EXHIBIT 19.0

ICF Corporate Policies

INSIDER INFORMATION AND SECURITIES TRADING

Policy Number: GenCounsel.POL.0002

Last Revised: September 19,2024

The following policies and procedures (this “Policy”) of ICF International, Inc. (together with its subsidiaries, the “Company” or “ICF”) explain the stringent ethical and legal prohibitions against insider trading and tipping and emphasize the importance of complying with the disclosure and reporting requirements and other regulations of the Securities and Exchange Commission (the “SEC”). ICF is committed to upholding both the letter and spirit of the securities laws, rules, and regulations of the United States. Although this policy is established to comply with U.S. regulations, this Policy applies to all Company operations worldwide. Where specific conduct may be permitted under local law, but is prohibited by this Policy, we must comply with this Policy.

We encourage our officers, employees, and non-employee members of the Board of Directors (“Directors”) to become stockholders of ICF International, Inc. However, it is important that investing in the Company’s securities does not create the appearance of any impropriety, and that all investment activities comply with applicable laws and regulations. Failure to observe this Policy could result in embarrassment to you or the Company and, in some instances, serious legal consequences for you and for the Company. Violation of this Policy may result in disciplinary action up to and including termination of your employment by the Company, and fines and criminal penalties imposed by the SEC. If you have any doubt as to your responsibilities under this Policy, seek clarification and guidance from the Company’s Office of General Counsel.

To avoid even the appearance of impropriety, this Policy applies to all of us at the Company. This includes all officers, Directors and employees as well as family members (including in-laws) who reside in the same household. It also applies to any other person or entity (such as a company, partnership, or trust) over which an officer, Director, or employee has significant influence as it relates to securities trading decisions.

3.1.Summary of Key Points within this Policy

This Policy should be read in its entirety. However, certain key points for all employees are:

a.If you have material, non-public information about the Company, you may not trade in (buy or sell) Company stock.

b.Keep Information Confidential. You may not disclose confidential or financial information about the Company, especially not to financial analysts or institutional investors.

c.No Speculation. Short-term and speculative transactions in Company stock are strictly prohibited. See, in relation to this, the separate Hedging and Pledging Transactions Policy, Appendix B to the Company’s Corporate Governance Guidelines.

d.Stock Purchase Plans. Shares may be purchased automatically through the Employee Stock Purchase Plan (“ESPP”) in accordance with this Policy. However, you must consider the requirements of this Policy before selling any shares purchased through the ESPP. Individuals in the Insider Group (as defined below) may not enter, exit, or amend their contributions under the ESPP unless the decision is pre-cleared in accordance with Exhibit B and the change occurs during a Trading Window (as defined below).

e.Consequences. Violation of this Policy can have severe legal consequences for both you and the Company.

Key points for the Insider Group to know are:

f.Trading Windows. Specified officers and other designated personnel (as listed on Exhibit A) (the “Insider Group”), which includes Directors, may only trade in (buy or sell) Company stock during specified periods, known as “Trading Windows” (and even then, only when not in possession of material non-public information). Executive Officers means those Company officers designated by the Board of Directors of ICF to be Section 16 officers of the Company (“Executive Officers”), and typically only includes a small number of senior executives such as the CEO, CFO, and other individuals having corporate-wide policy making functions. The Insider Group and the Directors, and any other employees who at any time have access to material non-public information are collectively considered “Insiders”.

•Limited Exception – 10b5-1 Plans. While Insiders are generally prohibited from trading outside of a Trading Window, individuals who may have regular liquidity needs throughout the year can adopt a Rule 10b5-1 trading plan, as described in Exhibit C below, which gives Insiders the ability to trade in Company securities even outside of a Trading Window subject to a number of conditions including a 120-day cooling period. The establishment of any new Rule 10b5-1 trading plan, or the amendment or termination of an existing plan, requires pre-clearance using the form attached to this Policy as Exhibit B and compliance with the policy in Exhibit C.

g.Pre-Clear Trades and Trading Plans. Even during a “Trading Window,” the Insider Group must pre-clear all their transactions, the ESPP, and trading plans in Company stock, using the form attached to this Policy as Exhibit B.

h.Gifts. Directors and the Insider Group or Insiders must use Exhibit B to pre-clear gifts of equity.

i.Disclosures. The Company is required to make quarterly and annual disclosures related to potential individual 10b5-1 plans and to disclose the Company insider trading policies. ICF Directors and Executive Officers must make required filings with the SEC that disclose such transactions. ICF Legal and Accounting will assist with those disclosures.

3.2.Prohibition Against Insider Trading

Directors and their immediate families, and employees of the Company and their immediate families, are prohibited by law and this Policy from buying or selling Company securities while in the possession of material non-public information concerning the Company. You may be guilty of insider trading even if you do not “use” the material non-public information; it is sufficient that you were aware of the information when making a purchase or sale (and such awareness is usually presumed for the Insider Group listed on Exhibit A and for Directors). This prohibition applies both

to the Company’s securities and also to transactions in the securities of other companies that may be significant customers, suppliers, competitors, adverse litigants, financing sources, acquisition targets, or other companies with which you may become familiar in the course of your employment or dealings with the Company. The definitions and explanations below require making reasonable judgments; please consult with the ICF General Counsel with any questions or uncertainties.

3.2.1.1What Is Insider Trading?

Although there is no statutory definition of insider trading, it consists generally of purchasing or selling securities while in the possession of information that is (i) material and (ii) non-public. This prohibition applies not only to Directors and Company employees, but also to anyone else (including members of their immediate families) who receives material non-public information from a Director or Company employee, since it is also illegal to give “tips” to third parties. Therefore, it is possible for you to be charged with insider trading if a third party trades on the basis of non-public material information that you have given to them, even though you do not personally gain from the trading.

3.2.1.2To Whom Do Insider Trading Restrictions Apply?

These restrictions on insider trading apply to Directors, officers, and any other employee with access to material non-public information and to members of the immediate families of anyone in these groups and others who live in those households. The term immediate family means any child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, and includes adoptive relationships. There is a presumption that a person’s immediate family sharing the same household are insiders. However, that presumption of such beneficial ownership may be rebutted; see SEC Rule 16 at 1(a)(4).

3.2.1.3What Is “Material” Information?

There is no statutory definition of what constitutes “material” information. In determining whether information is material, it is necessary to (i) consider whether it is likely that a reasonable investor would consider the information important, i.e., as significantly altering the total mix of information available to him or her, in deciding whether to purchase or sell Company or other securities, and (ii) take into account, in the case of information concerning events that are uncertain, both the probability that the event will occur and the anticipated magnitude of the event if it occurs. Material information may either be positive or negative. It is also important to remember that the standard for whether particular information is material is relatively low and will always be viewed with the benefit of 20-20 hindsight.

3.2.1.4What Is “Non-public” Information?

In general, information is “non-public” until it is publicly disseminated, such as through the issuance of a press release or through disclosure in the Company’s filings with the SEC. In addition, information is not considered to be publicly available immediately after its release. If you have been in possession of material non-public information, you should not trade in Company securities until the third full trading day following the public disclosure or announcement of that material information.

Material non-public information (i.e., inside information) may include, but is not limited to, the following:

•News of a potential acquisition, merger, or disposition involving the Company;

•Financial results (e.g., unreported earnings, revenues, gains, or losses);

•Significant developments in major litigation;

•A change in dividend policy;

•Liquidity issues, extraordinary borrowing, or debt ratings;

•Cybersecurity or data privacy risks, incidents, or vulnerabilities;

•Developments concerning significant potential liabilities; or

•Obtaining or losing a major contract.

3.2.3What Are the Penalties for Trading on the Basis of Inside Information?

The securities laws prescribe heavy penalties for insider trading violations, including (i) civil penalties up to $5,000,000, and (ii) criminal penalties with jail sentences up to twenty years. Liability may extend not only to violators, but to the Company—which may face penalties of up to $25,000,000—and others as well. In addition, violators may be subject to further penalties including a fine of up to 300% of any profit received as a result of insider trading. The SEC and Department of Justice have been vigorous in their prosecution of insider trading.

If you become aware, or have reason to believe, that any of your colleagues have violated this Policy, U.S. securities laws, or applicable laws of any other jurisdiction, the Company encourages you to promptly report your concerns to the Company’s Office of General Counsel, to the extent not prohibited by applicable laws. Such reportable activities may include an Insider trading in the Company’s securities during a Blackout Period (discussed below) or before the disclosure of material, non-public information. Such a report may be made anonymously and you will not be retaliated against for making a report in “good faith,” meaning that you believe your report to be true and that you shared all of the information you had consistent with applicable laws.

3.3Adoption of “Trading Windows”: Transaction Pre-Clearance Procedures for Insiders

3.3.1Securities Transactions in General

If you are not designated as a member of the Insider Group, you may buy or sell Company stock at any time without pre-clearance, so long as you are not in possession of material, non-public information concerning the Company.

3.3.2Establishment of Company Trading Windows: Blackout Periods

The risk of insider trading is lower during the period immediately following the release of the Company’s quarterly and annual earnings. Accordingly, the Company requires that, with the exception of trades executed pursuant to a previously-approved 10b5-1 trading plan under this Policy and as described in Exhibit C (for which any waiting period has been satisfied), all Insiders refrain from conducting transactions in the Company’s securities other than during the period commencing on the opening of the market on the third full trading day following the release of

quarterly or annual earnings and continuing until the close of business on the day that is three weeks prior to the last day of the fiscal quarter (assuming that they do not have any other material, non-public information). For the avoidance of doubt, if quarterly or annual earnings are announced prior to the commencement of trading, then the day of the announcement will be the first full trading day following the earnings release. This period is called a “Trading Window”. Conversely, the period when Insiders are not permitted to trade in the Company’s securities is called the “Blackout Period”. The Company reserves the right to impose special blackout periods from time to time and/or to include additional employees in a “Blackout Period” if they become aware of material, non-public information. Please contact the Company’s Chief Financial Officer or the Office of General Counsel for more information.

Note that prohibitions against insider trading still apply during any Trading Window. Therefore, even during a Trading Window, Insiders should be aware of whether or not they are in possession of any material non-public information and Directors and the Insider Group are subject to the mandatory pre-clearance procedures described below.

3.3.3Mandatory Pre-Clearance

All transactions in Company securities (including establishing, amending, or terminating 10b5-1 trading plans) by Directors, the Insider Group set forth on Exhibit A to this Policy (as such exhibit may be amended by the Company from time to time), and members of their immediate families must be pre-approved by the Company’s Chief Financial Officer or the General Counsel (or designated attorneys in the Office of General Counsel, who, in turn, may pre-clear each others’ transactions in the Company’s securities. All pre-clearance requests should be submitted using the Pre-Clearance Approval Form attached as Exhibit B to this Policy to each of the Chief Financial Officer and the General Counsel at least two business days in advance of the proposed transaction. You are responsible for personally speaking with the Chief Financial Officer or the General Counsel (or designated attorneys in the Office of General Counsel) to ensure that the Pre-Clearance Approval Form has been received. If you leave a voicemail or e-mail message and do not receive a response, it is your responsibility to follow up to ensure that your message was received. Further, if you are an Executive Officer, notification of the trade request will be provided to the Chief Executive Officer (or, in the case of the Chief Executive Officer, notice will be given the Lead Independent Director of the Company’s Board of Directors).

When you seek pre-clearance, you will need to complete the Pre-Clearance Approval Form attached as Exhibit B to this Policy. Unless otherwise indicated in the pre-clearance approval, the approval to engage in securities transactions will expire upon the close of the Trading Window, or when you come into possession of material, non-public information, whichever occurs first.

3.3.3.2After Pre-Clearance

If you are considered an Executive Officer or a Director, once a transaction is pre-cleared and completed, you will need to authorize your broker to provide information regarding the exact dates and prices of each transaction directly to the Company for reporting purposes.

3.4Transactions in Company Securities by Insiders

3.4.1Prohibited Transactions and Exceptions

It is inappropriate, and, in certain cases a violation of federal law, for Insiders to engage in short-term or speculative transactions involving the Company’s securities as this may give rise to an appearance of impropriety. All transactions in the Company’s securities by Insiders should be made for investment purposes, and not with a view to a quick profit on a sale. Also, a pledge of the Company’s securities to secure debt could result in a default and sale of the pledged securities outside of the Insider’s control. For these reasons, the Company has adopted a separate Hedging and Pledging Transactions Policy attached as Appendix B to the Company’s Corporate Governance Guidelines.

There are, however, exceptions to the general rule that Insiders may only trade during a Trading Window and only when not in possession of material non-public information regarding the Company. Some of these exceptions are outlined below:

3.4.1.1Employee Stock Options

Insiders may exercise employee stock options for cash at any time. However, any shares acquired by an Insider via stock option exercise may only be sold during a Trading Window. Insiders may only exercise their stock options as part of a broker-assisted cashless exercise, or participate in any other market sale for the purpose of generating the cash needed to pay the exercise price of an option, during a Trading Window (assuming that they do not otherwise have any material, non-public information).

3.4.1.2Sales of Shares to Pay Withholding Obligations

The sale of shares to pay withholding tax obligations upon the exercise of stock options, the vesting of restricted stock or settlement of restricted stock units may occur outside a Trading Window if the Insider elected in writing at the time of the grant to have the Company withhold shares to satisfy tax withholding requirements.

3.4.1.3Employee Stock Purchase Plan

If you are in the Insider Group defined in Exhibit A, you must pre-clear ESPP trades and trade during a Trading Window following pre-clearance approval using the form set forth in Exhibit B. Generally, all other employees, assuming that they do not otherwise have any material, non-public information at the time that make them Insiders, may purchase Company stock pursuant to the Company’s ESPP because the dates for such purchases are fixed in advance for all participants in the ESPP.

Under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), an Insider may trade in Company securities even at a time when he/she may be aware of material non-public information that would otherwise subject him/her to securities liability; provided, that the transactions are made pursuant to a pre-established arrangement or plan for future trades, or pursuant to instructions to a third party to execute trades on behalf of the Insider, both pursuant to regulatory requirements (typically referred to as a “trading plan”). So long as a trading plan is entered into when the Insider is not aware of any material non-public information and made in good faith and not with the intent to evade the insider trading prohibitions of the securities laws, and the

mandatory cooling off periods and disclosures are made, the Insider should be entitled to rely on such a trading plan as an affirmative defense against insider trading allegations. To comply with this Policy, the trading plan, and any amendment or early termination of the plan, must be pre-approved in writing by the Chief Financial Officer or General Counsel (or designated attorneys in the Office of General Counsel) and meet the requirements of Rule 10b5-1 and the Company’s Rule 10b5-1 Policy, which is set forth on Exhibit C to this Policy. If you are eligible to establish such a trading plan pursuant to the Rule 10b5-1 Policy and wish to establish such a trading plan, you should consult with the Chief Financial Officer or General Counsel (or designated attorneys in the Office of General Counsel).

Directors and Executive Officers must pre-clear gifts of ICF stock using Exhibit B to assess that dispositions are bona fide gifts of equity and can be reported on Form 4 within two business days by the Company. ICF employees not in the Insider Group may make a gift without pre-clearance. You may make a gift of your Company securities at any time (so long as it is a bona fide gift, i.e., you pre-clear if required, it is not a bribe, and it is not an attempt to evade the insider trading prohibitions of the securities laws). If the gift is to a family member of an Insider, that family member must not sell the Company’s securities except during a Trading Window (assuming that they do not otherwise have any material, non-public information). If a gift is made by an Insider other than during a Trading Window to a charitable organization, neither the Insider nor any family member may be a trustee, director, officer, or employee of that organization.

3.4.2Additional Securities Law Prohibitions

Section 16(b) of the Exchange Act prohibits Directors and Executive Officers from profiting from selling Company securities within six months of the purchase of securities (or from profiting from purchasing Company securities within six months of a sale), and this is the Company’s policy, as well.

3.4.3Recovery of Short-Swing Profits

Under Section 16(b) of the Exchange Act, any profits realized by a Director or Executive Officer from any non-exempt purchase and sale transactions in any equity security of the Company within a period of less than six months are required to be paid to the Company. The terms “purchase” and “sale” are construed broadly for purposes of Section 16(b) and under some circumstances may include transactions such as gifts, as well as transactions by members of the immediate families and households of Directors and Executive Officers. Where there are multiple short-swing transactions, sales and purchases are matched to give the greatest possible recovery. Although most transactions between a Director or Executive Officer and the Company, such as option grants and exercises and restricted stock grants and vestings, are exempt from short-swing profit recovery, each case must be examined carefully to ensure that it falls within an appropriate exemption. Directors and Executive Officers should consult with the Chief Financial Officer or General Counsel prior to engaging in any transaction in Company securities to determine if an exemption from Section 16(b) short-swing profit liability is available.

3.5Transaction Reporting for Directors and Executive Officers under Section 16 of the Exchange Act

3.5.1Reporting Requirements—Overview

Section 16(a) of the Exchange Act requires each Director and Executive Officer (defined above) of the Company to file reports with the SEC setting forth the number of shares of Company equity securities of which he or she is the “beneficial” owner and any transaction in such security. A Form 4 describing each transaction, including gift transactions, generally must be filed with the SEC within two business days after the day on which the transaction takes place.

3.5.2Transactions That Must Be Reported

Changes in Ownership. Directors and Executive Officers are required to report any changes in their ownership of Company securities, including transactions effected for their own accounts, as well as transactions effected for accounts under employee benefit plans or trusts and transactions by family members that are attributed to Directors and Executive Officers under the SEC’s beneficial ownership rules. Directors and Executive Officers should make sure that their immediate family members are aware of these rules.

Trading Plan (10b5-1) Disclosures. If, during the last fiscal quarter, any Director or Executive Officer has adopted or terminated a 10b5-1 plan or another pre-arranged trading plan that does not qualify as a 10b5-1 plan (including modifications to any such plans), the Company must provide a description of the material terms of such plans, including the name and title of the Director or Executive Officer, date of the adoption or termination, duration, and aggregate number of shares to be sold or purchased. The Company is not required to disclose the price at which trades are authorized to be made under the plan.

All other 10b5-1 plans by ICF employees, which are not held by either a Director or Executive Officer, must be reviewed and approved by ICF General Counsel, but those plans do not require a public disclosure by ICF.

Annual Policy Disclosure. On a yearly basis, the Company is required to disclose (in Form 10-K, Form 20-F, and in any proxy statements) whether it has adopted insider trading-related policies and procedures governing the purchase, sale, or other disposition of their securities by directors, officers, employees, or the issuer itself. A copy of such policies and procedures must be filed as an exhibit to such Form 10-K or Form 20-F.

3.5.3Proxy Statement Disclosure of Delinquent Reports

The Company is required to report each delinquent Section 16 filing in a separate section of its proxy statement and/or annual report on Form 10-K. Moreover, the SEC has authority to bring enforcement actions against Directors and Executive Officers who do not file Section 16 reports on a timely basis.

Although reporting persons are personally responsible for complying with the Section 16 reporting rules, the Company assists Directors and Executive Officers with their public filings. Given the two-business day deadline for filing, it is essential that all Directors and Executive Officers who engage in transactions in Company securities report such transactions immediately to the Chief Financial Officer or the General Counsel so the necessary filings can be made.

4Roles and Responsibilities/Authorities

•For questions regarding this Policy please contact: ICF General Counsel

•To report a violation of this Policy please contact: ICF General Counsel or ICF’s Hotline here: https://www.icf.ethicspoint.com/

•Submit your “Pre-Clearance Approval Form for Proposed Transactions in the Securities of ICF International” to the Company’s Chief Financial Officer and the Company’s General Counsel.

•Employee Stock Purchase Plan

•Board Member Stock Ownership Policy

•Executive Stock Ownership Policy

•Hedging and Pledging Transactions Policy

EXHIBIT A: Insider Group – ICF Insiders Subject to the Mandatory Pre-Clearance Requirements in Section 3.3.3

•All members of the Board of Directors of ICF International, Inc. (“Directors”)

•Named Executive Officers (NEOs) and the CEO’s Direct Reports + Specific Key Executives

•Senior Vice President and Vice President, Business Operations

•Corporate Controller/Principal Accounting Officer

•Head of Business Transformation

•Head of Financial Planning and Analysis

•Head of M&A/Corporate Development

•The following employees reporting directly to members of the senior leadership team:

oGroup Operations Directors

oBusiness Managers and Business Development officers reporting to Operating Group Leaders

•All employees of the Financial Planning & Analysis, Internal Audit, Investor Relations, Legal and Compliance, Mergers & Acquisitions, Tax, and Treasury and Risk Management functions, and employees of the Accounting, Finance, Finance Transformation, Corporate Communications and Public Affairs staff who are involved in preparation and/or review of corporate financials and related information, including, but not limited to, quarterly and annual financial disclosures, earnings release materials, and SEC filings. The ICF functional and business leaders are periodically required to review the specific list of designated ICF Insiders for their functional and business teams to identify those who are involved in preparing and/or reviewing financial and related information or who may have access to material, non-public information within the scope of their work responsibilities.

Insiders will be notified of, and asked to acknowledge, their designation under the Policy and the requirements applicable to them hereunder.

Note: This list is subject to change as circumstances require. You should refer any questions to the Chief Financial Officer or the General Counsel.

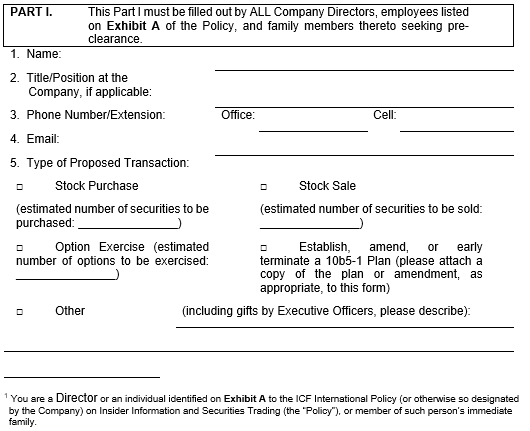

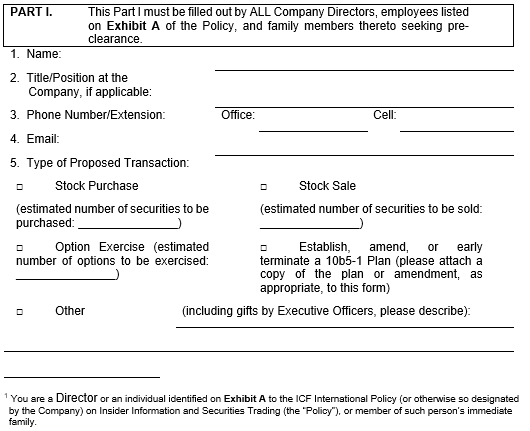

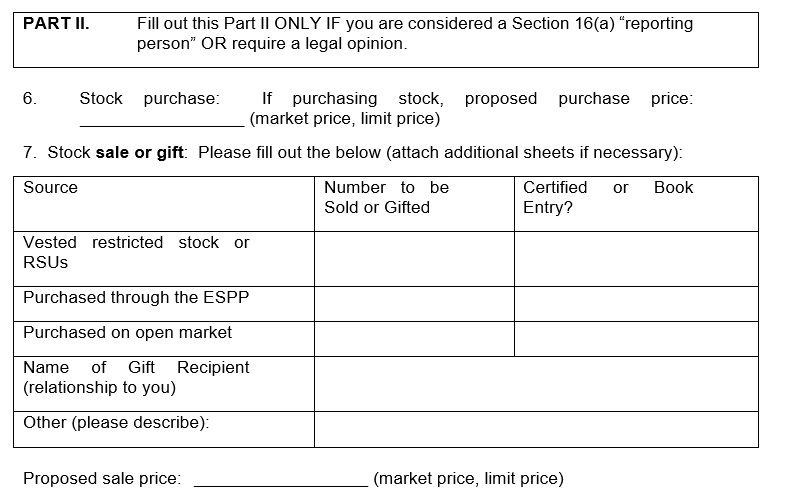

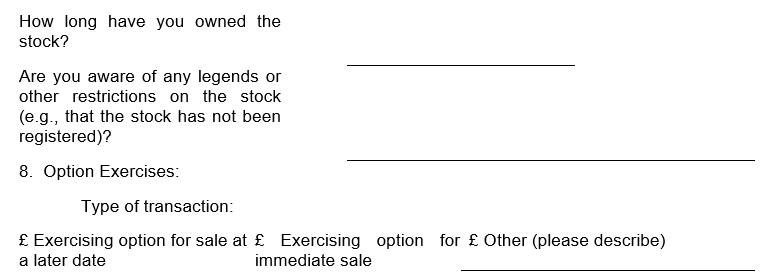

EXHIBIT B: Pre-clearance Approval Form for Proposed Transactions in the Securities of ICF International

If you are an Insider1 and are required to pre-clear your transactions in the securities of the Company or you are seeking to establish, modify, or early terminate a 10b5-1 trading plan, you must submit this completed form to the Company’s Chief Financial Officer (Barry Broadus, 703-934-3040, Barry.Broadus@icf.com) and General Counsel (James Daniel, 703-934-3879, james.daniel@icf.com), at least two business days prior to the proposed transaction.

You are responsible for personally speaking with the Chief Financial Officer or General Counsel (or designated attorneys in the Office of General Counsel) regarding this pre-approval request. If you have not received a response prior to the proposed transaction date, you may not assume that the transaction has been approved.

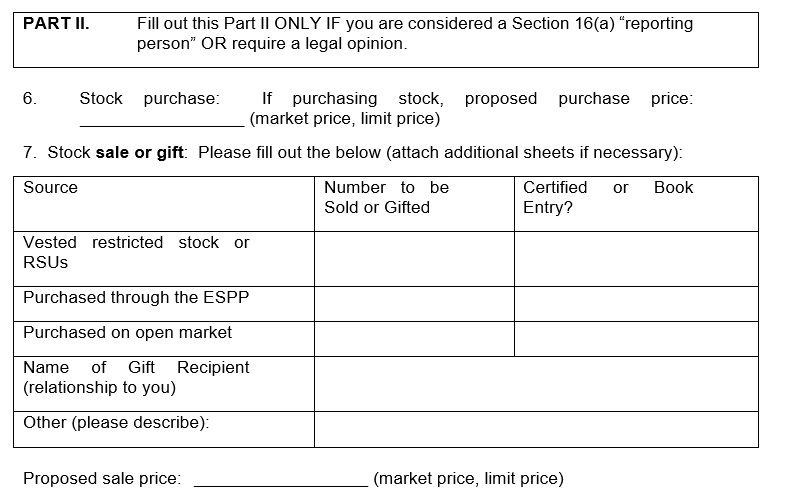

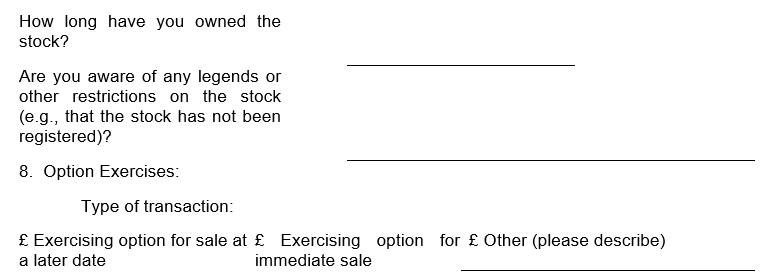

Part I and the Certification in Part III must be filled out by ALL Company Directors, ALL individuals identified on Exhibit A of the Policy, and family members thereto seeking pre-clearance. Part II need ONLY be filled out by those persons considered a “reporting person” under Section 16(a) of the Securities Exchange Act of 1934, as amended (e.g., you file Forms 3, 4, or 5) OR if your proposed transaction will require a legal opinion (e.g., for legended securities).

| | | | | |

Please provide the information below (attach additional sheets if necessary): |

| Grant Date | Number | |

| | | |

| | | |

9. Broker Contact information (if applicable): | |

Name: | |

Address: | |

| | | | | | |

Telephone: | | Email: | |

PART III. Certification—This Part III must be filled out by ALL Company Directors, employees listed on Exhibit A of the Policy, and family members thereof seeking pre-clearance. |

By submitting this form, you certify that: |

You are not in possession of any material non-public information about the Company; |

•You have not violated any provision of the Policy; |

•If you are proposing to sell stock, you are in compliance with the Company’s stock ownership policies for executive officers or Directors as may be applicable to you, and you will continue to be in compliance with such policies upon execution of the proposed sale; •If you are proposing to adopt or modify a 10b5-1 plan, you certify that you (a) are not aware of any material nonpublic information about the Company or its stock; and (b) are adopting the plan in good faith and not as part of a plan or scheme to evade insider trading prohibitions of Rule 10b-5; and |

•To the best of your knowledge, you have fully and honestly disclosed all material information regarding this transaction. |

SUBMITTED BY: | | | |

Signature: | | Date | |

Name: | | | |

Title: | | | |

APPROVED BY: | | | |

Signature: | | Date | |

Name: | | | |

Title: | | | |

The approval to engage in the securities transactions identified above will expire upon the close of the Trading Window, or when you come into possession of material non-public information, whichever occurs first. If you are uncertain whether you possess material non-public information, please contact the Company’s Chief Financial Officer or General Counsel.

EXHIBIT C: Rule 10b5-1 Policy

ICF International, Inc. (the “Company”) has a “Policy on Insider Information and Securities Trading” (the “Insider Trading Policy”) which prohibits members of the Company’s Board of Directors, Executive Officers, and certain employees of the Company (and their immediate family members who reside in the same household) from trading in the Company’s securities when in possession of material non-public information about the Company. In accordance with the Insider Trading Policy, the Company has established “trading window periods” (as defined in the Policy) during which specified individuals may trade in the Company’s securities (assuming that they do not possess material non-public information). Conversely, the Company also imposes “blackout periods” wherein these same individuals are not permitted to trade in the Company’s securities.

Rule 10b5 under the Exchange Act prohibits the purchase or sale of securities on the basis of material non-public information. SEC Rule 10b5-1 provides an affirmative defense for a person charged with insider trading for transactions made at a time said person had material non-public information about the Company, so long as the transactions were made under a pre-established arrangement or plan for future trades with respect to company securities, or pursuant to instructions to a third party to execute trades on behalf of said person, both pursuant to regulatory requirements (typically referred to as a “trading plan”). A trading plan must be entered into in good faith, and not intend to evade the prohibitions of Rule 10b5-1. In an effort to further enhance the Company’s corporate governance practices and demonstrate that the Rule 10b5-1 plans entered into by the Company’s Insider Group are entered into in good faith, the Company has established this Rule 10b5-1 Policy (this “Policy”). This Policy establishes certain guidelines relating to the adoption and operation of Rule 10b5-1 trading plans for those in the Insider Group (defined in Exhibit A) who wish to participate in such plans.

2.Who is Subject to this Policy?

Insider Group members who both (i) are in compliance with the Company’s stock ownership policies, as may be applicable, and (ii) establish a trading plan under Rule 10b5-1 that also meets the additional, Company-imposed requirements set forth below under “What are the Trading Plan Provisions” (a “Trading Plan”), will be allowed to have their agent execute sales and purchases under the Trading Plan even if, at the time the trades take effect, the Insider Group member may be aware of material non-public information or may be subject to a “blackout period”. Insider Group members and other employees who set up Rule 10b5-1 trading plans subsequent to the adoption date of this Policy that do not qualify as Trading Plans will remain subject to the Company’s blackout periods for all trades, including sales and purchases under their Rule 10b5-1 plans, unless they obtain approval in writing from the General Counsel (or designated attorneys in the Office of General Counsel) for an exemption, which will only be granted in the Company’s discretion, prior to making such purchase or sale. For the avoidance of doubt, those Company employees who have Rule 10b5-1 plans already in place prior to this Policy adoption will be considered to qualify as Trading Plans. Notwithstanding the foregoing, the parameters for participation in a Trading Plan will

be established by the Company and the Company may require suspension of any purchase or sale of Company securities under such Trading Plan as it deems necessary.

3.What are the 10b5-1 Trading Plan Provisions?

In order to qualify as a Trading Plan (and therefore be allowed to proceed with sales and purchases during blackout periods), a trading plan set up by an Insider Group member must be in a form that meets both the requirements of Rule 10b5-1 and the following requirements:

1.Adopted in Trading Window. It must be adopted during a trading window period at a time when the Insider Group member does not possess material non-public information about the Company.

2.Pre-Approval Required. The plan must be approved in advance by the Chief Financial Officer and the General Counsel (or designated attorneys in the Office of General Counsel).

3.Cooling Off Periods. The SEC requires that Trading Plans include waiting periods between the adoption or modification of a Trading Plan and the occurrence of the first trade under that new or modified Trading Plan. This is known as a “cooling off” period.

a.120 Day Cooling Off Period. For ICF Directors and all those in the Insider Group the Trading Plan must include a cooling off period of 120 days.

b.30 Day Cooling Off. For employees who are not Directors or in the Insider Group, and for ICF company trading plans, the Trading Plan must include a cooling off period of at least 30 days.

4.Specificity. It must specify the number and price of securities to be traded and the dates on which the trades will occur, or establish a clear formula that is self-executing by the broker under the plan.

5.Duration. It should have a term that does not exceed two years. It is recommended that the Insider Group member consider a term of no longer than twelve (12) months.

6.Certification. If an ICF Director and Executive Officer, you must certify as to your 10b5-1 plans at time of adoption or modification that you: (a) are not aware of any material nonpublic information (“MNPI”) about the Company or its securities; and (b) are adopting the plan in good faith and not as part of a plan or scheme to evade insider trading prohibitions of Rule 10b-5.

7.Continuation of Good Faith. The good faith obligation extends beyond the adoption of a 10b5-1 plan and requires the Insider to continue to act in good faith throughout the duration of the plan.

8.Company Rights. It must by its terms be subject to the right of the Company to suspend trades to the extent the Company deems such suspension to be in the best interests of the Company.

9.No Overlapping or Single Trade Plans. Overlapping trading plans or single-trade plans are generally prohibited.

10.Trading Outside the Plan. The Insider Group may still trade securities outside the plan while it is in effect; provided, they comply with the Insider Trading Policy, pre-clearance in trade window, and other applicable Company policies, such as applicable stock ownership requirements.

11.Amendments and Terminations. A plan may only be amended or terminated during a trading window and when the Insider Group member desiring to amend or terminate the plan in good faith and does not possess material non-public information about the Company, and such proposed change to the previously-approved 10b5-1 plan is approved by the Chief Financial Officer or the General Counsel (or designated attorneys in the Office of General Counsel).

12.Waiting Period After Termination. Insider Group members who terminate a plan prior to its scheduled expiration date may not institute a new plan for a minimum of 90 days. During the 90-day period, Insider Group members may make trades outside their respective plans, subject to the Insider Trading Policy and other applicable Company policies, such as applicable stock ownership requirements.

4.Policy Communication and Interpretation

The Company’s Legal Department is responsible for the communication and interpretation of this Policy, which includes:

•Communicating this Policy to the Insider Group whose trades will be subject to provisions of this Policy;

•Communicating any subsequent Policy revisions; and

•Communicating this Policy to new hires to those positions listed on Exhibit A of the Insider Trading Policy, new positions added to the specified officer list on Exhibit A of the Insider Trading Policy, and new Directors.