Company License Consents”), (vii) notices to, or consents, approvals or waivers from, and compliance with applicable requirements of, the United States Nuclear Regulatory Commission (the “NRC”) under the Atomic Energy Act of 1954, as amended (the “Atomic Energy Act”); (viii) notices to or filings required under, and compliance with other applicable requirements of, the United States Committee on Foreign Investment pursuant to the Exon-Florio amendment to the Defense Production Act of 1950, as amended, and (ix) compliance with any such filings and notices as may be required under applicable Environmental Laws (the consents, approvals, waivers, filings, notices, declarations or registrations set forth insub-clauses (iii) through(ix) above being hereinafter collectively referred to as the “Required Consents”), no consents, approvals or waivers of, or filings, notices, declarations or registrations with, any Governmental Authority are necessary for the execution, delivery and performance of this Agreement by the Company or the consummation by the Company of the Transactions, other than such consents, approvals, waivers, filings, notices, declarations or registrations that, if not obtained, made or given, would not, individually or in the aggregate, reasonably be expected to have a Company Material Adverse Effect or to impair in any material respect the ability of the Company to perform its obligations hereunder or prevent or materially delay consummation of the Transactions.

SECTION 2.5Company SEC Documents; Financial Statements; Undisclosed Liabilities.