UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21922

RS Variable Products Trust

(Exact name of registrant as specified in charter)

| | |

388 Market Street San Francisco, CA | | 94111 |

| (Address of principal executive offices) | | (Zip code) |

Terry R. Otton

c/o RS Investments

388 Market Street

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-221-3253

Date of fiscal year end: December 31

Date of reporting period: June 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

2011 Semiannual Report

All data as of June 30, 2011

RS Variable Products Trust

| Ÿ | | RS Large Cap Alpha VIP Series |

| | | | |

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE | | |  | |

TABLE OF CONTENTS

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2011. The views expressed in the investment team letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

RS LARGE CAP ALPHA VIP SERIES

The Statement of Additional Information provides further information about the investment team, including information regarding their compensation, other accounts they manage, and their ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the relevant Prospectus or visit our Web site at www.guardianinvestor.com.

RS Large Cap Alpha VIP Series Commentary

Highlights

| Ÿ | | The broad U.S. equity market, as defined by the S&P 500® Index1, delivered positive performance in the first half of 2011, despite renewed concerns over the strength of the economic recovery. |

| Ÿ | | RS Large Cap Alpha VIP Series returned positive performance for the six-month period, but underperformed the benchmark Russell 1000® Value Index2, as well as the S&P 500® Index. The Fund’s performance relative to the Russell 1000 Value was held back by stock selection in the consumer discretionary, financial services, and energy sectors. Stock selection in the technology sector aided relative performance. |

| Ÿ | | RS Large Cap Alpha VIP Series seeks long-term capital appreciation by identifying large-cap companies with improving returns on invested capital (ROIC). |

Market Overview

The broad U.S. equity market, as defined by the S&P 500® Index, started out the year on a positive note, delivering positive absolute first quarter returns as investors focused on generally healthy corporate profits and better market liquidity in the wake of the Federal Reserve’s most recent round of quantitative easing. The market experienced renewed downward volatility in March, however, as economic fears resurfaced, aggravated by the earthquake in Japan, the debt crisis in Europe, and a spike in oil prices. Investors were also uneasy regarding how the economy might fare if the Federal Reserve were to wind down its quantitative easing efforts. As employment growth continued to stagnate and the housing market remained weak, economic fears took center stage during the second quarter, contributing to downward volatility in equity prices. As many investors lost their appetites for risk, they sought refuge in more economically defensive investments in areas such as consumer staples and health care.

Fund Performance Overview

RS Large Cap Alpha VIP Series returned 1.87% for the six-month period ended June 30, 2011, underperforming the benchmark Russell 1000® Value Index, which

returned 5.92%, and the S&P 500® Index, which returned 6.02%.

Among the Fund’s largest individual detractors for the period were a number of financial services holdings. The Fund’s detractors included Citigroup, Inc., which was pressured after reporting lackluster revenues and earnings performance, and Aflac, Inc., a supplemental insurance provider that generates over 70% of its cash flows from Japan. The company has faced questions over its financial exposure tied to the Tohoku earthquake and ensuing tsunami, as well as over the short-term ramifications of its decision to de-risk its investment portfolio. We believe that the tragic events in Japan will not have a material impact on the Aflac’s long-term return profile; moreover, we believe that reducing risk is in the long-term best interests of company’s shareholders.

While we have seen evidence of improving capital positions, liquidity, and underwriting standards within the financial services sector, we seek to be discriminating in our financial services investments, concentrating on insurance companies that we believe possess structurally superior distribution models, as well as banks that we believe focus on “relationship lending” and possess low cost core deposit franchises.

The Fund’s other large detractors included retailer Gap, Inc., which lost ground amid concerns over cotton prices and how a sluggish U.S. economy might impact consumer spending. Economic uncertainty also weighed on the share price performance of Martin Marietta Materials, Inc., a producer of aggregates for the construction industry.

On a positive note, relative performance was aided by stock selection in the technology sector, and in particular by our investment in Symantec Corp., a security software and services provider capitalizing on increasing enterprise investment in technology to fend off increasingly sophisticated cyber threats. Within business services and technology, we continue to seek to allocate capital to businesses with understandable and predictable revenue streams as well as high customer retention rates and recurring cash flow characteristics.

Other positive contributors included shares of Praxair, Inc., a supplier of industrial gases, which has capitalized

RS LARGE CAP ALPHA VIP SERIES

on strong demand for its compressed ultra-pure oxygen and other gases used in the production of integrated circuits and other high tech and industrial products. The company continues to win new contracts both domestically and in China. The Fund’s relative performance was also aided by our investment in drug maker Pfizer, which benefited from investors’ renewed enthusiasm for more defensive, large-cap health care stocks during the second quarter. Investors have also welcomed the company’s efforts to rein in costs and shed underperforming product lines.

Outlook

We believe that we are in a period of protracted volatility as the markets grapple with a variety of issues, including deleveraging, deflation/inflation risks, government budget deficits, higher taxes, and the potential for rising risk premiums. In this environment, we continue to focus on identifying company-specific structural changes that we believe will lead to improving returns on invested capital.

RS Funds are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the RS Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our web site at www.guardianinvestor.com or to obtain a printed copy, call 800-221-3253.

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2011.

As with all mutual funds, the value of an investment in the Fund could decline, in which case you could lose money. The Fund invests primarily in equity securities and therefore exposes you to the general risks of investing in stock markets.

RS LARGE CAP ALPHA VIP SERIES

Characteristics

| | |

| Total Net Assets: $972,910,447 | | |

| | |

| |

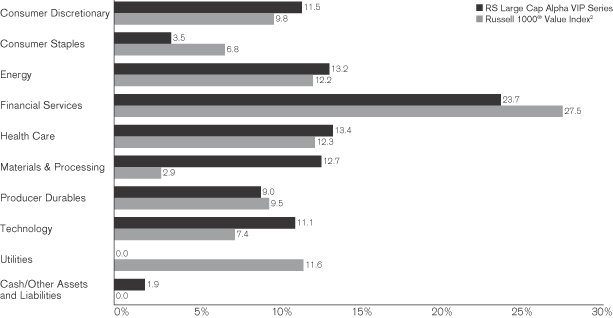

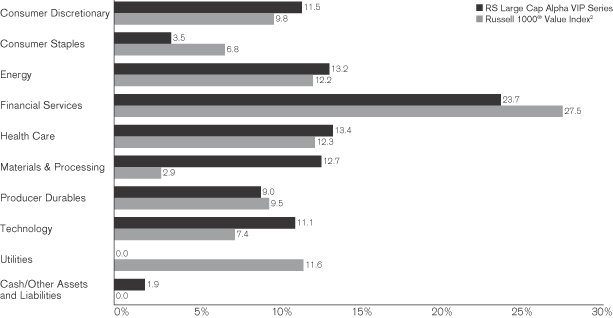

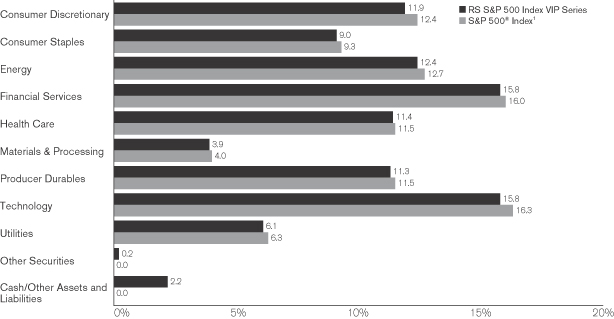

| Sector Allocation vs. Index3 |

|

| | | | |

| | |

| Top Ten Holdings4 | | | |

| | |

| Holding | | % of Total

Net Assets | |

| Praxair, Inc. | | | 4.73% | |

| Symantec Corp. | | | 4.19% | |

| Citigroup, Inc. | | | 4.18% | |

| eBay, Inc. | | | 3.90% | |

| Occidental Petroleum Corp. | | | 3.88% | |

| Activision Blizzard, Inc. | | | 3.77% | |

| Talisman Energy, Inc. | | | 3.74% | |

| CVS Caremark Corp. | | | 3.51% | |

| Aflac, Inc. | | | 3.50% | |

| Pfizer, Inc. | | | 3.49% | |

| Total | | | 38.89% | |

| 1 | The S&P 500® Index is an unmanaged market-capitalization-weighted index generally considered to be representative of U.S. equity market activity. The index consists of 500 stocks representing leading industries of the U.S. economy. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 2 | The Russell 1000® Value Index is an unmanaged market-capitalization-weighted index that measures the performance of those companies in the Russell 1000® Index (which consists of the 1,000 largest U.S. companies based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values. Index results assume the reinvestment of dividends paid on stocks constituting the Index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 3 | The Fund’s holdings are allocated to each sector based on their Russell Global Sector classification. If a holding is not classified by Russell, it is assigned a Russell designation by RS Investments. Cash includes short-term investments and net other assets and liabilities. |

| 4 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

RS LARGE CAP ALPHA VIP SERIES

Performance Update

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Average Annual Returns | |

| | | | | | | | |

| | | Inception Date | | | Year-to-Date | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since Inception | |

| RS Large Cap Alpha VIP Series | | | 4/13/83 | | | | 1.87% | | | | 25.23% | | | | 3.32% | | | | 6.76% | | | | 3.32% | | | | 10.58% | |

| Russell 1000® Value Index2 | | | | | | | 5.92% | | | | 28.94% | | | | 2.28% | | | | 1.15% | | | | 3.99% | | | | 11.32% | |

| S&P 500® Index1 | | | | | | | 6.02% | | | | 30.69% | | | | 3.34% | | | | 2.94% | | | | 2.72% | | | | 10.69% | |

Since inception performance for the indexes is measured from 3/31/1983, the month end prior to the Fund’s commencement of operations.

| | |

| |

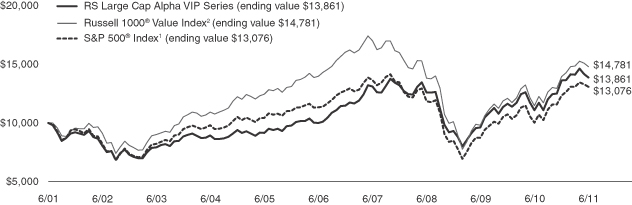

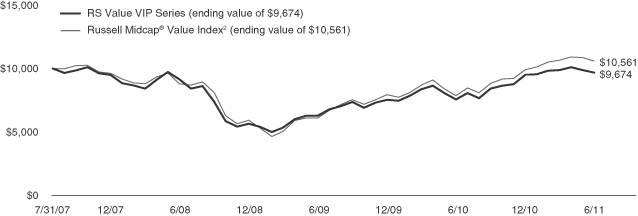

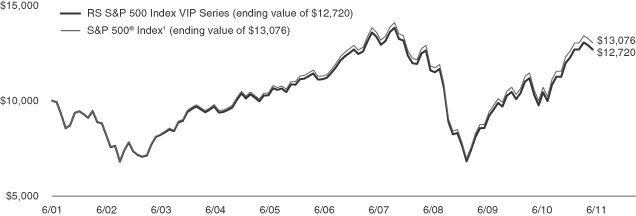

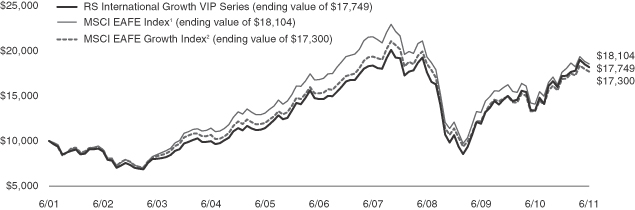

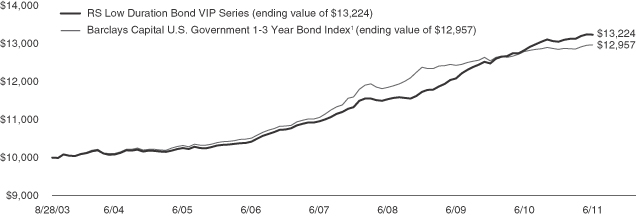

| Results of a Hypothetical $10,000 Investment |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Large Cap Alpha VIP Series, the Russell 1000® Value Index, and in the S&P 500® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee or predict future results. The Fund is the successor to The Guardian Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Total return figures reflect an expense limitation in effect for the periods shown; without such limitation, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contractowner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | Beginning

Account Value

1/1/11 | | Ending

Account Value

6/30/11 | | | Expenses Paid

During Period*

1/1/11-6/30/11 | | | Expense Ratio

During Period 1/1/11-6/30/11 | |

| Based on Actual Return | | $1,000.00 | | | $1,018.70 | | | | $2.75 | | | | 0.55% | |

| Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | | $1,022.07 | | | | $2.75 | | | | 0.55% | |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS — RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | |

| June 30, 2011 (unaudited) | | Shares | | | Value | |

| Common Stocks – 98.1% | |

| Asset Management & Custodian – 2.1% | |

State Street Corp. | | | 461,450 | | | $ | 20,806,781 | |

| | | | | | | | | |

| | | | | | | | 20,806,781 | |

| Back Office Support, HR and Consulting – 2.9% | |

Synopsys, Inc.(1) | | | 1,088,422 | | | | 27,983,330 | |

| | | | | | | | | |

| | | | | | | | 27,983,330 | |

| Banks: Diversified – 6.1% | |

KeyCorp | | | 3,728,900 | | | | 31,061,737 | |

Regions Financial Corp. | | | 4,539,468 | | | | 28,144,702 | |

| | | | | | | | | |

| | | | | | | | 59,206,439 | |

| Building Materials – 3.2% | |

Martin Marietta Materials, Inc. | | | 395,595 | | | | 31,635,732 | |

| | | | | | | | | |

| | | | | | | | 31,635,732 | |

| Chemicals: Specialty – 4.7% | |

Praxair, Inc. | | | 424,177 | | | | 45,976,545 | |

| | | | | | | | | |

| | | | | | | | 45,976,545 | |

| Computer Services, Software & Systems – 7.3% | |

Microsoft Corp. | | | 1,148,277 | | | | 29,855,202 | |

Symantec Corp.(1) | | | 2,067,500 | | | | 40,771,100 | |

| | | | | | | | | |

| | | | | | | | 70,626,302 | |

| Consumer Services: Miscellaneous – 3.9% | |

eBay, Inc.(1) | | | 1,175,470 | | | | 37,932,417 | |

| | | | | | | | | |

| | | | | | | | 37,932,417 | |

| Diversified Financial Services – 4.2% | |

Citigroup, Inc. | | | 977,068 | | | | 40,685,112 | |

| | | | | | | | | |

| | | | | | | | 40,685,112 | |

| Diversified Manufacturing Operations – 3.0% | |

Honeywell International, Inc. | | | 487,455 | | | | 29,047,443 | |

| | | | | | | | | |

| | | | | | | | 29,047,443 | |

| Drug & Grocery Store Chains – 3.5% | |

CVS Caremark Corp. | | | 907,730 | | | | 34,112,493 | |

| | | | | | | | | |

| | | | | | | | 34,112,493 | |

| Electronic Entertainment – 3.8% | |

Activision Blizzard, Inc. | | | 3,142,040 | | | | 36,699,027 | |

| | | | | | | | | |

| | | | | | | | 36,699,027 | |

| Health Care Facilities – 2.9% | |

HCA Holdings, Inc.(1) | | | 866,400 | | | | 28,591,200 | |

| | | | | | | | | |

| | | | | | | | 28,591,200 | |

| Insurance: Life – 6.2% | |

Aflac, Inc. | | | 729,171 | | | | 34,037,702 | |

Prudential Financial, Inc. | | | 413,800 | | | | 26,313,542 | |

| | | | | | | | | |

| | | | | | | | 60,351,244 | |

| Insurance: Multi-Line – 3.1% | |

MetLife, Inc. | | | 677,700 | | | | 29,730,699 | |

| | | | | | | | | |

| | | | | | | | 29,730,699 | |

| Insurance: Property-Casualty – 2.0% | |

The Allstate Corp. | | | 639,900 | | | | 19,536,147 | |

| | | | | | | | | |

| | | | | | | | 19,536,147 | |

| | | | | | | | |

| June 30, 2011 (unaudited) | | Shares | | | Value | |

| Medical & Dental Instruments & Supplies – 1.0% | |

Covidien PLC | | | 184,300 | | | $ | 9,810,289 | |

| | | | | | | | | |

| | | | | | | | 9,810,289 | |

| Metals & Minerals: Diversified – 2.3% | |

BHP Billiton Ltd., ADR | | | 239,637 | | | | 22,676,849 | |

| | | | | | | | | |

| | | | | | | | 22,676,849 | |

| Oil: Crude Producers – 13.2% | |

Canadian Natural Resources Ltd. | | | 504,162 | | | | 21,104,221 | |

Occidental Petroleum Corp. | | | 362,500 | | | | 37,714,500 | |

Southwestern Energy Co.(1) | | | 773,732 | | | | 33,177,628 | |

Talisman Energy, Inc. | | | 1,775,640 | | | | 36,382,864 | |

| | | | | | | | | |

| | | | | | | | 128,379,213 | |

| Pharmaceuticals – 9.5% | |

Merck & Co., Inc. | | | 866,621 | | | | 30,583,055 | |

Pfizer, Inc. | | | 1,646,100 | | | | 33,909,660 | |

Warner Chilcott PLC, Class A | | | 1,159,300 | | | | 27,973,909 | |

| | | | | | | | | |

| | | | | | | | 92,466,624 | |

| Precious Metals & Minerals – 2.5% | |

Goldcorp, Inc. | | | 495,409 | | | | 23,913,392 | |

| | | | | | | | | |

| | | | | | | | 23,913,392 | |

| Specialty Retail – 5.0% | |

The Gap, Inc. | | | 1,680,970 | | | | 30,425,557 | |

Urban Outfitters, Inc.(1) | | | 655,386 | | | | 18,449,116 | |

| | | | | | | | | |

| | | | | | | | 48,874,673 | |

| Toys – 2.6% | |

Hasbro, Inc. | | | 575,592 | | | | 25,285,757 | |

| | | | | | | | | |

| | | | | | | | 25,285,757 | |

| Transportation Miscellaneous – 3.1% | |

United Parcel Service, Inc., Class B | | | 414,300 | | | | 30,214,899 | |

| | | | | | | | | |

| | | | | | | | 30,214,899 | |

Total Common Stocks

(Cost $819,888,880) | | | | | | | 954,542,607 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Repurchase Agreements – 1.9% | |

State Street Bank and Trust Co. Repurchase Agreement, 0.01%, dated 6/30/2011, maturity value of $17,989,005, due 7/1/2011(2) | | $ | 17,989,000 | | | | 17,989,000 | |

Total Repurchase Agreements

(Cost $17,989,000) | | | | | | | 17,989,000 | |

Total Investments - 100.0%

(Cost $837,877,880) | | | | | | | 972,531,607 | |

| Other Assets, Net - 0.0% | | | | | | | 378,840 | |

| Total Net Assets - 100.0% | | | | | | $ | 972,910,447 | |

| (1) | Non-income producing security. |

| | | | |

| 8 | | | | The accompanying notes are an integral part of these financial statements. |

RS LARGE CAP ALPHA VIP SERIES

| (2) | The table below presents collateral for repurchase agreements. |

| | | | | | | | | | | | |

| Security | | Coupon | | | Maturity

Date | | | Value | |

| U.S. Treasury Note | | | 1.00% | | | | 3/31/2012 | | | $ | 18,349,163 | |

Legend:

ADR — American Depositary Receipt.

The following is a summary of the inputs used as of June 30, 2011 in valuing the Fund’s investments. For more information on valuation inputs, please refer to Note 1a of the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Investments in Securities (unaudited) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 954,542,607 | | | $ | — | | | $ | — | | | $ | 954,542,607 | |

| Repurchase Agreements | | | — | | | | 17,989,000 | | | | — | | | | 17,989,000 | |

| Total | | $ | 954,542,607 | | | $ | 17,989,000 | | | $ | — | | | $ | 972,531,607 | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 9 |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | |

Statement of Assets and Liabilities As of June 30, 2011 (unaudited) | | | |

Assets | | | | |

Investments, at value | | $ | 972,531,607 | |

Cash and cash equivalents | | | 87 | |

Dividends/interest receivable | | | 974,981 | |

Receivable for fund shares subscribed | | | 217,067 | |

Prepaid expenses | | | 144,404 | |

| | | | | |

Total Assets | | | 973,868,146 | |

| | | | | |

| | |

Liabilities | | | | |

Payable for fund shares redeemed | | | 453,021 | |

Payable to adviser | | | 389,639 | |

Accrued trustees’ fees | | | 12,021 | |

Payable organization costs and offering costs | | | 5,487 | |

Accrued expenses/other liabilities | | | 97,531 | |

| | | | | |

Total Liabilities | | | 957,699 | |

| | | | | |

Total Net Assets | | $ | 972,910,447 | |

| | | | | |

| | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 1,027,544,104 | |

Accumulated undistributed net investment income | | | 4,038,684 | |

Accumulated net realized loss from investments and foreign currency transactions | | | (193,326,620 | ) |

Net unrealized appreciation on investments and translation of assets and liabilities in foreign currencies | | | 134,654,279 | |

| | | | | |

Total Net Assets | | $ | 972,910,447 | |

| | | | | |

Investments, at Cost | | $ | 837,877,880 | |

| | | | | |

| | |

Pricing of Shares | | | | |

Shares of Beneficial Interest Outstanding with no Par Value | | | 25,113,381 | |

Net Asset Value Per Share | | | $38.74 | |

| | | | | |

| | | | |

Statement of Operations For the Six-Month Period Ended June 30, 2011 (unaudited) | |

Investment Income | | | | |

Dividends | | $ | 6,774,601 | |

Interest | | | 1,197 | |

Withholding taxes on foreign dividends | | | (60,545 | ) |

| | | | | |

Total Investment Income | | | 6,715,253 | |

| | | | | |

| | |

Expenses | | | | |

Investment advisory fees | | | 2,441,146 | |

Professional fees | | | 61,582 | |

Administrative service fees | | | 59,206 | |

Custodian fees | | | 45,729 | |

Trustees’ fees | | | 21,689 | |

Other expenses | | | 49,535 | |

| | | | | |

Total Expenses | | | 2,678,887 | |

| | |

Less: Custody credits | | | (3 | ) |

| | | | | |

Total Expenses, Net | | | 2,678,884 | |

| | | | | |

Net Investment Income | | | 4,036,369 | |

| | | | | |

| | |

Realized Gain/(Loss) and Change in Unrealized Appreciation/Depreciation on Investments and Foreign Currency Transactions | | | | |

Net realized gain from investments | | | 79,021,676 | |

Net realized gain from foreign currency transactions | | | 3,728 | |

Net change in unrealized appreciation/depreciation on investments | | | (64,842,844 | ) |

Net change in unrealized appreciation/depreciation on translation of assets and liabilities in foreign currencies | | | (2,404 | ) |

| | | | | |

Net Gain on Investments and Foreign Currency Transactions | | | 14,180,156 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 18,216,525 | |

| | | | | |

| | | | | |

| | | | |

| 10 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | |

Statements of Changes in Net Assets Six-month-ended numbers are unaudited | | | | | | |

| | | |

| | | For the

Six Months Ended

6/30/11 | | | For the

Year Ended

12/31/10 | |

| | | | |

Operations | | | | | | | | |

Net investment income | | $ | 4,036,369 | | | $ | 6,650,177 | |

Net realized gain from investments and foreign currency transactions | | | 79,025,404 | | | | 85,779,530 | |

Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities in foreign currencies | | | (64,845,248 | ) | | | 51,479,712 | |

| | | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | | 18,216,525 | | | | 143,909,419 | |

| | | | | | | | | |

| | | |

Distributions to Shareholders | | | | | | | | |

Net investment income | | | — | | | | (21,130,486 | ) |

| | | | | | | | | |

Total Distributions | | | — | | | | (21,130,486 | ) |

| | | | | | | | | |

| | | |

Capital Share Transactions | | | | | | | | |

Proceeds from sales of shares | | | 43,204,462 | | | | 72,498,697 | |

Reinvestment of distributions | | | — | | | | 21,130,486 | |

Cost of shares redeemed | | | (63,405,386 | ) | | | (122,911,738 | ) |

| | | | | | | | | |

Net Decrease in Net Assets Resulting from Capital Share

Transactions | | | (20,200,924 | ) | | | (29,282,555 | ) |

| | | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | (1,984,399 | ) | | | 93,496,378 | |

| | | | | | | | | |

| | | |

Net Assets | | | | | | | | |

Beginning of period | | | 974,894,846 | | | | 881,398,468 | |

| | | | | | | | | |

End of period | | $ | 972,910,447 | | | $ | 974,894,846 | |

| | | | | | | | | |

Accumulated Undistributed Net Investment Income Included in Net Assets | | $ | 4,038,684 | | | $ | 2,315 | |

| | | | | | | | | |

| | | |

Other Information: | | | | | | | | |

Shares | | | | | | | | |

Sold | | | 1,113,135 | | | | 2,095,271 | |

Reinvested | | | — | | | | 564,383 | |

Redeemed | | | (1,631,622 | ) | | | (3,562,948 | ) |

| | | | | | | | | |

Net Decrease | | | (518,487 | ) | | | (903,294 | ) |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 11 |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

The financial highlights table is intended to help you understand the Fund’s financial performance for the past six reporting periods. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial Highlights Six-month-ended numbers are unaudited | | | | | | | | | | |

| | | Net Asset Value,

Beginning of

Period | | | Net Investment

Income | | | Net Realized

and Unrealized

Gain/(Loss) | | | Total

Operations | | | Distributions

From Net

Investment

Income | | | Distributions

From Net

Realized

Capital Gains | | | Total

Distributions | |

Six Months Ended 6/30/111 | | $ | 38.03 | | | $ | 0.16 | | | $ | 0.55 | | | $ | 0.71 | | | $ | — | | | $ | — | | | $ | — | |

Year Ended 12/31/10 | | | 33.22 | | | | 0.28 | | | | 5.37 | | | | 5.65 | | | | (0.84 | ) | | | — | | | | (0.84 | ) |

Year Ended 12/31/09 | | | 26.60 | | | | 0.35 | | | | 6.32 | | | | 6.67 | | | | (0.05 | ) | | | — | | | | (0.05 | ) |

Year Ended 12/31/08 | | | 38.43 | | | | 0.46 | | | | (11.85 | ) | | | (11.39 | ) | | | (0.44 | ) | | | — | | | | (0.44 | ) |

Year Ended 12/31/07 | | | 33.67 | | | | 0.36 | | | | 4.75 | | | | 5.11 | | | | (0.35 | ) | | | — | | | | (0.35 | ) |

Year Ended 12/31/06 | | | 29.29 | | | | 0.39 | | | | 4.59 | | | | 4.98 | | | | (0.60 | ) | | | — | | | | (0.60 | ) |

| | | | |

| 12 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End of

Period | | | Total

Return2 | | | Net Assets, End

of Period (000s) | | | Net Ratio of

Expenses to

Average Net

Assets3 | | | Gross Ratio of

Expenses to

Average Net

Assets | | | Net Ratio of Net

Investment Income

to Average Net Assets3 | | | Gross Ratio of Net

Investment Income

to Average Net Assets | | | Portfolio

Turnover Rate | |

| $ | 38.74 | | | | 1.87% | | | $ | 972,910 | | | �� | 0.55% | | | | 0.55% | | | | 0.83% | | | | 0.83% | | | | 25% | |

| | 38.03 | | | | 17.05% | | | | 974,895 | | | | 0.55% | | | | 0.55% | | | | 0.75% | | | | 0.75% | | | | 60% | |

| | 33.22 | | | | 25.09% | | | | 881,398 | | | | 0.57% | | | | 0.58% | | | | 1.30% | | | | 1.31% | | | | 145% | |

| | 26.60 | | | | (29.62)% | | | | 668,245 | | | | 0.56% | | | | 0.56% | | | | 1.25% | | | | 1.25% | | | | 44% | |

| | 38.43 | | | | 15.19% | | | | 1,082,788 | | | | 0.57% | | | | 0.57% | | | | 0.93% | | | | 0.93% | | | | 60% | |

| | 33.67 | | | | 17.26% | | | | 1,048,865 | | | | 0.57% | | | | 0.57% | | | | 1.17% | | | | 1.17% | | | | 85% | |

Distributions reflect actual per-share amounts distributed for the period.

| 1 | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. |

| 2 | Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc.’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

| 3 | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of fee waivers, expense limitations and custody credits, if applicable. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 13 |

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

June 30, 2011 (unaudited)

RS Variable Products Trust (the “Trust”), a Massachusetts business trust organized on May 18, 2006, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently offers twelve series. RS Large Cap Alpha VIP Series (the “Fund”) is a series of the Trust. The Fund is a diversified fund. The financial statements for the other remaining series of the Trust are presented in separate reports.

The Fund has authorized an unlimited number of shares of beneficial interest with no par value. Shares are bought and sold at closing net asset value (“NAV”), which is the price for all outstanding shares of the Fund. Class I shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”). GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”). The Fund is currently offered to insurance company separate accounts that fund certain variable annuity and variable life insurance contracts issued by GIAC.

Note 1. Significant Accounting Policies

The following policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations Marketable securities are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and asked prices. Securities traded on the NASDAQ Stock Market, LLC (“NASDAQ”) are generally valued at the NASDAQ official closing price, which may not be the last sale price. If the NASDAQ official closing price is not available for a security, that security is generally valued using the last reported sale price, or, if no sales are reported, at the mean between the closing bid and asked prices. Short-term investments that will mature in 60 days or less are valued at amortized cost, which approximates market value. Repurchase agreements are carried at cost, which approximates market value. Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars using the prevailing exchange rates at the close of the New York Stock Exchange (“NYSE”).

Securities for which market quotations are not readily available or for which market quotations may be considered unreliable are valued at their fair values as determined in accordance with guidelines and procedures adopted by the Trust’s Board of Trustees.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued using methods approved by the Board of Trustees. In addition, if there has been a movement in the U.S. markets that exceeds a specified threshold, the values of the Fund’s investments in foreign securities are generally determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities.

The Fund has adopted the authoritative guidance under GAAP on determining fair value when the volume and level of activity for an asset or liability have significantly decreased and for identifying transactions that are not orderly. Accordingly, if the Fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

In accordance with Financial Accounting Standards Board Codification Topic 820 (“ASC Topic 820”), fair value is defined as the price that the Fund would receive upon selling an investment in an “arm’s length” transaction to a willing buyer in the principal or most advantageous market for the investment. ASC Topic 820 established a hierarchy for classification of fair value measurements for disclosure purposes. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. The hierarchy of inputs is summarized in the three broad levels listed below.

| Ÿ | | Level 1 — unadjusted quoted prices in active markets for identical investments |

| Ÿ | | Level 2 — inputs other than unadjusted quoted prices that are observable either directly or indirectly (including adjusted quoted prices for similar investments, interest rates, prepayment speeds, credit risks, etc.) |

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

| Ÿ | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A security’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Trust. The Trust considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, and provided by independent sources that are actively involved in the relevant market. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an investment’s assigned level within the hierarchy.

Effective beginning with the Fund’s current fiscal year, the Financial Accounting Standards Board requires reporting entities to make disclosures about purchases, sales, issuances and settlements of Level 3 securities on a gross basis. For the six months ended June 30, 2011, the Fund had no securities classified as Level 3.

There were no significant transfers between Level 1 and Level 2 for the six months end June 30, 2011.

In determining a security’s placement within the hierarchy, the Trust separates the Fund’s investment portfolio into two categories: investments and derivatives (e.g., futures).

Investments Investments whose values are based on quoted market prices in active markets, and are therefore classified within Level 1, include active listed equities. The Trust does not adjust the quoted price for such instruments, even in situations where the Fund holds a large position and a sale could reasonably be expected to impact the quoted price.

Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. These include certain U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, state, municipal and provincial obligations, and certain foreign equity securities.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at

all. Level 3 investments include, among others, private placement securities. When observable prices are not available for these securities, the Trust uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the Trust in estimating the value of Level 3 investments include the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of financing, recapitalizations, and other transactions across the capital structure. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Trust in the absence of market information. Assumptions used by the Trust due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations.

Derivatives Exchange-traded derivatives, such as futures contracts and exchange traded option contracts, are typically classified within Level 1 or Level 2 of the fair value hierarchy depending on whether or not they are deemed to be actively traded. Certain derivatives, such as generic forwards, swaps and options, have inputs which can generally be corroborated by market data and are therefore classified within Level 2.

b. Federal Income Taxes The Fund intends to continue complying with the requirements of the Internal Revenue Code to qualify as a regulated investment company and to distribute substantially all net investment income and realized net capital gains, if any, to shareholders. Therefore, the Fund does not expect to be subject to income tax, and no provision for such tax has been made.

From time to time, however, the Fund may choose to pay an excise tax if the cost of making the required distribution exceeds the amount of the excise tax.

As of June 30, 2011, the Trust has reviewed the tax positions for open periods, as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements. The Fund recognizes interest and penalties, if any, related to unrecognized tax positions as income tax expense in the Statement of Operations. For the six months ended June 30, 2011, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for tax years before 2007 and by state authorities for tax years before 2006.

c. Securities Transactions Securities transactions are accounted for on the date securities are purchased or

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

d. Foreign Currency Translation The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are generally translated into U.S. dollars at the exchange rates quoted at the close of the NYSE on each business day. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

e. Investment Income Dividend income is generally recorded on the ex-dividend date. Interest income, which includes amortization/accretion of premium/discount, is accrued and recorded daily.

f. Expenses Many expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets.

g. Custody Credits The Fund has entered into an arrangement with its custodian, State Street Bank and Trust Company, whereby credits realized as a result of uninvested cash balances are used to reduce the Fund’s custodian expenses. The Fund’s custody credits, if any, are shown in the accompanying Statement of Operations.

h. Distributions to Shareholders The Fund intends to declare and distribute substantially all net investment income, if any, at least once a year. Unless the Fund is instructed otherwise, all distributions to shareholders are credited in the form of additional shares of the Fund at the net asset value, recorded on the ex-dividend date.

i. Capital Accounts Due to the timing of dividend distributions and the differences in accounting for income and realized gains/(losses) for financial statement purposes versus federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains/(losses) were recorded by the Fund.

Note 2. Transactions with Affiliates

a. Advisory Fee Under the terms of the advisory agreement, which is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to RS Investment Management Co. LLC (“RS Investments”). Guardian Investor Services LLC (“GIS”), a subsidiary of Guardian Life, holds a majority interest in RS Investments. RS Investments receives an investment advisory fee based on the average daily net assets of the Fund at an annual rate of 0.50%. The Fund has also entered into an agreement with GIS for distribution services with respect to its shares.

b. Compensation of Trustees and Officers Trustees and officers of the Trust who are interested persons, as defined in the 1940 Act, of RS Investments receive no compensation from the Fund for acting as such. Trustees of the Trust who are not interested persons of RS Investments receive compensation and reimbursement of expenses from the Trust.

Note 3. Federal Income Taxes

a. Distributions to Shareholders The tax character of distributions paid to shareholders during the year ended December 31, 2010, which is the most recently completed tax year, was as follows:

|

Ordinary

Income |

| $21,130,486 |

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Permanent book and tax basis differences will result in reclassifications to paid-in capital, undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions. Undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions may include temporary book and tax differences, which will reverse in a subsequent period.

As of December 31, 2010, the Fund made the following reclassifications of permanent book and tax basis differences:

| | | | | | | | |

| Paid-in-Capital | | Accumulated Net Investment

Income/(Loss) | | | Accumulated

Net Realized

Gain/(Loss) | |

| $(82,016,863) | | $ | 9,978,977 | | | $ | 72,037,886 | |

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

The tax basis of distributable earnings as of December 31, 2010 was as follows:

| | | | |

| | | Undistributed Ordinary Income | | |

| | | $2,315 | | |

During any particular year, net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, are normally distributed to shareholders annually.

During the year ended December 31, 2010, the Fund utilized $82,716,312 of capital loss carryovers. Capital loss carryovers available to the Fund at December 31, 2010 were as follows:

| | | | |

| Expiring | | Amount | |

| 2011 | | $ | 95,938,938 | |

| 2015 | | | 63,066 | |

| 2016 | | | 15,285,989 | |

| 2017 | | | 160,708,957 | |

| | | | | |

| Total | | $ | 271,996,950 | |

| | | | | |

| | | | | |

Capital loss carryovers of $82,015,263 expired in the year ended December 31, 2010.

In determining its taxable income, current tax law permits the Fund to elect to treat all or a portion of any net capital or currency loss realized after October 31 as occurring on the first day of the following fiscal year. For the year ended December 31, 2010, the Fund had no such losses.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted. The Act modernizes several of the federal income and excise tax rules related to regulated investment companies, and with certain exceptions, is effective for taxable years beginning after December 22, 2010.

Among the changes are revisions to capital loss carryforward rules allowing for capital losses to be carried forward to one or more subsequent taxable years without expiration. Rules previously in effect limited the carryforward period to eight taxable years. Capital loss carryforwards generated in taxable years beginning after the effective date of the Act must be fully used before capital loss carryforwards generated in taxable years prior to the effective date of the Act. Changes to excise tax rules include timing of recognition of certain income and a change in the required distribution rate for capital gains.

b. Tax Basis of Investments The cost of investments for federal income tax purposes at June 30, 2011, was

$838,241,206. The gross unrealized appreciation and depreciation on investments, on a tax basis, at June 30, 2011, aggregated $144,402,930 and $(10,112,529), respectively, resulting in net unrealized appreciation of $134,290,401.

Note 4. Investments

a. Investment Purchases and Sales The cost of investments purchased and the proceeds from investments sold (excluding short-term investments) amounted to $245,109,946 and $269,230,887, respectively, for the six months ended June 30, 2011.

b. Foreign Securities Foreign securities investments involve special risks and considerations not typically associated with those of U.S. origin. These risks include, but are not limited to, currency risk; adverse political, social, and economic developments; and less reliable information about issuers. Moreover, securities of some foreign companies may be less liquid and their prices more volatile than those of comparable U.S. companies.

c. Industry or Sector Concentration In its normal course of business, the Fund may invest a significant portion of its assets in companies within a limited number of industries or sectors. As a result, the Fund may be subject to a greater risk of loss than that of a fund invested in a wider spectrum of industries or sectors because the stocks of many or all of the companies in the industry, group of industries, sector, or sectors may decline in value due to developments adversely affecting the industry, group of industries, sector, or sectors.

d. Repurchase Agreements The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities (including U.S. government agency securities). Repurchase agreements are fully collateralized (including the interest accrued thereon) and such collateral is marked-to-market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, the Fund will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, the Fund maintains the right to sell the collateral (although it may be prevented or delayed from doing so in certain circumstances) and may claim any resulting loss against the seller.

Note 5. Temporary Borrowings

The Fund, with other funds managed by RS Investments, shares in a $75 million committed revolving credit/overdraft protection facility from State Street Bank and Trust Company for temporary purposes, including the meeting of redemption requests that otherwise might

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

require the untimely disposition of securities. Interest is calculated based on market rates at the time of borrowing; all the funds that are parties to the facility share in a commitment fee that is allocated among the funds on the basis of their respective net assets. The Fund may borrow up to the lesser of one-third of its total assets (including amounts borrowed) or any lower limit specified in the Fund’s Statement of Additional Information or Prospectus.

For the six months ended June 30, 2011, the Fund did not borrow from the facility.

Note 6. Review for Subsequent Events

The Trust has evaluated subsequent events through the issuance of the Fund’s financial statements and determined that no material events have occurred that require disclosure.

Note 7. Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

SUPPLEMENTAL INFORMATION (UNAUDITED)

Meeting of Shareholders

A special meeting of the shareholders of RS Variable Products Trust (“the Trust”) was held on May 20, 2011. At the meeting, the shareholders of the Trust elected Judson Bergman, Kenneth R. Fitzsimmons, Jr., Anne M. Goggin, Christopher C. Melvin, Jr., Deanna M. Mulligan, Gloria S. Nelund, Terry R. Otton, and John P. Rohal as trustees of the Trust.

Proposal To Elect Trustees

| | | | |

Nominee | | Votes For | | Votes Against/Withheld |

| Judson Bergman | | 264,351,869.410 | | 14,579,441.977 |

| Kenneth R. Fitzsimmons, Jr. | | 264,417,319.717 | | 14,513,991.670 |

| Anne M. Goggin | | 265,496,967.524 | | 13,434,343.863 |

| Christopher C. Melvin, Jr. | | 264,182,743.884 | | 14,748,567.503 |

| Deanna M. Mulligan | | 264,603,554.628 | | 14,327,756.759 |

| Gloria S. Nelund | | 265,607,677.552 | | 13,323,633.835 |

| Terry R. Otton | | 265,360,024.512 | | 13,571,286.875 |

| John P. Rohal | | 264,052,063.420 | | 14,879,247.967 |

Portfolio Holdings and Proxy Voting Procedures

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Securities and Exchange Commission’s Web site at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. This information is also available, without charge, upon request, by calling toll-free 800-221-3253.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available (i) without charge, upon request, by calling toll-free 800-221-3253; and (ii) on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

The Statement of Additional Information includes additional information about the Trust’s Trustees and Officers and is available, without charge, upon request by calling toll-free 800-221-3253.

This report is transmitted to shareholders only. It is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of a Fund unless accompanied or preceded by that Fund’s current prospectus. Past performance results shown in this report should not be considered a representation of future performance. Investment returns and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are as dated and are subject to change.

2011 Semiannual Report

All data as of June 30, 2011

RS Variable Products Trust

| Ÿ | | RS Small Cap Growth Equity VIP Series |

| | | | |

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE | | |  | |

TABLE OF CONTENTS

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2011. The views expressed in the investment team letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

RS SMALL CAP GROWTH EQUITY VIP SERIES

The Statement of Additional Information provides further information about the investment team, including information regarding his compensation, other accounts he manages, and his ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the relevant Prospectus or visit our Web site at www.guardianinvestor.com.

Highlights

| Ÿ | | Small-cap shares, as defined by the Russell 2000® Index1, delivered solid performance in the first half of 2011, despite renewed economic uncertainty. |

| Ÿ | | RS Small Cap Growth Equity VIP Series outperformed the benchmark Russell 2000® Growth Index2 for the six-month period ended June 30, 2011 as well as the Russell 2000® Index. The Fund’s performance relative to the Russell 2000® Growth Index was supported in particular by stock selection in the consumer discretionary sector. Stock selection in the energy and utilities sectors hindered relative performance. |

| Ÿ | | RS Small Cap Growth Equity VIP Series seeks long-term capital growth by investing in small-cap companies that we believe have greater earnings potential relative to market expectations. |

Market Overview

The broad U.S. equity market, as defined by the S&P 500® Index3, started out the year on a positive note, delivering solid first quarter returns as investors focused on generally healthy corporate profits and better market liquidity in the wake of the Federal Reserve’s most recent round of quantitative easing. The market experienced renewed downward volatility in March, however, as economic fears resurfaced, aggravated by the earthquake in Japan, the debt crisis in Europe, and a spike in oil prices. As the first half of 2011 drew to a close, investors’ appetites for risk became muted, as they sought refuge in more economically defensive investments in the consumer staples, health care, and utility sectors.

Fund Performance Overview

RS Small Cap Growth Equity VIP Series gained 13.70% over the six-month period ended June 30, 2011, outperforming the benchmark Russell 2000® Growth Index, which returned 8.59%, as well as the Russell 2000® Index, which returned 6.21%.

Portfolio Review

The Fund’s relative performance benefited from stock selection in the consumer discretionary sector, and in particular from our investments in several retailers. One standout performer was Ulta Salon, Cosmetics & Fragrance, a retailer of both high end and discount beauty supply brands that continues to report solid revenue performance as it capitalizes on its store expansion plans and high customer touchpoint strategy.

In the health care sector, we benefited from our investment in Pharmasset, a biotechnology company that is focused on developing next generation treatments for hepatitis C (HCV), a condition that affects a large and relatively underserved population. Against this backdrop, we believe that there is a huge potential market for Pharmasset’s orally administered HCV drug that has fewer side effects than competing drugs.

Among our technology holdings, our relative results were supported by strong performance by Fortinet, the manufacturer of an advanced data security hardware system that processes huge amounts of information at a fast rate to identify potential cyber threats. We believe the company is well positioned to benefit from continued enterprise investment in the data security area.

On a negative note, other technology investments in the Fund struggled due to some inventory building by customers, which dampened near-term earnings prospects. Relative detractors included Oclaro, a supplier of optical components. We remain positive on Oclaro’s long-term prospects, given our view that data networking equipment and components will be in great demand over the next few years as companies build out data networks to accommodate the growing volumes of data traffic.

Also within technology, we were less reassured by prospects for networking connectivity software maker Smith Micro Software, another detractor for the period, which has faced uncertainty over inventory issues and the delayed roll-out of Verizon’s 4G technology. We liquidated our investment in the company as it failed to progress towards our initial investment thesis.

Within healthcare, the Fund’s relative performance was dampened by our investment in Salix Pharmaceuticals. The stock declined sharply in February after the FDA failed to approve the company’s liver disease drug for a secondary indication to treat a digestive disorder. Given the uncertainty around a new strategy for FDA approval, we exited the position.

Outlook

We remain optimistic on the outlook for our portfolio of companies as they continue to maneuver through a backdrop of mixed signals in the global economy. We continue to believe that small-cap companies house some of the most compelling innovations, and we continue to focus on companies that we believe will realize sustained earnings growth. As long-term investors, we seek to look

RS SMALL CAP GROWTH EQUITY VIP SERIES

beyond short-term cyclical factors and strive to position the Fund to benefit from innovations and growth opportunities across a variety of industries.

RS Funds are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the RS Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our web site at www.guardianinvestor.com or to obtain a printed copy, call 800-221-3253.

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2011.

As with all mutual funds, the value of an investment in the Fund could decline, in which case you could lose money. Small cap investing entails special risks. Small cap stocks have tended to be more volatile and to drop more in down markets than large cap stocks. This may happen because small companies may be limited in terms of product lines, financial resources, and management.

RS SMALL CAP GROWTH EQUITY VIP SERIES

Characteristics

| | |

| Total Net Assets: $108,379,117 | | |

| | | | |

| |

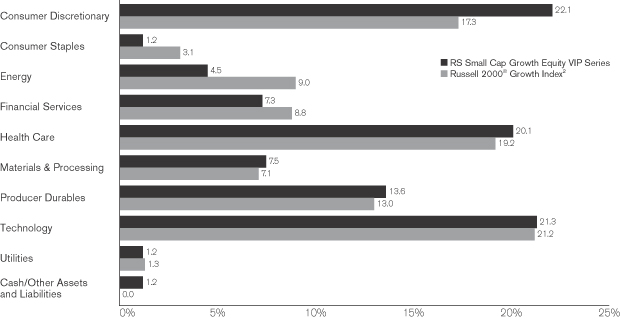

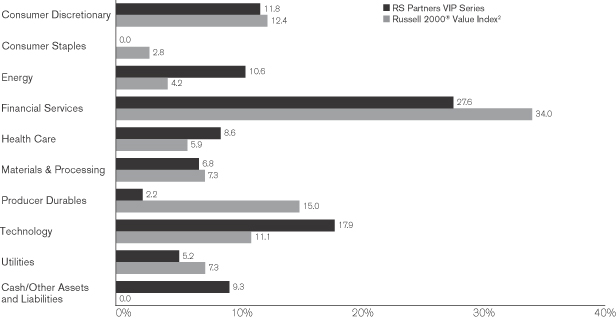

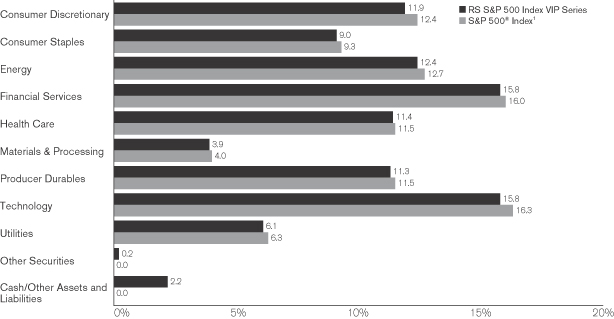

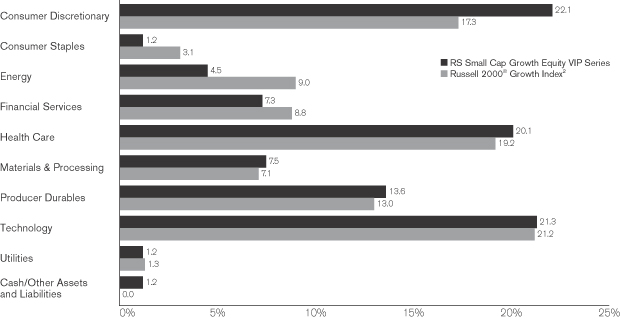

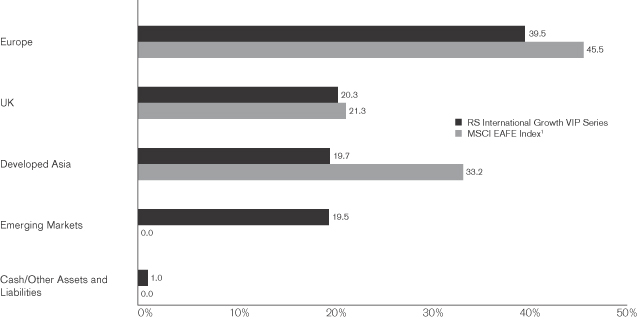

| Sector Allocation vs. Index4 | |

| |

| | |

| Top Ten Holdings5 | | | |

| | |

Holding | | % of Total

Net Assets | |

| Ulta Salon, Cosmetics & Fragrance, Inc. | | | 1.82% | |

| HEICO Corp., Class A | | | 1.74% | |

| Vitamin Shoppe, Inc. | | | 1.66% | |

| Steven Madden Ltd. | | | 1.62% | |

| Netlogic Microsystems, Inc. | | | 1.62% | |

| RBC Bearings, Inc. | | | 1.56% | |

| Wright Express Corp. | | | 1.56% | |

| Ancestry.com, Inc. | | | 1.55% | |

| Team Health Holdings, Inc. | | | 1.55% | |

| Gardner Denver, Inc. | | | 1.54% | |

| Total | | | 16.22% | |

| 1 | The Russell 2000® Index is an unmanaged market capitalization-weighted index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which consists of the 3,000 largest U.S. companies based on total market capitalization. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 2 | The Russell 2000® Growth Index is an unmanaged market capitalization-weighted index that measures the performance of those companies in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. (The Russell 2000 Index is an unmanaged market capitalization-weighted index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which consists of the 3,000 largest U.S. companies based on total market capitalization.) Investment results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 3 | The S&P 500® Index is an unmanaged market-capitalization-weighted index generally considered to be representative of U.S. equity market activity. The index consists of 500 stocks representing leading industries of the U.S. economy. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

RS SMALL CAP GROWTH EQUITY VIP SERIES

| 4 | The Fund’s holdings are allocated to each sector based on their Russell Global Sector classification. If a holding is not classified by Russell, it is assigned a Russell designation by RS Investments. Cash includes short-term investments and net other assets and liabilities. |

| 5 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

Performance Update

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Average Annual Total Returns | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Inception

Date | | | Year-to-Date | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since

Inception | |

| RS Small Cap Growth Equity VIP Series | | | 5/1/97 | | | | 13.70% | | | | 48.21% | | | | 13.23% | | | | 8.33% | | | | 8.03% | | | | 9.01% | |

| Russell 2000® Growth Index2 | | | | | | | 8.59% | | | | 43.50% | | | | 8.35% | | | | 5.79% | | | | 4.63% | | | | 5.83% | |

| Russell 2000® Index1 | | | | | | | 6.21% | | | | 37.41% | | | | 7.77% | | | | 4.08% | | | | 6.27% | | | | 7.73% | |

| | | | | | | |

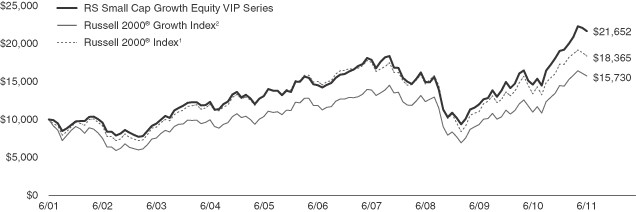

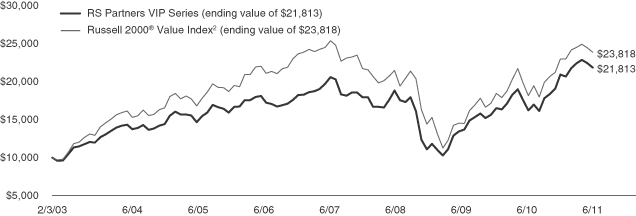

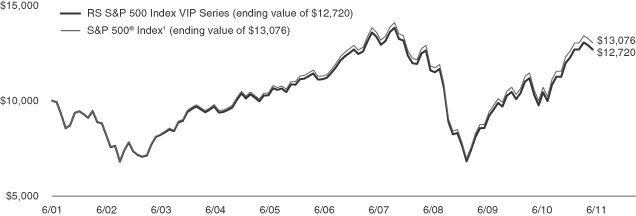

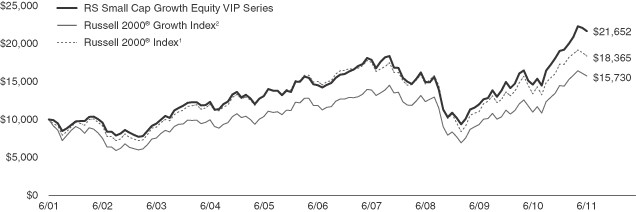

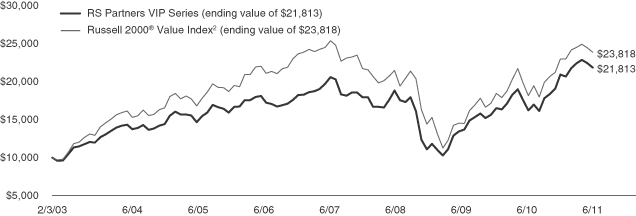

| Results of a Hypothetical $10,000 Investment | | | | | | | | | | | | | | | | | | | |

| |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Small Cap Growth Equity VIP Series, in the Russell 2000® Growth Index, and in the Russell 2000® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee or predict future results. The Fund is the successor to The Guardian Small Cap Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contract owner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | Beginning

Account Value 1/1/11 | | Ending Account Value 6/30/11 | | | Expenses Paid During Period* 1/1/11-6/30/11 | | | Expense Ratio During Period 1/1/11-6/30/11 | |

| Based on Actual Return | | $1,000.00 | | | $1,137.00 | | | | $4.52 | | | | 0.85% | |

| Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | | $1,020.56 | | | | $4.27 | | | | 0.85% | |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS — RS SMALL CAP GROWTH EQUITY VIP SERIES

| | | | | | | | |

| June 30, 2011 (unaudited) | | Shares | | | Value | |

| Common Stocks – 98.8% | | | | | | | | |

| Advertising Agencies – 1.5% | | | | | | | | |

Velti PLC(1) | | | 98,100 | | | $ | 1,658,871 | |

| | | | | | | | | |

| | | | | | | | 1,658,871 | |

| Aerospace – 1.7% | | | | | | | | |

HEICO Corp., Class A | | | 47,538 | | | | 1,890,111 | |

| | | | | | | | | |

| | | | | | | | 1,890,111 | |

| Asset Management & Custodian – 0.3% | |

Financial Engines, Inc.(1) | | | 11,500 | | | | 298,080 | |

| | | | | | | | | |

| | | | | | | | 298,080 | |

| Auto Parts – 1.5% | |

LKQ Corp.(1) | | | 62,600 | | | | 1,633,234 | |

| | | | | | | | | |

| | | | | | | | 1,633,234 | |

| Back Office Support, HR and Consulting – 2.6% | |

Dice Holdings, Inc.(1) | | | 86,332 | | | | 1,167,209 | |

ICF International, Inc.(1) | | | 31,600 | | | | 802,008 | |

Robert Half International, Inc. | | | 30,400 | | | | 821,712 | |

| | | | | | | | | |

| | | | | | | | 2,790,929 | |

| Banks: Diversified – 1.0% | |

IBERIABANK Corp. | | | 18,800 | | | | 1,083,632 | |

| | | | | | | | | |

| | | | | | | | 1,083,632 | |

| Biotechnology – 5.3% | |

Aegerion Pharmaceuticals, Inc.(1) | | | 30,500 | | | | 480,375 | |

Aveo Pharmaceuticals, Inc.(1) | | | 40,270 | | | | 829,965 | |

Medivation, Inc.(1) | | | 37,400 | | | | 801,482 | |

Myriad Genetics, Inc.(1) | | | 32,145 | | | | 730,013 | |

NPS Pharmaceuticals, Inc.(1) | | | 104,600 | | | | 988,470 | |

Pharmasset, Inc.(1) | | | 9,700 | | | | 1,088,340 | |

Seattle Genetics, Inc.(1) | | | 41,900 | | | | 859,788 | |

| | | | | | | | | |

| | | | | | | | 5,778,433 | |

| Chemicals: Diversified – 1.0% | |

LSB Industries, Inc.(1) | | | 26,500 | | | | 1,137,380 | |

| | | | | | | | | |

| | | | | | | | 1,137,380 | |

| Chemicals: Specialty – 1.2% | |

Balchem Corp. | | | 29,800 | | | | 1,304,644 | |

| | | | | | | | | |

| | | | | | | | 1,304,644 | |

| Commercial Vehicles & Parts – 1.3% | |

Commercial Vehicle Group, Inc.(1) | | | 99,200 | | | | 1,407,648 | |

| | | | | | | | | |

| | | | | | | | 1,407,648 | |

| Communications Technology – 3.5% | |

ADTRAN, Inc. | | | 25,700 | | | | 994,847 | |

NETGEAR, Inc.(1) | | | 24,800 | | | | 1,084,256 | |

Oclaro, Inc.(1) | | | 138,487 | | | | 930,633 | |

Polycom, Inc.(1) | | | 12,600 | | | | 810,180 | |

| | | | | | | | | |

| | | | | | | | 3,819,916 | |

| Computer Services, Software & Systems – 10.4% | |

comScore, Inc.(1) | | | 52,287 | | | | 1,354,233 | |

Concur Technologies, Inc.(1) | | | 26,400 | | | | 1,321,848 | |

Digital River, Inc.(1) | | | 31,965 | | | | 1,027,995 | |

Fortinet, Inc.(1) | | | 59,800 | | | | 1,631,942 | |

| | | | | | | | | |

| | | | | | | | |

| June 30, 2011 (unaudited) | | Shares | | | Value | |

| Computer Services, Software & Systems (continued) | |

Gartner, Inc.(1) | | | 26,500 | | | $ | 1,067,685 | |

Informatica Corp.(1) | | | 25,340 | | | | 1,480,616 | |

Sapient Corp.(1) | | | 59,100 | | | | 888,273 | |

The Ultimate Software Group, Inc.(1) | | | 28,700 | | | | 1,562,141 | |

VeriFone Systems, Inc.(1) | | | 20,394 | | | | 904,474 | |

| | | | | | | | | |

| | | | | | | | 11,239,207 | |

| Computer Technology – 0.7% | |

Super Micro Computer, Inc.(1) | | | 45,800 | | | | 736,922 | |

| | | | | | | | | |

| | | | | | | | 736,922 | |

| Consumer Electronics – 1.4% | | | | | | | | |

RealD, Inc.(1) | | | 65,461 | | | | 1,531,133 | |

| | | | | | | | | |

| | | | | | | | 1,531,133 | |

| Consumer Lending – 1.4% | |