UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21922

RS Variable Products Trust

(Exact name of registrant as specified in charter)

| | |

388 Market Street San Francisco, CA | | 94111 |

| (Address of principal executive offices) | | (Zip code) |

Terry R. Otton

c/o RS Investments

388 Market Street

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-221-3253

Date of fiscal year end: December 31

Date of reporting period: June 30, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

RS Variable Products Trust

RS Core Equity VIP Series

| | |

| 06.30.08 | |  |

| | |

| | Table of Contents |

Except as otherwise specifically stated, all information and portfolio manager commentary, including portfolio security positions, is as of June 30, 2008. The views expressed in the portfolio manager letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

| | |

| | RS Core Equity VIP Series |

| | |

| | Manind V. Govil, CFA Manind V. Govil (RS Investments) has managed RS Core Equity VIP Series since 2005.* Mr. Govil joined RS Investments in October 2006 in connection with GIS’s acquisition of an interest in RS Investments. Prior to that, Mr. Govil served as the head of equity investments at Guardian Life since August 2005. From 2001 to August 2005, Mr. Govil served as the lead portfolio manager — large cap blend/core equity, co-head of equities and head of equity research at Mercantile Capital Advisers. Prior to 2001, he was lead portfolio manager — core equity, at Mercantile. Mr. Govil received a B.S. degree from the University of Bombay, India and an M.B.A. from the University of Cincinnati. |

| * | Includes service as the portfolio manager of the Fund’s predecessor fund for periods prior to October 9, 2006, the commencement of operations of the Fund. |

The Statement of Additional Information provides further information about the portfolio manager, including information regarding his compensation, other accounts he manages, and his ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the relevant Prospectus or visit our Web site at www.guardianinvestor.com.

Highlights

Ø | | During a difficult six-month period for the equity markets, the Fund had a negative return but nonetheless outperformed its benchmark, the S&P 500® Index3. |

| Ø | | The Fund’s relative performance for the period benefited from stock selection in a number of sectors, including financials, health care, information technology (IT), and industrials. |

| Ø | | Poor performance by several holdings in the utilities and telecommunications services sectors dampened returns. |

Market Overview

U.S. stocks fell sharply during the first quarter, with investors spooked by a weakening economy and growing concerns about the health of the financial system. The market began to recover some lost ground early in the second quarter, however, as the Federal Reserve Board took aggressive action to restore market liquidity, cutting the target federal funds rate by 225 basis points by mid-April. Nonetheless this resurgence proved short-lived, as markets again succumbed to investor unease over surging energy and food prices, an ailing housing market, and a softening economy. For the six-month period ended June 30, 2008, the S&P 500® Index declined 11.91%, the Dow Jones Industrial Average4 declined 13.38%, and the Nasdaq Composite5 declined 13.55%.

Performance

The RS Core Equity VIP Series declined 4.81% during the period, outperforming the benchmark S&P 500® Index, which declined 11.91%.

Portfolio Review

The Fund’s relative performance for the period benefited from stock selection in the financials sector, especially in the diversified financial services and insurance areas. Relative returns were also aided by stock selection in the health care sector, especially from overweight exposure to outperforming biotechnology names including Celegene, which appears to be benefiting from its drug pipeline and its Revlimid cancer drug franchise.

Stock selection in the IT sector also contributed to the Fund’s relative performance. Top contributors in this area included IT services holdings such as electronic payments processor MasterCard, one of our strongest individual performers for the period, and video game maker

| | |

| RS Core Equity VIP Series | | 3 |

| | |

| | RS Core Equity VIP Series (continued) |

Nintendo. Nintendo is benefiting from its highly popular Wii video game platform, which is taking market share and helping expand the demographics of video gaming beyond the core young male audience to include entire families. Nintendo also has portable gaming devices and, we believe, a promising library of proprietary game software.

The Fund also capitalized on its investments in a number of individual energy holdings, including global provider of energy services Halliburton, our top-performing stock for the period, and oil and gas exploration company Devon Energy.

Performance was hindered by the Fund’s only investment in the utilities sector, global power producer AES. While AES has a solid track record of managing utilities worldwide, its stock price declined as higher financing costs and a near-freeze in credit availability delayed some of its expansion projects. Additionally, underperforming telecommunications services companies, such as AT&T and Mexico’s wireless provider America Movil, weighed on returns.

Additional major detractors included wireless communications handset maker Nokia and government- sponsored mortgage financing agency Freddie Mac, which has been severely affected by the mortgage-lending fallout and resulting liquidity crisis. Meanwhile, aircraft manufacturing giant Boeing suffered from concerns over the health of the U.S. airline industry.

Outlook

As a core offering, the RS Core Equity VIP Series seeks to deliver solid long-term results across a range of market environments. We believe that over long periods of time, our consistent focus on fundamental research and disciplined stock selection will help deliver solid investment results. Of course, while our investment process emphasizes bottom-up analysis of individual companies, we cannot ignore the weakening U.S. economy. Our investment actions during this time have favored companies that we believe will prove more resilient in a slowing economy. We wish to emphasize as well that we continue hold ourselves to the highest standards of professionalism and integrity.

Finally, I wanted to mention that as of August 1, it will have been three years since I became the portfolio manager of the Fund. In that time I’ve hired an investment team of experienced analysts who adhere to a time-tested investment process, which has delivered strong performance for the Fund. We are proud of the accomplishment of beating the benchmark by over 6.7 percentage points on an annualized basis for the three year period ended 6/30/08.

Thank you for your investment and ongoing support.

Manind V. Govil

Portfolio Manager

RS Funds are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the RS Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our web site at www.guardianinvestor.com or to obtain a printed copy, call 800-221-3253.

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and portfolio manager commentary, including portfolio security positions, is as of June 30, 2008.

As with all mutual funds, the value of an investment in the Fund could decline, in which case you could lose money. The Fund invests primarily in equity securities and therefore exposes you to the general risks of investing in stock markets.

| | |

| 4 | | RS Core Equity VIP Series |

| | |

| Total Net Assets: $928,264,846 | | Data as of June 30, 2008 |

| | |

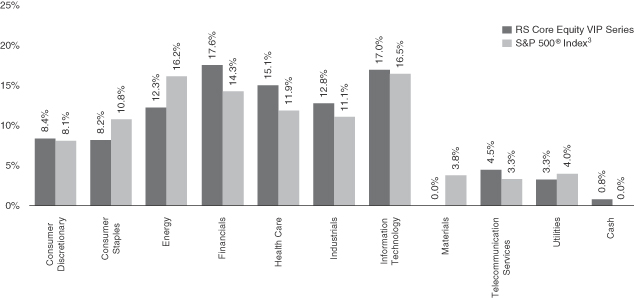

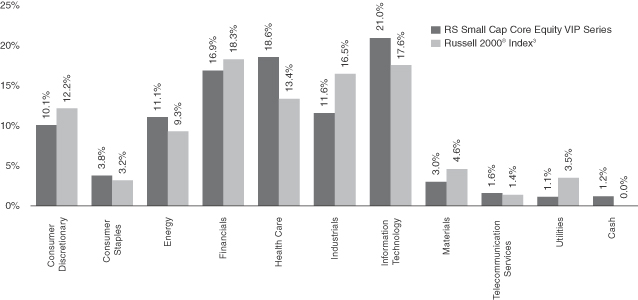

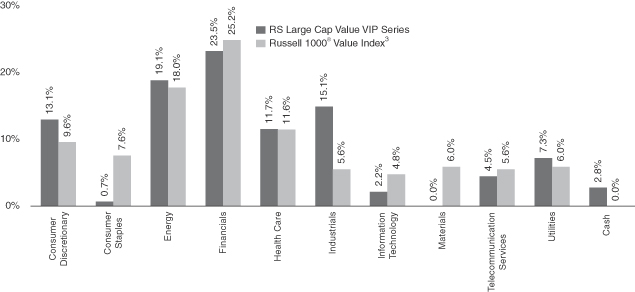

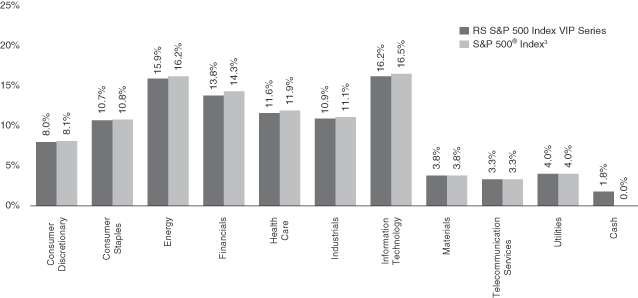

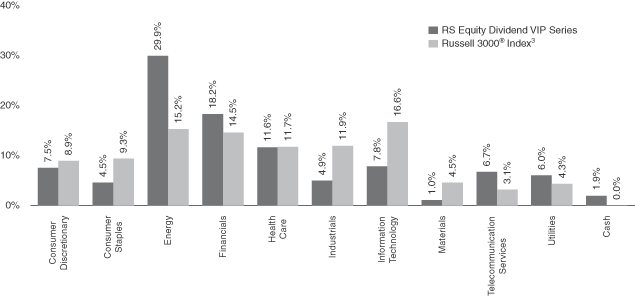

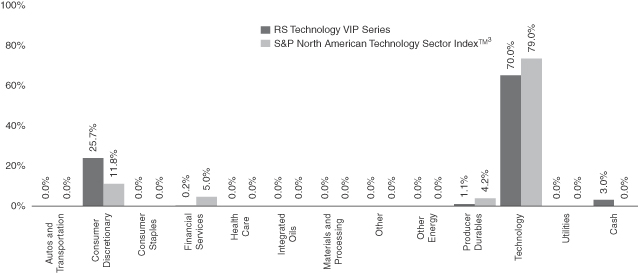

| | Sector Allocation vs. Index1 |

| | |

| | Top Ten Holdings2 |

| | |

| | |

| Company | | Percentage of Total Assets |

Halliburton Co. | | 6.48% |

MasterCard, Inc. | | 4.12% |

Abbott Laboratories | | 3.72% |

The AES Corp. | | 3.37% |

Republic Services, Inc. | | 3.35% |

Enterprise Products Partners, L.P. | | 3.26% |

People’s United Financial, Inc. | | 3.15% |

Aon Corp. | | 2.93% |

Nokia Oyj | | 2.70% |

Celgene Corp. | | 2.69% |

| Total | | 35.77% |

| 1 | The sector allocation represents the Global Industry Classification Standard (GICS), which was developed by Morgan Stanley Capital International (MSCI) and Standard & Poor’s (S&P). The Fund’s holdings are allocated to each sector based on their GICS classification. Cash includes short-term investments and net other assets and liabilities. |

| 2 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

3 | The S&P 500® Index is an unmanaged market-capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 4 | The Dow Jones Industrial Average is a price-weighted index of 30 companies that serves as a measure of the entire U.S. market, covering such diverse industries as financial services, technology, retail, entertainment and consumer goods. |

| 5 | The Nasdaq Composite Index is an unmanaged index that measures all Nasdaq domestic and non-U.S.-based common stocks listed on the Nasdaq stock market. |

| | |

| RS Core Equity VIP Series | | 5 |

| | |

| | RS Core Equity VIP Series (continued) |

| | |

| | Performance Update Average Annual Returns as of 06/30/08 |

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Inception Date | | Year-to-Date | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Since Inception |

RS Core Equity VIP Series | | 04/13/83 | | -4.81% | | -4.11% | | 11.18% | | 9.68% | | 1.96% | | 11.48% |

S&P 500® Index3 | | | | -11.91% | | -13.12% | | 4.40% | | 7.58% | | 2.88% | | 11.60% |

Since inception performance for the index is measured from 3/31/1983, the month end prior to the Fund’s commencement of operations.

| | |

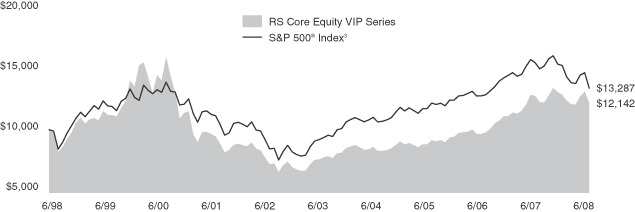

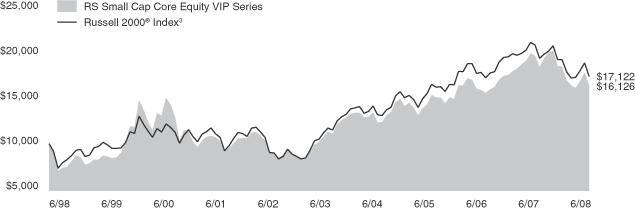

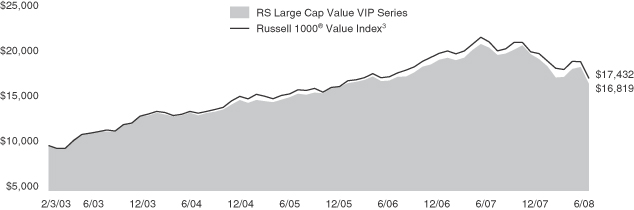

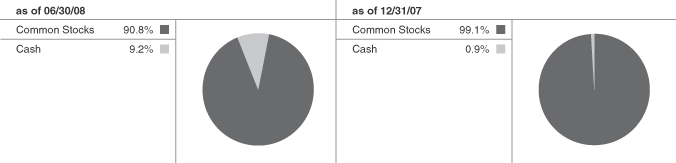

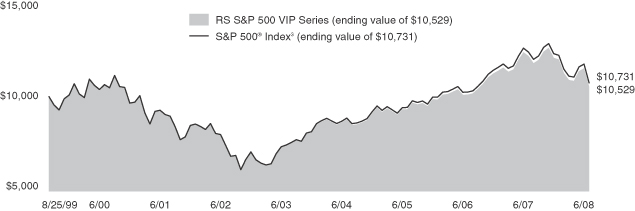

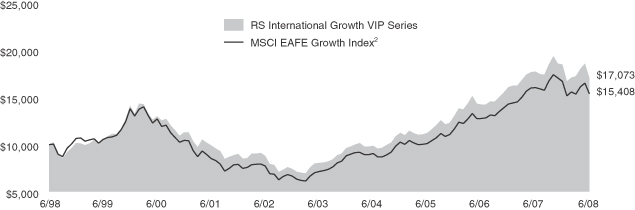

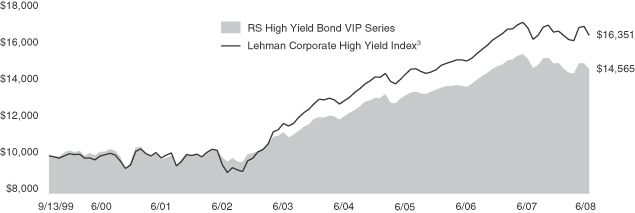

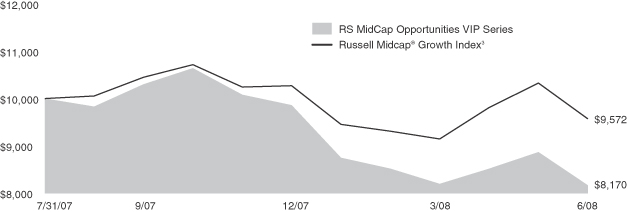

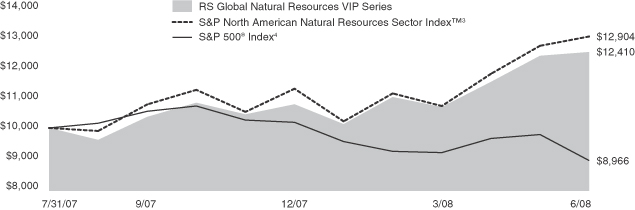

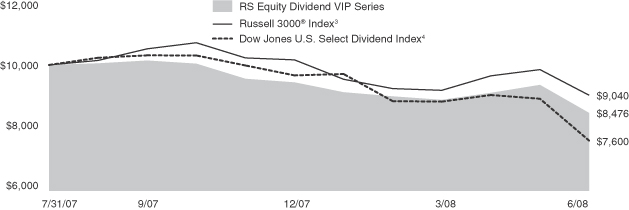

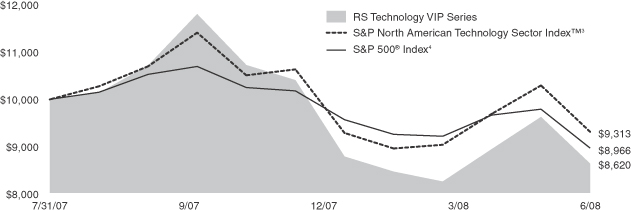

| | Results of a Hypothetical $10,000 Investment |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Core Equity VIP Series and in the S&P 500® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee future results. The Fund is the successor to The Guardian Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s total gross annual operating expense ratio as of the most current prospectus is 0.57%. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Total return figures reflect an expense limitation in effect for the periods shown; without such limitation, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contractowner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

| | |

| 6 | | RS Core Equity VIP Series |

| | |

| | Understanding Your Fund’s Expenses — unaudited |

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; distribution (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these cost with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | | | |

| | | Beginning

Account Value

01/01/08 | | Ending

Account Value

06/30/08 | | Expenses Paid

During Period*

01/01/08-06/30/08 | | Expense Ratio

During Period

01/01/08-06/30/08 |

Based on Actual Return | | $1,000.00 | | $951.90 | | $2.77 | | 0.57% |

Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | $1,022.03 | | $2.87 | | 0.57% |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

| | |

| RS Core Equity VIP Series | | 7 |

| | |

| | Schedule of Investments – RS Core Equity VIP Series |

| | | | | |

| June 30, 2008 (unaudited) | | Shares | | Value |

| | | | | |

| Common Stocks — 99.2% |

| Aerospace & Defense — 3.8% |

General Dynamics Corp. | | 145,500 | | $ | 12,251,100 |

The Boeing Co. | | 350,400 | | | 23,028,288 |

| | | | | |

| | | | | 35,279,388 |

| Airlines — 0.4% |

AMR Corp.(1) | | 717,150 | | | 3,671,808 |

| | | | | |

| | | | | 3,671,808 |

| Biotechnology — 5.2% |

Celgene Corp.(1) | | 391,500 | | | 25,005,105 |

Cephalon, Inc.(1) | | 209,754 | | | 13,988,494 |

Gilead Sciences, Inc.(1) | | 175,200 | | | 9,276,840 |

| | | | | |

| | | | | 48,270,439 |

| Capital Markets — 2.5% |

The Goldman Sachs Group, Inc. | | 134,100 | | | 23,454,090 |

| | | | | |

| | | | | 23,454,090 |

| Commercial Services & Supplies — 3.3% |

Republic Services, Inc. | | 1,047,100 | | | 31,098,870 |

| | | | | |

| | | | | 31,098,870 |

| Communications Equipment — 4.7% |

Nokia Oyj, ADR(2) | | 1,022,400 | | | 25,048,800 |

QUALCOMM, Inc. | | 425,400 | | | 18,874,998 |

| | | | | |

| | | | | 43,923,798 |

| Computers & Peripherals — 2.2% |

Apple, Inc.(1) | | 58,900 | | | 9,862,216 |

EMC Corp.(1) | | 748,700 | | | 10,998,403 |

| | | | | |

| | | | | 20,860,619 |

| Construction & Engineering — 2.4% |

KBR, Inc. | | 626,800 | | | 21,881,588 |

| | | | | |

| | | | | 21,881,588 |

| Consumer Finance — 0.4% |

SLM Corp.(1) | | 197,300 | | | 3,817,755 |

| | | | | |

| | | | | 3,817,755 |

| Diversified Financial Services — 3.6% |

Interactive Brokers Group, Inc., Class A(1) | | 515,280 | | | 16,555,946 |

JPMorgan Chase & Co. | | 483,000 | | | 16,571,730 |

| | | | | |

| | | | | 33,127,676 |

| Diversified Telecommunication Services — 2.2% |

AT&T, Inc. | | 617,936 | | | 20,818,264 |

| | | | | |

| | | | | 20,818,264 |

| Electrical Equipment — 0.8% |

Rockwell Automation, Inc. | | 175,700 | | | 7,683,361 |

| | | | | |

| | | | | 7,683,361 |

| Electronic Equipment & Instruments — 0.5% |

Tyco Electronics Ltd. | | 132,875 | | | 4,759,583 |

| | | | | |

| | | | | 4,759,583 |

| Energy Equipment & Services — 6.5% |

Halliburton Co. | | 1,132,900 | | | 60,123,003 |

| | | | | |

| | | | | 60,123,003 |

| | | | | |

| June 30, 2008 (unaudited) | | Shares | | Value |

| | | | | |

| Food Products — 4.2% |

Campbell Soup Co. | | 515,800 | | $ | 17,258,668 |

General Mills, Inc. | | 362,800 | | | 22,047,356 |

| | | | | |

| | | | | 39,306,024 |

| Health Care Equipment & Supplies — 1.7% |

Covidien Ltd. | | 233,375 | | | 11,176,329 |

Hologic, Inc.(1) | | 215,300 | | | 4,693,540 |

| | | | | |

| | | | | 15,869,869 |

| Health Care Providers & Services — 2.9% |

Cardinal Health, Inc. | | 289,300 | | | 14,922,094 |

Medco Health Solutions, Inc.(1) | | 249,000 | | | 11,752,800 |

| | | | | |

| | | | | 26,674,894 |

| Hotels, Restaurants & Leisure — 1.7% |

McDonald’s Corp. | | 283,100 | | | 15,915,882 |

| | | | | |

| | | | | 15,915,882 |

| Household Durables — 1.5% |

Newell Rubbermaid, Inc. | | 815,400 | | | 13,690,566 |

| | | | | |

| | | | | 13,690,566 |

| Independent Power Producers & Energy Traders — 3.4% |

The AES Corp.(1) | | 1,626,200 | | | 31,239,302 |

| | | | | |

| | | | | 31,239,302 |

| Industrial Conglomerates — 2.1% |

Tyco International Ltd. | | 476,900 | | | 19,095,076 |

| | | | | |

| | | | | 19,095,076 |

| Information Technology Services — 5.8% |

Fidelity National Information Services, Inc. | | 232,534 | | | 8,582,830 |

MasterCard, Inc., Class A | | 144,200 | | | 38,287,984 |

Western Union Co. | | 290,000 | | | 7,168,800 |

| | | | | |

| | | | | 54,039,614 |

| Insurance — 7.1% |

Aon Corp. | | 591,300 | | | 27,164,322 |

The Chubb Corp. | | 483,800 | | | 23,711,038 |

W. R. Berkley Corp. | | 632,800 | | | 15,288,448 |

| | | | | |

| | | | | 66,163,808 |

| Internet Software & Services — 1.4% |

eBay, Inc.(1) | | 276,600 | | | 7,559,478 |

Google, Inc., Class A(1) | | 10,800 | | | 5,685,336 |

| | | | | |

| | | | | 13,244,814 |

| Media — 3.1% |

Grupo Televisa S.A., ADR(2) | | 595,600 | | | 14,068,072 |

The McGraw-Hill Companies, Inc. | | 364,500 | | | 14,623,740 |

| | | | | |

| | | | | 28,691,812 |

| Oil, Gas & Consumable Fuels — 5.9% |

Devon Energy Corp. | | 60,700 | | | 7,293,712 |

Enterprise Products Partners, L.P. | | 1,024,980 | | | 30,277,909 |

Kinder Morgan Energy

Partners, L.P. | | 302,600 | | | 16,863,898 |

| | | | | |

| | | | | 54,435,519 |

The accompanying notes are an integral part of these financial statements.

| | |

| 8 | | RS Core Equity VIP Series |

| | | | | |

| June 30, 2008 (unaudited) | | Shares | | Value |

| | | | | |

| Pharmaceuticals — 5.3% |

Abbott Laboratories | | 652,000 | | $ | 34,536,440 |

Schering-Plough Corp. | | 736,500 | | | 14,501,685 |

| | | | | |

| | | | | 49,038,125 |

| Software — 2.3% |

Nintendo Co., Ltd., ADR(2) | | 300,800 | | | 21,010,880 |

| | | | | |

| | | | | 21,010,880 |

| Specialty Retail — 2.1% |

Best Buy Co., Inc. | | 213,600 | | | 8,458,560 |

The Home Depot, Inc. | | 471,300 | | | 11,037,846 |

| | | | | |

| | | | | 19,496,406 |

| Thrifts & Mortgage Finance — 4.0% |

Freddie Mac | | 457,900 | | | 7,509,560 |

People’s United Financial, Inc. | | 1,875,800 | | | 29,262,480 |

| | | | | |

| | | | | 36,772,040 |

| Tobacco — 3.9% |

Altria Group, Inc. | | 611,000 | | | 12,562,160 |

Philip Morris International, Inc. | | 486,500 | | | 24,028,235 |

| | | | | |

| | | | | 36,590,395 |

| Wireless Telecommunication Services — 2.3% |

America Movil SAB de C.V., ADR, Series L(2) | | 401,700 | | | 21,189,675 |

| | | | | |

| | | | | 21,189,675 |

| | | | | |

Total Common Stocks

(Cost $874,925,510) | | | | | 921,234,943 |

| | |

| | | Shares | | Value |

Other Investments—For Trustee Deferred

Compensation Plan — 0.0% |

RS Core Equity Fund, Class Y(3) | | 188 | | | 7,610 |

RS Emerging Growth Fund, Class Y(3) | | 256 | | | 8,863 |

RS Emerging Markets Fund, Class A(3) | | 251 | | | 6,078 |

RS Equity Dividend Fund, Class Y(3) | | 113 | | | 953 |

RS Global Natural Resources Fund, Class Y(3) | | 130 | | | 5,683 |

RS Growth Fund, Class Y(3) | | 389 | | | 4,805 |

RS Investment Quality Bond Fund, Class A(3) | | 101 | | | 974 |

RS Investors Fund, Class Y(3) | | 353 | | | 3,349 |

RS MidCap Opportunities Fund, Class Y(3) | | 181 | | | 2,188 |

RS Partners Fund, Class Y(3) | | 172 | | | 5,119 |

RS S&P 500 Index Fund, Class A(3) | | 105 | | | 929 |

RS Smaller Company Growth Fund, Class Y(3) | | 102 | | | 1,709 |

RS Technology Fund, Class Y(3) | | 186 | | | 2,731 |

RS Value Fund, Class Y(3) | | 351 | | | 9,004 |

| | | | | |

Total Other Investments

(Cost $63,587) | | | | | 59,995 |

| | | | | |

| June 30, 2008 (unaudited) | | Shares | | Value |

| | | | | |

| Short-Term Investments — 0.4% |

State Street Institutional Liquid Reserves(4) | | 3,672,806 | | $ | 3,672,806 |

| | | | | |

Total Short-Term Investment

(Cost $3,672,806) | | | | | 3,672,806 |

| | | | | |

Total Investments — 99.6%

(Cost $878,661,903) | | | | | 924,967,744 |

| | | | | |

| Other Assets, Net — 0.4% | | | | | 3,297,102 |

| | | | | |

| Total Net Assets — 100.0% | | | | $ | 928,264,846 |

(1) | Non-income producing security. |

(2) | ADR — American Depositary Receipt. |

(3) | Investments in designated RS Mutual Funds under a deferred compensation plan adopted for disinterested Trustees. See 2b in Notes to Financial Statements. |

(4) | Money Market Fund registered under the Investment Company Act of 1940. |

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund’s investments carried at value:

| | | |

| Valuation Inputs | | Investments

in Securities |

Level 1 – Quoted Prices | | $ | 924,967,744 |

Level 2 – Significant Other Observable Inputs | | | — |

Level 3 – Significant Unobservable Inputs | | | — |

Total | | $ | 924,967,744 |

The accompanying notes are an integral part of these financial statements.

| | |

| RS Core Equity VIP Series | | 9 |

| | |

| | Financial Information — RS Core Equity VIP Series |

| | |

| | Statement of Assets and Liabilities As of June 30, 2008 (unaudited) |

| | | | |

| |

Assets | | | | |

Investments, at value | | $ | 924,967,744 | |

Receivable for investments sold | | | 3,964,828 | |

Dividends/interest receivable | | | 928,920 | |

Receivable for fund shares subscribed | | | 229,345 | |

Due from distributor | | | 8,175 | |

Prepaid expenses | | | 26,085 | |

| | | | |

Total Assets | | | 930,125,097 | |

| | | | |

Liabilities | | | | |

Payable for fund shares redeemed | | | 1,041,535 | |

Payable to adviser | | | 398,505 | |

Accrued shareholder reports expense | | | 216,948 | |

Trustees’ deferred compensation | | | 59,995 | |

Payable for investments purchased | | | 12,309 | |

Accrued expenses/other liabilities | | | 130,959 | |

| | | | |

Total Liabilities | | | 1,860,251 | |

| | | | |

Total Net Assets | | $ | 928,264,846 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 1,122,908,574 | |

Accumulated undistributed net investment income | | | 5,970,443 | |

Accumulated net realized loss from investments | | | (246,920,012 | ) |

Net unrealized appreciation on investments | | | 46,305,841 | |

| | | | |

Total Net Assets | | $ | 928,264,846 | |

| | | | |

Investments, at Cost | | $ | 878,661,903 | |

| | | | |

Pricing of Shares | | | | |

| |

Shares of Beneficial Interest Outstanding with no Par Value | | | 25,379,026 | |

| |

Net Asset Value Per Share | | | $36.58 | |

| | |

| | Statement of Operations For the Six-Month Period Ended June 30, 2008 (unaudited) |

| | | | |

| |

Investment Income | | | | |

Interest | | $ | 90,570 | |

Dividends | | | 8,486,475 | |

Withholding taxes on foreign dividends | | | (137,483 | ) |

| | | | |

Total Investment Income | | | 8,439,562 | |

| | | | |

Expenses | | | | |

Investment advisory fees | | | 2,475,906 | |

Shareholder reports | | | 117,421 | |

Professional fees | | | 103,842 | |

Custodian fees | | | 48,617 | |

Administrative service fees | | | 74,427 | |

Trustees’ fees and expenses | | | 33,209 | |

Insurance expense | | | 17,681 | |

Other expense | | | 13,378 | |

| | | | |

Total Expenses | | | 2,884,481 | |

Less: Fee waiver by distributor | | | (61,840 | ) |

| | | | |

Total Expenses, Net | | | 2,822,641 | |

| | | | |

Net Investment Income | | | 5,616,921 | |

| | | | |

Realized Gain/(Loss) and Change in Unrealized Appreciation (Depreciation) on Investments | | | | |

Net realized gain from investments | | | 13,188,495 | |

Net change in unrealized depreciation on investments | | | (69,393,254 | ) |

| | | | |

Net Loss on Investments | | | (56,204,759 | ) |

| | | | |

Net Decrease in Net Assets Resulting from Operations | | $ | (50,587,838 | ) |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| 10 | | RS Core Equity VIP Series |

| | |

| | Statement of Changes in Net Assets Six-month-ended numbers are unaudited |

| | | | | | | | |

| | |

| | | For the

Six Months Ended

06/30/08 | | | For the

Year Ended

12/31/07 | |

Operations | | | | | | | | |

Net investment income | | $ | 5,616,921 | | | $ | 10,183,566 | |

Net realized gain from investments and foreign currency transactions | | | 13,188,495 | | | | 159,843,003 | |

Net change in unrealized depreciation on investments and on translation of assets and liabilities in foreign currency | | | (69,393,254 | ) | | | (17,240,939 | ) |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (50,587,838 | ) | | | 152,785,630 | |

| | | | | | | | |

| | |

Distributions to Shareholders | | | | | | | | |

Net investment income | | | — | | | | (9,822,651 | ) |

| | | | | | | | |

Total Distributions | | | — | | | | (9,822,651 | ) |

| | | | | | | | |

| | |

Capital Share Transactions | | | | | | | | |

Proceeds from sales of shares | | | 26,269,061 | | | | 54,330,025 | |

Reinvestment of distributions | | | — | | | | 9,822,651 | |

Cost of shares redeemed | | | (130,204,748 | ) | | | (173,192,410 | ) |

| | | | | | | | |

Net Decrease in Net Assets Resulting from Capital Share Transactions | | | (103,935,687 | ) | | | (109,039,734 | ) |

| | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | (154,523,525 | ) | | | 33,923,245 | |

| | |

Net Assets | | | | | | | | |

| | |

Beginning of period | | | 1,082,788,371 | | | | 1,048,865,126 | |

| | | | | | | | |

End of period | | $ | 928,264,846 | | | $ | 1,082,788,371 | |

| | | | | | | | |

Accumulated Undistributed Net Investment Income Included in Net Assets | | $ | 5,970,443 | | | $ | 353,522 | |

| | | | | | | | |

| | |

Other Information: | | | | | | | | |

| | |

Shares | | | | | | | | |

Sold | | | 705,831 | | | | 1,452,212 | |

Reinvested | | | — | | | | 257,609 | |

Redeemed | | | (3,504,978 | ) | | | (4,683,847 | ) |

| | | | | | | | |

Net Decrease | | | (2,799,147 | ) | | | (2,974,026 | ) |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| RS Core Equity VIP Series | | 11 |

| | |

| | Financial Information — RS Core Equity VIP Series (continued) |

The financial highlights table is intended to help you understand the Fund’s financial performance for the past six reporting periods. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all distributions).

| | |

| | Financial Highlights Six-month-ended numbers are unaudited |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset Value,

Beginning of

Period | | Net Investment

Income | | Net Realized

and Unrealized

Gain/(Loss) | | | Total

Operations | | | Distributions

From Net

Investment

Income | | Distributions

From Net

Realized

Capital Gains | | Total

Distributions |

| | | | | | | | |

Six Months Ended 06/30/081 | | $ | 38.43 | | $ | 0.22 | | $ | (2.07 | ) | | $ | (1.85 | ) | | $ | — | | $ | — | | $ | — |

| | | | | | | | |

Year Ended 12/31/07 | | | 33.67 | | | 0.36 | | | 4.75 | | | | 5.11 | | | | (0.35) | | | — | | | (0.35) |

| | | | | | | | |

Year Ended 12/31/06 | | | 29.29 | | | 0.39 | | | 4.59 | | | | 4.98 | | | | (0.60) | | | — | | | (0.60) |

| | | | | | | | |

Year Ended 12/31/05 | | | 28.42 | | | 0.50 | | | 0.70 | | | | 1.20 | | | | (0.33) | | | — | | | (0.33) |

| | | | | | | | |

Year Ended 12/31/04 | | | 27.30 | | | 0.39 | | | 1.23 | | | | 1.62 | | | | (0.50) | | | — | | | (0.50) |

| | | | | | | | |

Year Ended 12/31/03 | | | 22.71 | | | 0.28 | | | 4.57 | | | | 4.85 | | | | (0.26) | | | — | | | (0.26) |

The accompanying notes are an integral part of these financial statements.

| | |

| 12 | | RS Core Equity VIP Series |

| | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End of

Period | | Total

Return3 | | | Net Assets, End

of Period (000s) | | Net Ratio of

Expenses to

Average Net

Assets2 | | | Gross Ratio of

Expenses to

Average Net

Assets | | | Net Ratio of Net

Investment Income

to Average

Net Assets2 | | | Gross Ratio of Net

Investment Income

to Average

Net Assets | | | Portfolio

Turnover Rate | |

| | | | | | | |

| $36.58 | | (4.81 | )% | | $ | 928,265 | | 0.57 | % | | 0.58 | % | | 1.13 | % | | 1.12 | % | | 23 | % |

| | | | | | | |

| 38.43 | | 15.19 | % | | | 1,082,788 | | 0.57 | % | | 0.57 | % | | 0.93 | % | | 0.93 | % | | 60 | % |

| | | | | | | |

| 33.67 | | 17.26 | % | | | 1,048,865 | | 0.57 | % | | 0.57 | % | | 1.17 | % | | 1.17 | % | | 85 | % |

| | | | | | | |

| 29.29 | | 4.30 | % | | | 1,035,234 | | 0.56 | % | | 0.56 | % | | 1.67 | % | | 1.67 | % | | 103 | % |

| | | | | | | |

| 28.42 | | 6.00 | % | | | 1,261,203 | | 0.54 | % | | 0.54 | % | | 1.29 | % | | 1.29 | % | | 76 | % |

| | | | | | | |

| 27.30 | | 21.45 | % | | | 1,454,546 | | 0.54 | % | | 0.54 | % | | 1.06 | % | | 1.06 | % | | 77 | % |

Distributions reflect actual per-share amounts distributed for the period.

| | 1 | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. |

| | 2 | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of custody credits, if applicable. |

| | 3 | Total returns do not reflect the effects of charges deducted pursuant to the terms of Guardian Insurance & Annuity Company, Inc.’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

The accompanying notes are an integral part of these financial statements.

| | |

| RS Core Equity VIP Series | | 13 |

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (unaudited) |

RS Variable Products Trust (the “Trust”), a Massachusetts business trust organized on May 18, 2006, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently offers seventeen series. RS Core Equity VIP Series (the “Fund”) is a series of the Trust. The Fund is a diversified fund. The financial statements for the other remaining series of the Trust are presented in separate reports.

The Fund has authorized an unlimited number of shares of beneficial interest with no par value. Class I shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”). GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”). The Fund is currently offered to insurance company separate accounts that fund certain variable annuity and variable life insurance contracts issued by GIAC.

| Note 1. | | Significant Accounting Policies |

The following policies are in conformity with accounting principles generally accepted in the United States of America. The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations

Marketable securities are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and asked prices. Securities traded on the Nasdaq Stock Market, Inc. (“Nasdaq”) are generally valued at the Nasdaq official closing price, which may not be the last sale price. If the Nasdaq official closing price is not available for a security, that security is generally valued using the last reported sale price, or, if no sales are reported, at the mean between the closing bid and asked prices. Short-term investments that will mature in 60 days or less are valued at amortized cost, which approximates market value. Repurchase agreements are carried at cost, which approximates market value (See Note 4c). Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars using the prevailing exchange rates at the close of the New York Stock Exchange (“NYSE”). Investments in open-end management investment companies that are registered under the 1940 Act are valued based upon the net asset values determined by such investment companies.

Securities for which market quotations are not readily available or for which market quotations may be considered unreliable are valued at their fair values as determined in accordance with guidelines and procedures adopted by the Trust’s Board of Trustees.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued using methods approved by the Board of Trustees. In addition, if there has been a movement in the U.S. markets that exceeds a specified threshold, the values of the Fund’s investments in foreign securities are generally determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities.

In its normal course of business, the Fund may invest a significant portion of its assets in companies concentrated within a number of industries or sectors. As a result, the Fund may be subject to a greater risk of loss than that of a fund invested in a wider spectrum of industries or sectors because the stocks of many or all of the companies in the industry, group of industries, sector, or sectors may decline in value due to developments adversely affecting the industry, group of industries, sector, or sectors.

The Fund adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157"), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. FAS 157 established a hier-

| | |

| 14 | | RS Core Equity VIP Series |

archy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The hierarchy of inputs is summarized in the three broad levels listed below.

| Ø | | Level 1 – quoted prices in active markets for identical investments |

| Ø | | Level 2 – significant other observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risks, etc.) |

| Ø | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

b. Federal Income Taxes

The Fund intends to continue complying with the requirements of the Internal Revenue Code to qualify as a regulated investment company and to distribute substantially all net investment income and realized net capital gains, if any, to shareholders. Therefore, the Fund does not expect to be subject to income tax, and no provision for such tax has been made.

From time to time, however, the Fund may choose to pay an excise tax if the cost of making the required distribution exceeds the amount of the excise tax.

The Fund adopted the provisions of FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement No. 109” (“FIN 48”) on January 1, 2007. FIN 48 permits the recognition of tax benefits of an uncertain tax position only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Trust has reviewed the Fund’s tax positions for all open tax years, and concluded that adoption had no effect on the Fund’s financial position or results of operations. The Fund has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions it has taken or expects to take in future tax returns.

The Fund files U.S. tax returns. While the statute of limitations remains open to examine the Fund’s U.S. tax returns filed for the prior three fiscal years, no examinations are in progress or anticipated at this time. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c. Securities Transactions

Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

d. Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are generally translated into U.S. dollars at the exchange rates quoted at the close of the NYSE on each business day. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

e. Investment Income

Dividend income is generally recorded on the ex-dividend date, except certain cash dividends from foreign securities, which are recorded as soon as the Fund is informed of the ex-dividend date. Interest income,

| | |

| RS Core Equity VIP Series | | 15 |

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (unaudited) (continued) |

which includes amortization/accretion of premium/discount, is accrued and recorded daily.

f. Expenses

Many expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets.

g. Custody Credits

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce the Fund’s custodian expenses. The Fund could have employed the uninvested assets to produce income in the Fund if the Fund had not entered into such an arrangement. The Fund’s custody credits, if any, are shown in the accompanying Statement of Operations.

h. Distributions to Shareholders

The Fund intends to distribute substantially all of its net investment income typically at least once each year and any net realized capital gains once each year. Unless the Fund is instructed otherwise, all distributions to shareholders are credited in the form of additional shares of the Fund at the net asset value, recorded on the ex-dividend date.

i. Capital Accounts

Due to the timing of dividend distributions and the differences in accounting for income and realized gains/(losses) for financial statement purposes versus federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains/(losses) were recorded by the Fund.

j. Temporary Borrowings

The Fund, with other funds managed by RS Investment Management Co. LLC (“RS Investments”), shares in a $75 million committed revolving credit/overdraft protection facility from State Street Bank and Trust Company for temporary purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is calculated based on market rates at the time of borrowing; all the funds that are parties to the facility share in a commitment fee that is allocated among the funds on the basis of their respective net assets. The Fund may borrow up to the lesser of one-third of its total assets (including amounts borrowed) or any lower limit specified in the Fund’s Statement of Additional Information or Prospectus.

| | | | | | |

Amount

Outstanding at 06/30/08 | | Average

Borrowing* | | Average

Interest Rate* | |

| $ — | | $ | 301,464 | | 2.56 | % |

| * | For the six months ended June 30, 2008. |

| Note 2. | | Transactions with Affiliates |

a. Advisory Fee and Expense Limitation

Under the terms of the advisory agreement, which is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to RS Investments. Guardian Investor Services LLC (“GIS”), a subsidiary of Guardian Life, holds a majority interest in RS Investments. RS Investments receives an investment advisory fee based on the average daily net assets of the Fund, at an annual rate of 0.50%. The Fund has also entered into an agreement with GIS for distribution services with respect to its shares.

An expense limitation has been imposed pursuant to a written agreement between RS Investments and the Trust in effect through December 31, 2009, to limit the Fund’s total annual fund operating expenses to 0.57% of the average daily net assets of the Fund.

b. Compensation of Trustees and Officers

Trustees and officers of the Trust who are interested persons of RS Investments, as defined in the 1940 Act, receive no compensation from the Fund for acting as such. Trustees of the Trust who are not interested persons of RS Investments (“disinterested Trustees”) receive compensation and reimbursement of expenses.

Under a Deferred Compensation Plan (the “Plan”), a disinterested Trustee may elect to defer receipt of all, or a portion, of his/her annual compensation. The amount of the Fund’s deferred compensation obligation to a Trustee is determined by adjusting the amount of the deferred compensation to reflect the investment return

| | |

| 16 | | RS Core Equity VIP Series |

of one or more RS Funds designated for the purpose by the Trustee. The Fund may cover its deferred compensation obligation to a Trustee by investing in one or more of such designated RS Funds. The Fund’s liability for deferred compensation to a Trustee is adjusted periodically to reflect the investment performance of the RS Funds designated by the Trustee. Deferred amounts remain in the Fund until distributed in accordance with the Plan. Trustees’ fees in the accompanying financial statements include the current fees, either paid in cash or deferred, and the net increase or decrease in the value of the deferred amounts.

| Note 3. | | Federal Income Taxes |

a. Distributions to Shareholders

The tax character of distributions paid during the year ended December 31, 2007, which is the most recently completed tax year, was as follows:

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Permanent book and tax basis differences will result in reclassifications to paid-in capital, undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions. Undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions may include temporary book and tax differences, which will reverse in a subsequent period.

The tax basis of distributable earnings as of December 31, 2007, which is the most recently completed tax year, was as follows:

|

Undistributed Ordinary Income |

$411,975 |

During any particular year, net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, are normally distributed to shareholders annually.

Capital loss carryovers available to the Fund at December 31, 2007 were as follows:

| | |

Expiring | | Amount |

| 2010 | | $164,712,479 |

| 2011 | | 95,938,938 |

| | |

| Total | | $260,651,417 |

During the year ended December 31, 2007, the Fund utilized capital loss carryovers of $158,879,718.

Under current income tax law, net capital and currency losses realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year. For the year ended December 31, 2007, which is the most recently completed tax year, the Fund had no such losses.

b. Tax Basis of Investments

The cost of investments for federal income tax purposes at June 30, 2008, was $878,203,554. The gross unrealized appreciation and depreciation of investments, on a tax basis, at June 30, 2008, aggregated $137,074,417 and $(90,310,227), respectively, resulting in net unrealized appreciation of $46,764,190.

a. Investment Purchases and Sales

The cost of investments purchased and the proceeds from investments sold (excluding short-term investments) amounted to $231,054,396 and $326,742,573, respectively, for the six months ended June 30,2008.

b. Foreign Securities

Foreign securities investments involve special risks and considerations not typically associated with those of U.S. origin. These risks include, but are not limited to, currency risk; adverse political, social, and economic developments; and less reliable information about issuers. Moreover, securities of some foreign companies

| | |

| RS Core Equity VIP Series | | 17 |

| | |

| | Notes to Financial Statements — RS Core Equity VIP Series (unaudited) (continued) |

may be less liquid and their prices more volatile than those of comparable U.S. companies.

c. Repurchase Agreements

The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities (including U.S. government agency securities). Repurchase agreements are fully collateralized (including the interest accrued thereon) and such collateral is marked-to-market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, the Fund will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, the Fund maintains the right to sell the collateral and may claim any resulting loss against the seller.

| Note 5. | | New Accounting Pronouncement |

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about the Fund’s derivative and hedging activities. The Trust is currently evaluating the impact the adoption of FAS 161 will have on the Fund’s financial statement disclosures.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

On October 6, 2004, RS Investment Management, L.P. (“RSIM L.P.”), the investment adviser to the RS family of funds prior to GIS’s acquisition of a majority of the outstanding interests in RS Investments, entered into settlement agreements with the Securities and Exchange Commission (the “SEC”) and the Office of the New York State Attorney General (the “NYAG”). The settlement agreements relate to certain investors’ frequent trading of shares of RS Emerging Growth Fund during 2000 through 2003. In its settlement with the SEC, RSIM L.P. consented to the entry of an order by the SEC (the “SEC Order”) instituting and settling administrative and cease-and-desist proceedings against it.

Under the terms of the settlement agreements, RS Investments has paid disgorgement of $11.5 million and a civil money penalty of $13.5 million for a total payment of $25 million, all of which has been distributed to certain current and former shareholders of certain RS Funds in a manner determined by an independent consultant. Details are available on RS Investments’ Settlement Web site at www.rssettlement.com. The settlement agreement with the NYAG also requires RS Investments to reduce its management fee for certain RS Funds in the aggregate amount of approximately $5 million over a period of five years. In addition, RS Investments has made a number of undertakings to the SEC and the NYAG relating to compliance, ethics, and legal oversight and mutual fund governance and disclosure.

G. Randall Hecht, the former co-president of RS Investment Trust and the former chairman of the Board of Trustees of RS Investment Trust, was also named a respondent in the SEC Order and consented to its entry. As part of the settlement agreement with the SEC, Mr. Hecht agreed, among other things, to pay a civil money penalty, to not serve as a Trustee of RS Investment Trust for a period of five years, and to limit his duties with RS Investments (of which he was chairman) for 12 months.

Steven M. Cohen, the former treasurer of RS Investment Trust and the former chief financial officer of RS Investments, was also named a respondent in the SEC Order and consented to its entry. As part of the settlement agreement with the SEC, Mr. Cohen agreed to, among other things, a civil money penalty and suspensions from association with any investment adviser or registered

| | |

| 18 | | RS Core Equity VIP Series |

investment company for nine months and from serving as an officer or a director of any investment company or investment adviser for an additional two years. In addition, in accordance with the settlements, Mr. Cohen resigned as an officer and employee of RS Investments.

RSIM L.P. and Messrs. Hecht and Cohen neither admit nor deny the findings set forth in the SEC Order, and RSIM L.P. neither admits nor denies the findings in its settlement agreement with the NYAG. A copy of the SEC Order is available on the SEC’s Web site at www.sec.gov, and a copy of the settlement agreement with the NYAG is available on the NYAG’s Web site at www.oag.state.ny.us.

RSIM L.P. and not any of the RS Funds will bear all the costs of complying with the settlements, including payments of disgorgement and civil penalties (except those paid by Messrs. Hecht and Cohen individually), and the associated legal fees relating to these regulatory proceedings.

It is possible that these matters and/or related developments may result in increased Fund redemptions and reduced sales of Fund shares, which could result in increased costs and expenses, or may otherwise adversely affect the Fund.

After the announcement of those settlements, three related civil lawsuits were commenced. These lawsuits were consolidated into one proceeding in the U.S. District Court for the District of Maryland on April 19, 2005 (In re Mutual Funds Investment Litigation, Case No. 04-MD-15863-JFM). The district court appointed a lead plaintiff, and a consolidated complaint was filed. The consolidated complaint, brought on behalf of a purported class of investors in certain RS Funds between

October 6, 1999, and October 5, 2004, seeks compensatory damages and other related relief. The complaint

originally named RS Investments, RS Investment Management, Inc., RSIM L.P., RS Investment Trust, and certain current or former Trustees, subadvisers, employees, and officers of RS Investment Trust or RSIM L.P. as defendants. It generally tracked the factual allegations made in the SEC and NYAG settlements, including the allegations that fund prospectuses were false and misleading, and alleged a variety of theories for recovery, including, among others, that defendants violated Sections 34(b), 36(a), 36(b), and 48(a) of the 1940 Act and breached fiduciary duties to investors. The consolidated lawsuit further alleged that defendants violated, or caused to be violated, Sections 11, 12(a)(2), and 15 of the Securities Act of 1933 and Sections 10(b) and 20(a) of the Securities Exchange Act of 1934.

On May 27, 2005, the defendants moved to dismiss the consolidated action. On November 3, 2005, the Court issued a ruling dismissing all claims against RS Investment Trust. As for the claims against the other RS defendants, the Court dismissed the claims arising under: Sections 34(b) and 36(a) of the 1940 Act; Sections 11, 12(a)(2), and 15 of the Securities Act of 1933; and state law. The Court allowed plaintiffs to proceed against some of the RS defendants with their claims arising under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Sections 36(b) and 48(a) of the 1940 Act. Although initially the Court deferred any ruling on the claims against the named independent trustees, on July 24, 2006, the Court dismissed all remaining claims against the former and current independent trustees of RS Investment Trust. The discovery phase has been completed with respect to the litigation and the defendants have made a motion for summary judgment.

Additional lawsuits arising out of the same circumstances and presenting similar or different or additional allegations may be filed against certain RS Funds, RS Investments, or their affiliates in the future. RS Investments does not believe that the pending consolidated action will materially affect its ability to continue to provide to the Fund the services it has agreed to provide. It is not possible at this time to predict whether the litigation will have any material adverse effect on the Fund.

| | |

| RS Core Equity VIP Series | | 19 |

| | |

| | Supplemental Information — unaudited |

Approval of Investment Advisory Agreements for Certain Series of RS Variable Products Trust*

The Board of Trustees of RS Variable Products Trust (the “Trust”), including all of the Trustees who are not interested persons of the Trust or of RS Investments (the “disinterested Trustees”), met in person on August 13 — 14, 2007, to consider the continuation of the investment advisory and sub-advisory agreements (collectively, the “Advisory Agreements”) for the one-year period commencing September 1, 2007 for certain funds of the Trust, including RS Core Equity VIP Series, RS Small Cap Core Equity VIP Series, and RS Partners VIP Series (the “RS-Managed Funds”); and RS Money Market VIP Series, RS High Yield Bond VIP Series, RS Investment Quality Bond VIP Series, RS Low Duration Bond VIP Series, RS Emerging Markets VIP Series, RS International Growth VIP Series, RS Large Cap Value VIP Series, RS S&P 500 Index VIP Series, and RS Asset Allocation VIP Series (the “Sub-Advised Funds” and together with the RS-Managed Funds, the “Funds”).

RS Investment Management Co. LLC (“RS Investments”) is responsible for the day-to-day investment management of the RS-Managed Funds; various Sub-Advisers (the “Sub-Advisers”) overseen by RS Investments are responsible for the day-to-day investment management of the Sub-Advised Funds. Guardian Investor Services LLC (“GIS”), a subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”), serves as Sub-Adviser to RS Money Market VIP Series, RS High Yield Bond VIP Series, RS Investment Quality Bond VIP Series, RS Low Duration Bond VIP Series, RS S&P 500 Index VIP Series, and RS Asset Allocation VIP Series; Guardian Baillie Gifford Limited serves as Sub-Adviser, and Baillie Gifford Overseas Limited serves as Sub-Sub-Adviser to RS International Growth VIP Series and RS Emerging Markets VIP Series (the sub-advisory and sub-sub-advisory agreements relating to these Funds are also considered “Advisory Agreements” for purposes of this discussion, and the sub-sub-adviser is also considered a Sub-Adviser for purposes of this discussion); UBS Global Asset Management (Americas) Inc. serves as Sub-Adviser to RS Large Cap Value VIP Series.

At their meeting, the Trustees considered a number of factors in determining to approve the continuation of the Advisory Agreements. In all of their deliberations regarding the Advisory Agreements, the disinterested Trustees were advised by their independent counsel, with whom they had separate meetings and discussions on a number of occasions during and preceding the dates of the official Board meeting. In addition, the Trustees were assisted in their review by the Chief Compliance Officer of the Trust, who reviewed all of the information presented to the Trustees and, with the assistance of independent counsel to the disinterested Trustees, prepared a written report on the key factors for the Trustees. That written report discussed a number of the factors described below and concluded that the information that RS Investments had provided to the Trustees provided a reasonable basis for the Trustees to conclude that the advisory fees proposed in connection with the continuation of the Advisory Agreements were reasonable with respect to each Fund.

The Trustees were also assisted in their review by two independent consultants retained by the Trustees. The consultants provided assistance in a variety of aspects of the Trustees’ review, including, among other things, the development of appropriate expense and performance peer groups for the Funds, review of expense and performance data received by the Trustees, consideration of economies of scale, analysis of profitability data from RS Investments and the Sub-Advisers, and evaluation of industry trends. The consultants met with the Trustees on a number of occasions, both by telephone and at the August 2007 in-person meeting.

In their consideration of the Advisory Agreements, the Trustees were mindful generally of the recent changes in the structure and organization of RS Investments, noting specifically the acquisition by GIS, a subsidiary of Guardian Life, of a majority ownership of the firm, and the continuing integration of the investment management

| * | The Advisory Agreements for the series of the Trust not discussed at the meeting were not subject to review by the Trustees at the meeting. |

| | |

| 20 | | RS Core Equity VIP Series |

capabilities of RS Investments and of GIS. They considered RS Investments’ representations that the integration of the two firms had been implemented successfully to date and had resulted in a stronger, deeper, and more diverse portfolio management organization. The Trustees had also discussed the integration with management and observed its effects over the course of the preceding year.

The Trustees considered the fees charged by RS Investments to the Funds under the Advisory Agreements and the fees paid to the various Sub-Advisers. In this connection, representatives of RS Investments noted to the Trustees that the fees charged by RS Investments to the Funds reflect a number of factors. They noted, for example, the generally high quality of the investment management teams at RS Investments, the high levels of compensation that are required to retain the firm’s investment professionals, and the alternative employment opportunities available to many of those professionals, including highly remunerative positions at hedge fund managers. They also noted that, as to the Sub-Advised Funds, RS Investments pays the majority, in most cases the large majority, of the fees it receives to the Sub-Advisers.

RS Investments furnished information to the Trustees compiled by the independent Lipper organization showing a comparison of RS Investments’ fee rate for each Fund compared to peer mutual funds having similar objectives, strategies, and asset sizes. The Trustees also reviewed information from that compilation showing total expenses for the Funds in comparison to the peer funds. In his report, the Chief Compliance Officer noted that the advisory fees for the Funds, particularly the RS Large Cap Value VIP Series, although the same as the retail RS Funds, are relatively high compared to peer funds; and that the advisory fee for RS Money Market VIP Series was among the highest, though not the highest, in its peer group, though he noted that the advisory fees for RS Money Market VIP Series’ peer group fell within a relatively narrow band. Because of the relatively higher advisory fees for RS Money Market VIP Series, the disinterested Trustees proposed that the annual advisory fee rate for that Fund be reduced by 5 basis points, to an annual rate of 0.45% of the Fund’s average daily net assets. RS Investments agreed to implement that reduction in the near future. The Trustees considered the total expense ratios of the Funds and noted that a number of them were higher than the median of their peer funds. They noted that in some cases that appeared to be due to the level of the Funds’ advisory fees and, in many cases, the Funds’ custodial fees were relatively high. They noted in this regard that RS Investments may in the future voluntarily waive fees with respect to certain of the Funds. They also noted in this regard that the Funds’ recently renegotiated custodial arrangements were likely to result in substantial savings to the Funds in the coming year. The disinterested Trustees plan to monitor whether those expected savings occur.

The Trustees considered information provided by RS Investments as to the fees charged by RS Investments to clients other than the Funds, including institutional separate accounts and mutual funds for which RS Investments serves as Sub-Adviser. RS Investments generally charges lower fees to those accounts. In a number of cases, such an account pays fees at the same rate as the comparable Fund on assets up to a specified level, and then at lower rates on additional assets. In some cases, an account’s fee rate will be lower at all levels than that of the comparable Fund. Representatives of RS Investments explained that compliance, reporting, and other legal burdens of providing investment advice to mutual funds exceed those required to provide advisory services to non-mutual fund clients such as retirement or pension plans. In addition, they pointed out that there is substantially greater legal and other risk to RS Investments in managing public mutual funds than in managing private accounts. They also explained that the services and resources required of RS Investments where it sub-advises mutual funds sponsored by others are substantially less than in the case of the Funds, since many of the compliance and regulatory responsibilities related to the management function are retained by the primary adviser. RS Investments also noted that it provides advisory services in a number of investment disciplines to Guardian Life, at

| | |

| RS Core Equity VIP Series | | 21 |

| | |

| | Supplemental Information — unaudited (continued) |

rates generally lower than it charges to other advisory clients.

RS Investments furnished detailed financial information, in the form of a consolidated profit and loss statement, showing the revenues and expenses related to the management of the RS Funds as a whole and each of RS Investments’ other categories of advisory clients, respectively. That information showed the substantial costs of providing services to the Funds. RS Investments also furnished a detailed profitability analysis with respect to RS Partners VIP Series for the three months ended December 31, 2006 and the five months ended May 31, 2007. The Chief Compliance Officer reported on the profitability levels for that Fund. The Trustees noted that RS Investments’ profitability on its mutual fund business as a whole was higher than the profitability of the separate account advisory business; the Chief Compliance Officer noted in his report that the higher profit margin appeared justifiable by the higher risk and responsibilities associated with the mutual fund business.

The Trustees considered whether economies of scale would likely be realized as the Funds grow and whether a reduction in the advisory fees paid by the Funds by means of breakpoints would be appropriate. In his report, the Chief Compliance Officer noted that RS Investments had decided some time ago to eliminate its hedge fund business and the related revenue to focus its existing investment management resources on its mutual fund and institutional business. He noted that the profits from the Funds enable RS Investments to devote greater resources to the management of the Funds, including organizational enhancements and financial incentives for the portfolio managers, analysts, and other personnel who in many cases have lucrative alternative employment and business opportunities available to them. He noted, as well, that the investment management process for certain investment disciplines does not necessarily benefit from economies of scale. He also noted that shareholders of the Funds are likely to benefit to some degree to the extent that the expenses of the Funds are reduced over time simply by virtue of their increased sizes, even in the absence of management fee reductions. The Trustees also consid ered a report provided to them by their independent consultants as to economies of scale, both generally and as to the Funds specifically, and the consultants’ recommendations that the Trustees give careful consideration in the future to the manner in which shareholders might realize some of the benefit of such economies over time, as the Funds grow in size. The Trustees noted that the Funds had already benefited from certain economies resulting from the combination of RS Investments and GIS, including, for example, through the reduced custodial fees the combined firm had been able to negotiate.

The Trustees considered the nature, extent, and quality of the services provided by RS Investments. In this regard, the Trustees took into account the experience of the Funds’ portfolio management teams and of RS Investments’ senior management, and the time and attention devoted by each to the Funds. The Trustees considered the performance of each Fund (although only for relatively recent periods in most cases), while also considering its applicable investment objective and strategy and its overall expense ratio. The Trustees also received information throughout the year regarding the capabilities of RS Investments in securities trading, and changes in personnel in RS Investments’ trading staff. The Trustees also considered RS Investments’ significant responsibilities in monitoring the services provided by the Sub-Advisers.

The Trustees reviewed performance information for each Fund for various periods. That review included an examination of comparisons of the performance of the Funds to relevant securities indexes and various peer groups of mutual funds prepared by the independent Lipper and Morningstar organizations with respect to various periods, and relative rankings of the Funds compared to peer funds during various periods. The Trustees noted that, in his report, the Chief Compliance Officer had found that none of the Funds appeared to have substantially lagged all peer mutual funds and indexes for all relevant periods.

The Trustees also considered the research and other similar services RS Investments receives from many of the broker-dealers with which it places the Funds’ (as

| | |

| 22 | | RS Core Equity VIP Series |

well as other RS Investments clients’) portfolio transactions and from third parties with which these broker- dealers have arrangements. The Trustees receive information on those arrangements quarterly throughout the year and have the opportunity to discuss that information with representatives of RS Investments at the meetings. The Trustees considered the benefit to RS Investments and its affiliates from such services including that (1) the services are of value to RS Investments and its affiliates in advising RS Investments’ clients (including the Funds) and (2) RS Investments might otherwise be required to purchase some of these services for cash. The Trustees considered information provided to them quarterly during the year regarding the benefits to RS Investments of research and brokerage services provided in connection with so-called “bundled brokerage” arrangements. The Trustees concluded that these “soft dollar” relationships’ benefit to RS Investments was reasonable and that the Funds also benefited from them.

The Trustees reviewed detailed information regarding the various Sub-Advisers to the Funds, including information as to compliance with federal securities laws, capabilities and experience of portfolio management personnel and any changes in such personnel in the past year, financial information as to the Sub-Advisers, information as to their trading practices, and general information as to the pricing of the Sub-Advisers’ services.

The Trustees considered generally the nature and quality of the administrative services provided to the Funds by RS Investments and by GIS, including, among other things, changes in and enhancements to the firms’ personnel and capabilities, their performance during the course of the preceding year, and the responsiveness of senior management to the Trustees’ requests.

The Trustees noted a number of specific recent enhancements to the services provided by RS Investments, including, among others, the following factors cited by the Chief Compliance Officer:

| Ø | | RS Investments has seen significant organizational changes after its transaction with GIS, including many changes that have strengthened the organization and its ability to devote greater resources to the services provided to the Funds. Integration work continues, but the Chief Compliance Officer believes RS Investments is a more robust organization as a result of the transaction. |

| Ø | | RS Investments has been responsive to concerns raised by the Trustees in the past year. |

| Ø | | RS Investments has added significant managerial talent in the areas of finance, fund administration, and accounting. |

| Ø | | RS Investments has provided necessary staffing, training, and other compliance resources necessary for the Chief Compliance Officer to perform his responsibilities as the Chief Compliance Officer. |

The Trustees also considered the Chief Compliance Officer’s conclusion that RS Investments provides high quality advisory and related services to the Funds.