UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21922

RS Variable Products Trust

(Exact name of registrant as specified in charter)

| | |

388 Market Street San Francisco, CA | | 94111 |

| (Address of principal executive offices) | | (Zip code) |

Matthew H. Scanlan

c/o RS Investments

388 Market Street

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-221-3253

Date of fiscal year end: December 31

Date of reporting period: June 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

2012 Semiannual Report

All data as of June 30, 2012

RS Variable Products Trust

| Ÿ | | RS Large Cap Alpha VIP Series |

| | | | |

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE | | |  | |

TABLE OF CONTENTS

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2012. The views expressed in the investment team letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

RS LARGE CAP ALPHA VIP SERIES

The Statement of Additional Information provides further information about the investment team, including information regarding their compensation, other accounts they manage, and their ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the relevant Prospectus or visit our Web site at www.guardianinvestor.com.

RS Large Cap Alpha VIP Series

Highlights

| Ÿ | | The U.S. equity market measured by the S&P 500® Index1 delivered positive performance during the first half of 2012 despite continued economic uncertainty, increased investors risk aversion and concerns over the potential outcomes of the European debt crisis. |

| Ÿ | | During the first half of 2012, RS Large Cap Alpha VIP Series (the “Fund”) underperformed its benchmarks, the Russell 1000® Value Index2 and the S&P 500® Index. The Fund’s performance relative to the Russell 1000® Value Index was held back by stock selection in the financial services, materials & processing, and producer durables sectors. Conversely, stock selection in the consumer discretionary, consumer staples, and health care sectors aided relative performance. |

| Ÿ | | The Fund seeks long-term capital appreciation by seeking to identify large cap companies with improving returns on invested capital, based on the investment team’s assessment of risk (the possibility of permanent capital impairment) and its assessment of reward (the future value of an enterprise). |

Market Overview

Equity markets measured by the S&P 500® Index started out the year on a positive note, aided by encouraging economic news and low U.S. interest rates. Against this backdrop, equities delivered strong performance during the first quarter. The market experienced renewed downward pressure during the second quarter, however, as persistent high unemployment and lackluster corporate and consumer spending trends raised concerns over the strength of the economic recovery. Adding to investor unease were the ongoing debt crisis in Europe and signs of slowing economic growth in China and other economies in Asia. While the resulting sell-off was widespread, the equity markets did recover some in June. As such, most sectors of the Russell 1000® Value Index delivered positive performance during the six-month period. The exception was the energy sector, where share prices fell due to declines in oil and natural gas prices.

Fund Performance Overview

RS Large Cap Alpha VIP Series returned 7.44% for the six month period ended June 30, 2012, underperforming

the benchmark Russell 1000® Value Index, which returned 8.68%, and the benchmark S&P 500® Index, which returned 9.49%.

Global economic uncertainty once again contributed to volatility in commodity prices and downward pressure on natural resource equity prices, notably during the second quarter. This uncertainty created a difficult environment for a number of holdings in the Fund, including diversified upstream oil and gas company Talisman Energy Inc. and Goldcorp Inc., an operator of gold mines across North and South America. Both stocks were detractors from the Fund’s performance relative to the benchmarks. Despite the recent difficult environment for many raw-materials-related stocks, we believe that the longer-term outlook for many commodities remains intact, driven primarily by limited spare capacity and rising marginal costs of supply.

In a challenging environment for many technology stocks, security software and services provider Symantec also detracted from the Fund’s relative performance. The company’s stock traded down due to some weakness in its storage and server management business. Nonetheless, in our view, Symantec remains well positioned to capitalize on the longer term need and desire for enterprise investment in technology to fend off increasingly sophisticated cyber threats.

On a positive note, relative performance was assisted by stock selection in the consumer discretionary sector, due in part to an investment in specialty apparel retailer Gap Inc. The retailer reported solid store-based and online sales trends for its line-up of global brands, including Gap, Old Navy, Banana Republic and Athleta. With the stock price responding to the resulting improvement in both margins and ROIC, we exited our position during the second quarter.

Another positive contributor during the period, internet commerce pioneer eBay benefited from growing sales volumes, as well as its expanding PayPal online payments business. PayPal has continued its torrid growth rate and at the end of the period was beginning to see substantial margin improvement as more revenues are driven over a largely fixed cost base and ongoing penetration of markets abroad.

Relative performance was also supported by an investment in property and casualty insurer Allstate Corp. In line with our original thesis, Allstate has been more

RS LARGE CAP ALPHA VIP SERIES

disciplined in its approach to underwriting in both its homeowner and auto segments. We believe that this improvement, combined with Allstate’s superior captive agency distribution model, is a competitive advantage that will allow the company to continue to generate improving returns.

Outlook

Entering 2012, our outlook was one of cautious optimism. Many of the fundamental factors that have plagued the market over the past few years – a constrained consumer, mounting budget deficits, unfunded entitlement programs, potential changes to U.S. tax policies, concerns regarding Europe, historically high corporate margins and returns, limited reinvestment opportunities as reflected in large corporate cash balances, and the inevitable impact of global deleveraging – remain in place. However, there are other variables that we view as positive. These include the slow

re-emergence of US manufacturing, a growing appreciation of our country’s advantaged energy position, the partial disintermediation of global supply chains due to rising transportation and local labor costs, a vastly improved local and regional banking industry, and initial signs of improvement in the housing market.

We continue to study our investment universe, seeking those companies that we believe have a business plan in place that will drive future value creation for owners, in situations where we believe we can define our downside risk and be adequately compensated for deploying our investors’ capital. Over the last several years, the market has been characterized by periods of elevated levels of correlations across and within asset classes. For fundamental business analysts, these conditions can be frustrating. However, we will continue to seek to find ways to exploit the company-specific value creation that we believe remains largely ignored by many investors in today’s public equity markets.

RS Funds are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the RS Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our web site at www.guardianinvestor.com or to obtain a printed copy, call 800-221-3253.

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2012.

As with all mutual funds, the value of an investment in the Fund could decline, in which case you could lose money. The Fund invests primarily in equity securities and therefore exposes you to the general risks of investing in stock markets.

RS LARGE CAP ALPHA VIP SERIES

Characteristics (unaudited)

| | |

| Total Net Assets: $944,613,148 | | |

| | |

| |

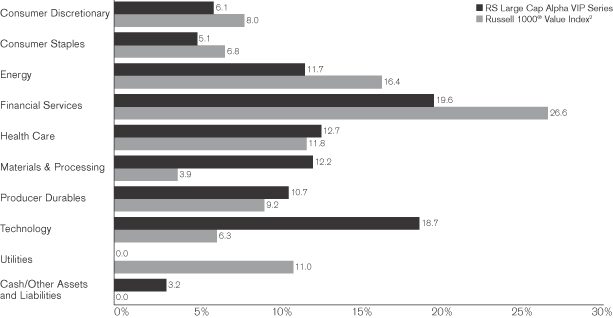

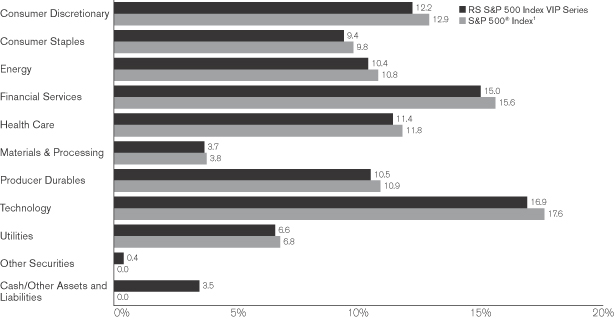

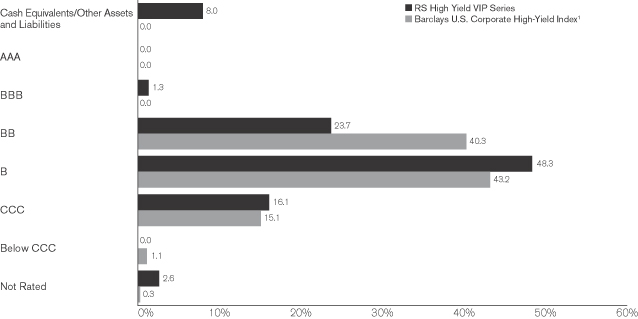

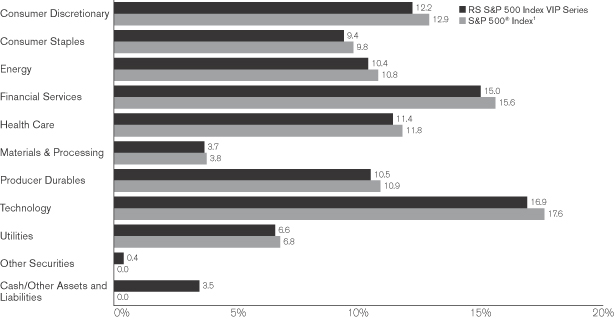

| Sector Allocation vs. Index3 |

|

| | | | |

| | |

| Top Ten Holdings4 | | | |

| | |

| Holding | | % of Total

Net Assets | |

| Southwestern Energy Co. | | | 5.66% | |

| Microsoft Corp. | | | 5.57% | |

| Motorola Solutions, Inc. | | | 4.01% | |

| Symantec Corp. | | | 3.98% | |

| Pfizer, Inc. | | | 3.96% | |

| United Parcel Service, Inc., Class B | | | 3.95% | |

| News Corp., Class A | | | 3.95% | |

| Martin Marietta Materials, Inc. | | | 3.91% | |

| Merck & Co., Inc. | | | 3.91% | |

| Praxair, Inc. | | | 3.76% | |

| Total | | | 42.66% | |

| 1 | The S&P 500® Index is an unmanaged market-capitalization-weighted index generally considered to be representative of U.S. equity market activity. The index consists of 500 stocks representing leading industries of the U.S. economy. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 2 | The Russell 1000® Value Index is an unmanaged market-capitalization-weighted index that measures the performance of those companies in the Russell 1000® Index (which consists of the 1,000 largest U.S. companies based on total market capitalization) with lower price-to-book ratios and lower forecasted growth values. Index results assume the reinvestment of dividends paid on stocks constituting the Index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 3 | The Fund’s holdings are allocated to each sector based on their Russell Global Sector classification. If a holding is not classified by Russell, it is assigned a Russell designation by RS Investments. Cash includes short-term investments and net other assets and liabilities. |

| 4 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

RS LARGE CAP ALPHA VIP SERIES

Performance Update (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Average Annual Returns | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Inception Date | | | Year-to-Date | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since Inception | |

| RS Large Cap Alpha VIP Series | | | 4/13/83 | | | | 7.44% | | | | -4.26% | | | | 11.38% | | | | 0.25% | | | | 5.14% | | | | 10.03% | |

| Russell 1000® Value Index2 | | | | | | | 8.68% | | | | 3.01% | | | | 15.80% | | | | -2.19% | | | | 5.28% | | | | 11.03% | |

| S&P 500® Index1 | | | | | | | 9.49% | | | | 5.45% | | | | 16.40% | | | | 0.22% | | | | 5.33% | | | | 10.52% | |

Since inception performance for the indexes is measured from 3/31/1983, the month end prior to the Fund’s commencement of operations.

| | |

| |

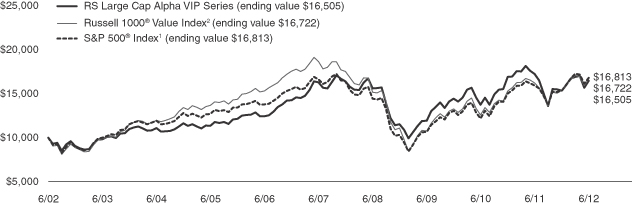

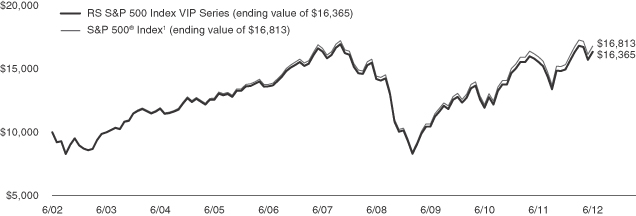

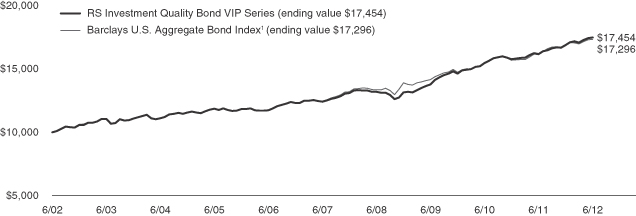

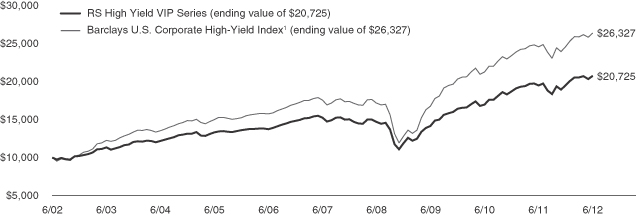

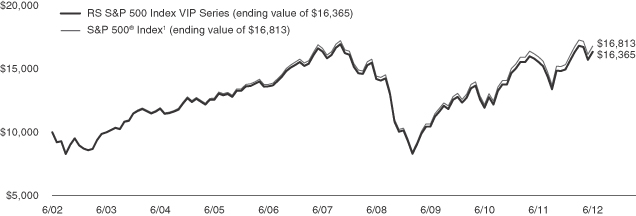

| Results of a Hypothetical $10,000 Investment |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Large Cap Alpha VIP Series, the Russell 1000® Value Index, and in the S&P 500® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee or predict future results. The Fund is the successor to The Guardian Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Total return figures reflect an expense limitation in effect for the periods shown; without such limitation, the performance shown would have been lower. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contractowner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | Beginning

Account Value

1/1/12 | | Ending

Account Value

6/30/12 | | | Expenses Paid

During Period*

1/1/12-6/30/12 | | | Expense Ratio

During Period

1/1/12-6/30/12 | |

| Based on Actual Return | | $1,000.00 | | | $1,074.40 | | | | $2.84 | | | | 0.55% | |

| Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | | $1,022.13 | | | | $2.77 | | | | 0.55% | |

| * | Expenses are equal to the Fund's annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS – RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | |

June 30, 2012 (unaudited) | | Shares | | | Value | |

Common Stocks – 96.8% | |

| Aerospace – 2.5% | | | | | | | | |

Lockheed Martin Corp. | | | 274,693 | | | $ | 23,920,267 | |

| | | | | | | | | |

| | | | | | | | 23,920,267 | |

| Asset Management & Custodian – 4.0% | |

Franklin Resources, Inc. | | | 129,500 | | | | 14,373,205 | |

State Street Corp. | | | 519,120 | | | | 23,173,517 | |

| | | | | | | | | |

| | | | | | | | 37,546,722 | |

| Banks: Diversified – 3.4% | |

KeyCorp | | | 4,196,120 | | | | 32,477,969 | |

| | | | | | | | | |

| | | | | | | | 32,477,969 | |

| Building Materials – 3.9% | |

Martin Marietta Materials, Inc. | | | 468,635 | | | | 36,937,811 | |

| | | | | | | | | |

| | | | | | | | 36,937,811 | |

| Chemicals: Specialty – 3.8% | |

Praxair, Inc. | | | 326,337 | | | | 35,482,622 | |

| | | | | | | | | |

| | | | | | | | 35,482,622 | |

| Computer Services, Software & Systems – 11.6% | |

Microsoft Corp. | | | 1,719,547 | | | | 52,600,943 | |

Symantec Corp.(1) | | | 2,570,430 | | | | 37,553,982 | |

Yahoo! Inc.(1) | | | 1,217,480 | | | | 19,272,708 | |

| | | | | | | | | |

| | | | | | | | 109,427,633 | |

Consumer Services: Miscellaneous – 2.2% | |

eBay, Inc.(1) | | | 485,790 | | | | 20,408,038 | |

| | | | | | | | | |

| | | | | | | | 20,408,038 | |

| Diversified Manufacturing Operations – 2.3% | |

Honeywell International, Inc. | | | 386,505 | | | | 21,582,439 | |

| | | | | | | | | |

| | | | | | | | 21,582,439 | |

| Diversified Media – 3.9% | |

News Corp., Class A | | | 1,673,275 | | | | 37,297,300 | |

| | | | | | | | | |

| | | | | | | | 37,297,300 | |

| Drug & Grocery Store Chains – 3.5% | |

CVS Caremark Corp. | | | 697,800 | | | | 32,608,194 | |

| | | | | | | | | |

| | | | | | | | 32,608,194 | |

| Electronic Entertainment – 3.1% | |

Activision Blizzard, Inc. | | | 2,454,462 | | | | 29,428,999 | |

| | | | | | | | | |

| | | | | | | | 29,428,999 | |

| Financial Data & Systems – 3.0% | |

Thomson Reuters Corp. | | | 993,044 | | | | 28,252,102 | |

| | | | | | | | | |

| | | | | | | | 28,252,102 | |

| Foods – 1.6% | |

Kellogg Co. | | | 297,580 | | | | 14,679,621 | |

| | | | | | | | | |

| | | | | | | | 14,679,621 | |

| Health Care Management Services – 1.5% | |

UnitedHealth Group, Inc. | | | 235,000 | | | | 13,747,500 | |

| | | | | | | | | |

| | | | | | | | 13,747,500 | |

| | | | | | | | |

June 30, 2012 (unaudited) | | Shares | | | Value | |

| Insurance: Life – 4.5% | |

Aflac, Inc. | | | 455,974 | | | $ | 19,419,933 | |

Prudential Financial, Inc. | | | 484,340 | | | | 23,456,586 | |

| | | | | | | | | |

| | | | | | | | 42,876,519 | |

| Insurance: Property-Casualty – 3.7% | |

The Allstate Corp. | | | 993,530 | | | | 34,862,968 | |

| | | | | | | | | |

| | | | | | | | 34,862,968 | |

| Metals & Minerals: Diversified – 1.9% | |

BHP Billiton Ltd., ADR | | | 269,707 | | | | 17,611,867 | |

| | | | | | | | | |

| | | | | | | | 17,611,867 | |

| Oil: Crude Producers – 11.7% | |

Occidental Petroleum Corp. | | | 314,874 | | | | 27,006,743 | |

Southwestern Energy Co.(1) | | | 1,674,202 | | | | 53,457,270 | |

Talisman Energy, Inc. | | | 2,654,327 | | | | 30,418,587 | |

| | | | | | | | | |

| | | | | | | | 110,882,600 | |

| Pharmaceuticals – 11.2% | |

Merck & Co., Inc. | | | 883,771 | | | | 36,897,439 | |

Pfizer, Inc. | | | 1,625,080 | | | | 37,376,840 | |

Warner Chilcott PLC, Class A(1) | | | 1,785,821 | | | | 32,001,913 | |

| | | | | | | | | |

| | | | | | | | 106,276,192 | |

| Precious Metals & Minerals – 2.6% | |

Goldcorp, Inc. | | | 643,605 | | | | 24,186,676 | |

| | | | | | | | | |

| | | | | | | | 24,186,676 | |

| Scientific Instruments: Control & Filter – 2.0% | |

Parker Hannifin Corp. | | | 243,580 | | | | 18,726,430 | |

| | | | | | | | | |

| | | | | | | | 18,726,430 | |

| Securities Brokerage & Services – 1.0% | |

The Charles Schwab Corp. | | | 742,400 | | | | 9,599,232 | |

| | | | | | | | | |

| | | | | | | | 9,599,232 | |

| Telecommunications Equipment – 4.0% | |

Motorola Solutions, Inc. | | | 787,740 | | | | 37,898,171 | |

| | | | | | | | | |

| | | | | | | | 37,898,171 | |

| Transportation Miscellaneous – 3.9% | |

United Parcel Service, Inc., Class B | | | 473,920 | | | | 37,325,939 | |

| | | | | | | | | |

| | | | | | | | 37,325,939 | |

Total Common Stocks

(Cost $871,022,973) | | | | 914,043,811 | |

| | | | |

| 8 | | | | The accompanying notes are an integral part of these financial statements. |

RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | |

| June 30, 2012 (unaudited) | | Principal

Amount | | | Value | |

| Repurchase Agreements – 3.0% | | | | | |

| | | |

State Street Bank and Trust Co. Repurchase Agreement, 0.01%, dated 6/29/2012, maturity value of $28,411,024, due 7/2/2012(2) | | $ | 28,411,000 | | | $ | 28,411,000 | |

Total Repurchase Agreements

(Cost $28,411,000) | | | | 28,411,000 | |

Total Investments - 99.8%

(Cost $899,433,973) | | | | 942,454,811 | |

| Other Assets, Net - 0.2% | | | | 2,158,337 | |

| Total Net Assets - 100.0% | | | $ | 944,613,148 | |

| (1) | Non-income producing security. |

| (2) | The table below presents collateral for repurchase agreements. |

| | | | | | | | | | | | |

| Security | | Coupon | | | Maturity

Date | | | Value | |

| U.S. Treasury Bond | | | 4.625% | | | | 2/15/2040 | | | $ | 28,985,755 | |

Legend:

ADR — American Depositary Receipt.

The following is a summary of the inputs used as of June 30, 2012 in valuing the Fund’s investments. For more information on valuation inputs, please refer to Note 1a of the accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 914,043,811 | | | $ | — | | | $ | — | | | $ | 914,043,811 | |

Repurchase Agreements | | | — | | | | 28,411,000 | | | | — | | | | 28,411,000 | |

| Total | | $ | 914,043,811 | | | $ | 28,411,000 | | | $ | — | | | $ | 942,454,811 | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 9 |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | |

Statement of Assets and Liabilities

As of June 30, 2012 (unaudited) | | | |

Assets | | | | |

Investments, at value | | $ | 942,454,811 | |

Cash and cash equivalents | | | 630 | |

Receivable for investments sold | | | 18,351,398 | |

Dividends/interest receivable | | | 1,072,719 | |

Receivable for fund shares subscribed | | | 137,265 | |

| | | | | |

Total Assets | | | 962,016,823 | |

| | | | | |

| | |

Liabilities | | | | |

Payable for investments purchased | | | 16,808,349 | |

Payable to adviser | | | 372,000 | |

Payable for fund shares redeemed | | | 83,609 | |

Accrued trustees’ fees | | | 6,328 | |

Accrued expenses/other liabilities | | | 133,389 | |

| | | | | |

Total Liabilities | | | 17,403,675 | |

| | | | | |

Total Net Assets | | $ | 944,613,148 | |

| | | | | |

| | |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 1,040,115,012 | |

Accumulated undistributed net investment income | | | 5,606,206 | |

Accumulated net realized loss from investments | | | (144,128,908 | ) |

Net unrealized appreciation on investments | | | 43,020,838 | |

| | | | | |

Total Net Assets | | $ | 944,613,148 | |

| | | | | |

Investments, at Cost | | $ | 899,433,973 | |

| | | | | |

| | |

Pricing of Shares | | | | |

Shares of Beneficial Interest Outstanding with no Par Value | | | 25,743,252 | |

Net Asset Value Per Share | | | $36.69 | |

| | | | | |

| | | | |

Statement of Operations

For the Six-Month Period Ended June 30, 2012 (unaudited) | |

Investment Income | | | | |

Dividends | | $ | 8,317,290 | |

Interest | | | 6,292 | |

Withholding taxes on foreign dividends | | | (157,388 | ) |

| | | | | |

Total Investment Income | | | 8,166,194 | |

| | | | | |

| | |

Expenses | | | | |

Investment advisory fees | | | 2,324,133 | |

Administrative service fees | | | 53,429 | |

Shareholder reports | | | 50,132 | |

Professional fees | | | 45,139 | |

Custodian fees | | | 41,404 | |

Trustees’ fees | | | 20,527 | |

Other expenses | | | 25,226 | |

| | | | | |

Total Expenses | | | 2,559,990 | |

| | |

Less: Custody credits | | | (2 | ) |

| | | | | |

Total Expenses, Net | | | 2,559,988 | |

| | | | | |

Net Investment Income | | | 5,606,206 | |

| | | | | |

| | |

Realized Gain/(Loss) and Change in Unrealized Appreciation/Depreciation on Investments | | | | |

Net realized gain from investments | | | 37,443,755 | |

Net change in unrealized appreciation/depreciation on investments | | | 22,341,959 | |

| | | | | |

Net Gain on Investments | | | 59,785,714 | |

| | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 65,391,920 | |

| | | | | |

| | | | | |

| | | | |

| 10 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | |

Statements of Changes in Net Assets

Six-month-ended numbers are unaudited | | | | | | |

| | | |

| | | For the Six

Months Ended

6/30/12 | | | For the

Year Ended

12/31/11 | |

| | | | |

Operations | | | | | | | | |

Net investment income | | $ | 5,606,206 | | | $ | 9,114,628 | |

Net realized gain from investments | | | 37,443,755 | | | | 81,132,185 | |

Net change in unrealized appreciation/depreciation on investments | | | 22,341,959 | | | | (178,820,648 | ) |

| | | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 65,391,920 | | | | (88,573,835 | ) |

| | | | | | | | | |

| | | |

Distributions to Shareholders | | | | | | | | |

Net investment income | | | — | | | | (9,165,005 | ) |

| | | | | | | | | |

Total Distributions | | | — | | | | (9,165,005 | ) |

| | | | | | | | | |

| | | |

Capital Share Transactions | | | | | | | | |

Proceeds from sales of shares | | | 58,483,675 | | | | 104,608,313 | |

Reinvestment of distributions | | | — | | | | 9,165,005 | |

Cost of shares redeemed | | | (54,366,197 | ) | | | (115,825,574 | ) |

| | | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Capital Share Transactions | | | 4,117,478 | | | | (2,052,256 | ) |

| | | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | 69,509,398 | | | | (99,791,096 | ) |

| | | | | | | | | |

| | | |

Net Assets | | | | | | | | |

Beginning of period | | | 875,103,750 | | | | 974,894,846 | |

| | | | | | | | | |

End of period | | $ | 944,613,148 | | | $ | 875,103,750 | |

| | | | | | | | | |

Accumulated Undistributed Net Investment Income Included in Net Assets | | $ | 5,606,206 | | | $ | — | |

| | | | | | | | | |

| | | |

Other Information: | | | | | | | | |

Shares | | | | | | | | |

Sold | | | 1,607,826 | | | | 2,893,849 | |

Reinvested | | | — | | | | 276,220 | |

Redeemed | | | (1,491,473 | ) | | | (3,175,038 | ) |

| | | | | | | | | |

Net Increase/(Decrease) | | | 116,353 | | | | (4,969 | ) |

| | | | | | | | | |

| | | | | | | | | |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 11 |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

The financial highlights table is intended to help you understand the Fund's financial performance for the past six reporting periods. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial Highlights Six-month-ended numbers are unaudited | | | | | | | | | | | | | | | | | | | |

| | | Net Asset Value,

Beginning of

Period | | | Net Investment

Income | | | Net Realized

and Unrealized

Gain/(Loss) | | | Total

Operations | | | Distributions

From Net

Investment

Income | | | Distributions

From Net

Realized

Capital Gains | | | Total

Distributions | |

Six Months Ended 6/30/121 | | $ | 34.15 | | | $ | 0.22 | | | $ | 2.32 | | | $ | 2.54 | | | $ | — | | | $ | — | | | $ | — | |

Year Ended 12/31/11 | | | 38.03 | | | | 0.36 | | | | (3.88 | ) | | | (3.52 | ) | | | (0.36 | ) | | | — | | | | (0.36 | ) |

Year Ended 12/31/10 | | | 33.22 | | | | 0.28 | | | | 5.37 | | | | 5.65 | | | | (0.84 | ) | | | — | | | | (0.84 | ) |

Year Ended 12/31/09 | | | 26.60 | | | | 0.35 | | | | 6.32 | | | | 6.67 | | | | (0.05 | ) | | | — | | | | (0.05 | ) |

Year Ended 12/31/08 | | | 38.43 | | | | 0.46 | | | | (11.85 | ) | | | (11.39 | ) | | | (0.44 | ) | | | — | | | | (0.44 | ) |

Year Ended 12/31/07 | | | 33.67 | | | | 0.36 | | | | 4.75 | | | | 5.11 | | | | (0.35 | ) | | | — | | | | (0.35 | ) |

| | | | |

| 12 | | | | The accompanying notes are an integral part of these financial statements. |

FINANCIAL INFORMATION — RS LARGE CAP ALPHA VIP SERIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net Asset

Value, End of

Period | | | Total

Return2 | | | Net Assets, End

of Period (000s) | | | Net Ratio of

Expenses to

Average Net

Assets3 | | | Gross Ratio of

Expenses to

Average Net

Assets | | | Net Ratio of Net

Investment Income

to Average

Net Assets3 | | | Gross Ratio of Net

Investment Income

to Average

Net Assets | | | Portfolio

Turnover Rate | |

| $ | 36.69 | | | | 7.44% | | | $ | 944,613 | | | | 0.55% | | | | 0.55% | | | | 1.21% | | | | 1.21% | | | | 27% | |

| | 34.15 | | | | (9.22)% | | | | 875,104 | | | | 0.57% | | | | 0.57% | | | | 0.98% | | | | 0.98% | | | | 51% | |

| | 38.03 | | | | 17.05% | | | | 974,895 | | | | 0.55% | | | | 0.55% | | | | 0.75% | | | | 0.75% | | | | 60% | |

| | 33.22 | | | | 25.09% | | | | 881,398 | | | | 0.57% | | | | 0.58% | | | | 1.30% | | | | 1.31% | | | | 145% | |

| | 26.60 | | | | (29.62)% | | | | 668,245 | | | | 0.56% | | | | 0.56% | | | | 1.25% | | | | 1.25% | | | | 44% | |

| | 38.43 | | | | 15.19% | | | | 1,082,788 | | | | 0.57% | | | | 0.57% | | | | 0.93% | | | | 0.93% | | | | 60% | |

Distributions reflect actual per-share amounts distributed for the period.

| 1 | Ratios for periods less than one year have been annualized, except for total return and portfolio turnover rate. |

| 2 | Total returns do not reflect the effects of charges deducted pursuant to the terms of The Guardian Insurance & Annuity Company, Inc.’s variable contracts. Inclusion of such charges would reduce the total returns for all periods shown. |

| 3 | Net Ratio of Expenses to Average Net Assets and Net Ratio of Net Investment Income to Average Net Assets include the effect of fee waivers and expense limitations and exclude the effect of custody credits, if applicable. |

| | | | |

| The accompanying notes are an integral part of these financial statements. | | | | 13 |

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

June 30, 2012 (unaudited)

RS Variable Products Trust (the “Trust”), a Massachusetts business trust organized on May 18, 2006, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust currently offers nine series. RS Large Cap Alpha VIP Series (the “Fund”) is a series of the Trust. The Fund is a diversified fund. The financial statements for the other remaining series of the Trust are presented in separate reports.

The Fund has authorized an unlimited number of shares of beneficial interest with no par value. The Fund currently offers only Class I shares. Shares are bought and sold at closing net asset value (“NAV”), which is the price for all outstanding shares of the Fund. Class I shares of the Fund are only sold to certain separate accounts of The Guardian Insurance & Annuity Company, Inc. (“GIAC”). GIAC is a wholly-owned subsidiary of The Guardian Life Insurance Company of America (“Guardian Life”). The Fund is currently offered to insurance company separate accounts that fund certain variable annuity and variable life insurance contracts issued by GIAC.

Note 1. Significant Accounting Policies

The following policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

a. Investment Valuations Marketable securities are valued at the last reported sale price on the principal exchange or market on which they are traded; or, if there were no sales that day, at the mean between the closing bid and asked prices. Securities traded on the NASDAQ Stock Market, LLC (“NASDAQ”) are generally valued at the NASDAQ official closing price, which may not be the last sale price. If the NASDAQ official closing price is not available for a security, that security is generally valued using the last reported sale price, or, if no sales are reported, at the mean between the closing bid and asked prices. Short-term investments that will mature in 60 days or less are valued at amortized cost, which approximates market value. Repurchase agreements are carried at cost, which approximates market value (See Note 4d). Foreign securities are valued in the currencies of the markets in which they trade and then converted to U.S. dollars using the prevailing exchange rates at the close of the New York Stock Exchange (“NYSE”).

Securities for which market quotations are not readily available or for which market quotations may be considered unreliable are valued at their fair values as determined in accordance with guidelines and procedures adopted by the Trust’s Board of Trustees.

Securities whose values have been materially affected by events occurring before the Fund’s valuation time but after the close of the securities’ principal exchange or market may be fair valued in accordance with guidelines and procedures adopted by the Board of Trustees. In addition, if there has been a movement in the U.S. markets that exceeds a specified threshold, the values of the Fund’s investments in foreign securities are generally determined by a pricing service using pricing models designed to estimate likely changes in the values of those securities.

The Fund has adopted the authoritative guidance under GAAP on determining fair value when the volume and level of activity for an asset or liability have significantly decreased and for identifying transactions that are not orderly. Accordingly, if the Fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

In accordance with Financial Accounting Standards Board (“FASB”) Codification Topic 820 (“ASC Topic 820”), fair value is defined as the price that the Fund would receive upon selling an investment in an “arm’s length” transaction to a willing buyer in the principal or most advantageous market for the investment. ASC Topic 820 established a hierarchy for classification of fair value measurements for disclosure purposes. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. The hierarchy of inputs is summarized in the three broad levels listed below.

| Ÿ | | Level 1 — unadjusted quoted prices in active markets for identical investments |

| Ÿ | | Level 2 — inputs other than unadjusted quoted prices that are observable either directly or indirectly (including adjusted quoted prices for similar |

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

| | | investments, interest rates, prepayment speeds, credit risks, etc.) |

| Ÿ | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A security’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Trust. The Trust considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, and provided by independent sources that are actively involved in the relevant market. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an investment’s assigned level within the hierarchy.

The FASB requires reporting entities to make disclosures about purchases, sales, issuances and settlements of Level 3 securities on a gross basis. For the six months ended June 30, 2012, the Fund had no securities classified as Level 3.

The Fund’s policy is to recognize transfers between Level 1, Level 2 and Level 3 at the end of the reporting period. For the six months ended June 30, 2012, there were no transfers between Level 1 and Level 2.

In determining a security’s placement within the hierarchy, the Trust separates the Fund’s investment portfolio into two categories: investments and derivatives (e.g., futures).

Investments Investments whose values are based on quoted market prices in active markets, and are therefore classified within Level 1, include active listed equities. The Trust does not adjust the quoted price for such instruments, even in situations where the Fund holds a large position and a sale could reasonably be expected to impact the quoted price.

Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. These include certain U.S. government and sovereign obligations, most government agency securities, investment-grade corporate bonds, certain mortgage products, state, municipal and provincial

obligations, and certain foreign equity securities, including securities whose prices may have been affected by events occurring after the close of trading on their principal exchange or market and, as a result, whose values are determined by a pricing service as described above, or securities whose values are otherwise determined using fair valuation methods approved by the Fund’s Board of Trustees.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. Level 3 investments include, among others, private placement securities. When observable prices are not available for these securities, the Trust uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the Trust in estimating the value of Level 3 investments include, for example, the original transaction price, recent transactions in the same or similar instruments, completed or pending third-party transactions in the underlying investment or comparable issuers, subsequent rounds of financing, recapitalizations, and other transactions across the capital structure. Level 3 investments may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the Trust in the absence of market information. Assumptions used by the Trust due to the lack of observable inputs may significantly impact the resulting fair value and therefore the Fund’s results of operations.

Derivatives Exchange-traded derivatives, such as futures contracts and exchange traded option contracts, are typically classified within Level 1 or Level 2 of the fair value hierarchy depending on whether or not they are deemed to be actively traded. Certain derivatives, such as generic forwards, swaps and options, have inputs which can generally be corroborated by market data and are therefore classified within Level 2.

b. Taxes The Fund intends to continue complying with the requirements of the Internal Revenue Code to qualify as a regulated investment company and to distribute substantially all net investment income and realized net capital gains, if any, to shareholders. Therefore, the Fund does not expect to be subject to income tax, and no provision for such tax has been made.

From time to time, however, the Fund may choose to pay an excise tax if the cost of making the required distribution exceeds the amount of the excise tax.

As of June 30, 2012, the Trust has reviewed the tax positions for open periods, as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements. The Trust is

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax positions as income tax expense in the Statement of Operations. For the six months ended June 30, 2012, the Fund did not incur any such interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for tax years before 2008 and by state authorities for tax years before 2007.

c. Securities Transactions Securities transactions are accounted for on the date securities are purchased or sold (trade date). Realized gains or losses on securities transactions are determined on the basis of specific identification.

d. Foreign Currency Translation The accounting records of the Fund are maintained in U.S. dollars. Investment securities and all other assets and liabilities of the Fund denominated in a foreign currency are generally translated into U.S. dollars at the exchange rates quoted at the close of the NYSE on each business day. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates in effect on the dates of the respective transactions. The Fund does not isolate the portion of the fluctuations on investments resulting from changes in foreign currency exchange rates from the fluctuations in market prices of investments held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

e. Investment Income Dividend income is generally recorded on the ex-dividend date. Interest income, which includes amortization/accretion of premium/discount, is accrued and recorded daily.

f. Expenses Many expenses of the Trust can be directly attributed to a specific series of the Trust. Expenses that cannot be directly attributed to a specific series of the Trust are generally apportioned among all the series in the Trust, based on relative net assets.

g. Custody Credits The Fund has entered into an arrangement with its custodian, State Street Bank and Trust Company, whereby credits realized as a result of uninvested cash balances are used to reduce the Fund’s custodian expenses. The Fund’s custody credits, if any, are shown in the accompanying Statement of Operations (but not in the Financial Highlights) as a reduction to the Fund’s expenses.

h. Distributions to Shareholders The Fund intends to declare and distribute substantially all net investment income, if any, at least once a year. Unless the Fund is

instructed otherwise, all distributions to shareholders are credited in the form of additional shares of the Fund at the net asset value, recorded on the ex-dividend date.

i. Capital Accounts Due to the timing of dividend distributions and the differences in accounting for income and realized gains/(losses) for financial statement purposes versus federal income tax purposes, the fiscal year in which amounts are distributed may differ from the year in which the income and realized gains/(losses) were recorded by the Fund.

Note 2. Transactions with Affiliates

a. Advisory Fee Under the terms of the advisory agreement, which is reviewed and approved annually by the Board of Trustees, the Fund pays an investment advisory fee to RS Investment Management Co. LLC (“RS Investments”). Guardian Investor Services LLC (“GIS”), a subsidiary of Guardian Life, holds a majority interest in RS Investments. RS Investments receives an investment advisory fee based on the average daily net assets of the Fund at an annual rate of 0.50%. The Fund has also entered into an agreement with GIS for distribution services with respect to its shares.

b. Compensation of Trustees and Officers Trustees and officers of the Trust who are interested persons, as defined in the 1940 Act, of RS Investments receive no compensation from the Fund for acting as such. Trustees of the Trust who are not interested persons of RS Investments receive compensation and reimbursement of expenses from the Trust.

Note 3. Federal Income Taxes

a. Distributions to Shareholders The tax character of distributions paid to shareholders during the year ended December 31, 2011, which is the most recently completed tax year, was as follows:

| | |

Ordinary Income |

| $9,165,005 |

Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences, and differing characterizations of distributions made by the Fund. Permanent book and tax basis differences will result in reclassifications to paid-in capital, undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

transactions. Undistributed net investment income and accumulated undistributed net realized gain/(loss) on investments and foreign currency transactions may include temporary book and tax differences, which will reverse in a subsequent period.

As of December 31, 2011, the Fund made the following reclassifications of permanent book and tax basis differences:

| | | | | | | | |

| Paid-in-Capital | | Accumulated Net Investment Income | | | Accumulated

Net Realized Loss | |

| $(9,695,238) | | $ | 48,062 | | | $ | 9,647,176 | |

During any particular year, net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed and, therefore, are normally distributed to shareholders annually.

During the year ended December 31, 2011, the Fund utilized $86,289,646 of capital loss carryovers. Capital loss carryovers available to the Fund at December 31, 2011 were as follows:

| | | | |

| Expiring | |

Amount | |

| 2015 | | $ | 63,066 | |

| 2016 | | | 15,285,989 | |

| 2017 | | | 160,708,957 | |

| | | | | |

| Total | | $ | 176,058,012 | |

| | | | | |

| | | | | |

Capital loss carryovers of $9,649,292 expired in the year ended December 31, 2011.

In determining its taxable income, current tax law permits the Fund to elect to treat all or a portion of any net capital or currency loss realized after October 31 as occurring on the first day of the following fiscal year. For the year ended December 31, 2011, the Fund elected to defer net capital and currency losses of $5,114,092.

b. Tax Basis of Investments The cost of investments for federal income tax purposes at June 30, 2012, was $899,746,711. The gross unrealized appreciation and depreciation on investments, on a tax basis, at June 30, 2012, aggregated $71,143,987 and $(28,435,887), respectively, resulting in net unrealized appreciation of $42,708,100.

Note 4. Investments

a. Investment Purchases and Sales The cost of investments purchased and the proceeds from investments sold (excluding short-term investments)

amounted to $301,400,174 and $226,663,696, respectively, for the six months ended June 30, 2012.

b. Foreign Securities Foreign securities investments involve special risks and considerations not typically associated with those of U.S. origin. These risks include, but are not limited to, currency risk; adverse political, social, and economic developments; and less reliable information about issuers. Moreover, securities of some foreign companies may be less liquid and their prices more volatile than those of comparable U.S. companies.

c. Industry or Sector Concentration In its normal course of business, the Fund may invest a significant portion of its assets in companies within a limited number of industries or sectors. As a result, the Fund may be subject to a greater risk of loss than that of a fund invested in a wider spectrum of industries or sectors because the stocks of many or all of the companies in the industry, group of industries, sector, or sectors may decline in value due to developments adversely affecting the industry, group of industries, sector, or sectors.

d. Repurchase Agreements The collateral for repurchase agreements is either cash or fully negotiable U.S. government securities (including U.S. government agency securities). Repurchase agreements are fully collateralized (including the interest accrued thereon) and such collateral is marked-to-market daily while the agreements remain in force. If the value of the collateral falls below the repurchase price plus accrued interest, the Fund will typically require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults, the Fund maintains the right to sell the collateral (although it may be prevented or delayed from doing so in certain circumstances) and may claim any resulting loss against the seller.

Note 5. Temporary Borrowings

The Fund, with other funds managed by RS Investments, shares in a $100 million committed revolving credit facility from State Street Bank and Trust Company for temporary purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Interest is calculated based on market rates at the time of borrowing.

For the six months ended June 30, 2012, the Fund did not borrow under the facility.

NOTES TO FINANCIAL STATEMENTS — RS LARGE CAP ALPHA VIP SERIES (UNAUDITED)

Note 6. Review for Subsequent Events

Management has evaluated subsequent events through the issuance of the Fund’s financial statements and determined that no material events have occurred that require disclosure.

Note 7. Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

Note 8. New Accounting Pronouncement

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update 2011-11, Balance Sheet (Topic 210) — Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”). Effective for annual reporting periods beginning on or after January 1, 2013 and interim periods within those annual periods, ASU 2011-11 is intended to enhance disclosure requirements on the offsetting of financial assets and liabilities. At this time, management is evaluating the implications of ASU 2011-11 and its impact of the financial statements.

SUPPLEMENTAL INFORMATION (UNAUDITED)

Portfolio Holdings and Proxy Voting Procedures

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Securities and Exchange Commission’s Web site at http://www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330. This information is also available, without charge, upon request, by calling toll-free 800-221-3253.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 will be available (i) without charge, upon request, by calling toll-free 800-221-3253; and (ii) on the Securities and Exchange Commission’s Web site at http://www.sec.gov.

The Statement of Additional Information includes information about the Trust’s Trustees and Officers and is available, without charge, upon request by calling toll-free 800-221-3253.

This report is transmitted to shareholders only. It is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of a Fund unless accompanied or preceded by that Fund’s current prospectus. Past performance results shown in this report should not be considered a representation of future performance. Investment returns and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Statements and other information herein are as dated and are subject to change.

2012 Semiannual Report

All data as of June 30, 2012

RS Variable Products Trust

| Ÿ | | RS Small Cap Growth Equity VIP Series |

| | | | |

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE | | |  | |

TABLE OF CONTENTS

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2012. The views expressed in the investment team letters are those of the Fund’s portfolio manager(s) and are subject to change without notice. They do not necessarily represent the views of RS Investments. The letters contain some forward-looking statements providing current expectations or forecasts of future events; they do not necessarily relate to historical or current facts. There can be no guarantee that any forward-looking statement will be realized. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events, or otherwise. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

RS SMALL CAP GROWTH EQUITY VIP SERIES

The Statement of Additional Information provides further information about the investment team, including information regarding their compensation, other accounts they manage, and their ownership interests in the Fund. For information on how to receive a copy of the Statement of Additional Information, please see the back cover of the relevant Prospectus or visit our Web site at www.guardianinvestor.com.

RS Small Cap Growth Equity VIP Series

Highlights

| Ÿ | | Small cap growth stocks as measured by the Russell 2000® Growth Index1 advanced in the first six months of 2012, despite uncertainty over the economic outlook and the future of the European monetary union. The Russell 2000® Index2 underperformed the larger cap S&P 500® Index3, due in part to heightened investor risk aversion later in the period. |

| Ÿ | | RS Small Cap Growth Equity VIP Series outperformed the benchmark Russell 2000® Growth Index and the Russell 2000® Index for the six-month period ended June 30, 2012. Fund performance relative to the Russell 2000® Growth Index was supported by stock selection in the technology, health care, energy and consumer staples sectors. Stock selection in the materials, producer durables, and utilities sectors detracted from relative performance. |

| Ÿ | | RS Small Cap Growth Equity VIP Series seeks long-term capital growth by normally investing in small-cap companies that we believe will produce sustainable earnings growth over a multi-year horizon. |

Market Overview

Equity markets measured by the S&P 500® Index started out the year on a positive note, as investors welcomed encouraging economic news and low U.S. interest rates. Against this backdrop, small cap growth stocks delivered strong performance, aided by more attractive valuations and a pickup in IPO and merger and acquisition activity. But optimism on the economy appeared to fade in the spring, as persistent high unemployment and weaker than expected corporate and consumer spending raised fears that the recovery might stall. Adding to this cloud of uncertainty were the ongoing debt crisis in Europe and signs of slowing economic growth in China and other Asian economies. As a result, investors became more risk averse and sold out of growth-oriented names, particularly in the technology sector. Energy stocks also fell sharply late in the period, as investors reassessed their expectations for global economic growth and raw materials demand.

Fund Performance Overview

RS Small Cap Growth Equity VIP Series returned 10.12% over the six-month period ended June 30, 2012, and outperformed its benchmarks, the Russell 2000®

Growth Index, which returned 8.81% and the Russell 2000® Index, which returned 8.53%.

Portfolio Review

The Fund’s performance relative to the Russell 2000® Growth Index was aided by several investments in the health care sector. These included Medivation Inc., a biopharmaceutical company focused on the development of small molecule drugs to address serious diseases for which there are limited treatment options. The stock gained support from positive trial results for the company’s new prostate cancer drug, which is awaiting both U.S. Food and Drug Administration approval and approval in the European Union.

The recent pickup in mergers and acquisition activity in the health care area also benefited Fund performance during the period. Notably, Inhibitex Inc., one of our holdings, announced it was being acquired by pharmaceutical company Bristol-Myers Squibb Co. for $2.4 billion, a significant premium. Inhibitex is an early-stage biotech company focused on oral, small molecule compounds to treat viral infections such as Hepatitis C. The stock proved a strong contributor to the Fund’s relative performance.

Relative results were also supported by an investment in Ulta Salon, Cosmetics & Fragrance Inc. The retailer of both high end and discount beauty supply brands has been capitalizing on its store expansion plans and innovative customer strategy.

On a negative note, several of the Fund’s other consumer discretionary investments weighed on relative performance in a challenging environment for many retailers. Detractors included beverage chain Caribou Coffee Co. Inc., as well as Body Central Corp., a retailer of trendy young women’s apparel. We decided to sell both positions later in the period given the economic sensitivity of their models.

While the Fund’s overall stock selection in the energy sector assisted relative performance, our investment in CARBO Ceramics Inc. hurt our results. The company makes a key material used in the hydraulic fracturing, or fracking, process to improve oil and natural gas drilling production. The downward volatility in natural gas prices dampened the company’s earnings prospects earlier in the year, and we chose to exit the position.

RS SMALL CAP GROWTH EQUITY VIP SERIES

Outlook

As we look ahead, we remain cautiously optimistic on the economic outlook even as we acknowledge near-term risks including the potential for slowing growth in Europe and China. Nonetheless, we believe that low interest rates and modest inflation in the United States will provide a favorable environment for small cap stocks. We remain focused on identifying what we believe are

well-managed, well-capitalized growth companies that in our view will be able to grow their revenues and tap new market opportunities even in a less certain economic environment. We continue to spend much of our time visiting companies in person and seeing first-hand how they are adapting to changing conditions.

RS Funds are sold by prospectus only. You should carefully consider the investment objectives, risks, charges and expenses of the RS Funds before making an investment decision. The prospectus contains this and other important information. Please read it carefully before investing or sending money. Please visit our web site at www.guardianinvestor.com or to obtain a printed copy, call 800-221-3253.

Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. Fund holdings will vary.

Except as otherwise specifically stated, all information and investment team commentary, including portfolio security positions, is as of June 30, 2012.

As with all mutual funds, the value of an investment in the Fund could decline, in which case you could lose money. Small cap investing entails special risks. Small cap stocks have tended to be more volatile and to drop more in down markets than large cap stocks. This may happen because small companies may be limited in terms of product lines, financial resources, and management.

RS SMALL CAP GROWTH EQUITY VIP SERIES

Characteristics (unaudited)

| | |

| Total Net Assets: $89,555,511 | | |

| | | | |

| |

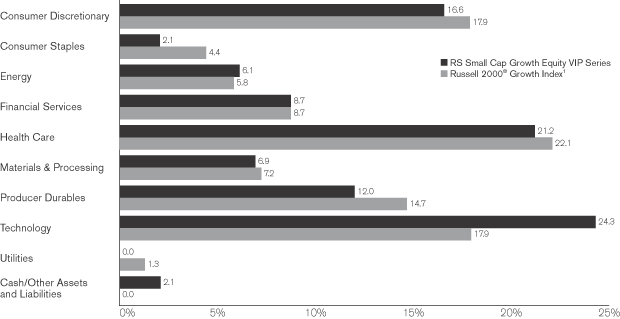

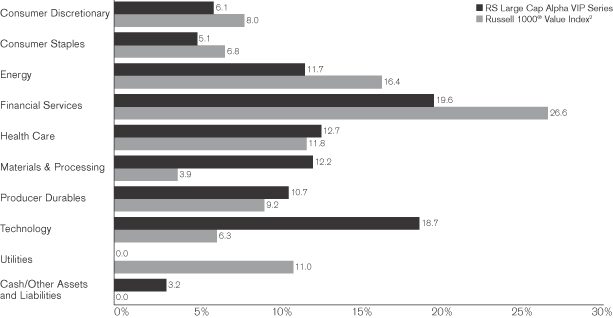

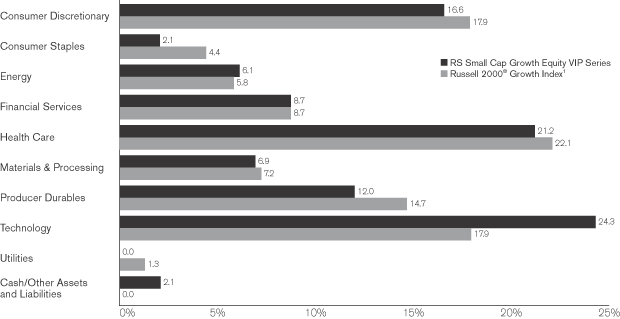

| Sector Allocation vs. Index4 | |

| |

| | |

| Top Ten Holdings5 | | | |

| | |

| Holding | | % of Total

Net Assets | |

| Vitamin Shoppe, Inc. | | | 1.93% | |

| Portfolio Recovery Associates, Inc. | | | 1.93% | |

| Ultimate Software Group, Inc. | | | 1.91% | |

| Grand Canyon Education, Inc. | | | 1.79% | |

| BioMarin Pharmaceutical, Inc. | | | 1.79% | |

| Aspen Technology, Inc. | | | 1.77% | |

| Fortinet, Inc. | | | 1.75% | |

| Old Dominion Freight Line, Inc. | | | 1.74% | |

| Hexcel Corp. | | | 1.73% | |

| AmTrust Financial Services, Inc. | | | 1.72% | |

| Total | | | 18.06% | |

| 1 | The Russell 2000® Growth Index is an unmanaged market capitalization-weighted index that measures the performance of those companies in the Russell 2000 Index with higher price-to-book ratios and higher forecasted growth values. (The Russell 2000 Index is an unmanaged market capitalization-weighted index that measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which consists of the 3,000 largest U.S. companies based on total market capitalization.) Investment results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 2 | The Russell 2000® Index is an unmanaged market capitalization-weighted index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which consists of the 3,000 largest U.S. companies based on total market capitalization. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

| 3 | The S&P 500® Index is an unmanaged market-capitalization-weighted index generally considered to be representative of U.S. equity market activity. The index consists of 500 stocks representing leading industries of the U.S. economy. Index results assume the reinvestment of dividends paid on the stocks constituting the index. You may not invest in the index, and, unlike the Fund, the index does not incur fees or expenses. |

RS SMALL CAP GROWTH EQUITY VIP SERIES

| 4 | The Fund’s holdings are allocated to each sector based on their Russell Global Sector classification. If a holding is not classified by Russell, it is assigned a Russell designation by RS Investments. Cash includes short-term investments and net other assets and liabilities. |

| 5 | Portfolio holdings are subject to change and should not be considered a recommendation to buy or sell individual securities. |

Performance Update (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Average Annual Total Returns | |

| | | | | | | | |

| | | Inception Date | | | Year-to-Date | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Since Inception | |

| RS Small Cap Growth Equity VIP Series | | | 5/1/97 | | | | 10.12% | | | | -5.35% | | | | 19.57% | | | | 2.79% | | | | 7.91% | | | | 8.00% | |

| Russell 2000® Growth Index1 | | | | | | | 8.81% | | | | -2.71% | | | | 18.09% | | | | 1.99% | | | | 7.39% | | | | 5.25% | |

| Russell 2000® Index2 | | | | | | | 8.53% | | | | -2.08% | | | | 17.80% | | | | 0.54% | | | | 7.00% | | | | 7.05% | |

| |

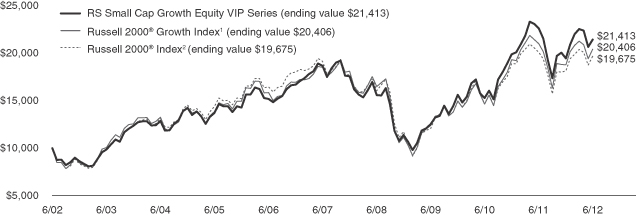

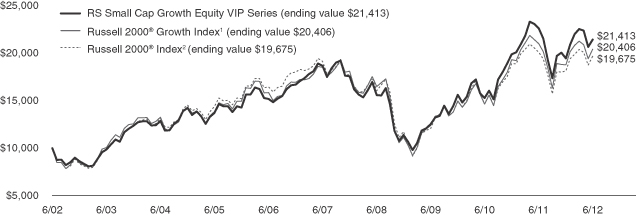

| Results of a Hypothetical $10,000 Investment | |

| |

The chart above shows the performance of a hypothetical $10,000 investment made 10 years ago in RS Small Cap Growth Equity VIP Series, in the Russell 2000® Growth Index, and in the Russell 2000® Index. Index returns do not include the fees and expenses of the Fund, but do include the reinvestment of dividends.

Performance quoted represents past performance and does not guarantee or predict future results. The Fund is the successor to The Guardian Small Cap Stock Fund; performance shown includes performance of the predecessor fund for periods prior to October 9, 2006. Investment return and principal value will fluctuate, so shares, when redeemed, may be worth more or less than their original cost. Please keep in mind that any high double-digit returns are highly unusual and cannot be sustained. The Fund’s fees and expenses are detailed in the Financial Highlights section of this report. Fees and expenses are factored into the net asset value of your shares and any performance numbers we release. Performance results assume the reinvestment of dividends and capital gains. The return figures shown do not reflect the deduction of taxes that a contract owner/policyholder may pay on Fund distributions or redemption units. The actual total returns for owners of variable annuity contracts or variable life insurance policies that provide for investment in the Fund will be lower to reflect separate account and contract/policy charges. Current and month-end performance information, which may be lower or higher than that cited, is available by calling 800-221-3253 and is periodically updated on our Web site: www.guardianinvestor.com.

UNDERSTANDING YOUR FUND’S EXPENSES (UNAUDITED)

By investing in the Fund, you incur two types of costs: (1) transaction costs, including, as applicable, sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including as applicable, investment advisory fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated. The table below shows the Fund’s expenses in two ways:

Expenses based on actual return

This section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Expenses based on hypothetical 5% return for comparison purposes

This section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with the cost of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore the second section is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | Beginning

Account Value

1/1/12 | | Ending

Account Value

6/30/12 | | | Expenses Paid

During Period*

1/1/12-6/30/12 | | | Expense Ratio

During Period

1/1/12-6/30/12 | |

| Based on Actual Return | | $1,000.00 | | | $1,101.20 | | | | $4.55 | | | | 0.87% | |

| Based on Hypothetical Return (5% Return Before Expenses) | | $1,000.00 | | | $1,020.54 | | | | $4.37 | | | | 0.87% | |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

SCHEDULE OF INVESTMENTS — RS SMALL CAP GROWTH EQUITY VIP SERIES

| | | | | | | | |

| June 30, 2012 (unaudited) | | Shares | | | Value | |

| Common Stocks – 97.9% | |

| Aerospace – 2.9% | |

BE Aerospace, Inc.(1) | | | 27,228 | | | $ | 1,188,774 | |

HEICO Corp., Class A | | | 44,941 | | | | 1,449,797 | |

| | | | | | | | | |

| | | | | 2,638,571 | |

| Asset Management & Custodian – 1.1% | | | | | |

Financial Engines, Inc.(1) | | | 48,028 | | | | 1,030,201 | |

| | | | | | | | | |

| | | | | 1,030,201 | |

| Auto Parts – 1.6% | | | | | | | | |

LKQ Corp.(1) | | | 42,446 | | | | 1,417,696 | |

| | | | | | | | | |

| | | | | 1,417,696 | |

| Back Office Support, HR and Consulting – 2.0% | |

Huron Consulting Group, Inc.(1) | | | 26,500 | | | | 838,725 | |

Robert Half International, Inc. | | | 33,820 | | | | 966,237 | |

| | | | | | | | | |

| | | | | 1,804,962 | |

| Banks: Diversified – 1.3% | | | | | | | | |

Signature Bank(1) | | | 18,739 | | | | 1,142,517 | |

| | | | | | | | | |

| | | | | 1,142,517 | |

| Biotechnology – 5.4% | | | | | | | | |

Aegerion Pharmaceuticals, Inc.(1) | | | 42,812 | | | | 635,330 | |

Amicus Therapeutics, Inc.(1) | | | 84,200 | | | | 463,100 | |

Dynavax Technologies Corp.(1) | | | 120,500 | | | | 520,560 | |

Idenix Pharmaceuticals, Inc.(1) | | | 56,639 | | | | 583,381 | |

Medivation, Inc.(1) | | | 11,127 | | | | 1,017,008 | |

NPS Pharmaceuticals, Inc.(1) | | | 128,208 | | | | 1,103,871 | |

Seattle Genetics, Inc.(1) | | | 18,800 | | | | 477,332 | |

| | | | | | | | | |

| | | | | 4,800,582 | |

| Building: Roofing, Wallboard & Plumbing – 1.2% | |

Beacon Roofing Supply, Inc.(1) | | | 41,200 | | | | 1,039,064 | |

| | | | | | | | | |

| | | | | 1,039,064 | |

| Commercial Vehicles & Parts – 0.7% | | | | | |

Commercial Vehicle Group, Inc.(1) | | | 72,085 | | | | 621,373 | |

| | | | | | | | | |

| | | | | 621,373 | |

| Computer Services, Software & Systems – 17.7% | |

Aspen Technology, Inc.(1) | | | 68,279 | | | | 1,580,659 | |

BroadSoft, Inc.(1) | | | 30,774 | | | | 891,215 | |

CommVault Systems, Inc.(1) | | | 13,816 | | | | 684,859 | |

Concur Technologies, Inc.(1) | | | 20,600 | | | | 1,402,860 | |

Demand Media, Inc.(1) | | | 30,000 | | | | 336,000 | |

ExactTarget, Inc.(1) | | | 53,000 | | | | 1,158,580 | |

Fortinet, Inc.(1) | | | 67,625 | | | | 1,570,252 | |

Gartner, Inc.(1) | | | 24,847 | | | | 1,069,663 | |

Infoblox, Inc.(1) | | | 52,800 | | | | 1,210,704 | |

InterXion Holding N.V.(1) | | | 40,800 | | | | 738,888 | |

Proofpoint, Inc.(1) | | | 50,300 | | | | 852,585 | |

SPS Commerce, Inc.(1) | | | 33,100 | | | | 1,005,578 | |

Tangoe, Inc.(1) | | | 44,100 | | | | 939,771 | |

Ultimate Software Group, Inc.(1) | | | 19,171 | | | | 1,708,520 | |

VeriFone Systems, Inc.(1) | | | 20,220 | | | | 669,080 | |

| | | | | | | | | |

| | | | | 15,819,214 | |

| | | | | | | | |

| June 30, 2012 (unaudited) | | Shares | | | Value | |

| Consumer Lending – 1.9% | | | | | | | | |

Portfolio Recovery Associates, Inc.(1) | | | 18,893 | | | $ | 1,724,175 | |

| | | | | | | | | |

| | | | | 1,724,175 | |

| Containers & Packaging – 1.0% | | | | | | | | |

Rock-Tenn Co., Class A | | | 16,616 | | | | 906,403 | |

| | | | | | | | | |

| | | | | 906,403 | |

| Cosmetics – 1.7% | | | | | | | | |

Elizabeth Arden, Inc.(1) | | | 38,700 | | | | 1,501,947 | |

| | | | | | | | | |

| | | | | | | | | |