UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number 811-21922 |

RS Variable Products Trust

|

| (Exact name of registrant as specified in charter) |

| | |

388 Market Street San Francisco, CA | | 94111 |

| (Address of principal executive offices) | | (Zip code) |

Terry R. Otton

c/o RS Investments

388 Market Street

San Francisco, CA 94111

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 800-766-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| Item 1. | Report to Shareholders. |

RS Variable Products Trust

RS Core Equity VIP Series

| | |

| 6.30.07 | |  |

| | |

| | Table of Contents |

| | |

| RS Core Equity VIP Series | | |

| |

| Portfolio Manager Biography | | 3 |

| |

| Letter from Portfolio Manager | | 3 |

| |

| Fund Performance | | 7 |

| |

| Understanding Your Fund’s Expenses | | 8 |

| |

Financial Information | | |

| |

| Schedule of Investments | | 9 |

| |

| Statement of Assets and Liabilities | | 11 |

| |

| Statement of Operations | | 11 |

| |

| Statements of Changes in Net Assets | | 12 |

| |

| Financial Highlights | | 14 |

| |

| Notes to Financial Statements | | 16 |

| |

| Supplemental Information | | 23 |

Except as otherwise specifically stated, all information and portfolio manager commentary, including portfolio security positions, is as of June 30, 2007. The views expressed in the portfolio manager letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

| | |

| | RS Core Equity VIP Series |

| | |

| | Manind V. Govil (RS Investments) has managed the RS Core Equity VIP Series since 2005*. Mr. Govil joined RS Investments in October 2006 in connection with Guardian Investor Services LLC (GIS)’s acquisition of an interest in RS Investments. Prior to that, Mr. Govil had served as the head of equity investments at The Guardian Life Insurance Company of America (“Guardian Life”) since August 2005. From 2001 to August 2005, Mr. Govil served as the lead portfolio manager — large cap blend/core equity, co-head of equities and head of equity research at Mercantile Capital Advisers. Prior to 2001, he was lead portfolio manager — core equity, at Mercantile. Mr. Govil received a B.A. degree from the University of Bombay, India, and an M.B.A. from the University of Cincinnati and is a Chartered Financial Analyst. |

| * | Includes service as the portfolio manager of the Fund’s Predecessor Fund for periods prior to October 9, 2006, the commencement of operations of the Fund. |

Fund Philosophy

Seeks long-term capital appreciation.

Investment Process

We seek investment opportunities across the entire market spectrum, from growth stocks to value stocks. In our view “growth,” “value,” and “core” represent a continuum of investing rather than opposing or incompatible strategies. We do not employ preset hurdles for earnings growth or limits on valuation metrics; rather we look for stocks that we believe are mispriced relative to a company’s underlying fundamental prospects, creating an opportunity where potential reward significantly outweighs risk.

Intensive fundamental research is the cornerstone of our investment process, which involves a willingness to question consensus. Key elements of our research process include judging the skill, track record, and integrity of a company’s management as well as analyzing the company’s market share and profitability trends vs. peer companies.

We use a bottom-up investment process to invest in what we believe are the best individual stock opportunities within key market sectors. We also apply a risk-controlled portfolio construction process. As fundamental investors we use rigorous quantitative tools to help us screen a vast large-cap universe and highlight potentially mispriced securities as well as to manage our portfolio. Then our team of sector managers analyzes the fundamentals and the valuations of these individual companies to assess their risk/reward profiles and decide whether to recommend particular stocks for the Fund.

Performance

We are pleased to report that during the second quarter, RS Core Equity VIP Series returned 10.22% vs. 6.28% for the benchmark S&P 500® Index3. Our stock picks outperformed sector peers across most economic groups, most notably in technology and financials. Stock selection was slightly negative in the consumer discretionary and industrials sectors.

For the first half of 2007, the Fund returned 14.35% vs. 6.96% for the benchmark. Technology, financials, and health care were the strongest contributors to performance. Our utilities and industrials holdings lagged the rest of the portfolio yet have detracted only slightly from relative performance compared to the index.

Portfolio Review

Top-down sector allocations had a modestly positive net impact during the quarter and the half-year ended June 30, 2007 on relative performance vs. the benchmark; this factor was of minor importance compared with the bottom-up impact of individual stock selection, however. This is consistent with our investment

| | |

| RS CORE EQUITY VIP SERIES | | 3 |

| | |

| | RS Core Equity VIP Series (continued) |

philosophy and process, which are geared toward finding the best individual stock ideas across the investment landscape.

The top three contributors to performance — for both the second quarter and the first half of 2007— were transaction processor MasterCard, computer and personal electronics maker Apple, and energy services contractor Transocean.

MasterCard was our top performer in 2006 and continues to bear fruit in 2007 as it posts results that exceed Wall Street’s expectations. As we wrote in our 2006 year-end letter, we believe the stock market has significantly underestimated MasterCard’s earnings potential along with its management’s skill and determination to unlock value for shareholders, including themselves.

Apple’s stock continued its strong first quarter performance as investors became increasingly excited about the iPhone launch on June 29. As the launch date neared, we were unable to justify our 4.7% position based on valuation derived from reasonable assumptions about iPhone sales. We sold most of the stock position in June, but are maintaining a modest position and would consider adding back at the right valuation.

Transocean is a leading provider of turnkey offshore oil- and gas-drilling and related services. The company has benefited from strong demand and limited supply for offshore rigs. Transocean had been one of the Fund’s largest holdings for some time, but we trimmed the position in June as the stock approached our price target; we redeployed funds to other stock ideas where we see more near-term upside.

There were no major detractors from the second quarter performance, and the only stock that has meaningfully crimped Fund returns during 2007 is American Airlines’ parent, AMR. AMR and the airline industry overall have suffered from higher fuel expenses. Though AMR stock is down year to date in an “up” stock market, we believe its operational turnaround remains on course. We added to the position on second quarter weakness as we still believe the stock has significant upside potential when external cost pressures do subside and the market recognizes and rewards AMR for better operating performance.

Changes to the Fund

Portfolio turnover was modest during the second quarter, but we did make a handful of changes. In addition to trimming Apple and Transocean, the most significant shifts were adding Home Depot and selling Lowe’s and Macy’s.

We bought Home Depot as a replacement for home improvement competitor Lowe’s, as we believe that Home Depot offers more upside potential and specific likely catalysts to drive that upside. We invested in Home Depot during the second quarter expecting the company to take action to divest the supply business, along with other shareholder-friendly actions such as a major share buyback. In late June the company announced specifics on both topics, including a better-than-expected $10.3 billion price for selling the supply business to private equity buyers. Home Depot also announced a $22 billion share buyback, amounting to about 30% of the company’s outstanding shares. We believe that Home Depot will now focus on improving sales at its core retail stores.

We became concerned early in the second quarter that sales were weakening in the core Macy’s stores. Macy’s was also progressing more slowly than we expected at integrating the recently acquired May Department Stores. This deterioration caused us to view Macy’s stock as fully valued. We redeployed the funds to more attractive opportunities.

Outlook

As a core offering, the RS Core Equity VIP Series seeks to deliver solid long-term results across the range of market environments. We believe that over long periods of time, a consistent focus on fundamental research and disciplined stock selection are key to building solid investment results.

Valuation dispersion among companies with stronger and weaker fundamental prospects has narrowed further since our previous report. We continue to find

| | |

| 4 | | RS CORE EQUITY VIP SERIES |

attractively valued investment opportunities among traditional growth companies across market sectors, as valuations of “growth” and “value” stocks have tended to converge in recent quarters. The portfolio favors companies that we expect to grow market share while maintaining profit margins.

We wish to emphasize that we hold ourselves to the highest standards of professionalism and integrity for the benefit of our shareholders, with whom we invest alongside. Thank you for your investment in RS Core Equity VIP Series and for your ongoing support. We promise to do our very best, and we appreciate your confidence in us.

Sincerely,

Manind V. Govil

Portfolio Manager

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and portfolio manager commentary, including portfolio security positions, is as of June 30, 2007.

As with all mutual funds, the value of an investment in the Fund could decline, so you could lose money. The Fund invests primarily in equity securities and therefore exposes you to the general risks of investing in stock markets.

| | |

| RS CORE EQUITY VIP SERIES | | 5 |

| | |

| | RS Core Equity VIP Series (continued) |

| | |

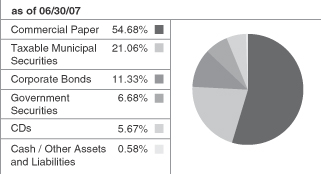

| Assets under Management $1,127,429,021 | | Data as of June 30, 2007 |

| | |

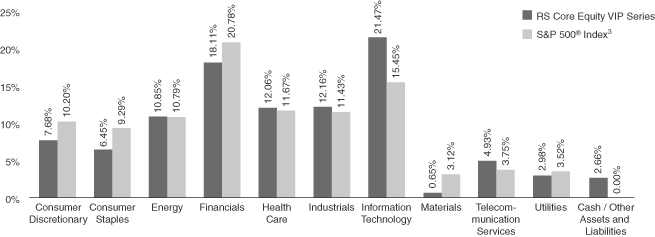

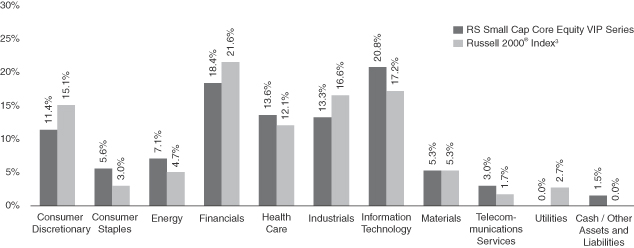

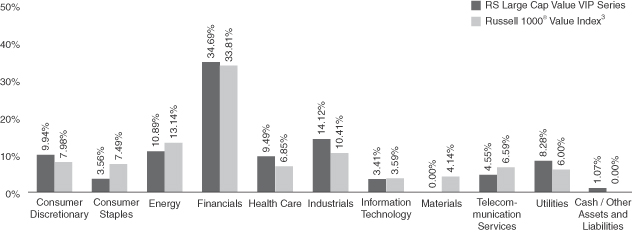

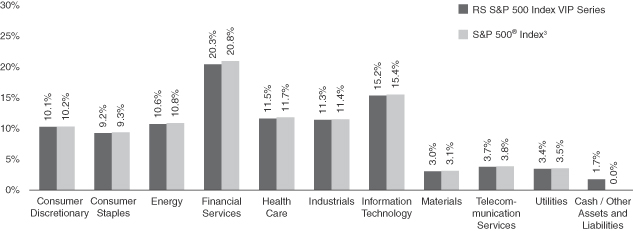

| | Sector Allocation vs. Index1 |

| | |

| | Top Ten Holdings2 |

| | |

| | |

| Company | | Percentage of Total Net Assets |

MasterCard, Inc. | | 5.10% |

Halliburton Co. | | 4.51% |

AT&T, Inc. | | 3.50% |

Enterprise Products Partners LP | | 3.05% |

The AES Corp. | | 2.98% |

The Boeing Co. | | 2.96% |

Wyeth | | 2.96% |

Aon Corp. | | 2.83% |

The Goldman Sachs Group, Inc. | | 2.71% |

Abbott Laboratories | | 2.63% |

| Total | | 33.23% |

1 | The sector allocation represents the Global Industry Classification Standard (GICS), which was developed by Morgan Stanley Capital International (MSCI) and Standard & Poor’s (S&P). The Fund’s holdings are allocated to each sector based on their GICS classification. Cash includes short-term investments and net other assets and liabilities. |

2 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

3 | The S&P 500® Index of 500 primarily large-cap U.S. stocks is generally considered to be representative of U.S. stock market activity. Index results assume the reinvestment of dividends paid on the stocks constituting the index. Unlike the Fund, the index does not incur fees or expenses. |

| | |

| 6 | | RS CORE EQUITY VIP SERIES |

| | |

| | Performance Update Average Annual Returns as of 06/30/07 |

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Inception

Date | | Year-to-Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since

Inception |

RS Core Equity VIP Series | | 04/13/83 | |

14.35% | |

31.13% | |

13.67% | |

10.27% | |

5.05% | |

12.16% |

S&P 500® Index3 | | | |

6.96% | |

20.59% | |

11.67% | |

10.71% | |

7.13% | |

12.78% |

Since inception performance for the index is measured from 3/31/1983, the month end prior to the Fund’s commencement of operations.

| | |

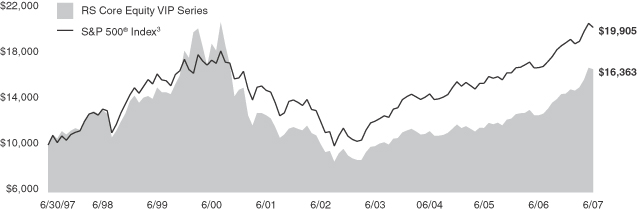

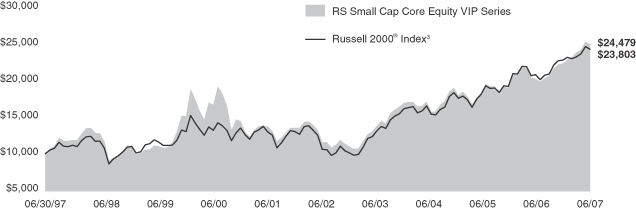

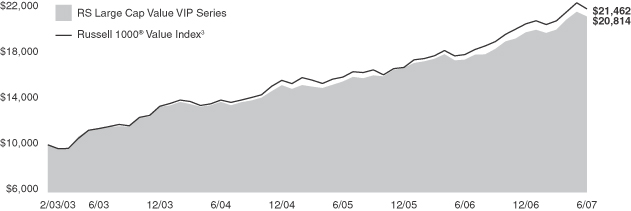

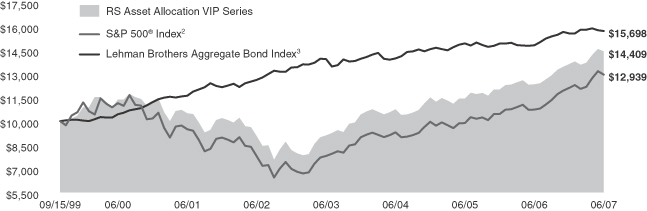

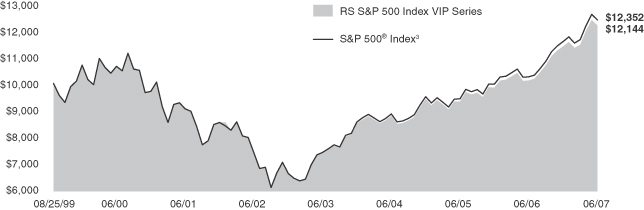

| | Results of a Hypothetical $10,000 Investment If invested on 06/30/97 |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Core Equity VIP Series and the S&P 500® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee future results. The Fund is the successor to The Guardian Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s total gross annual operating expense ratio as of the most current prospectus is 0.58%. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contractowner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 1-800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

| | |

| RS CORE EQUITY VIP SERIES | | 7 |

| | |

| | Understanding Your Fund’s Expenses — unaudited |

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these cost with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | | | |

| | | Beginning

Account Value 01/01/07 | | Ending

Account Value 06/30/07 | | Expenses Paid

During Period* 01/01/07-06/30/07 | | Expense Ratio

During Period* 01/01/07-06/30/07 |

| | | | | |

Based on Actual Return | | $1,000.00 | | $1,143.50 | | $2.96 | | 0.56% |

| | | | | |

Based on Hypothetical Return (5% return before expenses) | | $1,000.00 | | $1,022.03 | | $2.79 | | 0.56% |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| | |

| 8 | | RS CORE EQUITY VIP SERIES |

| | |

| | Schedule of Investments — RS Core Equity VIP Series |

| | | | | |

| June 30, 2007 (unaudited) | | Shares | | Value |

| | | | | |

| Common Stocks — 97.4% |

| Aerospace & Defense — 4.4% |

General Dynamics Corp. | | 211,400 | | $ | 16,535,708 |

The Boeing Co. | | 347,200 | | | 33,386,752 |

| | | | | |

| | | | | 49,922,460 |

| Airlines — 1.2% |

AMR Corp.(1) | | 520,450 | | | 13,713,857 |

| | | | | |

| | | | | 13,713,857 |

| Biotechnology — 3.5% |

Celgene Corp.(1) | | 294,200 | | | 16,866,486 |

Gilead Sciences, Inc.(1) | | 572,800 | | | 22,207,456 |

| | | | | |

| | | | | 39,073,942 |

| Capital Markets — 4.4% |

Legg Mason, Inc. | | 196,200 | | | 19,302,156 |

The Goldman Sachs Group, Inc. | | 141,200 | | | 30,605,100 |

| | | | | |

| | | | | 49,907,256 |

| Chemicals — 0.7% |

Rohm & Haas Company | | 134,100 | | | 7,332,588 |

| | | | | |

| | | | | 7,332,588 |

| Commercial Banks — 2.0% |

PNC Financial Services Group, Inc. | | 157,900 | | | 11,302,482 |

SunTrust Banks, Inc. | | 136,200 | | | 11,677,788 |

| | | | | |

| | | | | 22,980,270 |

| Commercial Services & Supplies — 1.9% |

Waste Management, Inc. | | 551,500 | | | 21,536,075 |

| | | | | |

| | | | | 21,536,075 |

| Communications Equipment — 6.3% |

Corning, Inc.(1) | | 855,100 | | | 21,847,805 |

Nokia Oyj, ADR(1)(2) | | 939,400 | | | 26,406,534 |

QUALCOMM, Inc. | | 521,600 | | | 22,632,224 |

| | | | | |

| | | | | 70,886,563 |

| Computers & Peripherals — 3.1% |

Apple, Inc.(1) | | 93,500 | | | 11,410,740 |

EMC Corp.(1) | | 1,274,100 | | | 23,061,210 |

| | | | | |

| | | | | 34,471,950 |

| Consumer Finance — 1.6% |

American Express Co. | | 142,400 | | | 8,712,032 |

AmeriCredit Corp.(1) | | 336,900 | | | 8,944,695 |

| | | | | |

| | | | | 17,656,727 |

| Diversified Financial Services — 3.3% |

Interactive Brokers Group, Inc., Class A(1) | | 542,580 | | | 14,720,195 |

JPMorgan Chase & Co. | | 462,800 | | | 22,422,660 |

| | | | | |

| | | | | 37,142,855 |

| Diversified Telecommunication Services — 3.5% |

AT&T, Inc. | | 951,936 | | | 39,505,344 |

| | | | | |

| | | | | 39,505,344 |

| Electronic Equipment & Instruments — 0.8% |

Jabil Circuit, Inc. | | 410,700 | | | 9,064,149 |

| | | | | |

| | | | | 9,064,149 |

| | | | | |

| June 30, 2007 (unaudited) | | Shares | | Value |

| | | | | |

| Energy Equipment & Services — 6.3% |

Halliburton Co. | | 1,474,100 | | $ | 50,856,450 |

Transocean, Inc.(1) | | 186,200 | | | 19,733,476 |

| | | | | |

| | | | | 70,589,926 |

| Food Products — 4.1% |

Campbell Soup Co. | | 629,300 | | | 24,423,133 |

General Mills, Inc. | | 382,000 | | | 22,316,440 |

| | | | | |

| | | | | 46,739,573 |

| Health Care Providers & Services — 3.0% |

Medco Health Solutions, Inc.(1) | | 210,400 | | | 16,409,096 |

UnitedHealth Group, Inc. | | 342,300 | | | 17,505,222 |

| | | | | |

| | | | | 33,914,318 |

| Hotels, Restaurants & Leisure — 2.3% |

McDonald’s Corp. | | 513,800 | | | 26,080,488 |

| | | | | |

| | | | | 26,080,488 |

| Household Durables — 1.5% |

Newell Rubbermaid, Inc. | | 558,400 | | | 16,433,712 |

| | | | | |

| | | | | 16,433,712 |

| Independent Power Producers & Energy Traders — 3.0% |

The AES Corp.(1) | | 1,535,600 | | | 33,598,928 |

| | | | | |

| | | | | 33,598,928 |

| Industrial Conglomerates — 1.7% |

Tyco International Ltd. | | 559,500 | | | 18,905,505 |

| | | | | |

| | | | | 18,905,505 |

| Information Technology Services — 8.6% |

Accenture Ltd., Class A | | 526,400 | | | 22,577,296 |

Fidelity National Information Services, Inc. | | 200,434 | | | 10,879,558 |

MasterCard, Inc., Class A | | 346,300 | | | 57,440,781 |

Western Union Co. | | 305,400 | | | 6,361,482 |

| | | | | |

| | | | | 97,259,117 |

| Insurance — 4.3% |

Aon Corp. | | 749,800 | | | 31,948,978 |

W. R. Berkley Corp. | | 522,200 | | | 16,992,388 |

| | | | | |

| | | | | 48,941,366 |

| Internet Software & Services — 2.7% |

eBay, Inc.(1) | | 445,200 | | | 14,326,536 |

Google, Inc., Class A(1) | | 30,400 | | | 15,910,752 |

| | | | | |

| | | | | 30,237,288 |

| Machinery — 2.0% |

Caterpillar, Inc. | | 284,600 | | | 22,284,180 |

| | | | | |

| | | | | 22,284,180 |

| Media — 1.3% |

Grupo Televisa S.A., ADR(1)(2) | | 540,200 | | | 14,914,922 |

| | | | | |

| | | | | 14,914,922 |

| Oil, Gas & Consumable Fuels — 4.6% |

Chevron Corp. | | 63,600 | | | 5,357,664 |

Devon Energy Corp. | | 154,300 | | | 12,080,147 |

Enterprise Products Partners L.P. | | 1,079,280 | | | 34,331,897 |

| | | | | |

| | | | | 51,769,708 |

The accompanying notes are an integral part of these financial statements.

| | |

| | Schedule of Investments – RS Core Equity VIP Series (continued) |

| | | | | |

| June 30, 2007 (unaudited) | | Shares | | Value |

| | | | | |

| Pharmaceuticals — 5.6% |

Abbott Laboratories | | 553,600 | | $ | 29,645,280 |

Wyeth | | 581,800 | | | 33,360,412 |

| | | | | |

| | | | | 63,005,692 |

| Road & Rail — 1.0% |

Burlington Northern Santa Fe Corp. | | 126,400 | | | 10,761,696 |

| | | | | |

| | | | | 10,761,696 |

| Specialty Retail — 2.6% |

The Home Depot, Inc. | | 739,700 | | | 29,107,195 |

| | | | | |

| | | | | 29,107,195 |

| Thrifts & Mortgage Finance — 2.4% |

Federal Home Loan Mortgage Corp. | | 270,800 | | | 16,437,560 |

People’s United Financial, Inc. | | 628,200 | | | 11,137,986 |

| | | | | |

| | | | | 27,575,546 |

| Tobacco — 2.3% |

Altria Group, Inc. | | 371,000 | | | 26,021,940 |

| | | | | |

| | | | | 26,021,940 |

| Wireless Telecommunication Services — 1.4% |

America Movil SAB de C.V., ADR(2) | | 260,400 | | | 16,126,573 |

| | | | | |

| | | | | 16,126,573 |

| | | | | |

Total Common Stocks

(Cost $898,049,455) | | | 1,097,461,709 |

| | | | | |

| June 30, 2007 (unaudited) | | Shares | | Value |

| | | | | |

| Other Investments — For Trustee Deferred Compensation Plan — 0.0% |

RS Core Equity Fund, Class Y(3) | | 21 | | $ | 897 |

RS Emerging Growth Fund, Class Y(3) | | 84 | | | 3,394 |

RS Emerging Markets Fund, Class A(3) | | 24 | | | 614 |

RS Global Natural Resources Fund, Class Y(3) | | 261 | | | 9,558 |

RS Growth Fund, Class Y(3) | | 197 | | | 3,287 |

RS Investors Fund, Class Y(3) | | 507 | | | 6,545 |

RS MidCap Opportunities Fund, Class Y(3) | | 169 | | | 2,736 |

RS Partners Fund, Class Y(3) | | 63 | | | 2,417 |

RS Smaller Company Growth Fund, Class Y(3) | | 86 | | | 1,967 |

RS Value Fund, Class Y(3) | | 60 | | | 1,861 |

| | | | | |

Total Other Investments

(Cost $31,160) | | | 33,276 |

| | | | | |

| | | Shares | | Value |

| | | | | |

| Short-Term Investments — 1.4% |

| Federated Prime Obligations Fund, Class B(4) | | 16,282,523 | | | 16,282,523 |

| | | | | |

Total Short-Term Investments

(Cost $16,282,523) | | | 16,282,523 |

| | | | | |

Total Investments — 98.8%

(Cost $914,363,138) | | | 1,113,777,508 |

| | | | | |

| Other Assets, Net — 1.2% | | | 13,651,513 |

| | | | | |

| Total Net Assets — 100.0% | | $ | 1,127,429,021 |

(1) | Non income-producing security. |

(2) | ADR — American Depositary Receipt. |

(3) | Investments in designated RS Mutual Funds under a deferred compensation plan adopted for disinterested Trustees. See Note B in Notes to Financial Statements. |

(4) | Money Market Fund registered under the Investment Company Act of 1940. |

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

| | |

| | Financial Information — RS Core Equity VIP Series |

| | |

| | Statement of Assets and Liabilities As of June 30, 2007 (unaudited) |

| | | | |

| |

Assets | | | | |

Investments, at value | | $ | 1,113,777,508 | |

Receivable for investments sold | | | 30,060,051 | |

Receivable for fund shares subscribed | | | 602,600 | |

Dividends/interest receivable | | | 491,596 | |

Prepaid expenses | | | 24,870 | |

| | | | |

Total Assets | | | 1,144,956,625 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | | 15,823,740 | |

Payable for fund shares redeemed | | | 1,048,326 | |

Payable to adviser | | | 465,551 | |

Deferred trustees’ compensation | | | 33,276 | |

Accrued expenses/other liabilities | | | 156,711 | |

| | | | |

Total Liabilities | | | 17,527,604 | |

| | | | |

Total Net Assets | | $ | 1,127,429,021 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | | 1,269,178,878 | |

Accumulated undistributed net investment income | | | 5,402,980 | |

Accumulated net realized loss from investments | | | (346,567,207 | ) |

Net unrealized appreciation on investments | | | 199,414,370 | |

| | | | |

Total Net Assets | | $ | 1,127,429,021 | |

| | | | |

Investments, at Cost | | $ | 914,363,138 | |

| | | | |

Pricing of Shares | | | | |

| |

Shares of Beneficial Interest Outstanding with no Par Value | | | 29,284,236 | |

| |

Net Asset Value Per Share | | | $38.50 | |

| | |

| | Statement of Operations For the Six Month Period Ended June 30, 2007 (unaudited) |

| | | | |

| |

Investment Income | | | | |

Interest | | $ | 250,032 | |

Dividends | | | 7,823,564 | |

Withholding taxes on foreign dividends | | | (84,690 | ) |

| | | | |

Total Investment Income | | | 7,988,906 | |

| | | | |

Expenses | | | | |

Investment advisory fees | | | 2,685,585 | |

Professional fees | | | 87,492 | |

Custodian fees | | | 87,834 | |

Shareholder reports | | | 56,810 | |

Trustees’ fees and expenses | | | 28,685 | |

Insurance expense | | | 25,204 | |

Administrative service fees | | | 16,171 | |

Registration fees | | | 475 | |

Other expense | | | 2,505 | |

| | | | |

Total Expenses | | | 2,990,761 | |

Less: Custody credits | | | (849 | ) |

| | | | |

Total Expenses, Net | | | 2,989,912 | |

| | | | |

Net Investment Income | | | 4,998,994 | |

| | | | |

Realized Gain and Change in Unrealized Appreciation on Investments | | | | |

Net realized gain from investments | | | 73,935,502 | |

Net change in unrealized appreciation on investments | | | 66,474,336 | |

| | | | |

Net Gain on Investments | | | 140,409,838 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 145,408,832 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| | Financial Information — RS Core Equity VIP Series (continued) |

| | |

| | Statement of Changes in Net Assets Six-month-ended numbers are unaudited |

| | | | | | | | |

| | |

| | | For the Six

Months

Ended 6/30/07 | | | For the Year

Ended 12/31/06 | |

Operations | | | | | | | | |

Net investment income | | $ | 4,998,994 | | | $ | 11,883,633 | |

Net realized gain on investments | | | 73,935,502 | | | | 109,138,789 | |

Net change in unrealized appreciation on investments | | | 66,474,336 | | | | 41,502,180 | |

| | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 145,408,832 | | | | 162,524,602 | |

| | | | | | | | |

| | |

Distributions to Shareholders from: | | | | | | | | |

Net investment income | | | — | | | | (19,311,193 | ) |

| | | | | | | | |

| | |

Capital Share Transactions | | | | | | | | |

Proceeds from sales of shares | | | 25,004,148 | | | | 42,985,511 | |

Reinvestment of distributions | | | — | | | | 19,311,192 | |

Cost of shares redeemed | | | (91,849,085 | ) | | | (191,878,962 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital share transactions | | | (66,844,937 | ) | | | (129,582,259 | ) |

| | | | | | | | |

Net Increase in Net Assets | | | 78,563,895 | | | | 13,631,150 | |

| | |

Net Assets | | | | | | | | |

| | |

Beginning of period | | | 1,048,865,126 | | | | 1,035,233,976 | |

| | | | | | | | |

End of period | | $ | 1,127,429,021 | | | $ | 1,048,865,126 | |

| | | | | | | | |

Accumulated Undistributed Net Investment Income included in Net Assets | | $ | 5,402,980 | | | $ | 403,986 | |

| | | | | | | | |

| | |

Other Information: | | | | | | | | |

| | |

Shares | | | | | | | | |

Sold | | | 686,291 | | | | 1,388,085 | |

Reinvested | | | — | | | | 643,933 | |

Redeemed | | | (2,554,254 | ) | | | (6,223,863 | ) |

| | | | | | | | |

Net Decrease | | | (1,867,963 | ) | | | (4,191,845 | ) |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

This page intentionally left blank

| | |

| RS CORE EQUITY VIP SERIES | | 13 |

| | |

| | Financial Information — RS Core Equity VIP Series |

The financial highlights table is intended to help you understand the Fund’s financial performance for the past five years and the six months ended June 30, 2007. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | |

| | Financial Highlights Six-month-ended numbers are unaudited |

| | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset Value,

Beginning of

Period | | Net Investment

Income | | Net Realized

and Unrealized

Gain/(loss) | | | Total From

Investment

Operations | | | Distributions

From Net

Investment

Income | | | Net Asset

Value,

End Of

Period |

| | | | | | | |

Six Months Ended 06/30/07(1) | | $ | 33.67 | | $ | 0.17 | | $ | 4.66 | | | $ | 4.83 | | | $ | — | | | $ | 38.50 |

| | | | | | | |

Year Ended 12/31/06 | | | 29.29 | | | 0.39 | | | 4.59 | | | | 4.98 | | | | (0.60 | ) | | | 33.67 |

| | | | | | | |

Year Ended 12/31/05 | | | 28.42 | | | 0.50 | | | 0.70 | | | | 1.20 | | | | (0.33 | ) | | | 29.29 |

| | | | | | | |

Year Ended 12/31/04 | | | 27.30 | | | 0.39 | | | 1.23 | | | | 1.62 | | | | (0.50 | ) | | | 28.42 |

| | | | | | | |

Year Ended 12/31/03 | | | 22.71 | | | 0.28 | | | 4.57 | | | | 4.85 | | | | (0.26 | ) | | | 27.30 |

| | | | | | | |

Year Ended 12/31/02 | | | 28.94 | | | 0.24 | | | (6.25 | ) | | | (6.01 | ) | | | (0.22 | ) | | | 22.71 |

The accompanying notes are an integral part of these financial statements.

| | | | | | | | | | | |

Total

Return* | | Net Assets, End of Period (000s) | | Net Ratio

of Expenses To Average

Net Assets(2) | | Net Ratio of Net

Investment Income

To Average

Net Assets(2) | | Portfolio

Turnover Rate | | |

| | | | | | |

| 14.35% | | $ | 1,127,429 | | 0.56% | | 0.93% | | 29% | | |

| | | | | | |

| 17.26% | | | 1,048,865 | | 0.57% | | 1.17% | | 85% | | |

| | | | | | |

| 4.30% | | | 1,035,234 | | 0.56% | | 1.67% | | 103% | | |

| | | | | | |

| 6.00% | | | 1,261,203 | | 0.54% | | 1.29% | | 76% | | |

| | | | | | |

| 21.45% | | | 1,454,546 | | 0.54% | | 1.06% | | 77% | | |

| | | | | | |

| (20.88)% | | | 1,365,328 | | 0.54% | | 0.85% | | 65% | | |

| | (1) | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. |

| | (2) | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of custody credits. |

| | * | Total returns do not reflect the effects of charges deducted pursuant to the terms of GIAC’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

The accompanying notes are an integral part of these financial statements.

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series |

June 30, 2007 (unaudited)

| Note A. | | Organization and Accounting Policies |

RS Variable Products Trust (the “Trust”), a Massachusetts business trust, was organized on May 18, 2006. The Trust currently offers seventeen series. RS Core Equity VIP Series (the “Fund” or “CEV”) is a series of the Trust. CEV is a diversified fund. The financial statements for the other remaining series of the Trust are presented in separate reports.

Class I shares of CEV are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”). GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“GLICOA”). The Fund is available for investment only through the purchase of certain variable annuity and variable life insurance contracts issued by GIAC.

The following accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America. The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Significant accounting policies of the Fund are as follows:

Investment Valuations

Marketable securities are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and asked prices. Securities traded on the Nasdaq Stock Market, Inc. (“Nasdaq”) are generally valued at the Nasdaq official closing price, which may not be the last sale price. If the Nasdaq official closing price is not available for a security, that security will generally be valued using the last reported sale price, or, if no sales are reported, at the mean between the closing bid and asked prices. Short-term investments that will mature in 60 days or less are valued at amortized cost, which approximates market value. Repurchase agreements are carried at cost, which approximates market value (see Note D). Foreign securities are valued in the currencies of the markets where they trade and then converted to U.S. dollars using the prevailing exchange rates at the close of the New York Stock Exchange (“NYSE”). Investments by the Fund in open-end management investment companies that are registered under the 1940 Act are valued based upon the net asset values of such investment companies.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued using methods approved by the Board of Trustees. In addition, if there has been a movement in the U.S. markets that exceeds a specified threshold or there is a foreign market holiday on a day when the NYSE is open, the values of the Fund’s investments in foreign securities generally will be determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities.

Securities for which market quotations are not readily available or for which market quotations are considered unreliable are valued at their fair values as determined in accordance with the guidelines and procedures adopted by the Fund’s Board of Trustees.

Futures contracts are valued at the settlement prices established by the boards of trade or exchanges on which they are traded.

Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

Dividend income is generally recorded on the ex-dividend date. Interest income, which includes accretion/discount, is accrued and recorded daily. Many expenses of the Trust can be directly attributed to a specific Fund. Expenses that cannot be directly attributed to a specific Fund are apportioned among all the series in the Trust, based on relative net assets.

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of unin-

vested cash balances were used to reduce a portion of the Fund’s expenses. During the period, under this arrangement, custodian fees were reduced in the amount of $849. The Fund could have employed the uninvested assets to produce income in the Fund if the Fund had not entered into such an arrangement.

Foreign-Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are translated into U.S. dollars at the exchange rates quoted at the close of the New York Stock Exchange on each business day. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Forward Foreign Currency Contracts

CEV may enter into forward foreign currency contracts. A forward foreign currency contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward exchange rate. Risks may arise from the potential inability of a counterparty to meet the terms of a contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. Fluctuations in the values of forward foreign currency contracts are recorded for book purposes as unrealized gains or losses from translation of other assets and liabilities denominated in foreign currencies by CEV. When forward contracts are closed, CEV will record realized gains or losses equal to the difference between the values of such forward contracts at the time each was opened and the values at the time each was closed. Such amounts are recorded in net realized gains or losses on foreign currency related transactions. CEV will not enter into a forward foreign currency contract if such contract would obligate it to deliver an amount of foreign currency in excess of the value of its portfolio securities or other assets denominated in that currency.

Futures Contracts

CEV may enter into financial futures contracts. In entering into such contracts, CEV is required to deposit with the broker either in cash or securities an amount equal to a certain percentage of the contract amount. Subsequent payments are made or received by CEV each day, depending on the daily fluctuations in the value of the contracts, and are recorded for financial statement purposes as variation margins paid or received by CEV. The daily changes in the variation margin are recognized as unrealized gains or losses by CEV. CEV may not achieve the anticipated benefits of the financial futures contracts and may realize a loss.

Dividend Distributions

Dividends from net investment income and net realized short-term and long-term capital gains for CEV will be distributed at least annually. All dividends to shareholders are credited in the form of additional shares of CEV at the net asset value, recorded on the ex-dividend date.

Due to the timing of dividend distributions and the differences in accounting for income and realized gains/(losses) for financial statement and federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains/(losses) were recorded by the Fund.

Taxes

The Fund intends to continue complying with the requirements of the Internal Revenue Code to qualify as regulated investment company, and to distribute all net investment income and realized net capital gains, if any, to shareholders. Therefore, the Fund does not expect to be subject to income tax, and no provision for such tax has been made.

From time to time, however, the Fund may choose to pay an excise tax where the cost of making the required distribution exceeds the amount of the tax.

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (continued) |

June 30, 2007 (unaudited)

The tax character of dividends paid to shareholders during the year ended December 31, 2006 was as follows:

| | | |

| | | Ordinary

Income |

2006 | | $ | 19,311,193 |

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications to paid-in capital. Undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions may include temporary book and tax differences, which will reverse in a subsequent period.

As of December 31, 2006, the components of accumulated losses on a tax basis were as follows:

| | | | | |

Undistributed

Ordinary

Income | | Capital Loss Carryforward | |

| $ | 411,379 | | $ | (419,817,030 | ) |

During any particular year, net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, are normally distributed to shareholders annually.

Under current income tax law, net capital and currency losses realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year. For the year ended December 31, 2006, the Fund elected to defer $289,962 net capital losses.

As of December 31, 2006, for federal income tax purposes, the Fund had capital losses carryforward as follows:

| | | | | | |

| | | Capital Loss

Carryforward | | | Expiration

Date |

| | $ | (83,266,729 | ) | | 2009 |

| | | (240,321,401 | ) | | 2010 |

| | | (95,938,938 | ) | | 2011 |

| | | | | | |

| Total | | $ | (419,527,068 | ) | | |

| | | | | | |

| Note B. | | Advisory Fees and Expense Limitation |

Under the terms of the advisory agreement, which is reviewed and approved annually by the Board of Trustees, the Fund pays RS Investment Management Co. LLC (“RS Investments”) an investment advisory fee calculated at an annual rate of 0.50% of the average daily net assets of the Fund.

Pursuant to a Sub-Administration and Accounting Services Agreement, Guardian Investor Services LLC (“GIS”), which holds a majority interest in RS Investments, receives fees at an annual rate of 0.052% of the Fund’s average daily net assets from RS Investments.

An expense limitation has been imposed pursuant to a written agreement between RS Investments and the Trust through December 31, 2009 to limit the Fund’s total annual operating expenses (excluding interest expense associated with securities lending) from exceeding 0.57% of the average daily net assets of CEV.

Trustees and officers of the Fund who are interested persons of RS Investments, as defined in the 1940 Act, receive no compensation from the Fund for acting as such. Trustees of the Fund who are not interested persons of RS Investments (“disinterested Trustees”) receive compensation and reimbursement of expenses.

Under a Deferred Compensation Plan (the “Plan”), a disinterested Trustee may elect to defer receipt of all, or a portion, of his/her annual compensation. The amount of the Fund’s deferred compensation obligation to a Trustee is determined by adjusting the amount of the

deferred compensation to reflect the investment return of one or more RS Funds designated for the purpose by the Trustee. The Fund may cover its deferred compensation obligation to a Trustee by investing in one or more of such designated Funds. The Fund’s liability for deferred compensation to a Trustee is adjusted periodically to reflect the investment performance of the Funds designated by the Trustee. Deferred amounts remain in the Fund until distributed in accordance with the Plan. Trustees’ fees in the accompanying financial statements include the current fees, either paid in cash or deferred, and the net increase or decrease in the value of the deferred amounts.

| Note C. | | Investment Transactions |

Purchases and proceeds from sales of securities (excluding short-term securities) amounted to $306,473,970 and $386,634,062, respectively, during the period ended June 30, 2007.

The gross unrealized appreciation and depreciation of investments, on a tax basis, excluding futures, at June 30, 2007 aggregated $218,319,224 and $18,973,769, respectively, resulting in net unrealized appreciation of $199,345,455. The cost of investments owned at June 30, 2007 for federal income tax purposes was $914,432,053.

| Note D. | | Repurchase Agreements |

The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities. Repurchase agreements are fully collateralized (including the interest earned thereon) and such collateral is marked-to-market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, CEV will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, CEV maintains the right to sell the collateral and may claim any resulting loss against the seller.

| Note E. | | Shares of Beneficial Interest |

There is an unlimited number of shares of beneficial interest authorized for CEV Class I. Transactions in shares of beneficial interest were as follows:

| | | | | | | | | | | | | | |

| | | Period Ended

June 30, 2007 | | | Year Ended

December 31, 2006 | | | Period Ended

June 30, 2007 | | | Year Ended

December 31, 2006 | |

| | | Shares | | | Amount | |

Shares sold | | 686,291 | | | 1,388,085 | | | $ | 25,004,148 | | | $ | 42,985,511 | |

Shares issued in reinvestment of dividends | | — | | | 643,933 | | | | — | | | | 19,311,192 | |

Shares repurchased | | (2,554,254 | ) | | (6,223,863 | ) | | | (91,849,085 | ) | | | (191,878,962 | ) |

| | |

Net decrease | | (1,867,963 | ) | | (4,191,845 | ) | | $ | (66,844,937 | ) | | $ | (129,582,259 | ) |

| | |

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (continued) |

June 30, 2007 (unaudited)

| Note F. | | Temporary Borrowings |

The Fund, with other funds managed by the same adviser, share in a $75 million committed revolving credit/overdraft protection facility from PNC Bank for temporary purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is calculated based on the market rates at the time of borrowing; all the funds that are parties to the facility share in a commitment fee that is allocated among the funds on the basis of their respective sizes. The Fund may borrow up to the lesser of one-third of its total assets (including amounts borrowed) or any lower limit specified in the Fund’s Statement of Additional Information or the Prospectus. For the six months ended June 30, 2007, the Fund did not borrow from the facility.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

| Note H. | | New Accounting Pronouncements |

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109” (“FIN 48”), which clarifies the accounting for uncertainty in tax positions taken or expected to be taken in a tax return. FIN 48 provides guidance on the measurement, recognition, classification and disclosure of tax positions, along with accounting for any related interest and penalties. FIN 48 is effective within the first required financial statement reporting period (semiannual reporting) for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the date of effectiveness. The Trust has concluded that the adoption of FIN 48 did not result in any material impact to the Fund’s financial statements, as applied to open tax years ended December 31, 2004 through December 31, 2006.

In September 2006, FASB issued FASB Statement No. 157, “Fair Value Measurement” (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Trust believes the adoption of SFAS 157 will have no material impact on its financial statements.

On October 6, 2004, RS Investment Management, L.P. (“RSIM L.P.”), the investment adviser to the RS Family of Funds prior to GIS’s acquisition of a majority of the outstanding interests in RS Investments, entered into settlement agreements with the Securities and Exchange Commission (the “SEC”) and the Office of the New York State Attorney General (the “NYAG”). The settlement agreements relate to certain investors’ frequent trading of shares of RS Emerging Growth Fund, a series of RS Investment Trust, during 2000 through 2003. In its settlement with the SEC, RSIM L.P. consented to the entry of an order by the SEC (the “SEC Order”) instituting and settling administrative and cease-and-desist proceedings against it. Under the terms of the settlement agreements, RS Investments has paid disgorgement of $11.5 million and a civil money penalty of $13.5 million for a total payment of $25 million, all of which will be distributed to certain current and former shareholders of certain series of RS Investment Trust in a manner to be determined by an independent consultant. The settlement agreement with the NYAG also requires RS Investments to reduce its management fee for certain funds in the aggregate amount of approximately $5 million over a period of five years. In addition, RS Investments has made a number of under- takings to the SEC and the NYAG relating to compliance, ethics, and legal oversight and mutual fund governance and disclosure.

G. Randall Hecht, the former co-president of RS Investment Trust and the former chairman of the Board of

Trustees of RS Investment Trust, was also named a respondent in the SEC Order and consented to its entry. As part of the settlement agreement with the SEC, Mr. Hecht agreed, among other things, to pay a civil money penalty, to not serve as a Trustee of RS Investment Trust for a period of five years, and to limit his duties with RS Investments (of which he was chairman) for 12 months.

Steven M. Cohen, the former treasurer of RS Investment Trust and the former chief financial officer of RS Investments, was also named a respondent in the SEC Order and consented to its entry. As part of the settlement agreement with the SEC, Mr. Cohen agreed to, among other things, a civil money penalty and suspensions from association with any investment adviser or registered investment company for nine months and from serving as an officer or a director of any investment company or investment adviser for an additional two years. In addition, in accordance with the settlements, Mr. Cohen resigned as an officer and employee of RS Investments.

RSIM L.P. and Messrs. Hecht and Cohen neither admit nor deny the findings set forth in the SEC Order, and RSIM L.P. neither admits nor denies the findings in its settlement agreement with the NYAG. A copy of the SEC Order is available on the SEC’s Web site at www.sec.gov, and a copy of the settlement agreement with the NYAG is available on the NYAG’s Web site at www.oag.state.ny.us.

RSIM L.P. and not any of the RS funds will bear all the costs of complying with the settlements, including payments of disgorgement and civil penalties (except those paid by Messrs. Hecht and Cohen individually), and the associated legal fees relating to these regulatory proceedings.

It is possible that these matters and/or related developments may result in increased Series redemptions and reduced sales of Series shares, which could result in increased costs and expenses, or may otherwise adversely affect the Series.

After the announcement of those settlements, three related civil lawsuits commenced. These lawsuits were consolidated into one proceeding in the U.S. District Court for the District of Maryland on April 19, 2005 (In re Mutual Funds Investment Litigation, Case No. 04-MD- 15863-JFM). The district court appointed a lead plaintiff, and a consolidated complaint was filed. The consolidated complaint, brought on behalf of a purported class of investors in RS funds between October 6, 1999, and October 5, 2004, seeks compensatory damages and other related relief. The complaint names RS Investments, RS Investment Management, Inc., RSIM L.P., RS Investment Trust, and certain current or former Trustees, subadvisers, employees, and officers of RS Investment Trust or RSIM L.P. as defendants. It generally tracks the factual allegations made in the SEC and NYAG settlements, including the allegations that fund prospectuses were false and misleading, and alleges a variety of theories for recovery, including, among others, that defendants violated Sections 34(b), 36(a), 36(b), and 48(a) of the 1940 Act and breached fiduciary duties to investors. The consolidated lawsuit further alleges that defendants violated, or caused to be violated, Sections 11, 12(a)(2), and 15 of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

On May 27, 2005, the defendants moved to dismiss the consolidated action. On November 3, 2005, the Court issued a ruling dismissing all claims against RS Investment Trust. As for the claims against the other RS defendants, the Court dismissed the claims arising under: sections 34(b) and 36(a) of the Investment Company Act of 1940; sections 11, 12(a)(2), and 15 of the Securities Act of 1933; and state law. The Court allowed plaintiffs to proceed against some of the RS defendants with their claims arising under sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and sections 36(b) and 48(a) of the Investment Company Act of 1940. Although initially the Court deferred any ruling on the claims against the named independent trustees, on July 24, 2006, the Court dismissed all remaining claims against the former and current independent trustees of RS Investment Trust. The litigation is currently in the discovery phase.

Additional lawsuits arising out of the same circumstances and presenting similar or different or additional

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (continued) |

June 30, 2007 (unaudited)

allegations may be filed against certain RS Funds, RS Investments, or their affiliates in the future. RS Investments does not believe that the pending consolidated action will materially affect its ability to continue to provide to the funds the services it has agreed to provide. It is not possible at this time to predict whether the litigation will have any material adverse effect on any of the Series.

| | |

| | Supplemental Information — unaudited |

Approval of Investment Advisory Agreements for Series of RS Variable Products Trust

The Board of Trustees of RS Variable Products Trust (the “Trust”), including all of the Trustees who are not interested persons of the Trust or of RS Investments (the “disinterested Trustees”), met in person on April 30, May 3, May 12, and May 24, 2006, to consider approval of an Investment Advisory Agreement between the Funds and RS Investments; a Sub-Advisory, Sub-Administration and Accounting Services Agreement between RS Investments and Guardian Investor Services LLC (“GIS”) with respect to RS Asset Allocation VIP Series, RS S&P 500 Index VIP Series, RS Investment Quality Bond VIP Series, RS Low Duration Bond VIP Series, RS High Yield Bond VIP Series, and RS Cash Management VIP Series; a Sub-Advisory Contract between RS Investments and UBS Global Asset Management (Americas) Inc. (“UBS”) with respect to RS Large Cap Value VIP Series; a Sub-Advisory, Sub-Administration and Accounting Services Agreement between RS Investments and Guardian Baillie Gifford Limited (“GBG”) with respect to RS International Growth VIP Series and RS Emerging Markets VIP Series; and a Sub-Sub-Investment Advisory Agreement between GBG and Baillie Gifford Overseas Limited (“BGO”) with respect to RS International Growth VIP Series and RS Emerging Markets Growth VIP Series (collectively, the “Advisory Agreements”). In all of their deliberations, the disinterested Trustees were advised by their independent counsel, with whom they had additional separate discussions on a number of occasions. In addition, the disinterested Trustees were assisted in their review by third-party consultants, whom the disinterested Trustees retained for purposes of assisting them in their consideration of the Advisory Agreements.

Each of the Funds was then newly formed in connection with the proposed reorganization of each of the Guardian-sponsored mutual funds (the “predecessor funds”) into a corresponding Fund advised by RS Investments and, with respect to a number of the Funds, sub-advised, or sub-sub-advised, by GIS, UBS, GBG or BGO. In the course of their deliberations, the Trustees met with representatives of RS Investments and of GIS, who discussed with the Trustees the capa-bilities of both firms, and what they saw as the complementary capabilities of the two firms in the areas of investment management and distribution/promotion of mutual fund shares. Representatives of the disinterested Trustees also met with representatives of UBS and BGO. The Trustees considered that it was anticipated that portfolio management personnel of each of the predecessor funds except The Guardian UBS VC Small Cap Value Fund (the predecessor fund to RS Partners VIP Series) would continue as the portfolio management personnel of the Funds, and that the portfolio management personnel of RS Investments’ Value Group would assume the portfolio management responsibility for RS Partners VIP Series.

The Trustees considered the fees proposed to be charged by RS Investments to the Funds, and, if applicable, by the sub-advisers to RS Investments or by BGO to GBG under the Advisory Agreements. The Trustees noted that the fees to be charged to the Funds under the Advisory Agreements were in all cases at least as favorable to the Funds as the fees charged to their predecessor funds. RS Investments furnished information to the Trustees compiled by the third-party consultants based on information from the independent Lipper and Morningstar organizations showing a comparison of RS Investments’ fee rate for each Fund compared to peer mutual funds having similar objectives, strategies, and asset sizes as selected by the third-party consultants. The Trustees also reviewed information from that compilation showing total expenses for the Funds in comparison to the peer funds.

RS Investments stated that each of the Funds would be subject to an expense limitation until December 31, 2009, that would be the same as the expense limitation of the relevant predecessor fund or determined based upon the predecessor fund’s expense ratio as of September 30, 2006. In addition, the Trustees recognized that it was possible the Funds over time could experience reduced expenses both because RS Investments and GIS, as a combined firm, may be in a position to purchase services from third parties for their clients at improved rates and because enhanced distribution

| | |

| | Supplemental Information — unaudited (continued) |

capabilities resulting from the combination may result in increases in the sizes of the Funds and possible reduced expenses through economies of scale.

The Trustees noted at the time that, because the Funds would be new Funds and because of the then upcoming consolidation of the RS and GIS fund families, it would be appropriate to consider in greater detail in the future whether and to what extent economies of scale might be realized as the Funds grow and whether a reduction in the advisory fees paid by the Funds by means of breakpoints might be appropriate.

The Trustees reviewed performance information for each of the predecessor funds for various periods. That review included an examination of comparisons of the performance of the predecessor funds to relevant securities indexes and various peer groups of mutual funds using data from the independent Lipper and Morningstar organizations with respect to various periods, and relative rankings of the predecessor funds compared to peer funds during various periods. The Trustees considered the performance of each predecessor fund over the life of the fund and in recent periods, while also considering its applicable investment objective and strategy and its overall expense ratio. The Trustees noted that the performance information presented to the Trustees showed that most of the predecessor funds were above the median performance among their peers for the three- and five-year periods, which the Trustees believed to be most relevant, but that certain funds had less favorable relative performance for other periods. The Trustees also noted that several funds had acceptable, if relatively high, total expense levels. In light of the fact that the Funds were then being formed in connection with the broader transaction involving GIS’s proposed acquisition of a majority interest in RS Investments, the Trustees determined to approve the Advisory Agreements for a one-year period (rather than the two-year period allowed under the Investment Company Act of 1940, as amended) in order to give themselves the opportunity to formally reconsider the Funds’ performance and expenses after having observed the Funds and the GIS organization during the Funds’ initial year of operation.

The Trustees considered the nature, extent, and quality of the services to be provided by RS Investments and the sub-advisers. In this regard, the Trustees took into account the experience of the proposed portfolio management teams and the resources available to them generally. After considering all of the information described above, the Trustees unanimously voted to approve the Advisory Agreements, including the advisory fees proposed in connection with that approval, for the one-year period commencing upon the Funds’ commencement of operations.

Portfolio Holdings and Proxy Voting Procedures

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Securities and Exchange Commission’s Web site at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. This information is also available, without charge, upon request, by calling toll-free 1-800-221-3253.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2007, are available (i) without charge, upon request, by calling toll-free 1-800-221-3253; and (ii) on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

RS Variable Products Trust

RS Small Cap Core Equity VIP Series

| | |

| 6.30.07 | |  |

| | |

| | Table of Contents |

Except as otherwise specifically stated, all information and portfolio manager commentary, including portfolio security positions, is as of June 30, 2007. The views expressed in the portfolio manager letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

| | |

| | RS Small Cap Core Equity VIP Series |

| | |

| | Matthew P. Ziehl (RS Investments) has managed RS Small Cap Core Equity VIP Series since 2002* Mr. Ziehl joined RS Investments in October 2006 in connection with GIS’s acquisition of an interest in RS Investments. From December 2001 to October 2006, Mr. Ziehl served as managing director at The Guardian Life Insurance Company of America (“Guardian Life.”). Prior to joining Guardian Life, Mr. Ziehl was a team leader with Salomon Brothers Asset Management, Inc. for small growth portfolios since January 2001, and a co-portfolio manager of Salomon Brothers Small Cap Growth Fund since August 1999. He holds a B.A. in political science from Yale University and an M.B.A. from New York University. Mr. Ziehl is also a Chartered Financial Analyst. |

| * | Includes service as the portfolio manager of the Fund’s Predecessor Fund for periods prior to October 9, 2006, the commencement of operations of the Fund. |

Fund Philosophy

Seeks long-term capital appreciation.

Investment Process

We seek investment opportunities across the entire U.S. small-cap market spectrum, from growth stocks to value stocks. In our view “growth,” “value,” and “core” represent a continuum of investing rather than opposing or incompatible strategies. We do not employ preset hurdles for earnings growth or limits on valuation metrics; rather we look for stocks that are mispriced relative to a company’s underlying fundamental prospects, creating an opportunity where potential reward significantly outweighs risk.

We use a bottom-up investment process to invest in what we believe to be the best individual small-cap stock opportunities within all the key market sectors. As fundamental investors we also use rigorous quantitative tools to help us screen a vast small-cap universe and highlight stocks that appear to be attractive on both earnings and valuation metrics. Then our team of sector managers analyzes the fundamentals and the valuations of these individual companies to assess their risk/reward profiles and decide whether to recommend particular stocks for the Fund. Key elements of our research process include judging the skill, track record, and integrity of a company’s management as well as analyzing the company’s market share and profitability trends vs. peer companies.

Performance

The RS Small Cap Core Equity VIP Series returned 4.80% during the second quarter of 2007, outpacing the Russell 2000® Index3 which returned 4.42%. Our stock selection outperformed the index in financial services, technology, and industrials. These results overcame weaker stock selection in health care and consumer discretionary stocks.

The second quarter builds on a strong year-to-date performance advantage. Through the first half of 2007, the Fund returned 11.78% vs. 6.45% for the Russell 2000® Index. Stock selection in technology and financials drove most of the strong relative performance, while health care was the only sector with significantly negative results. Sector weightings had modest net impact on relative performance vs. the index.

Portfolio Review

Our stock selection in financial services was very strong in the second quarter. During the quarter, we were approximately market weighted at 21% of the portfolio in financial related stocks. International Securities Exchange is a leading options-trading exchange, which gained a roughly 30% market share since its inception in 1999 due, we believe, to a superior technological architecture that has driven down trading costs for participants. Early in the second quarter, International Securities announced that it was selling out to Deutsche Börse Group at a substantial premium. We sold our shares at that time, as the stock traded up to the takeout price and we did not

| | |

| RS SMALL CAP CORE EQUITY VIP SERIES | | 3 |

| | |

| | RS Small Cap Core Equity VIP Series (continued) |

anticipate a competing offer. Other winners included Affiliated Managers Group, Investment Technology Group, and East West Bancorp.

Technology constituted approximately 19.6% of the portfolio, an overweight to the index. Again, strong stock selection led to relative gains over the index. Blue Coat Systems, a strong contributor in 2007, provides a suite of hardware and software products that allow network managers to improve performance and manage security of applications and internet-related communications over their networks. In particular, we think Blue Coat is very well positioned in the rapidly growing wide area network (WAN) accelerator space; WAN accelerators improve the speed and performance of network-based applications. Blue Coat’s latest quarterly results showed excellent growth in this area, and we believe that we are still in the early stages of rapid market growth in this segment. Blackboard, a provider of enterprise software to the education markets, also contributed strong returns in the quarter.

Trident Microsystems, which produces image-processing chips for digital televisions, predominantly large liquid-crystal display (LCD-based) televisions, hurt returns in the quarter. Trident has gained numerous design wins at key television makers including Sony and Sharp. We believe that the company is set for dramatic earnings growth in late 2007 and 2008, and it is therefore one of our largest holdings. Trident’s stock underperformed other chipmakers and the broader technology space in the second quarter on concerns that intense price competition at retail for flat-panel televisions would force component makers such as Trident to cut their prices. We believe these concerns to be overblown, as Trident has unique technology that allows cost savings by combining multiple functions on one chip; we believe this is a key reason for its recent design wins in the first place.

Rackable Systems, a provider of network servers and storage systems, declined sharply when the company reported disappointing quarterly results. We have sold the position as we sense that Rackable System’s competitive advantage will be challenged by Dell’s aggressive move into this market segment.

Industrials have been a strong contributor to benchmark returns in the past several years. Our weighting constituted just under 10% of portfolio assets during the quarter, and good stock selection more than compensated for our underweighting relative to the benchmark. B/E Aerospace is the leading manufacturer of aircraft seating and other interior systems for large commercial jets. The stock has benefited from increased visibility on demand for wide body aircraft, particularly the Airbus A380 and Boeing 787. Also driving revenues are the increased complexity and cost of business-class and first-class seats on large aircraft, both for new airplanes and for periodic retrofits of existing aircraft. As the stock rose during the second quarter, we trimmed our holding slightly to manage risk but maintain a significant position as we see an excellent business climate for several years forward.

Adam Weiner, who joined the RS Core Equity Team as of January 1, 2007 as our sector manager for industrial companies has helped us achieve strong performance from this group. We recently added several new industrial positions, bringing that sector closer to benchmark-neutral from the significant underweight we have maintained for several quarters. Newer additions to the portfolio sourced by Adam include Regal-Beloit Corp and EnPro Industries.

Regal-Beloit is one of the leading U.S. manufacturers of electric motors and generators. We bought the stock at depressed levels as investors were overly focused, we believe, on the company’s relatively modest exposure to a weakening residential housing market. We like Regal-Beloit’s leading market positions and management’s long-term track record of delivering value for its shareholders through targeted acquisitions and dividend growth.

EnPro Industries has the number one or two market positions with well-established brand names in a variety of niche industrial end markets for its highly engineered industrial products, including sealing products, bearings, air compressor systems, vacuum pumps, and diesel engines. We believe that investors tend to overlook the many positive attributes of this company due

| | |

| 4 | | RS SMALL CAP CORE EQUITY VIP SERIES |